Filed Pursuant to Rule 424(b)(5)

Registration File No. 333-215895

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 3, 2017)

€7,000,000,000

MEDTRONIC GLOBAL HOLDINGS S.C.A.

€500,000,000 Floating Rate Senior Notes due 2021

€1,500,000,000 0.000% Senior Notes due 2021

€1,500,000,000 0.375% Senior Notes due 2023

€1,500,000,000 1.125% Senior Notes due 2027

€1,000,000,000 1.625% Senior Notes due 2031

€1,000,000,000 2.250% Senior Notes due 2039

Fully and Unconditionally Guaranteed by

MEDTRONIC PUBLIC LIMITED COMPANY and MEDTRONIC, INC.

Medtronic Global Holdings S.C.A. (“Medtronic Luxco”) is offering €500,000,000 aggregate principal amount of floating rate senior notes due 2021 (the “floating rate notes”), €1,500,000,000 aggregate principal amount of 0.000% senior notes due 2021 (the “2021 notes”), €1,500,000,000 aggregate principal amount of 0.375% senior notes due 2023 (the “2023 notes”), €1,500,000,000 aggregate principal amount of 1.125% senior notes due 2027 (the “2027 notes”), €1,000,000,000 aggregate principal amount of 1.625% senior notes due 2031 (the “2031 notes”) and €1,000,000,000 aggregate principal amount of 2.250% senior notes due 2039 (the “2039 notes” and together with the 2021 notes, the 2023 notes, the 2027 notes and the 2031 notes, the “fixed rate notes”). The floating rate notes and the fixed rate notes are referred to collectively as the “notes.” The floating rate notes will mature on March 7, 2021. The 2021 notes will mature on March 7, 2021, the 2023 notes will mature on March 7, 2023, the 2027 notes will mature on March 7, 2027, the 2031 notes will mature on March 7, 2031 and the 2039 notes will mature on March 7, 2039. Interest will be paid on the floating rate notes on March 7, June 7, September 7 and December 7 of each year, beginning on June 7, 2019, and on the fixed rate notes on March 7 of each year, beginning on March 7, 2020.

The floating rate notes are not redeemable prior to their maturity except in connection with certain tax events as described in this paragraph. The fixed rate notes may be redeemed, in whole or in part, at any time prior to their maturity at the applicable redemption prices described in this prospectus supplement under the heading, “Description of Notes—Optional Redemption.” In addition, the notes of any series may be redeemed in whole but not in part, at any time at our option, in the event of certain developments affecting U.S., Luxembourg or Irish taxation. See “Description of Debt Securities of Medtronic Global Holdings S.C.A.—Redemption Upon Changes in Withholding Taxes” in the accompanying prospectus.

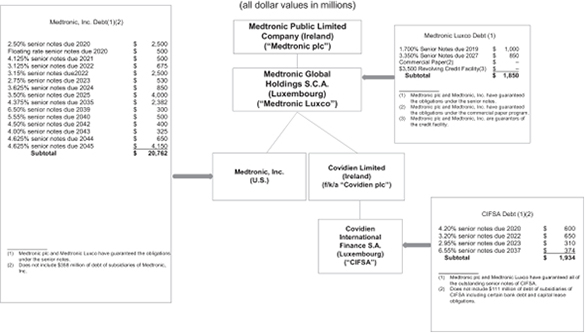

The notes will be general unsecured senior obligations of Medtronic Luxco and will rank equally in right of payment with all of Medtronic Luxco’s other existing and future unsecured senior obligations and will rank senior to any subordinated indebtedness that Medtronic Luxco may incur. All of Medtronic Luxco’s obligations under the notes will be fully and unconditionally guaranteed by Medtronic Public Limited Company (“Medtronic plc”), Medtronic Luxco’s parent, and by Medtronic, Inc., a wholly-owned indirect subsidiary of Medtronic Luxco, on a senior unsecured basis (the “guarantees”). The guarantees will rank equally in right of payment with all of Medtronic plc’s and Medtronic, Inc.’s other existing and future unsecured senior obligations.

Medtronic Luxco intends to apply to list the notes on the New York Stock Exchange. The listing application will be subject to approval by the New York Stock Exchange. Upon such listing, Medtronic Luxco will use commercially reasonable efforts to maintain such listing and satisfy the requirements for such continued listing as long as the notes are outstanding. The New York Stock Exchange is not a regulated market for the purposes of the EU Directive on Markets in Financial Instruments (2014/65/EU) (as amended, “MiFID II”).

Investing in the notes involves risks. See “Risk Factors” beginning on pageS-10 of this prospectus supplement, as well as the documents we file with the Securities and Exchange Commission that are incorporated by reference herein for more information.

| | | | | | | | | | | | |

| | | Price to

Investors | | | Underwriting

Discount | | | Proceeds, Before

Expenses, to

Medtronic Luxco | |

Per floating rate note | | | 100.222 | % | | | 0.200 | % | | | 100.022 | % |

floating rate notes total | | € | 501,110,000 | | | € | 1,000,000 | | | € | 500,110,000 | |

Per 2021 note | | | 99.878 | % | | | 0.200 | % | | | 99.678 | % |

2021 notes total | | € | 1,498,170,000 | | | € | 3,000,000 | | | € | 1,495,170,000 | |

Per 2023 note | | | 99.684 | % | | | 0.300 | % | | | 99.384 | % |

2023 notes total | | € | 1,495,260,000 | | | € | 4,500,000 | | | € | 1,490,760,000 | |

Per 2027 note | | | 99.552 | % | | | 0.425 | % | | | 99.127 | % |

2027 notes total | | € | 1,493,280,000 | | | € | 6,375,000 | | | € | 1,486,905,000 | |

Per 2031 note | | | 99.138 | % | | | 0.475 | % | | | 98.663 | % |

2031 notes total | | € | 991,380,000 | | | € | 4,750,000 | | | € | 986,630,000 | |

Per 2039 note | | | 98.985 | % | | | 0.650 | % | | | 98.335 | % |

2039 notes total | | € | 989,850,000 | | | € | 6,500,000 | | | € | 983,350,000 | |

| | | | | | | | | | | | |

Total | | € | 6,969,050,000 | | | € | 26,125,000 | | | € | 6,942,925,000 | |

| | | | | | | | | | | | |

The prices to investors set forth above do not include accrued interest, if any. Interest on the notes will accrue from March 7, 2019.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the notes to purchasers through the book-entry system of Clearstream Banking,société anonyme, and Euroclear Bank S.A./N.V. against payment on or about March 7, 2019.

Joint Book-Running Managers

| | |

Barclays | | BofA Merrill Lynch |

Co-Managers

| | | | |

| Citigroup | | Deutsche Bank | | Goldman Sachs & Co. LLC |

| HSBC | | J.P. Morgan | | Mizuho Securities |

The date of this prospectus supplement is March 4, 2019