Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02464

MFS SERIES TRUST IX

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: April 30*

Date of reporting period: October 31, 2018

| * | This Form N-CSR pertains to the following series of the Registrant: MFS Corporate Bond Fund, MFS Limited Maturity Fund, MFS Municipal Limited Maturity Fund, and MFS Total Return Bond Fund. The remaining series of the Registrant has a fiscal year end of October 31. |

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

Semiannual Report

October 31, 2018

MFS® Corporate Bond Fund

MFB-SEM

Table of Contents

MFS® Corporate Bond Fund

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Table of Contents

LETTER FROM THE EXECUTIVE CHAIRMAN

Dear Shareholders:

Rising bond yields, international trade friction, and geopolitical uncertainty have contributed to an uptick in market volatility in recent quarters — a departure from the

low-volatility environment that prevailed for much of 2017. Against this more challenging backdrop, equity markets in the United States have outperformed most international markets on a relative basis, though returns have been modest year to date on an absolute basis. Global economic growth has become less synchronized over the past few months, with Europe, China, and some emerging markets having shown signs of slowing growth while U.S. growth has remained above average.

Although the U.S. Federal Reserve continues to gradually raise interest rates and shrink its balance sheet, monetary policy remains fairly accommodative around the world, with many central banks taking only tentative steps toward tighter policies.

U.S. tax reforms adopted in late 2017 have been welcomed by equity markets while emerging market economies have recently had to contend with tighter financial conditions as a result of firmer U.S. Treasury yields and a stronger dollar. The split result of the U.S. midterm congressional elections suggests meaningful further U.S. fiscal stimulus is less likely than if the Republicans had maintained control of both houses of Congress. Globally, inflation remains largely subdued, but tight labor markets and moderate global demand have investors on the lookout for its potential reappearance. Increased U.S. protectionism is also a growing concern, as investors fear trade disputes could dampen business sentiment, leading to even slower global growth. While there has been progress on this front — NAFTA has been replaced with a new agreement between the U.S., Mexico, and Canada; the free trade pact with Korea has been updated; and a negotiating framework with the European Union has been agreed upon — tensions over trade with China remain quite high.

As a global investment manager with nearly a century of expertise, MFS® firmly believes active risk management offers downside mitigation and may help improve investment outcomes. We built our active investment platform with this belief in mind. Our long-term perspective influences nearly every aspect of our business, ensuring our investment decisions align with the investing time horizons of our clients.

Respectfully,

Robert J. Manning

Executive Chairman

MFS Investment Management

December 14, 2018

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

Table of Contents

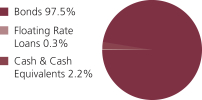

Portfolio structure (i)

| Fixed income sectors (i) | ||||

| Investment Grade Corporates | 78.7% | |||

| High Yield Corporates | 9.8% | |||

| U.S. Treasury Securities | 6.8% | |||

| Mortgage-Backed Securities | 1.1% | |||

| Emerging Markets Bonds | 1.1% | |||

| Floating Rate Loans | 0.3% | |||

| Commercial Mortgage-Backed Securities (o) | 0.0% | |||

| Asset-Backed Securities (o) | 0.0% |

| Composition including fixed income credit quality (a)(i) |

| |||

| AAA | 0.8% | |||

| AA | 1.8% | |||

| A | 22.5% | |||

| BBB | 54.9% | |||

| BB | 9.9% | |||

| CC (o) | 0.0% | |||

| C (o) | 0.0% | |||

| D (o) | 0.0% | |||

| U.S. Government | 6.8% | |||

| Federal Agencies | 1.1% | |||

| Cash & Cash Equivalents | 2.2% | |||

| Portfolio facts (i) | ||||

| Average Duration (d) | 7.0 | |||

| Average Effective Maturity (m) | 10.6 yrs. | |||

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. U.S. Government includes securities issued by the U.S. Department of the Treasury. Federal Agencies includes rated and unrated U.S. Agency fixed-income securities, U.S. Agency mortgage-backed securities, and collateralized mortgage obligations of U.S. Agency mortgage-backed securities. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

2

Table of Contents

Portfolio Composition – continued

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (o) | Less than 0.1%. |

Where the fund holds convertible bonds, they are treated as part of the equity portion of the portfolio.

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of October 31, 2018.

The portfolio is actively managed and current holdings may be different.

3

Table of Contents

Fund expenses borne by the shareholders during the period, May 1, 2018 through October 31, 2018

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period May 1, 2018 through October 31, 2018.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

4

Table of Contents

Expense Table – continued

| Share Class | Annualized Ratio | Beginning Account Value 5/01/18 | Ending Account Value | Expenses Paid During Period (p) 5/01/18-10/31/18 | ||||||||||||||

| A | Actual | 0.78% | $1,000.00 | $991.63 | $3.92 | |||||||||||||

| Hypothetical (h) | 0.78% | $1,000.00 | $1,021.27 | $3.97 | ||||||||||||||

| B | Actual | 1.53% | $1,000.00 | $987.12 | $7.66 | |||||||||||||

| Hypothetical (h) | 1.53% | $1,000.00 | $1,017.49 | $7.78 | ||||||||||||||

| C | Actual | 1.53% | $1,000.00 | $987.84 | $7.67 | |||||||||||||

| Hypothetical (h) | 1.53% | $1,000.00 | $1,017.49 | $7.78 | ||||||||||||||

| I | Actual | 0.53% | $1,000.00 | $992.85 | $2.66 | |||||||||||||

| Hypothetical (h) | 0.53% | $1,000.00 | $1,022.53 | $2.70 | ||||||||||||||

| R1 | Actual | 1.53% | $1,000.00 | $987.85 | $7.67 | |||||||||||||

| Hypothetical (h) | 1.53% | $1,000.00 | $1,017.49 | $7.78 | ||||||||||||||

| R2 | Actual | 1.03% | $1,000.00 | $989.66 | $5.17 | |||||||||||||

| Hypothetical (h) | 1.03% | $1,000.00 | $1,020.01 | $5.24 | ||||||||||||||

| R3 | Actual | 0.78% | $1,000.00 | $991.63 | $3.92 | |||||||||||||

| Hypothetical (h) | 0.78% | $1,000.00 | $1,021.27 | $3.97 | ||||||||||||||

| R4 | Actual | 0.53% | $1,000.00 | $992.13 | $2.66 | |||||||||||||

| Hypothetical (h) | 0.53% | $1,000.00 | $1,022.53 | $2.70 | ||||||||||||||

| R6 | Actual | 0.43% | $1,000.00 | $993.34 | $2.16 | |||||||||||||

| Hypothetical (h) | 0.43% | $1,000.00 | $1,023.04 | $2.19 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

5

Table of Contents

10/31/18 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Bonds - 96.5% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Aerospace - 2.3% | ||||||||

| Huntington Ingalls Industries, Inc., 3.483%, 12/01/2027 | $ | 11,950,000 | $ | 11,065,461 | ||||

| L3 Technologies, Inc., 3.85%, 6/15/2023 | 21,957,000 | 21,889,250 | ||||||

| Lockheed Martin Corp., 3.55%, 1/15/2026 | 7,857,000 | 7,670,125 | ||||||

| Northrop Grumman Corp., 2.55%, 10/15/2022 | 31,622,000 | 30,391,282 | ||||||

| Northrop Grumman Corp., 2.93%, 1/15/2025 | 27,106,000 | 25,543,557 | ||||||

|

| |||||||

| $ | 96,559,675 | |||||||

| Apparel Manufacturers - 0.5% | ||||||||

| Coach, Inc., 4.125%, 7/15/2027 | $ | 22,765,000 | $ | 21,305,060 | ||||

| Asset-Backed & Securitized - 0.1% | ||||||||

| Bayview Financial Revolving Mortgage Loan Trust, FLR, 3.894% (LIBOR - 1mo. + 1.6%), 12/28/2040 (z) | $ | 947,317 | $ | 888,338 | ||||

| Greenwich Capital Commercial Funding Corp., 5.856%, 7/10/2038 | 585,244 | 585,091 | ||||||

| JPMorgan Chase Commercial Mortgage Securities Corp., 5.965%, 7/15/2042 (n)(q) | 1,219,486 | 831,604 | ||||||

| Lehman Brothers Commercial Conduit Mortgage Trust, 0.955%, 2/18/2030 (i) | 181,751 | 2 | ||||||

|

| |||||||

| $ | 2,305,035 | |||||||

| Automotive - 3.5% | ||||||||

| General Motors Co., 5.15%, 4/01/2038 | $ | 10,480,000 | $ | 9,252,249 | ||||

| General Motors Co., 6.25%, 10/02/2043 | 10,919,000 | 10,449,924 | ||||||

| General Motors Financial Co., Inc., 2.35%, 10/04/2019 | 32,777,000 | 32,456,103 | ||||||

| General Motors Financial Co., Inc., 3.45%, 4/10/2022 | 9,528,000 | 9,275,076 | ||||||

| General Motors Financial Co., Inc., 4%, 10/06/2026 | 10,385,000 | 9,496,437 | ||||||

| General Motors Financial Co., Inc., 4.35%, 1/17/2027 | 6,485,000 | 6,023,648 | ||||||

| Lear Corp., 5.25%, 1/15/2025 | 15,224,000 | 15,599,477 | ||||||

| Lear Corp., 3.8%, 9/15/2027 | 36,241,000 | 32,903,530 | ||||||

| ZF North America Capital, Inc., 4.75%, 4/29/2025 (n) | 20,571,000 | 19,898,659 | ||||||

|

| |||||||

| $ | 145,355,103 | |||||||

| Broadcasting - 0.8% | ||||||||

| Netflix, Inc., 4.875%, 4/15/2028 (n) | $ | 21,124,000 | $ | 19,381,270 | ||||

| Time Warner, Inc., 3.8%, 2/15/2027 | 12,214,000 | 11,444,419 | ||||||

| Time Warner, Inc., 5.35%, 12/15/2043 | 4,056,000 | 3,817,615 | ||||||

|

| |||||||

| $ | 34,643,304 | |||||||

6

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Brokerage & Asset Managers - 2.5% | ||||||||

| Charles Schwab Corp., 3.85%, 5/21/2025 | $ | 22,971,000 | $ | 22,973,940 | ||||

| E*TRADE Financial Corp., 2.95%, 8/24/2022 | 15,023,000 | 14,478,463 | ||||||

| Intercontinental Exchange, Inc., 2.75%, 12/01/2020 | 6,672,000 | 6,595,752 | ||||||

| Intercontinental Exchange, Inc., 2.35%, 9/15/2022 | 19,865,000 | 19,034,822 | ||||||

| Intercontinental Exchange, Inc., 4%, 10/15/2023 | 14,230,000 | 14,470,359 | ||||||

| Intercontinental Exchange, Inc., 3.75%, 12/01/2025 | 8,952,000 | 8,851,773 | ||||||

| TD Ameritrade Holding Corp., 3.3%, 4/01/2027 | 16,712,000 | 15,729,877 | ||||||

|

| |||||||

| $ | 102,134,986 | |||||||

| Building - 2.6% | ||||||||

| CRH America Finance, Inc., 4.5%, 4/04/2048 (n) | $ | 16,362,000 | $ | 14,448,136 | ||||

| Martin Marietta Materials, Inc., 4.25%, 7/02/2024 | 7,431,000 | 7,428,359 | ||||||

| Martin Marietta Materials, Inc., 3.45%, 6/01/2027 | 8,095,000 | 7,385,911 | ||||||

| Martin Marietta Materials, Inc., 3.5%, 12/15/2027 | 14,186,000 | 12,842,128 | ||||||

| Masco Corp., 4.45%, 4/01/2025 | 3,390,000 | 3,376,329 | ||||||

| Masco Corp., 4.375%, 4/01/2026 | 11,202,000 | 11,043,381 | ||||||

| Masco Corp., 4.5%, 5/15/2047 | 12,265,000 | 10,151,768 | ||||||

| Owens Corning, 3.4%, 8/15/2026 | 5,864,000 | 5,311,580 | ||||||

| Standard Industries, Inc., 4.75%, 1/15/2028 (n) | 20,319,000 | 18,160,106 | ||||||

| Vulcan Materials Co., 4.5%, 6/15/2047 | 19,500,000 | 16,372,294 | ||||||

|

| |||||||

| $ | 106,519,992 | |||||||

| Business Services - 2.6% | ||||||||

| Cisco Systems, Inc., 2.2%, 2/28/2021 | $ | 12,891,000 | $ | 12,582,899 | ||||

| Equinix, Inc., 5.75%, 1/01/2025 | 13,055,000 | 13,299,781 | ||||||

| Equinix, Inc., 5.375%, 5/15/2027 | 4,197,000 | 4,155,030 | ||||||

| Fidelity National Information Services, Inc., 3.5%, 4/15/2023 | 2,389,000 | 2,359,106 | ||||||

| Fidelity National Information Services, Inc., 3%, 8/15/2026 | 13,572,000 | 12,338,966 | ||||||

| Fidelity National Information Services, Inc., 4.5%, 8/15/2046 | 6,787,000 | 6,266,763 | ||||||

| Fidelity National Information Services, Inc., 4.75%, 5/15/2048 | 14,440,000 | 13,784,616 | ||||||

| Fiserv, Inc., 2.7%, 6/01/2020 | 6,911,000 | 6,837,449 | ||||||

| MSCI, Inc., 5.75%, 8/15/2025 (n) | 15,656,000 | 16,086,540 | ||||||

| MSCI, Inc., 4.75%, 8/01/2026 (n) | 5,205,000 | 5,022,825 | ||||||

| MSCI, Inc., 5.375%, 5/15/2027 (n) | 15,000,000 | 14,850,000 | ||||||

|

| |||||||

| $ | 107,583,975 | |||||||

| Cable TV - 2.4% | ||||||||

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp., 6.384%, 10/23/2035 | $ | 19,932,000 | $ | 20,584,237 | ||||

| Cox Communications, Inc., 3.5%, 8/15/2027 (n) | 11,693,000 | 10,760,967 | ||||||

| Cox Communications, Inc., 4.6%, 8/15/2047 (n) | 3,670,000 | 3,267,378 | ||||||

| Sirius XM Radio, Inc., 5.375%, 4/15/2025 (n) | 1,635,000 | 1,619,672 | ||||||

| Sirius XM Radio, Inc., 5.375%, 7/15/2026 (n) | 19,940,000 | 19,491,350 | ||||||

| Sirius XM Radio, Inc., 5%, 8/01/2027 (n) | 26,833,000 | 25,214,702 | ||||||

7

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Cable TV - continued | ||||||||

| Time Warner Cable, Inc., 4.5%, 9/15/2042 | $ | 7,034,000 | $ | 5,653,791 | ||||

| Videotron Ltd., 5%, 7/15/2022 | 13,220,000 | 13,203,475 | ||||||

|

| |||||||

| $ | 99,795,572 | |||||||

| Chemicals - 1.7% | ||||||||

| Air Liquide Finance Co., 2.25%, 9/27/2023 (n) | $ | 11,552,000 | $ | 10,773,141 | ||||

| LyondellBasell Industries N.V., 6%, 11/15/2021 | 9,720,000 | 10,249,636 | ||||||

| Sasol Chemicals (USA) LLC, 5.875%, 3/27/2024 | 15,584,000 | 15,699,038 | ||||||

| Sasol Financing International PLC, 4.5%, 11/14/2022 | 22,091,000 | 21,456,767 | ||||||

| Sherwin-Williams Co., 4.5%, 6/01/2047 | 11,884,000 | 10,667,934 | ||||||

|

| |||||||

| $ | 68,846,516 | |||||||

| Computer Software - 1.3% | ||||||||

| Microsoft Corp., 3.45%, 8/08/2036 | $ | 20,000,000 | $ | 18,402,637 | ||||

| Microsoft Corp., 4.1%, 2/06/2037 | 13,500,000 | 13,527,084 | ||||||

| VeriSign, Inc., 4.625%, 5/01/2023 | 7,628,000 | 7,628,000 | ||||||

| VeriSign, Inc., 4.75%, 7/15/2027 | 13,576,000 | 12,782,483 | ||||||

|

| |||||||

| $ | 52,340,204 | |||||||

| Computer Software - Systems - 1.3% | ||||||||

| Apple, Inc., 3.2%, 5/11/2027 | $ | 31,231,000 | $ | 29,689,534 | ||||

| Apple, Inc., 4.5%, 2/23/2036 | 10,000,000 | 10,399,041 | ||||||

| Apple, Inc., 3.85%, 8/04/2046 | 8,346,000 | 7,627,773 | ||||||

| Apple, Inc., 4.25%, 2/09/2047 | 4,778,000 | 4,642,680 | ||||||

|

| |||||||

| $ | 52,359,028 | |||||||

| Conglomerates - 1.5% | ||||||||

| Roper Technologies, Inc., 3%, 12/15/2020 | $ | 24,787,000 | $ | 24,556,813 | ||||

| Roper Technologies, Inc., 4.2%, 9/15/2028 | 12,199,000 | 11,973,098 | ||||||

| United Technologies Corp., 4.625%, 11/16/2048 | 9,261,000 | 8,908,986 | ||||||

| Wabtec Corp., 4.7%, 9/15/2028 | 12,095,000 | 11,692,707 | ||||||

| Westinghouse Air Brake Technologies Corp., 4.15%, 3/15/2024 | 6,283,000 | 6,136,103 | ||||||

|

| |||||||

| $ | 63,267,707 | |||||||

| Consumer Products - 0.4% | ||||||||

| Reckitt Benckiser Treasury Services PLC, 3%, 6/26/2027 (n) | $ | 16,079,000 | $ | 14,686,418 | ||||

| Consumer Services - 2.1% | ||||||||

| IHS Markit Ltd., 4%, 3/01/2026 (n) | $ | 6,085,000 | $ | 5,726,898 | ||||

| Priceline Group, Inc., 3.65%, 3/15/2025 | 15,059,000 | 14,621,539 | ||||||

| Priceline Group, Inc., 3.6%, 6/01/2026 | 18,768,000 | 17,924,184 | ||||||

| Priceline Group, Inc., 3.55%, 3/15/2028 | 10,204,000 | 9,543,481 | ||||||

| Service Corp. International, 5.375%, 5/15/2024 | 18,149,000 | 18,353,176 | ||||||

| Visa, Inc., 4.15%, 12/14/2035 | 12,578,000 | 12,564,392 | ||||||

8

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Consumer Services - continued | ||||||||

| Visa, Inc., 3.65%, 9/15/2047 | $ | 9,718,000 | $ | 8,702,314 | ||||

|

| |||||||

| $ | 87,435,984 | |||||||

| Containers - 0.5% | ||||||||

| Ball Corp., 4%, 11/15/2023 | $ | 11,867,000 | $ | 11,510,990 | ||||

| Ball Corp., 5.25%, 7/01/2025 | 10,370,000 | 10,473,700 | ||||||

|

| |||||||

| $ | 21,984,690 | |||||||

| Electrical Equipment - 0.9% | ||||||||

| Arrow Electronics, Inc., 3.5%, 4/01/2022 | $ | 4,412,000 | $ | 4,328,030 | ||||

| Arrow Electronics, Inc., 3.25%, 9/08/2024 | 16,437,000 | 15,369,033 | ||||||

| Arrow Electronics, Inc., 3.875%, 1/12/2028 | 17,987,000 | 16,416,581 | ||||||

|

| |||||||

| $ | 36,113,644 | |||||||

| Electronics - 1.3% | ||||||||

| Broadcom Corp./Broadcom Cayman Finance Ltd., 3.875%, 1/15/2027 | $ | 45,163,000 | $ | 41,470,443 | ||||

| Tyco Electronics Group S.A., 3.5%, 2/03/2022 | 11,088,000 | 11,062,845 | ||||||

|

| |||||||

| $ | 52,533,288 | |||||||

| Emerging Market Sovereign - 0.1% | ||||||||

| Republic of South Africa, 5.65%, 9/27/2047 | $ | 6,589,000 | $ | 5,551,233 | ||||

| Energy - Independent - 0.3% | ||||||||

| Diamondback Energy, Inc., 4.75%, 11/01/2024 (n) | $ | 10,568,000 | $ | 10,277,380 | ||||

| Diamondback Energy, Inc., 5.375%, 5/31/2025 | 1,830,000 | 1,820,850 | ||||||

|

| |||||||

| $ | 12,098,230 | |||||||

| Energy - Integrated - 0.7% | ||||||||

| Eni S.p.A., 4.75%, 9/12/2028 (n) | $ | 14,052,000 | $ | 13,367,611 | ||||

| Shell International Finance B.V., 3.75%, 9/12/2046 | 16,673,000 | 14,816,802 | ||||||

|

| |||||||

| $ | 28,184,413 | |||||||

| Entertainment - 0.5% | ||||||||

| Royal Caribbean Cruises Ltd., 3.7%, 3/15/2028 | $ | 22,622,000 | $ | 20,703,149 | ||||

| Financial Institutions - 1.0% | ||||||||

| AerCap Ireland Capital Ltd., 3.65%, 7/21/2027 | $ | 24,414,000 | $ | 21,905,057 | ||||

| Avolon Holdings Funding Ltd., 5.125%, 10/01/2023 | 6,016,000 | 5,903,200 | ||||||

| International Lease Finance Corp., 5.875%, 8/15/2022 | 13,000,000 | 13,690,068 | ||||||

|

| |||||||

| $ | 41,498,325 | |||||||

| Food & Beverages - 5.0% | ||||||||

| Anheuser-Busch InBev Worldwide, Inc., 3.75%, 1/15/2022 | $ | 48,069,000 | $ | 48,114,633 | ||||

| Anheuser-Busch InBev Worldwide, Inc., 4.375%, 4/15/2038 | 8,822,000 | 8,019,033 | ||||||

9

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Food & Beverages - continued | ||||||||

| Conagra Brands, Inc., 5.3%, 11/01/2038 | $ | 10,886,000 | $ | 10,543,443 | ||||

| Conagra Brands, Inc., 5.4%, 11/01/2048 | 14,507,000 | 13,843,070 | ||||||

| Constellation Brands, Inc., 3.2%, 2/15/2023 | 17,602,000 | 17,058,450 | ||||||

| Constellation Brands, Inc., 4.25%, 5/01/2023 | 37,599,000 | 37,949,098 | ||||||

| Danone S.A., 2.077%, 11/02/2021 (n) | 11,063,000 | 10,572,848 | ||||||

| Danone S.A., 2.589%, 11/02/2023 (n) | 23,885,000 | 22,459,238 | ||||||

| Kraft Heinz Foods Co., 3.5%, 7/15/2022 | 7,915,000 | 7,817,318 | ||||||

| Kraft Heinz Foods Co., 3%, 6/01/2026 | 4,972,000 | 4,437,238 | ||||||

| Kraft Heinz Foods Co., 6.5%, 2/09/2040 | 10,504,000 | 11,396,470 | ||||||

| Tyson Foods, Inc., 4.5%, 6/15/2022 | 6,026,000 | 6,161,645 | ||||||

| Wm. Wrigley Jr. Co., 2.9%, 10/21/2019 (n) | 4,831,000 | 4,819,212 | ||||||

| Wm. Wrigley Jr. Co., 3.375%, 10/21/2020 (n) | 2,809,000 | 2,808,731 | ||||||

|

| |||||||

| $ | 206,000,427 | |||||||

| Forest & Paper Products - 0.4% | ||||||||

| Georgia-Pacific LLC, 5.4%, 11/01/2020 (n) | $ | 13,758,000 | $ | 14,257,388 | ||||

| International Paper Co., 6%, 11/15/2041 | 3,640,000 | 3,843,064 | ||||||

|

| |||||||

| $ | 18,100,452 | |||||||

| Gaming & Lodging - 1.7% | ||||||||

| GLP Capital LP/GLP Financing II, Inc., 5.75%, 6/01/2028 | $ | 24,600,000 | $ | 24,861,375 | ||||

| GLP Capital LP/GLP Financing II, Inc., 5.3%, 1/15/2029 | 5,895,000 | 5,791,838 | ||||||

| Hilton Domestic Operating Co., Inc., 5.125%, 5/01/2026 (n) | 8,944,000 | 8,742,760 | ||||||

| Marriott International, Inc., 4%, 4/15/2028 | 33,912,000 | 32,659,768 | ||||||

|

| |||||||

| $ | 72,055,741 | |||||||

| Insurance - 0.5% | ||||||||

| American International Group, Inc., 3.875%, 1/15/2035 | $ | 4,195,000 | $ | 3,597,691 | ||||

| American International Group, Inc., 4.7%, 7/10/2035 | 7,821,000 | 7,370,280 | ||||||

| American International Group, Inc., 4.5%, 7/16/2044 | 10,351,000 | 9,172,786 | ||||||

|

| |||||||

| $ | 20,140,757 | |||||||

| Insurance - Health - 2.1% | ||||||||

| Aetna, Inc., 2.8%, 6/15/2023 | $ | 9,637,000 | $ | 9,191,894 | ||||

| Centene Corp., 5.375%, 6/01/2026 (n) | 14,574,000 | 14,792,610 | ||||||

| Halfmoon Parent, Inc., 4.125%, 11/15/2025 (n) | 17,420,000 | 17,217,839 | ||||||

| UnitedHealth Group, Inc., 2.7%, 7/15/2020 | 25,646,000 | 25,443,816 | ||||||

| UnitedHealth Group, Inc., 4.625%, 7/15/2035 | 18,120,000 | 18,636,593 | ||||||

|

| |||||||

| $ | 85,282,752 | |||||||

| Insurance - Property & Casualty - 1.2% | ||||||||

| Berkshire Hathaway, Inc., 2.75%, 3/15/2023 | $ | 6,920,000 | $ | 6,716,724 | ||||

| Chubb INA Holdings, Inc., 2.875%, 11/03/2022 | 8,035,000 | 7,846,649 | ||||||

| CNA Financial Corp., 5.875%, 8/15/2020 | 4,010,000 | 4,175,128 | ||||||

10

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Insurance - Property & Casualty - continued | ||||||||

| Liberty Mutual Group, Inc., 4.85%, 8/01/2044 (n) | $ | 9,230,000 | $ | 8,900,456 | ||||

| Marsh & McLennan Cos., Inc., 4.8%, 7/15/2021 | 8,500,000 | 8,727,222 | ||||||

| Marsh & McLennan Cos., Inc., 3.5%, 6/03/2024 | 6,766,000 | 6,611,927 | ||||||

| Marsh & McLennan Cos., Inc., 4.35%, 1/30/2047 | 6,467,000 | 6,013,730 | ||||||

|

| |||||||

| $ | 48,991,836 | |||||||

| Machinery & Tools - 0.6% | ||||||||

| CNH Industrial Capital LLC, 4.2%, 1/15/2024 | $ | 9,230,000 | $ | 9,133,775 | ||||

| CNH Industrial Capital LLC, 3.85%, 11/15/2027 | 16,974,000 | 15,680,983 | ||||||

|

| |||||||

| $ | 24,814,758 | |||||||

| Major Banks - 15.2% | ||||||||

| Bank of America Corp., 2.738% to 1/23/2021, FLR (LIBOR - 3mo. + 2.738%) to 1/23/2022 | $ | 45,281,000 | $ | 44,381,330 | ||||

| Bank of America Corp., 3.124% to 1/20/2022, FLR (LIBOR - 3mo. + 1.16%) to 1/20/2023 | 17,201,000 | 16,808,202 | ||||||

| Bank of America Corp., 3.004%, 12/20/2023 | 1,782,000 | 1,714,639 | ||||||

| Bank of America Corp., 4.125%, 1/22/2024 | 14,866,000 | 14,952,336 | ||||||

| Bank of America Corp., 4.45%, 3/03/2026 | 13,347,000 | 13,201,575 | ||||||

| Bank of America Corp., 3.5%, 4/19/2026 | 19,080,000 | 18,149,182 | ||||||

| Bank of America Corp., 4.183%, 11/25/2027 | 25,000,000 | 24,001,407 | ||||||

| Bank of America Corp., 3.419% to 12/20/2027, FLR (LIBOR - 3mo. + 1.04%) to 12/20/2028 | 15,825,000 | 14,582,785 | ||||||

| Bank of America Corp., 6.1% to 3/17/2025, FLR (LIBOR - 3mo. + 3.898%) to 12/29/2049 | 18,007,000 | 18,479,684 | ||||||

| Bank of America Corp., 5.875% to 3/15/2028, FLR (LIBOR - 3mo. + 2.931%) to 12/31/2059 | 22,420,000 | 21,747,400 | ||||||

| Bank of New York Mellon Corp., 2.95%, 1/29/2023 | 52,612,000 | 51,159,968 | ||||||

| Bank of New York Mellon Corp., 3.442% to 2/07/2027, FLR (LIBOR - 3mo. + 1.069%) to 2/07/2028 | 23,523,000 | 22,582,052 | ||||||

| HSBC Holdings PLC, 3.4%, 3/08/2021 | 13,677,000 | 13,604,812 | ||||||

| HSBC Holdings PLC, 4.375%, 11/23/2026 | 10,488,000 | 10,170,255 | ||||||

| HSBC Holdings PLC, 6% to 5/22/2027, FLR (ICE Swap Rate - 5yr. + 3.746%) to 11/22/2065 | 9,768,000 | 8,986,560 | ||||||

| JPMorgan Chase & Co., 4.25%, 10/15/2020 | 6,107,000 | 6,201,893 | ||||||

| JPMorgan Chase & Co., 2.295%, 8/15/2021 | 15,000,000 | 14,521,800 | ||||||

| JPMorgan Chase & Co., 4.5%, 1/24/2022 | 26,589,000 | 27,325,193 | ||||||

| JPMorgan Chase & Co., 3.25%, 9/23/2022 | 30,989,000 | 30,562,922 | ||||||

| JPMorgan Chase & Co., 3.2%, 6/15/2026 | 9,000,000 | 8,396,338 | ||||||

| JPMorgan Chase & Co., 3.782% to 2/01/2027, FLR (LIBOR - 3mo. + 1.337%) to 2/01/2028 | 35,000,000 | 33,668,987 | ||||||

| JPMorgan Chase & Co., 3.54% to 5/01/2027, FLR (LIBOR - 3mo. + 1.38%) to 5/01/2028 | 18,887,000 | 17,807,779 | ||||||

11

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Major Banks - continued | ||||||||

| JPMorgan Chase & Co., 3.964% to 11/15/2047, FLR (LIBOR - 3mo. + 1.38%) to 11/15/2048 | $ | 12,400,000 | $ | 10,865,619 | ||||

| JPMorgan Chase & Co., 3.897% to 1/23/2048, FLR (LIBOR - 3mo. + 1.22%) to 1/23/2049 | 20,011,000 | 17,297,556 | ||||||

| JPMorgan Chase & Co., 6.75% to 2/01/2024, FLR (LIBOR - 3mo. + 3.78%) to 1/29/2049 | 15,247,000 | 16,260,925 | ||||||

| Morgan Stanley, 2.5%, 4/21/2021 | 5,620,000 | 5,475,610 | ||||||

| Morgan Stanley, 5.5%, 7/28/2021 | 5,652,000 | 5,920,152 | ||||||

| Morgan Stanley, 2.625%, 11/17/2021 | 32,200,000 | 31,228,913 | ||||||

| Morgan Stanley, 3.125%, 1/23/2023 | 22,096,000 | 21,382,368 | ||||||

| PNC Bank N.A., 2.6%, 7/21/2020 | 18,034,000 | 17,817,352 | ||||||

| Sumitomo Mitsui Financial Group, Inc., 3.102%, 1/17/2023 | 33,791,000 | 32,887,156 | ||||||

| UBS Group Funding (Switzerland) AG, 4.253%, 3/23/2028 (n) | 24,795,000 | 24,306,557 | ||||||

| Wachovia Corp., 6.605%, 10/01/2025 | 7,936,000 | 8,792,949 | ||||||

|

| |||||||

| $ | 625,242,256 | |||||||

| Medical & Health Technology & Services - 2.9% | ||||||||

| Becton, Dickinson and Co., 3.734%, 12/15/2024 | $ | 1,460,000 | $ | 1,415,272 | ||||

| Becton, Dickinson and Co., 4.685%, 12/15/2044 | 9,974,000 | 9,317,196 | ||||||

| Becton, Dickinson and Co., 4.669%, 6/06/2047 | 26,561,000 | 24,939,944 | ||||||

| HCA, Inc., 4.75%, 5/01/2023 | 7,090,000 | 7,160,900 | ||||||

| HCA, Inc., 5.25%, 6/15/2026 | 3,516,000 | 3,577,530 | ||||||

| Laboratory Corp. of America Holdings, 3.25%, 9/01/2024 | 16,049,000 | 15,323,125 | ||||||

| Laboratory Corp. of America Holdings, 3.6%, 2/01/2025 | 4,792,000 | 4,602,771 | ||||||

| Laboratory Corp. of America Holdings, 4.7%, 2/01/2045 | 8,278,000 | 7,684,163 | ||||||

| Thermo Fisher Scientific, Inc., 3%, 4/15/2023 | 9,452,000 | 9,109,656 | ||||||

| Thermo Fisher Scientific, Inc., 2.95%, 9/19/2026 | 14,540,000 | 13,277,535 | ||||||

| Thermo Fisher Scientific, Inc., 4.1%, 8/15/2047 | 27,051,000 | 24,296,186 | ||||||

|

| |||||||

| $ | 120,704,278 | |||||||

| Medical Equipment - 3.0% | ||||||||

| Abbott Laboratories, 2.9%, 11/30/2021 | $ | 30,627,000 | $ | 30,095,622 | ||||

| Abbott Laboratories, 4.75%, 11/30/2036 | 21,877,000 | 22,300,890 | ||||||

| Medtronic, Inc., 3.5%, 3/15/2025 | 32,749,000 | 32,058,746 | ||||||

| Medtronic, Inc., 4.375%, 3/15/2035 | 3,458,000 | 3,444,063 | ||||||

| Teleflex, Inc., 4.625%, 11/15/2027 | 2,045,000 | 1,906,963 | ||||||

| Zimmer Biomet Holdings, Inc., 3.55%, 4/01/2025 | 20,267,000 | 19,116,378 | ||||||

| Zimmer Biomet Holdings, Inc., FLR, 3.088% (LIBOR - 3mo. + 0.75%), 3/19/2021 | 13,874,000 | 13,881,259 | ||||||

|

| |||||||

| $ | 122,803,921 | |||||||

| Metals & Mining - 1.8% | ||||||||

| Glencore Funding LLC, 3%, 10/27/2022 (n) | $ | 2,911,000 | $ | 2,783,626 | ||||

| Glencore Funding LLC, 4.125%, 5/30/2023 (n) | 11,974,000 | 11,868,919 | ||||||

12

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Metals & Mining - continued | ||||||||

| Glencore Funding LLC, 4%, 4/16/2025 (n) | $ | 5,423,000 | $ | 5,186,557 | ||||

| Glencore Funding LLC, 4%, 3/27/2027 (n) | 21,861,000 | 20,101,854 | ||||||

| Glencore Funding LLC, 3.875%, 10/27/2027 (n) | 10,188,000 | 9,269,042 | ||||||

| Kinross Gold Corp., 5.95%, 3/15/2024 | 1,845,000 | 1,886,513 | ||||||

| Kinross Gold Corp., 4.5%, 7/15/2027 | 255,000 | 228,225 | ||||||

| Steel Dynamics, Inc., 5%, 12/15/2026 | 21,989,000 | 21,494,248 | ||||||

|

| |||||||

| $ | 72,818,984 | |||||||

| Midstream - 3.4% | ||||||||

| APT Pipelines Ltd., 4.25%, 7/15/2027 (n) | $ | 5,122,000 | $ | 4,916,145 | ||||

| APT Pipelines Ltd., 5%, 3/23/2035 (n) | 12,850,000 | 12,662,778 | ||||||

| Dominion Gas Holdings LLC, 2.8%, 11/15/2020 | 7,949,000 | 7,845,663 | ||||||

| MPLX LP, 4.5%, 4/15/2038 | 12,937,000 | 11,527,409 | ||||||

| ONEOK, Inc., 4.95%, 7/13/2047 | 38,103,000 | 36,018,808 | ||||||

| Sabine Pass Liquefaction LLC, 5.625%, 4/15/2023 | 10,865,000 | 11,437,911 | ||||||

| Sabine Pass Liquefaction LLC, 5.875%, 6/30/2026 | 13,222,000 | 14,036,783 | ||||||

| Sabine Pass Liquefaction LLC, 5%, 3/15/2027 | 7,084,000 | 7,116,987 | ||||||

| Sabine Pass Liquefaction LLC, 4.2%, 3/15/2028 | 13,455,000 | 12,802,844 | ||||||

| Tallgrass Energy LP, 4.75%, 10/01/2023 (n) | 21,726,000 | 21,495,161 | ||||||

|

| |||||||

| $ | 139,860,489 | |||||||

| Mortgage-Backed - 1.1% | ||||||||

| Freddie Mac, 3.136%, 10/25/2024 | $ | 36,026,000 | $ | 35,420,176 | ||||

| Freddie Mac, 3.244%, 8/25/2027 | 1,276,000 | 1,230,623 | ||||||

| Freddie Mac, 3.286%, 11/25/2027 | 7,744,000 | 7,477,622 | ||||||

|

| |||||||

| $ | 44,128,421 | |||||||

| Natural Gas - Distribution - 1.6% | ||||||||

| NiSource Finance Corp., 3.85%, 2/15/2023 | $ | 10,894,000 | $ | 10,818,457 | ||||

| NiSource Finance Corp., 4.8%, 2/15/2044 | 4,239,000 | 4,162,415 | ||||||

| NiSource, Inc., 5.65%, 2/01/2045 | 8,731,000 | 9,426,766 | ||||||

| Sempra Energy, 3.25%, 6/15/2027 | 42,879,000 | 39,475,442 | ||||||

|

| |||||||

| $ | 63,883,080 | |||||||

| Network & Telecom - 1.0% | ||||||||

| AT&T, Inc., 2.45%, 6/30/2020 | $ | 5,778,000 | $ | 5,689,468 | ||||

| AT&T, Inc., 3.8%, 3/01/2024 | 15,387,000 | 15,100,938 | ||||||

| AT&T, Inc., 4.5%, 5/15/2035 | 13,000,000 | 11,728,623 | ||||||

| AT&T, Inc., 5.15%, 11/15/2046 (n) | 4,012,000 | 3,653,396 | ||||||

| AT&T, Inc., 5.65%, 2/15/2047 | 4,148,000 | 4,029,051 | ||||||

|

| |||||||

| $ | 40,201,476 | |||||||

13

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Oils - 1.9% | ||||||||

| Marathon Petroleum Corp., 3.4%, 12/15/2020 | $ | 11,333,000 | $ | 11,329,871 | ||||

| Marathon Petroleum Corp., 4.75%, 9/15/2044 | 16,090,000 | 14,763,874 | ||||||

| Marathon Petroleum Corp., 4.5%, 4/01/2048 (n) | 17,824,000 | 15,748,006 | ||||||

| Valero Energy Corp., 3.4%, 9/15/2026 | 20,305,000 | 18,731,606 | ||||||

| Valero Energy Corp., 4.9%, 3/15/2045 | 17,086,000 | 16,300,202 | ||||||

|

| |||||||

| $ | 76,873,559 | |||||||

| Other Banks & Diversified Financials - 3.3% | ||||||||

| Capital One Financial Corp., 3.75%, 4/24/2024 | $ | 5,016,000 | $ | 4,883,362 | ||||

| Capital One Financial Corp., 3.3%, 10/30/2024 | 36,018,000 | 33,976,306 | ||||||

| Citizens Bank N.A., 2.25%, 3/02/2020 | 21,010,000 | 20,710,648 | ||||||

| Citizens Bank N.A., 2.55%, 5/13/2021 | 9,910,000 | 9,642,841 | ||||||

| Discover Bank, 7%, 4/15/2020 | 17,724,000 | 18,515,268 | ||||||

| Groupe BPCE S.A., 4.5%, 3/15/2025 (n) | 6,746,000 | 6,521,796 | ||||||

| Macquarie Bank Ltd., 6.125% to 3/08/2027, FLR (Swap Rate -5yr. + 3.703%) to 12/31/2165 (n) | 4,524,000 | 4,060,290 | ||||||

| SunTrust Banks, Inc., 2.7%, 1/27/2022 | 27,944,000 | 27,051,804 | ||||||

| SunTrust Banks, Inc., 3.3%, 5/15/2026 | 12,449,000 | 11,636,818 | ||||||

|

| |||||||

| $ | 136,999,133 | |||||||

| Pharmaceuticals - 0.8% | ||||||||

| Bayer U.S. Finance LLC, 3.875%, 12/15/2023 (n) | $ | 11,111,000 | $ | 10,941,758 | ||||

| Elanco Animal Health, Inc., 4.9%, 8/28/2028 (n) | 23,321,000 | 23,038,445 | ||||||

|

| |||||||

| $ | 33,980,203 | |||||||

| Pollution Control - 0.7% | �� | |||||||

| Republic Services, Inc., 5.25%, 11/15/2021 | $ | 6,200,000 | $ | 6,508,596 | ||||

| Republic Services, Inc., 3.95%, 5/15/2028 | 22,233,000 | 21,744,907 | ||||||

|

| |||||||

| $ | 28,253,503 | |||||||

| Precious Metals & Minerals - 0.4% | ||||||||

| Teck Resources Ltd., 6%, 8/15/2040 | $ | 4,507,000 | $ | 4,405,592 | ||||

| Teck Resources Ltd., 6.25%, 7/15/2041 | 13,526,000 | 13,492,185 | ||||||

|

| |||||||

| $ | 17,897,777 | |||||||

| Railroad & Shipping - 0.1% | ||||||||

| Canadian Pacific Railway Co., 4.5%, 1/15/2022 | $ | 4,058,000 | $ | 4,170,256 | ||||

| Restaurants - 0.4% | ||||||||

| Starbucks Corp., 4%, 11/15/2028 | $ | 17,610,000 | $ | 17,109,006 | ||||

| Retailers - 1.3% | ||||||||

| Best Buy Co., Inc., 5.5%, 3/15/2021 | $ | 17,673,000 | $ | 18,330,746 | ||||

| Dollar General Corp., 4.15%, 11/01/2025 | 5,508,000 | 5,445,159 | ||||||

14

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Retailers - continued | ||||||||

| Dollar Tree, Inc., 4%, 5/15/2025 | $ | 15,955,000 | $ | 15,329,730 | ||||

| Home Depot, Inc., 3%, 4/01/2026 | 7,218,000 | 6,838,828 | ||||||

| Home Depot, Inc., 4.875%, 2/15/2044 | 8,313,000 | 8,753,724 | ||||||

|

| |||||||

| $ | 54,698,187 | |||||||

| Specialty Chemicals - 0.1% | ||||||||

| Ecolab, Inc., 4.35%, 12/08/2021 | $ | 3,263,000 | $ | 3,345,666 | ||||

| Telecommunications - Wireless - 3.8% | ||||||||

| American Tower Corp., REIT, 4.7%, 3/15/2022 | $ | 7,973,000 | $ | 8,175,020 | ||||

| American Tower Corp., REIT, 3.5%, 1/31/2023 | 3,999,000 | 3,915,603 | ||||||

| American Tower Corp., REIT, 3%, 6/15/2023 | 19,876,000 | 19,039,729 | ||||||

| American Tower Corp., REIT, 4%, 6/01/2025 | 12,172,000 | 11,827,829 | ||||||

| American Tower Corp., REIT, 3.6%, 1/15/2028 | 21,944,000 | 20,187,376 | ||||||

| Crown Castle International Corp., 5.25%, 1/15/2023 | 4,570,000 | 4,765,735 | ||||||

| Crown Castle International Corp., 3.15%, 7/15/2023 | 16,889,000 | 16,209,142 | ||||||

| Crown Castle International Corp., 4.45%, 2/15/2026 | 15,364,000 | 15,181,081 | ||||||

| Crown Castle International Corp., 4%, 3/01/2027 | 9,286,000 | 8,860,564 | ||||||

| Crown Castle International Corp., 3.65%, 9/01/2027 | 8,862,000 | 8,193,710 | ||||||

| SBA Tower Trust, 2.898%, 10/15/2019 (n) | 9,621,000 | 9,567,331 | ||||||

| T-Mobile USA, Inc., 6%, 4/15/2024 | 21,678,000 | 22,219,950 | ||||||

| T-Mobile USA, Inc., 4.75%, 2/01/2028 | 9,336,000 | 8,635,800 | ||||||

|

| |||||||

| $ | 156,778,870 | |||||||

| Tobacco - 0.2% | ||||||||

| Reynolds American, Inc., 3.25%, 6/12/2020 | $ | 1,586,000 | $ | 1,580,636 | ||||

| Reynolds American, Inc., 4%, 6/12/2022 | 5,408,000 | 5,418,498 | ||||||

|

| |||||||

| $ | 6,999,134 | |||||||

| Transportation - Services - 0.1% | ||||||||

| ERAC USA Finance LLC, 7%, 10/15/2037 (n) | $ | 4,480,000 | $ | 5,472,808 | ||||

| U.S. Treasury Obligations - 6.8% | ||||||||

| U.S. Treasury Bonds, 3.5%, 2/15/2039 | $ | 202,235,000 | $ | 207,701,665 | ||||

| U.S. Treasury Bonds, 3%, 2/15/2048 | 76,420,300 | 70,667,881 | ||||||

|

| |||||||

| $ | 278,369,546 | |||||||

| Utilities - Electric Power - 4.2% | ||||||||

| Berkshire Hathaway Energy, 4.5%, 2/01/2045 | $ | 5,432,000 | $ | 5,265,401 | ||||

| Duke Energy Corp., 3.75%, 9/01/2046 | 11,123,000 | 9,486,526 | ||||||

| EDP Finance B.V., 5.25%, 1/14/2021 (n) | 4,828,000 | 4,940,492 | ||||||

| EDP Finance B.V., 3.625%, 7/15/2024 (n) | 10,744,000 | 10,170,614 | ||||||

| Enel Finance International N.V., 2.75%, 4/06/2023 (n) | 34,129,000 | 31,430,932 | ||||||

| Enel Finance International N.V., 4.75%, 5/25/2047 (n) | 9,461,000 | 7,871,946 | ||||||

15

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Utilities - Electric Power - continued | ||||||||

| Eversource Energy, 2.9%, 10/01/2024 | $ | 18,060,000 | $ | 17,165,418 | ||||

| Exelon Corp., 3.497%, 6/01/2022 | 17,819,000 | 17,377,864 | ||||||

| FirstEnergy Corp., 3.9%, 7/15/2027 | 9,834,000 | 9,390,972 | ||||||

| NextEra Energy Capital Holdings, Inc., 3.55%, 5/01/2027 | 20,319,000 | 19,318,695 | ||||||

| NextEra Energy Operating Co., 4.5%, 9/15/2027 (n) | 12,862,000 | 11,865,195 | ||||||

| PPL Capital Funding, Inc., 5%, 3/15/2044 | 3,193,000 | 3,213,323 | ||||||

| Public Service Enterprise Group, 2%, 11/15/2021 | 20,489,000 | 19,465,658 | ||||||

| Southern Co., 2.95%, 7/01/2023 | 6,880,000 | 6,568,892 | ||||||

|

| |||||||

| $ | 173,531,928 | |||||||

| Total Bonds (Identified Cost, $4,129,310,961) | $ | 3,973,314,735 | ||||||

| Floating Rate Loans (r) - 0.3% | ||||||||

| Medical & Health Technology & Services - 0.3% | ||||||||

| DaVita Healthcare Partners, Inc., Term Loan B, 5.052%, 6/24/2021 (Identified Cost, $13,201,307) | $ | 13,130,965 | $ | 13,141,220 | ||||

| Investment Companies (h) - 2.3% | ||||||||

| Money Market Funds - 2.3% | ||||||||

| MFS Institutional Money Market Portfolio, 2.21% (v) (Identified Cost, $96,840,209) | 96,850,112 | $ | 96,840,427 | |||||

| Other Assets, Less Liabilities - 0.9% | 35,427,967 | |||||||

| Net Assets - 100.0% | $ | 4,118,724,349 | ||||||

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund’s investments in affiliated issuers and in unaffiliated issuers were $96,840,427 and $3,986,455,955, respectively. |

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $586,309,387, representing 14.2% of net assets. |

| (q) | Interest received was less than stated coupon rate. |

| (r) | The remaining maturities of floating rate loans may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. These loans may be subject to restrictions on resale. The interest rate shown represents the weighted average of the floating interest rates on settled contracts within the loan facility at period end, unless otherwise indicated. The floating interest rates on settled contracts are determined periodically by reference to a base lending rate and a spread. |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

16

Table of Contents

Portfolio of Investments (unaudited) – continued

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| Restricted Securities | Acquisition Date | Cost | Value | |||||||

| Bayview Financial Revolving Mortgage Loan Trust, FLR, 3.894% (LIBOR - 1mo. + 1.6%), 12/28/2040 | 3/01/06 | $947,317 | $888,338 | |||||||

| % of Net assets | 0.0% | |||||||||

The following abbreviations are used in this report and are defined:

| FLR | Floating Rate. Interest rate resets periodically based on the parenthetically disclosed reference rate plus a spread (if any). The period-end rate reported may not be the current rate. All reference rates are USD unless otherwise noted. |

| ICE | Intercontinental Exchange |

| LIBOR | London Interbank Offered Rate |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

See Notes to Financial Statements

17

Table of Contents

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 10/31/18 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | ||||

Investments in unaffiliated issuers, at value (identified cost, $4,142,512,268) | $3,986,455,955 | |||

Investments in affiliated issuers, at value (identified cost, $96,840,209) | 96,840,427 | |||

Cash | 63,238 | |||

Receivables for | ||||

Investments sold | 2,910,254 | |||

Fund shares sold | 6,108,116 | |||

Interest | 40,669,323 | |||

Total assets | $4,133,047,313 | |||

| Liabilities | ||||

Payables for | ||||

Distributions | $885,569 | |||

Fund shares reacquired | 11,200,119 | |||

Payable to affiliates | ||||

Investment adviser | 87,291 | |||

Shareholder servicing costs | 1,636,338 | |||

Distribution and service fees | 35,889 | |||

Payable for independent Trustees’ compensation | 15,061 | |||

Accrued expenses and other liabilities | 462,697 | |||

Total liabilities | $14,322,964 | |||

Net assets | $4,118,724,349 | |||

| Net assets consist of | ||||

Paid-in capital | $4,335,056,870 | |||

Total distributable earnings (loss) | (216,332,521 | ) | ||

Net assets | $4,118,724,349 | |||

Shares of beneficial interest outstanding | 312,236,989 |

18

Table of Contents

Statement of Assets and Liabilities (unaudited) – continued

| Net assets | Shares outstanding | Net asset value per share (a) | ||||||||||

Class A | $1,581,201,445 | 119,795,340 | $13.20 | |||||||||

Class B | 38,832,497 | 2,948,153 | 13.17 | |||||||||

Class C | 154,670,366 | 11,754,668 | 13.16 | |||||||||

Class I | 1,061,852,660 | 80,518,933 | 13.19 | |||||||||

Class R1 | 5,699,836 | 432,855 | 13.17 | |||||||||

Class R2 | 39,594,358 | 2,999,491 | 13.20 | |||||||||

Class R3 | 155,596,358 | 11,788,039 | 13.20 | |||||||||

Class R4 | 75,496,930 | 5,718,404 | 13.20 | |||||||||

Class R6 | 1,005,779,899 | 76,281,106 | 13.19 | |||||||||

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $13.79 [100 / 95.75 x $13.20]. On sales of $100,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R6. |

See Notes to Financial Statements

19

Table of Contents

Financial Statements

Six months ended 10/31/18 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income (loss) | ||||

Income | ||||

Interest | $86,848,400 | |||

Dividends from affiliated issuers | 1,199,441 | |||

Other | 693 | |||

Total investment income | $88,048,534 | |||

Expenses | ||||

Management fee | $8,657,481 | |||

Distribution and service fees | 3,457,410 | |||

Shareholder servicing costs | 1,968,216 | |||

Administrative services fee | 307,185 | |||

Independent Trustees’ compensation | 41,368 | |||

Custodian fee | 113,063 | |||

Shareholder communications | 403,298 | |||

Audit and tax fees | 37,303 | |||

Legal fees | 22,422 | |||

Miscellaneous | 208,280 | |||

Total expenses | $15,216,026 | |||

Fees paid indirectly | (3,241 | ) | ||

Reduction of expenses by investment adviser and distributor | (246,913 | ) | ||

Net expenses | $14,965,872 | |||

Net investment income (loss) | $73,082,662 | |||

| Realized and unrealized gain (loss) | ||||

Realized gain (loss) (identified cost basis) | ||||

Unaffiliated issuers | $(45,912,242 | ) | ||

Affiliated issuers | 12,827 | |||

Net realized gain (loss) | $(45,899,415 | ) | ||

Change in unrealized appreciation or depreciation | ||||

Unaffiliated issuers | $(62,796,784 | ) | ||

Affiliated issuers | (9,441 | ) | ||

Net unrealized gain (loss) | $(62,806,225 | ) | ||

Net realized and unrealized gain (loss) | $(108,705,640 | ) | ||

Change in net assets from operations | $(35,622,978 | ) |

See Notes to Financial Statements

20

Table of Contents

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| Six months ended 10/31/18 | Year ended 4/30/18 | |||||||

| Change in net assets | (unaudited) | |||||||

| From operations | ||||||||

Net investment income (loss) | $73,082,662 | $146,498,932 | ||||||

Net realized gain (loss) | (45,899,415 | ) | 22,370,348 | |||||

Net unrealized gain (loss) | (62,806,225 | ) | (178,790,288 | ) | ||||

Change in net assets from operations | $(35,622,978 | ) | $(9,921,008 | ) | ||||

Total distributions declared to shareholders (a) | $(72,541,576 | ) | $(149,082,041 | ) | ||||

Change in net assets from fund share transactions | $(768,390,379 | ) | $901,620,983 | |||||

Total change in net assets | $(876,554,933 | ) | $742,617,934 | |||||

| Net assets | ||||||||

At beginning of period | 4,995,279,282 | 4,252,661,348 | ||||||

At end of period (b) | $4,118,724,349 | $4,995,279,282 | ||||||

| (a) | Distributions from net investment income and from net realized gain are no longer required to be separately disclosed. See Note 2. For the year ended April 30, 2018, distributions from net investment income were $149,082,041. |

| (b) | Parenthetical disclosure of accumulated distributions in excess of net investment income is no longer required. See Note 2. For the year ended April 30, 2018, end of period net assets included accumulated distributions in excess of net investment income of $2,736,690. |

See Notes to Financial Statements

21

Table of Contents

Financial Statements

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

Six months 10/31/18 | Year ended | |||||||||||||||||||||||

| Class A | 4/30/18 | 4/30/17 | 4/30/16 | 4/30/15 | 4/30/14 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

Net asset value, beginning of | $13.52 | $13.92 | $13.99 | $14.11 | $14.02 | $14.38 | ||||||||||||||||||

| Income (loss) from investment operations |

| |||||||||||||||||||||||

Net investment income | $0.21 | $0.41 | $0.42 | (c) | $0.44 | $0.46 | $0.44 | |||||||||||||||||

Net realized and unrealized | (0.32 | ) | (0.39 | ) | (0.04 | ) | (0.06 | ) | 0.13 | (0.28 | ) | |||||||||||||

Total from investment | $(0.11 | ) | $0.02 | $0.38 | $0.38 | $0.59 | $0.16 | |||||||||||||||||

| Less distributions declared to shareholders |

| |||||||||||||||||||||||

From net investment income | $(0.21 | ) | $(0.42 | ) | $(0.45 | ) | $(0.46 | ) | $(0.50 | ) | $(0.48 | ) | ||||||||||||

From net realized gain | — | — | — | (0.04 | ) | — | (0.04 | ) | ||||||||||||||||

Total distributions declared to | $(0.21 | ) | $(0.42 | ) | $(0.45 | ) | $(0.50 | ) | $(0.50 | ) | $(0.52 | ) | ||||||||||||

Net asset value, end of | $13.20 | $13.52 | $13.92 | $13.99 | $14.11 | $14.02 | ||||||||||||||||||

Total return (%) (r)(s)(t)(x) | (0.84 | )(n) | 0.08 | 2.73 | (c) | 2.83 | 4.27 | 1.18 | ||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

| |||||||||||||||||||||||

Expenses before expense | 0.79 | (a) | 0.80 | 0.81 | (c) | 0.83 | 0.83 | 0.82 | ||||||||||||||||

Expenses after expense | 0.78 | (a) | 0.79 | 0.80 | (c) | 0.82 | 0.82 | 0.81 | ||||||||||||||||

Net investment income (loss) | 3.11 | (a) | 2.95 | 3.04 | (c) | 3.24 | 3.26 | 3.19 | ||||||||||||||||

Portfolio turnover | 20 | (n) | 38 | 28 | 30 | 29 | 31 | |||||||||||||||||

Net assets at end of period | $1,581,201 | $1,648,508 | $1,597,201 | $1,709,595 | $1,572,022 | $1,489,744 | ||||||||||||||||||

See Notes to Financial Statements

22

Table of Contents

Financial Highlights – continued

Six months ended 10/31/18 | Year ended | |||||||||||||||||||||||

| Class B | 4/30/18 | 4/30/17 | 4/30/16 | 4/30/15 | 4/30/14 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

Net asset value, beginning of | $13.50 | $13.89 | $13.96 | $14.08 | $13.99 | $14.35 | ||||||||||||||||||

| Income (loss) from investment operations |

| |||||||||||||||||||||||

Net investment income | $0.16 | $0.31 | $0.32 | (c) | $0.34 | $0.35 | $0.34 | |||||||||||||||||

Net realized and unrealized | (0.33 | ) | (0.39 | ) | (0.05 | ) | (0.06 | ) | 0.13 | (0.29 | ) | |||||||||||||

Total from investment | $(0.17 | ) | $(0.08 | ) | $0.27 | $0.28 | $0.48 | $0.05 | ||||||||||||||||

| Less distributions declared to shareholders |

| |||||||||||||||||||||||

From net investment income | $(0.16 | ) | $(0.31 | ) | $(0.34 | ) | $(0.36 | ) | $(0.39 | ) | $(0.37 | ) | ||||||||||||

From net realized gain | — | — | — | (0.04 | ) | — | (0.04 | ) | ||||||||||||||||

Total distributions declared to | $(0.16 | ) | $(0.31 | ) | $(0.34 | ) | $(0.40 | ) | $(0.39 | ) | $(0.41 | ) | ||||||||||||

Net asset value, end of | $13.17 | $13.50 | $13.89 | $13.96 | $14.08 | $13.99 | ||||||||||||||||||

Total return (%) (r)(s)(t)(x) | (1.29 | )(n) | (0.60 | ) | 1.96 | (c) | 2.06 | 3.49 | 0.42 | |||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

| |||||||||||||||||||||||

Expenses before expense | 1.54 | (a) | 1.55 | 1.56 | (c) | 1.58 | 1.58 | 1.57 | ||||||||||||||||

Expenses after expense | 1.53 | (a) | 1.54 | 1.55 | (c) | 1.57 | 1.57 | 1.57 | ||||||||||||||||

Net investment income (loss) | 2.36 | (a) | 2.20 | 2.30 | (c) | 2.50 | 2.52 | 2.44 | ||||||||||||||||

Portfolio turnover | 20 | (n) | 38 | 28 | 30 | 29 | 31 | |||||||||||||||||

Net assets at end of period | $38,832 | $47,698 | $61,123 | $72,298 | $80,296 | $87,094 | ||||||||||||||||||

See Notes to Financial Statements

23

Table of Contents

Financial Highlights – continued

Six months 10/31/18 | Year ended | |||||||||||||||||||||||

| Class C | 4/30/18 | 4/30/17 | 4/30/16 | 4/30/15 | 4/30/14 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

Net asset value, beginning of | $13.48 | $13.88 | $13.94 | $14.06 | $13.97 | $14.33 | ||||||||||||||||||

| Income (loss) from investment operations |

| |||||||||||||||||||||||

Net investment income | $0.16 | $0.31 | $0.32 | (c) | $0.34 | $0.35 | $0.34 | |||||||||||||||||

Net realized and unrealized | (0.32 | ) | (0.40 | ) | (0.04 | ) | (0.06 | ) | 0.13 | (0.29 | ) | |||||||||||||

Total from investment | $(0.16 | ) | $(0.09 | ) | $0.28 | $0.28 | $0.48 | $0.05 | ||||||||||||||||

| Less distributions declared to shareholders |

| |||||||||||||||||||||||

From net investment income | $(0.16 | ) | $(0.31 | ) | $(0.34 | ) | $(0.36 | ) | $(0.39 | ) | $(0.37 | ) | ||||||||||||

From net realized gain | — | — | — | (0.04 | ) | — | (0.04 | ) | ||||||||||||||||

Total distributions declared to | $(0.16 | ) | $(0.31 | ) | $(0.34 | ) | $(0.40 | ) | $(0.39 | ) | $(0.41 | ) | ||||||||||||

Net asset value, end of | $13.16 | $13.48 | $13.88 | $13.94 | $14.06 | $13.97 | ||||||||||||||||||

Total return (%) (r)(s)(t)(x) | (1.22 | )(n) | (0.67 | ) | 2.04 | (c) | 2.06 | 3.50 | 0.42 | |||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

| |||||||||||||||||||||||

Expenses before expense | 1.54 | (a) | 1.55 | 1.56 | (c) | 1.58 | 1.58 | 1.57 | ||||||||||||||||

Expenses after expense | 1.53 | (a) | 1.54 | 1.56 | (c) | 1.57 | 1.57 | 1.57 | ||||||||||||||||

Net investment income (loss) | 2.36 | (a) | 2.20 | 2.30 | (c) | 2.50 | 2.52 | 2.45 | ||||||||||||||||

Portfolio turnover | 20 | (n) | 38 | 28 | 30 | 29 | 31 | |||||||||||||||||

Net assets at end of period | $154,670 | $182,315 | $242,889 | $264,424 | $271,920 | $276,008 | ||||||||||||||||||

See Notes to Financial Statements

24

Table of Contents

Financial Highlights – continued

Six months 10/31/18 | Year ended | |||||||||||||||||||||||

| Class I | 4/30/18 | 4/30/17 | 4/30/16 | 4/30/15 | 4/30/14 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

Net asset value, beginning of | $13.51 | $13.91 | $13.98 | $14.11 | $14.01 | $14.38 | ||||||||||||||||||

| Income (loss) from investment operations |

| |||||||||||||||||||||||

Net investment income | $0.23 | $0.45 | $0.45 | (c) | $0.47 | $0.49 | $0.47 | |||||||||||||||||

Net realized and unrealized | (0.32 | ) | (0.40 | ) | (0.04 | ) | (0.06 | ) | 0.14 | (0.29 | ) | |||||||||||||

Total from investment | $(0.09 | ) | $0.05 | $0.41 | $0.41 | $0.63 | $0.18 | |||||||||||||||||

| Less distributions declared to shareholders |

| |||||||||||||||||||||||

From net investment income | $(0.23 | ) | $(0.45 | ) | $(0.48 | ) | $(0.50 | ) | $(0.53 | ) | $(0.51 | ) | ||||||||||||

From net realized gain | — | — | — | (0.04 | ) | — | (0.04 | ) | ||||||||||||||||

Total distributions declared to | $(0.23 | ) | $(0.45 | ) | $(0.48 | ) | $(0.54 | ) | $(0.53 | ) | $(0.55 | ) | ||||||||||||

Net asset value, end of | $13.19 | $13.51 | $13.91 | $13.98 | $14.11 | $14.01 | ||||||||||||||||||

Total return (%) (r)(s)(t)(x) | (0.72 | )(n) | 0.33 | 2.99 | (c) | 3.01 | 4.60 | 1.36 | ||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

| |||||||||||||||||||||||

Expenses before expense | 0.54 | (a) | 0.55 | 0.56 | (c) | 0.57 | 0.58 | 0.57 | ||||||||||||||||

Expenses after expense | 0.53 | (a) | 0.54 | 0.56 | (c) | 0.57 | 0.57 | 0.57 | ||||||||||||||||

Net investment income (loss) | 3.36 | (a) | 3.19 | 3.25 | (c) | 3.48 | 3.50 | 3.43 | ||||||||||||||||

Portfolio turnover | 20 | (n) | 38 | 28 | 30 | 29 | 31 | |||||||||||||||||

Net assets at end of period | $1,061,853 | $1,781,450 | $2,005,193 | $720,809 | $553,364 | $446,377 | ||||||||||||||||||

See Notes to Financial Statements

25

Table of Contents

Financial Highlights – continued

Six months 10/31/18 | Year ended | |||||||||||||||||||||||

| Class R1 | 4/30/18 | 4/30/17 | 4/30/16 | 4/30/15 | 4/30/14 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

Net asset value, beginning of | $13.49 | $13.89 | $13.95 | $14.07 | $13.98 | $14.34 | ||||||||||||||||||

| Income (loss) from investment operations |

| |||||||||||||||||||||||

Net investment income | $0.16 | $0.31 | $0.32 | (c) | $0.34 | $0.36 | $0.34 | |||||||||||||||||

Net realized and unrealized | (0.32 | ) | (0.40 | ) | (0.04 | ) | (0.06 | ) | 0.12 | (0.29 | ) | |||||||||||||

Total from investment | $(0.16 | ) | $(0.09 | ) | $0.28 | $0.28 | $0.48 | $0.05 | ||||||||||||||||

| Less distributions declared to shareholders |

| |||||||||||||||||||||||

From net investment income | $(0.16 | ) | $(0.31 | ) | $(0.34 | ) | $(0.36 | ) | $(0.39 | ) | $(0.37 | ) | ||||||||||||

From net realized gain | — | — | — | (0.04 | ) | — | (0.04 | ) | ||||||||||||||||

Total distributions declared to | $(0.16 | ) | $(0.31 | ) | $(0.34 | ) | $(0.40 | ) | $(0.39 | ) | $(0.41 | ) | ||||||||||||

Net asset value, end of | $13.17 | $13.49 | $13.89 | $13.95 | $14.07 | $13.98 | ||||||||||||||||||

Total return (%) (r)(s)(t)(x) | (1.21 | )(n) | (0.67 | ) | 2.04 | (c) | 2.06 | 3.49 | 0.42 | |||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

| |||||||||||||||||||||||

Expenses before expense | 1.54 | (a) | 1.55 | 1.56 | (c) | 1.58 | 1.58 | 1.57 | ||||||||||||||||

Expenses after expense | 1.53 | (a) | 1.54 | 1.56 | (c) | 1.57 | 1.57 | 1.57 | ||||||||||||||||

Net investment income (loss) | 2.36 | (a) | 2.20 | 2.30 | (c) | 2.50 | 2.53 | 2.44 | ||||||||||||||||

Portfolio turnover | 20 | (n) | 38 | 28 | 30 | 29 | 31 | |||||||||||||||||

Net assets at end of period | $5,700 | $6,101 | $6,780 | $7,145 | $7,978 | $21,548 | ||||||||||||||||||

See Notes to Financial Statements

26

Table of Contents

Financial Highlights – continued

Six months 10/31/18 | Year ended | |||||||||||||||||||||||

| Class R2 | 4/30/18 | 4/30/17 | 4/30/16 | 4/30/15 | 4/30/14 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

Net asset value, beginning of | $13.53 | $13.92 | $13.99 | $14.11 | $14.02 | $14.38 | ||||||||||||||||||

| Income (loss) from investment operations |

| |||||||||||||||||||||||

Net investment income | $0.19 | $0.38 | $0.39 | (c) | $0.41 | $0.42 | $0.41 | |||||||||||||||||

Net realized and unrealized | (0.33 | ) | (0.39 | ) | (0.05 | ) | (0.06 | ) | 0.13 | (0.29 | ) | |||||||||||||

Total from investment | $(0.14 | ) | $(0.01 | ) | $0.34 | $0.35 | $0.55 | $0.12 | ||||||||||||||||

| Less distributions declared to shareholders |

| |||||||||||||||||||||||

From net investment income | $(0.19 | ) | $(0.38 | ) | $(0.41 | ) | $(0.43 | ) | $(0.46 | ) | $(0.44 | ) | ||||||||||||

From net realized gain | — | — | — | (0.04 | ) | — | (0.04 | ) | ||||||||||||||||

Total distributions declared to | $(0.19 | ) | $(0.38 | ) | $(0.41 | ) | $(0.47 | ) | $(0.46 | ) | $(0.48 | ) | ||||||||||||

Net asset value, end of | $13.20 | $13.53 | $13.92 | $13.99 | $14.11 | $14.02 | ||||||||||||||||||

Total return (%) (r)(s)(t)(x) | (1.04 | )(n) | (0.09 | ) | 2.47 | (c) | 2.58 | 4.01 | 0.93 | |||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

| |||||||||||||||||||||||

Expenses before expense | 1.04 | (a) | 1.05 | 1.06 | (c) | 1.08 | 1.08 | 1.07 | ||||||||||||||||

Expenses after expense | 1.03 | (a) | 1.04 | 1.05 | (c) | 1.07 | 1.07 | 1.07 | ||||||||||||||||

Net investment income (loss) | 2.86 | (a) | 2.70 | 2.79 | (c) | 3.00 | 3.01 | 2.94 | ||||||||||||||||

Portfolio turnover | 20 | (n) | 38 | 28 | 30 | 29 | 31 | |||||||||||||||||

Net assets at end of period | $39,594 | $43,827 | $49,948 | $58,938 | $74,307 | $77,290 | ||||||||||||||||||

See Notes to Financial Statements

27

Table of Contents

Financial Highlights – continued

Six months 10/31/18 | Year ended | |||||||||||||||||||||||

| Class R3 | 4/30/18 | 4/30/17 | 4/30/16 | 4/30/15 | 4/30/14 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

Net asset value, beginning of | $13.52 | $13.92 | $13.99 | $14.11 | $14.02 | $14.38 | ||||||||||||||||||

| Income (loss) from investment operations |

| |||||||||||||||||||||||

Net investment income | $0.21 | $0.41 | $0.43 | (c) | $0.44 | $0.46 | $0.44 | |||||||||||||||||

Net realized and unrealized | (0.32 | ) | (0.39 | ) | (0.05 | ) | (0.06 | ) | 0.13 | (0.28 | ) | |||||||||||||

Total from investment | $(0.11 | ) | $0.02 | $0.38 | $0.38 | $0.59 | $0.16 | |||||||||||||||||

| Less distributions declared to shareholders |

| |||||||||||||||||||||||

From net investment income | $(0.21 | ) | $(0.42 | ) | $(0.45 | ) | $(0.46 | ) | $(0.50 | ) | $(0.48 | ) | ||||||||||||

From net realized gain | — | — | — | (0.04 | ) | — | (0.04 | ) | ||||||||||||||||

Total distributions declared to | $(0.21 | ) | $(0.42 | ) | $(0.45 | ) | $(0.50 | ) | $(0.50 | ) | $(0.52 | ) | ||||||||||||

Net asset value, end of | $13.20 | $13.52 | $13.92 | $13.99 | $14.11 | $14.02 | ||||||||||||||||||

Total return (%) (r)(s)(t)(x) | (0.84 | )(n) | 0.08 | 2.73 | (c) | 2.83 | 4.27 | 1.18 | ||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

| |||||||||||||||||||||||

Expenses before expense | 0.79 | (a) | 0.81 | 0.81 | (c) | 0.83 | 0.83 | 0.82 | ||||||||||||||||

Expenses after expense | 0.78 | (a) | 0.80 | 0.80 | (c) | 0.82 | 0.82 | 0.82 | ||||||||||||||||

Net investment income (loss) | 3.11 | (a) | 2.95 | 3.04 | (c) | 3.24 | 3.26 | 3.19 | ||||||||||||||||

Portfolio turnover | 20 | (n) | 38 | 28 | 30 | 29 | 31 | |||||||||||||||||

Net assets at end of period | $155,596 | $167,404 | $61,292 | $65,655 | $69,696 | $63,349 | ||||||||||||||||||

See Notes to Financial Statements

28

Table of Contents

Financial Highlights – continued

Six months 10/31/18 | Year ended | |||||||||||||||||||||||

| Class R4 | 4/30/18 | 4/30/17 | 4/30/16 | 4/30/15 | 4/30/14 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

Net asset value, beginning of | $13.53 | $13.93 | $13.99 | $14.11 | $14.02 | $14.38 | ||||||||||||||||||

| Income (loss) from investment operations |

| |||||||||||||||||||||||

Net investment income | $0.23 | $0.45 | $0.46 | (c) | $0.48 | $0.49 | $0.48 | |||||||||||||||||

Net realized and unrealized | (0.33 | ) | (0.40 | ) | (0.04 | ) | (0.06 | ) | 0.14 | (0.29 | ) | |||||||||||||

Total from investment | $(0.10 | ) | $0.05 | $0.42 | $0.42 | $0.63 | $0.19 | |||||||||||||||||

| Less distributions declared to shareholders |

| |||||||||||||||||||||||

From net investment income | $(0.23 | ) | $(0.45 | ) | $(0.48 | ) | $(0.50 | ) | $(0.54 | ) | $(0.51 | ) | ||||||||||||

From net realized gain | — | — | — | (0.04 | ) | — | (0.04 | ) | ||||||||||||||||

Total distributions declared to | $(0.23 | ) | $(0.45 | ) | $(0.48 | ) | $(0.54 | ) | $(0.54 | ) | $(0.55 | ) | ||||||||||||

Net asset value, end of | $13.20 | $13.53 | $13.93 | $13.99 | $14.11 | $14.02 | ||||||||||||||||||

Total return (%) (r)(s)(t)(x) | (0.79 | )(n) | 0.33 | 3.06 | (c) | 3.09 | 4.53 | 1.43 | ||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

| |||||||||||||||||||||||

Expenses before expense | 0.54 | (a) | 0.55 | 0.56 | (c) | 0.58 | 0.58 | 0.57 | ||||||||||||||||

Expenses after expense | 0.53 | (a) | 0.54 | 0.56 | (c) | 0.57 | 0.57 | 0.57 | ||||||||||||||||

Net investment income (loss) | 3.36 | (a) | 3.19 | 3.29 | (c) | 3.49 | 3.51 | 3.44 | ||||||||||||||||

Portfolio turnover | 20 | (n) | 38 | 28 | 30 | 29 | 31 | |||||||||||||||||

Net assets at end of period | $75,497 | $74,027 | $169,661 | $148,266 | $150,116 | $139,924 | ||||||||||||||||||

See Notes to Financial Statements

29

Table of Contents

Financial Highlights – continued

Six months 10/31/18 | Year ended | |||||||||||||||||||||||

| Class R6 | 4/30/18 | 4/30/17 | 4/30/16 | 4/30/15 | 4/30/14 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

Net asset value, beginning of | $13.51 | $13.91 | $13.98 | $14.10 | $14.01 | $14.38 | ||||||||||||||||||

| Income (loss) from investment operations |

| |||||||||||||||||||||||

Net investment income | $0.23 | $0.46 | $0.47 | (c) | $0.49 | $0.51 | $0.49 | |||||||||||||||||

Net realized and unrealized | (0.32 | ) | (0.39 | ) | (0.04 | ) | (0.06 | ) | 0.13 | (0.29 | ) | |||||||||||||

Total from investment | $(0.09 | ) | $0.07 | $0.43 | $0.43 | $0.64 | $0.20 | |||||||||||||||||

| Less distributions declared to shareholders |

| |||||||||||||||||||||||

From net investment income | $(0.23 | ) | $(0.47 | ) | $(0.50 | ) | $(0.51 | ) | $(0.55 | ) | $(0.53 | ) | ||||||||||||

From net realized gain | — | — | — | (0.04 | ) | — | (0.04 | ) | ||||||||||||||||

Total distributions declared to | $(0.23 | ) | $(0.47 | ) | $(0.50 | ) | $(0.55 | ) | $(0.55 | ) | $(0.57 | ) | ||||||||||||

Net asset value, end of | $13.19 | $13.51 | $13.91 | $13.98 | $14.10 | $14.01 | ||||||||||||||||||

Total return (%) (r)(s)(t)(x) | (0.67 | )(n) | 0.43 | 3.09 | (c) | 3.20 | 4.64 | 1.47 | ||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

| |||||||||||||||||||||||

Expenses before expense | 0.44 | (a) | 0.45 | 0.46 | (c) | 0.46 | 0.47 | 0.46 | ||||||||||||||||

Expenses after expense | 0.43 | (a) | 0.44 | 0.45 | (c) | 0.45 | 0.46 | 0.46 | ||||||||||||||||

Net investment income (loss) | 3.45 | (a) | 3.27 | 3.39 | (c) | 3.57 | 3.61 | 3.57 | ||||||||||||||||

Portfolio turnover | 20 | (n) | 38 | 28 | 30 | 29 | 31 | |||||||||||||||||

Net assets at end of period | $1,005,780 | $1,043,950 | $58,575 | $44,475 | $26,041 | $18,414 | ||||||||||||||||||

| (a) | Annualized. |

| (c) | Amount reflects a one-time reimbursement of expenses by the custodian (or former custodian) without which net investment income and performance would be lower and expenses would be higher. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (n) | Not annualized. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (t) | Total returns do not include any applicable sales charges. |

| (x) | The net asset values and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

30

Table of Contents

(unaudited)

(1) Business and Organization

MFS Corporate Bond Fund (the fund) is a diversified series of MFS Series Trust IX (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

(2) Significant Accounting Policies

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund invests in high-yield securities rated below investment grade. Investments in below investment grade quality securities can involve a substantially greater risk of default or can already be in default, and their values can decline significantly. Below investment grade quality securities tend to be more sensitive to adverse news about the issuer, or the market or economy in general, than higher quality debt instruments. The fund invests in foreign securities. Investments in foreign securities are vulnerable to the effects of changes in the relative values of the local currency and the U.S. dollar and to the effects of changes in each country’s market, economic, industrial, political, regulatory, geopolitical, and other conditions.

In March 2017, the FASB issued Accounting Standards Update 2017-08, Receivables – Nonrefundable Fees and Other Costs (Subtopic 310-20) – Premium Amortization on Purchased Callable Debt Securities (“ASU 2017-08”). For entities that hold callable debt securities at a premium, ASU 2017-08 requires that the premium be amortized to the earliest call date. ASU 2017-08 will be effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Management has evaluated the potential impacts of ASU 2017-08 and believes that adoption of ASU 2017-08 will not have a material effect on the fund’s overall financial position or its overall results of operations.

In August 2018, the FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820) – Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”) which introduces new fair value disclosure requirements as well as eliminates and modifies certain existing fair value disclosure requirements. ASU 2018-13 would be effective for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years; however, management has elected to early adopt ASU 2018-13 effective with the

31

Table of Contents

Notes to Financial Statements (unaudited) – continued

current reporting period. The impact of the fund’s adoption was limited to changes in the fund’s financial statement disclosures regarding fair value, primarily those disclosures related to transfers between levels of the fair value hierarchy.

In August 2018, the Securities and Exchange Commission (SEC) released its Final Rule on Disclosure Update and Simplification (the “Final Rule”) which is intended to simplify an issuer’s disclosure compliance efforts by removing redundant or outdated disclosure requirements without significantly altering the mix of information provided to investors. Effective with the current reporting period, the fund adopted the Final Rule with the impacts being that the fund is no longer required to present the components of distributable earnings on the Statement of Assets and Liabilities or the sources of distributions to shareholders and the amount of undistributed net investment income on the Statements of Changes in Net Assets.