The information in this preliminary prospectus supplement is not complete and may be changed. The preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-280979

PRELIMINARY PROSPECTUS SUPPLEMENT

SUBJECT TO COMPLETION, DATED OCTOBER 30, 2024

Prospectus Supplement

, 2024

(To Prospectus Dated July 24, 2024)

$

Marsh & McLennan Companies, Inc.

$ % Senior Notes due 2027

$ % Senior Notes due 2030

$ % Senior Notes due 2031

$ % Senior Notes due 2035

$ % Senior Notes due 2044

$ % Senior Notes due 2055

$ Floating Rate Senior Notes due 2027

We will pay interest on the % Senior Notes due 2027 (the “2027 Notes”) on and of each year, beginning on , 2025. The 2027 Notes will mature on , 2027. We will pay interest on the % Senior Notes due 2030 (the “2030 Notes”) on and of each year, beginning on , 2025. The 2030 Notes will mature on , 2030. We will pay interest on the % Senior Notes due 2031 (the “2031 Notes”) on and of each year, beginning on , 2025. The 2031 Notes will mature on , 2031. We will pay interest on the % Senior Notes due 2035 (the “2035 Notes”) on and of each year, beginning on , 2025. The 2035 Notes will mature on , 2035. We will pay interest on the % Senior Notes due 2044 (the “2044 Notes”) on and of each year, beginning on , 2025. The 2044 Notes will mature on , 2044. We will pay interest on the % Senior Notes due 2055 (the “2055 Notes” and, together with the 2027 Notes, the 2030 Notes, the 2031 Notes, the 2035 Notes and the 2044 Notes, the “Fixed Rate Notes”) on and of each year, beginning on , 2025. The 2055 Notes will mature on , 2055.

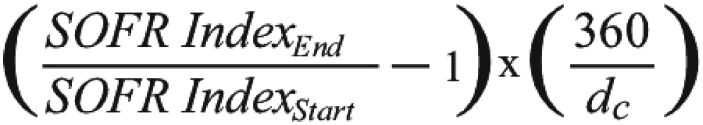

We will pay interest on the Floating Rate Senior Notes due 2027 (the “Floating Rate Notes”) quarterly in arrears on , , and of each year, beginning on , 2025. The Floating Rate Notes will bear interest at a floating rate, reset quarterly, equal to Compounded SOFR (as defined herein), plus %. The Floating Rate Notes will mature on , 2027. The Floating Rate Notes, together with the Fixed Rate Notes, are herein referred to as the “Notes.”

We intend to use the net proceeds from this offering to fund, in part, our pending acquisition of the parent company of McGriff Insurance Services, LLC (“McGriff”), an affiliate of TIH Insurance Holdings, including the payment of related fees and expenses, as well as for general corporate purposes, as described under the heading “Use of Proceeds.” We refer to the pending acquisition of McGriff as the “Transaction.” The closing of this offering is expected to occur prior to, and is not conditioned upon, the consummation of the Transaction.

In the event that (i) the Transaction is not consummated on or prior to the later of (x) September 29, 2025 or (y) the date that is five business days after any later date to which the parties to the Transaction’s Merger Agreement (as defined herein) may agree to extend the “Outside Date” in the Merger Agreement, (ii) the Merger Agreement is terminated or (iii) the Company notifies the Trustee (as defined herein), in writing, that it will not pursue the consummation of the Transaction (each, a “Special Mandatory Redemption Event”), the 2027 Notes, the 2030 Notes, the 2031 Notes, the 2035 Notes, the 2044 Notes and the Floating Rate Notes (collectively, the “Special Mandatory Redemption Notes”) will be subject to a special mandatory redemption. If a Special Mandatory Redemption Event occurs, we will be obligated to redeem all of the outstanding Special Mandatory Redemption Notes on the Special Mandatory Redemption Date (as defined herein) at the “special mandatory redemption price” equal to 101% of the aggregate principal amount thereof, plus accrued and unpaid interest, to, but not including, the Special Mandatory Redemption Date. See “Description of Notes—Special Mandatory Redemption.” The 2055 Notes are not subject to special mandatory redemption and will remain outstanding even if we do not consummate the Transaction, unless otherwise redeemed or repurchased as described herein. In the event of a special mandatory redemption, we intend to use the net proceeds of the 2055 Notes for general corporate purposes.

At our option, we may redeem one or more series of the Fixed Rate Notes offered hereby, in whole or in part at any time and from time to time, before their maturity at the redemption prices described herein under “Description of Notes—Optional Redemption.” We may not redeem the Floating Rate Notes prior to maturity (other than as a result of a special mandatory redemption).

The Notes will be our senior unsecured obligations and will rank equally with all of our other senior unsecured indebtedness from time to time outstanding.

Investing in the Notes involves risks. See the section entitled “Risk Factors” on page S-9 of this prospectus supplement, as well as the risks set forth in our other filings with the Securities and Exchange Commission (the “SEC”), which are incorporated by reference in this prospectus supplement and the accompanying prospectus, for a discussion of certain risks that should be considered in connection with an investment in the Notes.

| | | | | | | | | | | | |

| | | Public Offering

Price(1) | | | Underwriting

Discount | | | Proceeds to Company

(before expenses) | |

Per 2027 Note | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

Per 2030 Note | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

Per 2031 Note | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

Per 2035 Note | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

Per 2044 Note | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

Per 2055 Note | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

Per Floating Rate Note | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

| (1) | Plus accrued interest, if any, from , 2024, if settlement occurs after that date. |

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the Notes through the book-entry delivery system of The Depository Trust Company for the accounts of its participants, including Euroclear Bank SA/NV and Clearstream Banking, S.A., on or about , 2024.

Joint Book-Running Managers

| | | | | | |

| Citigroup | | BofA Securities | | Deutsche Bank Securities |

| | |

| HSBC | | J.P. Morgan | | Wells Fargo Securities |

| | | | | | |

| Barclays | | Goldman Sachs & Co. LLC | | Morgan Stanley | | RBC Capital Markets |

| | | | | | |

| Scotiabank | | TD Securities | | US Bancorp |