| UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION

|

Washington, D.C. 20549

|

FORM N-CSR

|

CERTIFIED SHAREHOLDER REPORT OF

|

| REGISTERED MANAGEMENT INVESTMENT COMPANIES |

Investment Company Act file number 811-2594 |

|

MFS SERIES TRUST IV |

|

| (Exact name of registrant as specified in charter) |

500 Boylston Street, Boston, Massachusetts 02116 |

|

| (Address of principal executive offices) (Zip code) |

Susan S. Newton |

| Massachusetts Financial Services Company |

| 500 Boylston Street |

| Boston, Massachusetts 02116 |

|

| (Name and address of agents for service) |

Registrant’s telephone number, including area code: (617) 954-5000 |

|

Date of fiscal year end: August 31 |

|

Date of reporting period: February 28, 2006 |

|

ITEM 1. REPORTS TO STOCKHOLDERS.

| NOT FDIC INSURED MAY LOSE VALUE NO BANK OR CREDIT UNION GUARANTEE NOT A DEPOSIT |

| NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR NCUA/NCUSIF |

MFS- Government Money Market Fund

Each fund seeks as high a level of current income as is considered consistent with preservation of capital and liquidity.

This report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

| TABLE OF CONTENTS | |

|

| |

| LETTER FROM THE CEO | 1 |

|

|

| PORTFOLIO COMPOSITION | 2 |

|

|

| PERFORMANCE SUMMARY | 3 |

|

|

| EXPENSE TABLES | 5 |

|

|

| PORTFOLIO OF INVESTMENTS | 7 |

|

|

| FINANCIAL STATEMENTS | 11 |

|

|

| NOTES TO FINANCIAL STATEMENTS | 19 |

|

|

| BOARD REVIEW OF INVESTMENT | |

| ADVISORY AGREEMENT | 24 |

|

|

| PROXY VOTING POLICIES AND | |

| INFORMATION | 24 |

|

|

| QUARTERLY PORTFOLIO DISCLOSURE | 24 |

|

|

| CONTACT INFORMATION | BACK COVER |

Dear Shareholders,

It has been said that change is the only constant in life. As investors have seen, that theme is still accurate today as we recently have experienced shifting economic cycles because of natural disasters and political instability around the globe.

Markets worldwide have fluctuated in the past year as devastating hurricanes had a dramatic effect on the international economy, particularly on oil prices. We witnessed political unrest in the Middle East, highlighted by instability in Iraq, and in Africa, the usually stable Nigeria also experienced violence. As a result, energy prices have bounced up and down, with crude oil prices at one point topping a record $70 per barrel.

Such cycles are not uncommon and in fact have almost become the norm in our everyday lives. What does all of this mean to you as an investor? In times like these, it helps to know that you’re working with a seasoned investment professional who has experience to guide you through difficult times. At MFS®, we believe our investment management team has the knowledge and confidence to navigate through difficult cycles and at the same time see through adversity to find investment opportunities for our clients and shareholders.

Our investment management process, honed over 80 years, combines a unique concept of teamwork with our unwavering focus on the long term. We firmly believe that the best way to realize long-term financial goals – be it a college education, a comfortable retirement, or a secure family legacy – is to follow a three-pronged approach that focuses on longer time horizons. Allocate holdings across the major asset classes – including stocks, bonds, and cash. Diversify within each class to take advantage of different market segments and investing styles. Rebalance assets regularly to maintain a desired asset allocation. Of course, these strategies cannot guarantee a profit or protect against a loss. This long-term approach requires diligence and patience, two traits that in our experience are essential to capitalizing on the many opportunities the financial markets can offer – through both up and down economic cycles.

Respectfully,

Robert J. Manning

Chief Executive Officer and Chief Investment Officer

MFS Investment Management®

April 17, 2006

The opinions expressed in this letter are those of MFS, and no forecasts can be guaranteed.

ANNUAL REPORT 1

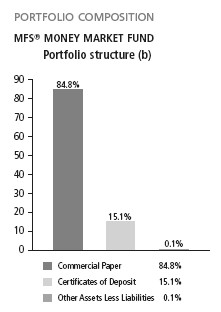

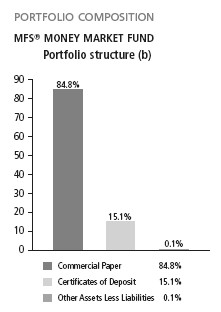

| Short term credit quality (r) | |

| Average Credit Quality | |

| Short Term Bonds (a) | A-1 |

|

|

| All holdings are rated ‘‘A-1’’ | |

| Money market maturity breakdown (b) |

| 0-29 days | 45.3% |

|

|

| 30-59 days | 20.7% |

|

|

| 60-89 days | 32.2% |

|

|

| 90-366 days | 1.7% |

|

|

| Other Assets Less Liabilities | 0.1% |

|

|

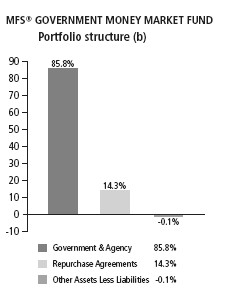

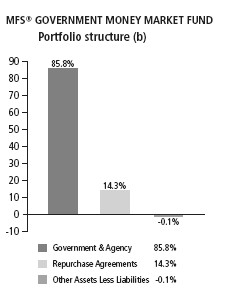

| Short term credit quality (r) | |

| Average Credit Quality | |

| Short Term Bonds (a) | A-1 |

|

|

| All holdings are rated ‘‘A-1’’ | |

| Money market maturity breakdown (b) |

| 0-29 days | 60.3% |

|

|

| 30-59 days | 8.7% |

|

|

| 60-89 days | 29.5% |

|

|

| 90-366 days | 1.6% |

|

|

| Other Assets Less Liabilities | -0.1% |

|

|

| (b) | For purposes of this graphical presentation, the bond component includes both accrued interest amounts and the equivalent exposure from any derivative holdings, if applicable. |

| (r) | Each security is assigned a rating from Moody’s Investors Service. If not rated by Moody’s, the rating will be that assigned by Standard & Poor’s. Likewise, if not assigned a rating by Standard & Poor’s, it will be based on the rating assigned by Fitch, Inc. If not rated by any of the three agencies, the security is considered Not Rated. U.S. Treasuries and U.S. Agency Securities are included in the ‘‘A-1’’-rating category. Percentages are based on the total market value of investments as of 2/28/06. |

| (a) | The Average Credit Quality is based upon a market weighted average of portfolio holdings that are rated by public rating agencies. |

From time to time ‘‘Other Assets Less Liabilities,’’ may be negative due to timing of cash receipts.

Percentages are based on net assets as of 2/28/06, unless otherwise noted.

The portfolios are actively managed, and current holdings may be different.

2 ANNUAL REPORT

PERFORMANCE SUMMARY THROUGH 2/28/06

Total returns as well as the current 7-day yield have been provided for the applicable time periods. Performance results reflect the percentage change in net asset value, including the reinvestment of any dividends and capital gains distributions. (See Notes to Performance Summary.)

An investment in either of the funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in either of these funds.

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. For most recent month-end performance, please visit mfs.com. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

| MFS Money Market Fund | | MFS Government Money Market Fund |

| Inception Date: 12/19/75 | | Inception Date: 2/26/82 |

| 6 Month Total Return: 1.92% | | 6 Month Total Return: 1.67% |

| Current 7-day yield: 4.21% | | Current 7-day yield: 3.61% |

| Current 7-day yield without waiver: 3.90% | | Current 7-day yield without waiver: 3.26% |

| | |

Yields quoted are based on the latest seven days ended as of February 28, 2006, with dividends annualized. The yield quotations more closely reflect the current earnings of the funds than the total return quotations. Shares of the funds can be purchased at net asset value without a sales charge.

Periods less than one year are actual not annualized.

Notes to Performance Summary

Performance results reflect any applicable expense subsidies, waivers, and adjustments in effect during the periods shown. Subsidies and fee waivers may be imposed to enhance a portfolio’s yield during periods when the portfolio’s operating expenses have a significant impact on the portfolio’s yield due to lower interest rates. Without such subsidies, waivers, and adjustments, the results would be less favorable. Please see the prospectus and financial statements for complete details.

ANNUAL REPORT 3

Performance Summary – continued

Key Risk Considerations

MFS® Money Market Fund

|

The portfolio’s yield changes daily and is based on changes in interest rates and market conditions, and in response to other economic, political, or financial developments. The value of the portfolio’s investments may fluctuate in response to many factors including the performance and valuation of the issuer and general market conditions. Municipal instruments can be volatile and significantly affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal instruments. Foreign investments can be more volatile than U.S. investments. As with any fixed-income security, securities issued by certain U.S. government agencies or instrumentalities are subject to the risk that the issuer will default on principal and interest payments. Investors should note that many U.S. government securities in which the portfolio may invest are not supported by the full faith and the credit of the United States Government (including securities issued by government sponsored enterprises and by certain U.S. federal agencies and instrumentalities) and involve increased credit risk. Although the portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the portfolio.

Please see the prospectus for further information regarding these and other risk considerations.

MFS® Government Money Market Fund

|

The portfolio’s yield changes daily and is based on changes in interest rates and market conditions, and in response to other economic, political, or financial developments. The value of the portfolio’s investments may fluctuate in response to many factors including the performance and valuation of the issuer and general market conditions. As with any fixed-income security, securities issued by certain U.S. government agencies or instrumentalities are subject to the risk that the issuer will default on principal and interest payments. Investors should note that many U.S. government securities in which the portfolio may invest are not supported by the full faith and the credit of the United States Government (including securities issued by government sponsored enterprises and by certain U.S. federal agencies and instrumentalities) and involve increased credit risk. Although the portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the portfolio.

Please see the prospectus for further information regarding these and other risk considerations.

4 ANNUAL REPORT

| EXPENSE TABLES | MFS® MONEY MARKET FUND |

| MFS® GOVERNMENT MONEY MARKET FUND |

Fund Expenses Borne by the Shareholders During the Period, September 1, 2005 through February 28, 2006.

As a shareholder of the funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments and redemption fees on certain exchanges and redemptions, and (2) ongoing costs, including management fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, September 1, 2005 through February 28, 2006.

Actual Expenses

The first line of the tables on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the tables on the following page provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

ANNUAL REPORT 5

Expense Tables – continued

|

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the second line of the table is useful in comparing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | Expenses |

| | Annualized | Beginning | Ending | Paid During |

| | Expense | Account Value | Account Value | Period (p) |

| MFS Money Market Fund | Ratio | 9/01/05 | 2/28/06 | 9/01/05-2/28/06 |

|

|

|

|

|

| Actual | 0.40% | $1,000.00 | $1,019.20 | $2.00 |

|

|

|

|

|

| Hypothetical (h) | 0.40% | $1,000.00 | $1,022.81 | $2.01 |

|

|

|

|

|

| | | | | Expenses |

| | Annualized | Beginning | Ending | Paid During |

| MFS Government | Expense | Account Value | Account Value | Period (p) |

| Money Market Fund | Ratio | 9/01/05 | 2/28/06 | 9/01/05-2/28/06 |

|

|

|

|

|

| Actual | 0.81% | $1,000.00 | $1,016.70 | $4.05 |

|

|

|

|

|

| Hypothetical (h) | 0.81% | $1,000.00 | $1,020.78 | $4.06 |

|

|

|

|

|

| (h) | 5% fund return per year before expenses. |

| (p) | Expenses paid is equal to each fund’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. |

| |

6 ANNUAL REPORT

| PORTFOLIO OF INVESTMENTS (unaudited) – 2/28/06 | | | | | |

| The Portfolio of Investments is a complete list of all securities owned by your fund. | | | |

| It is categorized by broad-based asset classes. | | | | | |

MFS Money Market Fund | | | | | |

Certificates of Deposit - 15.1% |

| Issuer | | Shares/Par | | | Value ($) |

| Banks & Credit Companies - 15.1% |

| Barclays Bank NY PLC, 4.455%, due 3/28/06 | $ | 31,226,000 | | $ | 31,226,000 |

| Caylon New York Branch, 4.73%, due 5/22/06 | | 25,000,000 | | | 25,000,000 |

| Credit Suisse First Boston, NY, 4.46%, due 3/13/06 | | 31,290,000 | | | 31,290,000 |

| Royal Bank of Canada New York Branch, 4.7125%, due 5/19/06 | | 29,372,000 | | | 29,371,325 |

| Total Certificates of Deposit, at Amortized Cost and Value | | | | $ | 116,887,325 |

Commercial Paper - 84.8% (y) | | | | | |

| Banks & Credit Companies - 26.5% | | | | | |

| Abbey National North America LLC, 4.56%, due 3/01/06 | $ | 21,365,000 | | $ | 21,365,000 |

| Bank of America Corp., 4.625%, due 4/25/06 | | 20,526,000 | | | 20,380,964 |

| Citigroup Funding, Inc., 4.67%, due 5/17/06 | | 7,000,000 | | | 6,930,080 |

| Depfa Bank PLC, 4.39%, due 3/06/06 (t) | | 6,500,000 | | | 6,496,037 |

| Depfa Bank PLC, 4.475%, due 4/11/06 (t) | | 16,596,000 | | | 16,511,418 |

| Depfa Bank PLC, 4.595%, due 5/03/06 (t) | | 7,995,000 | | | 7,930,710 |

| Dexia Delaware LLC, 4.395%, due 3/14/06 | | 8,946,000 | | | 8,931,802 |

| Dexia Delaware LLC, 4.64%, due 5/09/06 | | 8,000,000 | | | 7,928,853 |

| HBOS Treasury Services PLC, 4.65%, due 5/15/06 | | 6,673,000 | | | 6,608,355 |

| HBOS Treasury Services PLC, 4.655%, due 5/17/06 | | 24,419,000 | | | 24,175,872 |

| ING America Insurance Holdings, Inc., 4.37%, due 3/01/06 | | 28,667,000 | | | 28,667,000 |

| Svenska Handelsbanken, Inc., 4.395%, due 3/09/06 | | 18,478,000 | | | 18,459,953 |

| Svenska Handelsbanken, Inc., 4.57%, due 4/27/06 | | 367,000 | | | 364,344 |

| UBS Finance Delaware LLC, 4.63%, due 5/08/06 | | 6,300,000 | | | 6,244,903 |

| UBS Finance Delaware LLC, 4.625%, due 5/10/06 | | 24,979,000 | | | 24,754,362 |

| | | | | $ | 205,749,653 |

| Financial Institutions - 54.3% |

| Alpine Securitization Corp., 4.59%, due 4/18/06 (t) | $ | 1,000,000 | | $ | 993,880 |

| Alpine Securitization Corp., 4.65%, due 5/08/06 (t) | | 5,000,000 | | | 4,956,083 |

| American General Finance Corp., 4.42%, due 3/13/06 | | 6,170,000 | | | 6,160,910 |

| American General Finance Corp., 4.625%, due 5/11/06 | | 24,849,000 | | | 24,622,339 |

| Barton Capital LLC, 4.47%, due 3/07/06 (t) | | 3,248,000 | | | 3,245,580 |

| Barton Capital LLC, 4.4%, due 3/09/06 (t) | | 27,937,000 | | | 27,909,684 |

| CAFCO LLC, 4.63%, due 4/19/06 (t) | | 8,095,000 | | | 8,043,986 |

| CAFCO LLC, 4.65%, due 4/24/06 (t) | | 9,168,000 | | | 9,104,053 |

| CAFCO LLC, 4.64%, due 5/04/06 (t) | | 13,851,000 | | | 13,736,745 |

| CRC Funding LLC, 4.43%, due 3/06/06 (t) | | 11,579,000 | | | 11,571,876 |

| CRC Funding LLC, 4.58%, due 4/17/06 (t) | | 19,561,000 | | | 19,444,036 |

| Ciesco LLC, 4.385%, due 3/06/06 (t) | | 4,427,000 | | | 4,424,304 |

| Ciesco LLC, 4.6%, due 4/18/06 (t) | | 26,576,000 | | | 26,413,001 |

| | | SEMIANNUAL REPORT 7 |

| Portfolio of Investments (unaudited) – continued | | | | |

| Issuer | Shares/Par | | | Value ($) |

|

| |

|

|

| Commercial Paper - continued | | | | |

| Financial Institutions - continued |

| Citibank Credit Card Issuance Trust, 4.42%, due 3/08/06 (t) | $ 20,000,000 | | $ | 19,982,811 |

| Citibank Credit Card Issuance Trust, 4.59%, due 4/10/06 (t) | 11,069,000 | | | 11,012,548 |

| Edison Asset Securitization LLC, 4.6%, due 5/04/06 (t) | 31,196,000 | | | 30,940,886 |

| Govco, Inc., 4.6%, due 5/04/06 (t) | 31,140,000 | | | 30,885,344 |

| Jupiter Securitization Corp., 4.55%, due 4/05/06 (t) | 31,154,000 | | | 31,016,187 |

| Kitty Hawk Funding Corp., 4.39%, due 3/20/06 (t) | 29,758,000 | | | 29,689,052 |

| Old Line Funding LLC, 4.46%, due 3/02/06 (t) | 10,000,000 | | | 9,998,761 |

| Old Line Funding LLC, 4.46%, due 3/07/06 (t) | 4,307,000 | | | 4,303,798 |

| Park Avenue Receivable Co. LLC, 4.56%, due 3/01/06 (t) | 20,157,000 | | | 20,157,000 |

| Ranger Funding Co. LLC, 4.5%, due 3/07/06 (t) | 10,000,000 | | | 9,992,500 |

| Scaldis Capital LLC, 4.58%, due 4/28/06 (t) | 17,539,000 | | | 17,409,582 |

| Scaldis Capital LLC, 4.71%, due 5/30/06 (t) | 11,496,000 | | | 11,360,635 |

| Scaldis Capital LLC, 4.72%, due 5/31/06 (t) | 2,140,000 | | | 2,114,467 |

| Thunder Bay Funding LLC, 4.44%, due 3/03/06 (t) | 17,075,000 | | | 17,070,788 |

| Thunder Bay Funding LLC, 4.405%, due 3/21/06 (t) | 14,457,000 | | | 14,421,621 |

| | | $ | 420,982,457 |

| Insurance - 4.0% |

| Metlife, Inc., 4.38%, due 3/20/06 (t) | $ 25,278,000 | | $ | 25,219,566 |

| Metlife, Inc., 4.68%, due 5/11/06 (t) | 5,764,000 | | | 5,710,798 |

| | | | $ | 30,930,364 |

| Total Commercial Paper, at Amortized Cost and Value | | $ | 657,662,474 |

| Total Investments, at Amortized Cost and Value | | $ | 774,549,799 |

| Other Assets, Less Liabilities - 0.1% | | | | 1,025,406 |

|

|

|

|

| Net Assets - 100.0% | | | $ | 775,575,205 |

|

|

|

| See Portfolio Footnotes and Notes to Financial Statements | | | | |

|

|

|

|

| 8 SEMIANNUAL REPORT | | | | |

| PORTFOLIO OF INVESTMENTS (unaudited) – 2/28/06 | | | | | |

The Portfolio of Investments is a complete list of all securities owned by your fund. | | | |

| It is categorized by broad-based asset classes. | | | | | |

MFS Government Money Market Fund | | | | | |

U.S. Government Agency Obligations - 85.8% (y) |

| Issuer | | | Shares/Par | | | Value ($) |

| Fannie Mae, 4.252%, due 3/08/06 | $ | 900,000 | | $ | 899,255 |

| Fannie Mae, 4.355%, due 3/22/06 | | 1,048,000 | | | 1,045,338 |

| Fannie Mae, 4.339%, due 3/27/06 | | 300,000 | | | 299,060 |

| Fannie Mae, 4.36%, due 3/27/06 | | 400,000 | | | 398,740 |

| Fannie Mae, 4.35%, due 3/29/06 | | 300,000 | | | 298,985 |

| Fannie Mae, 4.55%, due 5/01/06 - 5/10/06 | | 728,000 | | | 722,128 |

| Fannie Mae, 4.6%, due 5/31/06 | | 364,000 | | | 359,767 |

| Farmer Mac, 4.33%, due 3/17/06 | | 2,500,000 | | | 2,495,189 |

| Federal Home Loan Bank, 4.275%, due 3/10/06 | | 1,200,000 | | | 1,198,717 |

| Federal Home Loan Bank, 4.55%, due 4/26/06 | | 270,000 | | | 268,089 |

| Federal Home Loan Bank, 4.53%, due 5/03/06 | | 950,000 | | | 942,469 |

| Freddie Mac, 4.23%, due 3/07/06 | | 700,000 | | | 699,506 |

| Freddie Mac, 4.33%, due 3/14/06 | | 400,000 | | | 399,375 |

| Freddie Mac, 4.336%, due 3/14/06 | | 165,000 | | | 164,742 |

| Freddie Mac, 4.4%, due 3/14/06 | | 1,000,000 | | | 998,411 |

| Freddie Mac, 4.38%, due 3/17/06 | | 500,000 | | | 499,027 |

| Freddie Mac, 4.34%, due 3/28/06 | | 343,000 | | | 341,884 |

| Freddie Mac, 4.35%, due 3/28/06 | | 398,000 | | | 396,702 |

| Freddie Mac, 4.39%, due 4/18/06 | | 1,000,000 | | | 994,146 |

| Freddie Mac, 4.55%, due 4/25/06 - 5/10/06 | | 894,000 | | | 886,470 |

| Freddie Mac, 4.53%, due 4/28/06 - 5/09/06 | | 2,434,000 | | | 2,413,620 |

| Freddie Mac, 4.52%, due 5/02/06 | | 1,000,000 | | | 992,216 |

| Freddie Mac, 4.552%, due 5/02/06 | | 800,000 | | | 793,728 |

| Freddie Mac, 4.54%, due 5/08/06 | | 400,000 | | | 396,570 |

| Total U.S. Government Agency Obligations, at Amortized |

| Cost and Value | $ | 18,904,134 |

| Repurchase Agreements - 14.3% |

| Issuer | | | Shares/Par | | | Value ($) |

| Goldman Sachs, 4.55%, dated 2/28/06, due 3/01/06, total to be |

| received $1,000,126 (secured by various U.S. Treasury and Federal | | | | | |

| Agency obligations in a jointly traded account) | $ | 1,000,000 | | $ | 1,000,000 |

| | �� | | SEMIANNUAL REPORT 9 |

| Portfolio of Investments (unaudited) – continued | | | |

| Repurchase Agreements - continued |

| Issuer | Shares/Par | | Value ($) |

| Morgan Stanley, 4.56%, dated 2/28/06, due 3/01/06, total to be |

| received $2,140,271 (secured by various U.S. Treasury and Federal | | | |

| Agency obligations in a jointly traded account) | $ 2,140,000 | $ | 2,140,000 |

|

|

|

|

| Total Repurchase Agreements, at Cost | | $ | 3,140,000 |

|

|

|

|

| Total Investments, at Amortized Cost and Value | | $22,044,134 |

|

|

|

| Other Assets, Less Liabilities - (0.1)% | | | (20,426) |

|

|

|

|

| Net Assets - 100.0% | | $22,023,708 |

|

|

|

| (y) | The rate shown represents an annualized yield at time of purchase. |

| (t) | Security exempt from registration with the U.S. Securities and Exchange Commission under Section 4(2) of the Securities Act of 1933. |

| |

See Notes to Financial Statements

|

10 SEMIANNUAL REPORT

FINANCIAL STATEMENTS | Statement of Assets and Liabilities (unaudited)

| This statement represents your fund’s balance sheet, which details the assets | | |

| and liabilities composing the total value of the fund. | | |

At 2/28/06 | | |

MFS Money Market Fund | | |

Assets |

| Investments, at amortized cost and value | $774,549,799 | |

| Cash | 966 | |

| Receivable for fund shares sold | 3,542,134 | |

| Interest receivable | 475,456 | |

| Other assets | 3,397 | |

| Total assets | $778,571,752 |

Liabilities |

| Distributions payable | $53,042 | |

| Payable for fund shares reacquired | 2,660,854 | |

| Payable to affiliates | | |

| Management fee | 6,349 | |

| Shareholder servicing costs | 100,943 | |

| Administrative services fee | 430 | |

| Payable for independent trustees’ compensation | 46,253 | |

| Accrued expenses and other liabilities | 128,676 | |

| Total liabilities | $2,996,547 |

| Net assets | | $775,575,205 |

Net assets consist of: |

| Paid-in capital | $775,575,240 | |

| Accumulated net realized gain (loss) on investments | (8,515) | |

| Undistributed net investment income | 8,480 | |

| Net assets | $775,575,205 |

| Shares of beneficial interest outstanding | | 775,575,287 |

| Net asset value per share |

| (net assets/shares of beneficial interest outstanding) | | $1.00 |

See Notes to Financial Statements |

| | | SEMIANNUAL REPORT 11 |

| Statement of Assets and Liabilities (unaudited) – continued | | |

| This statement represents your fund’s balance sheet, which details the assets | | |

| and liabilities composing the total value of the fund. | | |

| At 2/28/06 | | |

| MFS Government Money Market Fund | | |

| Assets | | |

|

|

|

| Investments, at amortized cost and value | $18,904,134 | |

| Repurchase agreements, at value | 3,140,000 | |

|

|

|

| Total investments, at amortized cost and value | | $22,044,134 |

|

|

|

| Cash | 740 | |

| Receivable for fund shares sold | 42,354 | |

| Interest receivable | 397 | |

| Other assets | 262 | |

|

|

|

| Total assets | | $22,087,887 |

|

|

|

| Liabilities | | |

|

|

|

| Distributions payable | $1,166 | |

| Payable for fund shares reacquired | 16,532 | |

| Payable to affiliates | | |

| Management fee | 184 | |

| Shareholder servicing costs | 3,464 | |

| Administrative services fee | 36 | |

| Payable for independent trustees’ compensation | 7,523 | |

| Accrued expenses and other liabilities | 35,274 | |

|

|

|

| Total liabilities | | $64,179 |

|

|

|

| Net assets | | $22,023,708 |

|

|

|

| Net assets consist of: | | |

|

|

|

| Paid-in capital | $22,031,421 | |

| Accumulated distributions in excess of net investment income | (7,713) | �� |

|

|

|

| Net assets | | $22,023,708 |

|

|

|

| Shares of beneficial interest outstanding | | 22,023,708 |

|

|

|

| Net asset value per share | | |

| (net assets/shares of beneficial interest outstanding) | | $1.00 |

|

|

|

| See Notes to Financial Statements | | |

|

|

|

12 SEMIANNUAL REPORT | | |

FINANCIAL STATEMENTS | Statement of Operations (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Six months ended 2/28/06 | | |

MFS Money Market Fund

| | |

Net investment income

| | |

| Interest income | $15,938,817 |

| Expenses | | |

| Management fee | $1,794,423 | |

| Shareholder servicing costs | 659,058 | |

| Administrative services fee | 39,988 | |

| Independent trustees’ compensation | 14,368 | |

| Custodian fee | 116,989 | |

| Shareholder communications | 29,158 | |

| Auditing fees | 13,065 | |

| Legal fees | 8,035 | |

| Registration fees | 39,084 | |

| Miscellaneous | 29,432 | |

| Total expenses | $2,743,600 |

| Fees paid indirectly | (101,117) | |

| Reduction of expenses by investment adviser | (1,217,453) | |

| Net expenses | $1,425,030 |

| Net investment income | $14,513,787 |

| Net realized gain (loss) on investments | $(35) |

| Change from operations | $14,513,752 |

See Notes to Financial Statements |

| | | SEMIANNUAL REPORT 13 |

| Statement of Operations (unaudited) – continued | | |

This statement describes how much your fund earned in investment income and accrued in | |

| expenses. It also describes any gains and/or losses generated by fund operations. | | |

Six months ended 2/28/06

| | |

MFS Government Money Market Fund

| | |

Net investment income

| | |

|

|

|

| Interest income | | $468,091 |

|

|

|

| Expenses | | |

| Management fee | $58,112 | |

| Shareholder servicing costs | 20,681 | |

| Administrative services fee | 5,984 | |

| Independent trustees’ compensation | 2,005 | |

| Custodian fee | 5,213 | |

| Shareholder communications | 447 | |

| Auditing fees | 13,065 | |

| Legal fees | 1,676 | |

| Registration fees | 17,234 | |

| Miscellaneous | 10,238 | |

|

|

|

| Total expenses | | $134,655 |

|

|

|

| Fees paid indirectly | (3,293) | |

| Reduction of expenses by investment adviser | (40,765) | |

|

|

|

| Net expenses | | $90,597 |

|

|

|

| Net investment income | | $377,494 |

|

|

|

| See Notes to Financial Statements | | |

14 SEMIANNUAL REPORT

| FINANCIAL STATEMENTS | Statements of Changes in Net Assets | |

These statements describe the increases and/or decreases in net assets resulting | |

| from operations, any distributions, and any shareholder transactions. | |

| | Six months ended | Year ended |

| | 2/28/06 | 8/31/05 |

| MFS Money Market Fund | (unaudited) | |

| Change in net assets | | |

|

|

|

| From operations | | |

|

|

|

| Net investment income | $14,513,787 | $17,132,395 |

| Net realized gain (loss) on investments | (35) | (151) |

|

|

|

| Change in net assets from operations | $14,513,752 | $17,132,244 |

|

|

|

| Distributions declared to shareholders | | |

|

|

|

| From net investment income | $(14,880,917) | $(16,765,114) |

|

|

|

| Fund share (principal) transactions | | |

|

|

|

| Net proceeds from sale of shares | $323,504,571 | $623,054,895 |

| Net asset value of shares issued to shareholders in | | |

| reinvestment of distributions | 14,280,677 | 16,089,710 |

| Cost of shares reacquired | (330,714,139) | (699,562,244) |

|

|

|

| Change in net assets from fund share transactions | $7,071,109 | $(60,417,639) |

|

|

|

| Total change in net assets | $6,703,944 | $(60,050,509) |

|

|

|

| Net assets | | |

|

|

|

| At beginning of period | 768,871,261 | 828,921,770 |

| At end of period (including undistributed net investment | | |

| income of $8,480 and $375,610, respectively) | $775,575,205 | $768,871,261 |

|

|

|

| See Notes to Financial Statements | | |

SEMIANNUAL REPORT 15

| Statements of Changes in Net Assets – continued | | |

These statements describe the increases and/or decreases in net assets resulting | |

| from operations, any distributions, and any shareholder transactions. | | |

Six months ended | Year ended |

| | 2/28/06 | 8/31/05 |

| MFS Government Money Market Fund | (unaudited) | |

| Change in net assets | | |

|

|

|

| From operations | | |

|

|

|

| Net investment income | $377,494 | $613,292 |

|

|

|

| Distributions declared to shareholders | | |

|

|

|

| From net investment income | $(387,494) | $(603,292) |

|

|

|

| Fund share (principal) transactions | | |

|

|

|

| Net proceeds from sale of shares | $8,475,368 | $22,096,030 |

| Net asset value of shares issued to shareholders in reinvestment | | |

| of distributions | 371,555 | 576,994 |

| Cost of shares reacquired | (11,227,181) | (38,056,006) |

|

|

|

| Change in net assets from fund share transactions | $(2,380,258) | $(15,382,982) |

|

|

|

| Total change in net assets | $(2,390,258) | $(15,372,982) |

|

|

|

| Net assets | | |

|

|

|

| At beginning of period | 24,413,966 | 39,786,948 |

| At end of period (including accumulated distributions in excess | | |

| of net investment income of $7,713 and undistributed net | | |

| investment income of $2,287) | $22,023,708 | $24,413,966 |

|

|

|

| See Notes to Financial Statements | | |

16 SEMIANNUAL REPORT

FINANCIAL STATEMENTS | Financial Highlights

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| MFS Money | Six months ended | Years ended 8/31 |

| Market Fund | 2/28/06 | 2005 | 2004 | 2003 | 2002 | 2001 |

| (unaudited) | | | | | |

| Net asset value, beginning | | | | | | |

| of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

|

|

|

|

|

|

| Income from investment | | | | | | |

| operations | | | | | | |

|

|

|

|

|

|

|

| Net investment income (d) | $0.02 | $0.02 | $0.01 | $0.01 | $0.02 | $0.05 |

| Net realized gain (loss) | | | | | | |

| on investments | (0.00)(w) | (0.00)(w) | — | — | — | — |

|

|

|

|

|

|

|

| Total from investment | | | | | | |

| operations | $0.02 | $0.02 | $0.01 | $0.01 | $0.02 | $0.05 |

|

|

|

|

|

|

|

| Less distributions declared | | | | | | |

| to shareholders | | | | | | |

|

|

|

|

|

|

|

| From net investment | | | | | | |

| income | $(0.02) | $(0.02) | $(0.01) | $(0.01) | $(0.02) | $(0.05) |

|

|

|

|

|

|

|

| Net asset value, end | | | | | | |

| of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

|

|

|

|

|

|

| Total return (%) (r)(t) | 1.92(n) | 2.16 | 0.64 | 0.81 | 1.67 | 4.97 |

|

|

|

|

|

|

|

| Ratios (%) (to average net assets) | | | | | |

| and Supplemental data: | | | | | | |

|

|

|

|

|

|

|

| Expenses before expense | | | | | | |

| reductions (f) | 0.71(a) | 0.75 | 0.67 | 0.60 | 0.68 | 0.67 |

| Expenses after expense | | | | | | |

| reductions (f) | 0.40(a) | 0.44 | 0.54 | 0.60 | 0.68 | 0.67 |

| Net investment income | 3.75(a) | 2.17 | 0.62 | 0.80 | 1.66 | 4.86 |

| Net assets at end of period | | | | | | |

| (000 Omitted) | $775,575 | $768,871 | $828,921 | $2,123,459 | $1,962,159 | $1,461,101 |

|

|

|

|

|

|

|

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (a) | Annualized. |

| (n) | Not annualized. |

| (w) | Per share amount was less than $0.01. |

| (d) | Per share data are based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly. |

| (t) | Total returns do not include any applicable sales charges. |

See Notes to Financial Statements

|

SEMIANNUAL REPORT 17

Financial Highlights – continued

|

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.| | | | | | |

| | | | |

| | Six months | | | |

| MFS Government Money | ended | Years ended 8/31 |

| Market Fund | 2/28/06 | 2005 | 2004 | 2003 | 2002 | 2001 |

| (unaudited) | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

|

|

|

|

|

|

| Income from investment | | | | | | |

| operations | | | | | | |

|

|

|

|

|

|

|

| Net investment income (d) | $0.02 | $0.02 | $0.01 | $0.01 | $0.01 | $0.05 |

|

|

|

|

|

|

|

| Less distributions declared | | | | | | |

| to shareholders | | | | | | |

|

|

|

|

|

|

|

| From net investment income | $(0.02) | $(0.02) | $(0.01) | $(0.01) | $(0.01) | $(0.05) |

|

|

|

|

|

|

|

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

|

|

|

|

|

|

| Total return (%) (r)(t) | 1.67(n) | 2.02 | 0.54 | 0.66 | 1.51 | 4.71 |

|

|

|

|

|

|

|

| Ratios (%) (to average net assets) | | | | | | |

| and Supplemental data: | | | | | | |

|

|

|

|

|

|

|

| Expenses before expense reductions (f) | 1.16(a) | 0.87 | 0.74 | 0.72 | 0.82 | 0.90 |

| Expenses after expense reductions (f) | 0.81(a) | 0.52 | 0.59 | 0.72 | 0.82 | 0.90 |

| Net investment income | 3.25(a) | 1.96 | 0.49 | 0.61 | 1.56 | 4.55 |

| Net assets at end of period | | | | | | |

| (000 Omitted) | $22,024 | $24,414 | $39,787 | $132,888 | $54,741 | $62,078 |

|

|

|

|

|

|

|

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (a) | Annualized. |

| (n) | Not annualized. |

| (d) | Per share data are based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly. |

| (t) | Total returns do not include any applicable sales charges. |

| |

See Notes to Financial Statements

|

18 SEMIANNUAL REPORT

NOTES TO FINANCIAL STATEMENTS (unaudited)

(1) Business and Organization

|

MFS Money Market Fund and MFS Government Money Market Fund (the funds) are each a series of MFS Series Trust IV (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

(2) Significant Accounting Policies

|

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Investment Valuations – Money market instruments are valued at amortized cost, which approximates market value. Amortized cost involves valuing an instrument at its cost as adjusted for amortization of premium or accretion of discount rather than its current market value. Each money market fund’s use of amortized cost is subject to the fund’s compliance with Rule 2a-7 of the Investment Company Act of 1940. The amortized cost value of an instrument can be different from the market value of an instrument.

Repurchase Agreements – Each fund may enter into repurchase agreements with institutions that the funds’ investment adviser has determined are creditworthy. Each repurchase agreement is recorded at cost. Each fund requires that the securities collateral in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. The funds monitor, on a daily basis, the value of the collateral to ensure that its value, including accrued interest, is greater than amounts owed to the funds under each such repurchase agreement. The funds, along with other affiliated entities of Massachusetts Financial Services Company (MFS), may utilize a joint trading account for the purpose of entering into one or more repurchase agreements.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. All premium and discount is amortized and accreted for financial statement purposes and tax reporting purposes in accordance with generally accepted accounting principles and federal tax regulations, respectively. All discount is accreted for tax reporting purposes as required by federal income tax regulations.

Fees Paid Indirectly – Each fund’s custody fee is reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the six months ended February 28, 2006, is shown as a reduction of total expenses on the Statement of Operations.

SEMIANNUAL REPORT 19

Notes to Financial Statements (unaudited) – continued

Tax Matters and Distributions – Each fund intends to continue to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. Accordingly, no provision for federal income tax is required in the financial statements. Foreign taxes, if any, have been accrued by the funds in the accompanying financial statements.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income for financial statement and tax purposes.

The tax character of distributions declared to shareholders is as follows:

| | | | Government Money |

| | Money Market Fund | Market Fund |

| | August 31, | August 31, | August 31, | August 31, |

| | 2005 | 2004 | 2005 | 2004 |

| Distributions declared from ordinary | | | | |

| income (including any short-term | | | | |

| capital gains) | $16,765,114 | $5,864,552 | $603,292 | $515,646 |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| | Money Market | Government Money |

| As of February 28, 2006 | Fund | Market Fund |

| Tax Cost of Investments | $774,549,799 | $22,044,134 |

| As of August 31, 2005 | | |

| Undistributed ordinary income | $462,026 | $12,134 |

| Capital loss carryforward | (8,480) | — |

| Other temporary differences | (86,416) | (9,847) |

As of August 31, 2005 the MFS Money Market Fund had available capital loss carryforwards to offset future realized gains.

Such losses expire as follows:

| August 31, 2011 | $(8,329) |

| August 31, 2013 | (151) |

| Total | $(8,480) |

20 SEMIANNUAL REPORT

Notes to Financial Statements (unaudited) – continued

(3) Transactions with Affiliates

|

Investment Adviser – Each fund has an investment advisory agreement with Massachusetts Financial Services Company (MFS) to provide overall investment advisory and administrative services, and general office facilities.

Each fund’s management fee is computed daily and paid monthly at the following annual rates:

| | |

| | First $300 million of average daily net assets | 0.50% |

| | | Next $400 million of average daily net assets | 0.45% |

| | Next $300 million of average daily net assets | 0.40% |

| | Average daily net assets in excess of $1 billion | 0.35% |

As part of a settlement agreement with the New York Attorney General concerning market timing and related matters, MFS has agreed to reduce each fund’s management fee to 0.15% of the fund’s average daily net assets for the period March 1, 2004 through February 28, 2009. For the six months ended February 28, 2006, this waiver amounted to $1,214,466 and $40,693 for the MFS Money Market Fund and MFS Government Money Market Fund, respectively, and is reflected as a reduction of total expenses in the Statement of Operations.

The management fee incurred for the six months ended February 28, 2006 was equivalent to an annual effective rate of 0.15% of each fund’s average daily net assets.

Distributor – Certain shares acquired through an exchange may be subject to a CDSC upon redemption depending on when the shares exchanged were originally purchased. Contingent deferred sales charges imposed during the six months ended February 28, 2006 for the MFS Money Market Fund and MFS Government Money Market Fund were $4,469 and $41, respectively.

Shareholder Servicing Agent – Each fund pays a portion of shareholder servicing costs to MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS. MFSC receives a fee from each fund, for its services as shareholder servicing agent, set periodically under the supervision of the fund’s Board of Trustees. For the six months ended February 28, 2006, the fee was $376,130 and $11,291, which equated to 0.0973% and 0.0972% annually of the fund’s average daily net assets for the MFS Money Market Fund and MFS Government Money Market Fund, respectively. MFSC also receives payment from each fund for out-of-pocket and sub-accounting expenses paid by MFSC on behalf of the fund. For the six months ended February 28, 2006, these costs amounted to $65,301 and $3,469 for the MFS Money Market Fund and MFS Government Money Market Fund, respectively.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to certain funds for which MFS acts as investment adviser. Under an administrative services agreement, the funds may partially reimburse MFS the costs incurred to provide these services, subject to review and approval by the Board of

SEMIANNUAL REPORT 21

Notes to Financial Statements (unaudited) – continued

Trustees. Each fund is charged a fixed amount plus a fee based on calendar year average net assets. Effective July 1, 2005, each fund’s annual fixed amount is $10,000.

The administrative services fee incurred for the six months ended February 28, 2006 was equivalent to an annual effective rate of 0.0103% and 0.0515% of the fund’s average daily net assets for the MFS Money Market Fund and MFS Government Money Market Fund, respectively.

Trustees’ and Officers’ Compensation – Each fund pays compensation to Independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The funds do not pay compensation directly to Trustees who are officers of the investment adviser, or to officers of the funds, all of whom receive remuneration for their services to the funds from MFS. Certain officers and Trustees of the funds are officers or directors of MFS, MFD, and MFSC. The funds have an unfunded, defined benefit plan for retired Independent Trustees which resulted in a pension expense of $4,539 and $827 for the MFS Money Market Fund and MFS Government Money Market Fund, respectively. This amount is included in independent trustees’ compensation for the six months ended February 28, 2006. The deferred liability for retirement benefits payable to retired Trustees amounted to $44,583 and $7,322, for the MFS Money Market Fund and MFS Government Money Market Fund respectively, at February 28, 2006, and is included in payable for independent trustees’ compensation.

Other – These funds and certain other MFS funds (the funds) have entered into a services agreement (the Agreement) which provides for payment of fees by the funds to Tarantino LLC in return for the provision of services of an Independent Chief Compliance Officer (ICCO) for the funds. The ICCO is an officer of the funds and the sole member of Tarantino LLC. The funds can terminate the Agreement with Tarantino LLC at any time under the terms of the Agreement. For the six months ended February 28, 2006, the fee paid to Tarantino LLC was $3,300 and $103 for the MFS Money Market Fund and MFS Government Money Market Fund, respectively. MFS has agreed to reimburse the funds for a portion of the payments made by the funds to Tarantino LLC in the amount of $2,987 and $72 for the MFS Money Market Fund and MFS Government Money Market Fund, respectively, which is shown as a reduction of total expenses in the Statement of Operations. Additionally, MFS has agreed to bear all expenses associated with office space, other administrative support, and supplies provided to the ICCO.

22 SEMIANNUAL REPORT

Notes to Financial Statements (unaudited) – continued

Purchases and sales of money market investments, exclusive of securities subject to repurchase agreements, were as follows:

| | Purchases | Sales |

| MFS Money Market Fund | $5,667,870,000 | $5,651,382,000 |

|

|

|

| MFS Government Money Market Fund | 589,525,000 | 532,506,000 |

|

|

|

| (5) Shares of Beneficial Interest |

Each fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest.

The MFS Money Market Fund is one of several mutual funds in which the MFS funds-of-funds may invest. The MFS funds-of-funds do not invest in the underlying MFS funds for the purpose of exercising management or control. At the end of the period, the MFS Conservative Allocation Fund and MFS Moderate Allocation Fund were the owners of record of approximately 8% and 12% respectively, of the value of outstanding voting shares. In addition, MFS Lifetime Retirement Income Fund, the MFS Lifetime 2010 Fund, and the MFS Lifetime 2020 Fund, were all the owners of record of less than 1% of the value of outstanding voting shares.

Each fund and other affiliated funds participate in a $1 billion unsecured line of credit provided by a syndication of banks under a credit agreement. Borrowings may be made for temporary financing needs. Interest is charged to each fund, based on its borrowings, at a rate equal to the Federal Reserve funds rate plus 0.35% . In addition, a commitment fee, based on the average daily, unused portion of the line of credit, is allocated among the participating funds at the end of each calendar quarter. The commitment fee allocated to the funds for the six months ended February 28, 2006 was $1,285 and $77 for the MFS Money Market Fund and MFS Government Money Market Fund, respectively and is included in miscellaneous expense on the Statement of Operations. The funds had no significant borrowings during the six months ended February 28, 2006.

SEMIANNUAL REPORT 23

BOARD REVIEW OF INVESTMENT ADVISORY AGREEMENT

A discussion regarding the Board’s most recent review and renewal of the Fund’s investment advisory agreement is available by clicking on the fund’s name under ‘‘Select a fund’’ on the MFS Web site (mfs.com).

PROXY VOTING POLICIES AND INFORMATION

A general description of the MFS funds’ proxy voting policies and procedures is available without charge, upon request, by calling 1-800-225-2606, by visiting the Proxy Voting section of mfs.com or by visiting the SEC’s Web site at http://www.sec.gov.

Information regarding how the fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available without charge by visiting the Proxy Voting section of mfs.com or by visiting the SEC’s Web site at http://www.sec.gov.

QUARTERLY PORTFOLIO DISCLOSURE

|

The trust will file a complete schedule of portfolio holdings with the Securities and Exchange Commission (the Commission) for the first and third quarters of each fiscal year on Form N-Q. The trust’s Form N-Q may be reviewed and copied at the:

Public Reference Room

Securities and Exchange Commission

Washington, D.C. 20549-0102

Information on the operation of the Public Reference Room may be obtained by calling the Commission at 1-800-SEC-0330. The trust’s Form N-Q is available on the EDGAR database on the Commission’s Internet Web site at http://www.sec.gov, and copies of this information may be obtained, upon payment of a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov or by writing the Public Reference Section at the above address.

A shareholder can also obtain the quarterly portfolio holdings report at mfs.com.

24 SEMIANNUAL REPORT

LETTER FROM THE CEO

Dear Shareholders,

It has been said that change is the only constant in life. As investors have seen, that theme is still accurate today as we recently have experienced shifting economic cycles because of natural disasters and political instability around the globe.

Markets worldwide have fluctuated in the past year as devastating hurricanes had a dramatic effect on the international economy, particularly on oil prices. We witnessed political unrest in the Middle East, highlighted by instability in Iraq, and in Africa, the usually stable Nigeria also experienced violence. As a result, energy prices have bounced up and down, with crude oil prices at one point topping a record $70 per barrel.

Such cycles are not uncommon and in fact have almost become the norm in our everyday lives. What does all of this mean to you as an investor? In times like these, it helps to know that you’re working with a seasoned investment professional who has experience to guide you through difficult times. At MFS®, we believe our investment management team has the knowledge and confidence to navigate through difficult cycles and at the same time see through adversity to find investment opportunities for our clients and shareholders.

Our investment management process, honed over 80 years, combines a unique concept of teamwork with our unwavering focus on the long term. We firmly believe that the best way to realize long-term financial goals – be it a college education, a comfortable retirement, or a secure family legacy – is to follow a three-pronged approach that focuses on longer time horizons. Allocate holdings across the major asset classes – including stocks, bonds, and cash. Diversify within each class to take advantage of different market segments and investing styles. Rebalance assets regularly to maintain a desired asset allocation. Of course, these strategies cannot guarantee a profit or protect against a loss. This long-term approach requires diligence and patience, two traits that in our experience are essential to capitalizing on the many opportunities the financial markets can offer – through both up and down economic cycles.

Robert J. Manning

Chief Executive Officer and Chief Investment Officer

MFS Investment Management®

April 17, 2006

The opinions expressed in this letter are those of MFS, and no forecasts can be guaranteed.

SEMIANNUAL REPORT 1

PORTFOLIO COMPOSITION

| Top ten holdings | |

| American Tower Corp., ‘‘A’’ | 3.1% |

|

|

| Amdocs Ltd. | 2.5% |

|

|

| Corporate Executive Board Co. | 2.3% |

|

|

| Juniper Networks, Inc. | 2.2% |

|

|

| Smith International, Inc. | 1.9% |

|

|

| Millipore Corp. | 1.9% |

|

|

| Advanced Medical Optics, Inc. | 1.8% |

|

|

| Analog Devices, Inc. | 1.8% |

|

|

| PETsMART, Inc. | 1.8% |

|

|

| DENTSPLY International, Inc. | 1.7% |

|

|

| Equity market sectors | |

| Health Care | 22.4% |

|

|

| Technology | 16.8% |

|

|

| Special Products & Services | 13.5% |

|

|

| Financial Services | 9.5% |

|

|

| Leisure | 7.9% |

|

|

| Energy | 7.2% |

|

|

| Retailing | 6.0% |

|

|

| Industrial Goods & Services | 6.0% |

|

|

| Utilities & Communications | 4.3% |

|

|

| Autos & Housing | 1.6% |

|

|

| Basic Materials | 1.3% |

|

|

| Consumer Staples | 0.7% |

|

|

| Transportation | 0.7% |

|

|

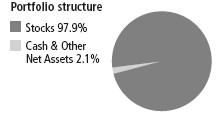

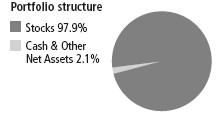

Percentages are based on net assets as of 2/28/06.

The portfolio is actively managed, and current holdings may be different.

2 SEMIANNUAL REPORT

Fund Expenses Borne by the Shareholders During the Period, September 1, 2005 through February 28, 2006.

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments and redemption fees on certain exchanges and redemptions, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period September 1, 2005 through February 28, 2006.

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

SEMIANNUAL REPORT 3

| Expense Table – continued | | | | |

| | | | | |

| | | | | Expenses |

| | Annualized | Beginning | Ending | Paid During |

| | Expense | Account Value | Account Value | Period (p) |

| Share Class | Ratio | 9/01/05 | 2/28/06 | 9/01/05-2/28/06 |

|

|

|

|

|

| Actual | 1.30% | $1,000.00 | $1,075.50 | $6.69 |

| A |

|

|

|

|

|

| Hypothetical (h) | 1.30% | $1,000.00 | $1,018.35 | $6.51 |

|

|

|

|

|

| Actual | 2.05% | $1,000.00 | $1,069.80 | $10.52 |

| B |

|

|

|

|

|

| Hypothetical (h) | 2.05% | $1,000.00 | $1,014.63 | $10.24 |

|

|

|

|

|

| Actual | 2.05% | $1,000.00 | $1,070.20 | $10.52 |

| C |

|

|

|

|

|

| Hypothetical (h) | 2.05% | $1,000.00 | $1,014.63 | $10.24 |

|

|

|

|

|

| Actual | 1.05% | $1,000.00 | $1,075.50 | $5.40 |

| I |

|

|

|

|

|

| Hypothetical (h) | 1.05% | $1,000.00 | $1,019.59 | $5.26 |

|

|

|

|

|

| Actual | 1.55% | $1,000.00 | $1,072.50 | $7.96 |

| R |

|

|

|

|

|

| Hypothetical (h) | 1.55% | $1,000.00 | $1,017.11 | $7.75 |

|

|

|

|

|

| Actual | 2.17% | $1,000.00 | $1,069.90 | $11.14 |

| R1 |

|

|

|

|

|

| Hypothetical (h) | 2.17% | $1,000.00 | $1,014.03 | $10.84 |

|

|

|

|

|

| Actual | 1.83% | $1,000.00 | $1,071.00 | $9.40 |

| R2 |

|

|

|

|

|

| Hypothetical (h) | 1.83% | $1,000.00 | $1,015.72 | $9.15 |

|

|

|

|

|

| Actual | 1.72% | $1,000.00 | $1,072.80 | $8.84 |

| R3 |

|

|

|

|

|

| Hypothetical (h) | 1.72% | $1,000.00 | $1,016.27 | $8.60 |

|

|

|

|

|

| Actual | 1.46% | $1,000.00 | $1,074.40 | $7.51 |

| R4 |

|

|

|

|

|

| Hypothetical (h) | 1.46% | $1,000.00 | $1,017.55 | $7.30 |

|

|

|

|

|

| Actual | 1.16% | $1,000.00 | $1,075.50 | $5.97 |

| R5 |

|

|

|

|

|

| Hypothetical (h) | 1.16% | $1,000.00 | $1,019.04 | $5.81 |

|

|

|

|

|

| Actual | 1.65% | $1,000.00 | $1,072.60 | $8.48 |

| 529A |

|

|

|

|

|

| Hypothetical (h) | 1.65% | $1,000.00 | $1,016.61 | $8.25 |

|

|

|

|

|

| Actual | 2.30% | $1,000.00 | $1,069.10 | $11.80 |

| 529B |

|

|

|

|

|

| Hypothetical (h) | 2.30% | $1,000.00 | $1,013.39 | $11.48 |

|

|

|

|

|

| Actual | 2.30% | $1,000.00 | $1,069.40 | $11.80 |

| 529C |

|

|

|

|

|

| Hypothetical (h) | 2.30% | $1,000.00 | $1,013.39 | $11.48 |

|

|

|

|

|

| (h) | 5% class return per year before expenses. |

| |

| (p) | Expenses paid is equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. |

| |

Effective October 1, 2005 the fund’s Class R1, Class R2, and Class R3 retirement plan administration and services fees were reduced (as described in Note 3 of the Notes to the Financial Statements). Had this fee reduction been in effect throughout the entire six month period, the annualized expense ratio would have been 2.15%, 1.81%, and 1.70% for Class R1, Class R2, and Class R3, respectively, and the actual expenses paid during the period would have been approximately $11.04, $9.30, and $8.74 for Class R1, Class R2, and Class R3, respectively.

4 SEMIANNUAL RPORT

| PORTFOLIO OF INVESTMENTS (unaudited) – 2/28/06 | | | | |

The Portfolio of Investments is a complete list of all securities owned by your fund. | | | |

| It is categorized by broad-based asset classes. | | | | |

Stocks - 97.9% | | | | |

|

|

|

|

| Issuer | Shares/Par | | | Value ($) |

|

|

|

|

| Aerospace - 1.6% | | | | |

|

|

|

|

| FLIR Systems, Inc. (n) | 327,490 | | $ | 8,462,341 |

| ITT Industries, Inc. | 356,620 | | | 18,722,550 |

| | |

|

|

| | | | $ | 27,184,891 |

|

|

|

|

| Automotive - 1.6% | | | | |

|

|

|

|

| Gentex Corp. (l) | 504,737 | | $ | 8,408,918 |

| Harman International Industries, Inc. (l) | 167,180 | | | 18,448,313 |

| | |

|

|

| | | | $ | 26,857,231 |

|

|

|

|

| Banks & Credit Companies - 3.4% | | | | |

|

|

|

|

| Commerce Bancorp, Inc. (l) | 766,700 | | $ | 25,431,439 |

| Investors Financial Services Corp. (l) | 399,520 | | | 18,022,347 |

| Nelnet, Inc., ‘‘A’’ (l)(n) | 125,060 | | | 5,183,737 |

| SLM Corp. | 157,730 | | | 8,897,549 |

| | |

|

|

| | | | $ | 57,535,072 |

|

|

|

|

| Biotechnology - 6.0% | | | | |

|

|

|

|

| Celgene Corp. (n) | 580,720 | | $ | 22,067,360 |

| Gen-Probe, Inc. (l)(n) | 318,470 | | | 15,910,761 |

| Genzyme Corp. (n) | 312,561 | | | 21,672,980 |

| Gilead Sciences, Inc. (n) | 424,200 | | | 26,414,934 |

| Human Genome Sciences, Inc. (n) | 469,520 | | | 5,878,390 |

| ImClone Systems, Inc. (l)(n) | 273,030 | | | 10,481,622 |

| | |

|

|

| | | | $ | 102,426,047 |

|

|

|

|

| Broadcast & Cable TV - 2.4% | | | | |

|

|

|

|

| Citadel Broadcasting Corp. (l) | 773,020 | | $ | 8,611,443 |

| Grupo Televisa S.A., ADR | 279,230 | | | 21,908,386 |

| XM Satellite Radio Holdings, Inc., ‘‘A’’ (l)(n) | 445,240 | | | 9,835,352 |

| | |

|

|

| | | | $ | 40,355,181 |

|

|

|

|

| Brokerage & Asset Managers - 3.6% | | | | |

|

|

|

|

| Calamos Asset Management, Inc. (l) | 121,300 | | $ | 4,654,281 |

| Chicago Mercantile Exchange Holdings, Inc. | 68,290 | | | 29,064,224 |

| Legg Mason, Inc. | 211,530 | | | 27,623,703 |

| | |

|

|

| | | | $ | 61,342,208 |

|

| Business Services - 12.0% | | | | |

|

| Alliance Data Systems Corp. (l)(n) | 500,660 | | $ | 21,658,552 |

| Amdocs Ltd. (n) | 1,287,530 | | | 42,642,993 |

| Bright Horizons Family Solutions, Inc. (l)(n) | 228,867 | | | 7,669,333 |

| Brink’s Co. (l) | 206,670 | | | 10,120,630 |

| Corporate Executive Board Co. | 389,433 | | | 38,943,300 |

| Getty Images, Inc. (n) | 303,660 | | | 24,605,570 |

|

| | SEMIANNUAL REPORT 5 |

| Portfolio of Investments (unaudited) – continued | | | | |

| Issuer | Shares/Par | | | Value ($) |

|

|

|

|

| Stocks - continued | | | | |

|

|

|

|

| Business Services - continued | | | | |

|

|

|

|

| Monster Worldwide, Inc. (n) | 472,770 | | $ | 23,146,819 |

| Paychex, Inc. | 517,718 | | | 20,734,606 |

| TALX Corp. | 219,449 | | | 7,013,590 |

| Universal Technical Institute, Inc. (l)(n) | 251,320 | | | 7,743,169 |

| | |

|

|

| | | | $ | 204,278,562 |

|

|

|

|

| Computer Software - 3.1% | | | | |

|

|

|

|

| Adobe Systems, Inc. (n) | 686,370 | | $ | 26,507,609 |

| Symantec Corp. (n) | 1,337,467 | | | 22,589,818 |

| TIBCO Software, Inc. (n) | 452,490 | | | 3,923,088 |

| | |

|

|

| | | | $ | 53,020,515 |

|

|

|

|

| Computer Software - Systems - 1.4% | | | | |

|

|

|

|

| MICROS Systems, Inc. (l)(n) | 552,680 | | $ | 23,925,517 |

|

|

|

|

| Consumer Goods & Services - 2.2% | | | | |

|

|

|

|

| Estee Lauder Cos., Inc., ‘‘A’’ | 326,210 | | $ | 12,206,778 |

| ITT Educational Services, Inc. (n) | 398,610 | | | 24,713,820 |

| | |

|

|

| | | | $ | 36,920,598 |

|

|

|

|

| Electrical Equipment - 2.6% | | | | |

|

|

|

|

| MSC Industrial Direct Co., Inc., ‘‘A’’ (l) | 426,290 | | $ | 20,193,357 |

| Rockwell Automation, Inc. | 128,700 | | | 8,773,479 |

| W.W. Grainger, Inc. | 202,530 | | | 14,995,321 |

| | |

|

|

| | | | $ | 43,962,157 |

|

|

|

|

| Electronics - 8.4% | | | | |

|

|

|

|

| Analog Devices, Inc. | 811,030 | | $ | 30,932,684 |

| KLA-Tencor Corp. (l) | 355,240 | | | 18,554,185 |

| Marvell Technology Group Ltd. (n) | 280,160 | | | 17,151,395 |

| PMC-Sierra, Inc. (l)(n) | 1,626,070 | | | 16,602,175 |

| SanDisk Corp. (n) | 371,630 | | | 22,424,154 |

| Tessera Technologies, Inc. (l)(n) | 325,290 | | | 10,158,807 |

| Xilinx, Inc. | 988,890 | | | 26,976,919 |

| | |

|

|

| | | | $ | 142,800,319 |

|

|

|

|

| Energy - Integrated - 1.2% | | | | |

|

|

|

|

| Amerada Hess Corp. | 142,210 | | $ | 19,669,065 |

|

|

|

|

| Forest & Paper Products - 0.3% | | | | |

|

|

|

|

| Aracruz Celulose S.A., ADR (l) | 117,700 | | $ | 5,784,955 |

|

|

|

|

| 6 SEMIANNUAL REPORT | | | | |

| Portfolio of Investments (unaudited) – continued | | | | |

| Issuer | Shares/Par | | | Value ($) |

|

|

|

|

| Stocks - continued | | | | |

|

|

|

|

| Gaming & Lodging - 2.0% | | | | |

|

|

|

|

| International Game Technology | 711,910 | | $ | 25,465,021 |

| Station Casinos, Inc. | 128,410 | | | 8,789,665 |

| | |

|

|

| | | | $ | 34,254,686 |

|

|

|

|

| Health Maintenance Organizations - 1.2% | | | | |

|

|

|

|

| Health Net, Inc. (l)(n) | 444,260 | | $ | 21,302,267 |

|

|

|

|

| Insurance - 2.5% | | | | |

|

|

|

|

| Ace Ltd. | 321,800 | | $ | 17,933,914 |

| Endurance Specialty Holdings Ltd. | 253,730 | | | 7,992,495 |

| PartnerRe Ltd. (l) | 266,650 | | | 16,161,657 |

| | |

|

|

| | | | $ | 42,088,066 |

|

|

|

|

| Leisure & Toys - 1.2% | | | | |

|

| |

|

|

| Electronic Arts, Inc. (n) | 381,640 | | $ | 19,833,831 |

|

| |

|

|

| Machinery & Tools - 1.8% | | | | |

|

|

|

|

| Precision Castparts Corp. | 214,390 | | $ | 11,371,246 |

| Roper Industries, Inc. (l) | 437,140 | | | 19,701,900 |

| | |

|

|

| | | | $ | 31,073,146 |

|

|

|

|

| Medical & Health Technology & Services - 1.3% | | | | |

|

| |

|

|

| Laboratory Corp. of America Holdings (n) | 224,650 | | $ | 13,054,412 |

| United Surgical Partners International, Inc. (l)(n) | 241,860 | | | 8,501,379 |

| | |

|

|

| | | | $ | 21,555,791 |

|

|

|

|

| Medical Equipment - 10.0% | | | | |

|

|

|

|

| Advanced Medical Optics, Inc. (n) | 696,020 | | $ | 30,958,969 |

| C.R. Bard, Inc. | 197,010 | | | 12,902,185 |

| Cytyc Corp. (n) | 928,449 | | | 26,767,185 |

| DENTSPLY International, Inc. | 515,710 | | | 29,390,313 |

| Millipore Corp. (n) | 457,440 | | | 31,714,315 |

| ResMed, Inc. (n) | 273,310 | | | 11,093,653 |

| St. Jude Medical, Inc. (n) | 391,140 | | | 17,835,984 |

| Thoratec Corp. (l)(n) | 507,270 | | | 10,206,272 |

| | |

|

|

| | | | $ | 170,868,876 |

|

|

|

|

| Metals & Mining - 0% | | | | |

|

|

|

|

| Aber Diamond Corp. | 3,400 | | $ | 128,274 |

|

|

|

|

| Network & Telecom - 3.9% | | | | |

|

| Comverse Technology, Inc. (l)(n) | 686,880 | | $ | 19,754,669 |

| Harris Corp. | 183,700 | | | 8,391,416 |

| Juniper Networks, Inc. (l)(n) | 2,050,700 | | | 37,712,373 |

| | |

|

|

| | | | $ | 65,858,458 |

|

|

|

|

| | SEMIANNUAL REPORT 7 |

| Portfolio of Investments (unaudited) – continued | | | | |

Issuer | Shares/Par | | | Value ($) |

|

|

|

|

| Stocks - continued | | | | |

|

|

|

|

| Oil Services - 6.0% | | | | |

|

|

|

|

| GlobalSantaFe Corp. | 403,510 | | $ | 22,330,243 |

| National Oilwell Varco, Inc. (n) | 303,460 | | | 18,474,645 |

| Noble Corp. | 396,700 | | | 29,320,097 |

| Smith International, Inc. | 831,660 | | | 32,210,192 |

| | |

|

|

| | | | $ | 102,335,177 |

|

|

|

|

| Pharmaceuticals - 3.9% | | | | |

|

|

|

|

| Allergan, Inc. | 215,170 | | $ | 23,294,304 |

| Endo Pharmaceuticals Holdings, Inc. (n) | 640,710 | | | 20,195,179 |

| Medicis Pharmaceutical Corp., ‘‘A’’ (l) | 808,890 | | | 23,004,832 |

| | |

|

|

| | | | $ | 66,494,315 |

|

|

|

|

| Restaurants - 2.3% | | | | |

|

|

|

|

| Cheesecake Factory, Inc. (l)(n) | 726,729 | | $ | 26,278,520 |

| Rare Hospitality International, Inc. (n) | 423,210 | | | 13,542,720 |

| | |

|

|

| | | | $ | 39,821,240 |

|

|

|

|

| Specialty Chemicals - 1.0% | | | | |

|

|

|

|

| Praxair, Inc. | 321,330 | | $ | 17,345,393 |

|

|

|

|

| Specialty Stores - 6.0% | | | | |

|

|

|

|

| Aeropostale, Inc. (n) | 348,990 | | $ | 10,012,523 |

| Bed Bath & Beyond, Inc. (n) | 256,050 | | | 9,228,042 |

| Chico’s FAS, Inc. (l)(n) | 334,980 | | | 15,760,809 |

| PETsMART, Inc. | 1,185,660 | | | 30,779,734 |

| Urban Outfitters, Inc. (n) | 707,410 | | | 19,878,221 |

| Williams-Sonoma, Inc. (n) | 424,360 | | | 17,182,336 |

| | |

|

|

| | | | $ | 102,841,665 |

|

|

|

|

| Telephone Services - 3.1% | | | | |

|

|

|

|

| American Tower Corp., ‘‘A’’ (n) | 1,661,170 | | $ | 52,875,041 |

|

|

|

|

| Trucking - 0.7% | | | | |

|

|

|

|

| Expeditors International of Washington, Inc. (l) | 155,220 | | $ | 12,074,564 |

|

|

|

|

| Utilities - Electric Power - 1.2% | | | | |

|

|

|

|

| NRG Energy, Inc. (n) | 456,590 | | $ | 19,747,518 |

|

|

|

|

| Total Stocks (Identified Cost, $1,439,094,811) | | | $ | 1,666,560,626 |

|

|

|

| Short-Term Obligations - 2.5% | | | | |

|

|

|

|

| General Electric Capital Corp., 4.56%, due 3/01/06, | | | | |

| at Amortized Cost (y) | $ 41,996,000 | | $ | 41,996,000 |

|

|

|

|

| 8 SEMIANNUAL REPORT | | | | |

| Portfolio of Investments (unaudited) – continued | | |

Collateral for Securities Loaned - 10.7% | | |

|

|

|

| Issuer | Shares/Par | Value ($) |

|

|

|