Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

MDP similar filings

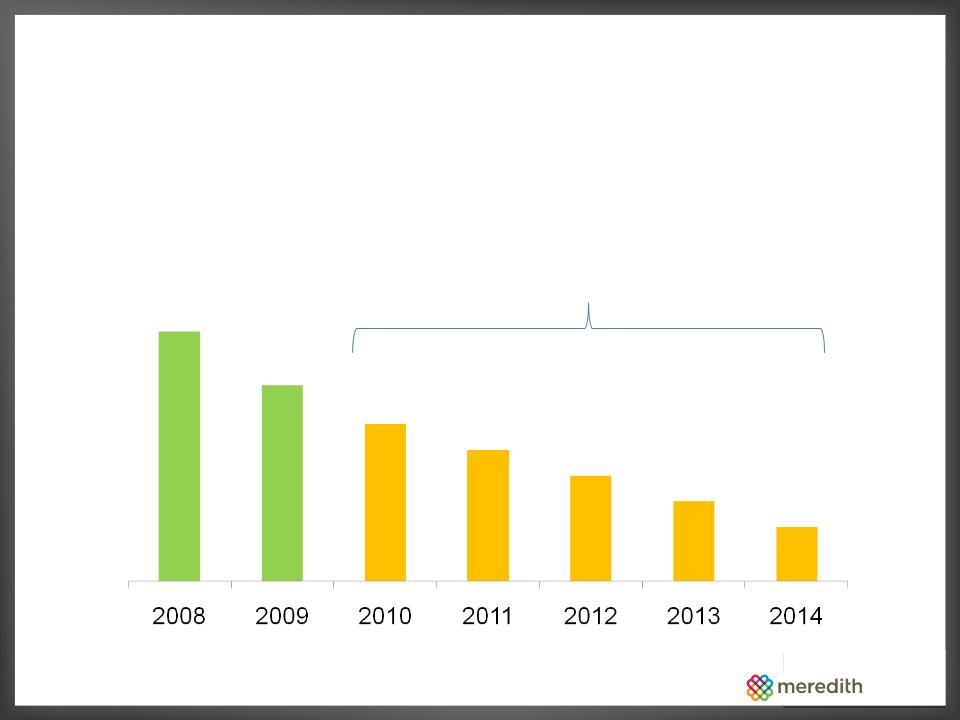

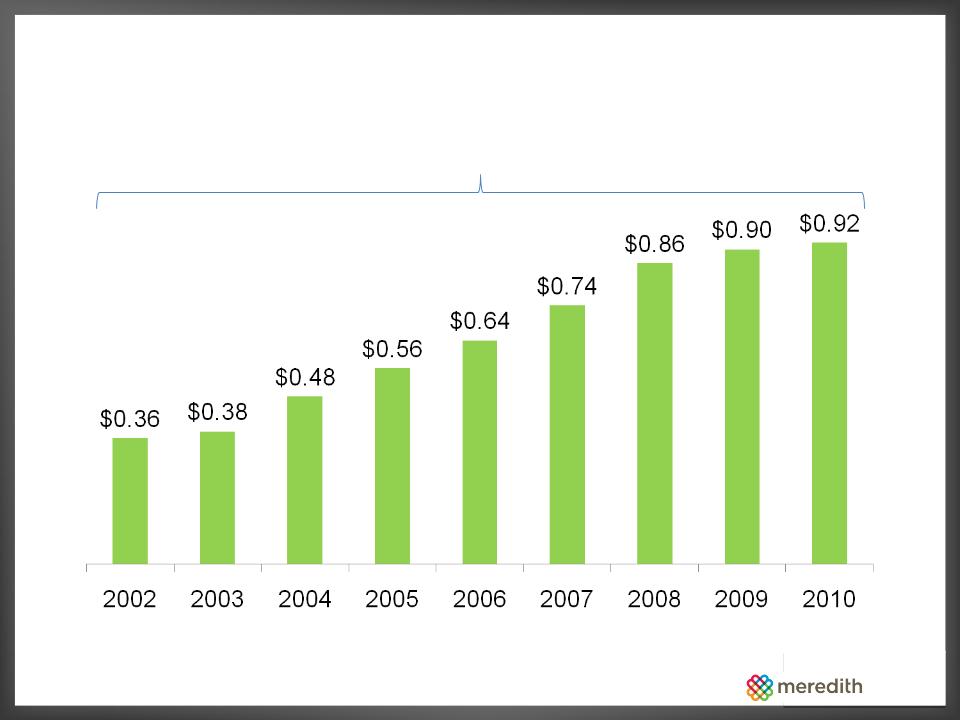

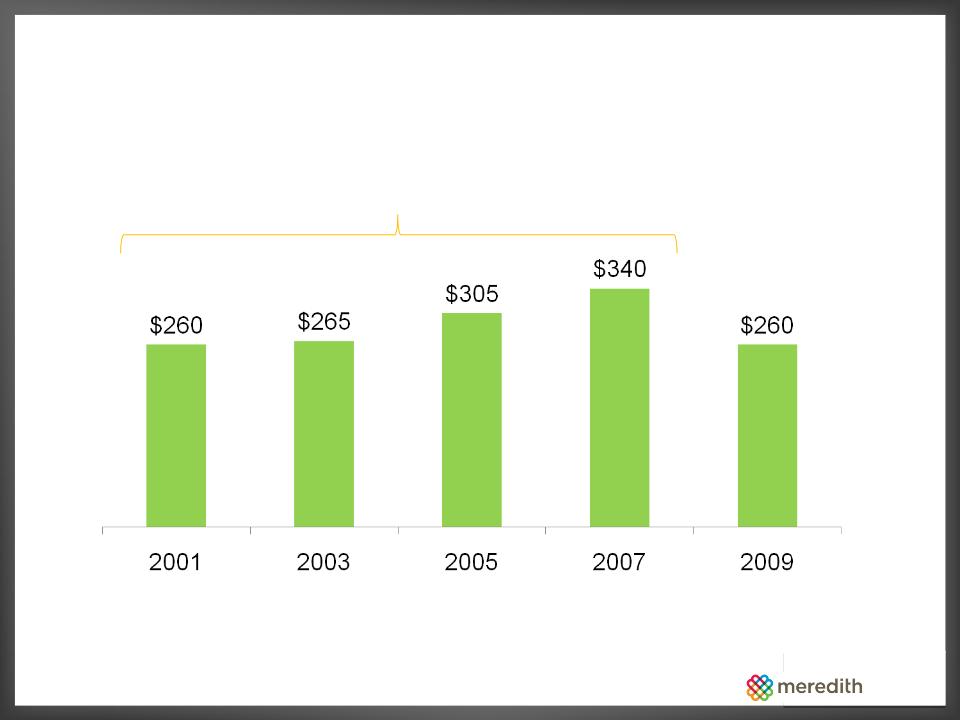

- 29 Jul 10 Meredith Reports Strong Fiscal 2010 Fourth Quarter & Full Year Results

- 30 Jun 10 Other Events

- 18 Jun 10 Entry into a Material Definitive Agreement

- 4 Jun 10 Other Events

- 10 May 10 Jefferies 6th Annual Global Internet, Media and Telecom Conference

- 28 Apr 10 Results of Operations and Financial Condition

- 28 Apr 10 Meredith Fiscal 2010 Third Quarter Earnings Rise Over 30 Percent

Filing view

External links