Citi 2014 Global Internet, Media and Telecommunications Conference January 6, 2014

Safe Harbor This presentation and management’s public commentary contain certain forward-looking statements that are subject to risks and uncertainties. These statements are based on management’s current knowledge and estimates of factors affecting the Company and its operations. Statements in this presentation that are forward-looking include, but are not limited to, the statements regarding advertising revenues and investment spending, along with the Company’s revenue and earnings per share outlook. Actual results may differ materially from those currently anticipated. Factors that could adversely affect future results include, but are not limited to, downturns in national and/or local economies; a softening of the domestic advertising market; world, national, or local events that could disrupt broadcast television; increased consolidation among major advertisers or other events depressing the level of advertising spending; the unexpected loss or insolvency of one or more major clients; the integration of acquired businesses; changes in consumer reading, purchasing and/or television viewing patterns; increases in paper, postage, printing, or syndicated programming or other costs; changes in television network affiliation agreements; technological developments affecting products or methods of distribution; changes in government regulations affecting the Company’s industries; increases in interest rates; and the consequences of any acquisitions and/or dispositions. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

+ local media brands + marketing solutions+ national media brands Agenda Meredith Overview National Media Group Growth Strategies Local Media Group Growth Strategies Financial Strategy 2 3

1. Powerful media and marketing company: A) Trusted national brands and an unrivaled female reach B) Leading full-service global digital marketing agency C) Portfolio of highly-rated television stations in fast-growing markets D) Creative advertising and marketing solutions for clients 2. Experienced management team with a proven record of operational excellence and value creation 3. Committed to Total Shareholder Return strategy + local media brands + marketing solutions+ national media brands Strong Investment Thesis 4 4

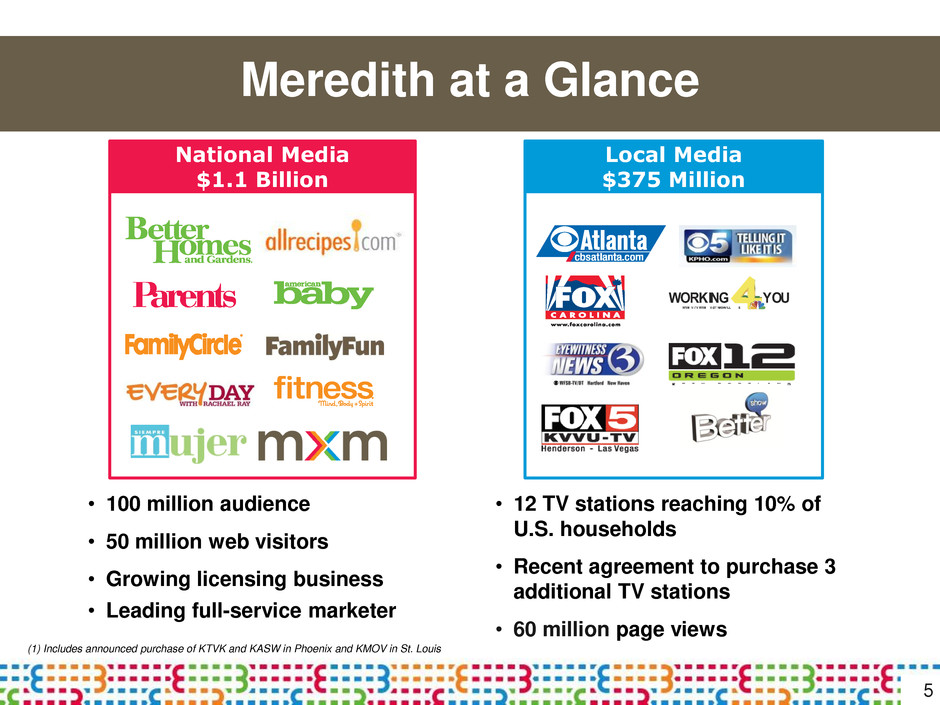

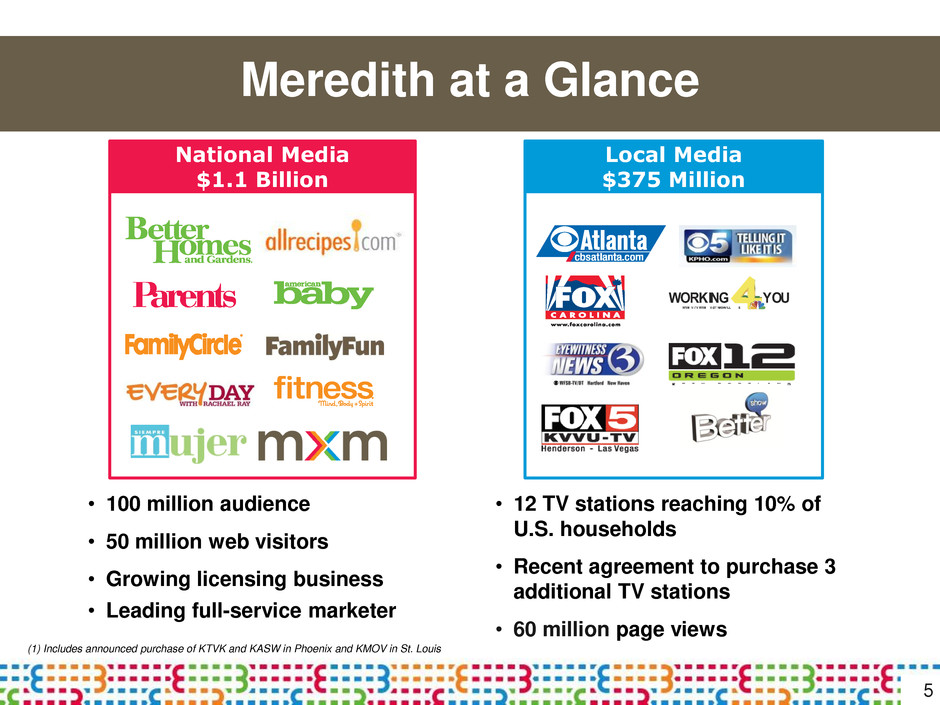

• 12 TV stations reaching 10% of U.S. households • Recent agreement to purchase 3 additional TV stations • 60 million page views • 100 million audience • 50 million web visitors • Growing licensing business • Leading full-service marketer + local media brands + marketing solutions+ national media brands National Media $1.1 Billion WORKING YOU WSM V -TV WSM V-DT NASHVILL E Local Media $375 Million Meredith at a Glance 3 5 (1) Includes announced purchase of KTVK and KASW in Phoenix and KMOV in St. Louis

Our National Media Group Reaches 100 Million American Women + local media brands + marketing solutions+ national media brands 4 6

Leading Global Digital Marketing Agency + local media brands + marketing solutions+ national media brands Our capabilities: Digital CRM Social media Mobile marketing Web design Database marketing Healthcare marketing Custom publishing International Our clients: 77

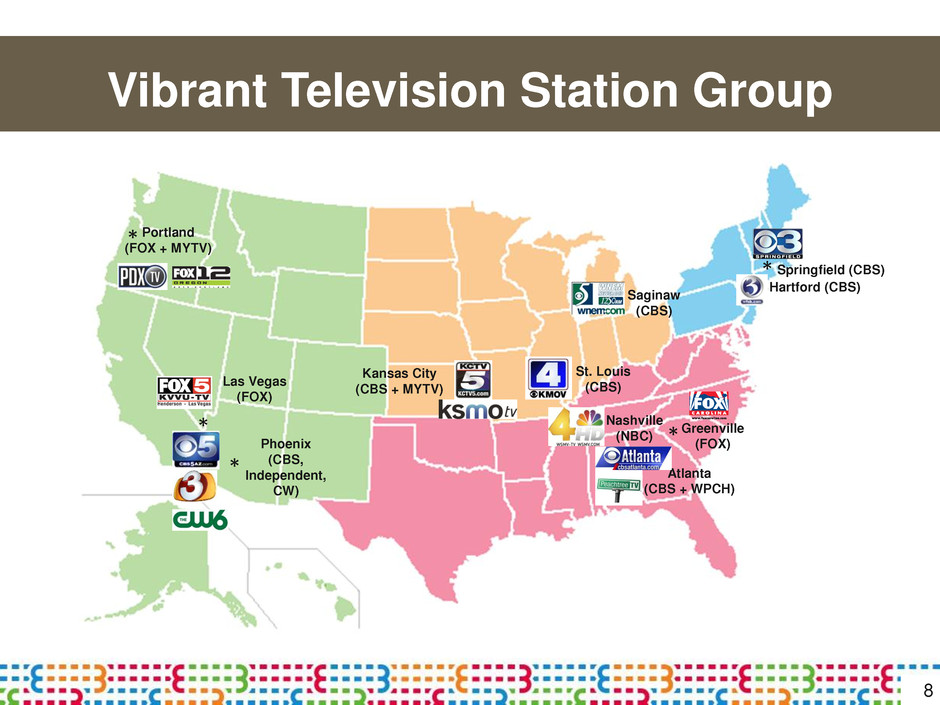

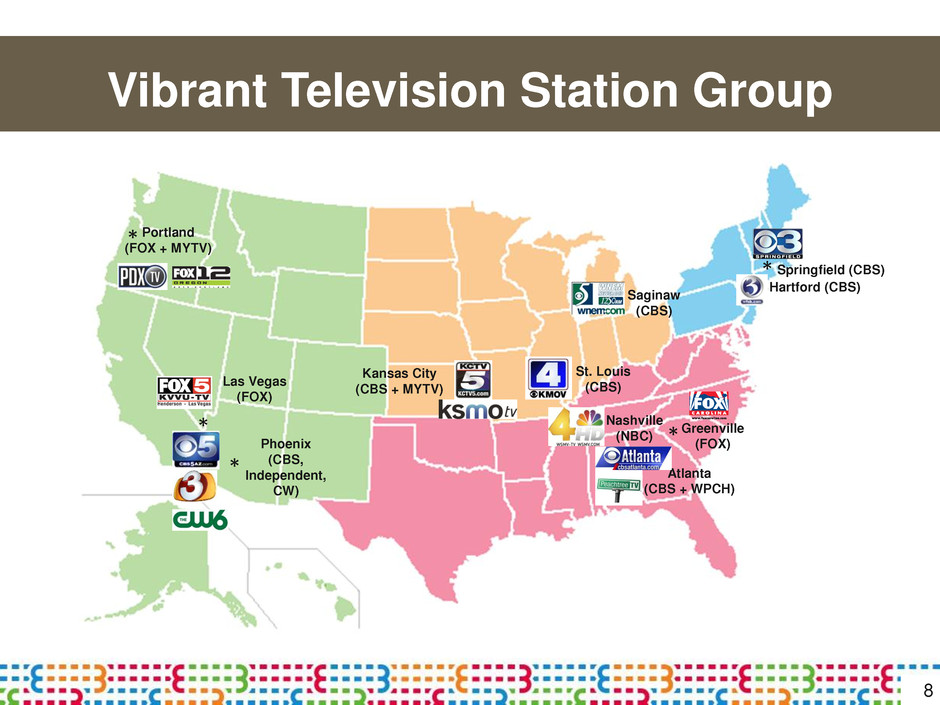

Vibrant Television Station Group + local media brands + marketing solutions+ national media brands 8 Portland (FOX + MYTV) Las Vegas (FOX) Phoenix (CBS, Independent, CW) Kansas City (CBS + MYTV) Saginaw (CBS) Atlanta (CBS + WPCH) Nashville (NBC) Greenville (FOX) Springfield (CBS) Hartford (CBS) * * * * * * * * * * St. Louis (CBS)

Monetizing Audience Scale Across Platforms + local media brands + marketing solutions+ national media brands 359

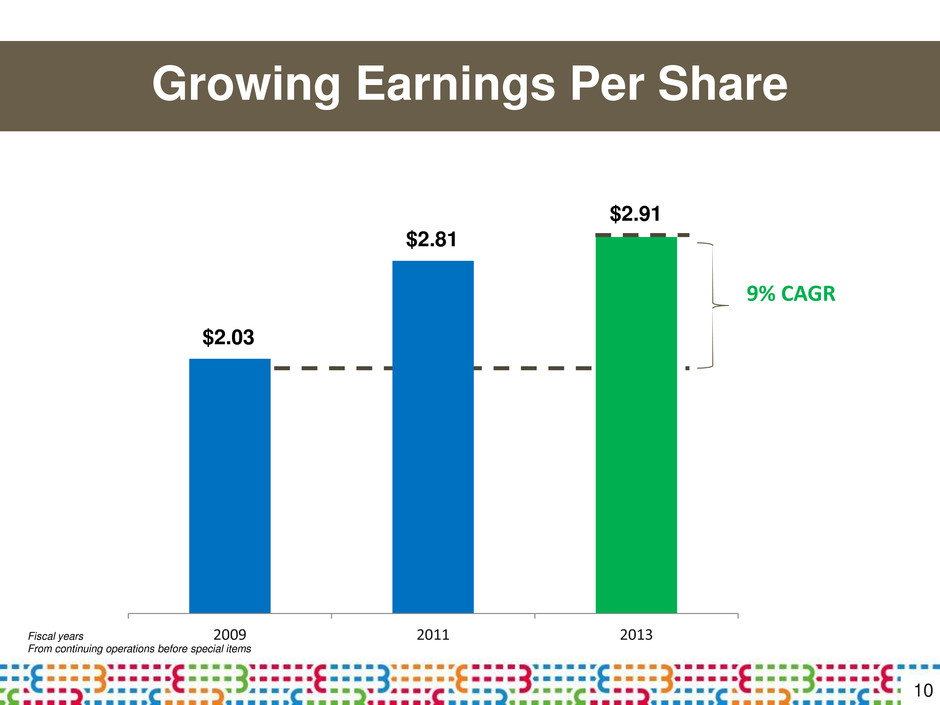

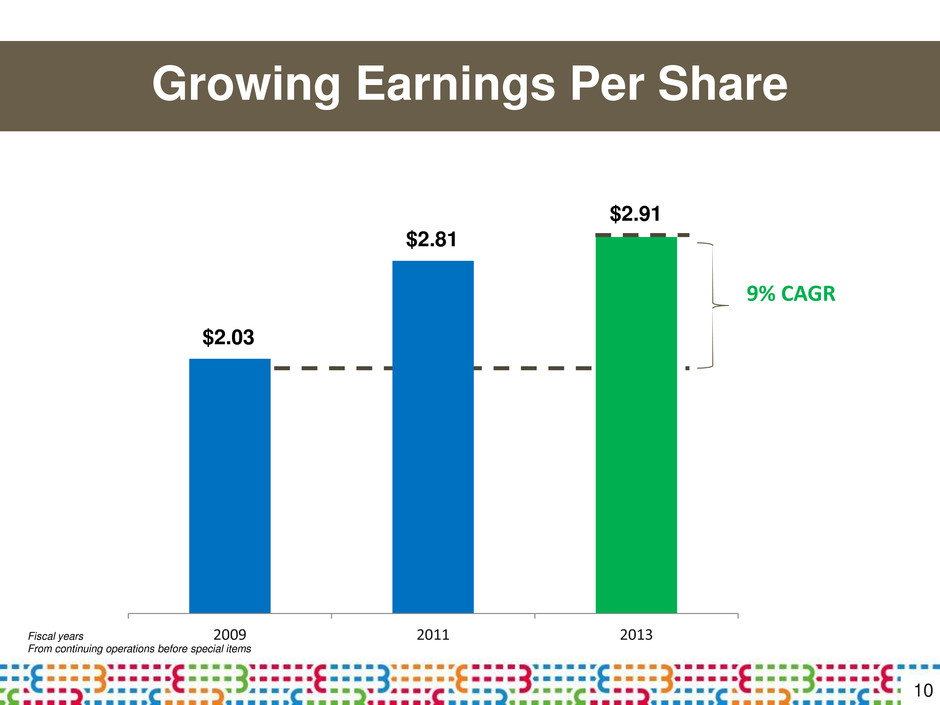

+ local media brands + marketing solutions+ national media brands Growing Earnings Per Share Fiscal years From continuing operations before special items $2.03 $2.81 $2.91 9% CAGR 3810 2009 2011 2013

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands Pursuing Three Parallel Paths Organically grow existing businesses Continue as industry consolidator in print & related media Aggressively grow our local television station group 11

Executing Series of Strategic Growth Initiatives Acquisitions expanding consumer reach and category diversity – Every Day with Rachael Ray – FamilyFun and EatingWell – Parenting and BabyTalk Increasing digital presence – Purchased Allrecipes.com, World’s #1 food site – Created Meredith Women’s Digital Network – Introduced tablet editions and mobile apps Expanding licensing business – Major expansion of Walmart program – Licensed BHG real estate to Realogy – Expanded international licensing activities 112

Executing Series of Strategic Growth Initiatives Enhancing our broadcasting business – Expanding portfolio of television stations – Growing advertising revenues – Management agreement with Peachtree in Atlanta – Increasing retransmission revenues – Expanding The Better Show’s national footprint 113

+ local media brands + marketing solutions+ national media brands Agenda Meredith Overview National Media Group Growth Strategies Local Media Group Growth Strategies Financial Strategy 104

+ local media brands + marketing solutions+ national media brands Keep our creative vibrant and relevant Prove the effectiveness of magazine advertising Increase consumer revenue Expand our digital business Aggressively pursue consolidation 15 National Media Growth Strategies

Keep our Creative Vibrant and Relevant + local media brands + marketing solutions+ national media brands Source: MRI #s in millions 70% Growth 68 115 Adult Readership in Millions 2001 2013 146

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands Food: – #1 player – 20% share Parenthood: – #1 player – 40% share Home: – #1 player – 40% share Prove Effectiveness of Magazine Advertising l l i i l ii l i 17

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands Innovating with the Meredith Sales Guarantee Objective: Prove that advertising in Meredith magazines drives sales…and guarantee it! 16 30+ participating brands Average sales lift = +9% Average ROI = $7.81 8

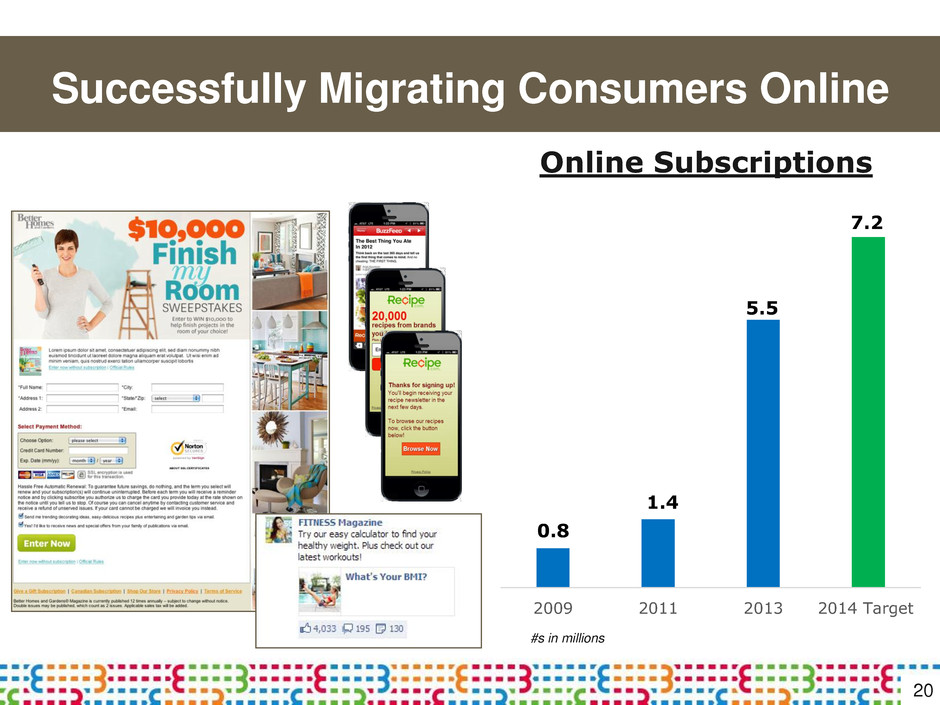

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands Increase Consumer Revenue 19 Move consumers to credit card auto renewal Increase price points for subscriptions Encourage tablet adoption Increase online subscription acquisition and renewal

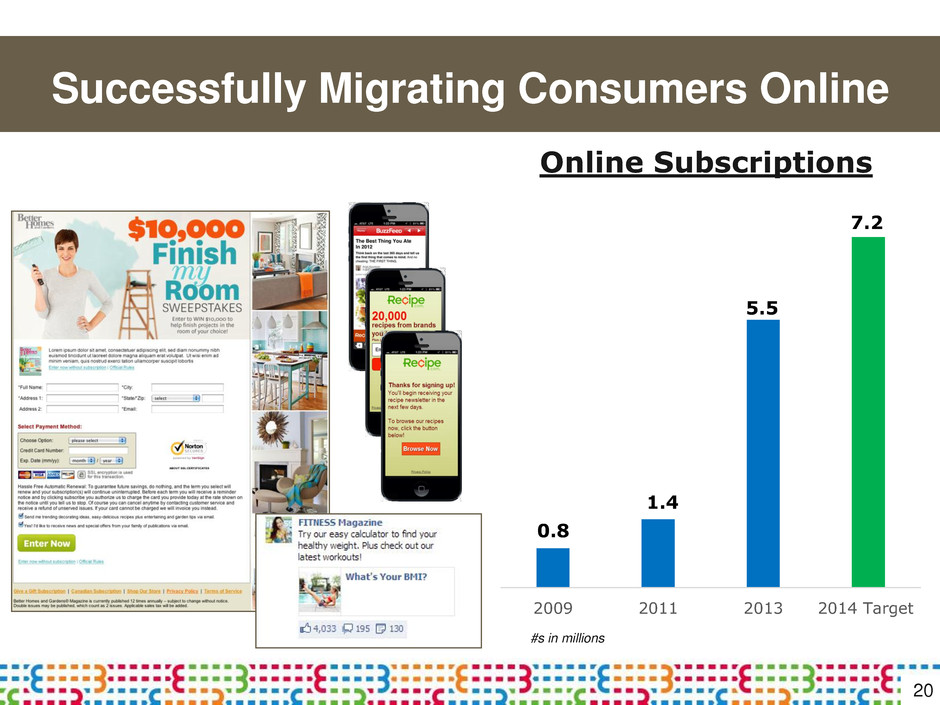

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands 2009 2011 2013 2014 Target Successfully Migrating Consumers Online 20 0.8 #s in millions 5.5 Online Subscriptions 7.2 1.4

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands 21 brand licensing International media licensing Retail products Real Estate Furniture Floral arrangements Digital syndication Growing Brand Licensing Activities

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands 30 Million 12 Million 11 Million 5 Million 23 Monthly Unique Visitors 2 Expanding Our Digital Business

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands Expanding the Allrecipes Brand In millions. Unique visitors; Source: ComScore No. 1 recipe site in the U.S. and world 30 million monthly unique visitors No. 1 food recipe channel on YouTube No. 1 downloaded Android, iPhone and iPad recipe applications Growth plan is being successfully executed across business: – Print – Television/Video – Tablet/Mobile – Social media – International 213

The New Allrecipes Magazine Guaranteed 650,000 ratebase Six-time annual frequency Excellent advertiser response 24

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands l l i i l ii l i 25 National Media Group Summary Investing to keep our brands relevant and grow consumer connection Proving magazine advertising effectiveness with Meredith Sales Guarantee Implementing circulation, licensing and commerce strategies to increase consumer-generated revenues Expanding our digital business including online, mobile, video, social Aggressively pursuing industry consolidation: 25

+ local media brands + marketing solutions+ national media brands Agenda Meredith Overview National Media Group Growth Strategies Local Media Group Growth Strategies Financial Strategy 1026

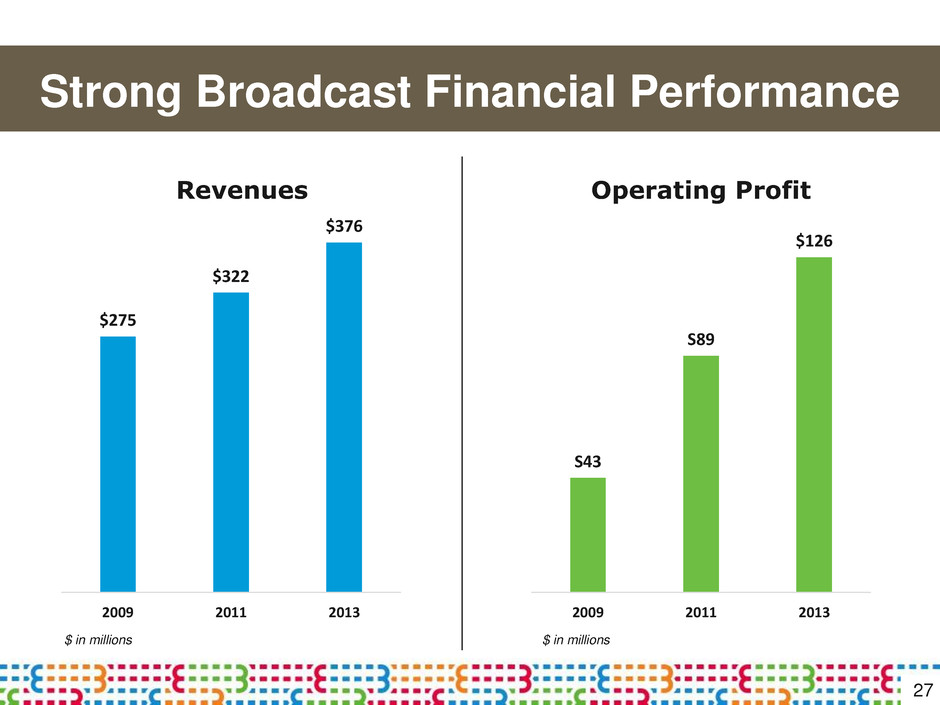

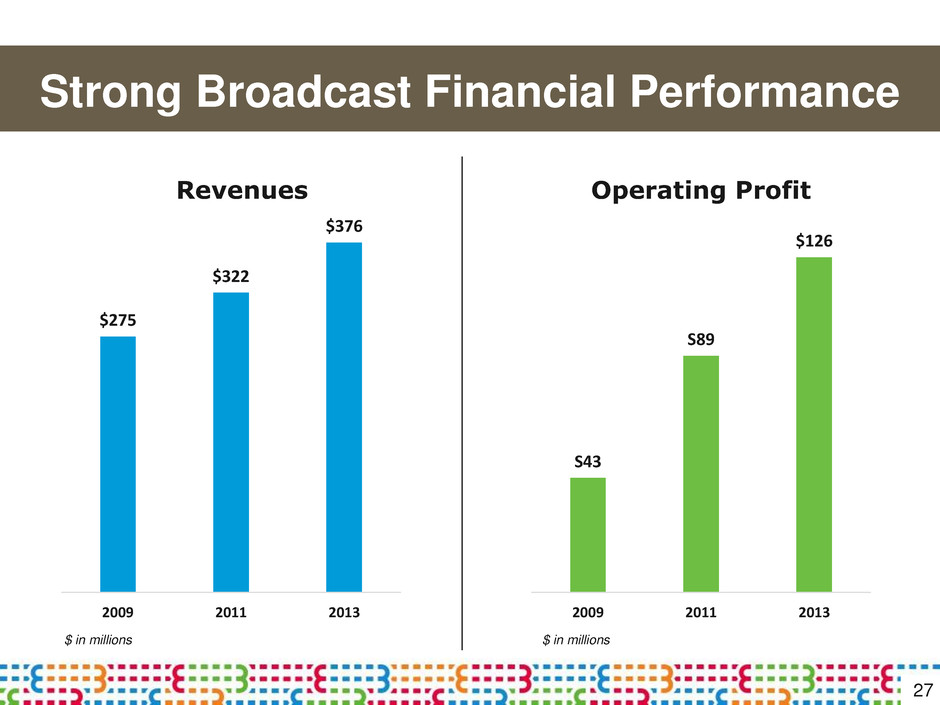

Strong Broadcast Financial Performance 27 $275 $322 $376 2009 2011 2013 Revenues S43 S89 $126 2009 2011 2013 Operating Profit $ in millions $ in millions

+ local media brands + marketing solutions+ national media brands Grow advertising revenues Increase retransmission revenues Embrace new platforms Expand portfolio of television stations 3228 Local Media Group Growth Strategies

Grow Advertising Revenues + local media brands + marketing solutions+ national media brands In millions 29 Non-political advertising Political advertising FY09 $291 $308 $24 $35 $39 $233 $256 $269 FY11 FY13 $257 29 #s in millions

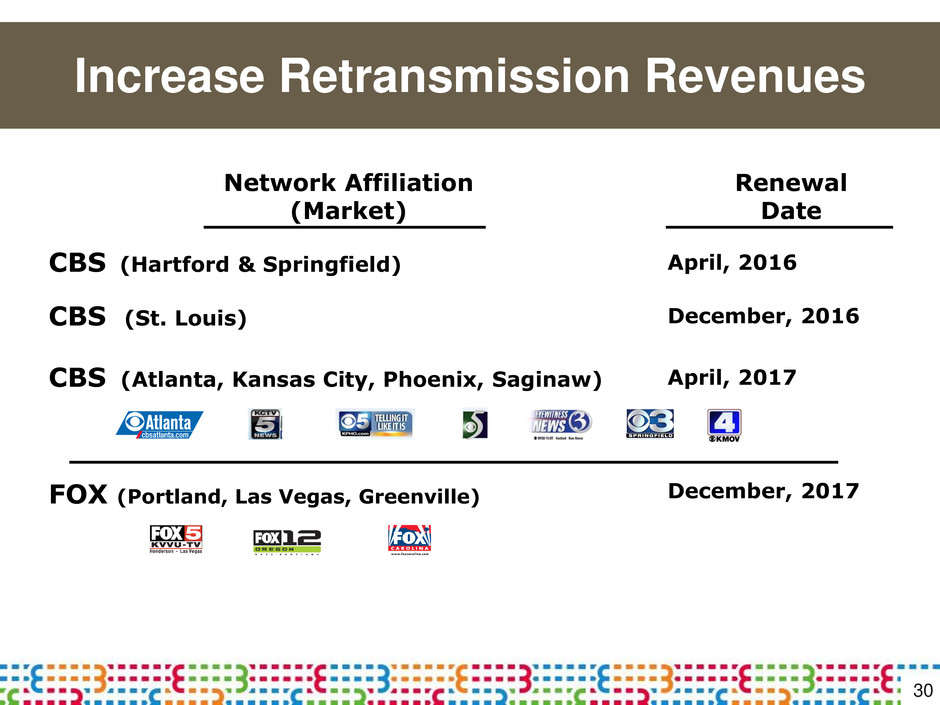

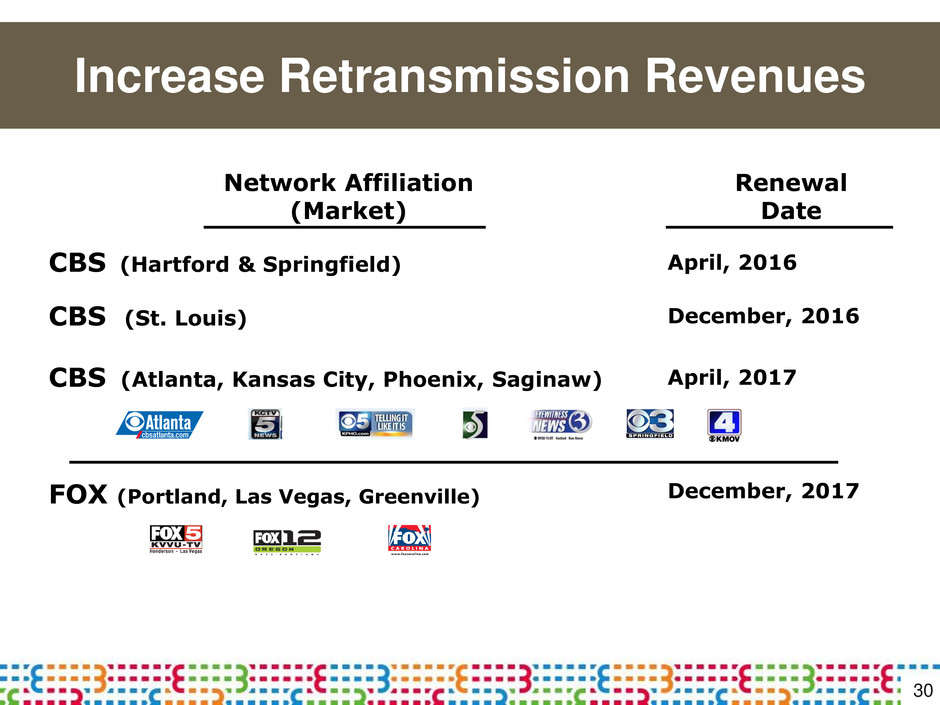

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands Network Affiliation (Market) Renewal Date CBS (Hartford & Springfield) April, 2016 CBS (St. Louis) December, 2016 CBS (Atlanta, Kansas City, Phoenix, Saginaw) April, 2017 FOX (Portland, Las Vegas, Greenville) December, 2017 Increase Retransmission Revenues l l i i l ii l i 30 30

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands Embrace New Platforms 31 410 430 560 650 1 Billion FY09 FY10 FY11 FY12 FY13 Annual Website Page Views #s in millions

+ local media brands + marketing solutions+ national media brands 32 Embrace New Platforms The Better Show Daily lifestyle program syndicated in 160 markets Renewed for 7th season Secured national cable distribution on the Hallmark Channel – 90 million U.S. homes Syndication fee plus added exposure Custom Video Creation Significant native advertising with K-Mart and Mohawk Carpet 32

+ local media brands + marketing solutions+ national media brands + local media brands + marketi g solutions+ national media brands 733 Expanding Portfolio of Stations Powerful independent station Produces the most local news in Arizona Phoenix: Market 12 St. Louis: Market 21 One of leading CW affiliates Attracts younger demographic Strong CBS affiliate Ranks #1 in midday, evening and late news

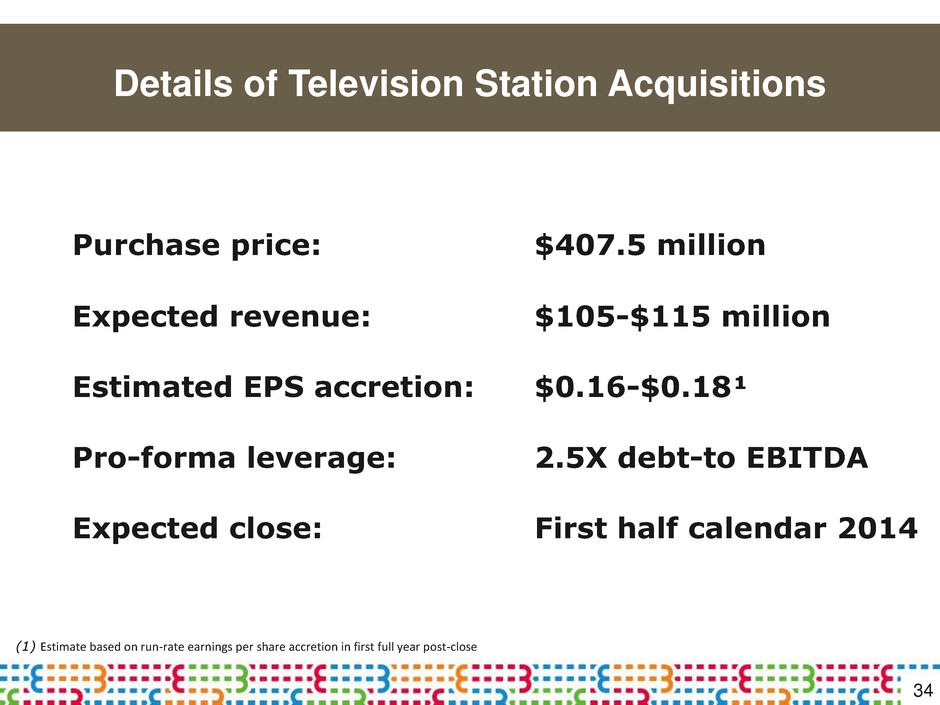

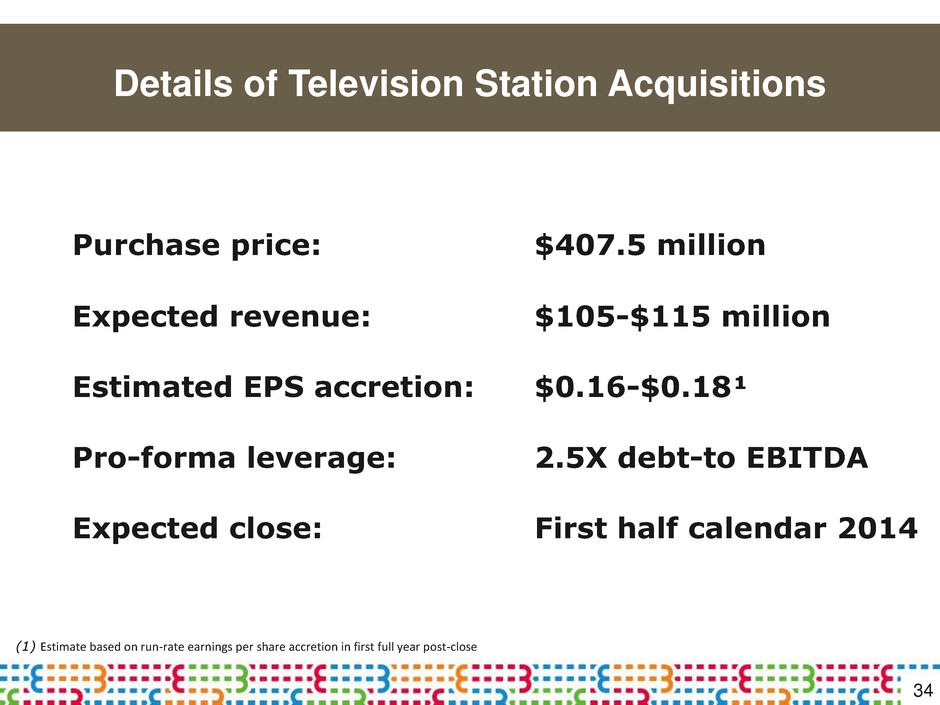

(1) Estimate based on run-rate earnings per share accretion in first full year post-close 34 Details of Television Station Acquisitions Purchase price: $407.5 million Expected revenue: $105-$115 million Estimated EPS accretion: $0.16-$0.18¹ Pro-forma leverage: 2.5X debt-to EBITDA Expected close: First half calendar 2014

+ local media brands + marketing solutions+ national media brands 35 Local Media Group Summary Growing non-political and political advertising revenues Increasing retransmission revenues Embracing new platforms including digital, mobile and original programming Expanding our portfolio of television stations 35

+ local media brands + marketing solutions+ national media brands Agenda Meredith Overview Local Media Group Growth Strategies National Media Group Growth Strategies Financial Strategy 236

+ local media brands + marketing solutions+ national media brands Commitment to Total Shareholder Return 1. Current annualized dividend of $1.63 per share 2. $100 million share repurchase program 3. Ongoing strategic investments to scale business and build shareholder value 37 37

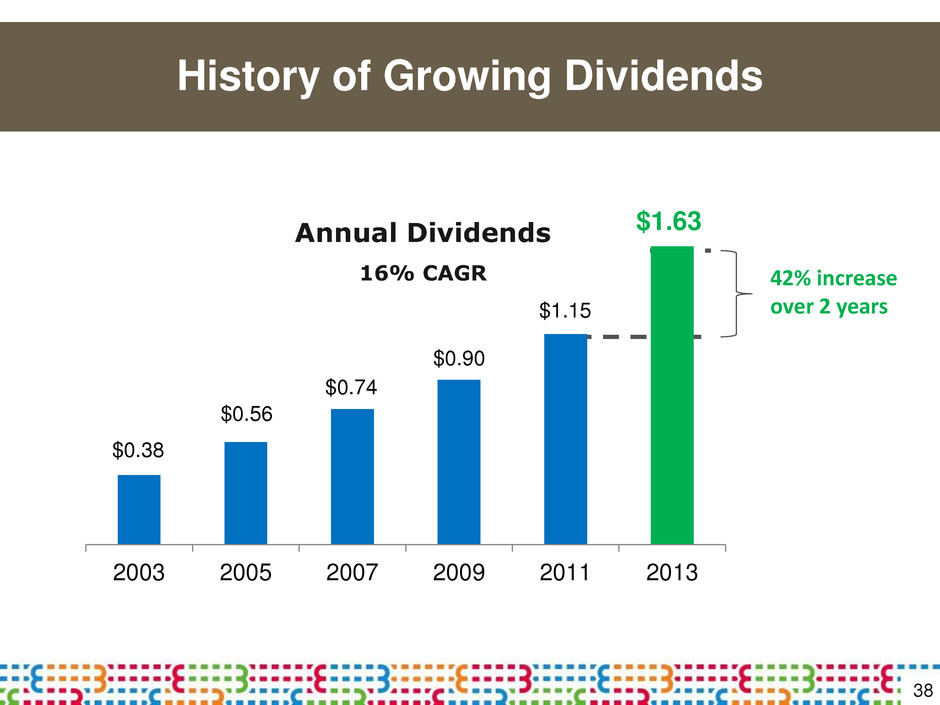

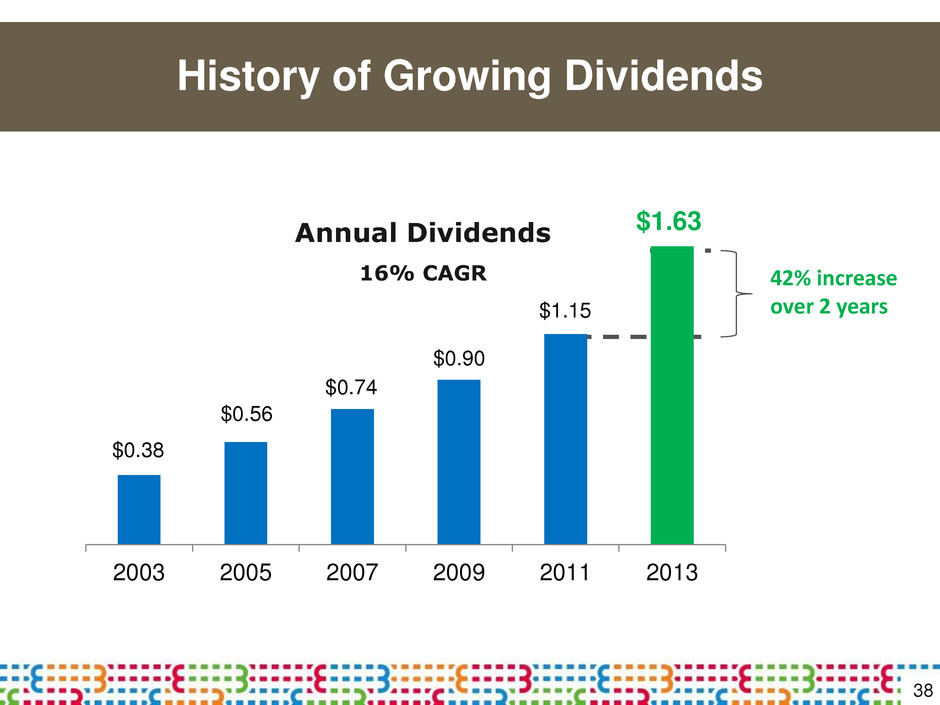

$0.38 $0.56 $0.74 $0.90 $1.15 $1.63 2003 2005 2007 2009 2011 2013 History of Growing Dividends + local media brands + marketing solutions+ national media brands Annual Dividends 16% CAGR 38 38 42% increase over 2 years

History of Buying Back Stock + local media brands + marketing solutions+ national media brands $30 $165 $370 $545 $575 $655 FY03 FY05 FY07 FY09 FY11 FY13 $ in millions Cumulative 39 39

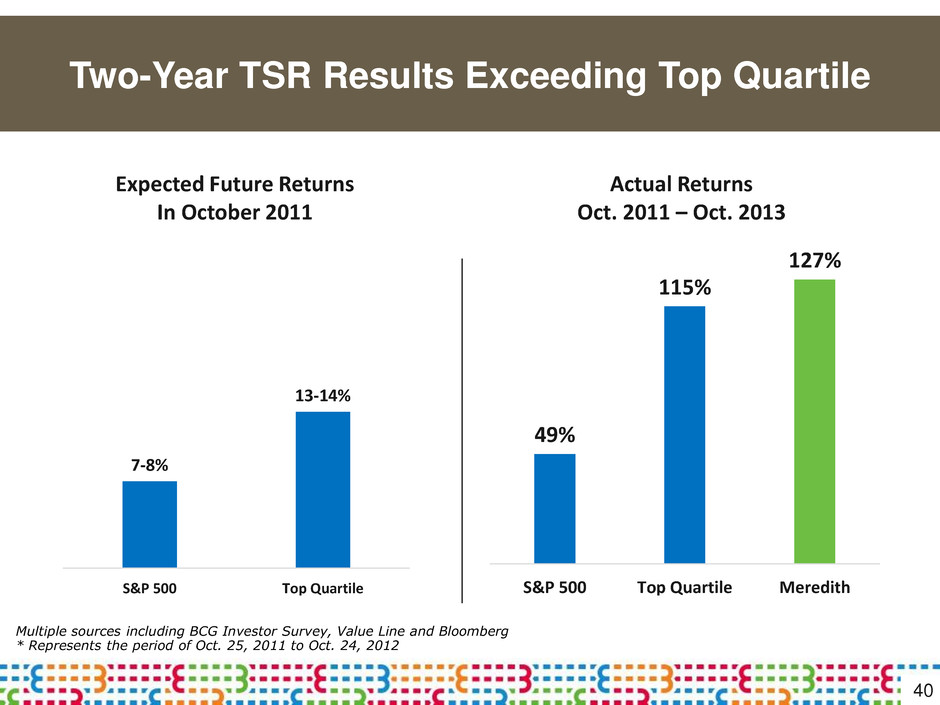

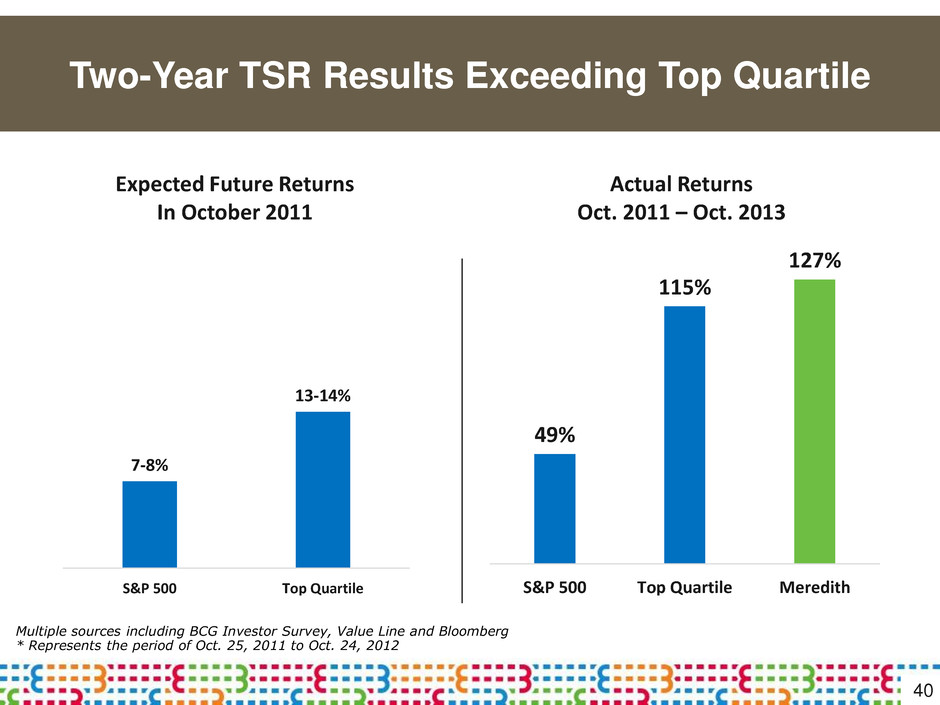

Multiple sources including BCG Investor Survey, Value Line and Bloomberg * Represents the period of Oct. 25, 2011 to Oct. 24, 2012 40 7-8% 13-14% S&P 500 Top Quartile 49% 115% 127% S&P 500 Top Quartile Meredith Two-Year TSR Results Exceeding Top Quartile Expected Future Returns In October 2011 Actual Returns Oct. 2011 – Oct. 2013

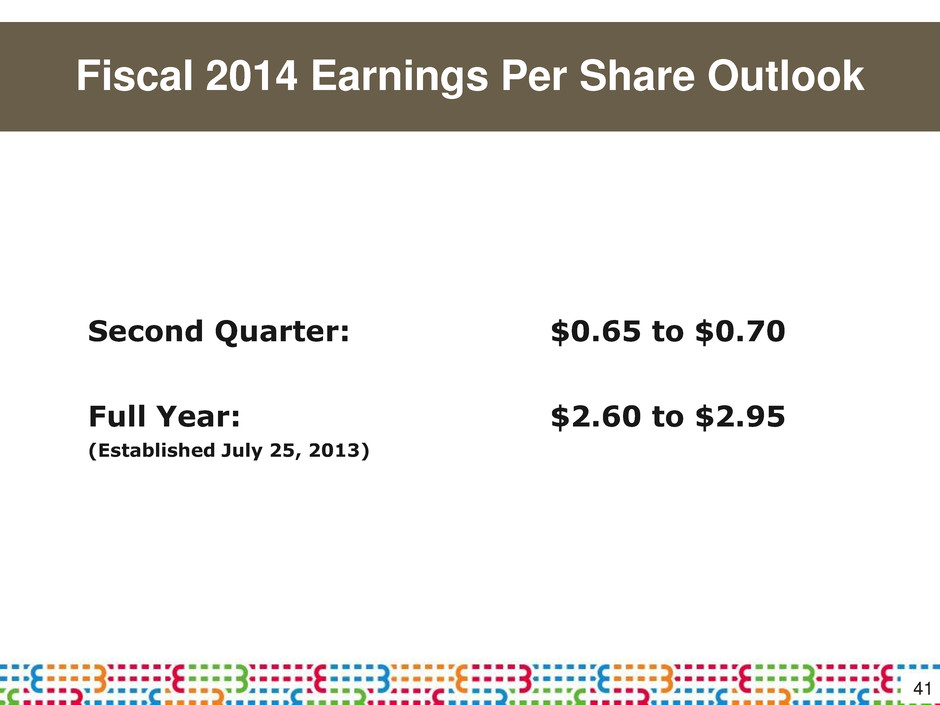

Fiscal 2014 Earnings Per Share Outlook + local media brands + marketing solutions+ national media brands 41 Second Quarter: $0.65 to $0.70 Full Year: $2.60 to $2.95 (Established July 25, 2013) 41

1. Powerful media and marketing company: A) Trusted national brands and an unrivaled female reach B) Leading full-service global digital marketing agency C) Portfolio of highly-rated television stations in fast-growing markets D) Creative advertising and marketing solutions for clients 2. Experienced management team with a proven record of operational excellence and value creation 3. Committed to Total Shareholder Return strategy + local media brands + marketing solutions+ national media brands Strong Investment Thesis 42 42