Exhibit 99.2

Whirlpool’s Proposal for Maytag

Internet Slides for Analysts Call

Monday, July 18

11:00 a.m. (EDT)

Whirlpool’s Proposal for Maytag

Consideration valued at $17 per Maytag share

– Premium of 21% to pending transaction

– At least 50% in cash, the balance in shares of Whirlpool stock

– Total Deal: $2.3 billion based on assumed debt of $969 million

Strong value for shareholders and direct benefits to consumers and trade customers

Combined company can achieve substantial cost efficiencies, fully deploy Whirlpool’s innovation capability and improve asset utilization

Proposal requires immediate and full access for due diligence

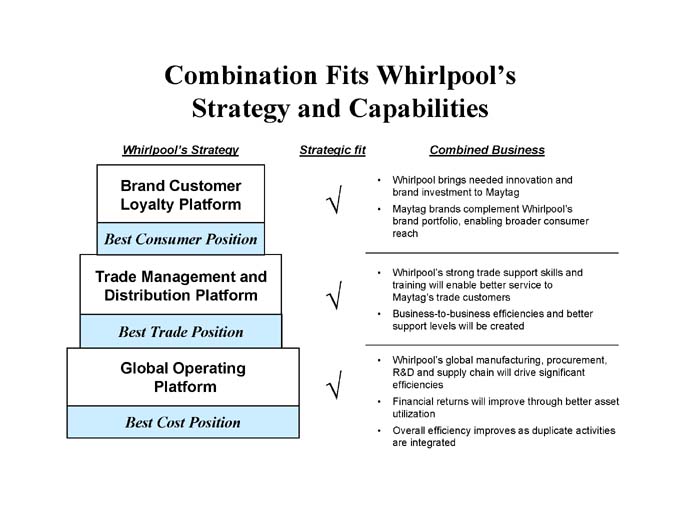

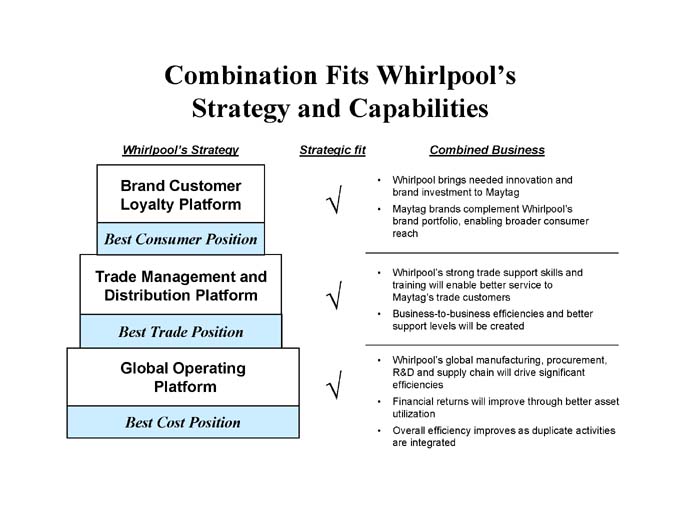

Combination Fits Whirlpool’s Strategy and Capabilities

Whirlpool’s Strategy

Brand Customer Loyalty Platform

Best Consumer Position

Trade Management and Distribution Platform

Best Trade Position

Global Operating

Platform

Best Cost Position

Strategic fit

Combined Business

Whirlpool brings needed innovation and brand investment to Maytag

Maytag brands complement Whirlpool’s brand portfolio, enabling broader consumer reach

Whirlpool’s strong trade support skills and training will enable better service to Maytag’s trade customers

Business-to-business efficiencies and better support levels will be created

Whirlpool’s global manufacturing, procurement, R&D and supply chain will drive significant efficiencies

Financial returns will improve through better asset utilization

Overall efficiency improves as duplicate activities are integrated

Benefits of Whirlpool-Maytag Combination

Maytag shareholders benefit from a clearly superior proposal and the opportunity to share in the ongoing value creation

Whirlpool shareholders benefit from the combined value creating opportunities

Consumers benefit through Maytag brands with access to Whirlpool innovation and efficiency

Trade customers benefit through the revitalization of the Maytag brands, increased efficiencies and support levels

Combination can create superior value for shareholders, consumers and trade customers

Summary

Strong value for both Whirlpool and Maytag shareholders and direct benefits to consumers and trade customers

Combination fits Whirlpool’s strategy and capabilities

Combined company can achieve substantial efficiencies that would deliver cost savings, innovation and needed investment in Maytag’s brands

Regulatory approval of proposed combination is expected

Proposal subject to due diligence and negotiation of definitive agreement

Whirlpool is best positioned to realize gains in efficiencies that translate into consumer and trade customer benefits

IMPORTANT INFORMATION

This material may contain forward-looking statements that speak only as of this date. The company disclaims any obligation to update such information. Forward-looking statements include, but are not limited to, statements regarding expected earnings per share, cash flow, and material costs for the full year 2005, as well as the expected consequences of enacted price increases. Although the company believes that the expectations reflected in the forward-looking statements are reasonable, it can give no assurance that those expectations will prove to have been correct. A discussion of certain factors that could cause results to differ materially from those anticipated is found in the company’s most recently filed Form 10-Q or Form 10-K. Other recent factors are whether the company’s proposal to acquire Maytag Corporation will be successful and, if the acquisition is completed, whether the expected synergies will be realized.

This material is not a substitute for the prospectus/proxy statement Whirlpool and Maytag would file with the Securities and Exchange Commission if a definitive agreement with Maytag is reached. Investors are urged to read any such prospectus/proxy statement, when available, which would contain important information. The prospectus/proxy statement would be, and other documents filed by Whirlpool and Maytag with the Securities and Exchange Commission are, available free of charge at the SEC’s website (www.sec.gov) or from Whirlpool by directing a request to Whirlpool Corporation, 2000 North M-63, Mail Drop 2800, Benton Harbor, MI 49022-2692, Attention: Larry Venturelli, Investor Relations.

Whirlpool is not currently engaged in a solicitation of proxies from the stockholders of Maytag in connection with Whirlpool’s proposed acquisition of Maytag. If a proxy solicitation commences, Whirlpool, Maytag and their respective directors, executive officers, and other employees may be deemed to be participants in such solicitation. Information about Whirlpool’s directors and executive officers is available in Whirlpool’s proxy statement, dated March 18, 2005, for its 2005 annual meeting of stockholders. Additional information about the interests of potential participants will be included in the prospectus/proxy statement Whirlpool and Maytag would file if a definitive agreement with Maytag is reached.