- MAS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Masco (MAS) DEF 14ADefinitive proxy

Filed: 1 Apr 24, 4:06pm

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rule 14a-6(i)(1) and 0-11. |

MASCO 2024

|

A LETTER FROM THE CHAIR OF OUR BOARD

|

|  |

Masco Corporation

17450 College Parkway

Livonia, MI 48152

313-274-7400

www.masco.com

April 1, 2024

Dear Masco Shareholders: |

2023 was another dynamic and successful year in which Masco improved on a number of operating metrics, demonstrated the sustained strength of our unmatched brand portfolio and unlocked significant shareholder value.

Masco continued to benefit from disciplined pricing and ongoing improvement in operational efficiencies in 2023, resulting in:

| • | Achievement of another year of EPS growth, delivering on our commitment of double-digit EPS growth through cycles; |

| • | A 200 basis point increase in our operating margin despite softer sales volume and market volatility; and |

| • | $610 million of capital returned to shareholders through dividends and share repurchases. |

I would like to thank Masco’s approximately 18,000 employees for their focus on our customers, strong execution and a continuous improvement mindset that is the cornerstone of the Masco Operating System. Their efforts delivered Masco’s strong 2023 performance.

Board Refreshment and Executive Management Team Succession

Our board refreshment continued in 2023 with the addition of two new directors. Jonathon Nudi, a Group President at General Mills, brings a wealth of expertise to the Board related to marketing and brand management within the retail channel, international business operations and product innovation. Sandeep Reddy, Chief Financial Officer at Domino’s Pizza, provides the Board with significant insights on the oversight of financial operations and functions, consumer-facing businesses, and risk management, as well as global expertise.

A LETTER FROM THE CHAIR OF OUR BOARD

|

|

MASCO 2024

|

|

Additionally, in October 2023, following the retirement of Masco’s previous Vice President, Chief Financial Officer, John Sznewajs, the Company welcomed Rick Westenberg into the role, with oversight for all our Finance functions as well as our Corporate Development and Information Technology departments. Rick brings the Company over 25 years of experience, including nearly 15 years leading global finance organizations. The Board is very pleased to have Rick join Masco’s strong performing management team.

We are Mindful of Our Impact

Masco’s focus on conducting business in a manner that contributes to a better environment in the communities where we live, work and do business continued in 2023. Sustainable products accounted for approximately fifty percent of Masco’s revenue in 2023. These products include paints that meet the GREENGUARD® certification or MPI Green PerformanceTM Standard, faucet and shower products that meet water flow conservation standards such as WaterSense® and the European Water Label, and lighting fixtures that use LED or reclaimed wood products.

I believe Masco is well positioned to deliver long-term shareholder value, with our industry leading brands, strong balance sheet and disciplined capital allocation. I am looking forward to the year ahead as the focus at Masco remains on delivering better living possibilities – for our homes, our environment and our community.

On behalf of the entire Board, thank you for your support and investment in Masco. We invite you to attend Masco Corporation’s Annual Meeting of Stockholders, which will be held virtually at 9:30 a.m. Eastern Time on Friday, May 10, 2024.

|

Sincerely,

Lisa A. Payne Chair of the Board |

THIS PROXY STATEMENT AND THE ENCLOSED PROXY CARD ARE BEING MAILED OR

OTHERWISE MADE AVAILABLE TO SHAREHOLDERS ON OR ABOUT APRIL 1, 2024.

MASCO 2024

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

| MASCO CORPORATION NOTICE OF ANNUAL |

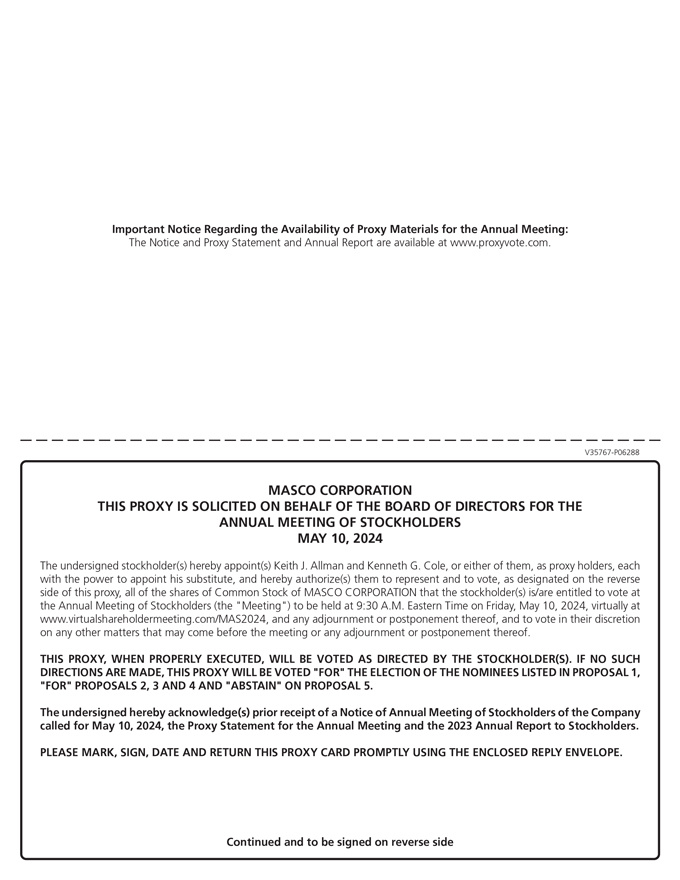

Our 2024 Annual Meeting of Stockholders will be held virtually through an audio-only webcast on May 10, 2024 at 9:30 a.m. Eastern Time. You will not be able to attend the meeting in person. Stockholders of record at the close of business on March 15, 2024 are entitled to vote at the Annual Meeting or any adjournment or postponement of the meeting. Whether or not you plan to attend the Annual Meeting, you can ensure that your shares are represented at the meeting by promptly voting by internet or by telephone, or by completing, signing, dating and returning your proxy card in the enclosed postage prepaid envelope. Instructions for each of these methods and the control number that you will need to vote are provided on the proxy card. You may withdraw your proxy before it is exercised by following the directions in the proxy statement. Alternatively, you may vote during the meeting.

By Order of the Board of Directors,

Kenneth G. Cole

Vice President, General Counsel and Secretary

ANNUAL MEETING INFORMATION: | ||||||||||

|

Date: |

May 10, 2024 |

|

| ||||||

Time: | 9:30 a.m. Eastern Time | |||||||||

Place: | Virtual Only Meeting at: www.virtualshareholdermeeting.com/MAS2024 | |||||||||

ANNUAL MEETING ITEMS OF BUSINESS:

1. To elect three Class III directors

2. To consider and act upon a proposal to approve the compensation paid, on an advisory basis, to our named executive officers

3. To ratify the selection of PricewaterhouseCoopers LLP as our independent auditors for 2024

4. To consider and act upon a management proposal to approve the 2024 Long Term Stock Incentive Plan

5. To consider and act upon on a stockholder proposal entitled, “Proposal 5 – Simple Majority Vote,” if properly presented at the Annual Meeting

6. To transact such other business as may properly come before the meeting

|

THE COMPANY RECOMMENDS THAT YOU VOTE AS FOLLOWS:

FOR each Class III director nominee

FOR the approval of the compensation paid to our named executive officers

FOR the selection of PricewaterhouseCoopers LLP as our independent auditors for 2024

FOR the approval of the 2024 Long Term Stock Incentive Plan

We are not making a voting recommendation for this proposal

| |||||||||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

|

MASCO 2024

|

|

PARTICIPATING IN OUR ANNUAL MEETING:

Online access to our virtual Annual Meeting will open at approximately 9:15 a.m. Eastern Time, on May 10, 2024 at www.virtualshareholdermeeting.com/MAS2024. To access the meeting, vote and ask questions, you will need to have a valid control number. Your control number can be found on your proxy card or voting instruction form. If you encounter any difficulties accessing the meeting during the check-in time or during the meeting, technical support will be available to you through the meeting website. Please refer to the “2024 Annual Meeting of Stockholders” section below for further details regarding our Annual Meeting.

Questions may be submitted during the Annual Meeting by following the instructions available on the meeting website. We will answer as many stockholder questions as time permits. However, we may not respond to questions that are not pertinent to the business of the meeting. Single responses to a group of substantially similar questions may be provided to avoid repetition. We ask that attendees please help us keep the proceedings orderly and follow the Annual Meeting rules of conduct that will be posted on the meeting website.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 10, 2024: THIS PROXY STATEMENT AND THE MASCO CORPORATION 2023 ANNUAL REPORT TO STOCKHOLDERS, WHICH INCLUDES THE COMPANY’S ANNUAL REPORT ON FORM 10-K, ARE AVAILABLE AT:

http://www.ezodproxy.com/masco/2024

THE COMPANY WILL PROVIDE A COPY OF ITS ANNUAL REPORT ON FORM 10-K, WITHOUT CHARGE, UPON A STOCKHOLDER’S WRITTEN REQUEST TO: INVESTOR RELATIONS, MASCO CORPORATION, 17450 COLLEGE PARKWAY, LIVONIA, MICHIGAN 48152.

MASCO 2024

|

2024 PROXY STATEMENT SUMMARY

|

| 2024 PROXY STATEMENT SUMMARY

|

In 2023, we delivered strong performance by improving a number of our operating metrics, including our operating profit and operating margin, even though softer sales volume for our products and market volatility contributed to a decrease in our year-over-year sales. We continue to leverage our industry-leading brands to deliver new product innovations, reinvest in our business to position us for future growth and deploy our capital allocation strategy to return value to our shareholders.

2024 PROXY STATEMENT SUMMARY

|

|

MASCO 2024

|

|

MASCO 2024

|

TABLE OF CONTENTS

|

TABLE OF CONTENTS

PART I—CORPORATE GOVERNANCE | ||||

| 1 |

| ||

| 9 |

| ||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 15 |

| ||

| 18 |

| ||

| 20 |

| ||

| 21 |

| ||

PART II—COMPENSATION DISCUSSION AND ANALYSIS | ||||

| 22 |

| ||

| 27 |

| ||

| 27 |

| ||

| 29 |

| ||

| 32 |

| ||

| 32 |

| ||

| 34 |

| ||

| 34 |

| ||

| 35 | ||||

We Require Minimum Levels of Stock Ownership by our Executives | 35 | |||

Our Equity Awards Have Double-Trigger Change of Control Provisions | 35 | |||

Our Compensation Committee Oversees an Annual Compensation Risk Evaluation | 35 | |||

Our Compensation Programs Encourage Executive Retention and Protect Us | 36 | |||

| 36 | ||||

| 36 | ||||

We Do Not Have Employment Agreements or Change in Control Agreements | 36 | |||

| 37 |

| ||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 |

| ||

| 39 |

| ||

| 40 |

| ||

TABLE OF CONTENTS

|

|

MASCO 2024

|

|

Proposal 2: Advisory Vote to Approve the Compensation of Our Named Executive Officers | 41 | |||

PART III—COMPENSATION OF EXECUTIVE OFFICERS | ||||

| 42 | ||||

| 44 | ||||

| 46 | ||||

| 48 | ||||

| 48 | ||||

Payment Upon Change in Control, Retirement, Termination, Disability or Death | 51 | |||

| 54 | ||||

| 55 | ||||

PART IV—AUDIT MATTERS | ||||

| 59 | ||||

| 60 | ||||

| 60 | ||||

Proposal 3: Ratification of Selection of Independent Auditors |

| 61 |

| |

PART V—EXECUTIVE OFFICERS AND BENEFICIAL OWNERSHIP | ||||

| 62 | ||||

Security Ownership of Management and Certain Beneficial Owners | 63 | |||

PART VI—OTHER PROPOSALS | ||||

Proposal 4: Approval of Our Masco Corporation 2024 Long Term Stock Incentive Plan | 65 | |||

| 73 | ||||

PART VII—GENERAL INFORMATION | ||||

| 74 | ||||

| 74 |

| ||

What is the difference between holding shares as a record holder and as a beneficial owner? |

| 74 |

| |

| 75 |

| ||

| 75 |

| ||

| 75 |

| ||

| 75 |

| ||

| 75 |

| ||

| 76 |

| ||

Who is paying for the expenses involved in preparing and mailing this proxy statement? |

| 76 |

| |

What happens if additional matters are presented at the Annual Meeting? |

| 76 |

| |

| 77 |

| ||

| 77 |

| ||

| 78 | ||||

| 79 | ||||

| A-1 | ||||

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

|

CORPORATE GOVERNANCE

|

This section of our proxy statement provides information on the qualifications, skills and experience of our director nominees and incumbent directors, the structure and responsibilities of our Board and its Committees, our Board’s self-evaluation and risk oversight processes, and other important corporate governance matters.

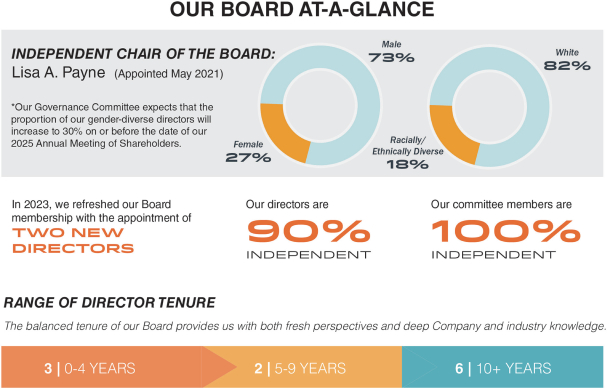

DIRECTORS AND DIRECTOR NOMINEES

Our Board is currently composed of eleven directors, ten of whom are independent directors. Our directors possess a wide array of skills and experience that provide a strong source of strategic and risk oversight, advice, and guidance to our management team.

The following director skills matrix highlights the balanced mix of skills and experience that are most relevant and important to our Company. The skills and experience identified for each director are those we believe are key and unique to each director’s contribution to our Board. This matrix is not meant to encompass or reflect all of the skills and experience possessed by each director. See the following pages for a full biography of each of our directors.

1

MASCO 2024

|

PART I - CORPORATE GOVERNANCE

|

Alexander | Allman | Denari | Ffolkes | Nudi | O’Herlihy | Parfet | Payne | Plant | Reddy | Stevens | ||||||||||||

Business Operations & Leadership Executive leadership experience at a large organization, including current or former service as a public company officer or other public company board service |  |  |  |  |  |  |  |  |  |  |  | |||||||||||

M&A Experience executing significant acquisitions and other organizational transactions to drive growth and advance long-term strategic plans |

|

|  |

|

|

|  |  |  |

|

| |||||||||||

Risk Management Experience effectively prioritizing and managing broad enterprise risks as well as anticipating and identifying emerging risks relevant to the business |

|

|

|

|

|

|  |  |

|  |  | |||||||||||

Finance & Accounting Experience with complex financial transactions and in driving capital allocation strategy, as well as a deep understanding of financial reporting and controls |

|

|

|

|

|

|  |  |  |  |  | |||||||||||

Product Innovation Experience driving market share growth through the successful execution of new product development initiatives |  |

|  |

|  |

|

|

|

|

|

| |||||||||||

International Business Leadership and oversight experience with multinational companies in global markets, with a deep knowledge of global industry dynamics and risks |  |

|

|  |  |  |

|

|

|  |  | |||||||||||

Manufacturing Expertise in managing and overseeing complex manufacturing operations, including knowledge of production processes, industry standards and safety protocols |

|  |

|  |

|  |

|

|  |

|

| |||||||||||

Marketing & Brand Management Expertise in the marketing and sales of industry-leading consumer products with a deep expertise in strengthening brand reputation |  |  |  |

|  |

|

|

|

|

|

| |||||||||||

Talent Management Expertise in the execution of talent management strategies and initiatives, including those focused on key employee development and retention, and succession planning |

|  |

|  |

|  |

|

|

|

|

| |||||||||||

2

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

DIRECTOR NOMINEES FOR CLASS III (if elected, term will expire at our Annual Meeting in 2027)

Mark R. Alexander

Age: 59

Director Since: 2014

Independent

Board Committees:

• Audit • Compensation

| POSITION: Chief Executive Officer, Icelandic Provisions, Inc., a provider of Icelandic dairy products, since 2019

RELEVANT SKILLS AND EXPERIENCE:

• Business Operation and Leadership: Strong experience in leadership and the successful execution of business growth strategy developed through his current experience as a CEO and as the former President of Campbell Soup Company’s largest division • International Business: Significant experience gained through his nearly 35-year career serving in various marketing, sales and management roles in the United States, Canada, Europe and Asia • Product Innovation: Deep expertise gained through his management responsibilities, including investing in brand-building, innovation and distribution • Marketing and Brand Management: Extensive experience with consumer-branded products, and a significant background in marketing and customer relations in his various roles

BUSINESS EXPERIENCE: Campbell Soup Company: • Senior Vice President (2009-2018) • President of Americas Simple Meals and Beverages (2015-2018) • President of Campbell North America (2012-2015), Campbell International (2010-2012) and Asia Pacific (2006-2009) • Chief Customer Officer and President - North America Baking & Snacking (2009-2010) • Served in various marketing, sales and management roles in the United States, Canada, Europe and Asia since 1989 | |

Marie A. Ffolkes

Age: 52

Director Since: 2017

Independent

Board Committees:

• Compensation • Governance (Chair) | POSITION: Managing Partner, GenNx360 Capital Partners, a private equity firm focused on investing in industrial and business services companies, since 2023

RELEVANT SKILLS AND EXPERIENCE:

• Business Operation and Leadership: Extensive experience acquired in developing and leading strategy implementation and driving operational profitability, as well as significant leadership experience • International Business: Global and cultural experience developed serving in leadership positions in China, South Korea, Brazil, Japan and Europe • Manufacturing: Significant experience with global manufacturing operations across multiple industrial sectors • Talent Management: Significant human capital experience gained in leadership roles of increasing responsibility across many industries and geographies

BUSINESS EXPERIENCE: • Founder and CEO, Axxelist, LLC, a private technology real estate company (since 2021) • Chief Executive Officer, TriMark USA, LLC (2020-2021) • President, Industrial Gases, Americas of Air Products & Chemicals, Inc. (2015-2020) • Tenneco: • Global Vice President and General Manager, Ride Performance Group (2013-2015) • Vice President and General Manager, Global Elastomers (2011-2013) • Johnson Controls International plc (formerly, Johnson Controls): • Vice President & General Manager South America Region, Automotive Group (2010-2011) • Vice President and General Manager, Hyundai-Kia Customer Business Unit (2008-2010) • Global Vice President, Japan (2006-2008)

OTHER PUBLIC COMPANY BOARDS: • Valero Energy Corporation (since 2022)

| |

3

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

John C. Plant

Age: 70

Director Since: 2012

Independent

Board Committees:

• Audit • Governance | POSITION: Chair of the Board and Chief Executive Officer, Howmet Aerospace Inc., a global supplier of engineered metal products, since 2020

RELEVANT SKILLS AND EXPERIENCE:

• Business Operation and Leadership: In-depth knowledge gained throughout his over three decades of executive leadership with experience in successfully leading businesses through periods of downturns as well as periods of growth and market development • M&A: Deep expertise gained through various roles, including leading the separation of Arconic Inc. into two independent, publicly traded companies – Howmet Aerospace Inc. and Arconic Corporation • Finance and Accounting: A strong background in finance through various roles, including key finance and operations positions • Manufacturing: Substantial expertise developed during his more than 20 combined years of global experience in manufacturing and engineered solutions at industrial companies

BUSINESS EXPERIENCE: • Chief Executive Officer (2019-2020) and Chair of the Board (2017-2020), Arconic Inc. • TRW Automotive Holdings Corp.: • Chair of the Board (2011-2015) • President and Chief Executive Officer and Director (2003-2015) • Co-member of the Chief Executive Office of TRW Inc. and the President and Chief Executive Officer of the automotive business of TRW Inc. (2001-2003)

OTHER PUBLIC COMPANY BOARDS: • Howmet Aerospace Inc. (since 2020) • Jabil Inc. (since 2016)

MEMBERSHIPS IN OTHER ORGANIZATIONS: • Director Emeritus, Automotive Safety Council • Director, Gates Industrial Corporation plc, a privately-held manufacturer of casters and wheels (2017-2019)

|

4

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

CLASS I DIRECTORS (term expiring at our Annual Meeting in 2025)

Jonathon J. Nudi

Age: 53

Director Since: 2023

Independent

Board Committees:

• Audit • Governance | POSITION: Group President, Pet, International and North America Foodservice, General Mills Inc., since 2024

RELEVANT SKILLS AND EXPERIENCE:

• Business Operation and Leadership: Extensive strategic and operational experience developed through serving in a variety of leadership positions, including driving profitable growth through organizational transformation and capability building • Marketing and Brand Management: Significant experience with consumer-branded products developed through his 30 years of experience with General Mills, including various positions of increasing responsibility in marketing and sales • International Business: Complex international experience gained through serving in a variety of positions in Europe, and leading segments that service consumers and customers in Asia, Australia, Europe, and Latin America • Product Innovation: Deep perspectives developed over his career, including responsibility for product development and a focus on consumer-first design process and product improvements

BUSINESS EXPERIENCE: • General Mills, Inc.: • Group President, North American Retail (2016-2023) • President, Europe and Australasia Region (2014-2016) • President, Snacks Division (2010-2014) • Vice President Marketing, Business Unit Director, Green Giant/SGC (2007-2010)

MEMBERSHIPS IN OTHER ORGANIZATIONS: • Board of Governors, First Tee, a charitable organization

|

Donald R. Parfet

Age: 71

Director Since: 2012

Independent

Board Committees:

• Compensation • Governance | POSITION:

• Managing Director, Apjohn Group, LLC, a business development company, since 2000 • General Partner, Apjohn Ventures Fund, Limited Partnership, a venture capital fund, since 2003

RELEVANT SKILLS AND EXPERIENCE:

• Business Operation and Leadership: Extensive experience in senior operational management, including in leading strategic planning and execution as well as driving business growth • M&A: Significant expertise developed over his career including experience in sourcing, assessing and governing portfolio opportunities and managing joint ventures • Risk Management: Expertise gained throughout his career including evaluating financial and development risk associated with emerging medicines • Finance and Accounting: Deep expertise gained through his service at venture capital firms as well as his many years in corporate finance

BUSINESS EXPERIENCE: • Senior Vice President, Pharmacia Corporation, a pharmaceutical company, from which he retired in 2000 • Served as a senior corporate officer of Pharmacia & Upjohn and The Upjohn Company, predecessors of Pharmacia Corporation

OTHER PUBLIC COMPANY BOARDS: • Lead Independent Director, Rockwell Automation, Inc. (since 2008) • Kelly Services, Inc. (since 2004) • Chair, Sierra Oncology, Inc. (2017-2019)

MEMBERSHIPS IN OTHER ORGANIZATIONS: • Director, Iaso Therapeutics, Inc., a private company focused on the development of novel technologies for next-generation vaccines • Director and trustee of a number of charitable and civic organizations

|

5

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

Lisa A. Payne

Age: 65

Director Since: 2006

Independent

Board Committees: None | POSITION: Independent Chair of our Board, since 2021

RELEVANT SKILLS AND EXPERIENCE:

• Business Operation and Leadership: Deep understanding of growth strategy and extensive experience in real estate investment, development and acquisition, as well as extensive experience in senior level and C-Suite roles • M&A: Significant experience developed during her 10 years as an investment banker, focused on acquisition and development financing and merger and acquisition advisory services • Risk Management: In-depth expertise gained through her finance-focused career, including in her prior role as CFO in which she gained deep understanding of macroeconomic risks that may impact business • Finance and Accounting: Substantial financial, accounting and corporate finance expertise gained through her experience as CFO and as an investment banker

BUSINESS EXPERIENCE: • President, Soave Real Estate Group. a privately held diversified management and investment company (2016-2017) • Taubman Centers, Inc.: • Vice Chair (2005-2016) • Chief Financial Officer (2005-2015) • Executive Vice President and Chief Financial and Administrative Officer (1997- 2005) • Investment banker, Goldman, Sachs & Co. (1987-1997)

OTHER PUBLIC COMPANY BOARDS: • Rockwell Automation, Inc. (since 2015) • J.C. Penney Company (2016-2020) • Taubman Centers, Inc. (1997-2016)

MEMBERSHIPS IN OTHER ORGANIZATIONS: • Director, Leaf Home Solutions LLC, a privately-held provider of technology-enabled home solutions • Chair of the Board, Soave Enterprises, LLC, a privately held diversified management and investment company (2016-2017)

|

Sandeep Reddy

Age: 53

Director Since: 2023

Independent

Board Committees:

• Audit • Governance | POSITION: Executive Vice President – Chief Financial Officer, Domino’s Pizza, Inc., since 2022

RELEVANT SKILLS AND EXPERIENCE:

• Business Operation and Leadership: Extensive experience gained over his almost 30 years serving in leadership roles at global consumer-facing businesses, including in business strategy development and through the oversight of international supply chain operations • Finance and Accounting: Significant expertise developed in numerous CFO roles with oversight of all financial operations and functions, including his current role where he is responsible for financial strategy and operations, including financial planning, treasury, financial reporting, tax, accounting and investor relations • International Business: Extensive experience in international business operations acquired while holding leadership positions for operations based in Europe and India • Risk Management: Expertise gained while serving in CFO roles with responsibility for risk oversight and, in his current role, responsibility for leading Domino’s environmental, social and governance efforts

BUSINESS EXPERIENCE: • Executive Vice President and Chief Financial Officer, Six Flags Entertainment Corporation (2020-2022) • Guess?, Inc.: • Chief Financial Officer (2013-2019) • Vice President and European Chief Financial Officer (2010-2013) • Served in various positions of increasing responsibility for Mattel, Inc., ultimately serving as Vice President of Finance and Supply Chain for France, Spain, Portugal and Italy (1997-2010)

|

6

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

CLASS II DIRECTORS (term expiring at our Annual Meeting in 2026)

Keith J. Allman

Age: 61

Director Since: 2014

Not Independent

Board Committees: None | POSITION: Our President and Chief Executive Officer, since 2014

RELEVANT SKILLS AND EXPERIENCE:

• Business Operation and Leadership: Strong business leadership skills and hands-on operational experience with our businesses have helped to provide the foundation for the current direction of our Company. Mr. Allman has, through his key leadership positions within our Company, acquired a deep knowledge of all aspects of our business, significant understanding of complex global operations, as well as Company-specific customer expertise • Manufacturing: Extensive experience gained through his decades in leading our cabinet and faucet manufacturing operations • Marketing and Brand Management: Expertise developed while playing an integral role in developing our strategies to strengthen our brands and overseeing our innovation efforts • Talent Management: Valuable insight into our Company’s culture developed over his many years with the Company, and, as our CEO, his overall responsibility for our human capital management strategy and initiatives

BUSINESS EXPERIENCE: • Masco Corporation: • Group President (2011-2014) • President, Delta Faucet (2007-2011) • Executive Vice President, Builder Cabinet Group (2004-2007) • Served in various management positions of increasing responsibility at Merillat Industries (1998-2003)

OTHER PUBLIC COMPANY BOARDS: • Oshkosh Corporation (since 2015)

MEMBERSHIPS IN OTHER ORGANIZATIONS: • Director, No Barriers, a charitable organization

|

Aine L. Denari

Age: 51

Director Since: 2022

Independent

Board Committees:

• Audit • Governance | POSITION: Executive Vice President and President of Brunswick Boat Group, Brunswick Corporation, a manufacturer of marine products, since 2020

RELEVANT SKILLS AND EXPERIENCE:

• Business Operation and Leadership: Extensive business and strategic experience acquired serving in a variety of executive management positions, including her current role, and in prior roles within the automotive and industrial industries and at major global consulting firms • M&A: Deep experience developed while at ZF, where she was responsible for the integration between ZF and TRW, including the strategy and implementation of all functions, businesses, systems and processes • Product Innovation: Expertise gained in her current role, where she is responsible for developing and implementing end-to-end technology solutions, and in her former role overseeing the development of Advanced Driver Assist Systems/Automated Driving • Marketing and Brand Management: Significant experience gained in her current role where she is responsible for the largest boat portfolio in the recreational marine industry with many of the leading US and International brands

BUSINESS EXPERIENCE: • ZF AG: • Senior Vice President and General Manager, Advanced Driver Assist Systems/Automated Driving (2017-2020) • Chief Integration Management Officer & Head of Strategic Performance Management Office (2015-2017) • Senior Vice President, Product Planning and Business Development (2014-2017) • Director, Strategy & Analytics, Ingersoll Rand Inc (2010-2014) • Engagement Manager, McKinsey & Company (2006-2010) • Management Consultant / Case Team Leader, Bain & Company (2003-2006) • Served in various engineering roles, including research, product planning and development and program management at Ford Motor Company (1996-2002)

|

7

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

Christopher A. O’Herlihy

Age: 60

Director Since: 2013

Independent

Board Committees:

• Compensation (Chair) | POSITION: President and Chief Executive Officer, Illinois Tool Works Inc., a global diversified industrial manufacturer of specialized industrial equipment, consumables, and related service businesses, since 2024

RELEVANT SKILLS AND EXPERIENCE:

• Business Operation and Leadership: Extensive experience acquired in his executive positions, through which he has acquired deep knowledge and experience in all aspects of business operations, including strategy development, product development, emerging markets and financial performance and structure • International Business: Significant expertise acquired while overseeing business operations in Europe, South America and Asia • Manufacturing: In-depth understanding of complex manufacturing operations gained during his more than 30 years with Illinois Tool Works, a diversified industrial manufacturer • Talent Management: Significant experience gained in leading and developing high-performing and key talent, including executive-level talent, through his over ten years serving in executive leadership positions

BUSINESS EXPERIENCE: • Illinois Tool Works Inc.: • Vice Chair (2015-2023) • Executive Vice President, with worldwide responsibility for Illinois Tool Works’ Food Equipment Group (2010-2015) • Group President – Food Equipment Group Worldwide (2010) • Group President – Food Equipment Group International (2009-2010) • For almost 30 years, served in various positions of increasing responsibility, including as Group President of the Polymers and Fluids Group

OTHER PUBLIC COMPANY BOARDS: • Illinois Tool Works (since 2024)

|

Charles K. Stevens, III

Age: 64

Director Since: 2018

Independent

Board Committees:

• Audit (Chair) • Compensation | POSITION: Retired Executive Vice President and Chief Financial Officer, General Motors Company

RELEVANT SKILLS AND EXPERIENCE:

• Business Operation and Leadership: Significant experience gained in his more than 30 years with General Motors serving in leadership roles with oversight of financial and accounting operations, through which he developed and executed business strategies to drive profitable growth • Risk Management: Strong analytic, strategic and financial skills and expertise developed through his extensive career at GM, which provides valuable perspectives and experience in performing risk evaluation, management and mitigation • Finance and Accounting: Extensive expertise developed over his time at GM serving in senior leadership roles with responsibility for overseeing all financial and accounting functions, resulting in a valuable understanding of finance, financial operations, international financial matters and investor relations • International Business: In-depth knowledge gained while serving for over 15 years in leadership positions in South America, Mexico and the Asia Pacific region, including China, Singapore, Indonesia and Thailand

BUSINESS EXPERIENCE: • General Motors Company, a global automotive company (1983-2018): • Executive Vice President and Chief Financial Officer (2014-2018) • Chief Financial Officer, GM North America (2010-2014) • Interim Chief Financial Officer, GM South America (2011-2013) • Chief Financial Officer, GM de Mexico (2008-2010) • Chief Financial Officer, GM Canada (2006-2008) • Held various positions of increasing responsibility, including several leadership positions with GM’s Asia Pacific region including China, Singapore, Indonesia and Thailand

OTHER PUBLIC COMPANY BOARDS: • Genuine Parts Company (commences service in April 2024) • Flex, Ltd. (since 2018) • Eastman Chemical Company (2022-May 2024) • Tenneco Inc. (2020-2022)

|

8

MASCO 2024

|

PART I - CORPORATE GOVERNANCE

|

BOARD OF DIRECTORS

Our Board of Directors is committed to maintaining our high standards of ethical business conduct and corporate governance principles and practices.

Board Structure

Our Board of Directors is comprised of eleven directors and is divided into three classes. Each class has a term of three years and each year the term of office of one class expires. Each director will hold office until the annual meeting for the year in which his or her term expires and until his or her successor shall be elected and shall qualify, subject, however, to prior death, resignation, retirement or removal from office.

Board Leadership

Lisa Payne was appointed as Chair of our Board in 2021. Ms. Payne has served on our Board since 2006, including as the Chair of our Audit Committee from 2015-2021 and as the Chair of our Governance Committee from 2021-2022.

Effective Oversight of our Company

The responsibilities, among others, of the independent Chair of our Board include:

| • | presiding at Board meetings and at executive sessions of the independent directors; |

| • | communicating with our CEO to provide guidance and advice as well as feedback following executive sessions of our independent directors; |

| • | discussing with management and approving our Board’s meeting agendas and assuring that there is sufficient time for discussion of all agenda items; |

| • | in preparation for Board meetings, consulting with management on information to be provided to our Board; |

| • | overseeing our Board’s annual review of our strategic plan and its execution; and |

| • | calling meetings of our independent directors, as necessary. |

Separation of our Chair of the Board and CEO Roles

Our Board believes that its current leadership structure is in the best interests of the Company and our shareholders at this time; however, our Board does not have a policy with respect to the separation of the roles of Chair of the Board and CEO. Our Board believes that this matter should be discussed and determined by our Board from time to time, based on all of the then-current facts and circumstances. If the roles of Chair of our Board and CEO are combined in the future, then a majority of our independent directors will elect a Lead Independent Director for a renewable one-year term.

Director Independence

Our Corporate Governance Guidelines require that a majority of our directors qualify as “independent” under the requirements of applicable law and the New York Stock Exchange’s listing standards.

Director Independence Standards

For a director to be considered independent, our Board must determine that the director does not have any direct or indirect material relationship with us. Our Board has adopted standards to assist it in making a determination of independence for directors. These standards are posted on our website at www.masco.com.

9

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

Assessment of our Directors’ Independence

Our Board has determined that ten of our eleven directors serving at December 31, 2023, including all of our non-employee directors, are independent. As an employee, Mr. Allman, our President and Chief Executive Officer, is not an independent director.

In making its independence determinations, our Board reviewed all transactions, relationships and arrangements for the last three fiscal years involving each non-employee director and the Company.

| • | In evaluating Aine Denari’s independence, our Board considered our purchases from her employer, Brunswick Corporation and its subsidiaries. In 2023, the aggregate amount of our purchases was approximately $155,000. Brunswick Corporation has reported revenue of $6.4 billion in 2023. Our Board does not believe that Ms. Denari has a material interest in these transactions. |

| • | In evaluating Christopher O’Herlihy’s independence, our Board considered purchases and sales between us and his employer, Illinois Tool Works Inc. and its subsidiaries. In 2023, the aggregate amount of our purchases was approximately $189,000 and the aggregate amount of our sales was approximately $81,000. Illinois Tool Works, Inc. has reported revenue of $16.1 billion in 2023. Our Board does not believe that Mr. O’Herlihy has a material interest in these transactions. |

| • | In evaluating Sandeep Reddy’s independence, our Board considered our our purchases of goods from his employer, Domino’s Pizza, Inc. In 2023, the aggregate amount of our purchases was approximately $18,000. Domino’s Pizza, Inc. has reported revenue of $4.5 billion in 2023. Our Board does not believe that Mr. Reddy has a material interest in these transactions. |

Our Board also determined that we did not make any discretionary charitable contributions exceeding the greater of $1 million or 2% of the revenues of any charitable organization in which any of our directors, or an immediate family member of any of our directors, was an executive officer and actively involved in the day-to-day operations.

Committee Member Independence Assessment

Our Board has determined that each member of our Audit Committee, Compensation Committee and Governance Committee qualifies as independent under the requirements of applicable law and the New York Stock Exchange’s listing standards.

Board Refreshment

Our Governance Committee periodically assesses the composition of our Board by reviewing our directors’ skills and expertise and reviews current director tenure, including whether any vacancies are expected on our Board due to retirement or otherwise. From time to time, our Board completes a director skills and experience assessment to provide our Governance Committee insight into our Board’s composition. Our Governance Committee uses this information to evaluate the skills and experience represented on our Board and to identify anticipated skills and experience that would be valuable to our Board in the future to best support our Company’s strategic objectives. The Board most recently completed this assessment in early 2023, following its annual strategy day.

In 2023, our Governance Committee considered candidate recommendations of our directors and engaged a third party director recruitment firm to assist with a director candidate search that resulted in our Board’s appointment of two new independent directors, Mr. Jonathon Nudi, the Group President, Pet, International and North America Foodservice of General Mills Inc. and Mr. Sandeep Reddy, the Executive Vice President – Chief Financial Officer of Domino’s Pizza, Inc.. Please refer to our director skills matrix and director biographies above for the valuable skills, experience and perspectives each bring to our Board.

10

MASCO 2024

|

PART I - CORPORATE GOVERNANCE

|

Board Membership and Composition

Board Membership

Our Governance Committee believes that directors should possess exemplary personal and professional reputations, reflecting high ethical standards and values. The expertise and experience of directors should provide a source of strategic and risk oversight, advice and guidance to our management. A director’s judgment should demonstrate an inquisitive and independent perspective with intelligence and practical wisdom. Directors should be free of any significant business relationships which would result in a potential conflict in judgment between our interests and the interests of those with whom we do business.

Our Governance Committee also considers additional criteria adopted by our Board for director nominees and the independence, financial literacy and financial expertise standards required by applicable law and by the New York Stock Exchange.

Board Composition

As part of its assessment of board composition and evaluation of potential director candidates, our Governance Committee considers whether our directors hold diverse viewpoints, professional experiences, education and other skills and attributes that are necessary to enhance our Board’s effectiveness. In addition, our Governance Committee believes that it is desirable for directors to possess diverse characteristics of gender, race, national origin, ethnicity and age, and considers such factors in its evaluation of candidates for board membership. Neither our Board nor our Governance Committee has adopted a formal Board diversity policy. Our Governance Committee expects that the proportion of our gender-diverse directors will increase to 30% on or before the date of our 2025 Annual Meeting of Shareholders.

Director Candidate Recommendations

The Governance Committee uses a number of sources to identify and evaluate director nominees. It is the Governance Committee’s policy to consider director candidates recommended by shareholders. All Board candidates, including those recommended by shareholders, are evaluated against the criteria described above. Shareholders wishing to have the Governance Committee consider a candidate should submit the candidate’s name and pertinent background information to our Secretary at the address stated below in “Communications with our Board of Directors.” Shareholders who wish to nominate director candidates for election to our Board should follow the procedures set forth in our Certificate of Incorporation and Bylaws.

Director Commitments

Our Board believes that each director should be committed to serving on our Board for an extended period of time and to devoting sufficient time to carry out the director’s duties and responsibilities in an effective manner for the benefit of our shareholders. Our Board’s Corporate Governance Guidelines require each director to promptly notify the Governance Committee Chair before accepting any invitation to serve on the board of any for-profit business entity. The Governance Committee evaluates and advises whether it believes service on such outside board would interfere with the director’s service on our Board.

Our Board recognizes that the public company commitments of our director, John Plant, who also serves as the Chair of the Board and Chief Executive Officer of Howmet Aerospace Inc. and as a member of Jabil Inc.’s board, exceed the policies of certain of our shareholders and of proxy advisors. Our Board believes that Mr. Plant has been a highly valued member of our Board since 2012, has demonstrated his active engagement through his consistent attendance and participation with Board matters, both during and in-between Board meetings, and that he has the time and ability to fulfill his obligations to our Board. During the past three years, Mr. Plant has attended 95% of all of our Board and

11

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

Committee meetings of which he is a member. He brings to our Board uniquely deep expertise in leading complex and efficient business and manufacturing operations and executing significant M&A transactions, as well as capital allocation strategies, all of which drive top-and bottom-line growth and long-term shareholder value creation. After robust and thorough discussion and consideration of Mr. Plant’s contributions to our Board, and his demonstrated continued focus and attention to our Company, our Board uniformly believes that his continued service as a director is in the best interest of our Company and our shareholders and recommends Mr. Plant for re-election at our Annual Meeting.

Board and Board Committee Self-Evaluation Process

Our Governance Committee is responsible for the oversight of our Board’s and each Board Committee’s annual self-evaluation process, including establishing evaluation criteria for the Board and Board Committees and reporting to the Board on the process and results of the Board self-evaluation and any recommendations for proposed changes to Board policies or practices. The self-evaluation process includes the following components:

Survey:

Each year our directors undertake an anonymous self-evaluation to assess our Board’s performance. The directors provide feedback on:

| • | The responsibilities of the Board, including the effectiveness of the Board’s oversight of strategy and risk; |

| • | Board and Committee structure and composition; |

| • | Board meetings; and |

| • | Board engagement with management. |

Periodically, our directors also undertake a board planning review and conduct a director skills and experience assessment, which facilitate both the Board’s understanding of its current composition and director succession planning in order to ensure our Board’s future composition is best able to support our company’s strategic objectives.

Individual Director Discussions:

The Chair of our Board and the Chair of our Governance Committee review a summary of the self-evaluation results. Each then conducts one-on-one discussions with our directors to discuss feedback on the topics included in the annual self-evaluation and to engage in in-depth discussions regarding the functions of the Board.

Review and Discussion by Governance Committee and Board:

Our Governance Committee discusses the self-evaluation results, including feedback from the individual director discussions with our Chair of the Board and the Chair of our Governance Committee, and considers opportunities for enhancements and recommendations. The evaluation results and recommendations are then discussed by the full Board.

Consider Feedback:

Director feedback is considered by the Board and the Committees, and Board and Committee policies and practices are updated as appropriate.

Committee Self-Evaluation Discussions:

Annually, each of our Board Committees engages in a Committee self-evaluation during executive session. In 2023, we enhanced our Committee self-evaluation process to align with our Board self-evaluation process and to facilitate robust and candid discussion among Committee members on the topics of Committee structure, composition and meetings, the effectiveness of the Committee’s oversight over the matters for which it has responsibility and the adequacy of the resources provided to the Committee, including third-party advisors.

12

MASCO 2024

|

PART I - CORPORATE GOVERNANCE

|

Risk Oversight

Our Board has a thorough approach to the oversight of our risk management practices, both directly and through its Committees. Our Board reviews and discusses with management comprehensive analyses describing the material risks facing us and the actions we are taking to mitigate these risks. Management provides updates regarding these risks and mitigation activities to the Board and Board Committees throughout the year, as necessary.

Our Board’s key risk oversight activities include:

Strategic risk oversight:

Each year our Board holds a strategy session in which management and our directors discuss how we are executing our current strategic objectives and developing our long-term strategy. In 2023, our Board’s strategy session included discussions with the General Managers of several of our business units. The session also included a discussion with a housing market expert and two of our institutional shareholders to provide our directors with an external perspective of us, our industry and macroeconomic factors that may impact us.

Enterprise risk oversight:

Each year our Board and management discuss our enterprise risk management profile and assessment, which includes financial, operational, legal, regulatory, ethics and compliance risks that are material to us, and how we are taking action to mitigate those risks.

Environmental, Social and Governance risk oversight:

Our Board oversees our ESG enterprise strategy and strategic initiatives and our ESG risks. In 2023, our Board reviewed our Corporate Sustainability Report and, as part of our enterprise risk management update, discussed with management our ESG-related risks.

Cybersecurity risk oversight:

Our Board oversees our cybersecurity risk and is responsible for ensuring that management has processes in place designed to identify and assess cybersecurity risks to which we are exposed, implement the appropriate protections to address such risks, identify cybersecurity threats and respond to and resolve cybersecurity incidents. In 2023, our Vice President, Information Technology discussed with the Board risks and trends associated with information technology, including cyber-attacks, and current and future planned actions to mitigate such risks. In addition, he reviewed with our Board updates related to our operational and resource readiness with respect to cyber incidents, our incident response processes and emerging cybersecurity risks.

Our Board has delegated certain oversight responsibilities to our Board Committees, as follows:

| Audit Committee: |

| Compensation Committee: |

| Governance Committee: | ||||

• Financial reporting

• Internal controls over financial reporting

• Legal and regulatory compliance

• Ethics and compliance program

• Risk disclosure

• ESG data controls and verification |

• Executive compensation program and policies

• CEO and executive management succession planning

• Enterprise talent strategy, including leadership and future workforce

• DE&I strategy, initiatives and goals |

• Governance structure

• Board composition, including refreshment and diversity

• Board and Committee self-evaluation process

• Director orientation and continuing education

• Governance trends and best practices

• Political contributions |

13

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

Board Meetings and Attendance

Our Board held nine meetings in 2023. Each director attended at least 75% of our Board meetings and applicable committee meetings that were held in 2023 during the period he or she served. It is our policy to encourage directors to attend our Annual Meeting of Shareholders, and all of our then-serving directors attended our 2023 Annual Meeting. Our independent directors meet separately at least once per year. Ms. Payne, as the Chair of our Board, presides over these executive sessions.

Communications with our Board

If you are interested in contacting the Chair of our Board, an individual director, our Board as a group, our independent directors as a group, or a specific Board Committee, you may send a communication, specifying the individual or group you wish to contact, in care of: Kenneth G. Cole, Secretary, Masco Corporation, 17450 College Parkway, Livonia, Michigan 48152. Certain communications that are unrelated to the duties and responsibilities of the Board will not be forwarded, such as: business solicitations; junk mail, mass mailings and spam; employment inquiries; and surveys.

14

MASCO 2024

|

PART I - CORPORATE GOVERNANCE

|

COMMITTEES OF OUR BOARD OF DIRECTORS

The standing committees of our Board are the Audit Committee, the Compensation Committee and the Governance Committee. These committees function pursuant to written charters adopted by our Board. The committee charters, as well as our Corporate Governance Guidelines and our Code of Ethics, are posted on our website at www.masco.com and are available to you in print from our website or upon request.

Audit Committee

|

|

|

|

|

| |||||||||||

Charles K. Stevens Chair

|

Mark R. Alexander

|

Aine L. Denari

|

Jonathon J.

|

John C. Plant

|

Sandeep Reddy

| |||||||||||

5 meetings in 2023 | ||||||||||||||||

All members are independent and financially literate and qualify as an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K. | ||||||||||||||||

Audit Committee responsibilities include assisting the Board in its oversight of the:

• integrity of our financial statements

• effectiveness of our internal controls over financial and other public reporting

• qualifications, independence, performance and remuneration of our independent auditors

• performance of our internal audit function

• compliance with legal and regulatory requirements, including our employees’ and directors’ compliance with our Code of Ethics

In addition, our Audit Committee reviews and discusses with management certain key financial and non-financial risks. | Audit Committee key activities in 2023:

• reviewed and approved our 2022 Form 10-K

• reviewed our Form 10-Qs filed in 2023 and related earnings press releases

• discussed with management quarterly updates on our internal controls over financial reporting

• reviewed with management quarterly updates on ethics matters and fraud reporting

• discussed with management certain risk management practices, including for employee benefit, treasury and insurance program matters

• discussed with management the SEC’s cybersecurity disclosure rule and reviewed our 2023 Form 10-K cybersecurity disclosure

• reviewed the performance of our internal and independent auditors

• participated in the selection of our new lead independent audit engagement partner in conjunction with the mandated rotation of that partner

• reviewed and approved our independent auditor’s 2024 integrated audit plan and service fees

• reviewed and approved our 2024 internal audit annual operating plan | |

15

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

Compensation and Talent Committee

|

|

|

|

| ||||||||||

Christopher A. O’Herlihy Chair |

Mark A. Alexander |

Marie A. Ffolkes |

Donald R. Parfet |

Charles K. Stevens | ||||||||||

7 meetings in 2023 | ||||||||||||||

All members are independent | ||||||||||||||

Our Compensation Committee is responsible for the following:

• the oversight and approval of our executive compensation programs

• determining the goals and objectives applicable to the compensation of our CEO and evaluating our CEO’s performance in light of those goals

• reviewing our executive succession plan, including periodically reviewing our CEO’s evaluation and recommendation of a potential successor

• overseeing our talent management and leadership strategies, including DE&I strategies

• determining and administering equity awards granted under our stock incentive plan

• administering our annual and long-term performance compensation programs

• reviewing and establishing our peer group

In addition, our Compensation Committee evaluates risks arising from our compensation policies and practices and has determined that such risks are not reasonably likely to have a material adverse effect on us. Our executive officers and other members of management report to the Compensation Committee on executive compensation programs at our business units to assess whether these programs or practices expose us to excessive risk. |

Compensation Committee key activities in 2023:

• reviewed and approved the incentive compensation paid to our executive officers in 2023

• reviewed with management a pay-for-performance analysis of our CEO’s compensation as compared to our peer group and a comparison of our executive officers’ compensation to market survey data

• established performance metrics and goals for our 2023 Annual Incentive Program, including a DE&I modifier

• established performance metrics and goals for our 2023-2025 Long-Term Incentive Program, including the introduction of a new relative total shareholder return (TSR) metric

• reviewed with management the Company’s leadership pipeline, focusing on succession management for key executive and business unit leadership positions and approach to leadership development

• discussed with management and the Committee’s outside compensation consultant executive compensation trends

• discussed with management the newly-promulgated SEC and NYSE requirements regarding executive incentive compensation recoupment and adopted a policy in alignment with such requirements

• reviewed and discussed with management the terms and conditions of our proposed 2024 Long Term Stock Inventive Plan

• reviewed our 2023 Form 10-K human capital management disclosure

• reviewed with management our shareholder engagement activities |

16

MASCO 2024

|

PART I - CORPORATE GOVERNANCE

|

Corporate Governance and Nominating Committee

|

|

|

|

|

| |||||||||

Marie A. Ffolkes Chair |

Aine L. Denari |

Jonathon J. Nudi |

Donald R. Parfet |

John C. Plant |

Sandeep Reddy | |||||||||

5 meetings in 2023 | ||||||||||||||

All members are independent | ||||||||||||||

Our Governance Committee is responsible for the following:

• advising our Board on the governance structure and conduct of our Board

• developing and recommending to our Board appropriate corporate governance guidelines and policies

• Board succession planning, including reviewing our Board’s structure and composition and the tenure of our directors

• Reviewing and reassessing the adequacy of the Company’s Political Contributions Policy, and annually review the Company’s political contributions

• reviewing the independence of our directors

• identifying and recommending qualified individuals for nomination and re-nomination to our Board

• recommending directors for appointment and re-appointment to Board committees

• reviewing and recommending to the Board our director compensation

• recommending to the Board those persons to be elected as officers of the Company | Governance Committee key activities in 2023:

• reviewed the results of our Board’s 2023 self-evaluation and a director skill-set analysis

• engaged in a director candidate search, resulting in the Board’s appointment of two new independent directors, Jonathon Nudi and Sandeep Reddy, to our Board and oversaw their orientation

• oversight of an enhancement to our Committee self-evaluation process to align with our Board self-evaluation process and to facilitate robust discussions regarding Committee composition, meetings and responsibilities

• discussed with management significant corporate governance trends

• reviewed with management our shareholder engagement activities

• reviewed 2022 political contributions in accordance with our Political Contributions Policy |

17

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

DIRECTOR COMPENSATION PROGRAM

Our non-employee directors receive the following compensation for service on our Board:

Compensation Element | Amount | |

Annual Cash Retainer | $130,000 | |

Annual Equity Retainer (a) | Restricted stock units with a value of $160,000 that vest in three equal installments over three years | |

Annual Chair of the Board Cash Retainer | $200,000 | |

Annual Committee Chair Cash Retainer | $25,000 for the Audit Committee | |

Meeting Fee (b) | None | |

Stock Retention Guideline | Directors must retain at least 50% of the equity they receive from us until their service as a director concludes | |

Annual Equity Retainer (row a): In 2023, the annual equity retainer was paid in the form of restricted stock units granted under our Non-Employee Director Equity Program. Our Non-Employee Director Equity Program imposes a limit on the amount of equity a director may receive during a year of the greater of 25,000 restricted stock units or equity with a grant date value of $500,000.

Meeting Fee (row b): Our Board may approve the payment of meeting fees to directors serving on three or more standing committees or serving as members of a special committee constituted by our Board. No such fees were paid for 2023.

Other Compensation

Our non-employee directors may also receive the following benefits, which are available to all of our employees:

| • | Matching gifts program under which we will match up to $5,000 of a director’s contributions to eligible 501(c)(3) tax-exempt organizations each year. Non-employee directors may participate in the matching gifts program until December 31 of the year in which their service as a director ends. |

| • | Employee purchase program under which a director may obtain rebates on certain of our products purchased for their personal use. |

In addition, if space is available, a director’s spouse is permitted to accompany a director who travels on Company aircraft to attend Board or committee meetings.

Annual Review of our Director Compensation Program

Our Governance Committee reviews our director compensation program annually, including reviewing an analysis of the competitiveness of the program, and recommends any changes to our Board. In 2023, the Committee did not recommend any changes to the Board.

18

MASCO 2024

|

PART I - CORPORATE GOVERNANCE

|

Director Compensation Table

The following table reflects 2023 compensation paid to our directors who served on our Board in 2023, other than Keith Allman, who is also a Company employee and receives no additional compensation for his service as a director. Reginald Turner concluded his service on our Board on May 11, 2023. Mr. Turner did not receive any additional payments in connection with his departure.

Name | Cash Fees Earned ($) | Restricted Stock Units ($) (a) | All Other Compensation ($) (b) | Total ($) | ||||

Mark R. Alexander | 130,000 | 159,843 | — | 289,843 | ||||

Aine L. Denari | 130,000 | 159,843 | 5,000 | 294,843 | ||||

Marie A. Ffolkes | 145,000 | 159,843 | 5,000 | 309,843 | ||||

Jonathon J. Nudi | 97,500 | 160,195 | — | 257,695 | ||||

Christopher A. O’Herlihy | 150,000 | 159,843 | 5,000 | 314,843 | ||||

Donald R. Parfet | 130,000 | 159,843 | 5,000 | 294,843 | ||||

Lisa A. Payne | 330,000 | 159,843 | — | 489,843 | ||||

John C. Plant | 130,000 | 159,843 | — | 289,843 | ||||

Sandeep Reddy | 87,500 | 146,846 | — | 234,346 | ||||

Charles K. Stevens | 155,000 | 159,843 | — | 314,843 | ||||

Reginald M. Turner | 32,500 | — | — | 32,500 | ||||

Restricted Stock Units (column a): In May 2023, we granted 3,040 restricted stock units to each non-employee director serving on our Board. In addition, in July 2023, we granted Jonathon Nudi, whose service began on June 1, 2023, 2,640 restricted stock units and we granted Sandeep Reddy, whose service began on June 15, 2023, 2,420 restricted stock units. The amounts reported in this column reflect the aggregate grant date fair value of the restricted stock units, calculated in accordance with accounting guidance. Directors realize the value of these grants over time because the vesting occurs pro rata over three years, and one-half of the restricted stock each of our directors receives as compensation must be retained until completion of their service on our Board.

All Other Compensation (column b): The amounts reported in this column reflect our contributions in 2023 to eligible tax-exempt organizations under our matching gifts program, as described above, for which directors receive no direct financial benefit.

Unvested Restricted Stock Units: The following table reports the unvested restricted stock units held on December 31, 2023 by each non-employee director who was serving on that date.

Director | Unvested Restricted Stock | |

Mark R. Alexander | 5,854 | |

Aine L. Denari | 5,930 | |

Marie A. Ffolkes | 5,854 | |

Jonathon J. Nudi | 2,640 | |

Christopher A. O’Herlihy | 5,854 | |

Donald R. Parfet | 5,854 | |

Lisa A. Payne | 5,854 | |

John C. Plant | 5,854 | |

Sandeep Reddy | 2,420 | |

Charles K. Stevens | 5,854 | |

19

PART I - CORPORATE GOVERNANCE

|

|

MASCO 2024

|

|

RELATED PERSON TRANSACTIONS

Our Board of Directors has adopted a Related Person Transaction Policy that requires our Board or a committee of independent directors to approve or ratify any transaction involving us in which any director, director nominee, executive officer, 5% beneficial owner or any of his or her immediate family members has a direct or indirect material interest.

Related Person Transaction Policy

Our policy covers:

| • | financial transactions and arrangements; |

| • | indebtedness and guarantees of indebtedness; and |

| • | transactions involving employment. |

Our policy excludes transactions determined by our Board not to involve a material interest of the related person, such as:

| • | ordinary course of business transactions of $120,000 or less; |

| • | transactions in which the related person’s interest is derived from service as a director of another entity or ownership of less than 10% of another entity’s stock; and |

| • | transactions in which the related person’s interest is derived from service as a director, trustee or officer of a not-for-profit organization or charity that receives donations from us, which are made in accordance with our matching gifts program. |

Assessing Related Person Transactions

Our policy requires directors, director nominees and executive officers to provide prompt written notice to our Secretary of any related transaction so it can be reviewed by our Governance Committee. If our Governance Committee determines that the related person has a direct or indirect material interest in the transaction, it will consider all relevant information to assess whether the transaction is in, or not inconsistent with, our best interests and the best interests of our shareholders. Our Governance Committee annually reviews previously-approved ongoing related transactions to determine whether the transactions should continue.

Related Persons Transactions for 2023

There are no transactions required to be described in this proxy statement.

20

MASCO 2024

|

PART I - CORPORATE GOVERNANCE

|

PROPOSAL 1: ELECTION OF CLASS III DIRECTOR NOMINEES

The term of office of our Class III Directors, who are Mark R. Alexander, Marie A. Ffolkes and John C. Plant, expires at this meeting.

Our Board proposes the re-election of Mr. Alexander, Ms. Ffolkes and Mr. Plant to serve as Class III Directors. The term of the Class III Directors elected at this Annual Meeting will expire at the Annual Meeting of Stockholders in 2027, or when their respective successors are elected and qualified.

Our Board expects that the persons named as proxy holders on the proxy card will vote the shares represented by each proxy for the election of each director nominee unless a contrary direction is given. If, prior to the meeting, a nominee is unable or unwilling to serve as a director, which our Board does not expect, the proxy holders may vote for an alternate nominee recommended by our Board, or our Board may reduce its size.

Information regarding each of our director nominees can be found above in “Director Nominees for Class III.”

Our Board recommends a vote FOR the election to our Board of Directors of each of the following Class III Director nominees:

| Name | Director Since | Occupation | ||

Mark R. Alexander | 2014

| Chief Executive Officer, Icelandic Provisions, Inc., a provider of Icelandic dairy products, since 2019

| ||

Marie A. Ffolkes |

2017 | Managing Partner, GenNx360 Capital Partners, a private equity firm focused on investing in industrial and business services companies, since 2023 | ||

John C. Plant |

2012 |

Chair of the Board and Chief Executive Officer, Howmet Aerospace Inc., a global supplier of engineered metal products, since 2020

| ||

The affirmative vote of a majority of the votes cast by shares is required for the election of directors. Abstentions and broker non-votes are not counted as votes cast, and therefore do not affect the outcome of the election. If an incumbent Director nominee fails to receive a majority of the votes cast, the Director is required to give his or her resignation to our Board. Our Board has 90 days after certification of the election results to decide whether to accept the Director’s resignation.

21

PART II - COMPENSATION DISCUSSION AND ANALYSIS

|

|

MASCO 2024

|

|

| COMPENSATION DISCUSSION AND ANALYSIS |

COMPENSATION PROGRAM HIGHLIGHTS

| • | In 2023, we improved our operating profit and operating margin and continued to execute our capital deployment strategy. Despite softer sales volume, our operating profit for the year increased 4% to $1.3 billion and our operating margin increased 200 basis points to 16.9% through disciplined pricing and continued improvement in operational efficiencies. We also continued to return value to our shareholders by repurchasing approximately 6.2 million shares of our common stock and increasing our quarterly dividend by approximately 2%. |

| • | Our compensation program is designed to emphasize pay-for-performance. We make pay dependent on performance through traditional means, including an annual cash incentive, a long-term performance-based award and stock options/stock appreciation rights (“SAR”) that vest ratably over 3 years. In addition, and different from many other companies, we formulaically base the size of our annual restricted stock unit (“RSU”) award on delivered performance. If earned, this RSU award vests ratably over 3 years. |

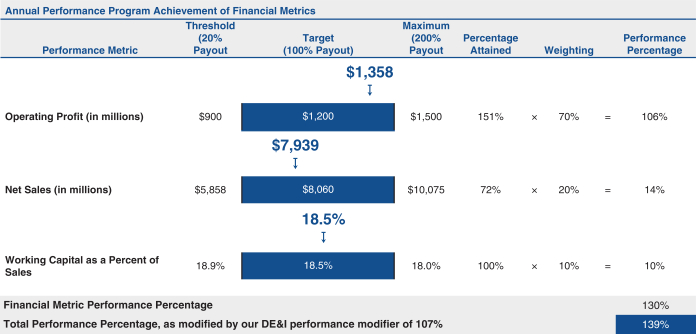

| • | We achieved 139% of our annual performance program’s performance target. In 2023, our annual incentives were based on the financial metrics of operating profit, net sales and working capital as a percent of sales as well as a DE&I performance modifier. As a result of our strong performance in 2023, particularly with respect to our operating profit, our executive officers earned 139% of target under our annual performance program, and received a cash bonus and an award of RSUs consistent with this performance. While most companies grant RSUs each year without a direct link to company performance, our program requires executives to earn their RSU grant each year through annual performance. |

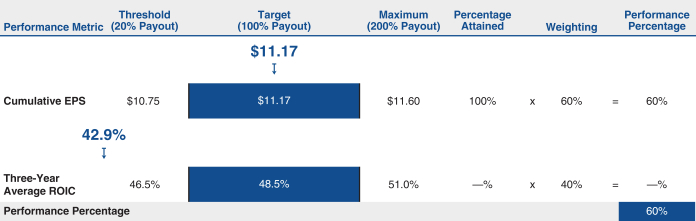

| • | Our 2021-2023 Long-term incentive program (“LTIP”) paid below target, at 60%. For the three-year period of 2021-2023, our LTIP was based on the financial metrics of cumulative earnings per share (“EPS”) and a three-year average return on invested capital (“ROIC”). We achieved 100% of our cumulative EPS target, but did not achieve our threshold for ROIC. Each of our executive officers received a share award consistent with this performance. |

| • | We continue to engage with shareholders and improve our compensation program. At last year’s Annual Meeting, our executive compensation program received 92% shareholder support, consistent with levels we have received in recent years. We continue to seek feedback from shareholders and, as appropriate, make adjustments to our program to ensure it remains aligned with long-term value creation. |

22

MASCO 2024

|

PART II - COMPENSATION DISCUSSION AND ANALYSIS

|

OUR NAMED EXECUTIVE OFFICERS

This Compensation Discussion and Analysis (“CD&A”) covers the elements of compensation awarded to, earned by or paid to our named executive officers (who we generally refer to as our “executive officers”) during 2023 and focuses on the principles underlying our company’s executive compensation policies and decisions. This CD&A explains the compensation for the following individuals:

| Name | Position | |

Keith J. Allman | President and Chief Executive Officer | |

Richard J. Westenberg | Vice President, Chief Financial Officer and Treasurer | |

Imran Ahmad | Group President | |

Jai Shah | Group President | |

Kenneth G. Cole | Vice President, General Counsel and Secretary | |

John G. Sznewajs | Former Vice President, Chief Financial Officer | |

David A. Chaika | Former Interim Chief Financial Officer | |

| • | Richard Westenberg commenced service as our Vice President, Chief Financial Officer on October 16, 2023 and was appointed as our Treasurer, effective April 1, 2024. |

| • | Imran Ahmad commenced service as our Group President on February 13, 2023. |

| • | John Sznewajs’ service as our Vice President, Chief Financial Officer concluded on May 31, 2023. |

| • | David Chaika, currently our Vice President, Finance, was appointed to serve as our Interim Chief Financial Officer, effective June 1, 2023, through October 15, 2023. Mr. Chaika’s service with us will conclude on or about April 30, 2024. |

OUR 2023 PERFORMANCE COMPENSATION PROGRAMS

Based on our performance in 2023, our eligible executive officers earned incentive compensation under our performance-based compensation programs, which include:

| • | Our annual performance program, under which we pay cash bonuses and grant RSUs to our executive officers if we meet annual performance goals; and |

| • | Our LTIP, under which our executive officers earn a stock award if we meet performance goals over a three-year period (2021-2023). |

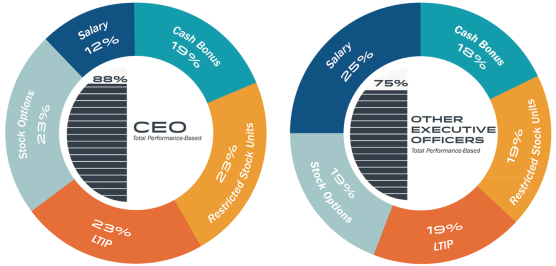

OUR EXECUTIVE OFFICERS’ PERFORMANCE-BASED TARGET COMPENSATION

The target compensation mix for our CEO and our other executive officers reflects our emphasis on long-term, performance-based compensation that incentivizes our executive officers to make strategic decisions that will strengthen our business and create long-term value for our stockholders. In 2023, approximately 88% of our CEO’s target compensation, and approximately 75% of the target compensation of our other executive officers, who participated in our 2023 annual performance program and 2023-2025 LTIP, was performance-based.

23

PART II - COMPENSATION DISCUSSION AND ANALYSIS

|

|

MASCO 2024

|

|

PERFORMANCE COMPENSATION AWARDED UNDER OUR PROGRAMS

2023 ANNUAL PERFORMANCE PROGRAM

| 2021-2023 LTIP

| |||||||||||||||||||||

Financial Performance Metric | Metric Weight | Target | Actual Performance (as adjusted) | Performance Percentage | Financial Performance Metric | Metric Weight | Target | Actual (as adjusted) | Performance Percentage | |||||||||||||

Operating Profit (in millions) | 70% | $1,200 | $1,358 | 106% | Cumulative EPS | 60% | $11.17 | $11.17 | 60% | |||||||||||||

Net Sales (in millions) | 20% | $8,060 | $7,939 | 14% | ||||||||||||||||||

Working Capital as a Percent of Sales | 10% | 18.5% | 18.5% | 10% | ROIC | 40% | 48.5% | 42.9% | —% | |||||||||||||

Financial Metric Performance Percentage | 130% | Total Performance Percentage | 60% | |||||||||||||||||||