Goldman Sachs

Communacopia XVIII

New York, Sept. 15-17, 2009

2

Safe Harbor

This presentation and management’s public commentary contain certain forward-looking statements that

are subject to risks and uncertainties. These statements are based on management’s current knowledge

and estimates of factors affecting the Company’s operations. Statements in this presentation that are

forward-looking include, but are not limited to, the statements regarding broadcast pacings, publishing

advertising revenues, as well as any guidance related to the Company’s financial performance.

are subject to risks and uncertainties. These statements are based on management’s current knowledge

and estimates of factors affecting the Company’s operations. Statements in this presentation that are

forward-looking include, but are not limited to, the statements regarding broadcast pacings, publishing

advertising revenues, as well as any guidance related to the Company’s financial performance.

Actual results may differ materially from those currently anticipated. Factors that could adversely affect

future results include, but are not limited to, downturns in national and/or local economies; a softening of

the domestic advertising market; world, national, or local events that could disrupt broadcast television;

increased consolidation among major advertisers or other events depressing the level of advertising

spending; the unexpected loss or insolvency of one or more major clients; the integration of acquired

businesses; changes in consumer reading, purchasing and/or television viewing patterns; increases in

paper, postage, printing, or syndicated programming costs; changes in television network affiliation

agreements; technological developments affecting products or the methods of distribution; changes in

government regulations affecting the Company’s industries; unexpected changes in interest rates; and the

consequences of any acquisitions and/or dispositions. The Company undertakes no obligation to update

any forward-looking statement, whether as a result of new information, future events, or otherwise.

future results include, but are not limited to, downturns in national and/or local economies; a softening of

the domestic advertising market; world, national, or local events that could disrupt broadcast television;

increased consolidation among major advertisers or other events depressing the level of advertising

spending; the unexpected loss or insolvency of one or more major clients; the integration of acquired

businesses; changes in consumer reading, purchasing and/or television viewing patterns; increases in

paper, postage, printing, or syndicated programming costs; changes in television network affiliation

agreements; technological developments affecting products or the methods of distribution; changes in

government regulations affecting the Company’s industries; unexpected changes in interest rates; and the

consequences of any acquisitions and/or dispositions. The Company undertakes no obligation to update

any forward-looking statement, whether as a result of new information, future events, or otherwise.

3

Agenda

§ Meredith Overview

§ Advertising Overview

§ Performance Improvement Plan

§ Financial Overview

4

Broad Media and Marketing Footprint

MEREDITH OVERVIEW

§ Integrated Marketing

§ Brand Licensing

§ Retransmission fees

§ Video Solutions

NATIONAL BRANDS

Revenues: $900 million

Revenues: $900 million

LOCAL BRANDS

Revenues: $270 million

Revenues: $270 million

§ 25 Subscription titles

§ 150 Newsstand titles

§ 30+ Websites

§ 12 television stations

§ 10% of U.S. households

§ 25+ Websites

MARKETING SERVICES &

DIVERSIFIED

Revenues: $240 million

DIVERSIFIED

Revenues: $240 million

4

5

Powerful National Brands Across Life Stages

MEREDITH OVERVIEW

PARENTHOOD/FAMILY

HOME/SHELTER

WOMEN’S HEALTH & LIFESTYLE

25 subscription magazines

30+ websites 15MM unique visitors

150+ Special Interest titles

6

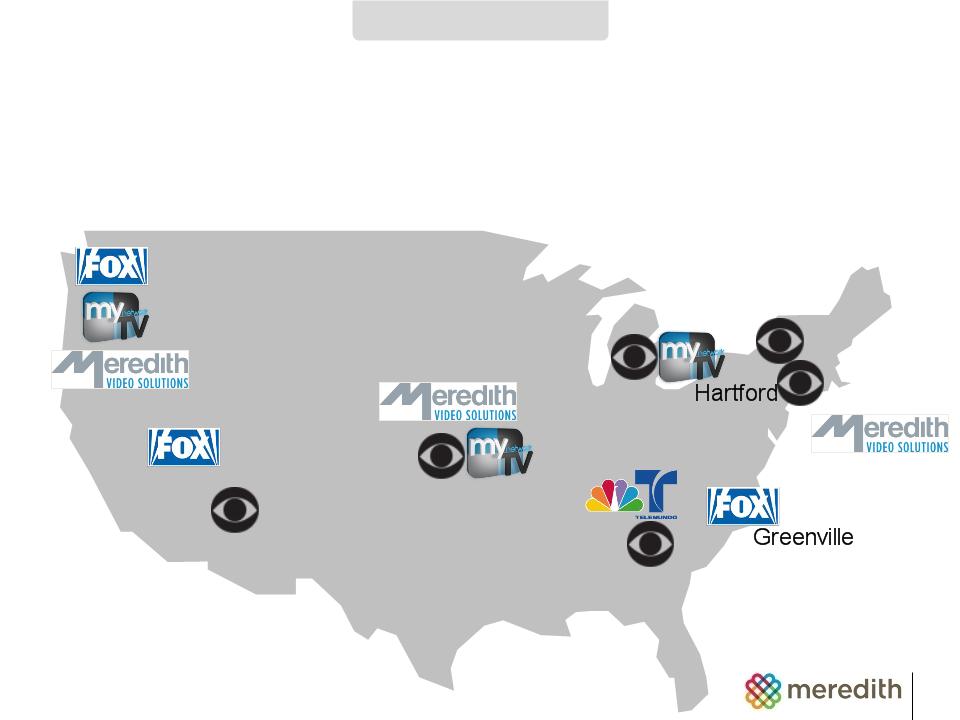

12 network affiliates

10MM+ households

Diverse Local Media Portfolio Across Country

MEREDITH OVERVIEW

25+ websites

5MM unique visitors

Mobile platforms

Syndicated Television

Kansas City

Phoenix

Flint-Saginaw

Atlanta

Nashville

Las Vegas

Portland

Springfield

New York

Des Moines

7

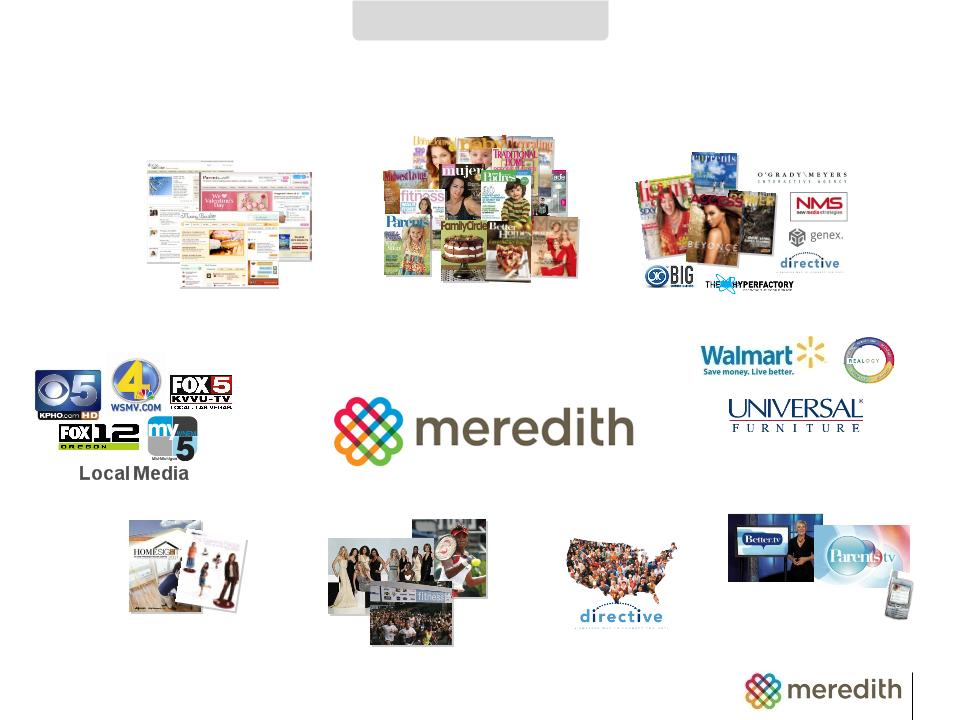

MEREDITH INTEGRATED

MARKETING

MARKETING

BRAND LICENSING

RETRANSMISSION/VIDEO

SOLUTIONS

SOLUTIONS

Growing Marketing Solutions and Diversified Businesses

MEREDITH OVERVIEW

8

Online: Meredith

Women’s Network

Women’s Network

Magazines: Home, Family,

Health & Well-being

Health & Well-being

Consumer Events

Custom Marketing

Database Marketing

Consumer Research

Broad Capabilities Across Media Platforms

Video Solutions

Brand Licensing

MEREDITH OVERVIEW

9

Agenda

§ Meredith Overview

§ Advertising Overview

§ Performance Improvement Plan

§ Financial Overview

10

2000 | 2007 | 2010 Forecast | |

Television | 30% | 34% | 35% |

Newspapers | 29% | 24% | 18% |

Radio | 11% | 9.4% | 8.0% |

Yellow Pages | 8.8% | 7.5% | 6.6% |

Consumer Magazines | 6.8% | 6.7% | 6.0% |

Trade Magazines | 5.9% | 5.3% | 5.7% |

Pure-Play Internet | 3.6% | 8.6% | 14% |

Out of Home | 2.8% | 3.7% | 4.8% |

Other | 2.0% | 1.0% | 2.1% |

TOTAL | 100% | 100% | 100% |

Source: Veronis Suhler Stevenson -September 2008

Industry Advertising Mix

ADVERTISING OVERVIEW

11

National Media Advertising

Meredith (1) | Industry (2) | |

1st Half 09 | (18)% | (12)% |

3rd Quarter 09 | (13)% | (22)% |

4th Quarter 09 | (11)% | (21)% |

1st Quarter 10 | (mid-single digits)%* | (?)% |

ADVERTISING OVERVIEW

(1) Meredith data

(2) Publishers Information Bureau

* Forecast

12

Local Media Advertising

Meredith (1) | Industry (2) | |

1st Half 09 | (20)% | (17)% |

3rd Quarter 09 | (30)% | (27)% |

4th Quarter 09 | (24)% | (25)% |

1st Quarter 10 | (mid-teens)% | (?)% |

ADVERTISING OVERVIEW

(1) Meredith data

(2) Television Bureau of Advertising

* Forecast

13

Agenda

§ Meredith Overview

§ Advertising Overview

§ Performance Improvement Plan

– Gain market share in core businesses

– Increase consumer connection

– Grow new revenue streams

– Exercise disciplined expense and cash management

§ Financial Overview

STRATEGIC OVERVIEW

14

Growing National Market Share

GAIN MARKET SHARE

Source: TNS Media Intelligence, 2009

Meredith’s Market Share | 2008 | 2009 |

Women’s Service & Lifestyle | 45% | 51% |

Parenthood | 43% | 44% |

Healthy Lifestyle | 15% | 17% |

Shelter | 10% | 13% |

Fiscal 2009 Second-Half Issues

15

Agenda

STRATEGIC OVERVIEW

§ Meredith Overview

§ Current Advertising Update

§ Performance Improvement Plan

– Gain market share in core businesses

– Increase consumer connection

– Grow new revenue streams

– Exercise disciplined expense and cash management

§ Financial Overview

16

INCREASING CONSUMER CONNECTION

Powerful National Consumer Connection

Source: Spring 1999 & 2009 MRI Reports

* Traditional Home and Midwest Living

1999 | 2009 | |

Better Homes and Gardens | 34 | 39 |

Ladies’ Home Journal | 16 | 12 |

Other* | 5 | 9 |

Subtotal | 55 | 60 |

Family Circle | 22 | 20 |

Parents | 12 | 16 |

American Baby | 5 | 7 |

Fitness | 6 | 6 |

More | NA | 2 |

Subtotal | 45 | 51 |

TOTAL | 100 | 111 |

+11%

Readership in Millions

17

Strong Growth in Local Consumer Connection

Hartford: #1 in all newscasts

Nashville: #1 in all evening newscasts

Portland: #1 in morning news

Las Vegas: #1 in morning news

Atlanta: morning news doubled

Greenville: morning news doubled

Phoenix: Late news ratings up 40%

INCREASING CONSUMER CONNECTION

18

Strong Growth in Online Consumer Connection

Source: Meredith Internal Data

In Millions

Online Page Views

CAGR: 25%

33

205

50

100

150

200

INCREASING CONSUMER CONNECTION

19

Agenda

STRATEGIC OVERVIEW

§ Meredith Overview

§ Advertising Overview

§ Performance Improvement Plan

– Gain market share in core businesses

– Increase consumer connection

– Grow new revenue streams

– Exercise disciplined expense and cash management

§ Financial Overview

20

§ Integrated Marketing +13% to $175 million

§ Brand Licensing +14% to $25 million

§ Retransmission revenues doubled to $16 million

§ Video Solutions revenues rose more than 50%

§ Mobile marketing opportunity

New Revenue Stream Growth

GROW NEW REVENUE STREAMS

21

§ April 2006

§ January 2007

§ October 2007

§ June 2008

§ July 2009

Growing Array of Integrated Marketing Capabilities

GROW NEW REVENUE STREAMS

22

• Content strategy

• Quarterly magazines

• Multi-language e-mail campaigns

• Food photography

• 200+ videos produced in

multiple languages

multiple languages

• Database Marketing strategy

• Campaign management

• Business intelligence

• Shopper purchase analytics

• Measurement

• Digital magazine

• iFood assistant

• Digital design

• Digital strategy

• Mobile strategy

• Mobile execution

• Online word of mouth

• Digital public relations

• Online intelligence

• Food blogging

GROW NEW REVENUE STREAMS

Meredith Integrated Marketing + Kraft CRM

23

Growing Presence in Brand Licensing

§ Walmart

– Sales on track to meet expectations

– SKUs doubled to more than 1,000 in 2009

– Expanding to Canada this fall

§ Furniture

– Launching a 5th BHG furniture line with

Universal

Universal

– 5-Star mattress program with Serta

§ International

– 15+ relationships across 20 territories

– Leading brands BHG and Parents in most

populous countries: China and India

populous countries: China and India

GROW NEW REVENUE STREAMS

24

$ in millions

GROW NEW REVENUE STREAMS

Increasing TV Retransmission Revenues

$4

$20+

$8

2006

(Actual)

2008

(Actual)

2010

(Estimate)

25

Meredith Video Solutions

§ 55 markets

§ 40+ percent of U.S.

§ Product integration growing

§ New VOD relationship with Mag Rack adds

25 million more homes

25 million more homes

§ 14 million Comcast homes

§ Discussions for carriage on Time

Warner, Cablevision

Warner, Cablevision

§ Those 3 MSOs reach 90% of

VOD cable homes

VOD cable homes

GROW NEW REVENUE STREAMS

Custom Video Production

§ Corporate clients: Kraft, Arm & Hammer, State Farm

26

§ The next big distribution platform

§ Opportunities in:

– Business to consumer

– Business to business

§ Clients increasingly asking for mobile marketing solutions

§ Relationship with The Hyperfactory

– Clients include Toyota, Coke, Blackberry, Nike, Vodafone, Disney

– Offices in New York, Los Angeles, New Zealand, India

GROW NEW REVENUE STREAMS

Mobile Opportunity

27

Agenda

§ Meredith Overview

§ Advertising Overview

§ Performance Improvement Plan

– Gain market share across businesses

– Increase consumer connection

– Grow new revenue streams

– Exercise disciplined cash expense management

§ Financial Overview

STRATEGIC OVERVIEW

28

Actions Taken

DISCIPLINED EXPENSE MANAGEMENT

§ Departmental efficiencies

§ Reductions in workforce

§ Strategic vendor sourcing initiative

§ Reduced capital expenditures

§ Aggressive working capital management

29

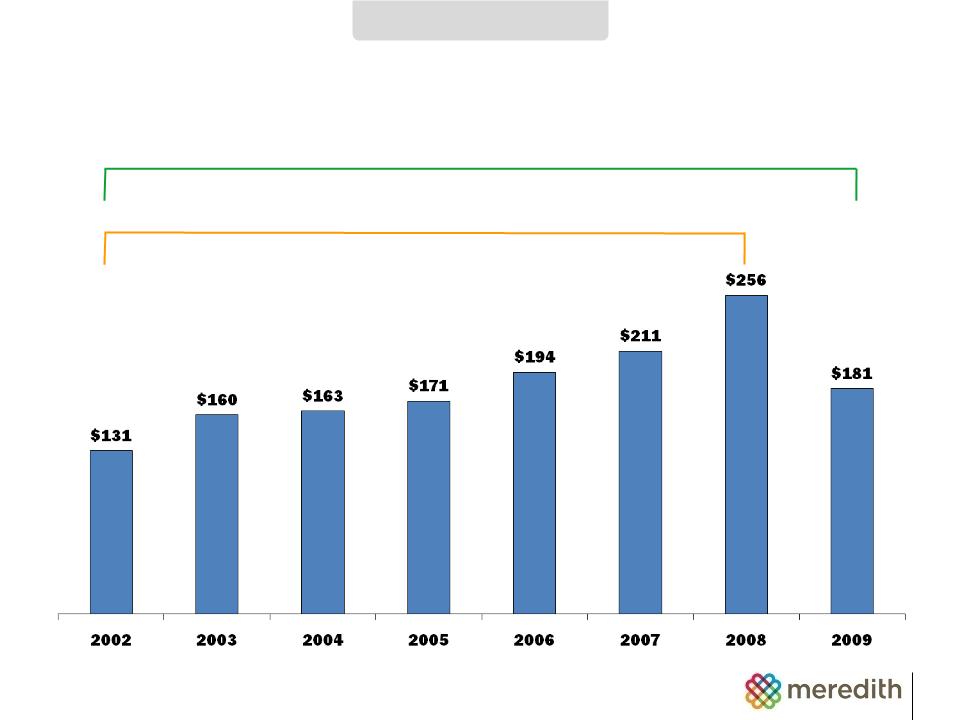

Historical Cash Flow From Operations

FINANCIAL OVERVIEW

12% CAGR

5% CAGR

30

Use of Cash: Fiscal 2000 through 2009

FINANCIAL OVERVIEW

200

Stock Option Exercises

$2,000

Utilization of Cash

100

Net Debt

300

Capital Expenditures

600

Acquisitions, Net of Dispositions

$2,000

Available Cash

$1,800

Operating Cash Flow

300

Dividends

$ in millions

$700

Share Repurchases

$1,000

SUBTOTAL

31

Calendar Year Dividends Per Share

FINANCIAL OVERVIEW

13% CAGR

32

Current | Capacity/Authorization | |

Debt Level | $380 million | Additional $470 million |

Debt-to-EBITDA Ratio | 1.8x | Less than 3.75x |

Interest Coverage Ratio | 10.9x | Greater than 2.75x |

Average Cost of Funds (1) | 5.4% |

As of 6/30/09

(1) After $75 million private placement dated 7/13/09

Financial Metrics

FINANCIAL OVERVIEW

33

$202 trailing 12 EBITDA

$202 trailing 12 EBITDA

$1.6B total cap

$1.2B market cap

§ Current dividend yield

§ EPS multiple:

§ EBITDA multiple

to market capitalization:

to market capitalization:

§ EBITDA multiple

to total capitalization:

to total capitalization:

$2.03 trailing 12 EPS

$27.56 share price

Current Valuation Metrics

• As of June 30, 2009 using trailing 4 quarters actual results, excluding discontinued operations and special items.

• Dividend data uses current dividend of $0.225 per quarter.

• Share price data is market close on Sept. 11, 2009.

FINANCIAL OVERVIEW

$0.90 dividend

$27.56 share price

3.3%

13.6x

6.1x

8.0x

34

Summary

§ Vibrant and profitable media assets and brands

§ Growing market share

§ Wide array of new revenue stream development

§ Strong financial foundation

Goldman Sachs

Communacopia XVIII

New York, Sept. 15-17, 2009