FOR IMMEDIATE RELEASE McCORMICK REPORTS 2022 FINANCIAL RESULTS AND PROVIDES 2023 OUTLOOK HUNT VALLEY, Md., January 26, 2023 - McCormick & Company, Incorporated (NYSE:MKC), a global leader in flavor, today reported financial results for the fourth quarter and fiscal year ended November 30, 2022 and provided its financial outlook for fiscal year 2023. • For fiscal year 2022, sales increased 1% from the prior year and, in constant currency, sales grew 3%. Earnings per share was $2.52 as compared to $2.80 in 2021. Adjusted earnings per share was $2.53 as compared to $3.05 in 2021. • For the fourth quarter, sales declined 2% from the year-ago period and, in constant currency, sales increased 2%. Earnings per share was $0.69 in the fourth quarter as compared to $0.73 in the year-ago period. Adjusted earnings per share was $0.73 as compared to $0.84 in the year-ago period. • For fiscal year 2023, McCormick expects to increase year-on-year sales by 5% to 7%. The Company expects to grow operating income by 10% to 12%. Adjusted operating income is expected to increase 9% to 11%. Chairman and CEO's Remarks Lawrence E. Kurzius, Chairman and CEO, stated, “Our fourth quarter concluded a challenging year for McCormick as we navigated a dynamic global environment including persistently high cost inflation and supply chain challenges, significant disruptions in China related to COVID, and the conflict in Ukraine. Despite market-driven volatility, we ended the year with positive momentum in consumer consumption trends and Flavor Solutions demand, stabilized service levels and supply, and meaningful progress in starting to reshape our cost structure, all of which are important drivers in our continued execution of McCormick’s long-term strategies. “For the fourth quarter, our reported sales declined 2%, but in constant currency grew 2%, both of which were within the range implied by our fiscal year 2022 guidance, but below our own expectations. COVID-related disruptions in China unfavorably impacted our expected sales growth for both the total Company and our Consumer segment by approximately 2%. Barring the China disruption, we estimate our total Company fourth quarter sales would have been comparable to the

year ago period, or grown 4% in constant currency, the mid-point of the implied range. Moreover, our reported fourth quarter sales comparison to the year-ago period included a 2% unfavorable impact attributable to the Kitchen Basics divestiture and the exits of our Consumer business in Russia and a low margin business in India. Accounting for these strategic exits, our underlying sales performance is strong. “Importantly, in our Consumer segment, aside from China, we saw strength in consumption trends, particularly in the U.S. where our fourth quarter total branded consumption grew 6%, and in our Flavor Solutions segment, our sales growth was outstanding with continued momentum across all regions. Consumers’ rising demand for flavor, whether through our products or our customers’ products, is not only reflected in this performance, but also reinforced by our most recent proprietary consumer insights research. Our alignment with the long-term consumer trends of cooking at home, clean and flavorful eating, and valuing trusted brands combined with our broad and advantaged portfolio, plus the fundamental strength of our categories continues to underscore McCormick’s positioning for long-term, differentiated growth and bolsters confidence in our 2023 sales growth outlook. “While our sales were within our implied guidance range, operating income for the fourth quarter fell short. Unfavorable product mix was a driving factor, particularly in our Consumer segment, primarily due to lower U.S. spice and seasonings sales stemming from fourth quarter inventory restocking comparisons in both 2021 and 2022 and lower sales in China. The sales mix between segments also contributed to unfavorable product mix. Meanwhile, in our Flavor Solutions segment, we made progress on reducing the elevated costs we are incurring to meet high demand in parts of our business; however, the impact of that progress was offset by unexpected, discrete one-time issues. “We are committed to increasing our profit realization in 2023. In our last earnings call, we discussed normalizing our supply chain costs and increasing efficiencies, while also strengthening our ability to service customers. We are targeting the elimination of $100 million of supply chain costs. We are also taking streamlining actions across our entire organization, targeting an incremental $25 million of cost savings. The combination of these actions, which is our Global Operating Effectiveness Program, is incremental to our CCI savings. We have a proven track record of cost reduction through our CCI program, and we are leveraging the same program discipline to drive results. We expect our Global Operating Effectiveness Program to drive annual cost savings of approximately $125 million, of which we expect to realize $75 million in 2023, enabling increased profit realization. Our actions are already yielding results and we expect their impact to scale-up as the year progresses. “As we look ahead to fiscal 2023, we will focus on capitalizing on strong demand, optimizing our cost structure, and positioning McCormick to deliver sustainable growth and long-term shareholder value. The fundamentals that drove our industry-leading historical financial performance remain strong and we are confident we are well positioned to drive profitable growth in 2023. “I want to recognize McCormick employees around the world for their contributions in 2022 and as they drive our momentum in 2023.”

Fourth Quarter 2022 Results McCormick reported a 2% sales decline in the fourth quarter from the year-ago period, or 2% sales growth in constant currency. Constant currency sales growth reflected a 9% increase from pricing actions partially offset by a 3% volume decline from the Kitchen Basics divestiture, lower China consumption due to COVID-related restrictions and the exits of a low margin business in India and the Consumer business in Russia, as well as a 4% decline in all other volume and product mix. Sales grew at a constant currency three-year compounded annual growth rate (CAGR) of 5% for the total Company off of a pre-pandemic baseline of 2019. The three-year constant currency CAGR's for the Consumer segment and the Flavor Solutions segment were 3% and 9%, respectively. Gross profit margin declined 380 basis points versus the fourth quarter of last year and adjusted gross profit margin, excluding special charges and transaction and integration expenses, declined 410 basis points. This decline was driven by higher cost inflation and other supply chain costs, as well as unfavorable product mix, partially offset by pricing actions and cost savings led by the Company's Comprehensive Continuous Improvement (CCI) program. Selling, general and administrative expenses declined from the year-ago period driven by lower incentive compensation expenses, partially offset by higher distribution costs and brand marketing investments. Operating income was $264 million in the fourth quarter of 2022 compared to $276 million in the fourth quarter of 2021. This decline was driven by gross margin compression, primarily in the Company’s Flavor Solutions segment, partially offset by lower selling, general and administrative expenses, special charges, and transaction and integration expenses. Excluding special charges, as well as transaction and integration expenses, adjusted operating income was $278 million compared to $309 million in the year-ago period. Earnings per share was $0.69 in the fourth quarter of 2022 compared to $0.73 in the fourth quarter of 2021. Special charges lowered earnings per share by $0.04 in the fourth quarter of 2022. Special charges and transaction and integration expenses lowered earnings per share by $0.11 in the fourth quarter of 2021. Excluding these impacts, adjusted earnings per share was $0.73 in the fourth quarter of 2022 compared to $0.84 in the year-ago period. This decrease was driven by lower adjusted operating income. Fiscal Year 2022 Results McCormick reported a 1% sales increase in 2022 as compared to 2021, or 3% in constant currency. Sales growth reflected an 8% increase from pricing actions partially offset by a 5% decrease in volume and product mix. The volume decline included a 1% unfavorable impact from lower China consumption due to COVID-related restrictions and the exits of a low margin business in India and the Consumer business in Russia. The impact of lower sales from the Kitchen Basics divestiture was offset by one month of incremental sales from the FONA acquisition.

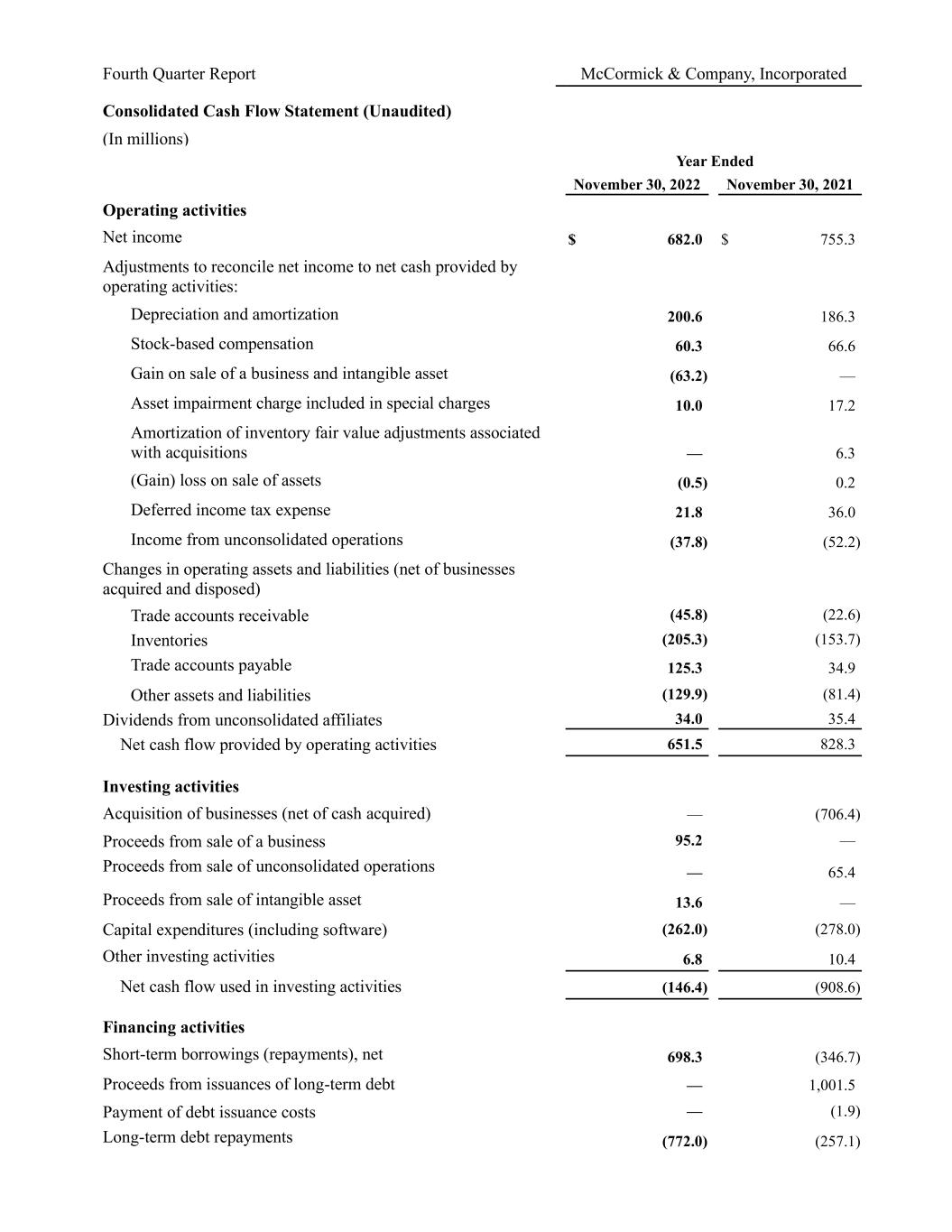

Sales grew at a constant currency three-year CAGR of 6% for the total Company off of a pre- pandemic baseline of 2019. The three-year constant currency CAGR's for the Consumer segment and the Flavor Solutions segment were 5% and 8%, respectively, showing sustained momentum in the business in both segments. Gross profit margin declined 370 basis points versus 2021 and adjusted gross profit margin, excluding special charges and transaction and integration expenses, declined 390 basis points. This decline was driven by higher cost inflation and other supply chain costs, as well as unfavorable product mix, partially offset by pricing actions and cost savings led by the Company's CCI program. Selling, general and administrative expenses declined from the year-ago period driven by lower incentive compensation expenses, partially offset by higher distribution costs and brand marketing investments. Operating income was $864 million in 2022 compared to $1.02 billion in 2021. This decline was driven by gross margin compression, primarily in the Company’s Flavor Solutions segment, partially offset by lower selling, general and administrative expenses and lower transaction and integration expenses. Excluding transaction and integration expenses, as well as special charges, adjusted operating income was $917 million compared to $1.10 billion in the year-ago period. Earnings per share was $2.52 in 2022 compared to $2.80 in the prior year. The net unfavorable impact of special charges, transaction and integration expenses, and the gain on the sale of the Kitchen Basics business lowered earnings per share by $0.01 in 2022. The net impact of special charges, transaction, and integration expenses, including an unfavorable income tax expense impact from a discrete item related to the acquisition of FONA, and the gain on the sale of the Company's minority stake in Eastern Condiments Private Ltd lowered earnings per share by $0.25 in 2021. Excluding these impacts, adjusted earnings per share was $2.53 in 2022 compared to $3.05 in 2021. This decrease was driven by lower adjusted operating income. Net cash provided by operating activities was $652 million in 2022 compared to $828 million in 2021. The decrease was primarily due to lower net income and higher inventory levels. Fiscal Year 2023 Financial Outlook McCormick's broad and advantaged global flavor portfolio enables the Company to meet the rising demand for flavor around the world. The Company is capitalizing on the growing consumer interests in healthy and flavorful cooking, digital engagement, valuing trusted brands, and purpose-minded practices. This, coupled with the breadth and reach of McCormick's portfolio and its proven strategies, position the Company to sustainably continue its growth trajectory. McCormick expects strong underlying business performance in 2023 driven by sales growth. The Company also expects a favorable impact to operating income from its Global Operating Effectiveness Program and the lapping of the negative impact of the COVID-related disruptions in China in 2022, partially offset by the Kitchen Basics divestiture and an expected increase in employee incentive compensation expenses given the expected improvement in underlying business performance. In addition, the Company expects earnings per share growth will be tempered by higher

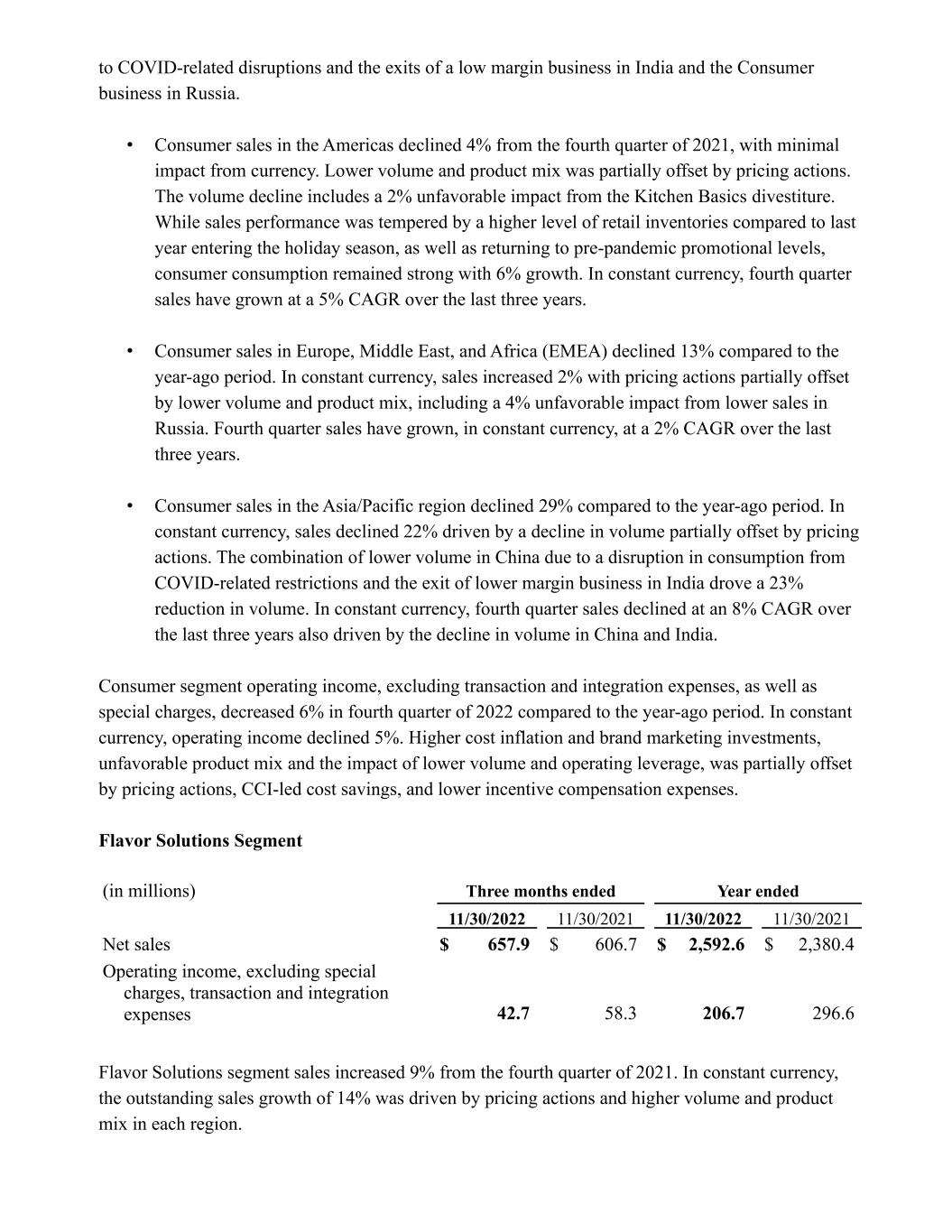

interest expense and a higher projected effective tax rate compared to 2022. Excluding this interest and tax headwind, McCormick's operating performance growth is expected to be strong. The Company expects minimal impact on net sales, operating income, and earnings per share from currency rates in 2023. In 2023, the McCormick expects to grow sales by 5% to 7% compared to 2022. The Company expects sales growth to be driven by primarily pricing actions, which in conjunction with cost savings, are expected to offset inflationary pressures. McCormick also expects to drive continued growth through the strength of its brands, as well as brand marketing, new products, category management, and differentiated customer engagement plans. Operating income in 2023 is expected to grow by 10% to 12% from $864 million in 2022. The Company anticipates approximately $50 million of special charges in 2023 that relate to previous organizational and streamlining actions. Excluding the impact of special charges and integration expenses in 2023 and 2022, adjusted operating income is expected to increase 9% to 11%. McCormick projects 2023 earnings per share to be in the range of $2.42 to $2.47, compared to $2.52 of earnings per share in 2022. The Company expects special charges to lower earnings per share by $0.14 in 2023. Excluding these impacts, the Company projects 2023 adjusted earnings per share to be in the range of $2.56 to $2.61, compared to $2.53 of adjusted earnings per share in 2022, which represents an expected increase of 1% to 3%. This reflects strong operating performance, partially offset by an 8% headwind from higher interest expense due to the higher interest-rate environment and lapping the impact of an optimization of the Company’s debt portfolio last year, as well as a 1% headwind from an anticipated increase in the Company's projected adjusted effective tax rate. For fiscal 2023, the Company expects strong cash flow driven by profit and working capital initiatives and anticipates returning a significant portion of cash flow to shareholders through dividends. Business Segment Results Consumer Segment (in millions) Three months ended Year ended 11/30/2022 11/30/2021 11/30/2022 11/30/2021 Net sales $ 1,037.8 $ 1,123.6 $ 3,757.9 $ 3,937.5 Operating income, excluding special charges, transaction and integration expenses 235.2 250.4 710.7 804.9 Consumer segment sales declined 8% from the fourth quarter of 2021. In constant currency, sales declined 4% attributable to lower volume and product mix, partially offset by pricing actions in all three regions. The Consumer segment volume decline included a 1% unfavorable impact from the Kitchen Basics divestiture and a combined negative impact of 3% from lower China consumption due

to COVID-related disruptions and the exits of a low margin business in India and the Consumer business in Russia. • Consumer sales in the Americas declined 4% from the fourth quarter of 2021, with minimal impact from currency. Lower volume and product mix was partially offset by pricing actions. The volume decline includes a 2% unfavorable impact from the Kitchen Basics divestiture. While sales performance was tempered by a higher level of retail inventories compared to last year entering the holiday season, as well as returning to pre-pandemic promotional levels, consumer consumption remained strong with 6% growth. In constant currency, fourth quarter sales have grown at a 5% CAGR over the last three years. • Consumer sales in Europe, Middle East, and Africa (EMEA) declined 13% compared to the year-ago period. In constant currency, sales increased 2% with pricing actions partially offset by lower volume and product mix, including a 4% unfavorable impact from lower sales in Russia. Fourth quarter sales have grown, in constant currency, at a 2% CAGR over the last three years. • Consumer sales in the Asia/Pacific region declined 29% compared to the year-ago period. In constant currency, sales declined 22% driven by a decline in volume partially offset by pricing actions. The combination of lower volume in China due to a disruption in consumption from COVID-related restrictions and the exit of lower margin business in India drove a 23% reduction in volume. In constant currency, fourth quarter sales declined at an 8% CAGR over the last three years also driven by the decline in volume in China and India. Consumer segment operating income, excluding transaction and integration expenses, as well as special charges, decreased 6% in fourth quarter of 2022 compared to the year-ago period. In constant currency, operating income declined 5%. Higher cost inflation and brand marketing investments, unfavorable product mix and the impact of lower volume and operating leverage, was partially offset by pricing actions, CCI-led cost savings, and lower incentive compensation expenses. Flavor Solutions Segment (in millions) Three months ended Year ended 11/30/2022 11/30/2021 11/30/2022 11/30/2021 Net sales $ 657.9 $ 606.7 $ 2,592.6 $ 2,380.4 Operating income, excluding special charges, transaction and integration expenses 42.7 58.3 206.7 296.6 Flavor Solutions segment sales increased 9% from the fourth quarter of 2021. In constant currency, the outstanding sales growth of 14% was driven by pricing actions and higher volume and product mix in each region.

• In the Americas, Flavor Solutions sales rose 13% compared to the fourth quarter of 2021, with minimal impact from currency. Sales growth was driven by continued high demand from packaged food and beverage companies as well as higher sales to branded foodservice customers. Fourth quarter sales have grown, in constant currency, at a 9% CAGR over the last three years. • The EMEA region's Flavor Solutions sales declined 2% compared to the fourth quarter of 2021, and in constant currency, sales increased 16%. The sales growth was broad-based across the portfolio led by strong growth with quick service restaurants and packaged food and beverage customers. In constant currency, fourth quarter sales have grown at a 11% CAGR over the last three years. • The Asia/Pacific region's Flavor Solutions sales were comparable to the fourth quarter of 2021. In constant currency, sales increased 11% driven by higher sales to quick service restaurants. Fourth quarter sales have grown, in constant currency, at a 7% CAGR over the last three years. Flavor Solutions segment operating income, excluding transaction and integration expenses, as well as special charges, was 27% lower in the fourth quarter of 2022 compared to the year-ago period. In constant currency, Flavor Solutions operating income declined 26% driven by higher cost inflation, elevated costs to meet high demand, unfavorable product mix and spending related to supply chain investments. These impacts were partially offset by higher sales, pricing actions, CCI-led cost savings, and lower incentive compensation expenses. Non-GAAP Financial Measures The tables below include financial measures of adjusted gross profit, adjusted gross profit margin, adjusted operating income, adjusted operating income margin, adjusted income tax expense, adjusted income tax rate, adjusted net income and adjusted diluted earnings per share. These represent non- GAAP financial measures which are prepared as a complement to our financial results prepared in accordance with United States generally accepted accounting principles. These financial measures exclude the impact, as applicable, of the following: Special charges – In our consolidated income statement, we include a separate line item captioned “Special charges” in arriving at our consolidated operating income. Special charges consist of expenses and income associated with certain actions undertaken by the Company to reduce fixed costs, simplify or improve processes, and improve our competitiveness and are of such significance in terms of both up-front costs and organizational/structural impact to require advance approval by our Management Committee. Upon presentation of any such proposed action (generally including details with respect to estimated costs, which typically consist principally of employee severance and related benefits, together with ancillary costs associated with the action that may include a non-cash component, such as an asset impairment, or a component which relates to inventory adjustments that are included in cost of goods sold; impacted employees or operations; expected timing; and expected savings) to the Management Committee and the Committee’s advance approval, expenses associated

with the approved action are classified as special charges upon recognition and monitored on an on- going basis through completion. Special charges for the year ended November 30, 2022 include a $13.6 million gain associated with the sale of the Kohinoor brand name. We exited our Kohinoor rice product line in India in the fourth quarter of fiscal year 2021. Transaction and integration expenses associated with the Cholula and FONA acquisitions – We exclude certain costs associated with our acquisitions of Cholula and FONA in November and December 2020, respectively, and their subsequent integration into the Company. Such costs, which we refer to as “Transaction and integration expenses,” include transaction costs associated with each acquisition, as well as integration costs following the respective acquisition, including the impact of the acquisition date fair value adjustment for inventories, together with the impact of discrete tax items, if any, directly related to each acquisition. Income from sale of unconsolidated operations – We exclude the gain realized upon our sale of an unconsolidated operation in March 2021. The sale of our 26% interest in Eastern Condiments Private Ltd resulted in a gain of $13.4 million, net of tax of $5.7 million. The gain is included in Income from unconsolidated operations in our consolidated income statement for the year ended November 30, 2021. Gain on sale of Kitchen Basics - We exclude the gain realized upon our sale of our Kitchen Basics business in August 2022. The pre-tax gain associated with the sale was $49.6 million for the year ended November 30, 2022. We believe that these non-GAAP financial measures are important. The exclusion of the items noted above provides additional information that enables enhanced comparisons to prior periods and, accordingly, facilitates the development of future projections and earnings growth prospects. This information is also used by management to measure the profitability of our ongoing operations and analyze our business performance and trends. These non-GAAP financial measures may be considered in addition to results prepared in accordance with GAAP, but they should not be considered a substitute for, or superior to, GAAP results. In addition, these non-GAAP financial measures may not be comparable to similarly titled measures of other companies because other companies may not calculate them in the same manner that we do. We intend to continue to provide these non-GAAP financial measures as part of our future earnings discussions and, therefore, the inclusion of these non-GAAP financial measures will provide consistency in our financial reporting. A reconciliation of these non-GAAP financial measures to the related GAAP financial measures is provided below:

(in millions except per share data) Three Months Ended Year Ended 11/30/2022 11/30/2021 11/30/2022 11/30/2021 Gross profit $ 624.4 $ 702.9 $2,274.5 $2,494.6 Impact of transaction and integration expenses included in cost of goods sold (1) — — — 6.3 Impact of special charges included in cost of goods sold (2) — 4.7 — 4.7 Adjusted gross profit $ 624.4 $ 707.6 $2,274.5 $2,505.6 Adjusted gross profit margin (3) 36.8 % 40.9 % 35.8 % 39.7 % Operating income $ 264.3 $ 276.2 $ 863.6 $1,015.1 Impact of transaction and integration expenses included in cost of goods sold (1) — — — 6.3 Impact of other transaction and integration expenses (1) — 2.0 2.2 29.0 Impact of special charges included in cost of goods sold (2) — 4.7 — 4.7 Impact of special charges (2) 13.6 25.8 51.6 46.4 Adjusted operating income $ 277.9 $ 308.7 $ 917.4 $1,101.5 % decrease versus year-ago period (10.0) % (16.7) % Adjusted operating income margin (4) 16.4 % 17.8 % 14.4 % 17.4 % Income tax expense $ 53.2 $ 57.2 $ 168.6 $ 192.7 Impact of transaction and integration expenses (1) — 0.4 0.6 (2.7) Impact of special charges (2) 2.6 2.2 13.3 7.1 Impact of sale of Kitchen Basics — — (11.6) — Adjusted income tax expense $ 55.8 $ 59.8 $ 170.9 $ 197.1 Adjusted income tax rate (5) 23.1 % 21.3 % 20.9 % 20.1 % Net income $ 185.7 $ 197.4 $ 682.0 $ 755.3 Impact of transaction and integration expenses (1) — 1.6 1.6 38.0 Impact of special charges (2) 11.0 28.3 38.3 44.0 Impact of after-tax gain on sale of Kitchen Basics — — (38.0) — Impact of after-tax gain on sale of unconsolidated operation — — — (13.4) Adjusted net income $ 196.7 $ 227.3 $ 683.9 $ 823.9 % decrease versus year-ago period (13.5) % (17.0) % Earnings per share - diluted $ 0.69 $ 0.73 $ 2.52 $ 2.80 Impact of transaction and integration expenses (1) — — 0.01 0.14 Impact of special charges (2) 0.04 0.11 0.14 0.16

Impact of after-tax gain on sale of Kitchen Basics — — (0.14) — Impact of after-tax gain on sale of unconsolidated operation — — — (0.05) Adjusted earnings per share - diluted $ 0.73 $ 0.84 $ 2.53 $ 3.05 % decrease versus year-ago period (13.1) % (17.0) % (1) Transaction and integration expenses include transaction and integration expenses associated with our acquisitions of Cholula and FONA. These expenses include the effect of the fair value adjustment to acquired inventories on cost of goods sold and the impact of a discrete deferred state income tax expense item, directly related to our December 2020 acquisition of FONA. This discrete tax item had a net unfavorable impact of $10.4 million or $0.04 per diluted share for the year ended November 30, 2021. (2) Special charges for the year ended November 30, 2022 include a $10.0 million non-cash intangible asset impairment charge associated with our exit of our business operations in Russia. Special charges for the year ended November 30, 2022 include a $13.6 million gain associated with the sale of the Kohinoor brand name. We exited our Kohinoor rice product line in India in the fourth quarter of fiscal 2021. Special charges for the year ended November 30, 2021 include $4.7 million which is reflected in Cost of goods sold and an $11.2 million non- cash impairment charge associated with the impairment of certain intangible assets. (3) Adjusted gross profit margin is calculated as adjusted gross profit as a percentage of net sales for each period presented. (4) Adjusted operating income margin is calculated as adjusted operating income as a percentage of net sales for each period presented. (5) Adjusted income tax rate is calculated as adjusted income tax expense as a percentage of income from consolidated operations before income taxes excluding transaction and integration expenses and special charges, and for 2022, the gain on a sale of a business, of $241.9 million and $817.0 million for the three months and year ended November 30, 2022, respectively, $280.7 million and $982.2 million for the three months and year ended November 30, 2021, respectively. Because we are a multi-national company, we are subject to variability of our reported U.S. dollar results due to changes in foreign currency exchange rates. Those changes have been volatile over the past several years. The exclusion of the effects of foreign currency exchange, or what we refer to as amounts expressed “on a constant currency basis,” is a non-GAAP measure. We believe that this non- GAAP measure provides additional information that enables enhanced comparison to prior periods excluding the translation effects of changes in rates of foreign currency exchange and provides additional insight into the underlying performance of our operations located outside of the U.S. It should be noted that our presentation herein of amounts and percentage changes on a constant currency basis does not exclude the impact of foreign currency transaction gains and losses (that is, the impact of transactions denominated in other than the local currency of any of our subsidiaries in their local currency reported results). Percentage changes in sales and adjusted operating income as well as compounded annual growth rates expressed on a constant currency basis are presented excluding the impact of foreign currency exchange. To present this information for historical periods, current period results for entities reporting in currencies other than the U.S. dollar are translated into U.S. dollars at the average exchange rates in effect during the corresponding period of the comparative year, rather than at the actual average exchange rates in effect during the current fiscal year. As a result, the foreign currency

impact is equal to the current year results in local currencies multiplied by the change in the average foreign currency exchange rate between the current fiscal period and the corresponding period of the comparative year. Rates of constant currency growth (decline) follow: Three Months Ended November 30, 2022 Percentage Change as Reported Impact of Foreign Currency Exchange Percentage Change on Constant Currency Basis Net sales Consumer Segment Americas (4.0)% (0.5)% (3.5)% EMEA (13.4)% (15.4)% 2.0% Asia/Pacific (28.6)% (6.5)% (22.1)% Total Consumer segment (7.6)% (3.3)% (4.3)% Flavor Solutions Segment Americas 12.9% (0.3)% 13.2% EMEA (1.8)% (17.7)% 15.9% Asia/Pacific —% (11.3)% 11.3% Total Flavor Solutions segment 8.5% (5.2)% 13.7% Total net sales (2.0)% (4.0)% 2.0% Adjusted operating income Consumer segment (6.1)% (1.0)% (5.1)% Flavor Solutions segment (26.8)% (0.8)% (26.0)% Total adjusted operating income (10.0)% (1.0)% (9.0)%

Year Ended November 30, 2022 Percentage Change as Reported Impact of Foreign Currency Exchange Percentage Change on Constant Currency Basis Net sales Consumer Segment Americas (1.1)% (0.2)% (0.9)% EMEA (14.7)% (9.6)% (5.1)% Asia/Pacific (10.1)% (2.0)% (8.1)% Total Consumer segment (4.6)% (2.1)% (2.5)% Flavor Solutions Segment Americas 11.4% (0.3)% 11.7% EMEA 5.5% (11.7)% 17.2% Asia/Pacific (0.2)% (5.4)% 5.2% Total Flavor Solutions segment 8.9% (3.2)% 12.1% Total net sales 0.5% (2.5)% 3.0% Adjusted operating income Consumer segment (11.7)% (0.8)% (10.9)% Flavor Solutions segment (30.3)% (2.4)% (27.9)% Total adjusted operating income (16.7)% (1.2)% (15.5)% Three Months Ended November 30, 2022 Percentage Change as Reported Impact of Foreign Currency Exchange Percentage Change on Constant Currency Basis 3 Year CAGR - Net sales Consumer Segment Americas 4.5% —% 4.5% EMEA (1.9)% (3.8)% 1.9% Asia/Pacific (8.3)% —% (8.3)% Total Consumer segment 2.4% (0.6)% 3.0% Flavor Solutions Segment Americas 9.0% (0.2)% 9.2% EMEA 7.5% (3.3)% 10.8% Asia/Pacific 4.7% (1.8)% 6.5% Total Flavor Solutions segment 8.3% (0.9)% 9.2% Total 3 Year CAGR - Net sales 4.5% (0.8)% 5.3%

Year Ended November 30, 2022 Percentage Change as Reported Impact of Foreign Currency Exchange Percentage Change on Constant Currency Basis 3 Year CAGR - Net sales Consumer Segment 4.7% (0.2)% 4.9% Flavor Solutions Segment 7.7% (0.4)% 8.1% Total 3 Year CAGR - Net sales 5.9% (0.3)% 6.2% To present “constant currency” information for the fiscal year 2023 projection, projected sales and adjusted operating income for entities reporting in currencies other than the U.S. dollar are translated into U.S. dollars at the company’s budgeted exchange rates for 2023 and are compared to the 2022 results, translated into U.S. dollars using the same 2023 budgeted exchange rates, rather than at the average actual exchange rates in effect during fiscal year 2022. To estimate the percentage change in adjusted earnings per share on a constant currency basis, a similar calculation is performed to arrive at adjusted net income divided by historical shares outstanding for fiscal year 2022 or projected shares outstanding for fiscal year 2023, as appropriate. The following provides a reconciliation of our estimated earnings per share to adjusted earnings per share for 2023 and actual results for 2022: Year Ended 2023 Projection 11/30/22 Earnings per share - diluted $2.42 to $2.47 $ 2.52 Impact of transaction and integration expenses — 0.01 Impact of special charges 0.14 0.14 Impact of after-tax gain on sale of Kitchen Basics — (0.14) Adjusted earnings per share - diluted $2.56 to $2.61 $ 2.53 Live Webcast As previously announced, McCormick will hold a conference call with analysts today at 8:00 a.m. ET. The conference call will be webcast live via the McCormick website. Go to ir.mccormick.com and follow directions to listen to the call and access the accompanying presentation materials. At this same location, a replay of the call will be available following the live call. Past press releases and additional information can also be found at this address. Forward-Looking Information Certain information contained in this release, including statements concerning expected performance, such as those relating to net sales, gross margin, earnings, cost savings, transaction and integration expenses, special charges, acquisitions, brand marketing support, volume and product mix, income tax expense and the impact of foreign currency rates are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These statements may be identified by the use of words such as “may,” “will,” “expect,” “should,” “anticipate,” “intend,” “believe” and “plan” and similar expressions. These statements may relate to: the impact of the COVID-19 pandemic on our business, suppliers, consumers, customers, and employees; disruptions

or inefficiencies in the supply chain, including any impact of COVID-19; the expected results of operations of businesses acquired by the Company; the expected impact of the inflationary cost environment, including commodity, packaging materials and transportation costs on our business; the expected impact of pricing actions on the Company's results of operations and gross margins; the impact of price elasticity on our sales volume and mix; the expected impact of factors affecting our supply chain, including transportation capacity, labor shortages, and absenteeism; the expected impact of productivity improvements, including those associated with our Comprehensive Continuous Improvement program, streamlining actions, including our Global Operating Effectiveness Program (GOEP), and global enablement initiative; the impact of the ongoing conflict between Russia and Ukraine, including the potential for broader economic disruption; expected working capital improvements; expectations regarding growth potential in various geographies and markets, including the impact from customer, channel, category, and e-commerce expansion; expected trends in net sales and earnings performance and other financial measures; the expected timing and costs of implementing our business transformation initiative, which includes the implementation of a global enterprise resource planning system; the expected impact of accounting pronouncements; the expectations of pension and postretirement plan contributions and anticipated charges associated with those plans; the holding period and market risks associated with financial instruments; the impact of foreign exchange fluctuations; the adequacy of internally generated funds and existing sources of liquidity, such as the availability of bank financing; the anticipated sufficiency of future cash flows to enable the payments of interest and repayment of short- and long-term debt, working capital needs, planned capital expenditures, as well as quarterly dividends and the ability to obtain additional short- and long-term financing or issue additional debt securities; and expectations regarding purchasing shares of McCormick's common stock under the existing repurchase authorization. These and other forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could significantly affect expected results. Results may be materially affected by factors such as: the company's ability to drive revenue growth; the company's ability to increase pricing to offset, or partially offset, inflationary pressures on the cost of our products; damage to the company's reputation or brand name; loss of brand relevance; increased private label use; the company's ability to drive productivity improvements, including those related to our CCI program and streamlining actions, including our GOEP; product quality, labeling, or safety concerns; negative publicity about our products; actions by, and the financial condition of, competitors and customers; the longevity of mutually beneficial relationships with our large customers; the ability to identify, interpret and react to changes in consumer preference and demand; business interruptions due to natural disasters, unexpected events or public health crises, including COVID-19; issues affecting the company's supply chain and procurement of raw materials, including fluctuations in the cost and availability of raw and packaging materials; labor shortage, turnover and labor cost increases; the impact of the ongoing conflict between Russia and Ukraine, including the potential for broader economic disruption; government regulation, and changes in legal and regulatory requirements and enforcement practices; the lack of successful acquisition and integration of new businesses; global economic and financial conditions generally, availability of financing, interest and inflation rates, and the imposition of tariffs, quotas, trade barriers and other similar restrictions; foreign currency fluctuations; the effects of increased level of debt service following the Cholula and FONA acquisitions as well as the effects that such increased debt service may have on

the company's ability to borrow or the cost of any such additional borrowing, our credit rating, and our ability to react to certain economic and industry conditions; risks associated with the phase-out of LIBOR; impairments of indefinite-lived intangible assets; assumptions we have made regarding the investment return on retirement plan assets, and the costs associated with pension obligations; the stability of credit and capital markets; risks associated with the company's information technology systems, including the threat of data breaches and cyber-attacks; the company's inability to successfully implement our business transformation initiative; fundamental changes in tax laws; including interpretations and assumptions we have made, and guidance that may be issued, and volatility in our effective tax rate; climate change; Environmental, Social and Governance (ESG) matters; infringement of intellectual property rights, and those of customers; litigation, legal and administrative proceedings; the company's inability to achieve expected and/or needed cost savings or margin improvements; negative employee relations; and other risks described in the company's filings with the Securities and Exchange Commission. Actual results could differ materially from those projected in the forward-looking statements. The company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. About McCormick McCormick & Company, Incorporated is a global leader in flavor. With over $6 billion in annual sales across 170 countries and territories, we manufacture, market and distribute spices, seasoning mixes, condiments and other flavorful products to the entire food industry including e-commerce channels, grocery, food manufacturers and foodservice businesses. Our most popular brands with trademark registrations include McCormick, French’s, Frank’s RedHot, Stubb’s, OLD BAY, Lawry’s, Zatarain’s, Ducros, Vahiné, Cholula, Schwartz, Kamis, DaQiao, Club House, Aeroplane and Gourmet Garden. Every day, no matter where or what you eat or drink, you can enjoy food flavored by McCormick. Founded in 1889 and headquartered in Hunt Valley, Maryland USA, McCormick is guided by our principles and committed to our Purpose – To Stand Together for the Future of Flavor. McCormick envisions A World United by Flavor where healthy, sustainable and delicious go hand in hand. To learn more, visit www.mccormickcorporation.com or follow McCormick & Company on Twitter, Instagram and LinkedIn. # # # For information contact: Investor Relations: Kasey Jenkins - kasey_jenkins@mccormick.com Corporate Communications: Lori Robinson - lori_robinson@mccormick.com (Financial tables follow)

Fourth Quarter Report McCormick & Company, Incorporated Consolidated Income Statement (Unaudited) (In millions except per-share data) Three months ended Year ended November 30, 2022 November 30, 2021 November 30, 2022 November 30, 2021 Net sales $ 1,695.7 $ 1,730.3 $ 6,350.5 $ 6,317.9 Cost of goods sold 1,071.3 1,027.4 4,076.0 3,823.3 Gross profit 624.4 702.9 2,274.5 2,494.6 Gross profit margin 36.8 % 40.6 % 35.8 % 39.5 % Selling, general and administrative expense 346.5 398.9 1,357.1 1,404.1 Transaction and integration expenses — 2.0 2.2 29.0 Special charges 13.6 25.8 51.6 46.4 Operating income 264.3 276.2 863.6 1,015.1 Interest expense 44.4 33.3 149.1 136.6 Other income, net 8.4 5.3 98.3 17.3 Income from consolidated operations before income taxes 228.3 248.2 812.8 895.8 Income tax expense 53.2 57.2 168.6 192.7 Net income from consolidated operations 175.1 191.0 644.2 703.1 Income from unconsolidated operations 10.6 6.4 37.8 52.2 Net income $ 185.7 $ 197.4 $ 682.0 $ 755.3 Earnings per share - basic $ 0.69 $ 0.74 $ 2.54 $ 2.83 Earnings per share - diluted $ 0.69 $ 0.73 $ 2.52 $ 2.80 Average shares outstanding - basic 268.3 267.4 268.2 $ 267.3 Average shares outstanding - diluted 269.9 269.9 270.2 269.9

Fourth Quarter Report McCormick & Company, Incorporated Consolidated Balance Sheet (Unaudited) (In millions) November 30, 2022 November 30, 2021 Assets Cash and cash equivalents $ 334.0 $ 351.7 Trade accounts receivable, net of allowances 573.7 549.5 Inventories 1,340.1 1,182.3 Prepaid expenses and other current assets 138.9 112.3 Total current assets 2,386.7 2,195.8 Property, plant and equipment, net 1,198.0 1,140.3 Goodwill 5,212.9 5,335.8 Intangible assets, net 3,387.9 3,452.5 Other long-term assets 939.4 781.4 Total assets $ 13,124.9 $ 12,905.8 Liabilities Short-term borrowings and current portion of long-term debt $ 1,507.3 $ 1,309.4 Trade accounts payable 1,171.0 1,064.2 Other accrued liabilities 754.1 850.2 Total current liabilities 3,432.4 3,223.8 Long-term debt 3,642.3 3,973.3 Deferred taxes 866.3 792.3 Other long-term liabilities 484.7 490.9 Total liabilities 8,425.7 8,480.3 Shareholders’ equity Common stock 2,138.6 2,055.1 Retained earnings 3,022.5 2,782.4 Accumulated other comprehensive loss (480.6) (426.5) Total McCormick shareholders' equity 4,680.5 4,411.0 Non-controlling interests 18.7 14.5 Total shareholders’ equity 4,699.2 4,425.5 Total liabilities and shareholders’ equity $ 13,124.9 $ 12,905.8

Fourth Quarter Report McCormick & Company, Incorporated Consolidated Cash Flow Statement (Unaudited) (In millions) Year Ended November 30, 2022 November 30, 2021 Operating activities Net income $ 682.0 $ 755.3 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 200.6 186.3 Stock-based compensation 60.3 66.6 Gain on sale of a business and intangible asset (63.2) — Asset impairment charge included in special charges 10.0 17.2 Amortization of inventory fair value adjustments associated with acquisitions — 6.3 (Gain) loss on sale of assets (0.5) 0.2 Deferred income tax expense 21.8 36.0 Income from unconsolidated operations (37.8) (52.2) Changes in operating assets and liabilities (net of businesses acquired and disposed) Trade accounts receivable (45.8) (22.6) Inventories (205.3) (153.7) Trade accounts payable 125.3 34.9 Other assets and liabilities (129.9) (81.4) Dividends from unconsolidated affiliates 34.0 35.4 Net cash flow provided by operating activities 651.5 828.3 Investing activities Acquisition of businesses (net of cash acquired) — (706.4) Proceeds from sale of a business 95.2 — Proceeds from sale of unconsolidated operations — 65.4 Proceeds from sale of intangible asset 13.6 — Capital expenditures (including software) (262.0) (278.0) Other investing activities 6.8 10.4 Net cash flow used in investing activities (146.4) (908.6) Financing activities Short-term borrowings (repayments), net 698.3 (346.7) Proceeds from issuances of long-term debt — 1,001.5 Payment of debt issuance costs — (1.9) Long-term debt repayments (772.0) (257.1)

Proceeds from exercised stock options 41.4 13.5 Taxes withheld and paid on employee stock awards (19.4) (15.4) Common stock acquired by purchase (38.8) (8.6) Dividends paid (396.7) (363.3) Net cash flow (used in) provided by financing activities (487.2) 22.0 Effect of exchange rate changes on cash and cash equivalents (35.6) (13.6) Decrease in cash and cash equivalents (17.7) (71.9) Cash and cash equivalents at beginning of period 351.7 423.6 Cash and cash equivalents at end of period $ 334.0 $ 351.7