UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02464

MFS SERIES TRUST IX

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: October 31*

Date of reporting period: April 30, 2015

| * | This Form N-CSR pertains to the following series of the Registrant: MFS Inflation-Adjusted Bond Fund. The remaining series of the Registrant each has a fiscal year end of April 30. |

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

SEMIANNUAL REPORT

April 30, 2015

MFS® INFLATION-ADJUSTED BOND FUND

IAB-SEM

MFS® INFLATION-ADJUSTED BOND FUND

CONTENTS

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

LETTER FROM THE CHAIRMAN

Dear Shareholders:

Global economic expansion slowed in early 2015 as the pace of U.S. growth decelerated sharply. Harsh weather hurt U.S. domestic demand, and a strong dollar

made exports more expensive. Also contributing to weakness were a slow, tentative eurozone economic recovery, a steady downturn in China’s pace of growth and ongoing sluggishness in Japan.

Asian and European central banks are making concerted stimulus efforts. The European Central Bank’s quantitative easing program shows early signs of gaining traction. The People’s Bank of China has introduced a series of targeted monetary policy actions. The Bank of Japan remains focused on its target of 2% consumer price inflation.

With little sign of inflation, the U.S. Federal Reserve has remained accommodative in the face of these global headwinds, though interest rate increases are expected to begin later this year.

The world’s financial markets have become increasingly complex in recent years. Now more than ever, it is important to understand companies on a global basis. At MFS®, we believe our integrated research platform, collaborative culture, active risk management process and long-term focus give us a research advantage.

As investors, we aim to add long-term value. We believe this approach will serve you well as you work with your financial advisor to reach your investment objectives.

Respectfully,

Robert J. Manning

Chairman

MFS Investment Management

June 16, 2015

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

PORTFOLIO COMPOSITION

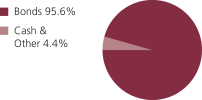

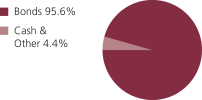

Portfolio structure (i)

| | | | |

| Fixed income sectors (i) | | | | |

| U.S. Treasury Securities | | | 95.6% | |

| | | | |

| Composition including fixed income credit quality (a)(i) | |

| U.S. Government | | | 95.6% | |

| Cash & Other | | | 4.4% | |

| |

| Portfolio facts (i) | | | | |

| Average Duration (d) | | | 6.5 | |

| Average Effective Maturity (m) | | | 8.8 yrs. | |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. U.S. Government includes securities issued by the U.S. Department of the Treasury. The fund may not hold all of these instruments. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining an instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

Where the fund holds convertible bonds, these are treated as part of the equity portion of the portfolio.

Cash & Other can include cash, other assets less liabilities, offsets to derivative positions, and short-term securities.

Percentages are based on net assets as of 4/30/15.

The portfolio is actively managed and current holdings may be different.

2

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, November 1, 2014 through April 30, 2015

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2014 through April 30, 2015.

The expenses include the payment of a portion of the transfer-agent-related expenses of MFS funds that invest in the fund. For further information, please see the Notes to the Financial Statements.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

3

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share Class | | | | Annualized

Expense

Ratio | | | Beginning

Account Value

11/01/14 | | | Ending

Account Value

4/30/15 | | | Expenses Paid During Period (p) 11/01/14-4/30/15 | |

| A | | Actual | | | 0.80% | | | | $1,000.00 | | | | $1,008.65 | | | | $3.98 | |

| | Hypothetical (h) | | | 0.80% | | | | $1,000.00 | | | | $1,020.83 | | | | $4.01 | |

| B | | Actual | | | 1.55% | | | | $1,000.00 | | | | $1,004.87 | | | | $7.71 | |

| | Hypothetical (h) | | | 1.55% | | | | $1,000.00 | | | | $1,017.11 | | | | $7.75 | |

| C | | Actual | | | 1.65% | | | | $1,000.00 | | | | $1,003.66 | | | | $8.20 | |

| | Hypothetical (h) | | | 1.65% | | | | $1,000.00 | | | | $1,016.61 | | | | $8.25 | |

| I | | Actual | | | 0.65% | | | | $1,000.00 | | | | $1,009.02 | | | | $3.24 | |

| | Hypothetical (h) | | | 0.65% | | | | $1,000.00 | | | | $1,021.57 | | | | $3.26 | |

| R1 | | Actual | | | 1.65% | | | | $1,000.00 | | | | $1,003.67 | | | | $8.20 | |

| | Hypothetical (h) | | | 1.65% | | | | $1,000.00 | | | | $1,016.61 | | | | $8.25 | |

| R2 | | Actual | | | 1.15% | | | | $1,000.00 | | | | $1,006.82 | | | | $5.72 | |

| | Hypothetical (h) | | | 1.15% | | | | $1,000.00 | | | | $1,019.09 | | | | $5.76 | |

| R3 | | Actual | | | 0.90% | | | | $1,000.00 | | | | $1,007.45 | | | | $4.48 | |

| | Hypothetical (h) | | | 0.90% | | | | $1,000.00 | | | | $1,020.33 | | | | $4.51 | |

| R4 | | Actual | | | 0.65% | | | | $1,000.00 | | | | $1,009.03 | | | | $3.24 | |

| | Hypothetical (h) | | | 0.65% | | | | $1,000.00 | | | | $1,021.57 | | | | $3.26 | |

| R5 | | Actual | | | 0.55% | | | | $1,000.00 | | | | $1,010.23 | | | | $2.74 | |

| | Hypothetical (h) | | | 0.55% | | | | $1,000.00 | | | | $1,022.07 | | | | $2.76 | |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

4

PORTFOLIO OF INVESTMENTS

4/30/15 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Bonds - 95.4% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| U.S. Treasury Inflation Protected Securities - 95.4% | | | | | |

| U.S. Treasury Bonds, 2.5%, 7/15/16 | | $ | 14,079,739 | | | $ | 14,790,329 | |

| U.S. Treasury Bonds, 0.125%, 4/15/17 | | | 61,134,027 | | | | 62,437,893 | |

| U.S. Treasury Bonds, 1.625%, 1/15/18 | | | 14,570,932 | | | | 15,556,743 | |

| U.S. Treasury Bonds, 0.125%, 4/15/20 | | | 26,779,719 | | | | 27,321,472 | |

| U.S. Treasury Bonds, 1.125%, 1/15/21 | | | 42,955,409 | | | | 46,217,357 | |

| U.S. Treasury Bonds, 0.375%, 7/15/23 | | | 56,887,621 | | | | 58,598,687 | |

| U.S. Treasury Bonds, 0.625%, 1/15/24 | | | 62,851,375 | | | | 65,827,010 | |

| U.S. Treasury Bonds, 0.125%, 7/15/24 | | | 47,347,621 | | | | 47,613,952 | |

| U.S. Treasury Bonds, 0.25%, 1/15/25 | | | 24,238,869 | | | | 24,549,419 | |

| U.S. Treasury Bonds, 2.375%, 1/15/25 | | | 32,045,994 | | | | 38,970,941 | |

| U.S. Treasury Bonds, 2%, 1/15/26 | | | 31,676,209 | | | | 37,637,766 | |

| U.S. Treasury Bonds, 2.375%, 1/15/27 | | | 18,588,966 | | | | 22,990,778 | |

| U.S. Treasury Bonds, 1.75%, 1/15/28 | | | 23,861,372 | | | | 27,979,320 | |

| U.S. Treasury Bonds, 3.625%, 4/15/28 | | | 15,509,295 | | | | 21,886,283 | |

| U.S. Treasury Bonds, 2.5%, 1/15/29 | | | 20,507,371 | | | | 26,210,984 | |

| U.S. Treasury Bonds, 3.875%, 4/15/29 | | | 19,361,104 | | | | 28,439,641 | |

| U.S. Treasury Bonds, 3.375%, 4/15/32 | | | 9,776,355 | | | | 14,348,327 | |

| U.S. Treasury Bonds, 2.125%, 2/15/40 | | | 12,152,004 | | | | 16,083,372 | |

| U.S. Treasury Bonds, 2.125%, 2/15/41 | | | 11,527,532 | | | | 15,389,255 | |

| U.S. Treasury Bonds, 0.75%, 2/15/42 | | | 21,146,241 | | | | 21,146,241 | |

| U.S. Treasury Bonds, 0.625%, 2/15/43 | | | 15,036,257 | | | | 14,560,495 | |

| U.S. Treasury Bonds, 1.375%, 2/15/44 | | | 29,176,846 | | | | 33,893,020 | |

| U.S. Treasury Bonds, 0.75%, 2/15/45 | | | 11,481,794 | | | | 11,530,235 | |

| U.S. Treasury Notes, 2.375%, 1/15/17 | | | 11,265,582 | | | | 11,943,274 | |

| U.S. Treasury Notes, 2.625%, 7/15/17 | | | 19,372,887 | | | | 21,054,396 | |

| U.S. Treasury Notes, 0.125%, 4/15/18 | | | 69,506,845 | | | | 71,163,054 | |

| U.S. Treasury Notes, 1.375%, 7/15/18 | | | 20,094,614 | | | | 21,554,608 | |

| U.S. Treasury Notes, 2.125%, 1/15/19 | | | 20,808,018 | | | | 22,937,593 | |

| U.S. Treasury Notes, 0.125%, 4/15/19 | | | 54,656,848 | | | | 55,907,998 | |

| U.S. Treasury Notes, 1.875%, 7/15/19 | | | 22,391,845 | | | | 24,739,496 | |

| U.S. Treasury Notes, 1.375%, 1/15/20 | | | 24,306,258 | | | | 26,345,699 | |

| U.S. Treasury Notes, 1.25%, 7/15/20 | | | 47,227,605 | | | | 51,363,704 | |

| U.S. Treasury Notes, 0.625%, 7/15/21 | | | 52,704,689 | | | | 55,393,472 | |

| U.S. Treasury Notes, 0.125%, 1/15/22 | | | 47,119,858 | | | | 47,672,056 | |

| U.S. Treasury Notes, 0.125%, 7/15/22 | | | 56,876,930 | | | | 57,756,759 | |

| U.S. Treasury Notes, 0.125%, 1/15/23 | | | 46,446,908 | | | | 46,831,534 | |

| Total Bonds (Identified Cost, $1,155,424,368) | | | | | | $ | 1,208,643,163 | |

5

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Money Market Funds - 6.5% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

MFS Institutional Money Market Portfolio, 0.09%,

at Cost and Net Asset Value (v) | | | 82,839,666 | | | $ | 82,839,666 | |

| Total Investments (Identified Cost, $1,238,264,034) | | | | | | $ | 1,291,482,829 | |

| | |

| Other Assets, Less Liabilities - (1.9)% | | | | | | | (24,462,994 | ) |

| Net Assets - 100.0% | | | | | | $ | 1,267,019,835 | |

| (v) | Underlying affiliated fund that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

See Notes to Financial Statements

6

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 4/30/15 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | |

| Assets | | | | |

Investments | | | | |

Non-affiliated issuers, at value (identified cost, $1,155,424,368) | | | $1,208,643,163 | |

Underlying affiliated funds, at cost and value | | | 82,839,666 | |

Total investments, at value (identified cost, $1,238,264,034) | | | $1,291,482,829 | |

Receivables for | | | | |

Fund shares sold | | | 591,452 | |

Interest | | | 2,660,261 | |

Receivable from investment adviser | | | 106,483 | |

Other assets | | | 4,404 | |

Total assets | | | $1,294,845,429 | |

| Liabilities | | | | |

Payables for | | | | |

Investments purchased | | | $27,300,039 | |

Fund shares reacquired | | | 222,474 | |

Payable to affiliates | | | | |

Shareholder servicing costs | | | 265,323 | |

Distribution and service fees | | | 3,921 | |

Payable for independent Trustees’ compensation | | | 1,576 | |

Accrued expenses and other liabilities | | | 32,261 | |

Total liabilities | | | $27,825,594 | |

Net assets | | | $1,267,019,835 | |

| Net assets consist of | | | | |

Paid-in capital | | | $1,254,259,864 | |

Unrealized appreciation (depreciation) on investments | | | 53,218,795 | |

Accumulated net realized gain (loss) on investments | | | (28,157,249 | ) |

Accumulated distributions in excess of net investment income | | | (12,301,575 | ) |

Net assets | | | $1,267,019,835 | |

Shares of beneficial interest outstanding | | | 120,145,121 | |

7

Statement of Assets and Liabilities (unaudited) – continued

| | | | | | | | | | | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share (a) | |

Class A | | | $58,755,368 | | | | 5,582,300 | | | | $10.53 | |

Class B | | | 14,909,782 | | | | 1,420,183 | | | | 10.50 | |

Class C | | | 15,775,105 | | | | 1,501,019 | | | | 10.51 | |

Class I | | | 5,721,717 | | | | 543,064 | | | | 10.54 | |

Class R1 | | | 501,386 | | | | 47,788 | | | | 10.49 | |

Class R2 | | | 2,596,285 | | | | 246,849 | | | | 10.52 | |

Class R3 | | | 1,510,937 | | | | 143,559 | | | | 10.52 | |

Class R4 | | | 183,153 | | | | 17,397 | | | | 10.53 | |

Class R5 | | | 1,167,066,102 | | | | 110,642,962 | | | | 10.55 | |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $11.00 [100 / 95.75 x $10.53]. On sales of $100,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R5. |

See Notes to Financial Statements

8

Financial Statements

STATEMENT OF OPERATIONS

Six months ended 4/30/15 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | |

| Net Investment loss | | | | |

Income | | | | |

Interest (including $10,715,021 of deflation adjustments on inflation protected securities) | | | $(8,061,426 | ) |

Dividends from underlying affiliated funds | | | 36,185 | |

Total investment income | | | $(8,025,241 | ) |

Expenses | | | | |

Management fee | | | $2,995,126 | |

Distribution and service fees | | | 248,820 | |

Shareholder servicing costs | | | 713,684 | |

Administrative services fee | | | 102,192 | |

Independent Trustees’ compensation | | | 10,290 | |

Custodian fee | | | 57,031 | |

Shareholder communications | | | 14,710 | |

Audit and tax fees | | | 19,316 | |

Legal fees | | | 4,402 | |

Miscellaneous | | | 77,171 | |

Total expenses | | | $4,242,742 | |

Fees paid indirectly | | | (5 | ) |

Reduction of expenses by investment adviser and distributor | | | (708,442 | ) |

Net expenses | | | $3,534,295 | |

Net investment loss | | | $(11,559,536 | ) |

| Realized and unrealized gain (loss) on investments | | | | |

Realized gain (loss) (identified cost basis) | | | | |

Investments | | | $(1,489,938 | ) |

Futures contracts | | | 94,647 | |

Net realized gain (loss) on investments | | | $(1,395,291 | ) |

Change in unrealized appreciation (depreciation) on investments | | | $25,376,358 | |

Net realized and unrealized gain (loss) on investments | | | $23,981,067 | |

Change in net assets from operations | | | $12,421,531 | |

See Notes to Financial Statements

9

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | | | |

| Change in net assets | | Six months ended

4/30/15 (unaudited) | | | Year ended

10/31/14 | |

| From operations | | | | | | | | |

Net investment income (loss) | | | $(11,559,536 | ) | | | $14,231,113 | |

Net realized gain (loss) on investments | | | (1,395,291 | ) | | | (2,437,406 | ) |

Net unrealized gain (loss) on investments | | | 25,376,358 | | | | 955,545 | |

Change in net assets from operations | | | $12,421,531 | | | | $12,749,252 | |

| Distributions declared to shareholders | | | | | | | | |

From net investment income | | | $(3,955,021 | ) | | | $(21,409,250 | ) |

Change in net assets from fund share transactions | | | $167,931,995 | | | | $107,035,412 | |

Total change in net assets | | | $176,398,505 | | | | $98,375,414 | |

| Net assets | | | | | | | | |

At beginning of period | | | 1,090,621,330 | | | | 992,245,916 | |

At end of period (including accumulated distributions in excess of net investment income of $12,301,575 and undistributed net investment income of $3,212,982, respectively) | | | $1,267,019,835 | | | | $1,090,621,330 | |

See Notes to Financial Statements

10

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/15 (unaudited) | | | Years ended 10/31 | |

| Class A | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $10.47 | | | | $10.57 | | | | $11.59 | | | | $11.27 | | | | $10.71 | | | | $10.07 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.11 | ) | | | $0.11 | | | | $0.10 | | | | $0.16 | | | | $0.37 | | | | $0.18 | |

Net realized and unrealized gain

(loss) on investments and

foreign currency | | | 0.20 | | | | (0.01 | ) | | | (0.91 | ) | | | 0.61 | | | | 0.47 | | | | 0.76 | |

Total from investment operations | | | $0.09 | | | | $0.10 | | | | $(0.81 | ) | | | $0.77 | | | | $0.84 | | | | $0.94 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.03 | ) | | | $(0.20 | ) | | | $(0.14 | ) | | | $(0.43 | ) | | | $(0.24 | ) | | | $(0.30 | ) |

From net realized gain on

investments | | | — | | | | — | | | | (0.07 | ) | | | (0.02 | ) | | | (0.04 | ) | | | — | |

Total distributions declared to

shareholders | | | $(0.03 | ) | | | $(0.20 | ) | | | $(0.21 | ) | | | $(0.45 | ) | | | $(0.28 | ) | | | $(0.30 | ) |

Net asset value, end of period (x) | | | $10.53 | | | | $10.47 | | | | $10.57 | | | | $11.59 | | | | $11.27 | | | | $10.71 | |

Total return (%) (r)(s)(t)(x) | | | 0.87 | (n) | | | 0.94 | | | | (7.09 | ) | | | 7.08 | | | | 8.06 | | | | 9.56 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.01 | (a) | | | 0.96 | | | | 0.98 | | | | 0.95 | | | | 0.96 | | | | 1.01 | |

Expenses after expense

reductions (f) | | | 0.80 | (a) | | | 0.80 | | | | 0.80 | | | | 0.80 | | | | 0.80 | | | | 0.75 | |

Net investment income (loss) | | | (2.13 | )(a)(l) | | | 1.07 | | | | 0.94 | | | | 1.43 | | | | 3.48 | | | | 1.72 | |

Portfolio turnover | | | 15 | (n) | | | 22 | | | | 28 | | | | 26 | | | | 35 | | | | 34 | |

Net assets at end of period

(000 omitted) | | | $58,755 | | | | $68,336 | | | | $92,806 | | | | $139,268 | | | | $112,341 | | | | $90,329 | |

See Notes to Financial Statements

11

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/15 (unaudited) | | | Years ended 10/31 | |

| Class B | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $10.46 | | | | $10.56 | | | | $11.58 | | | | $11.27 | | | | $10.71 | | | | $10.08 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.15 | ) | | | $0.04 | | | | $0.02 | | | | $0.08 | | | | $0.29 | | | | $0.10 | |

Net realized and unrealized gain

(loss) on investments and

foreign currency | | | 0.20 | | | | (0.02 | ) | | | (0.91 | ) | | | 0.61 | | | | 0.47 | | | | 0.75 | |

Total from investment operations | | | $0.05 | | | | $0.02 | | | | $(0.89 | ) | | | $0.69 | | | | $0.76 | | | | $0.85 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.01 | ) | | | $(0.12 | ) | | | $(0.06 | ) | | | $(0.36 | ) | | | $(0.16 | ) | | | $(0.22 | ) |

From net realized gain on

investments | | | — | | | | — | | | | (0.07 | ) | | | (0.02 | ) | | | (0.04 | ) | | | — | |

Total distributions declared to

shareholders | | | $(0.01 | ) | | | $(0.12 | ) | | | $(0.13 | ) | | | $(0.38 | ) | | | $(0.20 | ) | | | $(0.22 | ) |

Net asset value, end of period (x) | | | $10.50 | | | | $10.46 | | | | $10.56 | | | | $11.58 | | | | $11.27 | | | | $10.71 | |

Total return (%) (r)(s)(t)(x) | | | 0.49 | (n) | | | 0.18 | | | | (7.79 | ) | | | 6.27 | | | | 7.23 | | | | 8.61 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.76 | (a) | | | 1.71 | | | | 1.73 | | | | 1.70 | | | | 1.71 | | | | 1.74 | |

Expenses after expense

reductions (f) | | | 1.55 | (a) | | | 1.55 | | | | 1.55 | | | | 1.55 | | | | 1.58 | | | | 1.53 | |

Net investment income (loss) | | | (2.87 | )(a)(l) | | | 0.39 | | | | 0.18 | | | | 0.71 | | | | 2.75 | | | | 0.94 | |

Portfolio turnover | | | 15 | (n) | | | 22 | | | | 28 | | | | 26 | | | | 35 | | | | 34 | |

Net assets at end of period

(000 omitted) | | | $14,910 | | | | $16,193 | | | | $19,956 | | | | $32,992 | | | | $23,588 | | | | $20,187 | |

See Notes to Financial Statements

12

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/15 (unaudited) | | | Years ended 10/31 | |

| Class C | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $10.48 | | | | $10.57 | | | | $11.59 | | | | $11.28 | | | | $10.73 | | | | $10.09 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.16 | ) | | | $0.03 | | | | $0.01 | | | | $0.07 | | | | $0.29 | | | | $0.09 | |

Net realized and unrealized gain

(loss) on investments and

foreign currency | | | 0.20 | | | | (0.01 | ) | | | (0.91 | ) | | | 0.60 | | | | 0.45 | | | | 0.77 | |

Total from investment operations | | | $0.04 | | | | $0.02 | | | | $(0.90 | ) | | | $0.67 | | | | $0.74 | | | | $0.86 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.01 | ) | | | $(0.11 | ) | | | $(0.05 | ) | | | $(0.34 | ) | | | $(0.15 | ) | | | $(0.22 | ) |

From net realized gain on

investments | | | — | | | | — | | | | (0.07 | ) | | | (0.02 | ) | | | (0.04 | ) | | | — | |

Total distributions declared to

shareholders | | | $(0.01 | ) | | | $(0.11 | ) | | | $(0.12 | ) | | | $(0.36 | ) | | | $(0.19 | ) | | | $(0.22 | ) |

Net asset value, end of period (x) | | | $10.51 | | | | $10.48 | | | | $10.57 | | | | $11.59 | | | | $11.28 | | | | $10.73 | |

Total return (%) (r)(s)(t)(x) | | | 0.37 | (n) | | | 0.18 | | | | (7.89 | ) | | | 6.15 | | | | 7.05 | | | | 8.63 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.76 | (a) | | | 1.71 | | | | 1.73 | | | | 1.70 | | | | 1.71 | | | | 1.76 | |

Expenses after expense

reductions (f) | | | 1.65 | (a) | | | 1.65 | | | | 1.65 | | | | 1.65 | | | | 1.65 | | | | 1.60 | |

Net investment income (loss) | | | (3.00 | )(a)(l) | | | 0.27 | | | | 0.08 | | | | 0.61 | | | | 2.70 | | | | 0.88 | |

Portfolio turnover | | | 15 | (n) | | | 22 | | | | 28 | | | | 26 | | | | 35 | | | | 34 | |

Net assets at end of period

(000 omitted) | | | $15,775 | | | | $17,186 | | | | $24,249 | | | | $51,751 | | | | $46,289 | | | | $37,876 | |

See Notes to Financial Statements

13

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/15 (unaudited) | | | Years ended 10/31 | |

| Class I | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $10.48 | | | | $10.57 | | | | $11.60 | | | | $11.28 | | | | $10.72 | | | | $10.08 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.10 | ) | | | $0.13 | | | | $(0.09 | )(g) | | | $0.19 | | | | $0.41 | | | | $0.19 | |

Net realized and unrealized gain

(loss) on investments and

foreign currency | | | 0.19 | | | | (0.01 | ) | | | (0.71 | )(g) | | | 0.60 | | | | 0.45 | | | | 0.77 | |

Total from investment operations | | | $0.09 | | | | $0.12 | | | | $(0.80 | ) | | | $0.79 | | | | $0.86 | | | | $0.96 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.03 | ) | | | $(0.21 | ) | | | $(0.16 | ) | | | $(0.45 | ) | | | $(0.26 | ) | | | $(0.32 | ) |

From net realized gain on

investments | | | — | | | | — | | | | (0.07 | ) | | | (0.02 | ) | | | (0.04 | ) | | | — | |

Total distributions declared to

shareholders | | | $(0.03 | ) | | | $(0.21 | ) | | | $(0.23 | ) | | | $(0.47 | ) | | | $(0.30 | ) | | | $(0.32 | ) |

Net asset value, end of period (x) | | | $10.54 | | | | $10.48 | | | | $10.57 | | | | $11.60 | | | | $11.28 | | | | $10.72 | |

Total return (%) (r)(s)(x) | | | 0.90 | (n) | | | 1.18 | | | | (7.03 | ) | | | 7.22 | | | | 8.21 | | | | 9.72 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 0.76 | (a) | | | 0.71 | | | | 0.67 | | | | 0.70 | | | | 0.71 | | | | 0.76 | |

Expenses after expense

reductions (f) | | | 0.65 | (a) | | | 0.65 | | | | 0.65 | | | | 0.65 | | | | 0.65 | | | | 0.61 | |

Net investment income (loss) | | | (1.92 | )(a)(l) | | | 1.24 | | | | (0.74 | ) | | | 1.67 | | | | 3.81 | | | | 1.89 | |

Portfolio turnover | | | 15 | (n) | | | 22 | | | | 28 | | | | 26 | | | | 35 | | | | 34 | |

Net assets at end of period

(000 omitted) | | | $5,722 | | | | $5,566 | | | | $7,116 | | | | $621,396 | | | | $457,623 | | | | $371,902 | |

See Notes to Financial Statements

14

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/15 (unaudited) | | | Years ended 10/31 | |

| Class R1 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $10.46 | | | | $10.55 | | | | $11.57 | | | | $11.26 | | | | $10.71 | | | | $10.07 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.15 | ) | | | $0.03 | | | | $0.01 | | | | $0.07 | | | | $0.30 | | | | $0.08 | |

Net realized and unrealized gain

(loss) on investments and

foreign currency | | | 0.19 | | | | (0.01 | ) | | | (0.91 | ) | | | 0.60 | | | | 0.44 | | | | 0.78 | |

Total from investment operations | | | $0.04 | | | | $0.02 | | | | $(0.90 | ) | | | $0.67 | | | | $0.74 | | | | $0.86 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.01 | ) | | | $(0.11 | ) | | | $(0.05 | ) | | | $(0.34 | ) | | | $(0.15 | ) | | | $(0.22 | ) |

From net realized gain on

investments | | | — | | | | — | | | | (0.07 | ) | | | (0.02 | ) | | | (0.04 | ) | | | — | |

Total distributions declared to

shareholders | | | $(0.01 | ) | | | $(0.11 | ) | | | $(0.12 | ) | | | $(0.36 | ) | | | $(0.19 | ) | | | $(0.22 | ) |

Net asset value, end of period (x) | | | $10.49 | | | | $10.46 | | | | $10.55 | | | | $11.57 | | | | $11.26 | | | | $10.71 | |

Total return (%) (r)(s)(x) | | | 0.37 | (n) | | | 0.18 | | | | (7.90 | ) | | | 6.16 | | | | 7.06 | | | | 8.64 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.77 | (a) | | | 1.71 | | | | 1.73 | | | | 1.70 | | | | 1.71 | | | | 1.76 | |

Expenses after expense

reductions (f) | | | 1.65 | (a) | | | 1.65 | | | | 1.65 | | | | 1.65 | | | | 1.65 | | | | 1.61 | |

Net investment income (loss) | | | (2.87 | )(a)(l) | | | 0.29 | | | | 0.06 | | | | 0.63 | | | | 2.80 | | | | 0.83 | |

Portfolio turnover | | | 15 | (n) | | | 22 | | | | 28 | | | | 26 | | | | 35 | | | | 34 | |

Net assets at end of period

(000 omitted) | | | $501 | | | | $707 | | | | $787 | | | | $1,192 | | | | $1,299 | | | | $1,129 | |

See Notes to Financial Statements

15

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/15 (unaudited) | | | Years ended 10/31 | |

| Class R2 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $10.47 | | | | $10.57 | | | | $11.59 | | | | $11.27 | | | | $10.72 | | | | $10.08 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.14 | ) | | | $0.08 | | | | $0.06 | | | | $0.12 | | | | $0.34 | | | | $0.14 | |

Net realized and unrealized gain

(loss) on investments and

foreign currency | | | 0.21 | | | | (0.02 | ) | | | (0.91 | ) | | | 0.61 | | | | 0.46 | | | | 0.77 | |

Total from investment operations | | | $0.07 | | | | $0.06 | | | | $(0.85 | ) | | | $0.73 | | | | $0.80 | | | | $0.91 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.02 | ) | | | $(0.16 | ) | | | $(0.10 | ) | | | $(0.39 | ) | | | $(0.21 | ) | | | $(0.27 | ) |

From net realized gain on

investments | | | — | | | | — | | | | (0.07 | ) | | | (0.02 | ) | | | (0.04 | ) | | | — | |

Total distributions declared to

shareholders | | | $(0.02 | ) | | | $(0.16 | ) | | | $(0.17 | ) | | | $(0.41 | ) | | | $(0.25 | ) | | | $(0.27 | ) |

Net asset value, end of period (x) | | | $10.52 | | | | $10.47 | | | | $10.57 | | | | $11.59 | | | | $11.27 | | | | $10.72 | |

Total return (%) (r)(s)(x) | | | 0.68 | (n) | | | 0.58 | | | | (7.42 | ) | | | 6.73 | | | | 7.58 | | | | 9.17 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.26 | (a) | | | 1.21 | | | | 1.23 | | | | 1.20 | | | | 1.21 | | | | 1.26 | |

Expenses after expense

reductions (f) | | | 1.15 | (a) | | | 1.15 | | | | 1.15 | | | | 1.15 | | | | 1.15 | | | | 1.10 | |

Net investment income (loss) | | | (2.65 | )(a)(l) | | | 0.75 | | | | 0.53 | | | | 1.07 | | | | 3.20 | | | | 1.39 | |

Portfolio turnover | | | 15 | (n) | | | 22 | | | | 28 | | | | 26 | | | | 35 | | | | 34 | |

Net assets at end of period

(000 omitted) | | | $2,596 | | | | $3,230 | | | | $3,573 | | | | $5,218 | | | | $4,982 | | | | $5,260 | |

See Notes to Financial Statements

16

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/15 (unaudited) | | | Years ended 10/31 | |

| Class R3 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $10.47 | | | | $10.57 | | | | $11.59 | | | | $11.27 | | | | $10.71 | | | | $10.07 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.11 | ) | | | $0.11 | | | | $0.09 | | | | $0.15 | | | | $0.36 | | | | $0.16 | |

Net realized and unrealized gain

(loss) on investments and

foreign currency | | | 0.19 | | | | (0.02 | ) | | | (0.91 | ) | | | 0.61 | | | | 0.47 | | | | 0.77 | |

Total from investment operations | | | $0.08 | | | | $0.09 | | | | $(0.82 | ) | | | $0.76 | | | | $0.83 | | | | $0.93 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.03 | ) | | | $(0.19 | ) | | | $(0.13 | ) | | | $(0.42 | ) | | | $(0.23 | ) | | | $(0.29 | ) |

From net realized gain on

investments | | | — | | | | — | | | | (0.07 | ) | | | (0.02 | ) | | | (0.04 | ) | | | — | |

Total distributions declared to

shareholders | | | $(0.03 | ) | | | $(0.19 | ) | | | $(0.20 | ) | | | $(0.44 | ) | | | $(0.27 | ) | | | $(0.29 | ) |

Net asset value, end of period (x) | | | $10.52 | | | | $10.47 | | | | $10.57 | | | | $11.59 | | | | $11.27 | | | | $10.71 | |

Total return (%) (r)(s)(x) | | | 0.74 | (n) | | | 0.84 | | | | (7.19 | ) | | | 6.98 | | | | 7.95 | | | | 9.45 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.01 | (a) | | | 0.96 | | | | 0.98 | | | | 0.95 | | | | 0.96 | | | | 1.01 | |

Expenses after expense

reductions (f) | | | 0.90 | (a) | | | 0.90 | | | | 0.90 | | | | 0.90 | | | | 0.90 | | | | 0.85 | |

Net investment income (loss) | | | (2.17 | )(a)(l) | | | 1.07 | | | | 0.83 | | | | 1.31 | | | | 3.33 | | | | 1.59 | |

Portfolio turnover | | | 15 | (n) | | | 22 | | | | 28 | | | | 26 | | | | 35 | | | | 34 | |

Net assets at end of period

(000 omitted) | | | $1,511 | | | | $1,677 | | | | $1,972 | | | | $2,619 | | | | $2,448 | | | | $2,589 | |

See Notes to Financial Statements

17

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/15 (unaudited) | | | Years ended 10/31 | |

| Class R4 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $10.47 | | | | $10.56 | | | | $11.59 | | | | $11.27 | | | | $10.71 | | | | $10.07 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.10 | ) | | | $0.15 | | | | $0.11 | | | | $0.18 | | | | $0.40 | | | | $0.19 | |

Net realized and unrealized gain

(loss) on investments and

foreign currency | | | 0.19 | | | | (0.03 | ) | | | (0.91 | ) | | | 0.61 | | | | 0.46 | | | | 0.77 | |

Total from investment operations | | | $0.09 | | | | $0.12 | | | | $(0.80 | ) | | | $0.79 | | | | $0.86 | | | | $0.96 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.03 | ) | | | $(0.21 | ) | | | $(0.16 | ) | | | $(0.45 | ) | | | $(0.26 | ) | | | $(0.32 | ) |

From net realized gain on

investments | | | — | | | | — | | | | (0.07 | ) | | | (0.02 | ) | | | (0.04 | ) | | | — | |

Total distributions declared to

shareholders | | | $(0.03 | ) | | | $(0.21 | ) | | | $(0.23 | ) | | | $(0.47 | ) | | | $(0.30 | ) | | | $(0.32 | ) |

Net asset value, end of period (x) | | | $10.53 | | | | $10.47 | | | | $10.56 | | | | $11.59 | | | | $11.27 | | | | $10.71 | |

Total return (%) (r)(s)(x) | | | 0.90 | (n) | | | 1.18 | | | | (7.04 | ) | | | 7.22 | | | | 8.22 | | | | 9.72 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 0.76 | (a) | | | 0.71 | | | | 0.73 | | | | 0.70 | | | | 0.71 | | | | 0.76 | |

Expenses after expense

reductions (f) | | | 0.65 | (a) | | | 0.65 | | | | 0.65 | | | | 0.65 | | | | 0.65 | | | | 0.61 | |

Net investment income (loss) | | | (1.96 | )(a)(l) | | | 1.39 | | | | 1.01 | | | | 1.58 | | | | 3.76 | | | | 1.84 | |

Portfolio turnover | | | 15 | (n) | | | 22 | | | | 28 | | | | 26 | | | | 35 | | | | 34 | |

Net assets at end of period

(000 omitted) | | | $183 | | | | $297 | | | | $381 | | | | $622 | | | | $324 | | | | $312 | |

See Notes to Financial Statements

18

Financial Highlights – continued

| | | | | | | | | | | | |

| | | Six months

ended

4/30/15 (unaudited) | | | Years ended 10/31 | |

| Class R5 | | | 2014 | | | 2013 (i) | |

| | | | | | | | |

Net asset value, beginning of period | | | $10.48 | | | | $10.58 | | | | $11.35 | |

| Income (loss) from investment operations | | | | | |

Net investment income (loss) (d) | | | $(0.10 | ) | | | $0.15 | | | | $0.16 | (g) |

Net realized and unrealized gain (loss) on investments

and foreign currency | | | 0.21 | | | | (0.03 | ) | | | (0.84 | )(g) |

Total from investment operations | | | $0.11 | | | | $0.12 | | | | $(0.68 | ) |

| Less distributions declared to shareholders | | | | | |

From net investment income | | | $(0.04 | ) | | | $(0.22 | ) | | | $(0.09 | ) |

Net asset value, end of period (x) | | | $10.55 | | | | $10.48 | | | | $10.58 | |

Total return (%) (r)(s)(x) | | | 1.02 | (n) | | | 1.14 | | | | (5.97 | )(n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.66 | (a) | | | 0.65 | | | | 0.65(a | ) |

Expenses after expense reductions (f) | | | 0.55 | (a) | | | 0.60 | | | | 0.53(a | ) |

Net investment income (loss) | | | (1.89 | )(a)(l) | | | 1.42 | | | | 2.20(a | ) |

Portfolio turnover | | | 15 | (n) | | | 22 | | | | 28 | |

Net assets at end of period (000 omitted) | | | $1,167,066 | | | | $977,429 | | | | $841,405 | |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (g) | The per share amount varies from the net investment income and/or net realized and unrealized gain/loss for the period because of the timing of sales of fund shares and the per share amounts of realized and unrealized gains and losses and/or inflation/deflation adjustments at such time. |

| (i) | For the period from the class inception, March 1, 2013, through the stated period end. |

| (l) | Recognition of net investment income by the fund may be affected by inflation/deflation adjustments through period end and the actual annual net investment income ratio may differ. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (t) | Total returns do not include any applicable sales charges. |

| (x) | The net asset values per share and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

19

NOTES TO FINANCIAL STATEMENTS

(unaudited)

(1) Business and Organization

MFS Inflation-Adjusted Bond Fund (the fund) is a diversified series of MFS Series Trust IX (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

(2) Significant Accounting Policies

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued.

In June 2014, FASB issued Accounting Standards Update 2014-11, Transfers and Servicing (Topic 860) – Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures (“ASU 2014-11”). ASU 2014-11 changes the accounting for repurchase-to-maturity transactions (i.e., repurchase agreements that settle at the same time as the maturity of the transferred financial asset) and enhances the required disclosures for repurchase agreements and other similar transactions. Although still evaluating the potential impacts of ASU 2014-11 to the fund, management expects that the impact of the fund’s adoption will be limited to additional financial statement disclosures which would first be effective for interim reporting periods beginning after March 15, 2015.

Balance Sheet Offsetting – The fund’s accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund’s right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’s in-scope financial instruments and transactions.

Investment Valuations – Debt instruments and floating rate loans, including restricted debt instruments, are generally valued at an evaluated or composite bid as provided by a third-party pricing service. Short-term instruments with a maturity at

20

Notes to Financial Statements (unaudited) – continued

issuance of 60 days or less may be valued at amortized cost, which approximates market value. Futures contracts are generally valued at last posted settlement price as provided by a third-party pricing service on the market on which they are primarily traded. Futures contracts for which there were no trades that day for a particular position are generally valued at the closing bid quotation as provided by a third-party pricing service on the market on which such futures contracts are primarily traded. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. Values obtained from third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted

21

Notes to Financial Statements (unaudited) – continued

quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. The following is a summary of the levels used as of April 30, 2015 in valuing the fund’s assets or liabilities:

| | | | | | | | | | | | | | | | |

| Investments at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| U.S. Treasury Bonds & U.S. Government Agency & Equivalents | | | $— | | | | $1,208,643,163 | | | | $— | | | | $1,208,643,163 | |

| Mutual Funds | | | 82,839,666 | | | | — | | | | — | | | | 82,839,666 | |

| Total Investments | | | $82,839,666 | | | | $1,208,643,163 | | | | $— | | | | $1,291,482,829 | |

For further information regarding security characteristics, see the Portfolio of Investments.

Inflation-Adjusted Debt Securities – The fund invests in inflation-adjusted debt securities issued by the U.S. Treasury. The principal value of these debt securities is adjusted through income according to changes in the Consumer Price Index. These debt securities typically pay a fixed rate of interest, but this fixed rate is applied to the inflation-adjusted principal amount. The principal paid at maturity of the debt security is typically equal to the inflation-adjusted principal amount, or the security’s original par value, whichever is greater. Other types of inflation-adjusted securities may use other methods to adjust for other measures of inflation.

Derivatives – The fund uses derivatives for different purposes, primarily to increase or decrease exposure to a particular market or segment of the market, or security, to increase or decrease interest rate or currency exposure, or as alternatives to direct investments. Derivatives are used for hedging or non-hedging purposes. While hedging can reduce or eliminate losses, it can also reduce or eliminate gains. When the fund uses derivatives as an investment to increase market exposure, or for hedging purposes, gains and losses from derivative instruments may be substantially greater than the derivative’s original cost. The derivative instruments used by the fund futures contracts. At April 30, 2015, the fund did not have any outstanding derivative instruments.

The following table presents, by major type of derivative contract, the realized gain (loss) on derivatives held by the fund for the six months ended April 30, 2015 as reported in the Statement of Operations:

| | | | |

| Risk | | Futures Contracts | |

| Interest Rate | | | $94,647 | |

There is no change in unrealized appreciation (depreciation) on derivative transactions at period end.

Derivative counterparty credit risk is managed through formal evaluation of the creditworthiness of all potential counterparties. On certain, but not all, uncleared derivatives, the fund attempts to reduce its exposure to counterparty credit risk whenever possible by entering into an ISDA Master Agreement on a bilateral basis. The ISDA Master Agreement gives each party to the agreement the right to terminate all transactions traded under such agreement if there is a certain deterioration in the

22

Notes to Financial Statements (unaudited) – continued

credit quality of the other party. Upon an event of default or a termination of the ISDA Master Agreement, the non-defaulting party has the right to close out all transactions traded under such agreement and to net amounts owed under each transaction to one net amount payable by one party to the other. This right to close out and net payments across all transactions traded under the ISDA Master Agreement could result in a reduction of the fund’s credit risk to such counterparty equal to any amounts payable by the fund under the applicable transactions, if any.

Collateral and margin requirements differ by type of derivative. Margin requirements are set by the clearing broker and the clearing house for cleared derivatives (i.e., futures contracts, cleared swaps, and exchange-traded options) while collateral terms are contract specific for uncleared derivatives (i.e., forward foreign currency exchange contracts, uncleared swap agreements, and uncleared options). For derivatives traded under an ISDA Master Agreement, which contains a collateral support annex, the collateral requirements are netted across all transactions traded under such agreement and one amount is posted from one party to the other to collateralize such obligations. Cash that has been segregated to cover the fund’s collateral or margin obligations under derivative contracts, if any, will be reported separately in the Statement of Assets and Liabilities as “Restricted cash” or “Deposits with brokers.” Securities pledged as collateral or margin for the same purpose, if any, are noted in the Portfolio of Investments.

Futures Contracts – The fund entered into futures contracts which may be used to hedge against or obtain broad market exposure, interest rate exposure, or to manage duration. A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date.

Upon entering into a futures contract, the fund is required to deposit with the broker, either in cash or securities, an initial margin in an amount equal to a certain percentage of the notional amount of the contract. Subsequent payments (variation margin) are made or received by the fund each day, depending on the daily fluctuations in the value of the contract, and are recorded for financial statement purposes as unrealized gain or loss by the fund until the contract is closed or expires at which point the gain or loss on futures contracts is realized.

The fund bears the risk of interest rates or securities prices moving unexpectedly, in which case, the fund may not achieve the anticipated benefits of the futures contracts and may realize a loss. While futures contracts may present less counterparty risk to the fund since the contracts are exchange traded and the exchange’s clearinghouse guarantees payments to the broker, there is still counterparty credit risk due to the insolvency of the broker. The fund’s maximum risk of loss due to counterparty credit risk is equal to the margin posted by the fund to the broker plus any gains or minus any losses on the outstanding futures contracts.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

23

Notes to Financial Statements (unaudited) – continued

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. All premium and discount is amortized or accreted for financial statement purposes in accordance with U.S. generally accepted accounting principles. Inflation-indexed bonds are fixed-income securities whose principal value is periodically adjusted upward or downward based on the rate of inflation. Interest is accrued based on the principal value, which is adjusted for inflation. Any increase or decrease in the principal amount of an inflation-indexed bond is generally recorded as an increase or decrease in interest income, respectively, even though the adjusted principal is not received until maturity. Interest payments received in additional securities are recorded on the ex-interest date in an amount equal to the value of the security on such date.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Fees Paid Indirectly – The fund’s custody fee may be reduced according to an arrangement that measures the value of U.S. dollars deposited with the custodian by the fund. This amount, for the six months ended April 30, 2015, is shown as a reduction of total expenses in the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns, when filed, will remain subject to examination by the Internal Revenue Service for a three year period. Management has analyzed the fund’s tax positions taken on federal and state tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

Book/tax differences primarily relate to amortization and accretion of debt securities and wash sale loss deferrals.

24

Notes to Financial Statements (unaudited) – continued

The tax character of distributions made during the current period will be determined at fiscal year end. The tax character of distributions declared to shareholders for the last fiscal year is as follows:

| | | | |

| | | 10/31/14 | |

Ordinary income (including any

short-term capital gains) | | | $21,409,250 | |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| | | | |

| As of 4/30/15 | | | |

| Cost of investments | | | $1,250,809,134 | |

| Gross appreciation | | | 48,019,441 | |

| Gross depreciation | | | (7,345,746 | ) |

| Net unrealized appreciation (depreciation) | | | $40,673,695 | |

| |

| As of 10/31/14 | | | |

| Undistributed ordinary income | | | 4,912,535 | |

| Capital loss carryforwards | | | (11,151,945 | ) |

| Other temporary differences | | | (1,699,553 | ) |

| Net unrealized appreciation (depreciation) | | | 12,232,424 | |

The aggregate cost above includes prior fiscal year end tax adjustments, if applicable.

As of October 31, 2014, the fund had capital loss carryforwards available to offset future realized gains. Such losses are characterized as follows:

| | | | |

| Short-Term | | | $(6,077,540 | ) |

| Long-Term | | | (5,074,405 | ) |

| Total | | | $(11,151,945 | ) |

Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), the above net capital losses may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Previously, net capital losses were carried forward for eight years and treated as short-term losses.

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution and service fees. The fund’s income and common expenses are allocated to shareholders based on the value of settled shares outstanding of each class. The fund’s realized and unrealized gain (loss) are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. Class B shares will convert to Class A

25

Notes to Financial Statements (unaudited) – continued

shares approximately eight years after purchase. The fund’s distributions declared to shareholders as reported in the Statements of Changes in Net Assets are presented by class as follows:

| | | | | | | | |

| | | From net investment

income | |

| | | Six months

ended

4/30/15 | | | Year

ended

10/31/14 | |

| Class A | | | $190,169 | | | | $1,433,216 | |

| Class B | | | 16,619 | | | | 197,903 | |

| Class C | | | 13,449 | | | | 202,233 | |

| Class I | | | 18,321 | | | | 122,052 | |

| Class R1 | | | 467 | | | | 7,689 | �� |

| Class R2 | | | 6,608 | | | | 50,448 | |

| Class R3 | | | 4,366 | | | | 30,171 | |

| Class R4 | | | 778 | | | | 7,103 | |

| Class R5 | | | 3,704,244 | | | | 19,358,435 | |

| Total | | | $3,955,021 | | | | $21,409,250 | |

(3) Transactions with Affiliates

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at an annual rate of 0.50% of the fund’s average daily net assets.

MFS has agreed in writing to reduce its management fee by a specified amount if certain MFS mutual fund assets exceed thresholds agreed to by MFS and the fund’s Board of Trustees. For the six months ended April 30, 2015, this management fee reduction amounted to $38,753, which is included in the reduction of total expenses in the Statement of Operations. The management fee incurred for the six months ended April 30, 2015 was equivalent to an annual effective rate of 0.49% of the fund’s average daily net assets.

The investment adviser has agreed in writing to pay a portion of the fund’s total annual operating expenses, excluding interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses, such that total fund operating expenses do not exceed the following rates annually of each class’s average daily net assets:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Classes | |

| A | | B | | | C | | | I | | | R1 | | | R2 | | | R3 | | | R4 | | | R5 | |

| 0.80% | | | 1.55% | | | | 1.65% | | | | 0.65% | | | | 1.65% | | | | 1.15% | | | | 0.90% | | | | 0.65% | | | | 0.60% | |

This written agreement will continue until modified by the fund’s Board of Trustees, but such agreement will continue at least until February 29, 2016. For the six months ended April 30, 2015, this reduction amounted to $630,641, which is included in the reduction of total expenses in the Statement of Operations.

Distributor – MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, as distributor, received $2,087 for the six months ended April 30, 2015, as its portion of the initial sales charge on sales of Class A shares of the fund.

26

Notes to Financial Statements (unaudited) – continued

The Board of Trustees has adopted a distribution plan for certain share classes pursuant to Rule 12b-1 of the Investment Company Act of 1940.

The fund’s distribution plan provides that the fund will pay MFD for services provided by MFD and financial intermediaries in connection with the distribution and servicing of certain share classes. One component of the plan is a distribution fee paid to MFD and another component of the plan is a service fee paid to MFD. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Distribution Plan Fee Table:

| | | | | | | | | | | | | | | | | | | | |

| | | Distribution

Fee Rate (d) | | | Service

Fee Rate (d) | | | Total

Distribution

Plan (d) | | | Annual

Effective

Rate (e) | | | Distribution

and Service

Fee | |

| Class A | | | — | | | | 0.25% | | | | 0.25% | | | | 0.15% | | | | $77,888 | |

| Class B | | | 0.75% | | | | 0.25% | | | | 1.00% | | | | 0.90% | | | | 76,739 | |

| Class C | | | 0.75% | | | | 0.25% | | | | 1.00% | | | | 1.00% | | | | 82,019 | |

| Class R1 | | | 0.75% | | | | 0.25% | | | | 1.00% | | | | 1.00% | | | | 2,607 | |

| Class R2 | | | 0.25% | | | | 0.25% | | | | 0.50% | | | | 0.50% | | | | 7,626 | |

| Class R3 | | | — | | | | 0.25% | | | | 0.25% | | | | 0.25% | | | | 1,941 | |

| Total Distribution and Service Fees | | | | $248,820 | |

| (d) | In accordance with the distribution plan for certain classes, the fund pays distribution and/or service fees equal to these annual percentage rates of each class’s average daily net assets. The distribution and service fee rates disclosed by class represent the current rates in effect at the end of the reporting period. Any rate changes, if applicable, are detailed below. |

| (e) | The annual effective rates represent actual fees incurred under the distribution plan for the six months ended April 30, 2015 based on each class’s average daily net assets. MFD has voluntarily agreed to rebate a portion of each class’s 0.25% service fee attributable to accounts for which MFD retains the 0.25% service fee except for accounts attributable to MFS or its affiliates’ seed money. For the six months ended April 30, 2015, this rebate amounted to $242, $4, and $8 for Class A, Class B, and Class C, respectively, and is included in the reduction of total expenses in the Statement of Operations. 0.10% of the Class A service fee is currently being waived under a written waiver arrangement. For the six months ended April 30, 2015, this waiver amounted to $31,155 and is included in the reduction of total expenses in the Statement of Operations. Assets attributable to Class B shares purchased prior to May 1, 2006 are subject to the 0.25% annual Class B service fee. On assets attributable to all other Class B shares 0.15% of the Class B service fee is being paid by the fund and 0.10% of the Class B service fee is being waived under a written agreement. For the six months ended April 30, 2015, this waiver amounted to $7,639 and is included in the reduction of total expenses in the Statement of Operations. These written agreements will continue until modified by the fund’s board of Trustees, but such agreements will continue at least until February 29, 2016. |

Certain Class A shares are subject to a contingent deferred sales charge (CDSC) in the event of a shareholder redemption within 18 months of purchase. Class C shares are subject to a CDSC in the event of a shareholder redemption within 12 months of purchase. Class B shares are subject to a CDSC in the event of a shareholder

27

Notes to Financial Statements (unaudited) – continued

redemption within six years of purchase. All contingent deferred sales charges are paid to MFD and during the six months ended April 30, 2015, were as follows:

| | | | |

| | | Amount | |

| Class A | | | $35 | |

| Class B | | | 17,288 | |

| Class C | | | 69 | |

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent calculated as a percentage of the average daily net assets of the fund as determined periodically under the supervision of the fund’s Board of Trustees. For the six months ended April 30, 2015, the fee was $26,301, which equated to 0.0044% annually of the fund’s average daily net assets. MFSC also receives payment from the fund for out-of-pocket expenses, sub-accounting and other shareholder servicing costs which may be paid to affiliated and unaffiliated service providers. Class R5 shares do not incur sub-accounting fees. For the six months ended April 30, 2015, these out-of-pocket expenses, sub-accounting and other shareholder servicing costs amounted to $71,124.

Under a Special Servicing Agreement among MFS, certain MFS funds which invest in other MFS funds (“MFS fund-of-funds”) and certain underlying funds in which a MFS fund-of-funds invests (“underlying funds”), each underlying fund may pay a portion of each MFS fund-of-funds’ transfer agent-related expenses, including sub-accounting fees payable to financial intermediaries, to the extent such payments do not exceed the benefits realized or expected to be realized by the underlying fund from the investment in the underlying fund by the MFS fund-of-funds. For the six months ended April 30, 2015, these costs for the fund amounted to $616,259 and are included in “Shareholder servicing costs” in the Statement of Operations.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the six months ended April 30, 2015 was equivalent to an annual effective rate of 0.0171% of the fund’s average daily net assets.

Trustees’ and Officers’ Compensation – The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to Trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration for their services to the fund from MFS. Certain officers and Trustees of the fund are officers or directors of MFS, MFD, and MFSC.

Other – This fund and certain other funds managed by MFS (the funds) have entered into a service agreement (the ISO Agreement) which provides for payment of fees solely by the funds to Tarantino LLC in return for the provision of services of an Independent Senior Officer (ISO) for the funds. Frank L. Tarantino serves as the ISO and is an officer of the funds and the sole member of Tarantino LLC. The funds can

28

Notes to Financial Statements (unaudited) – continued

terminate the ISO Agreement with Tarantino LLC at any time under the terms of the ISO Agreement. For the six months ended April 30, 2015, the fee paid by the fund under this agreement was $2,055 and is included in “Miscellaneous” expense in the Statement of Operations. MFS has agreed to bear all expenses associated with office space, other administrative support, and supplies provided to the ISO.

The fund invests in the MFS Institutional Money Market Portfolio which is managed by MFS and seeks current income consistent with preservation of capital and liquidity. Income earned on this investment is included in “Dividends from underlying affiliated funds” in the Statement of Operations. This money market fund does not pay a management fee to MFS.

On March 18, 2015, MFS redeemed 521 shares of Class I for an aggregate amount of $5,448.

(4) Portfolio Securities

For the six months ended April 30, 2015, purchases and sales of investments, other than short-term obligations, were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

| U.S. Government securities | | | $298,375,782 | | | | $167,879,595 | |

(5) Shares of Beneficial Interest

The fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest. Transactions in fund shares were as follows:

| | | | | | | | | | | | | | | | |

| | | Six months ended

4/30/15 | | | Year ended

10/31/14 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares sold | | | | | | | | | | | | | | | | |

Class A | | | 396,340 | | | | $4,144,605 | | | | 1,073,012 | | | | $11,291,364 | |

Class B | | | 34,407 | | | | 360,115 | | | | 109,992 | | | | 1,158,272 | |

Class C | | | 86,657 | | | | 904,979 | | | | 160,062 | | | | 1,685,667 | |

Class I | | | 81,710 | | | | 855,565 | | | | 85,819 | | | | 904,225 | |

Class R1 | | | 6,620 | | | | 68,943 | | | | 18,640 | | | | 195,911 | |

Class R2 | | | 30,476 | | | | 318,439 | | | | 63,346 | | | | 663,313 | |

Class R3 | | | 62,316 | | | | 652,175 | | | | 27,651 | | | | 290,740 | |

Class R4 | | | 2,824 | | | | 29,657 | | | | 4,779 | | | | 50,103 | |

Class R5 | | | 19,618,830 | | | | 204,607,590 | | | | 14,977,526 | | | | 156,547,872 | |

| | | 20,320,180 | | | | $211,942,068 | | | | 16,520,827 | | | | $172,787,467 | |

29

Notes to Financial Statements (unaudited) – continued

| | | | | | | | | | | | | | | | |

| | | Six months ended

4/30/15 | | | Year ended

10/31/14 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares issued to shareholders in reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 16,595 | | | | $173,772 | | | | 121,652 | | | | $1,275,937 | |

Class B | | | 1,294 | | | | 13,501 | | | | 15,377 | | | | 161,107 | |

Class C | | | 1,197 | | | | 12,501 | | | | 17,762 | | | | 186,196 | |

Class I | | | 1,466 | | | | 15,367 | | | | 9,751 | | | | 102,302 | |

Class R1 | | | 45 | | | | 467 | | | | 733 | | | | 7,689 | |

Class R2 | | | 516 | | | | 5,397 | | | | 3,952 | | | | 41,438 | |

Class R3 | | | 414 | | | | 4,338 | | | | 2,875 | | | | 30,171 | |

Class R4 | | | 74 | | | | 778 | | | | 675 | | | | 7,103 | |

Class R5 | | | 352,953 | | | | 3,704,238 | | | | 1,840,970 | | | | 19,358,435 | |

| | | 374,554 | | | | $3,930,359 | | | | 2,013,747 | | | | $21,170,378 | |

| | | | |