American Airlines Group Inc. 2018 Cowen Global Transportation Conference Robert Isom President September 5, 2018 EXHIBIT 99.1

Cautionary Statement Regarding Forward-Looking Statements and Information This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about future financial and operating results, the Company’s plans, objectives, estimates, expectations, and intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the Company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2018 (especially in Part I, Item 2 Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A Risk Factors) and in the Company’s other filings with the Securities and Exchange Commission (“SEC”), and other risks and uncertainties listed from time to time in the Company’s other filings with the SEC. There may be other factors of which the Company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statements.

Overview Integration successful and continuing; well positioned to execute on transformative initiatives: Fleet changes to reduce complexity and enable efficient, low-cost growth Network optimization adds margin-accretive flying at our most profitable hubs Product improvements to ensure industry-leading travel experience while remaining competitive and growing revenue Innovation and investments in product and people are designed to create long-term margin expansion

Achieved a single operating certificate on schedule Combined frequent flier programs and merged reservation systems with zero customer impact Opened state-of-the-art combined integrated operations center Re-banked DFW, MIA and ORD hubs Signed JCBAs with six unionized groups Adjusted compensation for all team members with average salary increases of 41% Merged over 1,300 IT systems Co-located operations at more than 140 airports Moved all pilots and aircraft onto a single operating platform Transformational Change - Integration Five years post-merger…

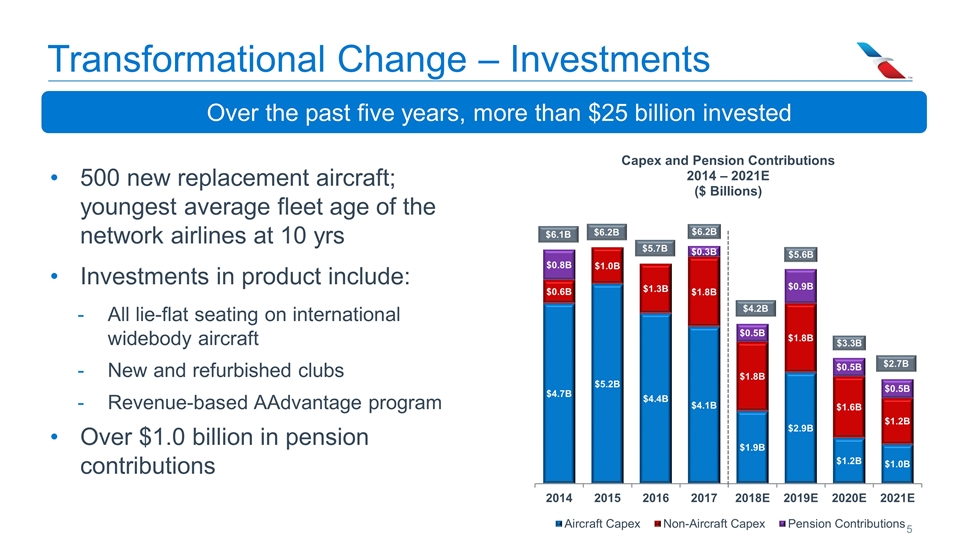

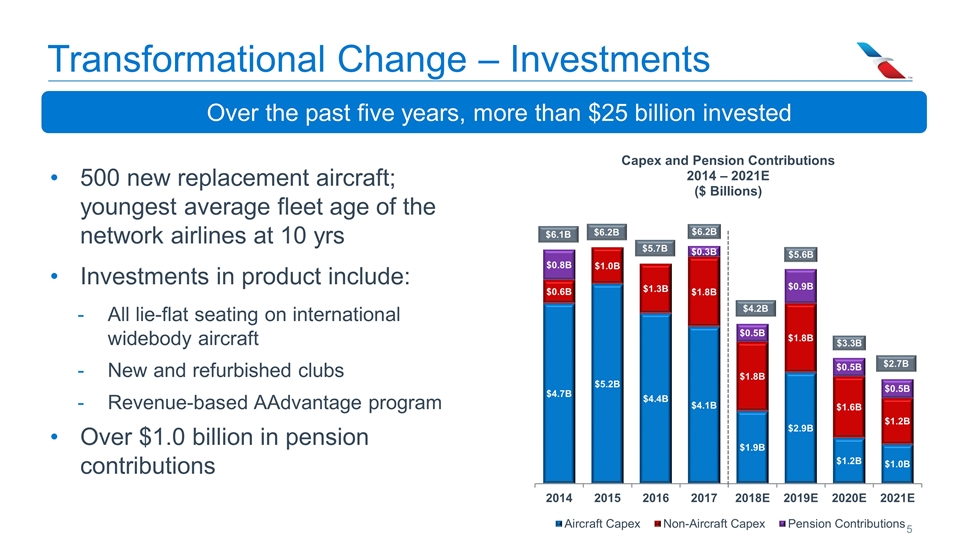

500 new replacement aircraft; youngest average fleet age of the network airlines at 10 yrs Investments in product include: All lie-flat seating on international widebody aircraft New and refurbished clubs Revenue-based AAdvantage program Over $1.0 billion in pension contributions Transformational Change – Investments Over the past five years, more than $25 billion invested

Fleet Transformation – Optimized Fleet Mix Aircraft order book now better matches deliveries with fleet needs Deferred 40 Boeing 737 MAX aircraft and 22 A321neo aircraft Cancelled order with Airbus for 22 A350 aircraft Other actions: Acquired an additional 15 Embraer E175 regional jets for delivery in 2019 Acquired 15 Bombardier CRJ900 regional jets for delivery in 2019 and 2020 Acquired an additional 47 Boeing 787-8 and 787-9 aircraft for delivery between 2020 and 2026 Changes to fleet improve revenue and reduce operational complexity

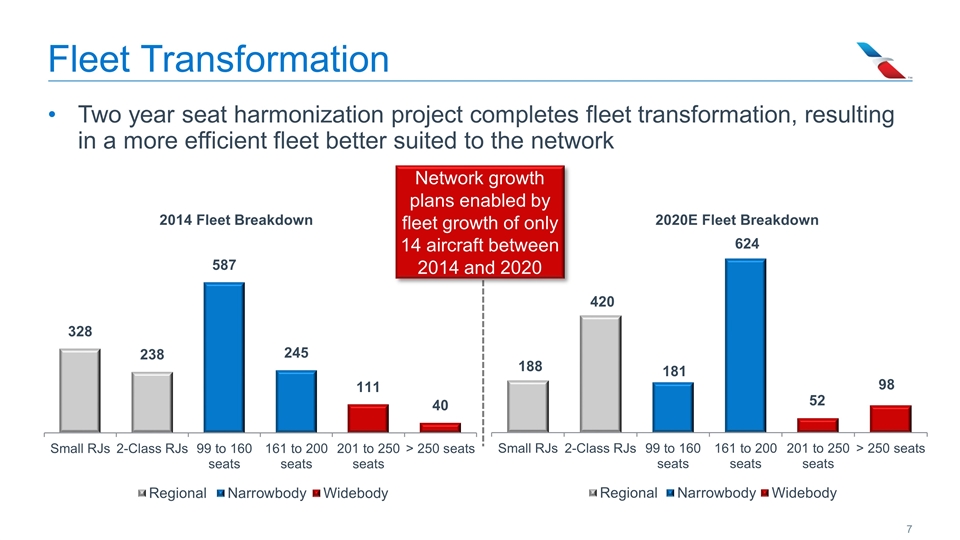

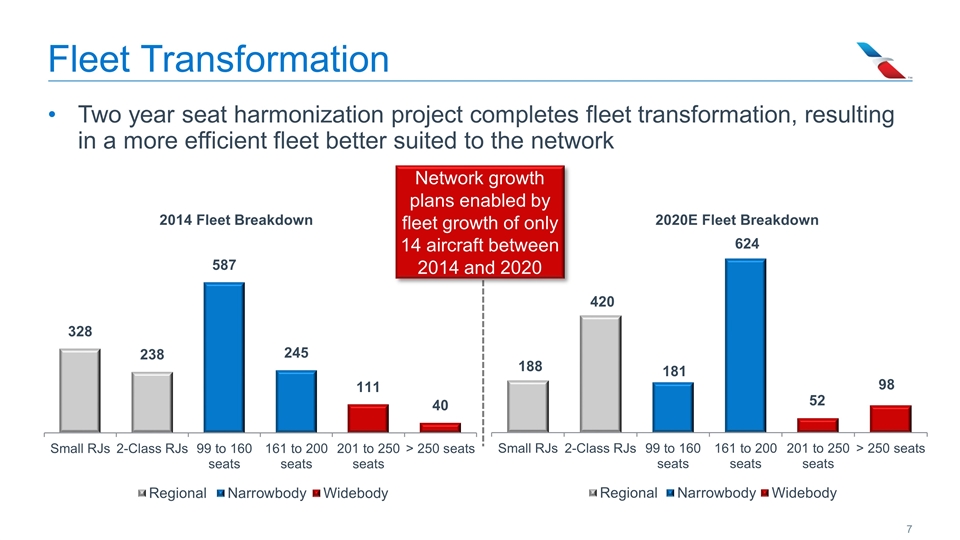

Fleet Transformation Network growth plans enabled by fleet growth of only 14 aircraft between 2014 and 2020 Two year seat harmonization project completes fleet transformation, resulting in a more efficient fleet better suited to the network

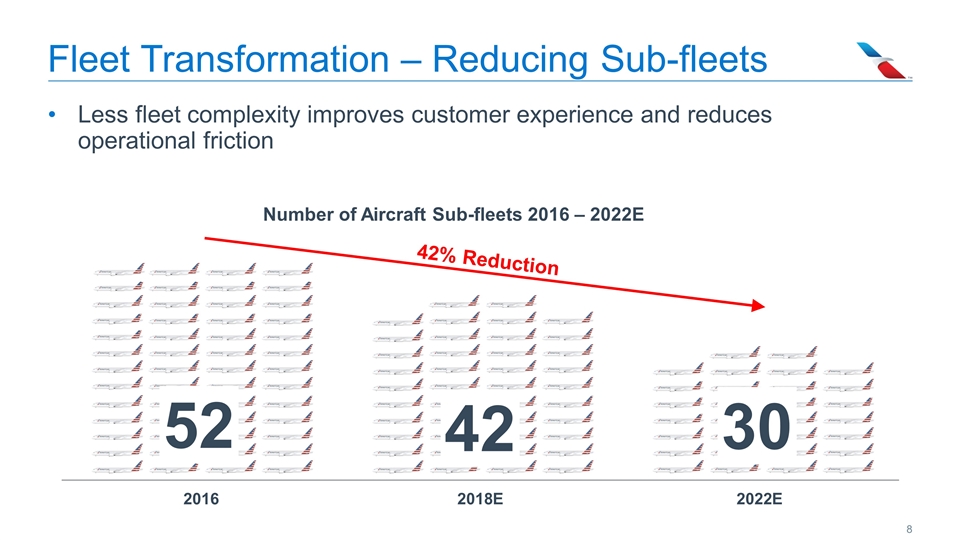

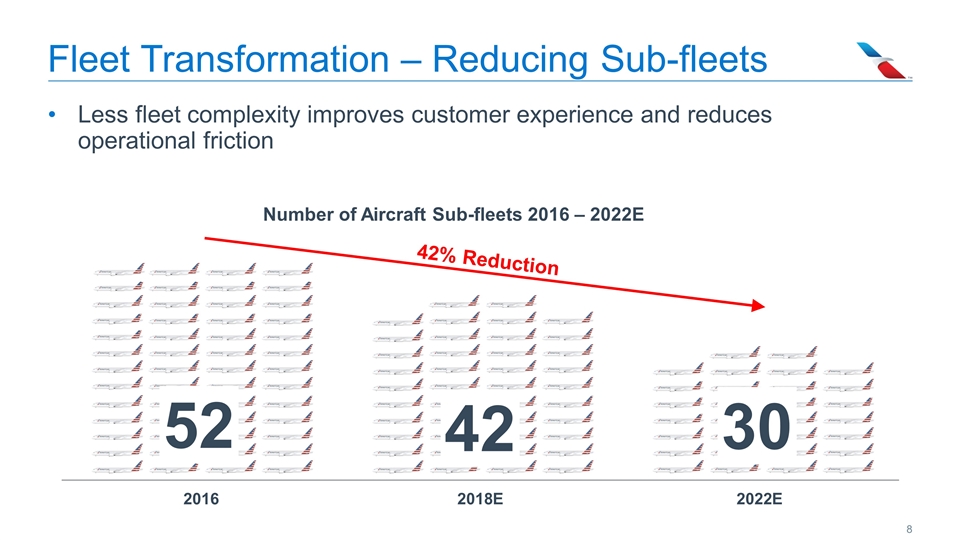

Fleet Transformation – Reducing Sub-fleets Less fleet complexity improves customer experience and reduces operational friction 42% Reduction

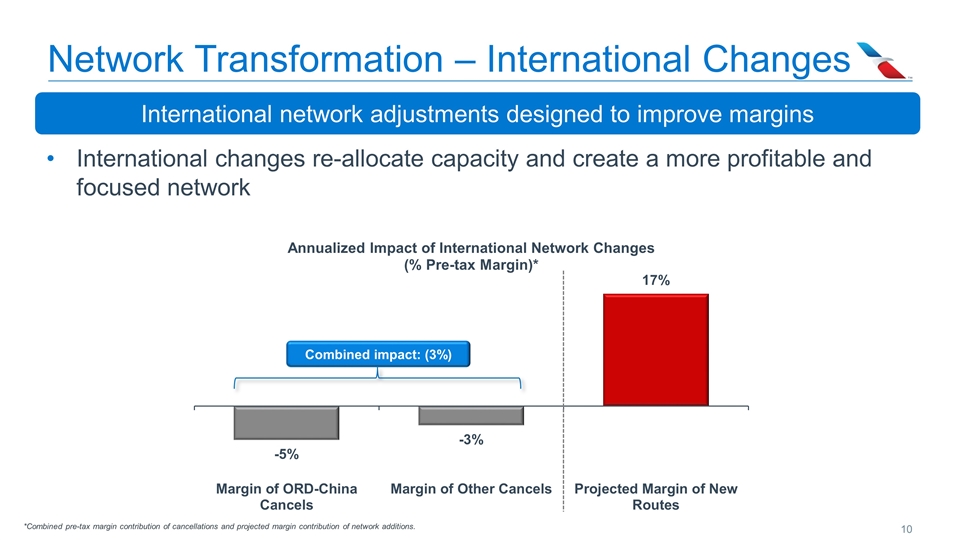

Network Transformation – International Changes Strong alliance network serves key destinations and enables route prioritization to improve our overall profitability Network profitability always under review Recent Reductions (include) Chicago – Beijing Chicago – Shanghai Miami – Belo Horizonte DFW – Quito Recent Additions (include) Charlotte – Munich Phoenix – London DFW – Dublin Philadelphia – Berlin

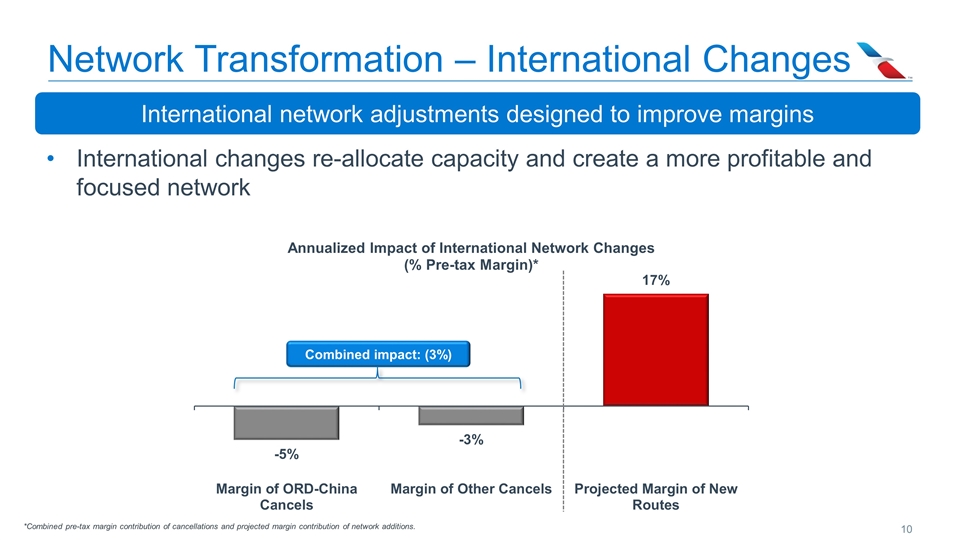

Network Transformation – International Changes International changes re-allocate capacity and create a more profitable and focused network International network adjustments designed to improve margins *Combined pre-tax margin contribution of cancellations and projected margin contribution of network additions. Combined impact: (3%)

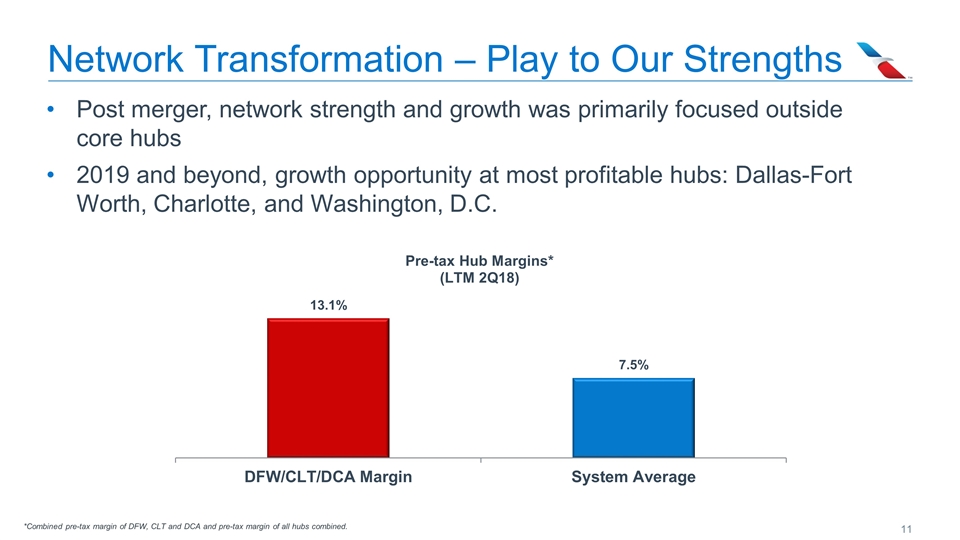

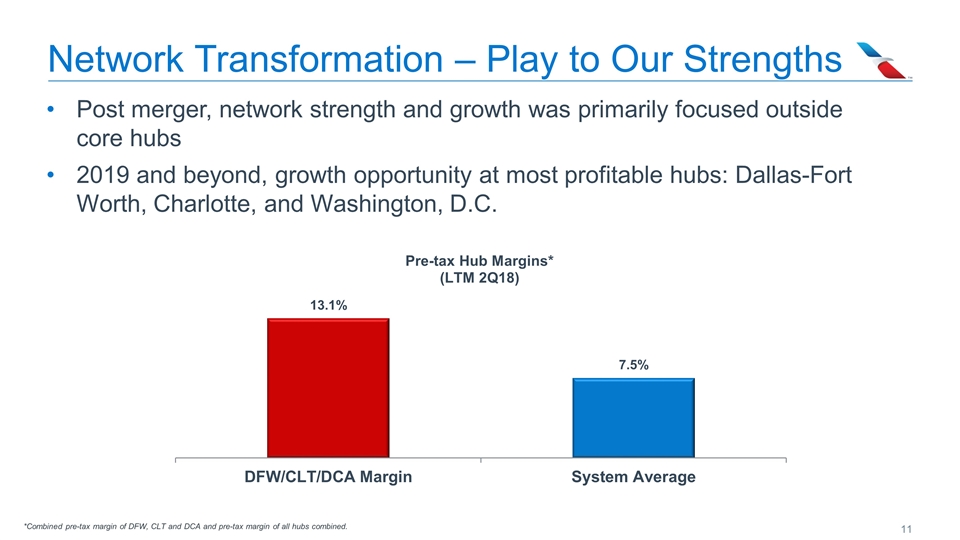

Network Transformation – Play to Our Strengths Post merger, network strength and growth was primarily focused outside core hubs 2019 and beyond, growth opportunity at most profitable hubs: Dallas-Fort Worth, Charlotte, and Washington, D.C. *Combined pre-tax margin of DFW, CLT and DCA and pre-tax margin of all hubs combined.

Network Transformation – Play to Our Strengths Uniquely positioned to grow feed at our most profitable hubs, adding high margin flying to the network Los Angeles Phoenix Miami New York Washington, D.C. Philadelphia Chicago Dallas-Fort Worth Charlotte

Network Transformation – Play to Our Strengths Uniquely positioned to grow feed at our most profitable hubs, adding high margin flying to the network Dallas-Fort Worth Charlotte Washington, D.C. Access to 15 additional gates in 2019 Access to 7 additional gates in 2020 14 upgauged gates in 2021

Network Transformation – Play to Our Strengths Uniquely positioned to grow feed at our most profitable hubs, adding high margin flying to the network Dallas-Fort Worth Charlotte OAK FLG TUS DRT CYS MSO CMI ECP SRQ EYW AVL ACK HVN AVP ITH BUF SBN New routes added in 2018 from CLT and DFW to the contiguous 48 states .

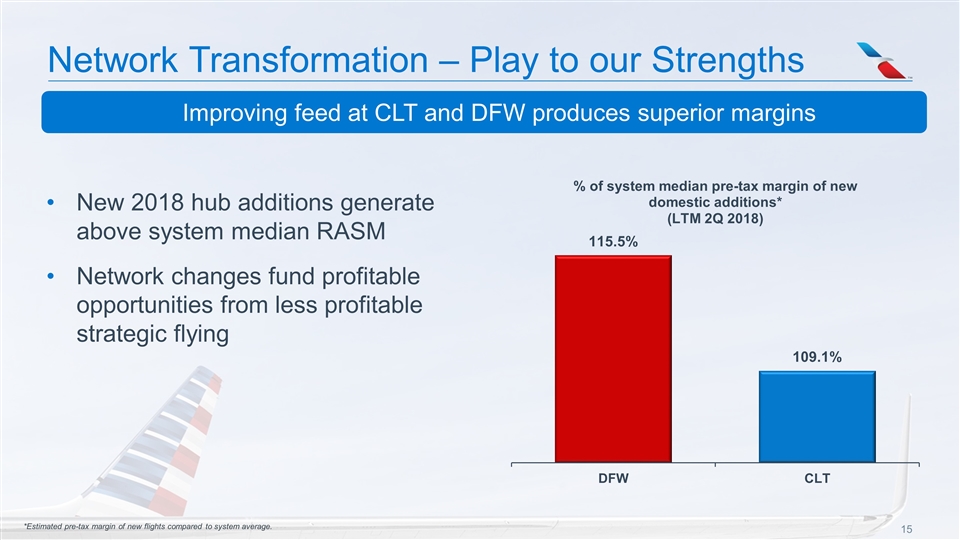

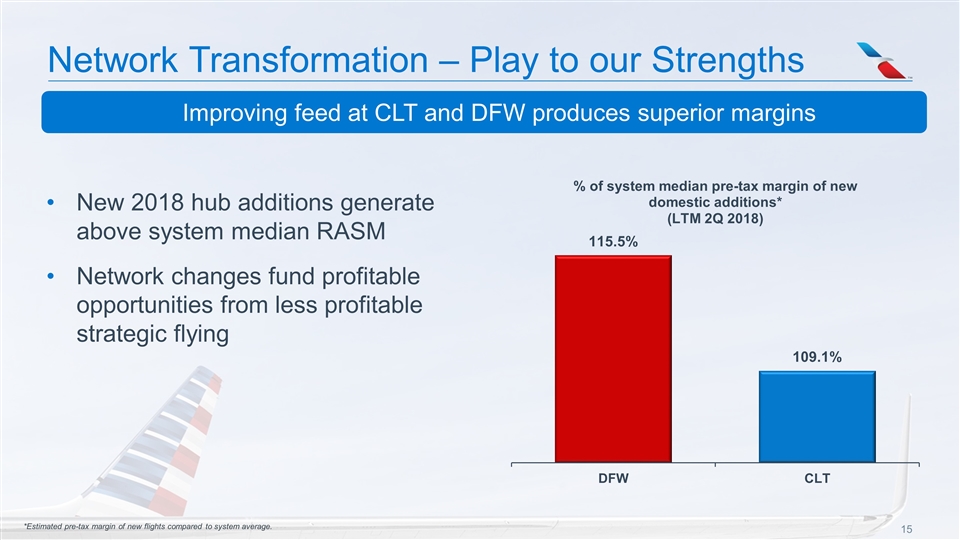

Network Transformation – Play to our Strengths Improving feed at CLT and DFW produces superior margins New 2018 hub additions generate above system median RASM Network changes fund profitable opportunities from less profitable strategic flying *Estimated pre-tax margin of new flights compared to system average.

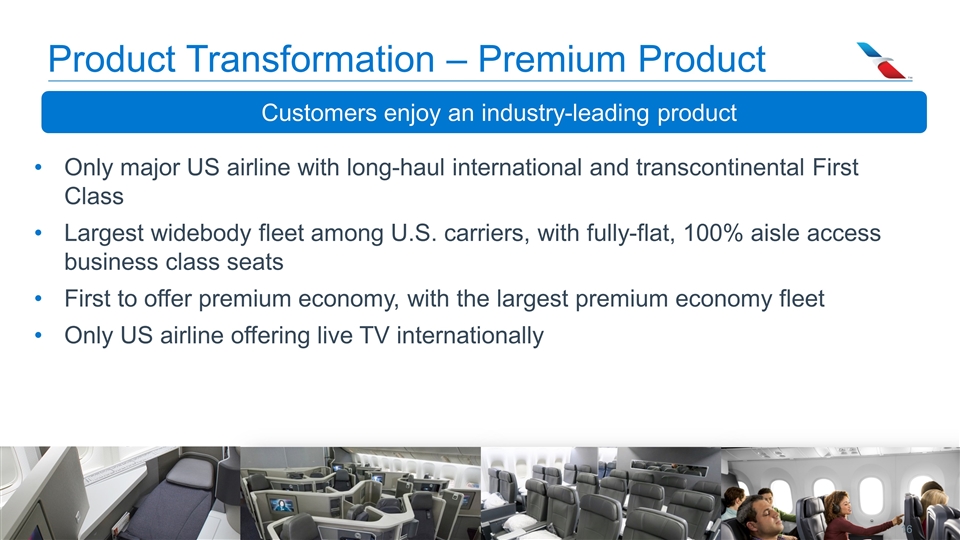

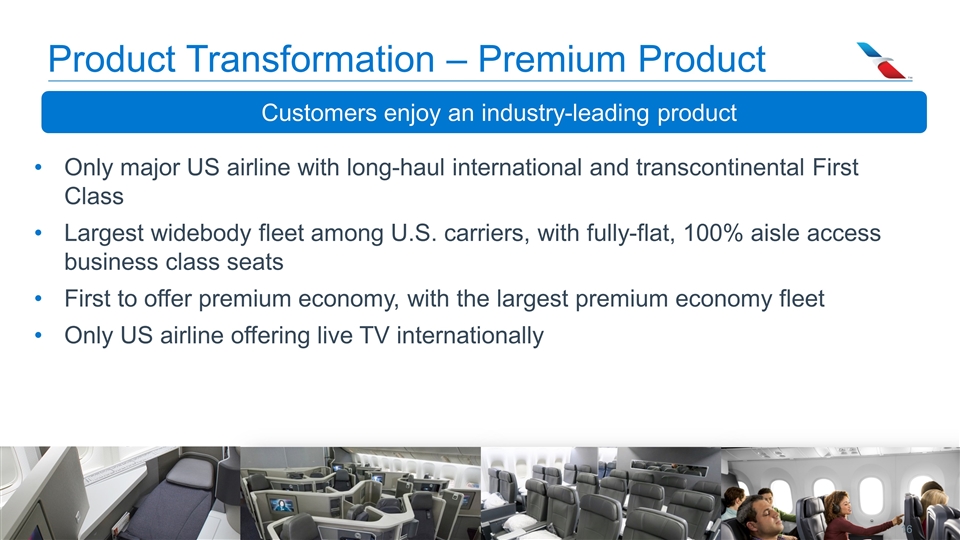

Product Transformation – Premium Product Only major US airline with long-haul international and transcontinental First Class Largest widebody fleet among U.S. carriers, with fully-flat, 100% aisle access business class seats First to offer premium economy, with the largest premium economy fleet Only US airline offering live TV internationally Customers enjoy an industry-leading product

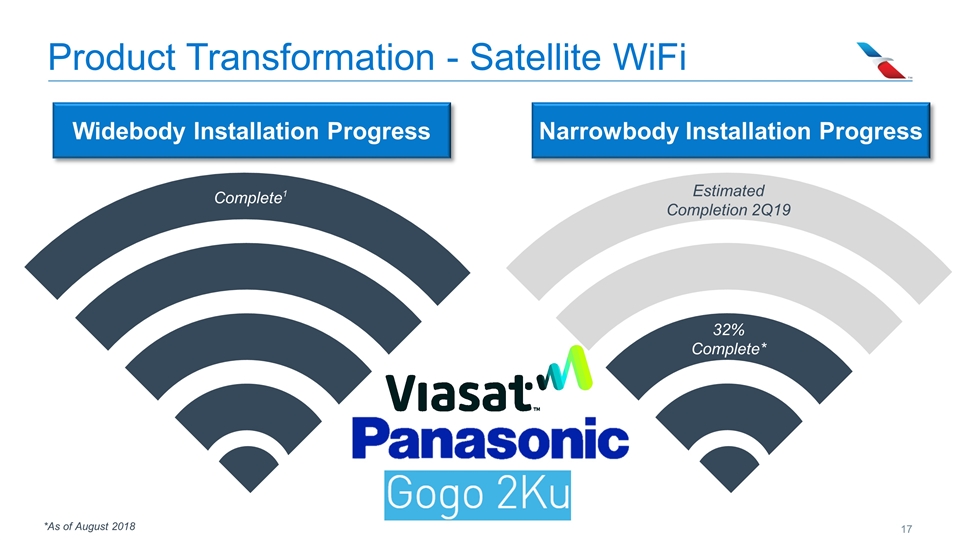

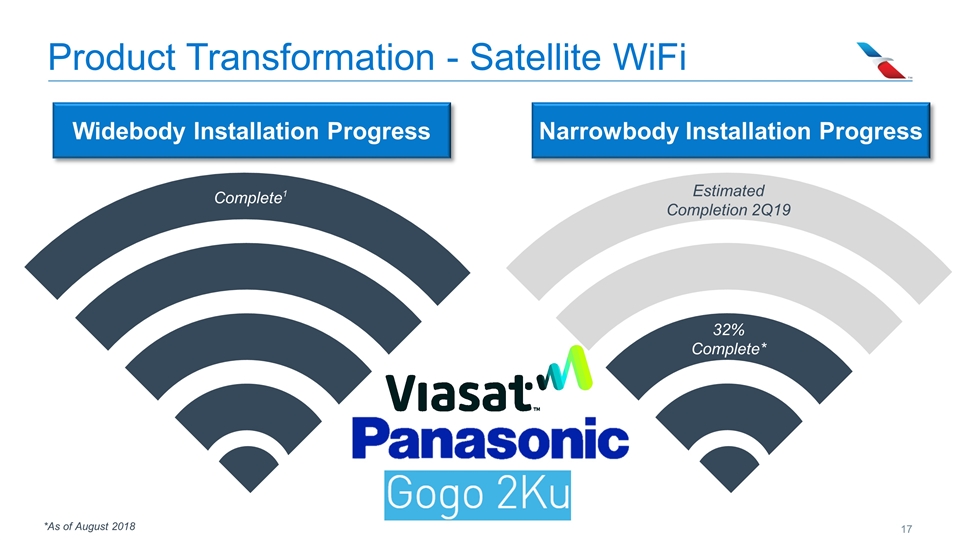

Product Transformation - Satellite WiFi Complete1 32% Complete* Widebody Installation Progress Narrowbody Installation Progress Estimated Completion 2Q19 *As of August 2018

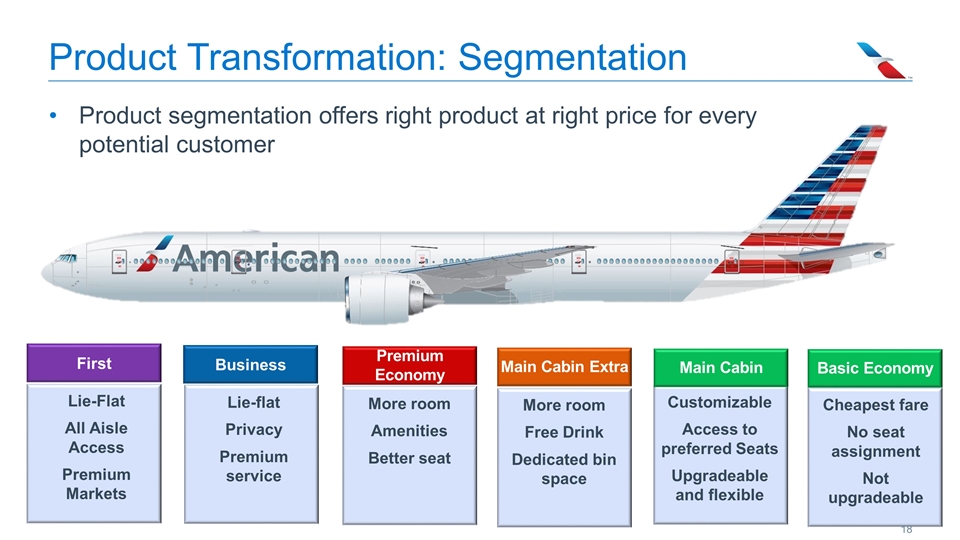

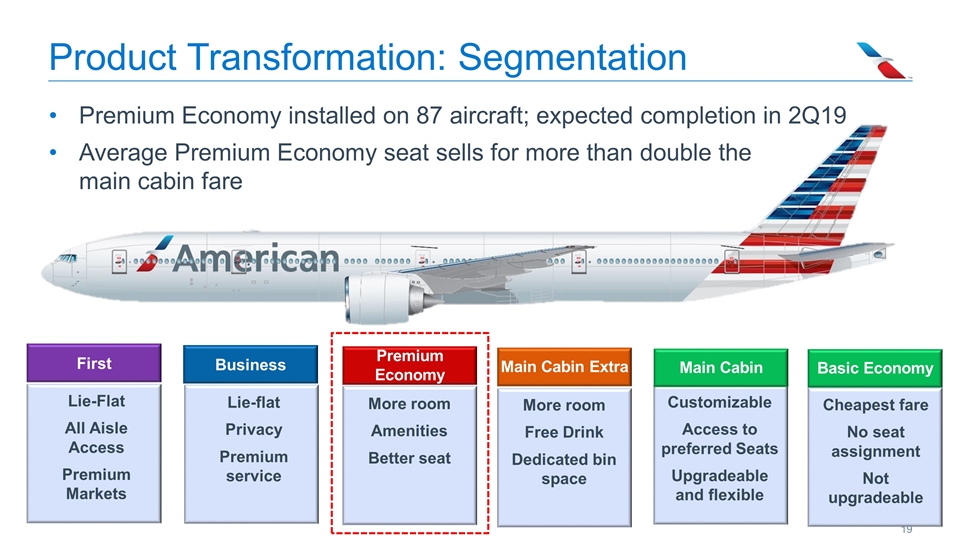

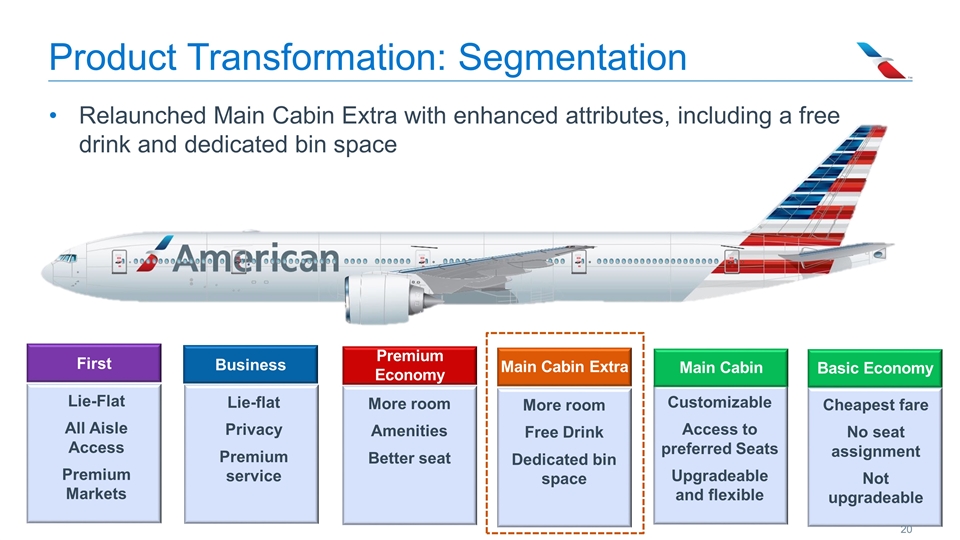

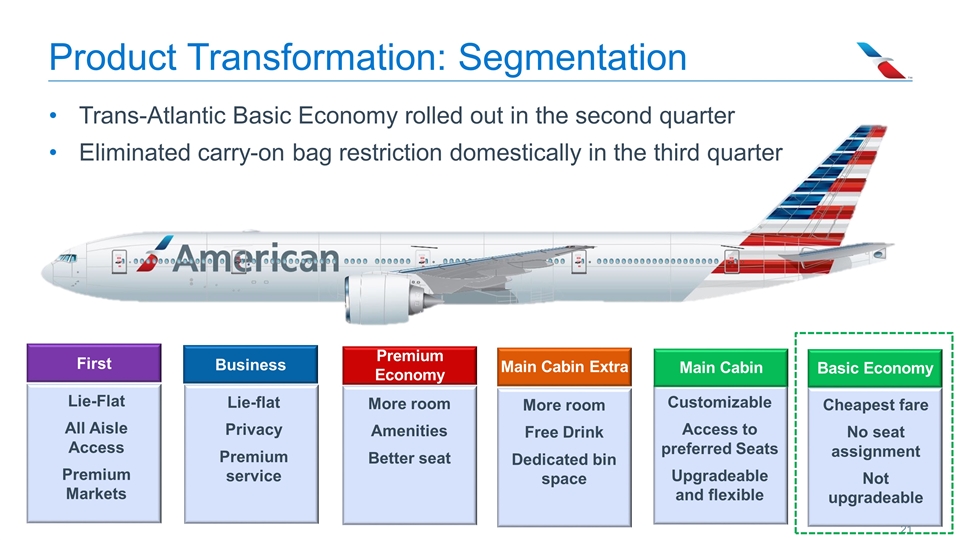

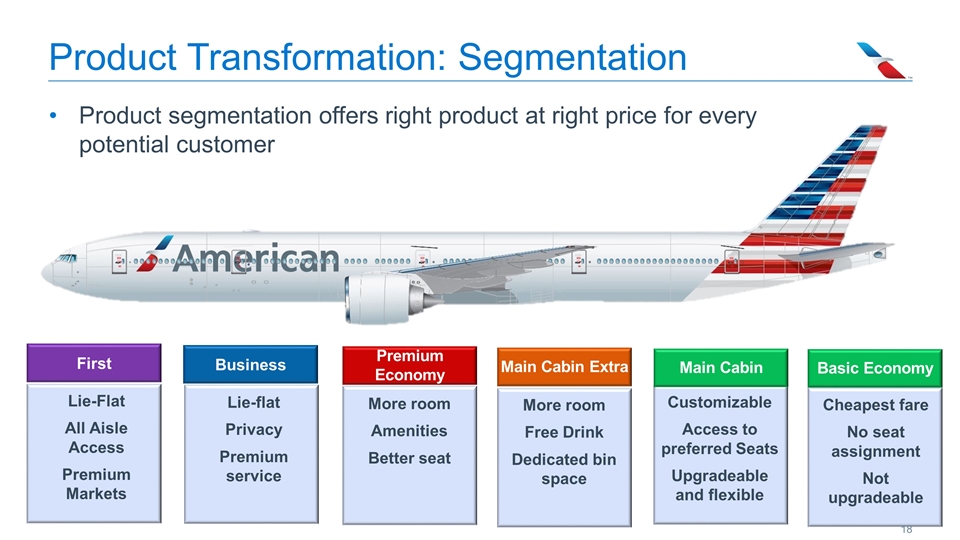

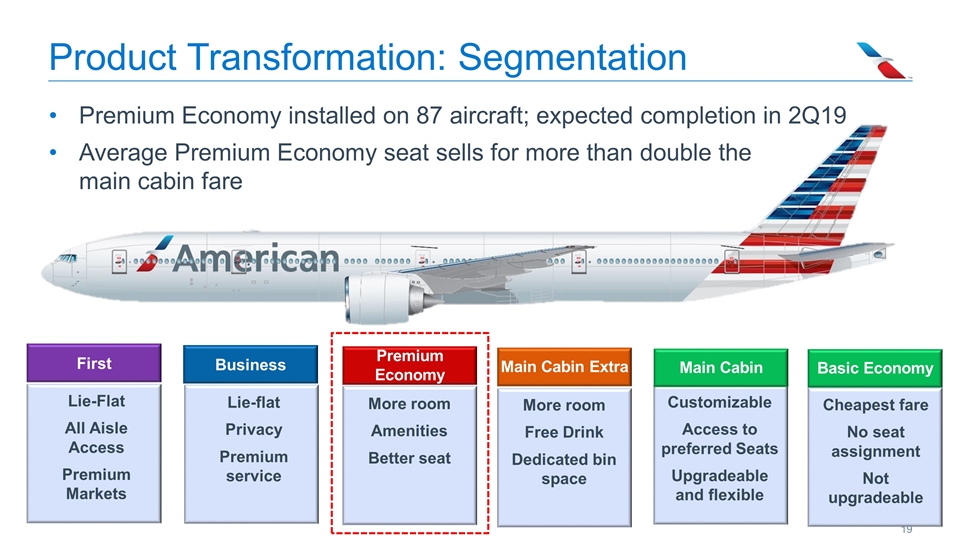

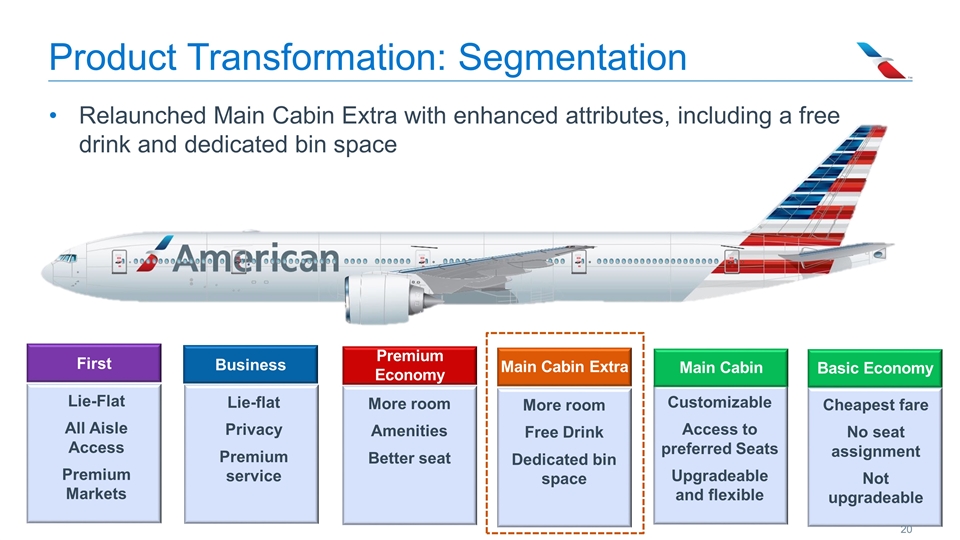

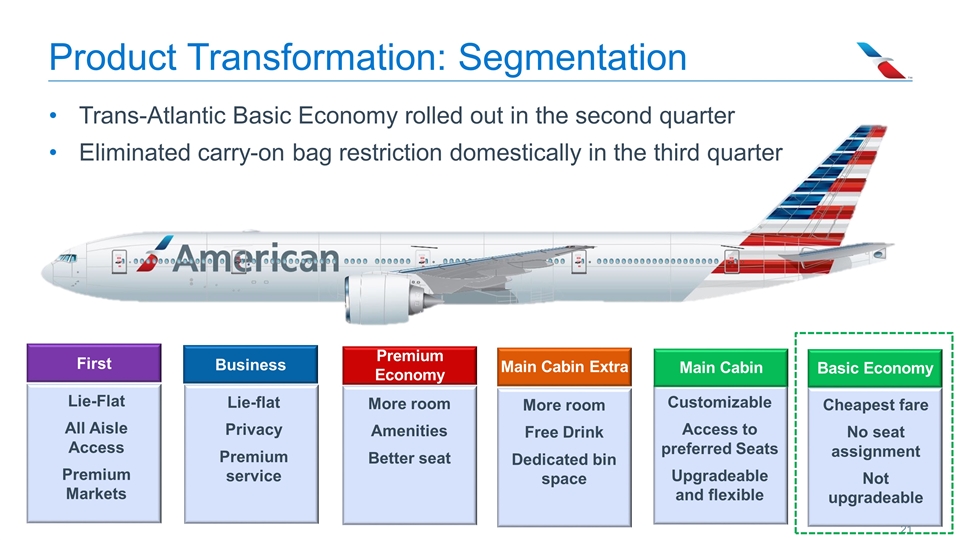

Product segmentation offers right product at right price for every potential customer Product Transformation: Segmentation First Lie-Flat All Aisle Access Premium Markets Business Lie-flat Privacy Premium service Premium Economy More room Amenities Better seat Main Cabin Customizable Access to preferred Seats Upgradeable and flexible Basic Economy Cheapest fare No seat assignment Not upgradeable Main Cabin Extra More room Free Drink Dedicated bin space

Premium Economy installed on 87 aircraft; expected completion in 2Q19 Average Premium Economy seat sells for more than double the main cabin fare First Lie-Flat All Aisle Access Premium Markets Business Lie-flat Privacy Premium service Premium Economy More room Amenities Better seat Main Cabin Customizable Access to preferred Seats Upgradeable and flexible Basic Economy Cheapest fare No seat assignment Not upgradeable Main Cabin Extra More room Free Drink Dedicated bin space Product Transformation: Segmentation

Relaunched Main Cabin Extra with enhanced attributes, including a free drink and dedicated bin space First Lie-Flat All Aisle Access Premium Markets Business Lie-flat Privacy Premium service Premium Economy More room Amenities Better seat Main Cabin Customizable Access to preferred Seats Upgradeable and flexible Basic Economy Cheapest fare No seat assignment Not upgradeable Main Cabin Extra More room Free Drink Dedicated bin space Product Transformation: Segmentation

Trans-Atlantic Basic Economy rolled out in the second quarter Eliminated carry-on bag restriction domestically in the third quarter First Lie-Flat All Aisle Access Premium Markets Business Lie-flat Privacy Premium service Premium Economy More room Amenities Better seat Main Cabin Customizable Access to preferred Seats Upgradeable and flexible Basic Economy Cheapest fare No seat assignment Not upgradeable Main Cabin Extra More room Free Drink Dedicated bin space Product Transformation: Segmentation

Product Transformation – Loyalty Program AAdvantage program can be further leveraged and monetized, helping American win customer preference in both the short and long term Launched new elite tier – Platinum Pro More members qualifying for elite status despite higher requirements Revenue growth continues from co-brand card programs Launch of new no-fee MileUp card targets a new customer segment – extending the reach and building loyalty AAdvantage evolves and continues to lead the industry ConciergeKey Invite Only

Product Transformation - Ancillaries Executing on a number of opportunities to grow revenue Post-purchase opportunities for customers Includes upsell to premium cabins Already rolled out by peers Ancillary bundles and third party placements Sale of bundled ancillary add-ons Better enabling sale of third party products Already rolled out by peers

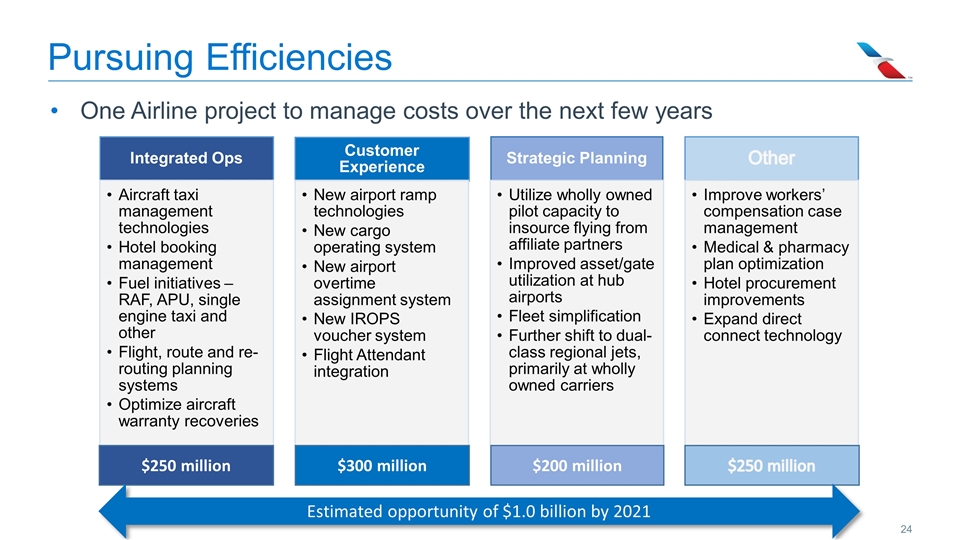

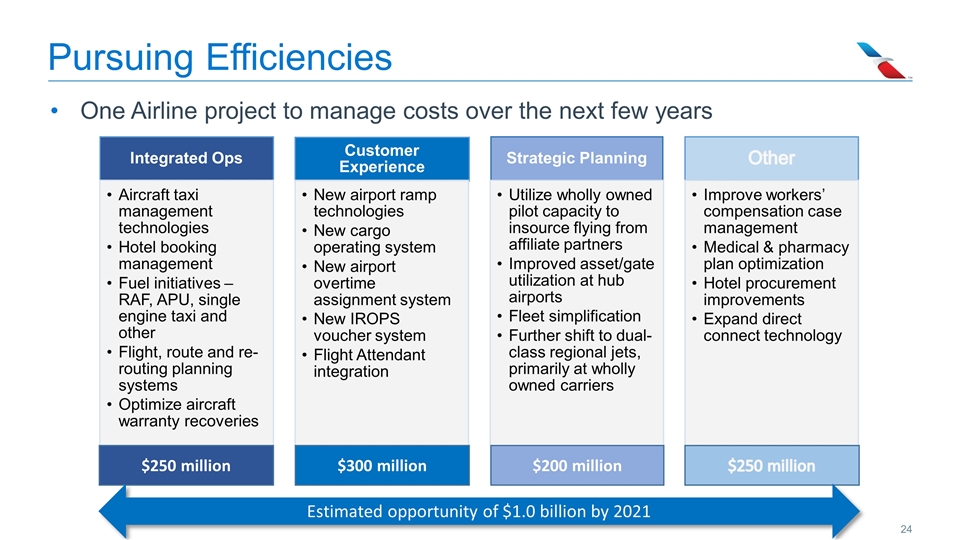

One Airline project to manage costs over the next few years Pursuing Efficiencies $250 million $300 million $200 million $250 million Estimated opportunity of $1.0 billion by 2021 Integrated Ops Customer Experience New airport ramp technologies New cargo operating system Strategic Planning Other New airport overtime assignment system New IROPS voucher system Utilize wholly owned pilot capacity to insource flying from affiliate partners Improve workers’ compensation case management Hotel procurement improvements Flight Attendant integration Expand direct connect technology Optimize aircraft warranty recoveries Flight, route and re-routing planning systems Fuel initiatives – RAF, APU, single engine taxi and other Hotel booking management Aircraft taxi management technologies Further shift to dual-class regional jets, primarily at wholly owned carriers Fleet simplification Improved asset/gate utilization at hub airports Medical & pharmacy plan optimization

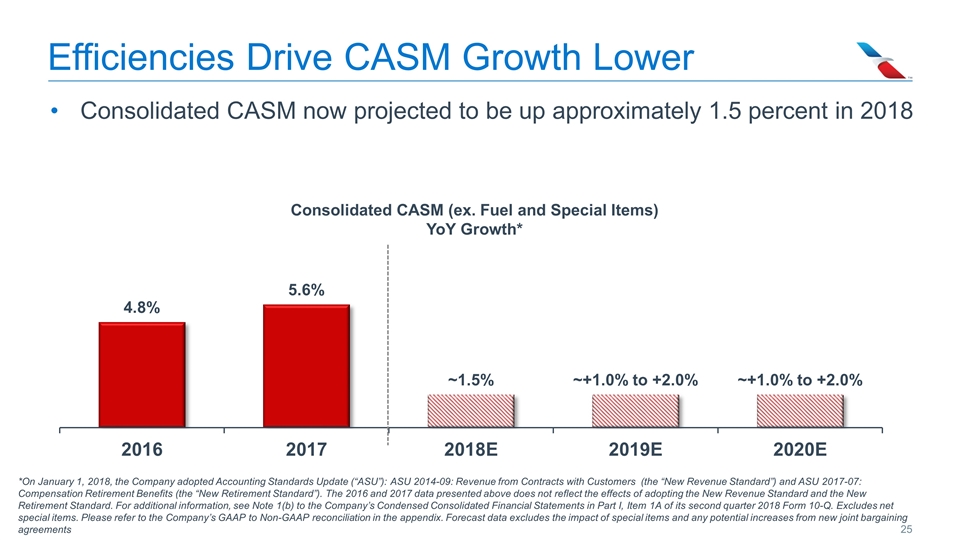

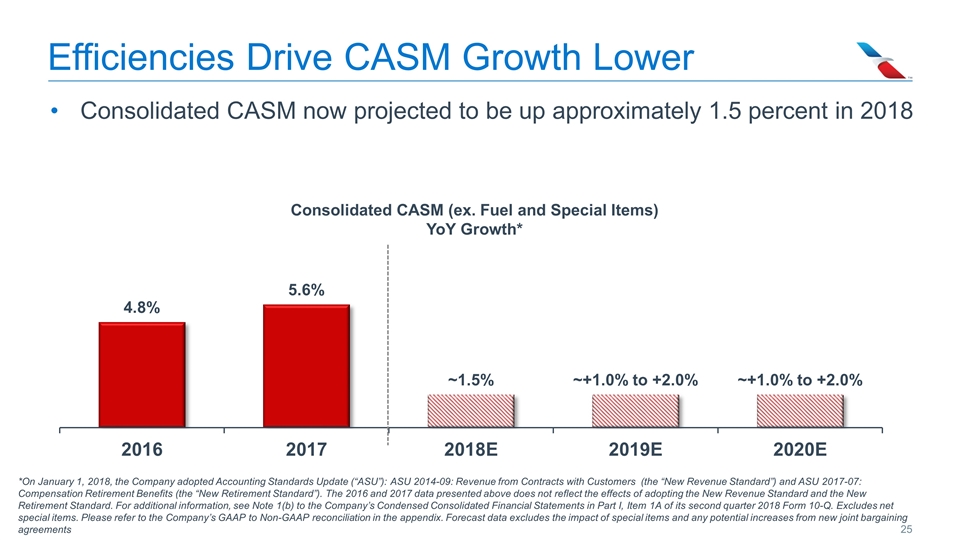

Consolidated CASM now projected to be up approximately 1.5 percent in 2018 Efficiencies Drive CASM Growth Lower *On January 1, 2018, the Company adopted Accounting Standards Update (“ASU”): ASU 2014-09: Revenue from Contracts with Customers (the “New Revenue Standard”) and ASU 2017-07: Compensation Retirement Benefits (the “New Retirement Standard”). The 2016 and 2017 data presented above does not reflect the effects of adopting the New Revenue Standard and the New Retirement Standard. For additional information, see Note 1(b) to the Company’s Condensed Consolidated Financial Statements in Part I, Item 1A of its second quarter 2018 Form 10-Q. Excludes net special items. Please refer to the Company’s GAAP to Non-GAAP reconciliation in the appendix. Forecast data excludes the impact of special items and any potential increases from new joint bargaining agreements

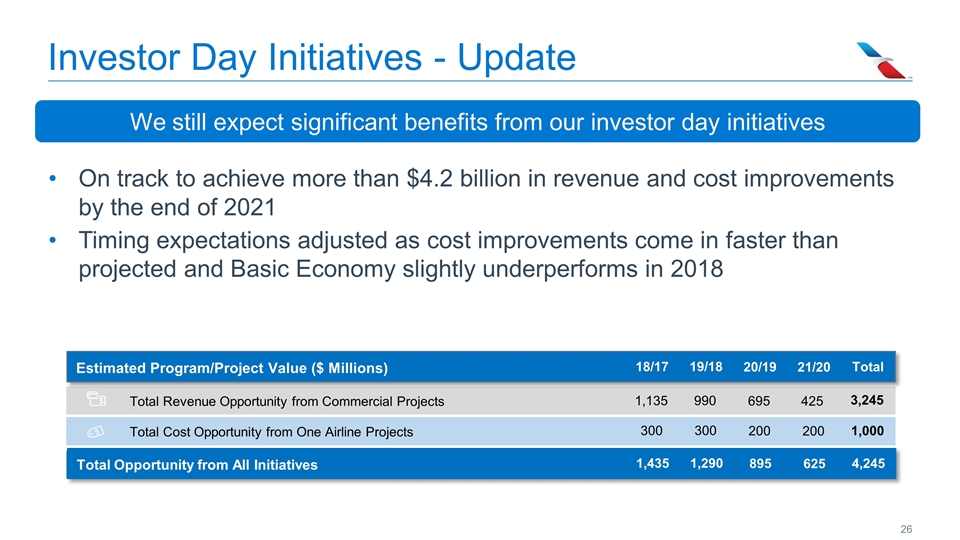

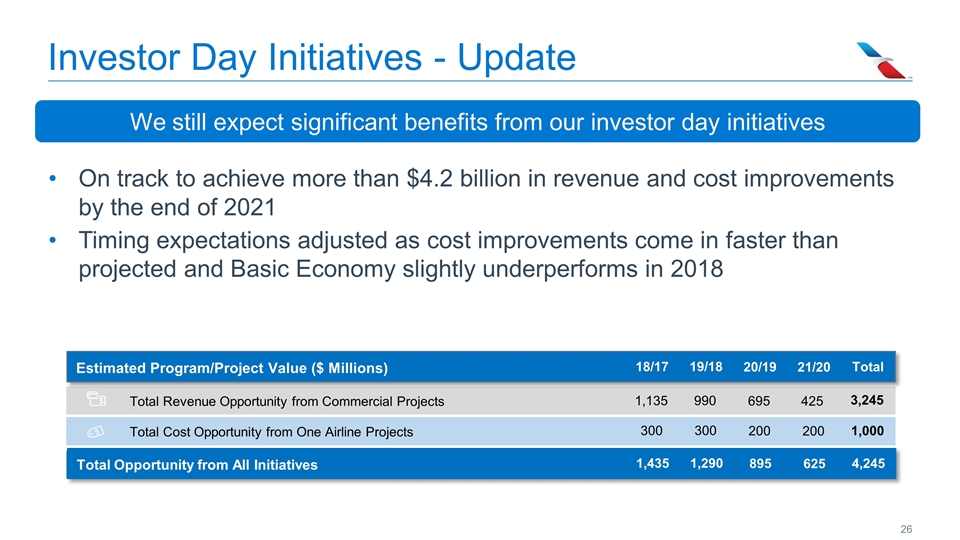

Investor Day Initiatives - Update We still expect significant benefits from our investor day initiatives 200 300 200 1,000 300 Total Cost Opportunity from One Airline Projects 695 990 425 3,245 1,135 Total Revenue Opportunity from Commercial Projects 20/19 19/18 21/20 Total 18/17 Estimated Program/Project Value ($ Millions) 895 1,290 625 4,245 1,435 Total Opportunity from All Initiatives On track to achieve more than $4.2 billion in revenue and cost improvements by the end of 2021 Timing expectations adjusted as cost improvements come in faster than projected and Basic Economy slightly underperforms in 2018

Our Long-Term Vision

Looking Forward American achievements post merger… Successful integration Significant investment Transformed product offering Investments in our team …now well-positioned for future success Youngest fleet of the network carriers enables very low-cost future growth Network optimization around most profitable hubs designed to grow margins Product changes improving both customer and team member experience On track to achieve more than $3.2 billion in revenue benefits and $1 billion in cost improvements by 2021 Playing the long game and building for a sustainable and successful future

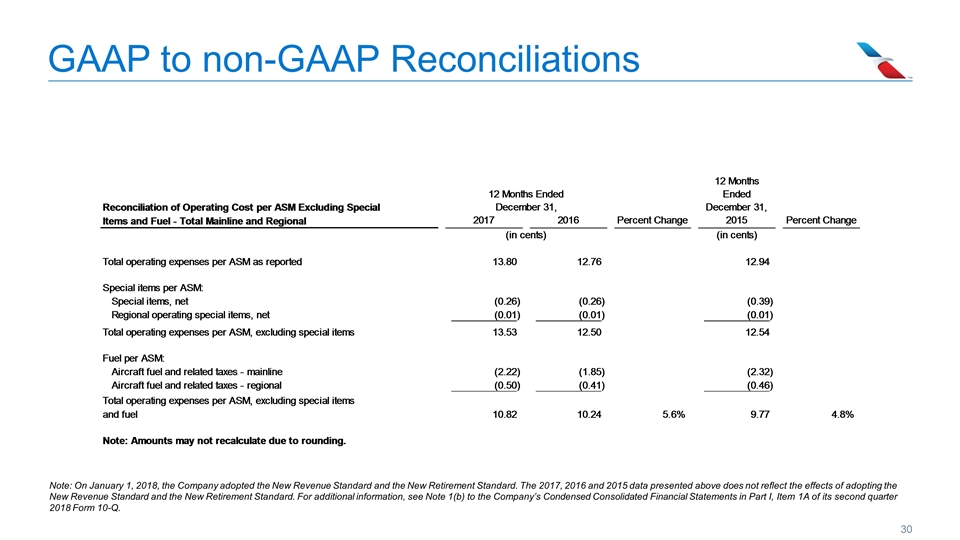

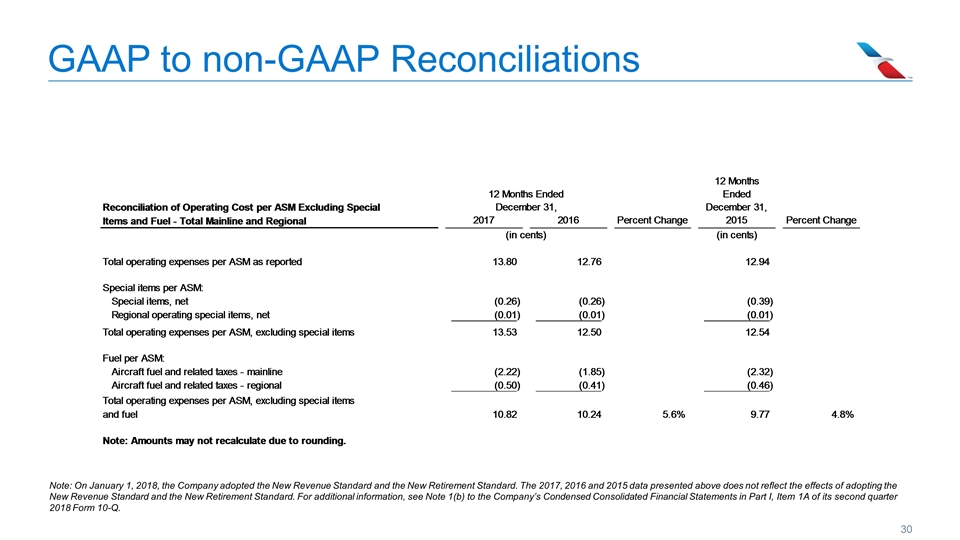

GAAP to Non-GAAP Reconciliations

GAAP to non-GAAP Reconciliations Note: On January 1, 2018, the Company adopted the New Revenue Standard and the New Retirement Standard. The 2017, 2016 and 2015 data presented above does not reflect the effects of adopting the New Revenue Standard and the New Retirement Standard. For additional information, see Note 1(b) to the Company’s Condensed Consolidated Financial Statements in Part I, Item 1A of its second quarter 2018 Form 10-Q.