QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

Analysts International Corporation | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

ANALYSTS INTERNATIONAL

2004

Annual Meeting of Shareholders

Notice of Annual Meeting

and Proxy Statement

| Section | Page | ||

|---|---|---|---|

| Notice of Annual Meeting | 1 | ||

Proposal Number One: Election of Directors | 2 | ||

| Nominees | 2 | ||

| Board Committees and Compensation | 4 | ||

| Ownership of Company Common Shares by Management | 9 | ||

Proposal Number Two: Appointment of Auditors | 10 | ||

| Independent Auditors' Fees | 10 | ||

| Report of the Audit Committee | 11 | ||

Proposal Number Three: Approval of the 2004 Equity Incentive Plan | 12 | ||

| Description of the 2004 Equity Incentive Plan | 12 | ||

| Federal Income Tax Matters | 14 | ||

| New Plan Benefits | 15 | ||

| Vote Required | 15 | ||

| Equity Compensation Plan Table | 16 | ||

Executive Compensation | 17 | ||

| Compensation Committee Report | 17 | ||

| Summary Compensation Table | 19 | ||

| Options | 20 | ||

| Other Arrangements | 21 | ||

| Stock Performance Graph | 22 | ||

Other Information | 23 | ||

| Other Business | 23 | ||

| Voting at the Meeting | 23 | ||

| Principal Shareholders | 24 | ||

| Solicitation of Proxies | 25 | ||

| 2005 Shareholder Proposals | 25 | ||

Appendix A | A-1 | ||

| Appendix B | B-1 | ||

Our 2003 Annual Report is enclosed.

Your vote is important. You can vote in person at the meeting. If you are unable to attend, you can vote by Internet, telephone or proxy card. See "Voting at the Meeting" on page 23 for details.

3601 West 76th Street

Edina MN 55435

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| Time | 3:00 p.m. on Wednesday, May 26, 2004 | |||

Place | Edina Country Club 5100 Wooddale Avenue Edina, Minnesota 55424 | |||

Items of Business | 1. | To elect nine members to the Board of Directors. | ||

2. | To ratify the appointment of Deloitte & Touche LLP as independent auditors to examine the Company's accounts for the year ending January 1, 2005. | |||

3. | To approve the 2004 Equity Incentive Plan. | |||

4. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement. | |||

Record Date | You can vote if you were a shareholder of record on March 31, 2004. | |||

Colleen M. Davenport

Secretary

April 16, 2004

(approximate date of mailing)

1

PROPOSAL NUMBER ONE

Election of Directors for a Term of One Year

Nominees

The Nominating Committee recommended to the Board the following persons to be elected as directors of the Company for a term of one year. Following is information about each nominee, including biographical data for at least the last five years. Should one or more of these nominees become unavailable to accept nomination or election as a director, the individuals named as proxies on the enclosed proxy card will vote the shares that they represent for the election of such other persons as the Board may recommend.

| John D. Bamberger, 48, is the Company's Executive Vice President and Chief Operating Officer. He has served in that capacity since February 2002 and served as the Company's Senior Vice President of Sales and Operations from November 2000 until February 2002. Previously, he was the CEO of SequoiaNET.com, Inc., acquired by the Company in April 2000, from April 2000 until November 2000. For more than the five years prior to April 2000, he was the CEO of SequoiaNET.com. He has been a director since February 2002. |

| Krzysztof K. Burhardt, 61, is a Partner at Clotho & Associates, a firm specializing in the identification of technical and business ventures. Prior to joining Clotho & Associates, Mr. Burhardt was Vice President Technology at Honeywell International from June 1999 to August 2000 and Vice President, Honeywell Technology Center at Honeywell, Inc. from May 1998 to June 1999. From 1995 to 1998, he was Vice President and Chief Technology Officer at Imation Corporation. He has been a director since December 2002 when he was appointed by the Board. He is a member of the Compensation and Nomination/Governance Committees. |

| Willis K. Drake, 80, is retired Chairman of the Board of Data Card Corporation, a manufacturer of embossing and encoding equipment. Mr. Drake is also a director of Unimax Systems Corporation and ATE Systems. Mr. Drake became an Analysts International director in 1982. He is a member of the Compensation and Nomination/Governance Committees. |

2

| Michael B. Esstman, 57, is retired Senior Vice President, GTE International Telecom Services, GTE Corporation. Prior to serving as Senior Vice President at GTE, Mr. Esstman was Executive Vice President, Customer Segments, GTE Domestic Telephone Operations from 1995 to 1997. He has been a director since December 2002 when he was appointed by the Board. He is a member of the Audit and Nomination/Governance Committees. |

| Frederick W. Lang, 79, is the Company's Chairman of the Board. From 1966 to May 2002, he first served as the Company's President and Chief Executive Officer and then as Chairman and Chief Executive Officer. He has been a director since 1966. |

| Michael J. LaVelle, 64, is the Company's President and Chief Executive Officer. He has been employed by the Company since 1989. He served as the Company's Southern Region Vice President and Senior Vice President of Operations and President and Chief Operating Officer prior to being named President and Chief Executive Officer in 2002. Mr. LaVelle has been a director since 2000. |

| Margaret A. Loftus, 59, is a principal in Loftus Brown-Wescott, Inc., business consultants, and also served as Vice President-Software for Cray Research, Inc. She is a director of Datalink Corporation and is Board Chair of Unimax Systems Corporation. Ms. Loftus has been an Analysts International director since 1993. She is a member of the Audit and Nomination/Governance Committees. |

3

| Edward M. Mahoney, 74, is retired Chairman and Chief Executive Officer of Fortis Advisers, Inc., an investment advisor, and Fortis Investors, Inc., a broker-dealer. He is also a former director of the eleven Fortis mutual fund companies managed by Fortis Advisers, Inc. Mr. Mahoney has been an Analysts International director since 1980. He is Chairman of the Compensation and Audit Committees. |

| Robb L. Prince, 62, is a financial consultant and former Vice President and Treasurer of Jostens Inc., a school products and recognition company. He is also a former director of the eleven mutual fund companies managed by Fortis Advisers, Inc. and Fortis Securities, a closed-end securities fund. Mr. Prince became an Analysts International director in 1994. He is Chairman of the Nomination/Governance Committee and a member of the Audit and Compensation Committees. |

Board Independence, Independent Committees and Communications to Board

Majority Independent Board / Executive Sessions

The Company's Board of Directors is comprised of a total of nine members. Six of the members are "independent" as defined by the rules and regulations of Nasdaq and the Securities and Exchange Commission. Six of the nominees proposed for election herein are "independent" as defined by the rules and regulations of Nasdaq and the Securities and Exchange Commission.

The independent directors are: Krzysztof K. Burhardt, Willis K. Drake, Michael B. Esstman, Margaret A. Loftus, Edward M. Mahoney, and Robb L. Prince. Messrs. Burhardt, Drake, Esstman, Mahoney, Prince and Ms. Loftus are independent directors as defined under Nasdaq rules and the Securities and Exchange Act, as amended. The six independent directors hold regularly scheduled executive sessions, generally in conjunction with regularly scheduled board meetings, but in no event less than two times per year.

Board Committees and Compensation

The three standing committees of the Board of Directors are the Audit Committee, the Compensation Committee and the Nomination/Governance Committee.

Audit Committee

The members of the Audit Committee, all of whom are non-employee directors, are: Edward M. Mahoney (Chair), Michael B. Esstman, Margaret A. Loftus and Robb L. Prince. All of the members of the Audit Committee are "independent" as defined by the rules and regulations of Nasdaq and the Securities and Exchange Commission. The

4

Committee held 3 meetings during the past fiscal year, and Committee members consulted with one another on Committee matters between meetings. The Committee's purpose is to oversee the majority of the Company's accounting and financial reporting policies and practices and to assist the Board of Directors in fulfilling its fiduciary and corporate accountability responsibilities.

Audit Committee Duties and Responsibilities

The Committee's responsibilities include: i) appointment, retention and compensation of the Company's independent certified public accountants; ii) review and approval of the scope of the annual audit as proposed by the independent certified public accountants; iii) review of the results of the annual audit and quarterly reviews conducted by the independent certified public accountants; iv) review and pre-approval of non-audit services to be rendered by the Company's independent certified public accountants; v) maintaining a system for anonymous reporting of accounting irregularities; and vi) considering recommendations of the independent certified public accountants regarding the Company's system of internal accounting controls and financial reporting.

The Committee's responsibilities also include conducting executive sessions with the external auditors, management, Chief Financial Officer and internal audit staff as necessary, reviewing the performance of the external auditors and discharging them if necessary. The Company's independent certified public accountants always have direct access to Audit Committee members. The Committee is required to prepare and present an annual report to the Board as called for in the Committee's Charter. This Proxy Statement provides further information about the Audit Committee under the caption "Report of the Audit Committee."

The Audit Committee Charter, previously adopted and recently amended by the Company's Board of Directors further describes the role of the Audit Committee in overseeing the Company's financial reporting process. The Charter is attached to this Proxy Statement as Appendix A.

Audit Committee Financial Expert

The Board of Directors has determined that Robb L. Prince is an "audit committee financial expert" as defined by the Securities and Exchange Commission. He served as Vice President and Treasurer of Jostens, Inc. from 1982 to 1995, during which time Jostens was publicly traded on the New York Stock Exchange. Mr. Prince also served as a member of the Audit Committee of the Fortis Companies, a New York Stock Exchange Company, for approximately 10 years. For approximately three of those years, he served as chair of the Fortis Companies' audit committee.

The Board based its determination on the following factors. As Vice President and Treasurer at Jostens, Mr. Prince was responsible for Jostens' accounting function for approximately seven years and the company's internal audit function for approximately three years. His responsibilities in overseeing the accounting and internal audit functions required an understanding of generally accepted accounting principles and financial statements and the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves.

Mr. Prince's duties at Jostens also required him to analyze and evaluate financial statements and to supervise one or more people in the preparation, audit, analysis or evaluation of financial statements. The Board of Directors also has concluded that

5

the complexity of the accounting issues raised by Mr. Prince's duties at Jostens presented a breadth and level of complexity of accounting issues generally comparable to those raised by Analysts International's financial statements. In overseeing the internal audit function at Jostens, Mr. Prince gained an understanding of internal controls and procedures for financial reporting. Finally, Mr. Prince's lengthy service on the audit committee at Fortis Companies, and his tenure as chair of the committee, provided him with experience and an understanding of audit committee functions.

Compensation Committee

The members of the Compensation Committee are: Edward M. Mahoney (Chair), Krzysztof K. Burhardt, Willis K. Drake and Robb L. Prince. All of the Committee members are non-employee directors. The Committee held 2 meetings and took action on stock option grants at regular board meetings. The Committee took no action without meeting during the fiscal year. Committee members also consulted with one another on Committee matters during the year. The Committee's purpose is to monitor management compensation for consistency with corporate objectives and shareholders' interests. It approves the annual salaries and incentive plans for executive officers, monitors and administers retirement plans for executive officers, grants options under the Company's employee stock option plans, and oversees and monitors compensation plans for other key management positions.

Nomination/Governance Committee

The Nomination/Governance Committee is comprised of five non-employee directors who are "independent" as defined under the rules and regulations of Nasdaq and the Securities and Exchange Commission. The members of the Committee are Robb L. Prince (Chair), Krzysztof K. Burhardt, Willis K. Drake, Michael B. Esstman and Margaret Loftus. The Committee held no meetings during the fiscal year; however, Committee members consulted with one another on Committee matters throughout the year.

Nomination/Governance Committee Duties and Responsibilities

The Committee is responsible for: i) developing, reviewing and revising the Company's corporate governance standards, and codes of conduct; ii) policies and processes for evaluation of all Board members and the chairperson, election or reelection of Board members and succession planning; iii) reviewing the skills composition of the Board and making recommendations based thereon; and iv) overseeing organization, membership and evaluation of Board committee's members. In addition, the Committee also meets as necessary to consider the nomination and screening of the Board candidates and the performance of Board members.

A copy of the Nomination/Governance Committee Charter, which has been adopted by the Company's Board of Directors and further describes the role of Committee, is attached to this Proxy Statement as Appendix B.

Code of Ethical Business Conduct

The Board of Directors has adopted a Code of Ethical Business Conduct, which applies to all officers, directors and employees of the Company. The Code is publicly available free of charge in theInvestors section of the Company's website at www.analysts.com.

Policies Concerning Nomination Process

The Nomination/Governance Committee believes that candidates for directors should have certain minimum qualifications,

6

including possessing the ability to read and understand basic financial statements; being under 72 years of age (except those directors already serving on the Board prior to December 13, 2002); having experience with the Company's business and industry or experience in general business practices; having high moral character and mature judgment; being able to work collegially with others; and not currently serving on more than four Boards of public companies. The Nomination/Governance Committee reserves the right to modify these minimum qualifications from time to time.

The Nomination/Governance committee will consider candidates for nomination as a candidate recommended by shareholders, directors, third party search firms engaged by the Company and other sources. In evaluating director nominees, the Committee considers the following factors: i) the appropriate size and the diversity of the Company's Board of Directors; ii) the needs of the Board with respect to the particular talents and experience of its directors; iii) the knowledge, skills and experience of nominees, including experience in the industry in which the Company operates, business, finance, management or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board; iv) familiarity with domestic and international business matters; v) experience with accounting rules and practices; vi) appreciation of the relationship between the Company's business and changes in the Company's industry and business in general; and viii) the desire to balance the considerable benefit of board continuity with the periodic injection of the fresh perspective provided by new members.

The Nomination/Governance Committee will consider the attributes of the candidates and the needs of the Board and will review all candidates in the same manner, regardless of the source of the recommendation.

Communications with the Board

The Board provides a process for shareholders to send communications to the Board or any of the directors. Shareholders may send written communications to the Board or any of the directors c/o Corporate Secretary, Analysts International Corporation, 3601 West 76th Street, Edina, MN 55435. All communications will be compiled by the Secretary of the Company and submitted to the Board or the individual directors on a periodic basis.

Board Meetings and Fees

During the past fiscal year, the Board of Directors held 6 meetings. Each of the incumbent directors attended at least 97% of the aggregate of all meetings of the Board of Directors and of the committees, if any, upon which such director served, during the period for which such person has been a director or committee member.

Non-employee directors each received a quarterly fee of $4,500 and fees of $900 for each Board of Directors meeting attended and $700 for each committee meeting attended. In addition, such directors were each granted an option for 6,000 shares of common stock of the Company at an exercise price of $2.00 per share on January 3, 2003 pursuant to the 1996 Stock Option Plan for Non-Employee Directors. Under that plan, each outside director receives an annual grant of options to purchase 6,000 shares of Analysts International common stock. The exercise price of the options is the fair market value of Analysts International common stock on the date of grant. Each option has a term of ten years and becomes exercisable in four equal installments commencing on the first anniversary of the date of grant and continuing for the three successive

7

anniversaries thereafter. In the event of the retirement (as defined in the Plan) or death of an outside director, all options granted to such director are immediately exercisable.

Attendance at Annual Shareholders Meeting

The Company always has expected directors to attend the Annual Shareholders Meeting. The Company recently formalized its policy that all directors attend the annual meeting. The policy also provides that in the event that a director is unable to attend the Annual Meeting, the director must send a written notice at least ten (10) days prior to such meeting, or as soon as practicable in the event of sudden or emergent circumstances. All of our board members attended the immediately preceding Annual Shareholders Meeting, except Mr. Lang who was unable to attend.

8

Ownership of Company Common Shares by Management

The following table shows shares of Analysts International common stock beneficially owned by the Company's directors and executive officers as of March 31, 2004:

Name | Common Shares Owned(1) | Acquirable Within 60 Days(2) | Total Ownership | |||||

|---|---|---|---|---|---|---|---|---|

John D. Bamberger | 518,344 | 114,750 | 633,094 | |||||

| Krzysztof K. Burhardt | 1,000 | 1,500 | 2,500 | |||||

| Colleen M. Davenport | 3,010 | 32,000 | 35,010 | |||||

| Willis K. Drake | 10,006 | 33,000 | 43,006 | |||||

| Michael B. Esstman(3) | 3,000 | 1,500 | 4,500 | |||||

| Frederick W. Lang(3) | 406,478 | 1,500 | 407,978 | |||||

| Michael J. LaVelle | 44,271 | 142,674 | 186,945 | |||||

| Margaret A. Loftus(3) | 6,085 | 33,000 | 39,085 | |||||

| Edward M. Mahoney(3) | 32,051 | 33,000 | 65,051 | |||||

| John T. Paprocki(4) | 24,908 | -0- | 24,908 | |||||

| Robb L. Prince | 10,475 | 33,000 | 43,475 | |||||

| David J. Steichen | -0- | 17,500 | 17,500 | |||||

| All Directors and Executive Officers(5) | 1,503,052 | |||||||

- (1)

- Except as otherwise indicated, each person possesses sole voting and investment power over the shares shown above.

- (2)

- Shares that can be purchased by exercising options which were exercisable, or can be exercised within 60 days of, the record date.

- (3)

- Mr. Esstman's total includes 1,000 shares owned by the Esstman Investment Ltd. partnership and of which he is a 1% owner and his children are 99% owners. Mr. Lang's share total includes 22,500 shares owned by adult children and of which he disclaims beneficial ownership. Ms. Loftus' total includes 535 shares owned by an adult child and of which she disclaims beneficial ownership. Mr. Mahoney's total includes 14,000 shares owned by him as trustee and over which he has sole voting and investment power.

- (4)

- Mr. Paprocki left the Company in October 2003. Mr. Paprocki's total ownership number is based on the information available to the Company in October 2003.

- (5)

- Total ownership by management is 6.2% of the outstanding shares. Mr. Lang owns 1.7% of the total outstanding shares and Mr. Bamberger owns 2.6% of the total shares. No other executive officer or director owns more than 1% of the total outstanding shares.

Section 16(a) of the 1934 Act requires the Company's directors, and executive officers, and persons who own more than ten percent of the Common Stock of the Company, to file with the Securities and Exchange Commission ("Commission") initial reports of beneficial ownership and reports of changes in beneficial ownership of common shares of the Company. Directors, officers and greater than ten percent shareholders are required by the regulations of the Commission to furnish the Company with copies of all Section 16(a) reports they file. To the Company's knowledge, based solely on review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended January 3, 2004, all Form 3, Form 4 and Form 5 filing requirements were met except one Form 4 filing for Mr. Steichen.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE NOMINEES.

9

PROPOSAL NUMBER TWO

Appointment of Independent Auditors

Unless otherwise directed by the shareholders, shares represented by proxy at the meeting will be voted in favor of ratification of the appointment of the firm of Deloitte & Touche LLP to examine the accounts of the Company for the fiscal year ending January 1, 2005. Management believes that neither Deloitte & Touche LLP nor any of its partners presently has or has held within the past three years any direct or indirect interest in the Company. A representative of Deloitte & Touche LLP is expected to be present at the annual meeting and will be given an opportunity to make a statement if so desired and to respond to appropriate questions.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" THE PROPOSAL TO APPROVE THE APPOINTMENT OF DELOITTE & TOUCHE LLP.

Independent Auditors' Fees

The following fees were paid to Deloitte & Touche LLP for fiscal years 2002 and 2003:

| | | Deloitte & Touche LLP | | |||||

|---|---|---|---|---|---|---|---|---|

FY 2003 | FY 2002 | |||||||

Audit Fees(1) | $ | 139,800 | $ | 125,594 | ||||

| Audit-Related Fees(2) | 15,300 | 6,700 | ||||||

| Tax Fees(3) | 25,000 | 32,240 | ||||||

| All Other Fees(4) | 0 | 0 | ||||||

- (1)

- Audit Fees are primarily for services including the audit of the Company's financial statements for the most recent fiscal year and the reviews of the financial statements included in each of the Company's Quarterly Reports on Form 10-Q during the fiscal year ended January 3, 2004.

- (2)

- Audit-Related Fees are primarily for services in connection with employee benefit plan audits, accounting research, UK regulatory audit, and Sarbanes-Oxley Section 404 advisory services.

- (3)

- Tax Fees include fees for services provided in connection with tax consulting and tax return review services.

- (4)

- The Company paid no Other Fees to Deloitte & Touche.

The Audit Committee has considered whether provision of the above non-audit services is compatible with maintaining Deloitte & Touche LLP's independence and has determined that such services are compatible with maintaining Deloitte & Touche LLP's independence.

The Audit Committee has adopted a policy requiring the pre-approval of audit, audit-related, tax and other services. This policy also prohibits the purchase of the non-audit services prohibited by the rules and regulations of the SEC.

10

Report of the Audit Committee

The role of the Audit Committee is to oversee the majority of the Company's financial reporting process. Management is responsible for the Company's financial statements and reporting process, including the Company's systems of internal controls. The Company's independent auditors are responsible for auditing the Company's financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America. A copy of the Audit Committee Charter, which has been adopted by the Company's Board of Directors and further describes the role of the Audit Committee in overseeing the Company's financial reporting process, is attached to this Proxy Statement as Appendix A. The Company's Code of Ethics for Senior Financial Officers, which has been adopted by the Company's Board of Directors, is publicly available free of charge in theInvestors section of the Company's website at www.analysts.com.

In performing its functions, the Audit Committee reports that:

• The Committee met with the Company's independent auditors, with and without management present, to discuss the overall scope and plans for their audit, the results of their examination, their evaluation of the Company's internal controls, and the overall quality of the Company's financial reporting;

• The Committee reviewed and discussed with management the audited financial statements included in the Company's Annual Report, management's representations regarding the financial statements and the Company's internal controls;

• The Committee discussed with the Company's independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees), as modified and supplemented;

• The Committee received the written disclosures and the letter from the Company's independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committee), as modified and supplemented, and discussed with them matters relating to their independence;

• The Committee received information from management and the independent auditors with respect to information technology consulting services relating to financial information systems design and implementation and other non-audit services provided by the Company's independent auditors, and considered whether the provision of those services is compatible with maintaining the auditors' independence; and

• The individual Committee members and the Committee as a whole comply with the independence requirements set forth in applicable regulations.

Based upon its reviews and discussions with the independent auditors and management, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended January 3, 2004 for filing with the Securities and Exchange Commission.

E.M. Mahoney, Chair

M.B. Esstman

M.A. Loftus

R.L. Prince

Members of the Audit Committee

11

PROPOSAL NUMBER THREE

Approval of 2004 Equity Incentive Plan

The Board of Directors recently approved the Analysts International Corporation 2004 Equity Incentive Plan (the "2004 Plan"), subject to approval by the Company's shareholders. The Board believes that granting fairly-priced stock options and restricted stock awards to employees, officers and directors are an effective means to promote the future growth and development of the Company. Such options and awards, among other things, increase these individuals' proprietary interest in the Company's success and enables the Company to attract and retain qualified personnel. The Board therefore recommends that all shareholders vote in favor of the 2004 Plan.

The 2004 Plan is in addition to the Analysts International Corporation 1994 and 1999 Stock Option Plan(s), which the shareholders previously approved (the "Prior Plans"). If the 2004 Plan is approved by the shareholders, the Company will continue to grant stock options under the Prior Plans until all options are granted under each of the Prior Plans or upon expiration of an individual plan, whichever is sooner. The number of options issued and remaining to be issued from the Prior Plans is set forth in theEquity Compensation Table section of this Proxy Statement. If the shareholders do not approve the 2004 Plan, future stock options will continue to be granted under the Prior Plans.

The affirmative vote of a majority of the shares of the Company's common stock represented and voting on this proposal at the 2004 Annual Meeting of Shareholders is required for approval of the 2004 Plan.

Description of 2004 Equity Incentive Plan

A general description of the material features of the 2004 Plan follows, but this description is qualified in its entirety by reference to the full text of the 2004 Plan, a copy of which may be obtained without charge upon request to Colleen M. Davenport, the Company's Secretary and General Counsel, at the Company's headquarters address.

General. Effective March 29, 2004, the Board adopted the 2004 Equity Incentive Plan. Under the 2004 Plan, the Board or a committee appointed by the Board may award nonqualified or incentive stock options or restricted stock (collectively referred to as an "Award" or "Awards") to those officers, directors and employees (the "Participants") of the Company (including its subsidiaries and affiliates) whose performance, in the judgment of the Administrator, can have a significant effect on the success of the Company. Directors may receive grants of nonqualified stock options only.

Shares Available. Assuming the shareholders approve the 2004 Plan, the total number of shares of the Company's common stock available for grants of Awards to Participants directly or indirectly under the 2004 Plan shall be one million (1,000,000) shares of common stock. If any Awards granted under the 2004 Plan expire or terminate prior to exercise or otherwise lapse, the shares subject to such portion of the Award are available for subsequent grants of Awards.

The total number of shares and the exercise price per share of common stock that may be issued pursuant to outstanding

12

Awards are subject to adjustment by the Board of Directors upon the occurrence of stock dividends, stock splits or other recapitalizations, or because of mergers, consolidations, reorganizations or similar transactions in which the Company receives no consideration. The Board may also provide for the protection of Participants in the event of a merger, liquidation, reorganization, divestiture (including a spin-off) or similar transaction.

Administration and Types of Awards. The 2004 Plan may be administered by the Board or by a Committee of the Board of Directors (hereinafter referred to as the "Administrator"). Any committee appointed by the Board to administer the 2004 Plan shall consist of at least two "non-employee" directors (as defined in Rule 16b-3, or any successor provision, of the General Rules and Regulations under the Securities Exchange Act of 1934). The Administrator has broad powers to administer and interpret the 2004 Plan, including the authority: (i) to establish rules for the administration of the 2004 Plan; (ii) to select the Participants in the 2004 Plan; (iii) to determine the types of Awards to be granted and the number of shares covered by such Awards; and (iv) to set the terms and conditions of such Awards. All determinations and interpretations of the Administrator are binding on all interested parties.

Options. Options granted under the 2004 Plan may be either "incentive" stock options within the meaning of Section 422 of the Internal Revenue Code ("I.R.C.") or "nonqualified" stock options that do not qualify for special tax treatment under Section 422 or similar provisions of the I.R.C. No incentive stock option may be granted with a per share exercise price less than the fair market value of a share of the underlying common stock on the date the incentive stock option is granted. The per share exercise price for nonqualified stock options granted under the 2004 Plan also will not be less than the fair market value of a share of the Company's common stock on the date the nonqualified stock option is granted. The fair market value of the Company's common stock was $2.91 on March 31, 2004.

The period during which an option may be exercised and whether the option will be exercisable immediately, in stages, or otherwise is set by the Administrator. An incentive stock option may not be exercisable more than ten (10) years from the date of grant. Participants generally must pay for shares upon exercise of options with cash, certified check or common stock of the Company valued at the stock's then "fair market value" as defined in the 2004 Plan. Each incentive option granted under the 2004 Plan is nontransferable during the lifetime of the Participant. A nonqualified stock option may, if permitted by the Administrator, be transferred to certain family members, family limited partnerships and family trusts.

The Administrator may, in its discretion, modify or impose additional restrictions on the term or exercisability of an option. The Administrator may also determine the effect that a Participant's termination of employment with the Company or a subsidiary may have on the exercisability of such option. The grants of stock options under the 2004 Plan are subject to the Administrator's discretion. Consequently, future grants to eligible Participants cannot be determined at this time.

Stock Awards. The Administrator also authorized to grant awards of restricted stock. Each restricted stock award granted pursuant to the 2004 Plan shall be

13

evidenced by a written restricted stock agreement (the "Restricted Stock Agreement"). The Restricted Stock Agreement shall be in such form as may be approved from time to time by the Administrator and may vary from Participant to Participant; provided, however, that each Participant and each Restricted Stock Agreement shall comply with and be subject to the terms and conditions described in the Plan and may include the possibility of forfeiture. No restricted stock award shall be transferable, in whole or in part, by the Participant, other than by will or by the laws of descent and distribution, prior to the date the risks of forfeiture described in the Restricted Stock Agreement have lapsed.

Amendment. The Board of Directors may terminate or amend the 2004 Plan, except that the terms of Award agreements then outstanding may not be adversely affected without the consent of the Participant. The Board of Directors may not amend the 2004 Plan to materially increase the total number of shares of common stock available for issuance under the 2004 Plan, materially increase the benefits accruing to any individual or materially modify the requirements for eligibility to participate in the 2004 Plan without the approval of the Company's shareholders if such approval is required to comply with the I.R.C. or other applicable laws or regulations.

Federal Income Tax Matters

Options. "Nonqualified" stock options granted under the 2004 Plan are not intended to and do not qualify for favorable tax treatment available to "incentive" stock options under I.R.C. Section 422. Generally, no income is taxable to the Participant (and the Company is not entitled to any deduction) upon the grant of a nonqualified stock option. When a nonqualified stock option is exercised, the Participant generally must recognize compensation taxable as ordinary income equal to the difference between the option price and the fair market value of the shares on the date of exercise. The Company normally will receive a deduction equal to the amount of compensation the Participant is required to recognize as ordinary income and must comply with applicable tax withholding requirements.

"Incentive" stock options granted pursuant to the 2004 Plan are intended to qualify for favorable tax treatment to the Participant under Code Section 422. Under Code Section 422, a Participant realizes no taxable income when the incentive stock option is granted. If the Participant has been an employee of the Company or any subsidiary at all times from the date of grant until three months before the date of exercise, the Participant will realize no taxable income when the option is exercised. If the Participant does not dispose of shares acquired upon exercise for a period of two years from the granting of the incentive stock option and one year after receipt of the shares, the Participant may sell the shares and report any gain as capital gain. The Company will not be entitled to a tax deduction in connection with either the grant or exercise of an incentive stock option, but may be required to comply with applicable withholding requirements. If the Participant should dispose of the shares prior to the expiration of the two-year or one-year periods described above, the Participant will be deemed to have received compensation taxable as ordinary income in the year of the early sale in an amount equal to the lesser of (i) the difference between the fair market value of the Company's common stock on the date of exercise and the option price of the shares, or (ii) the difference between the sale

14

price of the shares and the option price of shares. In the event of such an early sale, the Company will be entitled to a tax deduction equal to the amount recognized by the Participant as ordinary income. The foregoing discussion ignores the impact of the alternative minimum tax, which may particularly be applicable to the year in which an incentive stock option is exercised.

Stock Awards. Generally, no income is taxable to the recipient of a restricted stock award in the year that the award is granted. Instead, the Participant will recognize compensation taxable as ordinary income equal to the fair market value of the shares in the year in which the transfer restrictions lapse. Alternatively, if a Participant makes a "Section 83(b)" election, the Participant will, in the year that the restricted stock award is granted, recognize compensation taxable as ordinary income equal to the fair market value of the shares on the date of the award. The Company normally will receive a deduction equal to the amount of compensation the recipient is required to recognize as ordinary taxable income, and must comply with applicable tax withholding requirements.

New Plan Benefits

The Company's management and Board of Directors believe that adoption of the 2004 Plan will enable the Company to continue to attract and retain a strong management and employee base, and will further link key employees to and reward them for increases in shareholder value. Currently, no Awards have been granted under the 2004 Plan. Because future grants of Awards under the 2004 Plan are subject to the Administrator's discretion, the future benefits or amounts that may be received by employees, officers or directors under the 2004 Plan cannot be determined at this time.

Vote Required

Under applicable Minnesota law and Nasdaq rules, approval of the 2004 Plan requires the affirmative vote of the holders of a majority of the voting power of the shares represented in person or by proxy at the Annual Meeting with authority to vote on such matter, provided that such majority must be greater than 25% of the Company's outstanding shares entitled to vote.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" THE 2004 EQUITY INCENTIVE PLAN.

15

Equity Compensation Plan Table

The following table provides information as of January 3, 2004 about the Company's equity compensation plans.

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |||

|---|---|---|---|---|---|

Equity compensation plans approved by security holders(1) | 1,989,709 | 8.14 | 298,256(2) | ||

| Equity compensation plans not approved by security holders(3) | 135,973 | 3.19 | 84,480 | ||

Totals |

- (1)

- Shareholders previously approved the Analysts International Corporation 1994 and 1999 and the Analysts International Corporation 1996 Stock Option Plan for Non-Employee Directors. Options issued under the Plans become exercisable in increments of 25% over a four-year period beginning one year after the date of the grant.

- (2)

- The 1994 Plan, which had 33,972 securities remaining for issuance at January 3, 2004, expires in October 2004, after which no additional options will be issued.

- (3)

- In 2000, the Board of Directors adopted the Analysts International Corporation 2000 Nonqualified Stock Option Plan in conjunction with its acquisition of the remaining 19.9% of SequoiaNET.com. The Plan remains in effect until terminated by the Board. The Plan provided for 225,000 nonqualified options to be available for grant at no less than 85% of fair market value on the date of grant. No options have been granted at less than 100% of value on the date of grant. Options are exercisable pursuant to terms and conditions of stock option agreements established by the Administrator of the Plan. All options issued under this plan become exercisable in increments of 25% over a four-year period beginning one year after the date of the grant.

16

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Board of Directors administers the Company's executive compensation program. The Compensation Committee, consisting of four non-employee directors, meets formally and consults informally during the year. A more complete description of the functions of the Compensation Committee is set forth above under the caption "Board Committees and Compensation."

Compensation Philosophy and Objectives. The Company's executive compensation philosophy is to pay for performance. The objectives of the Company's executive compensation program are to:

• Provide compensation that enables the Company to attract and retain key executives.

• Reward the achievement of desired Company performance goals.

• Align the interest of the Company's executives to shareholder return through long-term opportunities for stock ownership.

The executive compensation program provides an overall level of compensation opportunity that the Compensation Committee believes, in its judgment and experience, is competitive with other companies of comparable size and complexity. Actual compensation levels may be greater or less than compensation levels at other companies based upon annual and long-term Company performance as well as individual performance. The Compensation Committee uses its discretion to establish executive compensation at levels that in its judgment are warranted by external or internal factors as well as an executive's individual circumstances. In arriving at what it considers appropriate levels and components of compensation, the Compensation Committee from time to time utilizes industry compensation data provided by Watson Wyatt & Company, a nationally recognized compensation consulting firm, or other publicly available resources.

Executive Compensation Program Components. The Company's executive compensation program consists of base salary, annual cash bonus incentives and long-term incentives in the form of stock options. The particular elements of the compensation program are discussed more fully below.

Base Salary. Base pay levels of executives are determined by the potential impact of the individual on the Company and its performance, the skills and experience required by the position, salaries paid by other companies for comparable positions and personal and corporate development goals and the overall performance of the Company. Base salaries for executives are maintained at levels that the Compensation Committee believes, based on its own judgment and experience, are competitive with other companies of comparable size and complexity.

Annual Cash Bonus Incentives. The Compensation Committee emphasizes annual cash bonus incentives as a means of rewarding executives for significant Company and individual performance. Prior to the beginning of each fiscal year, the Compensation Committee establishes objective performance criteria for incentive compensation for each executive officer,

17

taking into account business conditions and profit projections for the coming year. Incentive compensation for each executive officer is based on attainment of the performance criteria so established. Performance criteria for each of the past three fiscal years for Mr. LaVelle, Mr. Bamberger, Mr. Paprocki, Ms. Davenport and Mr. Steichen have been based on the Company's attainment of specified pre-tax profit objectives.

The Compensation Committee believes that this incentive arrangement creates a direct relationship between the most important measure of Company performance—profit—and executive compensation.

Long-Term Incentives. Long-term incentives are provided in the form of stock options. The Committee and the Board of Directors believe that management's ownership of a significant equity interest in the Company is a major incentive in building shareholder wealth and aligning the long-term interests of management and shareholders. Stock options, therefore, are granted at the market value of the common shares on date of grant and typically vest in installments of 25% per year beginning one year after grant. The value received by the executive from an option granted depends completely on increases in the market price of the Company's common shares over the option exercise price. Consequently, the value of the compensation is aligned directly with increases in shareholder value. Grants of stock options are made by the Compensation Committee based upon the executive's contribution toward Company performance and expected contribution toward meeting the Company's long-term strategic goals.

Deferred Compensation. The Company maintains a non-qualified deferred compensation plan referred to as the Special Executive Retirement Plan (SERP) for executives whom the Compensation Committee determines should participate in the Plan. Further information about this Plan can be found in the "Other Arrangements" section herein.

Tax Deductibility Considerations. Deductibility of compensation paid to the Company's executive officers is limited to $1 million per executive, except for certain "performance-based" compensation as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended. The Committee has been advised that compensation attributable to stock options granted under plans approved by shareholders will qualify as performance-based compensation. For 2004, compensation in the form of salary and cash bonus incentives will not exceed the limit and therefore will be fully deductible, and the Committee does not anticipate that compensation in these forms for any individual executive officer will exceed the deductibility limit in the foreseeable future. The Committee will take appropriate action regarding the deductibility of executive compensation at such future time as it deems necessary.

E.M. Mahoney, Chair

K.K. Burhardt

W.K. Drake

R.L. Prince

Members of the Compensation Committee

18

The following table sets forth the cash and non-cash compensation awarded to or earned by the Chief Executive Officer and other executive officers of the Company for the years ended January 3, 2004, December 28, 2002 and December 31, 2001.

| | Annual Compensation | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Long-Term Compensation Options(#) | All Other Compensation(3) | |||||||||||

| Name and Principal Position | Year(1) | Salary | Bonus(2) | ||||||||||

M.J. LaVelle(4) President & Chief Executive Officer | 2003 2002 2001 | $ | 375,433 357,364 305,590 | $ | - -0- - -0- - -0- | - -0- 50,000 25,000 | $ $ $ | 1,967 1,980 1,980 | |||||

J.D. Bamberger(5) Executive Vice President & Chief Operating Officer | 2003 2002 2001 | $ | 361,977 328,330 332,500 | $ $ | - -0- 74,046 37,023 | - -0- 15,000 18,000 | $ $ $ | 477 450 450 | |||||

John T. Paprocki(6) Former Chief Financial Officer | 2003 2002 2001 | $ $ | 411,053 275,818 - -0- | $ $ | - -0- - -0- - -0- | - -0- 50,000 - -0- | $ $ | 580 518 - -0- | |||||

Colleen M. Davenport(7) Secretary and General Counsel | 2003 2002 2001 | $ $ | 203,750 198,904 152,286 | $ $ $ | - -0- - -0- - -0- | - -0- 20,000 13,000 | $ $ | 213 270 270 | |||||

David J. Steichen(8) Interim Chief Financial Officer | 2003 2002 2001 | $ $ | 131,493 111,674 115,812 | $ $ | - -0- - -0- 5,000 | 10,000 5,000 5,000 | $ $ | 268 270 270 | |||||

- (1)

- The Company changed its fiscal year end from June 30 to December 31 effective December 31, 2000, and, in 2002, changed its fiscal year end to the Saturday closest to December 31. In the above table, "2003" means the year ended January 3, 2004; "2002" means the year ended December 28, 2002; and "2001" means the year ended December 31, 2001.

- (2)

- Represents amounts paid with respect to the fiscal years shown under the incentive compensation plans described herein.

- (3)

- Represents life insurance premiums paid for each executive officer.

- (4)

- Mr. LaVelle became President and Chief Executive Officer in May 2002.

- (5)

- Mr. Bamberger became an executive officer of the Company in November 2000.

- (6)

- Mr. Paprocki joined the Company in 2002 and left the Company in October 2003.

- (7)

- Ms. Davenport was appointed Secretary and General Counsel in November 2000.

- (8)

- Mr. Steichen was appointed Interim Chief Financial Officer in October 2003.

19

Options

The following tables show certain information regarding stock options granted during fiscal 2003 to the Company's executive officers, the number of options exercised by them during the fiscal year and the number and value of options unexercised at fiscal year end.

Aggregated Option Grants in Last Fiscal Year

| | | | | | Potential Realizable Value(2) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name | Number of Options Granted(1) | % of Total Options Granted In Fiscal Year | Exercise Price | Expiration Date | 5% | 10% | |||||||||

M.J. LaVelle | 0 | 0% | N/A | N/A | $ | 0 | $ | 0 | |||||||

J.D. Bamberger | 0 | 0% | N/A | N/A | $ | 0 | $ | 0 | |||||||

J.T. Paprocki | 0 | 0% | N/A | N/A | $ | 0 | $ | 0 | |||||||

C.M. Davenport | 0 | 0% | N/A | N/A | $ | 0 | $ | 0 | |||||||

D.J. Steichen | 10,000 | 3.5% | $ | 3.00 | 12/18/2013 | $ | 1,500 | $ | 3,000 | ||||||

- (1)

- All options were granted at an exercise price equal to the fair market value on the date of grant. The grants provide that the options are not exercisable during the first year after the grant, and thereafter become exercisable at the rate of 25% per year for each of the next four years.

- (2)

- The dollar amounts under these columns are the result of calculations at 5% and 10% rates required by rules of the Securities and Exchange Commission and are not intended to forecast possible future appreciation, if any, of the stock price.

Aggregated Option Exercises in Last Fiscal Year

and FY-End Option Value

| | | | Unexercised Shares | Value of Unexercised In-The-Money Shares | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Shares Acquired On Exercise | Value Realized | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||

M.J. LaVelle | - -0- | $ | 0 | 130,174 | 62,500 | $ | 0 | $ | 0 | ||||||

J.D. Bamberger | - -0- | $ | 0 | 89,250 | 45,750 | $ | 675 | $ | 2,025 | ||||||

J.T. Paprocki | 12,500 | $ | 9,875 | - -0- | - -0- | $ | 0 | $ | 0 | ||||||

C.M. Davenport | - -0- | $ | 0 | 27,000 | 25,500 | $ | 0 | $ | 0 | ||||||

D. J. Steichen | - -0- | $ | 0 | 17,500 | 17,500 | $ | 0 | $ | 1,800 | ||||||

GRAND TOTAL: | 12,500 | $ | 9,875 | 263,924 | 151,250 | $ | 675 | $ | 3,825 | ||||||

20

Other Arrangements

Employment Contracts. Agreements with the Company's executive officers provide that, following a change in control, the Company will (i) continue their employment for 36 months without reduction in compensation (base salary or incentive) or benefits and (ii) provide them with a severance payment should their employment be terminated during the 36 months. The amount of the severance payment would be three times annualized compensation. Mr. Bamberger's employment contract, signed in conjunction with the April 2000 acquisition of SequoiaNET.com, provides for a specific term with an expiration date of April 23, 2004. The contract automatically renews for one-year periods thereafter unless terminated on sixty (60) days' prior written notice by either party.

Senior Executive Retirement Plan. The Company's executive officers are eligible for retirement benefits under an executive retirement plan which provides for a lump sum or an annual payment at normal retirement age equal to a percentage of average cash compensation for the highest five years of the last ten years of employment. The percentages are 45% for Messrs. LaVelle and Bamberger and 30% for Ms. Davenport. Benefits for Messrs. LaVelle and Bamberger, and Ms. Davenport are further limited by a vesting schedule which provides for full vesting after twenty years of employment with the Company. The benefit is payable for fifteen years in the case of retirement after age 65. Estimated annual benefits payable to Mr. LaVelle, Mr. Bamberger, and Ms. Davenport under these plans following retirement at age 65 are $125,030, $114,000 and $60,000, respectively. A trust agreement has been entered into with Wells Fargo Bank Minnesota, N.A., as trustee, under which the trustee is to hold the assets required to fund the plans for executive officers and make the required distributions.

21

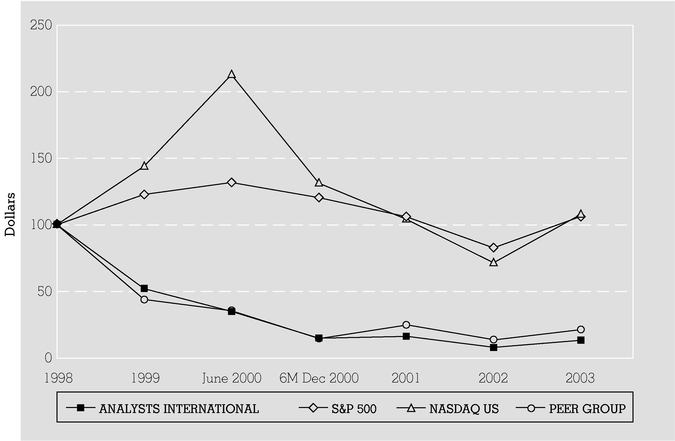

Stock Performance Graph

The following graph compares the Company's five-year cumulative total return over the period beginning January 1, 1999 and ending December 31, 2003 as compared to the NASDAQ Index, the S&P 500 Index, and a peer group index selected by the Company. The total shareholder return assumes $100 invested at the beginning of the period in Analysts International Common Stock and in each of the foregoing indices. It also assumes reinvestment of all dividends. Past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

December 2003

ASSUMES INITIAL INVESTMENT OF $100

*TOTAL RETURN ASSUMES REINVESTMENT OF DIVIDENDS

NOTE: TOTAL RETURNS BASED ON MARKET CAPITALIZATION

The peer group index reflects the stock performance of the following publicly traded companies in the Company's industry: Butler International, Inc., Ciber Inc., Comforce Corp., Computer Horizons, Computer Task Group, and Keane, Inc.

22

Other Business

The three proposals that have been properly submitted for action by shareholders at the Annual Meeting are as listed in the Notice of Annual Meeting of Shareholders. Management is not aware of any other items of business which will be presented for shareholder action at the Annual Meeting. Should any other matters properly come before the meeting for action by shareholders, the shares represented by proxies will be voted in accordance with the judgment of the persons voting the proxies.

Voting at the Meeting

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of proxies in the accompanying form. Shares will be voted in the manner directed by the shareholders through their proxies, Internet voting or telephone voting. As of the record date, March 31, 2004, there were 24,211,957 shares of common stock outstanding and entitled to be voted. Each share is entitled to one vote. Cumulative voting is not permitted.

Proxy cards that are signed by shareholders but lack any such specification will be voted in favor of the proposals as set forth herein. A shareholder giving a proxy may revoke it at any time before it is exercised by (a) delivering to the Secretary of the Company, at or prior to the meeting, a later dated duly executed proxy relating to the same shares, or (b) delivering to the Secretary of the Company, at or prior to the meeting, a written notice of revocation bearing a later date than the proxy. Any written notice or proxy revoking a previously submitted proxy should be sent to Analysts International Corporation, 3601 West 76th Street, Edina, Minnesota 55435, Attention: Colleen M. Davenport, Secretary.

Alternatively, in lieu of returning signed proxy cards, shareholders of record can vote their shares over the Internet or by calling a specially designated telephone number. These Internet and telephone voting procedures are designed to authenticate shareholders' identities, to allow shareholders to provide their voting instructions, and to confirm that their instructions have been recorded properly. Specific instructions for shareholders of record who wish to use the Internet or telephone voting procedures are set forth on the enclosed proxy card. The proxy card covers the number of shares to be voted, including any shares held for those who own shares of common stock through the Analysts International Corporation Savings and Investment Plan.

The enclosed proxy card also serves as a voting instruction to the Trustee of the Analysts International Savings and Investment Plan for shares held in the Plan as of the record date, provided that instructions are furnished over the Internet or by telephone by May 25, 2004, or that the card is signed, returned, and received by the Trustee no later than May 24, 2004. If instructions are not received over the Internet or by telephone by May 25, 2004, or if the signed proxy card is not returned and received by May 24, 2004, the shares in the Plan will be voted by the Trustee in proportion to the shares for which the Trustee receives timely voting instructions.

Directors will be elected by a favorable vote of a plurality of the common shares cast with respect to the election of

23

directors. The affirmative vote of a majority of the common shares voting at the meeting is required for the ratification of the appointment of auditors.

All shares voted by proxy, including abstentions, will be counted in determining whether a quorum is present at the meeting. Abstentions and broker non-votes will not affect the three proposals to be acted upon at the meeting.

Principal Shareholders

The table below sets forth certain information as to each person or entity known to the Company to be the beneficial owner of more than 5% of the Company's common stock:

Name and Address of Beneficial Owner | Number of Shares Beneficially Owned | Percent of Class | ||||||

|---|---|---|---|---|---|---|---|---|

Columbia Wanger Asset Management, L.P. WAM Acquisition GP, Inc. Columbia Acorn Trust 227 West Monroe Street Suite 3000 Chicago, IL 60606 | 2,813,200(1) | 11.6% | ||||||

FleetBoston Financial Corporation 111 Westminster Street Providence, RI 02903 | 1,349,400(2) | 5.6% | ||||||

Heartland Advisors, Inc. 789 North Water Street Milwaukee, WI 53202 | 1,400,000(3) | 5.8% | ||||||

Royce & Associates, Inc. 1414 Avenue of the Americas New York, NY 10019 | 1,213,800(4) | 5.0% | ||||||

- (1)

- As reported in their Schedule 13G dated February 13, 2004, Columbia Wanger Asset Management, L.P. and WAM Acquisition GP, Inc. ("WAM" and "WAM GP", respectively) have shared voting power over 2,813,200 shares and shared dispositive power over 2,813,200 shares. These securities are owned by various individual and/or institutional investors which WAM serves as an investment advisor with power to direct investments and/or shared power to vote the securities. WAM GP serves as WAM's general partner with shared voting and shared dispositive power over the securities. Columbia Acorn Trust, an investment company, has shared voting power and shared dispositive power over 2,556,600 of the 2,813,200 shares. For the purposes of the reporting requirements of the Securities Exchange Act of 1934, WAM, WAM GP, and Columbia Acorn Trust are deemed to be beneficial owners of such securities; however, WAM, WAM GP and Columbia Acorn Trust expressly disclaim that they are, in fact, the beneficial owners of such securities.

- (2)

- As reported in its Schedule 13G dated February 13, 2004, FleetBoston Financial Corporation, a holding company, has sole voting power over 904,600 shares and sole dispositive power over 1,349,400 shares. The subsidiaries of FleetBoston acquiring the shares are Fleet National Bank, a bank, and Columbia Management Advisors, Inc., an investment advisor.

24

- (3)

- As reported in its Schedule 13G dated February 12, 2004, Heartland Advisors, Inc., an investment advisor, has shared voting power and shared dispositive power over 1,400,000 shares.

- (4)

- As reported in its Schedule 13G dated February 11, 2004, Royce and Associates, Inc. has sole voting power over 1,213,800 shares and sole dispositive power over 1,213,800 shares. These securities are owned by various individual and institutional investors which Royce and Associates, Inc. serves as investment advisors with power to direct investments and/or shared power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Royce Associates, Inc. is deemed to be beneficial owner of such securities; however, Royce and Associates, Inc. expressly disclaims that it is, in fact, the beneficial owner of such securities.

Solicitation of Proxies

Solicitation will be conducted primarily by mail, and, in addition, directors, officers and employees of the Company may solicit proxies personally, by telephone or by mail at no additional compensation to them. The Company will reimburse brokerage houses and other custodians for their reasonable expenses in forwarding proxy materials to beneficial owners of common stock. The Company has retained D. F. King & Co., Inc., 48 Wall Street, New York, New York 10005, to assist with solicitation of proxies from brokerage houses and other custodians who are record holders of shares owned beneficially by others, the estimated cost of which is $5,000 plus out-of-pocket expenses.

2005 Shareholder Proposals

Any appropriate proposal submitted by a shareholder of the Company and intended to be presented at the 2005 annual meeting of shareholders must be received by the Company by December 15, 2004 to be considered for inclusion in the Company's proxy statement and related proxy for the 2005 annual meeting.

Also, if a shareholder proposal intended to be presented at the 2005 annual meeting but not included in the Company's proxy statement and proxy is received by the Company after February 28, 2005 then management named in the Company's proxy form for the 2005 annual meeting will have discretionary authority to vote shares represented by such proxies on the shareholder proposal, if presented at the meeting, without including information about the proposal in the Company's proxy material.

By Order of the Board of Directors | ||

| ||

Colleen M. Davenport Secretary |

Whether or not you plan to attend the meeting, please fill in, date and sign the enclosed proxy exactly as your name appears thereon and mail it promptly in the enclosed envelope.

25

APPENDIX A—AUDIT COMMITEE CHARTER

Audit Committee Charter of Analysts International Corporation

Committee Purpose and Charter

The Board of Directors ("Board") is the ultimate corporate governance body of Analysts International Corporation ("Company"). As such, the Board is charged with overseeing the majority of the material aspects of the management of the Company's operations. To assist the Board in performing its oversight role, and to help the Board meet its fiduciary duties to the shareholders of the Company, the Board has created an audit committee ("Committee"). For its part, the Committee is charged with oversight of the Company's internal control systems, its external and internal audit process, and its external and internal financial reporting process. This audit committee charter is intended to set forth the roles, responsibilities, authority, and procedures of the Committee as required by Nasdaq and the SEC. Nothing in this charter shall in any way change the responsibility of any committee member or any non-member director, such responsibilities being defined by Minnesota law and by the Company's Articles of Incorporation and Bylaws. Minnesota law and the Company's Articles of Incorporation and Bylaws shall likewise govern committee appointments and action.

The Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing, internal control and financial reporting practices of the Company. The Committee's oversight role will culminate with participation in the annual preparation of the Company's audited financial statements and quarterly preparation of unaudited financial statements, which the Committee will recommend to the Board as provided herein.

Committee Membership Requirements

The Committee shall consist of at least three (3) independent directors who meet the financial literacy requirements of Nasdaq and the SEC. A Committee member's independence and additional qualifications shall be determined in accordance with the rules and regulations of the Nasdaq and the SEC. At least one member of the Committee shall be an "audit committee financial expert," as such term is defined in the applicable regulations.

Structure

A Committee member shall be appointed by the Board and shall serve until the next annual organizational meeting of the Board, or until their successors are duly elected and qualified, but the Board may remove Committee members at any time by Board action.

One member of the Committee shall be appointed annually to act as chairperson. The chairperson shall assist with creating the agenda for Committee meetings. The chairperson shall be responsible for leadership of the Committee, including scheduling and presiding over meetings, preparing agendas, and making regular reports to the Board. The chair will also maintain regular liaison with the CEO, CFO (or equivalent personnel), the Company's Legal

A-1

Department, the lead external audit partner and the Company's director of internal audit function or equivalent personnel.

The Board shall make an initial determination, and as deemed necessary thereafter, as to whether any member of the Committee (preferably excluding the Committee chairperson) qualifies as an "audit committee financial expert" as that term is defined in the statute and applicable regulations.

The Committee shall meet at least four times annually. Additional meetings shall be scheduled as considered necessary by the Committee chairperson. Minutes of all meetings shall be recorded and maintained by the Committee.

The Committee shall have separate executive sessions with the external auditors, management, CFO and the internal staff responsible for the internal audit function as many times as necessary and as further outlined below. The external auditors and internal staff responsible for the internal audit function shall report directly to the Committee as necessary.

Quorum

A majority of the appointed Committee members shall constitute a quorum and shall be able to conduct the Committee's business.

Committee Expectations and Information Needs

The Committee shall communicate, as necessary, Committee expectations regarding the nature, timing, and extent of Committee information needs to management, Company personnel responsible for the internal audit function, and external parties including external auditors. Management and external auditors will provide such materials on a timely basis prior to scheduled meetings.

Responsibilities

In accordance with the Committee's purpose, it shall have the following duties and responsibilities:

- 1.

- The Committee shall appoint, compensate and oversee the Company's external auditors. Pursuant to the Committee policy adopted October 10, 2002, the Committee will review such policy with Management on an annual basis to determine permitted services to be obtained through the external auditor, if any. The Committee shall pre-approve such proposed services and, if any, non-audit services to be performed by the external audit firm throughout the year. Neither the Committee nor the Board shall approve, and the Company's independent auditors shall not provide to the Company, non-audit services as prohibited by the SEC regulations if such services are to be provided contemporaneously while serving as independent auditors of the Company.

- 2.

- The Committee shall receive annually a formal written statement from the external auditors consistent with Independence Standards Board Standard 1. Additionally, the

A-2

Committee shall discuss with the external auditor any relationships or services that may affect the external auditor's objectivity or independence.

- 3.

- The Committee shall meet regularly with the external auditors, without management or others present, in order to assess the performance and ethical disposition of the financial and accounting management and the effectiveness and independence of those who perform the internal audit function, as applicable.

- 4.

- The Committee shall annually review, with or without management consultation, the performance of the external auditors and discharge the external auditors when circumstances warrant.

- 5.

- The Committee shall annually consider the scope of the annual audit, staffing of the annual audit and the accounting fees for the annual audit to ensure that the economics support the scope and staffing of the annual audit.

- 6.

- The Committee shall oversee the relationship with the external auditors, including discussing with the auditors the nature and rigor of the audit process, receiving and reviewing audit reports, and providing the auditors full access to the Committee (and the Board) to report on any and all appropriate matters.

- 7.

- The Committee shall review and discuss with management and the external auditors the audited financial statements. These discussions shall include the matters required to be discussed under Statement of Auditing Standards No. 61 and consideration of the nature and quality of the Company's critical accounting principles and practices as applied in its financial reporting. These discussions shall include a review of particularly sensitive accounting estimates, reserves and accruals, judgmental areas, audit adjustments (whether or not recorded), alternative treatments of financial information within GAAP (including their ramifications and the methods preferred by the external auditors) and other such inquiries as the Committee or the external auditors shall deem appropriate. Based on such review the Committee shall make its recommendation to the Board as to the inclusion of the Company's audited financial statements in the Company's Annual Report on Form 10-K.

- 8.

- The Committee shall oversee internal audit activities, including discussing with management, and Company personnel responsible for the internal audit function, the organization, objectivity, responsibilities, plans, results, budget and staffing for the function. The Committee also shall discuss with management, Company personnel responsible for internal audit function and external auditors the quality and adequacy of and compliance with the Company's internal controls, as well as the discovery of any individually material gaps and/or failures in the Company's internal control procedures.

- 9.

- The Committee shall discuss with representative(s) of management and the external auditors: (1) the interim financial information contained in the Company's Quarterly Report on Form 10-Q prior to its filing, (2) the earnings announcement prior to its release (if practicable), and (3) the results of the review of such information by the external auditors. (These discussions may be held with the Committee as a whole or with the Committee chair in person or by telephone.)

A-3

- 10.

- The Committee shall inquire of management and the external auditors to ascertain whether there were any significant financial reporting issues that arose during the accounting period and if so how they were resolved.

- 11.

- The Committee shall review any material communication between management and the external auditors, including management letters given to the external auditors and schedules of unadjusted differences. The Committee shall inquire whether the external auditors encountered any difficulties in obtaining the letter or any specific representations therein.

- 12.

- The Committee shall discuss with management, the Company's counsel and the external auditors: i) the substance of any significant legal issues raised by in-house and outside legal counsel concerning litigation, contingencies, claims, or assessments and understand how such matters are reflected in the Company's financial statements; and ii) any material reports or inquiries from regulatory or governmental agencies.

- 13.

- The Committee shall prepare an annual report to be presented to the Board. The report shall include, at a minimum, the following representations:

- (a)

- that the Committee has reviewed and discussed the audited financial statements with management;

- (b)

- that the Committee has discussed with the independent auditors the matters required to be discussed by SAS 61, as may be modified or supplemented;

- (c)

- that the Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), as may be modified or supplemented, and has discussed with the independent accountant the independent accountant's independence;

- (d)