- GENC Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Gencor Industries (GENC) DEF 14ADefinitive proxy

Filed: 7 Feb 03, 12:00am

SCHEDULE 14A INFORMATION

(Rule 14-A-101)

Information Required in Proxy Statement Schedule 14A Information

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant Under 14a-12 |

Gencor Industries, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | $125 per Exchange Act Rules 0-11(c)(1), 14a-6(i)(2) or item 22(a)(2) of Schedule 14A. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

GENCOR INDUSTRIES, INC.

5201 NORTH ORANGE BLOSSOM TRAIL, ORLANDO, FLORIDA 32810

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MARCH 7, 2003

TO THE SHAREHOLDERS OF GENCOR INDUSTRIES, INC.:

Notice is hereby given that the Annual Meeting of Shareholders of Gencor Industries, Inc., a Delaware corporation (the “Company”), will be held at the Gencor Corporate Offices; 5201 North Orange Blossom Trail, Orlando, Florida, on March 7, 2003 at 9:00 A.M., local time, for the following purposes, all of which are more completely set forth in the accompanying Proxy Statement:

| 1. | To elect the Director to be voted upon by the holders of Common Stock and to elect the Directors to be voted upon by the holders of Class B Stock. |

| 2. | To ratify the selection of Moore Stephens Lovelace, P.A., independent certified public accountants, as auditors for the Company for the year ending September 30, 2003. |

| 3. | To transact such other business as may properly come before the meeting. |

| Only shareholders of record at the close of business on January 10, 2003 are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. Shareholders should review the information provided herein in conjunction with the Company’s 2002 Annual Report, which accompanies this Proxy Statement. |

| The Company’s Proxy Statement and proxy accompany this notice. |

By order of the Board of Directors,

Jeanne M. Lyons, Secretary

Orlando, Florida

Date: January 21, 2003

Enclosures

****YOUR VOTE IS IMPORTANT****

YOU ARE URGED TO DATE, SIGN, AND PROMPTLY RETURN YOUR PROXY SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND IN ORDER THAT THE PRESENCE OF A QUORUM MAY BE ASSURED. THE PROMPT RETURN OF YOUR SIGNED PROXY, REGARDLESS OF THE NUMBER OF SHARES YOU HOLD, WILL AID THE COMPANY IN REDUCING THE EXPENSE OF ADDITIONAL PROXY SOLICITATION. THE GIVING OF SUCH PROXY DOES NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IN THE EVENT YOU ATTEND THE MEETING.

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MARCH 7, 2003

This Proxy Statement is furnished in connection with the Annual Meeting of Shareholders of Gencor Industries, Inc. (the “Company”) to be held March 7, 2003, at 9:00 a.m. local time, or any adjournments or postponements thereof at the Gencor Corporate Offices, 5201 North Orange Blossom Trail, Orlando, Florida. This Proxy Statement and accompanying proxy are first being mailed to shareholders on or about January 21, 2003.

SOLICITATION AND REVOCATION OF PROXY

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of the Company to be used at the Annual Meeting of the holders of the Company’s Common Stock, par value $.10 per share, and Class B Stock, par value $.10 per share (herein referred to as “Common Stock” and “Class B Stock,” respectively) to be held March 7, 2003. The enclosed proxy may be revoked at any time before it is exercised by attending and voting in person at the meeting, by giving written notice of revocation to the Secretary of the Company prior to the taking of the vote for which such proxy has been given, or by delivery to the Secretary of the Company of a duly executed proxy bearing a later date. Notice and delivery shall occur upon actual receipt by the Secretary of the Company at its principal place of business. The cost of soliciting proxies will be borne by the Company. In addition to the use of the mails, proxies may be solicited personally, by telephone, or by telegraph by the Directors, Officers, and employees of the Company, or by the Company’s transfer agent. Also, the Company will make arrangements with banks, brokerage houses, and other nominees, fiduciaries, and custodians holding shares in their names or in those of their nominees to forward proxy materials to the beneficial owners of shares, and the Company will upon request, reimburse such entities for their reasonable expenses in sending the proxy materials. All properly executed unrevoked proxies received in time for the meeting will be voted as specified. If no other indication is made, the proxies will be voted for the election of Directors shown as nominees and as recommended by the Board of Directors with regard to all other matters.

VOTING SECURITIES

At the close of business on December 18, 2002, there were 6,884,070 shares of Common Stock and 1,798,398 shares of Class B Stock outstanding and entitled to vote at the Annual Meeting.

The holders of such shares are entitled to one vote for each share of stock held by them on any matter to be presented at the Annual Meeting, including the election of Directors. The holders of Common Stock and Class B Stock will vote separately as a class on the election of Directors. Only shareholders of record at the close of business on January 10, 2003 are entitled to vote at the Annual Meeting and any adjournment thereof. Although the Company has not polled its Directors and Executive Officers, management expects that the Directors and Executive Officers will vote for the nominees and proposals as shown herein.

The presence at the Annual Meeting, in person or by proxy, of a majority of the outstanding shares of each class of Common Stock and Class B Stock will constitute a quorum.

1

PROPOSALS TO SHAREHOLDERS

I. ELECTION OF DIRECTORS

The Company’s Certificate of Incorporation provides that 75% (calculated to the nearest whole number, rounding a fractional number of five-tenths (.5) to the next highest whole number) of the members of the Board shall be elected by Class B shareholders voting separately as a class. The Company anticipates that the Class B Directors will be elected by the holders of Class B Stock.

Pursuant to the Company’s Bylaws the Board of Directors has fixed the number of Directors at five. Each Director elected at the Annual Meeting shall hold office until his respective successor has been elected and qualified, or until such individual’s earlier resignation or removal. Vacancies may be filled by a majority vote of the remaining directors then in office. Mr. John M. Panettiere resigned during 2002. Mr. Charles E. Newman was elected unanimously by the remaining directors to fill the vacancy.

The Board of Directors has selected the following person as nominee for election by the holders of Common Stock as a Director at the 2002 Annual Meeting of Shareholders:

To be elected by the holders of Common Stock:

James H. Stollenwerk

The affirmative vote of shareholders holding a majority of the Company’s issued and outstanding Common Stock in attendance at the meeting, either in person or by proxy, is required to approve this proposal. Abstentions and broker non-votes will have no effect.

The Board of Directors has selected the following persons as nominees for election by the holders of Class B Stock as Directors at the 2002 Annual Meeting of Shareholders:

E.J. Elliott

John E. Elliott

Randolph H. Fields

Charles E. Newman

The affirmative vote of shareholders holding a majority of the Company’s issued and outstanding Class B Stock in attendance at the meeting, either in person or by proxy, is required to approve this proposal. Abstentions and broker non-votes will have no effect.

The Board of Directors recommends an affirmative vote for the above nominees.

It is the intention of the persons named in the accompanying form of proxy to nominate and, unless otherwise directed, vote such proxies for the election of the nominees named above as Directors. The Board of Directors knows of no reason why any nominee for Director would be unable to serve as a Director. If any nominee should for any reason become unable to serve, the shares represented by all valid proxies will be voted for the election of such other person as the Board of Directors may designate, or the Board of Directors may reduce the number of Directors to eliminate the vacancy.

2

DIRECTORS AND EXECUTIVE OFFICERS

The names of nominees for director and the Named Executive Officers of the Company are listed in the following table:

Name and Principal Occupation or Employment (1) | First Became a Director | First Became an Executive Officer | ||

Directors to be Elected by Class B Shareholders: | ||||

E. J. Elliott | ||||

Chairman of the Board and President (2) (3) | 1968 | 1968 | ||

John E. Elliott | ||||

Executive Vice President (2) (3) | 1985 | 1985 | ||

Randolph H. Fields (5) | ||||

Attorney, Greenberg Traurig, P.A. since October, 1995 | 2002 | |||

(Managing Shareholder, Orlando office since August, 2001) | ||||

Charles E. Newman, CPA (5) | 2002 | |||

Partner, Newman & Associates, P.A. | ||||

Director to be Elected by Common Stock Shareholders: | ||||

James H. Stollenwerk (5) | 2002 | |||

Vice Chairman of Rexcon, a Division of Rose Industries 1997—present | ||||

President & CEO, Rexnord and successor Rexworks, Inc. | ||||

President, Construction Industry Manufacturers Association 1994—1997 | ||||

Executive Officers (4) | ||||

David F. Brashears | ||||

Senior Vice President Technology | 1978 | |||

Marc G. Elliott | ||||

President, Construction Equipment Group (3) | ||||

Previously served as Vice President, Marketing | 1993 | |||

Scott W. Runkel | ||||

Chief Financial Officer and Treasurer | ||||

Financial advisor prior to joining the Company in August 2000, and | ||||

former partner in the accounting firm of Ernst &Young. | 2000 | |||

Jeanne M. Lyons | ||||

Secretary | 1996 |

| (1) | Except as otherwise indicated, there has been no change in principal occupation or employment during the past five years. |

| (2) | Member of the Executive Committee. |

| (3) | E.J. Elliott is the father of John E. Elliott and Marc G. Elliott. |

| (4) | Each executive officer holds office until his successor has been elected and qualified, or until his earlier resignation or removal. |

| (5) | Member of the Audit Committee. |

3

Meetings of the Board of Directors and Certain Committees of the Board

During the fiscal year ended September 30, 2002, the Board of Directors of the Company held 6 meetings. All Directors attended more than 75% of the meetings and to NASD definitions thereof.

The Compensation Committee endeavors to ensure that the compensation program for executive officers of the Company is effective in attracting and retaining key executives responsible for the success of the Company and in promoting its long-term interests and those of its stockholders. The committee, without applying any specific quantitative formulas, considers such factors as net income, earnings per share, duties and scope of responsibility, industry standards and comparable salaries for the geographic area, corporate growth, profits, goals and market share increases. The functions of the Compensation Committee include establishment of compensation plans for Gencor’s executive officers and administration of certain of Gencor’s employee benefit and compensation programs. During the 2002 fiscal year, base salary was increased for one executive officer, to maintain a competitive compensation level for that position, and no options were granted to such individual. The members of the Compensation Committee that were elected to the Committee in February of 2002 did not meet in fiscal year 2002.

The Audit Committee’s responsibilities include selecting the Company’s auditors and reviewing the Company’s audit plan, financial statements and internal accounting and audit procedures. The Audit Committee Charter was adopted by the Board of Directors and a copy is included as Appendix I herein. During the fiscal year ended September 30, 2002, the Audit Committee had three meetings which were attended by all members. The Company believes that all members of the Audit Committee are “independent” as defined under NASD listing standards (but notes that Randolph H. Fields is a principal in the Company’s primary outside law firm.)

Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors, officers and certain stockholders to file with the Commission an initial statement of beneficial ownership and certain statements of changes in beneficial ownership of equity securities of the Company. Based solely on its review of such forms received by it, the Company is unaware of any instances of noncompliance, or late compliance, with such filings during the fiscal year ended September 30, 2002, by its officers, directors or stockholders.

Directors Fees

Directors fees are paid by the Company to non-employee directors at the rate of $1,000 per month, plus $1,000 per meeting attended. Total fees paid in fiscal 2002 were $26,000.

4

EXECUTIVE COMPENSATION

The following table presents certain annual and long-term compensation for the Company’s Chief Executive Officer, the four highest-paid executive officers (collectively the “Named Executive Officers”) as well as the total compensation paid to each individual during the Company’s last three fiscal years:

SUMMARY COMPENSATION TABLE

Annual Compensation | Long-Term Compensation Awards | (2) | |||||||||||||

Name and Principal Position | Year | Salary (1) ($) | Bonus ($) | Securities Underlying Options (#) | All Other Compensation ($) | ||||||||||

E. J. Elliott Chairman of the Board and President | 2002 2001 2000 | 400,000 400,000 451,000 | 0 0 0 | 0 0 0 | 5,249 5,250 4,500 | ||||||||||

John E. Elliott Executive Vice President | 2002 2001 2000 | 250,000 250,000 289,000 | 0 0 0 | 0 0 0 | 0 0 0 | ||||||||||

David F. Brashears Senior Vice President, Technology | 2002 2001 2000 | 170,000 125,000 127,000 | 0 0 150,000 | (a | ) | 0 120,000 0 | 2,592 2,438 2,344 | ||||||||

Marc G. Elliott President, Construction Equipment Group | 2002 2001 2000 | 210,000 210,000 214,000 | 0 0 0 | 0 0 0 | 0 0 0 | ||||||||||

D. William Garrett Vice President, Sales | 2002 2001 2000 | 188,220 226,000 209,000 | 0 0 0 | (a | ) | 0 50,000 0 | 4,330 5,500 5,214 | ||||||||

Scott W. Runkel Chief Financial Officer and Treasurer | 2002 2001 2000 | 225,000 225,000 23,798 | 0 0 0 | 0 0 100,000 | 4,219 0 0 | ||||||||||

(a) Includes grant of 40,000 shares each for options which expired on 7/24/01.

(1) Does not include an amount for incidental personal use of business automobiles furnished by the Company to certain of its Named Executive Officers. The Company has determined that the aggregate incremental cost of such benefits to the Named Executive Officers does not exceed, as to any named individual, the lesser of $50,000 or 10% of the cash compensation reported for such person.

(2) The compensation reported under All Other Compensation represents contributions to the Company’s 401(k) Plan on behalf of the Named Executive Officers to match 2000-2002 pretax executive contributions (included under salary) made by each executive officer to such plan.

5

Option Grants in Fiscal Year 2002

There were no options granted during the fiscal year 2002 to the Named Executive Officers.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table provides information concerning stock options exercised by each of the Named Executive Officers of Gencor during fiscal 2002 and the value of options held by such officers at the end of each year measured in terms of the closing price of Gencor Common Stock on September 30, 2002.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

Shares Acquired on Exercise (#) | Value Realized ($) | *Number of Securities Underlying Unexercised Options at September 30, | *Value of Unexercised In-the-Money Options at September 30, | |||||

Name | 2002 | 2002 | ||||||

E. J. Elliott | 0 | 0 | 590,000 E | 0 | ||||

John E. Elliott | 0 | 0 | 318,000 E | 0 | ||||

Marc G. Elliott | 0 | 0 | 318,000 E | 0 | ||||

David F. Brashears | 0 | 0 | 20,000 E 96,000 U 24,000 E | 0 0 0 | ||||

Scott W. Runkel | 0 | 0 | 40,000 E 60,000 U | 31,200 E 46,800 U |

| * | Exercisable (E)/Unexercisable (U) |

STOCK OPTION PLAN

1997 Stock Option Plan

In July 1996, the Company’s Board of Directors, subject to the approval of its shareholders, adopted the Gencor Industries, Inc. 1997 Stock Option Plan (the “1997 Plan”) which provides for the issuance of stock options to purchase an aggregate of up to 1,200,000 shares of the Company’s Common Stock, 1,200,000 shares of the Company’s Class B Stock and up to fifteen percent (15%) of the authorized common stock of any subsidiary .The 1997 Plan permits the grant of options to officers, directors and key employees of the Company. The 1997 Plan was approved by shareholders on April 11, 1997.

6

REPORT OF THE AUDIT COMMITTEE

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, accounting and financial reporting principles and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors, Moore Stephens Lovelace, P. A., are responsible for performing an independent audit of the consolidated financial statements in accordance with generally accepted auditing standards.

In performing its oversight role, the Audit Committee has considered and discussed the audited financial statements with management. The Audit Committee has also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees,as currently in effect. The Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1,Independent Discussions with Audit Committees, as currently in effect, and has discussed with the auditors the auditors’ independence.

Based on the review and discussions described in this report, and subject to the limitations on the role and responsibilities of the Audit Committee with regard to its oversight functions referred to below, the Audit Committee approved the audited financial statements for inclusion in the Company’s Annual Report on Form 10-K for the fiscal years ended September 30, 2002, for filing with the Securities and Exchange Commission.

The members of the Audit Committee are not professionally engaged by the Company to practice auditing or accounting and a majority of the members are not experts in the fields of accounting or auditing, including with respect to matters of auditor independence. Members of the Audit Committee rely without independent verification on the information provided to them and on the representations made by management and the independent auditors. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that Moore Stephens Lovelace, P.A. is in fact independent.

Respectfully submitted,

Charles E. Newman

James Stollenwerk

Randolph H. Fields

7

REPORT OF THE COMPENSATION COMMITTEE

General

During fiscal year 2002 the Compensation Committee (the “Committee”) of the Board of Directors consisted of John M. Panettiere, James Stollenwerk and Randolph Fields, each of whom serve as non-employee directors of the Company. In November 2002, Mr. Charles E. Newman replaced Mr. Panettiere as a member of the Committee. The Compensation Committee administers the Company’s executive compensation program, monitors corporate performance and its relationship to compensation for executive officers, and makes appropriate recommendations concerning matters of executive compensation.

Compensation Philosophy

One of the major objectives of the Committee was to develop and implement a compensation program designed to attract, motivate, reward and retain the broad-based management talent required to achieve the Company’s business objectives. The Committee believed that offering a competitive base salary and certain incentives designed to encourage achievement of the Company’s objectives were the two major components of its compensation philosophy.

Base Salary

The Company’s salary levels for executive officers are intended to be consistent with competitive pay practices of similar sized companies within the industry. In determining executive officers’ salaries, the Compensation Committee considered such factors as the level of responsibility, competitive trends, the financial performance and resources of the Company. An individual’s experience level, overall job performance, prior service and job knowledge were also important considerations. Base salaries were increased for one executive officer during fiscal 2002 to maintain a competitive compensation level for that position.

Incentives

Incentives consist of stock options and, to a lesser extent, cash awards. The Committee believes that the compensation program should provide employees with an opportunity to increase their ownership and potential for financial gain from increases in the Company’s stock price. This approach closely aligns the interests of shareholders, executives and employees. Therefore, executives and other employees are eligible to receive stock options, giving them the right to purchase shares of the Company’s Common Stock at a specified price in the future. The grant of options is based primarily on a key employee’s potential contribution to the Company’s growth and profitability, as measured by the market value of the Company’s Common Stock. The granting of cash awards is discretionary and is not dependent on any one factor.

Respectfully submitted,

THE COMPENSATION COMMITTEE

James Stollenwerk

Randolph H. Fields

8

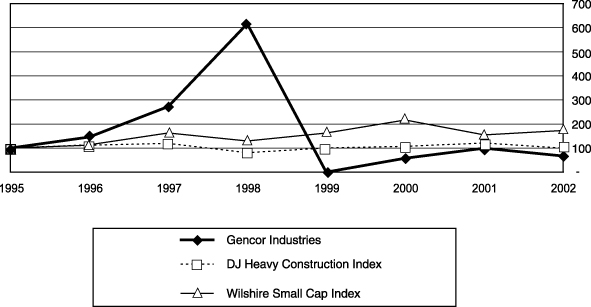

STOCK PERFORMANCE GRAPH

The following graph sets forth the cumulative total shareholder return (assuming reinvestment of dividends) to Gencor Industries’ shareholders during the seven-year period ended September 30, 2002, as well as the Wilshire Small Capitalization Index and the Dow Jones Heavy Construction Index. The stock performance graph assumes $100 was invested on October 1, 1995. On December 22, 1997, a cash dividend of $0.025 per share (split adjusted) was declared by Gencor Industries, payable January 14,1998 to shareholders of record on December 31,1997.

Comparison of Cumulative Total Return Among Gencor Industries, Inc., the

Wilshire Small Capitalization Index and the Dow Jones Heavy Construction Index

9/30/95 | 9/30/96 | 9/30/97 | 9/30/98 | 9/30/99 | 9/30/00 | 9/30/01 | 9/30/02 | |||||||||

(1) | (2) | |||||||||||||||

Gencor Industries, Inc. | 100.00 | 145.79 | 272.24 | 616.60 | — | 57.49 | 99.19 | 66.80 | ||||||||

DJ Heavy Construction Index | 100.00 | 111.83 | 119.37 | 80.76 | 100.45 | 107.14 | 121.01 | 99.53 | ||||||||

Wilshire Small Cap Index | 100.00 | 113.33 | 162.63 | 129.25 | 162.39 | 216.42 | 154.43 | 172.89 |

| (1) | On February 22, 1999, the American Stock Exchange suspended trading on the Company’s stock. |

| (2) | Effective June 1, 2000, the Company’s stock was de-listed from the American Stock Exchange. Subsequent to June 1, 2000, the Company’s stock has traded on the “pink sheets” under the stock symbol “GCRX”. |

9

CERTAIN TRANSACTIONS WITH MANAGEMENT

The Company leases vehicles from Marcar Leasing Corporation (“Marcar”), a corporation engaged in general leasing to the public of machinery, as well as, vehicles owned by members of E.J. Elliott’s immediate family, including Marc G. Elliott. The terms of the leases are established based on the rates charged by independent leasing organizations and are believed by the Company to be more favorable than those generally available from independent third parties. Leases between the Company and Marcar generally provide for equal monthly payments over either thirty-six months or forty-eight months. During fisca1 2002, the Company made lease payments to Marcar in the aggregate amount of $204,000.

Randolph H. Fields, a director of the Company, is a principal shareholder of the law firm of Greenberg Traurig P.A., which serves as the Company’s primary legal counsel.

10

Security Ownership Of Certain Beneficial Owners And Management

The following table sets forth certain information as of January 10, 2003 with respect to (i) each person known to management to be the beneficial owner of more than 5% of the Company’s Common Stock or Class B Stock, (ii) each Director, (iii) each Executive Officer of the Company named in the Summary Compensation Table, and (iv) the Directors and Executive Officers of the Company as a group. Except as otherwise noted, each named beneficial owner has sole voting and investment power over the shares shown.

Amount and Nature of Beneficial Ownership (1) | Percent of Class (1) | |||||||||||

Name And Address of Beneficial Owner | Common Stock | Class B Stock | Common Stock | Class B Stock | ||||||||

E. J. Elliott | 1,340,658 | (2)(3) | 1,348,318 |

| 17.9 | % | 75.0 | % | ||||

5201 N. Orange Blossom Trail | ||||||||||||

Orlando, Florida 32810 | ||||||||||||

John E. Elliott | 458,072 |

| 449,520 | (4) | 6.7 | % | 21.2 | % | ||||

5201 N. Orange Blossom Trail | ||||||||||||

Orlando, Florida 32810 | ||||||||||||

Marc G. Elliott | 120,000 |

| 419,520 | (4) | 1.7 | % | 19.8 | % | ||||

5201 N. Orange Blossom Trail | ||||||||||||

Orlando, Florida 32810 | ||||||||||||

David F. Brashears | 84,912 | (5) | — |

| 0.9 | % | — |

| ||||

5201 N. Orange Blossom Trail | ||||||||||||

Orlando, Florida 32810 | ||||||||||||

Scott W. Runkel | 40,000 | (6) | — |

| 0.6 | % | — |

| ||||

5201 N. Orange Blossom Trail | ||||||||||||

Orlando, Florida 32810 | ||||||||||||

Jeanne M. Lyons | 2,000 |

| — |

| 0.0 | % | — |

| ||||

5201 N. Orange Blossom Trail | ||||||||||||

Orlando, Florida 32810 | ||||||||||||

Harvey Houtkin | 371,457 | (8) | — |

| 5.4 | % | ||||||

160 Summit Avenue | ||||||||||||

Montvale, NJ 07645 | ||||||||||||

All Directors and Executive Officers as a group (9 persons) | 2,045,642 | (9) | 2,217,358 | (10) | 27.1 | % | 91.1 | % | ||||

| (1) | In accordance with Rule 13d-3-f the Securities Exchange Act of 1934, as amended, shares that are not outstanding, but that are subject, to option, warrants, rights or conversion privileges exercisable within 60 days have been deemed to be outstanding for the purpose of computing the percentage of outstanding shares owned by the individual having such right but have not been deemed outstanding for the purpose of computing the percentage for any other person, |

11

| (2) | Includes 48,978 shares owned by the Elliott Foundation, Inc. |

| (3) | Includes options to purchase 590,000 shares of Common Stock . |

| (4) | Includes options to purchase 318,000 shares of Class B Stock. |

| (5) | Includes options to purchase 44,000 shares of Common Stock . |

| (6) | Includes options to purchase 40,000 shares of Common Stock. |

| (7) | Includes options to purchase 7,000 shares of Common Stock. |

| (8) | Based on a Schedule 13G dated February 8, 2002 filed by Harvey Houtkin with the Securities and Exchange Commission. Includes 318,729 shares with sole power to vote or direct the vote and 52,728 shares with shared power to vote or direct the vote. Amount beneficially owned 371,457 (excludes 166,958 shares (2.4%) owned by Mr. Houtkin’s wife Sherry Houtkin, 45,237 shares (0.7%) owned by Mr. Houtkin’s adult son Stuart, and 28,258 shares (0.4%) owned by Mr. Houtkin’s adult son Michael, as to all of which Mr. Houtkin disclaims beneficial ownership.) |

| (9) | Includes options to purchase 676,000 shares of Common Stock. |

| (10) | Includes options to purchase 636,000 shares of Class B Stock . |

2. SELECTION OF AUDITORS

Moore Stephens Lovelace, P.A. has served as the Company’s independent auditors for fiscal years 2000–2002.

Moore Stephens Lovelace, P.A. was reappointed by the Board of Directors, on the recommendation of the Audit Committee, as its independent accountants for fiscal 2003. Representatives of Moore Stephens Lovelace, P.A. are expected to appear at the Annual Meeting to make a statement, if they wish to do so, and to be available to answer appropriate questions from shareholders at that time.

The Board of Directors has approved the Company’s engagement of Moore Stephens Lovelace, P.A. as the Company’s independent auditors. Moore Stephens Lovelace, P.A. has served as the Company’s independent auditors since fisca1 2000, and is familiar with the Company’s business and management.

Audit Fees

The aggregate fees billed by Moore, Stephens, Lovelace, P.A. for the last fiscal year annual audit and audit related services were approximately $158,000.

All Other Fees

The aggregate fees billed by Moore, Stephens, Lovelace, P.A. for the last fiscal year for non-audit related services were $47,000.

The Board of Directors has reviewed the fee structure and believes that Moore Stephens Lovelace, P.A. has the independence necessary to act as the Company’s independent auditors.

While ratification by shareholders of this appointment is not required by law or the Company’s Certificate of Incorporation or Bylaws, management believes that such ratification is desirable. In the event this appointment is not ratified by an affirmative vote of shareholders holding a majority of the Company’s issued and outstanding Common Stock and Class B Stock, together, in attendance at the meeting, either in person or by proxy, the Board of Directors of the Company will consider that fact when it appoints independent public accountants for the next fiscal year.

12

The Board of Directors recommends a vote for the ratification and approval of its selection of Moore Stephens Lovelace, P.A. at the 2002 Annual Meeting.

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors does not intend to present any matter for action at the Annual Meeting, other than as set forth in the Notice of Annual Meeting. If any other matters properly come before the Annual Meeting, it is intended that the holders of the proxies will act in accordance with their judgment on such matters.

SHAREHOLDER PROPOSALS

In order to be eligible for inclusion in the proxy materials for the Company’s 2003 Annual Meeting of Shareholders, any shareholder proposal to take action at such meeting must be received by the President of the Company by September 1, 2003. Shareholder proposals must be made in compliance with applicable legal requirements promulgated by the Securities and Exchange Commission and be furnished to the President by certified mail, return receipt requested.

YOU ARE URGED TO SIGN AND RETURN YOUR PROXY PROMPTLY TO MAKE CERTAIN YOUR SHARES WILL BE VOTED AT THE 2002 ANNUAL MEETING. FOR YOUR CONVENIENCE, A RETURN ENVELOPE IS ENCLOSED.

BY ORDER OF THE BOARD OF DIRECTORS

Jeanne M. Lyons, Secretary

Orlando, Florida

January 21, 2003

13

Appendix A

GENCOR INDUSTRIES, INC.

Audit Committee Charter | June 3, 2002 |

I. Organization

This charter governs the operations of the audit committee. The committee shall be appointed by the board of directors and shall comprise at least three directors, each of whom are independent of management and the Company. Members of the committee shall be considered independent if they have no relationship that may interfere with the exercise of their independence from management and the Company. All committee members shall be financially literate, (or shall become financially literate within a reasonable period of time after appointment to the committee,) and at least one member shall have accounting or related financial management expertise.

II. Statement of Policy

The audit committee shall provide assistance to the board of directors in fulfilling their oversight responsibility to the shareholders, potential shareholders, the investment community, and others relating to the Company’s financial statements and the financial reporting process, the systems of internal accounting and financial controls, the internal audit function, the annual independent audit of the Company’s financial statements, and the legal compliance and ethics programs as established by management and the board. In so doing, it is the responsibility of the committee to maintain free and open communication between the committee, independent auditors, the internal auditors and management of the Company. In discharging its oversight role, the committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities, and personnel of the Company and the power to retain outside counsel, or other experts for this purpose.

III. Responsibilities and Processes

The primary responsibility of the audit committee is to oversee the Company’s financial reporting process on behalf of the board and report the results of their activities to the board. Management is responsible for preparing the Company’s financial statements, and the independent auditors are responsible for auditing those financial statements. The committee is carrying out its responsibilities believes its policies and procedures should remain flexible, in order to best react to changing conditions and circumstances. The committee should take the appropriate actions to set the overall corporate “tone” for quality financial reporting, sound business risk practices, and ethical behavior.

The following shall be the principal recurring processes of the audit committee in carrying out its oversight responsibilities. The processes are set forth as a guide with the understanding that the committee may supplement them as appropriate.

| A. | The committee shall have a clear understanding with management and the independent auditors that the independent auditors are ultimately accountable to the board and the audit committee, as representatives of the Company’s shareholders. |

| B. | The committee shall have the ultimate authority and responsibility to evaluate and, where appropriate, recommend the replacement of the independent auditors. |

| C. | The committee shall discuss with the internal auditors and the independent auditors the overall scope and plans for their respective audits including the adequacy of staffing and compensation. |

A-1

| D. | Also, the committee shall discuss with management, the internal auditors, and the independent auditors the adequacy and effectiveness of the accounting and financial controls, including the Company’s system to monitor and manage business risk, and legal and ethical compliance programs. |

| E. | Further, the committee shall meet separately with the internal auditors and the independent auditors, with and without management present, to discuss the results of their examinations. |

| F. | The committee shall review the interim financial statements with management and the independent audits prior to the filing of the Company’s Quarterly Report on Form 10-Q. Also, the committee shall discuss the results of the quarterly review and any other matters required to be communicated to the committee by the independent auditors under generally accepted auditing standards. The chair of the committee may represent the entire committee for the purposes of this review. |

| G. | The committee shall discuss with the auditors their independence from management and the Company including the matters in the written disclosures required by the Independence Standards Board and shall consider the compatibility of nonaudit services with the auditors’ independence. |

| H. | The committee shall review with management and the independent auditors the financial statements to be included in the Company’s Annual Report on Form 10-K (or the annual report to shareholders if distributed prior to the filing of Form 10-K), including their judgment about the quality, not just acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements. Also, the committee shall discuss the results of the annual audit and any other matters required to be communicated to the committee by the independent auditors under generally accepted auditing standards. |

| I. | Annually, the committee shall review and recommend to the board the selection of the Company’s independent auditors, subject to shareholders’ approval. |

IV. Meetings

The committee will meet at least four times a year, with authority to convene additional meetings, as circumstances require. All committee members are expected to attend each meeting, in person or via tele- or video-conference. The committee will invite members of management, auditors or others to attend meetings and provide pertinent information, as necessary. It will hold private meetings with auditors (see below) and executive sessions. Meeting agendas will be prepared and provided in advance to members, along with appropriate briefing materials. Minutes will be prepared.

| A. | Reporting Responsibilities |

| 1. | Regularly report to the board of directors about committee activities, issues and related recommendations |

| 2. | Provide an open avenue of communication between internal audit, the external auditors and the board of directors |

| 3. | Report annually to the shareholders, describing the committee’s composition, responsibilities and how they were discharged, and any other information required by rule |

| 4. | Review any other reports the company issues that relate to committee responsibilities |

| B. | Other Responsibilities |

| 1. | Review and assess the adequacy of the committee charter annually, requesting board approval for proposed changes. |

| 2. | Institute and oversee special investigations as needed. |

A-2

| 3. | Confirm annually that all responsibilities outlined in this charter have been carried out. |

| 4. | Perform other activities related to this charter as requested by the board of directors. |

With respect to the foregoing responsibilities and processes, the Committee recognizes that the Company’s financial management, including its internal audit staff, as well as the independent auditors, have more time, knowledge, and more detailed information regarding the company than do Committee members. Consequently, in discharging its oversight responsibilities, the Committee will not provide or be deemed to provide any expertise or special assurance as to the Company’s financial statements or any professional certification as to the independent auditors’ work. While the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. This is the responsibility of management and the independent auditors. Nor is it the duty of the Committee to conduct investigations, to resolve disagreements, if any, between management and the independent auditors, or to assure compliance with laws and regulations and the Company’s internal policies and procedures.

A-3

COMMON SHAREHOLDER PROXY

GENCOR INDUSTRIES INC.

THIS COMMON SHAREHOLDER PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS MARCH 7, 2003

The undersigned, hereby appoints E.J. Elliott, John E. Elliott, or any of them, as proxies, each with the power to appoint his or her substitutes, to represent, and vote all shares of Common Stock on behalf of the undersigned as designated below at the Annual Meeting of Shareholders of Gencor Industries, Inc., to be held March 7, 2003 and any adjournments thereof, with all powers the undersigned would possess if personally present and voting at such meeting. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting.

This Proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder. If no direction is indicated, the Proxy will vote FOR Proposals 1 and 2.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1 AND 2.

x PLEASE MARK VOTES AS IN THIS SAMPLE.

1) ELECTION OF DIRECTOR: James H. Stollenwerk | ¨ FOR the nominee listed to the left | ¨ WITHHOLD AUTHORITY to vote for the nominee listed to the left. |

2) Proposal to ratify the selection of Moore Stephens Lovelace, P.A. as auditors.

¨ FOR | ¨ AGAINST | ¨ ABSTAIN |

Please sign exactly as name(s) appears hereon. When signing as attorney, executor, administrator, trustee or guardian, please give full title. If shares are jointly held, each holder must sign. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by an authorized person.

Check appropriate box to indicate changes below; Address Change?¨ Name Change?¨ |

Number of Shares: |

Dated: , 2003 |

Signature |

Signature if held jointly |

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY IN THE ENCLOSED ENVELOPE |