QuickLinks -- Click here to rapidly navigate through this documentMcCORMICK & COMPANY 2002 ANNUAL REPORT

Allspice

This year's annual report is scented with allspice. Allspice is the dried, un-ripened fruit of a small evergreen tree, the Pimenta Dioica. Its aroma is a pleasant blend of cinnamon, clove and nutmeg. Primarily harvested in Jamaica, allspice was one of the spices "discovered" by Columbus when he sought black pepper while in the Caribbean Islands. In Europe, it is commonly known as Pimento. A staple in curry dishes, allspice is in a wide range of other contemporary recipes including Caribbean Baked Bananas, Harvest Pork with Apples and Sauerkraut, and Allspice Chocolate Truffles. These recipes and many more can be found on McCormick's global websites.

Contents

| 1 | | Financial Highlights |

| 2 | | Letter to Shareholders |

| 5 | | McCormick at a Glance |

| 6 | | Recipes for Success: Higher Margins, Innovation, Growth |

| 12 | | McCormick Worldwide |

| 14 | | Board of Directors |

| 15 | | Corporate Officers and Operating Executives |

| 16 | | Recipe for Community Service |

| 17 | | Management's Discussion and Analysis |

| 29 | | Report of Management, Report of Independent Auditors |

| 30 | | Financial Statements and Notes |

| 44 | | Historical Financial Summary |

| 45 | | Investor Information |

Our Mission

The primary mission of McCormick & Company is to profitably expand its worldwide leadership position in the spice, seasoning and flavoring markets.

Company Description

McCormick is the global leader in the manufacture, marketing and distribution of spices, seasonings and flavors to the entire food industry. Customers range from retail outlets and food service providers to food processing businesses. In addition, our packaging group manufactures and markets

plastic bottles and tubes for the food, personal care and other industries. Founded in 1889 and built on a culture of Multiple Management, McCormick has approximately 9,000 employees.

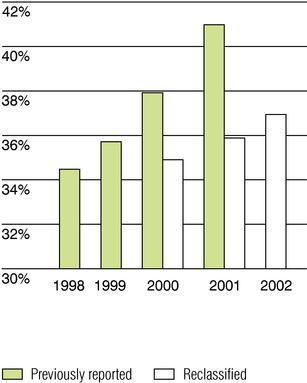

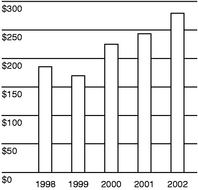

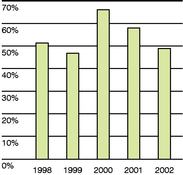

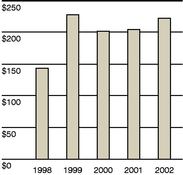

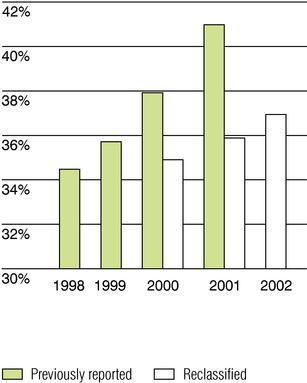

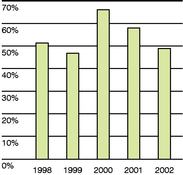

| Net Sales(2) | | Gross Profit Margin(2) |

| in millions | | |

|

|

|

- (2)

- McCormick adopted EITF 01-09 in 2002. The graphs display net sales and gross profit margin for 2000 and 2001 as reclassified to reflect this change, and as previously reported.

Financial Highlights

for the year ended November 30 (millions except per share data)

| | 2002

| | 2001

| | % change

| |

|---|

| Net sales | | $ | 2,320.0 | | $ | 2,218.5 | | 4.6 | % |

| Gross profit margin | | | 36.9 | % | | 35.9 | % | | |

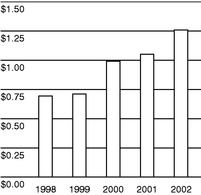

| Operating income | | $ | 277.7 | | $ | 240.6 | | 15.4 | % |

| Net income | | | 179.8 | | | 146.6 | | 22.6 | % |

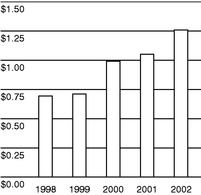

| Earnings per share—assuming dilution | | | 1.26 | | | 1.05 | | 20.0 | % |

| Earnings per share—excluding amortization—assuming dilution(1) | | | 1.26 | | | 1.13 | | 11.5 | % |

| Dividends paid per share | | $ | .42 | | $ | .40 | | 5.0 | % |

| Market price per share—close | | | 23.79 | | | 21.50 | | 10.7 | % |

| Average shares outstanding—assuming dilution | | | 142.3 | | | 140.2 | | 1.5 | % |

| | |

| |

| |

| |

| Other Performance Measures: | | | | | | | | | |

| | |

| |

| |

| |

| Debt-to-total-capital | | | 49.2 | % | | 58.3 | % | | |

| Return on invested capital | | | 15.7 | % | | 15.4 | % | | |

| Economic value added (EVA) | | $ | 89.6 | | $ | 78.7 | | 13.9 | % |

| | |

| |

| |

| |

- (1)

- McCormick adopted SFAS 142 in 2002. Earnings per share for 2001 is adjusted to exclude goodwill amortization.

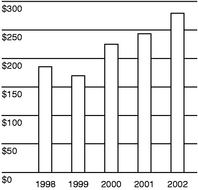

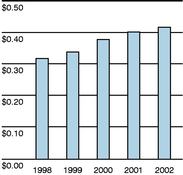

Operating Income

in millions | Earnings per share—assuming dilution | Economic Value Added (EVA)

in millions |

|

|

|

1

Letter to Shareholders

McCormick reported another year of record financial results in 2002. In the last five years, McCormick has accelerated its rate of performance with an average annual growth rate of 6% for sales and 15% for earnings per share. In 2002:

- •

- Sales grew 5% to $2.3 billion, primarily through strong volume.

- •

- Gross profit margin increased one percentage point to 36.9%.

- •

- As a result of higher sales, margin improvement and reduced interest expense, earnings per share rose 12% to $1.26 on a comparable basis, excluding amortization.

- •

- New product successes, expansion with our strategic customers, share gains and favorable foreign currencies, grew sales of our food businesses 5%. Operating income on a comparable basis, excluding special charges and amortization, rose 8% for our food businesses as a result of a favorable raw material environment, more value-added products and cost efficiencies.

- •

- We overcame both sales weakness in our packaging business and difficulties in our U.K. brokerage operation with strength in our food businesses. We have instituted changes to each of these operations to improve profitability.

- •

- Our stock price continued to increase in 2002 and we split our stock two-for-one on April 8.

We achieved these results in a year during which we were completing the first phase of our Beyond 2000 (B2K) program that required significant technology and process changes. B2K is a global initiative designed to significantly improve business processes through state-of-the-art information technology.

Despite this major initiative and the added challenges posed by our packaging business and U.K. brokerage operation, we increased our investment in brand marketing and product development and launched a number of innovative products which deliver the taste consumers have come to trust. Most importantly, we were able to both invest in the business and meet our profit goal in 2002.

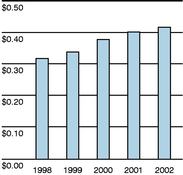

Cash flow was used to pay dividends, reduce debt and to fund the B2K program and other capital expenditures. Dividends paid to shareholders increased for the 16th consecutive year. McCormick is proud to have paid dividends yearly for the last 78 years. Funding for our B2K program will continue, but at a reduced level, appropriate to meet our needs. Following the 2000 acquisition of Ducros, the largest spice company in Europe, we committed to return to our target

Robert J. Lawless

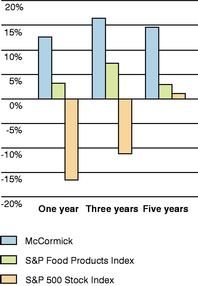

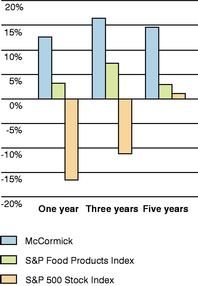

Chairman, President & CEO | | Total Shareholder Return

Includes Dividends

|

2

debt-to-total-capital of 45-55% by the end of 2002. This commitment was met at the end of our third quarter in 2002, and a level of 49% was achieved by year-end.

The McCormick recipe for success is simple: Improve margins, invest in the business, and increase sales and profits.

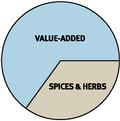

One of the ways we improve margins is by focusing marketing support and development resources on value-added, higher-margin products. Today, value-added products account for 65% of sales with the other 35% coming from ingredients. Our B2K program, with a strong emphasis on optimizing the management of our supply chain, creates a global platform for future profit improvement, more efficient working capital and enhanced relationships with our trading partners. We have identified more than 100 distinct opportunities to reduce costs in our supply chain. These opportunities include the global procurement of ingredients and packaging, more efficient logistics and streamlined, lower cost operations.

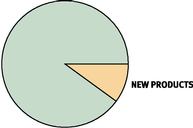

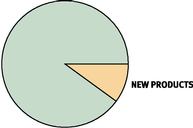

We are investing in our business to drive sales. Research and development expenditures have nearly doubled in the last five years. In 2002, for example, a new sensory center was opened in order to increase our ability to explore and determine preferences in taste. The center is one of many ways we are maintaining our competitive edge in supplying the grocery industry, food processors and the restaurant industry with consumer-preferred flavors. New products developed in the last three years accounted for 10% of 2002 sales.

Included in our B2K investment was the launch of a promotional management program that improves the effectiveness of our significant spending on brand marketing. We are also focused on geographic expansion in Europe and Asia to increase sales. To better supply our strategic, multi-national industrial customers, we recently established new supply relationships in Uruguay and Thailand.

With our return to a target range of 45-55% debt-to-total-capital, we are pursuing acquisitions of both industrial businesses and consumer brands that will extend our leadership position in our key markets. We also plan to reactivate our share repurchase program in 2003.

We are confident in our long-term ability to continue our margin improvement and sales growth. In March 2002, we established key annual financial goals for the next five years:

- •

- Increase sales 5%, with a range of 3-7%

- •

- Increase earnings per share 10-12%

- •

- Generate free cash flow of $100 million

Our Core Values

We believe…

- •

- our people are the most important ingredient of our success.

- •

- our top priority is to continuously add value for our shareholders.

- •

- customers are the reason we exist.

- •

- our business must be conducted honestly and ethically.

- •

- the best way to achieve our goals is through teamwork.

The McCormick recipe for success is simple:

Improve margins, invest in the business, and increase sales and profits.

3

Strong leadership and a positive attitude

An effective strategy requires great execution. Execution is the result of strong leadership and a talented and enthusiastic staff, both trademarks of McCormick employees.

McCormick has a powerful combination of long-term, experienced management and new leaders with complementary skills and backgrounds. We offer our employees exposure to numerous roles and functions. For instance, multi-function teams were responsible for the success of projects such as the B2K implementation and related supply chain improvements. Through these experiences and more formal leadership training efforts, we are not only executing our strategies but preparing our next generation of company leaders.

During this past year, Fran Contino accepted new responsibility for supply chain functions and a change in title to Executive Vice President, Chief Financial Officer and Supply Chain. Bob Miller, Vice President—Management Information Systems, retired. Bob Schroeder, President—U.S. Consumer Products Division, announced his retirement at the end of 2003. Alan Wilson was promoted to succeed Bob as President—U.S. Consumer Products Division. Chuck Langmead was promoted to Vice President and General Manager—Food Service and Global Restaurant Division. Tapan Chakrabarty joined McCormick as Vice President and Managing Director—Industrial—Asia Pacific.

For more than 70 years, we have benefited from our Multiple Management philosophy that inspires employee participation and recognition. Our core values define who we are and how we work together. We are committed to a diverse workforce and a spirit of inclusion.

In 2002, it was our employees who created McCormick's success. I salute their efforts and share their pride in what has been accomplished.

A recipe for success

Today, our Company operates in a challenging environment. In key markets around the globe, competition is strong and customers are consolidating. The breadth of our business puts us in a unique position to maintain leadership.

Our business is creating flavors that deliver satisfaction to an ever-increasing universe of consumers. Whether it is a product found in a retail store, a food prepared at home, a quick serve restaurant or a dining chain, it is likely that the flavor is provided by McCormick. We add flavor to all kinds of products up and down the grocery aisles including breakfast cereal, yogurt, snack chips and beverages. At home, consumers enjoy using our products to spice up a gourmet meal or easily prepare an appetizing weeknight meal. Have a quick serve restaurant sandwich, eat at a casual dining chain or order carry-out and you are likely to taste a sauce, breading or seasoning developed by McCormick. We believe that each and every day, no matter what you eat, McCormick is adding flavor to your food for your enjoyment.

Improve margins, invest for growth, increase sales and profits. This is a formula for success that not only has led us to five years of great performance but promises to increase momentum in the years ahead.

Consider the initiatives that we have instituted in the last year which bode well for our future:

- •

- Implemented the initial phase of B2K in our largest operating unit

- •

- Opened our state-of-the-art sensory center

- •

- Launched new products in key markets worldwide

- •

- Organized to improve our supply chain

Our stock price has performed well as a result of a straightforward strategy and consistent financial performance that distinguish McCormick as a compelling investment. Annual shareholder return was 13% over the last year and 16% over the last three years, well above returns of the S&P 500 Index and S&P Food Products Index.

In the coming year, I am confident that we will continue to build value for our shareholders through the increased efficiencies, profitability and growth investors have come to expect.

Robert J. Lawless, Chairman, President & CEO

4

McCormick at a Glance

| | Consumer Business

| | Industrial Business

| | Packaging Business

|

|---|

Business description |

|

• |

|

Markets spices, herbs, extracts, seasoning blends, sauces and marinades to retail outlets such as grocery, drug and mass merchandise stores. |

|

• |

|

Markets spices, blended seasonings, condiments, coatings, and compound flavors to food processors, restaurant chains, distributors and warehouse clubs. |

|

• |

|

Markets plastic bottles and tubes to the food, personal care and other industries. |

Market position |

|

• |

|

Leading market share, exceeding 40% in U.S., 45% in U.K., 50% in France, 50% in Canada. And, leading share in many smaller markets. |

|

• |

|

Leading supplier to distributors and warehouse clubs. One of the leading suppliers of blended seasonings to U.S. food processors. |

|

• |

|

One of the leading suppliers of highly specialized packaging in the U.S. |

2002 financial results |

|

• |

|

Sales increased 5%. |

|

• |

|

Sales increased 6%. |

|

• |

|

Sales decreased 5%. |

|

|

• |

|

Operating income increased 2%; excluding U.K. brokerage operation impact, increased in line with sales(1) |

|

• |

|

Operating income increased 19%.(1) |

|

• |

|

Operating income increased 4%.(1) |

2002 highlights |

|

• |

|

New products launched in the last 3 years accounted for 6% of 2002 sales. |

|

• |

|

New products launched in the last 3 years accounted for 15% of 2002 sales. |

|

• |

|

New products launched in the last 3 years accounted for 19% of 2002 sales. |

|

|

• |

|

Installed new promotion system in U.S. to measure effectiveness and optimize spending beginning in 2003. |

|

• |

|

Increased global sales of value-added, higher-margin products with an 8% growth in seasonings. |

|

• |

|

Through a number of initiatives, achieved an operating margin of 9.5% despite reduced market demand for tubes.(1) |

|

|

• |

|

Introduced improved packaging in Europe to make products more visible, contemporary and relevant. |

|

• |

|

Through a better product mix and cost efficiencies, achieved 10.8% in operating margin, up from 9.7% in 2001.(1) |

|

|

|

|

Strategy and outlook |

|

• |

|

Increase sales by leveraging our brands through

• effective marketing

• accelerated innovation

• brand acquisition

• geographic expansion |

|

• |

|

Increase sales by expanding global flavor and food service business, building our leadership position in flavors, seasonings and condiments. |

|

• |

|

Increase sales through new products and distribution. Stabilize profit growth stream. |

|

|

• |

|

Interest in bold and exotic flavors is growing, but food preparation must be quick and easy. McCormick is satisfying this appetite for flavor with leading brands in key markets around the world. |

|

• |

|

The desire for flavors continues to grow and customers turn to McCormick to deliver a broad range of consumer-preferred flavors that become marketplace winners. |

|

• |

|

McCormick is developing innovative features and using new materials to continue market leadership. |

|

|

|

|

|

|

|

|

|

|

|

|

|

- (1)

- Excluding special charges and goodwill amortization.

5

Recipe for Higher Margins

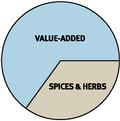

During the last five years, McCormick has increased gross profit margins from less than 33% to nearly 37%. We have achieved this increase through a shift in mix to more value-added, higher-margin products and through cost reductions in many areas of our business. This shift to more value-added, higher-margin products has been aided by the acquisition of Ducros and the introduction of successful new products. New cost reduction initiatives include procurement on a more global basis, effective customer and product segmentation, supplier rationalization, capital expenditures that improve efficiencies, and careful control of expenses. Over the next five years, we expect to reach a gross profit margin of 40%.

Emphasis on value-added products improves margins. In our consumer business, we are directing our development and promotional resources toward value-added products.1 StepTM seasonings in the U.S.,ShotzTM seasonings in the U.K. andLa Grille Rub®Marinade in Canada are all new products featuring a blend of seasonings that reduce time in meal preparation. In our industrial business, food service customers are seeking products that reduce preparation time and provide consistently great menu items. We offer a wide range of flavor solutions to the food service industry as well as unique packaging features that improve product handling. In dealing with food processors, we benefit by emphasizing sophisticated flavor solutions such as compound flavors which offer margins superior to bulk ingredient margins. The percent of sales from value-added products has reached 65% and continues to grow.

Beyond 2000 provides a seamless platform. Beyond 2000 (B2K) is a global program utilizing state-of-the-art information technology to increase the efficiency and profitability of our business processes. In 2002, we began to use

6

the new technology and processes in a significant portion of U.S. operations. The rollout of the B2K program to our remaining U.S. industrial operations and many international operating units will occur through 2005. We will continue to integrate and optimize all of our businesses through broader access to information and increased collaboration with our trading partners. Through B2K, employee time devoted to transaction execution will be reduced and more time will be devoted to the growth and effectiveness of the business.

Focus on supply chain to realize efficiencies. We have achieved cost reductions throughout the supply chain—from procurement of our raw materials to product delivery. In 2002, we made an organizational change bringing most components of our supply chain under the direction of Fran Contino. This new organization closely aligns our strategic functions of finance, global business solutions, operations, strategic sourcing and logistics. With this new organizational focus, enabled by the capabilities of B2K, we are positioning ourselves to achieve the highest level of customer satisfaction and cost optimization.

Fuel for growth By reducing our need for working capital, increasing cash flow, and improving margins, we will increase our "fuel for growth." Development of higher-margin products and expense reduction in the areas of procurement and production are already evident in our bottom line. Operating profit margins will be further increased by lowering general administrative expenses and improving our ability to sell and distribute efficiently. With our "fuel for growth" we will invest in programs to increase sales and profitability at McCormick.

2002 Net Sales

65% of sales are from value-added products

Efforts to improve margins are meeting with success as we increase focus on our supply chain. At a distribution center in Belcamp, Maryland, new technologies bring heightened efficiencies and cost optimization and will lead to higher levels of customer satisfaction.

The new1 Step line of seasoning blends responds to consumer preferences for great taste with ease of preparation. Great taste on the run!

7

Recipe for Innovation

Innovation at McCormick begins with recognizing emerging eating trends and our expertise in developing great flavors. Both lead to successful new products. New products developed during the last three years accounted for 10% of sales in 2002. New products range from zesty seasoning blends to bold condiments and sophisticated new flavors. We continue to invest in people, facilities and equipment to maintain our competitive edge in flavor innovation.

Developing consumer-preferred flavors. A recentParade Magazine survey reported that 82% of consumers say taste—not cost—determines which foods they purchase and prepare. Around the world, our product development process is designed to deliver flavors that consumers prefer. The process begins with recognizing current trends in categories such as ethnic cuisine, easy food preparation, and eating on-the-go. Our research and development teams bring together the skills of chefs, flavor chemists and analytical scientists who are experts in seasonings, condiments, coatings and compound flavors. Not surprisingly, McCormick's sensory capabilities are well recognized and among the best in the industry. Sensory evaluation of new products by consumers is the final step in the development process. The result of this multi-staged methodology is that we are able to deliver integrated products that are winners with consumers as well as our retail and industrial customers.

Providing a wide range of flavor solutions. When you enjoy great tasting food you are most likely tasting a McCormick flavor. We have extended our consumer business from spices and herbs to a wide variety of convenient seasoning blends. Launched in 2001,La Grille Rub Marinade (Montreal Steak) became the third largest selling item in the Canadian spice market in 2002. In the U.S.,1 Step seasonings, launched at the end of 2002, offer consumers fast and easy to prepare meals that taste great and provide the satisfaction of home cooking. In the U.K., a line of fun, innovative products calledShotz aimed at 18 to 30 year olds who are intimidated by cooking, are a success. For the food service industry, we can provide an array of flavors to satisfy changing tastes and dining preferences. For a lunchtime chicken sandwich for example, we can create the marinade, coating, sauce and bread topping. Our breadth of flavor solutions is unique in the industry and gives McCormick a competitive advantage.

Investing in enhanced capabilities. We have nearly doubled our research and development spending in the last five years by hiring experts who excel in value-added product development, by adding equipment to analyze flavors and instituting state-of-the-art facility improvements. In 2000 we opened a new culinary center for our research chefs, and in 2002 a new sensory center was initiated to support our product analysis. These new facilities are both housed in our U.S. Technical Innovation Center where product development sessions with customers have increased more than 25% since 1998. But investment in innovation is not limited to product development. With the initial B2K implementation, we launched a promotional management program that improves the effectiveness of our significant spending on brand marketing. Additionally, we engage the consumer through our global websites. We continue to invest in our websites to improve their appeal, relevance and ease of use.

Investing in innovation McCormick has the skills, tools and creativity to successfully innovate and deliver consumer-preferred flavors. We will continue to invest to build our capabilities and to drive sales growth.

2002 Net Sales

10% of 2002 sales were from new products launched during the last three years. | | The Bag 'n Season® line, which has been a success in other global markets, was adapted for the microwave and launched in China in 2002. This convenient, value-added product matches consumer trends of the fast-paced, urban Chinese lifestyle.

|

8

Members of McCormick's product development team and clients can view panel tests (descriptive or consumer) from an observation room via a one-way mirror. The flexible design and advanced technology of our new sensory center lets viewers watch the panel through the mirror, via closed circuit screening, on videotape or over the Internet.

9

Recipe for Growth

Sales have grown at a 6% average annual growth rate since 1997. An annual sales growth rate of 3-7% is our target for the next five years. Innovative products and expansion of successful products into new markets are propelling our growth. We introduced our U.S. seafood brands in Australia in the mid-1990s, and in 2001 they were relaunched as theSimply SeafoodTM line of products. Sales of these items grew 18% in 2002. Ducros brand salt and pepper grinders from France gained a strong position in the U.S. under the McCormick label. Our grilling products, which began in Canada, moved to the U.S. and today are found in markets around the world. Sales of our consumer grilling items grew worldwide more than 12% in 2002.

In addition to these product successes, sales growth will be achieved by strengthening customer relationships, expanding geographically, and through further acquisitions.

Strengthening customer relationships to maintain our leadership. McCormick is regarded as the premier supplier and category leader in the spice and seasoning industry. In 2002, the Company was recognized by two major customers for excellence as a supplier to the food service industry. We have built many long-term relationships with industrial customers for whom we play an important role in developing the next unique snack seasoning, sandwich sauce or beverage flavor. In our consumer business, we are a supplier of both brand and private label products. We form sales-based supply contracts with our retail customers in several key markets. These partnerships reinforce our position as category leader with higher sales being a shared objective. Our market share in many of these markets is well ahead of the next competitor. In all of our businesses, we have the skills, determination, market knowledge and resources to create partnerships in which McCormick and its customers can enjoy further success.

Expanding geographically because the desire for flavors knows no boundaries. Since the Ducros acquisition in 2000, McCormick has established a foundation for growth in Europe. The Ducros spice business in Europe was the largest acquisition in the history of the Company. In 2001, we realigned our manufacturing facilities between France and the U.K. In 2002, we formed five geographic clusters in Europe and moved from a country-based to a regional focus. Our European management group complements experienced McCormick employees with managers from other European consumer businesses. We are preparing for further market penetration in Europe by utilizing new distribution channels, employing better merchandising and strengthening brand support. Global expansion is achieved by supporting our customers. In 2002, we established new supply sources for industrial customers in Uruguay and Thailand. In China, where sales increased 14% in 2002, we are continuing distribution of branded products into new regions and supporting the growth of key industrial customers.

Growing through acquisitions that enhance our portfolio of flavors. With the successful integration of Ducros, we are now confidently pursuing additional acquisitions. We plan to acquire leading consumer brands that deliver flavor as well as industrial businesses that specialize in value-added products. We are concentrating on companies located in geographic areas that offer the best opportunity for growth, namely North America, Europe and parts of Asia. We will be aggressive, yet disciplined in seeking acquisitions.

| | 2002 Net Sales

Sales to international markets exceed 35%

The newShotz line of seasoning blends in the U.K. is directed at 18-30 year olds who have limited experience in the kitchen but want restaurant quality taste in a few easy steps. A national TV ad drove the message about this fun product in a clever package. | | Using the Ducros acquisition as a platform, we are creating a truly pan-European business. Our focus is now regional rather than country-based. Further European market penetration will be gained via new distribution channels, enhanced merchandising and strong brand support. |

10

We are improving margins, investing in the business, and increasing sales and profits. These simple steps have been therecipe for our success over the last five years. They are the keys to future growth and increased shareholder value.

11

McCormick Worldwide

12

|

|

Industrial Products

Ingredients

Spices and Herbs

Extracts

Essential oils and

Oleoresins

Coating systems

Batters

Breaders

Marinades

Glazes

Rubs

Seasonings

Seasoning blends

Salty snack seasonings

Side dish seasonings

(rice, pasta, potato)

Sauces and Gravies

Condiments

Sandwich sauces

Ketchup

Mustards

Jams and Jellies

Seafood cocktail sauces

Salad dressings

Flavored oils

Compound Flavors

Beverage flavors

Dairy flavors

Confectionery flavors

Processed Flavors

Meat flavors

Savory flavors |

From locations around the world, our consumer brands reach more than 80 countries. Our industrial business provides a wide range of products to multinational restaurants and food processors.McCormick flavors span the globe.

13

| |  |

| Barry Beracha, Robert Lawless, William Stevens and Michael Fitzpatrick | | Francis Contino, James Brady and Robert Schroeder |

Board of Directors

Barry H. Beracha, 60

Executive Vice President

Sara Lee Corporation, Chief Executive Officer

Sara Lee Bakery Group—food, household and body care products and apparel

Chicago, Illinois

Director since 2000 *

James T. Brady, 62

Managing Director

Mid-Atlantic Ballantrae International, Ltd.—international management consultants

New York, New York

Director since 1998 +

Francis A. Contino, 57

Executive Vice President, Chief Financial Officer & Supply Chain

McCormick & Company, Inc.

Director since 1998

Robert G. Davey, 53

President—Global Industrial Group

McCormick & Company, Inc.

Director since 1994 | | Edward S. Dunn, Jr., 59

President

Dunn Consulting—

business consulting services

Williamsburg, Virginia

Director since 1998 *

J. Michael Fitzpatrick, 56

President & Chief Operating Officer

Rohm and Haas Company—paint and coatings, electronics, household products, personal care and salt

Philadelphia, Pennsylvania

Director since 2001 *

Freeman A. Hrabowski, III, 52

President

University of Maryland Baltimore County

Baltimore, Maryland

Director since 1997 +

Robert J. Lawless, 56

Chairman, President and Chief Executive Officer

McCormick & Company, Inc.

Director since 1994 | | John C. Molan, 56

President—Europe and Asia

McCormick & Company, Inc.

Director since 2000

Carroll D. Nordhoff, 57

Executive Vice President

McCormick & Company, Inc.

Director since 1991

Robert W. Schroeder, 57

Executive Vice President

McCormick & Company, Inc.

Director since 1996

William E. Stevens, 60

Chairman

BBI Group—venture capital

St. Louis, Missouri

Director since 1988 +

Karen D. Weatherholtz, 52

Senior Vice President—Human Relations

McCormick & Company, Inc.

Director since 1992 |

- +

- Audit Committee member

- *

- Compensation Committee member

14

| |  |

| Freeman Hrabowski and Carroll Nordhoff | | John Molan, Edward Dunn, Karen Weatherholtz and Robert Davey |

| | | | | | | |

| Corporate Officers | | Operating Executives |

| | | | | | | |

Robert J. Lawless

Chairman, President and Chief Executive Officer ‡

Allen M. Barrett, Jr.

Vice President—Corporate Communications

Paul C. Beard

Vice President—Finance

Joyce L. Brooks

Assistant Treasurer—Financial Services

W. Geoffrey Carpenter

Associate General Counsel & Assistant Secretary

Robert P. Conrad

Assistant Treasurer—International

Francis A. Contino

Executive Vice President, Chief Financial Officer & Supply Chain ‡

Robert G. Davey

President—Global Industrial Group ‡

Stephen J. Donohue

Vice President—Strategic Sourcing

Dr. Hamed Faridi

Vice President—Research & Development | | H. Grey Goode, Jr.

Vice President—Tax

Kenneth A. Kelly, Jr.

Vice President & Controller

Roger T. Lawrence

Vice President—Quality Assurance

Sharon H. Mirabelle

Vice President—Shared Services

Michael J. Navarre

Vice President—Operations

Carroll D. Nordhoff

Executive Vice President‡

Robert W. Schroeder

Executive Vice President

Robert W. Skelton

Senior Vice President, General Counsel & Secretary

Karen D. Weatherholtz

Senior Vice President—Human Relations

Jeryl Wolfe

Vice President—Global Business Solutions/Chief Information Officer | | Arduino Bianchi

President & Managing Director—McCormick De Centro America, S.A. de C.V.

Randy Carper

Vice President & General Manager—Frito Worldwide Division

Tapan Chakrabarty

Vice President & Managing Director—Industrial—Asia Pacific

Robert G. Davey

President—Global Industrial Group

Lazaro Gonzalez

President and Managing Director—McCormick Pesa, S.A. de C.V.

Randal M. Hoff

Vice President & General Manager—McCormick Flavor Division

Gavin Jacobs

Managing Director—McCormick South Africa Proprietary Limited

Charles T. Langmead

Vice President & General Manager—Food Service and Global Restaurant Division | | Timothy J. Large

Managing Director—McCormick Foods Australia Pty. Ltd.

John C. Molan

President—Consumer & Food Service—Europe and Asia

James M. Morrisroe

Vice President—McCormick Flavor Group—Europe

Donald E. Parodi

Vice President—Packaging Group

Steve Rafter

President—Tubed Products, Inc.

Victor K. Sy

Vice President and Managing Director—Consumer—McCormick Far East

Mark T. Timbie

President—La Cie McCormick Canada Co.

Iwan Williams

Vice President—Consumer—Europe

Alan D. Wilson

President—U.S. Consumer Products Division |

| | | | | | |

‡Executive Committee member

15

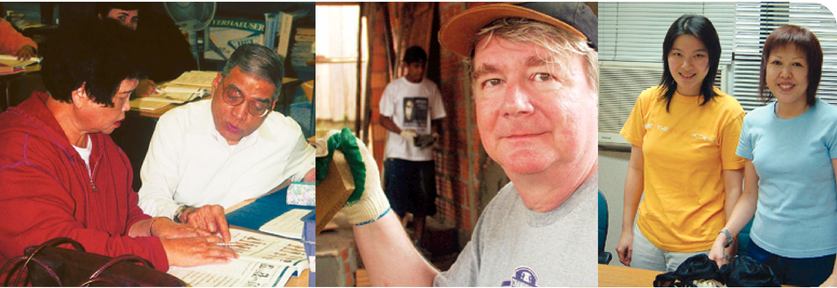

Recipe for Community Service

If recent world events have taught us anything, it is that we should cherish and protect family, neighbors and communities. From its beginning, McCormick has done more than build a thriving business. The Company has always been caring and civic-minded. McCormick's long-standing commitment to be a benevolent and involved member of the community is part of our culture.

Communities around the world have benefited in many ways from charitable activities of McCormick and its global employee population. These acts have been both large and small. Some come from the Company at large; others are from small groups and even individual employees. Some involve monetary donations and ongoing support. Others can be measured in the many hours that employees donate to a multitude of community organizations and activities. For many civic-minded McCormick employees, the leap from participation to passion is a quick one. The overall goal is always the same—the well-being and prosperity of a community and its citizens.

The Company has a formalized program of charitable giving that grants funds to worthwhile causes. Civic, health, welfare, education and arts projects receive the greatest attention. McCormick is also a committed supporter of initiatives such as Second Harvest and other food bank organizations. A perennial program is Charity Day when a vast majority of employees contribute time and salary to community organizations, which the Company matches.

Much of our attention is also focused on youth with a number of scholarships that provide the opportunity for young people to capitalize on their character. Each year, McCormick presents Unsung Heroes Scholarship Awards to worthy male and female high school student-athletes. The Company also takes an active role in Junior Achievement and other youth mentoring opportunities at schools, through scouting and in sports/recreation leagues.

McCormick's commitment to community service is rooted in the Company's history and thrives today. It's championed by the leadership team and supported at all levels of the Company. It's Bill Rauh, a Product Development Manager in Maryland, helping to build a church in a poverty-stricken area of Brazil. It's Betty Tan, of McCormick's Southeast Asian operation, devoting time to the local Breast Cancer Foundation. It's Naru Ojha, a scientist in Maryland, teaching in an "English as a second language" program.

A caring Company and involved employees create a successful recipe for community enrichment.

Naru Ojha devotes spare time teaching in an "English as a second language" program. "I can't forget the smiles on the faces of those men and women from various lands. They showed such pride as they spoke to their children in English."

Bill Rauh helped build a church in a poverty-stricken area of Brazil. "It was so rewarding to see the people when we held the first service in the church. During our 10-day mission, we built the church from the ground up."

Betty Tan (left) is a volunteer at the local Breast Cancer Foundation. "Our group provides a safe, caring environment for people coping with breast cancer. We share information, experiences and support."

16

Management's Discussion and Analysis

Certain performance measures used in this section are not defined by accounting principles generally accepted in the United States (GAAP). Refer to the bottom of this page for a discussion of the definitions and use of these terms.

The Company adopted Statement of Financial Accounting Standard (SFAS) No. 142 effective December 1, 2001. In accordance with this pronouncement, the Company ceased amortization of goodwill and indefinite lived intangible assets. Prior year financial information has not been restated. The amounts reported for operating income and net income in 2001 and 2000, in this section of the report, are presented as previously reported and also "excluding amortization" for comparability with current year results.

On February 19, 2002, the Company's Board of Directors announced a two-for-one stock split of both classes of common stock, effective April 8, 2002. As a result of the stock split, the Company's shareholders received an additional common share for each share held. All per share amounts and numbers of shares outstanding in this report have been restated for the stock split for all periods presented.

The Company measures segment performance in its internal reporting based on operating income excluding special charges and amortization. Management believes that this measurement is an important indicator of the ongoing operations of the individual business segments. Special charges are managed and measured through separate reporting to management.

Overview

For 2002, the Company reported net income of $179.8 million or $1.26 of diluted earnings per share compared to $146.6 million or $1.05 of diluted earnings per share in 2001. Excluding amortization, diluted earnings per share were $1.13 in 2001.

In summary, diluted earnings per share for 2002 increased by $.13 over 2001, excluding amortization. On a per share basis, this was achieved through higher operating income of $.11 and reduced interest expense of $.04, partially offset by the effect of increased shares outstanding of $.02.

In 2002, the Company continued to grow sales, gross profit and operating profit in both its consumer and industrial businesses. This was offset in part by continued weakness in our packaging business and operational difficulties in the U.K. brokerage portion of our consumer business. The Company has instituted changes to the packaging and U.K. brokerage operations to improve their profitability going forward.

Other Performance Measures

The other performance measures described below are used throughout this annual report to present alternative views of the Company's performance. Management believes that these other performance measures are used by industry analysts and investors to evaluate the Company's performance relative to its peers and, therefore, when read in conjunction with the financial statements, are informative. These measures are not defined by accounting principles generally accepted in the United States and may be calculated differently from similar measures used by other companies.

" Economic value added" (EVA)—McCormick defines economic value added as net income from operations, excluding interest and amortization expense, in excess of a capital charge for average capital employed. An "EVA" mark is owned by Stern Stewart & Co.

"Excluding Ducros"—Certain measures are presented excluding the results from the Ducros business and interest on the debt used to finance the acquisition, which was acquired on August 31, 2000. For the year ended November 30, 2000, this means excluding the results of Ducros for the fourth quarter ended November 30, 2000. For the year ended November 30, 2001, this means excluding the results of Ducros for the nine months ended August 31, 2001.

"Return on invested capital" (ROIC)—McCormick defines return on invested capital as net income from operations, excluding interest and amortization expense, divided by the sum of interest-bearing debt and equity (including minority interest).

17

In 2001, the Company formalized a plan to more rapidly streamline its operations to increase efficiency and reduce costs. The plan included the consolidation of several distribution and manufacturing locations, the reduction of administrative and manufacturing positions, and the reorganization of several joint ventures. Special charges recorded in 2002 under this plan were $8.0 million ($5.8 million after-tax) versus $11.7 million ($7.7 million after-tax) in 2001.

Beyond 2000

Late in 1999, the Company initiated the Beyond 2000 (B2K) program as a global program of business process improvement. B2K is designed to optimize our supply chain, reengineer our back office processes, strengthen our product development process, extend collaborative processes with our trading partners and generally enhance our capabilities to increase sales and profit. We have increased our overall levels of capital spending and expense from historical levels to support this effort.

In 2002, we implemented the initial phase of our B2K program and began using the new state-of-the-art technology and processes in a significant portion of U.S. operations, including our largest operating unit. The rollout of B2K to our remaining U.S. industrial operations and many international operating units will occur through 2005. We will continue to integrate and optimize all of our businesses through broader access to information and increased collaboration with our trading partners. Through B2K, employee time devoted to transaction execution will be reduced and more time will be devoted to the growth and effectiveness of the business.

Results of Operations—2002 compared to 2001

Net sales from consolidated operations in 2002 increased 4.6% to $2.3 billion when compared to 2001 primarily as a result of volume. The favorable effect of foreign currency fluctuations contributed 0.9% to this overall increase.

In 2002, net sales for the consumer business increased 4.9% compared to 2001 primarily as a result of volume. The favorable effect of foreign currency fluctuations contributed 1.5% to this overall increase. In local currency, consumer sales in the Americas increased 3.9%. Sales increased from higher sales of core products and the introduction of new products. Sales in the Americas also benefited from a price increase that was offset in part by higher promotional trade spending which is recorded as a reduction of sales. In Europe, sales in local currency increased 2.6%. This increase was attributable to favorable sales volume partially offset by unfavorable product mix. In the Asia/Pacific region, sales in local currency increased 4.3% due primarily to higher volumes in China which generated 8.3% sales growth. Growth in China was more modest in 2002 due to a strategic initiative that is underway. The Company is de-emphasizing some of its less profitable products in that market, such as ketchup and soy sauce, in order to focus on core products, such as spices and seasoning mixes, which have a higher margin.

In 2002, net sales for the industrial business increased 6.0% versus 2001 primarily as a result of volume. The favorable effect of foreign currency fluctuations contributed 0.5% to this overall increase. In local currency, industrial sales in the Americas were up 5.8% due to strong sales, particularly of seasoning products and products sold to our food service customers. In Europe, sales in local currency increased 1.3%. This increase was attributable to favorable sales volumes partially offset by unfavorable product mix. In the Asia/Pacific region, sales in local currency increased 11.4% due to

Dividends paid

18

increased volume predominantly in China as we continue to expand with our worldwide industrial customers.

In 2002, net sales for the packaging business decreased 5.2% versus 2001. The continued softening in the U.S. economy caused further declines in demand for our customers' products that are packaged in our tubes primarily during the first half of 2002. There were signs of improved demand in the second half of 2002, and sales in the fourth quarter of 2002 were up 9.4% compared to the fourth quarter of 2001.

Gross profit margin increased to 36.9% in 2002 from 35.9% in 2001. Gross profit margins for the Company were favorably impacted by global procurement initiatives and ongoing efforts to improve efficiencies. In the consumer business, gross profit margin improvement was also due to favorable raw material costs. In the industrial business, gross profit margin also improved due to a shift in product mix to higher-margin, more value-added products. These favorable effects on our food business gross margins were partially offset by implementation costs related to our B2K program and poor performance of our U.K. brokerage operation.

Selling, general and administrative expenses in the prior year included amortization of $12.9 million. Excluding amortization in 2001, selling, general and administrative expenses were higher in 2002 than 2001 on both a dollar basis and as a percentage of net sales. These increases were primarily due to increased distribution, pension, and insurance costs, as well as a higher investment in the Beyond 2000 program. The increased distribution costs are due to increased costs to service our customers during the initial system implementation of B2K and costs incurred in our U.K. brokerage operation. Insurance costs have increased concurrent with an industry-wide trend. While implementation expenses of B2K peaked in 2002, the future decrease in implementation expenses will be slightly more than offset by future increases in depreciation expense on the B2K systems that are implemented.

Pension expense was $15.2 million, $10.4 million and $10.2 million for the years ended November 30, 2002, 2001 and 2000, respectively. The increase in pension expense in 2002 was primarily due to a decrease in the discount rate from 8.0% to 7.25% and the fact that the U.S. pension plan investment returns during 2001 and 2002 have reflected the general decline in the U.S. stock market and have been below the expected long-term rate of return used to calculate pension expense. As a result of these investment return shortfalls and to the declining interest rate environment, the Company has reevaluated its pension assumptions and made the following changes in connection with the valuation performed at the end of 2002: the discount rate was reduced from 7.25% to 7.0%; the expected long-term rate of return was reduced from 10.0% to 9.0%; the salary scale was reduced from 4.5% to 4.0%; and a more recent mortality table was adopted. As a result of these changes and the less than expected investment return experience of 2001 and 2002, 2003 pension expense is expected to increase 60% over the 2002 level.

Operating income margin was 12.0% in 2002 compared to 10.8% in 2001. Excluding amortization, operating income margin was 11.4% in 2001.

In the consumer business, operating income margin was 16.5% in 2002 compared to 15.6% in 2001. Special charges for the consumer segment decreased to $2.6 million in 2002 from $5.1 million in 2001. Operating income margin excluding special charges and amortization was 16.7% in 2002 and 17.2% in 2001. Income from increased sales and favorable raw material costs was offset by poor performance in the U.K. brokerage operation. Late last year, the customer service function for the U.K. brokerage operation was outsourced to its distributor. The distributor did not adequately control the customer service process, which led to $4.0 million of inventory and receivable write-offs in 2002. (These write-offs were not part of the special charges.) In addition, the brokerage business had not been performing to expectations. The customer service function was brought back in-house and the Company switched distributors. No additional write-offs are anticipated and other changes to the U.K. brokerage operation have been made to improve profitability going forward.

In the industrial business, operating income margin was 10.7% in 2002 compared to 9.0% in 2001. Special charges for the industrial business decreased to $1.8 million in 2002 from $6.0 million in 2001. Operating income margin excluding special charges and amortization was 10.8% in 2002 and 9.7% in 2001. The increase in operating income margin versus prior year is due to continued cost reduction initiatives and a continued shift in sales to higher-margin, more value-added products. This improvement was led by strong performance with U.S. food service customers and in the Asia/Pacific region.

In the packaging business, operating income margin was 9.3% in 2002 compared to 8.5% in 2001. Special charges for the packaging business decreased to $0.4 million in 2002 from $0.6 million in 2001. Operating income margin excluding special charges and amortization was 9.5% in 2002 and 8.9% in 2001. The packaging segment continued to

19

experience softness in the first half of 2002, due to reduced demand for our customers' products, particularly tubes for personal care and cosmetics. However, there were signs of improvement in the packaging segment in the second half of the year. The increase in operating margin versus prior year is due to actions taken to adjust production activities, including a reduction in workforce.

Interest expense decreased in 2002 versus 2001 due to favorable interest rates and lower average debt levels.

Other income decreased in 2002 compared to 2001. This decrease is attributable to exchange losses on foreign currency transactions.

The effective tax rate for 2002 was 31.6%, down from 33.0% in 2001. The lower tax rate was attributable to the elimination of amortization, which is generally a non-tax deductible expense. This effect is predominantly in international operations.

Income from unconsolidated operations increased to $22.4 million in 2002 versus $21.5 million in 2001. Unconsolidated operations consist primarily of our McCormick de Mexico and Signature Brands joint ventures.

Results of Operations—2001 compared to 2000

On August 31, 2000, the Company acquired, through its subsidiary, McCormick France, S.A.S., one hundred percent of the share capital of Ducros, S.A., and Sodis, S.A.S. from Eridania Beghin-Say, S.A. Ducros is the leading consumer spice and herb business in Europe as well as the leading manufacturer and distributor of dessert aid products. Sodis manages the racking and merchandising of the Ducros products in supermarkets and hypermarkets. Collectively, these two operations are referred to as "Ducros" in this report.

The purchase price for the stock of Ducros was 2.75 billion French francs (equivalent to $379 million). The purchase contract provides for a potential adjustment to the purchase price with interest from the date of purchase. This adjustment procedure has not been concluded, however the potential adjustment under the contract can only decrease the purchase price. Any reduction in the purchase price would be recorded as a decrease to goodwill, and any interest received would be recorded as interest income.

The Company adopted Emerging Issues Task Force (EITF) 01-09 as of December 1, 2002. As a result of the adoption, results for 2001 and 2000 have been reclassified. See note 1 of Notes to Consolidated Financial Statements.

Net sales from consolidated operations in 2001 increased 8.6% to $2.2 billion when compared to 2000. Excluding the unfavorable effect of foreign currency exchange rates and the acquisition of Ducros, sales grew 3.5%.

In 2001, net sales for the consumer business increased 14.2% compared to 2000. Excluding the impact of Ducros and the impact of foreign currency exchange rates, net sales grew 3.4%. In local currency, consumer sales in the Americas were up 2.2% due to favorable sales volume. Sales of branded products were increased through effective promotion, advertising and merchandising and through the introduction of new products. In Europe, sales in local currency grew 6.5% excluding Ducros. This increase was attributable to favorable sales volume particularly in the U.K. In the Asia/Pacific region, sales in local currency increased 4.3% due to higher volume in China as the Company continued to penetrate new regions and expand the availability of the McCormick brand.

The industrial business also had a successful year in 2001, as net sales increased 4.8% versus 2000. Excluding the impact of Ducros and foreign exchange, sales grew 4.1%. In local currency, industrial sales in the Americas were up 3.8% due to higher restaurant sales, sales of new flavor and seasoning products to our snack seasoning customers, and increased sales to warehouse clubs. In Europe, sales in local currency grew 4.0% excluding Ducros due largely to favorable sales volume in the U.K. In the Asia/Pacific region, sales in local currency increased 8.5% due to sales growth with global restaurant customers in China.

In 2001, net sales for the packaging business increased 0.9% versus 2000. In the first half of 2001, tube and bottle sales were strong and resin costs were stabilizing. However, the second half of 2001 saw softening in the U.S. economy which caused a decline in consumer demand for our customers' products, particularly tubes for personal care and cosmetics.

20

Gross profit margin increased to 35.9% in 2001 from 34.8% in 2000, a 110 basis point improvement. Approximately two-thirds of this improvement was attributable to the Ducros business, which has a higher gross profit margin than the Company's other businesses. In the consumer business, gross profit margin improvement was due to a combination of the addition of the Ducros business, price increases in the U.S. business, lower costs of certain raw materials, and cost reduction initiatives. In the industrial business, gross profit margin improvement was mainly due to a shift in product mix to higher-margin, more value-added products as well as cost reduction initiatives and reduced costs of certain raw materials. Lower volumes and product mix in our packaging business resulted in lower margins in 2001.

Selling, general and administrative expenses were higher in 2001 than 2000 on both a dollar basis and as a percentage of net sales. These increases were primarily due to the new Ducros business, including $8.2 million in related goodwill amortization, increased distribution expenses due to higher energy costs, and higher investment for the B2K program. The 2000 results included a $3.8 million charge for the bankruptcy of an industrial customer.

Operating income margin was 10.8% in 2001 compared to 11.0% in 2000. Excluding amortization, operating income margin was 11.4% in 2001 and 2000.

In the consumer business, operating income margin was 15.6% in 2001 compared to 17.2% in 2000. Excluding special charges and amortization, operating income margin was 17.2% in 2001 and 17.9% in 2000. The decrease in operating income margin versus prior year was due primarily to the lower operating income margin of the Ducros business. Increases in operating profit due to price increases and reduced raw material costs were offset by increased investment spending on programs such as B2K.

In the industrial business, operating income margin was 9.0% in 2001 compared to 8.2% in 2000. Excluding special charges and amortization, operating income margin was 9.7% in 2001 and 8.4% in 2000. The increase in operating income margin versus prior year is due to cost reduction initiatives and a shift in sales to higher-margin, more value-added products. In addition, there were favorable effects of reduced raw material costs.

In the packaging business, operating income margin was 8.5% in 2001 compared to 9.9% in 2000. Excluding special charges and amortization, operating income margin was 8.9% in 2001 and 10.0% in 2000. The decrease in operating margin versus prior year is due to competitive pricing pressure and product mix impacting our gross margins.

Interest expense increased in 2001 versus 2000 due to higher average debt levels in 2001 as a result of the Ducros acquisition. Excluding Ducros, interest expense in 2001 decreased compared to 2000 due to favorable interest rates and lower average debt levels.

Other income increased in 2001 compared to 2000. This increase is attributable to interest income and exchange gains on foreign currency transactions.

The effective tax rate for 2001 was 33.0%, down from 35.8% in 2000. The Company transacts business in many

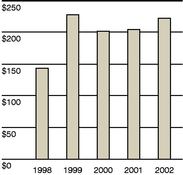

Debt-to-Total-Capital

21

different taxing jurisdictions around the world, all of which assess different tax rates. The mix of earnings among these jurisdictions is what caused a lower tax rate in 2001 versus 2000.

Income from unconsolidated operations increased to $21.5 million in 2001 versus $18.6 million in 2000, primarily due to continued strong performance from our McCormick de Mexico and Signature Brands joint ventures.

Financial Condition

Continued strong cash flows from operations enabled the Company to fund operating projects and investments designed to meet our growth objectives and reduce debt levels.

In the consolidated statement of cash flows, cash provided by operating activities was $223.7 million in 2002 compared to $204.5 million in 2001 and $202.0 million in 2000. Over the past three years, there has been an annual increase in cash flow from profits, excluding depreciation and amortization, and from dividends received from our unconsolidated affiliates. In 2000, cash flow also increased due to reductions in working capital items. In 2001 and 2002, working capital items decreased cash flow. When 2002 is compared to 2001 the increase in receivables is mainly due to strong sales in the fourth quarter of 2002. The increase in inventory is due to higher levels to meet increased sales and the temporary effect of increased inventory as B2K was implemented at several of our U.S. locations. When 2001 is compared to 2000, there were favorable trends in both receivables and inventories. These were offset by a $14.7 million interest rate swap settlement in the first quarter of 2001 used to fix the interest rate of the Ducros acquisition financing. Retirement plan funding reduced operating cash flow over the past several years by $23.6 million in 2002, $18.5 million in 2001, and $8.7 million in 2000. The 2003 contribution is expected to be below the amount contributed in 2002.

Investing activities used cash of $105.6 million in 2002 versus $111.9 million in 2001 and $442.6 million in 2000. The major use of cash for investing activities in 2000 was the acquisition of businesses, including the acquisition of Ducros in the third quarter. Capital expenditures in 2002 of $110.7 were slightly lower than in 2001, however the increments in 2002 and 2001 over 2000 were largely due to planned spending on B2K.

Financing activities used cash of $111.6 million in 2002 and $85.4 million in 2001 versus providing cash of $254.6 million in 2000. The Company financed $370.0 million of the Ducros acquisition through its issuance of commercial paper in August 2000, thereby increasing cash flows from short-term borrowings. The Company funded the balance of the purchase price from internally generated funds. In the first quarter of 2001, the Company finalized its medium-term note program for the Ducros acquisition and issued $300.0 million of notes, which replaced the existing commercial paper notes used to finance the transaction. In addition, during the third quarter of 2001, the Company retired $75.0 million of 8.95% fixed rate notes by issuing commercial paper. The variable rate on the $75.0 million of commercial paper is being fixed at 6.35% by interest rate swaps from 2001 through 2011. In the fourth quarter of 2002, the Company repaid short-term borrowings based on cash flow generated from operations. The common stock issued and common stock acquired by purchase in 2002

Cash from operations

in millions

22

and 2001 relates to the Company's stock compensation plans. In 2000, however, the Company purchased 2.5 million shares of common stock for $62.6 million under the Company's $250 million share repurchase program. Due to the acquisition of Ducros, the Company suspended the share repurchase program in May 2000. The Company is actively pursuing the purchase of additional consumer brands and value-added industrial businesses to broaden its portfolio. Excess cash after acquisitions will be used for share repurchase. Accordingly, the Company has reactivated its $250 million share repurchase program under which $141 million remains available for repurchase.

The return on plan assets of the Company sponsored pension plans has been below the expected long-term rate of return in 2001 and 2002. Pension plan investment returns during 2001 and 2002 have reflected the general decline in the stock market. As a result, the market value of the pension plan assets on the measurement date was below the accumulated benefit obligation, and the Company was required to record a minimum pension liability of $110.2 million ($69.1 million after-tax) as calculated under Statement of Financial Accounting Standard (SFAS) No. 87. This resulted in an increase in the pension liability of $110.2 million, a decrease in other comprehensive income of $69.1 million, an increase deferred tax assets of $40.1 million, and an increase in intangible assets of $1.0 million.

On January 8, 2003, the Company acquired, through its subsidiary, McCormick (UK) Ltd., the Uniqsauces business of Uniq PLC., a European chilled convenience food group, for approximately $19.5 million in cash. This acquisition will be financed through the Company's operating cash flow and borrowings from existing credit lines. Uniqsauces manufactures and markets condiments to retail grocery and food service customers, including quick service restaurants.

Dividend payments increased to $58.6 million in 2002, up 6.4% compared to $55.1 million in 2001. Dividends paid in 2002 totaled $.42 per share, up from $.40 per share in 2001. In November 2002, the Board of Directors approved a 4.8% increase in the quarterly dividend from $.105 to $.11 per share. Over the last 10 years, dividends have increased 10 times and have risen at a compounded annual rate of 8.3%.

The Company's ratio of debt-to-total-capital was 49.2% as of November 30, 2002, a decrease from 58.3% at November 30, 2001. The decrease was primarily due to lower average debt levels and increases in shareholders' equity. The Company has returned to its target range of 45-55% for the debt-to-total-capital ratio; however, future acquisitions could alter this projection.

Management believes that internally generated funds and existing sources of liquidity are sufficient to meet current and anticipated financing requirements during the next 12 months.

Special Charges

Over the last three years, the Company made significant progress in streamlining its operations in a manner consistent with its strategic plan. Gross profit margins improved during this period by 210 basis points. This served as fuel for revenue growth and improved profits. With the investment in B2K, the Company is well positioned to continue this record of improving margins into the future.

While the year 2002 was another record year for McCormick, the U.S. and global economies did not fare as well. Recognizing that it is not immune to the impact of these difficult financial times on our customers and consumers, the Company formalized a plan in 2001 to more rapidly streamline its operations to meet the challenges that it, and all companies, faced in 2002 and in the future.

This plan, adopted during the 2001 fourth quarter, included the consolidation of several distribution and manufacturing locations, the reduction of administrative and manufacturing positions, and the reorganization of several joint ventures. The total plan will cost approximately $32.6 million ($25.6 million after tax). Total cash expenditures in connection with these costs will approximate $16.7 million, which will be funded through internally generated funds. Once fully implemented, annualized savings are expected to be approximately $8.0 million ($5.3 million after tax). These savings will be used for investment spending on initiatives such as brand support and supply chain management. The aforementioned savings and administrative expenses are expected to be included within the cost of goods sold and selling, general and administrative expenses in the consolidated statement of income.

23

In the fourth quarter of 2001, the Company recorded charges of $11.7 million ($7.7 million after tax) under this plan. Of this amount, $10.8 million was classified as special charges and $0.9 million as cost of goods sold in the consolidated statement of income. Additional amounts under the plan were not recorded at that time as they were either incremental costs directly related to the implementation of the plan, or the plans were not sufficiently detailed to allow for accounting accrual.

The costs recorded in the fourth quarter of 2001 related to the consolidation of manufacturing in Canada, a distribution center consolidation in the U.S., a product line elimination and a realignment of our sales operations in the U.K., and a workforce reduction of 275 positions which encompasses plans in all segments and across all geographic areas. As of November 30, 2002, 190 of the 275 position reductions had been realized.

The major components of the 2001 special charges include charges for employee termination benefits of $6.3 million, asset write-downs of $1.6 million, and other related exit costs of $3.8 million.

During the year ended November 30, 2002, the Company recorded an additional $8.0 million ($5.8 million after-tax) of special charges associated with the 2001 restructuring plan, which could not be accrued at that time. These charges included the write-off of an investment in an industry purchasing consortium, further costs of lease exit and relocation costs related to the workforce reduction and realignment of consumer sales operations in the U.S., further severance and other costs related to the previously discussed workforce reduction and an additional 10 administrative and 34 production related positions, further costs related to the closure of a U.S. distribution center and further costs of the consolidation of manufacturing in Canada that primarily resulted from the disposition of a manufacturing facility. During 2002, total cash expenditures in connection with the plan were $6.3 million. Streamlining actions accrued as of November 30, 2002 are expected to be completed in 2003.

The major components of the 2002 special charges include charges for employee termination benefits of $3.8 million, asset write-downs of $3.3 million, and other related exit costs of $0.9 million.

Costs yet to be incurred ($12.9 million) from the 2001 restructuring plan include the reorganization of several joint ventures and additional costs related to the consolidation of manufacturing locations, primarily costs of relocating employees and machinery and equipment. Additional cash expenditures under the plan will approximate $10.4 million. These actions are expected to be completed in 2003 and 2004.

Refer to note 2 of the notes to consolidated financial statements for further information.

Market Risk Sensitivity

The Company utilizes derivative financial instruments to enhance its ability to manage risk, including foreign exchange and interest rate exposures, which exist as part of its ongoing business operations. The Company does not enter into contracts for trading purposes, nor is it a party to any leveraged derivative instrument. The use of derivative financial instruments is monitored through regular communication with senior management and the utilization of written guidelines. The information presented below should be read in conjunction with notes 6 and 7 of the notes to consolidated financial statements.

Foreign Exchange Risk—The Company is exposed to fluctuations in foreign currency in the following main areas: cash flows related to raw material purchases; the translation of foreign currency earnings to U.S. dollars; the value of foreign currency investments in subsidiaries and unconsolidated affiliates and cash flows related to repatriation of these investments. Primary exposures include the U.S. dollar versus functional currencies of the Company's major markets (Euro, British pound sterling, Australian dollar, Canadian dollar, Mexican peso, Japanese yen, and Chinese renminbi). The Company enters into foreign currency exchange contracts to facilitate managing foreign currency risk.

The following table summarizes the foreign currency exchange contracts held at November 30, 2002. All contracts are valued in U.S. dollars using year-end 2002 exchange rates and have been designated as hedges of foreign currency transactional exposures, firm commitments or anticipated transactions, all with a maturity period of less than one year.

24

Currency Sold

| | Currency

Received

| | Notional

Value

(millions)

| | Average

Contractual

Exchange Rate

(USD/fc)

| | Fair

Value

(millions)

| |

|---|

| Foreign currency exchange contracts | | | | | | | | | | | |

| Euro | | USD | | $ | 13.4 | | .96 | | $ | (.3 | ) |

| British pound sterling | | USD | | | 6.8 | | 1.52 | | | (.1 | ) |

| Canadian dollar | | USD | | | 4.8 | | .64 | | | — | |

The Company has a number of smaller contracts with an aggregate notional value of $2.0 million to purchase or sell various other currencies, such as Australian dollar, Swiss franc, Polish zloty, and South African rand as of November 30, 2002. The aggregate fair value of these contracts was $(0.1) at November 30, 2002.

At November 30, 2001, the Company had foreign currency exchange contracts for the Euro, British pound sterling, Canadian dollar, Australian dollar, and Swiss franc with a notional value of $38.0 million, all of which matured in 2002. The fair value of these contracts was $0.6 million at November 30, 2001.

Contracts with durations which are less than 5 days and used for short-term cash flow funding within the Company are not included in the notes or table above.

During 2002, the foreign currency translation component in other comprehensive income is principally related to the impact of exchange rate fluctuations on the Company's net investments in France, the U.K., Canada, and Australia. The Company did not hedge its net investments in subsidiaries and unconsolidated affiliates in 2002, 2001, or 2000.

Interest Rate Risk—The Company's policy is to manage interest rate risk by entering into both fixed and variable rate debt. The Company also uses interest rate swaps to achieve a desired mix of its fixed and variable rate debt. The table that follows provides principal cash flows and related interest rates, excluding the effect of interest rate swaps, by fiscal year of maturity at November 30, 2002 and 2001. For foreign currency-denominated debt, the information is presented in U.S. dollar equivalents. Variable interest rates are based on the weighted-average rates of the portfolio at the end of the year presented.

Year of Maturity at November 30, 2002

| | 2003

| | 2004

| | 2005

| | 2006

| | Thereafter

| | Total

| | Fair Value

|

|---|

| | (millions)

|

|---|

| Debt | | | | | | | | | | | | | | | | | | | | | |

| Fixed rate | | $ | .6 | | $ | 16.3 | | $ | 32.3 | | $ | 196.6 | | $ | 205.6 | | $ | 451.4 | | $ | 495.6 |

| Average interest rate | | | 1.75 | % | | 7.03 | % | | 7.10 | % | | 7.42 | % | | 7.52 | % | | | | | |

| | |

| |

| |

| |

| |

| |

| |

|

| Variable rate | | $ | 136.7 | | | — | | | — | | | — | | $ | 3.1 | | $ | 139.8 | | $ | 139.8 |

| Average interest rate | | | 2.70 | % | | | | | | | | | | | 3.34 | % | | | | | |

Year of Maturity at November 30, 2001

| | 2003

| | 2004

| | 2005

| | 2006

| | Thereafter

| | Total

| | Fair Value

|

|---|

| | (millions)

|

|---|

| Debt | | | | | | | | | | | | | | | | | | | | | |

| Fixed rate | | $ | 1.0 | | $ | .5 | | $ | 16.3 | | $ | 32.3 | | $ | 401.9 | | $ | 452.0 | | $ | 464.8 |

| Average interest rate | | | 3.81 | % | | 1.41 | % | | 7.03 | % | | 7.10 | % | | 7.47 | % | | | | | |

| | |

| |

| |

| |

| |

| |

| |

|

| Variable rate | | $ | 209.8 | | | — | | | — | | | — | | $ | 3.1 | | $ | 212.9 | | $ | 212.9 |

| Average interest rate | | | 3.19 | % | | | | | | | | | | | 3.31 | % | | | | | |

| | |

| |

| |

| |

| |

| |

| |

|

Note: The variable interest rate on $75 million of commercial paper is hedged by interest rate swaps through 2011. Net interest payments will be fixed at 6.35% during this period. Interest rate swaps, settled upon the issuance of the medium-term notes, effectively fixed the interest rate on $294 million of the notes at a weighted average fixed rate of 7.62%.

25

Commodity Risk—The Company purchases certain raw materials which are subject to price volatility caused by weather and other unpredictable factors. While future movements of raw material costs are uncertain, a variety of programs, including periodic raw material purchases, purchases of raw materials for future delivery, and customer price adjustments help the Company address this risk. Generally, the Company does not use derivatives to manage the volatility related to this risk.

Contractual Obligations and Commercial Commitments

The following table reflects a summary of our contractual obligations and commercial commitments as of November 30, 2002:

Payments Due by Year

| | Total

| | 2003

| | 2004

| | 2005

| | 2006 and

thereafter

|

|---|

| | (in millions)

|

|---|

| Contractual Cash Obligations | | | | | | | | | | | | | | | |

| Notes payable | | $ | 136.7 | | $ | 136.7 | | | — | | | — | | | — |

| Long-term debt | | | 454.5 | | | .6 | | $ | 16.3 | | $ | 32.3 | | $ | 405.3 |

| Operating leases | | | 63.5 | | | 14.1 | | | 10.5 | | | 7.2 | | | 31.7 |

| Raw material purchase obligations | | | 74.4 | | | 74.4 | | | — | | | — | | | — |

| Other purchase obligations | | | 13.5 | | | 13.5 | | | — | | | — | | | — |

| | |

| |

| |

| |

| |

|

| Total contractual cash obligations | | $ | 742.6 | | $ | 239.3 | | $ | 26.8 | | $ | 39.5 | | $ | 437.0 |

| | |

| |

| |

| |

| |

|

Amount of Commitment Expiration by Year

| | Total

| | 2003

| | 2004

| | 2005

| | 2006 and

thereafter

|

|---|

| | (in millions)

|

|---|

| Commercial Commitments | | | | | | | | | | | | | | | |

| Guarantees | | $ | 18.2 | | $ | 1.5 | | $ | .5 | | $ | 15.0 | | $ | 1.2 |

| Standby letters of credit | | | 9.8 | | | 9.8 | | | — | | | — | | | — |

| Lines of credit | | | 409.7 | | | 184.7 | | | — | | | — | | | 225.0 |