Placeholder for Saks MXM video

UBS 40th Annual Global Media and Communications Conference • December 2012

Safe Harbor This presentation and management’s public commentary contain certain forward-looking statements that are subject to risks and uncertainties. These statements are based on management’s current knowledge and estimates of factors affecting the Company and its operations. Statements in this presentation that are forward-looking include, but are not limited to, the statements regarding advertising revenues and investment spending, along with the Company’s revenue and earnings per share outlook. Actual results may differ materially from those currently anticipated. Factors that could adversely affect future results include, but are not limited to, downturns in national and/or local economies; a softening of the domestic advertising market; world, national, or local events that could disrupt broadcast television; increased consolidation among major advertisers or other events depressing the level of advertising spending; the unexpected loss or insolvency of one or more major clients; the integration of acquired businesses; changes in consumer reading, purchasing and/or television viewing patterns; increases in paper, postage, printing, or syndicated programming costs; changes in television network affiliation agreements; technological developments affecting products or the methods of distribution; changes in government regulations affecting the Company’s industries; unexpected changes in interest rates; and the consequences of any acquisitions and/or dispositions. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise. 3

+ local media brands + marketing solutions + national media brands Agenda Meredith Overview Key Initiatives: National Media Group Key Initiatives: Local Media Group Financial Strategy 4

1. Powerful media and marketing company: A) Trusted national brands and an unrivaled female reach B) Leading full-service global digital marketing agency C) Portfolio of highly-rated television stations in fast-growing markets 2. Experienced management team with a proven record of operational excellence and value creation 3. Strong stewards of capital, committed to Total Shareholder Return strategy 3 Things to Know about Meredith + local media brands + marketing solutions + national media brands 5

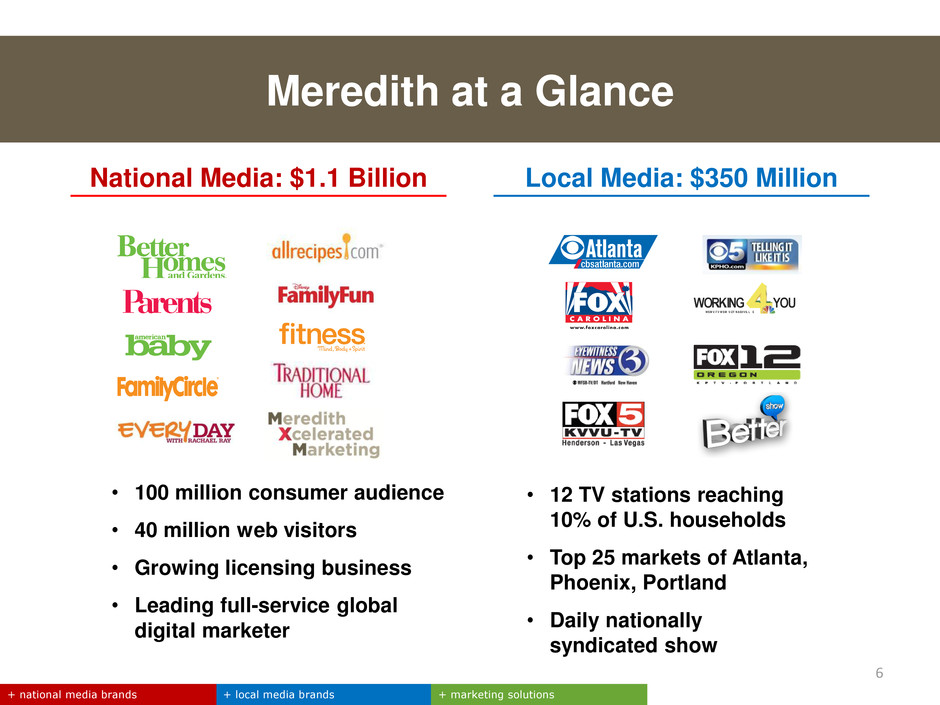

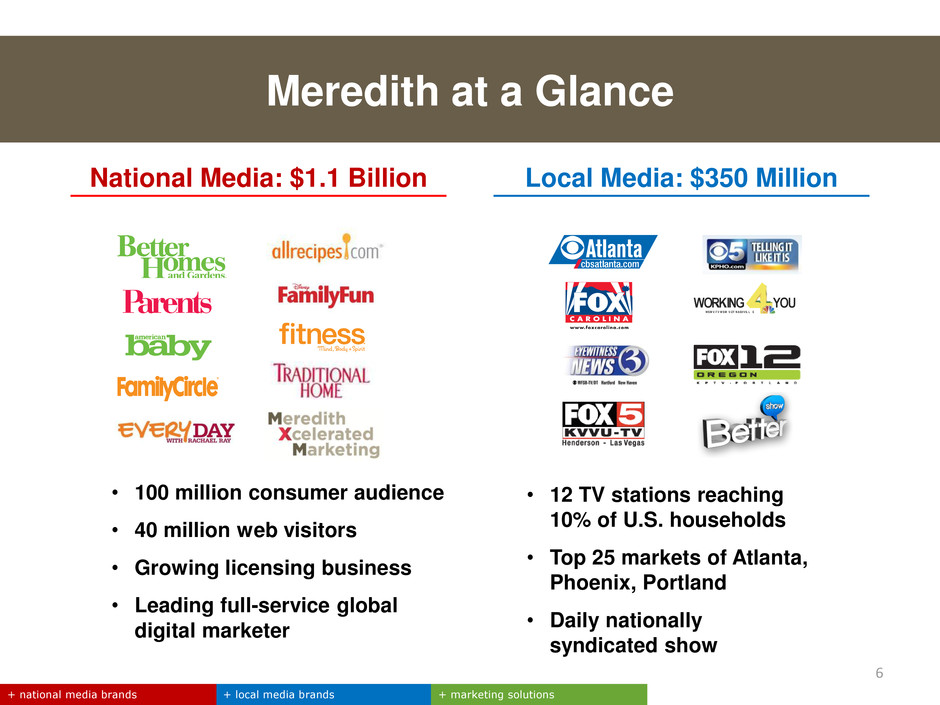

Meredith at a Glance + local media brands + marketing solutions + national media brands 6 National Media: $1.1 Billion Local Media: $350 Million WORKING YOU WS M V -TV W SM V-DT NASHV IL L E • 12 TV stations reaching 10% of U.S. households • Top 25 markets of Atlanta, Phoenix, Portland • Daily nationally syndicated show • 100 million consumer audience • 40 million web visitors • Growing licensing business • Leading full-service global digital marketer

YOUNG ADULTS YOUNG FAMILIES FAMILIES WOMEN OF WORTH Reaching 100 Million Women Focused on their families, their homes, and their self-development + local media brands + marketing solutions + national media brands

Local Brands in Growth Markets Source: US Census + local media brands + marketing solutions + national media brands West +14% Midwest +4% South +14% Northeast +3% Portland (FOX + MYTV) Las Vegas (FOX) Phoenix (CBS) Kansas City (CBS + MYTV) Saginaw (CBS) Atlanta (CBS) Nashville (NBC) Greenville (FOX) Springfield (CBS) Hartford (CBS) * * * * * * * * * * 8

Monetizing Audience Scale Across Platforms Online: Meredith Women’s Network & Allrecipes.com Magazines: Home, Family, Health & Well-being Consumer Events Meredith Xcelerated Marketing Database Marketing Video Studios Brand Licensing Local Media + local media brands + marketing solutions + national media brands 9 Tablet/Mobile

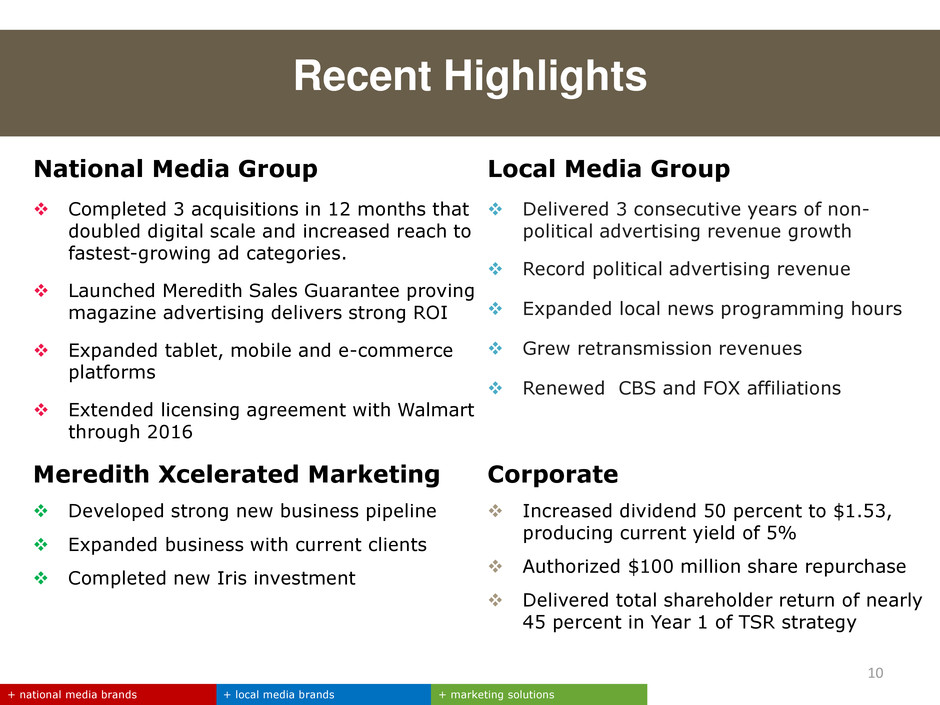

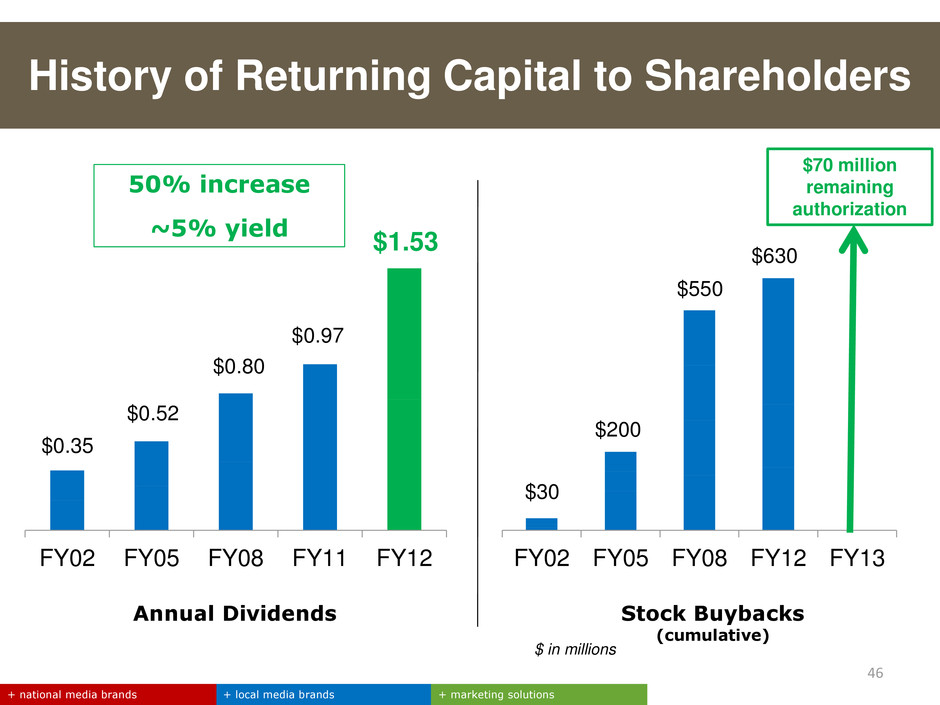

National Media Group Completed 3 acquisitions in 12 months that doubled digital scale and increased reach to fastest-growing ad categories. Launched Meredith Sales Guarantee proving magazine advertising delivers strong ROI Expanded tablet, mobile and e-commerce platforms Extended licensing agreement with Walmart through 2016 10 Meredith Xcelerated Marketing Developed strong new business pipeline Expanded business with current clients Completed new Iris investment Local Media Group Delivered 3 consecutive years of non- political advertising revenue growth Record political advertising revenue Expanded local news programming hours Grew retransmission revenues Renewed CBS and FOX affiliations Corporate Increased dividend 50 percent to $1.53, producing current yield of 5% Authorized $100 million share repurchase Delivered total shareholder return of nearly 45 percent in Year 1 of TSR strategy Recent Highlights + local media brands + marketing solutions + national media brands

11 + local media brands + marketing solutions + national media brands Agenda Meredith Overview Key Initiatives: National Media Group — Gaining advertising market share — Capitalizing on strength in food, parenting and home categories — Increasing reach to fast-growing categories — Growing brand licensing — Executing digital strategy — Maximizing Meredith Xcelerated Marketing Key Initiatives: Local Media Group Financial Strategy

Placeholder for NMG video

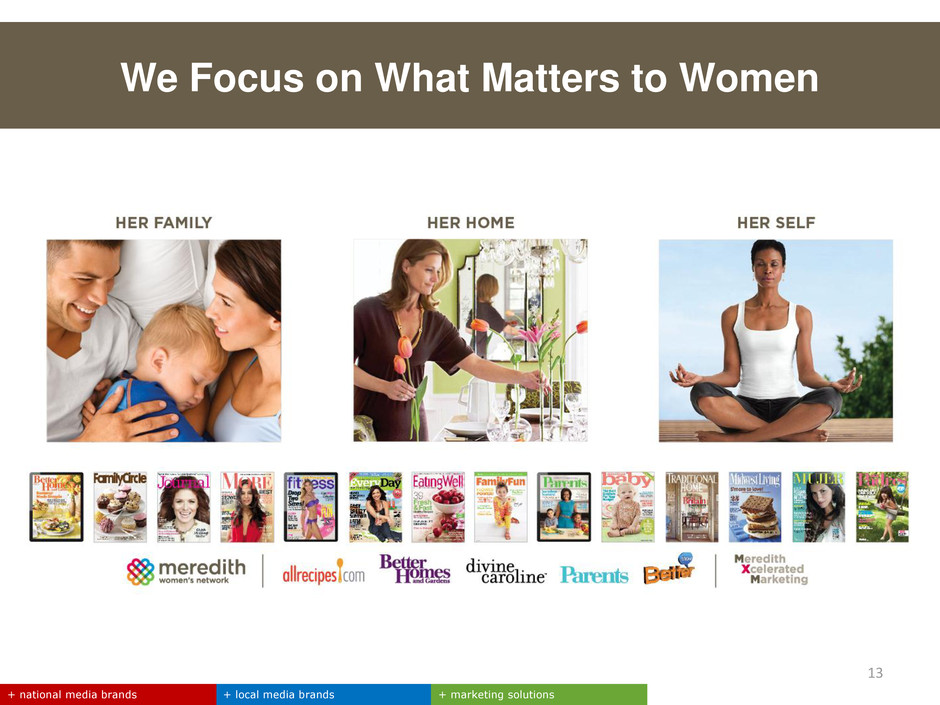

13 We Focus on What Matters to Women + local media brands + marketing solutions + national media brands

Our Consumer Reach is Growing Across Platforms #s in millions + local media brands + marketing solutions + national media brands 14 3 10 40 2001 2007 2013 Magazine Readership Online Unique Visitors 68 108 116 2001 2007 2013 5% CAGR 25% CAGR

15 Better Homes and Gardens is America’s #1 Choice Magazine • Largest paid monthly title in the U.S. • Most trusted magazine brand among women • #1 share of market in the Women’s Service Category Online and social media • Largest women’s service website • #1 magazine brand on Pinterest • Strong presence on Facebook, Tumblr and Twitter Mobile and tablet media • Available on all major platforms • 2M downloads for Must Have Recipes + local media brands + marketing solutions + national media brands

Market Share per PIB; since 2001 Growing Market Share vs. Peers + local media brands + marketing solutions + national media brands 16 Growth in Advertising Revenue Market Share 2012 21% 17% 15% 11% 2001 20% 14% 10% 5% Market share 5% 30% 50% 120% 0% 20% 40% 60% 80% 100% 120% 140% Time Hearst Conde Nast MeredithMeredith

+ local media brands + marketing solutions + national media brands Innovative Meredith Sales Guarantee Research-driven product that proves advertising in Meredith’s magazines drives sales Based on Nielsen Homescan data that is highly trusted by major advertisers Currently 13 major consumer brands participating Recently expanded to pharmaceutical clients 17

Meredith Magazines Generate Higher ROI 18 $2.79 $6.48 $6.61 Digital All Print Meredith Print $2.36 $8.29 Digital All Print Meredith Print All Categories Food Category $2.73 $4.00 $5.59 Digital All Print Meredith Print Beauty Category Chart shows average ROI (ROI: incremental sales generated per media dollar spent) Copyright 2012 Nielsen Catalina Solutions (864 digital studies, 17 Meredith print, 5 other print) $13.78 + local media brands + marketing solutions + national media brands

DIGITAL VIDEO MOBILE PRINT TABLET SOCIAL 19 #1 Share in the Food Category + local media brands + marketing solutions + national media brands Dominant player with nearly 20% share of advertising market

#1 Share in the Parenthood Category Dominant player with 40% share of advertising market + local media brands + marketing solutions + national media brands 20

21 #1 Share in the Home Category Dominant player with 40% share of advertising market + local media brands + marketing solutions + national media brands Better Homes and Gardens – World’s #1 home brand Traditional Home – Luxury category leader; Advertising Age ―A List‖ Deliver the largest female audience – 47 million across all brands

22 #1 Share in the Hispanic Category + local media brands + marketing solutions + national media brands Reach more than 1 in 3 Hispanic women in the U.S. Siempre Mujer– Largest Spanish-language women’s lifestyle brand Ser Padres – #1 Spanish-language parenthood brand Meredith Hispanic Ventures – Experts in multi-cultural messaging

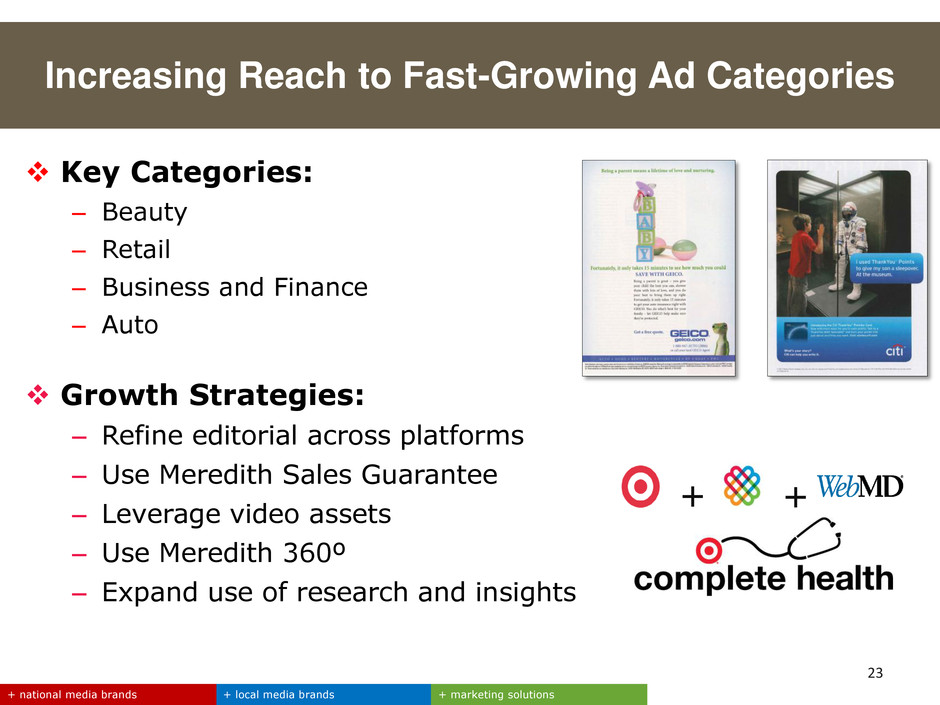

23 Key Categories: – Beauty – Retail – Business and Finance – Auto Growth Strategies: – Refine editorial across platforms – Use Meredith Sales Guarantee – Leverage video assets – Use Meredith 360º – Expand use of research and insights Increasing Reach to Fast-Growing Ad Categories + local media brands + marketing solutions + national media brands + +

Walmart − Renewed/expanded program through 2016 − Currently 3,000+ SKU’s − Major product areas include: • Bedroom linens, bath towels • Dishware for kitchens, dining rooms • Home furnishings • Outdoor furniture, garden essentials Better Homes and Gardens Real Estate − 7,600 agents in 25 U.S. states + Canada Meredith International − 25 relationships in 20 countries Expanding Brand Licensing Activities + local media brands + marketing solutions + national media brands 24

+ local media brands + marketing solutions + national media brands 25 Meredith Women’s Network: 40 Million Unique Visitors The #1 Premium Network in the Women’s Lifestyle Category

#1 Food Brand in the World 25 million UVS Top 550 U.S. website 55 million pieces of content created by user community annually #5 ranking among social sites, behind 12+ million app downloads— world’s most downloaded recipe apps 17 Sites 22 Countries 11 Languages 9 Apps

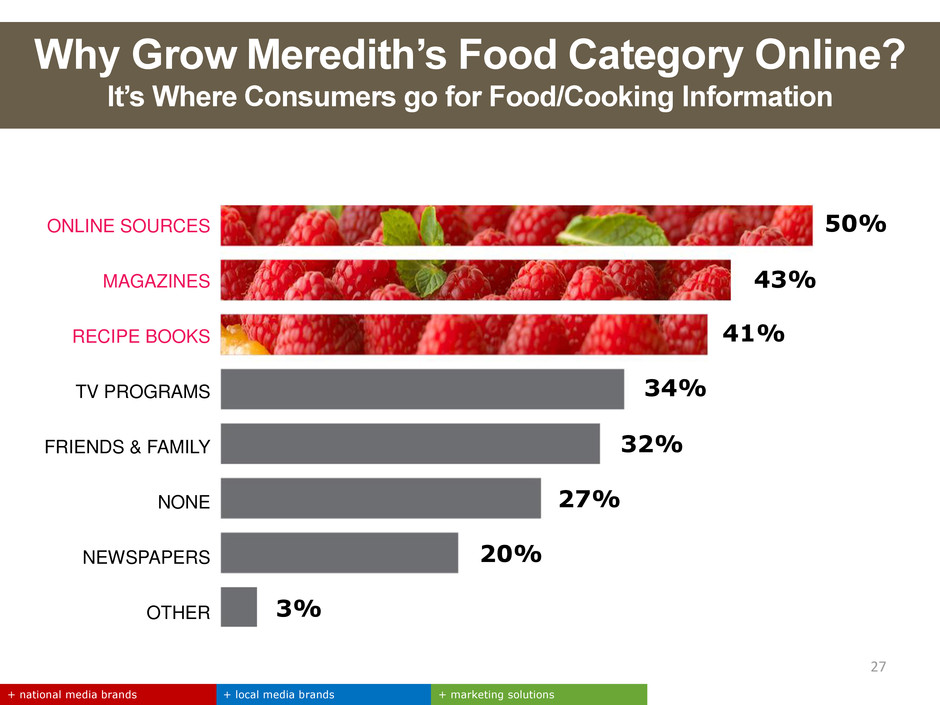

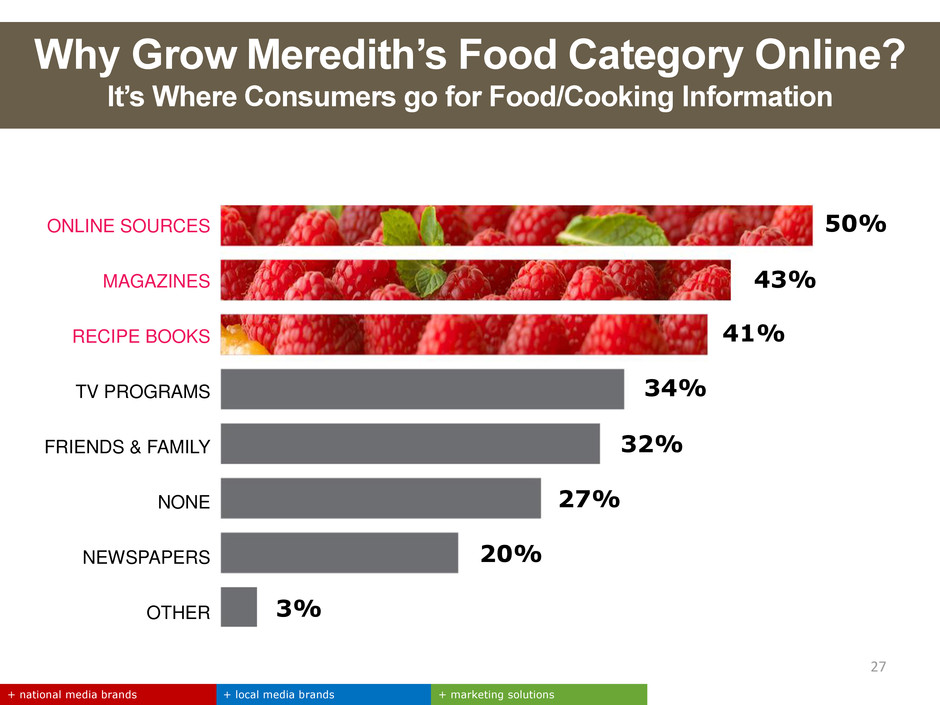

ONLINE SOURCES MAGAZINES RECIPE BOOKS TV PROGRAMS FRIENDS & FAMILY NONE NEWSPAPERS OTHER 34% 32% 27% 20% 3% + local media brands + marketing solutions + national media brands 27 50% 41% 32% 20% 43% 34% 27% 3% Why Grow Meredith’s Food Category Online? It’s Where Consumers go for Food/Cooking Information

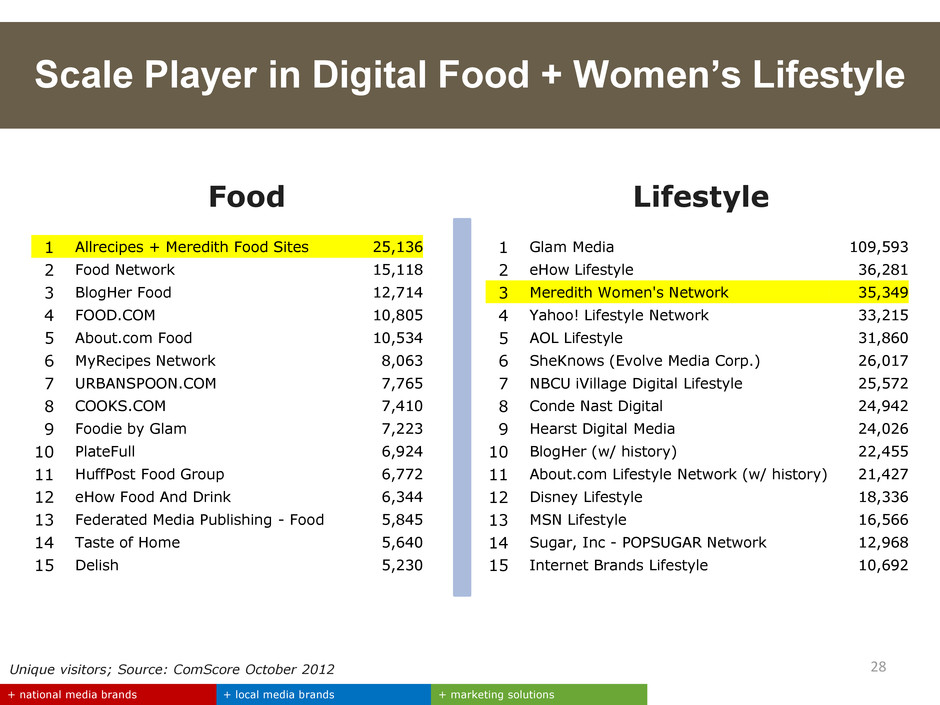

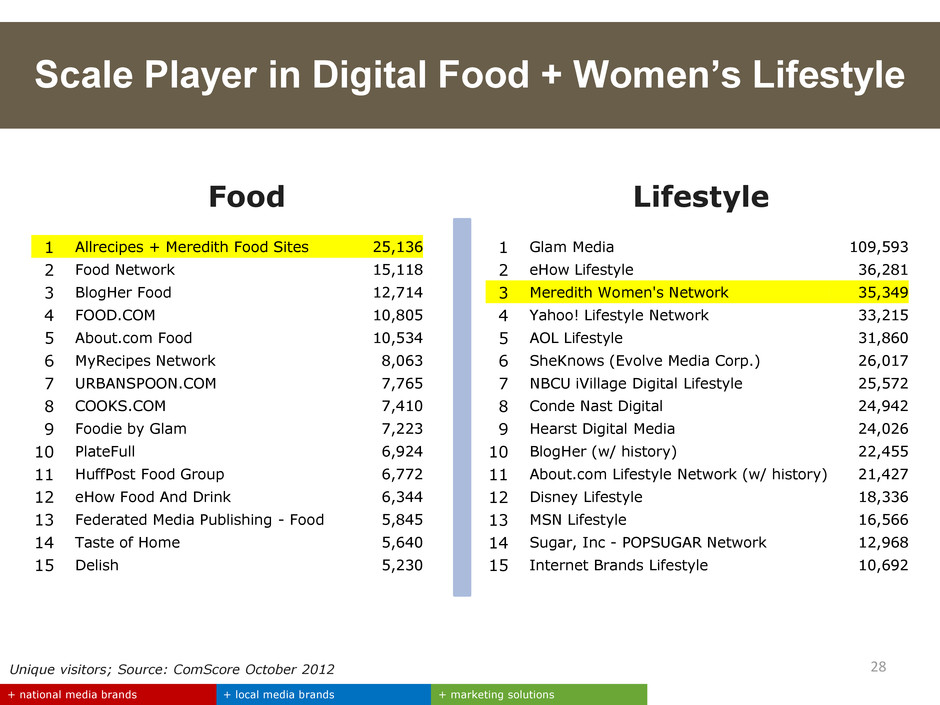

1 Allrecipes + Meredith Food Sites 25,136 1 Glam Media 109,593 2 Food Network 15,118 2 eHow Lifestyle 36,281 3 BlogHer Food 12,714 3 Meredith Women's Network 35,349 4 FOOD.COM 10,805 4 Yahoo! Lifestyle Network 33,215 5 About.com Food 10,534 5 AOL Lifestyle 31,860 6 MyRecipes Network 8,063 6 SheKnows (Evolve Media Corp.) 26,017 7 URBANSPOON.COM 7,765 7 NBCU iVillage Digital Lifestyle 25,572 8 COOKS.COM 7,410 8 Conde Nast Digital 24,942 9 Foodie by Glam 7,223 9 Hearst Digital Media 24,026 10 PlateFull 6,924 10 BlogHer (w/ history) 22,455 11 HuffPost Food Group 6,772 11 About.com Lifestyle Network (w/ history) 21,427 12 eHow Food And Drink 6,344 12 Disney Lifestyle 18,336 13 Federated Media Publishing - Food 5,845 13 MSN Lifestyle 16,566 14 Taste of Home 5,640 14 Sugar, Inc - POPSUGAR Network 12,968 15 Delish 5,230 15 Internet Brands Lifestyle 10,692 Scale Player in Digital Food + Women’s Lifestyle Food Unique visitors; Source: ComScore October 2012 Lifestyle + local media brands + marketing solutions + national media brands 28

Mobile web, apps, tablets Web Mobile Video eBooks Allrecipes.com is Growing Across Platforms 29

Placeholder for Allrecipes/Microsoft video

Growing Mobile & Tablet Presence + local media brands + marketing solutions + national media brands 31 10 MOBILE SITES Mobile drives 32% of all traffic, with 47 million average monthly visits DIGITAL EDITIONS 21 brands on multiple devices and stores MOBILE APPS 21+ million downloads across 20 apps

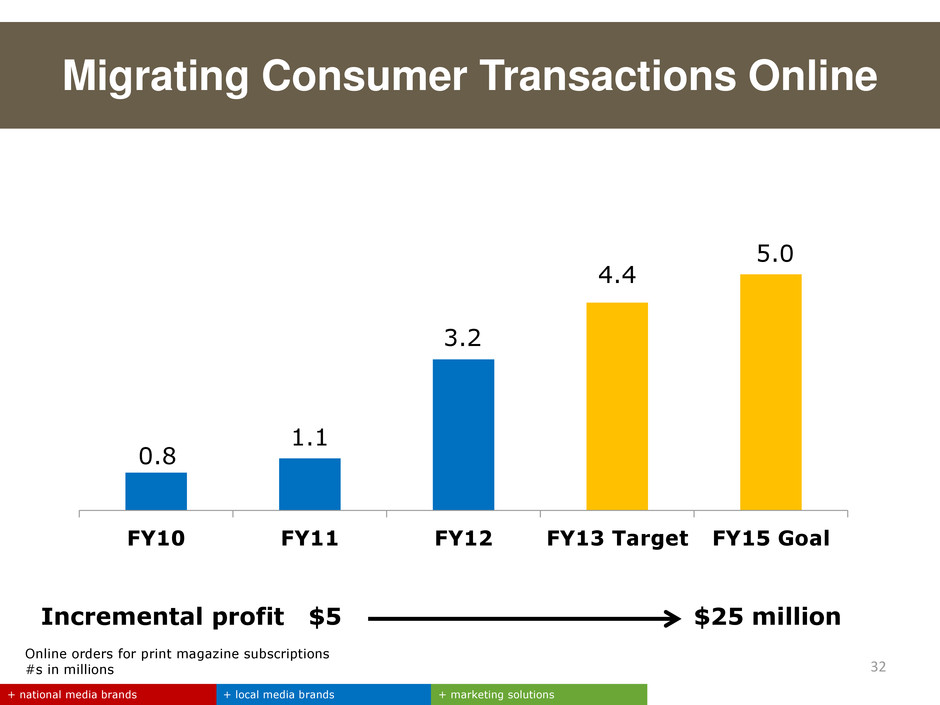

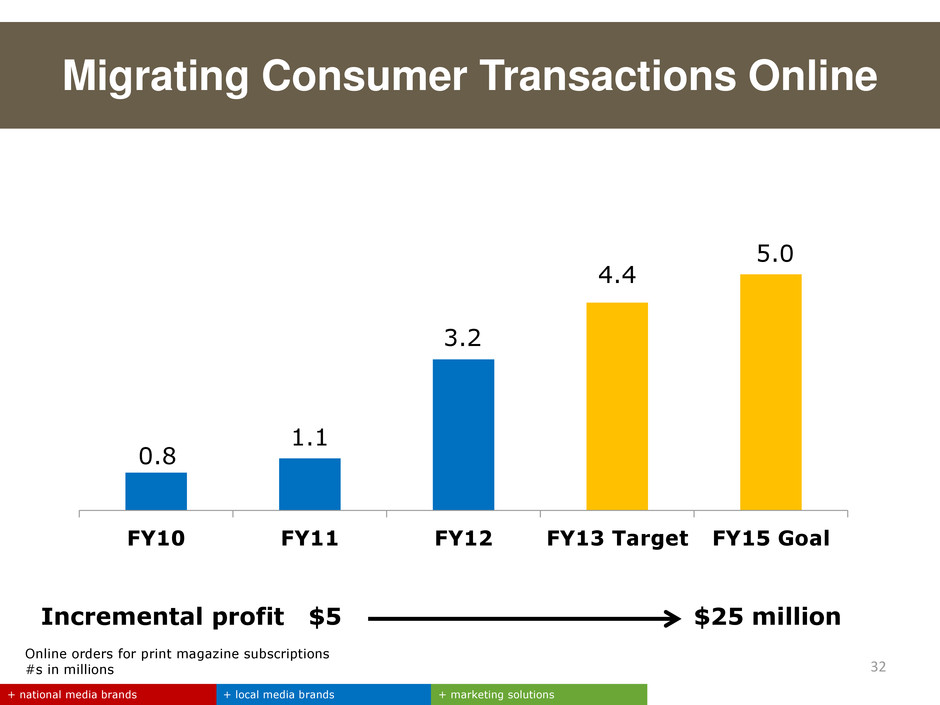

+ local media brands + marketing solutions + national media brands Migrating Consumer Transactions Online 0.8 1.1 3.2 4.4 5.0 FY10 FY11 FY12 FY13 Target FY15 Goal Online orders for print magazine subscriptions #s in millions 32 Incremental profit $5 $25 million

+ local media brands + marketing solutions + national media brands Our capabilities: Digital CRM Social Media Mobile marketing Web design Database marketing Healthcare marketing Custom publishing International Our clients: 33 Meredith Xcelerated Marketing Experts at Multi-Channel Engagement

EMAIL IN-STORE PRINT MAGAZINES LCI.COM TABLET Lowe’s Creative Ideas Marketing Engine VIDEO SOCIAL MARKETING + local media brands + marketing solutions + national media brands IDEAS CREATIVAS 34

Placeholder for Hartford video

+ local media brands + marketing solutions + national media brands Agenda Meredith Overview Key Initiatives: National Media Group Key Initiatives: Local Media Group — Growing ratings to drive rates — Continuing non-political advertising growth — Capitalizing on political advertising opportunity — Increasing digital revenues — Growing non-traditional revenues Financial Strategy 36

Growing Ratings to Drive Advertising Rates Hartford #1 in all newscasts #1 sign-on to sign-off Portland #1 in morning and late news Las Vegas #1 morning and late news Saginaw #1 in all newscasts #1 sign-on to sign-off Nashville #1 in early evening 37

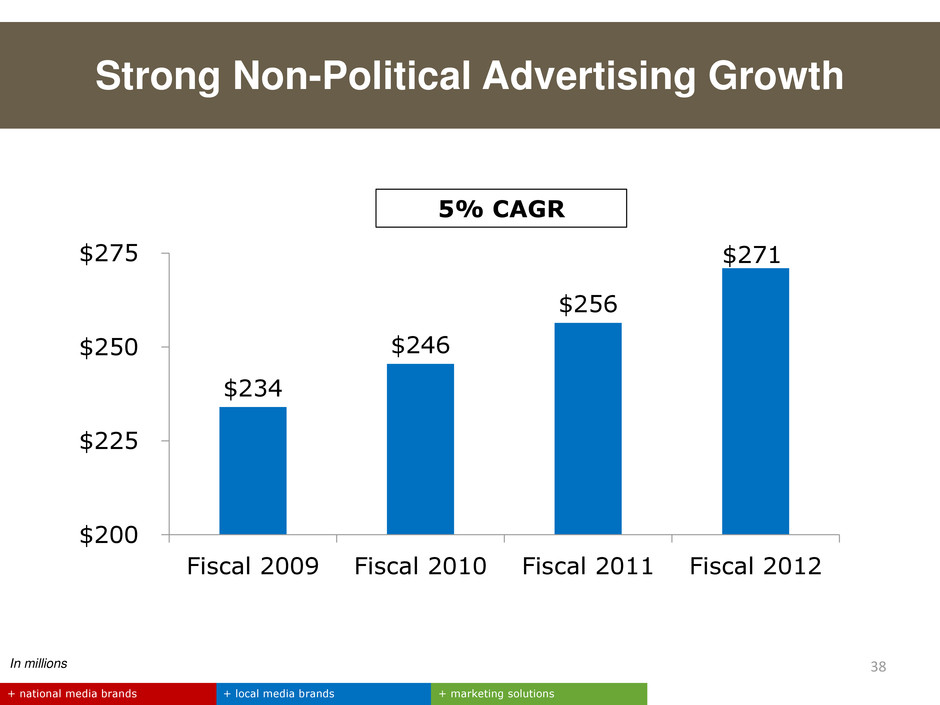

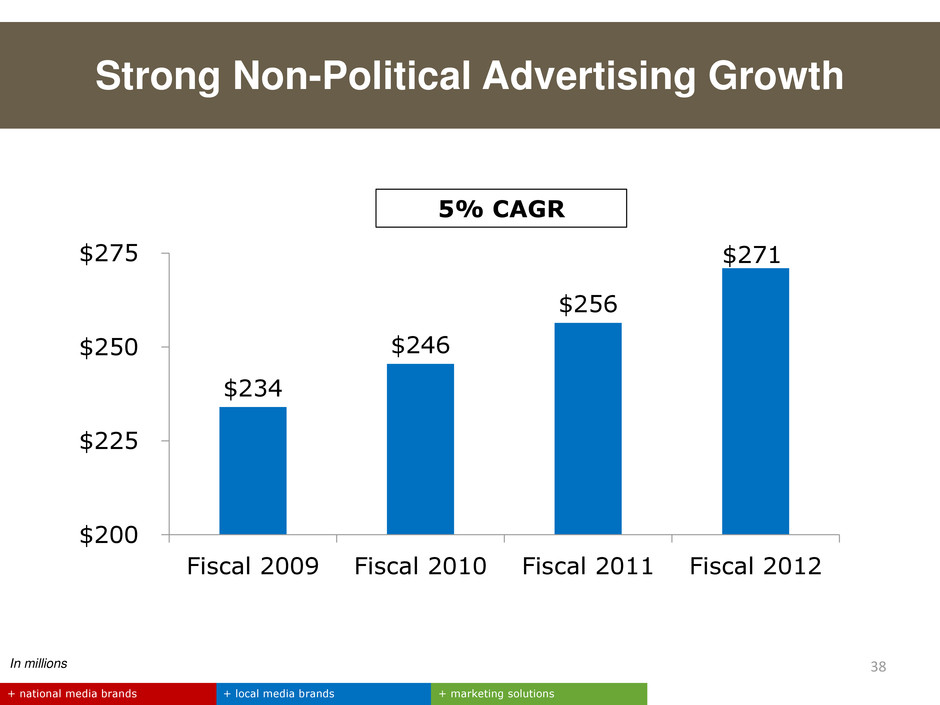

Strong Non-Political Advertising Growth + local media brands + marketing solutions + national media brands In millions 38 $234 $246 $256 $200 $225 $250 $275 Fiscal 2009 Fiscal 2010 Fiscal 2011 Fiscal 2012 $271 5% CAGR

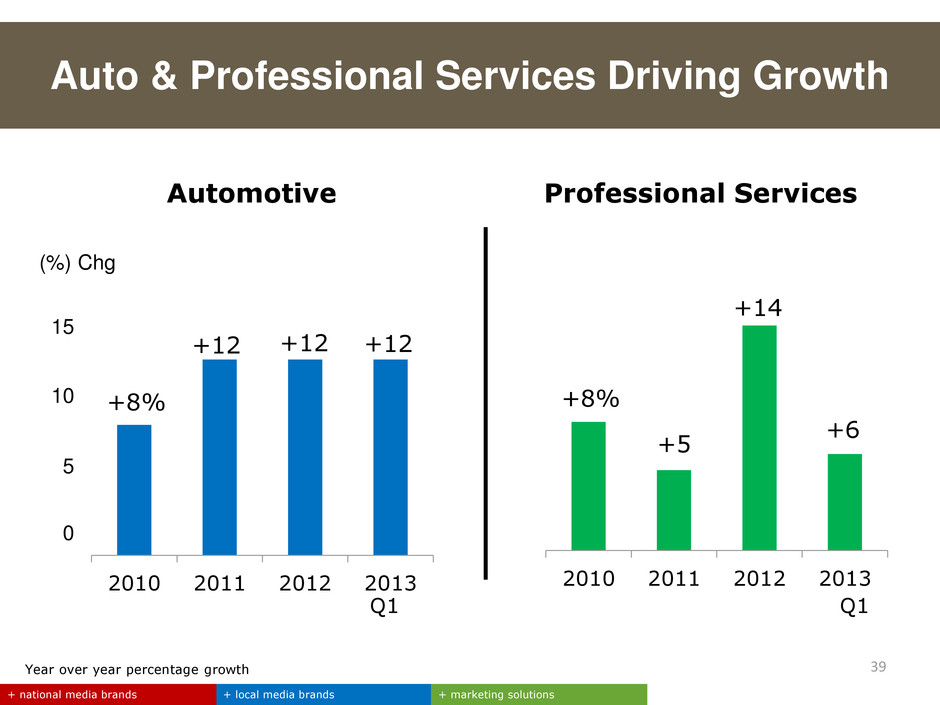

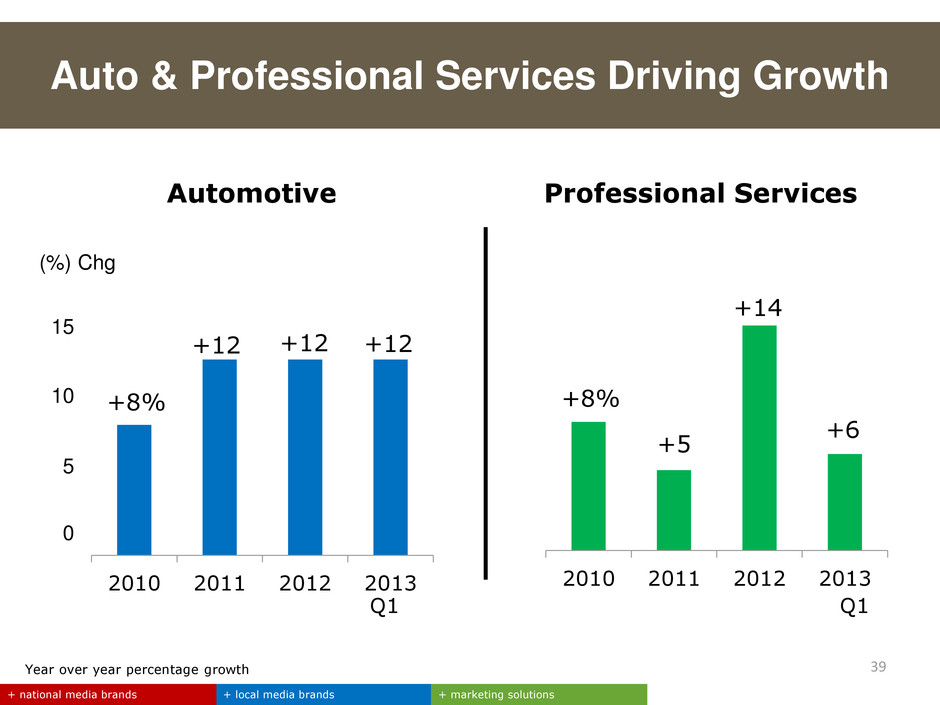

Auto & Professional Services Driving Growth +8% +5 +14 +6 2010 2011 2012 2013 + local media brands + marketing solutions + national media brands Automotive Professional Services Year over year percentage growth +8% +12 +12 +12 2010 2011 2012 2013 Q1 Q1 39 (%) Chg 5 15 10 0

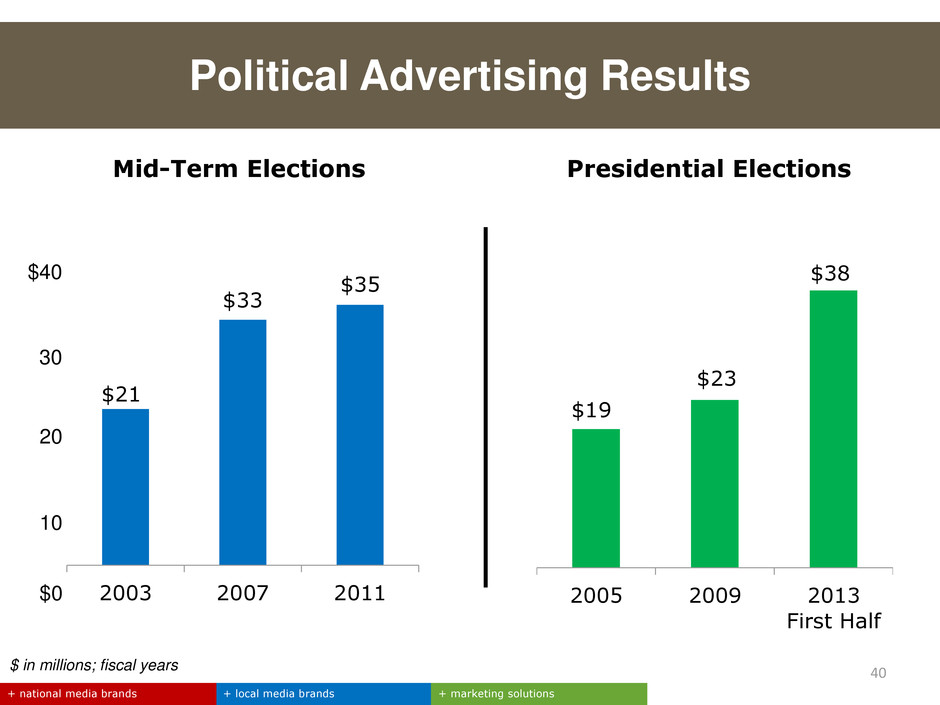

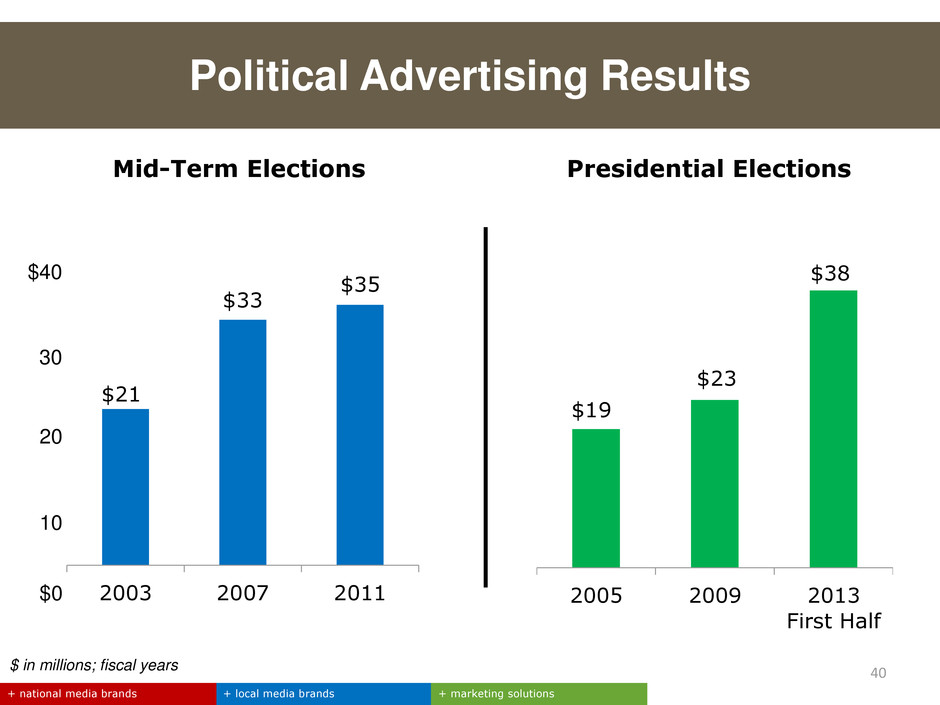

2003 2007 2011 $21 $33 $35 2005 2009 2013 First Half $19 $23 Mid-Term Elections Presidential Elections $ in millions; fiscal years $38 Political Advertising Results 40 + local media brands + marketing solutions + national media brands 20 10 $0 $40 30

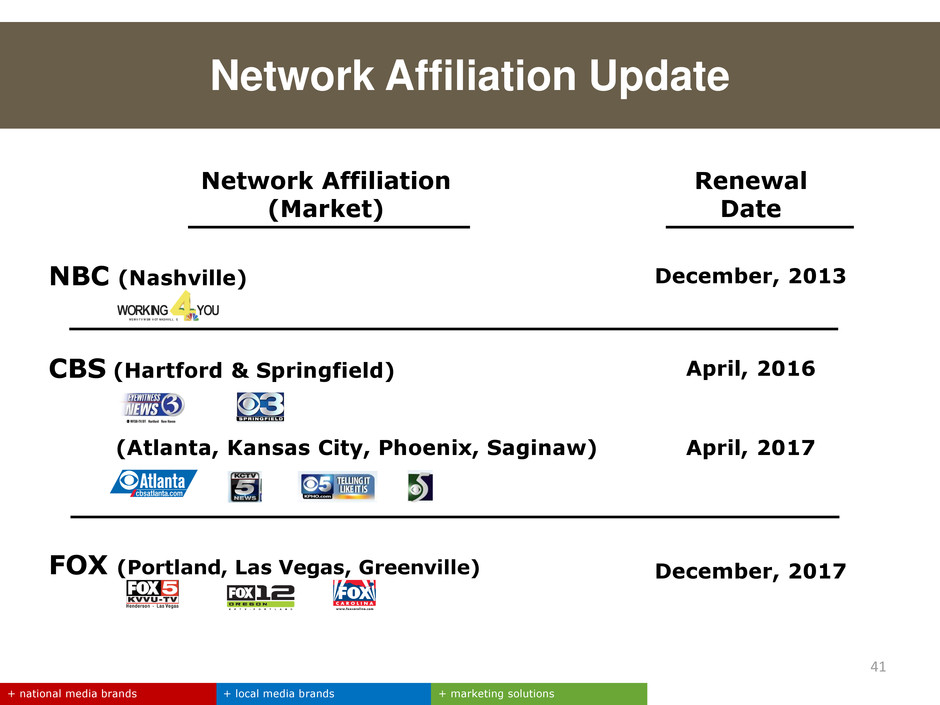

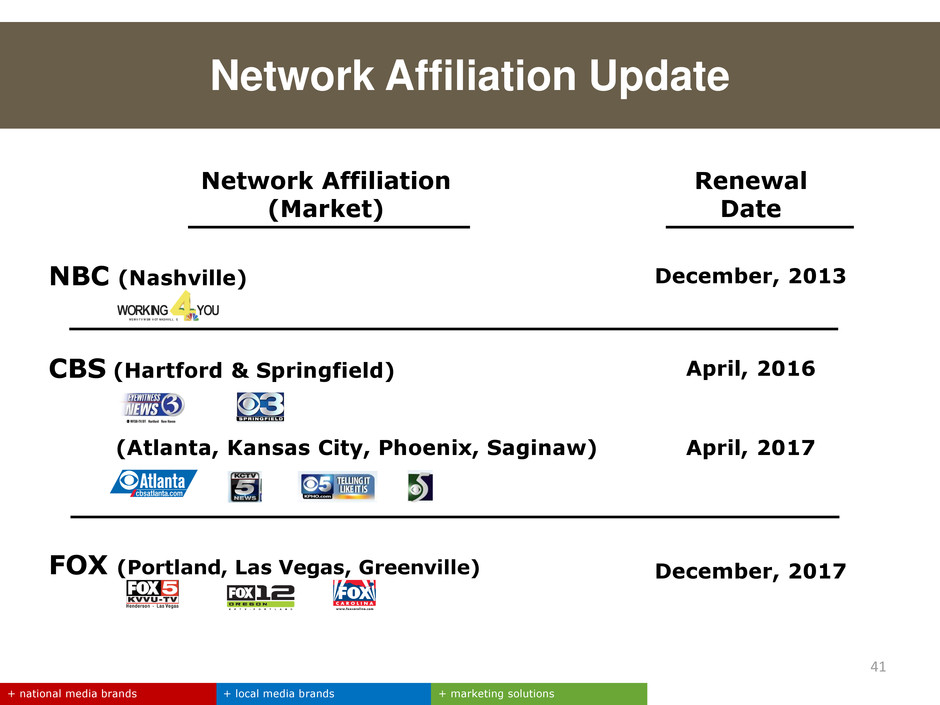

Network Affiliation (Market) Renewal Date NBC (Nashville) December, 2013 CBS (Hartford & Springfield) April, 2016 (Atlanta, Kansas City, Phoenix, Saginaw) April, 2017 FOX (Portland, Las Vegas, Greenville) December, 2017 Network Affiliation Update + local media brands + marketing solutions + national media brands 41 WORKING YOU WS M V -TV W SM V-DT NASHV IL L E

+ local media brands + marketing solutions + national media brands Agenda Meredith Overview Key Initiatives: National Media Group Key Initiatives: Local Media Group Financial Strategy 42

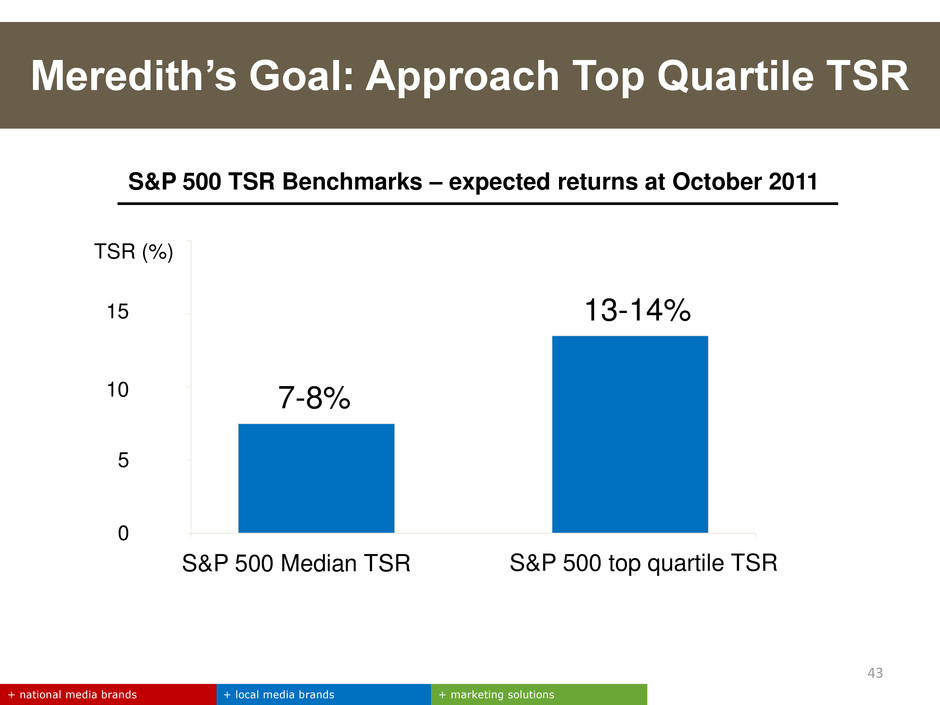

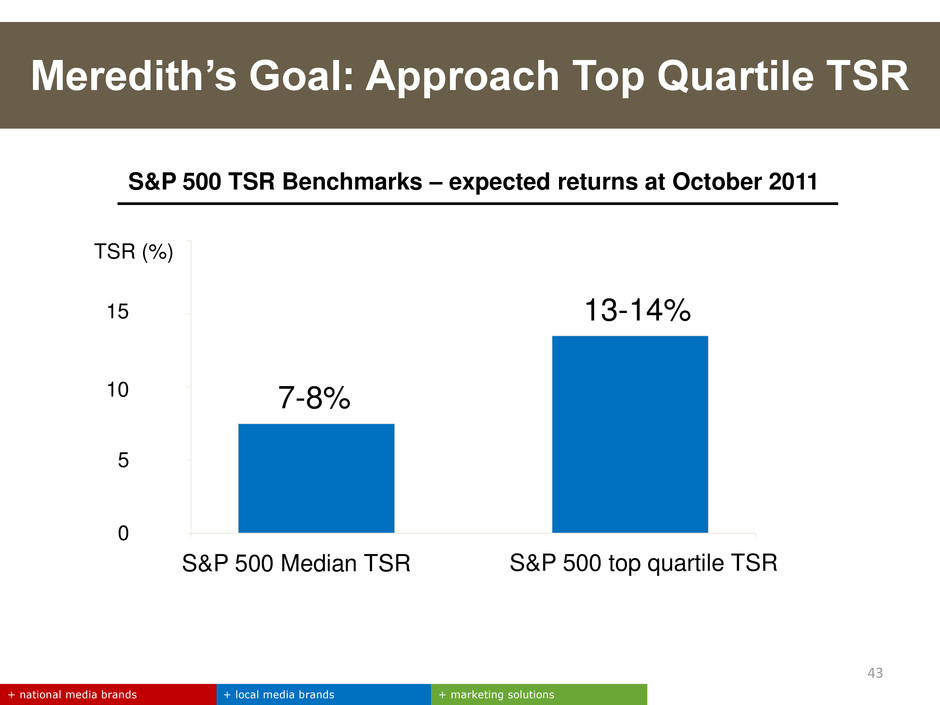

TSR (%) 5 15 10 0 13-14% 7-8% S&P 500 Median TSR S&P 500 top quartile TSR S&P 500 TSR Benchmarks – expected returns at October 2011 Meredith’s Goal: Approach Top Quartile TSR + local media brands + marketing solutions + national media brands 43

Revenue growth 2 – 4% Net margin expansion 2 – 4% Net income Growth 4 – 8% 1.Based on timing of share repurchase plan and actual share price. Note: There is a strong commitment to maintaining this dividend payout level. The range in dividend yield results from the expected variance in share price. + local media brands + marketing solutions + national media brands 1. 2. 3. Earnings Growth Free Cash Flow Yield Change in Valuation Other potential TSR contributors • Acquisition accretion TBD • PE Multiple Change TBD Dividend yield 4 – 5% Buyback yield 2%1 Net debt change (0)% FCF contribution 6 – 7% Annual TSR (%) 10 – 15% Meredith’s View of Total Shareholder Return 44

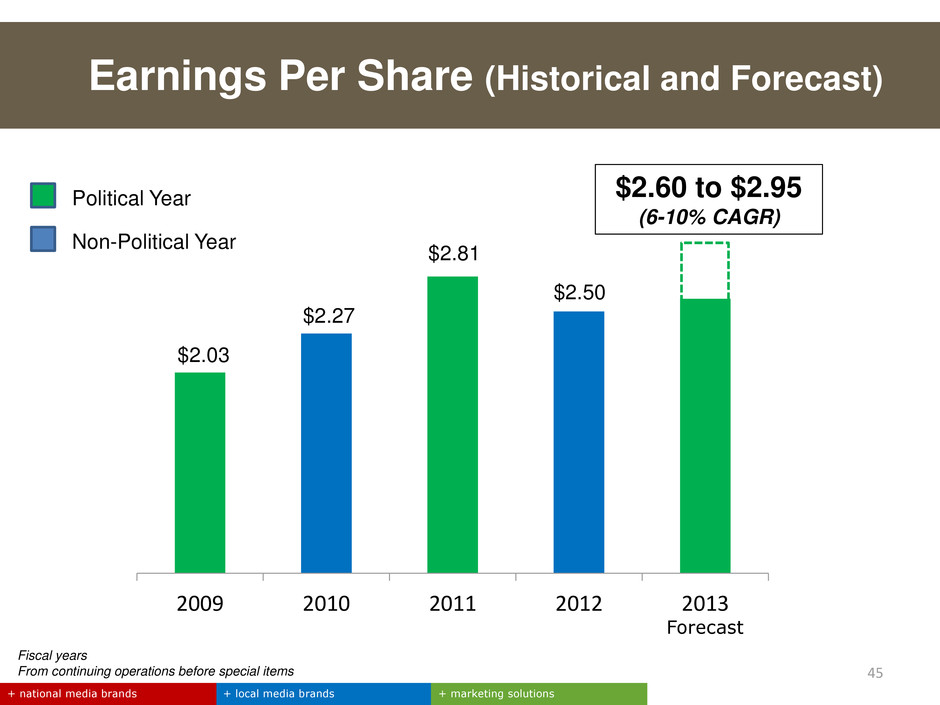

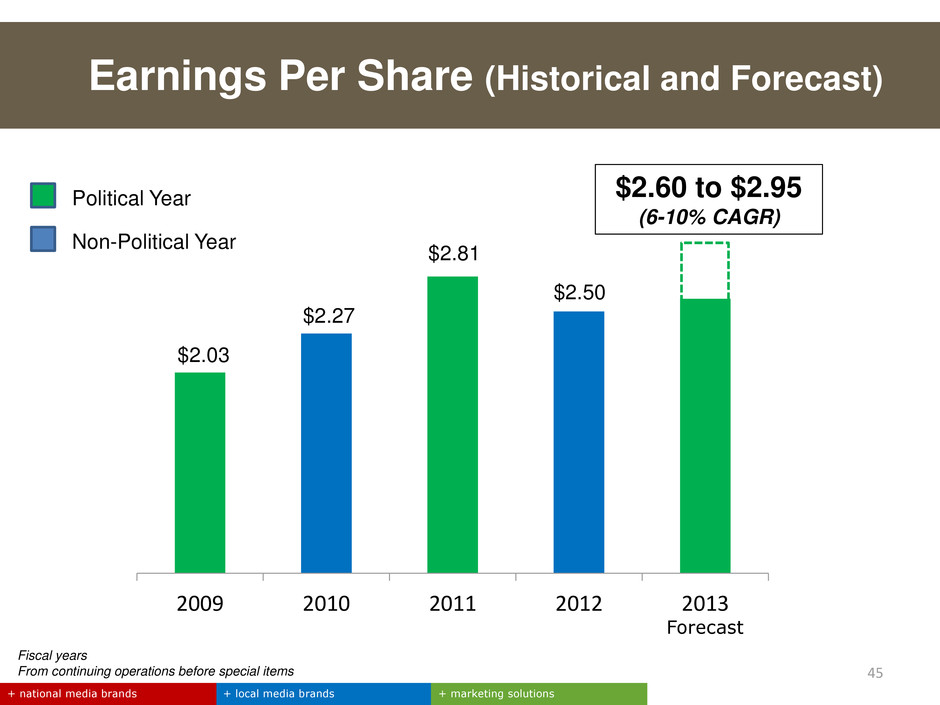

45 Fiscal years From continuing operations before special items 2009 2010 2011 2012 2013 $2.03 $2.27 $2.81 $2.50 $2.60 to $2.95 (6-10% CAGR) Forecast + local media brands + marketing solutions + national media brands Earnings Per Share (Historical and Forecast) Non-Political Year Political Year

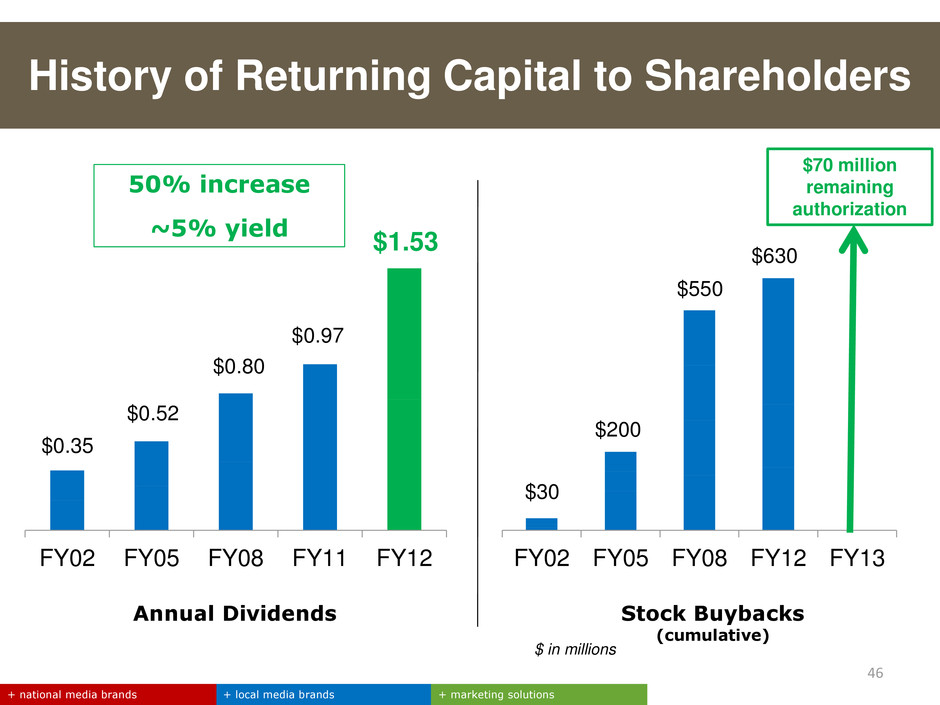

46 History of Returning Capital to Shareholders + local media brands + marketing solutions + national media brands $30 $200 $550 $630 FY02 FY05 FY08 FY12 FY13 $70 million remaining authorization $0.35 $0.52 $0.80 $0.97 $1.53 FY02 FY05 FY08 FY11 FY12 Annual Dividends Stock Buybacks (cumulative) $ in millions 50% increase ~5% yield

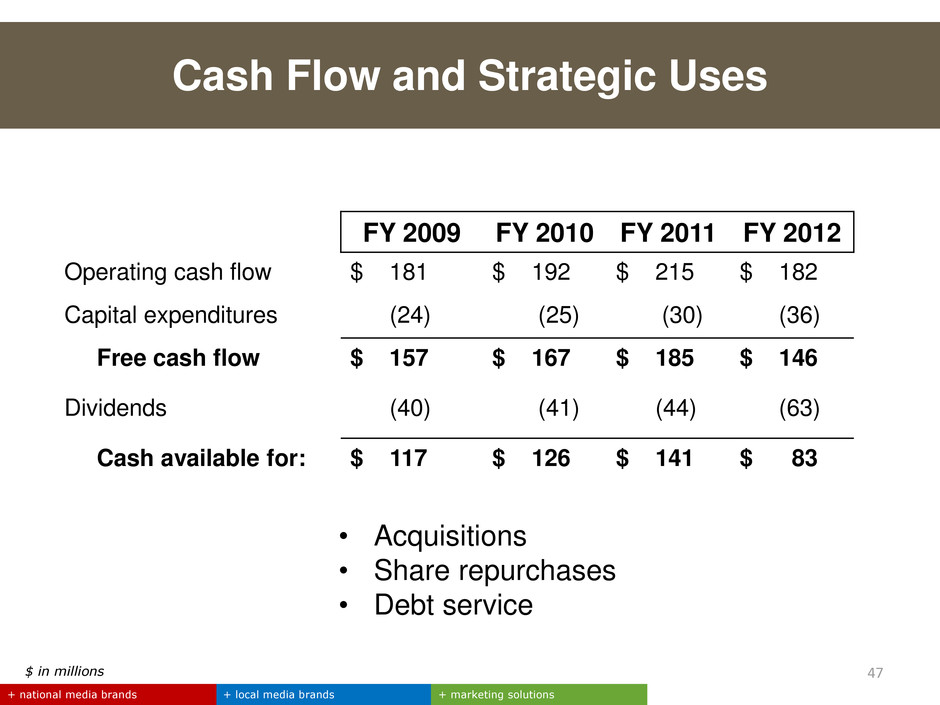

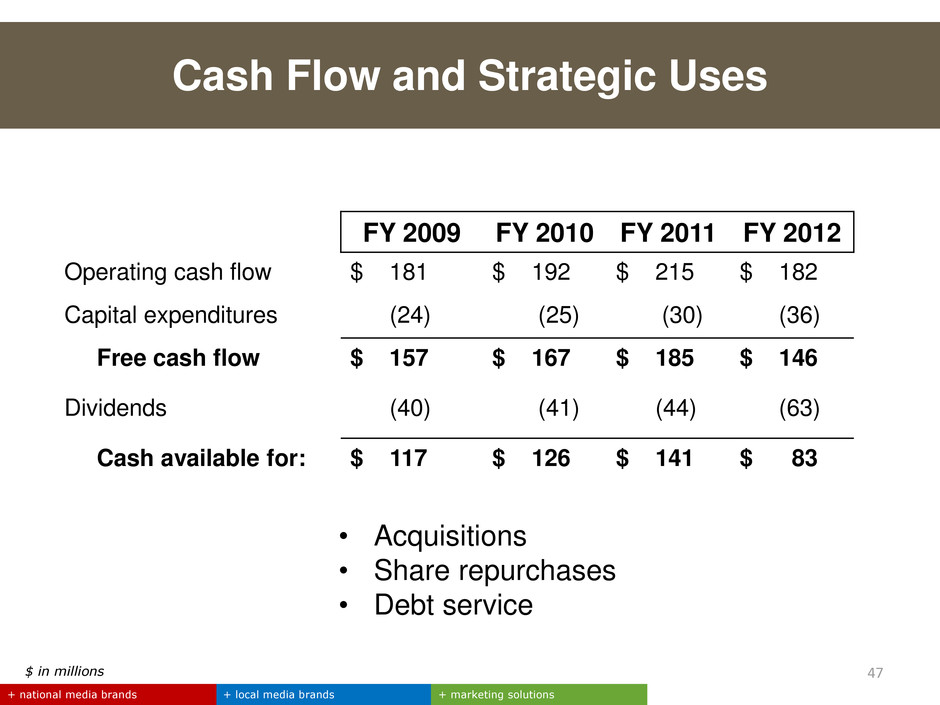

Cash Flow and Strategic Uses + local media brands + marketing solutions + national media brands FY 2009 FY 2010 FY 2011 FY 2012 Operating cash flow $ 181 $ 192 $ 215 $ 182 Capital expenditures (24) (25) (30) (36) Free cash flow $ 157 $ 167 $ 185 $ 146 Dividends (40) (41) (44) (63) Cash available for: $ 117 $ 126 $ 141 $ 83 • Acquisitions • Share repurchases • Debt service 47 $ in millions

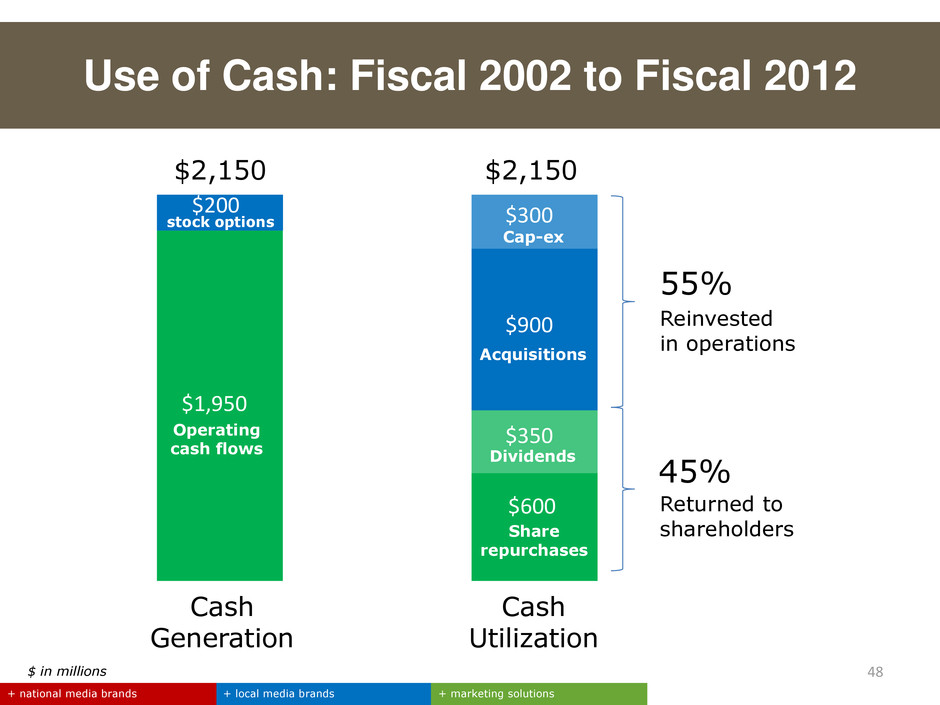

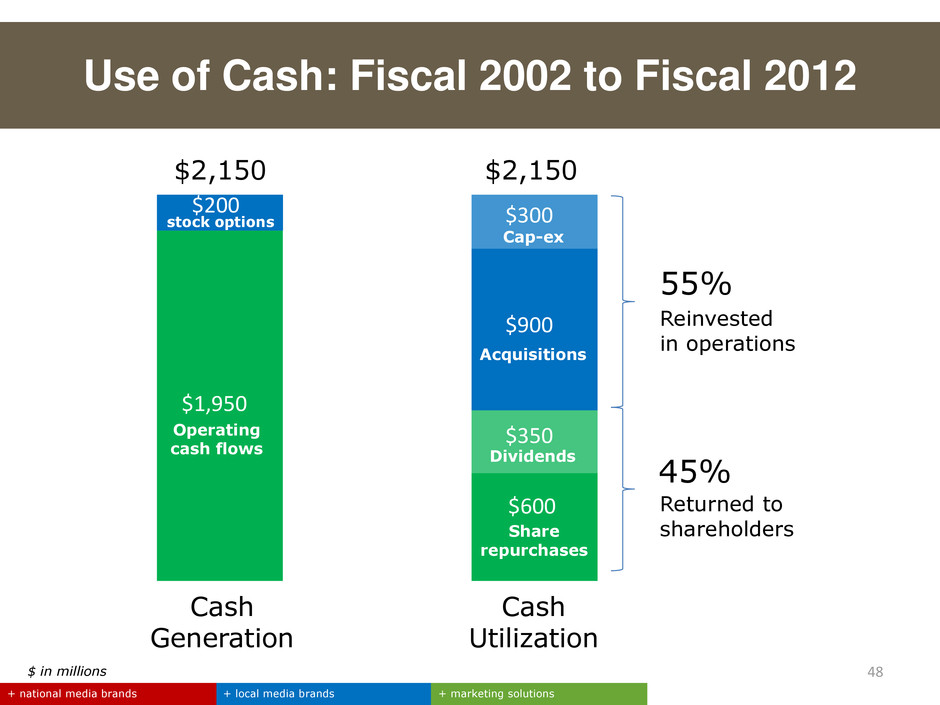

48 + local media brands + marketing solutions + national media brands $ in millions $1,900 $200 $1,950 $200 Cash Generation Cash Utilization $2,150 $2,150 $600 $350 Dividends $300 $900 Share repurchases Acquisitions Cap-ex Operating cash flows stock options 45% 55% Reinvested in operations Returned to shareholders Use of Cash: Fiscal 2002 to Fiscal 2012

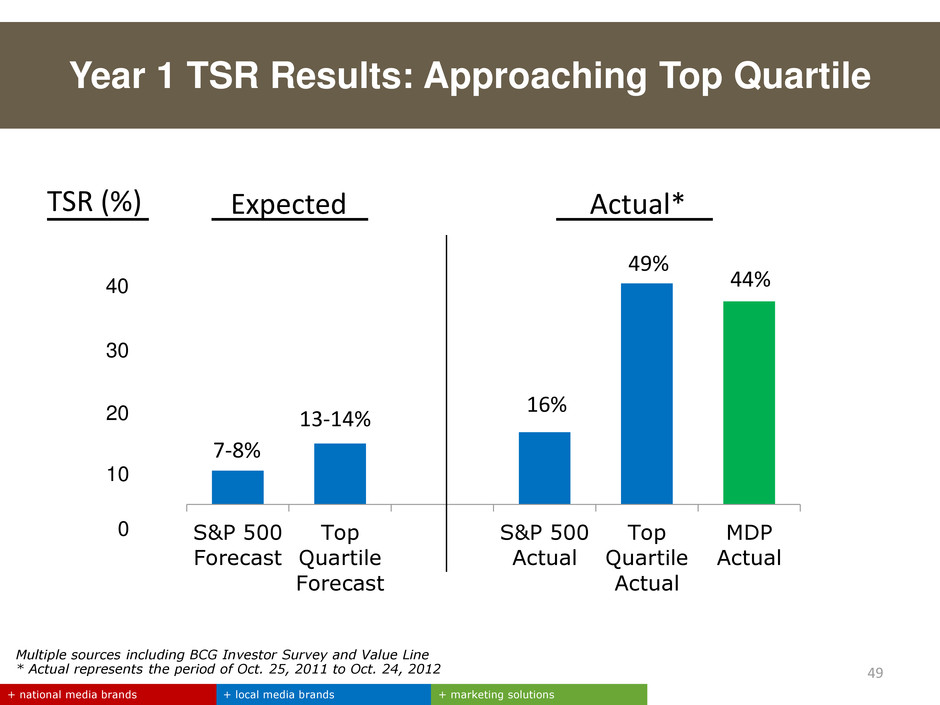

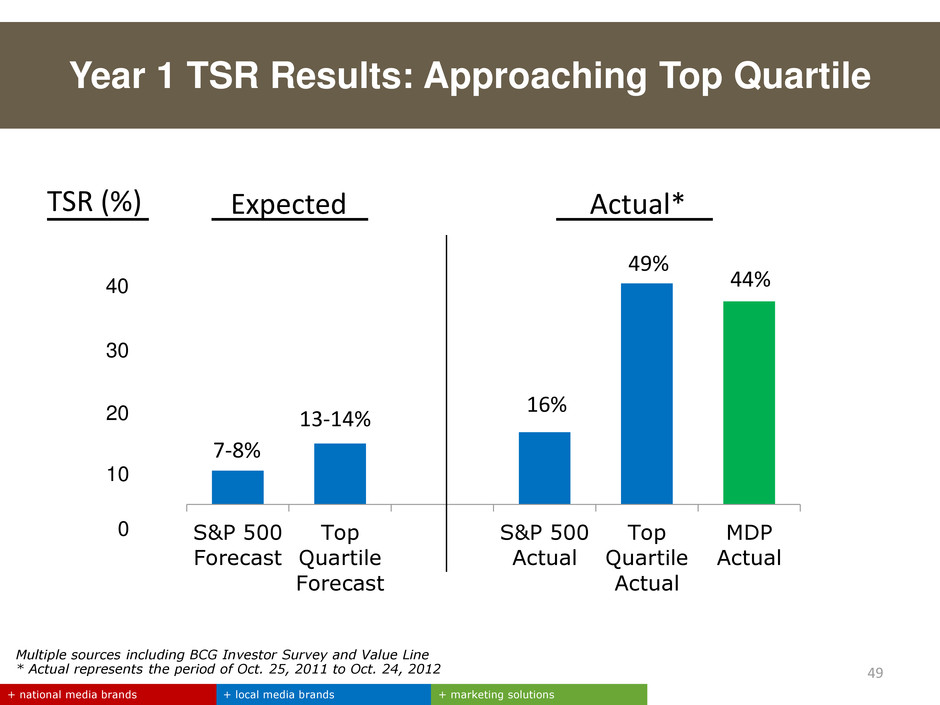

TSR (%) 10 30 20 0 Multiple sources including BCG Investor Survey and Value Line * Actual represents the period of Oct. 25, 2011 to Oct. 24, 2012 Year 1 TSR Results: Approaching Top Quartile + local media brands + marketing solutions + national media brands 49 S&P 500 Forecast Top Quartile Forecast S&P 500 Actual Top Quartile Actual MDP Actual 40 7-8% 16% 13-14% 44% 49% Expected Actual*

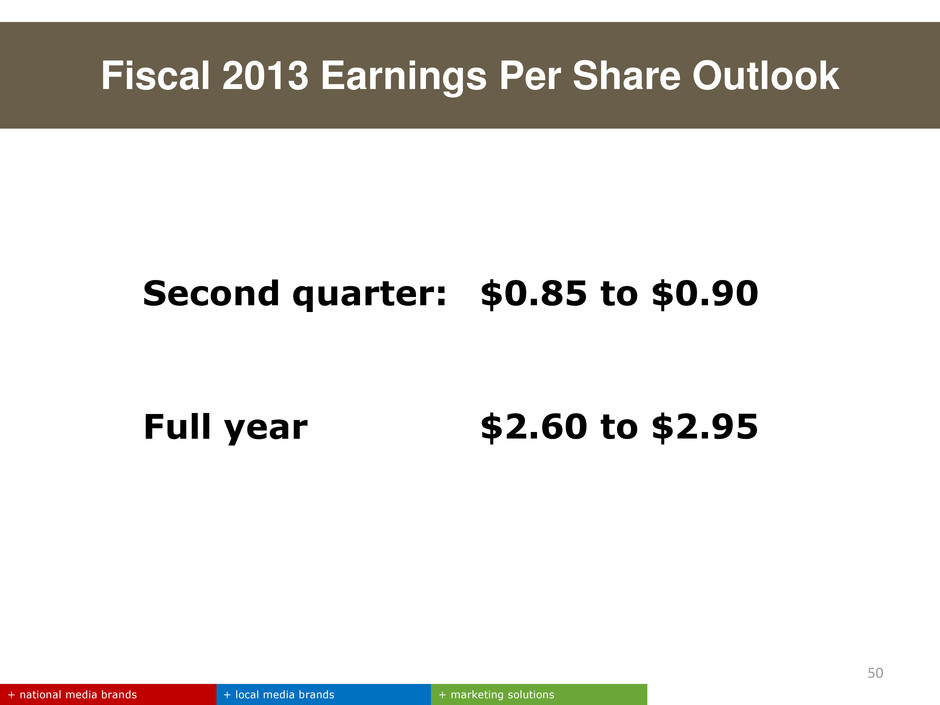

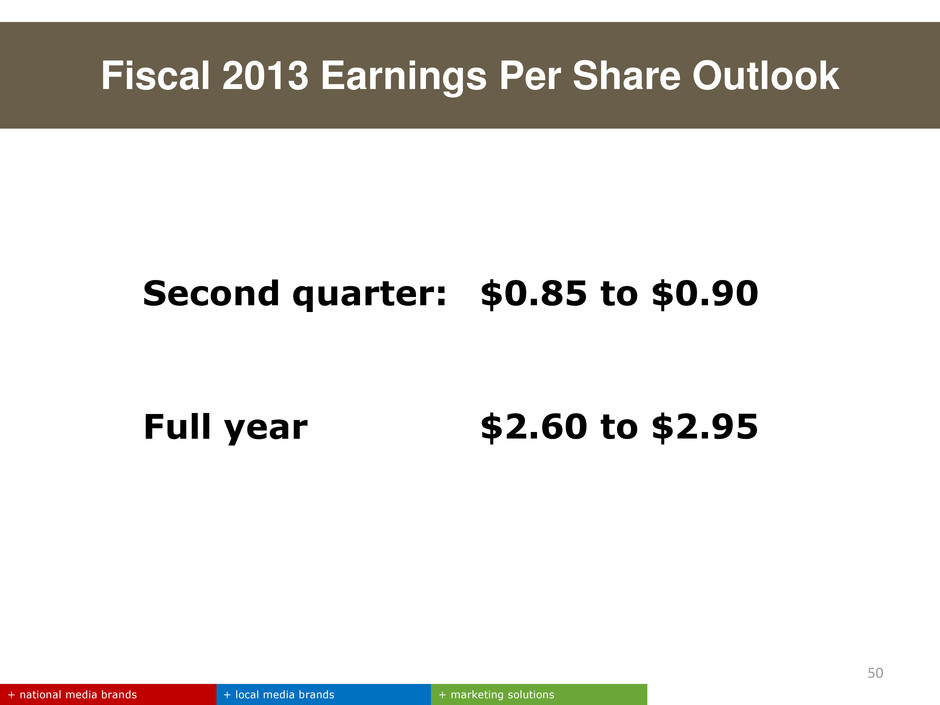

Fiscal 2013 Earnings Per Share Outlook + local media brands + marketing solutions + national media brands 50 Second quarter: Full year $0.85 to $0.90 $2.60 to $2.95

1. Powerful media and marketing company: A) Trusted national brands and an unrivaled female reach B) Leading full-service global digital marketing agency C) Portfolio of highly-rated television stations in fast-growing markets 2. Experienced management team with a proven record of operational excellence and value creation 3. Committed to Total Shareholder Return strategy + local media brands + marketing solutions + national media brands 51 Strong Investment Thesis Targeting 10-15 percent annual Total Shareholder Return

UBS 40th Annual Global Media and Communications Conference • December 2012