UBS 42nd Annual Global Media and Communications Conference December 8, 2014

Safe Harbor This presentation and management’s public commentary contain certain forward-looking statements that are subject to risks and uncertainties. These statements are based on management’s current knowledge and estimates of factors affecting the Company and its operations. Statements in this presentation that are forward-looking include, but are not limited to, the statements regarding advertising revenues and investment spending, along with the Company’s revenue and earnings per share outlook. Actual results may differ materially from those currently anticipated. Factors that could adversely affect future results include, but are not limited to, downturns in national and/or local economies; a softening of the domestic advertising market; world, national, or local events that could disrupt broadcast television; increased consolidation among major advertisers or other events depressing the level of advertising spending; the unexpected loss or insolvency of one or more major clients or vendors; the integration of acquired businesses; changes in consumer reading, purchasing and/or television viewing patterns; increases in paper, postage, printing, syndicated programming or other costs; changes in television network affiliation agreements; technological developments affecting products or methods of distribution; changes in government regulations affecting the Company’s industries; increases in interest rates; and the consequences of any acquisitions and/or dispositions. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise. 2

Agenda Meredith Overview National Media Group Local Media Group Total Shareholder Return 3

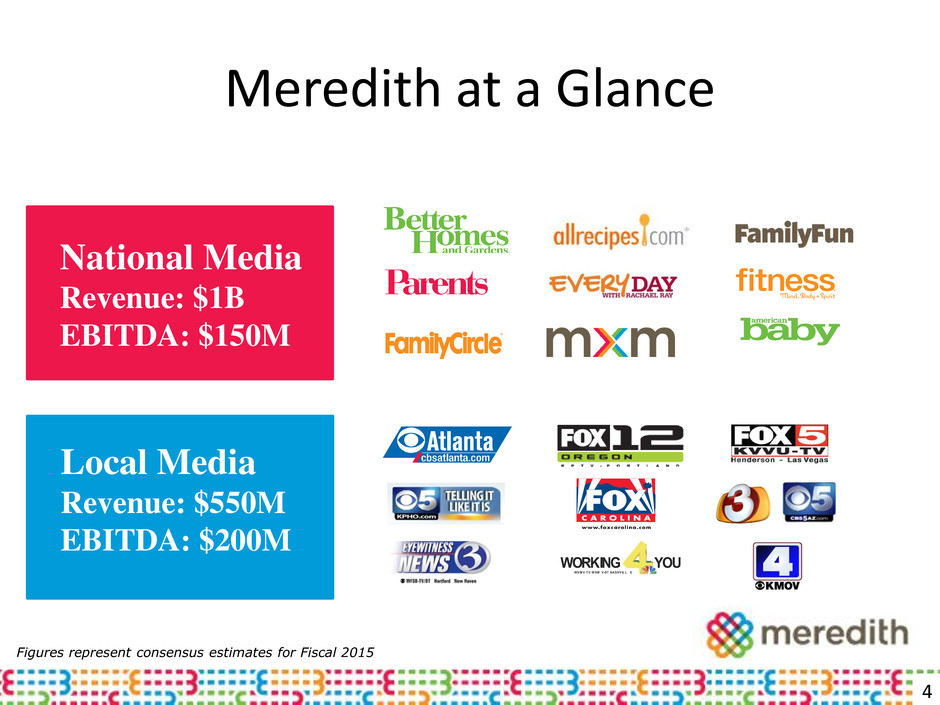

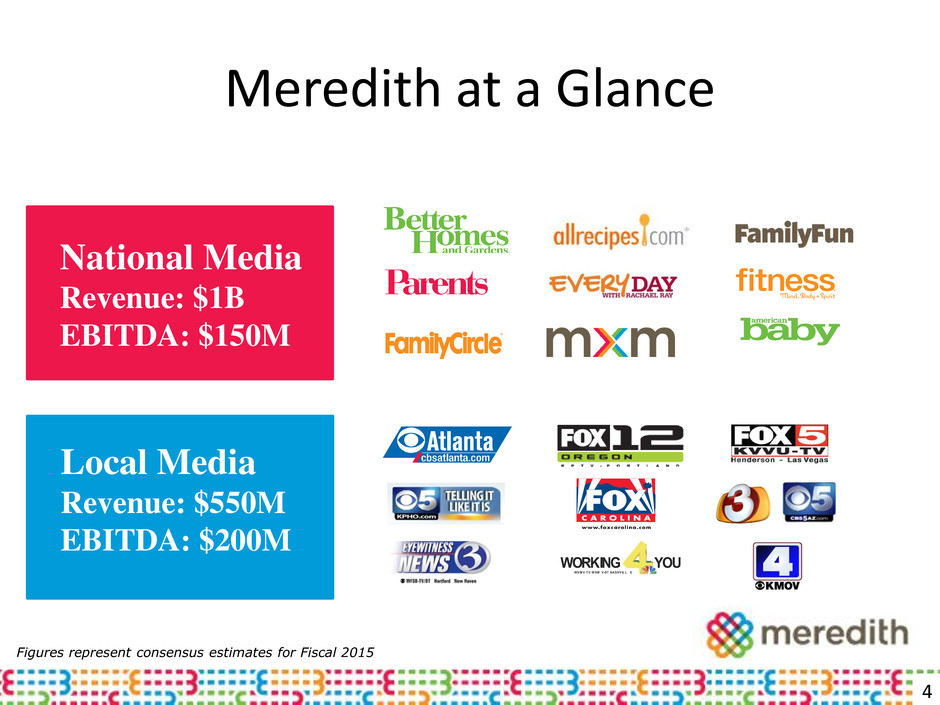

Meredith at a Glance National Media Revenue: $1B EBITDA: $150M 4 WORKING YOU WS M V -TV W SM V-DT NASHV IL L E Local Media Revenue: $550M EBITDA: $200M Figures represent consensus estimates for Fiscal 2015

2014: A Year of Accomplishment Record revenue and EBITDA performance Stronger-than-expected political advertising revenue Increased retransmission revenue and contribution Added 4 strong stations to group; created 2 duopolies Local Media 5

2014: A Year of Accomplishment Rapid growth in digital, mobile, video and social platforms Added Martha Stewart media properties to portfolio Established presence in the wedding marketplace Strong performance from non-advertising-related activities National Media 6

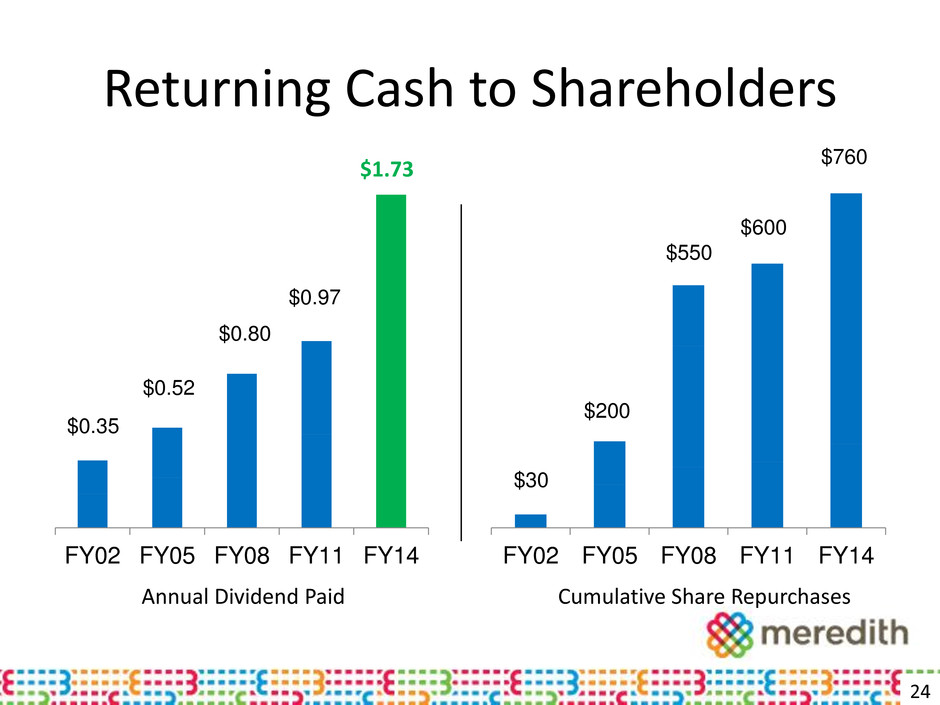

2014: A Year of Accomplishment Grew dividend for 21st straight year Authorized $100 million for share repurchases More than half of debt fixed at low rate Successful execution of Total Shareholder Return Strategy Corporate 7

Agenda Meredith Overview National Media Group Local Media Group Total Shareholder Return 8

National Media Group Footprint The largest female audience across every life stage and platform YOUNG ADULTS YOUNG FAMILIES ESTABLISHED FAMILIES WOMEN OF WORTH 9 18M 12M 26M 10M

Our Brands Deliver What’s Important to Her Seasons and styles change but women’s priorities remain the same 10

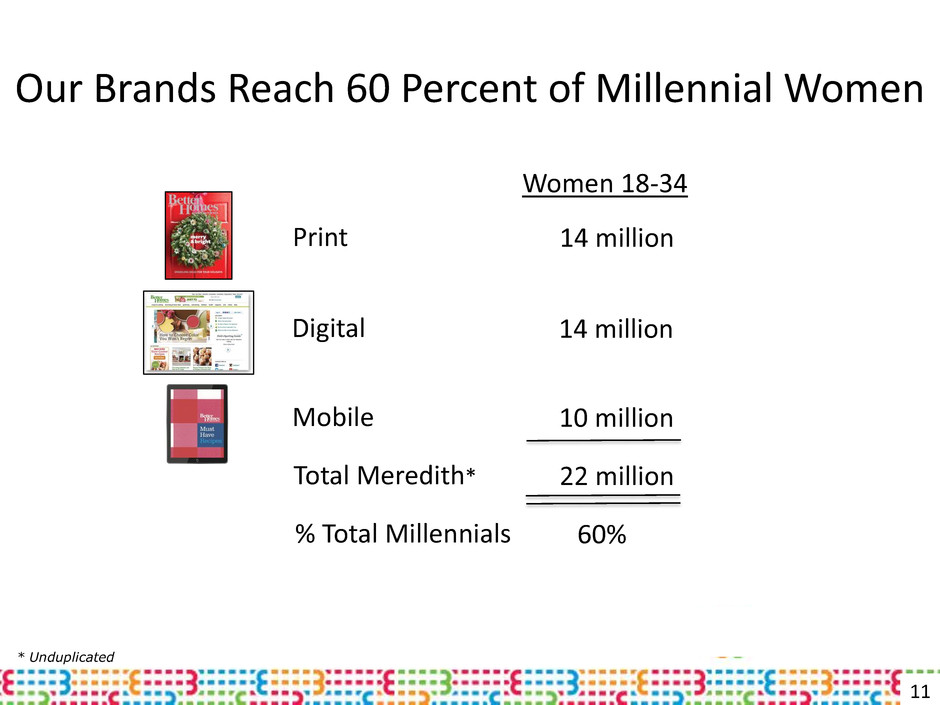

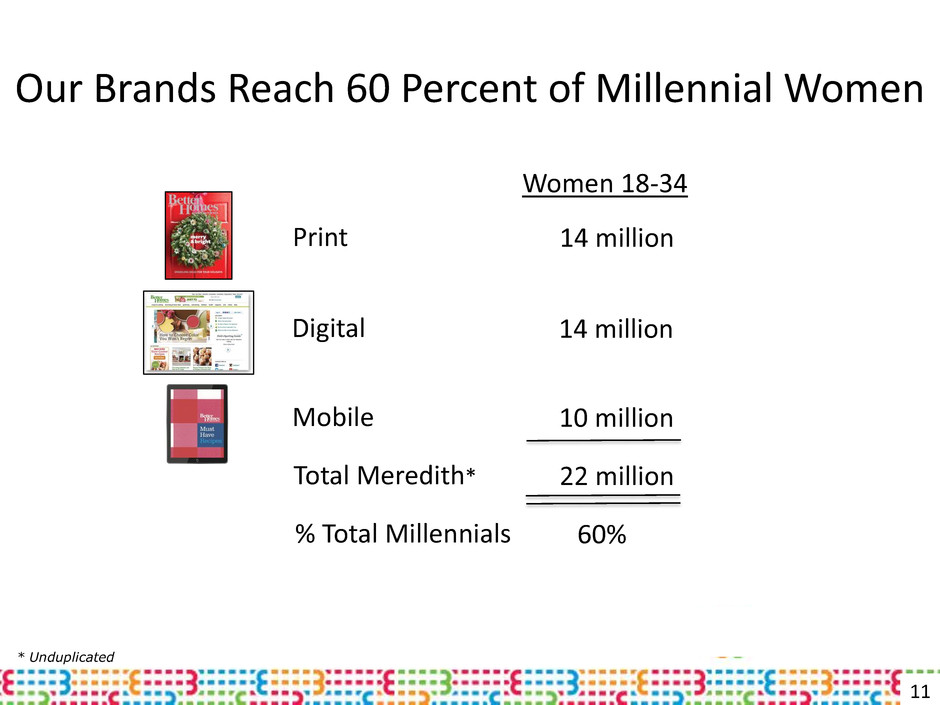

11 Our Brands Reach 60 Percent of Millennial Women Print Digital Mobile 14 million 14 million 10 million Women 18-34 22 million 60% Total Meredith* % Total Millennials * Unduplicated

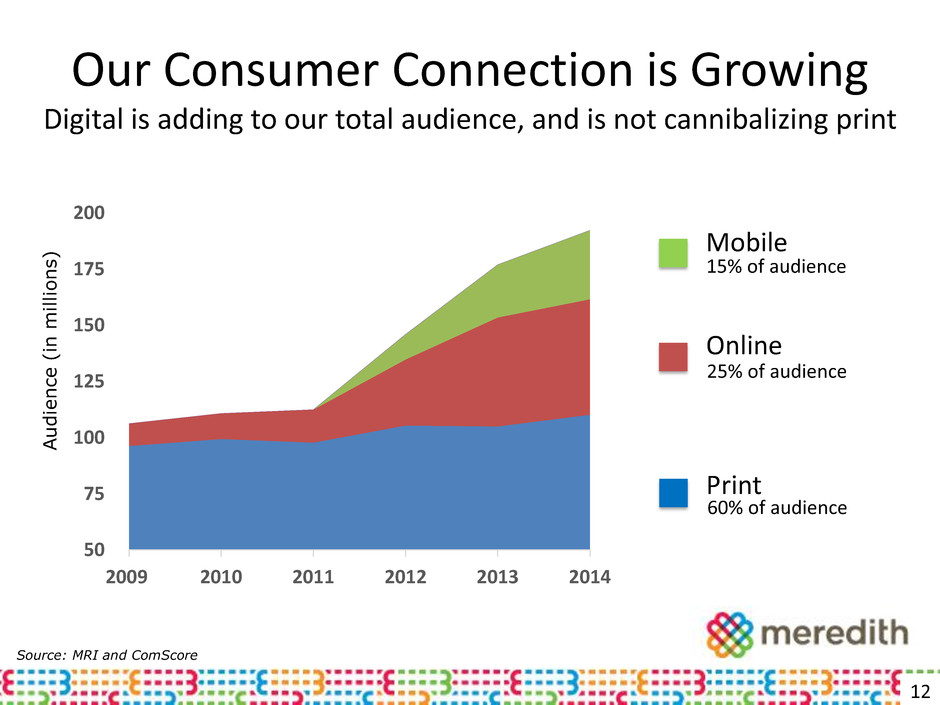

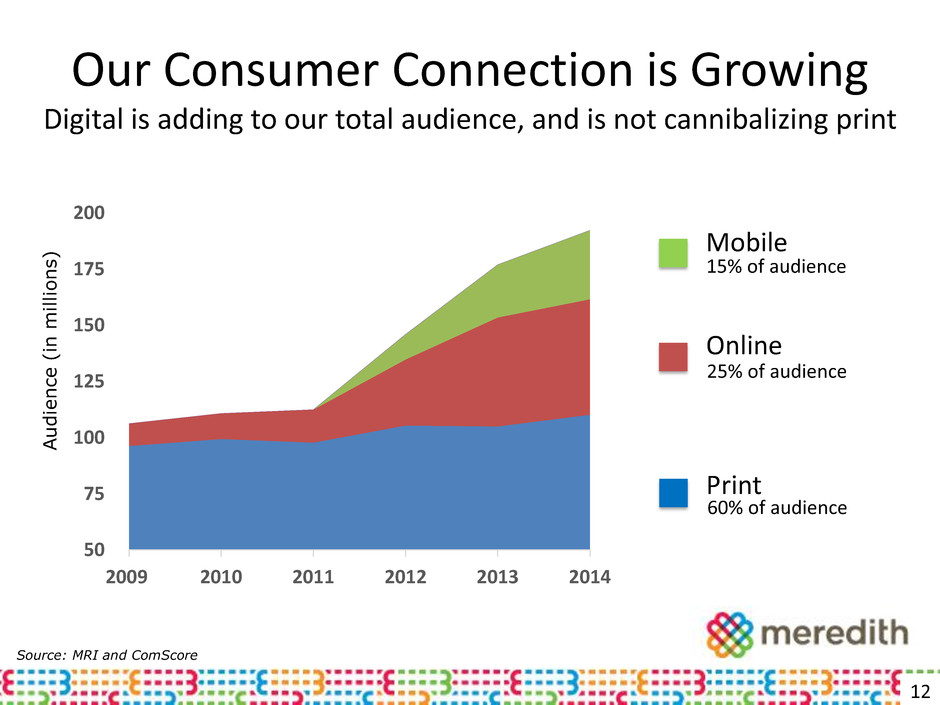

50 75 100 125 150 175 200 2009 2010 2011 2012 2013 2014 12 Our Consumer Connection is Growing Digital is adding to our total audience, and is not cannibalizing print A ud ienc e ( in m il li on s ) Print Online Mobile 15% of audience 25% of audience 60% of audience Source: MRI and ComScore

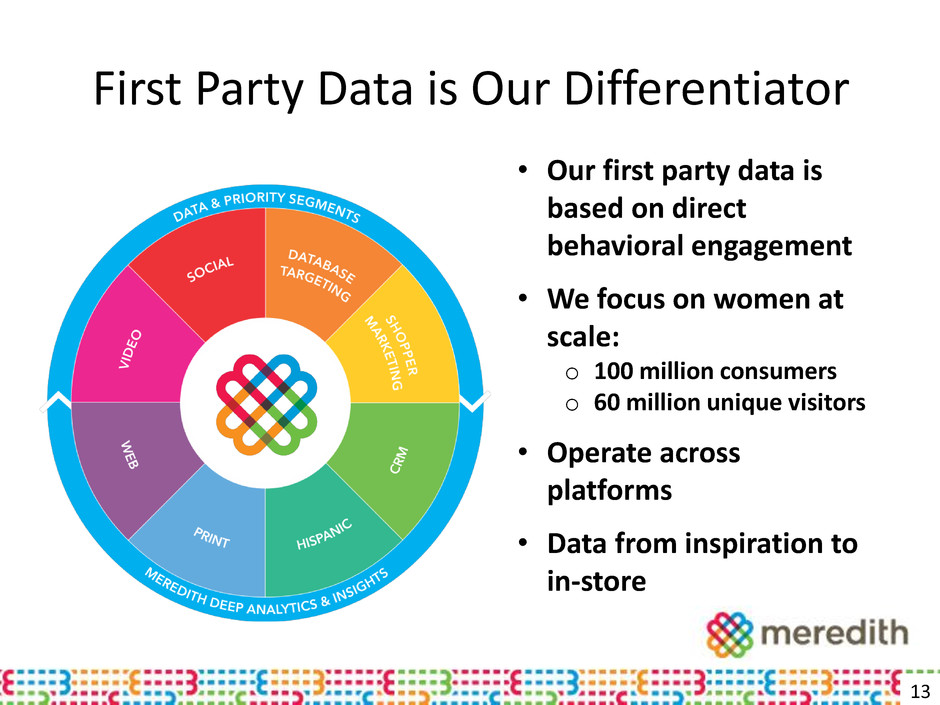

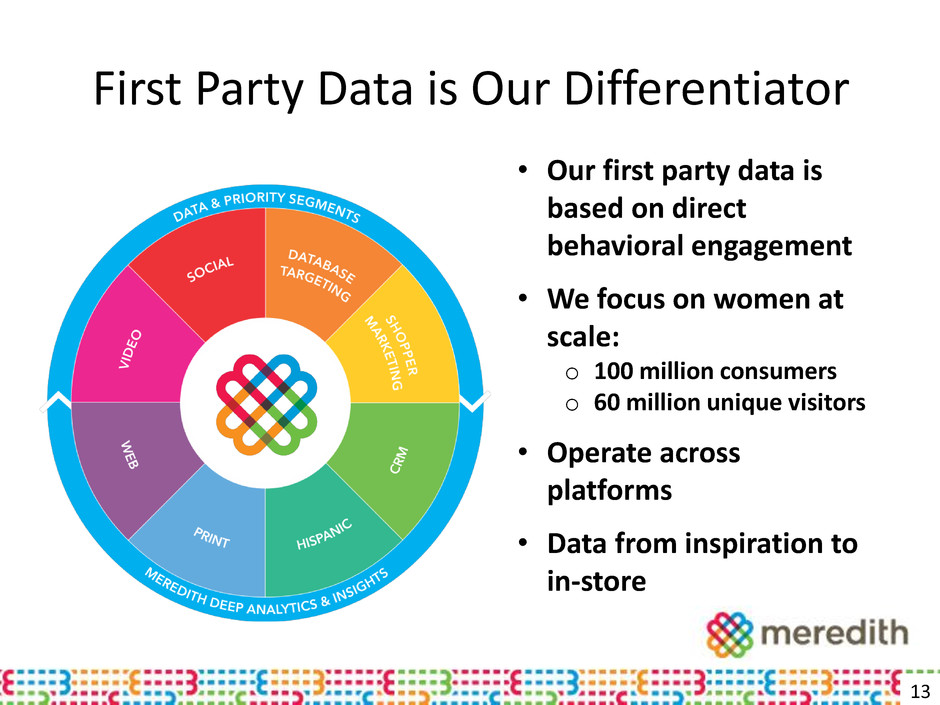

First Party Data is Our Differentiator • Our first party data is based on direct behavioral engagement • We focus on women at scale: o 100 million consumers o 60 million unique visitors • Operate across platforms • Data from inspiration to in-store 13

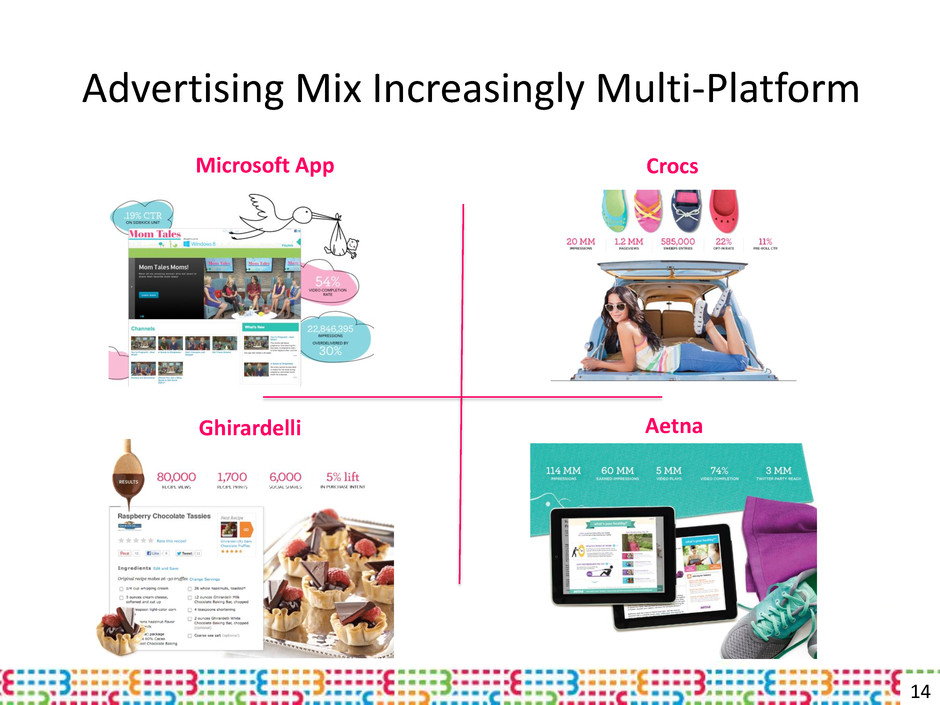

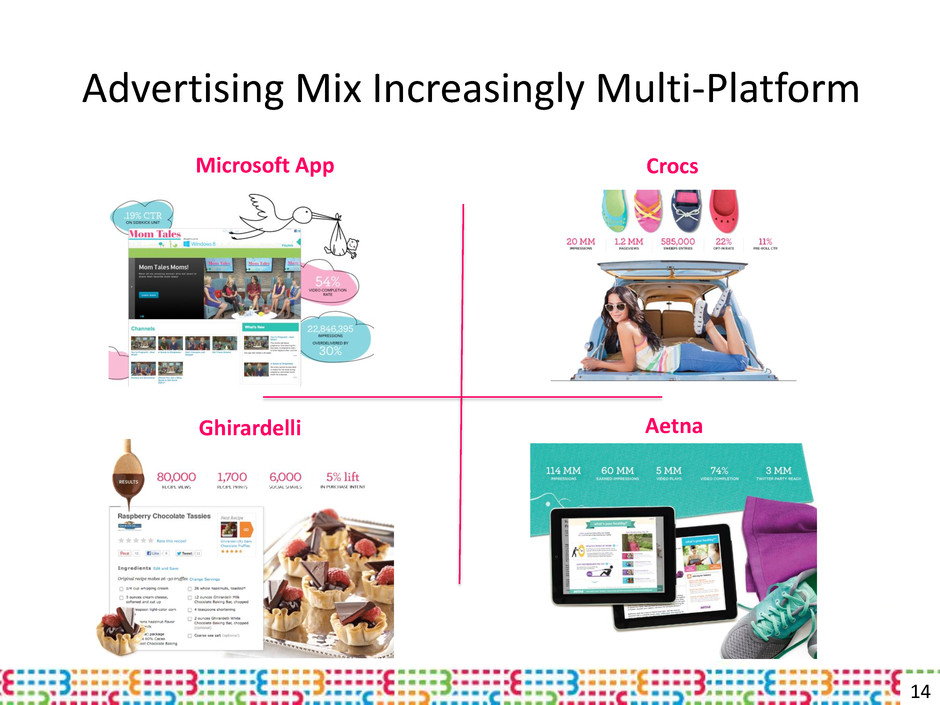

Advertising Mix Increasingly Multi-Platform 14 Microsoft App Ghirardelli Crocs Aetna

Strong Performance from Non-Advertising Activities 15 brand licensing International media licensing Real Estate Floral arrangements Digital syndication Cookware Retail products

Expanding Our Competitive Position Martha Stewart Living Marthastewart.com 16 Women’s Lifestyle: Martha Stewart Weddings Mywedding.com Wedding media: Eat This, Not That! New product launches:

Agenda Meredith Overview National Media Group Local Media Group Total Shareholder Return 17

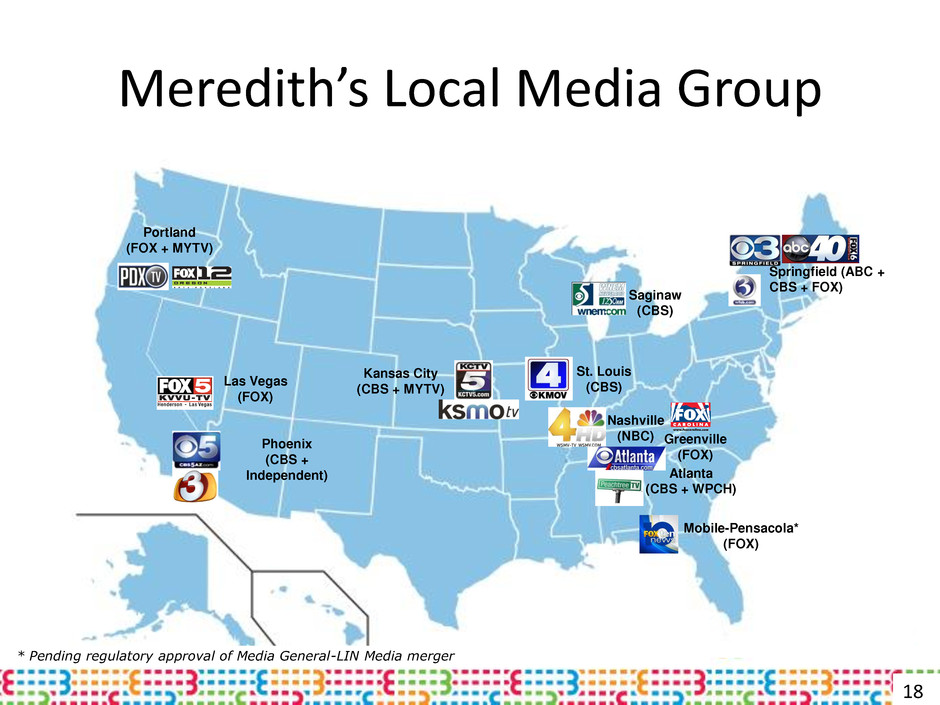

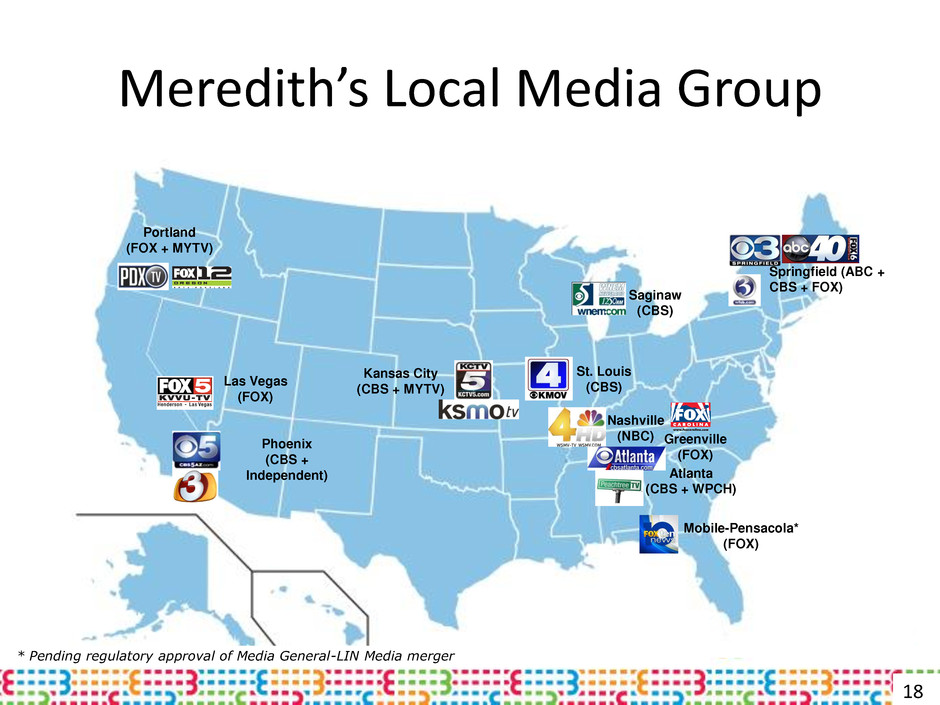

Meredith’s Local Media Group 18 Portland (FOX + MYTV) Las Vegas (FOX) Phoenix (CBS + Independent) Kansas City (CBS + MYTV) Saginaw (CBS) Atlanta (CBS + WPCH) Nashville (NBC) Springfield (ABC + CBS + FOX) St. Louis (CBS) Greenville (FOX) Mobile-Pensacola* (FOX) * Pending regulatory approval of Media General-LIN Media merger

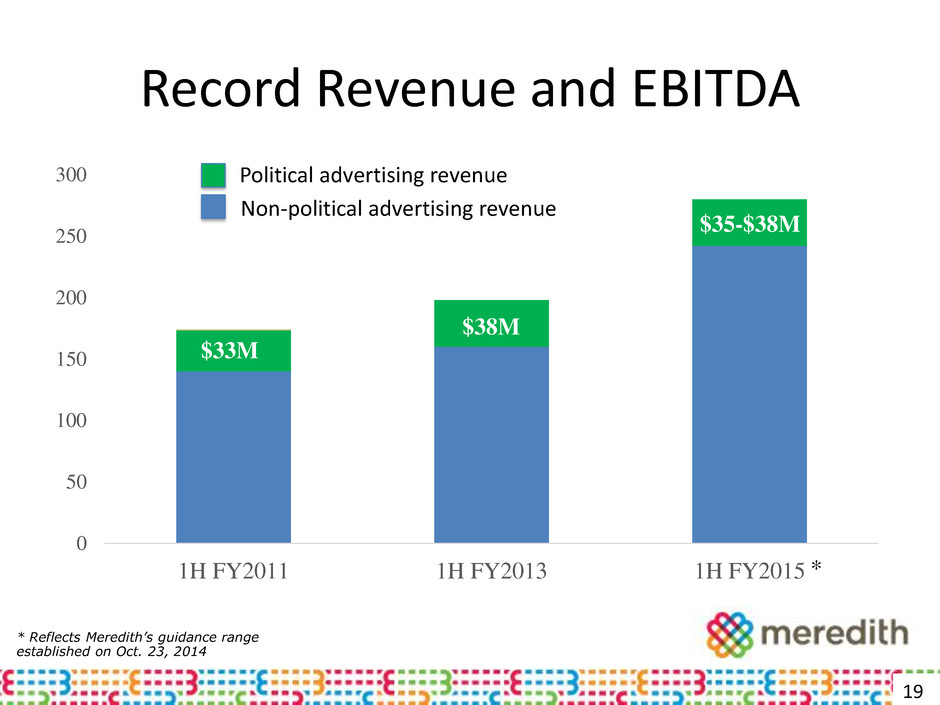

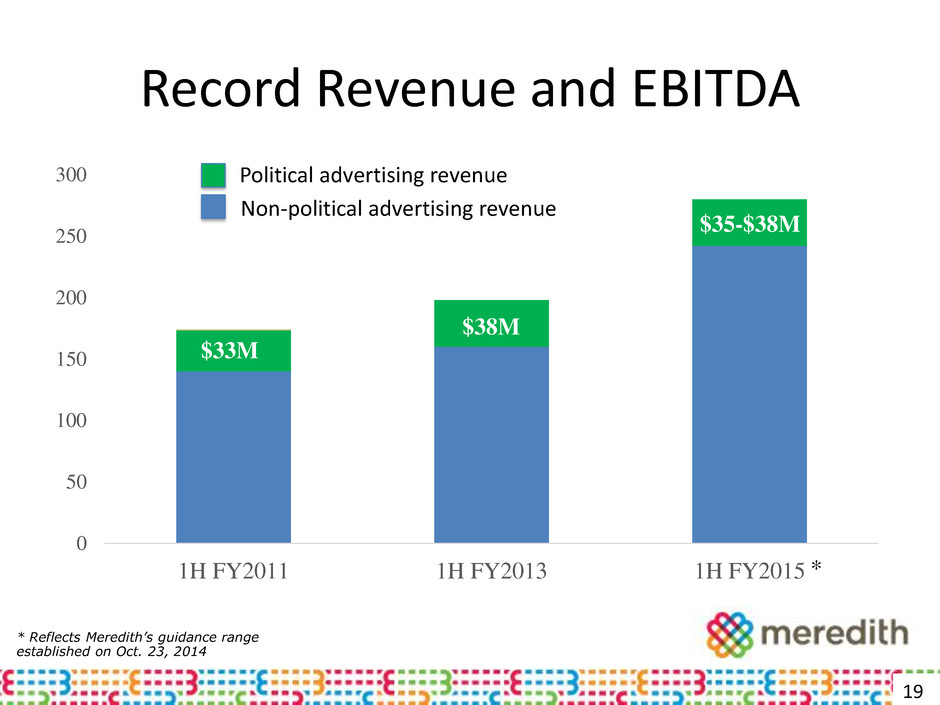

Record Revenue and EBITDA 19 0 50 100 150 200 250 300 1H FY2011 1H FY2013 1H FY2015 $33M $38M $35-$38M * * Reflects Meredith’s guidance range established on Oct. 23, 2014 Non-political advertising revenue Political advertising revenue

Growing Retransmission Revenue and Contribution 20 MVPD Renewal Date MVPD Satellite FY 2017 Phone FY 2015-2016 Cable FY 2015 - 2018 Network Affiliation / Market Renewal Date ABC Springfield FY 2015 CBS Hartford/Springfield FY 2016 St. Louis FY 2017 Atlanta, Phoenix, Kansas City, Flint/Saginaw FY 2018 FOX Springfield FY 2016 Portland, Las Vegas, Greenville, Mobile-Pensacola FY 2018 NBC Nashville FY 2018

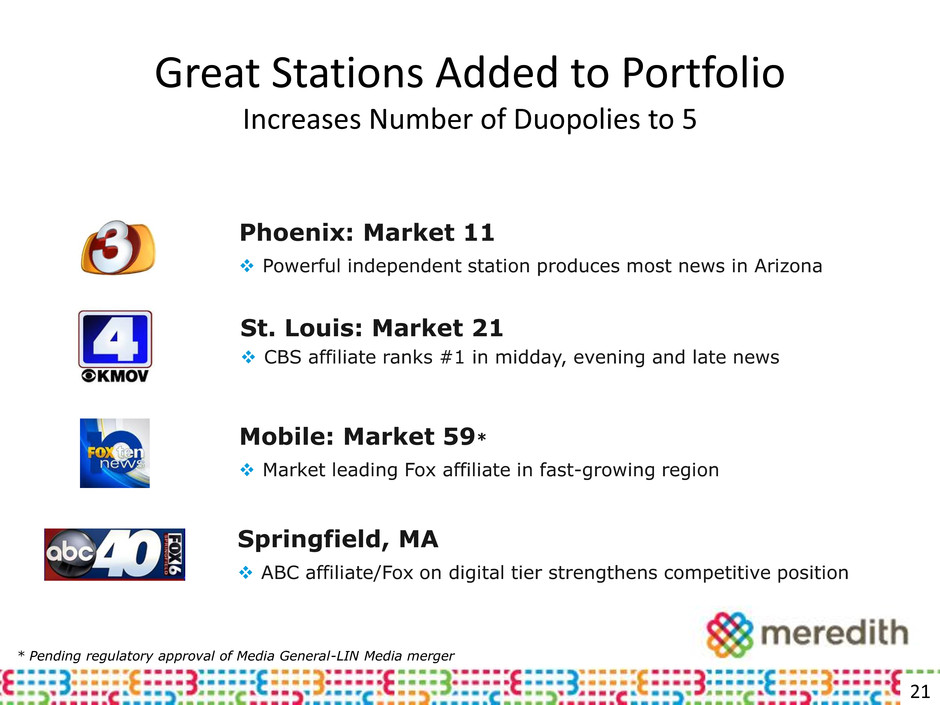

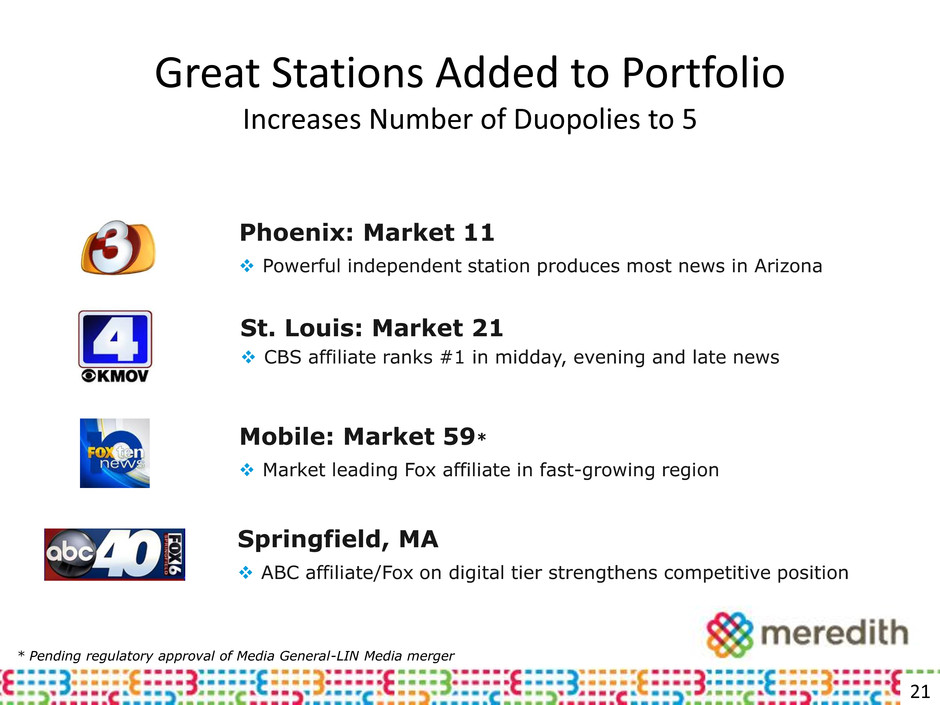

Great Stations Added to Portfolio Increases Number of Duopolies to 5 Powerful independent station produces most news in Arizona Phoenix: Market 11 St. Louis: Market 21 CBS affiliate ranks #1 in midday, evening and late news ABC affiliate/Fox on digital tier strengthens competitive position Springfield, MA Market leading Fox affiliate in fast-growing region Mobile: Market 59* 21 * Pending regulatory approval of Media General-LIN Media merger

Agenda Meredith Overview National Media Group Local Media Group Total Shareholder Return 22

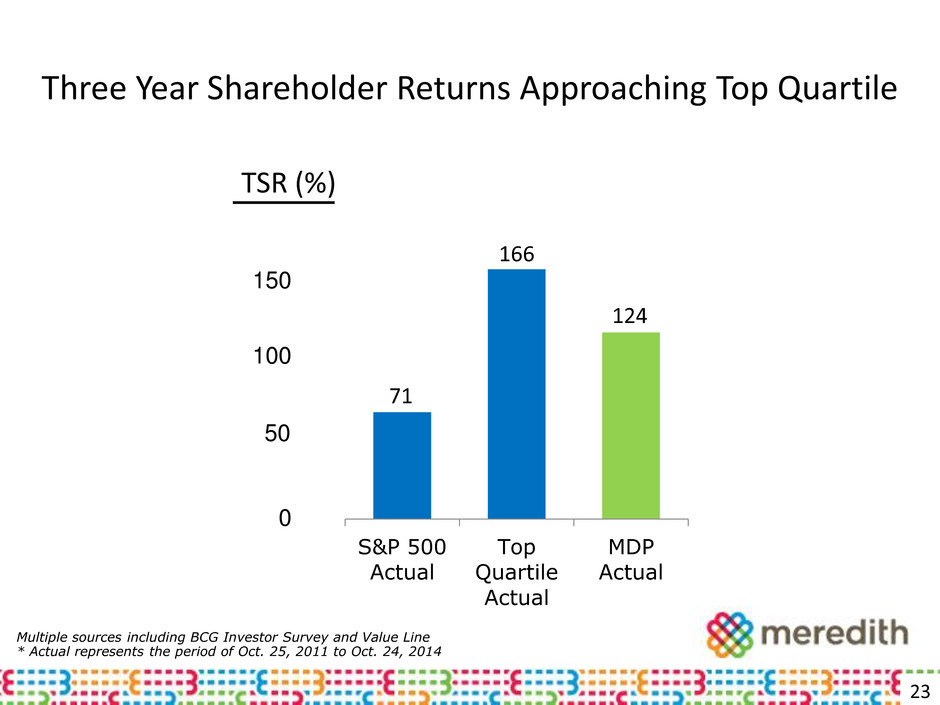

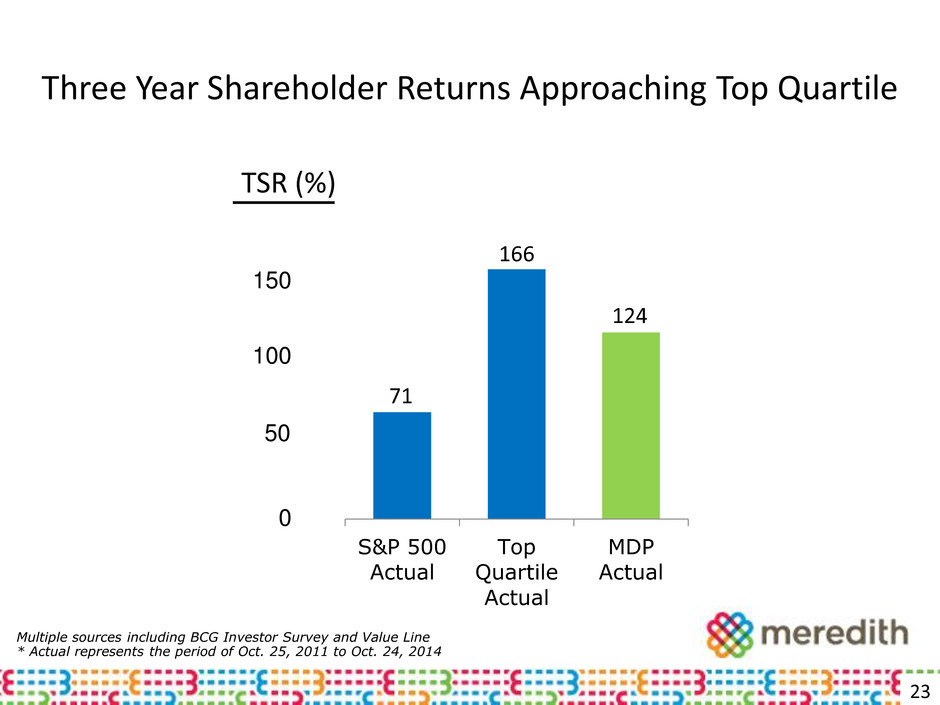

Three Year Shareholder Returns Approaching Top Quartile 23 71 166 124 S&P 500 Actual Top Quartile Actual MDP Actual TSR (%) 50 150 100 0 Multiple sources including BCG Investor Survey and Value Line * Actual represents the period of Oct. 25, 2011 to Oct. 24, 2014

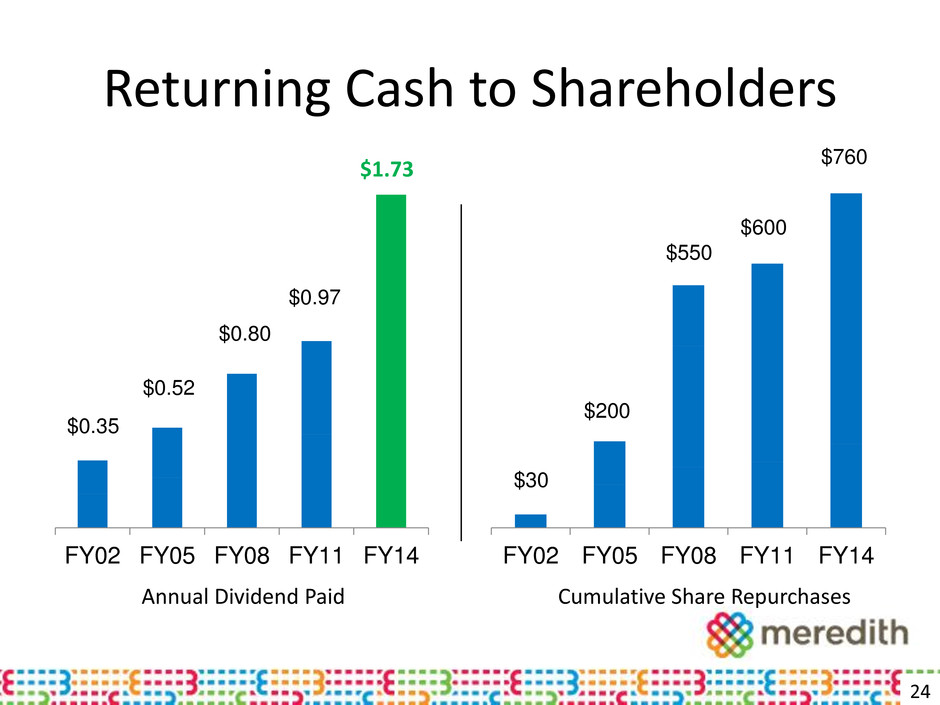

Returning Cash to Shareholders 24 $0.35 $0.52 $0.80 $0.97 FY02 FY05 FY08 FY11 FY14 $1.73 Annual Dividend Paid Cumulative Share Repurchases $30 $200 $550 $600 $760 FY02 FY05 FY08 FY11 FY14

Looking Ahead to Calendar 2015 Grow non-political advertising revenue Increase retransmission revenue and contribution Enhancing digital and mobile platforms Complete integration of station acquisitions Local Media National Media Evolve and strengthen our advertising activities Aggressively expand our digital-related businesses Integrate new business additions Grow revenue from individual consumer Corporate Continue to consolidate our respective industries Increase cash returned to shareholders Execute Total Shareholder Return strategy 25

5 Reasons to Invest in Meredith 1 Largest reach to American women across life stages 2 Powerful national and local media brands 3 Growing digital and mobile activities 4 Aggressively adding new revenue streams 5 Track record of returning cash to shareholders 26

UBS 42nd Annual Global Media and Communications Conference December 8, 2014