UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ____)

Filed by the Registrant [ X ]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ X ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under §240.14a-12

AMREP CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[ X ] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

AMREP CORPORATION

(An Oklahoma corporation)

NOTICE OF 2012 ANNUAL MEETING OF SHAREHOLDERS

September 19, 2012

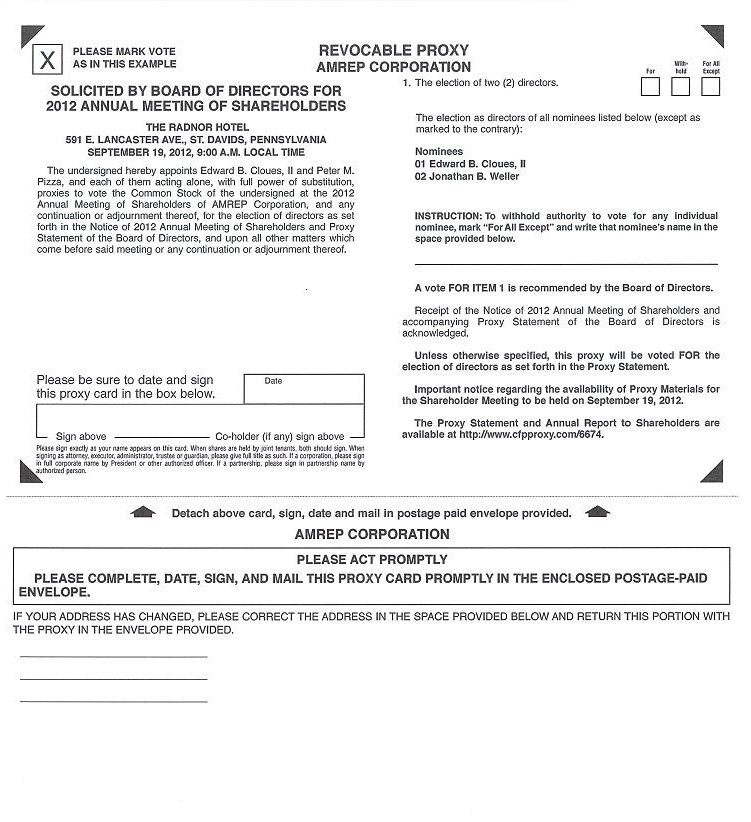

NOTICE IS HEREBY GIVEN that the 2012 Annual Meeting of Shareholders of AMREP Corporation (the “Company”) will be held at the Radnor Hotel, 591 East Lancaster Avenue, St. Davids, Pennsylvania on September 19, 2012 at 9:00 A.M. for the following purposes:

(1) To elect two directors in Class I to hold office until the 2015 Annual Meeting and until their successors are elected and qualified; and

(2) To consider and act upon such other business as may properly come before the meeting.

In accordance with the By-Laws, the Board of Directors has fixed the close of business on July 25, 2012 as the record date for the determination of shareholders of the Company entitled to notice of and to vote at the meeting and any continuation or adjournment thereof. The list of such shareholders will be available for inspection by shareholders during the ten days prior to the meeting at the offices of the Company, 300 Alexander Park, Suite 204, Princeton, New Jersey 08540.

Whether or not you expect to be present at the meeting, please mark, date and sign the enclosed proxy and return it to the Company in the self-addressed envelope enclosed for that purpose. The proxy is revocable and will not affect your right to vote in person in the event you attend the meeting.

By Order of the Board of Directors

Irving Needleman, Secretary

Dated: August 29, 2012

Princeton, New Jersey

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting To Be Held On September 19, 2012

The Proxy Statement and Annual Report to Shareholders

are available at http://www.cfpproxy.com/6674

Upon the written request of any shareholder of the Company, the Company will provide to such shareholder a copy of the Company’s annual report on Form 10-K for fiscal 2012, including the financial statements, filed with the Securities and Exchange Commission. Any request should be directed to Irving Needleman, Secretary, AMREP Corporation, 300 Alexander Park, Suite 204, Princeton, New Jersey 08540. There will be no charge for such report unless one or more exhibits thereto are requested, in which case the Company’s reasonable expenses of furnishing exhibits may be charged. |

AMREP CORPORATION

300 Alexander Park, Suite 204

Princeton, New Jersey 08540

__________________________

PROXY STATEMENT

__________________________

ANNUAL MEETING OF SHAREHOLDERS

To be Held at 9:00 A.M. on September 19, 2012

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of AMREP Corporation (the “Company”) for use at the Annual Meeting of Shareholders of the Company to be held on September 19, 2012, and at any continuation or adjournment thereof (the “Annual Meeting”). The Annual Meeting will be held at the Radnor Hotel, 591 East Lancaster Avenue, St. Davids, Pennsylvania.

The Annual Report of the Company on Form 10-K for the fiscal year ended April 30, 2012 filed on July 26, 2012 with the Securities and Exchange Commission is included in this mailing but does not constitute a part of the proxy solicitation material. This Proxy Statement and the accompanying Notice of 2012 Annual Meeting of Shareholders and proxy card are first being sent to shareholders on or about August 29, 2012.

What will be voted on at the Annual Meeting?

The Board is divided into three classes with the term of each class ending at the third Annual Meeting following its election and upon the election of directors at that meeting. At this Annual Meeting, shareholders will vote on the election of two nominees to serve on the Board as Class I directors until the 2015 Annual Meeting.

How does the Board recommend I vote on the proposal?

The Board recommends that you vote “FOR” each of the nominees named in this Proxy Statement.

Who is entitled to vote at the Annual Meeting?

Only shareholders of record as of the close of business on July 25, 2012, the date fixed by the Board in accordance with the Company’s By-Laws, are entitled to notice of and to vote at the Annual Meeting.

If I have given a proxy, how do I revoke that proxy?

Anyone giving a proxy may revoke it at any time before it is exercised by giving the Secretary of the Company written notice of the revocation, by submitting a proxy bearing a later date or by attending the Annual Meeting and voting.

How will my proxy be voted?

All properly executed, unrevoked proxies in the enclosed form that are received in time will be voted in accordance with the shareholders’ directions and, unless contrary directions are given, will be voted for the election as directors of the nominees named in this Proxy Statement.

How many votes are needed to elect directors?

The two nominees receiving the highest number of “FOR” votes will be elected as directors. This is referred to as a plurality.

What if a nominee is unwilling or unable to serve?

This is not expected to occur but, in the event that it does, proxies will be voted for a substitute nominee designated by the Board or, in the discretion of the Board, the position may be left vacant.

How will abstentions and broker non-votes affect the voting?

Abstentions and broker non-votes have no effect on the voting for election of directors. Under the rules that govern brokers, uncontested elections of directors had previously been considered routine matters, and brokers or nominees who held shares in “street name” on behalf of beneficial owners could vote the shares without instructions from those owners. These rules, however, have been amended, and now, if the broker or nominee for a beneficial owner of shares does not have instructions on how to vote in the uncontested director election, a broker non-vote of those shares will occur, which means the shares will not be voted in the election. If your shares are held in “street name,” you must cast your vote or instruct your nominee or broker to do so if you want your vote to count in the election of directors.

How many shares can be voted at the Annual Meeting?

As of July 25, 2012, the Company had issued and outstanding 5,996,212 shares of Common Stock, par value $.10 per share. Each share of Common Stock is entitled to one vote on matters to come before the Annual Meeting.

How many votes will I be entitled to cast at the Annual Meeting?

You will be entitled to cast one vote for each share of Common Stock you held at the close of business on July 25, 2012, the record date for the Annual Meeting, as shown on the list of shareholders at that date prepared by the Company’s transfer agent for the Common Stock.

What is a “quorum?”

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock of the Company authorized to vote will constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted in determining whether a quorum is present at the Annual Meeting. Broker non-votes at the meeting are not considered likely as brokers and nominees who do not receive voting instructions from their beneficial owners on the one matter scheduled for consideration are not expected to have the shares they hold for such owners represented at the meeting.

Who may attend the Annual Meeting?

All shareholders of the Company who owned shares of record at the close of business on July 25, 2012 may attend the Annual Meeting. If you want to vote in person and you hold Common Stock in street name (i.e., your shares are held in the name of a brokerage firm, bank or other nominee), you must obtain a proxy card issued in your name from the firm that holds your shares and bring that proxy card to the Annual Meeting, together with a copy of a statement from that firm reflecting your share ownership as of the record date, and valid identification. If you hold your shares in street name and want to attend the Annual Meeting but not vote in person, you must bring to the Annual Meeting a copy of a statement from the firm that holds your shares reflecting your share ownership as of the record date, and valid identification.

-2-

COMMON STOCK OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Set forth in the following table is information concerning the ownership of the Common Stock of the Company by the persons who, to the knowledge of the Company, own beneficially more than 5% of the outstanding shares. The table also sets forth the same information concerning beneficial ownership for each director of the Company, each current executive officer of the Company, and all directors and current executive officers of the Company as a group. Unless otherwise indicated, (i) reported ownership is as of July 25, 2012, and (ii) the Company understands that the beneficial owners have sole voting and investment power with respect to the shares beneficially owned by them. In the case of directors and executive officers, the information below has been provided by such persons at the request of the Company.

Beneficial Owner | Shares Owned Beneficially | % of Class |

Nicholas G. Karabots (Director) P.O. Box 736 Fort Washington, PA 19034 | 2,753,078 | 45.9 |

Albert V. Russo (Director) Lena Russo, Clifton Russo, Lawrence Russo c/o American Simlex Company 401 Broadway New York, NY 10013 | 1,116,540 (1) | 18.6 |

Robert E. Robotti, et al | 571,590 (2) | 9.5 |

John H. Lewis, et al | 310,921 (3) | 5.2 |

| Other Directors and Executive Officers | ||

| Edward B. Cloues, II | 2,500 | * |

| Lonnie A. Coombs | 3,000 | * |

| Michael P. Duloc | 2,500 (4) | * |

| Theodore J. Gaasche | - | - |

| Irving Needleman | - | - |

| Peter M. Pizza | - | - |

| Samuel N. Seidman | 13,500 | * |

| Jonathan B. Weller | 1,500 | * |

Directors and Current Executive Officers as a Group (10 persons) | 3,892,618 (1),(4) | 64.9 |

_________________________

* Indicates less than 1%.

| (1) | Albert V. Russo, Lena Russo, Clifton Russo and Lawrence Russo have reported that they share voting power as to these shares and that each of them has sole dispositive power as to the following numbers of such shares representing the indicated percentages of the outstanding Common Stock: Albert V. Russo – 663,741 (11.1%); Lena Russo – 33,740 (0.6%); Clifton Russo – 237,617 (4.0%); and Lawrence Russo – 181,442 (3.0%). |

-3-

| (2) | The following table sets forth information regarding the beneficial ownership of Common Stock of the Company by Robert E. Robotti, Robotti & Company, Incorporated (“R&CoI”), Robotti & Company, LLC (“R&CoL”), Robotti & Company Advisors, LLC (“R&CoA”) and RVB Value Fund, L.P. (“RV”), all of 6 East 43rd Street, New York, NY 11017-4651, Kenneth R. Wasiak of 488 Madison Avenue, New York, NY 10022 and Ravenswood Management Company, L.L.C. (“RMC”), The Ravenswood Investment Company, L.P. (“RIC”) and Ravenswood Investments III, L.P. (“RI”), all of 104 Gloucester Road, Massapequa, NY 11758. The information in the table is derived from Amendment 2 filed jointly by these persons on February 15, 2012 to the Schedule 13D filed with the Securities and Exchange Commission on October 26, 2007. |

Beneficial Owner | Shares Owned Beneficially | % of Class (a) |

Robert E. Robotti (b),(c),(d),(e),(f) | 571,590 | 9.5 |

R&CoI (b),(c) | 571,590 | 9.5 |

R&CoL (b) | 4,100 | * |

R&CoA (c) | 567,490 | 9.5 |

RV (d) | 23,322 | * |

Kenneth R. Wasiak (d),(e),(f) | 160,887 | 2.7 |

RMC (d),(e),(f) | 160,887 | 2.7 |

RIC (e) | 86,597 | 1.4 |

RI (f) | 50,698 | * |

_________________________

* Indicates less than 1%.

| (a) Based upon the number of issued and outstanding shares of Common Stock at July 25, 2012. |

| (b) Each of Mr. Robotti and R&CoI share with R&CoL the power to vote or direct the vote, and the power to dispose or direct the disposition, of 4,100 shares of Common Stock owned by the discretionary customers of R&CoL. |

| (c) Each of Mr. Robotti and R&CoI share with R&CoA the power to vote or to direct the vote, and the power to dispose or direct the disposition, of 406,603 shares of Common Stock owned by the advisory clients of R&CoA. |

| (d) Each of Messrs. Robotti, Wasiak and RMC share with RV the power to vote or to direct the vote, and the power to dispose or to direct the disposition, of 23,322 shares of Common Stock owned by RV. |

| (e) Each of Messrs. Robotti, Wasiak and RMC share with RIC the power to vote or direct the vote, and the power to dispose or direct the disposition, of 86,597 shares of Common Stock owned by RIC. |

| (f) Each of Messrs. Robotti, Wasiak and RMC share with RI the power to vote or to direct the vote, and the power to dispose or direct the disposition, of 50,698 shares of Common Stock owned by RI. |

In an institutional investment manager’s report on Form 13F filed by Mr. Robotti with the Securities and Exchange Commission on August 15, 2012, he reported that at June 30, 2012, he had sole voting authority and shared investment discretion over 201,719 shares and sole voting authority and investment discretion over an additional 4,100 shares of Common Stock of the Company.

| (3) | The following table sets forth information regarding the beneficial ownership of Common Stock of the Company by John H. Lewis, Osmium Partners, LLC (“Osmium Partners”), Osmium Capital, LP (the “Fund”), Osmium Capital II, LP (“Fund II”), and Osmium Spartan, LP (“Fund III”; the Fund, Fund II and Fund III collectively, the “Funds”), each of 388 Market Street, Suite 920, San Francisco, CA 94111. The information in the table is derived from a Schedule 13G filed jointly by these persons with the Securities and Exchange Commission on July 6, 2012. |

-4-

Beneficial Owner | Shares Owned Beneficially | % of Class (a) |

| John H. Lewis | 310,921 (b) | 5.2 |

| Osmium Partners | 286,621 (c) | 4.8 |

| Fund | 89,361 (d) | 1.5 |

| Fund II | 182,557 (d) | 3.0 |

| Fund III | 14,703 (d) | * |

_________________________

* Indicates less than 1%.

| (a) Based upon the number of issued and outstanding shares of Common Stock at July 25, 2012. |

| (b) Mr. Lewis has sole power to vote or direct the vote, and sole power to dispose or direct the disposition, of 24,300 of such shares, and shares with Osmium Capital the power to vote or direct the vote, and the power to dispose or direct the disposition, of a total of 286,621 of such shares, which are directly owned by the Funds. |

| (c) Osmium Partners shares with Mr. Lewis the power to vote or direct the vote, and dispose or direct the disposition, of these shares, which are directly owned by the Funds. |

| (d) The shares are directly owned by the beneficial owner, and the power to vote or direct the vote, and the power to dispose or direct the disposition, of such shares is shared with Mr. Lewis and Osmium Partners. |

| (4) | Held jointly with Mr. Duloc’s spouse. |

ELECTION OF DIRECTORS

The Board is a classified board divided into three classes - Class I, Class II and Class III, each of which consists of two directors who serve for a term of three years. At this Annual Meeting, two Class I directors will be elected to serve until the 2015 Annual Meeting and until their successors are elected and qualified.

At the recommendation of its Nominating and Corporate Governance Committee, the Board is nominating Edward B. Cloues, II and Jonathan B. Weller, who are the incumbent Class I directors, for reelection at the Annual Meeting. Although the Board does not expect that either of the persons nominated will be unable to serve as a director, should either of them become unavailable it is intended that the shares represented by proxies in the accompanying form will be voted for the election of a substitute nominee or nominees recommended to the Board by the Nominating and Corporate Governance Committee or, in the discretion of the Board, the position may be left vacant.

The Board unanimously recommends a vote “FOR” the two Class I nominees.

The following information relates to the nominees of the Board for election and the directors whose terms of office do not expire this year.

Nominees to serve until the 2015 Annual Meeting (Class I):

EDWARD B. CLOUES, II, age 64, has been a director of the Company since 1994 and currently serves as the Chairman of the Board. He also serves as a director of Hillenbrand, Inc. and as a director and Chairman of the Board of each of Penn Virginia Corporation and PVR GP, LLC, the General Partner of PVR Partners, L.P. For more than five years prior to its sale on April 1, 2010, Mr. Cloues was a director, the Chairman of the Board and Chief Executive Officer of K-Tron International, Inc., a material handling equipment manufacturer. Mr. Cloues has been a law firm partner at a major global law firm where he specialized in mergers and acquisitions and other business law matters. That experience combined with the experience gained from his former 12 year chief executive position with K-Tron International, Inc., which had been publicly held prior to its sale, has given him a strong background in dealing with complex business transactions and general management issues. Additionally, he brings to the Board a broad understanding of governance and compensation issues as a result of his service on several other public company boards.

-5-

JONATHAN B. WELLER, age 65, has been a director of the Company since 2007. After his retirement from full-time employment in April 2006, Mr. Weller worked as an Adjunct Lecturer at the Wharton School of the University of Pennsylvania from January 2007 to May 2009. From June 2004 to April 2006, Mr. Weller was Vice Chairman of Pennsylvania Real Estate Investment Trust, a public national owner, manager and operator of retail properties. He also served as Pennsylvania Real Estate Investment Trust’s President and Chief Operating Officer from 1994 to June 2004, and served on its Board of Trustees from 1994 to March 2006. Mr. Weller is a director of PVR GP, LLC, the General Partner of PVR Partners, L.P. (“PVR”) and had been a director of PVG GP, LLC, the General Partner of Penn Virginia GP Holdings, L.P. prior to its merger with PVR. He also is a member of the Advisory Board of Momentum Real Estate Fund, LLC. Mr. Weller brings to the Board 36 years of experience in the real estate business as well as experience in dealing with complex financial transactions. Also, his service on other public company boards enhances the Board’s ability to deal with governance and compensation matters.

Directors continuing in office until the 2013 Annual Meeting (Class II):

LONNIE A. COOMBS, age 64, has been a director of the Company since 2001. Mr. Coombs is a certified public accountant and provides accounting, tax and business consulting services, and has been engaged in this occupation for more than the past five years with his firm, Lonnie A. Coombs, CPA. Mr. Coombs brings to the Board the expertise in financial and accounting matters he has accumulated over his almost 40 years as a practicing certified public accountant, and the diverse business knowledge he has gained in dealing through his practice with a broad range of commercial enterprises.

SAMUEL N. SEIDMAN, age 78, has been a director of the Company since 1977. Mr. Seidman is the President of Seidman & Co., Inc., an economic consulting and investment banking firm that he founded, and also serves as a director and Chairman of the Board of Productivity Technologies Corp., a manufacturer of metal forming and materials handling automation equipment and a wirer of control panels. He has held these positions for more than the past five years. He is a former director of InkSure Technologies Inc. Mr. Seidman provides the Board with his experience as a public company director, having served on a number of boards over the years. He also has a strong business background both through operating his own economic consulting and investment banking business and having managed several other businesses.

Directors continuing in office until the 2014 Annual Meeting (Class III):

NICHOLAS G. KARABOTS, age 79, has been a director of the Company since 1993 and currently serves as the Vice Chairman of the Board. Mr. Karabots is the Chairman of the Board of Directors and Chief Executive Officer of Kappa Media Group, Inc., Spartan Organization, Inc., Jericho National Golf Club, Inc. and other private companies that are primarily engaged in the publishing, printing, recreational sports and real estate businesses, and has held these positions for more than the past five years. Mr. Karabots brings to the Board his extensive business experience obtained through over 50 years of owning and operating a variety of businesses, including businesses involved in real estate development, printing and publishing.

ALBERT V. RUSSO, age 58, has been a director of the Company since 1996. Mr. Russo is the Managing Partner of real estate entities Russo Associates and Pioneer Realty and is a Partner of American Simlex Company, a textile exporter, and has held these positions for more than the past five years. Mr. Russo is also the Managing Partner of 401 Broadway Building, a real estate company which acquired its principal asset in 2006 from a court appointed receiver for 401 Broadway Realty Company, of which he

-6-

was a general partner, in connection with the resolution of a dispute among the partners. Mr. Russo has been involved in the ownership and management of commercial real estate for more than 25 years and contributes to the Board his specialized knowledge of the real estate business.

THE BOARD OF DIRECTORS AND ITS COMMITTEES

The Company’s Common Stock is listed on the New York Stock Exchange, and the Company is subject to the Exchange’s Corporate Governance Standards (the “Governance Standards”). The Governance Standards, among other things, generally require a listed company to have independent directors within the meaning of the Governance Standards as a majority of its board of directors and for the board to have an audit committee, a nominating/corporate governance committee and a compensation committee, each composed entirely of independent directors. Prior to May 29, 2012, the Company was a “controlled company” within the meaning of the Governance Standards because Nicholas G. Karabots and entities related to him had the power to vote more than a majority of the outstanding Common Stock. The Governance Standards permit a controlled company to choose not to comply with its requirements for nominating/corporate governance and compensation committees. The Board chose not to have a nominating/corporate governance committee and to have Mr. Karabots, who is not an independent director, as one member of the Board’s Compensation and Human Resources Committee.

Mr. Karabots does not qualify as an independent director under the Governance Standards because he owns, and he and certain of his family members are executives of, publishers that are customers for the Company’s newsstand distribution and subscription and product fulfillment services for which the payments involved are in amounts greater than permitted under the Governance Standards for a director to be considered independent. Also, his son-in-law, Michael P. Duloc, is the President and Chief Executive Officer of the constituent companies of the Company’s Media Services businesses.

On May 29, 2012, Mr. Karabots through a charitable gift of shares in the Company reduced the percentage of the Company’s outstanding shares of Common Stock that he and entities related to him have the power to vote to 45.9% and, accordingly, the Company ceased to be a controlled company within the meaning of the Governance Standards. The Board has since established its Nominating and Corporate Governance Committee, which meets the requirements of the Governance Standards. The Governance Standards applicable to the Company’s loss of controlled company status allow it a period of up to one year before its Compensation and Human Resources Committee must be comprised entirely of independent directors and Mr. Karabots has continued as a member of that Committee and is expected to remain so for so long as the Governance Standards permit.

Based principally on their responses to questions to these persons regarding the relationships addressed by the Governance Standards and discussions with them, the Board has determined that other than his service as a director, each of Edward B. Cloues, II, Lonnie A. Coombs, Albert V. Russo, Samuel N. Seidman and Jonathan B. Weller has no material relationship with the Company either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company and, therefore, meets the director independence requirements of the Governance Standards. The Board was informed that Mr. Coombs, who is a certified public accountant, (i) for many years has provided, and expects to continue to provide, business and tax consulting services to certain companies owned by Mr. Karabots, including companies that are customers for the Company’s newsstand distribution and subscription and product fulfillment services, (ii) the revenues from such business and tax consulting services for the Company’s last three fiscal years have accounted for from 5.3% to 13.5% of Mr. Coombs’ professional service revenues over those periods, and (iii) Mr. Coombs is also a director of a private company controlled by Mr. Karabots and in the past has served as a director of other such companies. However, the Board concluded that Mr. Coombs’ relationships with Mr. Karabots and his companies is as an independent contractor, and not as an employee, partner, shareholder or officer, and would not interfere with Mr. Coombs’ independence from the Company’s management.

-7-

As required by the Governance Standards, the Board has adopted Corporate Governance Guidelines (the “Guidelines”) that address various matters involving the Board and the conduct of its business. The Board has also adopted a Code of Business Conduct and Ethics setting forth principles of business conduct applicable to the directors, officers and employees of the Company. The Guidelines and Code of Business Conduct and Ethics, as well as the charters of the Board’s Nominating and Corporate Governance Committee, Audit Committee, and Compensation and Human Resources Committee, may be viewed under “Corporate Governance” on the Company’s website at www.amrepcorp.com, and written copies will be provided to any shareholder upon written request to the Company at AMREP Corporation, 300 Alexander Park, Suite 204, Princeton, New Jersey 08540, Attention: Corporate Secretary. The Company intends to disclose on its website any amendment to or waiver of any provision of the Code of Business Conduct and Ethics that applies to any of its executive officers, including its principal executive officer and principal financial and accounting officer.

Directors are expected to attend Annual Meetings of Shareholders, and all of the directors attended last year’s Annual Meeting. The Board held seven meetings during the last fiscal year, and all of the directors attended at least 75% of the total of those meetings and the meetings during such year of the Board Committees of which they were members. Pursuant to the Guidelines, the Board has established a policy that the non-management directors meet in executive session at least twice per year and that the independent directors also meet in executive session at least twice per year. Since December 31, 2010, no member of management has been a director. The Chairman of the Board (currently, Edward B. Cloues, II), if in attendance, will be the presiding director at each such executive session; otherwise, those attending will select a presiding director.

Any shareholder or other interested person wishing to communicate with the Board or any of the directors may send a letter addressed to the member or members of the Board to whom the communication is directed in care of AMREP Corporation, 300 Alexander Park, Suite 204, Princeton, New Jersey 08540, Attention: Corporate Secretary. All such communications will be forwarded to the specified addressee(s).

The Board has an Executive Committee, which generally has the power of the Board and acts, as needed, between meetings of the Board. The current members of the Executive Committee are Messrs. Cloues, Karabots and Russo. Mr. Cloues is Chairman of the Board and of the Executive Committee, and Mr. Karabots is Vice Chairman of the Board and of the Executive Committee. During the last fiscal year the Executive Committee met two times on a formal basis and frequently on an informal basis.

On June 28, 2012, the Board first established its Nominating and Corporate Governance Committee, adopted the Committee’s written charter, and appointed all of the independent directors as members, with Mr. Cloues as Chairman. The Committee held its first meeting on that date and determined to recommend to the Board that Mr. Cloues and Jonathan B. Weller be nominated for reelection as directors of the Company at the Annual Meeting. These nominees are incumbent directors, previously nominated by the Board and elected by the shareholders.

Under its charter, the Nominating and Corporate Governance Committee’s responsibilities include identifying individuals the Committee considers qualified to be elected Board members consistent with criteria approved by the Board, and recommending persons to be nominated by the Board for election by the shareholders. Among the criteria considered by the Committee in identifying suitable candidates are the experience, skills, and knowledge of business and management practices a candidate may possess and the perspective he or she may bring to the Board. Diversity is not a direct part of the formalized criteria except to the extent that the objective is to have members of the Board with diverse backgrounds such that as a unit they will possess the necessary skills to appropriately discharge their responsibilities as the Company’s directors. The Committee is also responsible for periodically reviewing and recommending changes to the Guidelines and for overseeing the Company’s corporate governance practices.

-8-

The Nominating and Corporate Governance Committee will consider candidates for director recommended by shareholders on the same basis as any other proposed nominees. Any shareholder desiring to propose a candidate for selection as a nominee of the Board for election at the 2013 Annual Meeting may do so by sending a written communication no later than May 1, 2013 to the Nominating and Corporate Governance Committee, AMREP Corporation, 300 Alexander Park, Suite 204, Princeton, New Jersey 08540, Attention: Corporate Secretary, identifying the proposing shareholder, specifying the number of shares of Common Stock held and stating the name and address of the proposed nominee and the information concerning such person that the regulations of the Securities and Exchange Commission require be included in a proxy statement relating to such person’s proposed election as a director.

The Board also has an Audit Committee that operates under a written charter adopted by the Board. Each member of the Audit Committee is an independent director, as defined by the Governance Standards. The duties of the Audit Committee include (i) appointing the Company’s independent registered public accounting firm, approving the services to be provided by that firm and its compensation and reviewing that firm’s independence and performance of services, (ii) reviewing the scope and results of the yearly audit by the independent registered public accounting firm, (iii) reviewing the Company’s system of internal controls and procedures, (iv) reviewing with management and the independent registered public accounting firm the Company’s annual and quarterly financial statements, (v) reviewing the Company’s financial reporting and accounting standards and principles, and (vi) overseeing the administration and enforcement of the Company’s Code of Business Conduct and Ethics. This Committee reports regularly to the Board concerning its activities. The members of this Committee are Messrs. Coombs (Chairman), Seidman and Weller, each of whom has been determined by the Board to be an independent director within the meaning of the Governance Standards. The Board has also determined that Mr. Coombs, who is a certified public accountant, qualifies as an audit committee financial expert within the meaning of Securities and Exchange Commission regulations. The Audit Committee held eight meetings during the last fiscal year.

In addition to the Audit Committee’s responsibilities set forth above, the Audit Committee has, pursuant to its charter, primary responsibility in the oversight of risks that could affect the Company. The full Board and its Executive Committee are actively involved in risk oversight and management of risk, with the full Board having ultimate responsibility for the oversight of risks facing the Company and for the management of those risks, but the Audit Committee conducts preliminary evaluations of risk and addresses risk prior to review by the Board of Directors. The Audit Committee considers and reviews with management, the Company’s internal control processes, and with the Company’s independent registered public accounting firm, the adequacy of the Company’s internal controls, including the processes for identifying significant risks or exposures, and elicits recommendations for the improvement of such procedures where needed. In addition to the Audit Committee’s role, the full Board is involved in the oversight and administration of risk and risk management practices by overseeing members of senior management in their risk management capacities. Members of the Company’s senior management have day-to-day responsibility for risk management and establishing risk management practices, and members of management are expected to report matters relating specifically to the Audit Committee directly thereto, and to report all other matters directly to the Executive Committee or the Board as a whole. Members of the Company’s senior management have an open line of communication to the Executive Committee and the Board and have the discretion to raise issues from time-to-time in any manner they deem appropriate, and management’s reporting on issues relating to risk management typically occurs through direct communication with directors or Committee members as matters requiring attention arise.

In furtherance of its risk oversight responsibilities, the Board has evaluated the Company's overall compensation policies and practices for its employees to determine whether such policies and practices create incentives that could reasonably be expected to affect the risks faced by the Company and their management, has further assessed whether any risks arising from these policies and practices are reasonably likely to have a material adverse effect on the Company, and has concluded that the risks arising

-9-

from the Company's policies and practices are not reasonably likely to have a material adverse effect on the Company.

The Board also has a Compensation and Human Resources Committee that operates under a written charter adopted by the Board. The Compensation and Human Resources Committee is responsible for reviewing and approving the corporate goals and objectives applicable to the Company’s Chief Executive Officer and determining his compensation and that of the Company’s other executive officers, establishing overall compensation and benefit levels and fixing bonus pools for other employees, and making recommendations to the Board concerning other matters relating to employee and director compensation. The members of this Committee are Messrs. Cloues, Karabots (Chairman) and Russo, and during the last fiscal year it held three formal meetings and also met periodically on an informal basis.

With respect to salaries, bonuses and other compensation and benefits, the decisions and recommendations of the Compensation and Human Resources Committee are subjective and are not based on any list of specific criteria. In the past, factors influencing the Committee’s decisions regarding executive salaries have included the Committee’s assessment of the executive’s performance and any changes in functional responsibility. In determining the salary to be paid to a particular individual, the Committee applies these and other criteria, while also using its best judgment of compensation applicable to other executives holding comparable positions both within the Company and at other companies. Additionally, the Committee in developing its recommendations regarding director compensation looks to director compensation at other public companies of the Company’s size. Executive officers of the Company do not play a role in determining their compensation. Neither the Board of Directors nor the Committee has engaged compensation consultants for the purposes of determining or advising upon executive or director compensation.

EXECUTIVE OFFICERS

For information with respect to identification of executive officers, see “Executive Officers of the Registrant” in Part I of the Company’s Annual Report on Form 10-K for the year ended April 30, 2012, filed pursuant to the Securities Exchange Act of 1934.

COMPENSATION OF EXECUTIVE OFFICERS

The following table contains summary information regarding the compensation of the Company’s Chief Executive Officer, the two other most highly compensated persons who were or may be deemed to have been executive officers of the Company at the end of its last fiscal year and a third highly compensated executive officer whose employment ended during the fiscal year.

Summary Compensation Table

Year(1) | Salary ($) | Bonus ($) | All Other Compensation(2) ($) | Total ($) | |

THEODORE J. GAASCHE(3) President and Chief Executive Officer of the Company | 2012 2011 | 346,738 49,011 | - - | 5,112 - | 351,850 49,011 |

MICHAEL P. DULOC President and Chief Executive Officer of the Company’s Media Services businesses | 2012 2011 | 382,500 380,625 | -(4) 15,000 | 62,973(5) 64,032 | 445,473 459,657 |

PETER M. PIZZA Vice President and Chief Financial Officer of the Company | 2012 2011 | 196,695 193,476 | - - | 6,146 6,306 | 202,841 200,052 |

JOHN F. MENEOUGH(6) President of Palm Coast Data LLC | 2012 2011 | 319,462 346,600 | - - | 510 1,594 | 319,972 348,194 |

_______________________________________

-10-

(1) The year references are to the fiscal years ended April 30.

| (2) | The amounts reported include auto allowances for certain of the named executives and payment of life insurance premiums and, additionally, in the case of Mr. Duloc, other perquisites and personal benefits. |

| (3) | Mr. Gaasche joined the Company as Vice President-Corporate Development in February 2011 and became President and Chief Executive Officer in August 2011. |

| (4) | The Compensation and Human Resources Committee established an incentive compensation plan for fiscal 2012 for Mr. Duloc under which he was entitled to earn a cash bonus based upon the levels of revenue and earnings (as defined) attributable to the Company’s Media Services businesses above stated targets. The targets were not reached and no bonus was earned. |

| (5) | The amount reported for 2012, in addition to an auto allowance and life insurance premium payment, includes housing expenses of $ 49,538 and partial reimbursement for club membership dues. |

| (6) | Mr. Meneough ceased being an officer effective August 1, 2011, and his employment ended in April 2012. |

Messrs. Pizza and Duloc have been Company employees since prior to March 1, 2004 and participate in the Company’s Retirement Plan for Employees (the “Retirement Plan”), which was amended effective January 1, 1998 to change it into a cash balance defined benefit plan. The Retirement Plan was subsequently frozen effective March 1, 2004, so that in the determination of the benefit payable, a participant’s compensation from and after March 1, 2004 is not taken into account. A participant’s benefit under the amended Retirement Plan is now comprised of (a) the participant’s cash balance as of February 29, 2004, plus interest on the cash balance (currently credited annually at the 30-year Treasury Rate for December of the previous year as published by the Board of Governors of the Federal Reserve System), and (b) the participant’s periodic pension benefit under the Retirement Plan as at December 31, 1997 had the participant been at normal retirement age at that date. Assuming that they (i) continue to be employed until age 65, and (ii) elect the life annuity form of pension, their annual retirement benefits are estimated to be: for Mr. Pizza $5,314; and for Mr. Duloc $10,392.

The Company’s executive officers are not subject to agreements or other arrangements that provide for payments upon change in control of the Company. The Company’s policies for severance payments upon termination of employment apply to the executive officers on the same basis as the Company’s other salaried employees. Additionally, the Compensation and Human Resources Committee retains the discretion to enter into severance agreements with individual executive officers on terms satisfactory to it.

In 2006 the Board adopted and the shareholders approved the 2006 Equity Compensation Plan (the “Equity Plan”), which authorizes stock-based awards of various kinds to employees covering up to a total of 400,000 shares of the Company’s Common Stock. While there are not individual agreements in place, under the terms of the Equity Plan its administrator has the discretion to accelerate the vesting of, or otherwise remove restrictions on, awards under the Equity Plan upon a change in control of the Company. No awards have been made under the Equity Plan. If awards are made in the future, the administrator of the Equity Plan would have a wide range of options to respond to changes in control in the best interests of the Company’s shareholders.

COMPENSATION OF DIRECTORS

Compensation for the non-employee members of the Board is approved by the Board, which considers recommendations for director compensation from the Company’s Compensation and Human Resources Committee.

Each non-employee member of the Board is paid an annual fee of $80,000 in equal quarterly installments and an additional $1,500 for each Board meeting attended in person and $500 for each Board

-11-

meeting attended by telephone unless, in the case of a telephonic meeting, the Board determines that the meeting and attendant preparation were so brief that no payment is warranted. Additionally, the Chairmen of the Audit Committee and the Compensation and Human Resources Committee are each paid an annual fee of $7,500, and each other member of those Committees is paid an annual fee of $5,000, in equal quarterly installments. The members of the Nominating and Corporate Governance Committee serve without additional compensation. Also, in addition to the fees described above, Edward B. Cloues, II is paid an annual fee of $135,000 for his services as Chairman of the Board and of the Executive Committee and a company owned by Nicholas G. Karabots is paid a monthly fee of $10,000 for making him available to act as Vice Chairman of the Board and of the Executive Committee.

The following table summarizes the compensation earned by the Company’s directors for fiscal 2012:

Name | Fees Earned or Paid in Cash ($) | Total ($) |

| Edward B. Cloues, II | 230,000 | 230,000 |

| Lonnie A. Coombs | 97,500 | 97,500 |

| Nicholas G. Karabots | 217,500(1) | 217,500(1) |

| Albert V. Russo | 95,000 | 95,000 |

| Samuel N. Seidman | 95,000 | 95,000 |

| Jonathan B. Weller | 95,000 | 95,000 |

| _________________________________ |

| (1) | Includes $120,000 paid to a company owned by Mr. Karabots. |

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information as of April 30, 2012 concerning Common Stock of the Company that is issuable under its compensation plans.

Plan Category | (A) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (B) Weighted average exercise price of outstanding options, warrants and rights | (C) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (A)) |

Equity compensation plans approved by shareholders | - | - | 400,000(1) |

Equity compensation plans not approved by shareholders | - | - | - |

| Total | - | - | 400,000 |

____________________________________

| (1) | Represents shares of Common Stock available for grant under the Equity Plan. |

CERTAIN TRANSACTIONS

On August 4, 1993, pursuant to an agreement with Nicholas G. Karabots and two corporations he then owned, the Company, in exchange for 575,593 shares of its Common Stock, acquired various rights to distribute magazines for its distribution business. Prior to that date Mr. Karabots had no affiliation with the Company. The distribution rights covered various magazines published by unaffiliated

-12-

publishers, as well as magazines published by Mr. Karabots’ companies. Mr. Karabots is a director, Vice Chairman of the Board and of the Executive Committee, Chairman of the Compensation and Human Resources Committee and the father-in-law of Michael P. Duloc, one of the Company’s executive officers. Mr. Duloc’s spouse, who is Mr. Karabots’ daughter, is an officer at one of Mr. Karabots’ companies to which the Company provides services.

A committee of the Board (the “Independent Committee”), comprised of directors whom the Board found to be independent of Mr. Karabots, was established with authority to consider and, if deemed appropriate, to approve new contracts and material modifications to existing contracts between the Company and companies owned or controlled by Mr. Karabots. The Independent Committee had no written charter establishing its policies and procedures. The approvals it has granted were based upon determinations after due inquiry that the contract terms were fair and reasonable and no less favorable to the Company than would be obtained in an arm’s length transaction with a non-affiliate having a volume of business with the Company comparable to that of Mr. Karabots. The most recent members of the Independent Committee were Messrs. Russo, Seidman and Weller. The Nominating and Corporate Governance Committee, which was established in June 2012 and is comprised of all of the independent directors, has succeeded to the responsibilities of the Independent Committee, and the terms of any future material transaction with Mr. Karabots or his publishing company will be subject to the approval of that Committee or a subcommittee of that Committee.

The conduct of the Company’s magazine distribution business involves the purchase of magazines from publishing companies, including a company owned or controlled by Mr. Karabots, and their resale to wholesalers. During the fiscal year ended April 30, 2012, the Company distributed magazines published by Mr. Karabots’ company pursuant to a distribution contract, as amended, approved by the Independent Committee that expires June 30, 2014. Mr. Karabots’ publishing company is the Company’s largest magazine distribution services customer. The Company’s fiscal 2012 revenue from its distribution contract with Mr. Karabots’ company was approximately $1,342,000.

Additionally, the Company provides subscription and product fulfillment services for Mr. Karabots’ publishing company. The most recent contract for those services, which was approved by the Independent Committee, expired on June 30, 2008. The Company has continued to provide subscription and product fulfillment services to Mr. Karabots’ publishing company under the terms of the expired contract on a month-to-month basis and the parties continue to engage in negotiations for a renewal. The parties have been unable to reach agreement on pricing for the renewal and Mr. Karabots’ publishing company has been deducting 10% from the amounts it is billed for subscription fulfillment services – a deduction of approximately $15,000 for fiscal 2012. The product fulfillment services have been provided at the historic prices, which amounted to approximately $40,000 for fiscal 2012.

For its fiscal year ended April 30, 2012, the Company’s revenues from the newsstand distribution and fulfillment services it provided to Mr. Karabots’ publishing company amounted to approximately $1,545,000, which was approximately 2.0% of the Company’s consolidated revenues for that period.

In the newsstand distribution services industry it is a customary practice that advance payments for magazine purchases are made by distributors to publishers based upon estimates of the amounts that will be due to them from the sales of the publications to the buying public. If the actual sales are less than estimated, overadvances will result, which the publishers are obligated to repay. It generally takes several months following the date that a publication goes on sale to determine its complete sales history. The Company’s distribution contract with Mr. Karabots’ publishing company calls for the advance payments to be based upon the sales histories of the publications involved. The overadvances to Mr. Karabots’ publishing company in fiscal 2012 were, in large part, attributable to sales declines for a number of those publications and those overadvances dissipated over time as the historic sales became more closely related to the actual sales. Based upon the Company’s estimates of actual sales, the Company believes

-13-

that during the period from May 1, 2011 to June 30, 2012, the highest net amount of the overadvances to Mr. Karabots’ publishing company was approximately $2,238,000, and that at June 30, 2012 it was zero.

The Company’s AMREP Southwest Inc. (“ASW”) subsidiary has a loan originally from Compass Bank (the “Loan”) in the current principal amount of $16,214,000 that matures on September 1, 2012. The Loan bears fluctuating interest at the annual rate of reserve adjusted 30-day LIBOR plus 3.5%, but not less than 5.0%, payable monthly, is secured by a mortgage on real estate owned by ASW having an appraised value as of October/November 2011 of $49,145,000, and requires the payment of certain quarterly installments of principal. Compass Bank has rejected the Company’s request for an extension of the Loan’s maturity and the Company, despite a number of efforts over the past several years, has not to date been successful in identifying any source of refinancing the Loan.

In July 2012, the Company was informed by Compass Bank that it was in discussions to sell the Loan to an unrelated third party, and the Company informed the Board of Directors, including Mr. Karabots, of the information received from Compass Bank. On August 2, 2012, Mr. Karabots informed Edward B. Cloues, II that it was Mr. Karabots’ understanding that neither the Company nor ASW is or will be able to repay or refinance the Loan by its maturity date, that in order to prevent ASW from defaulting on the Loan, Kappa Lending Group, LLC, an entity established and wholly-owned by Mr. Karabots (“Kappa Lending”), was contemplating acquiring the Loan for a discounted price of $15,250,000 plus accrued interest, and that such acquisition might occur as soon as August 9, 2012. Mr. Cloues was also informed that Albert V. Russo was expected to have some participation in the Loan if it was acquired by Kappa Lending, which the Company later learned was to be a 20% participation.

Additionally, Mr. Cloues was informed by Mr. Karabots that if Kappa Lending acquired the Loan, it intended to extend the Loan’s maturity to December 1, 2012 on its existing terms, except that no payments of principal would be required, to accord the Company a period for it (i) to seek to negotiate with Kappa Lending for the terms of a substantially longer extension, which likely would involve an increase in interest rate, and (ii) to determine if there was an alternate financing source available on terms more favorable than Kappa Lending’s terms, the proceeds of which would be used to repay the Loan at its principal amount or at some discount from that amount that might be acceptable to Kappa Lending.

Among the duties of the Company’s Nominating and Corporate Governance Committee specified in its charter is to review and approve any material contract or other transaction between the Company or any of its subsidiaries and any related person. The Committee is comprised of the Company’s five independent directors. It held a meeting on August 7, 2012, to discuss the Loan and the proposed purchase of the Loan by Kappa Lending, with Mr. Russo not in attendance and recusing himself because of his interest in the matter, and Mr. Coombs not in attendance and recusing himself because of his commercial relationship with Mr. Karabots.

At its meeting, the Committee engaged special counsel to assist it in addressing the matter. Such counsel, who had previously been informed of all of the significant current developments regarding the Loan, attended the meeting and advised the Committee concerning the proper discharge of its duties. In the course of the meeting, the Committee, among other things, considered information provided to it by the Company’s management regarding the Company’s and ASW’s financial condition and the results of their operations, both historical and projected. The Committee, all of whose members are long-standing members of the Board, also took notice of the numerous unsuccessful efforts of the Company and ASW over the past several years to obtain financing to replace the Loan.

After discussion, it was the Committee’s conclusions (i) that neither the Company nor ASW had the funds to pay the Loan at maturity at its principal amount or at the discounted amount being offered to Kappa Lending, or were able to obtain such funds on acceptable terms, if at all, and (ii) that the terms being proposed for extending the Loan maturity to December 1, 2012 were fair and reasonable to the

-14-

Company, recognizing that there were no assurances that the maturity would be extended past that date. Kappa Lending was informed of the Committee’s conclusions, and on August 13, 2012 Kappa Lending purchased the Loan for the above-stated price.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s directors, officers and holders of more than 10% of its Common Stock to file initial reports of ownership and reports of changes of ownership of the Common Stock with the Securities and Exchange Commission and the New York Stock Exchange. The related regulations require directors, officers and greater than 10% shareholders to provide copies of all Section 16(a) reports to the Company.

Based solely on a review of the copies of the reports received by the Company and certain written representations from the directors and executive officers, the Company believes that for the fiscal year ended April 30, 2012, all required Section 16(a) reports were filed on a timely basis.

AUDIT-RELATED MATTERS

The consolidated financial statements of the Company and its subsidiaries included in the Annual Report to Shareholders for the fiscal year ended April 30, 2012 have been audited by McGladrey LLP, an independent registered public accounting firm. No representative of McGladrey LLP is expected to attend the Annual Meeting. The Audit Committee has not yet approved the retention of an independent registered public accounting firm for fiscal 2013 as the Company customarily makes its selection later in its fiscal year but engages the prior year’s independent registered public accounting firm to perform quarterly reviews pending the current year’s audit engagement.

Audit Committee Report

The Audit Committee has reviewed and discussed the Company’s audited financial statements for fiscal 2012 with management, which has primary responsibility for the financial statements. McGladrey LLP, as the Company’s independent registered public accountants for fiscal 2012, is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with U.S. generally accepted accounting principles. The Committee has discussed with McGladrey LLP the matters that are required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. McGladrey LLP has provided to the Committee the written disclosures and the letter required by the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed with McGladrey LLP that firm’s independence. Based on these considerations, the Audit Committee has recommended to the Board that the financial statements audited by McGladrey LLP be included in the Company’s Annual Report on Form 10-K for fiscal 2012 for filing with the Securities and Exchange Commission.

The foregoing report is provided by the following directors who constitute the Audit Committee:

Lonnie A. Coombs, Chairman

Samuel N. Seidman

Jonathan B. Weller

-15-

Audit Fees

The following table sets forth certain information concerning the fees of McGladrey LLP for the Company’s last two fiscal years. The reported fees, except the Audit Fees, are amounts billed to the Company in the indicated fiscal years. The Audit Fees are for services for those fiscal years.

| Fiscal Year Ended April 30, | |||||||

| 2012 | 2011 | ||||||

| Audit Fees (1)...............................……............................. | $ | 169,100 | $ | 193,000 | |||

| Audit-Related Fees (2)...............……................................ | 30,750 | 39,782 | |||||

| Tax Fees (3)......................................……........................ | 35,690 | 54,040 | |||||

| All Other Fees (4).............................……......................... | - | 19,200 | |||||

| Total...........................................……................... | $ | 235,540 | $ | 306,022 | |||

| ________________________ |

| (1) | Consists of fees for the audit of the Company’s annual financial statements and reviews of the unaudited financial statements included in the Company’s quarterly reports to the Securities and Exchange Commission on Form 10-Q. |

| (2) | Consists of fees for the audits of employee benefit plans and, in 2011, an audit under Florida’s Single Audit Act related to Palm Coast Data LLC’s participation in Florida business incentive programs and assisting the Company in responding to a comment letter from the Securities and Exchange Commission regarding the Company’s financial statements. |

| (3) | Includes fees for tax compliance, tax advice and tax planning. The services principally involved reviews of the Company’s federal and certain state income tax returns, assistance in responding to federal and state income tax audits, and research and advice on miscellaneous tax questions. |

| (4) | Consists of fees in 2011 in connection with the Company’s filing of a registration statement for its Common Stock under the Securities Act of 1933, as amended. |

Pre-Approval Policies and Procedures

The Audit Committee pre-approves all audit services to be provided by the independent registered public accountants and, separately, all permitted non-audit services to be performed by the independent registered public accountants.

OTHER MATTERS

The Board knows of no matters that will be presented for consideration at the Annual Meeting other than the matters referred to in this Proxy Statement. Should any other matters properly come before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote such proxy in accordance with their best judgment.

SOLICITATION OF PROXIES

The Company will bear the cost of this solicitation of proxies. In addition to solicitation of proxies by mail, the Company may reimburse brokers and other nominees for the expense of forwarding proxy materials to the beneficial owners of stock held in their names. Directors, officers and employees of the Company may solicit proxies on behalf of the Board but will not receive any additional compensation therefor.

-16-

SHAREHOLDER PROPOSALS

From time to time, shareholders present proposals that may be proper subjects for inclusion in the Proxy Statement and for consideration at an annual meeting. Shareholders who intend to present proposals at the 2013 Annual Meeting and who wish to have such proposals included in the Company’s Proxy Statement for the 2013 Annual Meeting must be certain that such proposals are received by the Company’s Secretary at the Company’s executive offices, 300 Alexander Park, Suite 204, Princeton, New Jersey 08450, not later than April 20, 2013. Such proposals must meet the requirements set forth in the rules and regulations of the Securities and Exchange Commission in order to be eligible for inclusion in the Proxy Statement. For any proposal that is not submitted for inclusion in next year’s Proxy Statement but is, instead, sought to be presented directly at the 2013 Annual Meeting, Securities and Exchange Commission rules permit management to vote proxies in its discretion if the Company does not receive notice of the proposal prior to the close of business on July 5, 2013.

By Order of the Board of Directors

Irving Needleman, Secretary

Dated: August 29, 2012

-17-