UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02464

MFS SERIES TRUST IX

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199 (Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111Huntington Avenue Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: April 30*

Date of reporting period: April 30, 2024

*This Form N-CSR pertains to the following series of the Registrant: MFS Corporate Bond Fund, MFS Limited Maturity Fund, MFS Municipal Limited Maturity Fund, and MFS Total Return Bond Fund. The remaining series of the Registrant has a fiscal year end of October 31.

ITEM 1. REPORTS TO STOCKHOLDERS.

Item 1(a):

Annual Report

April 30, 2024

| 1 |

| 3 |

| 5 |

| 8 |

| 10 |

| 26 |

| 28 |

| 29 |

| 30 |

| 36 |

| 51 |

| 53 |

| 57 |

| 58 |

| 58 |

| 58 |

| 58 |

| 58 |

| 59 |

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

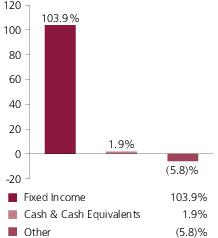

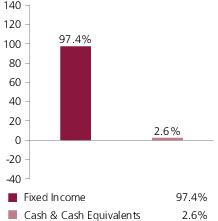

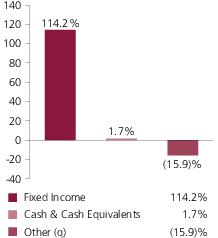

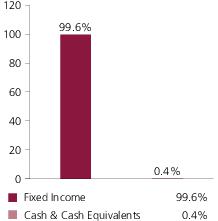

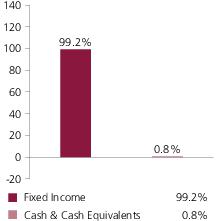

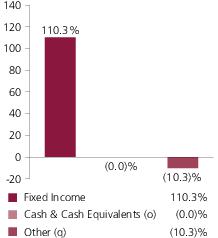

Portfolio structure (i)

Fixed income sectors (i)

| Investment Grade Corporates | 78.5% |

| U.S. Treasury Securities | 10.2% |

| High Yield Corporates | 5.6% |

| Emerging Markets Bonds | 4.6% |

| Non-U.S. Government Bonds | 1.3% |

| Collateralized Loan Obligations | 1.2% |

| Commercial Mortgage-Backed Securities | 0.9% |

| Asset-Backed Securities | 0.7% |

| Municipal Bonds | 0.5% |

| Residential Mortgage-Backed Securities | 0.4% |

Composition including fixed income credit quality (a)(i)

| AAA | 3.3% |

| AA | 3.2% |

| A | 27.8% |

| BBB | 51.5% |

| BB | 5.6% |

| B | 2.3% |

| C (o) | 0.0% |

| U.S. Government | 4.4% |

| Not Rated | 5.8% |

| Cash & Cash Equivalents | 1.9% |

| Other | (5.8)% |

Portfolio facts

| Average Duration (d) | 6.6 |

| Average Effective Maturity (m) | 10.1 yrs. |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. U.S. Government includes securities issued by the U.S. Department of the Treasury. Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. |

The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies.

Portfolio Composition - continued

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. The Average Duration calculation reflects the impact of the equivalent exposure of derivative positions, if any. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening feature (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

Where the fund holds convertible bonds, they are treated as part of the equity portion of the portfolio.

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Other includes equivalent exposure from currency derivatives and/or any offsets to derivative positions and may be negative.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

Management Review

Summary of Results

For the twelve months ended April 30, 2024, Class A shares of the MFS Corporate Bond Fund (fund) provided a total return of 1.50%, at net asset value. This compares with a return of 0.76% for the fund’s benchmark, the Bloomberg U.S. Credit Index.

Market Environment

In response to the strongest inflationary period in four decades, global central banks tightened monetary policy significantly during the reporting period, helping reduce price pressures, although more work is needed before inflation returns to target. Geopolitical strains remained high amid ongoing conflicts in Ukraine and in the Middle East, while relations between China and the US remained tense. The US sought to restrict the flow of advanced technologies to China and China looked to use its industrial overcapacity to increase exports to developed markets to bolster its slow-growing domestic economy. The conflict in the Middle East caused trade flow disruptions between Asia and Europe as shipping traffic was routed away from the Red Sea.

Although inflation has yet to reach central banks’ targets, policymakers have indicated their desire to begin cutting rates in the months ahead, although stickier-than-expected inflation could delay cuts in the US. The prospects for easier monetary policy along with resilient global economic growth have been supportive factors for risky assets, such as equities and high-yield bonds. Long-term interest rates moderated during the latter half of the reporting period, although rising government debt levels remained a concern over the medium term. Advancements in artificial intelligence and the adoption of novel weight-loss drugs were two areas of focus for investors during the period.

Factors Affecting Performance

Relative to the Bloomberg U.S. Credit Index, the fund’s exposure to “BB” and “B” rated(r) securities, which are not held by the benchmark, and its underweight exposure to “AAA” rated bonds contributed to relative performance. From a sector perspective, favorable bond selection within “BBB” rated bonds, primarily across the banking, communications, and REITS sectors, also strengthened relative returns.

Conversely, the fund’s exposure to “AA” rated securities, most notably within the treasury sector, detracted from relative performance. An overweight exposure to the electric utility sector also hindered relative results.

The fund’s cash and/or cash equivalents position during the period was another detractor from relative performance.

Respectfully,

Portfolio Manager(s)

Alexander Mackey and John Mitchell

| (r) | Securities rated “BBB”, “Baa”, or higher are considered investment grade; securities rated “BB”, “Ba”, or below are considered non-investment grade. Ratings are assigned to underlying securities utilizing ratings from Moody's, Fitch, and Standard & Poor's and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the |

Management Review - continued

lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). For securities that are not rated by any of the rating agencies, the security is considered Not Rated.

The views expressed in this report are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

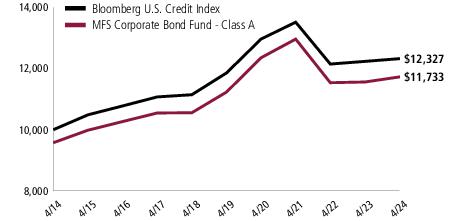

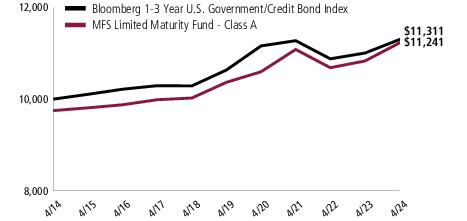

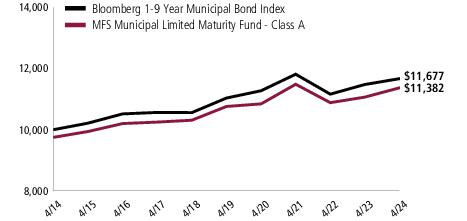

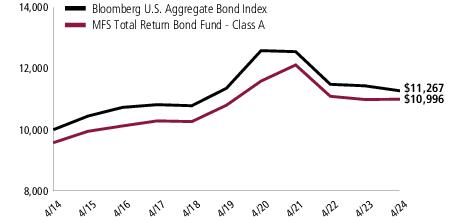

Performance Summary THROUGH 4/30/24

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

Performance Summary - continued

Total Returns through 4/30/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr |

| A | 5/08/1974 | 1.50% | 0.88% | 2.05% |

| B | 9/07/1993 | 0.74% | 0.14% | 1.30% |

| C | 1/03/1994 | 0.73% | 0.12% | 1.30% |

| I | 1/02/1997 | 1.67% | 1.11% | 2.30% |

| R1 | 4/01/2005 | 0.65% | 0.12% | 1.30% |

| R2 | 10/31/2003 | 1.16% | 0.63% | 1.80% |

| R3 | 4/01/2005 | 1.42% | 0.88% | 2.05% |

| R4 | 4/01/2005 | 1.67% | 1.13% | 2.31% |

| R6 | 6/01/2012 | 1.76% | 1.21% | 2.40% |

Comparative benchmark(s)

| Bloomberg U.S. Credit Index (f) | 0.76% | 0.78% | 2.11% |

Average annual with sales charge

| | | | |

A

With Initial Sales Charge (4.25%) | (2.81)% | 0.01% | 1.61% |

B

With CDSC (Declining over six years from 4% to 0%) (v) | (3.15)% | (0.20)% | 1.30% |

C

With CDSC (1% for 12 months) (v) | (0.24)% | 0.12% | 1.30% |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (v) | Assuming redemption at the end of the applicable period. |

Benchmark Definition(s)

Bloomberg U.S. Credit Index(a) – a market capitalization-weighted index that measures the performance of publicly issued, SEC-registered, U.S. corporate and specified foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements.

It is not possible to invest directly in an index.

| (a) | Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith. |

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented.

Performance Summary - continued

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund's performance results would be less favorable. Please see the prospectus and financial statements for complete details.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

Expense Table

Fund expenses borne by the shareholders during the period,

November 1, 2023 through April 30, 2024

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2023 through April 30, 2024.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Table - continued

Share

Class | | Annualized

Expense

Ratio | Beginning

Account Value

11/01/23 | Ending

Account Value

4/30/24 | Expenses

Paid During

Period (p)

11/01/23-4/30/24 |

| A | Actual | 0.76% | $1,000.00 | $1,078.76 | $3.93 |

| Hypothetical (h) | 0.76% | $1,000.00 | $1,021.08 | $3.82 |

| B | Actual | 1.52% | $1,000.00 | $1,074.89 | $7.84 |

| Hypothetical (h) | 1.52% | $1,000.00 | $1,017.30 | $7.62 |

| C | Actual | 1.52% | $1,000.00 | $1,074.04 | $7.84 |

| Hypothetical (h) | 1.52% | $1,000.00 | $1,017.30 | $7.62 |

| I | Actual | 0.51% | $1,000.00 | $1,079.23 | $2.64 |

| Hypothetical (h) | 0.51% | $1,000.00 | $1,022.33 | $2.56 |

| R1 | Actual | 1.51% | $1,000.00 | $1,073.99 | $7.79 |

| Hypothetical (h) | 1.51% | $1,000.00 | $1,017.35 | $7.57 |

| R2 | Actual | 1.01% | $1,000.00 | $1,076.48 | $5.21 |

| Hypothetical (h) | 1.01% | $1,000.00 | $1,019.84 | $5.07 |

| R3 | Actual | 0.77% | $1,000.00 | $1,077.81 | $3.98 |

| Hypothetical (h) | 0.77% | $1,000.00 | $1,021.03 | $3.87 |

| R4 | Actual | 0.51% | $1,000.00 | $1,079.13 | $2.64 |

| Hypothetical (h) | 0.51% | $1,000.00 | $1,022.33 | $2.56 |

| R6 | Actual | 0.42% | $1,000.00 | $1,079.73 | $2.17 |

| Hypothetical (h) | 0.42% | $1,000.00 | $1,022.77 | $2.11 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Portfolio of Investments

4/30/24

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Issuer | | | Shares/Par | Value ($) |

| Bonds – 97.0% |

| Aerospace & Defense – 2.6% |

| Boeing Co., 2.196%, 2/04/2026 | | $ | 8,727,000 | $8,140,332 |

| Boeing Co., 5.15%, 5/01/2030 | | | 15,298,000 | 14,468,699 |

| Boeing Co., 6.388%, 5/01/2031 (n)(w) | | | 6,580,000 | 6,609,558 |

| Boeing Co., 5.805%, 5/01/2050 | | | 36,763,000 | 32,532,438 |

| General Dynamics Corp., 3.625%, 4/01/2030 | | | 13,022,000 | 11,953,975 |

| L3 Harris Technologies, Inc., 5.4%, 1/15/2027 | | | 11,915,000 | 11,893,857 |

| L3 Harris Technologies, Inc., 5.4%, 7/31/2033 | | | 9,532,000 | 9,284,907 |

| TransDigm, Inc., 6.875%, 12/15/2030 (n) | | | 19,115,000 | 19,244,971 |

| | | | | $114,128,737 |

| Apparel Manufacturers – 0.3% |

| Tapestry, Inc., 7%, 11/27/2026 | | $ | 4,027,000 | $4,104,021 |

| Tapestry, Inc., 4.125%, 7/15/2027 | | | 2,710,000 | 2,554,040 |

| Tapestry, Inc., 3.05%, 3/15/2032 | | | 5,674,000 | 4,506,681 |

| | | | | $11,164,742 |

| Asset-Backed & Securitized – 3.1% |

| 3650R Commercial Mortgage Trust, 2021-PF1, “XA”, 1.126%, 11/15/2054 (i) | | $ | 111,783,707 | $5,143,392 |

| ACREC 2021-FL1 Ltd., “A”, FLR, 6.583% ((SOFR - 1mo. + 0.11448%) + 1.15%), 10/16/2036 (n) | | | 15,741,247 | 15,651,774 |

| Arbor Realty Trust, Inc., CLO, 2021-FL4, “AS”, FLR, 7.135% ((SOFR - 1mo. + 0.11448%) + 1.7%), 11/15/2036 (n) | | | 4,841,000 | 4,776,187 |

| ARI Fleet Lease Trust, 2023-A, “A2”, 5.41%, 2/17/2032 (n) | | | 3,767,459 | 3,755,117 |

| Bayview Financial Revolving Mortgage Loan Trust, FLR, 7.033% ((SOFR - 1mo. + 0.11448%) + 1.6%), 12/28/2040 (n) | | | 218,515 | 331,771 |

| BDS 2021-FL7 Ltd., “B”, FLR, 6.933% ((SOFR - 1mo. + 0.11448%) + 1.5%), 6/16/2036 (n) | | | 4,505,000 | 4,422,450 |

| Benchmark 2021-B27 Mortgage Trust, “XA”, 1.374%, 7/15/2054 (i) | | | 198,741,051 | 11,463,583 |

| JPMorgan Chase Commercial Mortgage Securities Corp., 5.754%, 7/15/2042 (n) | | | 23,552 | 20,572 |

| KREF 2018-FT1 Ltd., “A”, FLR, 6.501% ((SOFR - 1mo. + 0.11448%) + 1.07%), 2/15/2039 (n) | | | 8,240,294 | 8,096,147 |

| KREF 2018-FT1 Ltd., “AS”, FLR, 6.731% ((SOFR - 1mo. + 0.11448%) + 1.3%), 2/15/2039 (n) | | | 9,074,500 | 8,752,609 |

| LAD Auto Receivables Trust, 2023-2A, “A2”, 5.93%, 6/15/2027 (n) | | | 8,577,838 | 8,582,947 |

| MF1 2022-FL8 Ltd., “A”, FLR, 6.669% (SOFR - 1mo. + 1.35%), 2/19/2037 (n) | | | 12,662,588 | 12,568,834 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| OBX Trust, 2023-NQM5, “A1”, 5.988%, 12/01/2064 (n) | | $ | 5,605,563 | $5,556,395 |

| OBX Trust, 2024-NQM1, “A1”, 5.928%, 11/25/2063 (n) | | | 4,479,180 | 4,437,273 |

| OBX Trust, 2024-NQM3, “A1”, 6.129%, 12/25/2063 (n) | | | 5,999,032 | 5,971,838 |

| PFP III 2021-8 Ltd., “A”, FLR, 6.433% ((SOFR - 1mo. + 0.11448%) + 1%), 8/09/2037 (n) | | | 3,205,414 | 3,183,924 |

| PFP III 2021-8 Ltd., “AS”, FLR, 6.683% ((SOFR - 1mo. + 0.11448%) + 1.25%), 8/09/2037 (n) | | | 17,557,000 | 17,087,965 |

| SBNA Auto Lease Trust, 2023-A, “A2”, 6.27%, 4/20/2026 (n) | | | 8,318,977 | 8,347,740 |

| Toyota Lease Owner Trust, 2023-A, “A2”, 5.3%, 8/20/2025 (n) | | | 2,234,203 | 2,231,599 |

| Virginia Power Fuel Securitization LLC, 5.088%, 5/01/2027 | | | 5,527,000 | 5,483,013 |

| | | | | $135,865,130 |

| Automotive – 1.4% |

| Cummins, Inc., 5.15%, 2/20/2034 | | $ | 7,822,000 | $7,679,139 |

| Cummins, Inc., 5.45%, 2/20/2054 | | | 7,545,000 | 7,263,020 |

| Ford Motor Credit Co. LLC, 5.8%, 3/05/2027 | | | 8,394,000 | 8,338,378 |

| Ford Motor Credit Co. LLC, 4.95%, 5/28/2027 | | | 10,040,000 | 9,699,174 |

| Ford Motor Credit Co. LLC, 5.8%, 3/08/2029 | | | 9,607,000 | 9,440,902 |

| Ford Motor Credit Co. LLC, 5.113%, 5/03/2029 | | | 11,273,000 | 10,741,256 |

| Volkswagen Group of America Finance LLC, 6.2%, 11/16/2028 (n) | | | 8,166,000 | 8,340,587 |

| | | | | $61,502,456 |

| Broadcasting – 1.2% |

| Discovery Communications LLC, 4.125%, 5/15/2029 | | $ | 7,049,000 | $6,444,906 |

| Discovery Communications LLC, 5.3%, 5/15/2049 | | | 7,539,000 | 5,931,027 |

| Walt Disney Co., 3.5%, 5/13/2040 | | | 25,879,000 | 20,155,138 |

| Walt Disney Co., 4.75%, 9/15/2044 | | | 2,217,000 | 1,969,843 |

| Walt Disney Co., 3.6%, 1/13/2051 | | | 9,908,000 | 7,196,064 |

| WarnerMedia Holdings, Inc., 4.279%, 3/15/2032 | | | 9,967,000 | 8,585,440 |

| | | | | $50,282,418 |

| Brokerage & Asset Managers – 1.5% |

| Brookfield Finance, Inc., 2.34%, 1/30/2032 | | $ | 13,327,000 | $10,539,640 |

| Charles Schwab Corp., 5.643% to 5/19/2028, FLR (SOFR - 1 day + 2.210%) to 5/19/2029 | | | 6,874,000 | 6,884,822 |

| Charles Schwab Corp., 6.136% to 8/24/2033, FLR (SOFR - 1 day + 2.01%) to 8/24/2034 | | | 10,112,000 | 10,253,348 |

| LPL Holdings, Inc., 4.625%, 11/15/2027 (n) | | | 12,968,000 | 12,357,170 |

| LPL Holdings, Inc., 6.75%, 11/17/2028 | | | 3,337,000 | 3,429,617 |

| LPL Holdings, Inc., 4.375%, 5/15/2031 (n) | | | 16,854,000 | 14,995,077 |

| LSEG US Financial Corp., 5.297%, 3/28/2034 (n) | | | 6,298,000 | 6,118,148 |

| | | | | $64,577,822 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Building – 0.4% |

| Summit Materials LLC/Summit Materials Finance Corp., 7.25%, 1/15/2031 (n) | | $ | 5,889,000 | $6,049,970 |

| Vulcan Materials Co., 3.5%, 6/01/2030 | | | 6,389,000 | 5,739,163 |

| Vulcan Materials Co., 4.5%, 6/15/2047 | | | 7,860,000 | 6,439,033 |

| | | | | $18,228,166 |

| Business Services – 0.7% |

| Fiserv, Inc., 2.25%, 6/01/2027 | | $ | 11,840,000 | $10,758,145 |

| Fiserv, Inc., 4.4%, 7/01/2049 | | | 13,643,000 | 10,900,119 |

| Visa, Inc., 3.65%, 9/15/2047 | | | 9,718,000 | 7,377,059 |

| | | | | $29,035,323 |

| Cable TV – 1.3% |

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp., 5.375%, 5/01/2047 | | $ | 11,438,000 | $8,744,201 |

| Comcast Corp., 2.887%, 11/01/2051 | | | 22,816,000 | 13,798,429 |

| Cox Communications, Inc., 5.7%, 6/15/2033 (n) | | | 16,866,000 | 16,506,362 |

| Cox Communications, Inc., 4.5%, 6/30/2043 (n) | | | 4,237,000 | 3,326,010 |

| Sirius XM Radio, Inc., 4.125%, 7/01/2030 (n) | | | 17,335,000 | 14,701,132 |

| | | | | $57,076,134 |

| Chemicals – 0.4% |

| SCIH Salt Holdings, Inc., 4.875%, 5/01/2028 (n) | | $ | 18,888,000 | $17,561,845 |

| Computer Software – 0.7% |

| Cisco Systems, Inc., 5.5%, 1/15/2040 | | $ | 7,722,000 | $7,690,649 |

| Microsoft Corp., 2.525%, 6/01/2050 | | | 5,450,000 | 3,335,270 |

| Microsoft Corp., 2.5%, 9/15/2050 (n) | | | 14,610,000 | 8,772,181 |

| Oracle Corp., 5.55%, 2/06/2053 | | | 10,951,000 | 10,064,500 |

| | | | | $29,862,600 |

| Computer Software - Systems – 0.4% |

| Apple, Inc., 2.05%, 9/11/2026 (f) | | $ | 12,687,000 | $11,815,332 |

| Apple, Inc., 2.7%, 8/05/2051 | | | 6,683,000 | 4,118,167 |

| | | | | $15,933,499 |

| Conglomerates – 1.8% |

| nVent Finance S.à r.l., 5.65%, 5/15/2033 | | $ | 12,831,000 | $12,664,280 |

| Regal Rexnord Corp., 6.05%, 4/15/2028 (n) | | | 10,547,000 | 10,526,619 |

| Regal Rexnord Corp., 6.3%, 2/15/2030 (n) | | | 14,860,000 | 14,923,540 |

| Regal Rexnord Corp., 6.4%, 4/15/2033 (n) | | | 10,590,000 | 10,675,886 |

| Westinghouse Air Brake Technologies Corp., 3.2%, 6/15/2025 | | | 5,611,000 | 5,445,827 |

| Westinghouse Air Brake Technologies Corp., 4.7%, 9/15/2028 | | | 15,305,000 | 14,731,125 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Conglomerates – continued |

| Westinghouse Air Brake Technologies Corp., 5.611%, 3/11/2034 | | $ | 8,326,000 | $8,184,896 |

| | | | | $77,152,173 |

| Consumer Products – 1.0% |

| Kenvue, Inc., 5%, 3/22/2030 | | $ | 11,408,000 | $11,270,197 |

| Kenvue, Inc., 5.1%, 3/22/2043 | | | 10,021,000 | 9,454,810 |

| Kenvue, Inc., 5.05%, 3/22/2053 | | | 9,133,000 | 8,433,423 |

| Mattel, Inc., 3.75%, 4/01/2029 (n) | | | 15,859,000 | 14,394,377 |

| | | | | $43,552,807 |

| Consumer Services – 0.6% |

| CBRE Group, Inc., 5.95%, 8/15/2034 | | $ | 27,311,000 | $27,155,116 |

| Electrical Equipment – 0.5% |

| Arrow Electronics, Inc., 5.875%, 4/10/2034 | | $ | 20,675,000 | $19,928,416 |

| Electronics – 1.2% |

| Intel Corp., 5.7%, 2/10/2053 | | $ | 17,168,000 | $16,393,546 |

| Lam Research Corp., 1.9%, 6/15/2030 | | | 3,948,000 | 3,257,086 |

| Lam Research Corp., 4.875%, 3/15/2049 | | | 7,791,000 | 6,999,635 |

| NXP B.V./NXP Funding LLC/NXP USA, Inc., 5%, 1/15/2033 | | | 3,324,000 | 3,152,545 |

| NXP B.V./NXP Funding LLC/NXP USA, Inc., 3.125%, 2/15/2042 | | | 12,491,000 | 8,540,394 |

| Sensata Technologies, Inc., 4.375%, 2/15/2030 (n) | | | 14,219,000 | 12,730,086 |

| | | | | $51,073,292 |

| Emerging Market Quasi-Sovereign – 0.2% |

| Qatar Petroleum, 3.125%, 7/12/2041 (n) | | $ | 14,719,000 | $10,510,720 |

| Emerging Market Sovereign – 0.3% |

| United Mexican States, 6.338%, 5/04/2053 | | $ | 15,650,000 | $14,558,118 |

| Energy - Independent – 2.5% |

| Diamondback Energy, Inc., 5.4%, 4/18/2034 | | $ | 6,440,000 | $6,258,144 |

| Diamondback Energy, Inc., 5.75%, 4/18/2054 | | | 12,093,000 | 11,544,688 |

| EQT Corp., 5.7%, 4/01/2028 | | | 3,455,000 | 3,442,344 |

| EQT Corp., 3.625%, 5/15/2031 (n) | | | 11,873,000 | 10,270,088 |

| Occidental Petroleum Corp., 6.125%, 1/01/2031 | | | 7,894,000 | 7,993,070 |

| Occidental Petroleum Corp., 4.4%, 4/15/2046 | | | 16,739,000 | 12,931,675 |

| Permian Resources Operating LLC, 7%, 1/15/2032 (n) | | | 12,809,000 | 13,057,682 |

| Pioneer Natural Resources Co., 5.1%, 3/29/2026 | | | 8,177,000 | 8,116,977 |

| Pioneer Natural Resources Co., 1.9%, 8/15/2030 | | | 2,906,000 | 2,384,279 |

| Pioneer Natural Resources Co., 2.15%, 1/15/2031 | | | 21,285,000 | 17,525,130 |

| Santos Finance Ltd., 6.875%, 9/19/2033 (n) | | | 17,013,000 | 17,485,128 |

| | | | | $111,009,205 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Energy - Integrated – 0.4% |

| BP Capital Markets America, Inc., 1.749%, 8/10/2030 | | $ | 6,943,000 | $5,660,351 |

| BP Capital Markets America, Inc., 4.812%, 2/13/2033 | | | 4,600,000 | 4,397,100 |

| BP Capital Markets America, Inc., 3.001%, 3/17/2052 | | | 10,654,000 | 6,732,071 |

| | | | | $16,789,522 |

| Entertainment – 0.6% |

| Royal Caribbean Cruises Ltd., 4.25%, 7/01/2026 (n) | | $ | 18,053,000 | $17,334,301 |

| Six Flags Entertainment Corp., 6.625%, 5/01/2032 (n) | | | 8,554,000 | 8,519,880 |

| | | | | $25,854,181 |

| Financial Institutions – 1.5% |

| Avolon Holdings Funding Ltd., 4.375%, 5/01/2026 (n) | | $ | 4,843,000 | $4,665,593 |

| Avolon Holdings Funding Ltd., 3.25%, 2/15/2027 (n) | | | 9,024,000 | 8,320,444 |

| Avolon Holdings Funding Ltd., 2.75%, 2/21/2028 (n) | | | 3,243,000 | 2,869,248 |

| Fortress Transportation and Infrastructure Investors LLC, 7%, 5/01/2031 (n) | | | 13,702,000 | 13,776,022 |

| Global Aircraft Leasing Co. Ltd., 6.5% (6.5% Cash or 7.25% PIK), 9/15/2024 (n)(p) | | | 14,963,450 | 14,155,005 |

| Macquarie AirFinance Holdings Ltd., 8.125%, 3/30/2029 (n) | | | 5,642,000 | 5,899,862 |

| Macquarie AirFinance Holdings Ltd., 6.5%, 3/26/2031 (n) | | | 7,609,000 | 7,614,684 |

| SMBC Aviation Capital Finance DAC, 5.3%, 4/03/2029 (n) | | | 9,997,000 | 9,751,124 |

| | | | | $67,051,982 |

| Food & Beverages – 4.3% |

| Anheuser-Busch InBev Worldwide, Inc., 4.375%, 4/15/2038 | | $ | 4,622,000 | $4,095,582 |

| Anheuser-Busch InBev Worldwide, Inc., 4.75%, 4/15/2058 | | | 15,286,000 | 13,191,818 |

| Bacardi-Martini B.V., 5.4%, 6/15/2033 (n) | | | 21,513,000 | 20,669,374 |

| Campbell Soup Co., 5.2%, 3/21/2029 | | | 9,382,000 | 9,249,237 |

| Campbell Soup Co., 2.375%, 4/24/2030 | | | 3,409,000 | 2,867,487 |

| Constellation Brands, Inc., 2.25%, 8/01/2031 | | | 12,758,000 | 10,216,211 |

| Constellation Brands, Inc., 4.75%, 5/09/2032 | | | 13,091,000 | 12,369,212 |

| Constellation Brands, Inc., 3.75%, 5/01/2050 | | | 5,973,000 | 4,280,560 |

| Diageo Capital PLC, 2.375%, 10/24/2029 | | | 8,958,000 | 7,752,603 |

| Diageo Capital PLC, 5.625%, 10/05/2033 | | | 6,595,000 | 6,713,623 |

| JBS USA Food Co., 6.5%, 12/01/2052 | | | 11,976,000 | 11,337,063 |

| JBS USA Lux S.A./JBS USA Food Co./JBS USA Finance, Inc., 5.5%, 1/15/2030 | | | 4,282,000 | 4,133,408 |

| JBS USA Lux S.A./JBS USA Food Co./JBS USA Finance, Inc., 3.75%, 12/01/2031 | | | 12,802,000 | 10,814,427 |

| JDE Peet's N.V., 0.8%, 9/24/2024 (n) | | | 10,304,000 | 10,073,211 |

| Kraft Heinz Foods Co., 4.875%, 10/01/2049 | | | 12,944,000 | 11,114,531 |

| Kraft Heinz Foods Co., 5.5%, 6/01/2050 | | | 12,522,000 | 11,726,298 |

| Mars, Inc., 4.55%, 4/20/2028 (n) | | | 21,743,000 | 21,162,361 |

| SYSCO Corp., 4.45%, 3/15/2048 | | | 9,063,000 | 7,333,069 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Food & Beverages – continued |

| Viterra Finance B.V., 3.2%, 4/21/2031 (n) | | $ | 5,281,000 | $4,451,120 |

| Viterra Finance B.V., 5.25%, 4/21/2032 (n) | | | 3,134,000 | 2,995,301 |

| | | | | $186,546,496 |

| Gaming & Lodging – 1.5% |

| Flutter Treasury DAC, 6.375%, 4/29/2029 (n) | | $ | 7,016,000 | $7,035,013 |

| Marriott International, Inc., 4%, 4/15/2028 | | | 7,013,000 | 6,644,618 |

| Marriott International, Inc., 2.85%, 4/15/2031 | | | 12,565,000 | 10,539,306 |

| Melco Resorts Finance Ltd., 7.625%, 4/17/2032 (n) | | | 8,328,000 | 8,146,450 |

| Sands China Ltd., 2.85%, 3/08/2029 | | | 10,138,000 | 8,711,301 |

| Sands China Ltd., 3.25%, 8/08/2031 | | | 5,716,000 | 4,668,735 |

| VICI Properties LP/VICI Note Co., Inc., 4.25%, 12/01/2026 (n) | | | 7,044,000 | 6,721,189 |

| Wynn Macau Ltd., 5.5%, 10/01/2027 (n) | | | 14,957,000 | 14,092,829 |

| | | | | $66,559,441 |

| Insurance – 1.4% |

| Corebridge Financial, Inc., 3.9%, 4/05/2032 | | $ | 22,135,000 | $19,310,405 |

| Corebridge Financial, Inc., 4.35%, 4/05/2042 | | | 2,707,000 | 2,170,308 |

| Lincoln National Corp., 5.852%, 3/15/2034 | | | 22,341,000 | 21,464,083 |

| Sammons Financial Group, Inc., 6.875%, 4/15/2034 (n) | | | 17,496,000 | 17,258,520 |

| Unum Group, 4.125%, 6/15/2051 | | | 781,000 | 557,209 |

| | | | | $60,760,525 |

| Insurance - Health – 1.0% |

| Humana, Inc., 4.95%, 10/01/2044 | | $ | 9,162,000 | $7,852,005 |

| Humana, Inc., 5.5%, 3/15/2053 | | | 3,660,000 | 3,336,724 |

| UnitedHealth Group, Inc., 5.3%, 2/15/2030 | | | 8,423,000 | 8,425,631 |

| UnitedHealth Group, Inc., 4.625%, 7/15/2035 | | | 12,467,000 | 11,692,532 |

| UnitedHealth Group, Inc., 5.875%, 2/15/2053 | | | 12,207,000 | 12,428,885 |

| | | | | $43,735,777 |

| Insurance - Property & Casualty – 2.5% |

| Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, 6.75%, 4/15/2028 (n) | | $ | 5,404,000 | $5,398,298 |

| American International Group, Inc., 5.125%, 3/27/2033 | | | 12,789,000 | 12,266,813 |

| Arthur J. Gallagher & Co., 6.5%, 2/15/2034 | | | 14,386,000 | 14,982,159 |

| Arthur J. Gallagher & Co., 6.75%, 2/15/2054 | | | 11,784,000 | 12,689,053 |

| Fairfax Financial Holdings Ltd., 3.375%, 3/03/2031 | | | 11,222,000 | 9,590,540 |

| Fairfax Financial Holdings Ltd., 5.625%, 8/16/2032 | | | 4,771,000 | 4,631,033 |

| Fairfax Financial Holdings Ltd., 6%, 12/07/2033 (n) | | | 10,406,000 | 10,326,878 |

| Fairfax Financial Holdings Ltd., 6.35%, 3/22/2054 (n) | | | 11,191,000 | 11,063,456 |

| Panther Escrow Issuer, 7.125%, 6/01/2031 (n) | | | 10,393,000 | 10,446,900 |

| RenaissanceRe Holdings Ltd., 5.75%, 6/05/2033 | | | 17,426,000 | 16,986,250 |

| | | | | $108,381,380 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| International Market Quasi-Sovereign – 0.7% |

| NBN Co. Ltd. (Commonwealth of Australia), 5.75%, 10/06/2028 (n) | | $ | 16,054,000 | $16,269,966 |

| Ontario Teachers' Cadillac Fairview Properties, 2.5%, 10/15/2031 (n) | | | 20,295,000 | 16,047,768 |

| | | | | $32,317,734 |

| International Market Sovereign – 0.5% |

| Government of Bermuda, 5%, 7/15/2032 (n) | | $ | 25,609,000 | $24,149,287 |

| Machinery & Tools – 1.7% |

| AGCO Corp., 5.8%, 3/21/2034 | | $ | 22,046,000 | $21,570,830 |

| Ashtead Capital, Inc., 4.375%, 8/15/2027 (n) | | | 3,228,000 | 3,071,415 |

| Ashtead Capital, Inc., 5.55%, 5/30/2033 (n) | | | 9,885,000 | 9,465,087 |

| Ashtead Capital, Inc., 5.95%, 10/15/2033 (n) | | | 3,902,000 | 3,842,048 |

| CNH Industrial Capital LLC, 5.45%, 10/14/2025 | | | 17,462,000 | 17,421,489 |

| CNH Industrial Capital LLC, 5.5%, 1/12/2029 | | | 15,194,000 | 15,141,923 |

| CNH Industrial N.V., 3.85%, 11/15/2027 | | | 5,323,000 | 5,069,278 |

| | | | | $75,582,070 |

| Major Banks – 16.7% |

| Bank of America Corp., 4.376% to 4/27/2027, FLR (SOFR - 1 day + 1.58%) to 4/27/2028 | | $ | 25,565,000 | $24,709,673 |

| Bank of America Corp., 5.819% to 9/15/2028, FLR (SOFR - 1 day + 1.57%) to 9/15/2029 | | | 19,822,000 | 19,938,626 |

| Bank of America Corp., 2.687% to 4/22/2031, FLR (SOFR - 1 day + 1.32%) to 4/22/2032 | | | 8,035,000 | 6,620,320 |

| Bank of America Corp., 5.872% to 9/15/2033, FLR (SOFR - 1 day + 1.84%) to 9/15/2034 | | | 18,943,000 | 18,977,453 |

| Barclays PLC, 2.894% to 11/24/2031, FLR (CMT - 1yr. + 1.3%) to 11/24/2032 | | | 19,828,000 | 16,073,509 |

| Capital One Financial Corp., 6.312% to 6/08/2028, FLR (SOFR - 1 day + 2.640%) to 6/08/2029 | | | 8,133,000 | 8,204,894 |

| Comerica, Inc., 5.982% to 1/30/2029, FLR (SOFR - 1 day + 2.155%) to 1/30/2030 | | | 14,075,000 | 13,668,090 |

| Commonwealth Bank of Australia, 3.61% to 9/12/2029, FLR (CMT - 1yr. + 2.05%) to 9/12/2034 (n) | | | 12,534,000 | 11,056,556 |

| Commonwealth Bank of Australia, 3.305%, 3/11/2041 (n) | | | 18,459,000 | 13,026,226 |

| Credit Agricole S.A., 1.247% to 1/26/2026, FLR (SOFR - 1 day + 0.89162%) to 1/26/2027 (n) | | | 28,208,000 | 26,085,480 |

| Danske Bank A.S., 5.705% to 3/01/2029, FLR (CMT - 1yr. + 1.4%) to 3/01/2030 (n) | | | 16,262,000 | 16,059,180 |

| Deutsche Bank AG, 5.706% to 2/08/2027, FLR (SOFR - 1 day + 1.594%) to 2/08/2028 | | | 11,567,000 | 11,458,841 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Major Banks – continued |

| Deutsche Bank AG, 7.079% to 2/10/2033, FLR (SOFR - 1 day + 3.65%) to 2/10/2034 | | $ | 15,155,000 | $15,112,473 |

| HSBC Holdings PLC, 2.357% to 8/18/2030, FLR (SOFR - 1 day + 1.947%) to 8/18/2031 | | | 21,465,000 | 17,459,567 |

| HSBC Holdings PLC, 2.871% to 11/22/2031, FLR (SOFR - 1 day + 1.41%) to 11/22/2032 | | | 8,263,000 | 6,701,848 |

| Huntington Bancshares, Inc., 6.208% to 8/21/2028, FLR (SOFR - 1 day + 2.02%) to 8/21/2029 | | | 12,477,000 | 12,529,863 |

| JPMorgan Chase & Co., 6.07% to 10/22/2026, FLR (SOFR - 1 day + 1.33%) to 10/22/2027 | | | 25,493,000 | 25,792,738 |

| JPMorgan Chase & Co., 4.323% to 4/26/2027, FLR (SOFR - 1 day + 1.56%) to 4/26/2028 | | | 4,363,000 | 4,217,789 |

| JPMorgan Chase & Co., 3.54%, 5/01/2028 | | | 18,887,000 | 17,822,169 |

| JPMorgan Chase & Co., 5.581% to 4/22/2029, FLR (SOFR - 1 day + 1.16%) to 4/22/2030 | | | 9,529,000 | 9,520,553 |

| JPMorgan Chase & Co., 2.545% to 11/08/2031, FLR (SOFR - 1 day + 1.18%) to 11/08/2032 | | | 37,249,000 | 30,220,577 |

| JPMorgan Chase & Co., 5.336% to 1/23/2034, FLR (SOFR - 1 day + 1.62%) to 1/23/2035 | | | 7,807,000 | 7,567,503 |

| Mitsubishi UFJ Financial Group, Inc., 5.719% to 2/20/2025, FLR (CMT - 1yr. + 1.08%) to 2/20/2026 | | | 24,317,000 | 24,266,776 |

| Mitsubishi UFJ Financial Group, Inc., 1.64% to 10/13/2026, FLR (CMT - 1yr. + 0.67%) to 10/13/2027 | | | 14,185,000 | 12,904,742 |

| Mizuho Financial Group, 5.754%, 5/27/2034 | | | 14,342,000 | 14,304,145 |

| Morgan Stanley, 0.985% to 12/10/2025, FLR (SOFR - 1 day + 0.72%) to 12/10/2026 | | | 17,246,000 | 15,969,863 |

| Morgan Stanley, 5.449% to 7/20/2028, FLR (SOFR - 1 day + 1.63%) to 7/20/2029 | | | 8,281,000 | 8,230,355 |

| Morgan Stanley, 4.431% to 1/23/2029, FLR ((SOFR - 3mo. + 0.26161%) + 1.628%) to 1/23/2030 | | | 3,224,000 | 3,066,770 |

| Morgan Stanley, 3.622% to 4/01/2030, FLR (SOFR - 1 day + 3.12%) to 4/01/2031 | | | 23,279,000 | 20,923,291 |

| Morgan Stanley, 5.424% to 7/21/2033, FLR (SOFR - 1 day + 1.88%) to 7/21/2034 | | | 8,881,000 | 8,617,573 |

| National Australia Bank Ltd., 3.347% to 1/12/2032, FLR (CMT - 5yr. + 1.7%) to 1/12/2037 (n) | | | 21,704,000 | 17,859,314 |

| NatWest Group PLC, 5.847% to 3/02/2026, FLR (CMT - 1yr. + 1.35%) to 3/02/2027 | | | 10,295,000 | 10,287,522 |

| NatWest Group PLC, 5.583%, 3/01/2028 | | | 9,594,000 | 9,533,652 |

| Nordea Bank Abp, 1.5%, 9/30/2026 (n) | | | 24,233,000 | 21,981,528 |

| PNC Financial Services Group, Inc., 5.3% to 1/21/2027, FLR (SOFR - 1 day + 1.342%) to 1/21/2028 | | | 9,221,000 | 9,140,819 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Major Banks – continued |

| PNC Financial Services Group, Inc., 5.676% to 1/22/2034, FLR (SOFR - 1 day + 1.902%) to 1/22/2035 | | $ | 14,337,000 | $14,046,316 |

| Royal Bank of Canada, 2.3%, 11/03/2031 | | | 19,141,000 | 15,467,954 |

| Sumitomo Mitsui Financial Group, Inc., 1.71%, 1/12/2031 | | | 28,730,000 | 22,496,087 |

| Sumitomo Mitsui Trust Bank Ltd., 5.65%, 3/09/2026 (n) | | | 19,569,000 | 19,583,378 |

| Toronto-Dominion Bank, 4.108%, 6/08/2027 | | | 12,741,000 | 12,248,188 |

| Toronto-Dominion Bank, 4.693%, 9/15/2027 | | | 16,991,000 | 16,600,328 |

| UBS Group AG, 3.126% to 8/13/2029, FLR (LIBOR - 3mo. + 1.468%) to 8/13/2030 (n) | | | 34,761,000 | 30,471,470 |

| UBS Group AG, 4.375% to 2/10/2031, FLR (CMT - 1yr. + 3.313%) to 8/10/2171 (n) | | | 22,649,000 | 18,088,622 |

| UBS Group AG, 9.25% to 11/13/2033, FLR (CMT - 5yr. + 4.758%) to 5/13/2172 (n) | | | 5,754,000 | 6,314,940 |

| UniCredit S.p.A., 2.569% to 9/22/2025, FLR (CMT - 1yr. + 2.3%) to 9/22/2026 (n) | | | 18,700,000 | 17,832,499 |

| UniCredit S.p.A., 1.982% to 6/03/2026, FLR (CMT - 1yr. + 1.2%) to 6/03/2027 (n) | | | 10,140,000 | 9,335,118 |

| Wells Fargo & Co., 3.908% to 4/25/2025, FLR (SOFR - 1 day + 1.32%) to 4/25/2026 | | | 15,012,000 | 14,723,728 |

| Wells Fargo & Co., 5.574% to 7/25/2028, FLR (SOFR - 1 day + 1.74%) to 7/25/2029 | | | 13,754,000 | 13,710,074 |

| Wells Fargo & Co., 3.35% to 3/02/2032, FLR (SOFR - 1 day + 1.5%) to 3/02/2033 | | | 7,908,000 | 6,675,621 |

| | | | | $727,504,601 |

| Medical & Health Technology & Services – 2.6% |

| Alcon Finance Corp., 2.6%, 5/27/2030 (n) | | $ | 20,216,000 | $17,132,273 |

| Alcon Finance Corp., 3.8%, 9/23/2049 (n) | | | 6,904,000 | 5,042,582 |

| Becton, Dickinson and Co., 2.823%, 5/20/2030 | | | 5,566,000 | 4,796,772 |

| Becton, Dickinson and Co., 4.298%, 8/22/2032 | | | 3,494,000 | 3,209,815 |

| Becton, Dickinson and Co., 4.685%, 12/15/2044 | | | 6,838,000 | 5,872,780 |

| CVS Health Corp., 5%, 2/20/2026 | | | 8,421,000 | 8,336,947 |

| CVS Health Corp., 5.625%, 2/21/2053 | | | 10,784,000 | 9,947,681 |

| ICON Investments Six DAC, 5.809%, 5/08/2027 (w) | | | 17,938,000 | 17,938,000 |

| ICON Investments Six DAC, 5.849%, 5/08/2029 (w) | | | 5,758,000 | 5,758,000 |

| IQVIA Holdings, Inc., 6.25%, 2/01/2029 | | | 12,166,000 | 12,364,026 |

| Marin General Hospital, 7.242%, 8/01/2045 | | | 8,685,000 | 8,982,293 |

| Thermo Fisher Scientific, Inc., 4.977%, 8/10/2030 | | | 2,497,000 | 2,454,186 |

| Thermo Fisher Scientific, Inc., 2%, 10/15/2031 | | | 6,659,000 | 5,315,424 |

| Thermo Fisher Scientific, Inc., 2.8%, 10/15/2041 | | | 7,023,000 | 4,848,602 |

| | | | | $111,999,381 |

| Medical Equipment – 0.2% |

| Danaher Corp., 2.6%, 10/01/2050 | | $ | 16,527,000 | $9,798,664 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Metals & Mining – 1.2% |

| Anglo American Capital PLC, 2.25%, 3/17/2028 (n) | | $ | 11,184,000 | $9,862,680 |

| Anglo American Capital PLC, 2.625%, 9/10/2030 (n) | | | 4,570,000 | 3,833,715 |

| FMG Resources Ltd., 4.375%, 4/01/2031 (n) | | | 17,960,000 | 15,812,760 |

| Glencore Funding LLC, 3.875%, 10/27/2027 (n) | | | 8,624,000 | 8,126,012 |

| Novelis Corp., 4.75%, 1/30/2030 (n) | | | 18,174,000 | 16,629,588 |

| | | | | $54,264,755 |

| Midstream – 4.3% |

| Columbia Pipelines Holdings Co. LLC, 6.055%, 8/15/2026 (n) | | $ | 3,370,000 | $3,381,481 |

| Columbia Pipelines Operating Co. LLC, 6.497%, 8/15/2043 (n) | | | 4,836,000 | 4,915,338 |

| Columbia Pipelines Operating Co. LLC, 6.544%, 11/15/2053 (n) | | | 19,527,000 | 20,140,478 |

| Enbridge, Inc., 5.95%, 4/05/2054 | | | 9,370,000 | 9,073,287 |

| Enbridge, Inc., 8.5% to 1/15/2034, FLR (CMT - 5yr. + 4.431%) to 1/15/2054, FLR (CMT - 5yr. + 5.181%) to 1/15/2084 | | | 14,863,000 | 15,681,178 |

| Energy Transfer LP, 4%, 10/01/2027 | | | 8,335,000 | 7,924,164 |

| Energy Transfer LP, 5.95%, 5/15/2054 | | | 8,347,000 | 7,866,794 |

| Energy Transfer LP, 7.125% to 5/15/2030, FLR (CMT - 5yr. + 5.306%) to 5/15/2171 | | | 14,243,000 | 13,674,912 |

| EQM Midstream Partners LP, 4.5%, 1/15/2029 (n) | | | 8,946,000 | 8,277,095 |

| Galaxy Pipeline Assets Bidco Ltd., 1.75%, 9/30/2027 (n) | | | 21,103,364 | 19,554,328 |

| Galaxy Pipeline Assets Bidco Ltd., 2.16%, 3/31/2034 (n) | | | 3,466,081 | 2,891,455 |

| Plains All American Pipeline LP, 4.65%, 10/15/2025 | | | 15,024,000 | 14,766,485 |

| Plains All American Pipeline LP, 3.55%, 12/15/2029 | | | 11,859,000 | 10,667,454 |

| Plains All American Pipeline LP, 4.9%, 2/15/2045 | | | 8,649,000 | 7,181,175 |

| Targa Resources Corp., 4.2%, 2/01/2033 | | | 9,631,000 | 8,501,157 |

| Targa Resources Corp., 4.95%, 4/15/2052 | | | 20,184,000 | 16,805,409 |

| Venture Global Calcasieu Pass LLC, 6.25%, 1/15/2030 (n) | | | 4,378,000 | 4,328,606 |

| Venture Global Calcasieu Pass LLC, 4.125%, 8/15/2031 (n) | | | 5,012,000 | 4,374,335 |

| Venture Global LNG, Inc., 9.5%, 2/01/2029 (n) | | | 6,218,000 | 6,683,492 |

| | | | | $186,688,623 |

| Municipals – 0.5% |

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., Taxable, “B”, 2.746%, 6/01/2034 | | $ | 9,830,000 | $8,022,789 |

| National Finance Authority, NH, Utility Refunding Rev., Taxable (Wheeling Power Co. Project), “A”, 6.89%, 4/01/2034 | | | 13,505,000 | 13,498,258 |

| | | | | $21,521,047 |

| Natural Gas - Pipeline – 0.3% |

| APA Infrastructure Ltd., 5%, 3/23/2035 (n) | | $ | 12,850,000 | $11,632,828 |

| Oils – 0.4% |

| MC Brazil Downstream Trading S.à r.l., 7.25%, 6/30/2031 | | $ | 18,759,277 | $16,252,803 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Other Banks & Diversified Financials – 4.2% |

| AIB Group PLC, 6.608% to 9/13/2028, FLR (SOFR - 1 day + 2.33%) to 9/13/2029 (n) | | $ | 24,810,000 | $25,288,192 |

| AIB Group PLC, 5.871% to 3/28/2034, FLR (SOFR - 1 day + 1.91%) to 3/28/2035 (n) | | | 6,142,000 | 5,943,176 |

| BBVA Bancomer S.A. (Texas), 8.125%, 1/08/2039 (n) | | | 17,196,000 | 17,421,491 |

| BPCE S.A., 5.716% to 1/18/2029, FLR (CMT - 1yr. + 1.959%) to 1/18/2030 (n) | | | 12,906,000 | 12,760,133 |

| CaixaBank S.A., 5.673% to 3/15/2029, FLR (SOFR - 1 day + 1.78%) to 3/15/2030 (n) | | | 8,800,000 | 8,647,268 |

| CaixaBank S.A., 6.84% to 9/13/2033, FLR (SOFR - 1 day + 2.77%) to 9/13/2034 (n) | | | 16,173,000 | 16,714,501 |

| Intesa Sanpaolo S.p.A., 7.2%, 11/28/2033 (n) | | | 10,166,000 | 10,623,750 |

| Intesa Sanpaolo S.p.A., 7.8%, 11/28/2053 (n) | | | 8,606,000 | 9,242,850 |

| M&T Bank Corp., 7.413% to 10/30/2028, FLR (SOFR - 1 day + 2.80%) to 10/30/2029 | | | 2,051,000 | 2,126,704 |

| M&T Bank Corp., 6.082% to 3/13/2031, FLR (SOFR - 1 day + 2.26%) to 3/13/2032 | | | 6,688,000 | 6,534,294 |

| M&T Bank Corp., 5.053% to 1/27/2033, FLR (SOFR - 1 day + 1.850%) to 1/27/2034 | | | 4,573,000 | 4,116,220 |

| Macquarie Bank Ltd. of London, 6.125% to 3/08/2027, FLR (Swap Rate - 5yr. + 4.332%) to 12/31/2165 (n) | | | 14,680,000 | 14,220,788 |

| Macquarie Group Ltd., 6.255% to 12/07/2033, FLR (SOFR - 1 day + 2.303%) to 12/07/2034 (n) | | | 9,925,000 | 10,056,025 |

| Manufacturers and Traders Trust Co., 4.7%, 1/27/2028 | | | 11,201,000 | 10,604,301 |

| Truist Financial Corp., 7.161% to 10/30/2028, FLR (SOFR - 1 day + 2.446%) to 10/30/2029 | | | 20,259,000 | 21,212,711 |

| Truist Financial Corp., 5.711% to 1/24/2034, FLR (SOFR - 1 day + 1.922%) to 1/24/2035 | | | 7,975,000 | 7,739,633 |

| | | | | $183,252,037 |

| Pharmaceuticals – 2.4% |

| AbbVie, Inc., 5.35%, 3/15/2044 | | $ | 14,936,000 | $14,444,292 |

| AbbVie, Inc., 5.4%, 3/15/2054 | | | 8,759,000 | 8,480,211 |

| Bayer US Finance LLC, 6.125%, 11/21/2026 (n) | | | 10,771,000 | 10,787,939 |

| Bayer US Finance LLC, 6.25%, 1/21/2029 (n) | | | 4,093,000 | 4,112,684 |

| Bristol-Myers Squibb Co., 5.5%, 2/22/2044 | | | 7,453,000 | 7,230,329 |

| Bristol-Myers Squibb Co., 5.55%, 2/22/2054 | | | 9,363,000 | 9,036,384 |

| Merck & Co., Inc., 2.75%, 12/10/2051 | | | 7,976,000 | 4,865,616 |

| Pfizer Investment Enterprises Pte. Ltd., 5.3%, 5/19/2053 | | | 8,900,000 | 8,299,584 |

| Pfizer, Inc., 2.55%, 5/28/2040 | | | 7,976,000 | 5,423,195 |

| Roche Holdings, Inc., 5.338%, 11/13/2028 (n) | | | 20,567,000 | 20,671,713 |

| Roche Holdings, Inc., 5.489%, 11/13/2030 (n) | | | 10,734,000 | 10,849,009 |

| | | | | $104,200,956 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Pollution Control – 0.8% |

| GFL Environmental, Inc., 3.5%, 9/01/2028 (n) | | $ | 13,918,000 | $12,511,062 |

| GFL Environmental, Inc., 6.75%, 1/15/2031 (n) | | | 6,787,000 | 6,841,865 |

| Waste Management, Inc., 4.625%, 2/15/2033 | | | 16,964,000 | 16,148,050 |

| | | | | $35,500,977 |

| Precious Metals & Minerals – 0.7% |

| IAMGOLD Corp., 5.75%, 10/15/2028 (n) | | $ | 13,761,000 | $12,721,380 |

| Northern Star Resources Ltd. Co., 6.125%, 4/11/2033 (n) | | | 17,232,000 | 17,004,715 |

| | | | | $29,726,095 |

| Railroad & Shipping – 0.6% |

| Burlington Northern Santa Fe LLC, 5.2%, 4/15/2054 | | $ | 14,985,000 | $14,023,210 |

| Canadian Pacific Railway Co., 3.1%, 12/02/2051 | | | 17,537,000 | 11,258,469 |

| | | | | $25,281,679 |

| Real Estate - Office – 1.2% |

| Boston Properties LP, REIT, 3.65%, 2/01/2026 | | $ | 11,718,000 | $11,240,162 |

| Boston Properties LP, REIT, 4.5%, 12/01/2028 | | | 901,000 | 839,969 |

| Boston Properties LP, REIT, 2.45%, 10/01/2033 | | | 4,219,000 | 3,056,311 |

| COPT Defense Property LP, REIT, 2%, 1/15/2029 | | | 18,241,000 | 15,191,920 |

| COPT Defense Property LP, REIT, 2.75%, 4/15/2031 | | | 27,392,000 | 22,005,426 |

| | | | | $52,333,788 |

| Real Estate - Other – 1.8% |

| EPR Properties, REIT, 3.6%, 11/15/2031 | | $ | 21,022,000 | $17,065,430 |

| Extra Space Storage LP, 5.5%, 7/01/2030 | | | 16,979,000 | 16,734,377 |

| Lexington Realty Trust Co., 2.375%, 10/01/2031 | | | 16,899,000 | 13,152,013 |

| Prologis LP, REIT, 5.125%, 1/15/2034 | | | 20,823,000 | 20,088,334 |

| W.P. Carey, Inc., REIT, 2.45%, 2/01/2032 | | | 15,391,000 | 12,059,903 |

| | | | | $79,100,057 |

| Real Estate - Retail – 0.8% |

| NNN REIT, Inc., 5.6%, 10/15/2033 | | $ | 13,247,000 | $12,996,474 |

| STORE Capital Corp., REIT, 2.7%, 12/01/2031 | | | 26,269,000 | 20,311,103 |

| | | | | $33,307,577 |

| Retailers – 1.1% |

| Alimentation Couche-Tard, Inc., 3.439%, 5/13/2041 (n) | | $ | 1,953,000 | $1,428,327 |

| Alimentation Couche-Tard, Inc., 3.8%, 1/25/2050 (n) | | | 18,119,000 | 13,158,837 |

| Amazon.com, Inc., 3.6%, 4/13/2032 | | | 12,124,000 | 10,932,521 |

| AutoZone, Inc., 4.75%, 8/01/2032 | | | 9,131,000 | 8,615,510 |

| Home Depot, Inc., 3.3%, 4/15/2040 | | | 15,616,000 | 11,852,684 |

| Home Depot, Inc., 3.9%, 6/15/2047 | | | 2,382,000 | 1,839,538 |

| | | | | $47,827,417 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Specialty Chemicals – 0.6% |

| International Flavors & Fragrances, Inc., 1.23%, 10/01/2025 (n) | | $ | 8,252,000 | $7,724,392 |

| International Flavors & Fragrances, Inc., 1.832%, 10/15/2027 (n) | | | 3,953,000 | 3,466,382 |

| International Flavors & Fragrances, Inc., 2.3%, 11/01/2030 (n) | | | 4,867,000 | 3,947,567 |

| International Flavors & Fragrances, Inc., 5%, 9/26/2048 | | | 5,803,000 | 4,786,179 |

| International Flavors & Fragrances, Inc., 3.468%, 12/01/2050 (n) | | | 6,902,000 | 4,364,478 |

| | | | | $24,288,998 |

| Specialty Stores – 0.4% |

| DICK'S Sporting Goods, 4.1%, 1/15/2052 | | $ | 27,612,000 | $18,735,945 |

| Telecommunications - Wireless – 3.4% |

| American Tower Corp., 5.2%, 2/15/2029 | | $ | 11,727,000 | $11,511,984 |

| American Tower Corp., 5.45%, 2/15/2034 | | | 12,330,000 | 11,979,116 |

| Cellnex Finance Co. S.A., 3.875%, 7/07/2041 (n) | | | 32,683,000 | 24,779,630 |

| Crown Castle, Inc., REIT, 4.45%, 2/15/2026 | | | 10,709,000 | 10,472,138 |

| Crown Castle, Inc., REIT, 3.65%, 9/01/2027 | | | 8,862,000 | 8,305,347 |

| Millicom International Cellular S.A., 4.5%, 4/27/2031 (n) | | | 13,604,000 | 11,352,580 |

| Rogers Communications, Inc., 4.5%, 3/15/2042 | | | 8,577,000 | 7,062,204 |

| Rogers Communications, Inc., 4.55%, 3/15/2052 | | | 7,360,000 | 5,821,239 |

| T-Mobile USA, Inc., 2.05%, 2/15/2028 | | | 9,921,000 | 8,770,639 |

| T-Mobile USA, Inc., 5.05%, 7/15/2033 | | | 8,601,000 | 8,239,451 |

| T-Mobile USA, Inc., 3%, 2/15/2041 | | | 30,674,000 | 21,446,186 |

| Vodafone Group PLC, 5.625%, 2/10/2053 | | | 19,986,000 | 18,708,153 |

| | | | | $148,448,667 |

| Tobacco – 0.9% |

| B.A.T. Capital Corp., 6.343%, 8/02/2030 | | $ | 15,471,000 | $15,862,075 |

| B.A.T. Capital Corp., 5.834%, 2/20/2031 | | | 8,594,000 | 8,590,658 |

| Philip Morris International, Inc., 5.625%, 11/17/2029 | | | 5,491,000 | 5,537,389 |

| Philip Morris International, Inc., 5.125%, 2/15/2030 | | | 7,490,000 | 7,362,766 |

| | | | | $37,352,888 |

| Transportation - Services – 1.0% |

| Element Fleet Management Corp., 6.271%, 6/26/2026 (n) | | $ | 12,315,000 | $12,379,542 |

| Element Fleet Management Corp., 6.319%, 12/04/2028 (n) | | | 19,070,000 | 19,353,382 |

| GXO Logistics, Inc., 6.25%, 5/06/2029 (w) | | | 12,658,000 | 12,672,404 |

| | | | | $44,405,328 |

| U.S. Treasury Obligations – 4.4% |

| U.S. Treasury Bonds, 2.375%, 2/15/2042 | | $ | 92,207,000 | $64,649,353 |

| U.S. Treasury Bonds, 3.875%, 5/15/2043 | | | 66,652,000 | 58,125,230 |

| U.S. Treasury Bonds, 4.375%, 8/15/2043 | | | 13,516,000 | 12,622,677 |

| U.S. Treasury Bonds, 4.75%, 11/15/2043 | | | 8,368,000 | 8,208,485 |

| U.S. Treasury Bonds, 4.5%, 2/15/2044 | | | 9,070,000 | 8,610,831 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| U.S. Treasury Obligations – continued |

| U.S. Treasury Bonds, 2.875%, 5/15/2052 | | $ | 29,221,600 | $20,563,560 |

| U.S. Treasury Notes, 5%, 10/31/2025 | | | 8,687,000 | 8,666,640 |

| U.S. Treasury Notes, 4.875%, 11/30/2025 | | | 8,736,000 | 8,699,145 |

| | | | | $190,145,921 |

| Utilities - Electric Power – 8.3% |

| Adani Transmission Ltd., 4.25%, 5/21/2036 | | $ | 5,386,670 | $4,365,796 |

| Adani Transmission Step-One Ltd., 4%, 8/03/2026 | | | 14,632,000 | 13,621,061 |

| AEP Transmission Co. LLC, 5.4%, 3/15/2053 | | | 5,252,000 | 4,904,433 |

| Algonquin Power & Utilities Corp., 5.365%, 6/15/2026 | | | 5,767,000 | 5,706,766 |

| American Transmission Systems, Inc., 2.65%, 1/15/2032 (n) | | | 4,691,000 | 3,792,796 |

| Berkshire Hathaway Energy Co., 5.15%, 11/15/2043 | | | 3,795,000 | 3,515,418 |

| Berkshire Hathaway Energy Co., 4.6%, 5/01/2053 | | | 3,159,000 | 2,554,482 |

| Duke Energy Carolinas LLC, 2.45%, 2/01/2030 | | | 21,816,000 | 18,674,790 |

| Duke Energy Florida LLC, 6.2%, 11/15/2053 | | | 8,443,000 | 8,793,291 |

| Enel Finance International N.V., 4.625%, 6/15/2027 (n) | | | 16,585,000 | 16,104,596 |

| Enel Finance International N.V., 2.25%, 7/12/2031 (n) | | | 7,340,000 | 5,898,170 |

| Enel Finance International N.V., 5.5%, 6/15/2052 (n) | | | 4,500,000 | 4,005,221 |

| Enel Finance International N.V., 7.75%, 10/14/2052 (n) | | | 9,393,000 | 10,951,404 |

| ENGIE Energia Chile S.A., 6.375%, 4/17/2034 (n) | | | 15,527,000 | 15,349,992 |

| Eversource Energy, 5.5%, 1/01/2034 | | | 11,861,000 | 11,416,980 |

| FirstEnergy Corp., 4.15%, 7/15/2027 | | | 16,631,000 | 15,669,229 |

| FirstEnergy Corp., 3.4%, 3/01/2050 | | | 16,280,000 | 10,446,848 |

| Florida Power & Light Co., 2.45%, 2/03/2032 | | | 6,909,000 | 5,646,028 |

| Florida Power & Light Co., 3.95%, 3/01/2048 | | | 8,281,000 | 6,404,503 |

| Georgia Power Co., 4.7%, 5/15/2032 | | | 9,903,000 | 9,374,608 |

| Georgia Power Co., 4.95%, 5/17/2033 | | | 12,724,000 | 12,113,313 |

| Georgia Power Co., 5.125%, 5/15/2052 | | | 13,035,000 | 11,824,769 |

| Jersey Central Power & Light Co., 2.75%, 3/01/2032 (n) | | | 22,679,000 | 18,419,902 |

| MidAmerican Energy Co., 5.85%, 9/15/2054 | | | 15,452,000 | 15,542,596 |

| NextEra Energy Capital Holdings, Inc., 5.749%, 9/01/2025 | | | 8,412,000 | 8,417,383 |

| NextEra Energy Capital Holdings, Inc., 2.44%, 1/15/2032 | | | 2,720,000 | 2,184,035 |

| NextEra Energy Capital Holdings, Inc., 3.8% to 3/15/2027, FLR (CMT - 5yr. + 2.547%) to 3/15/2082 | | | 9,140,000 | 8,268,344 |

| Pacific Gas & Electric Co., 5.45%, 6/15/2027 | | | 10,156,000 | 10,091,317 |

| Pacific Gas & Electric Co., 2.5%, 2/01/2031 | | | 27,538,000 | 22,327,358 |

| Pacific Gas & Electric Co., 6.4%, 6/15/2033 | | | 4,889,000 | 4,974,670 |

| PPL Electric Utilities Corp., 4.85%, 2/15/2034 | | | 11,696,000 | 11,139,563 |

| Southern California Edison Co., 4.5%, 9/01/2040 | | | 7,827,000 | 6,582,053 |

| Southern California Edison Co., 3.65%, 2/01/2050 | | | 4,289,000 | 2,987,723 |

| WEC Energy Group, Inc., 4.75%, 1/09/2026 | | | 23,734,000 | 23,403,128 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Utilities - Electric Power – continued |

| Xcel Energy, Inc., 5.5%, 3/15/2034 | | $ | 25,243,000 | $24,343,097 |

| | | | | $359,815,663 |

| Total Bonds (Identified Cost, $4,525,958,060) | | $4,221,273,809 |

| Investment Companies (h) – 2.9% |

| Money Market Funds – 2.9% | |

| MFS Institutional Money Market Portfolio, 5.38% (v) (Identified Cost, $125,256,601) | | | 125,256,423 | $125,256,423 |

|

|

| Other Assets, Less Liabilities – 0.1% | | 6,138,892 |

| Net Assets – 100.0% | $4,352,669,124 |

| (f) | All or a portion of the security has been segregated as collateral for open futures contracts. | | | |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund's investments in affiliated issuers and in unaffiliated issuers were $125,256,423 and $4,221,273,809, respectively. | | | |

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. | | | |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $1,451,734,009, representing 33.4% of net assets. | | | |

| (p) | Payment-in-kind (PIK) security for which interest income may be received in additional securities and/or cash. | | | |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. | | | |

| (w) | When-issued security. | | | |

| The following abbreviations are used in this report and are defined: |

| CLO | Collateralized Loan Obligation |

| CMT | Constant Maturity Treasury |

| FLR | Floating Rate. Interest rate resets periodically based on the parenthetically disclosed reference rate plus a spread (if any). The period-end rate reported may not be the current rate. All reference rates are USD unless otherwise noted. |

| LIBOR | London Interbank Offered Rate |

| REIT | Real Estate Investment Trust |

| SOFR | Secured Overnight Financing Rate |

Portfolio of Investments – continued

Derivative Contracts at 4/30/24

| Futures Contracts |

| Description | Long/

Short | Currency | Contracts | Notional

Amount | Expiration

Date | Value/Unrealized

Appreciation

(Depreciation) |

| Asset Derivatives |

| Interest Rate Futures | | |

| U.S. Treasury Note 5 yr | Short | USD | 1,053 | $110,293,524 | June – 2024 | $2,193,146 |

| U.S. Treasury Ultra Note 10 yr | Short | USD | 2,256 | 248,653,500 | June – 2024 | 7,589,682 |

| | | | | | | $9,782,828 |

| Liability Derivatives |

| Interest Rate Futures | | |

| U.S. Treasury Bond 30 yr | Long | USD | 1,025 | $116,657,813 | June – 2024 | $(5,067,366) |

| U.S. Treasury Note 2 yr | Long | USD | 2,153 | 436,318,906 | June – 2024 | (3,737,067) |

| U.S. Treasury Ultra Bond 30 yr | Long | USD | 470 | 56,194,375 | June – 2024 | (2,802,992) |

| | | | | | | $(11,607,425) |

At April 30, 2024, the fund had liquid securities with an aggregate value of $5,522,550 to cover any collateral or margin obligations for certain derivative contracts.

See Notes to Financial Statements

Financial Statements

Statement of Assets and Liabilities

At 4/30/24

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | |

| Investments in unaffiliated issuers, at value (identified cost, $4,525,958,060) | $4,221,273,809 |

| Investments in affiliated issuers, at value (identified cost, $125,256,601) | 125,256,423 |

| Cash | 710,585 |

| Receivables for | |

| Investments sold | 18,469,054 |

| Fund shares sold | 7,217,029 |

| Interest | 49,372,238 |

| Other assets | 8,804 |

| Total assets | $4,422,307,942 |

| Liabilities | |

| Payables for | |

| Distributions | $616,757 |

| Net daily variation margin on open futures contracts | 57,022 |

| Investments purchased | 17,183,346 |

| When-issued investments purchased | 42,870,098 |

| Fund shares reacquired | 7,650,421 |

| Payable to affiliates | |

| Investment adviser | 87,767 |

| Administrative services fee | 3,368 |

| Shareholder servicing costs | 881,560 |

| Distribution and service fees | 25,545 |

| Payable for independent Trustees' compensation | 555 |

| Accrued expenses and other liabilities | 262,379 |

| Total liabilities | $69,638,818 |

| Net assets | $4,352,669,124 |

| Net assets consist of | |

| Paid-in capital | $5,296,131,576 |

| Total distributable earnings (loss) | (943,462,452) |

| Net assets | $4,352,669,124 |

| Shares of beneficial interest outstanding | 363,971,622 |

Statement of Assets and Liabilities – continued

| | Net assets | Shares

outstanding | Net asset value

per share (a) |

| Class A | $1,663,875,550 | 139,027,360 | $11.97 |

| Class B | 1,733,520 | 145,115 | 11.95 |

| Class C | 34,107,613 | 2,859,009 | 11.93 |

| Class I | 942,477,394 | 78,849,954 | 11.95 |

| Class R1 | 4,070,726 | 340,903 | 11.94 |

| Class R2 | 13,962,712 | 1,166,266 | 11.97 |

| Class R3 | 19,949,104 | 1,665,977 | 11.97 |

| Class R4 | 54,316,264 | 4,536,791 | 11.97 |

| Class R6 | 1,618,176,241 | 135,380,247 | 11.95 |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $12.50 [100 / 95.75 x $11.97]. On sales of $100,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R6. |

See Notes to Financial Statements

Financial Statements

Statement of Operations

Year ended 4/30/24

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income (loss) | |

| Income | |

| Interest | $205,527,883 |

| Dividends from affiliated issuers | 5,472,516 |

| Other | 771,540 |

| Total investment income | $211,771,939 |

| Expenses | |

| Management fee | $16,365,396 |

| Distribution and service fees | 4,781,789 |

| Shareholder servicing costs | 3,068,137 |

| Administrative services fee | 611,413 |

| Independent Trustees' compensation | 73,579 |

| Custodian fee | 182,621 |

| Shareholder communications | 355,275 |

| Audit and tax fees | 79,880 |

| Legal fees | 23,762 |

| Miscellaneous | 350,077 |

| Total expenses | $25,891,929 |

| Fees paid indirectly | (8,784) |

| Reduction of expenses by investment adviser and distributor | (549,411) |

| Net expenses | $25,333,734 |

| Net investment income (loss) | $186,438,205 |

| Realized and unrealized gain (loss) |

| Realized gain (loss) (identified cost basis) | |

| Unaffiliated issuers | $(264,904,878) |

| Affiliated issuers | 13,056 |

| Futures contracts | (3,701,486) |

| Foreign currency | 1 |

| Net realized gain (loss) | $(268,593,307) |

| Change in unrealized appreciation or depreciation | |

| Unaffiliated issuers | $143,942,602 |

| Affiliated issuers | (38,167) |

| Futures contracts | 867,043 |

| Net unrealized gain (loss) | $144,771,478 |

| Net realized and unrealized gain (loss) | $(123,821,829) |

| Change in net assets from operations | $62,616,376 |

See Notes to Financial Statements

Financial Statements

Statements of Changes in Net Assets

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | Year ended |

| | 4/30/24 | 4/30/23 |

| Change in net assets | | |

| From operations | | |

| Net investment income (loss) | $186,438,205 | $150,733,982 |

| Net realized gain (loss) | (268,593,307) | (327,077,618) |

| Net unrealized gain (loss) | 144,771,478 | 173,652,773 |

| Change in net assets from operations | $62,616,376 | $(2,690,863) |

| Total distributions to shareholders | $(187,927,023) | $(155,256,971) |

| Change in net assets from fund share transactions | $193,995,534 | $(456,065,226) |

| Total change in net assets | $68,684,887 | $(614,013,060) |

| Net assets | | |

| At beginning of period | 4,283,984,237 | 4,897,997,297 |

| At end of period | $4,352,669,124 | $4,283,984,237 |

See Notes to Financial Statements

Financial Statements

Financial Highlights

The financial highlights table is intended to help you understand the fund's financial performance for the past 5 years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Class A | Year ended |

| | 4/30/24 | 4/30/23 | 4/30/22 | 4/30/21 | 4/30/20 |

| Net asset value, beginning of period | $12.30 | $12.71 | $15.09 | $14.88 | $13.93 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.50 | $0.41 | $0.35 | $0.37 | $0.42 |

| Net realized and unrealized gain (loss) | (0.32) | (0.40) | (1.92) | 0.37 | 0.96 |

| Total from investment operations | $0.18 | $0.01 | $(1.57) | $0.74 | $1.38 |

| Less distributions declared to shareholders |

| From net investment income | $(0.51) | $(0.41) | $(0.36) | $(0.39) | $(0.43) |

| From net realized gain | — | (0.01) | (0.45) | (0.14) | — |

| Total distributions declared to shareholders | $(0.51) | $(0.42) | $(0.81) | $(0.53) | $(0.43) |

| Net asset value, end of period (x) | $11.97 | $12.30 | $12.71 | $15.09 | $14.88 |

| Total return (%) (r)(s)(t)(x) | 1.50 | 0.20 | (11.00) | 4.94 | 10.00 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 0.78 | 0.78 | 0.76 | 0.77 | 0.79 |

| Expenses after expense reductions (f) | 0.77 | 0.77 | 0.75 | 0.75 | 0.77 |

| Net investment income (loss) | 4.19 | 3.36 | 2.38 | 2.42 | 2.91 |

| Portfolio turnover | 59 | 46 | 54 | 37 | 36 |

| Net assets at end of period (000 omitted) | $1,663,876 | $1,726,630 | $1,932,006 | $2,328,936 | $1,996,170 |

See Notes to Financial Statements

Financial Highlights – continued

| Class B | Year ended |

| | 4/30/24 | 4/30/23 | 4/30/22 | 4/30/21 | 4/30/20 |

| Net asset value, beginning of period | $12.28 | $12.68 | $15.06 | $14.85 | $13.90 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.41 | $0.32 | $0.24 | $0.26 | $0.32 |

| Net realized and unrealized gain (loss) | (0.32) | (0.39) | (1.92) | 0.36 | 0.95 |

| Total from investment operations | $0.09 | $(0.07) | $(1.68) | $0.62 | $1.27 |

| Less distributions declared to shareholders |

| From net investment income | $(0.42) | $(0.32) | $(0.25) | $(0.27) | $(0.32) |

| From net realized gain | — | (0.01) | (0.45) | (0.14) | — |

| Total distributions declared to shareholders | $(0.42) | $(0.33) | $(0.70) | $(0.41) | $(0.32) |

| Net asset value, end of period (x) | $11.95 | $12.28 | $12.68 | $15.06 | $14.85 |

| Total return (%) (r)(s)(t)(x) | 0.74 | (0.48) | (11.70) | 4.17 | 9.20 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 1.53 | 1.53 | 1.51 | 1.52 | 1.54 |

| Expenses after expense reductions (f) | 1.52 | 1.52 | 1.50 | 1.50 | 1.53 |

| Net investment income (loss) | 3.40 | 2.60 | 1.62 | 1.70 | 2.18 |

| Portfolio turnover | 59 | 46 | 54 | 37 | 36 |

| Net assets at end of period (000 omitted) | $1,734 | $3,585 | $6,283 | $10,838 | $21,384 |

| Class C | Year ended |

| | 4/30/24 | 4/30/23 | 4/30/22 | 4/30/21 | 4/30/20 |

| Net asset value, beginning of period | $12.26 | $12.67 | $15.04 | $14.84 | $13.89 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.41 | $0.32 | $0.24 | $0.26 | $0.31 |

| Net realized and unrealized gain (loss) | (0.32) | (0.40) | (1.91) | 0.35 | 0.96 |

| Total from investment operations | $0.09 | $(0.08) | $(1.67) | $0.61 | $1.27 |

| Less distributions declared to shareholders |

| From net investment income | $(0.42) | $(0.32) | $(0.25) | $(0.27) | $(0.32) |

| From net realized gain | — | (0.01) | (0.45) | (0.14) | — |

| Total distributions declared to shareholders | $(0.42) | $(0.33) | $(0.70) | $(0.41) | $(0.32) |

| Net asset value, end of period (x) | $11.93 | $12.26 | $12.67 | $15.04 | $14.84 |

| Total return (%) (r)(s)(t)(x) | 0.73 | (0.56) | (11.65) | 4.10 | 9.21 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 1.53 | 1.53 | 1.51 | 1.51 | 1.54 |

| Expenses after expense reductions (f) | 1.52 | 1.52 | 1.50 | 1.50 | 1.53 |

| Net investment income (loss) | 3.43 | 2.60 | 1.62 | 1.68 | 2.16 |

| Portfolio turnover | 59 | 46 | 54 | 37 | 36 |

| Net assets at end of period (000 omitted) | $34,108 | $42,440 | $61,283 | $98,956 | $143,988 |

See Notes to Financial Statements

Financial Highlights – continued

| Class I | Year ended |

| | 4/30/24 | 4/30/23 | 4/30/22 | 4/30/21 | 4/30/20 |

| Net asset value, beginning of period | $12.29 | $12.69 | $15.07 | $14.87 | $13.92 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.53 | $0.44 | $0.39 | $0.41 | $0.46 |

| Net realized and unrealized gain (loss) | (0.33) | (0.39) | (1.92) | 0.36 | 0.96 |

| Total from investment operations | $0.20 | $0.05 | $(1.53) | $0.77 | $1.42 |

| Less distributions declared to shareholders |

| From net investment income | $(0.54) | $(0.44) | $(0.40) | $(0.43) | $(0.47) |

| From net realized gain | — | (0.01) | (0.45) | (0.14) | — |

| Total distributions declared to shareholders | $(0.54) | $(0.45) | $(0.85) | $(0.57) | $(0.47) |

| Net asset value, end of period (x) | $11.95 | $12.29 | $12.69 | $15.07 | $14.87 |

| Total return (%) (r)(s)(t)(x) | 1.67 | 0.53 | (10.79) | 5.14 | 10.28 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 0.53 | 0.53 | 0.51 | 0.52 | 0.53 |

| Expenses after expense reductions (f) | 0.52 | 0.52 | 0.50 | 0.50 | 0.52 |

| Net investment income (loss) | 4.43 | 3.60 | 2.62 | 2.66 | 3.15 |

| Portfolio turnover | 59 | 46 | 54 | 37 | 36 |

| Net assets at end of period (000 omitted) | $942,477 | $934,582 | $1,062,759 | $1,573,250 | $1,306,407 |

See Notes to Financial Statements

Financial Highlights – continued

| Class R1 | Year ended |

| | 4/30/24 | 4/30/23 | 4/30/22 | 4/30/21 | 4/30/20 |

| Net asset value, beginning of period | $12.28 | $12.68 | $15.05 | $14.85 | $13.90 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.41 | $0.32 | $0.24 | $0.26 | $0.31 |

| Net realized and unrealized gain (loss) | (0.33) | (0.39) | (1.91) | 0.35 | 0.96 |

| Total from investment operations | $0.08 | $(0.07) | $(1.67) | $0.61 | $1.27 |

| Less distributions declared to shareholders |

| From net investment income | $(0.42) | $(0.32) | $(0.25) | $(0.27) | $(0.32) |

| From net realized gain | — | (0.01) | (0.45) | (0.14) | — |

| Total distributions declared to shareholders | $(0.42) | $(0.33) | $(0.70) | $(0.41) | $(0.32) |

| Net asset value, end of period (x) | $11.94 | $12.28 | $12.68 | $15.05 | $14.85 |

| Total return (%) (r)(s)(t)(x) | 0.65 | (0.48) | (11.64) | 4.10 | 9.20 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 1.53 | 1.53 | 1.51 | 1.51 | 1.54 |

| Expenses after expense reductions (f) | 1.52 | 1.52 | 1.50 | 1.50 | 1.53 |

| Net investment income (loss) | 3.45 | 2.61 | 1.62 | 1.68 | 2.16 |

| Portfolio turnover | 59 | 46 | 54 | 37 | 36 |

| Net assets at end of period (000 omitted) | $4,071 | $3,629 | $3,922 | $5,391 | $5,970 |

| Class R2 | Year ended |

| | 4/30/24 | 4/30/23 | 4/30/22 | 4/30/21 | 4/30/20 |

| Net asset value, beginning of period | $12.31 | $12.71 | $15.09 | $14.88 | $13.93 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.47 | $0.38 | $0.31 | $0.34 | $0.39 |

| Net realized and unrealized gain (loss) | (0.33) | (0.39) | (1.91) | 0.36 | 0.95 |

| Total from investment operations | $0.14 | $(0.01) | $(1.60) | $0.70 | $1.34 |

| Less distributions declared to shareholders |

| From net investment income | $(0.48) | $(0.38) | $(0.33) | $(0.35) | $(0.39) |

| From net realized gain | — | (0.01) | (0.45) | (0.14) | — |

| Total distributions declared to shareholders | $(0.48) | $(0.39) | $(0.78) | $(0.49) | $(0.39) |

| Net asset value, end of period (x) | $11.97 | $12.31 | $12.71 | $15.09 | $14.88 |

| Total return (%) (r)(s)(t)(x) | 1.16 | 0.03 | (11.23) | 4.68 | 9.73 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 1.03 | 1.03 | 1.01 | 1.02 | 1.04 |

| Expenses after expense reductions (f) | 1.02 | 1.02 | 1.00 | 1.00 | 1.03 |

| Net investment income (loss) | 3.93 | 3.11 | 2.12 | 2.18 | 2.67 |

| Portfolio turnover | 59 | 46 | 54 | 37 | 36 |

| Net assets at end of period (000 omitted) | $13,963 | $17,271 | $19,328 | $28,348 | $31,346 |

See Notes to Financial Statements

Financial Highlights – continued

| Class R3 | Year ended |

| | 4/30/24 | 4/30/23 | 4/30/22 | 4/30/21 | 4/30/20 |

| Net asset value, beginning of period | $12.31 | $12.71 | $15.09 | $14.88 | $13.93 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.50 | $0.39 | $0.35 | $0.37 | $0.42 |

| Net realized and unrealized gain (loss) | (0.33) | (0.37) | (1.92) | 0.37 | 0.96 |

| Total from investment operations | $0.17 | $0.02 | $(1.57) | $0.74 | $1.38 |

| Less distributions declared to shareholders |

| From net investment income | $(0.51) | $(0.41) | $(0.36) | $(0.39) | $(0.43) |

| From net realized gain | — | (0.01) | (0.45) | (0.14) | — |

| Total distributions declared to shareholders | $(0.51) | $(0.42) | $(0.81) | $(0.53) | $(0.43) |

| Net asset value, end of period (x) | $11.97 | $12.31 | $12.71 | $15.09 | $14.88 |

| Total return (%) (r)(s)(t)(x) | 1.42 | 0.28 | (11.00) | 4.94 | 10.00 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 0.78 | 0.78 | 0.76 | 0.77 | 0.79 |

| Expenses after expense reductions (f) | 0.77 | 0.76 | 0.75 | 0.75 | 0.78 |