Exhibit 99.2

HOLDINGS COMPUTING June 2022 Flash July 2022

The following discussion is completely qualified by the legal disclosures on the several pages following this one Our goal is to share with you some of our strategic thinking and financial analysis we are using to guide the growth of our business The discussion is in line with our principles of being accountable and transparent with shareholders We operate in a hyper dynamic economic environment. That’s a fancy way of saying things change quickly. What we are telling you here is based on our estimates and assumptions which are our best guess. We reserve the right to revise our point of view based on new information and changes in the business environment Despite an uncertain, dynamic environment, we must plan and make operating and investment decisions. This presentation lays some of that out for your review

Legal Disclosure & Disclaimer This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act that reflect our current views with respect to, among other things, our operations, business strategy, interpretation of prior development activities, plans to develop and commercialize our products and services, potential market opportunity, financial performance and needs for additional financing. We have used words like "anticipate," "believe," "could," "estimate," "expect," "future," "intend," "may," "plan," "potential," "project," "will," and similar terms and phrases to identify forward-looking statements in this presentation. The forward-looking statements contained in this presentation are based on management's current expectations and are subject to substantial risks, uncertainty and changes in circumstances. Actual results may differ materially from those expressed by these expectations due to risks and uncertainties, including, among others, those related to our ability to obtain additional capital on favorable terms to us, or at all, the success, timing and cost of ongoing or future operations, the lengthy and unpredictable nature of the project development, and technology process and businesses in which we currently engage or may engage. These risks and uncertainties include, but may not be limited to, those described in our filings with the SEC. Forward-looking statements speak only as of the date of this presentation, and we undertake no obligation to review or update any forward-looking statement except as may be required by applicable law. 3

Legal Disclosure & Disclaimer The material in this presentation has been prepared by Soluna and is general background information about Soluna’s activities, current as at the date of this presentation and is provided for information purposes only. It should be read in conjunction with Soluna’s periodic and continuous disclosure announcements filed with the Securities and Exchange Commission. This presentation provides information in summary form only and is not intended to be complete. Soluna makes no representation or warranty, express or implied, as to the accuracy, completeness, fairness or reliability of any of the information, illustrations, examples, opinions, forecasts, reports, estimates and conclusions contained in this presentation. It is not intended to be relied upon as advice or a recommendation to investors or potential investors and does not take into account the investment objectives, financial situation, taxation situation or needs of any particular investor. Due care and consideration should be undertaken when considering and analyzing Soluna’s future performance and business prospects. THIS PRESENTATION IS NOT INTENDED TO SERVE AS A FORECAST OF ANY SUCH FUTURE PERFORMANCE OR PROSPECTS. An investor must not act on any matter contained in this document but must make its own assessment of Soluna and conduct its own investigations and analysis. Investors should assess their own individual financial circumstances and consider talking to a financial adviser, professional adviser or consultant before making any investment decision. This document does not constitute an offer, invitation, solicitation or recommendation with respect to the purchase or sale of any security in Soluna nor does it constitute financial product advice. This document is not a prospectus, product disclosure statement or other offer document under United States federal or state securities law or under any other law. This document has not been filed, registered or approved by regulatory authorities in any jurisdiction. Any projection, forecast, estimate or other “forward-looking” statement in this presentation only illustrates hypothetical performance under specified assumptions of events or conditions that have been clearly delineated herein. Such projections, forecasts, estimates or other “forward-looking” statements are not reliable indicators of future performance. Hypothetical or illustrative performance information contained in these materials may not be relied upon as a promise, prediction or projection of future performance and are subject to significant assumptions and limitations. In addition, not all relevant events or conditions may have been considered in developing such assumptions. READERS OF THIS DOCUMENT SHOULD UNDERSTAND THE ASSUMPTIONS AND EVALUATE WHETHER THEY ARE APPROPRIATE FOR THEIR PURPOSES. SOME EVENTS OR CONDITIONS MAY NOT HAVE BEEN CONSIDERED IN SUCH ASSUMPTIONS. ACTUAL EVENTS OR CONDITIONS WILL VARY AND MAY DIFFER MATERIALLY FROM SUCH ASSUMPTIONS. READERS SHOULD UNDERSTAND SUCH ASSUMPTIONS AND EVALUATE WHETHER THEY ARE APPROPRIATE FOR THEIR PURPOSES. This presentation may include figures related to past performance or simulated past performance as well as forecasted or simulated future performance. Soluna disclaims any obligation to update their views of such risks and uncertainties or to publicly announce the results of any revision to the forward-looking statements made herein. 4

Legal Disclosure & Disclaimer Use of Projections and Illustrations This presentation contains certain financial forecasts and illustrations. Neither Soluna’s [nor Soluna Holdings] independent auditors have studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation. The material in this presentation is for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: non-gaap revenue, cash contribution margin, cash contribution margin excluding tornado, cash contribution margin excl. tornado & shutdown, adjusted cost of cryptocurrency revenue and adjusted EBITDA contribution. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Use of Estimates in Monthly Presentations Numbers presented BEFORE the release of Form 10-Q for second quarter ended June 30th, 2022, are monthly estimates and subject to change upon final accounting adjustments and entries. These monthly estimates are presented as an illustration of management’s review of key metrics that help in understanding the performance of the Company. Readers are strongly encouraged to review this presentation in connection with the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2022 and the Company’s Annual Report on Form 10-K for the year ended December 31, 2021. 5

Key Operating Principles (1) Calculated as a percent of total undiluted shares 6

We buy curtailed energy from renewable power plants and convert it to clean, low-cost global computing. Batch-oriented Excess energy from Computing renewable sources like cryptocurrency mining

The $10B Digital currencies opportunity $5B beyond Pharma research crypto is $40B Batchable Graphics/video Computing $40B Scientific research 8

Agenda In this presentation, we will be covering the following items: Strategy Update June 2022 Results In Detail 9

Strategy Update 10

Engineered Right to thrive in company a BTC downturn Right plan for volatile environment 11

Strategy Update Distinct investment thesis Soluna is NOT a collection of projects Investing through the cycle Low-cost power enables Soluna to continue investment Execution milestones are path dependent 12

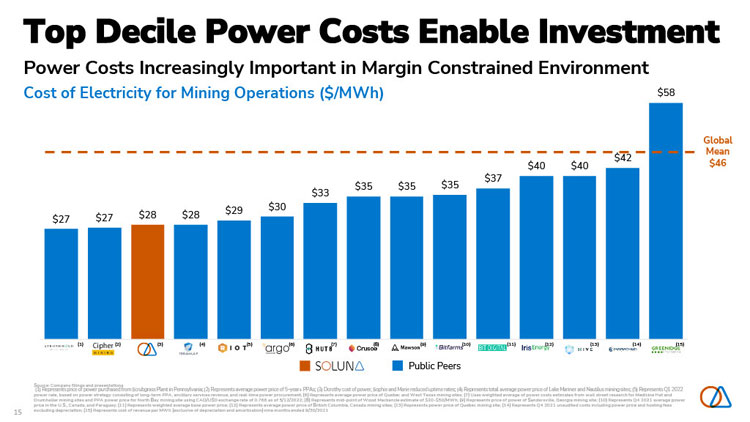

Distinct Investment Thesis Low power cost is the key value driver: Every site must have the ability to operate between $25-27 per MWh Assures operational profitability and ability to invest through the cycle Renewable energy generators & grid operators need flexible load capacity: Creates low-cost power opportunities Expansion into High Performance Computing: Clear target to grow organically and by acquisition Soluna is at the intersection of power and computing business Strong operating culture Volatile environment creates opportunities to consolidate the mining and high-performance computing verticals Strong value and Return on Invested Capital (“ROIC”) orientation applied to every opportunity 13

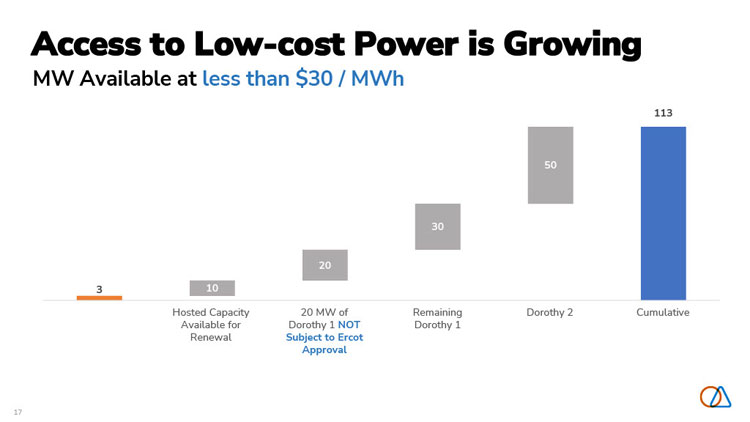

Now is The Time to Invest Important to Invest THROUGH the Cycle Cost of computing equipment down 70 80% since January Miner payback period < 1 year Near term pipeline of 100+ MW at less than $30 / MWh Sourcing Non-Dilutive Capital to Fund Growth Long-term pipeline of opportunities near 2 GW Project financing process remains active Enables Soluna to monetize intellectual property Focus on robust ROIC 14

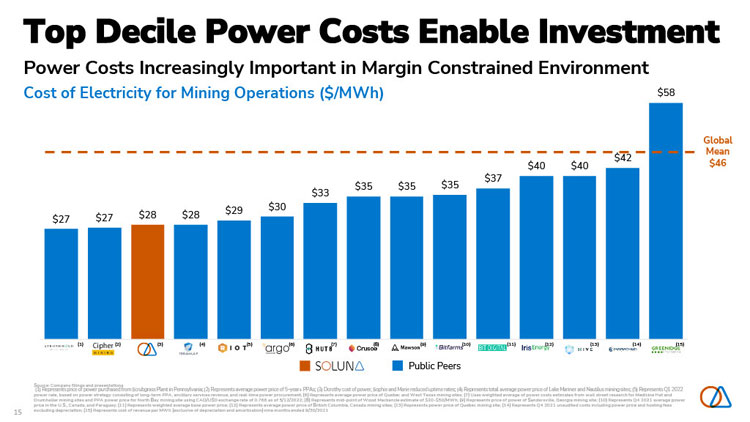

Top Decile Power Costs Enable Investment Power Costs Increasingly Important in Margin Constrained Environment Cost of Electricity for Mining Operations ($/MWh) $58 Global Mean $42 $40 $40 $46 $37 $35 $35 $35 $33 $29 $30 $27 $27 $28 $28 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) (14) (15) Public Peers Source: Company filings and presentations (1) Represents price of power purchased from Scrubgrass Plant in Pennsylvania; (2) Represents average power price of 5-year+ PPAs; (3) Dorothy cost of power, Sophie and Marie reduced uptime rates; (4) Represents total average power price of Lake Mariner and Nautilus mining sites; (5) Represents Q1 2022 power rate, based on power strategy consisting of long-term PPA, ancillary services revenue, and real-time power procurement; (6) Represents average power price of Quebec and West Texas mining sites; (7) Uses weighted average of power costs estimates from wall street research for Medicine Hat and Drumheller mining sites and PPA power price for North Bay mining site using CAD/USD exchange rate of 0.766 as of 5/12/2022; (8) Represents mid-point of Wood Mackenzie estimate of $20-$50/MWh; (9) Represents price of power of Sandersville, Georgia mining site; (10) Represents Q4 2021 average power price in the U.S., Canada, and Paraguay; (11) Represents weighted average base power price; (12) Represents average power price of British Columbia, Canada mining sites; (13) Represents power price of Quebec mining site; (14) Represents Q4 2021 unaudited costs including power price and hosting fees 15 excluding depreciation; (15) Represents cost of revenue per MWh (exclusive of depreciation and amortization) nine months ended 9/30/2021

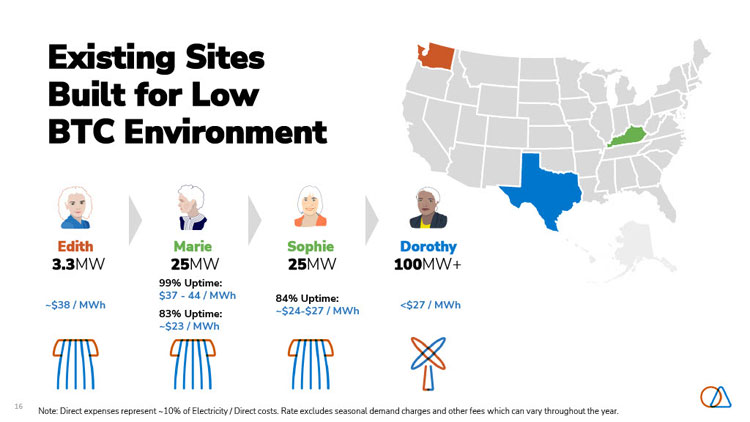

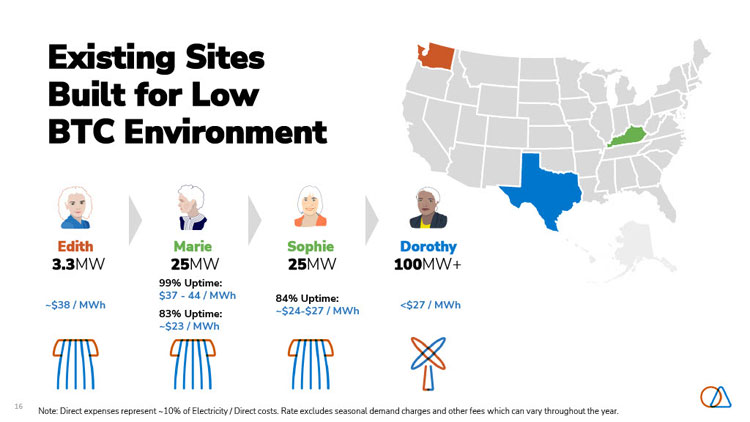

Existing Sites Built for Low BTC Environment Edith Marie Sophie Dorothy 3.3MW 25MW 25MW 100MW+ 99% Uptime: $37 - 44 / MWh 84% Uptime: ~$38 / MWh <$27 / MWh 83% Uptime: ~$24-$27 / MWh ~$23 / MWh 16 Note: Direct expenses represent ~10% of Electricity / Direct costs. Rate excludes seasonal demand charges and other fees which can vary throughout the year.

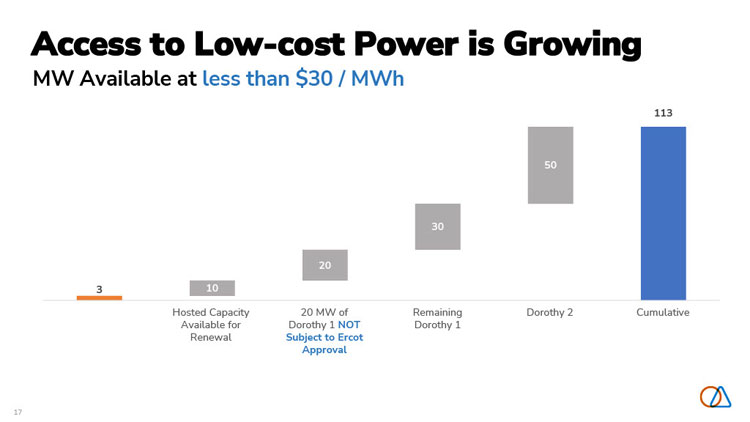

Access to Low-cost Power is Growing MW Available at less than $30 / MWh 113 50 30 20 3 10 Today Hosted Capacity Dorothy 20 MW of1 NOT Subject Remaining RemainingDorothy 1 Dorothy 2 Cumulative Available for Renewal Available for to Ercot Approval Dorothy 1 NOT Dorothy 1 Renewal Subject to Ercot Approval 17

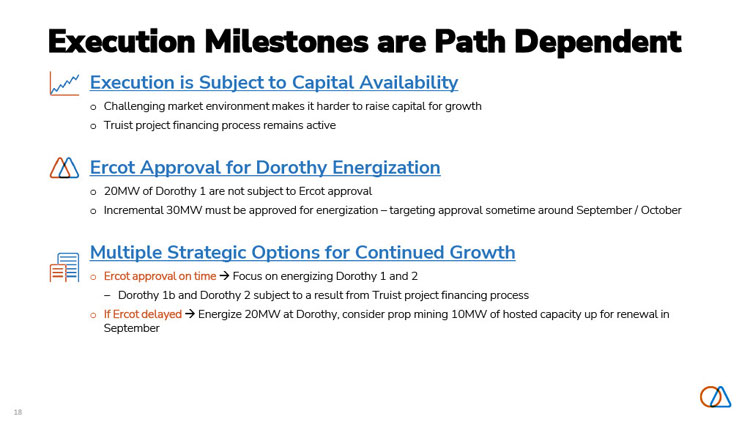

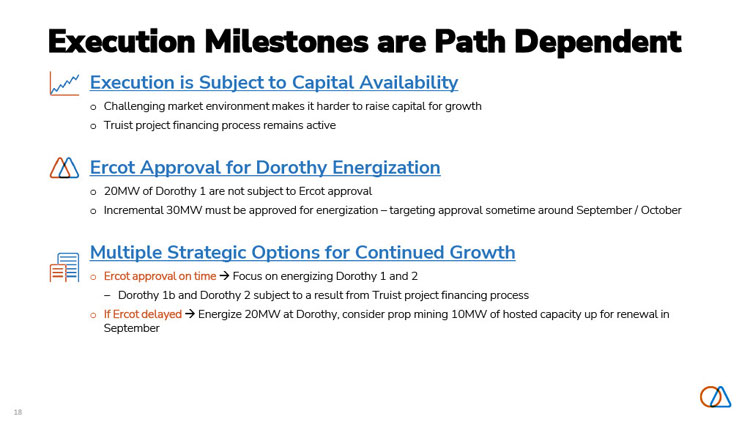

Execution Milestones are Path Dependent Execution is Subject to Capital Availability o Challenging market environment makes it harder to raise capital for growth o Truist project financing process remains active Ercot Approval for Dorothy Energization o 20MW of Dorothy 1 are not subject to Ercot approval o Incremental 30MW must be approved for energization targeting approval sometime around September / October Multiple Strategic Options for Continued Growth o Ercot approval on time → Focus on energizing Dorothy 1 and 2 Dorothy 1b and Dorothy 2 subject to a result from Truist project financing process o If Ercot delayed → Energize 20MW at Dorothy, consider prop mining 10MW of hosted capacity up for renewal in September 18

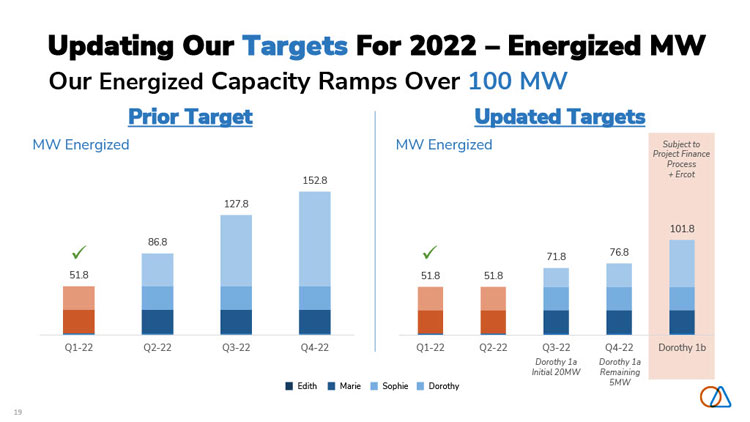

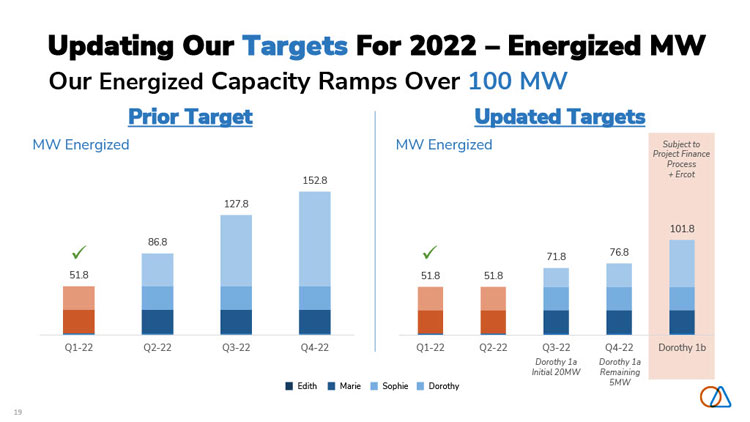

Updating Our Targets For 2022 Energized MW Our Energized Capacity Ramps Over 100 MW Prior Target Updated Targets MW Energized MW Energized Subject to Project Finance Process + Ercot 152.8 127.8 101.8 86.8 w w 71.8 76.8 51.8 51.8 51.8 Q1-22 Q2-22 Q3-22 Q4-22 Q1-22 Q2-22 Q3-22 Q4-22 Dorothy 1b Dorothy 1a Dorothy 1a Initial 20MW Remaining Edith Marie Sophie Dorothy 5MW 19

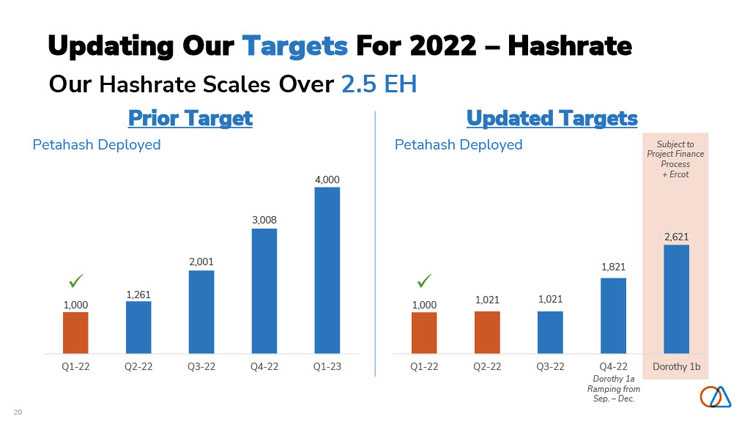

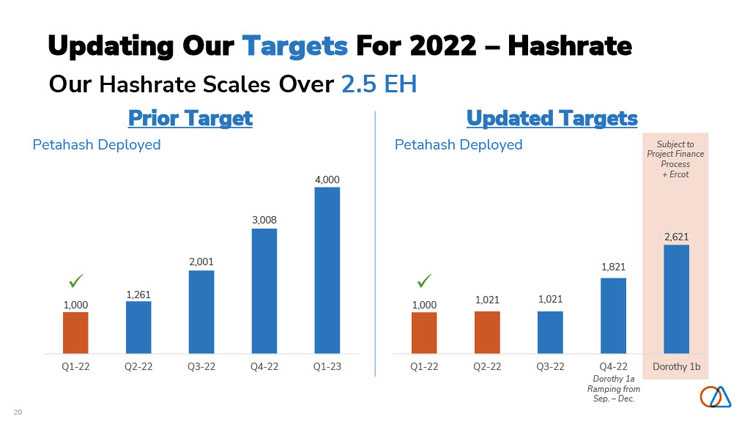

Updating Our Targets For 2022 Hashrate Our Hashrate Scales Over 2.5 EH Prior Target Updated Targets Petahash Deployed Petahash Deployed Subject to Project Finance Process + Ercot 4,000 3,008 2,621 2,001 1,821 w w 1,261 1,021 1,000 1,000 1,021 Q1-22 Q2-22 Q3-22 Q4-22 Q1-23 Q1-22 Q2-22 Q3-22 Q4-22 Dorothy 1b Dorothy 1a Ramping from Sep. Dec. 20

Growing Pipeline Supports Path Beyond 150MW and 4 EH Multiple opportunities for next 50 100MW Truist project financing process focused on supporting outsized pipeline growth Select 100MW+ 150MW 130MW Opportunities Dorothy Kati Cynthia Dorothy 1a Q4 Dorothy 1b & 2 Design Prospecting Subject to Capital Availability Powered by 21

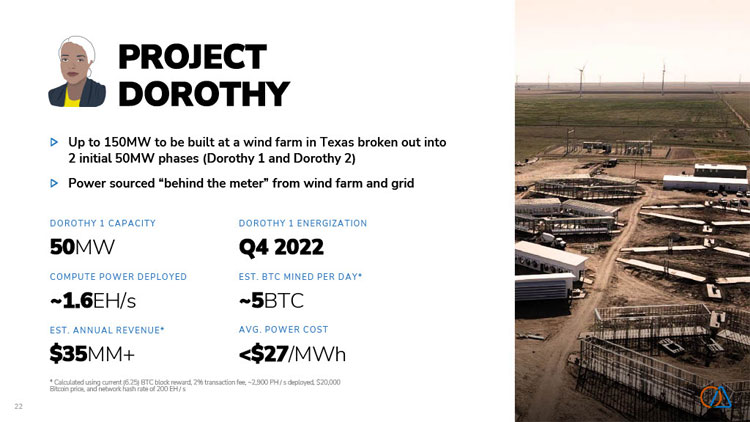

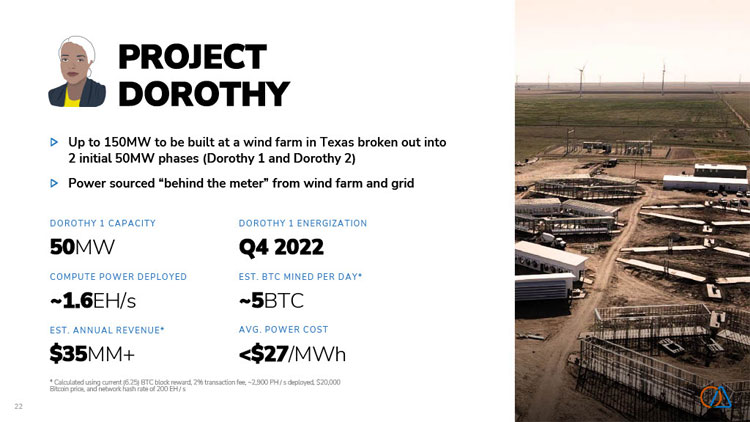

PROJECT DOROTHY Up to 150MW to be built at a wind farm in Texas broken out into 2 initial 50MW phases (Dorothy 1 and Dorothy 2) Power sourced “behind the meter” from wind farm and grid DOROTHY 1 CAPACITY DOROTHY 1 ENERGIZATION 50 MW Q4 2022 COMPUTE POWER DEPLOYED EST. BTC MINED PER DAY* ~1.6EH/s ~5BTC EST. ANNUAL REVENUE* AVG. POWER COST $35MM+ <$27/MWh * Calculated using current (6.25) BTC block reward, 2% transaction fee, ~2,900 PH / s deployed, $20,000 Bitcoin price, and network hash rate of 200 EH / s 22

Facility Results Review We will review each facility Then look at the consolidated results

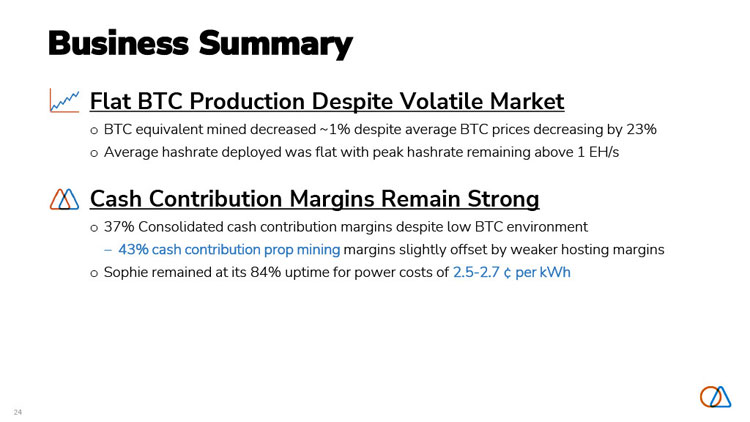

Business Summary Flat BTC Production Despite Volatile Market o BTC equivalent mined decreased ~1% despite average BTC prices decreasing by 23% o Average hashrate deployed was flat with peak hashrate remaining above 1 EH/s Cash Contribution Margins Remain Strong o 37% Consolidated cash contribution margins despite low BTC environment 43% cash contribution prop mining margins slightly offset by weaker hosting margins o Sophie remained at its 84% uptime for power costs of 2.5-2.7 ¢ per kWh 24

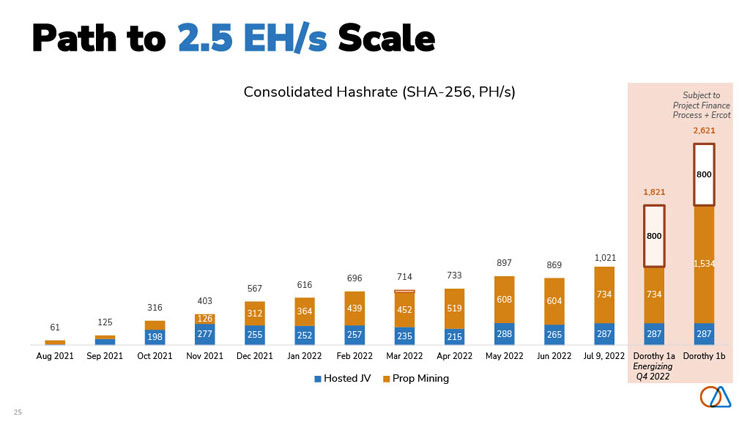

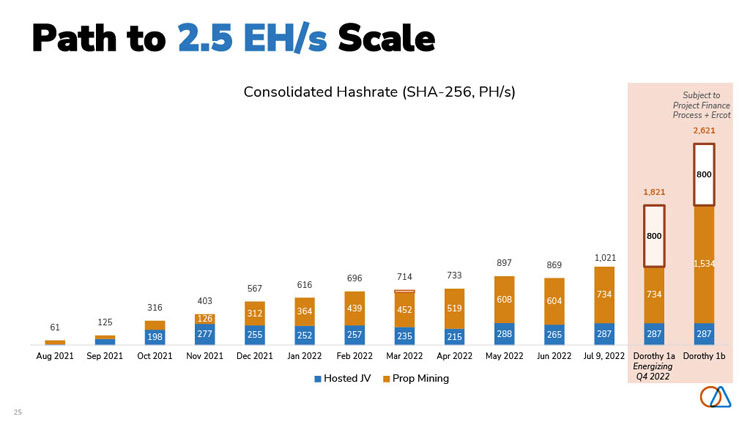

Path to 2.5 EH/s Scale Consolidated Hashrate (SHA-256, PH/s) Subject to Project Finance Process + Ercot 2,621 800 1,821 800 1,021 897 869 1,534 696 714 733 567 616 734 734 403 608 604 316 364 439 452 519 312 125 126 61 198 277 255 252 257 235 215 288 265 287 287 287 Aug 2021 Sep 2021 Oct 2021 Nov 2021 Dec 2021 Jan 2022 Feb 2022 Mar 2022 Apr 2022 May 2022 Jun 2022 Jul 9, 2022 Dorothy 1a Dorothy 1b Energizing Hosted JV Prop Mining Q4 2022 25

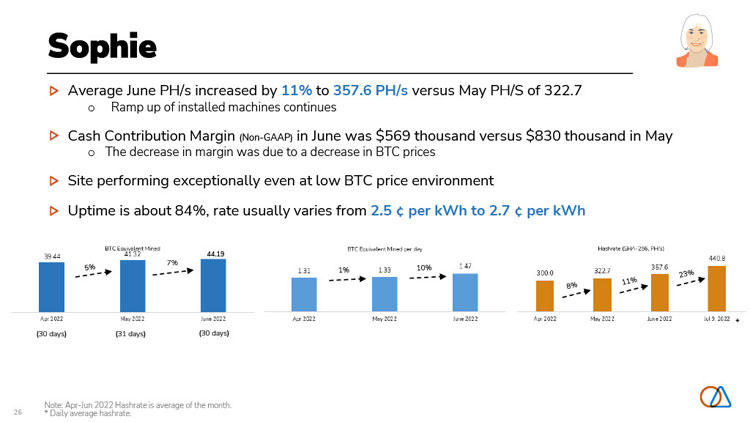

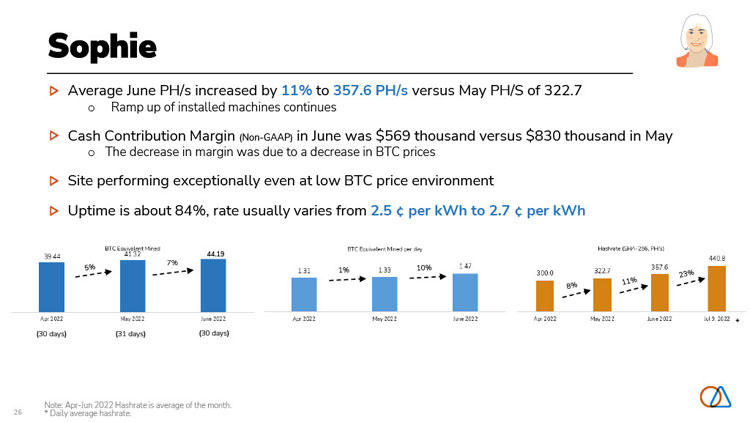

Sophie Average June PH/s increased by 11% to 357.6 PH/s versus May PH/S of 322.7 o Ramp up of installed machines continues Cash Contribution Margin (Non-GAAP) in June was $569 thousand versus $830 thousand in May o The decrease in margin was due to a decrease in BTC prices Site performing exceptionally even at low BTC price environment Uptime is about 84%, rate usually varies from 2.5 ¢ per kWh to 2.7 ¢ per kWh 44.19 7% * (30 days) (31 days) (30 days) Note: Apr-Jun 2022 Hashrate is average of the month. 26 * Daily average hashrate.

Sophie: Non-GAAP Historical Financials For more information on these non-GAAP financial measures, please see the section captioned “Reconciliation of non-GAAP results of operations to the nearest comparable GAAP measures”. To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: non-gaap revenue, contribution margin, cash contribution margin, adjusted cost of cryptocurrency revenue and adjusted EBITDA contribution. The presentation of this financial information is not intended to be considered in isolation or as a 27 substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

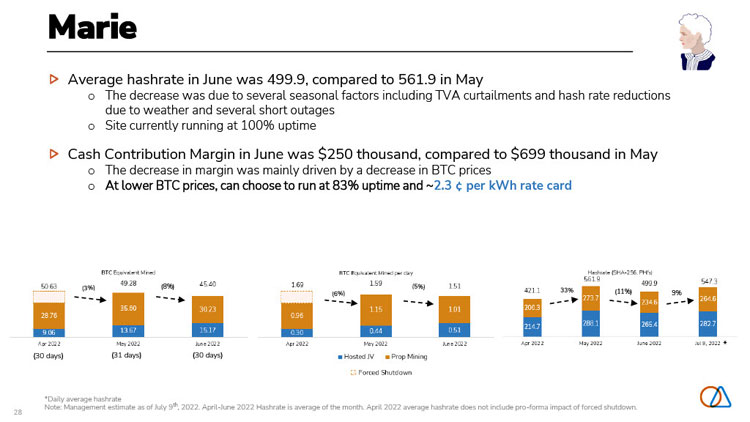

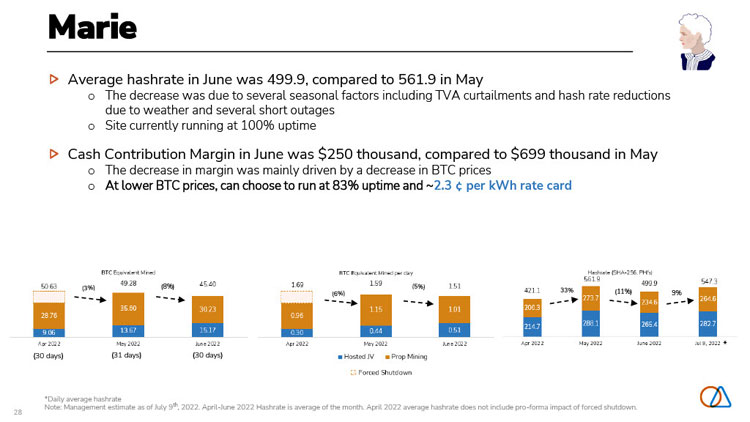

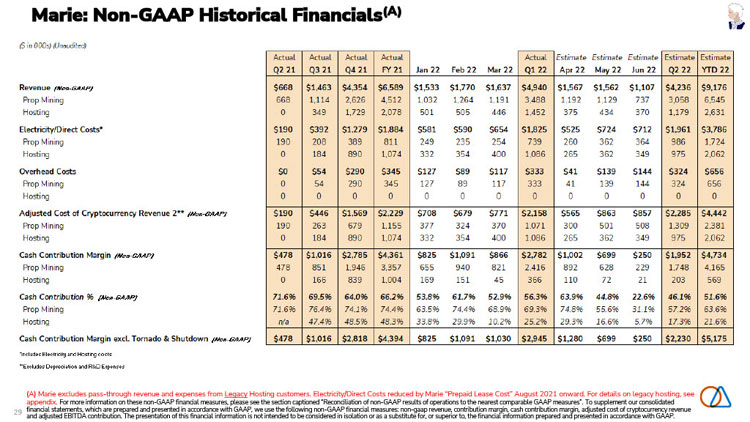

Marie Average hashrate in June was 499.9, compared to 561.9 in May o The decrease was due to several seasonal factors including TVA curtailments and hash rate reductions due to weather and several short outages o Site currently running at 100% uptime Cash Contribution Margin in June was $250 thousand, compared to $699 thousand in May o The decrease in margin was mainly driven by a decrease in BTC prices o At lower BTC prices, can choose to run at 83% uptime and ~2.3 ¢ per kWh rate card (8%) (11%) 9% * (30 days) (31 days) (30 days) *Daily average hashrate Note: Management estimate as of July 9th, 2022. April-June 2022 Hashrate is average of the month. April 2022 average hashrate does not include pro-forma impact of forced shutdown. 28

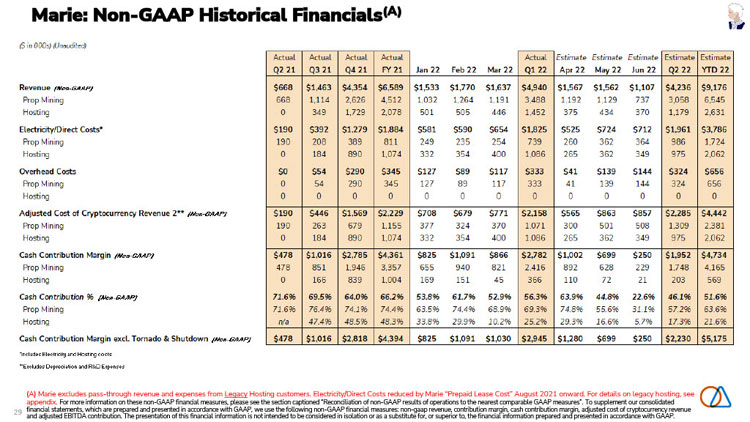

Marie: Non-GAAP Historical Financials(A) Revenue /iv^-baapj $668 $1,463 $4,354 $6,589 $1,533 $1,770 $1,637 $4,940 $1,567 $1,562 $1,107 $4,236 $9,176 Adjusted Cost of Cryptocurrency Revenue 2" (Nco-gaap) $190 $446 $1,569 $2,229 $708 $679 $771 $2,158 $565 $863 $857 $2,285 $4,442 Cash Contribution Margin fNoa-BMU? $478 $1,016 $2,785 $4,361 $825 $1,091 $866 $2,782 $1,002 $699 $250 $1,952 $4,734 Cash Contribution % /jv^ gaap/ 71.6% 69.5% 64.0% 66.2% 53.8% 61.7% 52.9% 56.3% 63.9% 44.8% 22.6% 46.1% 51.6% Cash Contribution Margin excl. Tornado & Shutdown /a/ch-gaap} $478 $1,016 $2,818 $4,394 $825 $1,091 $1,030 $2,945 $1,280 $699 $250 $2,230 $5,175 (A) Marie excludes pass-through revenue and expenses from Legacy Hosting customers. Electricity/Direct Costs reduced by Marie “Prepaid Lease Cost” August 2021 onward. For details on legacy hosting, see appendix. For more information on these non-GAAP financial measures, please see the section captioned “Reconciliation of non-GAAP results of operations to the nearest comparable GAAP measures”. To supplement our consolidated 29 financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: non-gaap revenue, contribution margin, cash contribution margin, adjusted cost of cryptocurrency revenue and adjusted EBITDA contribution. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Marie: Operating Metrics(A) Key Operating Metrics: Q2 21111 Q3 2l'2' Q4 2l'31 FY21(4’ Jan 22 Feb 22 Mar 22 Q122,5> Apr 22 May 22 Jun 22 Q2 22,e| YTD 22,?l Avg. Hashrate (SHA-256, PH/s) 12.80 58.62 324.77 205.06 400.93 475.58 447.90 441.47 421.08 561.86 499.94 494.29 467.88 Avg. Hashrate (Scrypt, GH/s) 221.90 187.50 165.03 191.48 140.99 141.57 76.76 119.77 146.45 164.28 141.15 150.63 135.20 (A) Marie excludes pass-through revenue and expenses from Legacy Hosting customers. Electricity/Direct Costs reduced by Marie “Prepaid Lease Cost” August 2021 onward. For details on legacy hosting, see appendix. For more information on these non-GAAP financial measures, please see the section captioned “Reconciliation of non-GAAP results of operations to the nearest comparable GAAP measures”. To supplement our consolidated 30 financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: non-gaap revenue, contribution margin, cash contribution margin, adjusted cost of cryptocurrency revenue and adjusted EBITDA contribution. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

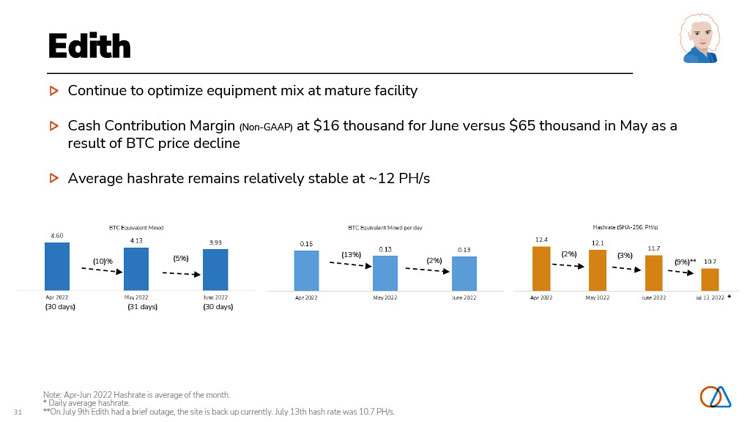

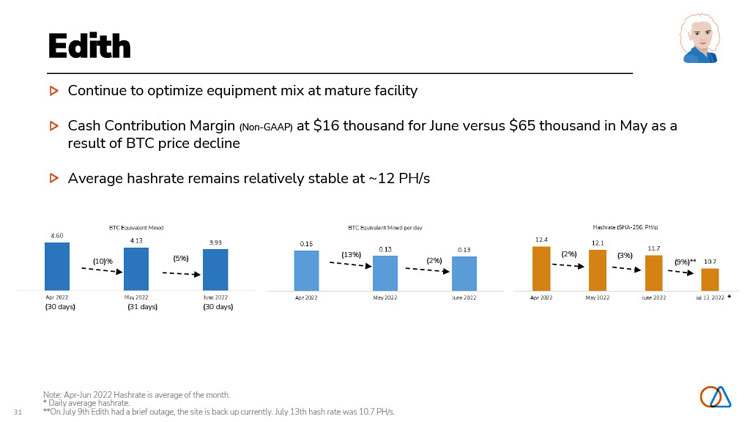

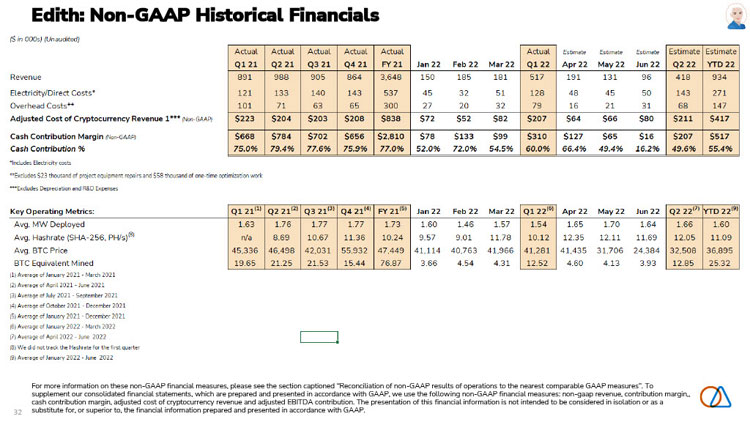

Edith Continue to optimize equipment mix at mature facility Cash Contribution Margin (Non-GAAP) at $16 thousand for June versus $65 thousand in May as a result of BTC price decline Average hashrate remains relatively stable at ~12 PH/s (13%) (2%) (3%) (10)% (5%) (2%) (9%)** * (30 days) (31 days) (30 days) Note: Apr-Jun 2022 Hashrate is average of the month. * Daily average hashrate. 31 **On July 9th Edith had a brief outage, the site is back up currently. July 13th hash rate was 10.7 PH/s.

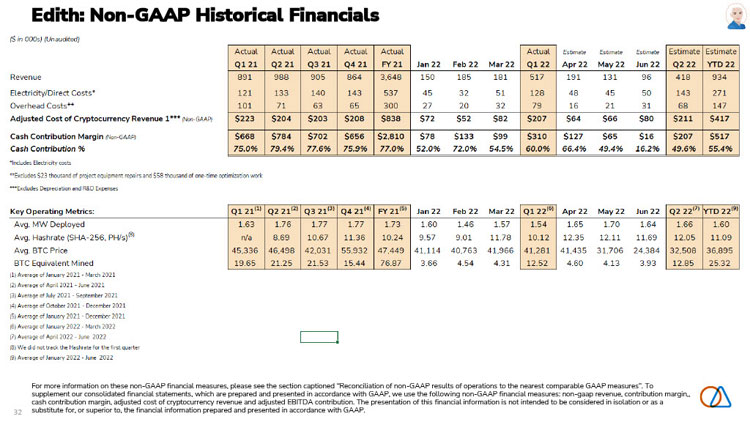

Edith: Non-GAAP Historical Financials Adjusted Cost of Cryptocurrency Revenue 1*** tNon-GMP) $223 $204 $203 $208 $838 $72 $52 $82 $207 $64 $66 $80 $211 $417 Cash Contribution % 75.0% 79.4% 77.6% 75.9% 77.0% 52.0% 72.0% 54.5% 60.0% 66.4% 49.4% 16.2% 49.6% 55.4% Key Operating Metrics: Q1 21(1) Q2 21(2) Q3 2l'31 Q4 21,4) FY2115’ Jan 22 Feb 22 Mar 22 Q1 22,6) Apr 22 May 22 Jun 22 Q2 22,7) YTD 22,9) For more information on these non-GAAP financial measures, please see the section captioned “Reconciliation of non-GAAP results of operations to the nearest comparable GAAP measures”. To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: non-gaap revenue, contribution margin,, cash contribution margin, adjusted cost of cryptocurrency revenue and adjusted EBITDA contribution. The presentation of this financial information is not intended to be considered in isolation or as a 32 substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

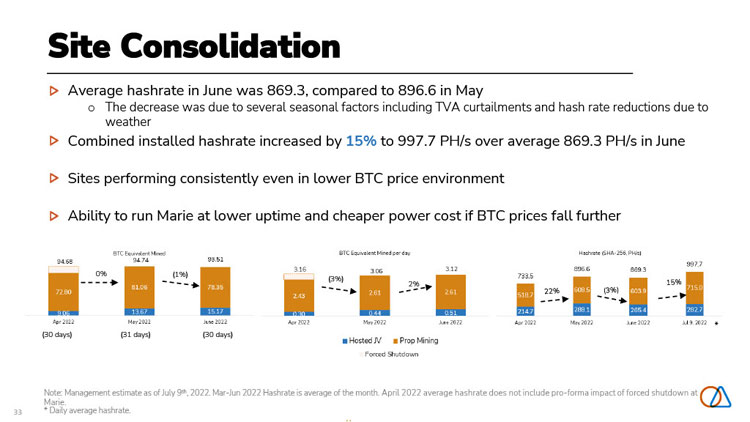

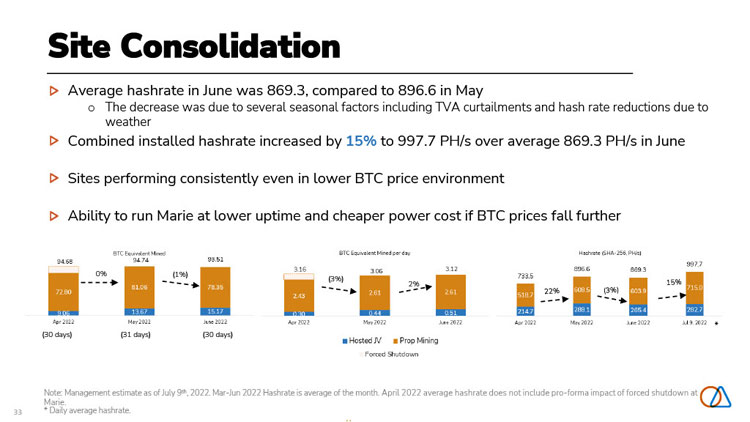

Site Consolidation Average hashrate in June was 869.3, compared to 896.6 in May o The decrease was due to several seasonal factors including TVA curtailments and hash rate reductions due to weather Combined installed hashrate increased by 15% to 997.7 PH/s over average 869.3 PH/s in June Sites performing consistently even in lower BTC price environment Ability to run Marie at lower uptime and cheaper power cost if BTC prices fall further 0% (1%) (3%) 2% * (30 days) (31 days) (30 days) Note: Management estimate as of July 9th, 2022. Mar-Jun 2022 Hashrate is average of the month. April 2022 average hashrate does not include pro-forma impact of forced shutdown at Marie. 33 * Daily average hashrate.

Consolidated Soluna Computing Non-GAAP Historical Financials(A) Revenue ifton-SAAP) $995 $1,657 $2,368 $7,990 $13,010 $2,977 $3,087 $3,200 $9,264 $3,392 $3,004 $2,280 $8,676 $17,940 Electricity/Direct Costs1* $143 $324 $532 $2,307 $3,306 $1,127 $1,152 $1,220 $3,499 $898 $1,150 $1,195 $3,244 $6,743 Adjusted Cost of Cryptocurrency Revenue 2** (Noij-saapi $251 $396 $664 $2,946 $4,258 $1,387 $1,348 $1,486 $4,221 $1,074 $1,409 $1,445 $3,928 $8,150 Cash Contribution Margin (Notj-saap) $744 $1,261 $1,703 $5,044 $8,752 $1,590 $1,739 $1,714 $5,043 $2,318 $1,595 $835 $4,748 $9,790 Cash Contribution % |Nqij-gaap| 74.8% 76.1% 71.9% 63.1% 67.3% 53.4% 56.3% 53.6% 54.4% 68.3% 53.1% 36.6% 54.7% 54.6% Cash Contribution Margin excl. Tornado & Shutdown (Non-GAAP) $744 $1,261 $1,703 $5,179 $8,888 $1,590 $1,739 $1,878 $5,206 $2,596 $1,595 $835 $5,026 $10,232 (A) Marie excludes pass-through revenue and expenses from Legacy Hosting customers. Electricity/Direct Costs reduced by Marie “Prepaid Lease Cost” August 2021 onward. For details on legacy hosting, see appendix. For more information on these non-GAAP financial measures, please see the section captioned “Reconciliation of non-GAAP results of operations to the nearest comparable GAAP measures”. To supplement our consolidated 34 financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: non-gaap revenue, contribution margin, cash contribution margin, adjusted cost of cryptocurrency revenue and adjusted EBITDA contribution. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Consolidated Soluna Computing Operating Metrics(A) Key Operating Metrics: Q121 Q2 2111' Q3 21(2) Q4 21(3) FY21(4) Jan 22 Feb 22 Mar 22 Q12215' Apr 22 May 22 Jun 22 Q2 22|e| YTD 22(7’ Avg. Hashrate (SHA-256, PH/s) - 21.49 69.29 428.57 173.12 616.45 696.37 686.31 666.38 733.46 896.62 869.25 833.11 749.74 Avg. BTC Price 45,336 46.498 42,031 55,932 47,449 41,114 40,763 41,966 41,281 41,435 31,706 24,384 32,508 36,895 (A) Marie excludes pass-through revenue and expenses from Legacy Hosting customers. Electricity/Direct Costs reduced by Marie “Prepaid Lease Cost” August 2021 onward. For details on legacy hosting, see appendix. For more information on these non-GAAP financial measures, please see the section captioned “Reconciliation of non-GAAP results of operations to the nearest comparable GAAP measures”. To supplement our consolidated 35 financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: non-gaap revenue, contribution margin, cash contribution margin, adjusted cost of cryptocurrency revenue and adjusted EBITDA contribution. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Appendix

Our data centers are named after catalyzers Edith Clarke was a pioneer in electrical engineering & power transmission. She was a first in so many ways. The first woman to earn an MSc degree at MIT in 1919. The first woman employed as an electrical engineer at General Electric in 1921. The first full-time electrical engineering professor in 1947, at Edith University of Texas. We’re influenced by Edith’s firsts. It drives us to help make renewable, affordable energy the world’s primary power source. Sophie Wilson is a detailed oriented designer who helped invent and deploy ARM technology. This was key to unlocking the mobile and custom chip revolution. She found ways to use processors in more simple ways. We’re building a data center to help the grid. We’re using Sophie’s methods to blend details and Sophie simplicity for our first greenfield project. Marie Curie was a fearless seeker of truth a pioneer in the field of radioactivity. She won two Nobel Prizes. In pursuit of the truth, Soluna is constructing a data center with complete transparency to help make the grid stable. Why such transparency? So, everyone can see & know what must happen, to do the right things. Including the players that have typically had a dark & controlling influence, making reckless Marie decisions. But no longer. 37

Marie: Impact of forced shutdown ($ in 000s) Marie - March (5 Days) Marie - April (8 Days) Estimate Shutdown Estimate Estimate Shutdown Estimate Mar 22 Impact* Pro-Forma Mar 22 Impact* Pro-Forma Revenue (Non-GAAP) $1,637 $319 $1,956 $1,567 $531 $2,098 Prop Mining 1,191 249 1,440 1,192 430 1,621 Hosted JV 446 70 515 375 101 477 Cash Contribution Margin (Non-GAAP) $866 $163 $1,030 $1,002 $278 $1,280 Prop Mining 821 149 970 892 258 1,149 Hosted JV 45 14 59 110 20 130 Forced shutdown led to a reduction in revenue of $531 and $319 thousand (12.82 and 7.59 BTC equivalent mined) in April and March, respectively and Cash Contribution Margin of $278 and $163 thousand, respectively A new line was installed to our facility resolving many of the issues. There are a few remaining issues we are seeking to resolve which may require an additional 5 days of down time over the remainder of the year. Marie excludes pass-through revenue and expenses from Legacy Hosting customers. Electricity/Direct Costs reduced by Marie “Prepaid Lease Cost” August 2021 onward. For more information on these non-GAAP financial measures, please see the section captioned “Reconciliation of non-GAAP results of operations to the nearest comparable GAAP measures”. To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: non-gaap revenue, contribution margin, cash contribution margin, adjusted cost of cryptocurrency revenue and adjusted EBITDA contribution. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. 38 *Note: Management estimate

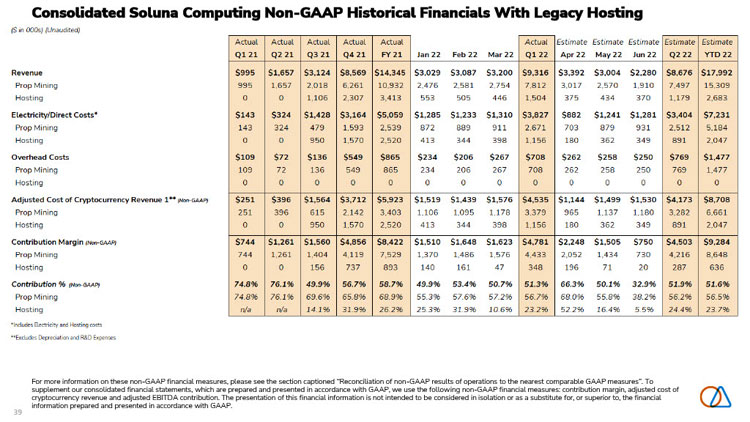

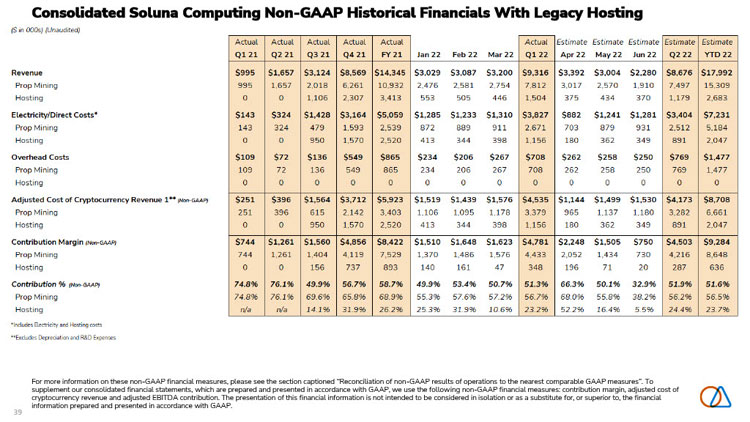

Consolidated Soluna Computing Non-GAAP Historical Financials With Legacy Hosting For more information on these non-GAAP financial measures, please see the section captioned “Reconciliation of non-GAAP results of operations to the nearest comparable GAAP measures”. To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: contribution margin, adjusted cost of cryptocurrency revenue and adjusted EBITDA contribution. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. 39

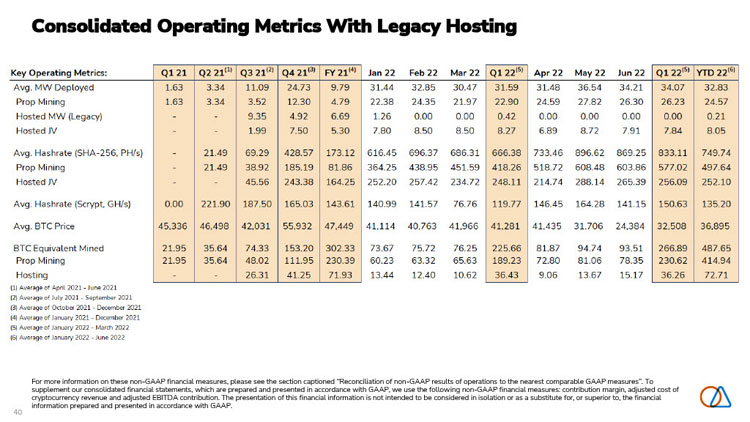

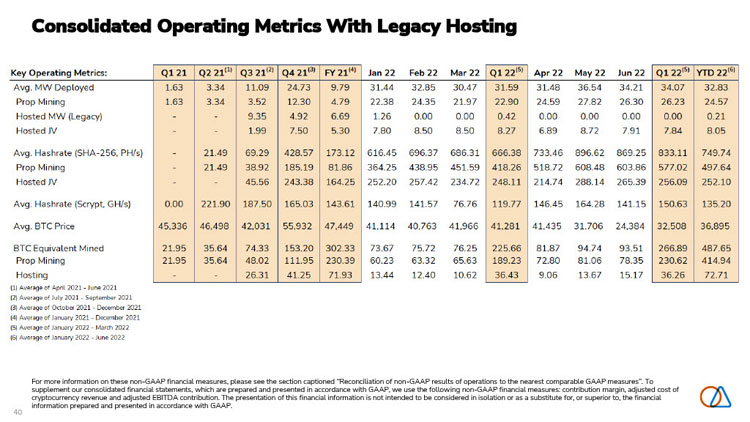

Consolidated Operating Metrics With Legacy Hosting For more information on these non-GAAP financial measures, please see the section captioned “Reconciliation of non-GAAP results of operations to the nearest comparable GAAP measures”. To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: contribution margin, adjusted cost of cryptocurrency revenue and adjusted EBITDA contribution. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. 40

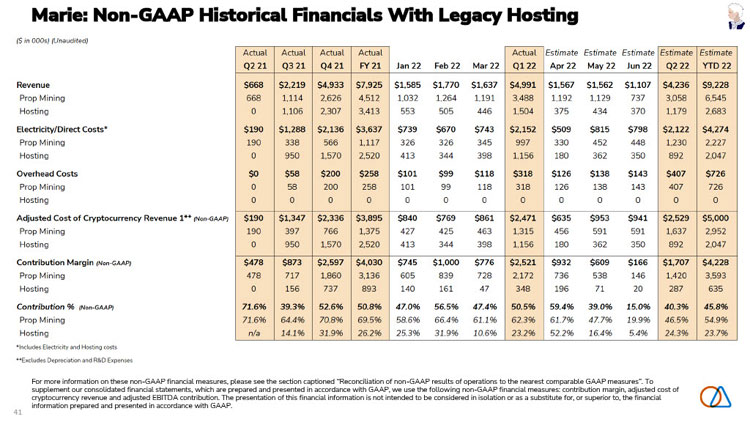

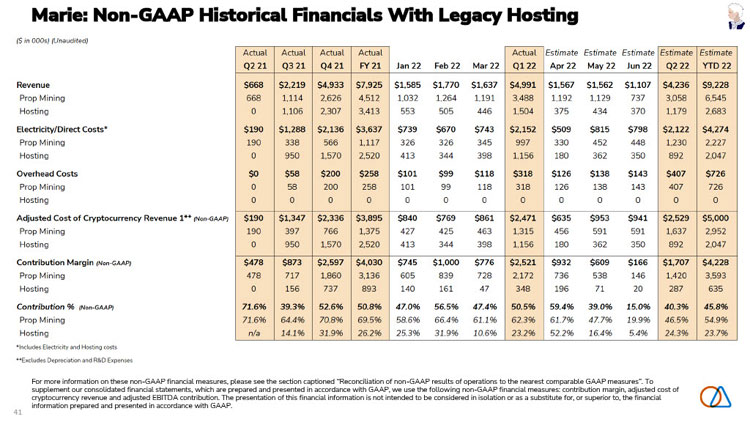

Marie: Non-GAAP Historical Financials With Legacy Hosting For more information on these non-GAAP financial measures, please see the section captioned “Reconciliation of non-GAAP results of operations to the nearest comparable GAAP measures”. To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: contribution margin, adjusted cost of cryptocurrency revenue and adjusted EBITDA contribution. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. 41

Reconciliation of non-GAAP results of operations to the nearest comparable GAAP measures 42

Reconciliation Of Non-GAAP Results 43

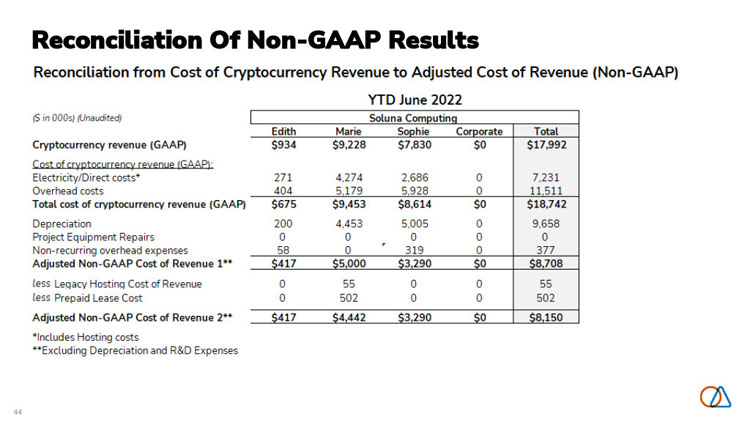

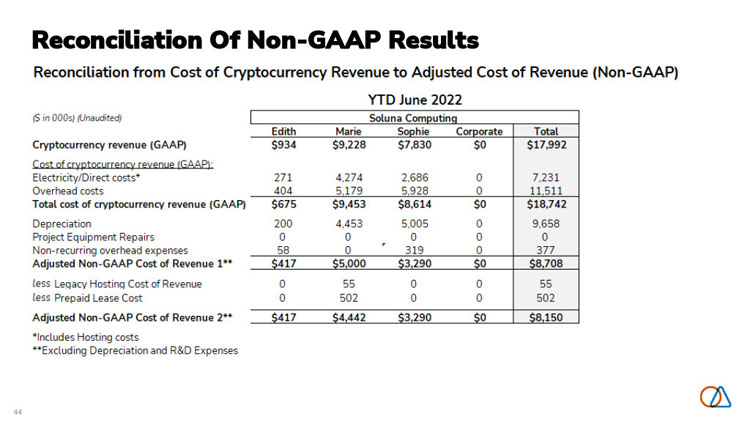

Reconciliation Of Non-GAAP Results 44

Reconciliation Of Non-GAAP Results 45

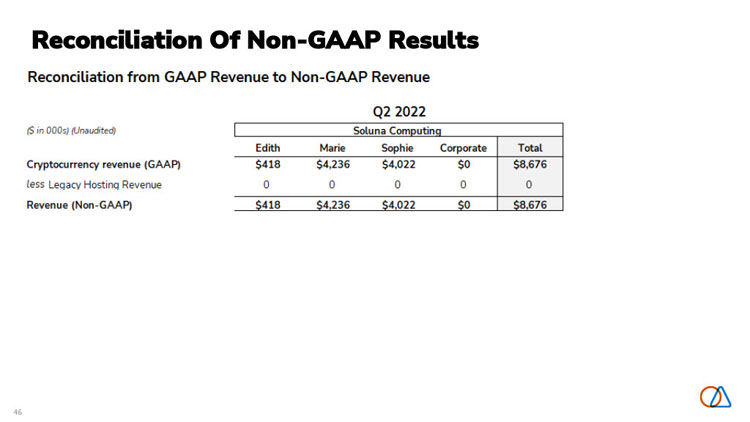

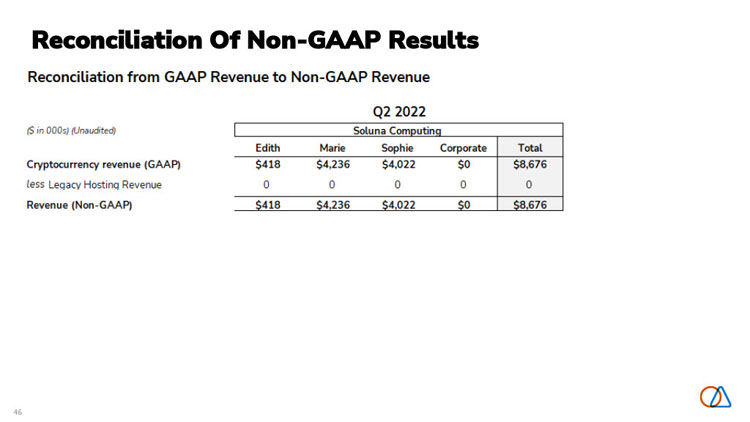

Reconciliation Of Non-GAAP Results 46

Reconciliation Of Non-GAAP Results 47

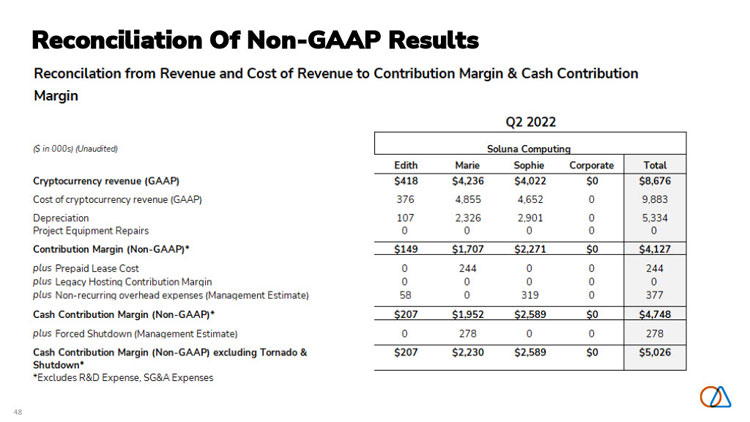

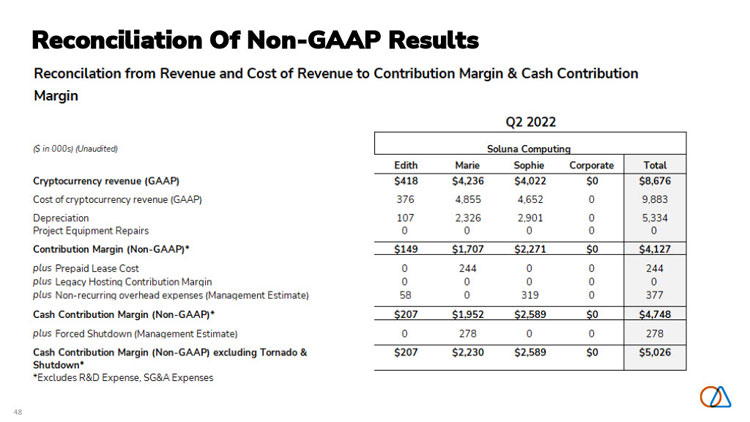

Reconciliation Of Non-GAAP Results 48

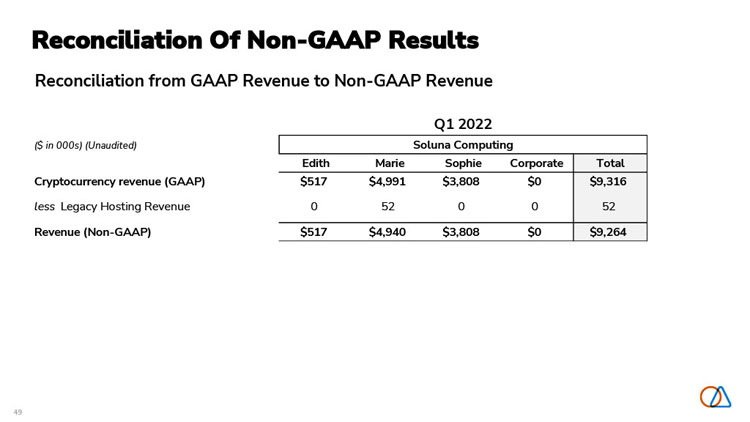

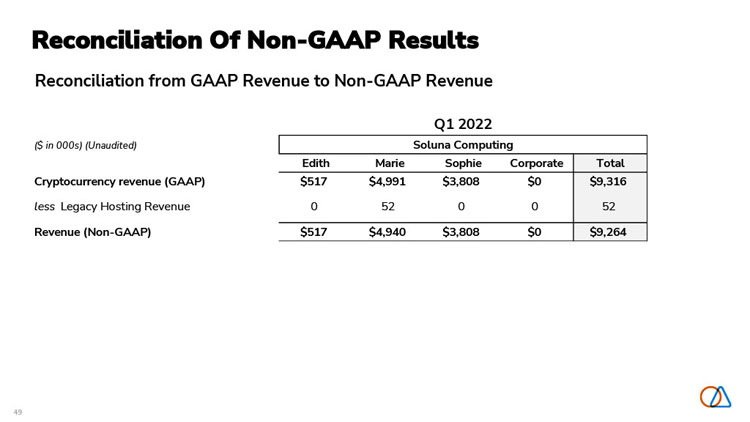

Reconciliation Of Non-GAAP Results Reconciliation from GAAP Revenue to Non-GAAP Revenue ($ in 000s) (Unaudited) Edith Marie Sophie Corporate Total Cryptocurrency revenue (GAAP) $517 $4,991 $3,808 $0 $9,316 less Legacy Hosting Revenue 0 52 0 0 52 Revenue (Non-GAAP) $517 $4,940 $3,808 $0 $9,264 Q1 2022 Soluna Computing 49

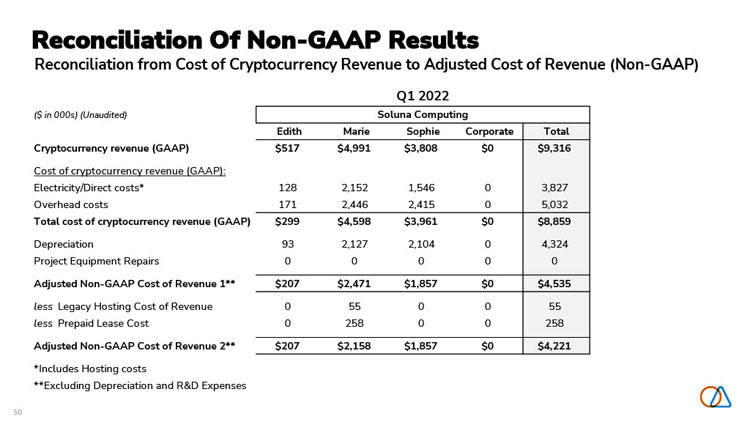

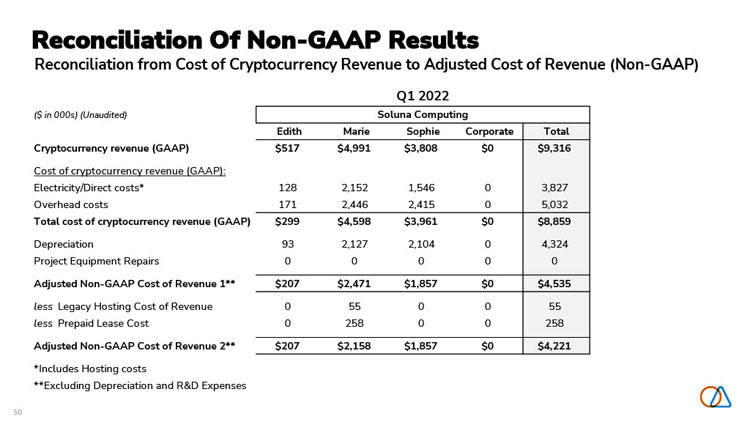

Reconciliation Of Non-GAAP Results Reconciliation from Cost of Cryptocurrency Revenue to Adjusted Cost of Revenue (Non-GAAP) ($ in 000s) (Unaudited) Edith Marie Sophie Corporate Total Cryptocurrency revenue (GAAP) $517 $4,991 $3,808 $0 $9,316 Cost of cryptocurrency revenue (GAAP): Electricity/Direct costs* 128 2,152 1,546 0 3,827 Overhead costs 171 2,446 2,415 0 5,032 Total cost of cryptocurrency revenue (GAAP) $299 $4,598 $3,961 $0 $8,859 Depreciation 93 2,127 2,104 0 4,324 Project Equipment Repairs 0 0 0 0 0 Adjusted Non-GAAP Cost of Revenue 1** $207 $2,471 $1,857 $0 $4,535 less Legacy Hosting Cost of Revenue 0 55 0 0 55 less Prepaid Lease Cost 0 258 0 0 258 Adjusted Non-GAAP Cost of Revenue 2** $207 $2,158 $1,857 $0 $4,221 *Includes Hosting costs **Excluding Depreciation and R&D Expenses Q1 2022 Soluna Computing 51

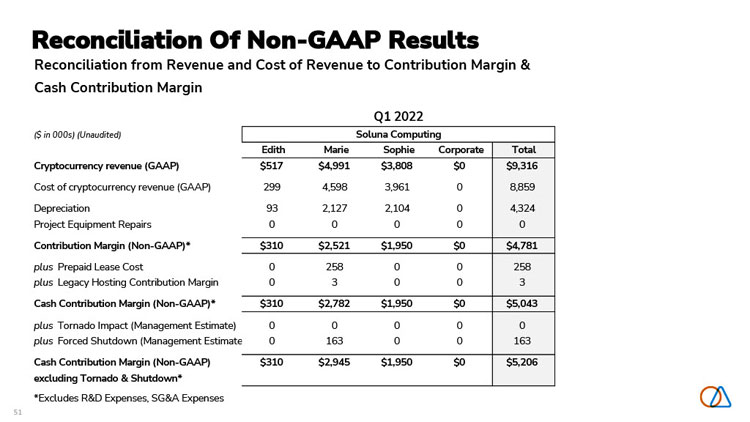

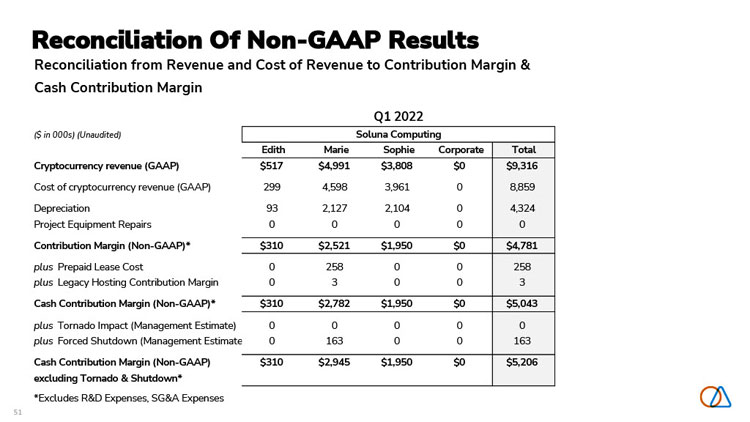

Reconciliation Of Non-GAAP Results ($ in 000s) (Unaudited) Edith Marie Sophie Corporate Total Cryptocurrency revenue (GAAP) $517 $4,991 $3,808 $0 $9,316 Cost of cryptocurrency revenue (GAAP) 299 4,598 3,961 0 8,859 Depreciation 93 2,127 2,104 0 4,324 Project Equipment Repairs 0 0 0 0 0 Contribution Margin (Non-GAAP)* $310 $2,521 $1,950 $0 $4,781 plus Prepaid Lease Cost 0 258 0 0 258 plus Legacy Hosting Contribution Margin 0 3 0 0 3 Cash Contribution Margin (Non-GAAP)* $310 $2,782 $1,950 $0 $5,043 plus Tornado Impact (Management Estimate) 0 0 0 0 0 plus Forced Shutdown (Management Estimate) 0 163 0 0 163 Cash Contribution Margin (Non-GAAP) excluding Tornado & Shutdown* $310 $2,945 $1,950 $0 $5,206 *Excludes R&D Expenses, SG&A Expenses Reconciliation from Revenue and Cost of Revenue to Contribution Margin & Cash Contribution Margin Q1 2022 Soluna Computing 51

Reconciliation Of Non-GAAP Results Reconciliation from GAAP Revenue to Non-GAAP Revenue FY 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total Cryptocurrency revenue (GAAP) $3,648 $7,925 $2,772 $0 $14,345 less Legacy Hosting Revenue 0 1,335 0 0 1,335 Revenue (Non-GAAP) $3,648 $6,590 $2,772 $0 $13,010 52

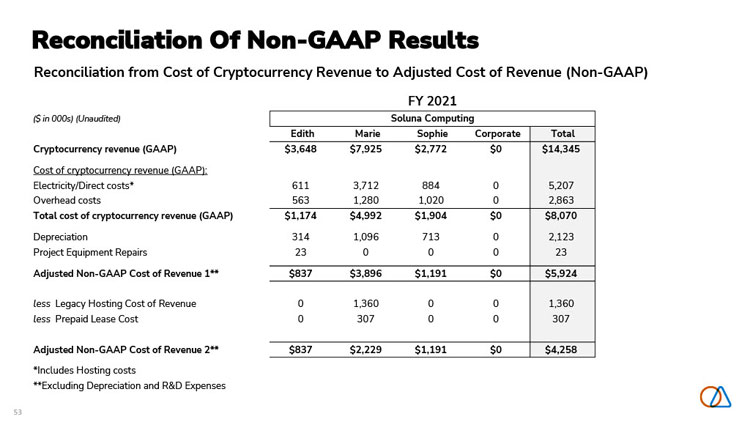

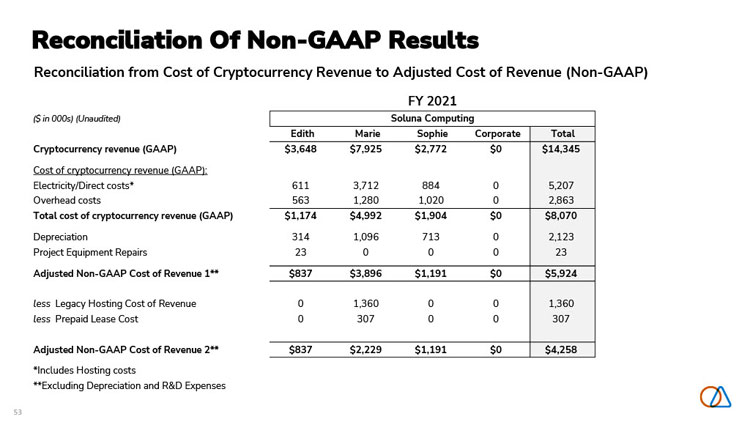

Reconciliation Of Non-GAAP Results Reconciliation from Cost of Cryptocurrency Revenue to Adjusted Cost of Revenue (Non-GAAP) FY 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total Cryptocurrency revenue (GAAP) $3,648 $7,925 $2,772 $0 $14,345 Cost of cryptocurrency revenue (GAAP): Electricity/Direct costs* 611 3,712 884 0 5,207 Overhead costs 563 1,280 1,020 0 2,863 Total cost of cryptocurrency revenue (GAAP) $1,174 $4,992 $1,904 $0 $8,070 Depreciation 314 1,096 713 0 2,123 Project Equipment Repairs 23 0 0 0 23 Adjusted Non-GAAP Cost of Revenue 1** $837 $3,896 $1,191 $0 $5,924 less Legacy Hosting Cost of Revenue 0 1,360 0 0 1,360 less Prepaid Lease Cost 0 307 0 0 307 Adjusted Non-GAAP Cost of Revenue 2** $837 $2,229 $1,191 $0 $4,258 *Includes Hosting costs **Excluding Depreciation and R&D Expenses 53

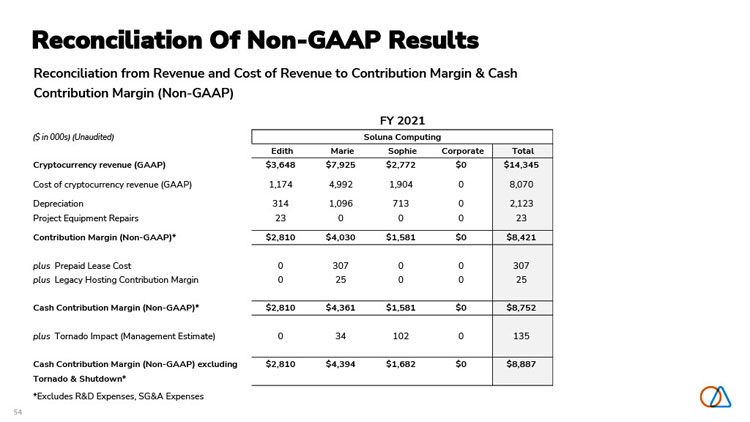

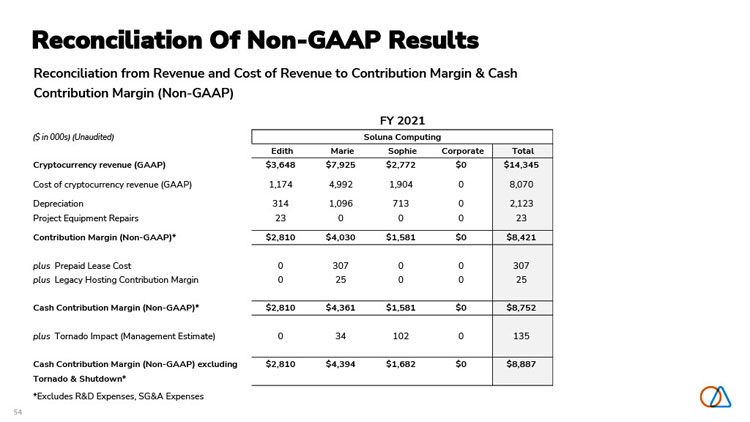

Reconciliation Of Non-GAAP Results Reconciliation from Revenue and Cost of Revenue to Contribution Margin & Cash Contribution Margin (Non-GAAP) FY 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total Cryptocurrency revenue (GAAP) $3,648 $7,925 $2,772 $0 $14,345 Cost of cryptocurrency revenue (GAAP) 1,174 4,992 1,904 0 8,070 Depreciation 314 1,096 713 0 2,123 Project Equipment Repairs 23 0 0 0 23 Contribution Margin (Non-GAAP)* $2,810 $4,030 $1,581 $0 $8,421 plus Prepaid Lease Cost 0 307 0 0 307 plus Legacy Hosting Contribution Margin 0 25 0 0 25 Cash Contribution Margin (Non-GAAP)* $2,810 $4,361 $1,581 $0 $8,752 plus Tornado Impact (Management Estimate) 0 34 102 0 135 Cash Contribution Margin (Non-GAAP) excluding $2,810 $4,394 $1,682 $0 $8,887 Tornado & Shutdown* *Excludes R&D Expenses, SG&A Expenses 54

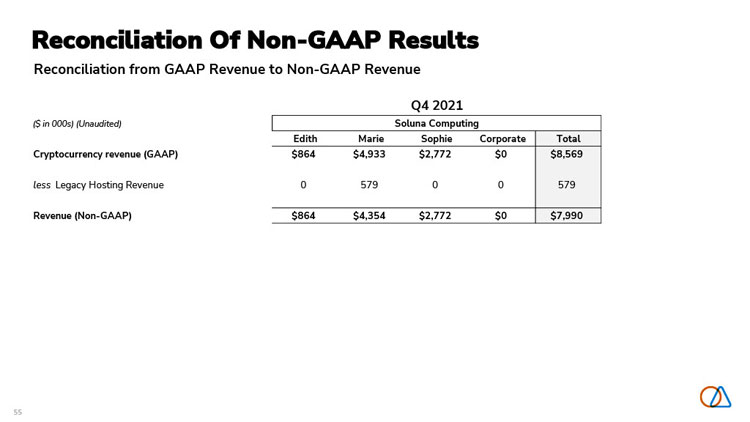

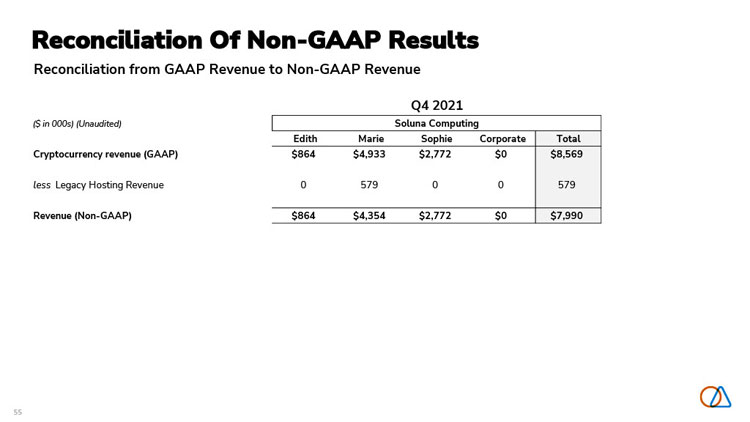

Reconciliation Of Non-GAAP Results Reconciliation from GAAP Revenue to Non-GAAP Revenue Q4 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total Cryptocurrency revenue (GAAP) $864 $4,933 $2,772 $0 $8,569 less Legacy Hosting Revenue 0 579 0 0 579 Revenue (Non-GAAP) $864 $4,354 $2,772 $0 $7,990 55

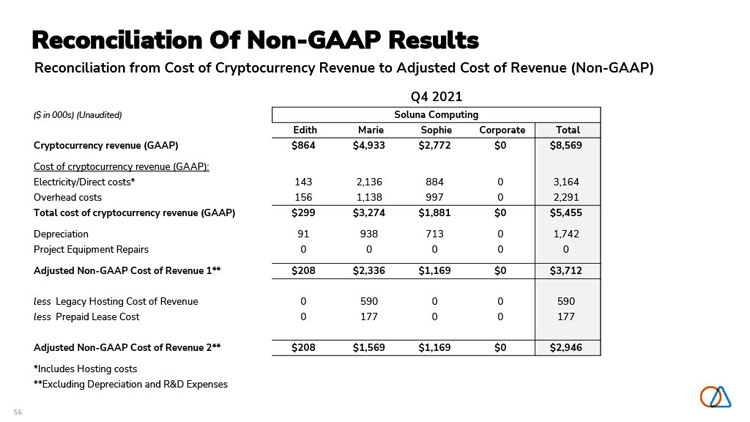

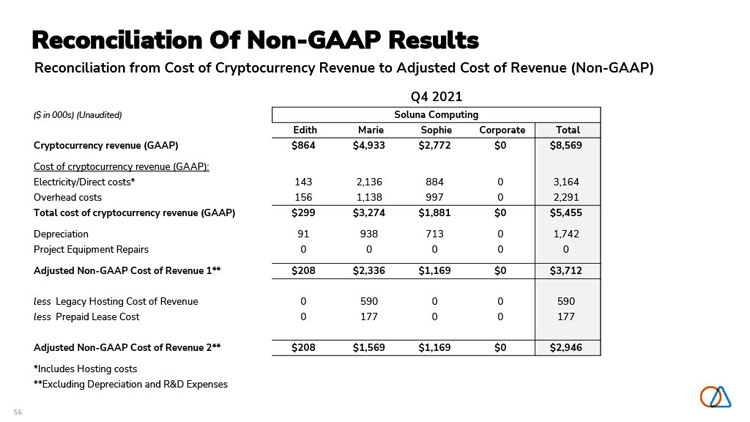

Reconciliation Of Non-GAAP Results Reconciliation from Cost of Cryptocurrency Revenue to Adjusted Cost of Revenue (Non-GAAP) Q4 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total Cryptocurrency revenue (GAAP) $864 $4,933 $2,772 $0 $8,569 Cost of cryptocurrency revenue (GAAP): Electricity/Direct costs* 143 2,136 884 0 3,164 Overhead costs 156 1,138 997 0 2,291 Total cost of cryptocurrency revenue (GAAP) $299 $3,274 $1,881 $0 $5,455 Depreciation 91 938 713 0 1,742 Project Equipment Repairs 0 0 0 0 0 Adjusted Non-GAAP Cost of Revenue 1** $208 $2,336 $1,169 $0 $3,712 less Legacy Hosting Cost of Revenue 0 590 0 0 590 less Prepaid Lease Cost 0 177 0 0 177 Adjusted Non-GAAP Cost of Revenue 2** $208 $1,569 $1,169 $0 $2,946 *Includes Hosting costs **Excluding Depreciation and R&D Expenses 56

Reconciliation Of Non-GAAP Results Reconciliation from Revenue and Cost of Revenue to Contribution Margin & Cash Contribution Margin (Non-GAAP) Q4 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total Cryptocurrency revenue (GAAP) $864 $4,933 $2,772 $0 $8,569 Cost of cryptocurrency revenue (GAAP) 299 3,274 1,881 0 5,455 Depreciation 91 938 713 0 1,742 Project Equipment Repairs 0 0 0 0 0 Contribution Margin (Non-GAAP)* $656 $2,597 $1,604 $0 $4,856 plus Prepaid Lease Cost 0 177 0 0 177 plus Legacy Hosting Contribution Margin 0 11 0 0 11 Cash Contribution Margin (Non-GAAP)* $656 $2,785 $1,604 $0 $5,044 plus Tornado Impact (Management Estimate) 0 34 102 0 135 Cash Contribution Margin (Non-GAAP) excluding $656 $2,818 $1,705 $0 $5,179 Tornado* *Excludes R&D Expenses, SG&A Expenses 57

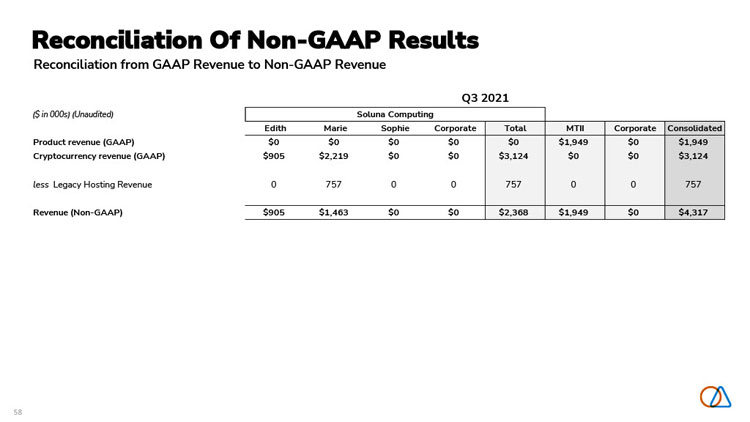

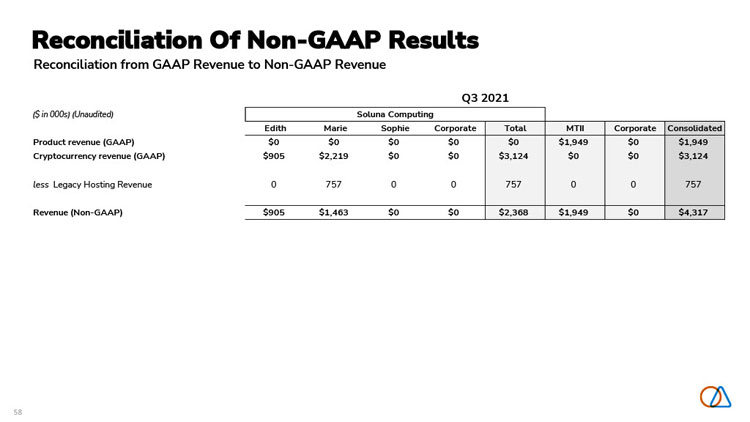

Reconciliation Of Non-GAAP Results Reconciliation from GAAP Revenue to Non-GAAP Revenue Q3 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total MTII Corporate Consolidated Product revenue (GAAP) $0 $0 $0 $0 $0 $1,949 $0 $1,949 Cryptocurrency revenue (GAAP) $905 $2,219 $0 $0 $3,124 $0 $0 $3,124 less Legacy Hosting Revenue 0 757 0 0 757 0 0 757 Revenue (Non-GAAP) $905 $1,463 $0 $0 $2,368 $1,949 $0 $4,317 58

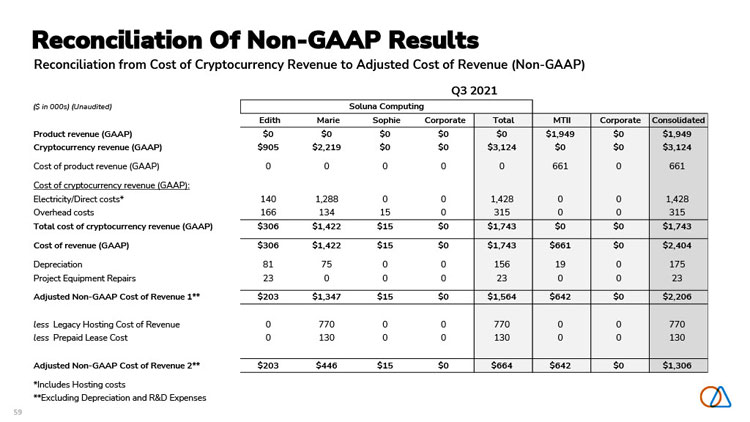

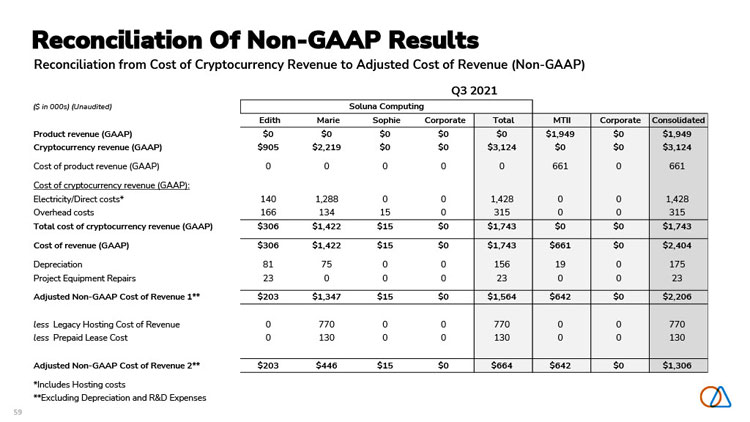

Reconciliation Of Non-GAAP Results Reconciliation from Cost of Cryptocurrency Revenue to Adjusted Cost of Revenue (Non-GAAP) Q3 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total MTII Corporate Consolidated Product revenue (GAAP) $0 $0 $0 $0 $0 $1,949 $0 $1,949 Cryptocurrency revenue (GAAP) $905 $2,219 $0 $0 $3,124 $0 $0 $3,124 Cost of product revenue (GAAP) 0 0 0 0 0 661 0 661 Cost of cryptocurrency revenue (GAAP): Electricity/Direct costs* 140 1,288 0 0 1,428 0 0 1,428 Overhead costs 166 134 15 0 315 0 0 315 Total cost of cryptocurrency revenue (GAAP) $306 $1,422 $15 $0 $1,743 $0 $0 $1,743 Cost of revenue (GAAP) $306 $1,422 $15 $0 $1,743 $661 $0 $2,404 Depreciation 81 75 0 0 156 19 0 175 Project Equipment Repairs 23 0 0 0 23 0 0 23 Adjusted Non-GAAP Cost of Revenue 1** $203 $1,347 $15 $0 $1,564 $642 $0 $2,206 less Legacy Hosting Cost of Revenue 0 770 0 0 770 0 0 770 less Prepaid Lease Cost 0 130 0 0 130 0 0 130 Adjusted Non-GAAP Cost of Revenue 2** $203 $446 $15 $0 $664 $642 $0 $1,306 *Includes Hosting costs **Excluding Depreciation and R&D Expenses 59

Reconciliation Of Non-GAAP Results Reconciliation from Revenue and Cost of Revenue to Contribution Margin & Cash Contribution Margin (Non-GAAP) Q3 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total MTII Corporate Consolidated Product revenue (GAAP) $0 $0 $0 $0 $0 $1,949 $0 $1,949 Cryptocurrency revenue (GAAP) $905 $2,219 $0 $0 $3,124 $0 $0 $3,124 Cost of product revenue (GAAP) 0 0 0 0 0 661 0 661 Cost of cryptocurrency revenue (GAAP) 306 1,422 15 0 1,743 0 0 1,743 Cost of revenue (GAAP) $306 $1,422 $15 $0 $1,743 $661 $0 $2,404 Depreciation 81 75 0 0 156 19 0 175 Project Equipment Repairs 23 0 0 0 23 0 0 23 Contribution Margin (Non-GAAP)* $702 $873 ($15) $0 $1,560 $1,307 $0 $2,867 plus Prepaid Lease Cost 0 130 0 0 130 0 0 130 plus Legacy Hosting Contribution Margin 0 13 0 0 13 0 0 13 Cash Contribution Margin (Non-GAAP)* $702 $1,016 ($15) $0 $1,703 $1,307 $0 $3,010 60

Reconciliation Of Non-GAAP Results Reconciliation from Cost of Cryptocurrency Revenue to Adjusted Cost of Revenue (Non-GAAP) Q2 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total MTII Corporate Consolidated Product revenue (GAAP) $0 $0 $0 $0 $0 $1,647 $0 $1,647 Cryptocurrency revenue (GAAP) $988 $669 $0 $0 $1,657 $0 $0 $1,657 Cost of product revenue (GAAP) 0 0 0 0 0 502 0 502 Cost of cryptocurrency revenue (GAAP): Electricity/Direct costs* 208 265 0 0 472 0 0 472 Overhead costs 71 0 1 0 73 0 0 73 Total cost of cryptocurrency revenue (GAAP) $279 $264 $1 $0 $545 $0 $0 $545 Cost of revenue (GAAP) $279 $264 $1 $0 $545 $502 $0 $1,047 Depreciation 74 74 0 0 149 17 0 166 Adjusted Non-GAAP Cost of Revenue 1** $204 $190 $1 $0 $396 $485 $0 $881 *Includes Hosting costs **Excluding Depreciation and R&D Expenses 61

Reconciliation Of Non-GAAP Results Reconciliation from Revenue and Cost of Revenue to Contribution Margin (Non-GAAP) Q2 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total MTII Corporate Consolidated Product revenue (GAAP) $0 $0 $0 $0 $0 $1,647 $0 $1,647 Cryptocurrency revenue (GAAP) $988 $669 $0 $0 $1,657 $0 $0 $1,657 Cost of product revenue (GAAP) 0 0 0 0 0 502 0 502 Cost of cryptocurrency revenue (GAAP) 279 264 1 0 545 0 0 545 Cost of revenue (GAAP) $279 $264 $1 $0 $545 $502 $0 $1,047 Depreciation 74 74 0 0 149 17 0 166 Contribution Margin (Non-GAAP)* $784 $478 ($1) $0 $1,261 $1,162 $0 $2,423 *Excludes R&D Expenses, SG&A Expenses 62

Reconciliation Of Non-GAAP Results Reconciliation from Cost of Cryptocurrency Revenue to Adjusted Cost of Revenue (Non-GAAP) Q1 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total MTII Corporate Consolidated Product revenue (GAAP) $0 $0 $0 $0 $0 $1,337 $0 $1,337 Cryptocurrency revenue (GAAP) $891 $104 $0 $0 $995 $0 $0 $995 Cost of product revenue (GAAP) 0 0 0 0 0 452 0 452 Cost of cryptocurrency revenue (GAAP): Electricity/Direct costs* 120 23 0 0 143 0 0 143 Overhead costs 170 9 6 0 185 0 0 185 Total cost of cryptocurrency revenue (GAAP) $290 $31 $7 $0 $328 $0 $0 $328 Cost of revenue (GAAP) $290 $31 $7 $0 $328 $452 $0 $780 Depreciation 68 8 0 0 76 17 0 93 Adjusted Non-GAAP Cost of Revenue 1** $222 $23 $7 $0 $251 $435 $0 $687 *Includes Hosting costs **Excluding Depreciation and R&D Expenses 63

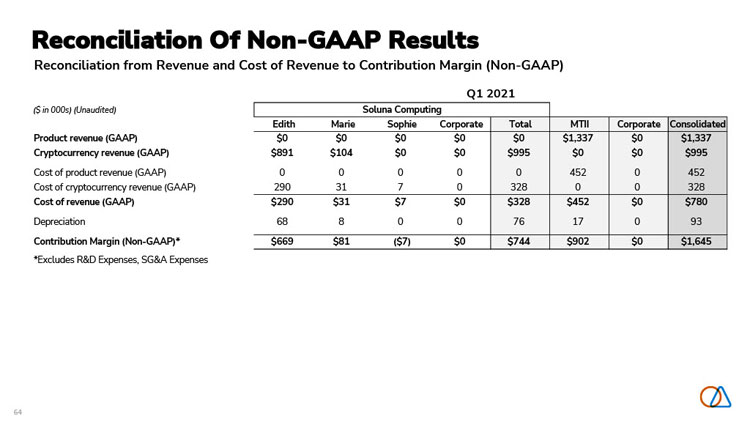

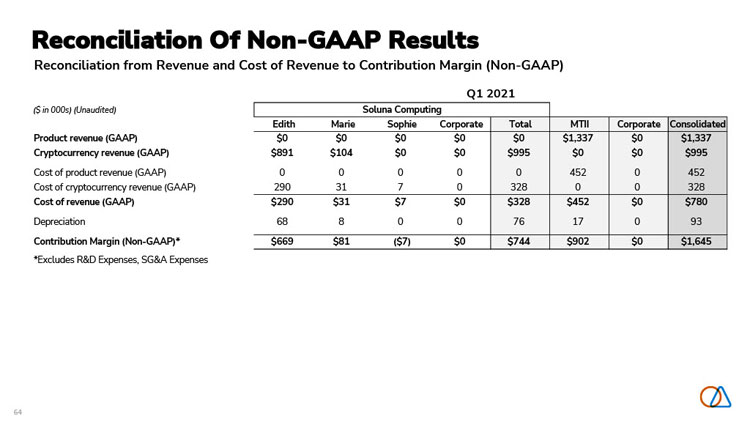

Reconciliation Of Non-GAAP Results Reconciliation from Revenue and Cost of Revenue to Contribution Margin (Non-GAAP) Q1 2021 ($ in 000s) (Unaudited) Soluna Computing Edith Marie Sophie Corporate Total MTII Corporate Consolidated Product revenue (GAAP) $0 $0 $0 $0 $0 $1,337 $0 $1,337 Cryptocurrency revenue (GAAP) $891 $104 $0 $0 $995 $0 $0 $995 Cost of product revenue (GAAP) 0 0 0 0 0 452 0 452 Cost of cryptocurrency revenue (GAAP) 290 31 7 0 328 0 0 328 Cost of revenue (GAAP) $290 $31 $7 $0 $328 $452 $0 $780 Depreciation 68 8 0 0 76 17 0 93 Contribution Margin (Non-GAAP)* $669 $81 ($7) $0 $744 $902 $0 $1,645 *Excludes R&D Expenses, SG&A Expenses 64

The future of renewable energy is computing. 65

Learn more at solunacomputing.com