1

General Investor Presentation

2

Safe Harbor

This presentation and management’s public commentary contain certain forward-looking statements

that are subject to risks and uncertainties. These statements are based on management’s current

knowledge and estimates of factors affecting the Company’s operations. Statements in this

presentation that are forward-looking include, but are not limited to, the statements regarding

broadcast pacings, publishing advertising revenues, as well as any guidance related to the Company’s

financial performance.

that are subject to risks and uncertainties. These statements are based on management’s current

knowledge and estimates of factors affecting the Company’s operations. Statements in this

presentation that are forward-looking include, but are not limited to, the statements regarding

broadcast pacings, publishing advertising revenues, as well as any guidance related to the Company’s

financial performance.

Actual results may differ materially from those currently anticipated. Factors that could adversely affect

future results include, but are not limited to, downturns in national and/or local economies; a softening

of the domestic advertising market; world, national, or local events that could disrupt broadcast

television; increased consolidation among major advertisers or other events depressing the level of

advertising spending; the unexpected loss or insolvency of one or more major clients; the integration

of acquired businesses; changes in consumer reading, purchasing and/or television viewing patterns;

increases in paper, postage, printing, or syndicated programming costs; changes in television network

affiliation agreements; technological developments affecting products or the methods of distribution;

changes in government regulations affecting the Company’s industries; unexpected changes in

interest rates; and the consequences of any acquisitions and/or dispositions. The Company

undertakes no obligation to update any forward-looking statement, whether as a result of new

information, future events, or otherwise.

future results include, but are not limited to, downturns in national and/or local economies; a softening

of the domestic advertising market; world, national, or local events that could disrupt broadcast

television; increased consolidation among major advertisers or other events depressing the level of

advertising spending; the unexpected loss or insolvency of one or more major clients; the integration

of acquired businesses; changes in consumer reading, purchasing and/or television viewing patterns;

increases in paper, postage, printing, or syndicated programming costs; changes in television network

affiliation agreements; technological developments affecting products or the methods of distribution;

changes in government regulations affecting the Company’s industries; unexpected changes in

interest rates; and the consequences of any acquisitions and/or dispositions. The Company

undertakes no obligation to update any forward-looking statement, whether as a result of new

information, future events, or otherwise.

3

Agenda

§ Meredith Overview

§ Strategic Initiatives

§ Financial Overview

Broad Media and Marketing Footprint

MEREDITH OVERVIEW

NATIONAL BRANDS

Revenues: $900 million

Revenues: $900 million

LOCAL BRANDS

Revenues: $270 million

Revenues: $270 million

§ 25 Subscription titles

§ 150 Newsstand titles

§ 12 television stations

§ 10% of U.S. households

ONLINE & DIVERSIFIED

Revenues: $240 million

Revenues: $240 million

4

5

Balanced Revenue Mix

MEREDITH OVERVIEW

ADVERTISING

REVENUES:

55%

REVENUES:

55%

NON-ADVERTISING

REVENUES:

45%

REVENUES:

45%

6

6

2000

2007

2010

Forecast

Television

30%

34%

35%

Newspapers

29%

24%

18%

Radio

11%

9.4%

8.0%

Yellow Pages

8.8%

7.5%

6.6%

Consumer Magazines

6.8%

6.7%

6.0%

Trade Magazines

5.9%

5.3%

5.7%

Pure-Play Internet

3.6%

8.6%

14%

Out of Home

2.8%

3.7%

4.8%

Other

2.0%

1.0%

2.1%

TOTAL

100%

100%

100%

Source: Veronis Suhler Stevenson -September 2008

Industry Advertising Mix

MEREDITH OVERVIEW

7

Powerful National Consumer Connection

MEREDITH OVERVIEW

Source: Spring 1999 & 2009 MRI Reports

1999

2009

Better Homes and Gardens

34

39

Special Interest Media

18

21

Ladies’ Home Journal

16

12

Other

5

9

Subtotal

73

81

Family Circle

22

20

Parents

12

15

American Baby

5

7

Fitness

6

6

More

NA

2

Subtotal

45

50

TOTAL

118

131

+11%

Readership in Millions

8

Growing Local Consumer Connection

MEREDITH OVERVIEW

CY03

CY08

Market growth

10M HH

11M HH

News hours

240

380

Morning news viewership

330,000

420,000

Late news viewership

900,000

1 Million

Meredith Television Stations

Source: Nielsen

Growing Online and Video Portfolio

MEREDITH OVERVIEW

§ 2 Broadband channels

§ 2.7 million video clips

§ Video on demand

§ Custom production

§ 30+ websites

§ 15 million unique visitors

§ 170 million page views

§ 3.0 million online

subscriptions

subscriptions

§ 25+ websites

§ 5 million unique visitors

§ 33 million page views

§ Mobile platforms

BROADBAND

9

10

Agenda

§ Meredith Overview

§ Strategic Initiatives

– Gain market share across businesses

– Grow new revenue streams

– Exercise disciplined expense management

§ Financial Overview

STRATEGIC OVERVIEW

Powerful Brands Across Life Stages

GAIN MARKET SHARE

PAREN

THOOD/FAMILY

THOOD/FAMILY

HOME/SHELTER

11

12

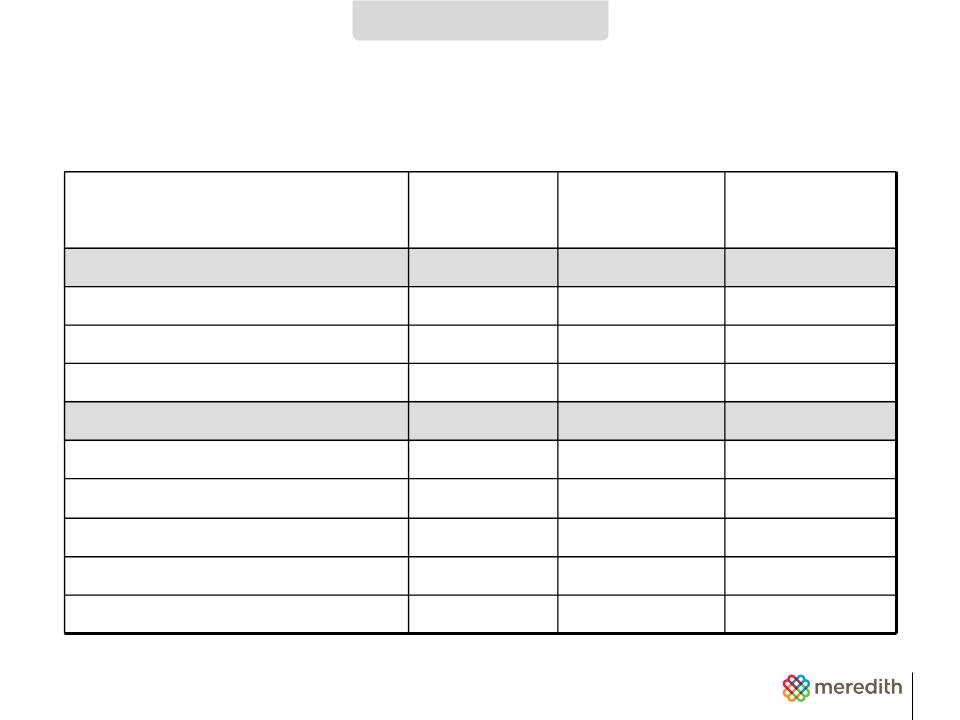

Ad Category Concentration and Historical Growth

GAIN MARKET SHARE

*Meredith data

** TNS Media Intelligence, Jan.-Dec. 2001 & 2008

Calendar

2001*

Calendar

2008*

7-Year Cumulative

Industry Growth**

Industry Growth**

Food

12%

22%

+7%

Cosmetics

7%

11%

+5%

Pharmaceutical

7%

11%

+26%

Non-DTC

3%

5%

+27%

Retail

4%

5%

+13%

Home

24%

9%

-28%

Direct Response

17%

11%

-21%

Travel

5%

4%

-5%

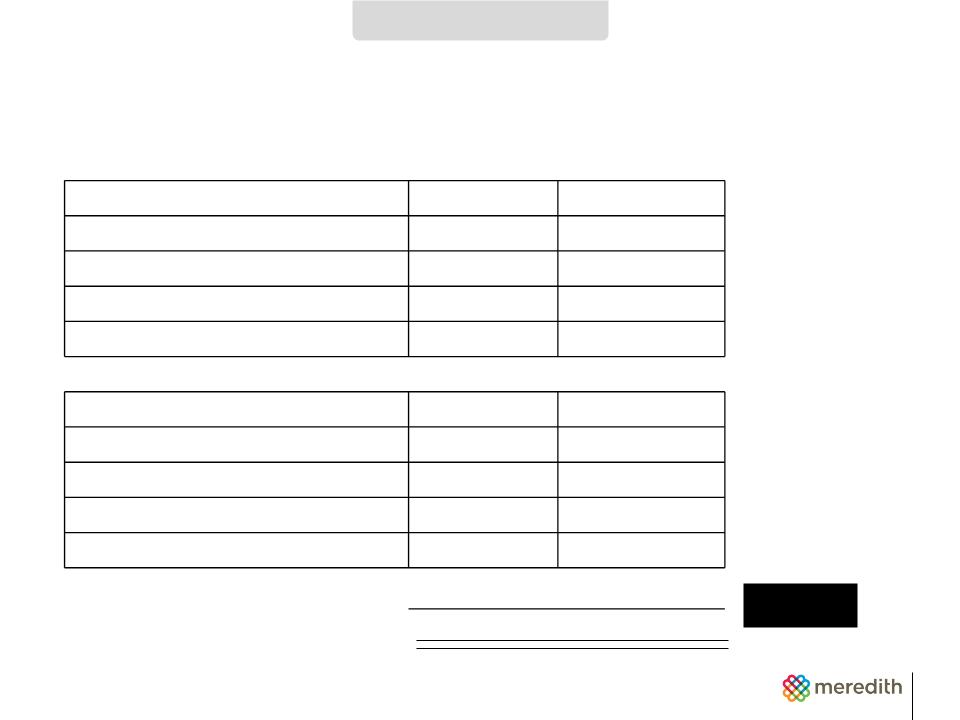

Corporate Sales Strategies

GAIN MARKET SHARE

13

14

Strategic Sales Strategies

§ Access more clients directly

§ Forge deeper senior-level ties

§ Sell solutions, not only ad space

§ Emphasize consumer insights

GAIN MARKET SHARE

15

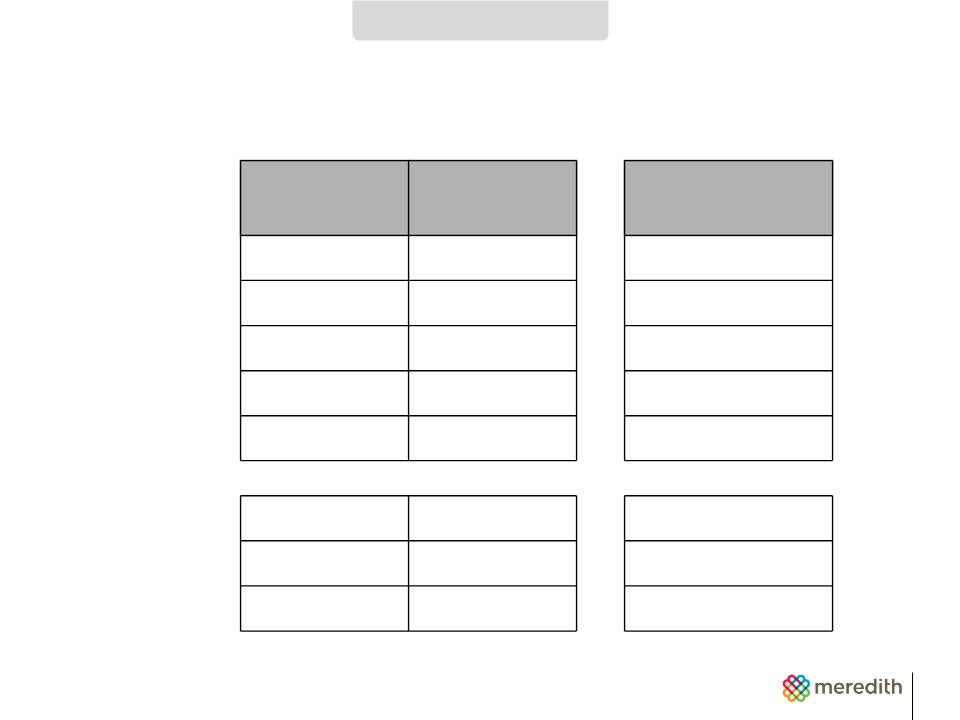

November 2007

November 2008

Time Inc.

74%

Meredith

72%

Conde Nast

67%

Time Inc.

71%

Hearst

61%

Conde Nast

57%

HFM

56%

Hearst

52%

Meredith

55%

HFM

51%

GAIN MARKET SHARE

Meredith is No.1 in Advertiser Perceptions

Source: Advertiser Intelligence Reports, November 2008

16

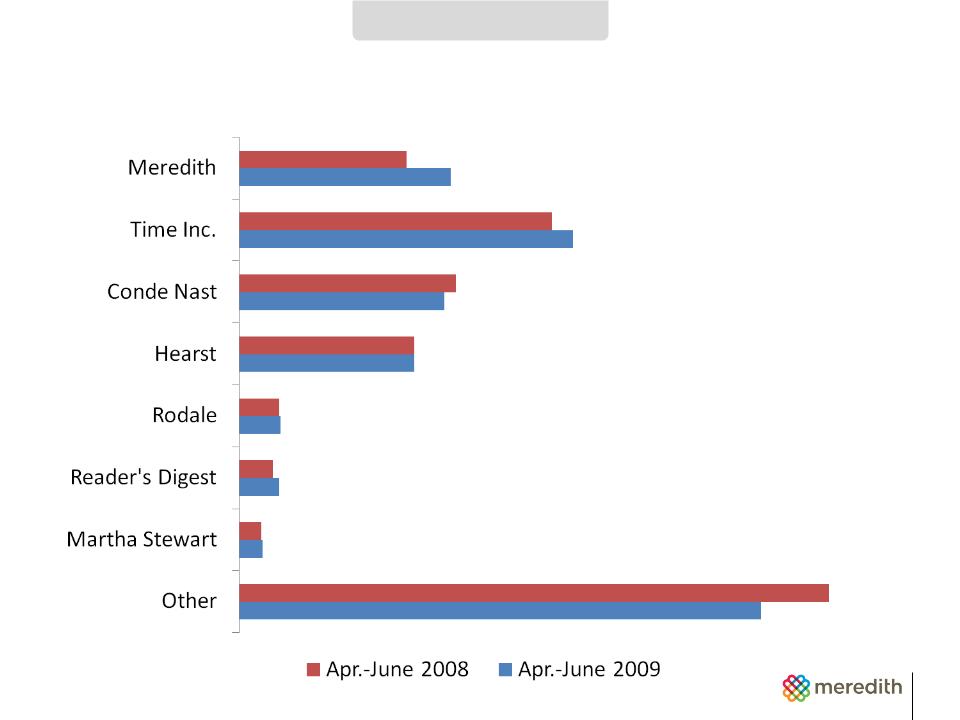

GAIN MARKET SHARE

Advertising Revenue Share: Meredith vs. Industry

12.8

10.1

20.2

18.9

12.4

13.1

10.6

10.6

2.4

2.5

2.4

2.0

1.4

1.3

31.6

35.7

Diverse Local Portfolio in Fast-Growing Markets

GAIN MARKET SHARE

STAND-ALONE STATIONS

DUOPOLIES/CLUSTERS

CORNE

RSTONES/BRANDED

PROGRAMS

RSTONES/BRANDED

PROGRAMS

17

18

Strategic Initiatives to Grow Local Revenues

GAIN MARKET SHARE

19

Strong Growth in Ratings

#1 across all time periods

#1 in afternoon and evening news

#1 in morning news

#1 in morning news

GAIN MARKET SHARE

Source: Nielsen May 2009 Households shares

+14%

+200%

+57%

+14%

+18%

20

Agenda

§ Meredith Overview

§ Strategic Initiatives

– Gain market share across businesses

– Grow new revenue streams

– Exercise disciplined expense management

§ Financial Overview

STRATEGIC OVERVIEW

Growing New Revenue Streams

INTEGRATED MARKETING

INTERACTIVE MEDIA

TV, WEB,

BROADBAND/RETRANSMISSION

BROADBAND/RETRANSMISSION

BRAND LICENSING

21

22

Meredith Integrated Marketing

O’Grady Meyers

Genex

New Media Strategies

Directive

Big Communications

Meredith Integrated Marketing

FY05

FY06

FY07

FY08

Custom Publishing

Online CRM Strategy,

Branding & Promotions

Branding & Promotions

Web Site Design

and Marketing

and Marketing

Viral and Word of

Mouth Marketing

Mouth Marketing

Database Marketing

Healthcare

Marketing

Marketing

GROW NEW REVENUE STREAMS

Hyperfactory

FY09

Mobile Marketing

23

Transforming from a vendor to strategic partner

CUSTOM PUBLISHER

RELATIONSHIP MARKETER

• Brand Messaging

• Awareness/intent to purchase

• Responsive/executional

• Ink-on-paper/magazine

• Turn-key/flat-fee solutions

VENDOR

PARTNER

• Brand Marketing

• Calls to action

• Proactive & Strategic

• Robust online & offline capabilities

• Fees based on blended rates

GROW NEW REVENUE STREAMS

Meredith Integrated Marketing

24

The Better Homes and

Gardens Network

Gardens Network

Better Homes and Gardens

Better Recipes

Mixing Bowl

The Real Girls Network

Divine Caroline

Fitness

More

Ladies’ Home Journal

The Parents Network

Parents

American Baby

Family Circle

Boost Online Presence and Grow Revenues

GROW NEW REVENUE STREAMS

25

Grow Brand Licensing

GROW NEW REVENUE STREAMS

26

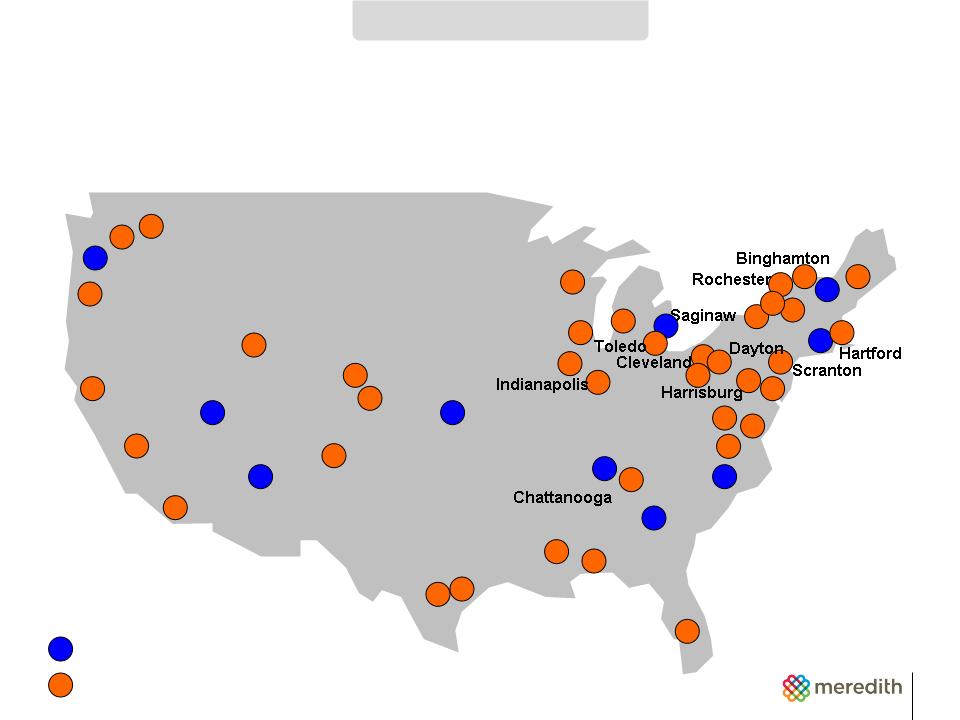

Kansas City

Phoenix

Nashville

Las Vegas

Greenville

Portland

Springfield

10 Meredith markets

38 Non-Meredith markets

Bakersfield

San Francisco

Norfolk

Philadelphia

Denver

San Diego

Green Bay

Milwaukee

Ft. Myers

Salt Lake City

Grand

Rapids

Rapids

Albuquerque

Providence

Buffalo

Portland

Spokane

Champaign

Jackson

Tri-Cities

Colorado

Springs

Springs

Yakima

Medford

Elmira

Dothan

Charlottesville

Atlanta

Houston

Austin

Columbus

Albany

Increase Presence for Better Show

GROW NEW REVENUE STREAMS

27

$4

$8

$20

(Actual)

(Actual)

(Estimate)

$ in millions

GROW NEW REVENUE STREAMS

Increase TV Retransmission Revenues

28

Agenda

§ Meredith Overview

§ Strategic Initiatives

– Gain market share across businesses

– Grow new revenue streams

– Exercise disciplined expense management

§ Financial Overview

STRATEGIC OVERVIEW

29

Actions Taken

DISCIPLINED EXPENSE MANAGEMENT

§ Departmental efficiencies

§ Reductions in workforce

§ Strategic vendor sourcing initiative

§ Reduced capital expenditures

§ Aggressive working capital management

30

Agenda

§ Meredith Overview

§ Strategic Initiatives

§ Financial Overview

31

Historical Operating Cash Flow

FINANCIAL OVERVIEW

$ in millions

$163

$171

$194

$211

$256

$181

32

Cash Flow Fiscal 2000 through 2009

FINANCIAL OVERVIEW

200

Stock Option Exercises

$2,000

Utilization of Cash

100

Net Debt

300

Capital Expenditures

600

Acquisitions, Net of Dispositions

$2,000

Available Cash

$1,800

Operating Cash Flow

300

Dividends

$ in millions

$700

Share Repurchases

33

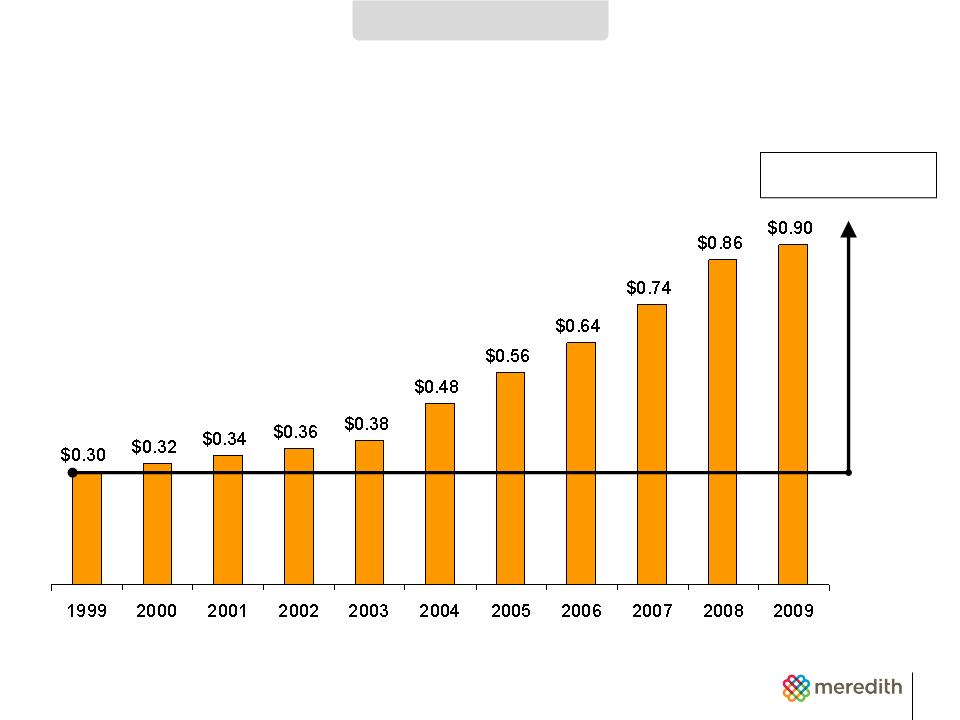

Calendar Year Dividends Per Share

FINANCIAL OVERVIEW

12% CAGR

34

Conservative Capital Structure

§ $380 million total debt

§ 5.4% cost of debt

§ 1.8x debt to EBITDA

FINANCIAL OVERVIEW

As of July 30, 2009

35

Current Valuation Metrics

§ Current dividend yield: 3.1%

§ EPS multiple: 13.9x

§ EBITDA multiple

to market capitalization: 5.9x

to market capitalization: 5.9x

§ EBITDA multiple

to total capitalization: 7.6x

to total capitalization: 7.6x

As of August 10, 2009 using trailing 4 quarters

actual results, excluding special items

actual results, excluding special items

FINANCIAL OVERVIEW

36

Summary

§ Vibrant and profitable media assets and brands

§ Growing online and video presence

§ Comprehensive Integrated Marketing capabilities

§ Growing brand licensing revenues

§ Strong financial foundation

37

General Investor Presentation