www.matw.com | Nasdaq: MATW © 2023 Matthews International Corporation. All Rights Reserved. INVESTOR PRESENTATION – QUARTERLY UPDATE Fiscal Third Quarter 2023

© 2023 Matthews International Corporation. All Rights Reserved. DISCLAIMER 2 Any forward-looking statements contained in this presentation are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove correct. Factors that could cause the Company's results to differ materially from the results discussed in such forward-looking statements principally include changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in the cost of materials used in the manufacture of the Company's products, changes in mortality and cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, or other factors such as supply chain disruptions, labor shortages or labor cost increases, changes in product demand or pricing as a result of domestic or international competitive pressures, ability to achieve cost-reduction objectives, unknown risks in connection with the Company's acquisitions, cybersecurity concerns, effectiveness of the Company's internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond the Company's control, impact of pandemics or similar outbreaks, or other disruptions to our industries, customers, or supply chains, the impact of global conflicts, such as the current war between Russia and Ukraine, and other factors described in the Company’s Annual Report on Form 10-K and other periodic filings with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this presentation, including any financial data, is made as of June 30, 2023 unless otherwise noted. The Company does not, and is not obligated to, update this information after the date of such information. Included in this report are measures of financial performance that are not defined by generally accepted accounting principles in the United States (“GAAP”). The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition and divestiture costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company’s core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. The Company believes that adjusted EBITDA provides relevant and useful information, which is used by the Company’s management in assessing the performance of its business. Adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management’s evaluation of its operating results. These items include stock-based compensation, the non-service portion of pension and postretirement expense, acquisition and divestiture costs, ERP integration costs, and strategic initiatives and other charges. Adjusted EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes, and the effects of certain acquisition, divestiture and ERP integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating operating performance. It is also useful as a financial measure for lenders and is used by the Company’s management to measure business performance. Adjusted EBITDA is not a measure of the Company's financial performance under GAAP and should not be considered as an alternative to net income or other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the Company's liquidity. The Company's definition of adjusted EBITDA may not be comparable to similarly titled measures used by other companies. The Company has presented constant currency sales and constant currency adjusted EBITDA and believes these measures provide relevant and useful information, which is used by the Company's management in assessing the performance of its business on a consistent basis by removing the impact of changes due to foreign exchange translation rates. These measures allow management, as well as investors, to assess the Company’s sales and adjusted EBITDA on a constant currency basis. The Company has also presented adjusted net income and adjusted earnings per share and believes each measure provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in assessing the performance of its business. Adjusted net income and adjusted earnings per share provides the Company with an understanding of the results from the primary operations of our business by excluding the effects of certain acquisition, divestiture and system-integration costs, and items that do not reflect the ordinary earnings of our operations. These measures provide management with insight into the earning value for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, these measures may be useful to an investor in evaluating the underlying operating performance of the Company’s business overall, as well as performance trends, on a consistent basis. The Company has also presented net debt and a net debt leverage ratio and believes each measure provides relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the indebtedness of the Company, net of cash and cash equivalents and relative to adjusted EBITDA. These measures allow management, as well as analysts and investors, to assess the Company’s leverage.. Lastly, the Company has presented free cash flow as supplemental measures of cash flow that are not required by, or presented in accordance with, GAAP. Management believes that these measures provide relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the cash generated by operations, excluding capital expenditures. These measures allows management, as well as analysts and investors, to assess the Company’s ability to pursue growth and investment opportunities designed to increase Shareholder value.

© 2023 Matthews International Corporation. All Rights Reserved. OUR BUSINESS SEGMENTS Matthews today builds on its legacy with development of new technologies that provide a platform for continued evolution and growth. 3 The SGK Brand Solutions segment is a leading provider of packaging solutions and brand experiences, helping companies simplify their marketing, amplify their brands and provide value. The Memorialization segment is a leading provider of memorialization products, including memorials, caskets, cremation- related products, and cremation and incineration equipment, primarily to cemetery and funeral home customers that help families move from grief to remembrance. The Industrial Technologies segment designs, manufactures, services and distributes high-tech custom energy storage solutions, product identification, and warehouse automation technologies and solutions.

© 2023 Matthews International Corporation. All Rights Reserved. Q3 2023 SUMMARY 4 Q3 2022 Q3 2023 Sales $ 421.7 $ 471.9 Diluted EPS $ 0.09 $ 0.28 Non-GAAP Adjusted EPS* $ 0.58 $ 0.74 Net Income Attributable to Matthews $ 2.9 $ 8.7 Adjusted EBITDA* $ 46.0 $ 56.2 Q3 YTD YTD 2022 YTD 2023 Sales $ 1,305.3 $ 1,400.7 Diluted (L)EPS $ (0.60) $ 0.69 Non-GAAP Adjusted EPS* $ 2.06 $ 1.92 Net (Loss) Income Attributable to Matthews $ (18.8) $ 21.6 Adjusted EBITDA* $ 154.5 $ 163.9 Q3 Highlights Strong operating performance driven by all business segments • Strong sales growth ◦ Consolidated sales up 11.9% YoY ◦ Industrial Technologies increased 66% ◦ Memorialization also higher • Higher adjusted EBITDA ◦ Consolidated adjusted EBITDA grew 22.1% YoY ◦ All segments contribute to adjusted EBITDA increase ◦ Net leverage ratio improved to 3.35x • Energy business continues to grow ◦ Higher energy storage sales on a YoY basis ◦ Recent acquisitions contribute to sales growth and capacity • Outlook ◦ Guidance of adjusted EBITDA of $215M to $235M reaffirmed for FY 2023 ◦ Projected adjusted EBITDA of at least $220M ◦ Cautious on timing of energy storage orders * See supplemental slides for Adjusted EPS and Adjusted EBITDA reconciliations and other important disclaimers regarding Matthews’ use of Non-GAAP measures ($ in millions except per-share amounts) 4

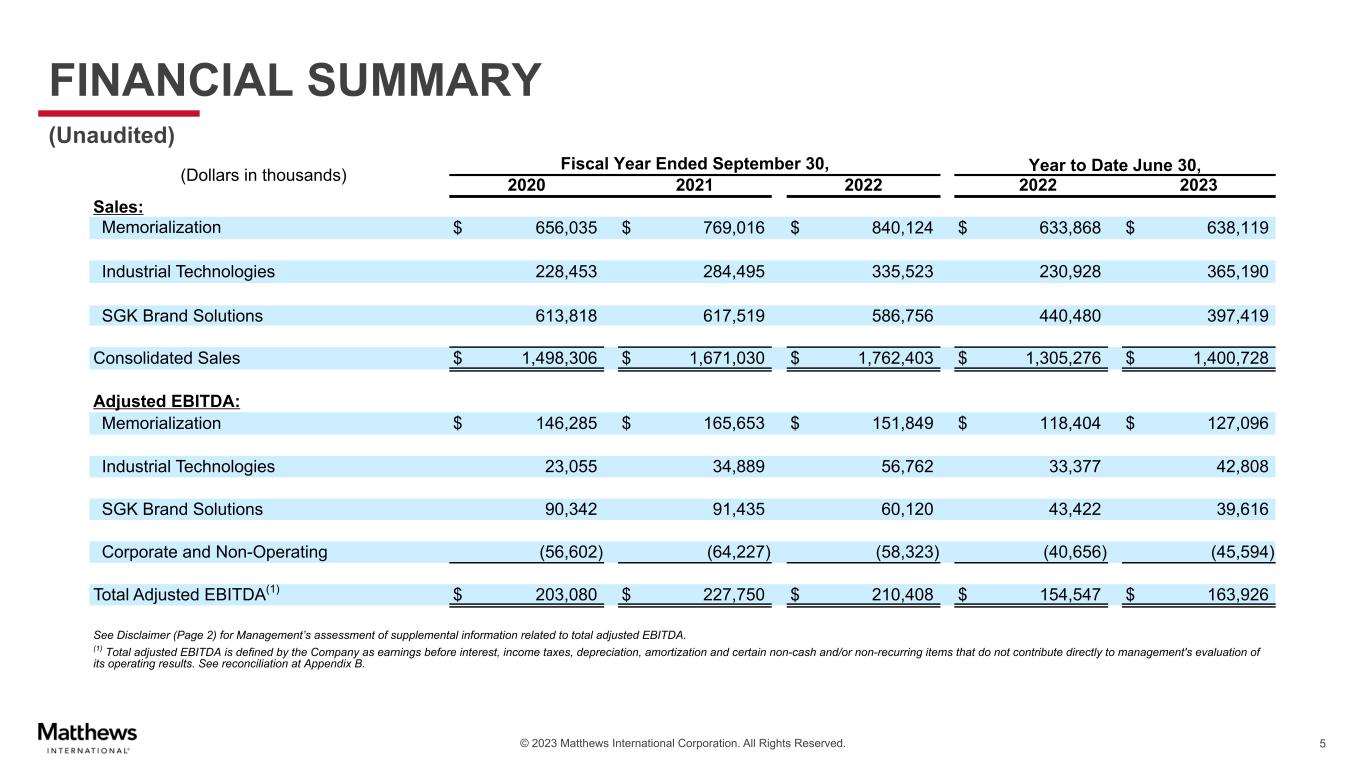

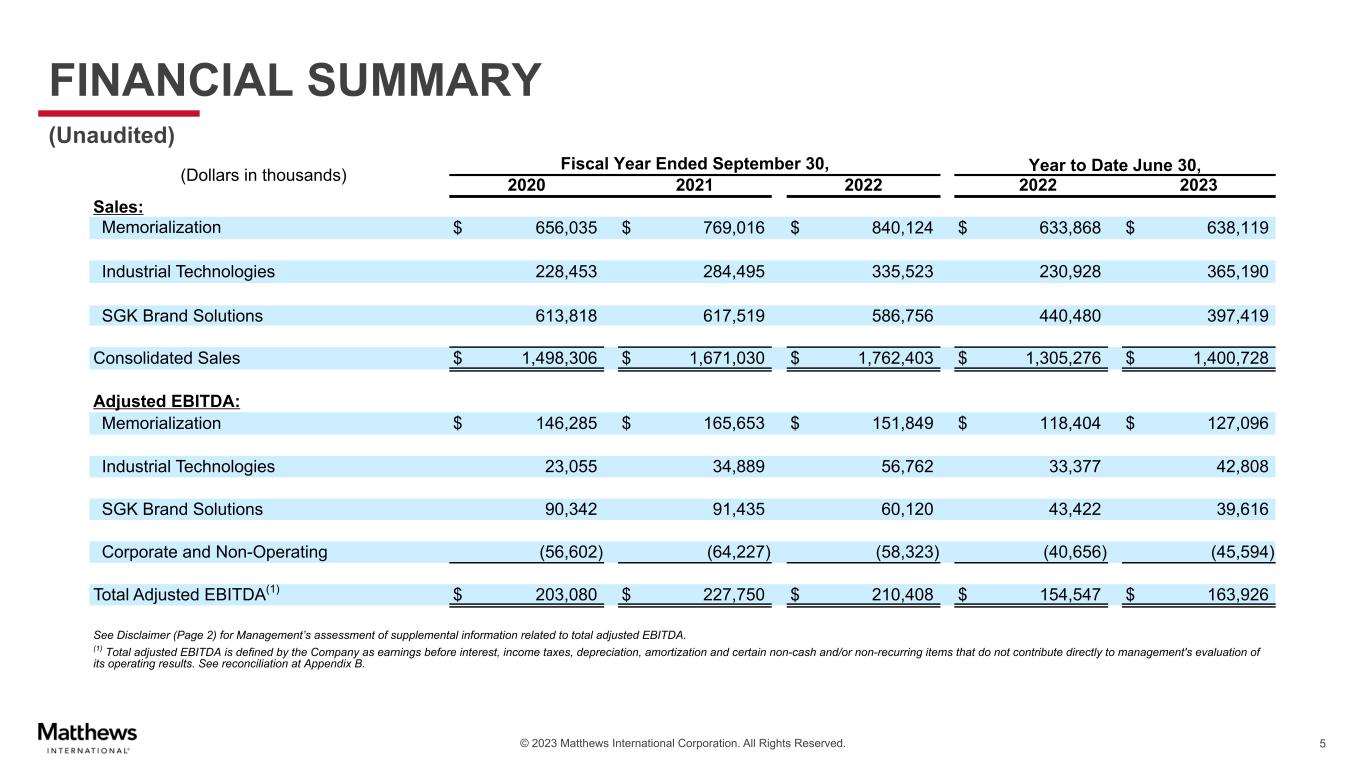

© 2023 Matthews International Corporation. All Rights Reserved. 5 FINANCIAL SUMMARY (Unaudited) (Dollars in thousands) Fiscal Year Ended September 30, Year to Date June 30, 2020 2021 2022 2022 2023 Sales: Memorialization $ 656,035 $ 769,016 $ 840,124 $ 633,868 $ 638,119 Industrial Technologies 228,453 284,495 335,523 230,928 365,190 SGK Brand Solutions 613,818 617,519 586,756 440,480 397,419 Consolidated Sales $ 1,498,306 $ 1,671,030 $ 1,762,403 $ 1,305,276 $ 1,400,728 Adjusted EBITDA: Memorialization $ 146,285 $ 165,653 $ 151,849 $ 118,404 $ 127,096 Industrial Technologies 23,055 34,889 56,762 33,377 42,808 SGK Brand Solutions 90,342 91,435 60,120 43,422 39,616 Corporate and Non-Operating (56,602) (64,227) (58,323) (40,656) (45,594) Total Adjusted EBITDA(1) $ 203,080 $ 227,750 $ 210,408 $ 154,547 $ 163,926 See Disclaimer (Page 2) for Management’s assessment of supplemental information related to total adjusted EBITDA. (1) Total adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management's evaluation of its operating results. See reconciliation at Appendix B.

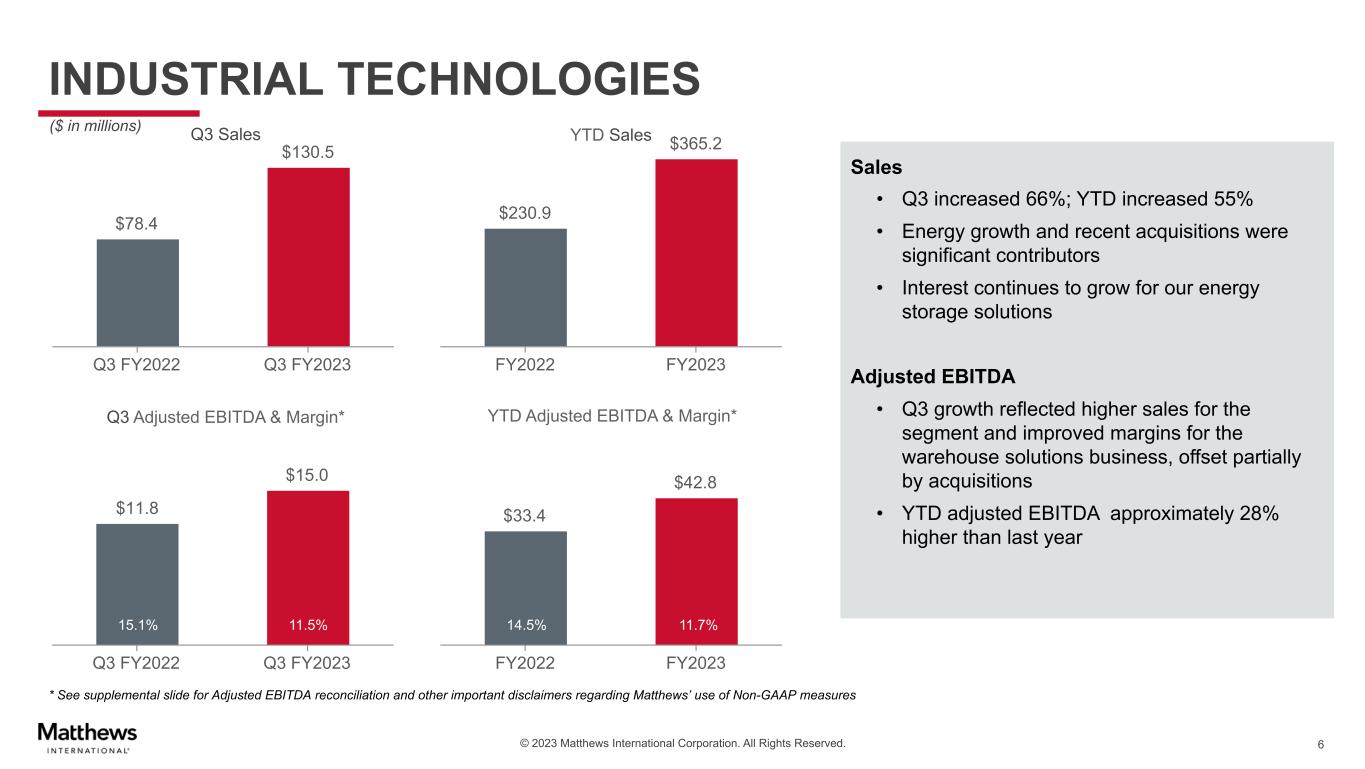

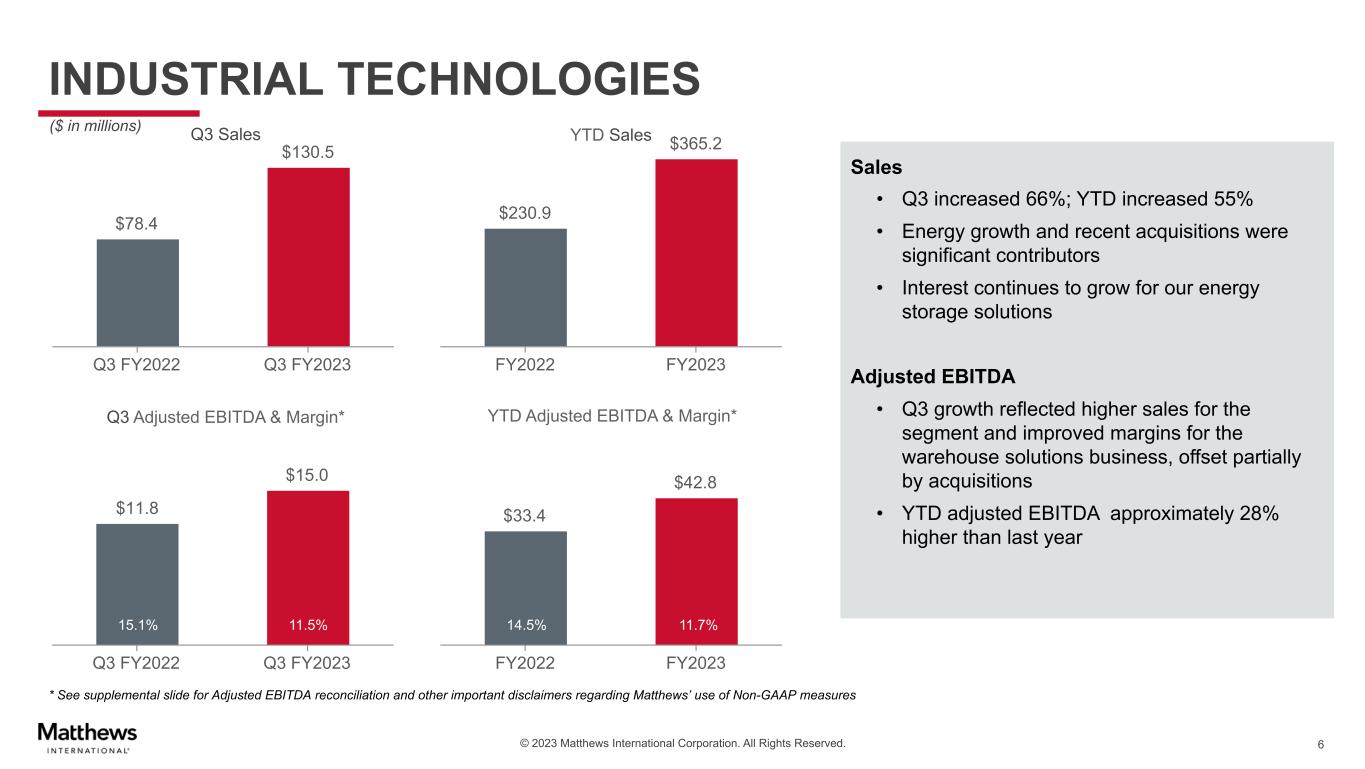

© 2023 Matthews International Corporation. All Rights Reserved. INDUSTRIAL TECHNOLOGIES 6 15.5% 12.4% 15.6%10.3% ($ in millions) $78.4 $130.5 Q3 FY2022 Q3 FY2023 $230.9 $365.2 FY2022 FY2023 $11.8 $15.0 Q3 FY2022 Q3 FY2023 $33.4 $42.8 FY2022 FY2023 15.1% 11.5% 14.5% 11.7% Q3 Sales Q3 Adjusted EBITDA & Margin* YTD Sales YTD Adjusted EBITDA & Margin* Sales • Q3 increased 66%; YTD increased 55% • Energy growth and recent acquisitions were significant contributors • Interest continues to grow for our energy storage solutions Adjusted EBITDA • Q3 growth reflected higher sales for the segment and improved margins for the warehouse solutions business, offset partially by acquisitions • YTD adjusted EBITDA approximately 28% higher than last year * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures 6

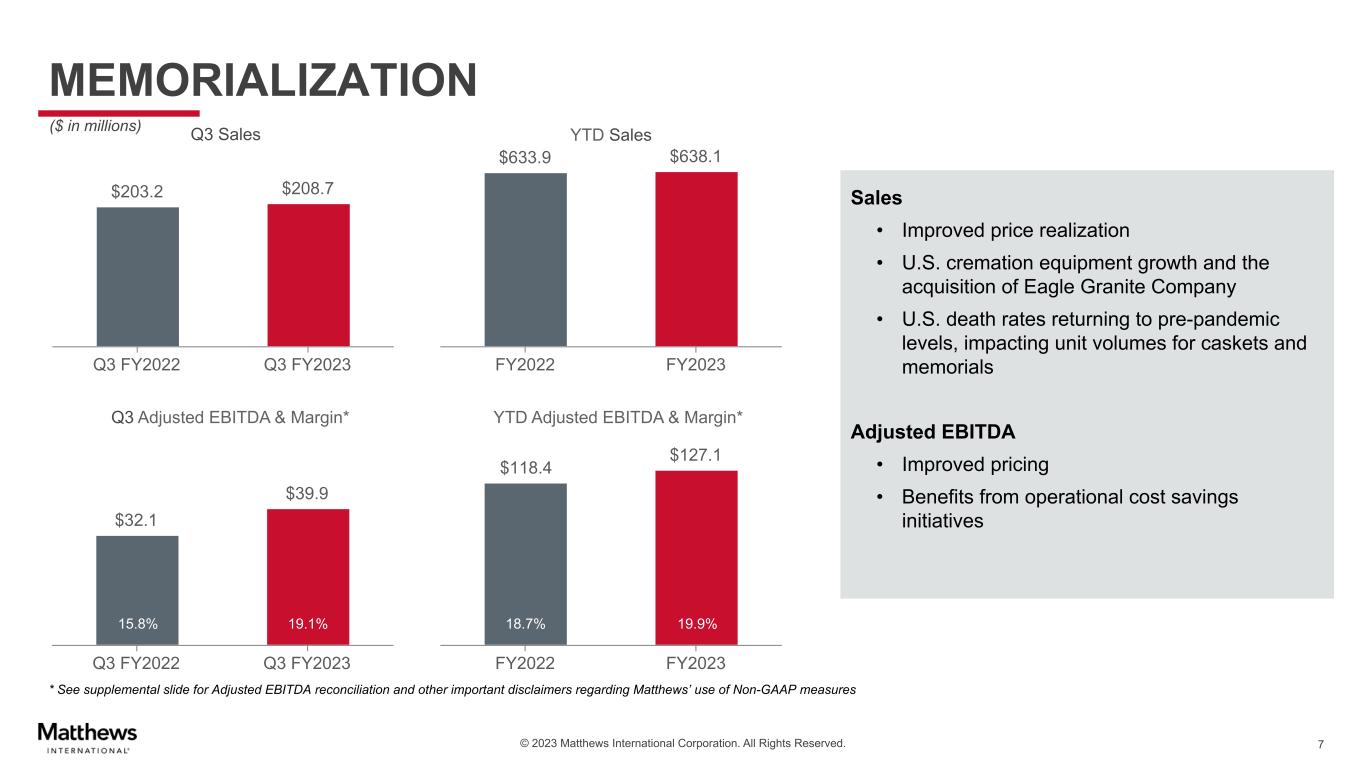

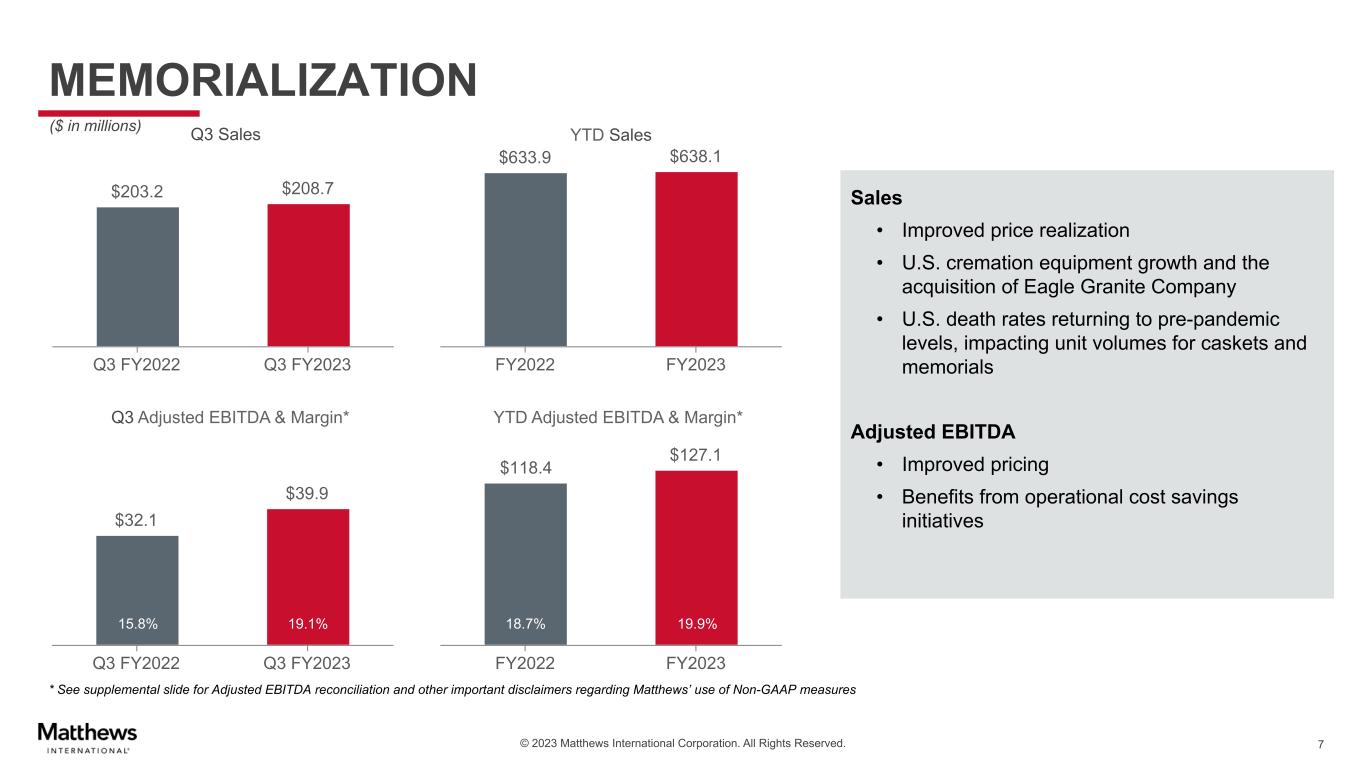

© 2023 Matthews International Corporation. All Rights Reserved. MEMORIALIZATION 7 23.0% 21.1% $203.2 $208.7 Q3 FY2022 Q3 FY2023 $633.9 $638.1 FY2022 FY2023 $32.1 $39.9 Q3 FY2022 Q3 FY2023 $118.4 $127.1 FY2022 FY2023 15.8% 19.1% 18.7% 19.9% ($ in millions) Q3 Sales Q3 Adjusted EBITDA & Margin* YTD Sales YTD Adjusted EBITDA & Margin* Sales • Improved price realization • U.S. cremation equipment growth and the acquisition of Eagle Granite Company • U.S. death rates returning to pre-pandemic levels, impacting unit volumes for caskets and memorials Adjusted EBITDA • Improved pricing • Benefits from operational cost savings initiatives * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures 7

© 2023 Matthews International Corporation. All Rights Reserved. SGK BRAND SOLUTIONS ($ in millions) 8 15.4% 12.9% $140.1 $132.6 Q3 FY2022 Q3 FY2023 $440.5 $397.4 FY2022 FY2023 $14.5 $16.4 Q3 FY2022 Q3 FY2023 $43.4 $39.6 FY2022 FY2023 12.3%10.4% 9.9% 10.0% Q3 Sales Q3 Adjusted EBITDA & Margin* YTD Sales YTD Adjusted EBITDA & Margin* Sales • Unfavorable currency impacts of $1.2 million for Q3 and $17.9 million YTD • European businesses continued to be challenged by unfavorable market conditions • Unfavorable impact due to site closures Adjusted EBITDA • Cost reduction initiatives • Improved conditions to pass along cost increases • Unfavorable currency impacts of $0.5 million for Q3 and $1.8 million YTD * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures 8

© 2023 Matthews International Corporation. All Rights Reserved. 9 APPENDIX

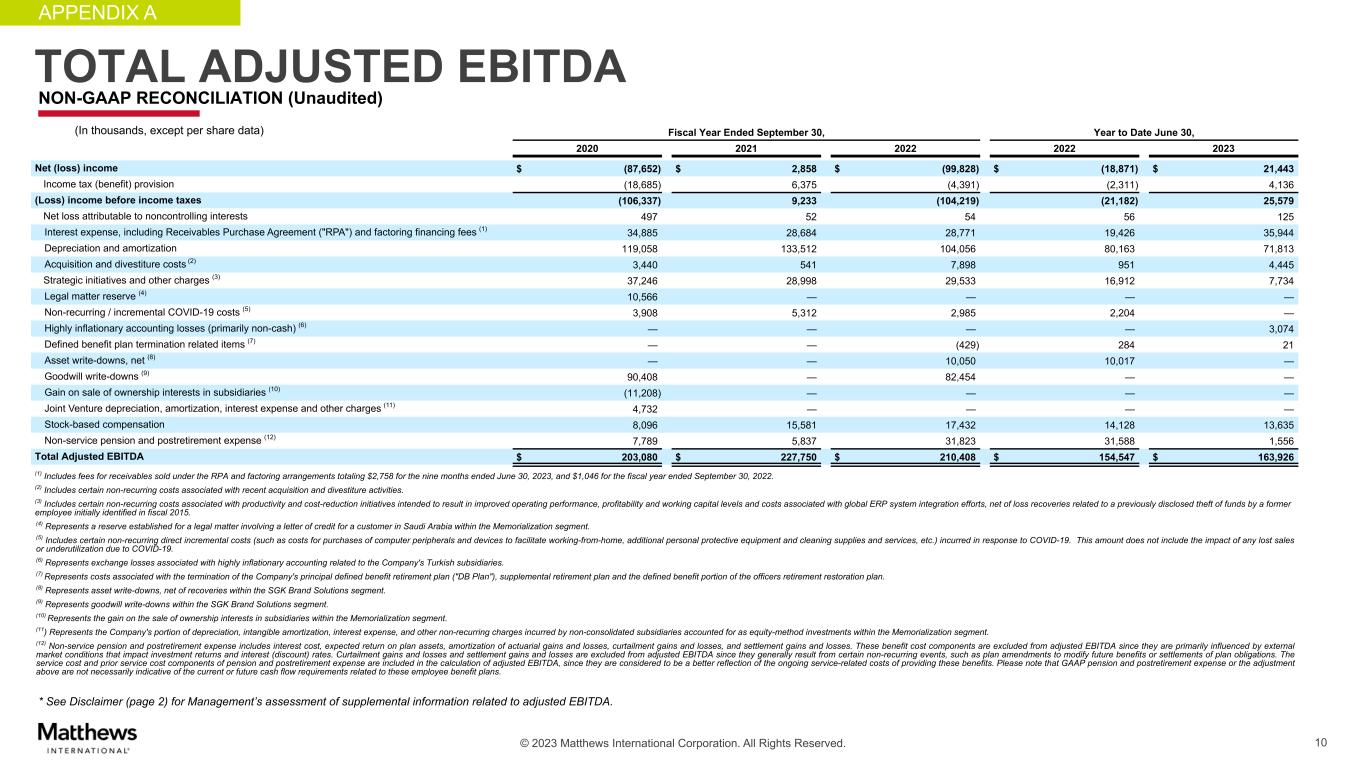

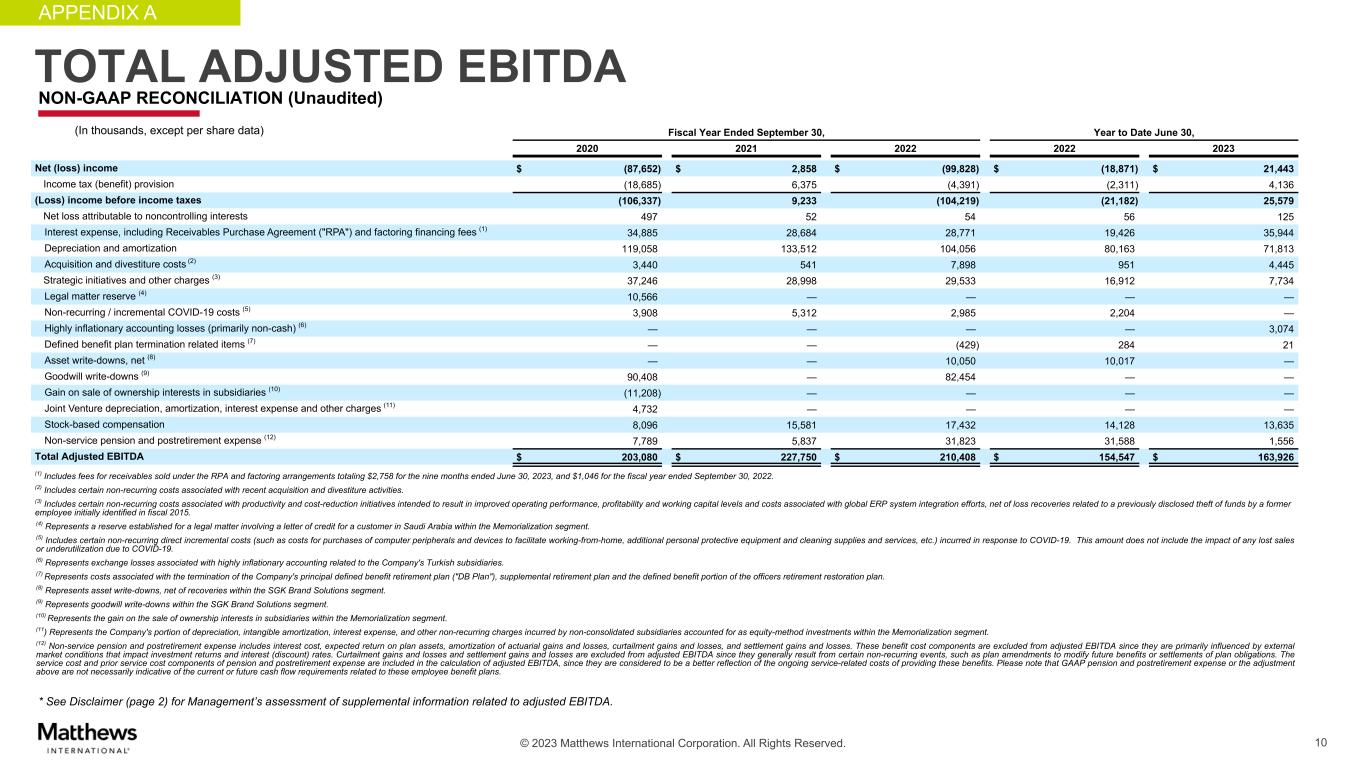

© 2023 Matthews International Corporation. All Rights Reserved. NON-GAAP RECONCILIATION (Unaudited) 10 APPENDIX A T T L ADJUSTED EBITDA Fiscal Year Ended September 30, Year to Date June 30, 2020 2021 2022 2022 2023 Net (loss) income $ (87,652) $ 2,858 $ (99,828) $ (18,871) $ 21,443 Income tax (benefit) provision (18,685) 6,375 (4,391) (2,311) 4,136 (Loss) income before income taxes (106,337) 9,233 (104,219) (21,182) 25,579 Net loss attributable to noncontrolling interests 497 52 54 56 125 Interest expense, including Receivables Purchase Agreement ("RPA") and factoring financing fees (1) 34,885 28,684 28,771 19,426 35,944 Depreciation and amortization 119,058 133,512 104,056 80,163 71,813 Acquisition and divestiture costs (2) 3,440 541 7,898 951 4,445 Strategic initiatives and other charges (3) 37,246 28,998 29,533 16,912 7,734 Legal matter reserve (4) 10,566 — — — — Non-recurring / incremental COVID-19 costs (5) 3,908 5,312 2,985 2,204 — Highly inflationary accounting losses (primarily non-cash) (6) — — — — 3,074 Defined benefit plan termination related items (7) — — (429) 284 21 Asset write-downs, net (8) — — 10,050 10,017 — Goodwill write-downs (9) 90,408 — 82,454 — — Gain on sale of ownership interests in subsidiaries (10) (11,208) — — — — Joint Venture depreciation, amortization, interest expense and other charges (11) 4,732 — — — — Stock-based compensation 8,096 15,581 17,432 14,128 13,635 Non-service pension and postretirement expense (12) 7,789 5,837 31,823 31,588 1,556 Total Adjusted EBITDA $ 203,080 $ 227,750 $ 210,408 $ 154,547 $ 163,926 (1) Includes fees for receivables sold under the RPA and factoring arrangements totaling $2,758 for the nine months ended June 30, 2023, and $1,046 for the fiscal year ended September 30, 2022. (2) Includes certain non-recurring costs associated with recent acquisition and divestiture activities. (3) Includes certain non-recurring costs associated with productivity and cost-reduction initiatives intended to result in improved operating performance, profitability and working capital levels and costs associated with global ERP system integration efforts, net of loss recoveries related to a previously disclosed theft of funds by a former employee initially identified in fiscal 2015. (4) Represents a reserve established for a legal matter involving a letter of credit for a customer in Saudi Arabia within the Memorialization segment. (5) Includes certain non-recurring direct incremental costs (such as costs for purchases of computer peripherals and devices to facilitate working-from-home, additional personal protective equipment and cleaning supplies and services, etc.) incurred in response to COVID-19. This amount does not include the impact of any lost sales or underutilization due to COVID-19. (6) Represents exchange losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries. (7) Represents costs associated with the termination of the Company's principal defined benefit retirement plan ("DB Plan"), supplemental retirement plan and the defined benefit portion of the officers retirement restoration plan. (8) Represents asset write-downs, net of recoveries within the SGK Brand Solutions segment. (9) Represents goodwill write-downs within the SGK Brand Solutions segment. (10) Represents the gain on the sale of ownership interests in subsidiaries within the Memorialization segment. (11) Represents the Company's portion of depreciation, intangible amortization, interest expense, and other non-recurring charges incurred by non-consolidated subsidiaries accounted for as equity-method investments within the Memorialization segment. (12) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted EBITDA. NON-GAAP RECONCILIATION (Unaudited) (In thousands, except per share data)

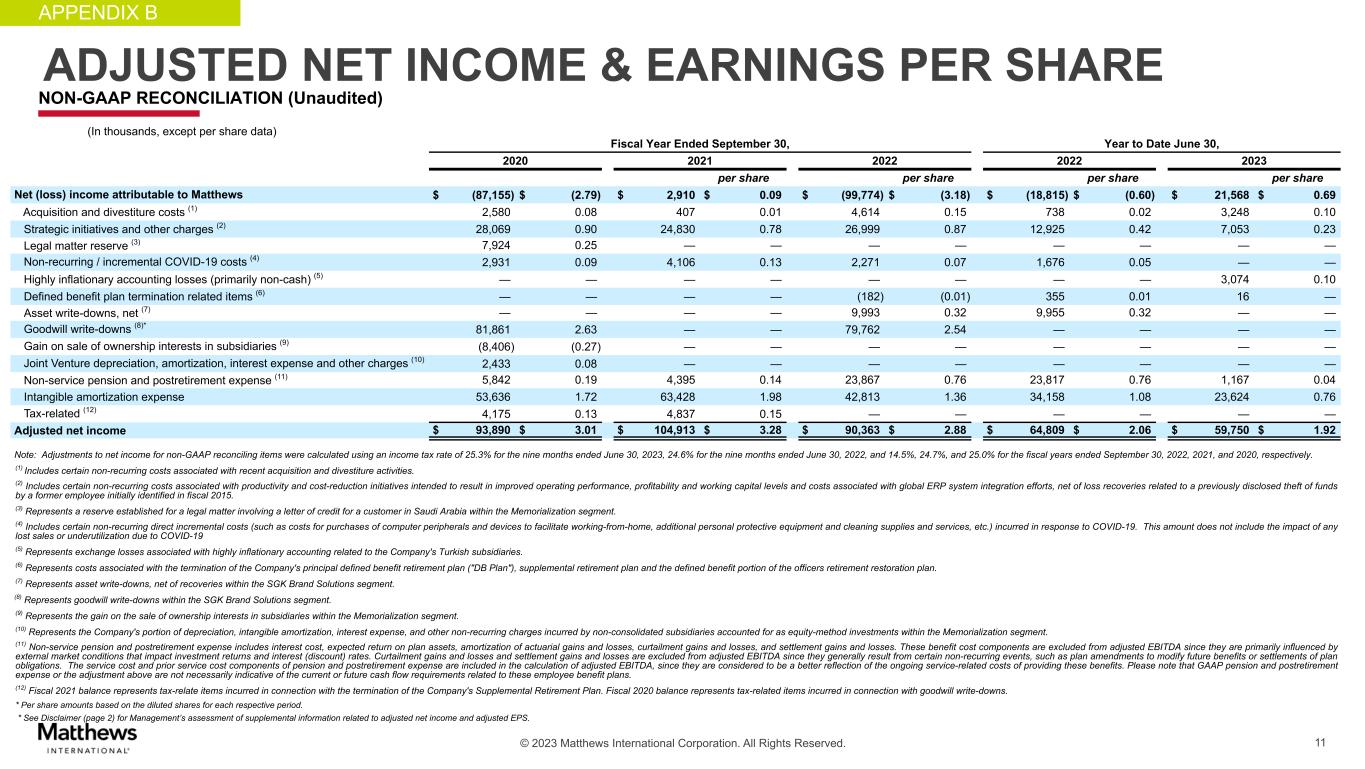

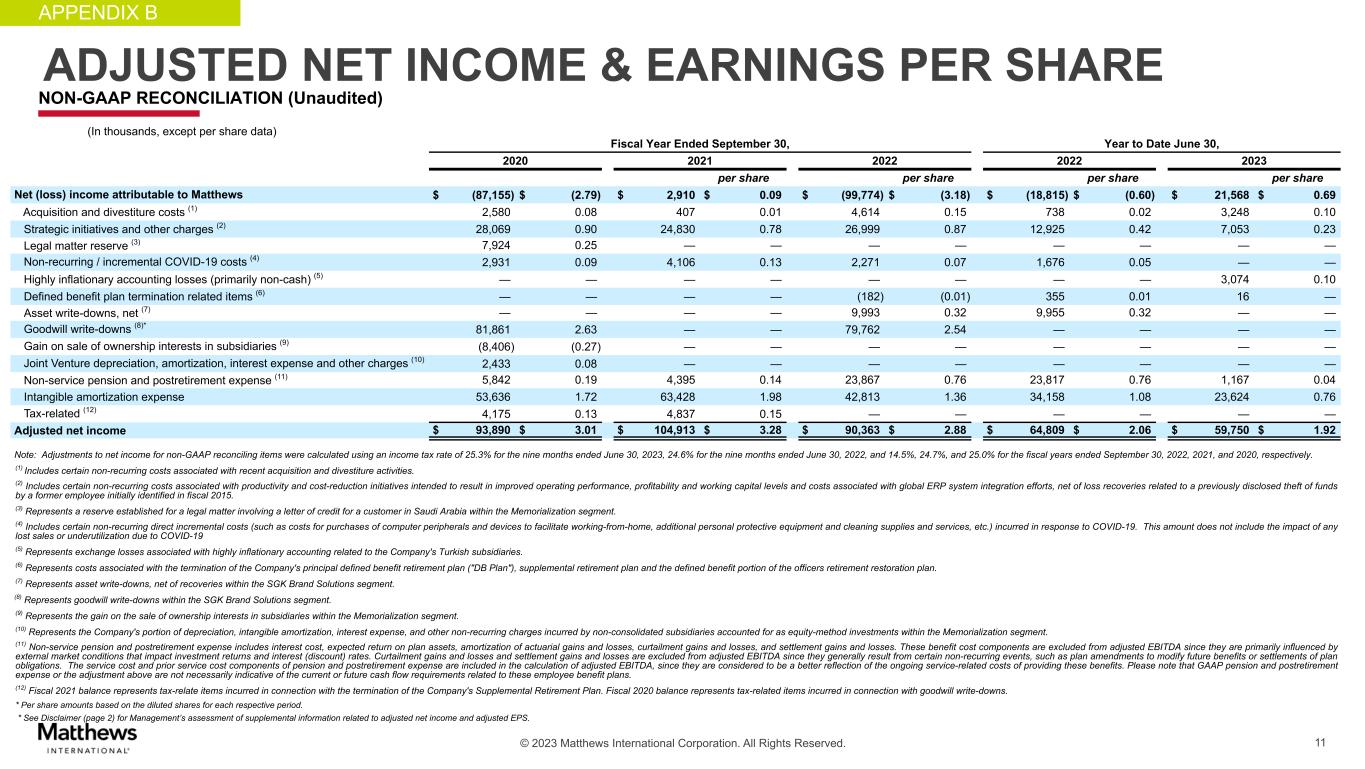

© 2023 Matthews International Corporation. All Rights Reserved. 11 APPENDIX B ADJUSTED NET INCOME & EARNINGS PER SHARE NON-GAAP RECONCILIATION (Unaudited) Fiscal Year Ended September 30, Year to Date June 30, 2020 2021 2022 2022 2023 per share per share per share per share Net (loss) income attributable to Matthews $ (87,155) $ (2.79) $ 2,910 $ 0.09 $ (99,774) $ (3.18) $ (18,815) $ (0.60) $ 21,568 $ 0.69 Acquisition and divestiture costs (1) 2,580 0.08 407 0.01 4,614 0.15 738 0.02 3,248 0.10 Strategic initiatives and other charges (2) 28,069 0.90 24,830 0.78 26,999 0.87 12,925 0.42 7,053 0.23 Legal matter reserve (3) 7,924 0.25 — — — — — — — — Non-recurring / incremental COVID-19 costs (4) 2,931 0.09 4,106 0.13 2,271 0.07 1,676 0.05 — — Highly inflationary accounting losses (primarily non-cash) (5) — — — — — — — — 3,074 0.10 Defined benefit plan termination related items (6) — — — — (182) (0.01) 355 0.01 16 — Asset write-downs, net (7) — — — — 9,993 0.32 9,955 0.32 — — Goodwill write-downs (8)* 81,861 2.63 — — 79,762 2.54 — — — — Gain on sale of ownership interests in subsidiaries (9) (8,406) (0.27) — — — — — — — — Joint Venture depreciation, amortization, interest expense and other charges (10) 2,433 0.08 — — — — — — — — Non-service pension and postretirement expense (11) 5,842 0.19 4,395 0.14 23,867 0.76 23,817 0.76 1,167 0.04 Intangible amortization expense 53,636 1.72 63,428 1.98 42,813 1.36 34,158 1.08 23,624 0.76 Tax-related (12) 4,175 0.13 4,837 0.15 — — — — — — Adjusted net income $ 93,890 $ 3.01 $ 104,913 $ 3.28 $ 90,363 $ 2.88 $ 64,809 $ 2.06 $ 59,750 $ 1.92 Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 25.3% for the nine months ended June 30, 2023, 24.6% for the nine months ended June 30, 2022, and 14.5%, 24.7%, and 25.0% for the fiscal years ended September 30, 2022, 2021, and 2020, respectively. (1) Includes certain non-recurring costs associated with recent acquisition and divestiture activities. (2) Includes certain non-recurring costs associated with productivity and cost-reduction initiatives intended to result in improved operating performance, profitability and working capital levels and costs associated with global ERP system integration efforts, net of loss recoveries related to a previously disclosed theft of funds by a former employee initially identified in fiscal 2015. (3) Represents a reserve established for a legal matter involving a letter of credit for a customer in Saudi Arabia within the Memorialization segment. (4) Includes certain non-recurring direct incremental costs (such as costs for purchases of computer peripherals and devices to facilitate working-from-home, additional personal protective equipment and cleaning supplies and services, etc.) incurred in response to COVID-19. This amount does not include the impact of any lost sales or underutilization due to COVID-19 (5) Represents exchange losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries. (6) Represents costs associated with the termination of the Company's principal defined benefit retirement plan ("DB Plan"), supplemental retirement plan and the defined benefit portion of the officers retirement restoration plan. (7) Represents asset write-downs, net of recoveries within the SGK Brand Solutions segment. (8) Represents goodwill write-downs within the SGK Brand Solutions segment. (9) Represents the gain on the sale of ownership interests in subsidiaries within the Memorialization segment. (10) Represents the Company's portion of depreciation, intangible amortization, interest expense, and other non-recurring charges incurred by non-consolidated subsidiaries accounted for as equity-method investments within the Memorialization segment. (11) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. (12) Fiscal 2021 balance represents tax-relate items incurred in connection with the termination of the Company's Supplemental Retirement Plan. Fiscal 2020 balance represents tax-related items incurred in connection with goodwill write-downs. * Per share amounts based on the diluted shares for each respective period. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted net income and adjusted EPS. (In thousands, except per share data)

© 2023 Matthews International Corporation. All Rights Reserved. 12 APPENDIX C NET DEBT & NET DEBT LEVERAGE RATIO NON-GAAP RECONCILIATION (Unaudited) (Dollars in thousands) Fiscal Year Ended September 30, June 30, 2020 2021 2022 2023 Long-term debt, current maturities $ 26,824 $ 4,624 $ 3,277 $ 2,941 Long-term debt 807,710 759,086 795,291 772,056 Total debt 834,534 763,710 798,568 774,997 Less: Cash and cash equivalents (41,334) (49,176) (69,016) (39,295) Net Debt $ 793,200 $ 714,534 $ 729,552 $ 735,702 Adjusted EBITDA $ 203,080 $ 227,750 $ 210,408 $ 219,787 Net Debt Leverage Ratio 3.9 3.1 3.5 3.3 * See Disclaimer (page 2) for Management’s assessment of supplemental information related to net debt and net debt leverage ratio.

© 2023 Matthews International Corporation. All Rights Reserved. 13 APPENDIX D FREE CASH FLOW NON-GAAP RECONCILIATION (Unaudited) (Dollars in thousands) Fiscal Year Ended September 30, Nine Months Ended June 30, 20232020 2021 2022 Cash Provided from Operating Activities $ 180,447 $ 162,811 $ 126,860 $ 76,906 Less: Capital Expenditures (34,849) (34,313) (61,321) (37,107) Free Cash Flow $ 145,598 $ 128,498 $ 65,539 $ 39,799 Note: See Disclaimer (Page 2) for Management’s assessment of supplemental information related to free cash flow.