1 A Powerful Diversified Media & Marketing Company 2016 Deutsche Bank Media, Internet & Telecom Conference March 7, 2016

Disclaimer 2 This presentation contains confidential information regarding Meredith Corporation (“Meredith” or the “Company”). This presentation constitutes “Business Information” under the Confidentiality Agreement the recipient signed and delivered to the Company and its use and retention are subject to the terms of such agreement. This presentation does not purport to contain all of the information that may be required to evaluate a potential transaction with the Company and any recipient hereof should conduct its own independent evaluation and due diligence investigation of the Company and the potential transaction. Nor shall this presentation be construed to indicate that there has been no change in the affairs of the Company since the date hereof or such other date as of which information is presented. Each recipient agrees that it will not copy, reproduce, disclose or distribute to others this presentation or the information contained herein, in whole or in part, at any time, without the prior written consent of the Company, except as expressly permitted in the Confidentiality Agreement. The recipient further agrees that it will cause its directors, officers, employees and representatives to use this presentation only for the purpose of evaluating its interest in a potential transaction with the Company and for no other purpose. Neither the Company nor any of its affiliates, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information contained in this presentation or any other information (whether communicated in written or oral form) transmitted or made available to the recipient, and each of such persons expressly disclaims any and all liability relating to or resulting from the use of this presentation. The recipient is not entitled to rely on the accuracy or completeness of this presentation and is entitled to rely solely on only those particular representations and warranties, if any, which may be made by the Company in a definitive written agreement, when, as and if executed, and subject to such limitations and restrictions as may be specified therein. This presentation and management’s commentary relating thereto may contain certain forward-looking statements that are subject to risks and uncertainties. These statements are based on management’s current knowledge and estimates of factors affecting the Company and its operations. Statements in this presentation that are forward-looking include, but are not limited to, the Company’s estimates of future revenues, profits and earnings per share. Actual results may differ materially from those currently anticipated. Factors that could adversely affect future results include, but are not limited to, downturns in national and/or local economies; a softening of the domestic advertising market; world, national or local events that could disrupt broadcast television; increased consolidation among major advertisers or other events depressing the level of advertising spending; the unexpected loss or insolvency of one or more major clients or vendors; the integration of acquired businesses; changes in consumer reading, purchasing and/or television viewing patterns; increases in paper, postage, printing, syndicated programming or other costs; changes in television network affiliation agreements; technological developments affecting products or methods of distribution; changes in government regulations affecting the Company’s industries; increases in interest rates; and the consequences of acquisitions and/or dispositions. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Today’s Agenda 3 Meredith Overview National Media Growth Strategies Local Media Growth Strategies Total Shareholder Return

Meredith’s Strong Investment Thesis 4 Portfolio of highly rated television stations in large and fast-growing markets Trusted national brands with an unrivaled female reach Profitable and growing digital business World’s 3rd largest brand licensor with very high margins Experienced management team with a proven record of operational excellence and shareholder value creation over time Strong and consistent cash flow generation, driven by: Commitment to delivering Top Third Total Shareholder Return: 1. 2. 3. Dividend payer for 69 years; increases for 23 consecutive years Share buyback program Accretive strategic acquisitions

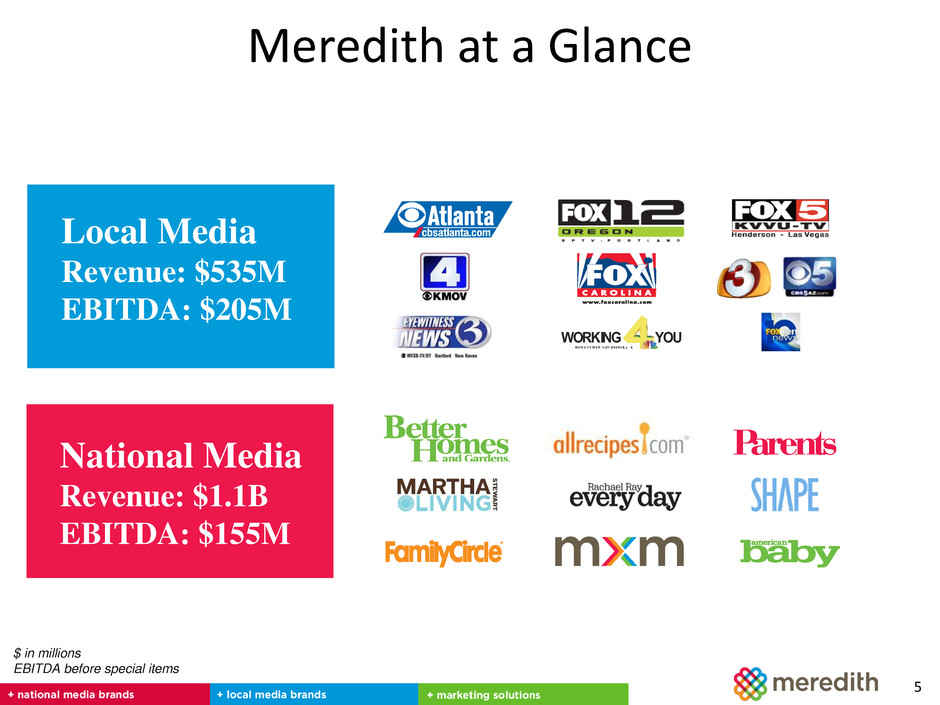

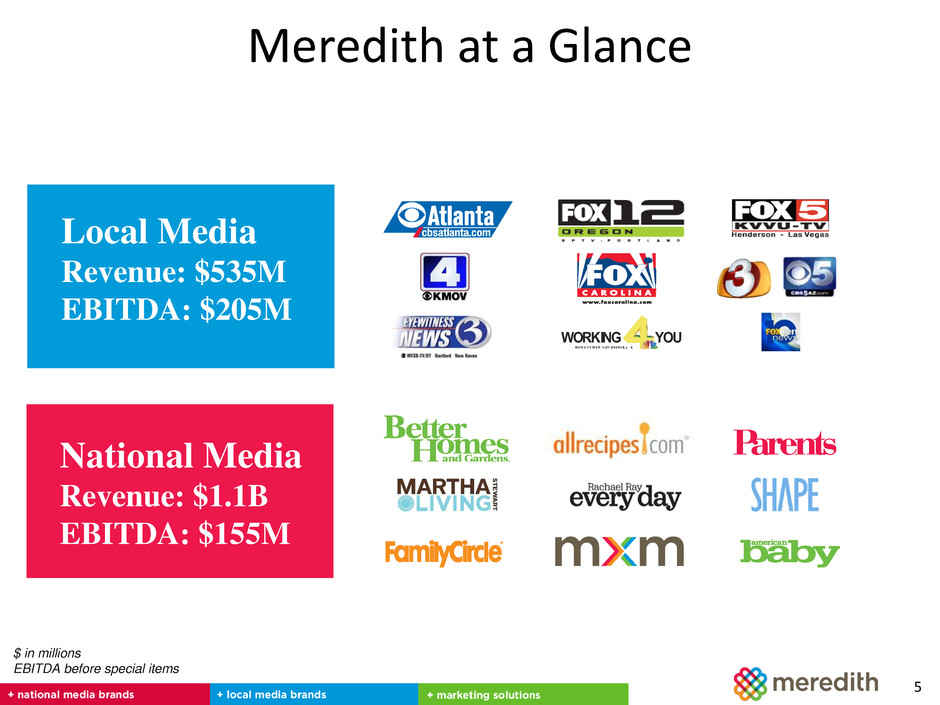

Meredith at a Glance 5 National Media Revenue: $1.1B EBITDA: $155M Local Media Revenue: $535M EBITDA: $205M WORKING YOU WS M V -TV W SM V-DT NASHV IL L E $ in millions EBITDA before special items

6 Record broadcast revenue and EBITDA Successful integration of 4 additional television stations Rapid growth in digital, mobile, video and social platforms Expanded scale with Martha Stewart, Shape media brands; entered wedding category and added digital ad tech platforms Grew dividend for 23nd straight year A Year of Significant Accomplishments

Today’s Agenda 7 Meredith Overview National Media Growth Strategies Local Media Growth Strategies Total Shareholder Return

National Media Group Footprint 8 Reaches 100 Million Unduplicated American Women Monthly 75 Million Unique Visitors | More than 60% of Millennial Women INGREDIENTS FOR Something Special YOUNG WOMEN YOUNG FAMILIES ESTABLISHED FAMILIES WOMEN OF WORTH NEW NESTERS

Executing National Media Group Strategies 9 Drive audience growth and engagement across platforms Grow share of advertising revenues Accelerate growth of profitable digital business Increase circulation profit contribution Expand Meredith Xcelerated Marketing Grow high margin brand licensing business

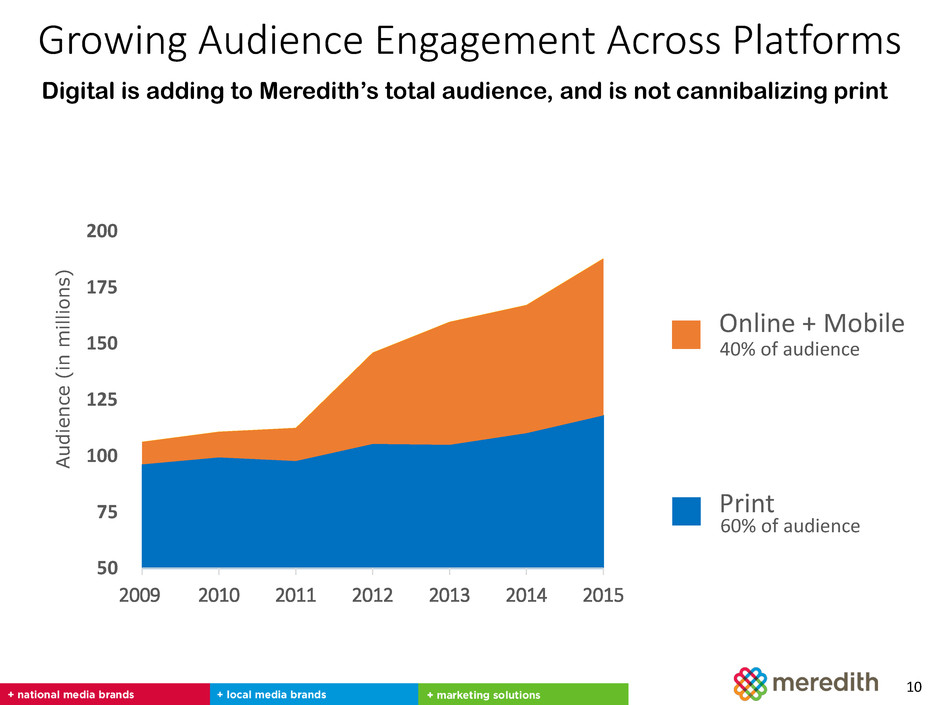

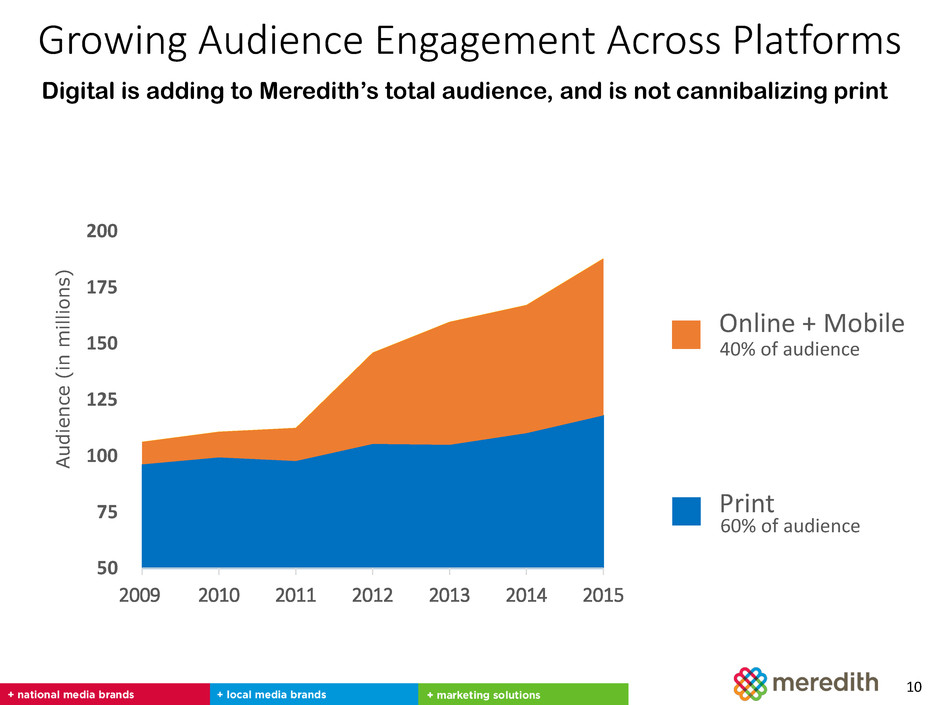

10 50 75 100 125 150 175 200 2009 2010 2011 2012 2013 2014 2015 A ud ienc e ( in m il li on s ) Print Online + Mobile 40% of audience 60% of audience Growing Audience Engagement Across Platforms Digital is adding to Meredith’s total audience, and is not cannibalizing print

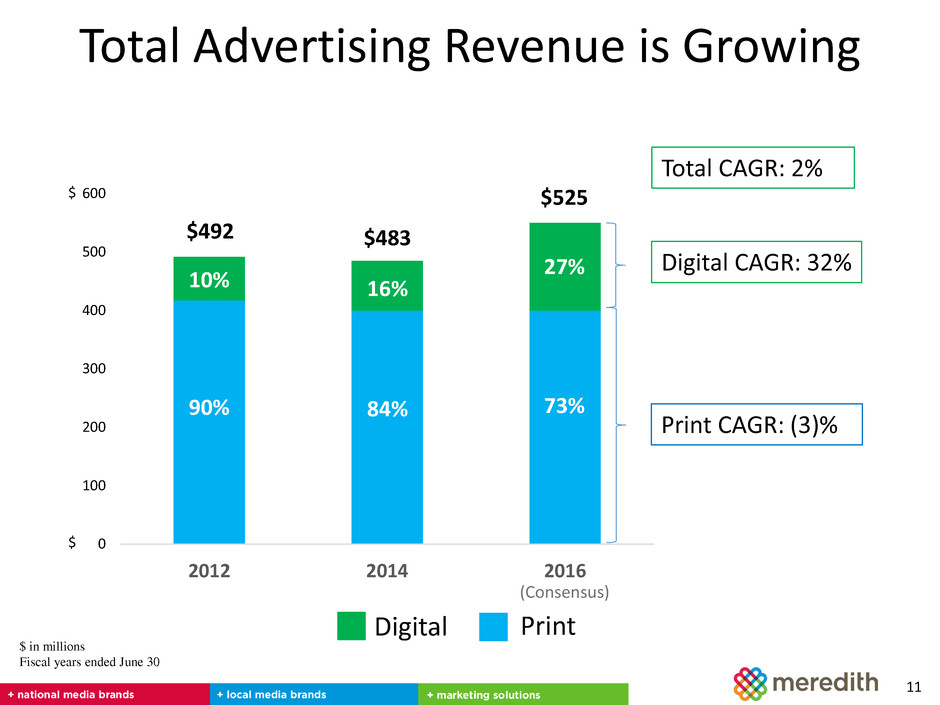

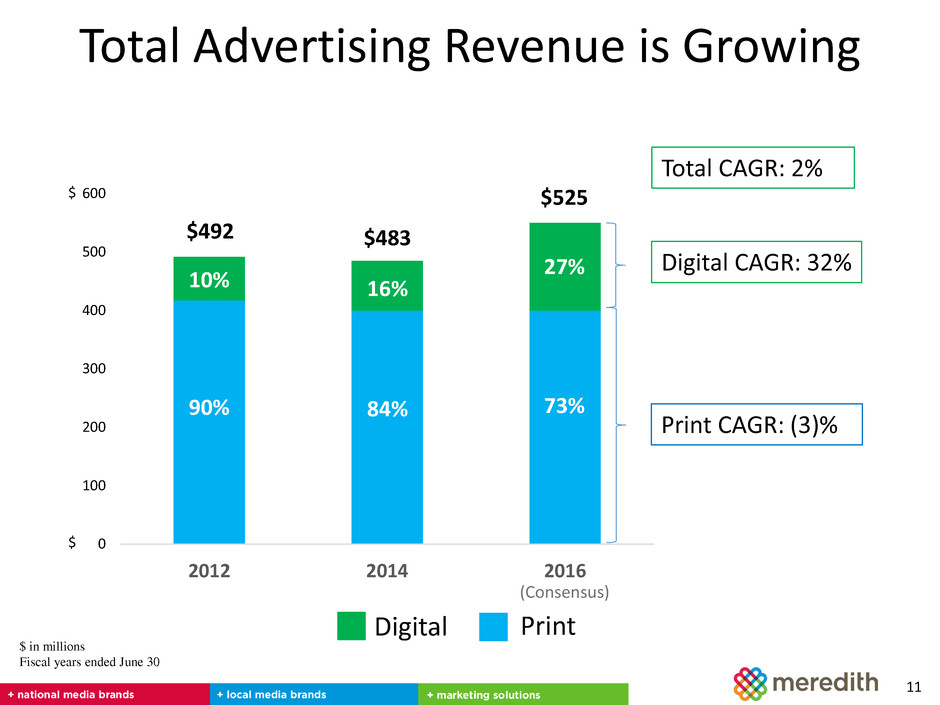

Digital CAGR: 32% Total Advertising Revenue is Growing 11 0 100 200 300 400 500 600 2012 2014 2016 $ in millions Fiscal years ended June 30 Print Digital $492 $525 $483 10% 15% 27% $ $ Print CAGR: (3)% Total CAGR: 2% 16% (Consensus) 90% 73% 84%

Accelerate Growth of Meredith Digital 12 An Engaged and Growing Audience of 75 Million

Circulation Auto-Renewal Has Large Upside 13 Lifetime Value $8.00 Traditional renewal methods Auto- renewal $15.00

MXM Provides Full Suite of Services for Leading National Brands Content strategy & execution Customer Relationship Management – Direct communication with consumers via mail, email and other sources Digital Marketing ‒ Website development ‒ Search engine optimization Mobile Marketing ‒ Mobile site and app development Social Media Marketing – Brand monitoring Data & Analytics ‒ Measurement ‒ Reporting ‒ Predictive analytics Areas of Focus: 14

15 Meredith is The World’s 3rd-Largest Licensor

Today’s Agenda 16 Meredith Overview National Media Growth Strategies Local Media Growth Strategies Total Shareholder Return

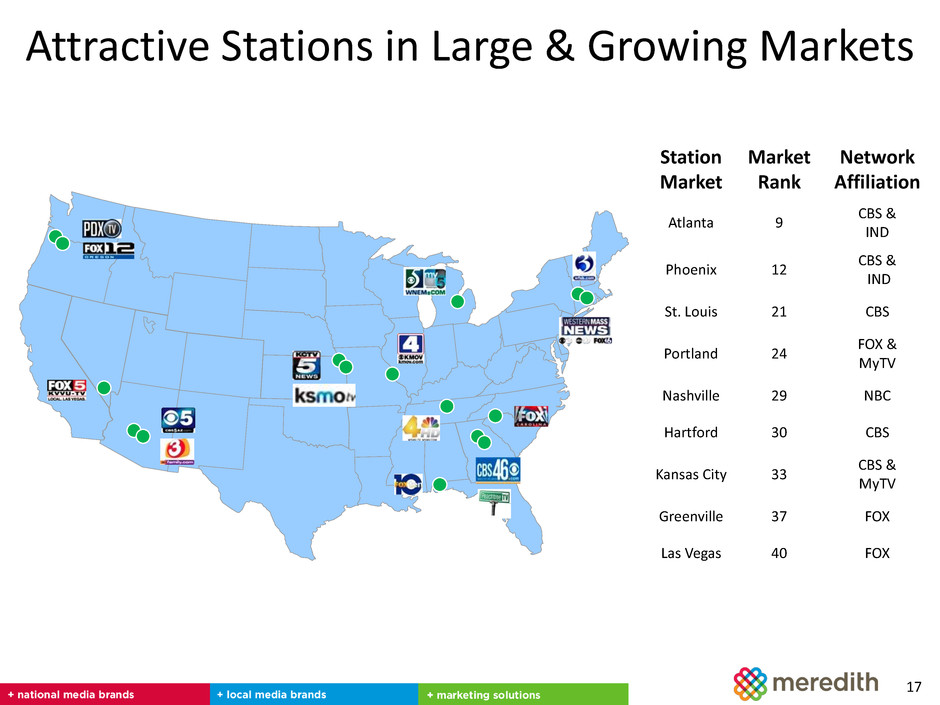

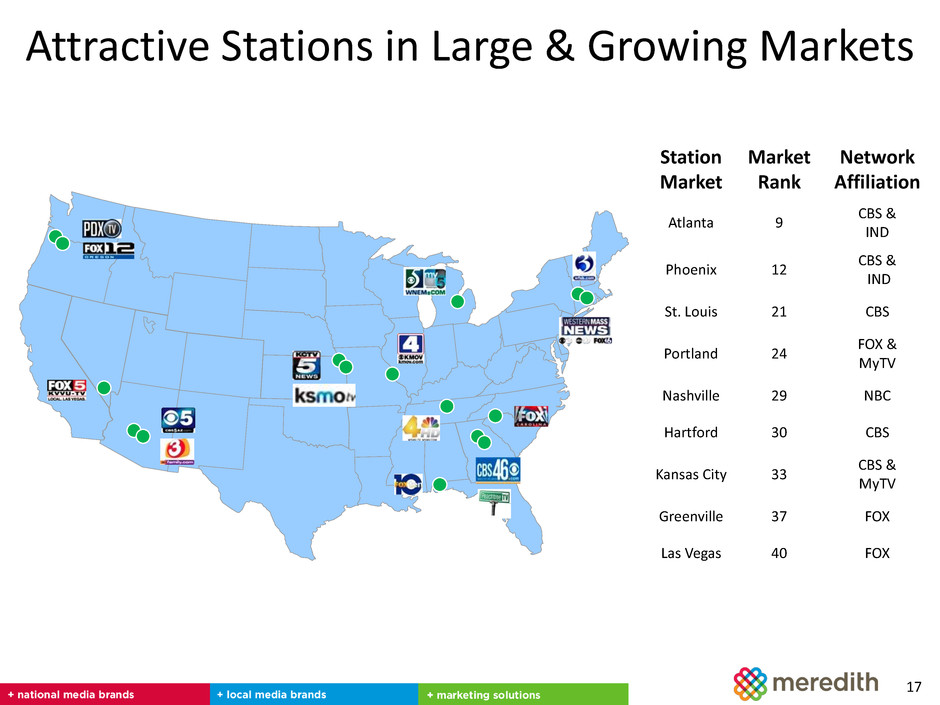

Attractive Stations in Large & Growing Markets 17 Station Market Market Rank Network Affiliation Atlanta 9 CBS & IND Phoenix 12 CBS & IND St. Louis 21 CBS Portland 24 FOX & MyTV Nashville 29 NBC Hartford 30 CBS Kansas City 33 CBS & MyTV Greenville 37 FOX Las Vegas 40 FOX

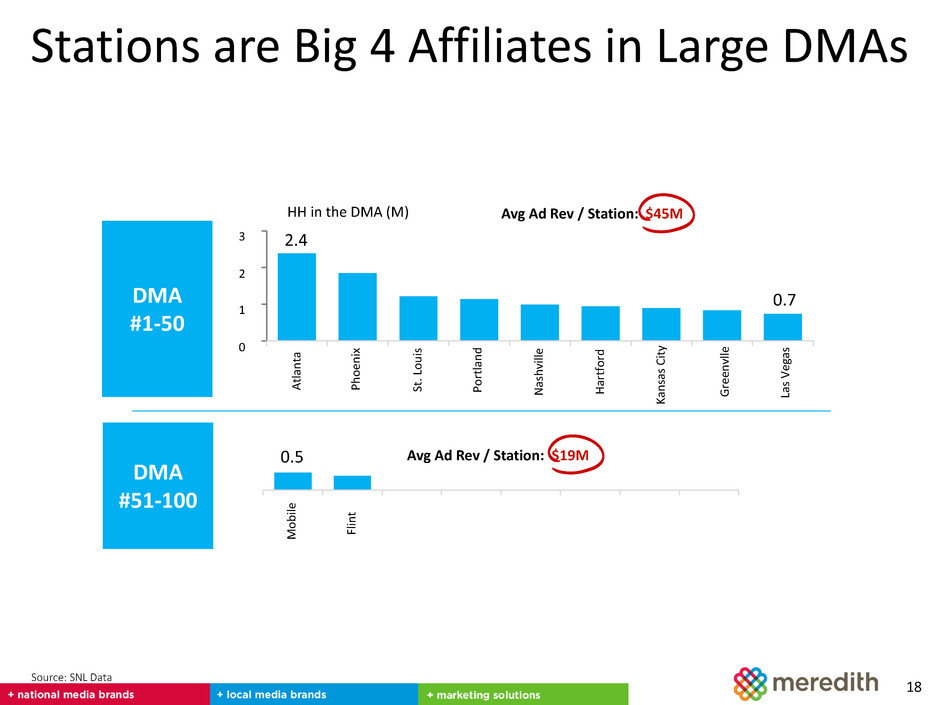

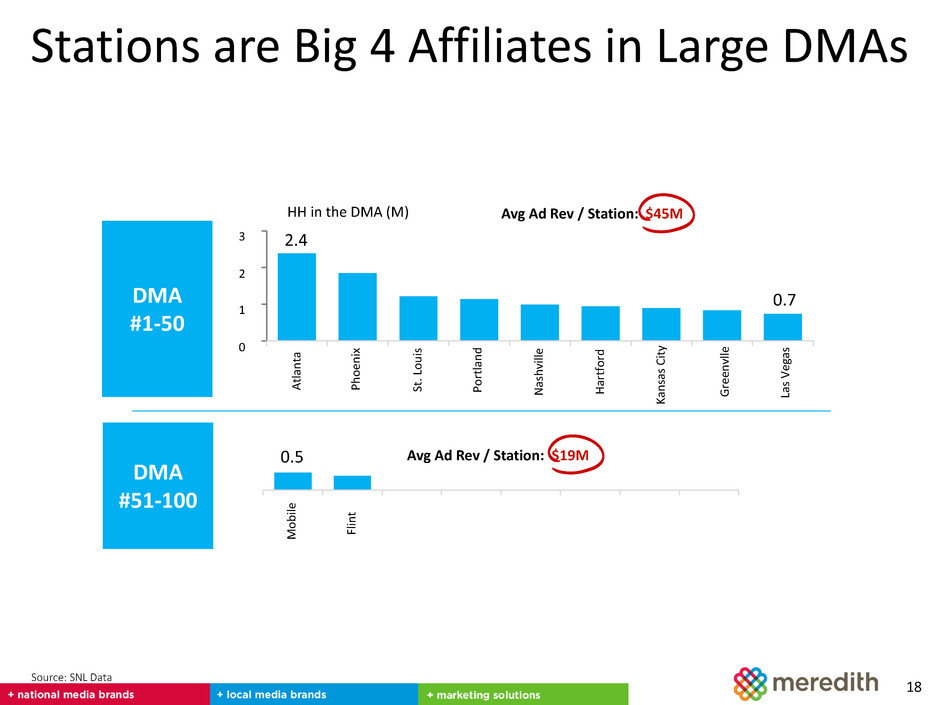

Stations are Big 4 Affiliates in Large DMAs 18 3 2 1 0 HH in the DMA (M) La s Vega s 0.7 G re en vl le Ka n sas C it y H ar tfor d N ash vil le P o rtl an d St. L o u is P h o en ix Atl an ta 2.4 Fl in t M o b ile 0.5 DMA #1-50 DMA #51-100 Avg Ad Rev / Station: $45M Avg Ad Rev / Station: $19M Source: SNL Data

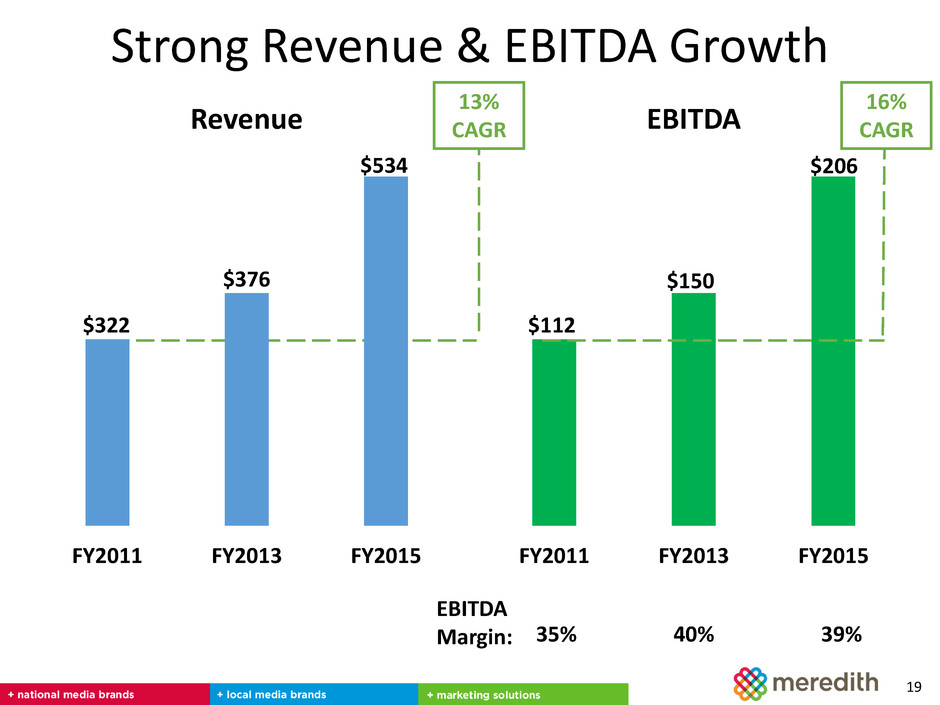

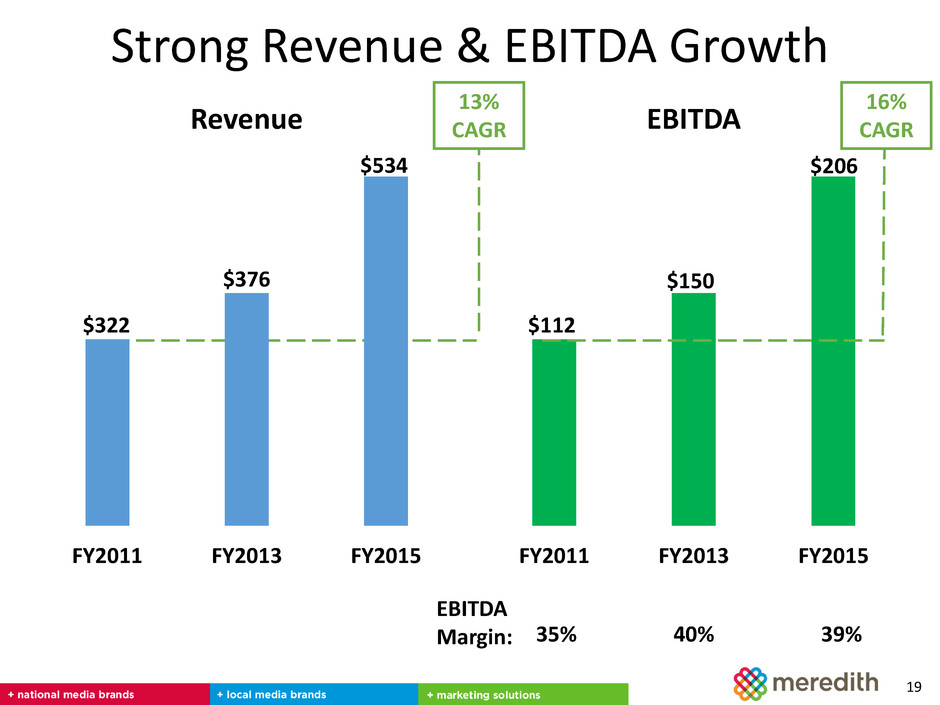

Strong Revenue & EBITDA Growth 19 FY2011 FY2013 FY2015 Revenue $534 EBITDA Margin: $322 35% 39% $376 40% 13% CAGR 16% CAGR FY2011 FY2013 FY2015 EBITDA $112 $150 $206

Local Media Growth Strategies 20 Increase News Viewership Grow Advertising Revenues Scale Digital Video and Mobile Increase Net Retransmission Contribution Maximize Recent Acquisitions and Expand Station Portfolio

Meredith Outperforms Television Industry 21 Calendar Meredith Industry Meredith vs. Industry (Pct. Pts.) 2011 4% 0% 4 2012 1% 1% 0 2013 3% 1% 2 2014 (2)% (1)% (1) 2015 2% 0% 2 Year-over-year change; Source: Television Bureau of Advertising; Non-Political Advertising Revenues

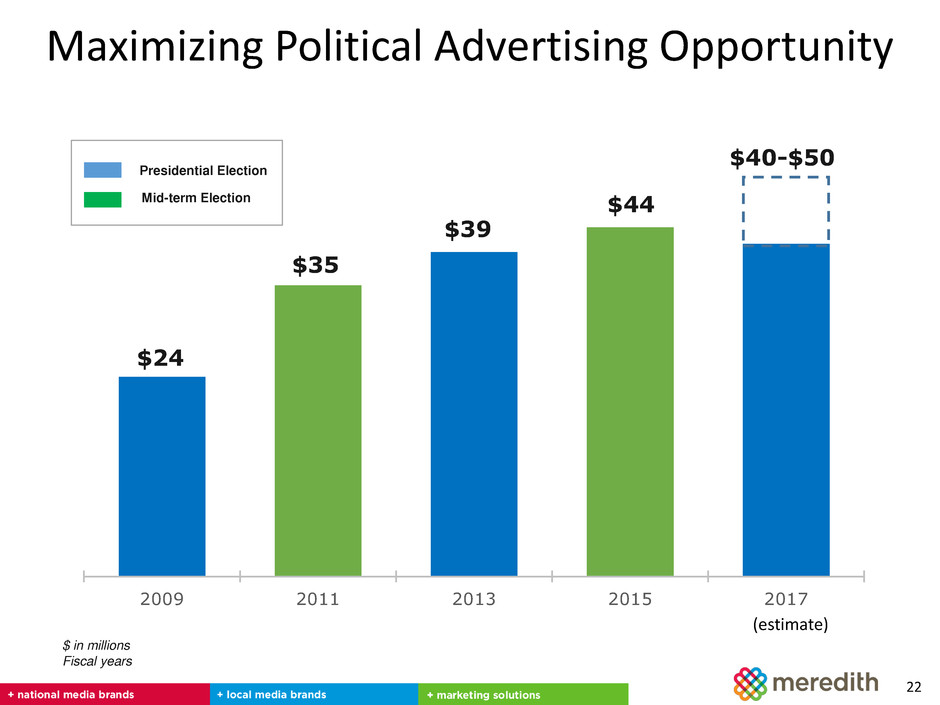

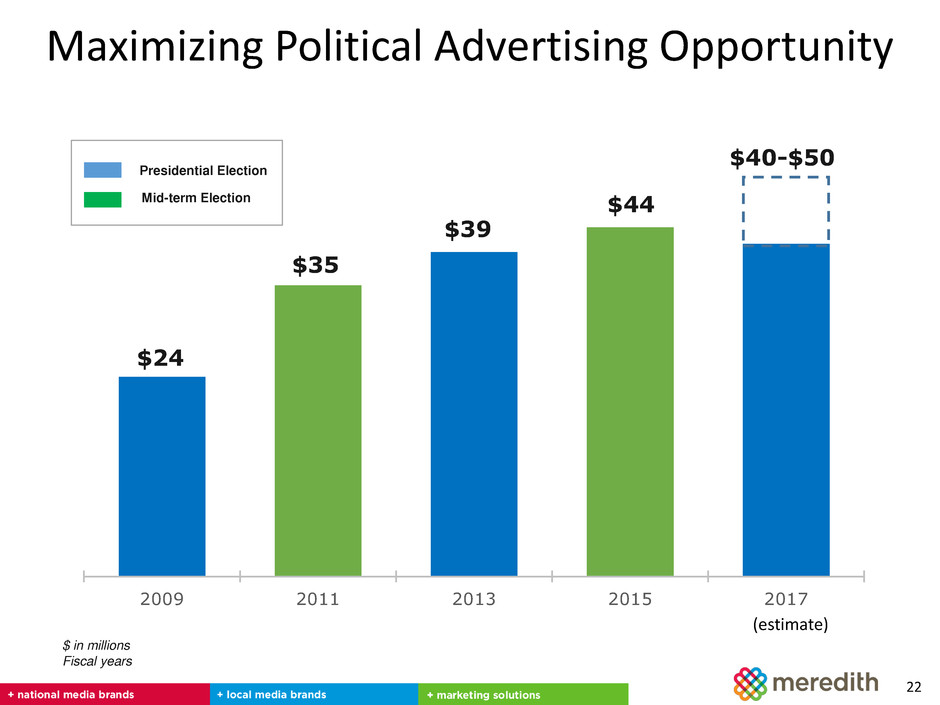

Maximizing Political Advertising Opportunity 22 2009 2011 2013 2015 2017 $40-$50 $35 $44 $24 $39 $ in millions Fiscal years Presidential Election Mid-term Election (estimate)

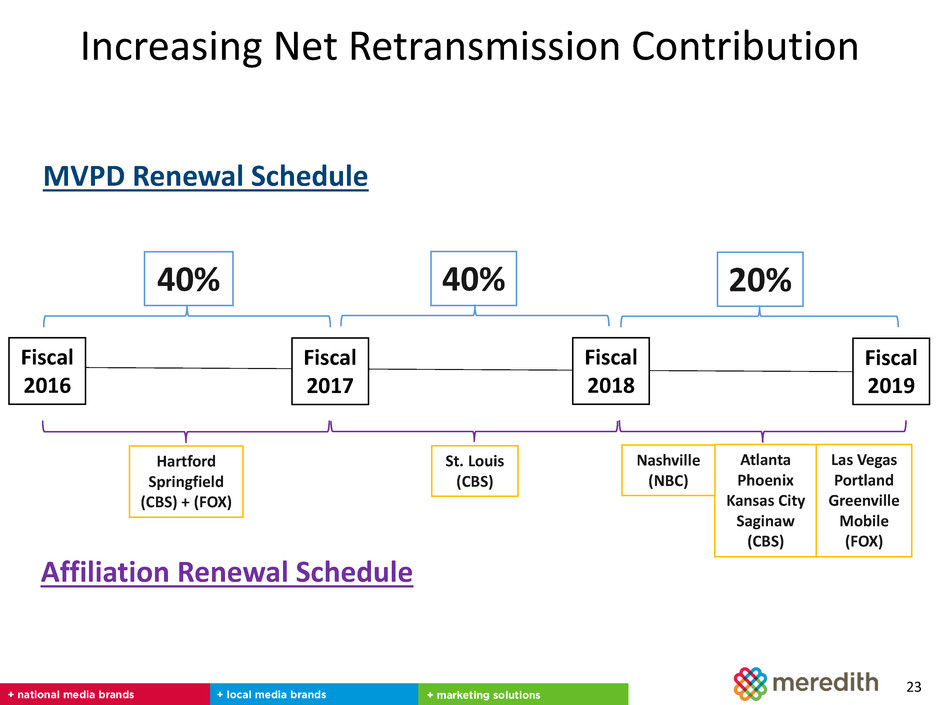

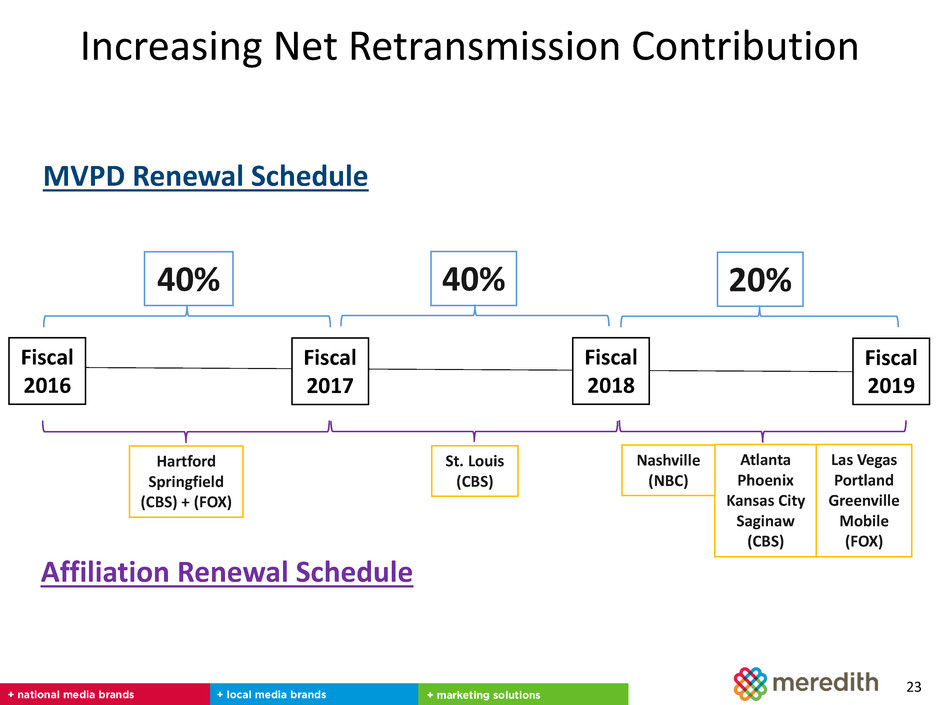

Increasing Net Retransmission Contribution 23 40% Hartford Springfield (CBS) + (FOX) St. Louis (CBS) Atlanta Phoenix Kansas City Saginaw (CBS) Las Vegas Portland Greenville Mobile (FOX) Fiscal 2019 MVPD Renewal Schedule Affiliation Renewal Schedule Nashville (NBC) Fiscal 2017 Fiscal 2018 Fiscal 2016 40% 20%

Today’s Agenda 24 Meredith Overview National Media Growth Strategies Local Media Growth Strategies Total Shareholder Return

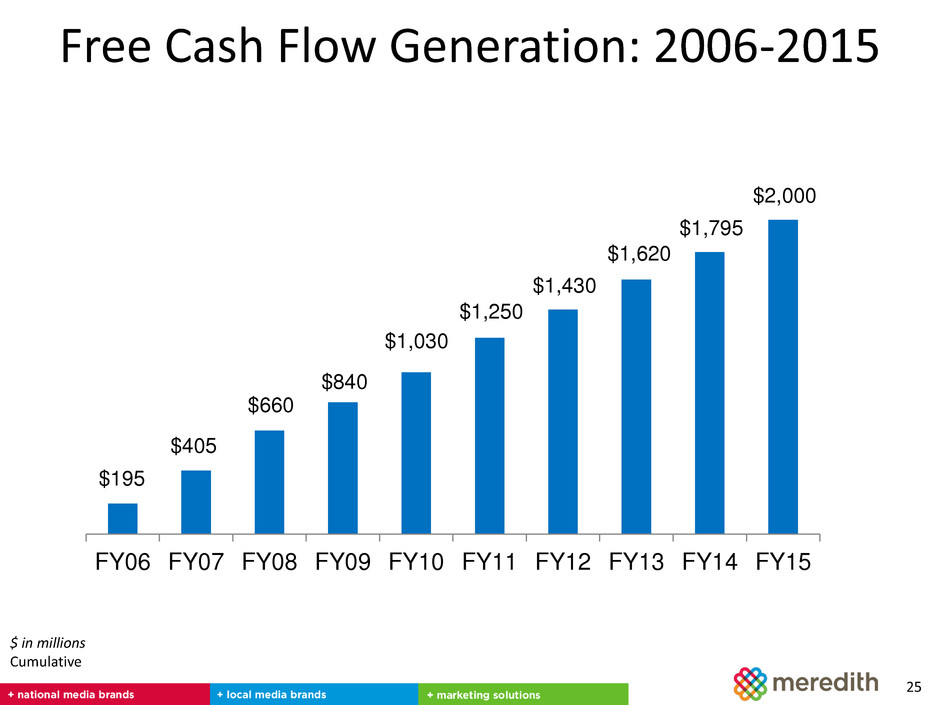

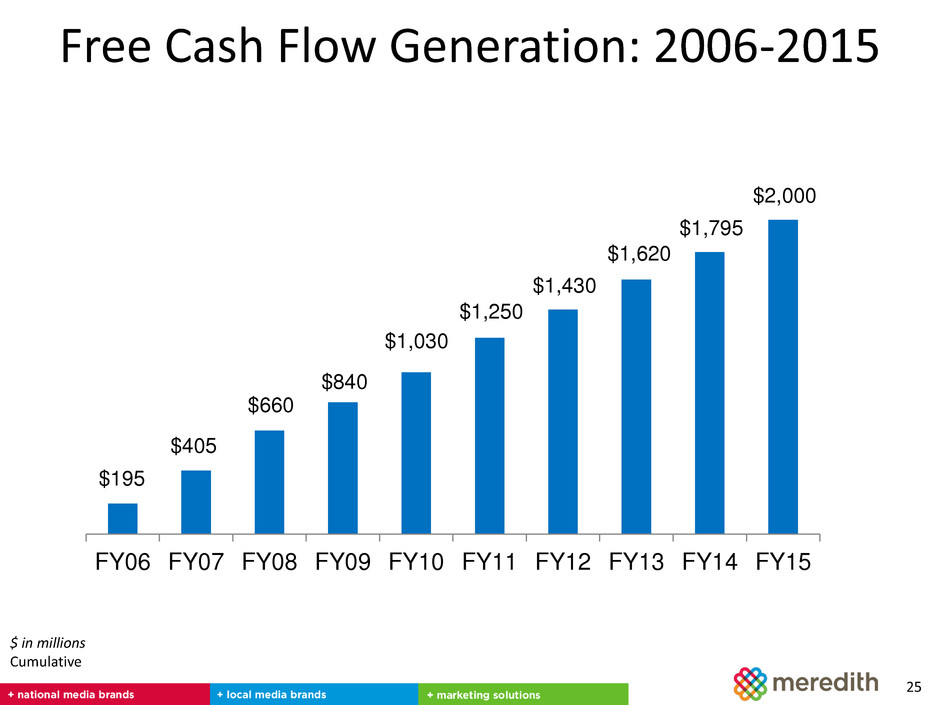

Free Cash Flow Generation: 2006-2015 25 $195 $405 $660 $840 $1,030 $1,250 $1,430 $1,620 $1,795 $2,000 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 $ in millions Cumulative

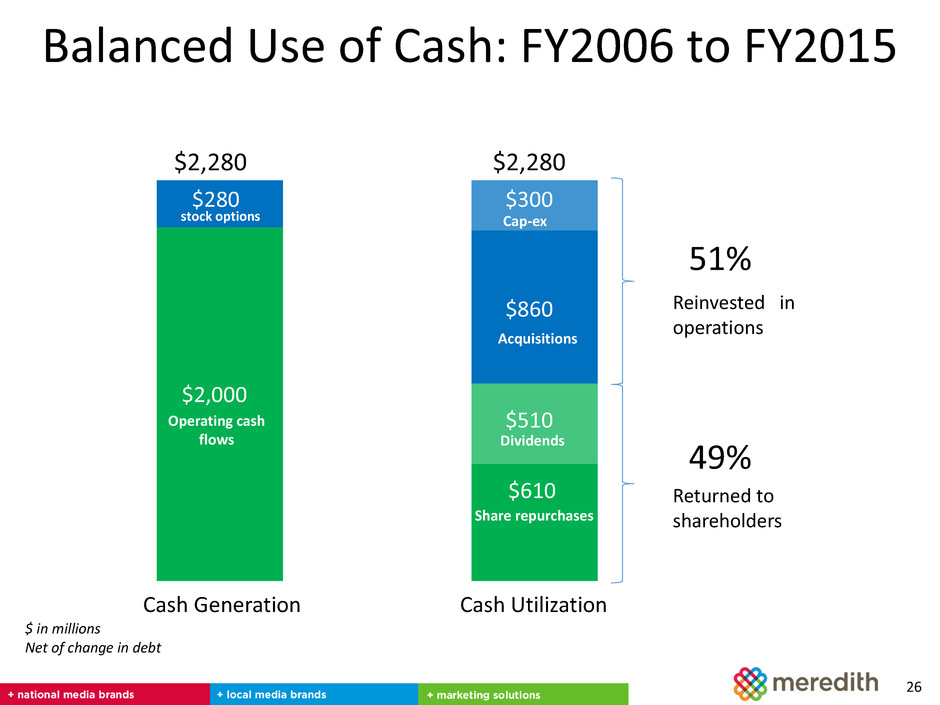

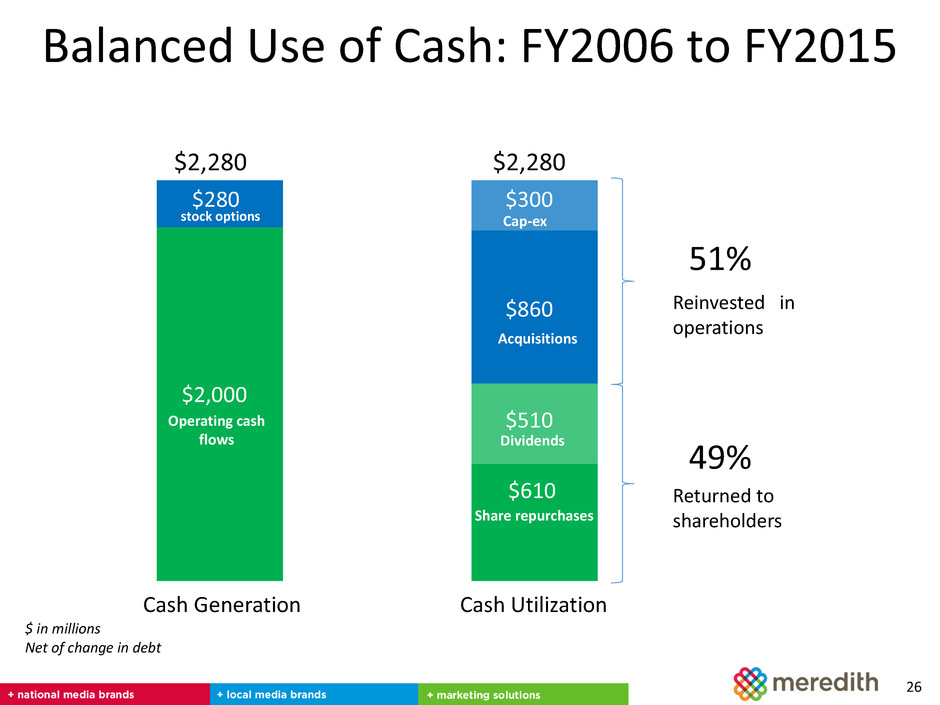

Balanced Use of Cash: FY2006 to FY2015 26 $ in millions Net of change in debt $2,000 $280 Cash Generation Cash Utilization $2,280 $2,280 $610 $510 Dividends $300 $860 Share repurchases Acquisitions Cap-ex Operating cash flows stock options Reinvested in operations Returned to shareholders 51% 49%

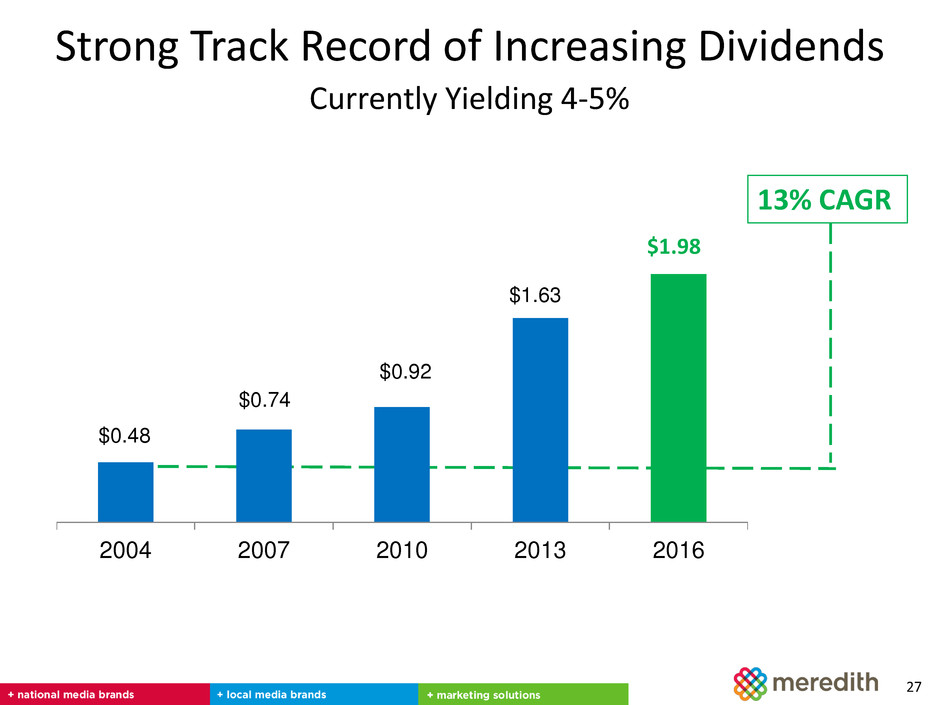

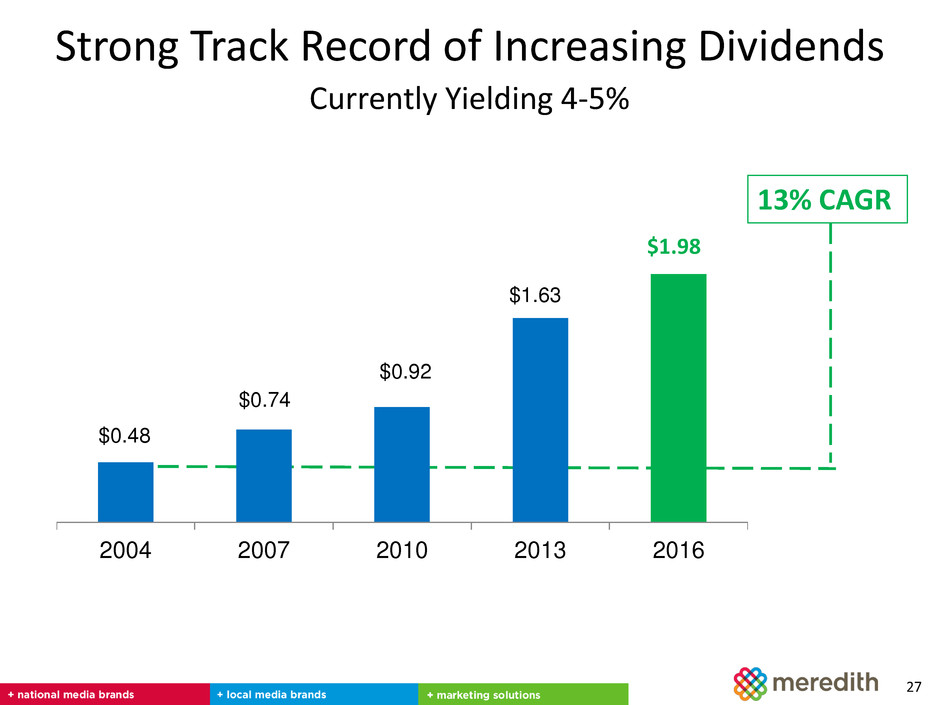

Strong Track Record of Increasing Dividends 27 $0.48 $0.74 $0.92 $1.63 2004 2007 2010 2013 2016 $1.98 13% CAGR Currently Yielding 4-5%

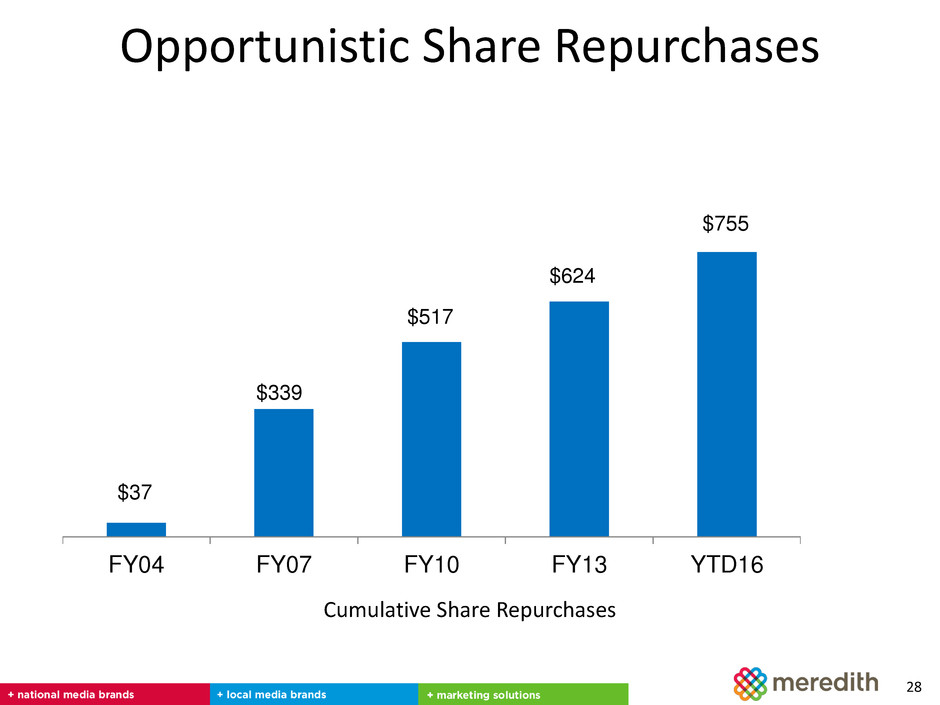

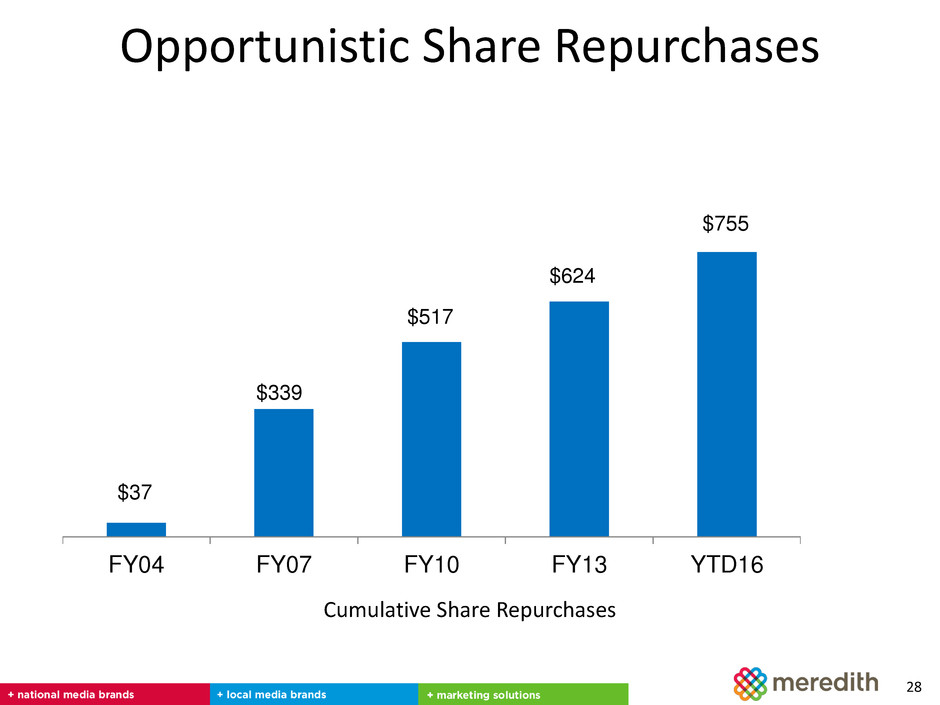

Opportunistic Share Repurchases 28 $37 $339 $517 $624 $755 FY04 FY07 FY10 FY13 YTD16 Cumulative Share Repurchases

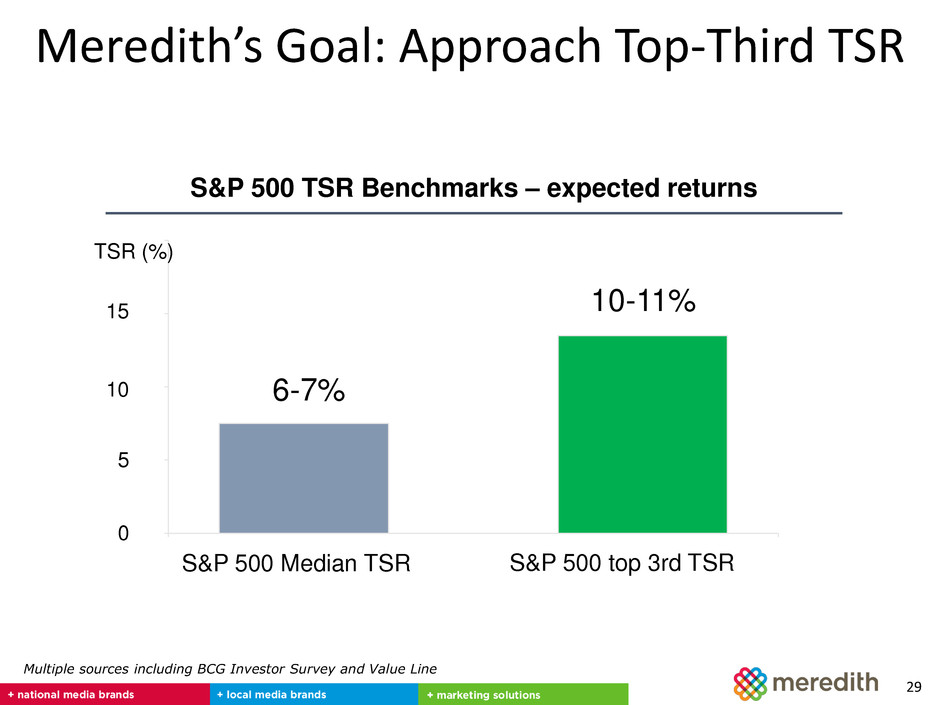

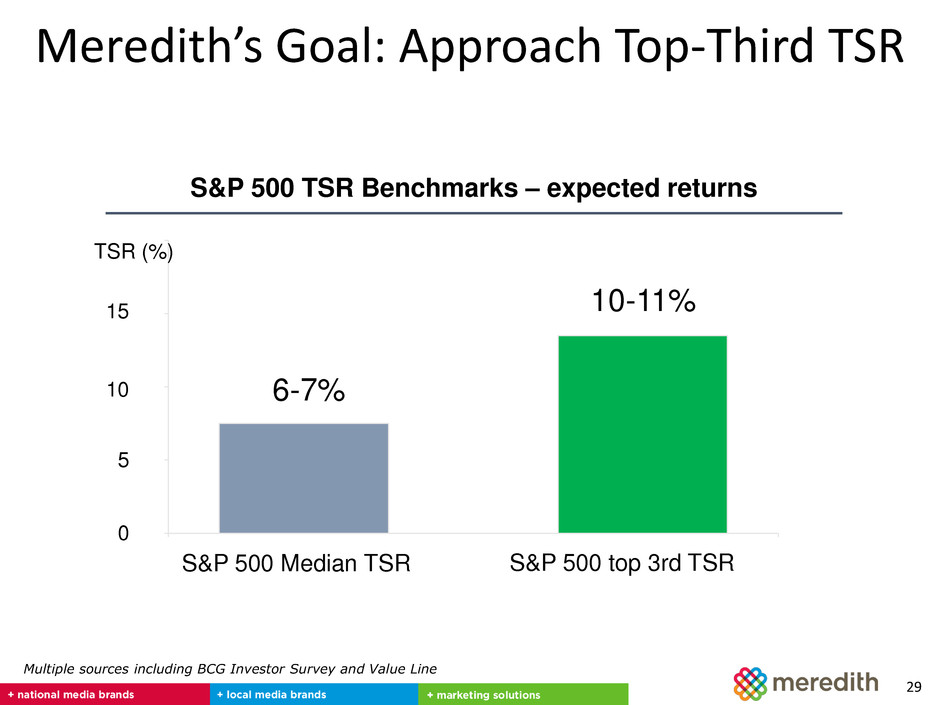

Meredith’s Goal: Approach Top-Third TSR 29 TSR (%) 5 15 10 0 S&P 500 Median TSR S&P 500 top 3rd TSR S&P 500 TSR Benchmarks – expected returns Multiple sources including BCG Investor Survey and Value Line 6-7% 10-11%

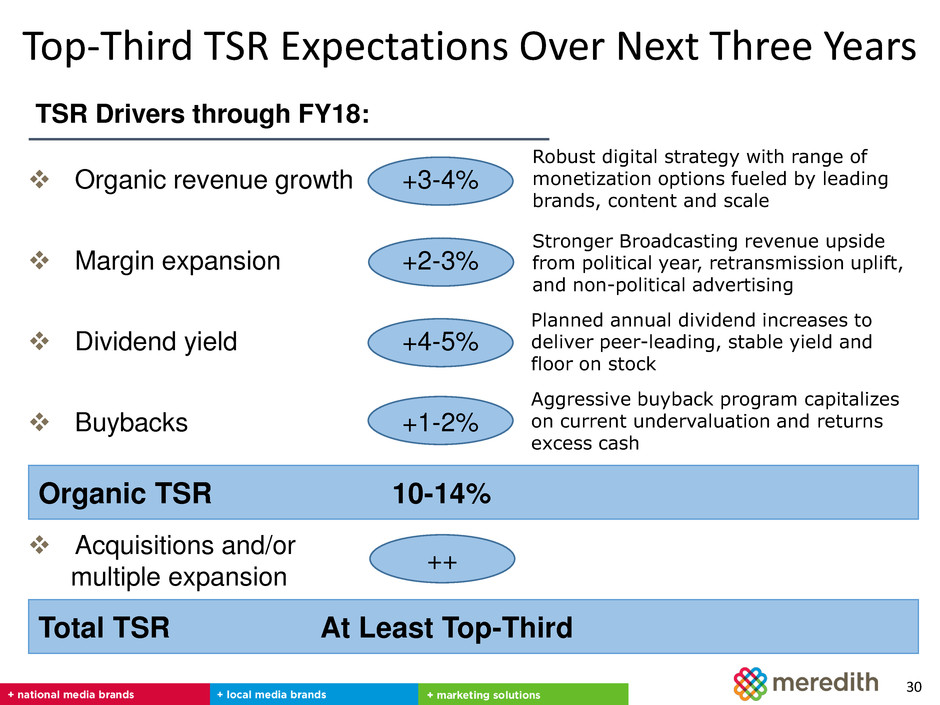

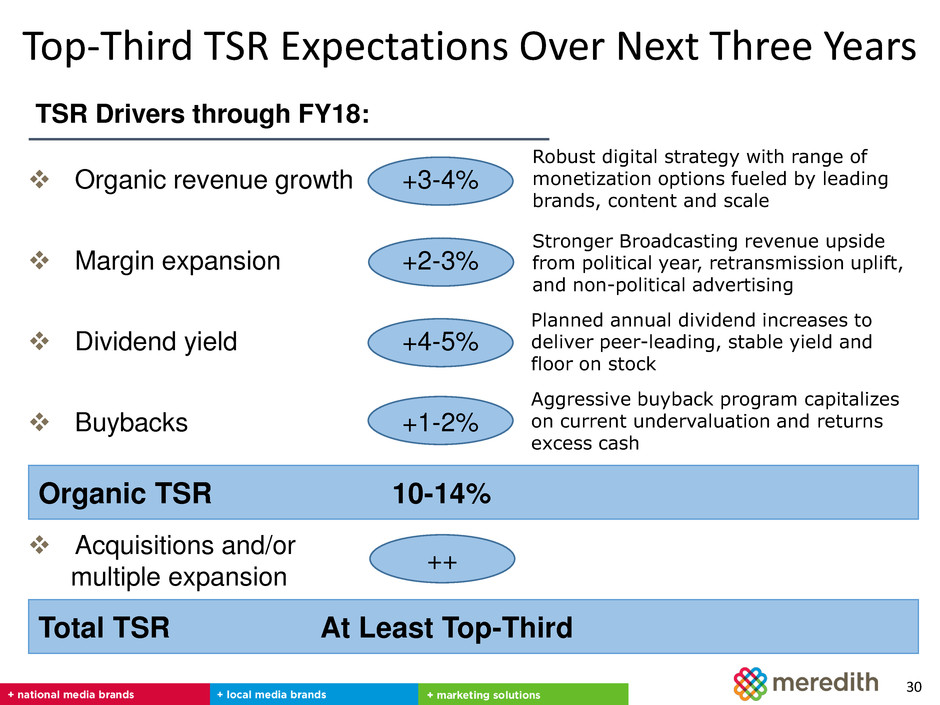

Top-Third TSR Expectations Over Next Three Years 30 Organic revenue growth Margin expansion Dividend yield Buybacks TSR Drivers through FY18: +3-4% +2-3% +4-5% +1-2% Organic TSR 10-14% Acquisitions and/or multiple expansion ++ Robust digital strategy with range of monetization options fueled by leading brands, content and scale Stronger Broadcasting revenue upside from political year, retransmission uplift, and non-political advertising Planned annual dividend increases to deliver peer-leading, stable yield and floor on stock Aggressive buyback program capitalizes on current undervaluation and returns excess cash Total TSR At Least Top-Third

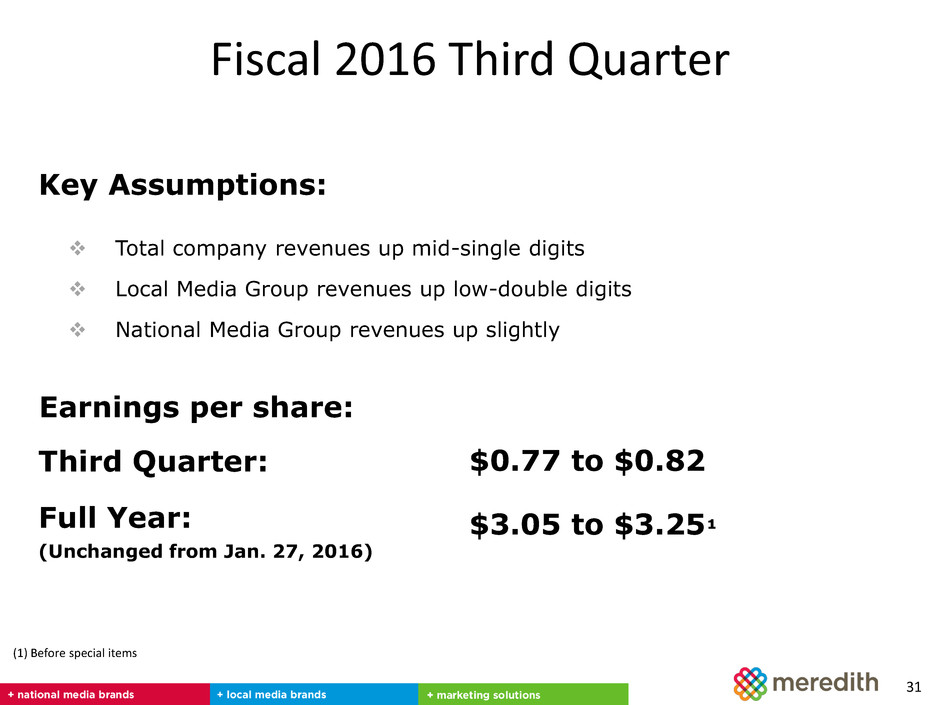

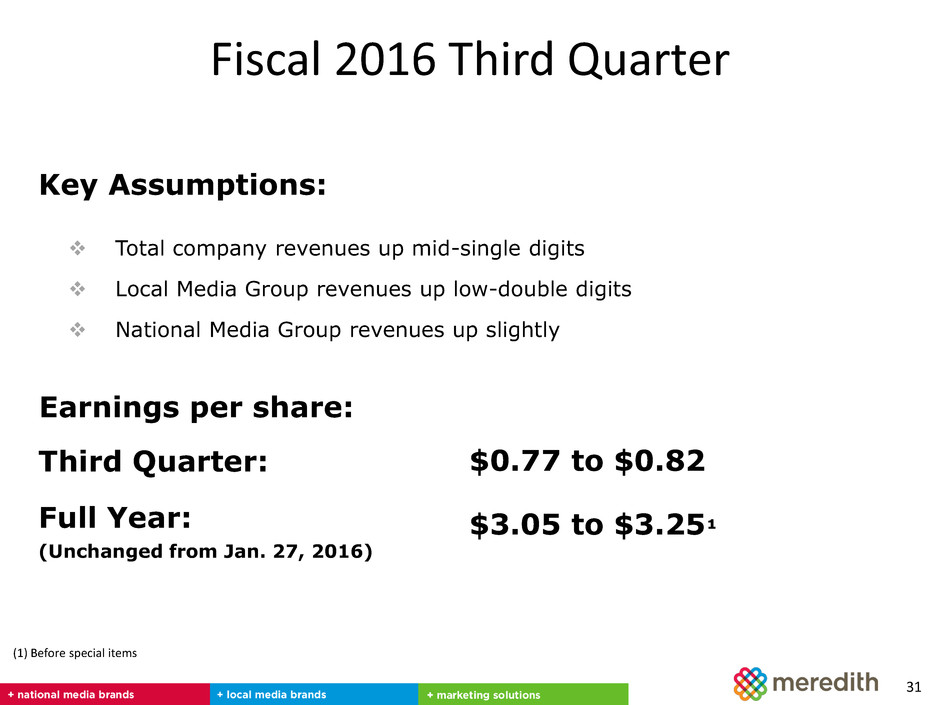

31 Fiscal 2016 Third Quarter Total company revenues up mid-single digits Local Media Group revenues up low-double digits National Media Group revenues up slightly Third Quarter: $0.77 to $0.82 Full Year: $3.05 to $3.25¹ (Unchanged from Jan. 27, 2016) Key Assumptions: Earnings per share: (1) Before special items

Key Takeaways from Today 32 Local Media Group delivering strong results fueled by: ― Growth in non-political advertising revenues ― Maximizing political advertising opportunity ― Increasing retransmission contribution National Media Group poised for another year of profit growth: ― Brand licensing delivering high-margin profit ― Circulation providing a stable source of revenue and contribution ― Digital advertising growth will soon offset print advertising declines Strong cash flows fueling 3-pronged TSR strategy: 1. Acquisitions and investments in business 2. Dividend growth 3. Share buybacks Meredith can deliver Top Third Total Shareholder Return

33 A Powerful Diversified Media & Marketing Company 2016 Deutsche Bank Media, Internet & Telecom Conference March 7, 2016