- MAT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Mattel (MAT) DEF 14ADefinitive proxy

Filed: 17 Apr 24, 4:21pm

☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

CHECK THE APPROPRIATE BOX: | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|  |

|  | |

Ynon Kreiz Chairman and Chief Executive Officer | Michael Dolan Independent Lead Director | |

|  |

2 | Mattel, Inc. |

| Date and Time May 29, 2024 at 1:00 p.m. (Los Angeles time) |  | Virtual Meeting You may attend the virtual meeting by visiting: www.virtualshareholdermeeting.com/MAT2024 |  | Record Date Holders of record of Mattel common stock at the close of business on April 5, 2024 |

Matter | The Board’s Recommendations | |

Proposal 1: | Election of the ten director nominees named in the Proxy Statement | FOR each Director Nominee |

Proposal 2: | Ratification of the selection of PricewaterhouseCoopers LLP as Mattel’s independent registered public accounting firm for the year ending December 31, 2024 | FOR |

Proposal 3: | Advisory vote to approve named executive officer compensation (“Say-on-Pay”) | FOR |

Proposal 4: | Approval of the Mattel, Inc. Amended and Restated 2010 Equity and Long-Term Compensation Plan | FOR |

Proposal 5: | Stockholder proposal requesting additional disclosure regarding political contributions and expenditures | AGAINST |

Such other business as may properly come before the 2024 Annual Meeting | ||

Jonathan Anschell Secretary El Segundo, California April 17, 2024 | How To Vote | |||

| Internet www.ProxyVote.com (prior to May 29, 2024). Attend our annual meeting virtually by logging into the virtual annual meeting website and vote by following the instructions provided on the website (during the meeting) | |||

| Telephone 1-800-690-6903 |  | Mail Mark, sign, date, and promptly mail the enclosed proxy card in the postage-paid envelope | |

Important Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting to be held on May 29, 2024. The proxy statement (“Proxy Statement”) and the annual report on Form 10-K for the fiscal year ended December 31, 2023 (“Annual Report”) are available at https://investors.mattel.com/financials/annual-reports. |

|  |

2024 Proxy Statement | 3 |

Director Nominees | |

Director Nominees Snapshot | |

Proposal 1 | ||

Director Nominee Skills, Experience, and Attributes | ||

Director Nominees for Election | ||

Proposal 3 | ||

2023 Business Overview | ||

2023 Individual Performance Assessments | ||

|

4 | Mattel, Inc. |

Proposal 5 | Stockholder Proposal Requesting Additional Disclosure Regarding Political Contributions and Expenditures | ||

Appendix A - Mattel, Inc. Amended and Restated 2010 Equity and Long-Term Compensation Plan | A-1 |

|  |

2024 Proxy Statement | 5 |

Overview 2023 was a milestone year for Mattel. We extended our leadership in our key toy categories and gained market share overall, achieved extraordinary success with the Barbie movie, and further strengthened our financial position. Full year Net Sales were comparable to the prior year, with growth in three of four regions,1 Gross Margin expansion, and a significant increase in cash flow. We ended 2023 with the strongest balance sheet we have had in years, and with more resources to continue to execute our strategy. We achieved an investment grade credit rating, resumed share repurchases for the first time since 2014, and repurchased $203 million of our common stock in 2023. Aligned with our capital allocation priorities, Mattel’s Board of Directors approved a new $1 billion share repurchase program in early 2024. We continued to improve operations in 2023 and successfully concluded the Optimizing for Growth cost savings program, which achieved total annualized gross cost savings of $343 million between 2021 and 2023. In February 2024, we announced a new Optimizing for Profitable Growth cost savings program, which will target an additional $200 million of annualized gross cost savings between 2024 and 2026. |

|

6 | Mattel, Inc. |

|  |

2024 Proxy Statement | 7 |

Proposal | The Board’s Recommendations | Page | |

1 | Election of Ten Director Nominees | FOR each Director Nominee | |

2 | Ratification of PricewaterhouseCoopers LLP as our Independent Accounting Firm for the Year Ending December 31, 2024 | FOR | |

3 | Advisory Vote to Approve Named Executive Officer Compensation | FOR | |

4 | Approval of the Mattel, Inc. Amended and Restated 2010 Equity and Long-Term Compensation Plan | FOR | |

5 | Stockholder Proposal Requesting Additional Disclosure Regarding Political Contributions and Expenditures | AGAINST | |

How To Vote | |||||

| Internet www.ProxyVote.com (prior to May 29, 2024). Attend our annual meeting virtually by logging into the virtual annual meeting website and vote by following the instructions provided on the website (during the meeting) |  | Telephone 1-800-690-6903 |  | Mail Mark, sign, date, and promptly mail the enclosed proxy card in the postage-paid envelope |

|

8 | Mattel, Inc. |

|  |

2024 Proxy Statement | 9 |

|  | ||||

Dr. Judy Olian | Dawn Ostroff | ||||

Director Since: 2018 | Director Since: 2024 | ||||

Committee Memberships: Compensation (Chair), Governance and Social Responsibility | Committee Membership: Compensation | ||||

Independent | Independent |

|  |  |  | ||||||||

Ynon Kreiz | Adriana Cisneros | Diana Ferguson* | Julius Genachowski* | ||||||||

Director Since: 2017 | Director Since: 2018 | Director Since: 2020 | Director Since: 2024 | ||||||||

Committee Membership: Stock Grant | Committee Membership: Governance and Social Responsibility | Committee Memberships: Audit (Chair), Executive | Committee Memberships: Audit, Governance and Social Responsibility | ||||||||

Chairman of the Board | Independent | Independent | Independent |

|  |  |  | ||||||||

Prof. Noreena Hertz | Soren Laursen | Roger Lynch | Dominic Ng* | ||||||||

Director Since: 2023 | Director Since: 2018 | Director Since: 2018 | Director Since: 2006 | ||||||||

Committee Membership: Governance and Social Responsibility (Chair) | Committee Memberships: Audit, Finance | Committee Memberships: Compensation, Finance | Committee Memberships: Finance (Chair), Audit, Executive | ||||||||

Independent | Independent | Independent | Independent |

|  |  |  |  |  |  |  |  |  |

Brand and Marketing | Corporate Citizenship / ESG | Entertainment / Media | Finance, Accounting, or Financial Reporting | Human Capital Management | Industry | International / Global Operations | Senior Leadership | Supply Chain | Technology / E-Commerce |

5 of 10 nominees | 7 of 10 nominees | 8 of 10 nominees | 8 of 10 nominees | 6 of 10 nominees | 6 of 10 nominees | 8 of 10 nominees | 9 of 10 nominees | 3 of 10 nominees | 6 of 10 nominees |

Racial/Ethnic Diversity | Gender Diversity | Independence | Average Tenure | Average Age | ||||||||

30% of nominees | 50% of nominees | 90% of nominees | 5.4 years | 60 years | ||||||||

Corporate Governance Practices | Board Practices | |

Annual elections for all directors Majority voting standard Robust Independent Lead Director role with significant responsibilities Stockholder right to call special meetings Stockholder right to proxy access Stockholder ability to remove directors with or without cause Stockholder ability to act by written consent | Routine review of Board leadership structure Annual Board and committee evaluations Robust Director and Chief Executive Officer (“CEO”) succession planning and search process Annual review and evaluation of the CEO’s performance by independent directors Quarterly executive sessions held without management present Comprehensive risk management with Board and committee oversight Nine of ten director nominees are independent | |

|  |

10 | Mattel, Inc. |

Total Percentage of Shares Held by Stockholders Contacted in Fall 2023 | Total Percentage of Shares Held by Stockholders Engaged in Fall 2023 |

~62% | ~56% |

|  |

2024 Proxy Statement | 11 |

Board Composition and Skill Sets | Board Leadership Structure | Board Oversight | ||

Business Strategy | Capital Allocation | Executive Compensation Programs | ||

Executive Succession Planning | Governance Practices | Environmental Sustainability |

CEO | Other NEOs** |

Compensation Components | Characteristics | 2023 Actions/Results |

Base Salary | •Provide fixed cash compensation based on individual role, skill set, market data, performance, criticality to the Company, and internal pay equity | Increased 2023 base salaries for certain NEOs, in recognition of outstanding performance and criticality to the Company, supported by competitive market practices based on data provided by Frederic W. Cook & Co. (“FW Cook”), as discussed on page 54. |

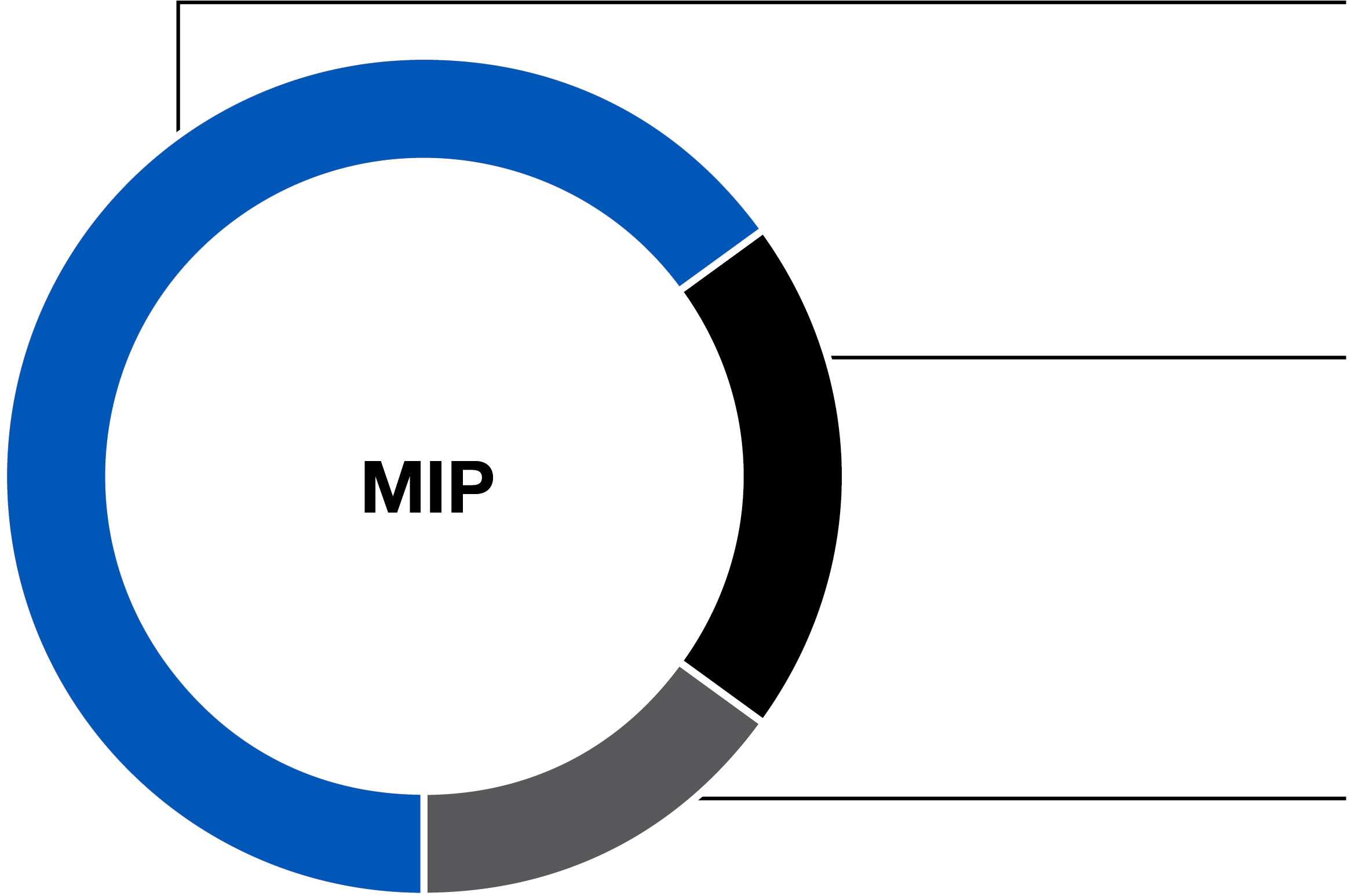

Annual Cash Incentive (MIP) | •Incentivize and motivate senior executives to achieve our short-term strategic and financial objectives that we believe will drive long-term stockholder value •Our 2023 MIP financial measures focused on improving profitability, accelerating topline growth, and improving our working capital position. The 2023 MIP was structured as follows: ◦65% MIP-Adjusted EBITDA Less Capital Charge ◦20% MIP-Adjusted Net Sales ◦15% MIP-Adjusted Gross Margin ◦Multiplier based on Individual Performance | Increased Mr. Kreiz’s 2023 target MIP opportunity in recognition of the criticality and impact of his role as Chairman & CEO, supported by competitive market practices based on data provided by FW Cook and our pay-for-performance philosophy, as discussed on page 54. The Company financial earnout for the 2023 MIP was 156.2% of target opportunity, as discussed on page 53. |

|  |

12 | Mattel, Inc. |

Compensation Components | Characteristics | 2023 Actions/Results |

Stock-Based Long-Term Incentives (LTIs) | •Aimed at focusing our senior executives on achieving our key long-term financial objectives, while rewarding relative growth in stockholder value that is sustained over several years | Increased 2023 LTI values for Mr. Kreiz and the other NEOs, supported by competitive market practices based on data provided by FW Cook and our pay-for- performance philosophy, as discussed on page 57. |

•Performance Units | •Incentivize and motivate senior executives to achieve key long-term financial objectives and stock price outperformance •The Performance Units granted under the three-year LTIP cycles are structured as follows: ◦Three-Year Cumulative Adjusted Free Cash Flow ◦Multiplier based on Three-Year Relative Total Stockholder Return (“TSR”) vs. S&P 500 constituents | The earnout for the 2021-2023 LTIP was 101% of target Performance Units granted, as discussed on page 59. |

•Stock Options | •Align senior executives’ interests with stockholders’ interests and drive focus on increasing long-term stockholder value •Vest in annual installments over three years and have ten-year terms | |

•RSUs | •Encourage senior executive stock ownership •Support stockholder-aligned retention •Vest in annual installments over three years | |

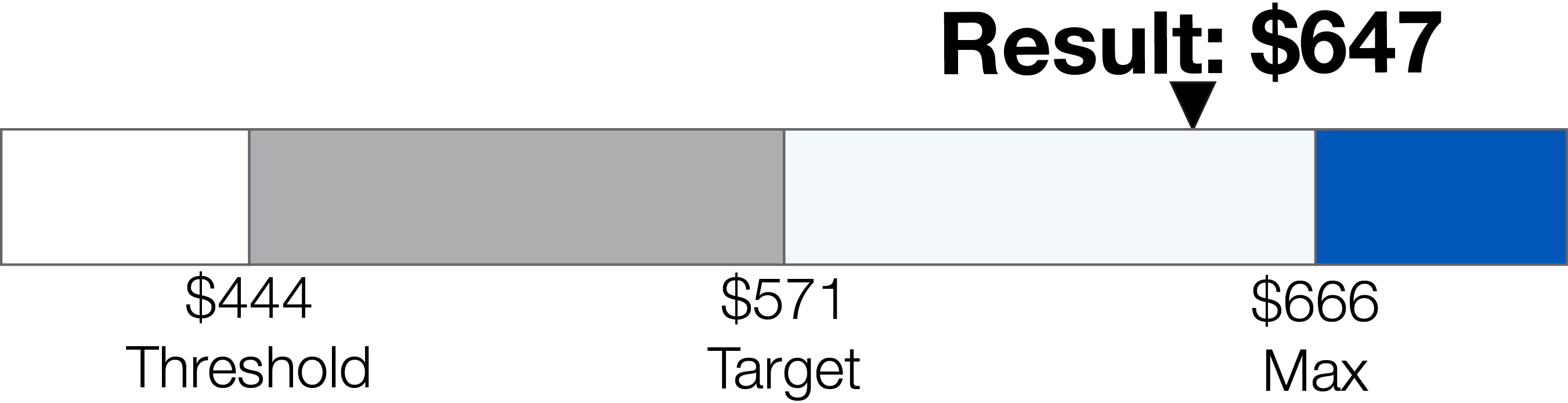

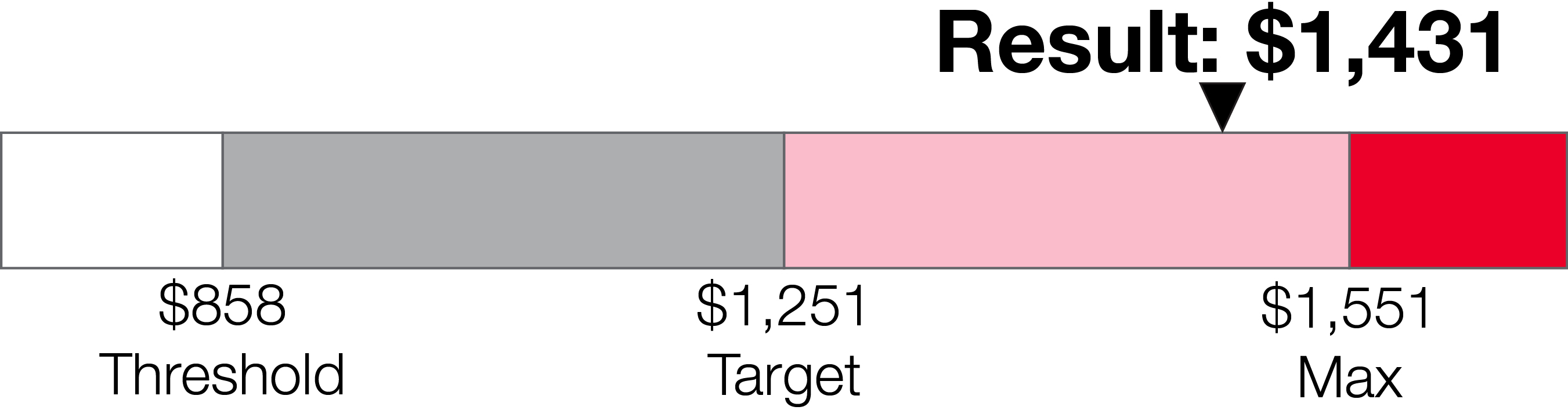

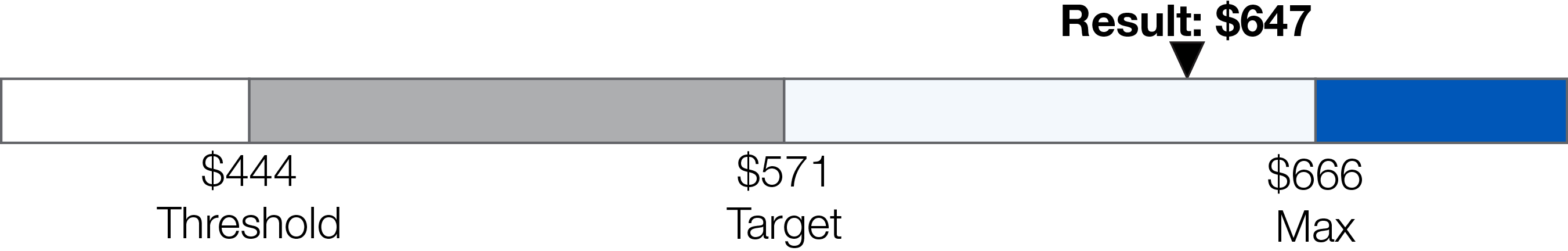

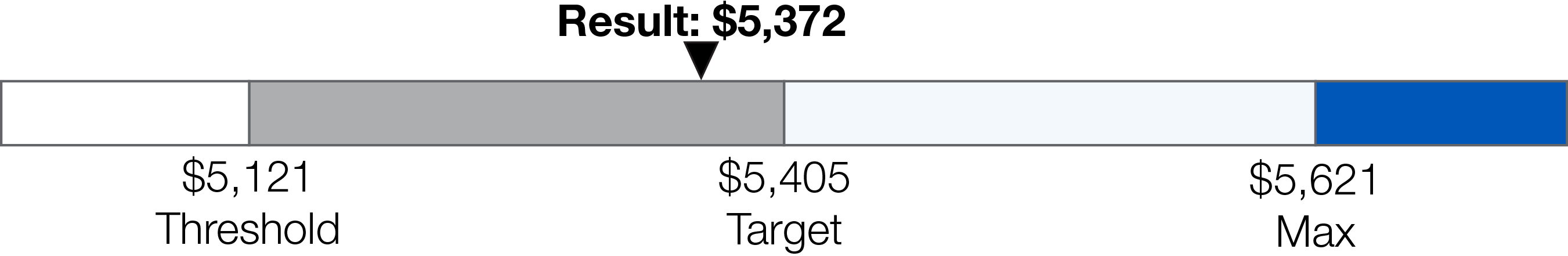

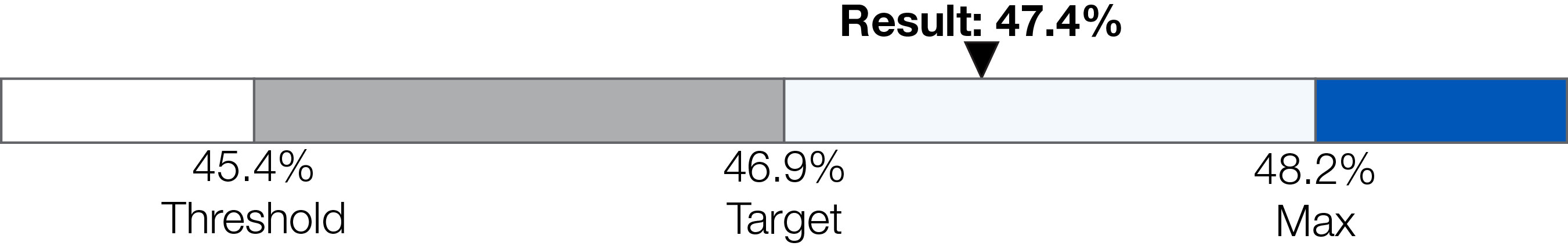

MIP-Adjusted EBITDA Less Capital Charge* | MIP-Adjusted Net Sales* | MIP-Adjusted Gross Margin* |

|  |  |

|  |

2024 Proxy Statement | 13 |

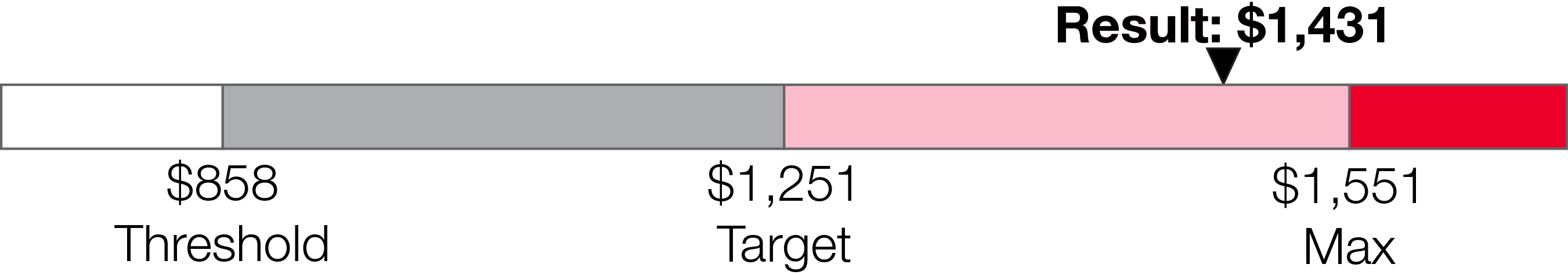

Three-Year Cumulative Adjusted Free Cash Flow* | Relative TSR Percentile | ||||

|  | ||||

What We Do | What We Do Not Do | ||

Clawback Policy applicable to all Section 16 officers and other officers at or above the level of Executive Vice President (“EVP”) Best practice severance benefits at competitive levels not greater than 2x the sum of base salary and annual bonus, applicable to the CEO and direct reports to the CEO Double-trigger accelerated vesting in the event of a change of control Robust stock ownership guidelines as a multiple of base salary: 6x for the CEO, 4x for the Chief Financial Officer (“CFO”), and 3x for other NEOs Independent compensation consultant Annual compensation risk assessment Annual review comparing executive compensation with peer companies (“peer group”) | No excise tax gross-ups on severance or other payments in connection with a change of control No poor pay practice tax gross-ups on perquisites and benefits No hedging or pledging by Board members, officers, or employees permitted No repricing of stock options without stockholder approval |

|  |

14 | Mattel, Inc. |

| Sustainable Design and Development What we do | |

Priorities: | Strategy: | |

•Product Quality and Safety •Sustainable Materials in Toys •Sustainable Packaging •Business Model Innovation | Develop innovative products and experiences that are better for our world by integrating sustainable materials and principles of product stewardship and circular design | |

Goals: | ||

•Achieve 100% recycled, recyclable, or bio-based plastic materials in our products and packaging by 2030 •Maintain 95% recycled or Forest Stewardship Council (“FSC”)-certified content in the paper and wood fiber used in our products and packaging •Reduce plastic packaging by 25% per product by 2030 (versus 2020 baseline)* | ||

|  |

2024 Proxy Statement | 15 |

| Responsible Sourcing and Production How we do it | |

Priorities: | Strategy: | |

•Ethical Sourcing, Human Rights, Fair Labor, and Environmental Standards in the Supply Chain •Worker Health and Safety •Energy/Climate Action •Waste Management •Ethics and Compliance | Optimize our resource use in operations to reduce environmental impact and promote ethical sourcing practices and worker health and safety throughout our supply chain | |

Goals: | ||

•Reduce absolute Scope 1 and 2 GHG emissions 50% by 2030 (versus 2019 baseline)* •Achieve zero manufacturing waste** by 2030 | ||

| Thriving and Inclusive Communities Those we impact | |

Priorities: | Strategy: | |

•Purposeful Play •Diversity, Equity & Inclusion •Family-Friendly Workplace •Philanthropy •Child Online Safety and Data Privacy •Responsible Marketing to Children | Create positive social impact through purposeful play and by supporting diverse, equitable, and inclusive communities where we live, work, and play | |

Goals: | ||

•Achieve and maintain 100% pay equity for all employees performing similar work globally •Increase representation of women at all levels of the organization •Increase representation of ethnicity at all levels of the organization | ||

|  |

16 | Mattel, Inc. |

100% Base Pay Ratio by Gender1 | 100% Base Pay Ratio by Ethnicity2 | 57% Total Representation of Women3 | 45% Total Representation of Ethnically Diverse Employees4 |

|  |

2024 Proxy Statement | 17 |

|  |  |  |

World's Best Employers & America’s Best Midsize Employers | Best Companies to Work For | America's Greatest Workplaces for Women & Most Trustworthy, Most Responsible Companies in America | Best Workplaces for Innovators |

|  |  |  |

100 Best Companies | Great Place to Work® Certified - USA, UK, DE, AUS | Best Places to Work HRC - USA, MX, BR | Best Places to Work in IT |

ESG Oversight |

|  |

18 | Mattel, Inc. |

Board of Directors | ||||

Audit Committee | Compensation Committee | Governance and Social Responsibility Committee | ||

•Oversees ESG-related compliance, including compliance with laws and regulations | •Considers progress of Mattel’s ESG priorities, strategy, and goals when assessing performance | •Assists the Board with oversight and review of ESG matters •Periodically receives reports from management and reports to the Board | ||

Management | ||||

•Reports to the Board’s Governance and Social Responsibility Committee, providing updates on progress toward Mattel’s ESG programs and plans on a periodic basis | ||||

ESG Executive Council | ||||

•Chaired by Mattel’s Chairman and CEO and composed of key senior executives throughout the organization •Defines Mattel’s ESG strategy and goals, and evaluates and approves programs and plans that advance Mattel’s ESG practices in support of the Company’s purpose and objectives, focusing on key workstreams designed to reinforce Mattel’s ESG strategy and goals •Aims to meet monthly to provide updates to management on progress toward goals and to review new programs, plans, and recommendations | ||||

Proposal 1: Election of Directors | |

| The Board recommends that stockholders vote FOR each of the nominees named herein for election as directors. |

|  |  |  |  | ||||

Ynon Kreiz | Adriana Cisneros | Diana Ferguson | Julius Genachowski | Prof. Noreena Hertz | ||||

|  |  |  |  | ||||

Soren Laursen | Roger Lynch | Dominic Ng | Dr. Judy Olian | Dawn Ostroff |

|  |

2024 Proxy Statement | 19 |

Skills, Experience, and Attributes |  |  |  |  |  |  |  |  |  |  | |

| Brand and Marketing As we look to capture the full value of our IP in the mid-to-long term, we believe directors with relevant experience in consumer marketing or brand management, especially on a global basis, provide important insights to our Board. | • | • | • | • | • | |||||

| Corporate Citizenship/ESG We benefit from directors with experience with sustainability and social impact initiatives designed to achieve long-term stockholder value through a responsible, sustainable business model. | • | • | • | • | • | • | • | |||

| Entertainment and Media We value experience in the entertainment/media industries, which provide important insight as we seek to capture the full value of our IP by monetizing our brands and franchises through film, television, digital gaming, live events, and music. | • | • | • | • | • | • | • | • | ||

| Finance, Accounting, or Financial Reporting We value directors with experience in finance, accounting, and/or financial reporting, as we measure our operating and strategic performance by reference to certain financial measures and are subject to various accounting and public company rules and requirements. Accordingly, we seek to have a number of directors who qualify as audit committee financial experts (as defined by SEC rules). | • | • | • | • | • | • | • | • | ||

| Human Capital Management Our people are among our most important assets and we believe the successful development and retention of our employees is critical to our success. As such, we benefit from having directors with an understanding of human capital management obtained from experience as a senior leader in a large organization. | • | • | • | • | • | • | ||||

| Industry Directors with experience in our industry provide valuable perspective on issues specific to our products and the operation of our business. | • | • | • | • | • | • | ||||

| International/Global Operations As our business is worldwide in scope, we benefit from directors having experience as a senior leader in a large organization with international operations. | • | • | • | • | • | • | • | • | ||

| Senior Leadership Directors with CEO or senior management experience have a demonstrated record of leadership and a practical understanding of organizations, processes, strategy, risk, and risk management, as well as methods to drive change and growth. | • | • | • | • | • | • | • | • | • | |

| Supply Chain As a global consumer goods company, we benefit from directors with experience in supply chain management or oversight, including international manufacturing, sourcing, inventory management, transportation and logistics, and supplier/vendor relationships. | • | • | • | |||||||

| Technology and E-Commerce Experience with technology/e-commerce, including in cybersecurity and data privacy, helps our Board oversee Mattel’s cybersecurity risks and advise management as we further grow our e-commerce business, including our DTC business. | • | • | • | • | • | • | ||||

|  |

20 | Mattel, Inc. |

| Ynon Kreiz | ||||||||||||||||

Chairman of the Board Age: 59 Director Since: 2017 | Mattel Committee Membership: Stock Grant Committee Other Current Public Directorships: Warner Music Group Corp. | ||||||||||||||||

Skills: | |||||||||||||||||

|  |  |  |  |  |  |  |  | |||||||||

Brand and Marketing | Corporate Citizenship / ESG | Entertain- ment / Media | Finance, Accounting, or Financial Reporting | Human Capital Management | Industry | International / Global Operations | Senior Leadership | Supply Chain | |||||||||

Career Highlights Maker Studios, Inc., a global digital media and content network company •Chairman of the Board (June 2012 – May 2014) •Chief Executive Officer (May 2013 – January 2015) Endemol Group, one of the world’s leading television production companies •Chairman of the Board and Chief Executive Officer (June 2008 – June 2011) Balderton Capital (formerly Benchmark Capital Europe), a venture capital firm •General Partner (2005 – 2007) Fox Kids Europe N.V., a children’s entertainment company •Chairman of the Board, Chief Executive Officer, and Co-founder (1996 – 2002) | Other Public Company Directorships •Warner Music Group Corp. since May 2015 Additional Leadership Experience and Service •Member, Academy of Motion Picture Arts & Science’s Executive Branch since 2023 •Board of Advisors, Anderson Graduate School of Management at UCLA since April 2015 •Chairman of Board of Trustees, Israeli Olympic Committee, London Games (2012) |

|  |

2024 Proxy Statement | 21 |

| Adriana Cisneros | ||||||||||||

Age: 44 Director Since: 2018 | Mattel Committee Membership: Governance and Social Responsibility Committee Other Current Public Directorships: AST SpaceMobile, Inc. | ||||||||||||

Skills: | |||||||||||||

|  |  |  |  |  | ||||||||

Brand and Marketing | Corporate Citizenship / ESG | Entertain- ment / Media | International / Global Operations | Senior Leadership | Technology / E-Commerce | ||||||||

Career Highlights Cisneros Group of Companies, a privately held company with over 90 years’ experience operating businesses globally with three divisions (Cisneros Media, Cisneros Interactive, and Cisneros Real Estate) •Chief Executive Officer since September 2013 •Vice Chairman and Director of Strategy (September 2005 – August 2013) Other Public Company Directorships •AST SpaceMobile, Inc. since April 2021 | Additional Leadership Experience and Service •Director, La Wawa since 2023 •Director, The Electric Factory since 2023 •Advisor, The Venture City since 2023 •Director, Americas Society/Council of the Americas since 2021 •Member, Strategic Advisory Board of Mission Advancement Corp. since 2020 •Director, Citibank Private Bank Latin American Advisory Board since 2018 •Director, Knight Foundation since 2018 •Director, Parrot Analytics since 2018 •Trustee, The Paley Center for Media since 2016 •Member, International Academy of Television Arts & Sciences since 2015 •Advisory Member, Museum of Modern Art - Cisneros Institute since 2012 •President, Fundación Cisneros since 2009 •Director, University of Miami (2017 – 2023) •Co-chair, Endeavor Miami (2014 – 2020) |

|  |

22 | Mattel, Inc. |

| Diana Ferguson | ||||||||||||

Age: 61 Director Since: 2020 | Mattel Committee Memberships: Audit Committee (Chair), Executive Committee Other Current Public Directorships: Gartner, Inc., Sally Beauty Holdings, Inc. | ||||||||||||

Skills: | |||||||||||||

|  |  |  |  |  | ||||||||

Finance, Accounting, or Financial Reporting | Human Capital Management | Industry | International / Global Operations | Senior Leadership | Supply Chain | ||||||||

Career Highlights Scarlett Investments, LLC, a private investment and consulting firm •Principal since August 2013 Cleveland Avenue LLC, a privately held venture capital and consulting firm •Chief Financial Officer (September 2015 – December 2020) The Folgers Coffee Company, a division of Procter & Gamble •Senior Vice President and Chief Financial Officer (April 2008 – November 2008) Merisant Worldwide, Inc., a maker of table-top sweeteners and sweetened food products •Executive Vice President and Chief Financial Officer (2007 – 2008) Sara Lee Corporation, a global consumer products company •Senior Vice President and Chief Financial Officer, Sara Lee Foodservice (2006 – 2007) •Senior Vice President Strategy and Corporate Development (2004 – 2006) •Vice President and Treasurer (2001 – 2004) | Other Public Company Directorships •Gartner, Inc. since 2021 •Sally Beauty Holdings, Inc. since 2019 •Invacare Corporation (2018 – 2022) •Frontier Communications Corporation (2014 – 2021) Additional Leadership Experience and Service •Director, Chicago Botanic Gardens since 2021 •Trustee, Groton School since 2015 •Board Member, Leadership Greater Chicago (2003 – 2005) |

|  |

2024 Proxy Statement | 23 |

| Julius Genachowski | ||||||||||||||

Age: 61 Director Since: 2024 | Mattel Committee Memberships: Audit Committee, Governance and Social Responsibility Committee Other Current Public Directorships: Mastercard Incorporated, Sonos, Inc. | ||||||||||||||

Skills: | |||||||||||||||

|  |  |  |  |  |  |  | ||||||||

Corporate Citizenship / ESG | Entertain- ment / Media | Finance, Accounting, or Financial Reporting | Human Capital Management | Industry | International / Global Operations | Senior Leadership | Technology / E-Commerce | ||||||||

Career Highlights The Carlyle Group, a global investment company •Senior Advisor since 2024 •Partner and Managing Director (2014 – 2023) President’s Intelligence Advisory Board, an independent intelligence advisory board within the Executive Office of the President •Member (August 2014 – January 2017) U.S. Federal Communications Commission, an independent federal agency of the United States •Chair (2009 – 2013) IAC Inc. (formerly IAC/InterActiveCorp), a holding company that owns brands across 100 countries •Member of Barry Diller’s Office of the Chairman, Chief of Business Operations, and General Counsel (1997 – 2005) Supreme Court of the United States •Law Clerk to David H. Souter (1993 – 1994) •Law Clerk to William J. Brennan, Jr. (1992 – 1993) | Other Public Company Directorships •Mastercard Incorporated since June 2014 •Sonos, Inc. since September 2013 •Sprint Corporation (August 2015 – April 2020) Additional Leadership Experience and Service •Director, HIAS since 2022 •Member, President-Elect Obama’s Transition Board (2008) •Chairperson, Obama Presidential Campaign Technology, Media and Telecommunications Policy Working Group (2008) |

|  |

24 | Mattel, Inc. |

| Prof. Noreena Hertz | ||||||||||

Age: 56 Director Since: 2023 | Mattel Committee Membership: Governance and Social Responsibility Committee (Chair) Other Current Public Directorships: Warner Music Group | ||||||||||

Skills: | |||||||||||

|  |  |  |  | |||||||

Corporate Citizenship / ESG | Entertain- ment / Media | Finance, Accounting, or Financial Reporting | Industry | Technology / E-Commerce | |||||||

Career Highlights University College London •Visiting Professor at the Institute for Global Prosperity since 2016 •Honorary Professor since 2013 University of Amsterdam •Professor of Globalisation, Sustainability, and Finance (2009 – 2013) University of Cambridge •Associate Director of the Centre for International Business and Management (2003 – 2013) | Other Public Company Directorships •Warner Music Group Corp. (2014 – 2016; 2017 – present) Additional Leadership Experience and Service •Director, Workhuman (Globoforce Limited) since April 2022 •Trustee, Inspiring Girls International Limited (2016 – 2023) •Member, RWE AG Digital Transformation Board (2015 – 2016) •Member, Inclusive Capitalism Taskforce (2012 – 2013) •Member, Edelman Europe Advisory Board (2009 – 2012) •Member, Citigroup Politics and Economics Global Advisory Board (2007 – 2008) |

|  |

2024 Proxy Statement | 25 |

| Soren Laursen | |||||||||

Age: 60 Director Since: 2018 | Mattel Committee Memberships: Audit Committee, Finance Committee | |||||||||

Skills: | ||||||||||

|  |  |  |  |  |  |  |  |  | |

Brand and Marketing | Corporate Citizenship / ESG | Entertain- ment / Media | Finance, Accounting, or Financial Reporting | Human Capital Management | Industry | International / Global Operations | Senior Leadership | Supply Chain | Technology / E-Commerce | |

Career Highlights Credo Partners AS, an investment firm focusing on mid-size companies •Operating Partner since 2023 •Head of Denmark (2019 – 2023) TOP-TOY, a toy retailer in the Nordic market •Chief Executive Officer (April 2016 – January 2018) LEGO Systems, Inc., the Americas division of the family- owned and privately-held The LEGO Group, a toy company based in Denmark •President (January 2004 – March 2016) The LEGO Company •Senior Vice President, Europe North and Europe East (April 2000 – December 2003) •Senior Vice President, Special Markets (1999 – 2000) •Vice President/General Manager, LEGO New Zealand (1995 – 1999) | Additional Leadership Experience and Service •Board member, Koble ApS since 2023 •Board member, The Army Painter since 2023 •Chairman, BørneRiget Fonden since 2020 •Advisor, AVT Business School since 2018 •Board member, Postevand ApS since 2015 •Board member, Varier Furniture A/S Oslo since 2014 •Advisor, American Toy Industry Association since 2014; Board member at large since 2004 •Director, Patentrenewals.com (2018 – 2023) •Board Member, BoeBeauty (2020 – 2021) •Director, Isabella A/S (2018 – 2020) •Interim Executive Director, Mattel (October 2018 – September 2019) •Director, A.T. Cross, R.I. (2014 – 2016) •Director, LEGO Children’s Fund (2010 – 2016) •Director, Connecticut Children’s Medical Center (2008 – 2016) |

|  |

26 | Mattel, Inc. |

| Roger Lynch | ||||||||||||

Age: 61 Director Since: 2018 | Mattel Committee Memberships: Compensation Committee, Finance Committee | ||||||||||||

Skills: | |||||||||||||

|  |  |  |  |  | ||||||||

Brand and Marketing | Entertain- ment / Media | Finance, Accounting, or Financial Reporting | International / Global Operations | Senior Leadership | Technology / E-Commerce | ||||||||

Career Highlights Condé Nast, a global media company •Chief Executive Officer since April 2019 Pandora Media, Inc., a streaming music service •Chief Executive Officer, President, and Director (September 2017 – February 2019) Sling TV Holding LLC, an on-demand internet streaming television service (subsidiary of DISH Network) •Chief Executive Officer and Director (July 2012 – August 2017) Dish Network LLC, a pay television operator •Executive Vice President, Advanced Technologies (November 2009 – July 2012) Video Networks International, Ltd., an internet protocol television provider •Chairman and Chief Executive Officer (2002 – 2009) Chello Broadband N.V., a broadband internet service provider in Europe •President and Chief Executive Officer (1999 – 2001) | Additional Leadership Experience and Service •Director, News Media Alliance since 2022 •Director, Partnership for New York City since 2021 •Director, USC Dornsife School of Letters, Arts and Sciences since 2018 •Director, Tuck School of Business at Dartmouth since 2017 •Director, Quibi LLC (2018 – 2020) •Board Observer, Roku LLC (2012 – 2017) •Director, Digitalsmiths LLC (2010 – 2015) |

|  |

2024 Proxy Statement | 27 |

| Dominic Ng | ||||||||||||||

Age: 65 Director Since: 2006 | Mattel Committee Memberships: Finance Committee (Chair), Audit Committee, Executive Committee Other Current Public Directorships: East West Bancorp, Inc. | ||||||||||||||

Skills: | |||||||||||||||

|  |  |  |  |  |  | |||||||||

Corporate Citizenship / ESG | Entertain- ment / Media | Finance, Accounting, or Financial Reporting | Human Capital Management | Industry | International / Global Operations | Senior Leadership | |||||||||

Career Highlights East West Bancorp, Inc. and East West Bank, a global bank based in California •Chief Executive Officer and Chairman of the Board since 1992 •President (1992 – 2009) Seyen Investment, Inc., a private family investment business •President (1990 – 1992) Deloitte & Touche LLP, an accounting firm •Certified Public Accountant (1980 – 1990) | Other Public Company Directorships •East West Bancorp, Inc. since 1992 •PacifiCare Health Systems, Inc. (2003 – 2005) •ESS Technology, Inc. (1998 – 2004) Additional Leadership Experience and Service •Member, Asia-Pacific Economic Cooperation Business Advisory Council since 2022 •Trustee, Academy Museum of Motion Pictures since 2018 •Trustee, University of Southern California since 2014 •Director of the following nonprofit entities and government organizations: California Bankers Association (2002 – 2011, 2016 – 2017); Chairman, Committee of 100 (2011 – 2014); The United Way of Greater Los Angeles (1995 – 2014); Pacific Council on International Policy (2010 – 2013); Los Angeles’ Mayor’s Trade Advisory Council as Co-Chair (2009 – 2011); and Federal Reserve Bank of San Francisco – Los Angeles Branch (2005 – 2011) |

|  |

28 | Mattel, Inc. |

| Dr. Judy Olian | ||||||||||

Age: 72 Director Since: 2018 | Mattel Committee Memberships: Compensation Committee (Chair), Governance and Social Responsibility Committee Other Current Public Directorships: Ares Management Corporation, United Therapeutics Corp. | ||||||||||

Skills: | |||||||||||

|  |  |  |  | |||||||

Corporate Citizenship / ESG | Finance, Accounting, or Financial Reporting | Human Capital Management | International / Global Operations | Senior Leadership | |||||||

Career Highlights Quinnipiac University •President since July 2018 UCLA Anderson School of Management •Dean and John E. Anderson Chair in Management (January 2006 – July 2018) Other Public Company Directorships •United Therapeutics Corp. since 2015 •Ares Management Corporation since 2014 | Additional Leadership Experience and Service •Member, CT Governor’s Workforce Commission since 2020 •Board member, Business-Higher Education Forum since 2019 •Advisory Board Member, Catalyst Inc. since 2011 •Director, UCLA Technology Development Corporation (2014 – 2018) •Chairman, Loeb Awards for Excellence in Business Journalism (2006 – 2018) •Member, International Advisory Board, Peking University School of Business (2007 – 2016) •Board member, AdvanceCT related to economic development, appointed by Governor of Connecticut |

|  |

2024 Proxy Statement | 29 |

| Dawn Ostroff | |||||||||

Age: 64 Director Since: 2024 | Mattel Committee Membership: Compensation Committee Other Current Public Directorships: Paramount Global | |||||||||

Skills: | ||||||||||

|  |  |  | |||||||

Brand and Marketing | Entertain- ment / Media | Senior Leadership | Technology / E-Commerce | |||||||

Career Highlights Spotify Technology S.A., an audio streaming service •Chief Content & Advertising Business Officer (2018 – 2023) Condé Nast Entertainment, an entertainment studio and distribution network •President (2011 – 2018) The CW Network, a joint venture of CBS and Warner Bros. •President of Entertainment (2006 – 2011) UPN Network, a subsidiary of CBS •President (2002 – 2006) Lifetime Television, a cable TV network •Executive Vice President of Entertainment (1996 – 2002) | Other Public Company Directorships •Paramount Global, since May 2023 •Activision Blizzard, Inc., August 2020 – October 2023 •Westfield Corporation, March 2016 – February 2018 Additional Leadership Experience and Service •Board Member, New York University since 2014 •Board of Governors, The Paley Center for Media (2020 – 2022) •Director, Anonymous Content (Emerson Collective Parent Company) (2018 – 2020) |

|  |

30 | Mattel, Inc. |

Under our Director Nominations Policy, each director nominee should, at a minimum, possess the following: •An outstanding record of professional accomplishment in his or her field of endeavor; •A high degree of professional integrity, consistent with Mattel’s values; •A willingness and ability to represent the general best interests of all of Mattel’s stockholders and not just one particular stockholder or constituency, including a commitment to enhancing stockholder value; and •A willingness and ability to participate fully in Board activities, including active membership on at least one Board committee and attendance at, and active participation in, meetings of the Board and the committee(s) of which he or she is a member, and no commitments that would, in the judgment of the Governance and Social Responsibility Committee, interfere with or limit his or her ability to do so. |

Our Director Nominations Policy also lists the following additional skills, experiences, and qualities that are desirable in director nominees: •Skills and experiences relevant to Mattel’s business, operations, or strategy; •Qualities that help the Board achieve a balance of a variety of knowledge, experience, and capability on the Board, and an ability to contribute positively to the collegial and collaborative culture among Board members; and •Qualities that contribute to the Board’s overall diversity – diversity being broadly construed to mean a variety of opinions, perspectives, professional and personal experiences, and backgrounds, as well as other differentiating characteristics. |

|  |

2024 Proxy Statement | 31 |

|  |

32 | Mattel, Inc. |

The Independent Lead Director’s duties include the following significant powers and responsibilities: •Presides at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors at the conclusion of Board meetings, at which the CEO and other members of management are not present; •Serves as liaison between the Chairman and the independent directors; •Approves information sent to the Board; •Approves Board meeting agendas; •Approves schedules of meetings to assure that there is sufficient time for discussion of all agenda items; •Has authority to call meetings of the independent directors; and •If requested by significant stockholders, is available for consultation and direct communication. |

|  |

2024 Proxy Statement | 33 |

Director | Audit | Compensation | Governance and Social Responsibility | Finance | Executive | Stock Grant |

Non-Employee Directors | ||||||

Adriana Cisneros | • | |||||

Michael DolanILD | • |  | ||||

Diana Ferguson† |  | • | ||||

Julius Genachowski† | • | • | ||||

Prof. Noreena Hertz |  | |||||

Soren Laursen† | • | • | ||||

Roger Lynch | • | • | ||||

Dominic Ng† | • |  | • | |||

Dr. Judy Olian |  | • | ||||

Dawn Ostroff | • | |||||

Employee Director | ||||||

Ynon Kreiz | • |

| Chair |

ILD | Independent Lead Director |

| Audit Committee Financial Expert |

| Member |

|  |

34 | Mattel, Inc. |

Audit Committee | Current Members: | Diana Ferguson (Chair), Julius Genachowski, Soren Laursen, Dominic Ng |

Members in 2023: | Diana Ferguson (Chair), R. Todd Bradley, Roger Lynch, Dominic Ng | |

Meetings in 2023: | 12 | |

The Board has determined that each member meets applicable SEC, Nasdaq, and Mattel independence and “financial sophistication” standards and qualifies as an “audit committee financial expert” under applicable SEC regulation. | ||

Compensation Committee | Current Members: | Dr. Judy Olian (Chair), Roger Lynch, Dawn Ostroff |

Members in 2023: | Michael Dolan (Chair), R. Todd Bradley, Dr. Judy Olian | |

Meetings in 2023: | 6 | |

The Board has determined that each member meets applicable Nasdaq and Mattel independence standards and qualifies as a “non-employee director” within the meaning of Rule 16b-3 of the Exchange Act. The Compensation Committee meets in executive session at least once each year without the CEO present. | ||

|  |

2024 Proxy Statement | 35 |

Finance Committee | Current Members: | Dominic Ng (Chair), Soren Laursen, Roger Lynch |

Members in 2023: | Dominic Ng (Chair), Soren Laursen, Roger Lynch | |

Meetings in 2023: | 5 |

Governance and Social Responsibility Committee | Current Members: | Prof. Noreena Hertz (Chair), Adriana Cisneros, Michael Dolan, Julius Genachowski, Dr. Judy Olian |

Members in 2023: | Ann Lewnes (Chair), Adriana Cisneros, Michael Dolan, Soren Laursen, Dr. Judy Olian | |

Meetings in 2023: | 5 | |

The Board has determined that each member meets applicable Nasdaq and Mattel independence standards. | ||

|  |

36 | Mattel, Inc. |

Female | Male | ||

Gender Identity | |||

Directors | 5 | 6 | |

Demographic Background | |||

African American or Black | 1 | - | |

Asian | - | 1 | |

Hispanic or Latinx | 1 | - | |

White | 3 | 5 |

|  |

2024 Proxy Statement | 37 |

Board Oversight The Board is responsible for overseeing Mattel’s ongoing assessment and management of material risks impacting Mattel’s business. The Board relies on Mattel’s management to identify and report on material risks, and relies on each Board committee to oversee management of specific risks related to that committee’s function. The Board engages in risk oversight throughout the year and specifically focuses on risks facing Mattel each year at a regularly scheduled Board meeting. | ||||

Audit Committee The Audit Committee oversees the Company’s assessment and management of Mattel’s material risks impacting the Company’s business, including those relating to the Company’s financial reporting and accounting, compliance, and cyber security. The Committee is also responsible for overseeing Mattel’s compliance risk, which includes risk relating to Mattel’s compliance with laws and regulations. The Committee annually reviews and discusses with management the material risks impacting the Company and the steps management has taken to monitor and control these risks | Compensation Committee The Compensation Committee oversees and assesses material risks associated with Mattel’s compensation structure, policies, and programs generally, including those that may relate to pay mix, selection of performance measures, the goal setting process, and the checks and balances on the payment of compensation. The Committee annually reviews a detailed compensation risk assessment conducted by its independent compensation consultant to confirm that Mattel’s compensation programs do not encourage excessive risk taking. See “Compensation Risk Review” on page 63 for a more detailed description of the Committee’s review of potential pay risk. | |||

Finance Committee The Finance Committee oversees and reviews with management risks relating to capital allocation and deployment, including Mattel’s credit facilities and debt securities, capital expenditures, dividend policy, mergers, acquisitions, dispositions, and other strategic transactions. The Committee also oversees third-party financial risks, which include risks arising from customers, vendors, suppliers, subcontractors, creditors, debtors, and counterparties in hedging transactions, mergers, acquisitions, dispositions, and other strategic transactions. | Governance and Social Responsibility Committee The Governance and Social Responsibility Committee oversees and reviews with management risks relating to governance and social responsibility matters, including sustainability, corporate citizenship, philanthropy, global manufacturing principles, public policy, environmental, health and safety matters. The Committee works with the Board to oversee how the Company fosters its culture. | |||

Management Consistent with their role as active managers of Mattel’s business, our senior executives play the most active role in risk management, and the Board looks to such officers to keep the Board apprised on an ongoing basis about risks impacting Mattel’s business and how such risks are being managed. Each year as part of Mattel’s risk evaluation process performed by its internal audit team, Mattel’s most senior executives provide input regarding material risks facing the business group or function that each manages. These risks are presented to the Audit Committee and the Board along with Mattel’s strategy for managing such risks. Since much of the Board’s risk oversight occurs at the committee level, Mattel believes that this process is important to make all directors aware of Mattel’s most material risks. | ||||

|  |

38 | Mattel, Inc. |

Key Areas of Focus for the Annual Evaluations | Improvements in Board Effectiveness Due to Evaluations | ||

•Board operations and meeting effectiveness •Board accountability •Board committee performance | •Enhanced agenda item selection •Enhanced Board and committee discussion formats •Enhanced interaction with management team •Enhanced opportunity to engage with talent and evaluate succession in the organization | ||

|  |

2024 Proxy Statement | 39 |

Board Evaluation Process | |||||||

1 - Questionnaires Directors provide feedback regarding board composition and structure, Board interaction with management, meetings and materials, effectiveness of the Board, future agenda items, and director education opportunities. | 2 - Committee Review The Governance and Social Responsibility Committee reviews the results of the evaluations. | ||||||

4 - Feedback and Action Based on the evaluation results, changes in practices or procedures are considered and implemented, as appropriate. | 3 - Board Review Results are presented to the Board. | ||||||

|  |

40 | Mattel, Inc. |

|  |

2024 Proxy Statement | 41 |

Non-Employee Director Compensation Program Elements: •Retainer-only cash compensation (i.e., no meeting fees) •Total annual compensation mix slightly weighted in favor of stock versus cash •Annual stock grants delivered as full value awards based on a fixed-value formula •Immediate vesting that avoids entrenchment •Robust stock ownership guidelines •Flexible voluntary deferral provisions •Annual total limit on stock and cash compensation in the stockholder approved stock plan •No major benefits or perquisites other than modest charitable gift matching |

Annual cash retainer | $105,000 |

Additional cash retainer for the Independent Lead Director of the Board | $50,000 |

Additional cash retainer for the Chairs of the Audit and Compensation Committees | $20,000 |

Additional cash retainer for the Chairs of the Executive, Finance, and Governance and Social Responsibility Committees | $15,000 |

Additional cash retainer for Audit Committee members, including the Chair | $10,000 |

|  |

42 | Mattel, Inc. |

Annual stock grant of deferred vested RSUs (intended fixed grant value) | $165,000 |

Name | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | All Other Compensation(3) ($) | Total ($) |

R. Todd Bradley | 115,000 | 165,005 | — | 280,005 |

Adriana Cisneros | 105,000 | 165,005 | 12,500 | 282,505 |

Michael Dolan | 190,000 | 165,005 | — | 355,005 |

Diana Ferguson | 135,000 | 165,005 | — | 300,005 |

Prof. Noreena Hertz | 131,250 | 203,755 | 7,500 | 342,505 |

Soren Laursen | 105,000 | 165,005 | 7,500 | 277,505 |

Ann Lewnes | 120,000 | 165,005 | 15,000 | 300,005 |

Roger Lynch | 115,000 | 165,005 | 15,000 | 295,005 |

Dominic Ng | 130,000 | 165,005 | 15,000 | 310,005 |

Dr. Judy Olian | 105,000 | 165,005 | 15,000 | 285,005 |

Name | Aggregate Stock Awards Outstanding as of December 31, 2023 |

R. Todd Bradley | 22,976 |

Adriana Cisneros | 35,577 |

Michael Dolan | 22,976 |

Diana Ferguson | 22,976 |

Prof. Noreena Hertz | 10,802 |

Soren Laursen | 22,976 |

Ann Lewnes | 22,976 |

Roger Lynch | 48,144 |

Dominic Ng | 98,048 |

Dr. Judy Olian | 22,976 |

|  |

2024 Proxy Statement | 43 |

|  |

44 | Mattel, Inc. |

Proposal 2: Ratification of Selection of Independent Registered Public Accounting Firm for the Year Ending December 31, 2024 | |

| The Board recommends a vote FOR the ratification of the selection of PricewaterhouseCoopers LLP as Mattel’s Independent Registered Public Accounting Firm. |

|  |

2024 Proxy Statement | 45 |

|  |

46 | Mattel, Inc. |

Fees | 2023 ($) | 2022 ($) |

Audit fees(1) | 9,577,000 | 8,583,000 |

Audit-related fees(2) | 95,000 | 276,000 |

Tax fees(3) | 1,523,000 | 2,097,000 |

All other fees(4) | 18,000 | 18,000 |

Total | 11,213,000 | 10,974,000 |

|  |

2024 Proxy Statement | 47 |

Proposal 3: Advisory Vote to Approve Named Executive Officer Compensation (“Say-on-Pay”) | |

| The Board recommends a vote FOR approval of the executive compensation of Mattel’s named executive officers. |

|

48 | Mattel, Inc. |

Name | Age | Position | Executive Officer Since |

Ynon Kreiz(1) | 59 | Chairman of the Board and Chief Executive Officer | 2018 |

Anthony DiSilvestro | 65 | Chief Financial Officer | 2020 |

Steve Totzke | 54 | President and Chief Commercial Officer | 2020 |

Jonathan Anschell | 56 | Executive Vice President, Chief Legal Officer, and Secretary | 2021 |

Roberto Isaias | 56 | Executive Vice President and Chief Supply Chain Officer | 2019 |

Anthony DiSilvestro Chief Financial Officer | Mr. DiSilvestro has been Chief Financial Officer since August 2020. From May 2014 to September 2019, he served as Senior Vice President and Chief Financial Officer of Campbell Soup Company, a manufacturer and marketer of branded food and beverage products. Mr. DiSilvestro held several leadership roles at Campbell Soup Company from 1996 to 2014, including Senior Vice President – Finance, Vice President – Controller, Vice President – Finance and Strategy, Campbell International, Vice President – Strategic Planning and Corporate Development, Vice President – Finance, North America Division, and Vice President and Treasurer. Earlier in his career, Mr. DiSilvestro held leadership roles at Scott Paper Company and the Continental Group. |

Steve Totzke President and Chief Commercial Officer | Mr. Totzke has been President and Chief Commercial Officer since April 2022. From July 2018 to March 2022, he served as Executive Vice President and Chief Commercial Officer. From February 2016 to July 2018, he served as Executive Vice President and Chief Commercial Officer – North America. From May 2014 to February 2016, he served as Senior Vice President, Sales and Shopper Marketing, and from April 2012 to May 2014, he served as Senior Vice President, U.S. Sales. From January 2010 to April 2012, he served as Vice President and General Manager, Australia, and from February 2008 to December 2009, he served as General Manager, Australia/New Zealand. Prior to that, he served as Senior Director of Sales and Vice President, Canada. |

Jonathan Anschell EVP, Chief Legal Officer, and Secretary | Mr. Anschell has been Executive Vice President, Chief Legal Officer, and Secretary since January 2021. From December 2019 to December 2020, he served as Executive Vice President and General Counsel, ViacomCBS Media Networks, a mass media company. From January 2016 to December 2019, he served as Executive Vice President, Deputy General Counsel and Secretary of CBS Corporation. From September 2004 to December 2019, he served as Executive Vice President and General Counsel of CBS Broadcasting Inc. Prior to that, Mr. Anschell was a partner with the law firm White O’Connor Curry. |

Roberto Isaias EVP and Chief Supply Chain Officer | Mr. Isaias has been Executive Vice President and Chief Supply Chain Officer since February 2019. From April 2014 to February 2019, he served as Senior Vice President and Managing Director Latin America. From December 2011 to April 2014, he served as Senior Vice President and General Manager Latin America (except Brazil). From September 2007 to December 2011, he served as Vice President and General Manager Mexico. From March 2005 to September 2007, he served as General Manager Latin America – South Cone (Chile, Argentina, Peru, Uruguay, Paraguay, and Bolivia). From August 2002 to March 2005, he was Senior Sales & Trade Marketing Director – Mexico. From August 2001 to August 2002, he served as Head of Commercial for Traditional Trade at Procter & Gamble Mexico. Prior to that, he served as Associate Director for the Modern Trade, Drug Distributors, and Key Regions at Procter & Gamble Mexico. Mr. Isaias’ full legal name is Roberto J. Isaias Zanatta. |

|  |

2024 Proxy Statement | 49 |

|  |  |  |  | ||||

Ynon Kreiz | Anthony DiSilvestro | Steve Totzke | Jonathan Anschell | Roberto Isaias | ||||

Chairman and Chief Executive Officer | Chief Financial Officer | President and Chief Commercial Officer | EVP, Chief Legal Officer, and Secretary | EVP and Chief Supply Chain Officer | ||||

Per SEC rules, Richard Dickson, our former President and Chief Operating Officer, was also an NEO for fiscal year 2023. | ||||||||

|  |

50 | Mattel, Inc. |

Compensation Components | Characteristics | 2023 Actions/Results |

Base Salary | •Provide fixed cash compensation based on individual role, skill set, market data, performance, criticality to the Company, and internal pay equity | Increased 2023 base salaries for certain NEOs, in recognition of outstanding performance and criticality to the Company, supported by competitive market practices based on data provided by FW Cook, as discussed on page 54. |

Annual Cash Incentive (MIP) | •Incentivize and motivate senior executives to achieve our short-term strategic and financial objectives that we believe will drive long-term stockholder value •Our 2023 MIP financial measures focused on improving profitability, accelerating topline growth, and improving our working capital position. The 2023 MIP was structured as follows: ◦65% MIP-Adjusted EBITDA Less Capital Charge ◦20% MIP-Adjusted Net Sales ◦15% MIP-Adjusted Gross Margin ◦Multiplier based on Individual Performance | Increased Mr. Kreiz’s 2023 target MIP opportunity in recognition of the criticality and impact of his role as Chairman & CEO, supported by competitive market practices based on data provided by FW Cook and our pay-for-performance philosophy, as discussed on page 54. The Company financial earnout for the 2023 MIP was 156.2% of target opportunity, as discussed on page 53. |

Stock-Based Long-Term Incentives (LTIs) | •Aimed at focusing our senior executives on achieving our key long-term financial objectives, while rewarding relative growth in stockholder value that is sustained over several years | Increased 2023 LTI values for Mr. Kreiz and the other NEOs, supported by competitive market practices based on data provided by FW Cook and our pay-for-performance philosophy, as discussed on page 57. |

•Performance Units | •Incentivize and motivate senior executives to achieve key long-term financial objectives and stock price outperformance •The Performance Units granted under the three-year LTIP cycles are structured as follows: ◦Three-Year Cumulative Adjusted Free Cash Flow ◦Multiplier based on Three-Year Relative TSR vs. S&P 500 constituents | The earnout for the 2021-2023 LTIP was 101% of target Performance Units granted, as discussed on page 59. |

•Stock Options | •Align senior executives’ interests with stockholders’ interests and drive focus on increasing long-term stockholder value •Vest in annual installments over three years and have ten-year-terms | |

•RSUs | •Encourage senior executive stock ownership •Support stockholder-aligned retention •Vest in annual installments over three years | |

|  |

2024 Proxy Statement | 51 |

CEO | Other NEOs** |

|  |

52 | Mattel, Inc. |

Company Financial Earnout of 2023 MIP Target Opportunity: 156.2% |

Earnout of 2021-2023 LTIP Target Performance Units: 101% |

|  |

2024 Proxy Statement | 53 |

Target Opportunity ($) | x | Financial Performance Earnout (%) | x | Individual Performance Multiplier (%) | = | MIP Payout ($)* |

Name and Position | 2023 MIP Target Opportunity as a % of Base Salary |

Ynon Kreiz, Chairman and Chief Executive Officer | 200 |

Anthony DiSilvestro, Chief Financial Officer | 100 |

Steve Totzke, President and Chief Commercial Officer | 80 |

Jonathan Anschell, EVP, Chief Legal Officer, and Secretary | 70 |

Roberto Isaias, EVP and Chief Supply Chain Officer | 70 |

Richard Dickson, Former President and Chief Operating Officer* | - |

|  |

54 | Mattel, Inc. |

Why This Measure Was Chosen | |

| 65% MIP-Adjusted EBITDA Less Capital Charge Directly linked to our strategic priority of continuing to improve profitability |

20% MIP-Adjusted Net Sales Directly linked to our strategic priority of accelerating topline growth | |

15% MIP-Adjusted Gross Margin Balances our approach to profitable growth, aligning with our cost savings programs |

|  |

2024 Proxy Statement | 55 |

Financial Measure | Weighting | Threshold (35% earned) | Target (100% earned) | Max (200% earned) | % Earned before weighting | % Earned after weighting |

MIP-Adjusted EBITDA Less Capital Charge* | 65% |  | 180.5% | 117.3% | ||

MIP-Adjusted Net Sales* | 20% |  | 92.4% | 18.5% | ||

MIP-Adjusted Gross Margin* | 15% |  | 135.8% | 20.4% | ||

TOTAL EARNED | 156.2% | |||||

|  |

56 | Mattel, Inc. |

Name and Position | Financial Performance Earnout (%) | Individual Performance Multiplier (%) | Total % of Target MIP Opportunity Earned (%) | MIP Payout ($) |

Ynon Kreiz, Chairman and Chief Executive Officer | 156.2 | 125 | 195.25 | 5,857,500 |

Anthony DiSilvestro, Chief Financial Officer | 156.2 | 110 | 171.82 | 1,546,380 |

Steve Totzke, President and Chief Commercial Officer | 156.2 | 125 | 195.25 | 1,249,600 |

Jonathan Anschell, EVP, Chief Legal Officer, and Secretary | 156.2 | 110 | 171.82 | 902,055 |

Roberto Isaias, EVP and Chief Supply Chain Officer | 156.2 | 125 | 195.25 | 956,725 |

Performance Units Performance Units are granted under our LTIP and earned based on the Company’s performance against a three-year financial performance measure, modified by our relative TSR over the three-year performance period. | Stock Options Stock options have value only with stock price appreciation and continued service over time, thereby aligning senior executives’ interests with stockholders’ interests. Our stock options vest in installments on each of the first three anniversaries of the grant date and have ten-year terms, subject to continued service through such date. | RSUs RSUs assist in meeting stock ownership requirements and serve as a stockholder-aligned retention tool. Our RSUs vest in installments on each of the first three anniversaries of the grant date, subject to continued service through such date. Our CEO does not receive RSUs, as his LTI mix is entirely performance-based and at risk with 75% Performance Units and 25% stock options. |

|  |

2024 Proxy Statement | 57 |

Name and Position | 2023-2025 Performance Units ($) | 2023 Stock Options ($) | 2023 RSUs ($) | 2023 Total LTI Value ($) |

Ynon Kreiz, Chairman and Chief Executive Officer | 8,559,375 | 2,853,125 | — | 11,412,500 |

Anthony DiSilvestro, Chief Financial Officer | 1,375,000 | 343,750 | 1,031,250 | 2,750,000 |

Steve Totzke, President and Chief Commercial Officer | 1,100,000 | 275,000 | 825,000 | 2,200,000 |

Jonathan Anschell, EVP, Chief Legal Officer, and Secretary | 715,000 | — | 715,000 | 1,430,000 |

Roberto Isaias, EVP and Chief Supply Chain Officer | 770,000 | — | 770,000 | 1,540,000 |

Richard Dickson, Former President and Chief Operating Officer* | 3,025,000 | 756,250 | 2,268,750 | 6,050,000 |

Target Performance Units Granted (#) | × | Three-Year Cumulative Adjusted Free Cash Flow Performance Earnout (%) | × | Three-Year Relative TSR Performance Multiplier (%) | = | LTIP Payout (#) |

|  |

58 | Mattel, Inc. |

Financial Measure | Threshold (37% Earned) | Target (100% Earned) | Max (150% Earned) | % Earned | ||

Three-Year Cumulative Adjusted Free Cash Flow* |  | 130% | ||||

($ in millions) | ||||||

Effect of Relative TSR Multiplier | ||||

Mattel TSR Relative to S&P 500 | ≤25th | 50th | ≥75th | 33rd |

TSR Multiplier | 67% | 100% | 133% | 78% |

Total Earned | 101% | |||

Name | Target Performance Units Granted | LTIP Earnout (Shares Earned) |

Ynon Kreiz, Chairman and Chief Executive Officer | 327,368 | 330,643 |

Anthony DiSilvestro, Chief Financial Officer | 45,832 | 46,290 |

Steve Totzke, President and Chief Commercial Officer | 43,649 | 44,085 |

Jonathan Anschell, EVP, Chief Legal Officer, and Secretary | 28,372 | 28,656 |

Roberto Isaias, EVP and Chief Supply Chain Officer | 22,916 | 23,145 |

Richard Dickson, Former President and Chief Operating Officer* | 98,210 | 85,416 |

|  |

2024 Proxy Statement | 59 |

Severance Plan reflects the following best practice provisions: •Double-trigger cash severance and stock grant acceleration that requires both a change of control and a qualifying termination of employment •Severance benefits set at competitive levels not greater than 2x the sum of annual base salary and annual bonus •No excise tax gross-ups |

|  |

60 | Mattel, Inc. |

|  |

2024 Proxy Statement | 61 |

|  |

62 | Mattel, Inc. |

Name and Position | Salary Multiple | Deadline |

Ynon Kreiz, Chairman and Chief Executive Officer | 6x | 4/30/2023 |

Anthony DiSilvestro, Chief Financial Officer | 4x | 6/30/2025 |

Steve Totzke, President and Chief Commercial Officer | 3x | 1/31/2024 |

Jonathan Anschell, EVP, Chief Legal Officer, and Secretary | 3x | 1/31/2026 |

Roberto Isaias, EVP and Chief Supply Chain Officer | 3x | 2/29/2024 |

|  |

2024 Proxy Statement | 63 |

|  |

64 | Mattel, Inc. |

Name, Principal Position, and Year | Salary(1) ($) | Bonus ($) | Stock Awards(2) ($) | Option Awards(2) ($) | Non-Equity Incentive Plan Compensation(3) ($) | Change In Pension Value and Nonqualified Deferred Compensation Earnings(4) ($) | All Other Compensation(5) ($) | Total ($) |

Ynon Kreiz Chairman and Chief Executive Officer | ||||||||

2023 | 1,500,000 | — | 8,559,377 | 2,853,125 | 5,857,500 | — | 178,384 | 18,948,385 |

2022 | 1,500,000 | — | 7,687,501 | 2,562,503 | — | — | 140,383 | 11,890,387 |

2021 | 1,500,000 | — | 7,500,001 | 2,499,996 | 4,500,000 | — | 128,898 | 16,128,895 |

Anthony DiSilvestro Chief Financial Officer | ||||||||

2023 | 900,000 | — | 2,406,250 | 343,748 | 1,546,380 | — | 109,226 | 5,305,604 |

2022 | 900,000 | — | 2,187,503 | 312,503 | — | — | 195,560 | 3,595,566 |

2021 | 900,000 | — | 1,575,018 | 524,999 | 1,800,000 | — | 107,495 | 4,907,512 |

Steve Totzke President and Chief Commercial Officer | ||||||||

2023 | 800,000 | — | 1,924,993 | 274,998 | 1,249,600 | — | 96,000 | 4,345,591 |

2022 | 800,000 | — | 1,750,021 | 250,003 | — | — | 98,320 | 2,898,344 |

2021 | 800,000 | — | 1,500,007 | 499,995 | 1,280,000 | — | 98,320 | 4,178,322 |

Jonathan Anschell EVP, Chief Legal Officer, and Secretary | ||||||||

2023 | 750,000 | — | 1,430,002 | — | 902,055 | — | 99,589 | 3,181,646 |

2022 | 700,000 | — | 1,137,477 | 162,495 | — | — | 87,000 | 2,086,972 |

2021 | 700,000 | 200,000 | 1,475,004 | 499,997 | 932,470 | — | 85,980 | 3,893,451 |

Roberto Isaias EVP and Chief Supply Chain Officer | ||||||||

2023 | 700,000 | — | 1,540,009 | — | 956,725 | — | 116,393 | 3,313,127 |

Richard Dickson Former President and Chief Operating Officer | ||||||||

2023 | 589,041 | — | 5,293,759 | 756,254 | — | — | 83,101 | 6,722,155 |

2022 | 1,000,000 | — | 3,937,496 | 562,506 | — | — | 133,799 | 5,633,801 |

2021 | 1,000,000 | — | 3,374,982 | 1,125,001 | 2,000,000 | — | 129,770 | 7,629,753 |

|  |

2024 Proxy Statement | 65 |

|  |

66 | Mattel, Inc. |

Name, Position, and Grant Date | Committee Action Date | Estimated Possible Payouts Under Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts Under Equity Incentive Plan Awards(2) | All Other Stock Awards: Number of Shares of Stock or Units(3) | All Other Option Awards: Number of Securities Underlying Options(4) | Exercise or Base Price of Option Awards ($) | Grant Date Fair Market Value of Stock and Option Awards(5) ($) | |||||

Threshold ($) | Target ($) | Maximum ($) | Threshold | Target | Maximum | |||||||

Ynon Kreiz Chairman and Chief Executive Officer | ||||||||||||

1,050,000 | 3,000,000 | 6,000,000 | ||||||||||

4/28/2023 | 4/28/2023 | 110,301 | 441,205 | 882,410 | 8,559,377 | |||||||

4/28/2023 | 4/28/2023 | 320,216 | 18.00 | 2,853,125 | ||||||||

Anthony DiSilvestro Chief Financial Officer | ||||||||||||

315,000 | 900,000 | 1,800,000 | ||||||||||

4/28/2023 | 4/28/2023 | 17,719 | 70,876 | 141,752 | 1,374,994 | |||||||

4/28/2023 | 4/28/2023 | 38,580 | 18.00 | 343,748 | ||||||||

4/28/2023 | 4/28/2023 | 57,292 | 1,031,256 | |||||||||

Steve Totzke President and Chief Commercial Officer | ||||||||||||

224,000 | 640,000 | 1,280,000 | ||||||||||

4/28/2023 | 4/28/2023 | 14,175 | 56,701 | 113,402 | 1,099,999 | |||||||

4/28/2023 | 4/28/2023 | 30,864 | 18.00 | 274,998 | ||||||||

4/28/2023 | 4/28/2023 | 45,833 | 824,994 | |||||||||

Jonathan Anschell EVP, Chief Legal Officer, and Secretary | ||||||||||||

183,750 | 525,000 | 1,050,000 | ||||||||||

4/28/2023 | 4/28/2023 | 9,214 | 36,856 | 73,712 | 715,006 | |||||||

4/28/2023 | 4/28/2023 | 39,722 | 714,996 | |||||||||

Roberto Isaias EVP and Chief Supply Chain Officer | ||||||||||||

171,500 | 490,000 | 980,000 | ||||||||||

4/28/2023 | 4/28/2023 | 9,923 | 39,691 | 79,382 | 770,005 | |||||||

4/28/2023 | 4/28/2023 | 42,778 | 770,004 | |||||||||

Richard Dickson(6) Former President and Chief Operating Officer | ||||||||||||

350,000 | 1,000,000 | 2,000,000 | ||||||||||

4/28/2023 | 4/28/2023 | 38,982 | 155,928 | 311,856 | 3,025,003 | |||||||

4/28/2023 | 4/28/2023 | 84,877 | 18.00 | 756,254 | ||||||||

4/28/2023 | 4/28/2023 | 126,042 | 2,268,756 | |||||||||

|  |

2024 Proxy Statement | 67 |

Option Awards | ||||||

Name and Position | Grant Date for Options | Number of Securities Underlying Unexercised Options Exercisable | Number of Securities Underlying Unexercised Options Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options | Option Exercise Price ($) | Option Expiration Date |

Ynon Kreiz Chairman and Chief Executive Officer | ||||||

4/28/2023 | 320,216(5) | 18.00 | 4/28/2033 | |||

4/29/2022 | 73,277 | 148,777(6) | 24.31 | 4/29/2032 | ||

8/2/2021 | 175,531 | 90,426(7) | 21.91 | 8/2/2031 | ||

7/31/2020 | 523,575 | 11.11 | 7/31/2030 | |||

8/1/2019 | 467,221 | 13.59 | 8/1/2029 | |||

8/1/2018 | 376,369 | 15.78 | 8/1/2028 | |||

Anthony DiSilvestro Chief Financial Officer | ||||||

4/28/2023 | 38,580(5) | 18.00 | 4/28/2033 | |||

4/29/2022 | 8,936 | 18,144(6) | 24.31 | 4/29/2032 | ||

8/2/2021 | 36,861 | 18,990(7) | 21.91 | 8/2/2031 | ||

6/30/2020 | 133,249 | 9.67 | 6/30/2030 | |||

Steve Totzke President and Chief Commercial Officer | ||||||

4/28/2023 | 30,864(5) | 18.00 | 4/28/2033 | |||

4/29/2022 | 7,149 | 14,515(6) | 24.31 | 4/29/2032 | ||

8/2/2021 | 35,106 | 18,085(7) | 21.91 | 8/2/2031 | ||

7/31/2020 | 82,237 | 11.11 | 7/31/2030 | |||

8/1/2019 | 88,063 | 13.59 | 8/1/2029 | |||

8/1/2018 | 54,745 | 15.78 | 8/1/2028 | |||

8/1/2017 | 122,616 | 19.72 | 8/1/2027 | |||

8/1/2016 | 67,073 | 32.72 | 8/1/2026 | |||

7/31/2015 | 64,767 | 23.21 | 7/31/2025 | |||

8/1/2014 | 26,228 | 35.25 | 8/1/2024 | |||

Jonathan Anschell EVP, Chief Legal Officer, and Secretary | ||||||

4/29/2022 | 4,646 | 9,435(6) | 24.31 | 4/29/2032 | ||

8/2/2021 | 11,409 | 5,878(7) | 21.91 | 8/2/2031 | ||

1/29/2021 | 14,981(8) | 18.12 | 1/29/2031 | |||

|  |

68 | Mattel, Inc. |

Option Awards | ||||||

Name and Position | Grant Date for Options | Number of Securities Underlying Unexercised Options Exercisable | Number of Securities Underlying Unexercised Options Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options | Option Exercise Price ($) | Option Expiration Date |

Roberto Isaias EVP and Chief Supply Chain Officer | ||||||

4/29/2022 | 4,289 | 8,709(6) | 24.31 | 4/29/2032 | ||

8/2/2021 | 9,215 | 4,748(7) | 21.91 | 8/2/2031 | ||

7/31/2020 | 28,783 | 11.11 | 7/31/2030 | |||

8/1/2019 | 25,685 | 13.59 | 8/1/2029 | |||

2/28/2019 | 22,978 | 14.42 | 2/28/2029 | |||

8/1/2016 | 36,585 | 32.72 | 8/1/2026 | |||

7/31/2015 | 52,073 | 23.21 | 7/31/2025 | |||

8/1/2014 | 33,482 | 35.25 | 8/1/2024 | |||

Richard Dickson Former President and Chief Operating Officer | ||||||

4/29/2022 | 48,744 | 24.31 | 8/3/2028 | |||

8/2/2021 | 119,681 | 21.91 | 8/3/2028 | |||

7/31/2020 | 246,711 | 11.11 | 8/3/2028 | |||

8/1/2019 | 220,157 | 13.59 | 8/3/2028 | |||

8/1/2018 | 205,292 | 15.78 | 8/1/2028 | |||

8/1/2017 | 544,959 | 19.72 | 8/1/2027 | |||

1/31/2017 | 773,994 | 26.21 | 1/31/2027 | |||

8/1/2016 | 243,902 | 32.72 | 8/1/2026 | |||

4/13/2015 | 607,477 | 24.31 | 4/13/2025 | |||

8/1/2014 | 89,286 | 35.25 | 8/1/2024 | |||

5/20/2014 | 75,630 | 38.53 | 5/20/2024 | |||

|  |

2024 Proxy Statement | 69 |

Stock Awards | ||||||

Name and Position | Grant Date for Stock Awards | Number of Shares or Units of Stock That Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested(1)($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested(1)($) | |

RSUs | Performance Units | |||||

Ynon Kreiz Chairman and Chief Executive Officer | ||||||

4/28/2023 | 882,410(2) | 16,659,901 | ||||

4/29/2022 | 270,782(3) | 5,112,364 | ||||

3/23/2021 | 330,642(4) | 6,242,521 | ||||

Anthony DiSilvestro Chief Financial Officer | ||||||

4/28/2023 | 57,292(5) | 1,081,673 | ||||

4/28/2023 | 141,752(2) | 2,676,278 | ||||

4/29/2022 | 25,838(6) | 487,821 | ||||

4/29/2022 | 44,030(3) | 831,286 | ||||

8/2/2021 | 8,148(7) | 153,834 | ||||

3/23/2021 | 46,290(4) | 873,955 | ||||

Steve Totzke President and Chief Commercial Officer | ||||||

4/28/2023 | 45,833(5) | 865,327 | ||||

4/28/2023 | 113,402(2) | 2,141,030 | ||||

4/29/2022 | 20,671(6) | 390,268 | ||||

4/29/2022 | 35,224(3) | 665,029 | ||||

8/2/2021 | 7,760(7) | 146,509 | ||||

3/23/2021 | 44,085(4) | 832,325 | ||||

Jonathan Anschell EVP, Chief Legal Officer, and Secretary | ||||||

4/28/2023 | 39,722(5) | 749,951 | ||||

4/28/2023 | 73,712(2) | 1,391,683 | ||||

4/29/2022 | 13,436(6) | 253,672 | ||||

4/29/2022 | 22,895(3) | 432,258 | ||||

8/2/2021 | 7,566(7) | 142,846 | ||||

3/23/2021 | 28,656(4) | 541,025 | ||||

1/29/2021 | 6,333(8) | 119,567 | ||||

Roberto Isaias EVP and Chief Supply Chain Officer | ||||||

4/28/2023 | 42,778(5) | 807,649 | ||||

4/28/2023 | 79,382(2) | 1,498,732 | ||||

4/29/2022 | 12,403(6) | 234,169 | ||||

4/29/2022 | 21,134(3) | 399,010 | ||||

8/2/2021 | 6,111(7) | 115,376 | ||||

3/23/2021 | 23,145(4) | 436,978 | ||||

Richard Dickson Former President and Chief Operating Officer | ||||||

4/29/2022 | 41,828(3) | 789,713 | ||||

3/23/2021 | 85,416(4) | 1,612,654 | ||||

|  |

70 | Mattel, Inc. |

Option Awards | Stock Awards | ||||

Name and Position | Number of Shares Acquired on Exercise | Value Realized on Exercise ($) | Number of Shares Acquired on Vesting(1) | Value Realized on Vesting(2) ($) | |

Ynon Kreiz, Chairman and Chief Executive Officer | — | — | 936,588 | 19,434,201 | |

Anthony DiSilvestro, Chief Financial Officer | — | — | 176,393 | 3,606,775 | |

Steve Totzke, President and Chief Commercial Officer | — | — | 127,262 | 2,622,767 | |

Jonathan Anschell, EVP, Chief Legal Officer, and Secretary | — | 91,535 | 20,106 | 399,047 | |

Roberto Isaias, EVP and Chief Supply Chain Officer | — | — | 92,739 | 1,917,130 | |

Richard Dickson, Former President and Chief Operating Officer | — | — | 368,496 | 7,610,706 | |

Name and Position | Executive Contributions in 2023(1) ($) | Company Contributions in 2023(2) ($) | Aggregate Earnings in 2023(3) ($) | Aggregate Withdrawals/ Distributions ($) | Aggregate Balance at End of 2023(4) ($) |

Ynon Kreiz, Chairman and Chief Executive Officer | — | 81,900 | 30,779 | — | 423,461 |

Anthony DiSilvestro, Chief Financial Officer | — | 39,900 | 9,269 | — | 137,230 |

Steve Totzke, President and Chief Commercial Officer | 104,600 | 42,300 | 323,250 | — | 2,438,569 |

Jonathan Anschell, EVP, Chief Legal Officer, and Secretary | 67,388 | 41,807 | 37,678 | — | 326,177 |

Roberto Isaias, EVP and Chief Supply Chain Officer | 523,918 | 51,671 | 317,949 | — | 2,020,206 |

Richard Dickson, Former President and Chief Operating Officer | 16,892 | 28,154 | 244,828 | — | 1,603,309 |

|  |

2024 Proxy Statement | 71 |

Name and Position | Aggregate Amounts Previously Reported ($) |

Ynon Kreiz, Chairman and Chief Executive Officer | 318,727 |

Anthony DiSilvestro, Chief Financial Officer | 94,042 |

Steve Totzke, President and Chief Commercial Officer | 1,326,803 |

Jonathan Anschell, EVP, Chief Legal Officer, and Secretary | — |

Roberto Isaias, EVP and Chief Supply Chain Officer | — |

Richard Dickson, Former President and Chief Operating Officer | 1,664,133 |

|  |

72 | Mattel, Inc. |

Name of Investment Option | Rate of Return: 1/1/2023 - 4/30/2023 (%) |

Fidelity VIP Government Money Market Initial | 1.48 |

Hartford Total Return HLS IA | 3.77 |

HIMCO U.S. Aggregate Bond Index | 3.92 |

PIMCO VIT Real Return Instl | 3.21 |

DFA VA US Large Value | 1.28 |

HIMCO S&P 500 Index Division | 9.18 |

Vanguard VIF Capital Growth | 7.84 |

Vanguard VIF Mid Cap Index | 3.05 |

NT Russell 2000 Index Division | 0.90 |

HIMCO MSCI EAFE Index Division | 12.15 |

American Funds International 2 | 10.11 |

Vanguard VIF Real Estate Index | 2.05 |

Mattel Stock Equivalent Fund | 0.90 |

Fixed Rate | 0.70 |

Name of Investment Option | Rate of Return: 5/1/2023 - 12/31/2023 (%) |

Arrowstreet International Equity ACWI ex US CIT Class A | 10.55 |

BlackRock LifePath® Index 2025 Fund O | 6.75 |

BlackRock LifePath® Index 2030 Fund O | 8.09 |

BlackRock LifePath® Index 2035 Fund O | 9.28 |

BlackRock LifePath® Index 2040 Fund O | 10.46 |

BlackRock LifePath® Index 2045 Fund O | 11.54 |

BlackRock LifePath® Index 2050 Fund O | 12.19 |

BlackRock LifePath® Index 2055 Fund O | 12.36 |

BlackRock LifePath® Index 2060 Fund O | 12.37 |

BlackRock LifePath® Index 2065 Fund O | 12.37 |

BlackRock LifePath® Index Retirement Fund O | 6.29 |

Blended Stable Value | 1.64 |

Bond Index Fund | 2.77 |

Extended Market Index Fund | 21.00 |

Fidelity® Strategic Real Return Fund Class K6 | (0.83) |

Mattel Company Stock Fund | 7.09 |

Non-U.S. Equity Index Fund | 6.55 |

PIMCO Income Fund Institutional Class | 2.02 |

S&P 500 Equity Index Fund | 15.73 |

SMID Cap Research Equity (Series 4) Portfolio | 15.81 |

|  |

2024 Proxy Statement | 73 |

|  |

74 | Mattel, Inc. |

|  |

2024 Proxy Statement | 75 |

Name, Position, and Trigger | Severance: Multiple of Salary and Bonus(1) ($) | Current Year Bonus(2) ($) | Value of Performance Units(3) ($) | Valuation of Equity Vesting Acceleration(4) ($) | Value of Other Benefits(5) ($) | Total Value ($) |

Ynon Kreiz, Chairman and Chief Executive Officer | ||||||

Change of Control | — | 5,857,500 | — | — | — | 5,857,500 |

Involuntary Termination | 9,000,000 | 5,857,500 | 11,211,661 | 281,790 | 115,631 | 26,466,582 |

COC Termination | 9,000,000 | 5,857,500 | 22,683,621 | 281,790 | 115,631 | 37,938,542 |

Retirement(6) | — | — | 7,435,416 | — | — | 7,435,416 |

Death/Permanent Disability | — | — | 11,211,661 | — | — | 11,211,661 |

Anthony DiSilvestro, Chief Financial Officer | ||||||

Change of Control | — | 1,546,380 | — | — | — | 1,546,380 |

Involuntary Termination | 2,700,000 | 1,546,380 | 1,674,543 | 504,421 | 82,752 | 6,508,096 |

COC Termination | 3,600,000 | 1,546,380 | 3,525,104 | 1,757,279 | 93,670 | 10,522,433 |

Retirement | — | — | — | — | — | — |

Death/Permanent Disability | — | — | 1,674,543 | 1,757,279 | — | 3,431,822 |

Steve Totzke, President and Chief Commercial Officer | ||||||

Change of Control | — | 1,249,600 | — | — | — | 1,249,600 |

Involuntary Termination | 2,160,000 | 1,249,600 | 1,472,791 | 198,329 | 98,762 | 5,179,482 |

COC Termination | 2,880,000 | 1,249,600 | 2,953,247 | 1,429,265 | 115,016 | 8,627,128 |

Retirement | — | — | — | — | — | — |

Death/Permanent Disability | — | — | 1,472,791 | 1,429,265 | — | 2,902,056 |

Jonathan Anschell, EVP, Chief Legal Officer, and Secretary | ||||||

Change of Control | — | 902,055 | — | — | — | 902,055 |

Involuntary Termination | 1,275,000 | 902,055 | 957,329 | 166,654 | 78,518 | 3,379,556 |

COC Termination | 2,550,000 | 902,055 | 1,919,624 | 1,277,422 | 107,036 | 6,756,137 |

Retirement | — | — | — | — | — | — |