Certain of the statements contained in this presentation should be considered forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward- looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about the Company’s plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the Company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth herein as well as in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 (especially in Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors), and other risks and uncertainties listed from time to time in the Company’s other filings with the Securities and Exchange Commission. Additionally, there may be other factors of which the Company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement. 2 Forward-looking statements

Strong second-quarter results 3 • Record quarterly revenue of $14.1 billion • Highest-ever quarterly operating income of $2.2 billion, resulting in an operating margin of 15.4% • Second-quarter GAAP net income of $1.3 billion and net income of $1.4 billion, excluding net special items1 • Best-ever second-quarter completion factor and controllable completion factor2 • Generated $1.2 billion of free cash flow1 in the second quarter • Ended the second quarter with $14.9 billion of total available liquidity 1. See GAAP to non-GAAP and free cash flow reconciliations at the end of this presentation. 2. Excluding second-quarter 2020 and second-quarter 2021, which were impacted by significantly reduced capacity due to COVID-19.

2Q 2019 2Q 2023 New AAdvantage® member accounts AAdvantage® remains strong 4 • AAdvantage® continues to grow, with enrollments up 61% vs. 2Q 2019 + 61% vs. 2Q 2019

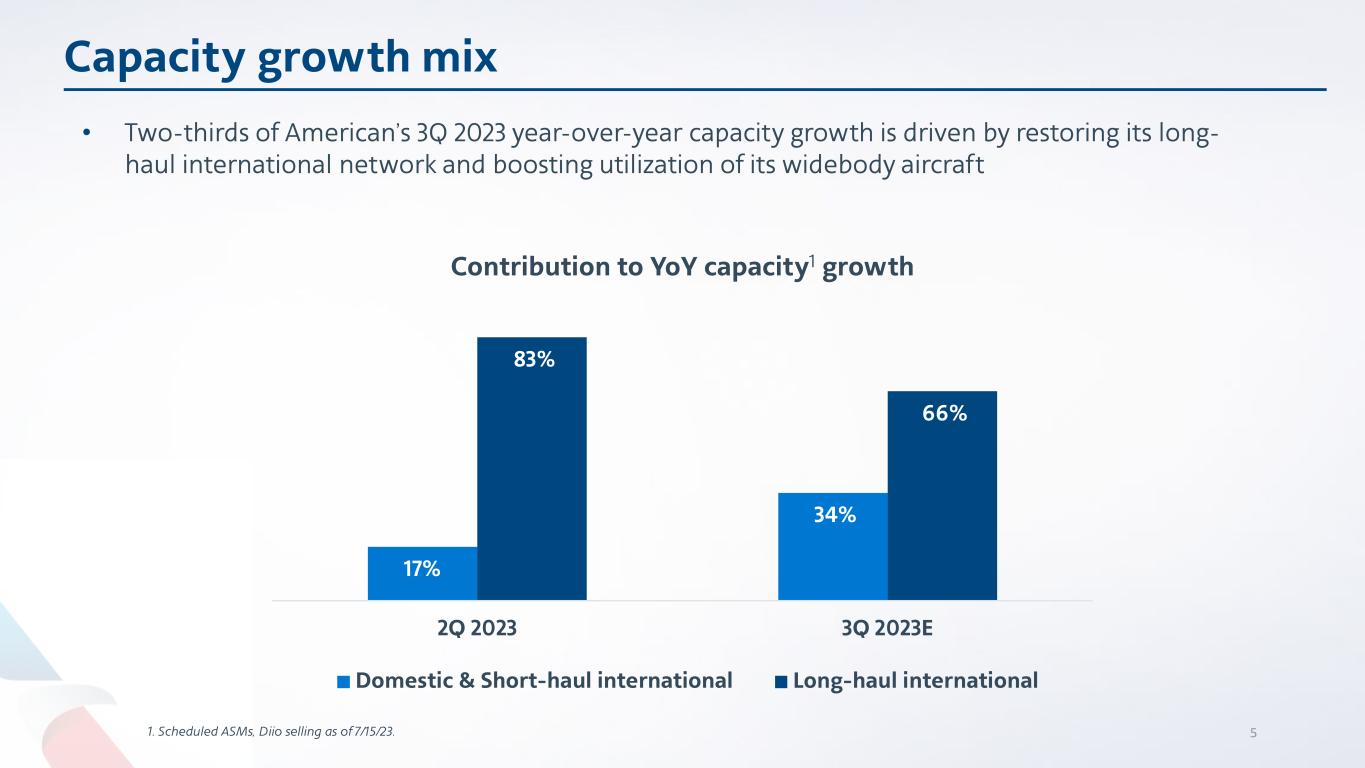

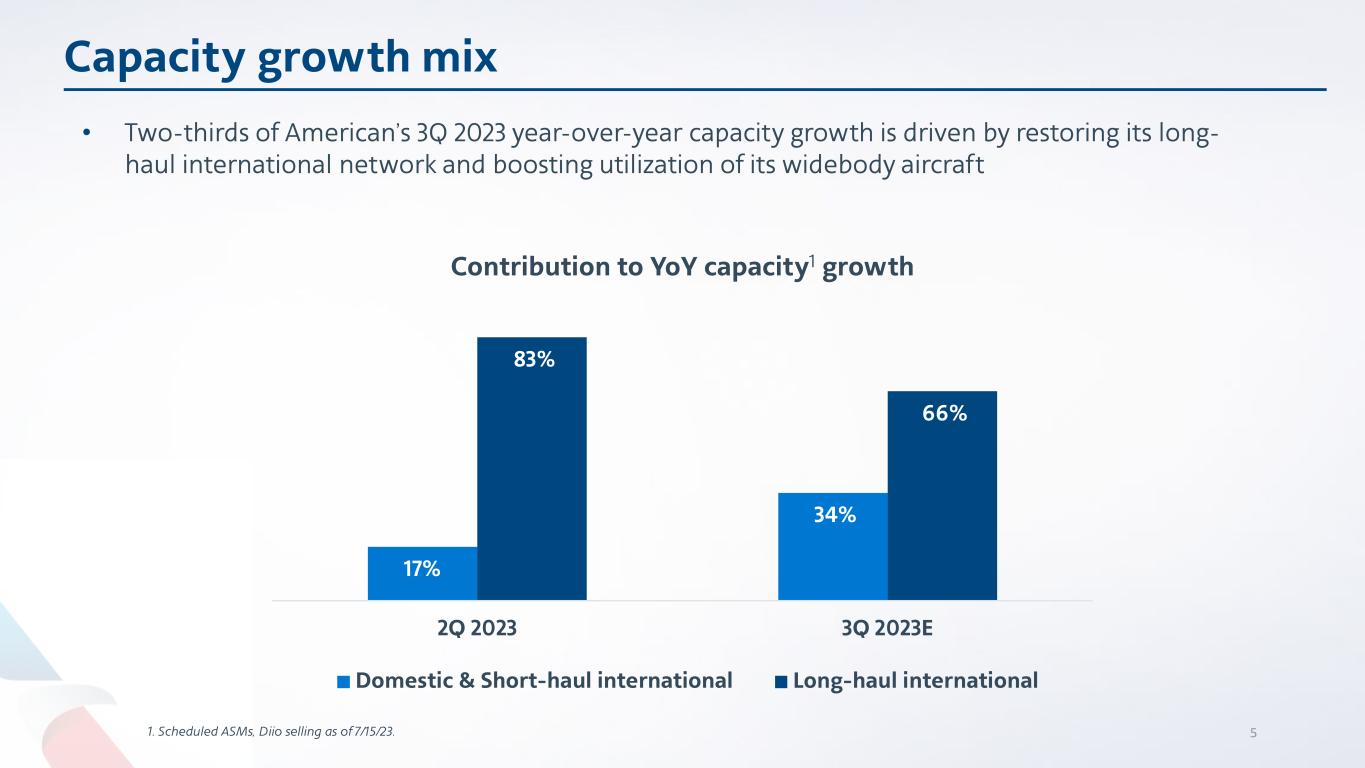

Capacity growth mix 5 • Two-thirds of American’s 3Q 2023 year-over-year capacity growth is driven by restoring its long- haul international network and boosting utilization of its widebody aircraft 17% 34% 83% 66% 2Q 2023 3Q 2023E Contribution to YoY capacity1 growth Domestic & Short-haul international Long-haul international 1. Scheduled ASMs, Diio selling as of 7/15/23.

6 Financial update

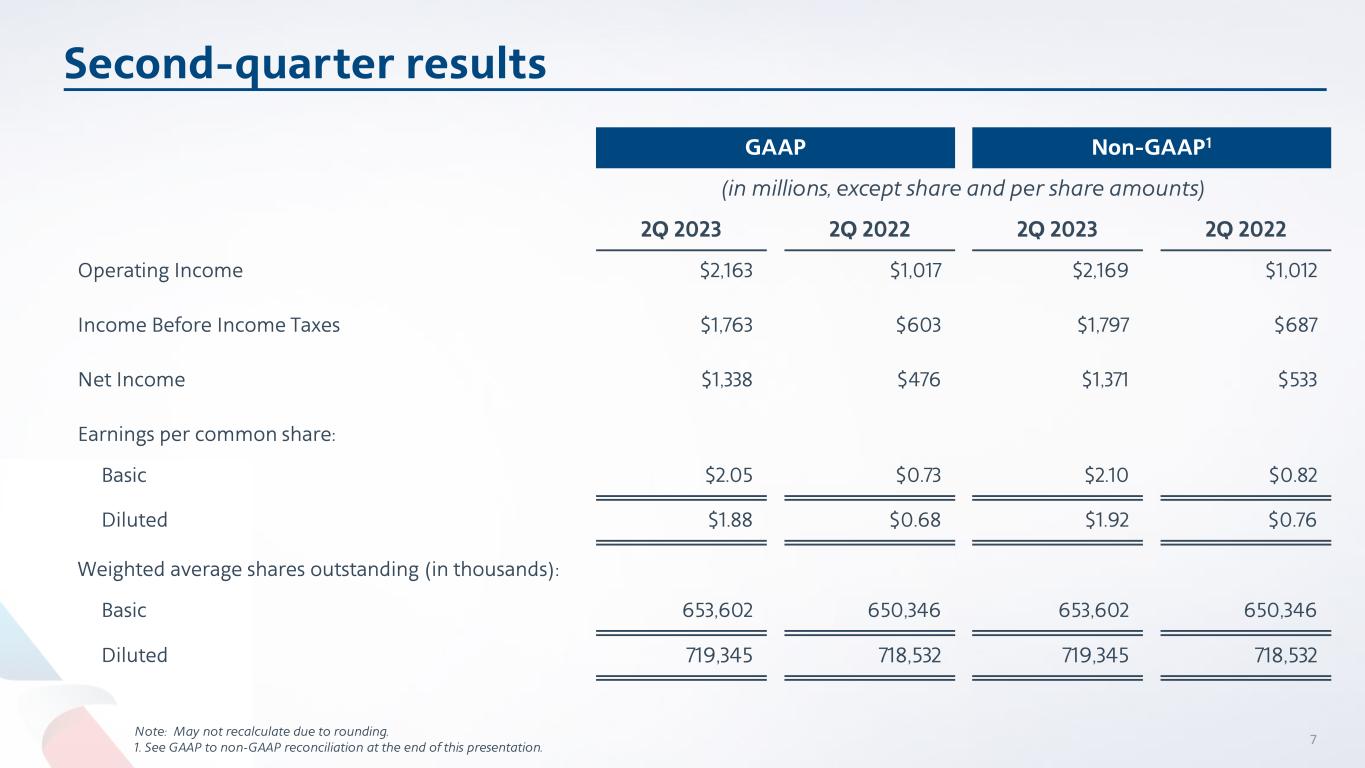

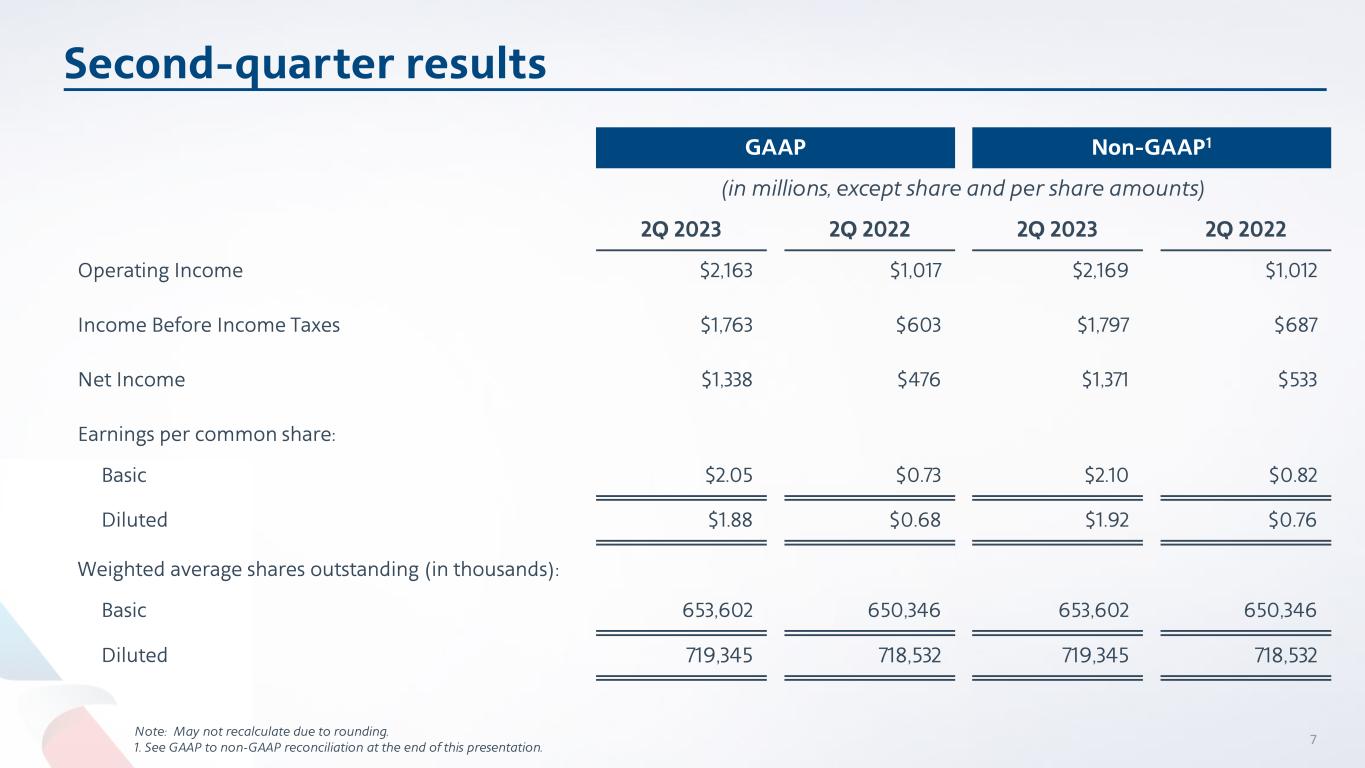

Second-quarter results 7Note: May not recalculate due to rounding. 1. See GAAP to non-GAAP reconciliation at the end of this presentation. GAAP Non-GAAP1 (in millions, except share and per share amounts) 2Q 2023 2Q 2022 2Q 2023 2Q 2022 Operating Income $2,163 $1,017 $2,169 $1,012 Income Before Income Taxes $1,763 $603 $1,797 $687 Net Income $1,338 $476 $1,371 $533 Earnings per common share: Basic $2.05 $0.73 $2.10 $0.82 Diluted $1.88 $0.68 $1.92 $0.76 Weighted average shares outstanding (in thousands): Basic 653,602 650,346 653,602 650,346 Diluted 719,345 718,532 719,345 718,532

Limited capex and debt maturities support deleveraging Younger fleet drives lower capex Note: May not recalculate due to rounding. 1. Source: Company filings. Debt payments include amortization and final maturity payments for debt and finance leases. 2. Source: Company filings. 2021 includes net inflows from return of PDPs. 8 Limited maturities minimize refi risk $5.2 $2.0 $0.2 $2.5 $2.5 ~ $3.0-$3.5 20 14 - 20 19 Av g. 20 20 A 20 21 A 20 22 A 20 23 E 20 24 E Total capex forecast2 (in billions) • Manufacturer delivery delays have pushed out aircraft capex requirements • Continue to expect moderate levels of capex through the end of the decade $1.8 $2.5 $3.2 $2.0 $1.0 $0.5 2022A 2023E 2024E Debt payments1 (in billions) Amortization Maturities $3.8 $3.5 $3.7

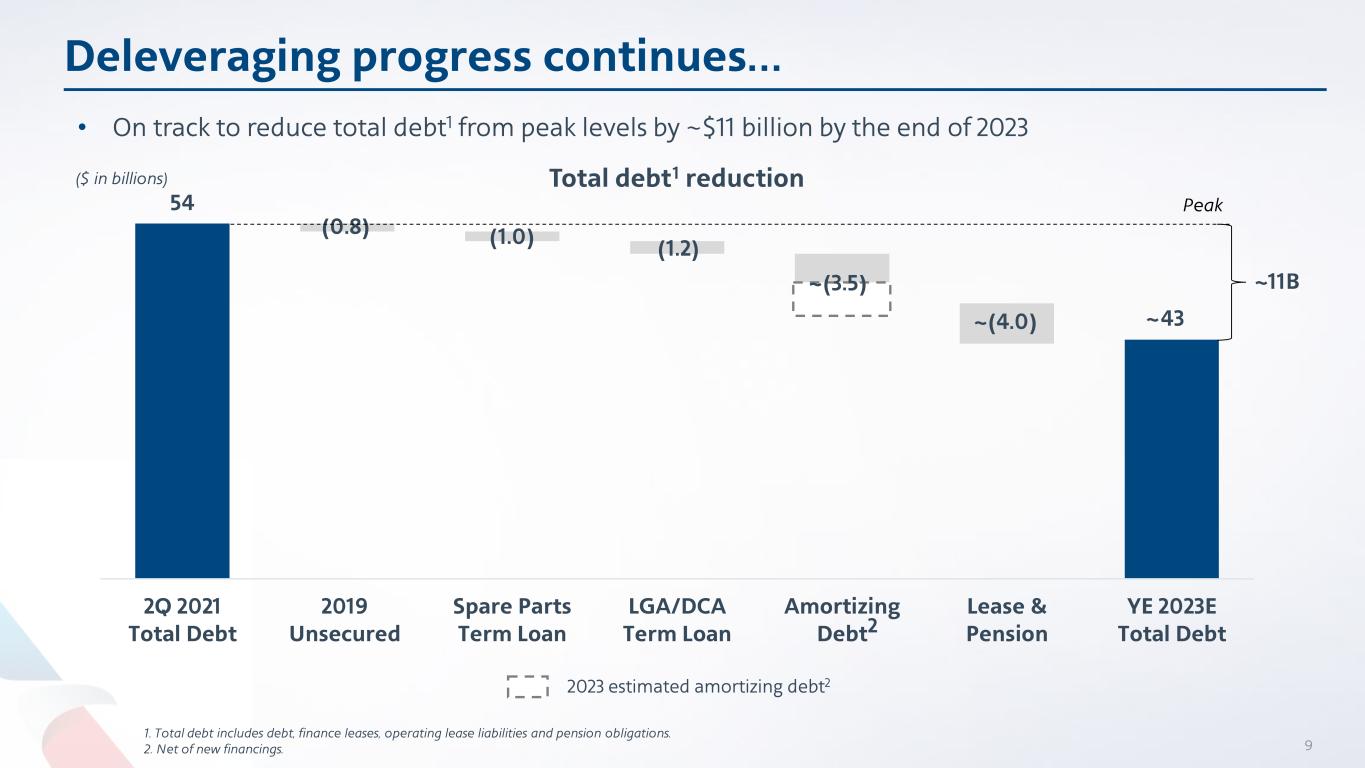

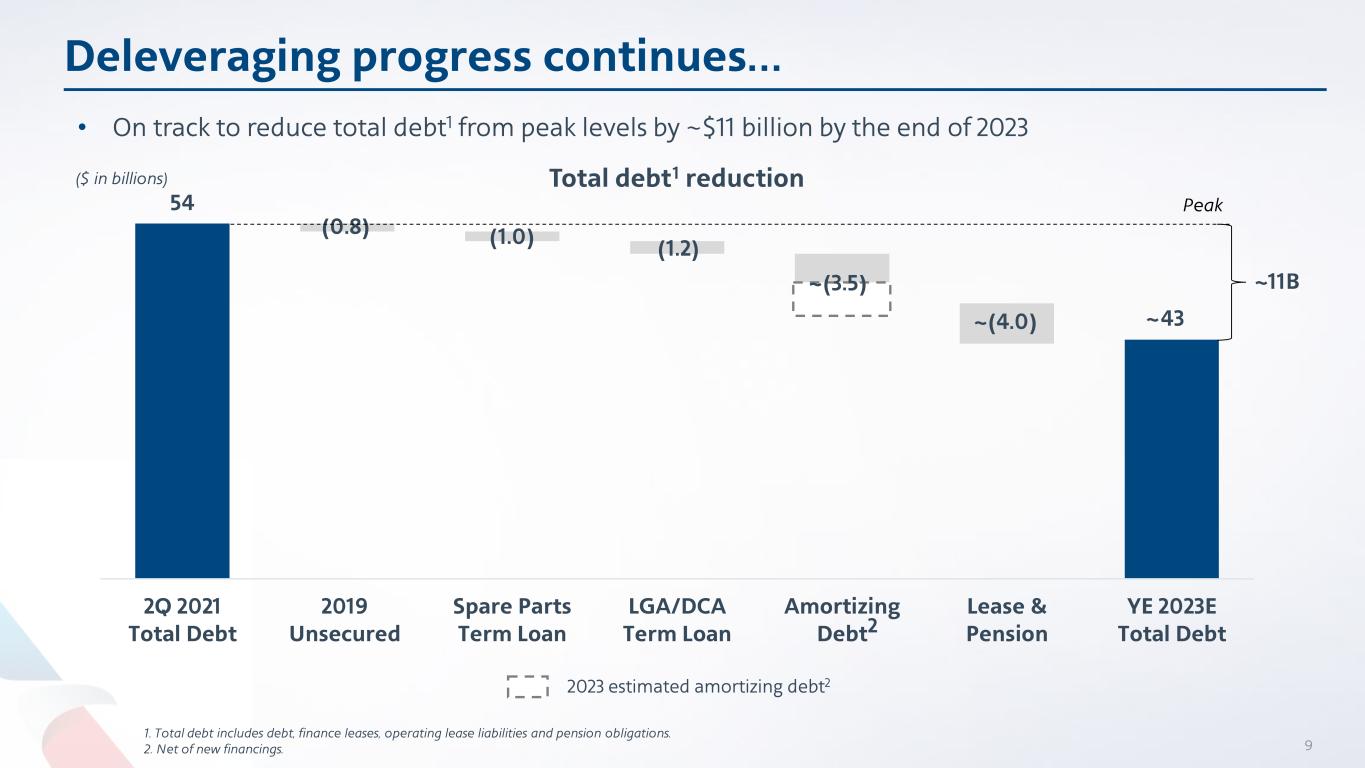

2Q 2021 Total Debt 2019 Unsecured Spare Parts Term Loan LGA/DCA Term Loan Amortizing Debt Lease & Pension YE 2023E Total Debt (1.0) (1.2) (0.8) Deleveraging progress continues… 9 ~11B 54 Peak • On track to reduce total debt1 from peak levels by ~$11 billion by the end of 2023 ($ in billions) ~43~(4.0) 1. Total debt includes debt, finance leases, operating lease liabilities and pension obligations. 2. Net of new financings. 2 ~(3.5) 2023 estimated amortizing debt2 Total debt1 reduction

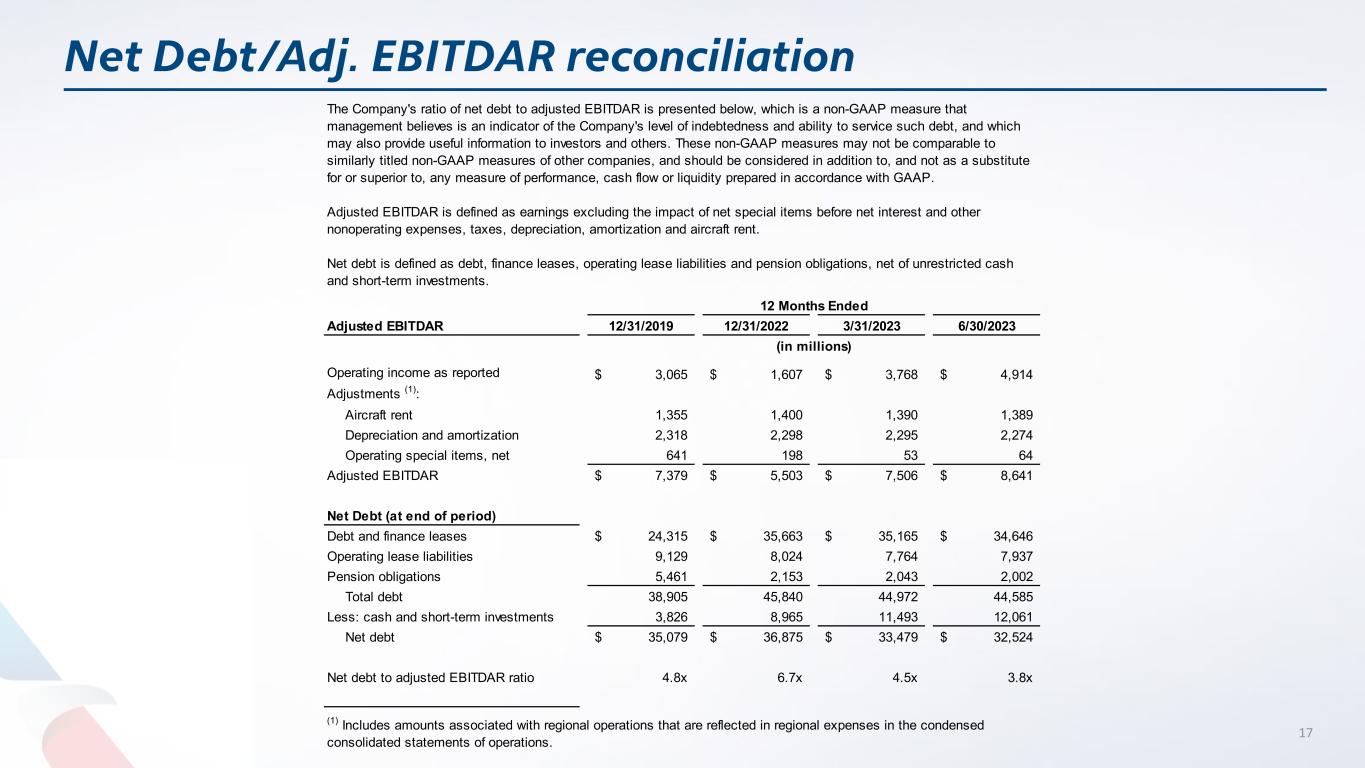

4.8x 6.7x 4.5x 3.8x ~ 4.0x 2019 2022 1Q 2023 2Q 2023 YE 2023E Net Debt1/Adj. EBITDAR2 Over Time …and credit ratios are improving 10 • Net debt1 to adjusted EBITDAR2 ratio of 3.8x at end of 2Q 2023, the lowest since year-end 2019 • Long-term target of BB credit rating would be supported by the completion of debt-reduction goal and continued earnings strength 1. Net debt is defined as debt, finance leases, operating lease liabilities and pension obligations net of unrestricted cash and short-term investments. 2. Adj. EBITDAR is defined as earnings excluding the impact of net special items before net interest, other non-operating expenses, taxes, depreciation, amortization and aircraft rent. See Adj. EBITDAR reconciliation at the end of this presentation.

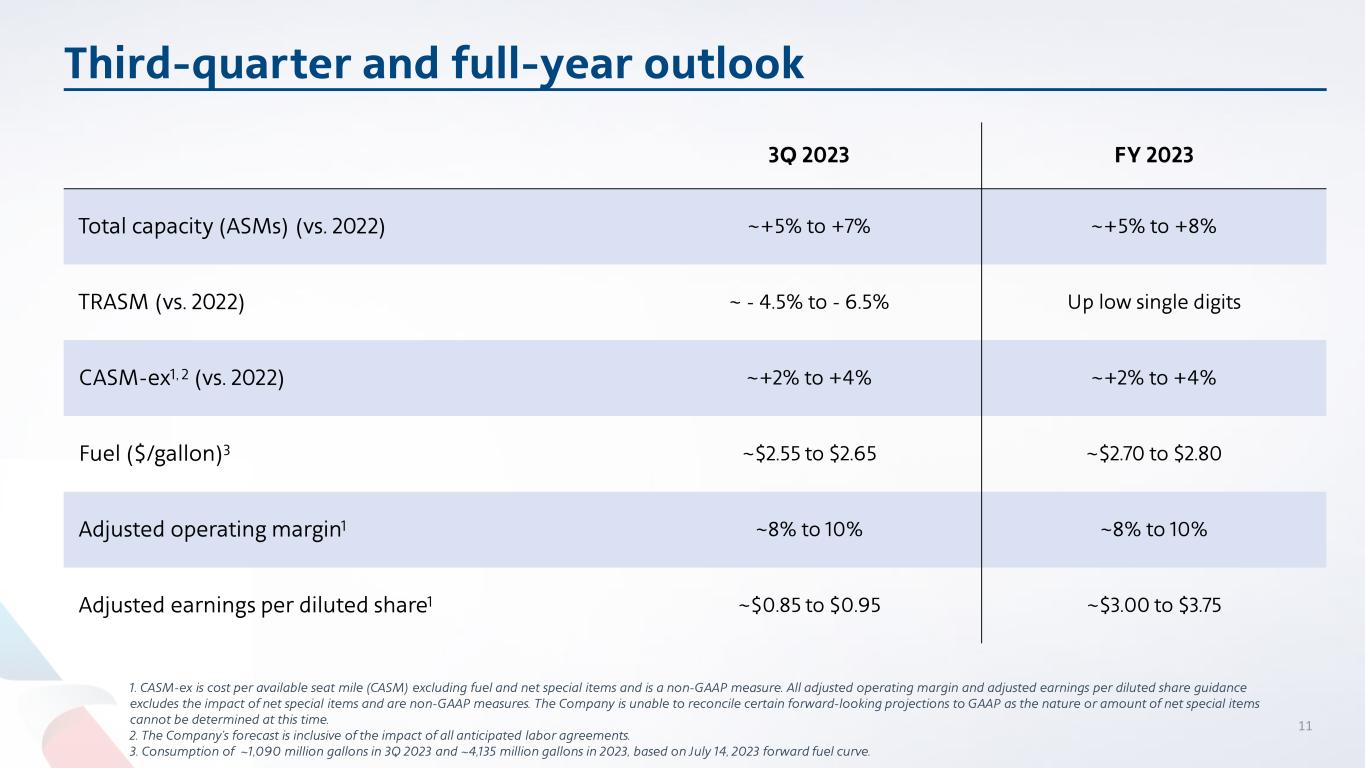

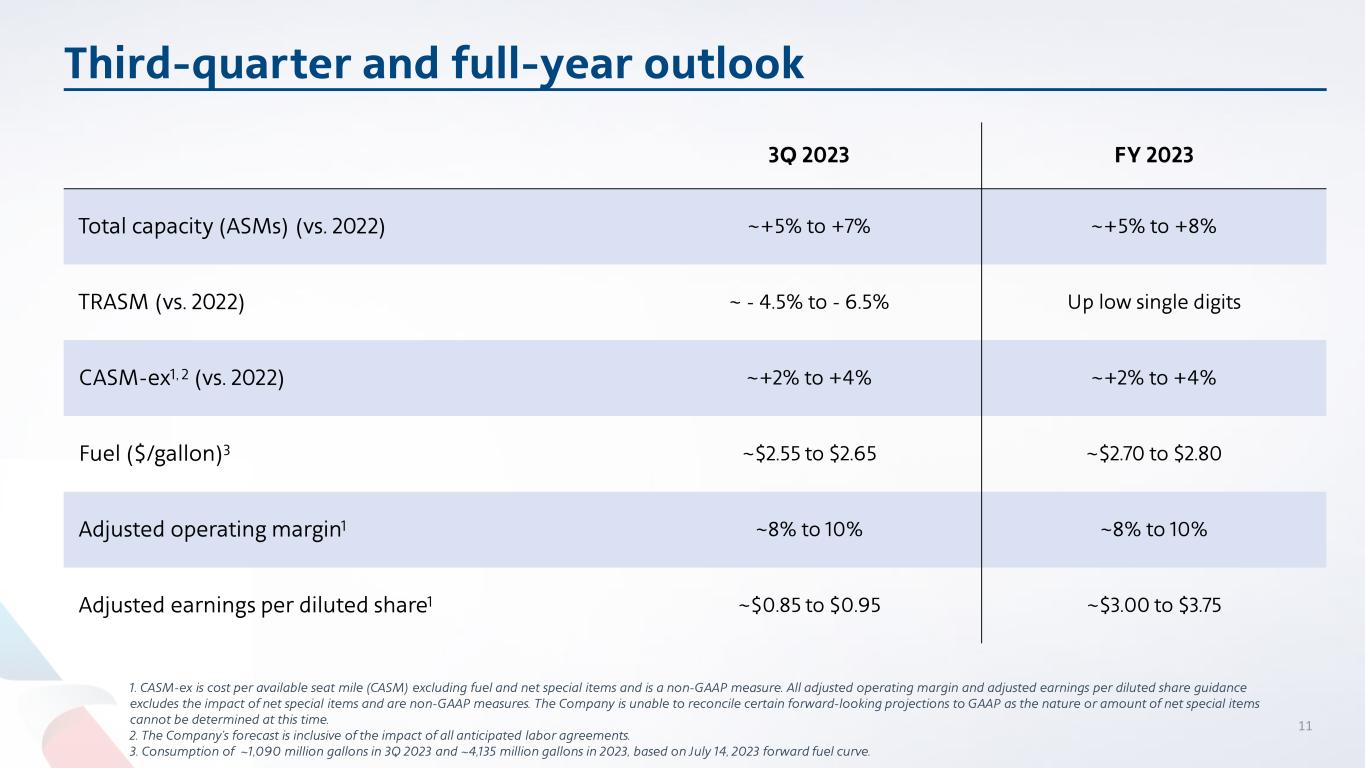

Third-quarter and full-year outlook 11 1. CASM-ex is cost per available seat mile (CASM) excluding fuel and net special items and is a non-GAAP measure. All adjusted operating margin and adjusted earnings per diluted share guidance excludes the impact of net special items and are non-GAAP measures. The Company is unable to reconcile certain forward-looking projections to GAAP as the nature or amount of net special items cannot be determined at this time. 2. The Company’s forecast is inclusive of the impact of all anticipated labor agreements. 3. Consumption of ~1,090 million gallons in 3Q 2023 and ~4,135 million gallons in 2023, based on July 14, 2023 forward fuel curve. 3Q 2023 FY 2023 Total capacity (ASMs) (vs. 2022) ~+5% to +7% ~+5% to +8% TRASM (vs. 2022) ~ - 4.5% to - 6.5% Up low single digits CASM-ex1, 2 (vs. 2022) ~+2% to +4% ~+2% to +4% Fuel ($/gallon)3 ~$2.55 to $2.65 ~$2.70 to $2.80 Adjusted operating margin1 ~8% to 10% ~8% to 10% Adjusted earnings per diluted share1 ~$0.85 to $0.95 ~$3.00 to $3.75

Visit our new Robert L. Crandall Campus website at aa.com/campus

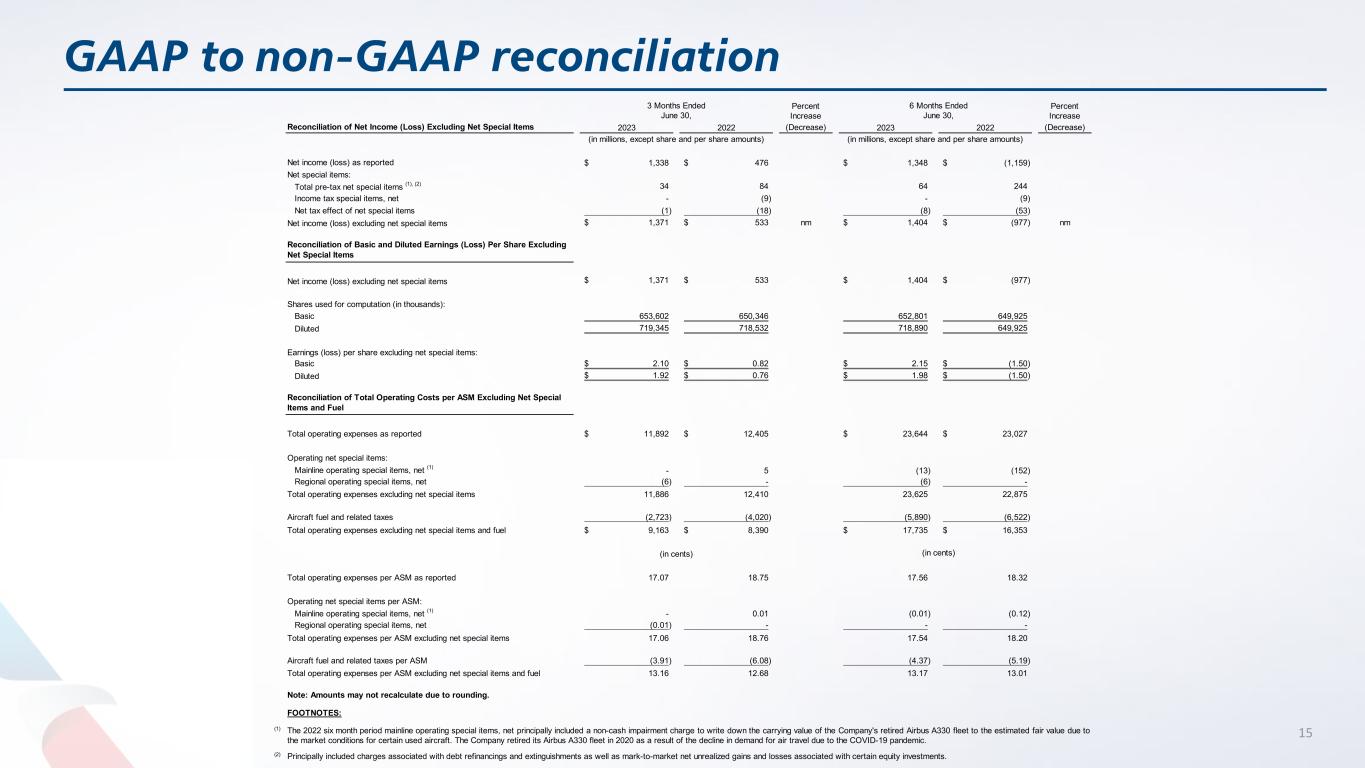

GAAP to non-GAAP reconciliation 13 Reconciliation of GAAP Financial Information to Non-GAAP Financial Information American Airlines Group Inc. (the Company) sometimes uses financial measures that are derived from the condensed consolidated financial statements but that are not presented in accordance with GAAP to understand and evaluate its current operating performance and to allow for period-to-period comparisons. The Company believes these non-GAAP financial measures may also provide useful information to investors and others. These non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. The Company is providing a reconciliation of reported non-GAAP financial measures to their comparable financial measures on a GAAP basis. The tables below present the reconciliations of the following GAAP measures to their non-GAAP measures: - Operating Income (Loss) (GAAP measure) to Operating Income (Loss) Excluding Net Special Items (non-GAAP measure) - Operating Margin (GAAP measure) to Operating Margin Excluding Net Special Items (non-GAAP measure) - Pre-Tax Income (Loss) (GAAP measure) to Pre-Tax Income (Loss) Excluding Net Special Items (non-GAAP measure) - Pre-Tax Margin (GAAP measure) to Pre-Tax Margin Excluding Net Special Items (non-GAAP measure) - Net Income (Loss) (GAAP measure) to Net Income (Loss) Excluding Net Special Items (non-GAAP measure) - Basic and Diluted Earnings (Loss) Per Share (GAAP measure) to Basic and Diluted Earnings (Loss) Per Share Excluding Net Special Items (non-GAAP measure) Management uses these non-GAAP financial measures to evaluate the Company's current operating performance and to allow for period-to-period comparisons. As net special items may vary from period-to-period in nature and amount, the adjustment to exclude net special items allows management an additional tool to understand the Company’s core operating performance. Additionally, the tables below present the reconciliations of total operating costs (GAAP measure) to total operating costs excluding net special items and fuel (non-GAAP measure) and total operating costs per ASM (CASM) to CASM excluding net special items and fuel. Management uses total operating costs excluding net special items and fuel and CASM excluding net special items and fuel to evaluate the Company's current operating performance and for period-to-period comparisons. The price of fuel, over which the Company has no control, impacts the comparability of period-to-period financial performance. The adjustment to exclude fuel and net special items allows management an additional tool to understand and analyze the Company’s non-fuel costs and core operating performance.

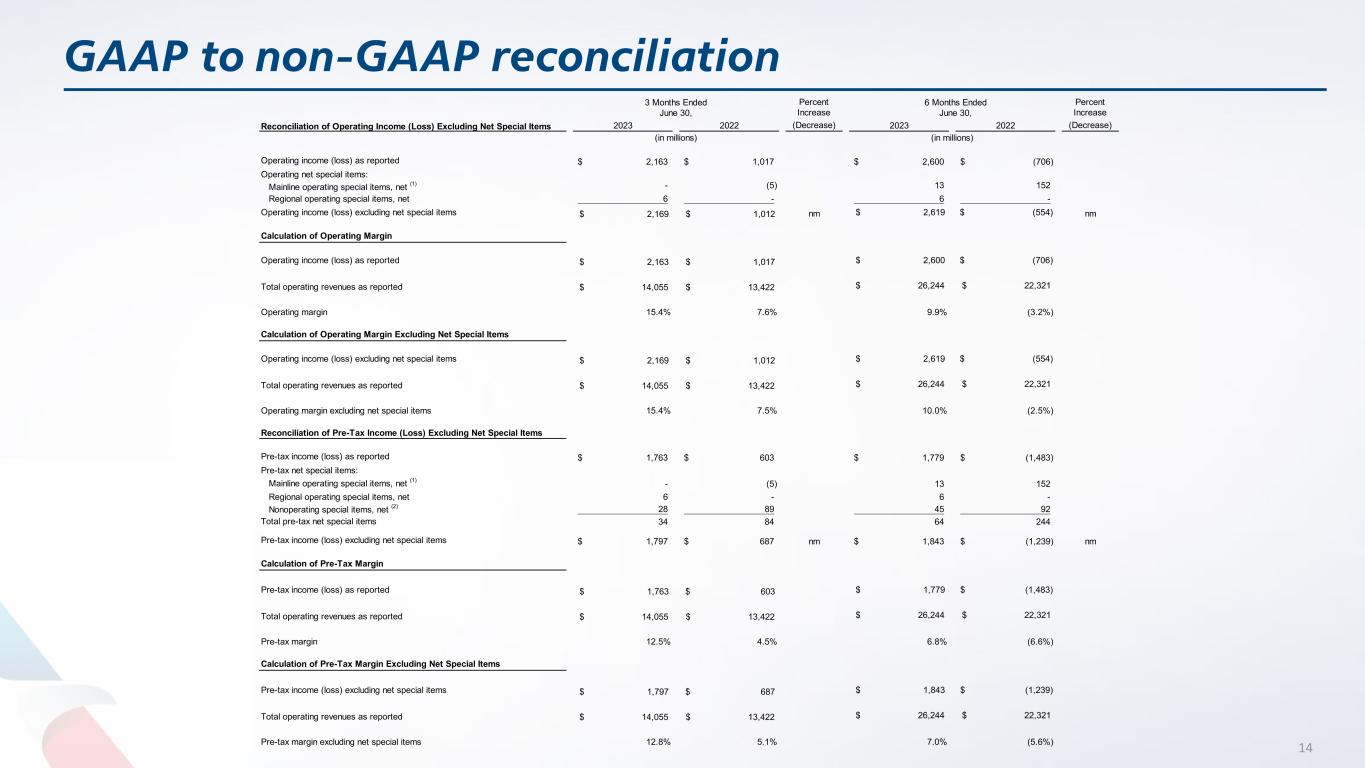

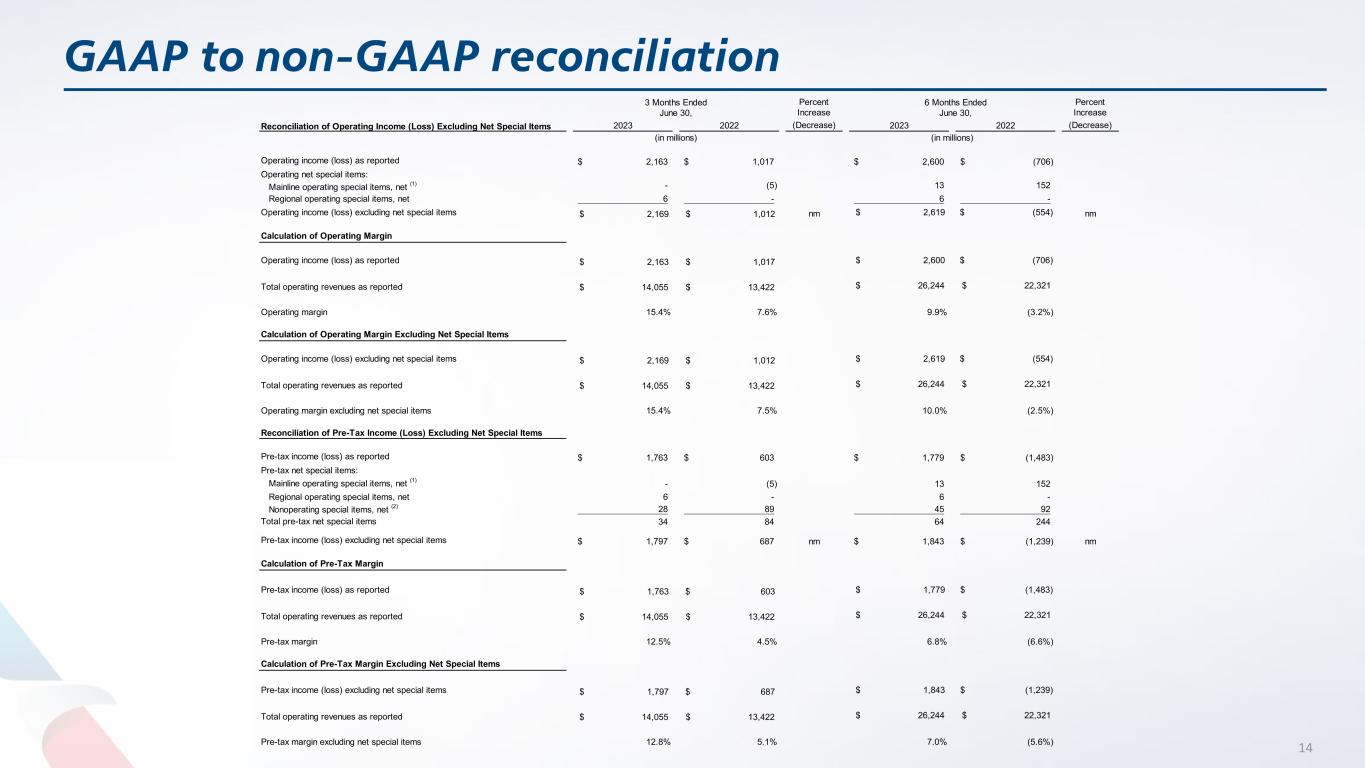

GAAP to non-GAAP reconciliation 14 Percent Increase Percent Increase 2023 2022 (Decrease) 2023 2022 (Decrease) Operating income (loss) as reported 2,163$ 1,017$ 2,600$ (706)$ Operating net special items: Mainline operating special items, net (1) - (5) 13 152 Regional operating special items, net 6 - 6 - Operating income (loss) excluding net special items $ 2,169 $ 1,012 nm $ 2,619 $ (554) nm Calculation of Operating Margin Operating income (loss) as reported $ 2,163 $ 1,017 $ 2,600 $ (706) Total operating revenues as reported $ 14,055 $ 13,422 $ 26,244 $ 22,321 Operating margin 15.4% 7.6% 9.9% (3.2%) Calculation of Operating Margin Excluding Net Special Items Operating income (loss) excluding net special items $ 2,169 $ 1,012 $ 2,619 $ (554) Total operating revenues as reported $ 14,055 $ 13,422 $ 26,244 $ 22,321 Operating margin excluding net special items 15.4% 7.5% 10.0% (2.5%) Reconciliation of Pre-Tax Income (Loss) Excluding Net Special Items Pre-tax income (loss) as reported 1,763$ 603$ 1,779$ (1,483)$ Pre-tax net special items: Mainline operating special items, net (1) - (5) 13 152 Regional operating special items, net 6 - 6 - Nonoperating special items, net (2) 28 89 45 92 Total pre-tax net special items 34 84 64 244 Pre-tax income (loss) excluding net special items 1,797$ 687$ nm 1,843$ (1,239)$ nm Calculation of Pre-Tax Margin Pre-tax income (loss) as reported $ 1,763 $ 603 $ 1,779 $ (1,483) Total operating revenues as reported $ 14,055 $ 13,422 $ 26,244 $ 22,321 Pre-tax margin 12.5% 4.5% 6.8% (6.6%) Calculation of Pre-Tax Margin Excluding Net Special Items Pre-tax income (loss) excluding net special items $ 1,797 $ 687 $ 1,843 $ (1,239) Total operating revenues as reported $ 14,055 $ 13,422 $ 26,244 $ 22,321 Pre-tax margin excluding net special items 12.8% 5.1% 7.0% (5.6%) 3 Months Ended June 30, Reconciliation of Operating Income (Loss) Excluding Net Special Items (in millions) (in millions) 6 Months Ended June 30,

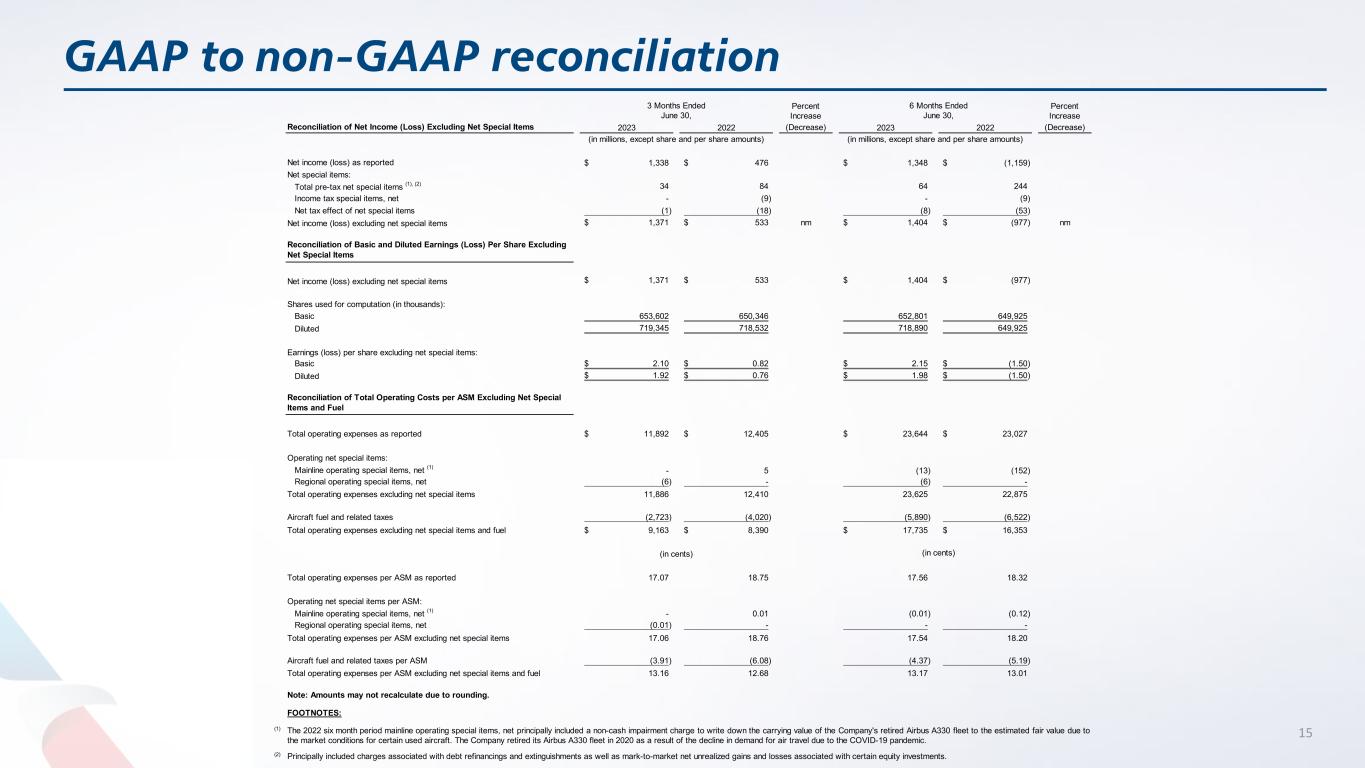

GAAP to non-GAAP reconciliation 15 Percent Increase Percent Increase Reconciliation of Net Income (Loss) Excluding Net Special Items 2023 2022 (Decrease) 2023 2022 (Decrease) Net income (loss) as reported 1,338$ 476$ 1,348$ (1,159)$ Net special items: Total pre-tax net special items (1), (2) 34 84 64 244 Income tax special items, net - (9) - (9) Net tax effect of net special items (1) (18) (8) (53) Net income (loss) excluding net special items 1,371$ 533$ nm 1,404$ (977)$ nm Reconciliation of Basic and Diluted Earnings (Loss) Per Share Excluding Net Special Items Net income (loss) excluding net special items 1,371$ 533$ 1,404$ (977)$ Shares used for computation (in thousands): Basic 653,602 650,346 652,801 649,925 Diluted 719,345 718,532 718,890 649,925 Earnings (loss) per share excluding net special items: Basic 2.10$ 0.82$ 2.15$ (1.50)$ Diluted 1.92$ 0.76$ 1.98$ (1.50)$ Reconciliation of Total Operating Costs per ASM Excluding Net Special Items and Fuel Total operating expenses as reported 11,892$ 12,405$ 23,644$ 23,027$ Operating net special items: Mainline operating special items, net (1) - 5 (13) (152) Regional operating special items, net (6) - (6) - Total operating expenses excluding net special items 11,886 12,410 23,625 22,875 Aircraft fuel and related taxes (2,723) (4,020) (5,890) (6,522) Total operating expenses excluding net special items and fuel 9,163$ 8,390$ 17,735$ 16,353$ Total operating expenses per ASM as reported 17.07 18.75 17.56 18.32 Operating net special items per ASM: Mainline operating special items, net (1) - 0.01 (0.01) (0.12) Regional operating special items, net (0.01) - - - Total operating expenses per ASM excluding net special items 17.06 18.76 17.54 18.20 Aircraft fuel and related taxes per ASM (3.91) (6.08) (4.37) (5.19) Total operating expenses per ASM excluding net special items and fuel 13.16 12.68 13.17 13.01 Note: Amounts may not recalculate due to rounding. FOOTNOTES: (1) (2) 3 Months Ended June 30, 6 Months Ended June 30, Principally included charges associated with debt refinancings and extinguishments as well as mark-to-market net unrealized gains and losses associated with certain equity investments. (in cents) The 2022 six month period mainline operating special items, net principally included a non-cash impairment charge to write down the carrying value of the Company's retired Airbus A330 fleet to the estimated fair value due to the market conditions for certain used aircraft. The Company retired its Airbus A330 fleet in 2020 as a result of the decline in demand for air travel due to the COVID-19 pandemic. (in cents) (in millions, except share and per share amounts) (in millions, except share and per share amounts)

Free Cash Flow reconciliation 16 (in millions) 5,096$ (833) 4,263$ (1) (3,745)$ 2,931 (19) (833)$ Net cash provided by operating activities 6 Months Ended June 30, 2023 Free cash flow Adjusted net cash used in investing activities (1) The Company's free cash flow summary is presented in the table below, which is a non-GAAP measure that management believes is useful information to investors and others in evaluating the Company's ability to generate cash from its core operating performance that is available for use to reinvest in the business or to reduce debt. The Company defines free cash flows as net cash provided by operating activities less net cash used in investing activities, adjusted for (1) net purchases of short-term investments and (2) change in restricted cash. We believe that calculating free cash flow as adjusted for these items is more useful for investors because short-term investment activity and restricted cash are not representative of activity core to our operations. This non-GAAP measure may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. Our calculation of free cash flow is not intended, and should not be used, to measure the residual cash flow available for discretionary expenditures because, among other things, it excludes mandatory debt service requirements and certain other non-discretionary expenditures. Adjusted net cash used in investing activities The following table provides a reconciliation of adjusted net cash used in investing activities for the six months ended June 30, 2023 (in millions): Net cash used in investing activities Adjustments: Net purchases of short-term investments Increase in restricted cash

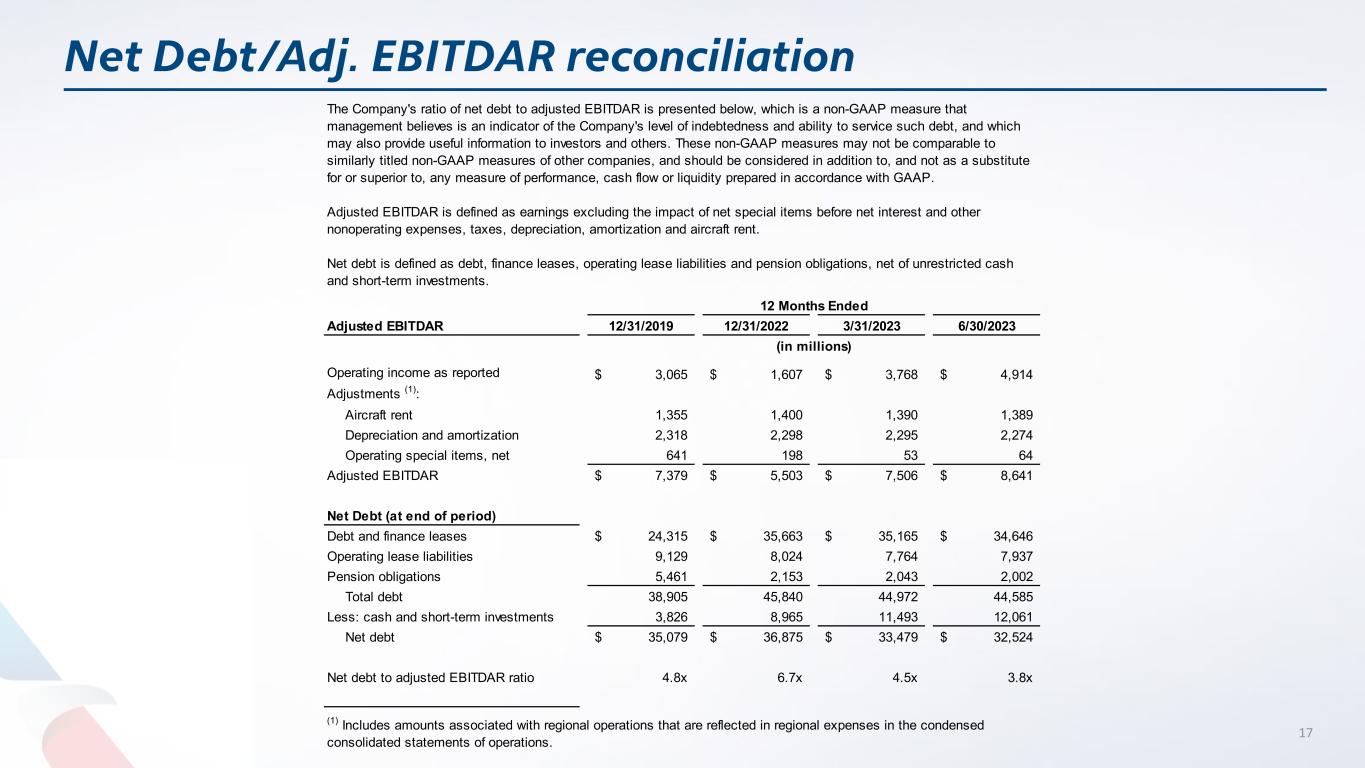

Net Debt/Adj. EBITDAR reconciliation 17 Adjusted EBITDAR 12/31/2019 12/31/2022 3/31/2023 6/30/2023 Operating income as reported 3,065$ 1,607$ 3,768$ 4,914$ Adjustments (1): Aircraft rent 1,355 1,400 1,390 1,389 Depreciation and amortization 2,318 2,298 2,295 2,274 Operating special items, net 641 198 53 64 Adjusted EBITDAR 7,379$ 5,503$ 7,506$ 8,641$ Net Debt (at end of period) Debt and finance leases 24,315$ 35,663$ 35,165$ 34,646$ Operating lease liabilities 9,129 8,024 7,764 7,937 Pension obligations 5,461 2,153 2,043 2,002 Total debt 38,905 45,840 44,972 44,585 Less: cash and short-term investments 3,826 8,965 11,493 12,061 Net debt 35,079$ 36,875$ 33,479$ 32,524$ Net debt to adjusted EBITDAR ratio 4.8x 6.7x 4.5x 3.8x 12 Months Ended The Company's ratio of net debt to adjusted EBITDAR is presented below, which is a non-GAAP measure that management believes is an indicator of the Company's level of indebtedness and ability to service such debt, and which may also provide useful information to investors and others. These non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. Adjusted EBITDAR is defined as earnings excluding the impact of net special items before net interest and other nonoperating expenses, taxes, depreciation, amortization and aircraft rent. Net debt is defined as debt, finance leases, operating lease liabilities and pension obligations, net of unrestricted cash and short-term investments. (1) Includes amounts associated with regional operations that are reflected in regional expenses in the condensed consolidated statements of operations. (in millions)

18