www.matw.com | Nasdaq: MATW Fourth Quarter Fiscal 2024 Earnings Teleconference November 22, 2024 Joseph C. Bartolacci President and Chief Executive Officer Steven F. Nicola Chief Financial Officer

© 2024 Matthews International Corporation. All Rights Reserved. DISCLAIMER 2 Any forward-looking statements contained in this presentation are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding the expectations, hopes, beliefs, intentions or strategies of the Company regarding the future, and may be identified by the use of words such as “expects,” “believes,” “intends,” “projects,” “anticipates,” “estimates,” “plans,” “seeks,” “forecasts,” “predicts,” “objective,” “targets,” “potential,” “outlook,” “may,” “will,” “could” or the negative of these terms, other comparable terminology and variations thereof. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations, and no assurance can be given that such expectations will prove correct. Factors that could cause the Company's results to differ materially from the results discussed in such forward-looking statements principally include changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in interest rates, changes in the cost of materials used in the manufacture of the Company's products, any impairment of goodwill or intangible assets, environmental liability and limitations on the Company’s operations due to environmental laws and regulations, disruptions to certain services, such as telecommunications, network server maintenance, cloud computing or transaction processing services, provided to the Company by third-parties, changes in mortality and cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, or other factors such as supply chain disruptions, labor shortages or labor cost increases, changes in product demand or pricing as a result of domestic or international competitive pressures, ability to achieve cost-reduction objectives, unknown risks in connection with the Company's acquisitions and divestitures, cybersecurity concerns and costs arising with management of cybersecurity threats, effectiveness of the Company's internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond the Company's control, impact of pandemics or similar outbreaks, or other disruptions to our industries, customers, or supply chains, the impact of global conflicts, such as the current war between Russia and Ukraine, the outcome of the Company's dispute with Tesla, Inc. ("Tesla"), and other factors described in the Company’s Annual Report on Form 10-K and other periodic filings with the U.S. Securities and Exchange Commission. Included in this report are measures of financial performance that are not defined by generally accepted accounting principles in the United States (“GAAP”). The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition and divestiture costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to certain commercial and operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company’s core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. The Company believes that adjusted EBITDA provides relevant and useful information, which is used by the Company’s management in assessing the performance of its business. Adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management’s evaluation of its operating results. These items include stock-based compensation, the non-service portion of pension and postretirement expense, acquisition and divestiture costs, ERP integration costs, and strategic initiatives and other charges. Adjusted EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes, and the effects of certain acquisition and divestiture and ERP integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating operating performance. It is also useful as a financial measure for lenders and is used by the Company’s management to measure business performance. Adjusted EBITDA is not a measure of the Company's financial performance under GAAP and should not be considered as an alternative to net income or other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the Company's liquidity. The Company's definition of adjusted EBITDA may not be comparable to similarly titled measures used by other companies. The Company has presented constant currency sales and constant currency adjusted EBITDA and believes these measures provide relevant and useful information, which is used by the Company's management in assessing the performance of its business on a consistent basis by removing the impact of changes due to foreign exchange translation rates. These measures allow management, as well as investors, to assess the Company’s sales and adjusted EBITDA on a constant currency basis. The Company has also presented adjusted net income and adjusted earnings per share and believes each measure provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in assessing the performance of its business. Adjusted net income and adjusted earnings per share provides the Company with an understanding of the results from the primary operations of our business by excluding the effects of certain acquisition, divestiture, and system-integration costs, and items that do not reflect the ordinary earnings of our operations. These measures provide management with insight into the earning value for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, these measures may be useful to an investor in evaluating the underlying operating performance of the Company’s business overall, as well as performance trends, on a consistent basis. Lastly, the Company has presented net debt and a net debt leverage ratio and believes each measure provides relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the indebtedness of the Company, net of cash and cash equivalents and relative to adjusted EBITDA. These measures allow management, as well as analysts and investors, to assess the Company’s leverage.

BUSINESS OVERVIEW

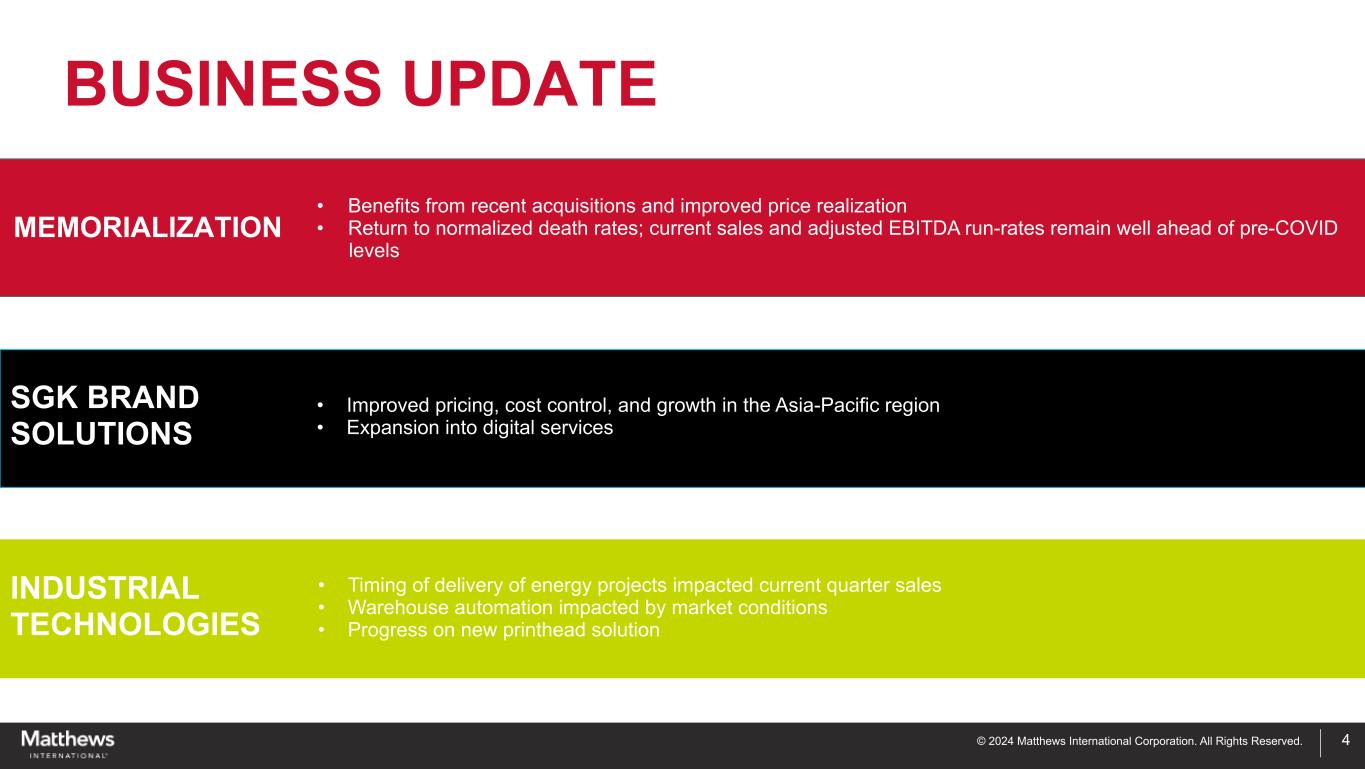

© 2024 Matthews International Corporation. All Rights Reserved. 4 SGK BRAND SOLUTIONS MEMORIALIZATION • Benefits from recent acquisitions and improved price realization • Return to normalized death rates; current sales and adjusted EBITDA run-rates remain well ahead of pre-COVID levels • Improved pricing, cost control, and growth in the Asia-Pacific region • Expansion into digital services BUSINESS UPDATE INDUSTRIAL TECHNOLOGIES • Timing of delivery of energy projects impacted current quarter sales • Warehouse automation impacted by market conditions • Progress on new printhead solution

© 2024 Matthews International Corporation. All Rights Reserved. Key Considerations • Projected adjusted EBITDA to be in the range of $205 million to $215 million • Solid performance expected for the Memorialization and SGK Brand Solutions segments • Uncertainty of project timing in the Industrial Technologies segment, specifically related to energy business; cost reduction programs should mitigate some of this impact • Higher quote activity in Warehouse Automation business • Projected higher operating cash flow OUTLOOK FOR FISCAL 2025 5

FINANCIAL OVERVIEW

© 2024 Matthews International Corporation. All Rights Reserved. Q4 & YTD FY2024 SUMMARY * See supplemental slides for Adjusted EPS and Adjusted EBITDA reconciliations, and other important disclaimers regarding Matthews’ use of Non-GAAP measures 4th Quarter ("Q4") Highlights Sales • SGK Brand Solutions segment current quarter sales higher than a year ago • Lower sales for the Industrial Technologies segment GAAP EPS • Reflects asset write-downs, including a goodwill impairment charge, and charges in connection with cost reduction programs Adjusted EBITDA • Lower adjusted EBITDA, primarily in the Industrial Technologies segment Adjusted EPS • Lower adjusted EBITDA and higher interest expense 7 Q4 2023 Q4 2024 Sales $ 480.2 $ 446.7 Gross Margin 31.4 % 26.3 % Diluted Earnings (Loss) Per Share $ 0.56 $ (2.21) Non-GAAP Adjusted EPS* $ 0.96 $ 0.55 Net Earnings (Loss) Attributable to Matthews $ 17.7 $ (68.2) Adjusted EBITDA* $ 61.9 $ 58.1 ($ in millions except per-share amounts) Q4 YTD YTD 2023 YTD 2024 Sales $ 1,880.9 $ 1,795.7 Gross Margin 30.7 % 29.5 % Diluted Earnings (Loss) Per Share $ 1.26 $ (1.93) Non-GAAP Adjusted EPS* $ 2.88 $ 2.17 Net Earnings (Loss) Attributable to Matthews $ 39.3 $ (59.7) Adjusted EBITDA* $ 225.8 $ 205.2

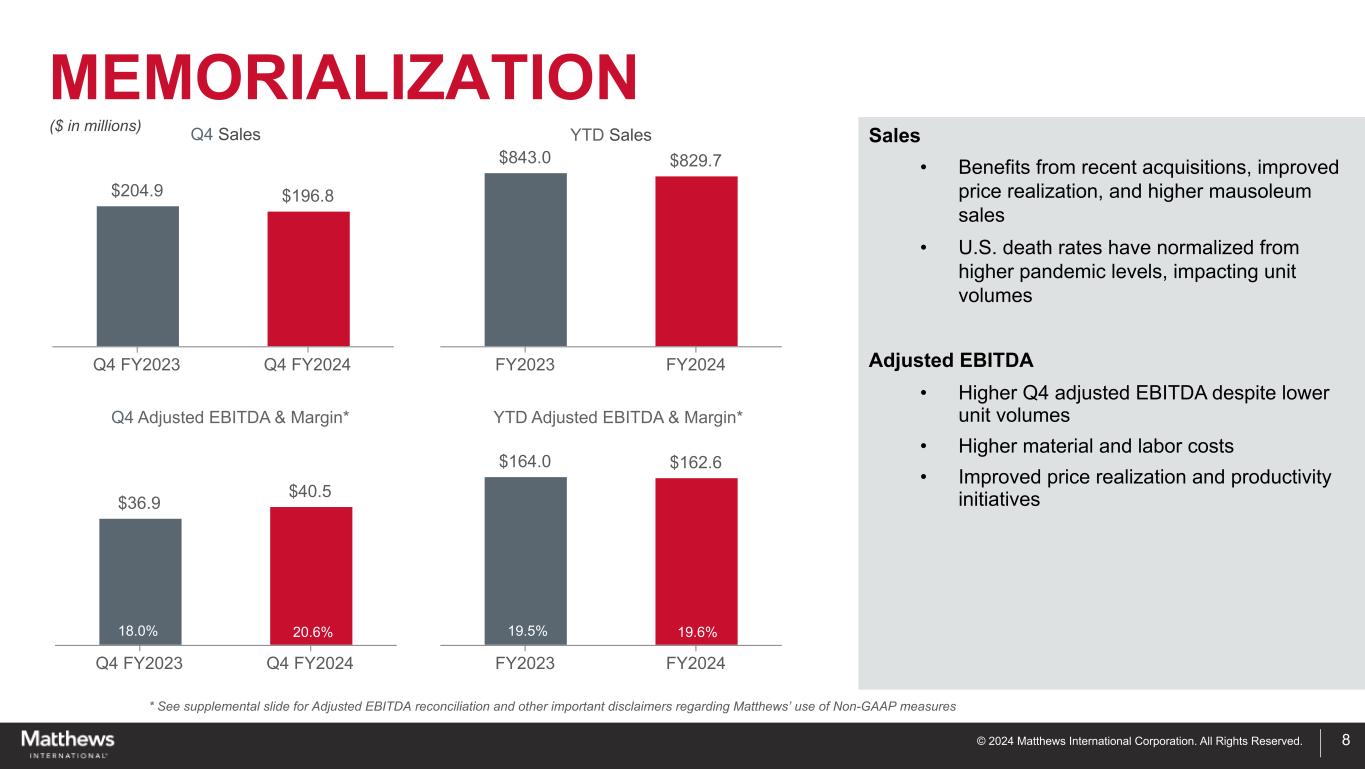

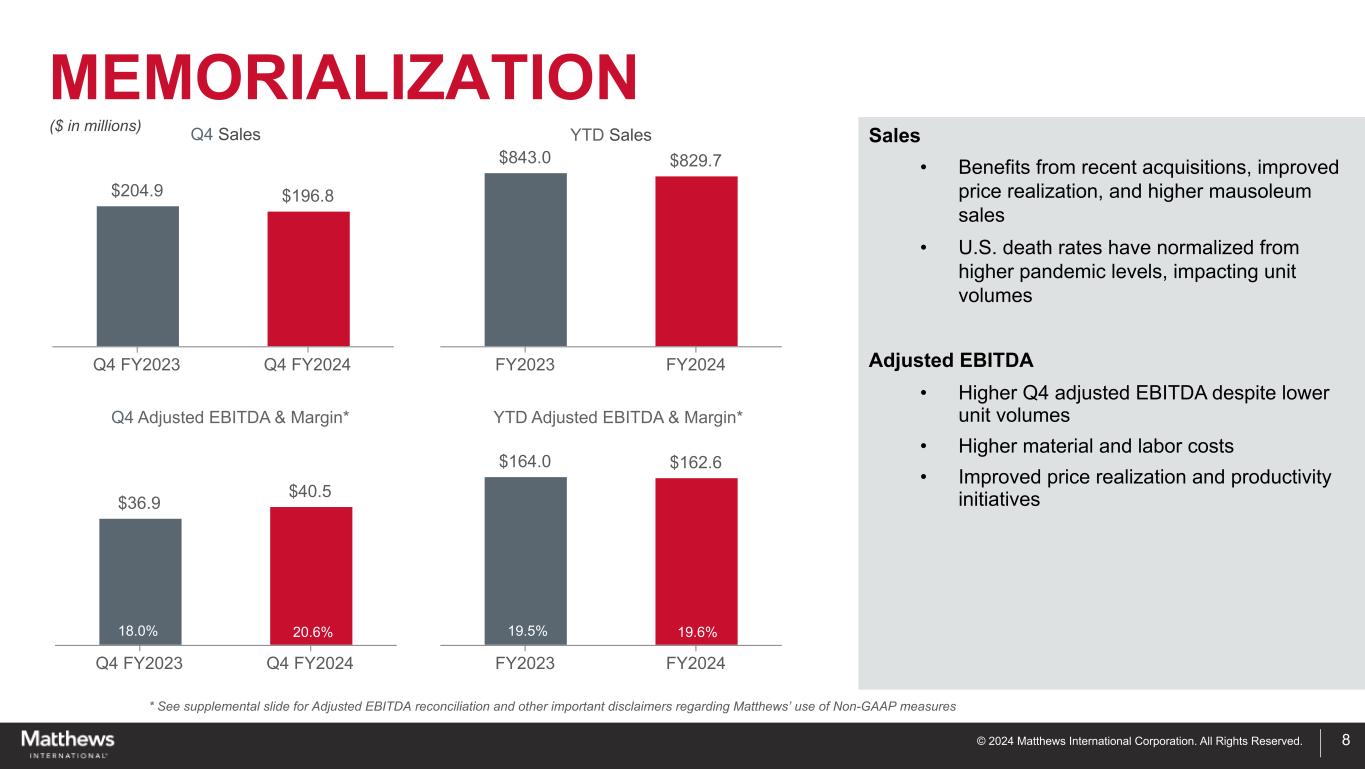

© 2024 Matthews International Corporation. All Rights Reserved. MEMORIALIZATION * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures 8 23.0% 21.1% $204.9 $196.8 Q4 FY2023 Q4 FY2024 $843.0 $829.7 FY2023 FY2024 $36.9 $40.5 Q4 FY2023 Q4 FY2024 $164.0 $162.6 FY2023 FY2024 Sales • Benefits from recent acquisitions, improved price realization, and higher mausoleum sales • U.S. death rates have normalized from higher pandemic levels, impacting unit volumes Adjusted EBITDA • Higher Q4 adjusted EBITDA despite lower unit volumes • Higher material and labor costs • Improved price realization and productivity initiatives 18.0% 20.6% 19.5% 19.6% ($ in millions) Q4 Sales Q4 Adjusted EBITDA & Margin* YTD Sales YTD Adjusted EBITDA & Margin*

© 2024 Matthews International Corporation. All Rights Reserved. SGK BRAND SOLUTIONS Sales • Q4 sales growth, primarily reflecting higher sales in the private-label and merchandising businesses, and improved pricing to help mitigate inflationary cost increases Adjusted EBITDA • Higher YTD adjusted EBITDA • Favorable impacts of cost reduction initiatives • Higher labor-related costs ($ in millions) * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures 9 15.4% 12.9% $134.7 $135.9 Q4 FY2023 Q4 FY2024 $532.1 $532.9 FY2023 FY2024 $17.5 $17.3 Q4 FY2023 Q4 FY2024 $57.1 $61.6 FY2023 FY2024 12.7%13.0% 10.7% 11.6% Q4 Sales Q4 Adjusted EBITDA & Margin* YTD Sales YTD Adjusted EBITDA & Margin*

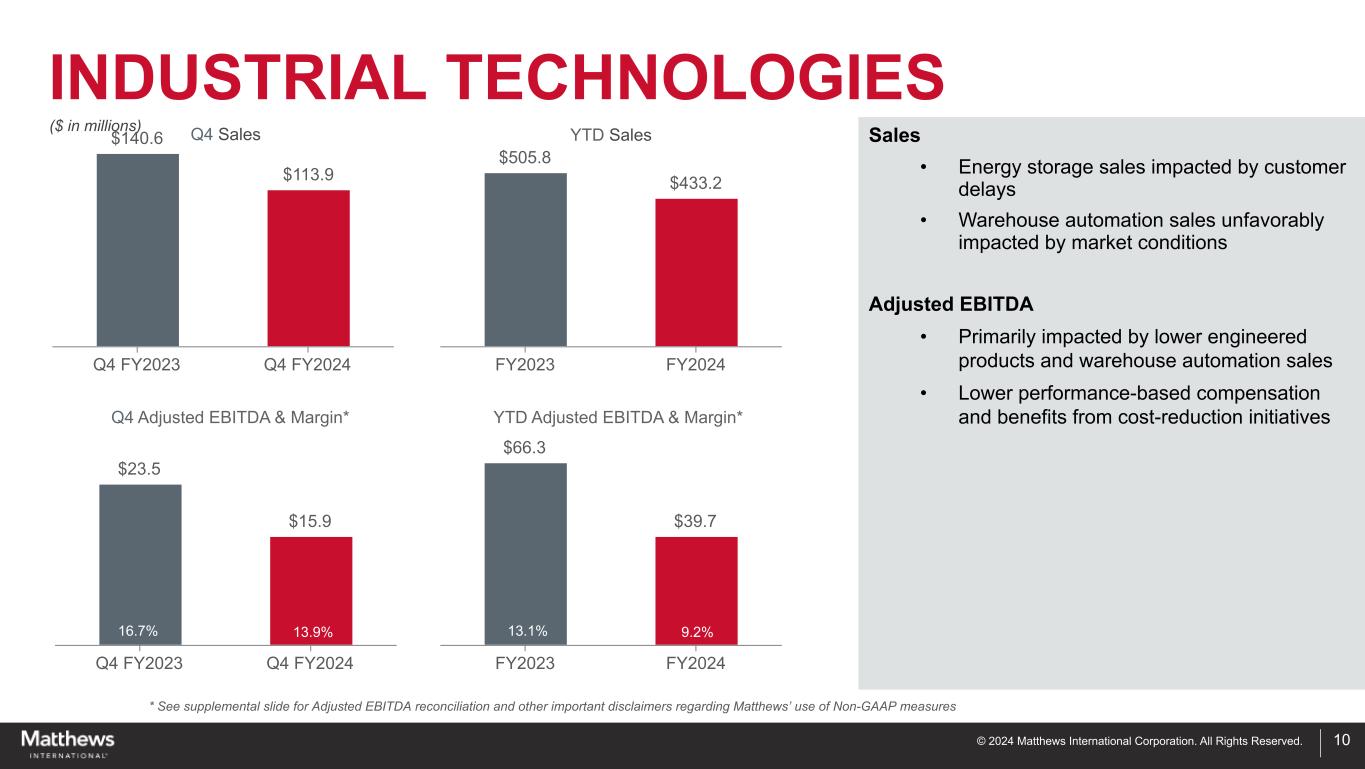

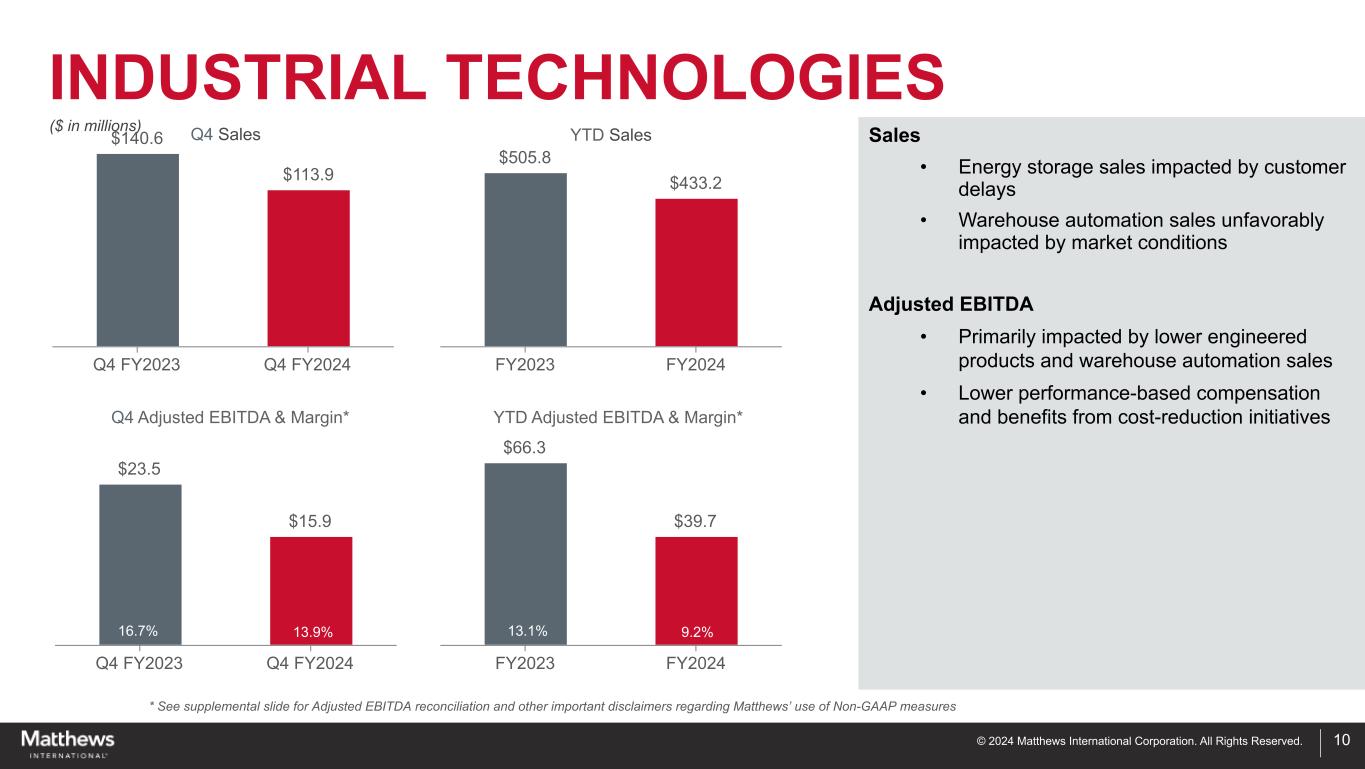

© 2024 Matthews International Corporation. All Rights Reserved. INDUSTRIAL TECHNOLOGIES * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures 10 15.5% 12.4% 15.6%10.3% Sales • Energy storage sales impacted by customer delays • Warehouse automation sales unfavorably impacted by market conditions Adjusted EBITDA • Primarily impacted by lower engineered products and warehouse automation sales • Lower performance-based compensation and benefits from cost-reduction initiatives ($ in millions) $140.6 $113.9 Q4 FY2023 Q4 FY2024 $505.8 $433.2 FY2023 FY2024 $23.5 $15.9 Q4 FY2023 Q4 FY2024 $66.3 $39.7 FY2023 FY2024 16.7% 13.9% 13.1% 9.2% Q4 Sales Q4 Adjusted EBITDA & Margin* YTD Sales YTD Adjusted EBITDA & Margin*

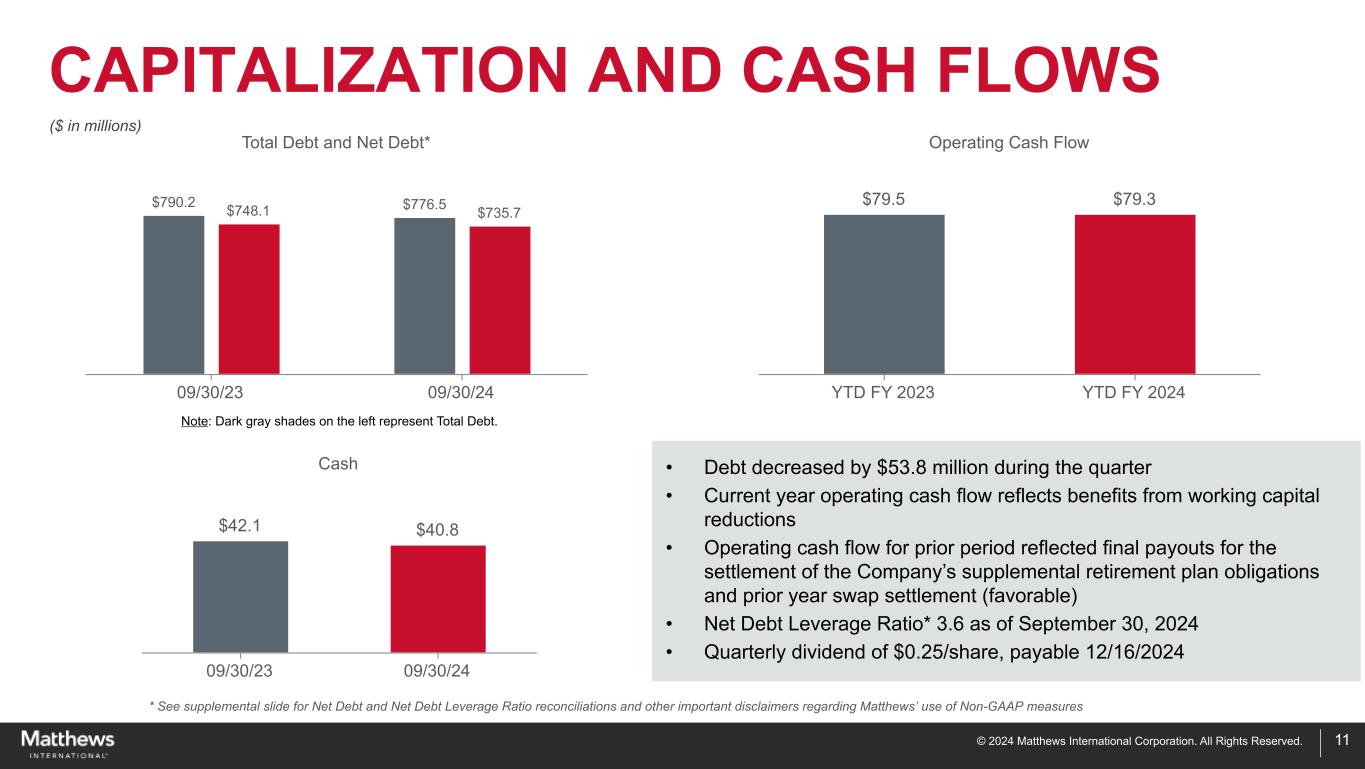

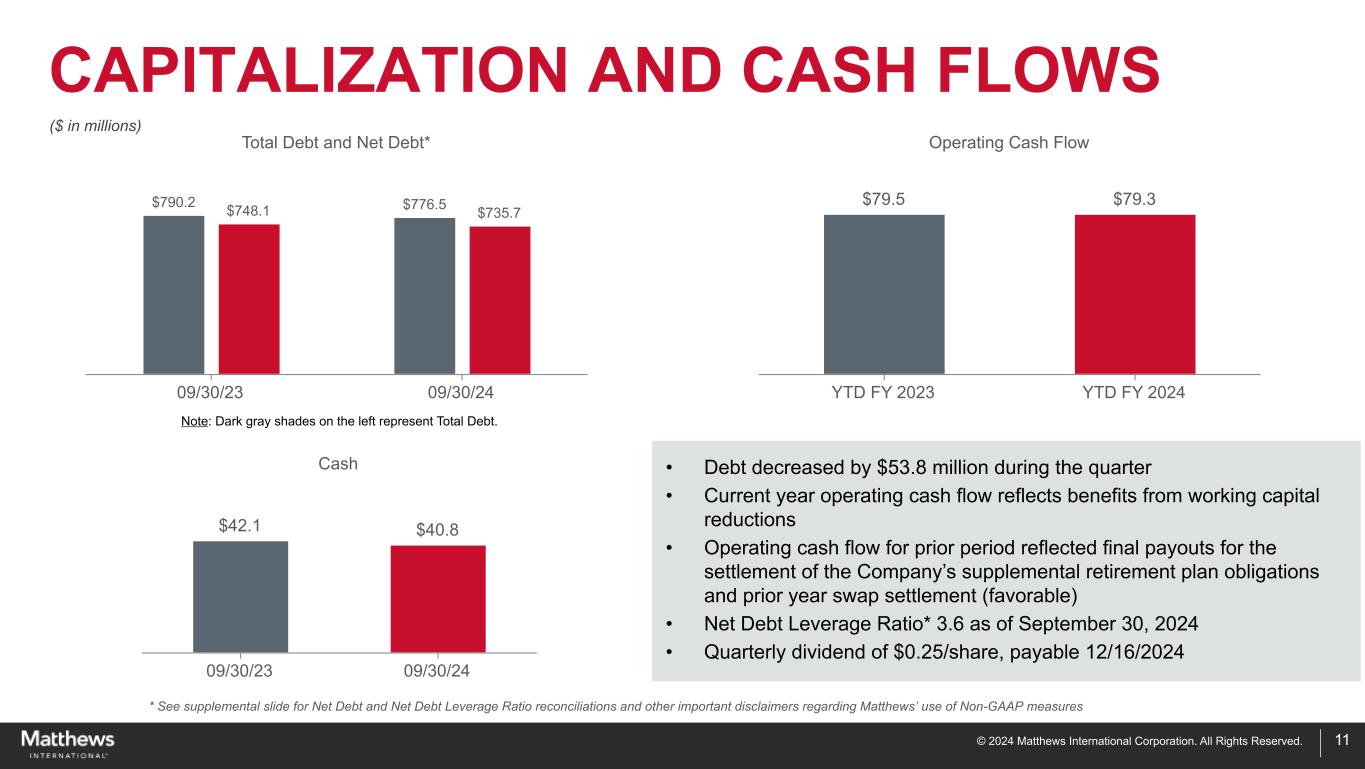

© 2024 Matthews International Corporation. All Rights Reserved. • Debt decreased by $53.8 million during the quarter • Current year operating cash flow reflects benefits from working capital reductions • Operating cash flow for prior period reflected final payouts for the settlement of the Company’s supplemental retirement plan obligations and prior year swap settlement (favorable) • Net Debt Leverage Ratio* 3.6 as of September 30, 2024 • Quarterly dividend of $0.25/share, payable 12/16/2024 CAPITALIZATION AND CASH FLOWS 11 * See supplemental slide for Net Debt and Net Debt Leverage Ratio reconciliations and other important disclaimers regarding Matthews’ use of Non-GAAP measures Note: Dark gray shades on the left represent Total Debt. Total Debt and Net Debt* $790.2 $776.5$748.1 $735.7 09/30/23 09/30/24 ($ in millions) Operating Cash Flow $79.5 $79.3 YTD FY 2023 YTD FY 2024 Cash $42.1 $40.8 09/30/23 09/30/24

SUPPLEMENTAL INFORMATION

© 2024 Matthews International Corporation. All Rights Reserved. 13 Included in this report are measures of financial performance that are not defined by GAAP, including, without limitation, adjusted EBITDA, adjusted net income and EPS, constant currency sales, constant currency adjusted EBITDA, and net debt and net debt leverage ratio. The Company defines net debt leverage ratio as outstanding debt (net of cash) relative to adjusted EBITDA. The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition and divestiture costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to operational initiatives and exit activities), stock-based compensation and the non- service portion of pension and postretirement expense. Constant currency sales and constant currency adjusted EBITDA removes the impact of changes due to foreign exchange translation rates. To calculate sales and adjusted EBITDA on a constant currency basis, amounts for periods in the current fiscal year are translated into U.S. dollars using exchange rates applicable to the comparable periods of the prior fiscal year. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company's core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company's calculations of its non-GAAP financial measures, however, may not be comparable to similarly titled measures reported by other companies. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provide investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

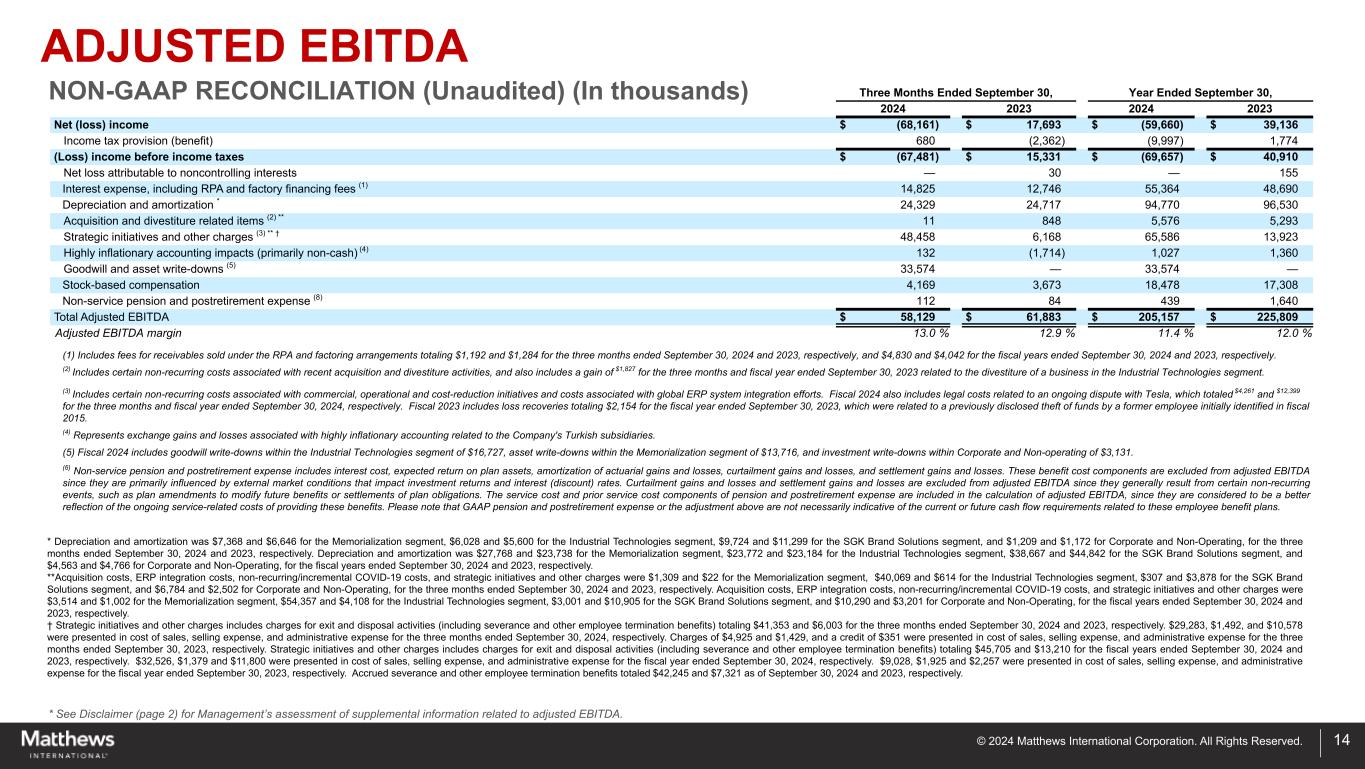

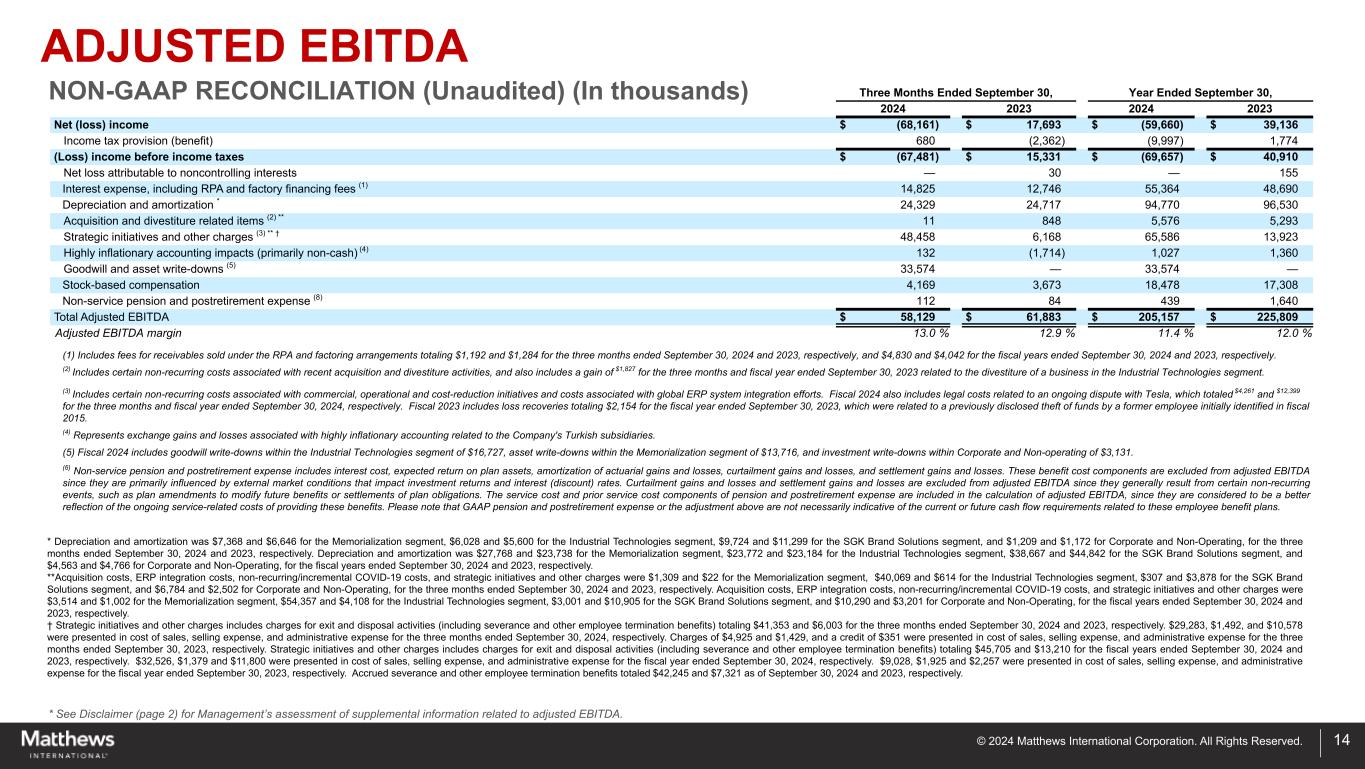

© 2024 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted EBITDA. 14 Three Months Ended September 30, Year Ended September 30, 2024 2023 2024 2023 Net (loss) income $ (68,161) $ 17,693 $ (59,660) $ 39,136 Income tax provision (benefit) 680 (2,362) (9,997) 1,774 (Loss) income before income taxes $ (67,481) $ 15,331 $ (69,657) $ 40,910 Net loss attributable to noncontrolling interests — 30 — 155 Interest expense, including RPA and factory financing fees (1) 14,825 12,746 55,364 48,690 Depreciation and amortization * 24,329 24,717 94,770 96,530 Acquisition and divestiture related items (2) ** 11 848 5,576 5,293 Strategic initiatives and other charges (3) ** † 48,458 6,168 65,586 13,923 Highly inflationary accounting impacts (primarily non-cash) (4) 132 (1,714) 1,027 1,360 Goodwill and asset write-downs (5) 33,574 — 33,574 — Stock-based compensation 4,169 3,673 18,478 17,308 Non-service pension and postretirement expense (8) 112 84 439 1,640 Total Adjusted EBITDA $ 58,129 $ 61,883 $ 205,157 $ 225,809 Adjusted EBITDA margin 13.0 % 12.9 % 11.4 % 12.0 % (1) Includes fees for receivables sold under the RPA and factoring arrangements totaling $1,192 and $1,284 for the three months ended September 30, 2024 and 2023, respectively, and $4,830 and $4,042 for the fiscal years ended September 30, 2024 and 2023, respectively. (2) Includes certain non-recurring costs associated with recent acquisition and divestiture activities, and also includes a gain of $1,827 for the three months and fiscal year ended September 30, 2023 related to the divestiture of a business in the Industrial Technologies segment. (3) Includes certain non-recurring costs associated with commercial, operational and cost-reduction initiatives and costs associated with global ERP system integration efforts. Fiscal 2024 also includes legal costs related to an ongoing dispute with Tesla, which totaled $4,261 and $12,399 for the three months and fiscal year ended September 30, 2024, respectively. Fiscal 2023 includes loss recoveries totaling $2,154 for the fiscal year ended September 30, 2023, which were related to a previously disclosed theft of funds by a former employee initially identified in fiscal 2015. (4) Represents exchange gains and losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries. (5) Fiscal 2024 includes goodwill write-downs within the Industrial Technologies segment of $16,727, asset write-downs within the Memorialization segment of $13,716, and investment write-downs within Corporate and Non-operating of $3,131. (6) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. * Depreciation and amortization was $7,368 and $6,646 for the Memorialization segment, $6,028 and $5,600 for the Industrial Technologies segment, $9,724 and $11,299 for the SGK Brand Solutions segment, and $1,209 and $1,172 for Corporate and Non-Operating, for the three months ended September 30, 2024 and 2023, respectively. Depreciation and amortization was $27,768 and $23,738 for the Memorialization segment, $23,772 and $23,184 for the Industrial Technologies segment, $38,667 and $44,842 for the SGK Brand Solutions segment, and $4,563 and $4,766 for Corporate and Non-Operating, for the fiscal years ended September 30, 2024 and 2023, respectively. **Acquisition costs, ERP integration costs, non-recurring/incremental COVID-19 costs, and strategic initiatives and other charges were $1,309 and $22 for the Memorialization segment, $40,069 and $614 for the Industrial Technologies segment, $307 and $3,878 for the SGK Brand Solutions segment, and $6,784 and $2,502 for Corporate and Non-Operating, for the three months ended September 30, 2024 and 2023, respectively. Acquisition costs, ERP integration costs, non-recurring/incremental COVID-19 costs, and strategic initiatives and other charges were $3,514 and $1,002 for the Memorialization segment, $54,357 and $4,108 for the Industrial Technologies segment, $3,001 and $10,905 for the SGK Brand Solutions segment, and $10,290 and $3,201 for Corporate and Non-Operating, for the fiscal years ended September 30, 2024 and 2023, respectively. † Strategic initiatives and other charges includes charges for exit and disposal activities (including severance and other employee termination benefits) totaling $41,353 and $6,003 for the three months ended September 30, 2024 and 2023, respectively. $29,283, $1,492, and $10,578 were presented in cost of sales, selling expense, and administrative expense for the three months ended September 30, 2024, respectively. Charges of $4,925 and $1,429, and a credit of $351 were presented in cost of sales, selling expense, and administrative expense for the three months ended September 30, 2023, respectively. Strategic initiatives and other charges includes charges for exit and disposal activities (including severance and other employee termination benefits) totaling $45,705 and $13,210 for the fiscal years ended September 30, 2024 and 2023, respectively. $32,526, $1,379 and $11,800 were presented in cost of sales, selling expense, and administrative expense for the fiscal year ended September 30, 2024, respectively. $9,028, $1,925 and $2,257 were presented in cost of sales, selling expense, and administrative expense for the fiscal year ended September 30, 2023, respectively. Accrued severance and other employee termination benefits totaled $42,245 and $7,321 as of September 30, 2024 and 2023, respectively. ADJUSTED EBITDA NON-GAAP RECONCILIATION (Unaudited) (In thousands)

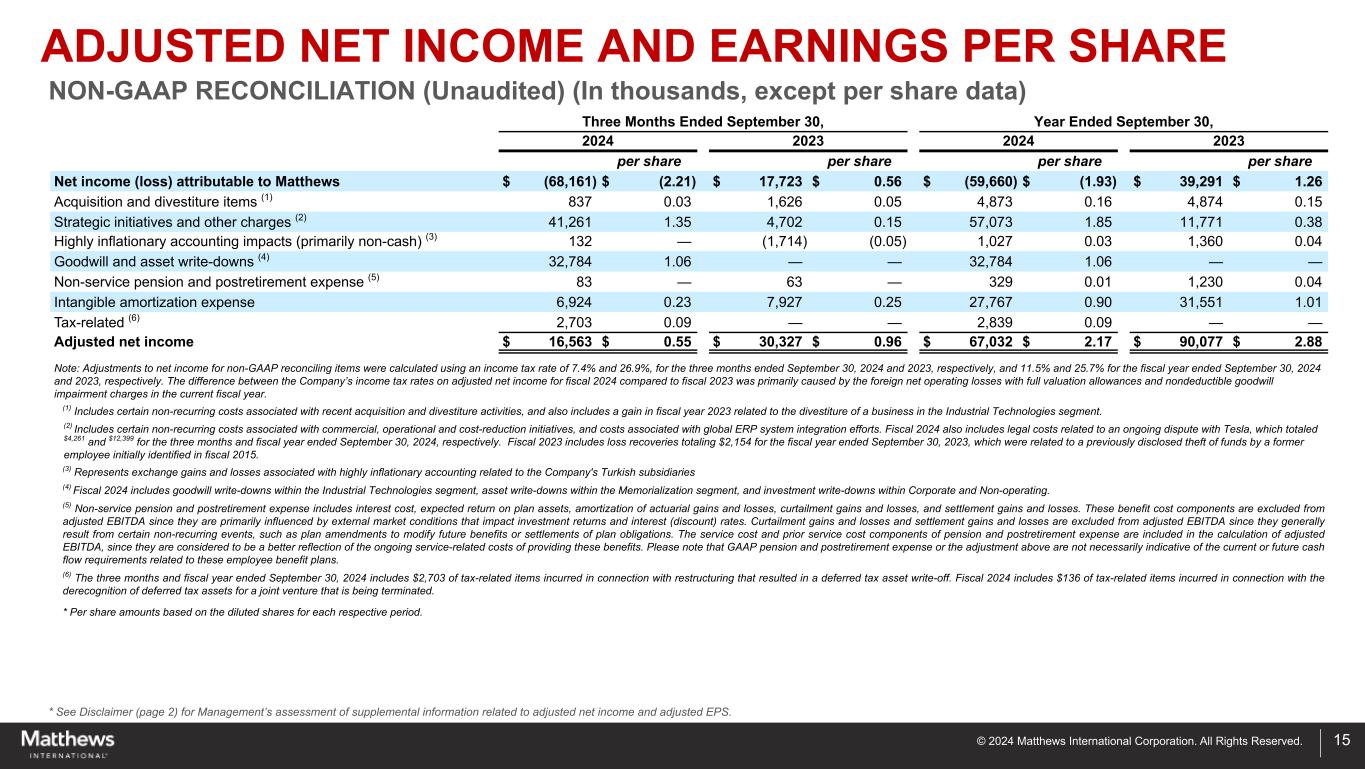

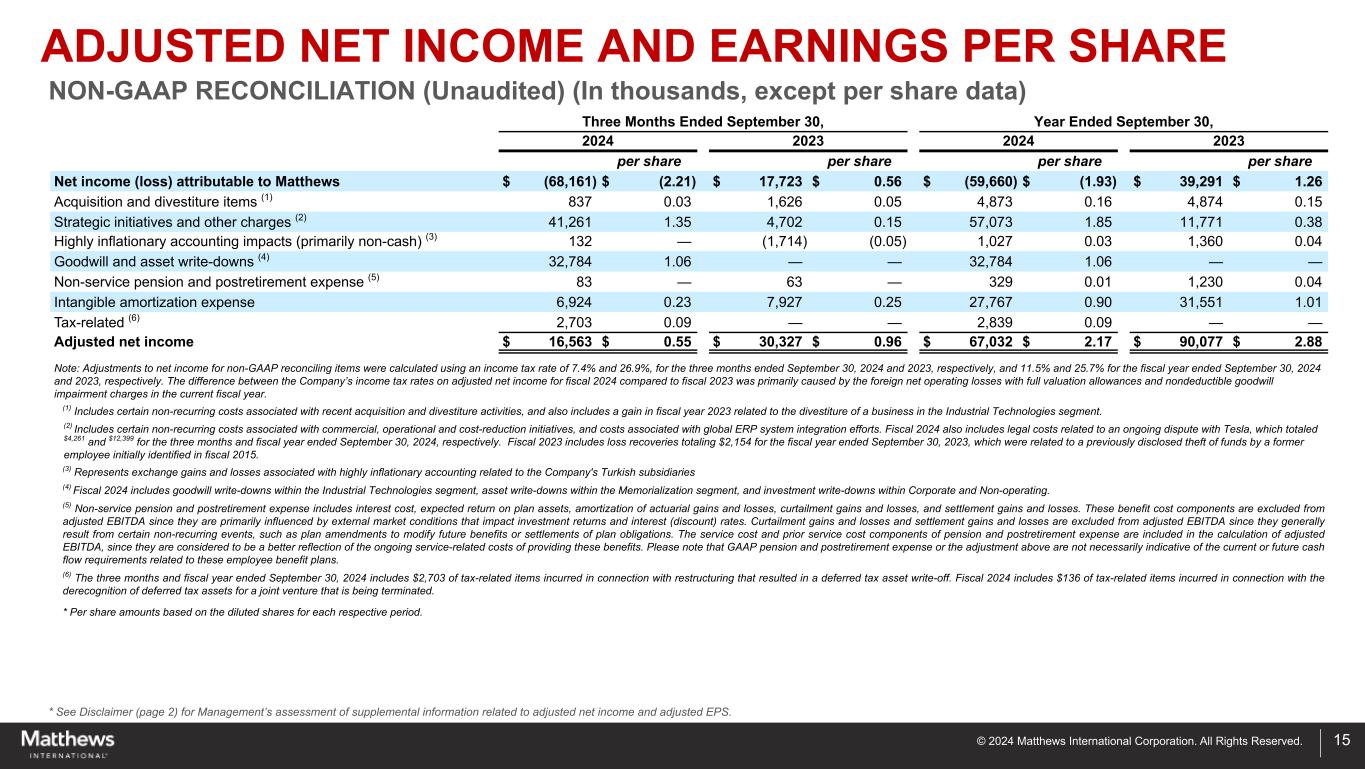

© 2024 Matthews International Corporation. All Rights Reserved. ADJUSTED NET INCOME AND EARNINGS PER SHARE NON-GAAP RECONCILIATION (Unaudited) (In thousands, except per share data) * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted net income and adjusted EPS. 15 Three Months Ended September 30, Year Ended September 30, 2024 2023 2024 2023 per share per share per share per share Net income (loss) attributable to Matthews $ (68,161) $ (2.21) $ 17,723 $ 0.56 $ (59,660) $ (1.93) $ 39,291 $ 1.26 Acquisition and divestiture items (1) 837 0.03 1,626 0.05 4,873 0.16 4,874 0.15 Strategic initiatives and other charges (2) 41,261 1.35 4,702 0.15 57,073 1.85 11,771 0.38 Highly inflationary accounting impacts (primarily non-cash) (3) 132 — (1,714) (0.05) 1,027 0.03 1,360 0.04 Goodwill and asset write-downs (4) 32,784 1.06 — — 32,784 1.06 — — Non-service pension and postretirement expense (5) 83 — 63 — 329 0.01 1,230 0.04 Intangible amortization expense 6,924 0.23 7,927 0.25 27,767 0.90 31,551 1.01 Tax-related (6) 2,703 0.09 — — 2,839 0.09 — — Adjusted net income $ 16,563 $ 0.55 $ 30,327 $ 0.96 $ 67,032 $ 2.17 $ 90,077 $ 2.88 Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 7.4% and 26.9%, for the three months ended September 30, 2024 and 2023, respectively, and 11.5% and 25.7% for the fiscal year ended September 30, 2024 and 2023, respectively. The difference between the Company’s income tax rates on adjusted net income for fiscal 2024 compared to fiscal 2023 was primarily caused by the foreign net operating losses with full valuation allowances and nondeductible goodwill impairment charges in the current fiscal year. (1) Includes certain non-recurring costs associated with recent acquisition and divestiture activities, and also includes a gain in fiscal year 2023 related to the divestiture of a business in the Industrial Technologies segment. (2) Includes certain non-recurring costs associated with commercial, operational and cost-reduction initiatives, and costs associated with global ERP system integration efforts. Fiscal 2024 also includes legal costs related to an ongoing dispute with Tesla, which totaled $4,261 and $12,399 for the three months and fiscal year ended September 30, 2024, respectively. Fiscal 2023 includes loss recoveries totaling $2,154 for the fiscal year ended September 30, 2023, which were related to a previously disclosed theft of funds by a former employee initially identified in fiscal 2015. (3) Represents exchange gains and losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries (4) Fiscal 2024 includes goodwill write-downs within the Industrial Technologies segment, asset write-downs within the Memorialization segment, and investment write-downs within Corporate and Non-operating. (5) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. (6) The three months and fiscal year ended September 30, 2024 includes $2,703 of tax-related items incurred in connection with restructuring that resulted in a deferred tax asset write-off. Fiscal 2024 includes $136 of tax-related items incurred in connection with the derecognition of deferred tax assets for a joint venture that is being terminated. * Per share amounts based on the diluted shares for each respective period.

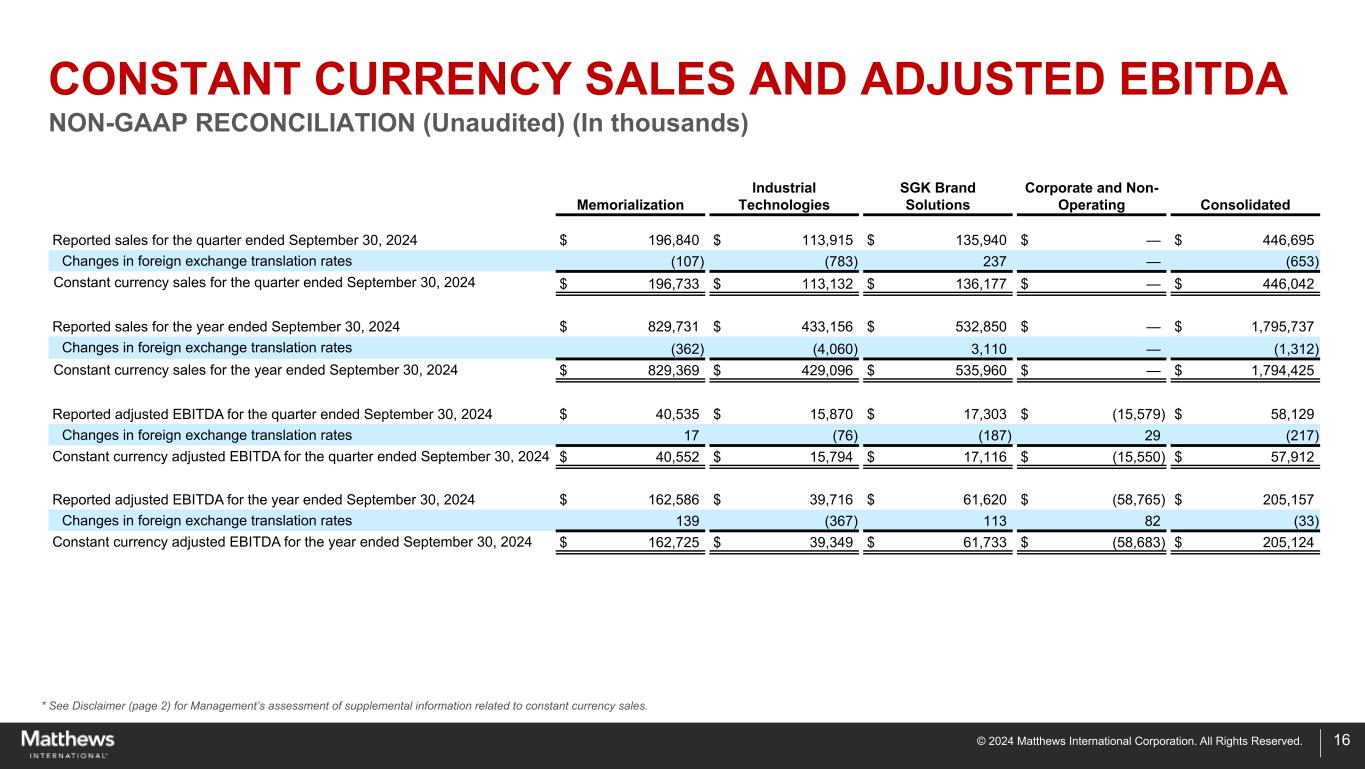

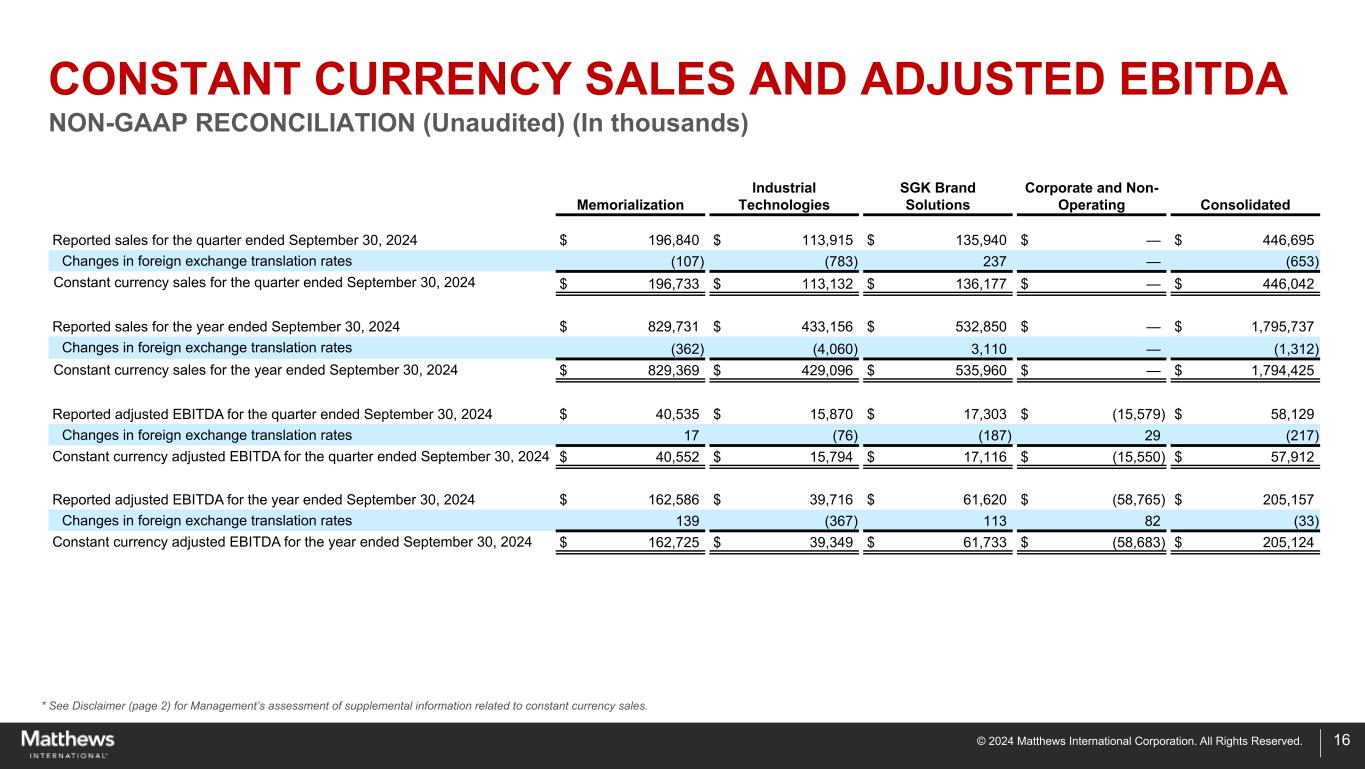

© 2024 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to constant currency sales. 16 CONSTANT CURRENCY SALES AND ADJUSTED EBITDA NON-GAAP RECONCILIATION (Unaudited) (In thousands) Memorialization Industrial Technologies SGK Brand Solutions Corporate and Non- Operating Consolidated Reported sales for the quarter ended September 30, 2024 $ 196,840 $ 113,915 $ 135,940 $ — $ 446,695 Changes in foreign exchange translation rates (107) (783) 237 — (653) Constant currency sales for the quarter ended September 30, 2024 $ 196,733 $ 113,132 $ 136,177 $ — $ 446,042 Reported sales for the year ended September 30, 2024 $ 829,731 $ 433,156 $ 532,850 $ — $ 1,795,737 Changes in foreign exchange translation rates (362) (4,060) 3,110 — (1,312) Constant currency sales for the year ended September 30, 2024 $ 829,369 $ 429,096 $ 535,960 $ — $ 1,794,425 Reported adjusted EBITDA for the quarter ended September 30, 2024 $ 40,535 $ 15,870 $ 17,303 $ (15,579) $ 58,129 Changes in foreign exchange translation rates 17 (76) (187) 29 (217) Constant currency adjusted EBITDA for the quarter ended September 30, 2024 $ 40,552 $ 15,794 $ 17,116 $ (15,550) $ 57,912 Reported adjusted EBITDA for the year ended September 30, 2024 $ 162,586 $ 39,716 $ 61,620 $ (58,765) $ 205,157 Changes in foreign exchange translation rates 139 (367) 113 82 (33) Constant currency adjusted EBITDA for the year ended September 30, 2024 $ 162,725 $ 39,349 $ 61,733 $ (58,683) $ 205,124

© 2024 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to net debt. 17 September 30, 2024 September 30, 2023 Long-term debt, current maturities $ 6,853 $ 3,696 Long-term debt 769,614 786,484 Total debt 776,467 790,180 Less: Cash and cash equivalents (40,816) (42,101) Net Debt $ 735,651 $ 748,079 Adjusted EBITDA $ 205,157 $ 225,809 Net Debt Leverage Ratio $ 3.6 $ 3.3 NET DEBT NON-GAAP RECONCILIATION (Unaudited) (In thousands)