EARNINGS ANNOUNCEMENT FOR THE QUARTER ENDED

October 1, 2005

Maytag Additional Information:

This document includes statements that do not directly or exclusively relate to historical facts. Such statements

are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. These forward-looking statements speak only as of this date and

include statements regarding anticipated future financial operating performance and results and expectations as

to the closing of the transaction with Whirlpool. These statements are based on the current expectations of

management of Maytag. There are a number of risks and uncertainties that could cause actual results to differ

materially from the forward-looking statements included in this document. For example, with respect to the

transaction with Whirlpool (1) Maytag may be unable to obtain shareholder approval required for the transaction;

(2) conditions to the closing of the transaction may not be satisfied or the merger agreement may be terminated

prior to closing; (3) Maytag may be unable to obtain the regulatory approvals required to close the transaction, or

required regulatory approvals may delay the transaction or result in the imposition of conditions that could have a

material adverse effect on Maytag or cause the parties to abandon the transaction; (4) Maytag may be unable to

achieve cost-cutting goals or it may take longer than expected to achieve those goals; (5) the transaction may

involve unexpected costs or unexpected liabilities; (6) the credit ratings of Maytag or its subsidiaries may be

different from what the parties expect; (7) the businesses of Maytag may suffer as a result of uncertainty

surrounding the transaction; (8) the industry may be subject to future regulatory or legislative actions that could

adversely affect Maytag; and (9) Maytag may be adversely affected by other economic, business, and/or

competitive factors. Additional factors that may affect the future results of Maytag are set forth in its filings with

the Securities and Exchange Commission ("SEC"), which are available at http://www.maytagcorp.com. Maytag

undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

2

Additional Information Relating to the Proposed Merger and Where to Find It

Whirlpool and Maytag have filed a preliminary prospectus/proxy statement with the SEC in connection with the

proposed transaction. Investors are urged to read the preliminary prospectus/proxy statement, and any other

relevant documents filed or to be filed by Whirlpool or Maytag, including the definitive prospectus/proxy

statement when available, because they contain or will contain important information. The preliminary

prospectus/proxy statement is, and other documents filed by Whirlpool and Maytag with the SEC are, available

free of charge at the SEC’s website (http://www.sec.gov) or from Whirlpool by directing a request to Whirlpool

Corporation, 2000 North M-63, Mail Drop 2800, Benton Harbor, MI 49022-2692, Attention: Larry Venturelli, Vice

President, Investor Relations. Neither this communication nor the preliminary prospectus/proxy statement

constitutes an offer to sell or the solicitation of an offer to buy Whirlpool common stock in any jurisdiction outside

the United States where such offer or issuance would be prohibited -- such an offer or issuance will only be

made in accordance with the applicable laws of such jurisdiction.

Whirlpool, Maytag and their respective directors, executive officers, and other employees may be deemed to be

participating in the solicitation of proxies from Maytag stockholders in connection with the approval of the

proposed transaction. Information about Whirlpool’s directors and executive officers is available in Whirlpool’s

proxy statement, dated March 18, 2005, for its 2005 annual meeting of stockholders. Information about

Maytag’s directors and executive officers is available in Maytag’s proxy statement, dated April 4, 2005, for its

2005 annual meeting of stockholders. Additional information about the interests of potential participants is

included in the preliminary prospectus/proxy statement Whirlpool and Maytag filed with the SEC.

3

Non-GAAP Measurements: In addition to the reported GAAP results provided throughout this document, the

company has provided certain non-GAAP measurements (“Net Free Cash Flow” and “Net Debt”). Reconciliations

from GAAP reported results to non-GAAP reported measurements can be found in this document .

The company has provided these non-GAAP measurements as a way to help investors better understand its cash

flow and debt position from period to period. Among other things, the company’s management uses these non-

GAAP measurements to evaluate its cash flow and debt position. The non-GAAP measures are intended only as a

supplement to the comparable GAAP measures and the company compensates for the limitations inherent in the

use of non-GAAP measures by using GAAP measures in conjunction with the non-GAAP measures. As a result,

investors should consider these non-GAAP measures in addition to, and not in substitution for, or as superior to,

measures of financial performance prepared in accordance with GAAP.

4

Welcome to Maytag’s

3rd Quarter 2005 Earnings Announcement

5

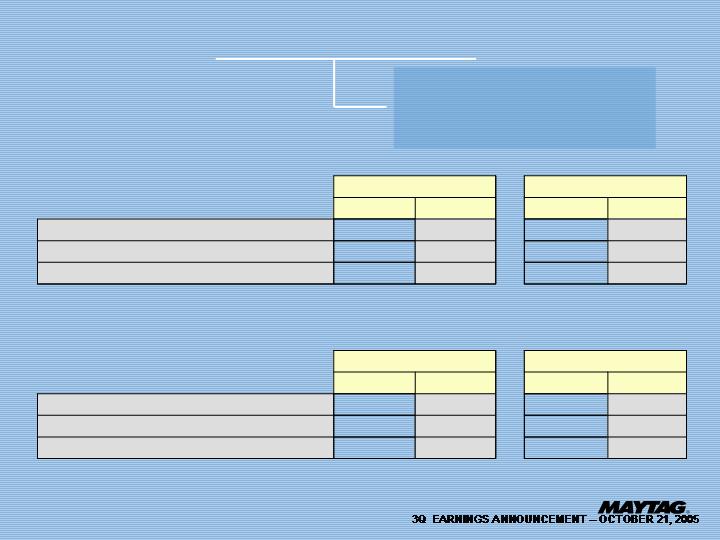

PERFORMANCE HIGHLIGHTS:

THIRD-QUARTER FINANCIAL REVIEW

Consolidated sales: $1.26 billion, up 6.5 percent versus 3Q 2004

Segment results:

Home Appliances Segment: $1.2 billion, up 6.7 percent

versus 3Q 2004

Commercial Products Segment: $63.8 million, up 2.5 percent

versus 3Q 2004

6

PERFORMANCE HIGHLIGHTS:

THIRD-QUARTER FINANCIAL REVIEW

Diluted Earnings Per Share

Net loss of 23 cents for the quarter versus net income of 9 cents reported

for 3Q 2004.

Earnings (loss) per share for 3Q 2005 and 3Q 2004 included the

following items:

October 1

October 2

2005

2004

Diluted Earnings (Loss) Per Share

(0.23)

$

0.09

$

Included in diluted earnings (loss) per share (net of tax)

were the following items:

Restructuring and related charges - Galesburg

0.01

0.10

Restructuring and related charges - reorganization

0.01

0.06

Gain on sale of property-Home Appliances

-

(0.10)

Three Months Ended

7

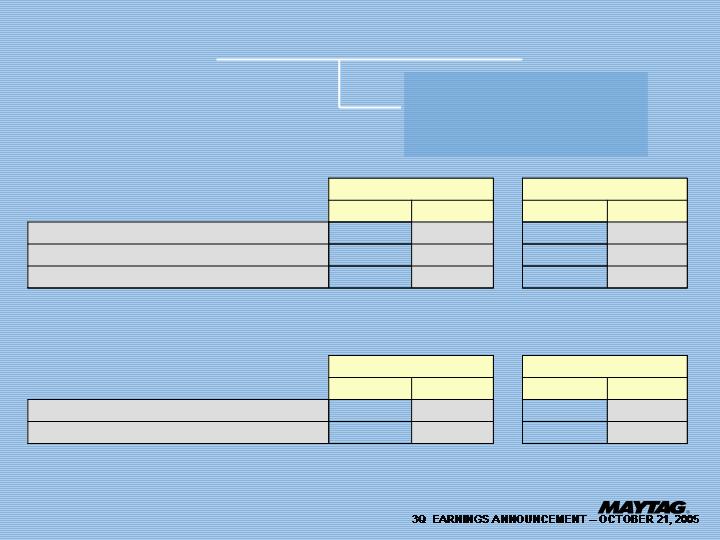

THIRD QUARTER 2005 - Performance Overview

Home Appliances sales up 6.7 percent

Sales up in refrigeration, laundry and cooking

Dishwashing slightly down

Floor care sales down

Maytag Services continues to produce strong revenue growth

Commercial Products up 2.5 percent

Operations benefited from:

Sales increases

Cost reductions (lower advertising and restructuring savings)

Offset by:

Excess manufacturing capacity

Rising material and transportation costs

Lower floor care pricing

8

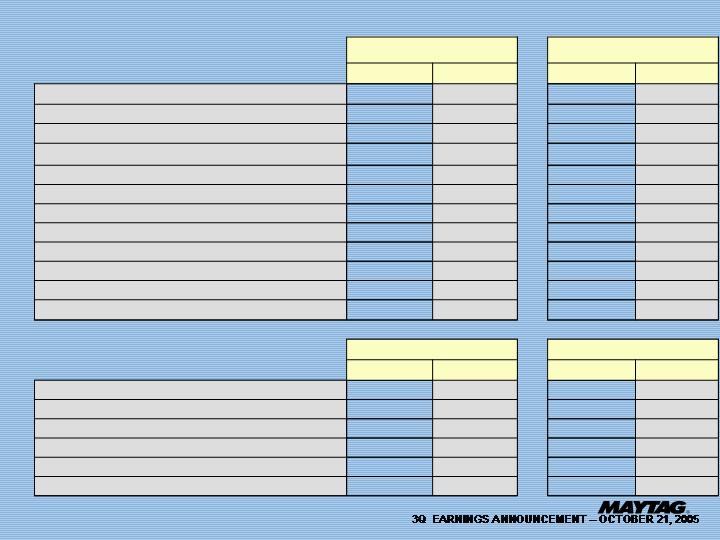

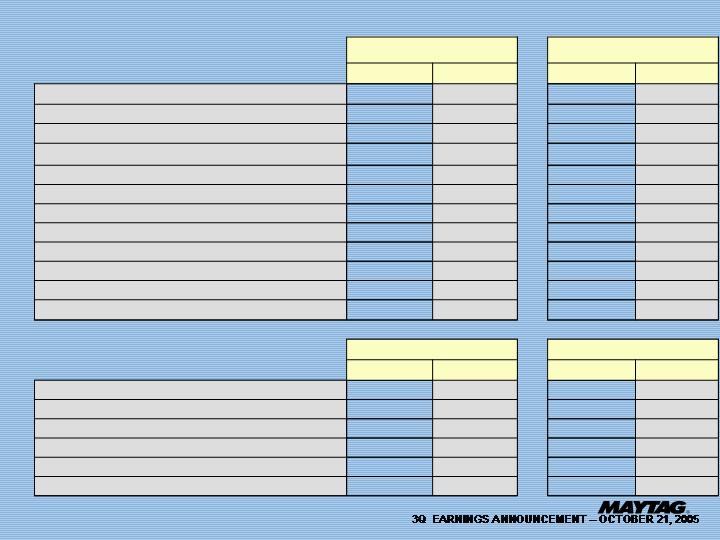

THIRD QUARTER - Consolidated Financial Highlights

(0.10)

-

(0.10)

-

Gain on Sale of Property

0.09

-

-

-

Adverse Judgment on Pre

-

acquisition Distributor Lawsuit

(0.00)

-

(0.00)

-

Income from Discontinued Operations

0.16

-

-

-

Front

-

load Washer Litigation

0.12

-

-

-

Goodwill Impairment

$ 0.47

$ 0.09

0.16

$ 0.02

Restructuring and Related Charges

2004

2005

2004

2005

Included in diluted earnings (loss) per share (net of tax):

Year to Date

Quarter

$ 0.06

$ (0.09)

$ 0.09

$ (0.23)

Diluted Earnings (Loss) Per Share

$ 5.1

$ (7.0)

$ 7.5

$ (18.2)

Net Income (Loss)

1.3%

1.2%

1.4%

0.0%

Operating Margin %

46.6

43.2

16.4

(0.6)

Operating Income (Loss)

18.5

-

-

-

Front

-

load Washer Litigation

9.6

-

-

-

Goodwill Impairment

$ 54.9

$ 10.7

$ 19.1

$ 2.4

Restructuring and Related Charges

10.9%

9.0%

10.3%

9.2%

% of Sales

$ 387.9

$ 328.7

$ 122.4

$ 115.8

Selling, General and Administrative

14.5%

10.5%

13.3%

9.3%

Gross Profit %

517.5

382.6

157.9

117.6

Gross Profit

$ 3,557.2

$ 3,660.4

$ 1,186.0

$ 1,262.9

Net Sales

2004

2005

2004

2005

$ in millions except per share data

Year to Date

Quarter

(0.10)

-

(0.10)

-

Gain on Sale of Property

0.09

-

-

-

Adverse Judgment on Pre

-

acquisition Distributor Lawsuit

(0.00)

-

(0.00)

-

Income from Discontinued Operations

0.16

-

-

-

Front

-

load Washer Litigation

0.12

-

-

-

Goodwill Impairment

$ 0.47

$ 0.09

0.16

$ 0.02

Restructuring and Related Charges

2004

2005

2004

2005

Included in diluted earnings (loss) per share (net of tax):

Year to Date

Quarter

$ 0.06

$ (0.09)

$ 0.09

$ (0.23)

Diluted Earnings (Loss) Per Share

$ 5.1

$ (7.0)

$ 7.5

$ (18.2)

Net Income (Loss)

1.3%

1.2%

1.4%

0.0%

Operating Margin %

46.6

43.2

16.4

(0.6)

Operating Income (Loss)

18.5

-

-

-

Front

-

load Washer Litigation

9.6

-

-

-

Goodwill Impairment

$ 54.9

$ 10.7

$ 19.1

$ 2.4

Restructuring and Related Charges

10.9%

9.0%

10.3%

9.2%

% of Sales

$ 387.9

$ 328.7

$ 122.4

$ 115.8

Selling, General and Administrative

14.5%

10.5%

13.3%

9.3%

Gross Profit %

517.5

382.6

157.9

117.6

Gross Profit

$ 3,557.2

$ 3,660.4

$ 1,186.0

$ 1,262.9

Net Sales

2004

2005

2004

2005

$ in millions except per share data

Year to Date

Quarter

9

THIRD QUARTER - Home Appliances Segment

. . . Manufactures, sells and services

major appliances and floor care

products sold in North America and

targeted international markets.

18.5

-

-

-

Front

-

load Washer Litigation

(9.7)

-

(9.7)

-

Gain on Sale of Property

$ 54.8

$ 10.3

$ 19.0

$ 2.4

Restructuring and Related Charges

2004

2005

2004

2005

Included in operating income:

Year to Date

Quarter

1.6%

1.4%

1.4%

0.0%

Percent of Sales

52.3

47.7

15.7

0.0

Operating Income

$ 3,346.2

$ 3,475.5

$ 1,123.8

$ 1,199.1

Net Sales

2004

2005

2004

2005

$ in millions

Year to Date

Quarter

18.5

-

-

-

Front

-

load Washer Litigation

(9.7)

-

(9.7)

-

Gain on Sale of Property

$ 54.8

$ 10.3

$ 19.0

$ 2.4

Restructuring and Related Charges

2004

2005

2004

2005

Included in operating income:

Year to Date

Quarter

1.6%

1.4%

1.4%

0.0%

Percent of Sales

52.3

47.7

15.7

0.0

Operating Income

$ 3,346.2

$ 3,475.5

$ 1,123.8

$ 1,199.1

Net Sales

2004

2005

2004

2005

$ in millions

Year to Date

Quarter

10

THIRD QUARTER - Commercial Products Segment

. . . Manufactures and sells

vending equipment and

commercial cooking products.

9.6

-

-

-

Goodwill Impairment

$ 0.1

$ 0.4

$ 0.1

$

-

Restructuring and Related Charges

2004

2005

2004

2005

Included in operating income (loss):

Year to Date

Quarter

-

2.7%

-

2.4%

1.1%

-

0.9%

Percent of Sales

(5.7)

(4.5)

0.7

(0.6)

Operating Income (Loss)

$ 211.0

$ 184.9

$ 62.2

$ 63.8

Net Sales

2004

2005

2004

2005

$ in millions

Year to Date

Quarter

9.6

-

-

-

Goodwill Impairment

$ 0.1

$ 0.4

$ 0.1

$

-

Restructuring and Related Charges

2004

2005

2004

2005

Included in operating income (loss):

Year to Date

Quarter

-

2.7%

-

2.4%

1.1%

-

0.9%

Percent of Sales

(5.7)

(4.5)

0.7

(0.6)

Operating Income (Loss)

$ 211.0

$ 184.9

$ 62.2

$ 63.8

Net Sales

2004

2005

2004

2005

$ in millions

Year to Date

Quarter

11

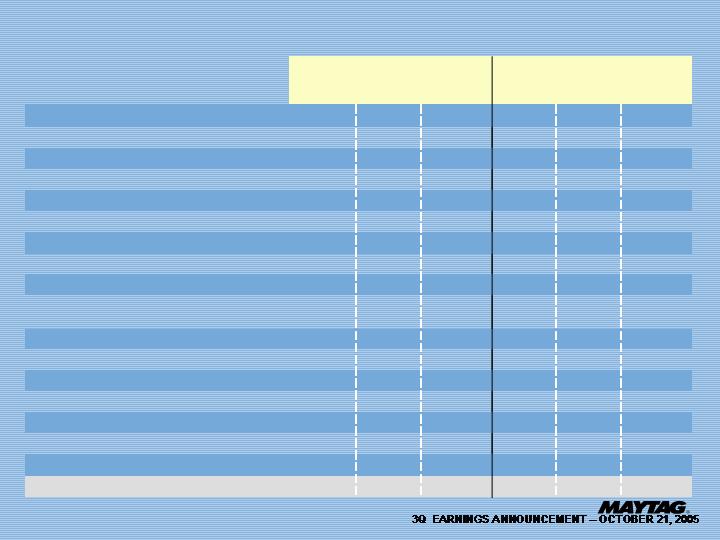

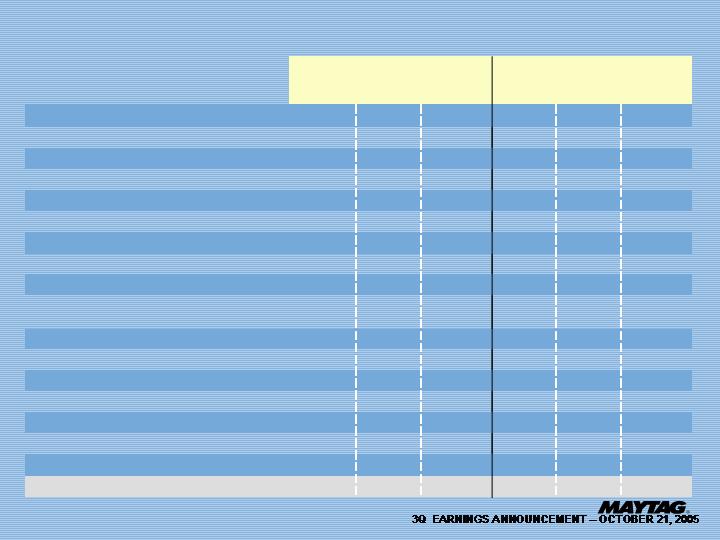

MAYTAG CORPORATION

Condensed Consolidated Statement of Operations for Third Quarter 2005

0.3

-

0.3

-

Income from discontinued Operations, Net of Tax

-

245.8%

4.8

(7.0)

-

356.3%

7.1

(18.2)

Income (Loss) from Continuing Operations

-

89.5%

44.0%

-

18.6%

33.6%

Effective Tax Rate

-

9.5

-

8.5

Merger

-

related Expense, Net

-

61.1%

7.2

2.8

-

134.9%

4.3

(1.5)

Other Income (Expense)

(2.3)

(5.5)

(1.1)

(9.2)

Income Tax Expense (Benefit)

-

236.0%

5.1

(7.0)

-

343.1%

7.5

(18.2)

Net Income (Loss)

% Change

2004

2005

% Change

2004

2005

$ in millions except per share data

Year to Date

Third Quarter

-

341.2%

14.3%

-

103.5%

-

87.4%

-

5.4%

-

25.5%

11.4%

6.5%

(0.23)

-

16.8

(0.6)

-

-

2.4

115.8

117.6

1,145.2

$ 1,262.9

(0.09)

-

48.8

43.2

-

-

10.7

328.7

382.6

3,277.9

$ 3,660.4

-

235.0%

0.06

0.09

Reported Diluted Earnings (Loss) per Share

10.5

-

Adverse Judgment on Pre

-

acquisition Distributor

Lawsuit

19.6%

40.8

14.7

Interest Expense

-

7.4%

46.6

16.4

Operating Income (Loss)

18.5

-

Front

-

load Washer Litigation

9.6

-

Goodwill Impairment

-

80.5%

54.9

19.1

Restructuring and Related Charges

-

15.3%

387.9

122.4

Selling, General and Administrative Expenses

-

26.1%

517.5

157.9

Gross Profit

7.8%

3,039.7

1,028.1

Cost of Sales

2.9%

$ 3,557.2

$ 1,186.0

Net Sales

0.3

-

0.3

-

Income from discontinued Operations, Net of Tax

-

245.8%

4.8

(7.0)

-

356.3%

7.1

(18.2)

Income (Loss) from Continuing Operations

-

89.5%

44.0%

-

18.6%

33.6%

Effective Tax Rate

-

9.5

-

8.5

Merger

-

related Expense, Net

-

61.1%

7.2

2.8

-

134.9%

4.3

(1.5)

Other Income (Expense)

(2.3)

(5.5)

(1.1)

(9.2)

Income Tax Expense (Benefit)

-

236.0%

5.1

(7.0)

-

343.1%

7.5

(18.2)

Net Income (Loss)

% Change

2004

2005

% Change

2004

2005

$ in millions except per share data

Year to Date

Third Quarter

-

341.2%

14.3%

-

103.5%

-

87.4%

-

5.4%

-

25.5%

11.4%

6.5%

(0.23)

-

16.8

(0.6)

-

-

2.4

115.8

117.6

1,145.2

$ 1,262.9

(0.09)

-

48.8

43.2

-

-

10.7

328.7

382.6

3,277.9

$ 3,660.4

-

235.0%

0.06

0.09

Reported Diluted Earnings (Loss) per Share

10.5

-

Adverse Judgment on Pre

-

acquisition Distributor

Lawsuit

19.6%

40.8

14.7

Interest Expense

-

7.4%

46.6

16.4

Operating Income (Loss)

18.5

-

Front

-

load Washer Litigation

9.6

-

Goodwill Impairment

-

80.5%

54.9

19.1

Restructuring and Related Charges

-

15.3%

387.9

122.4

Selling, General and Administrative Expenses

-

26.1%

517.5

157.9

Gross Profit

7.8%

3,039.7

1,028.1

Cost of Sales

2.9%

$ 3,557.2

$ 1,186.0

Net Sales

12

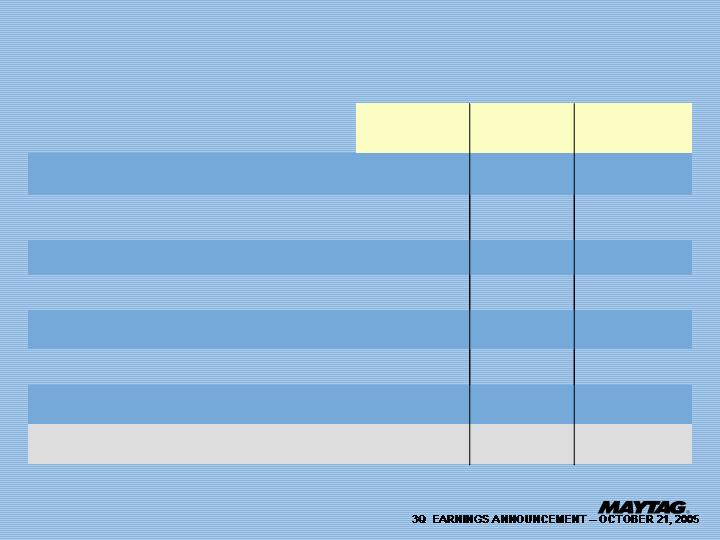

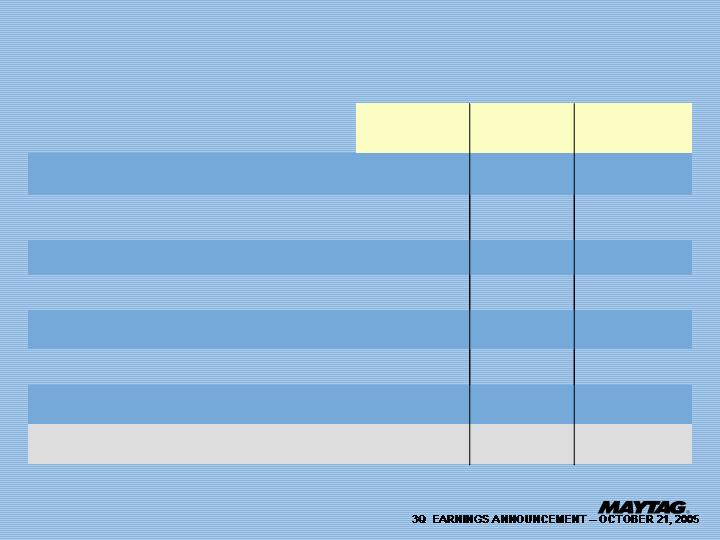

SELECTED BALANCE SHEET ITEMS

907.8

938.5

917.0

Net Debt

(Total Debt less Cash and Cash Equivalents)

69.0

57.8

57.2

Cash and Cash Equivalents

976.8

996.3

974.2

Total Debt

553.2

471.8

540.4

Payables

724.5

670.1

725.2

Receivables

$ 604.4

$ 572.6

$ 620.8

Inventories

16.3%

16.0%

16.7%

Percent of Rolling 12 Months Sales

$ 775.7

$ 770.9

$ 805.6

Working Capital

2005

2004

2005

$ in millions

Second Quarter

Third Quarter

Third Quarter

907.8

938.5

917.0

Net Debt

(Total Debt less Cash and Cash Equivalents)

69.0

57.8

57.2

Cash and Cash Equivalents

976.8

996.3

974.2

Total Debt

553.2

471.8

540.4

Payables

724.5

670.1

725.2

Receivables

$ 604.4

$ 572.6

$ 620.8

Inventories

16.3%

16.0%

16.7%

Percent of Rolling 12 Months Sales

$ 775.7

$ 770.9

$ 805.6

Working Capital

2005

2004

2005

$ in millions

Second Quarter

Third Quarter

Third Quarter

13

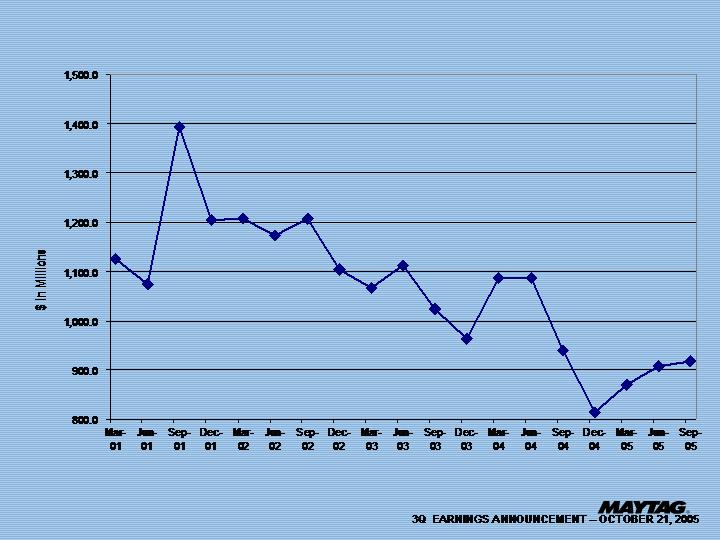

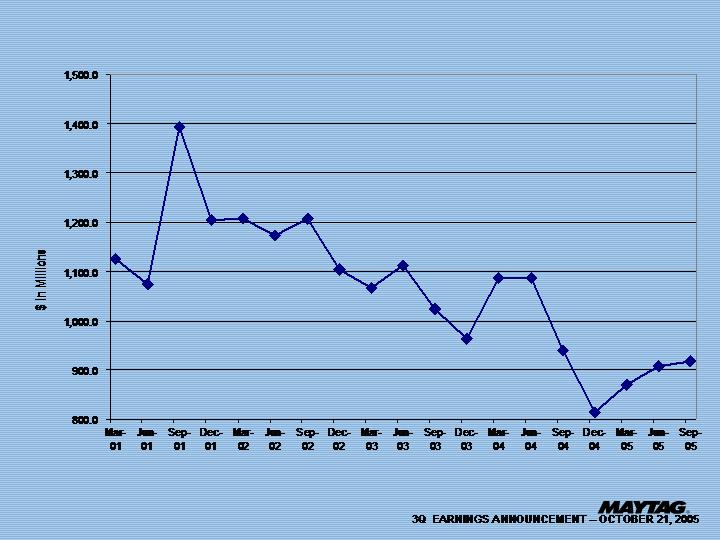

NET DEBT LEVELS

14

28.5

-

Net Proceeds from Financing Obligations

11.2

-

Proceeds from Business Disposition, Net of Transaction Costs

14.3

15.8

Proceeds from Property Disposition, Net of Transaction Costs

(9.7)

0.5

Loss (Gain) on Sale of Property

(67.0)

(64.7)

Capital Expenditures

9.6

-

Goodwill Impairment

9.8

(8.9)

Front

-

load Washer Litigation, Net of Cash Paid

3.0

2.6

Stock Options Exercised and Other

(173.6)

(205.7)

Change in Working Capital

$ 40.7

$ (94.3)

Net Free Cash Flow

(4.0)

(2.5)

Repayment of Long Term Debt

(42.6)

(28.7)

Dividends on Common Stock

40.5

(13.8)

Restructuring and Related Charges, Net of Cash Paid

106.7

105.6

Other

-

Net

Year to Date

MAYTAG CORPORATION STATEMENTS OF CASH FLOWS

Pension Expense

Pension Contributions

Postretirement Benefit Liability

Adverse Judgment on Pre

-

acquisition Distributor Lawsuit, Net of Cash Paid

Deferred Income Taxes

Depreciation & Amortization

Net Income (Loss)

$ 57.8

$ 57.2

Cash and Short

-

Term Investments at end of period

6.8

164.3

Cash and Short

-

Term Investments at beginning of period

$ 51.0

$ (107.1)

Change in Cash and Short

-

Term Investments

$ 107.7

$ (29.6)

Cash Provided by (Used in) Continuing Operations

47.4

53.8

(93.5)

(51.9)

(2.8)

(6.6)

10.5

(12.3)

29.7

(8.5)

128.0

125.2

$ 5.1

$ (7.0)

2004

2005

$ in Millions

28.5

-

Net Proceeds from Financing Obligations

11.2

-

Proceeds from Business Disposition, Net of Transaction Costs

14.3

15.8

Proceeds from Property Disposition, Net of Transaction Costs

(9.7)

0.5

Loss (Gain) on Sale of Property

(67.0)

(64.7)

Capital Expenditures

9.6

-

Goodwill Impairment

9.8

(8.9)

Front

-

load Washer Litigation, Net of Cash Paid

3.0

2.6

Stock Options Exercised and Other

(173.6)

(205.7)

Change in Working Capital

$ 40.7

$ (94.3)

Net Free Cash Flow

(4.0)

(2.5)

Repayment of Long Term Debt

(42.6)

(28.7)

Dividends on Common Stock

40.5

(13.8)

Restructuring and Related Charges, Net of Cash Paid

106.7

105.6

Other

-

Net

Year to Date

MAYTAG CORPORATION STATEMENTS OF CASH FLOWS

Pension Expense

Pension Contributions

Postretirement Benefit Liability

Adverse Judgment on Pre

-

acquisition Distributor Lawsuit, Net of Cash Paid

Deferred Income Taxes

Depreciation & Amortization

Net Income (Loss)

$ 57.8

$ 57.2

Cash and Short

-

Term Investments at end of period

6.8

164.3

Cash and Short

-

Term Investments at beginning of period

$ 51.0

$ (107.1)

Change in Cash and Short

-

Term Investments

$ 107.7

$ (29.6)

Cash Provided by (Used in) Continuing Operations

47.4

53.8

(93.5)

(51.9)

(2.8)

(6.6)

10.5

(12.3)

29.7

(8.5)

128.0

125.2

$ 5.1

$ (7.0)

2004

2005

$ in Millions

15

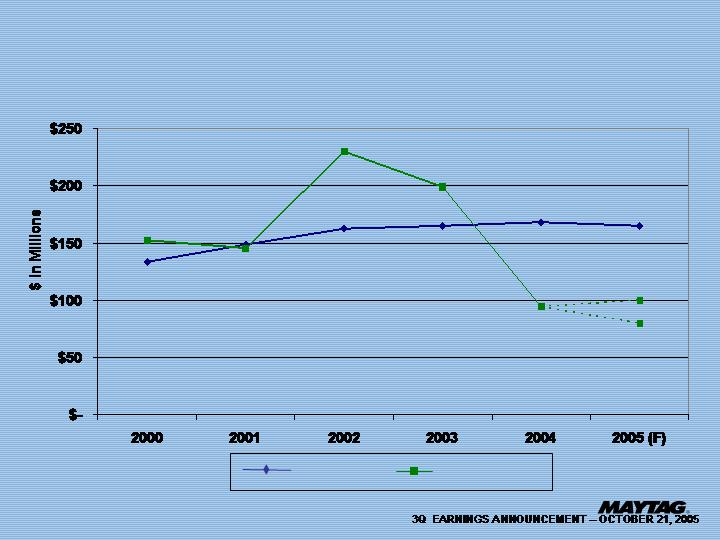

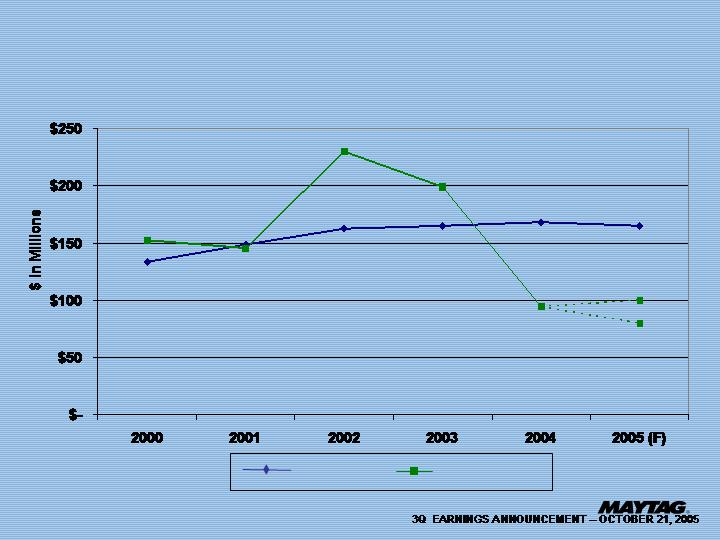

CAPITAL INVESTMENTS

$80

$100

Depreciation

Capital Expenditures

16

PERFORMANCE OUTLOOK

Opportunities

Fix manufacturing footprint / excess capacity

Upcoming product launches in floor care and refrigeration

Additional growth opportunities: Maytag Services

New market opportunities: Maytag International

Challenges

Continued unfavorable burden absorption

Higher raw material pricing and transportation costs

Merger-related costs

Product mix

17

MAYTAG HIGHLIGHTS

For the ninth consecutive year, Hoover receives the SPARC award for

retail category excellence.

Money Magazine selects Hoover as the top pick in vacuums

Leading consumer magazine gave high marks to our products:

Floor care - #1 in vacuum cleaner ratings last seven years

Refrigerator products - #1 Amana Side-by-Side; #2 Amana French Door

Cooking Products - #1 Jenn-Air Cook Top; #2 Jenn-Air Wall Oven

18

19