American Airlines Group Inc. Bank of America Merrill Lynch 2018 Transportation Conference Derek Kerr Chief Financial Officer Exhibit 99.1

Cautionary Statement Regarding Forward-Looking Statements and Information This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about future financial and operating results, the Company’s plans, objectives, estimates, expectations, and intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the Company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2018 (especially in Part I, Item 2 Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A Risk Factors) and in the Company’s other filings with the Securities and Exchange Commission (“SEC”), and other risks and uncertainties listed from time to time in the Company’s other filings with the SEC. There may be other factors of which the Company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statements.

Current Overview We are making significant investments in our team and product, and those investments are working Continued operational improvement Fleet and network transformation Product enhancements Revenue and cost initiatives American is playing the long game – we will continue to be innovative and invest in our product and people while ensuring the long-term financial strength of our company

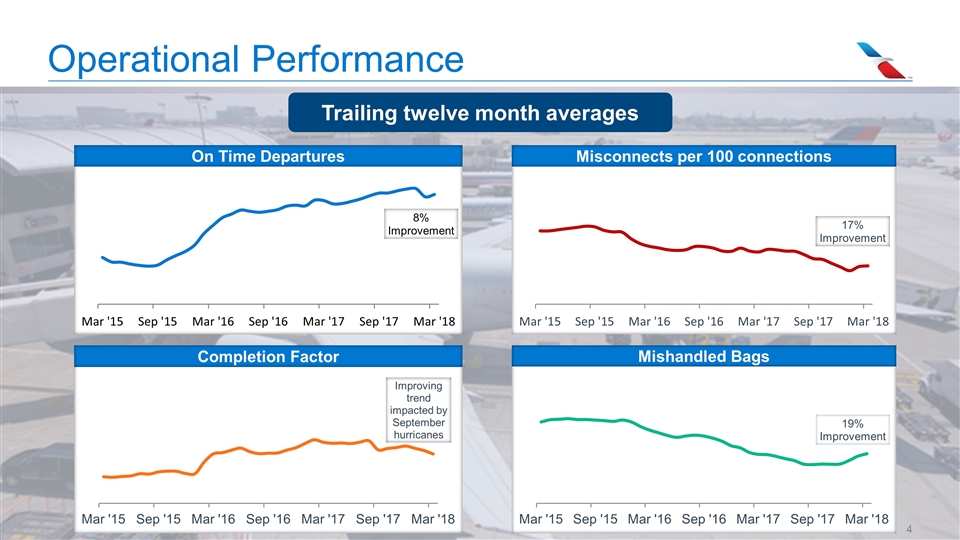

Operational Performance Trailing twelve month averages

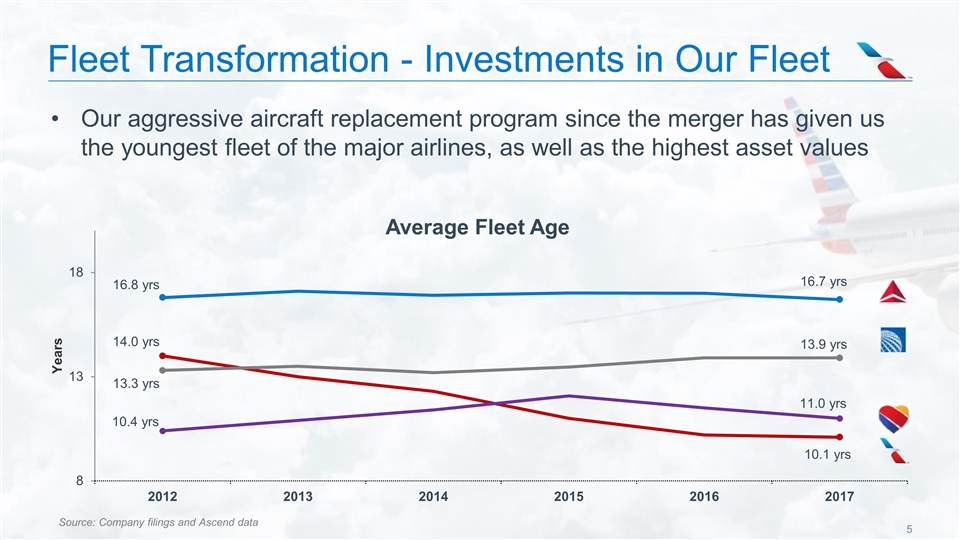

Fleet Transformation - Investments in Our Fleet Our aggressive aircraft replacement program since the merger has given us the youngest fleet of the major airlines, as well as the highest asset values Source: Company filings and Ascend data

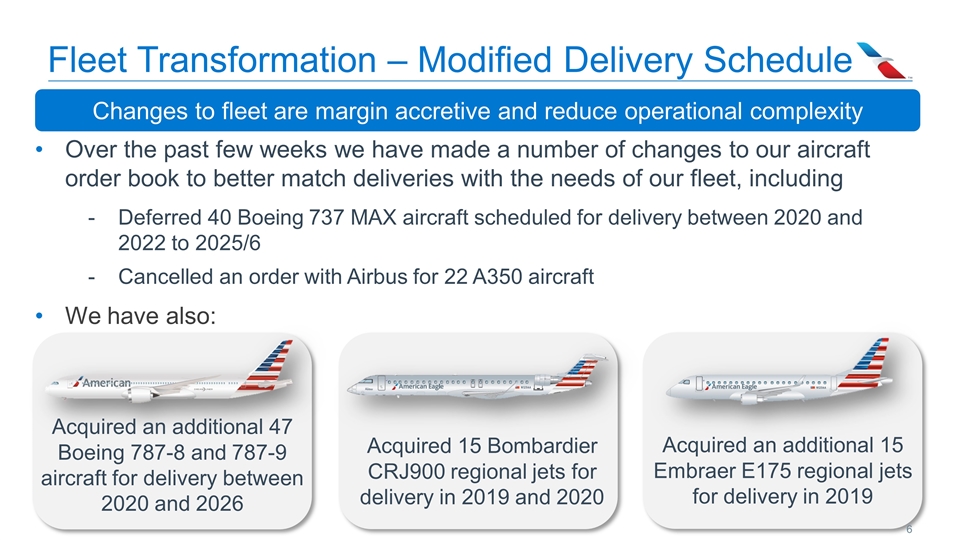

Fleet Transformation – Modified Delivery Schedule Over the past few weeks we have made a number of changes to our aircraft order book to better match deliveries with the needs of our fleet, including Deferred 40 Boeing 737 MAX aircraft scheduled for delivery between 2020 and 2022 to 2025/6 Cancelled an order with Airbus for 22 A350 aircraft We have also: Acquired an additional 15 Embraer E175 regional jets for delivery in 2019 Acquired 15 Bombardier CRJ900 regional jets for delivery in 2019 and 2020 Acquired an additional 47 Boeing 787-8 and 787-9 aircraft for delivery between 2020 and 2026 Changes to fleet are margin accretive and reduce operational complexity

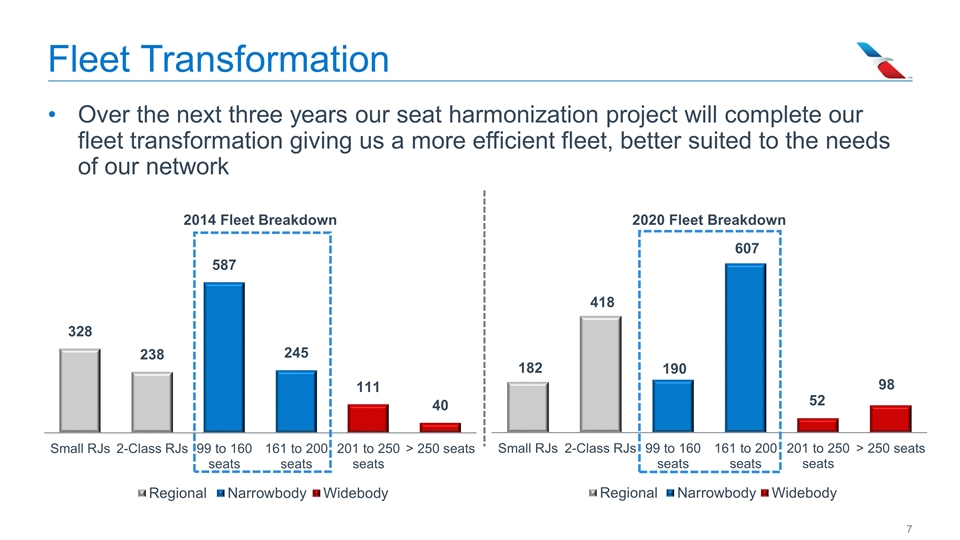

Fleet Transformation Over the next three years our seat harmonization project will complete our fleet transformation giving us a more efficient fleet, better suited to the needs of our network

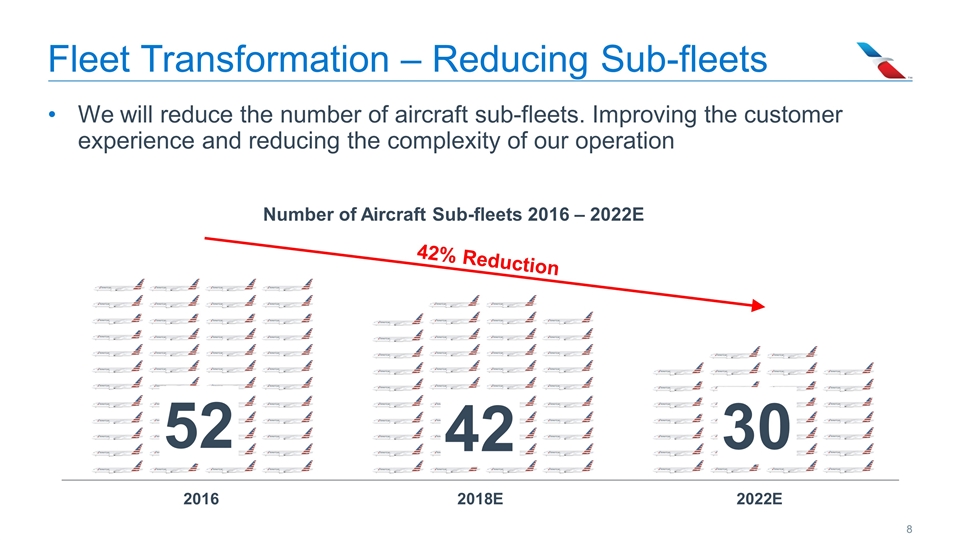

Fleet Transformation – Reducing Sub-fleets We will reduce the number of aircraft sub-fleets. Improving the customer experience and reducing the complexity of our operation 42% Reduction

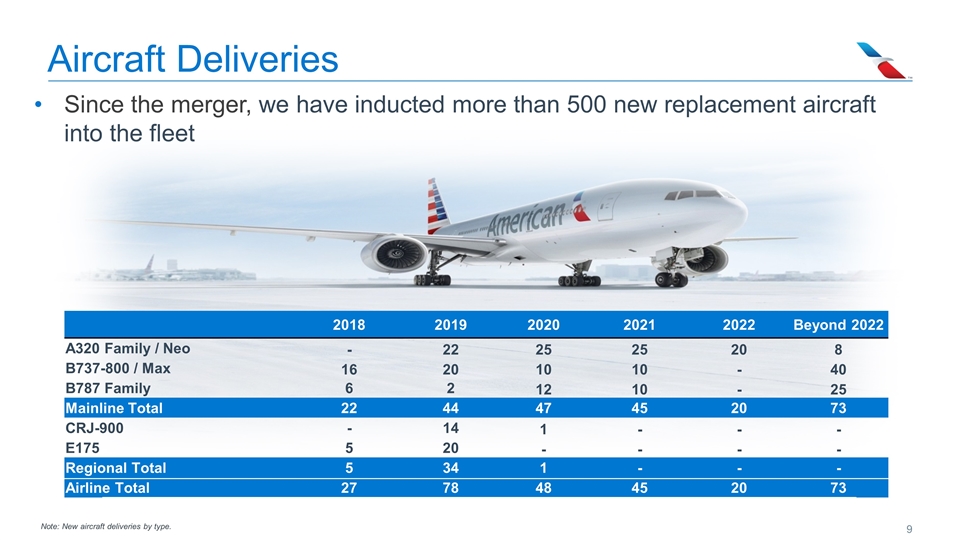

Aircraft Deliveries Since the merger, we have inducted more than 500 new replacement aircraft into the fleet Note: New aircraft deliveries by type. 2018 2019 2020 2021 2022 Beyond 2022 A320 Family / Neo - 22 25 25 20 8 B737-800 / Max 16 20 10 10 - 40 B787 Family 6 2 12 10 - 25 Mainline Total 22 44 47 45 20 73 CRJ-900 - 14 1 - - - E175 5 20 - - - - Regional Total 5 34 1 - - - Airline Total 27 78 48 45 20 73

Network Transformation - Growth at Our Hubs More flights at our highest margin hubs drives future earnings growth Access to new gates at terminal E in DFW airport will allow American to add up to 100 more flights a day Construction at Charlotte will allow American to add up to 75 additional daily departures As a result of this growth, total departures at American’s two largest, and most profitable, hubs will be higher than at any other carrier’s two largest hubs

Product Enhancements - Widebody Retrofits All Lie-flat Widebodies Premium Economy Retrofits

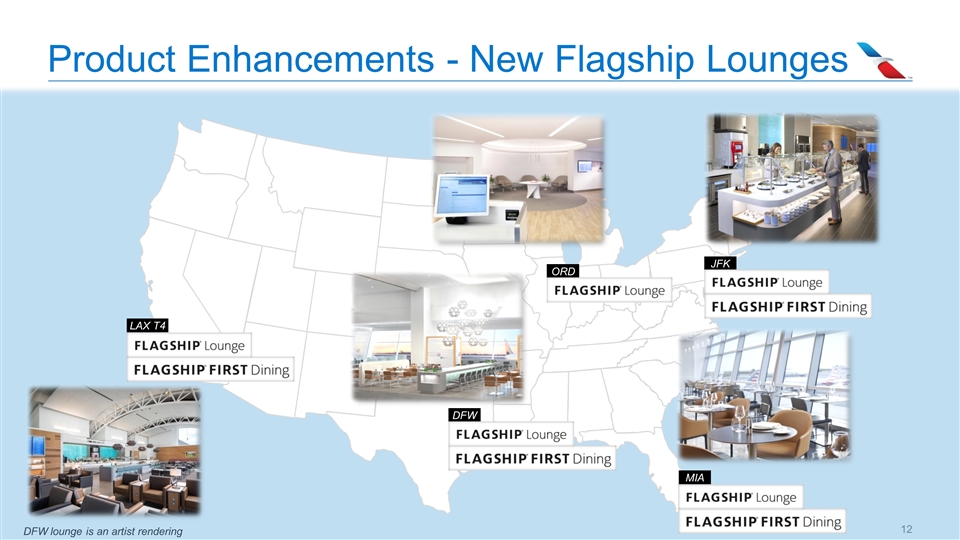

Product Enhancements - New Flagship Lounges ORD DFW lounge is an artist rendering JFK MIA DFW LAX T4

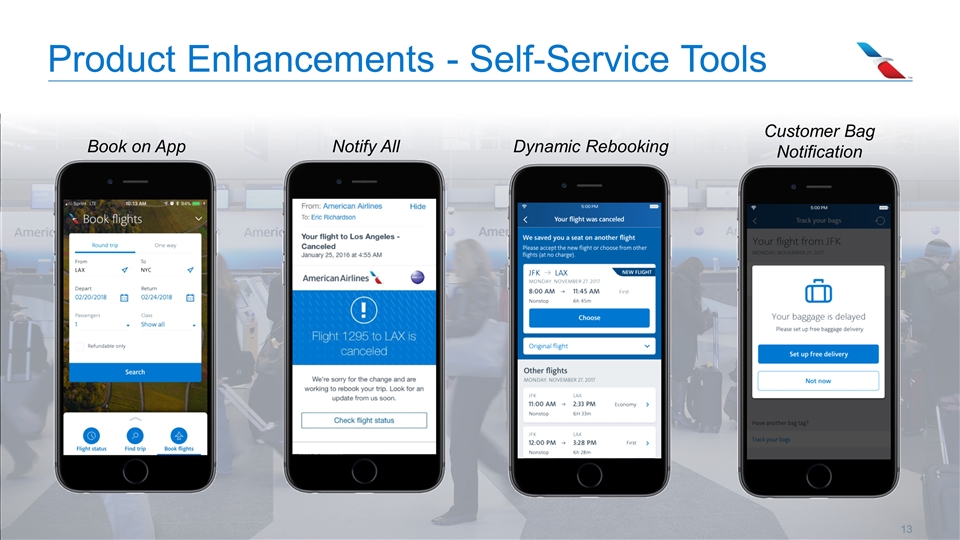

Product Enhancements - Self-Service Tools Notify All Customer Bag Notification Dynamic Rebooking Book on App

Product Enhancements - Commercial Initiatives Value Based AAdvantage Program Increased Focus on Sales Enhanced Revenue Management Tools

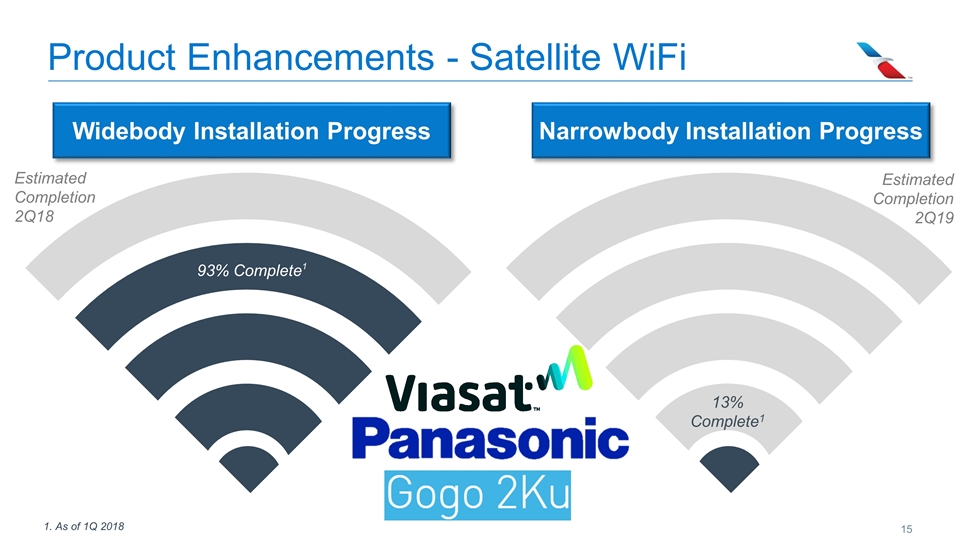

Product Enhancements - Satellite WiFi 93% Complete1 13% Complete1 Widebody Installation Progress Narrowbody Installation Progress Estimated Completion 2Q18 Estimated Completion 2Q19 1. As of 1Q 2018

2017 Investor Day Initiatives Remain On Track At our investor day in September, we outlined $2.9 billion in revenue and $1.0 billion in cost opportunities by 2021 We estimated that $1.35 billion of these would be achieved from revenue initiatives in 2018 and these remain on track Major revenue initiatives for 2018 include the rollout of basic and premium economy and revenue management changes We also guided to $200 million in cost reductions in 2018. We now believe that we will achieve $250 million by year-end We continue to expect to benefit from initiatives worth $3.9 billion by 2021

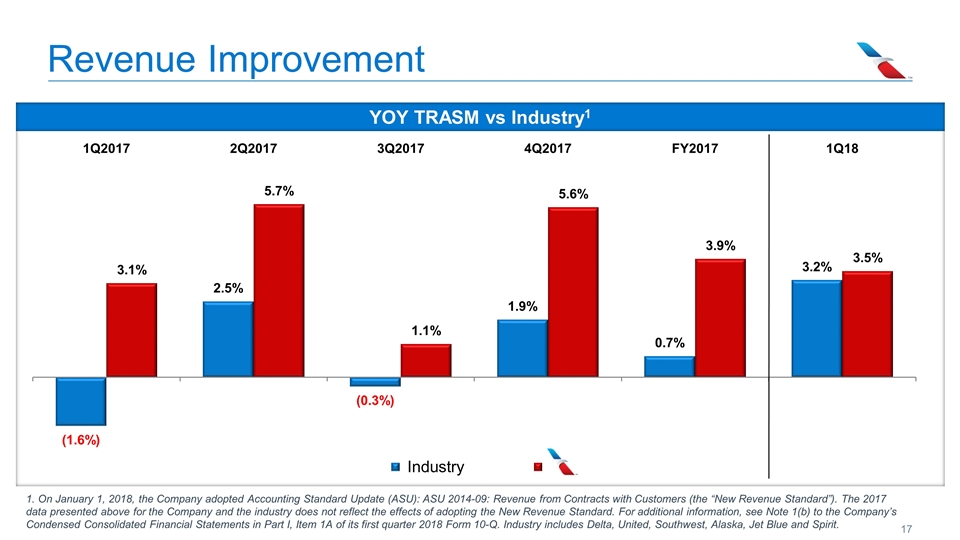

Revenue Improvement 1. On January 1, 2018, the Company adopted Accounting Standard Update (ASU): ASU 2014-09: Revenue from Contracts with Customers (the “New Revenue Standard”). The 2017 data presented above for the Company and the industry does not reflect the effects of adopting the New Revenue Standard. For additional information, see Note 1(b) to the Company’s Condensed Consolidated Financial Statements in Part I, Item 1A of its first quarter 2018 Form 10-Q. Industry includes Delta, United, Southwest, Alaska, Jet Blue and Spirit.

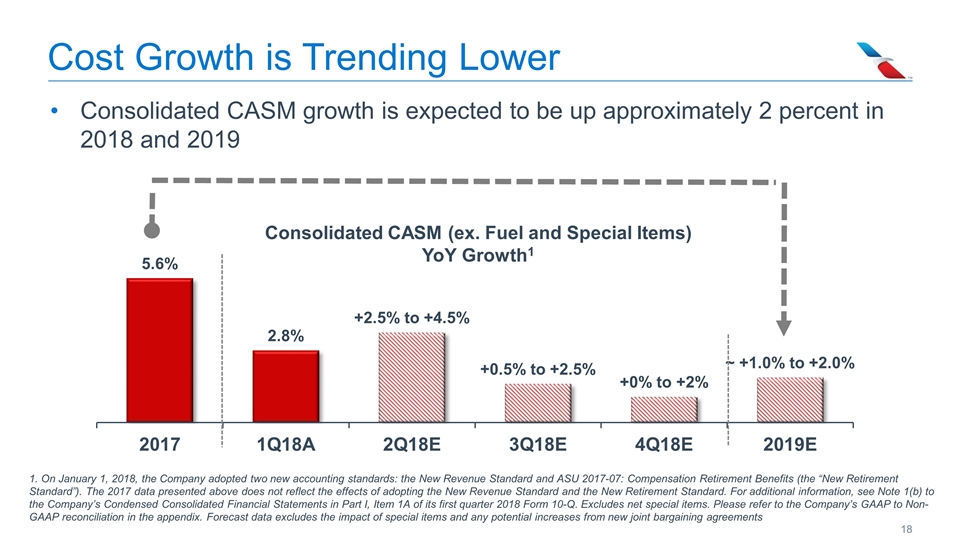

Consolidated CASM growth is expected to be up approximately 2 percent in 2018 and 2019 Cost Growth is Trending Lower 1. On January 1, 2018, the Company adopted two new accounting standards: the New Revenue Standard and ASU 2017-07: Compensation Retirement Benefits (the “New Retirement Standard”). The 2017 data presented above does not reflect the effects of adopting the New Revenue Standard and the New Retirement Standard. For additional information, see Note 1(b) to the Company’s Condensed Consolidated Financial Statements in Part I, Item 1A of its first quarter 2018 Form 10-Q. Excludes net special items. Please refer to the Company’s GAAP to Non-GAAP reconciliation in the appendix. Forecast data excludes the impact of special items and any potential increases from new joint bargaining agreements

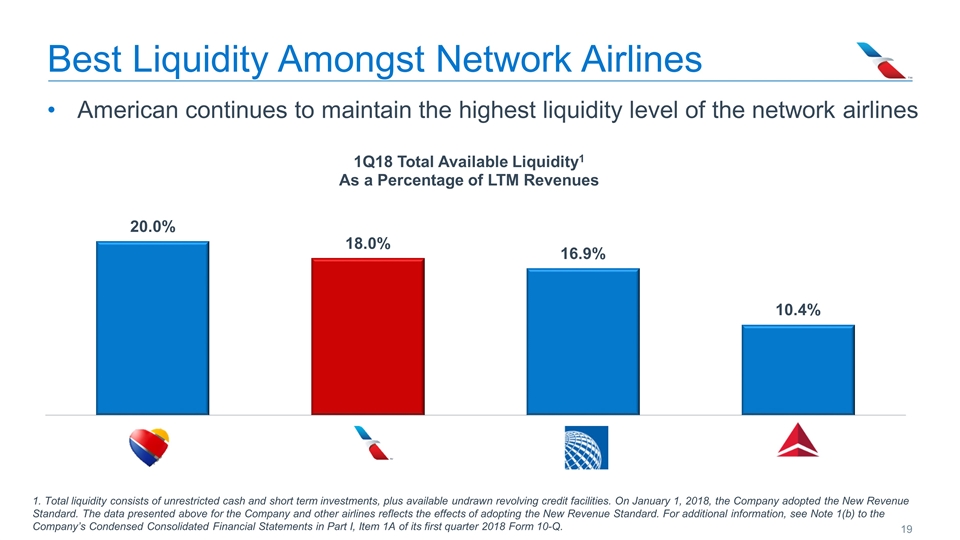

Best Liquidity Amongst Network Airlines American continues to maintain the highest liquidity level of the network airlines 1. Total liquidity consists of unrestricted cash and short term investments, plus available undrawn revolving credit facilities. On January 1, 2018, the Company adopted the New Revenue Standard. The data presented above for the Company and other airlines reflects the effects of adopting the New Revenue Standard. For additional information, see Note 1(b) to the Company’s Condensed Consolidated Financial Statements in Part I, Item 1A of its first quarter 2018 Form 10-Q.

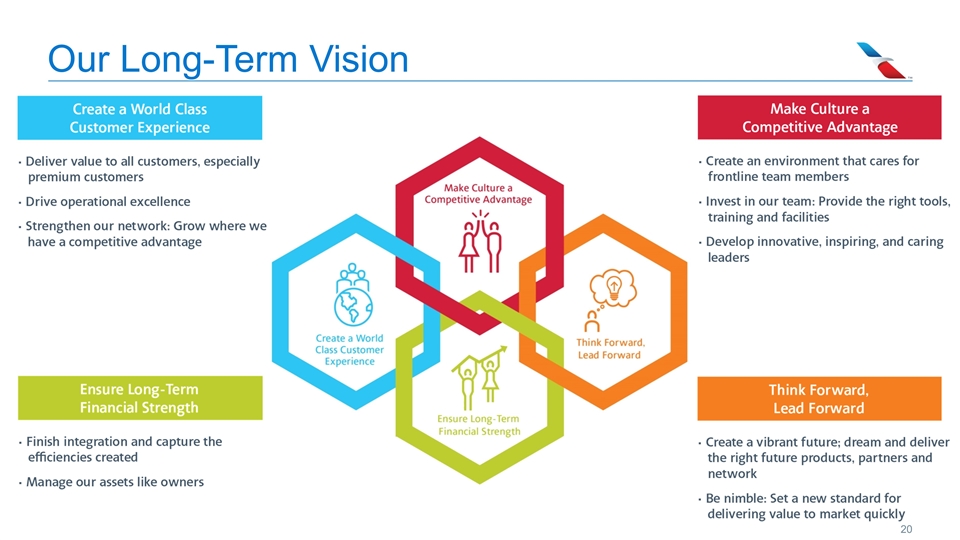

Our Long-Term Vision

Create a World-Class Customer Experience Filed an application along with Qantas seeking approval to form a new joint business between North America, Australia and New Zealand Re-branded LGA-ORD as part of our Shuttle portfolio Expanded Basic Economy to certain trans-Atlantic routes, including DFW-LHR Introduced new, improved meals on Pacific flights Continued progress on renovating existing clubs and launching new clubs across the system

Make Culture a Competitive Advantage Brought 7,000 leaders from around the company to Dallas for the Annual Leadership Conference Honored 103 team-members at the Annual Chairman’s Award celebration Completed the transition to a new HR/People system allowing seamless integration of all HR-related matters; completed first phase of transition to new payroll system

Ensure Long-Term Financial Strength Returned $498 million to shareholders through share repurchases and dividends in the quarter Announced an order for 47 new Boeing 787s, which will replace B767s, A330-300s and some older B777-200s Deferred 40 B737 MAX aircraft and 3 A321neos to better align narrowbody deliveries with retirements Announced an order for 15 E175 aircraft and 15 CRJ900 aircraft for delivery in 2019 and 2020 Announced new $2.0 billion share repurchase authorization to be completed by December 31, 2020 Lowered the margin and extended term loan secured by South American slots, gates and routes

Think Forward, Lead Forward Reached an agreement with the City of Chicago to speed the construction of three common use gates at ORD that will allow American to begin to close the competitive gate gap at that airport Completed all customer renovations at DFW Terminal B Opened five new gates at ORD Terminal 3, permitting American to provide improved service to its customers at this key competitive hub

Looking Forward The investments we have made are paying off… Six consecutive quarters of positive unit revenue growth, record first quarter revenue Youngest fleet of the big four airlines Transformed customer experience product Successful roll out of Basic and Premium Economy, with more to come AAL well positioned within industry We will continue our aggressive pursuit of revenue and cost initiatives Revenue gap expected to continue to close due to product, network, fleet and operational improvements We will continue to play the long game and invest for the future

GAAP to Non-GAAP Reconciliations

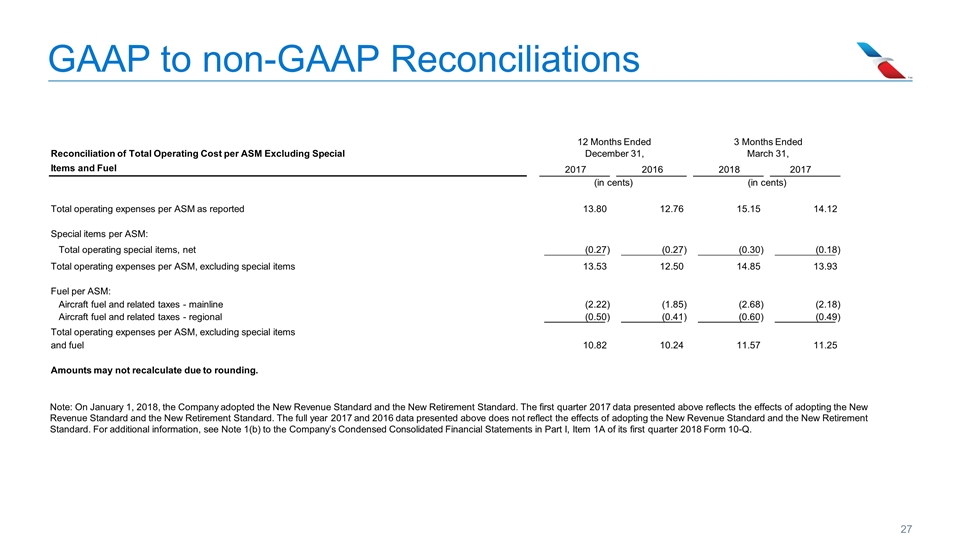

GAAP to non-GAAP Reconciliations Reconciliation of Total Operating Cost per ASM Excluding Special Items and Fuel 2017 2016 2018 2017 Total operating expenses per ASM as reported 13.80 12.76 15.15 14.12 Special items per ASM: Total operating special items, net (0.27) (0.27) (0.30) (0.18) Total operating expenses per ASM, excluding special items 13.53 12.50 14.85 13.93 Fuel per ASM: Aircraft fuel and related taxes - mainline (2.22) (1.85) (2.68) (2.18) Aircraft fuel and related taxes - regional (0.50) (0.41) (0.60) (0.49) Total operating expenses per ASM, excluding special items and fuel 10.82 10.24 11.57 11.25 Amounts may not recalculate due to rounding. 12 Months Ended December 31, (in cents) (in cents) 3 Months Ended March 31, Note: On January 1, 2018, the Company adopted the New Revenue Standard and the New Retirement Standard. The first quarter 2017 data presented above reflects the effects of adopting the New Revenue Standard and the New Retirement Standard. The full year 2017 and 2016 data presented above does not reflect the effects of adopting the New Revenue Standard and the New Retirement Standard. For additional information, see Note 1(b) to the Company’s Condensed Consolidated Financial Statements in Part I, Item 1A of its first quarter 2018 Form 10-Q.