1 Hello and welcome everyone. Thank you for the opportunity to share some insight about Meredith and our growing business operations. My name is Steve Lacy and I am the chairman and chief executive at Meredith Corporation. We’re very excited to host you today, and want to thank Wells Fargo for providing this venue.

Before we get started, I want to remind everyone that this presentation does include certain forward-looking statements. This is a reminder of the factors that could affect our business and its results over time. 2

We have a great business that delivers strong and growing cash flows. We have a balanced capital allocation strategy, re-investing approximately half of our cash generation to expand our business, and returning the other half to our shareholders. Our goal is to continue to deliver top-third Total Shareholder Returns. We are well-positioned to continue as an industry consolidator, and are constantly evaluating strategic acquisitions, both large and small. Finally, we have an experienced management team with a proven track record that consistently delivers results. 3

Today you will hear from what I consider the best group of senior executives in the media industry. This is the team behind the strong results Meredith has produced year-in and year-out. It’s an experienced team – the average tenure of our officer group at Meredith is over 12 years – yet one that has successfully adapted to the changing media landscape. I’ve been very fortunate to have hired and worked with each of them. By way of our agenda, Tom Harty, President and Chief Operating Officer, will open with an overview of our portfolio and our vision for the future. Paul Karpowicz, president of our Local Media Group, will cover the growth strategies in his group. Then you will hear from National Media Group President Jon Werther and CFO Joe Ceryanec. I will be back to moderate the Q&A. Please hold your questions until 4

then. Now I will turn it over to Tom. 4

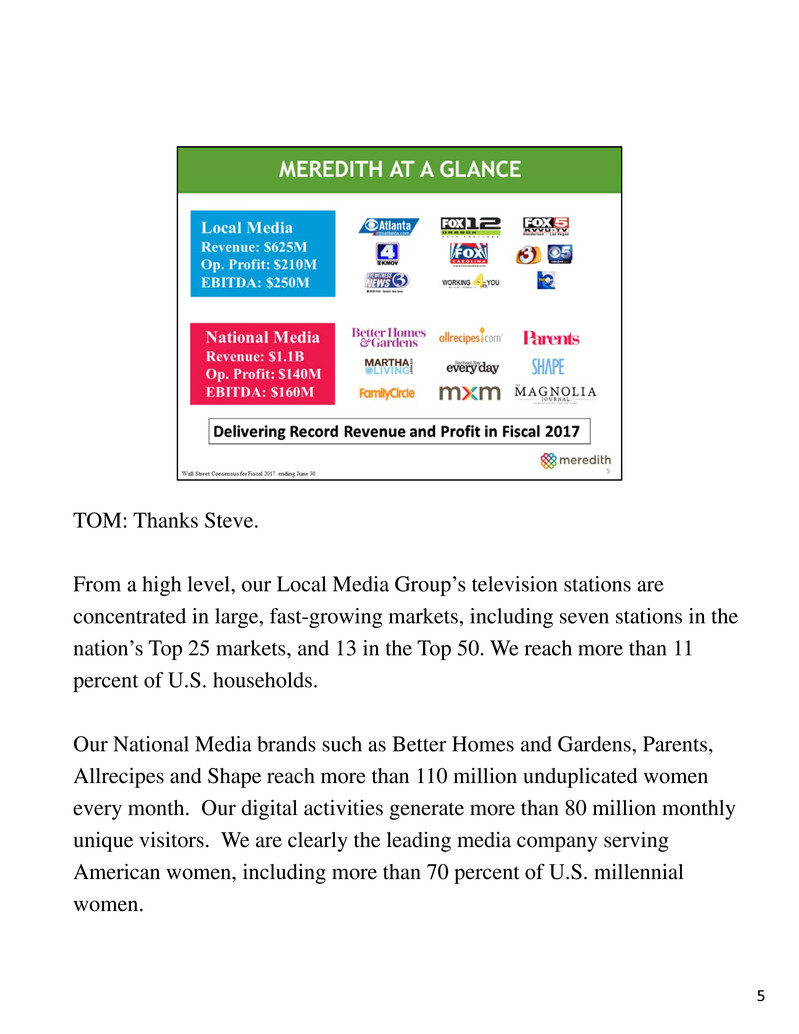

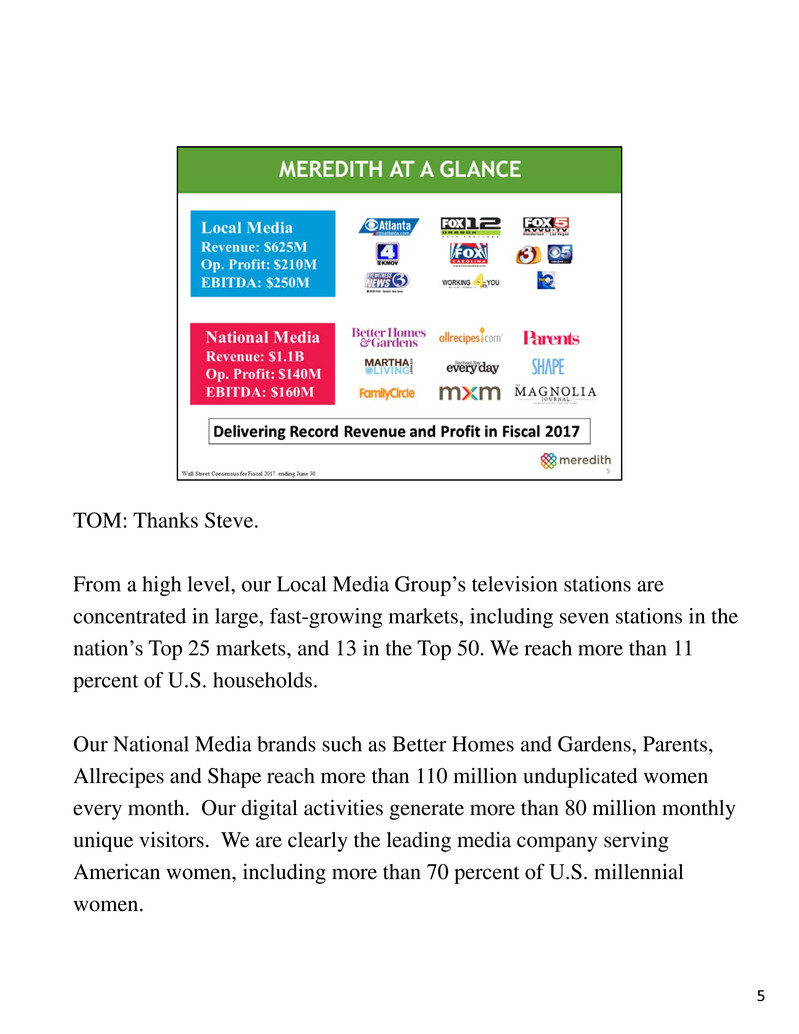

TOM: Thanks Steve. From a high level, our Local Media Group’s television stations are concentrated in large, fast-growing markets, including seven stations in the nation’s Top 25 markets, and 13 in the Top 50. We reach more than 11 percent of U.S. households. Our National Media brands such as Better Homes and Gardens, Parents, Allrecipes and Shape reach more than 110 million unduplicated women every month. Our digital activities generate more than 80 million monthly unique visitors. We are clearly the leading media company serving American women, including more than 70 percent of U.S. millennial women. 5

And we will deliver record revenue and profit in fiscal 2017. 5

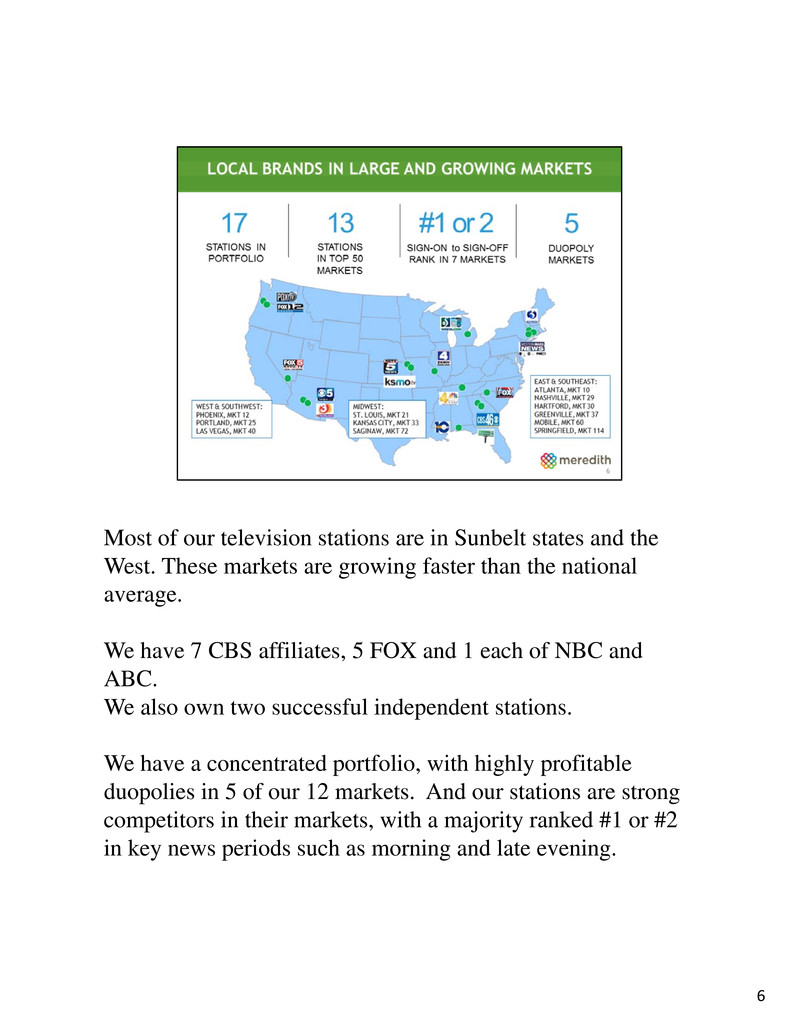

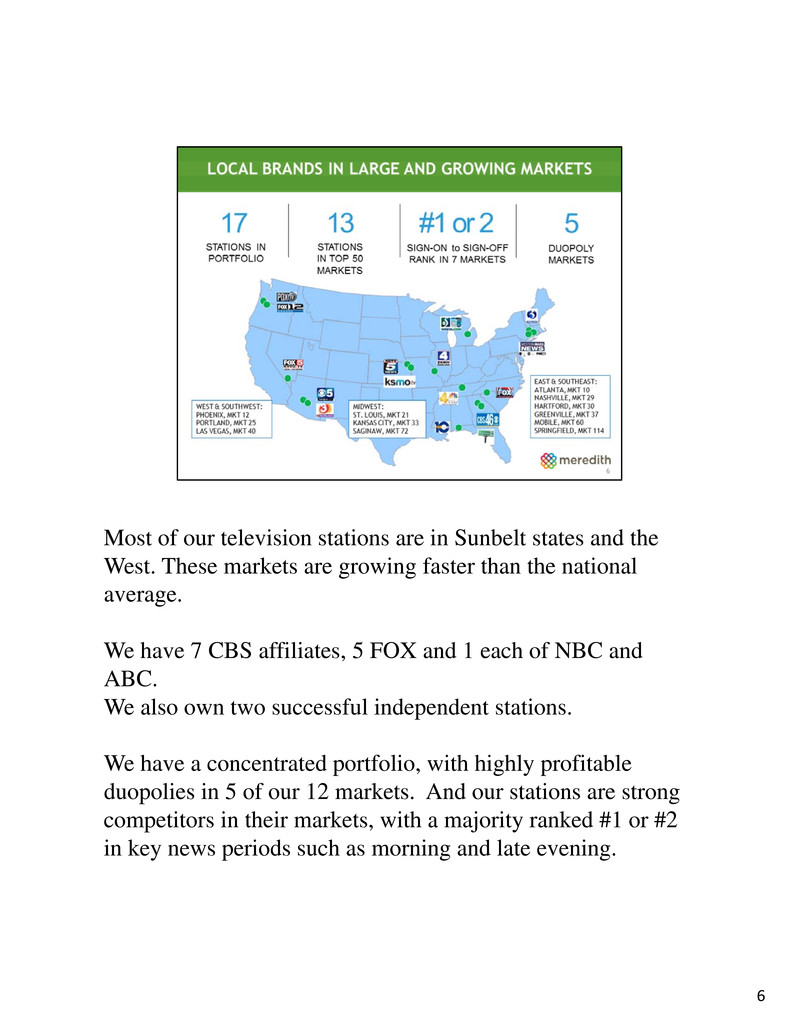

Most of our television stations are in Sunbelt states and the West. These markets are growing faster than the national average. We have 7 CBS affiliates, 5 FOX and 1 each of NBC and ABC. We also own two successful independent stations. We have a concentrated portfolio, with highly profitable duopolies in 5 of our 12 markets. And our stations are strong competitors in their markets, with a majority ranked #1 or #2 in key news periods such as morning and late evening. 6

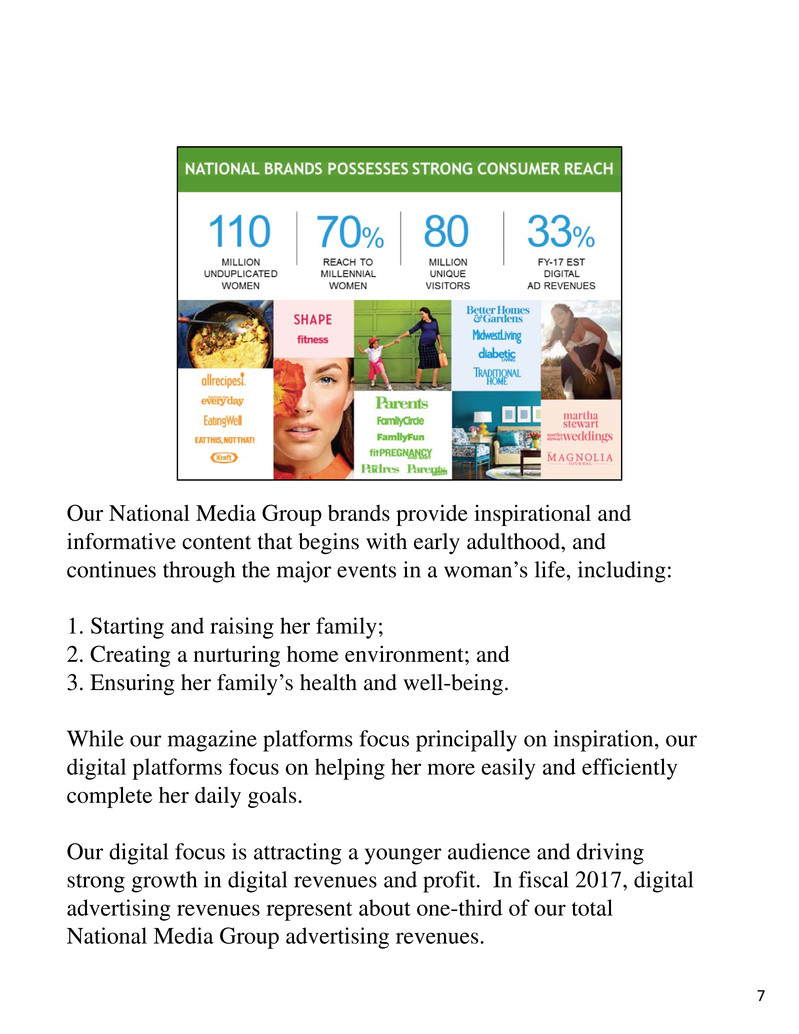

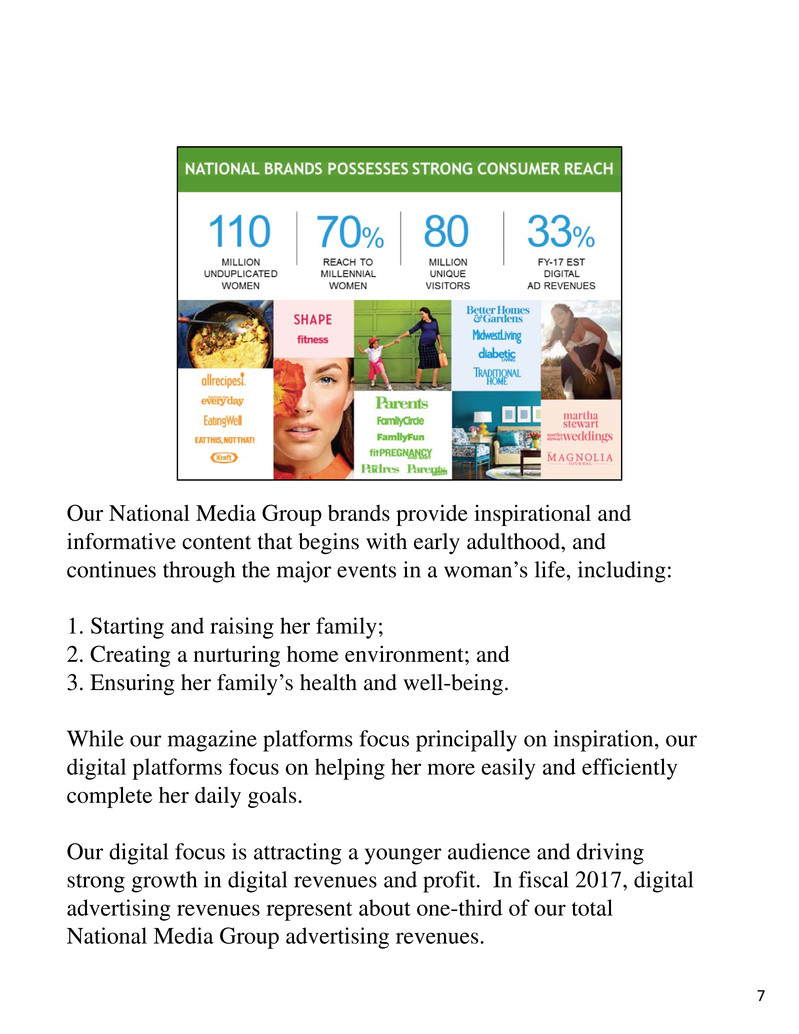

Our National Media Group brands provide inspirational and informative content that begins with early adulthood, and continues through the major events in a woman’s life, including: 1. Starting and raising her family; 2. Creating a nurturing home environment; and 3. Ensuring her family’s health and well-being. While our magazine platforms focus principally on inspiration, our digital platforms focus on helping her more easily and efficiently complete her daily goals. Our digital focus is attracting a younger audience and driving strong growth in digital revenues and profit. In fiscal 2017, digital advertising revenues represent about one-third of our total National Media Group advertising revenues. 7

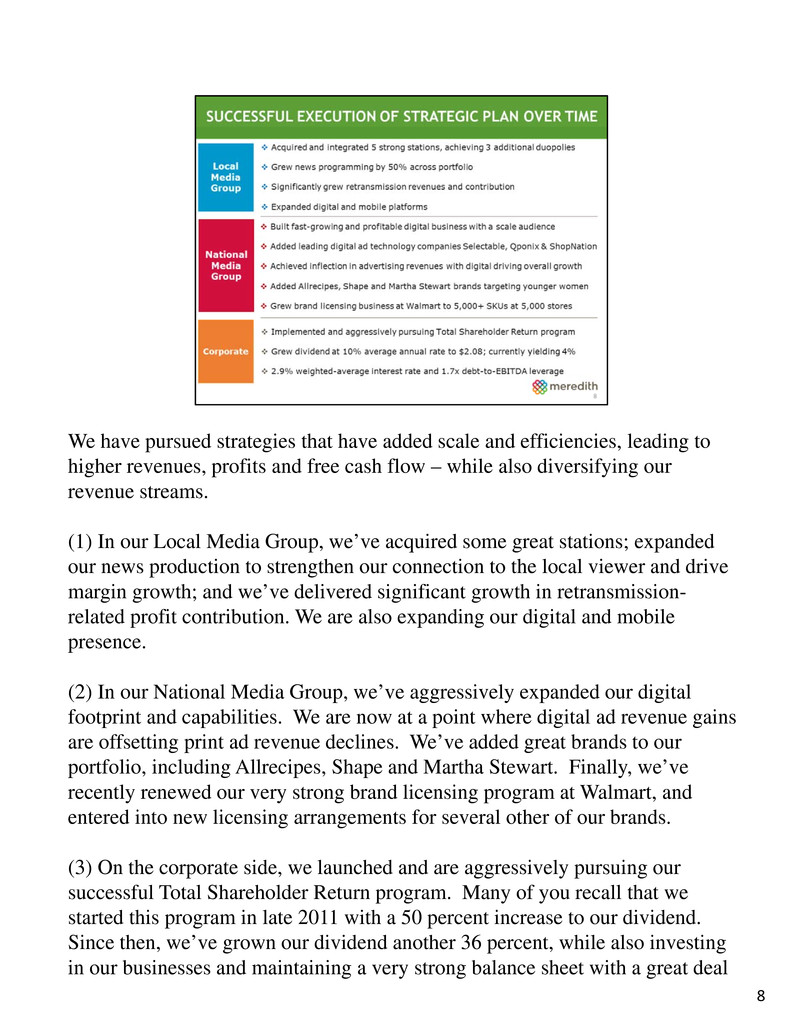

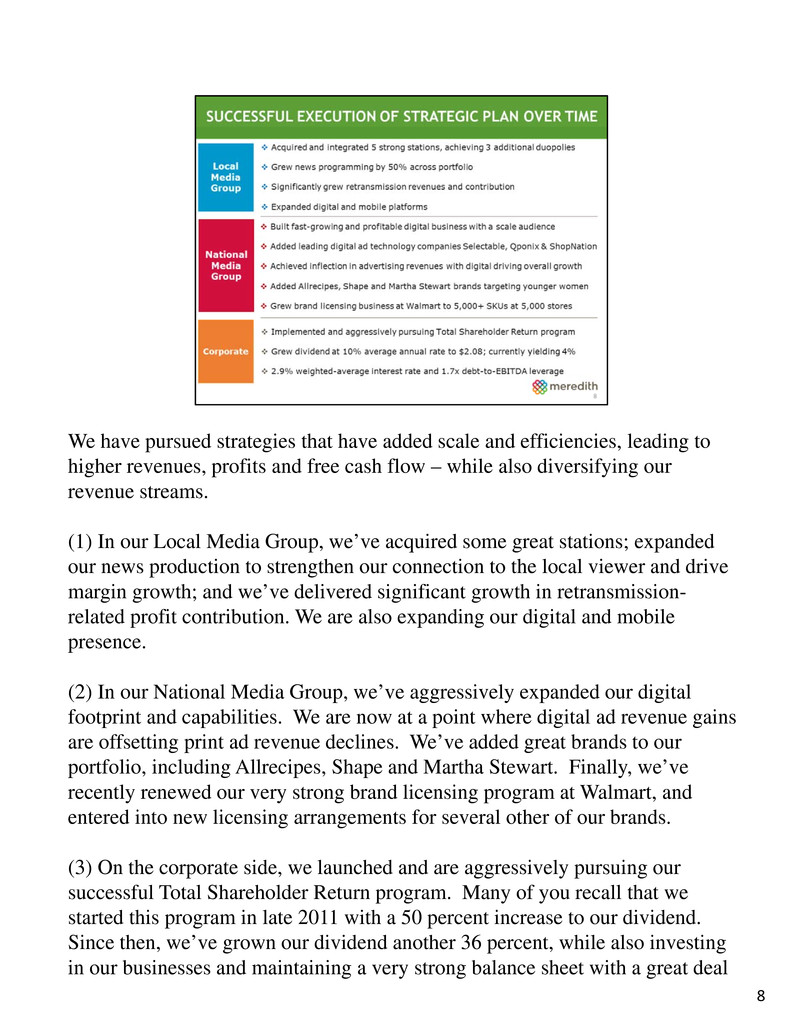

We have pursued strategies that have added scale and efficiencies, leading to higher revenues, profits and free cash flow – while also diversifying our revenue streams. (1) In our Local Media Group, we’ve acquired some great stations; expanded our news production to strengthen our connection to the local viewer and drive margin growth; and we’ve delivered significant growth in retransmission- related profit contribution. We are also expanding our digital and mobile presence. (2) In our National Media Group, we’ve aggressively expanded our digital footprint and capabilities. We are now at a point where digital ad revenue gains are offsetting print ad revenue declines. We’ve added great brands to our portfolio, including Allrecipes, Shape and Martha Stewart. Finally, we’ve recently renewed our very strong brand licensing program at Walmart, and entered into new licensing arrangements for several other of our brands. (3) On the corporate side, we launched and are aggressively pursuing our successful Total Shareholder Return program. Many of you recall that we started this program in late 2011 with a 50 percent increase to our dividend. Since then, we’ve grown our dividend another 36 percent, while also investing in our businesses and maintaining a very strong balance sheet with a great deal 8

of flexibility for further consolidation. 8

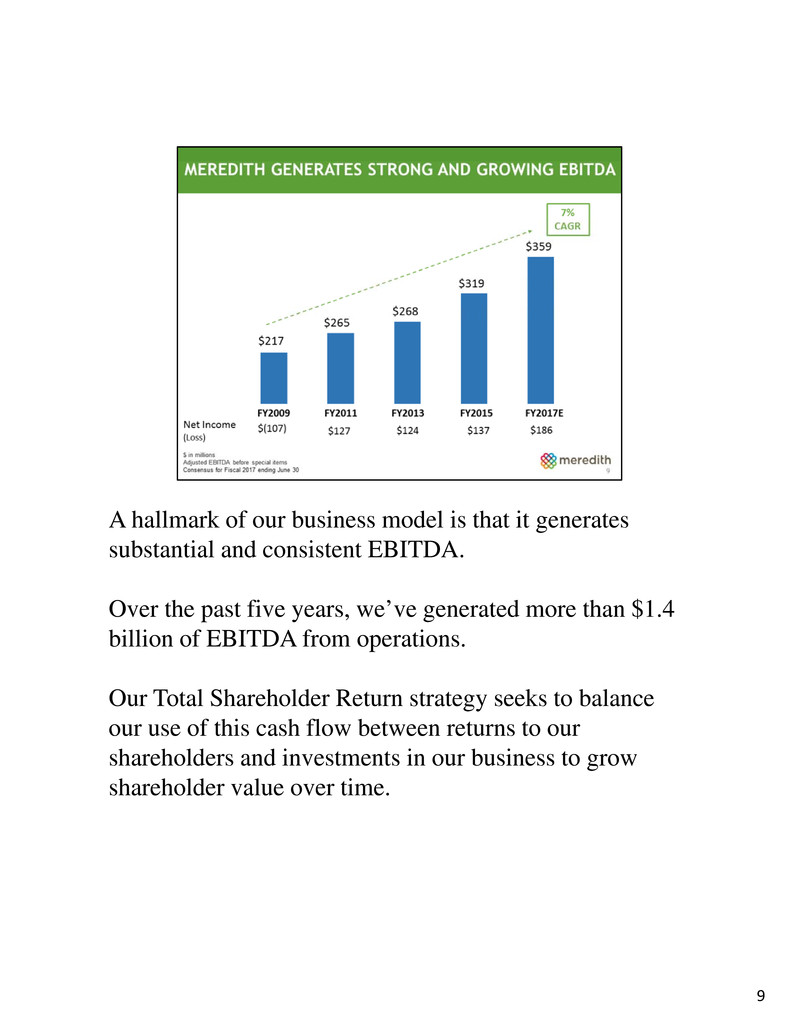

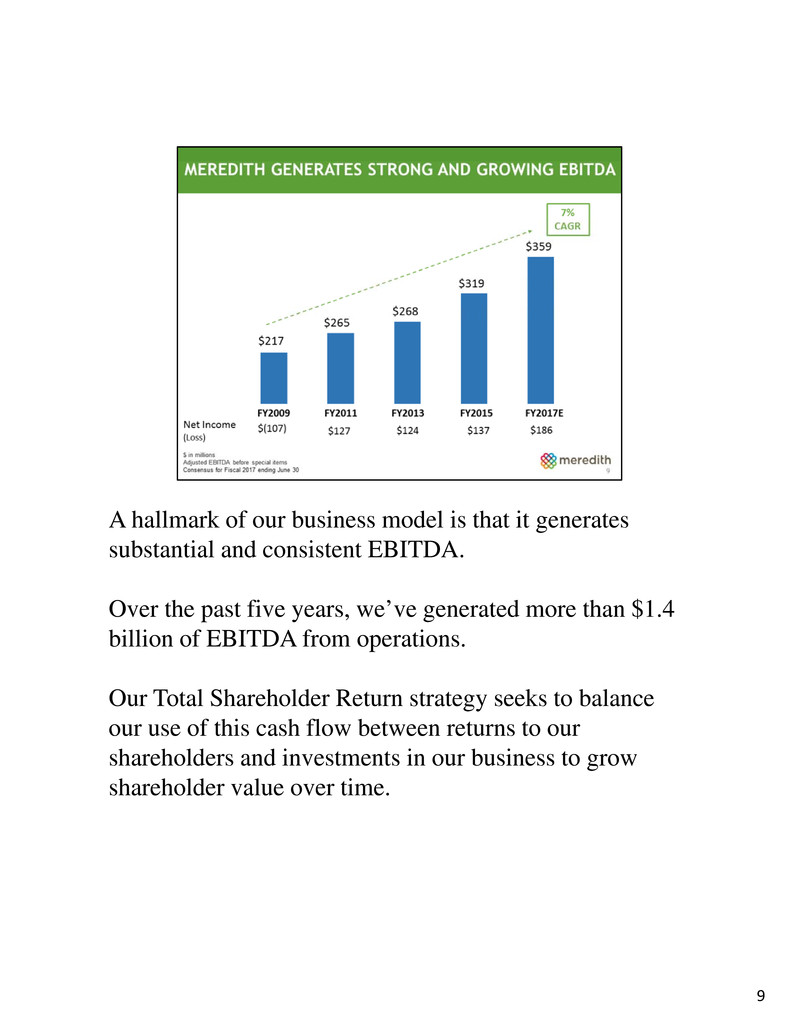

A hallmark of our business model is that it generates substantial and consistent EBITDA. Over the past five years, we’ve generated more than $1.4 billion of EBITDA from operations. Our Total Shareholder Return strategy seeks to balance our use of this cash flow between returns to our shareholders and investments in our business to grow shareholder value over time. 9

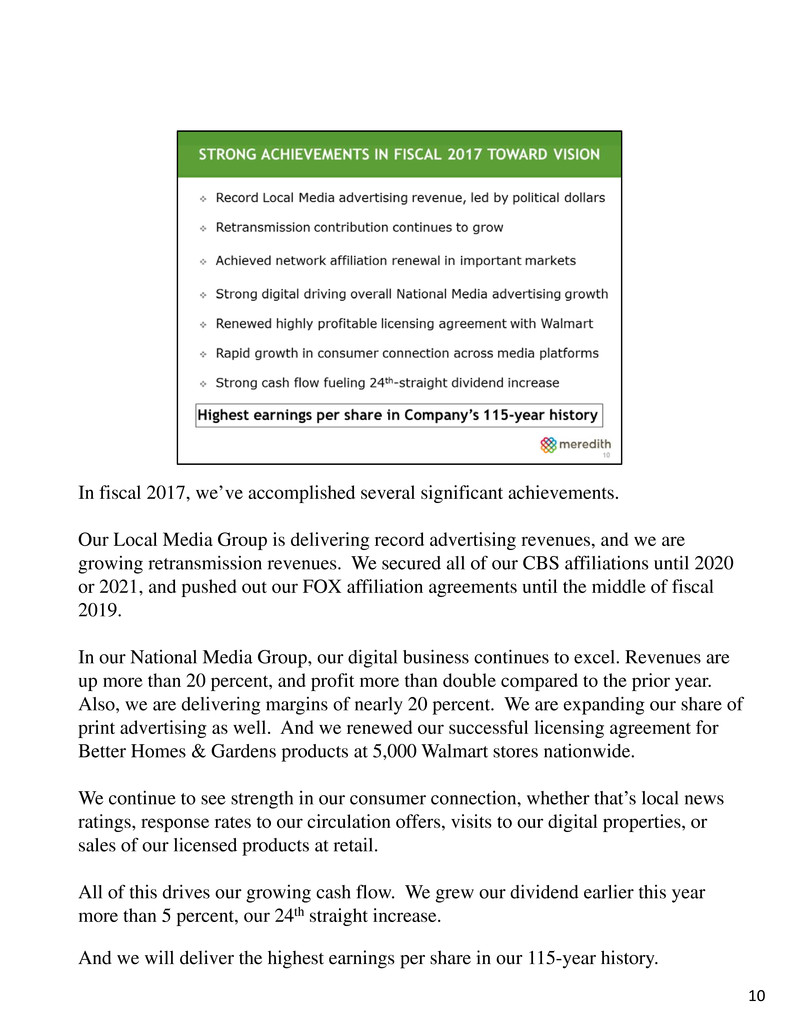

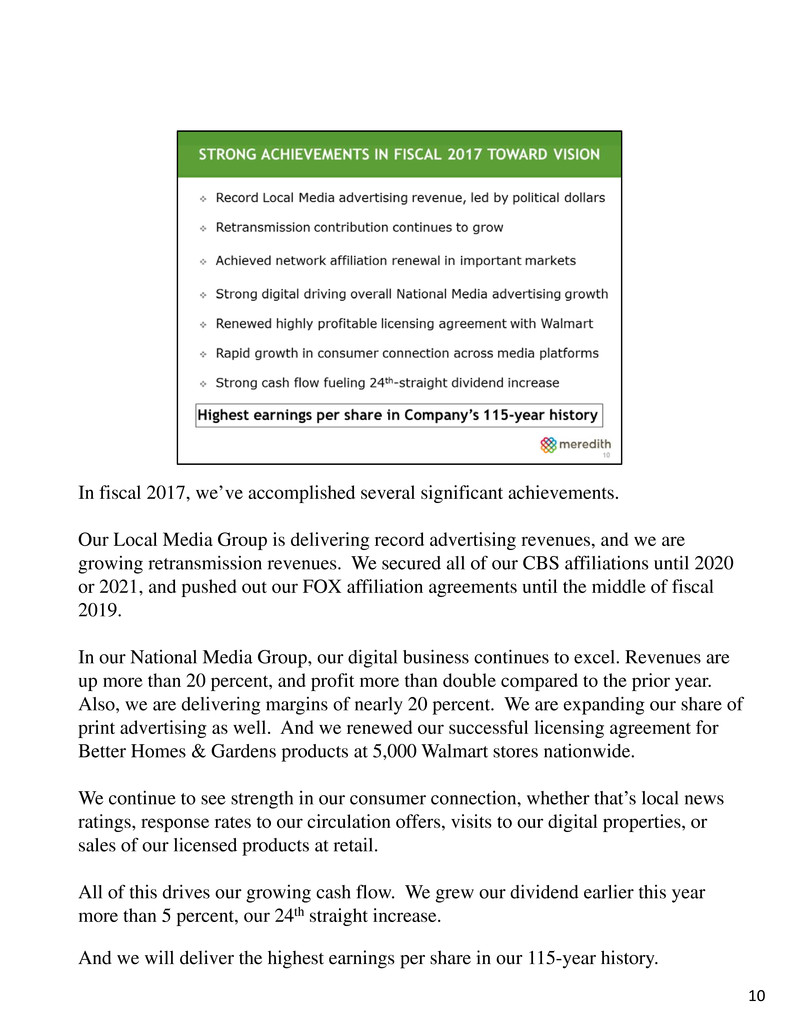

In fiscal 2017, we’ve accomplished several significant achievements. Our Local Media Group is delivering record advertising revenues, and we are growing retransmission revenues. We secured all of our CBS affiliations until 2020 or 2021, and pushed out our FOX affiliation agreements until the middle of fiscal 2019. In our National Media Group, our digital business continues to excel. Revenues are up more than 20 percent, and profit more than double compared to the prior year. Also, we are delivering margins of nearly 20 percent. We are expanding our share of print advertising as well. And we renewed our successful licensing agreement for Better Homes & Gardens products at 5,000 Walmart stores nationwide. We continue to see strength in our consumer connection, whether that’s local news ratings, response rates to our circulation offers, visits to our digital properties, or sales of our licensed products at retail. All of this drives our growing cash flow. We grew our dividend earlier this year more than 5 percent, our 24th straight increase. And we will deliver the highest earnings per share in our 115-year history. 10

Our Local Media Group is delivering the best year in its nearly 70-year history. Now I’m going to turn it over to Paul Karpowicz to explain why. 11

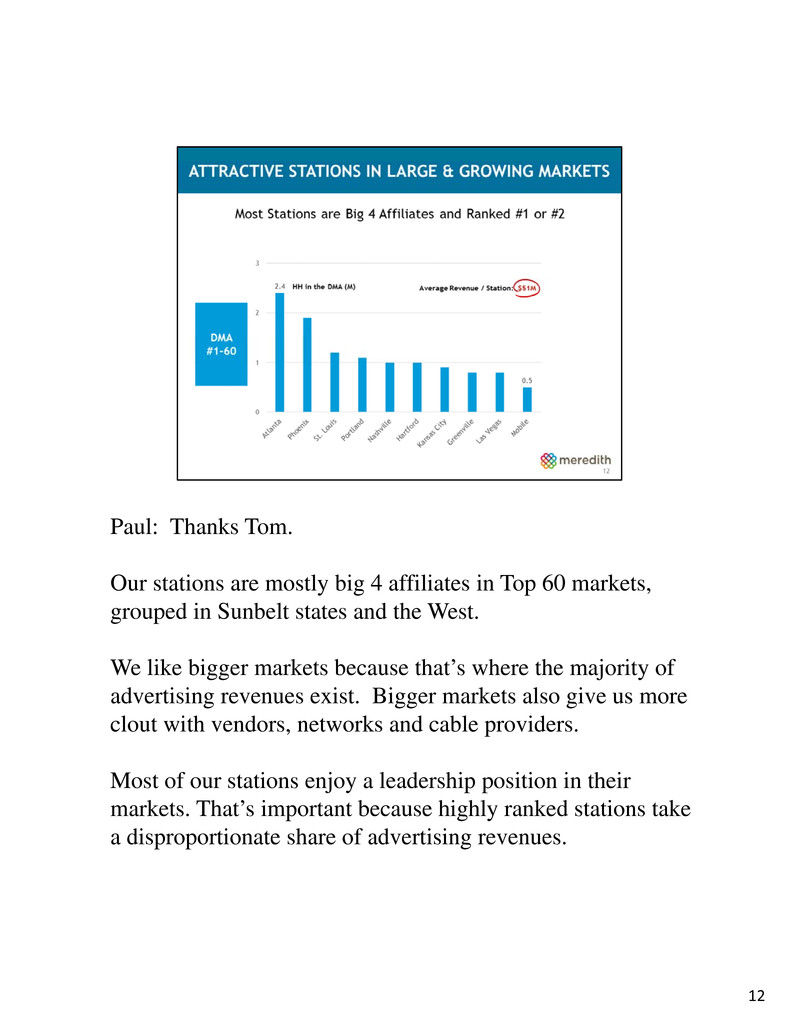

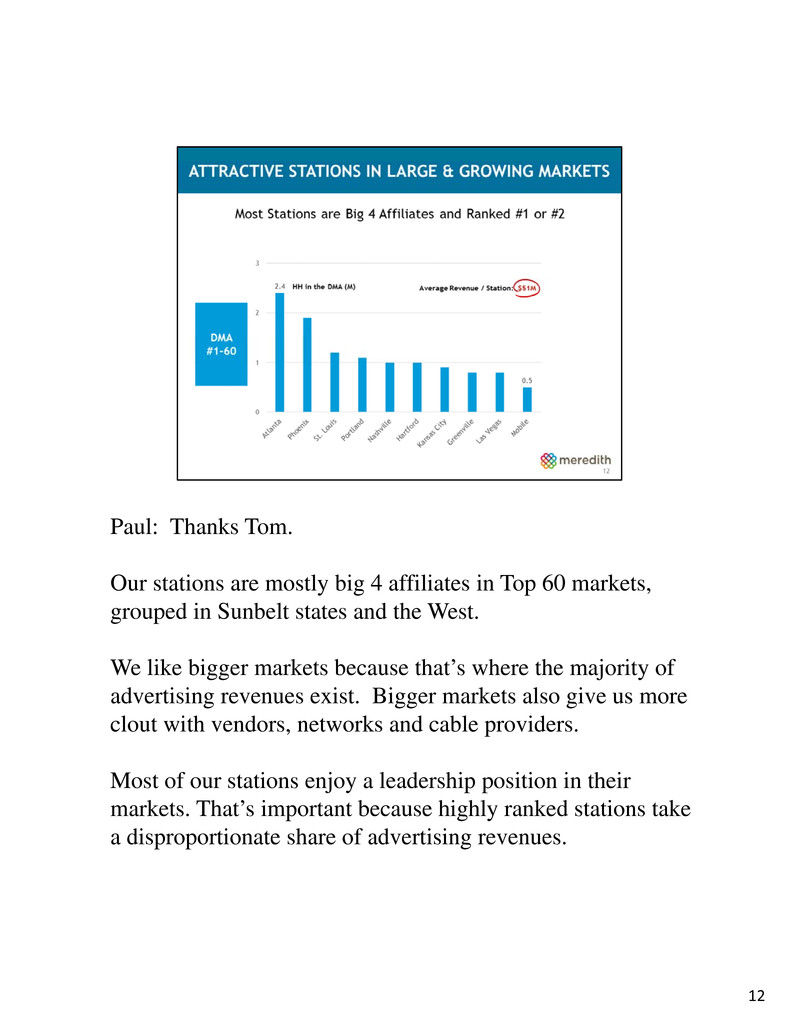

Paul: Thanks Tom. Our stations are mostly big 4 affiliates in Top 60 markets, grouped in Sunbelt states and the West. We like bigger markets because that’s where the majority of advertising revenues exist. Bigger markets also give us more clout with vendors, networks and cable providers. Most of our stations enjoy a leadership position in their markets. That’s important because highly ranked stations take a disproportionate share of advertising revenues. 12

Here are the growth strategies we’re pursuing in our Local Media Group. I will cover each of these initiatives in the next several slides. 13

Our local audience is the bedrock of our operations. In the past 10 years, we’ve more than doubled the hours of news and local programming we create weekly across our group from 300 hours to 700 hours. Growing local programming is essential. Unlike other programming from the networks or syndicators, we control 100 percent of the advertising inventory, and we are able to manage costs as well. 14

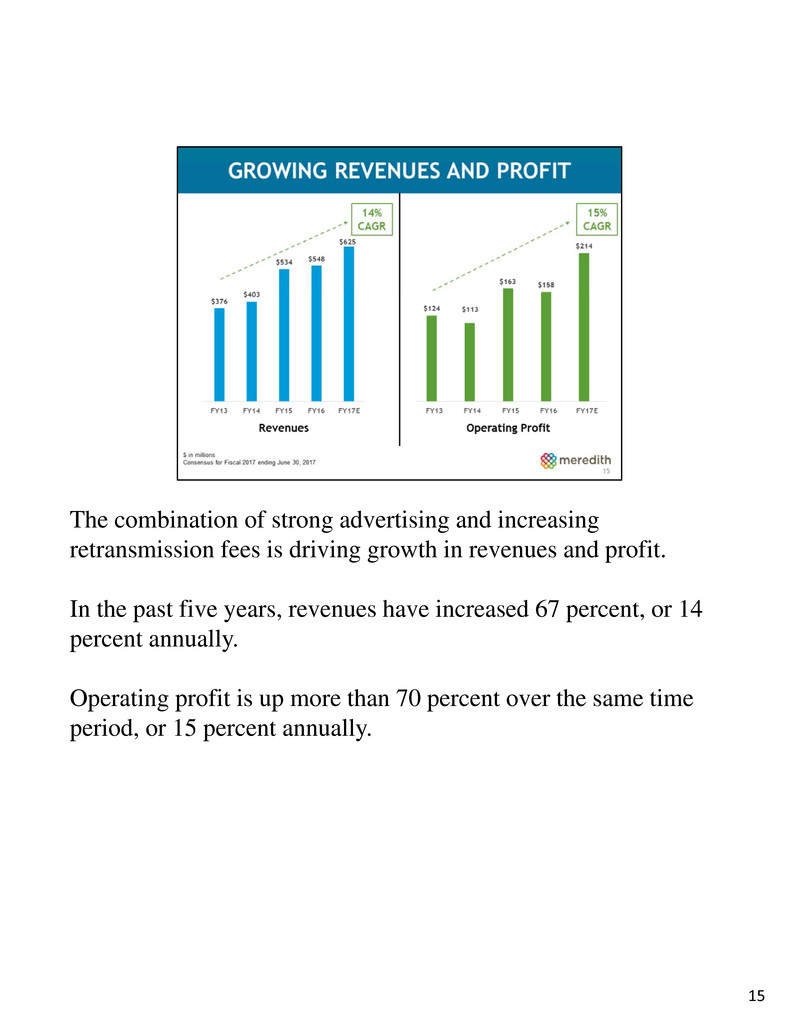

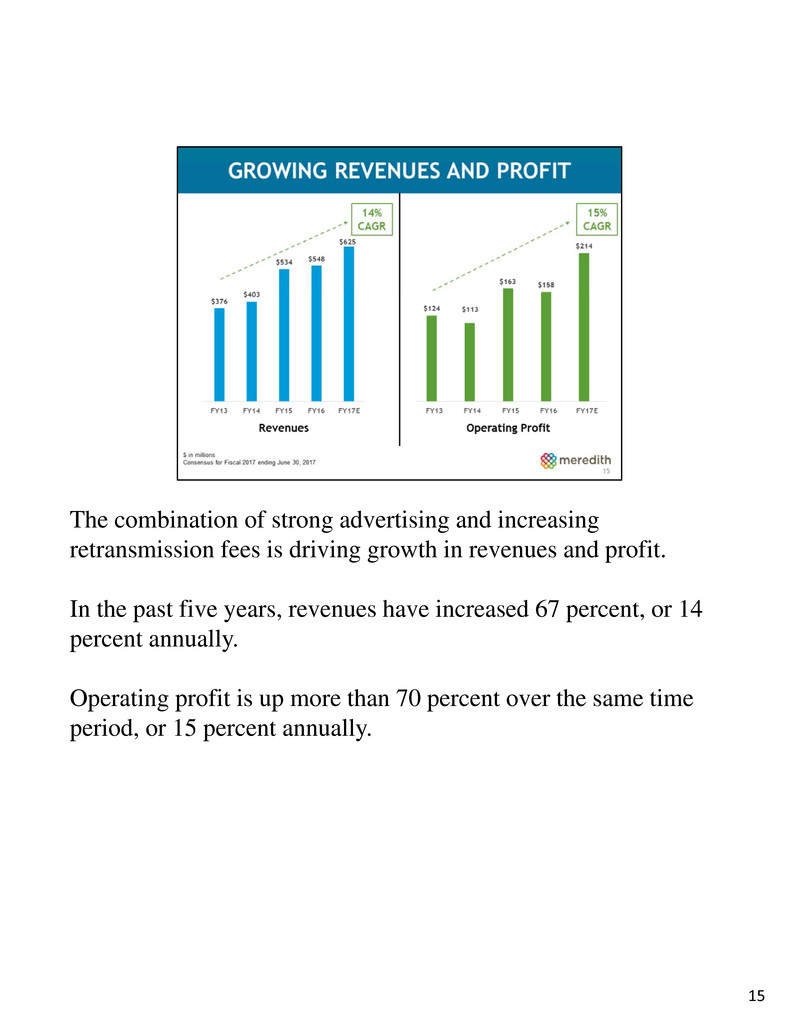

The combination of strong advertising and increasing retransmission fees is driving growth in revenues and profit. In the past five years, revenues have increased 67 percent, or 14 percent annually. Operating profit is up more than 70 percent over the same time period, or 15 percent annually. 15

Turning to advertising, we set a goal of generating $40 to $50 million of political advertising revenues in fiscal 2017. We surpassed that goal, generating $60 million. In fact, thanks to the special Congressional election in Georgia, we will probably add a couple more million of political ad revenue by the end of the fiscal year. Our fiscal 2017 performance is more than 50 percent higher than what we delivered in the last Presidential cycle, and about one-third more than fiscal 2015. 16

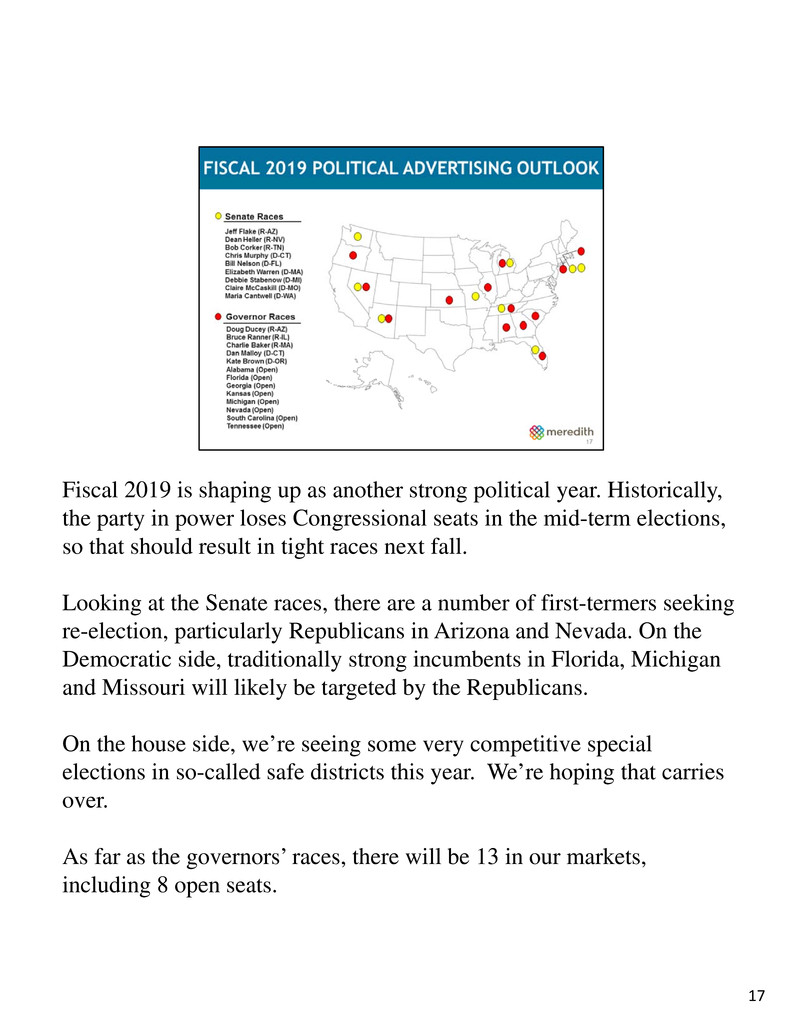

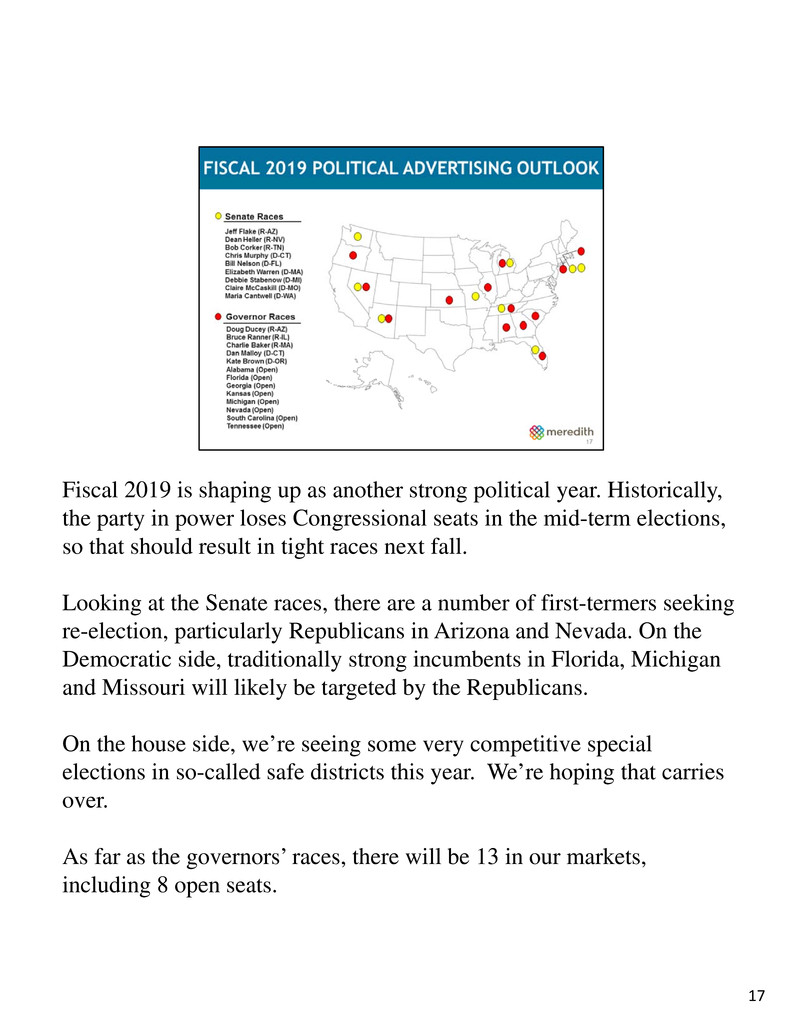

Fiscal 2019 is shaping up as another strong political year. Historically, the party in power loses Congressional seats in the mid-term elections, so that should result in tight races next fall. Looking at the Senate races, there are a number of first-termers seeking re-election, particularly Republicans in Arizona and Nevada. On the Democratic side, traditionally strong incumbents in Florida, Michigan and Missouri will likely be targeted by the Republicans. On the house side, we’re seeing some very competitive special elections in so-called safe districts this year. We’re hoping that carries over. As far as the governors’ races, there will be 13 in our markets, including 8 open seats. 17

Turning to our digital business, we’ve generated double-digit growth in revenues and profits in each of the last six years, with more expected. This has required a fundamental change in how we gather and report news – and how we go to market as well. The key is doing the best job creating local content and delivering it on whatever platform the consumer wants, whenever they want it. Additionally, we are leaning heavily into increasing engagement through apps and social media, particularly Facebook, which has become the best vehicle to drive traffic to our sites, and promote our on-air product. Our near-term goal is to generate 10 percent of our non-political advertising revenues from digital platforms. 18

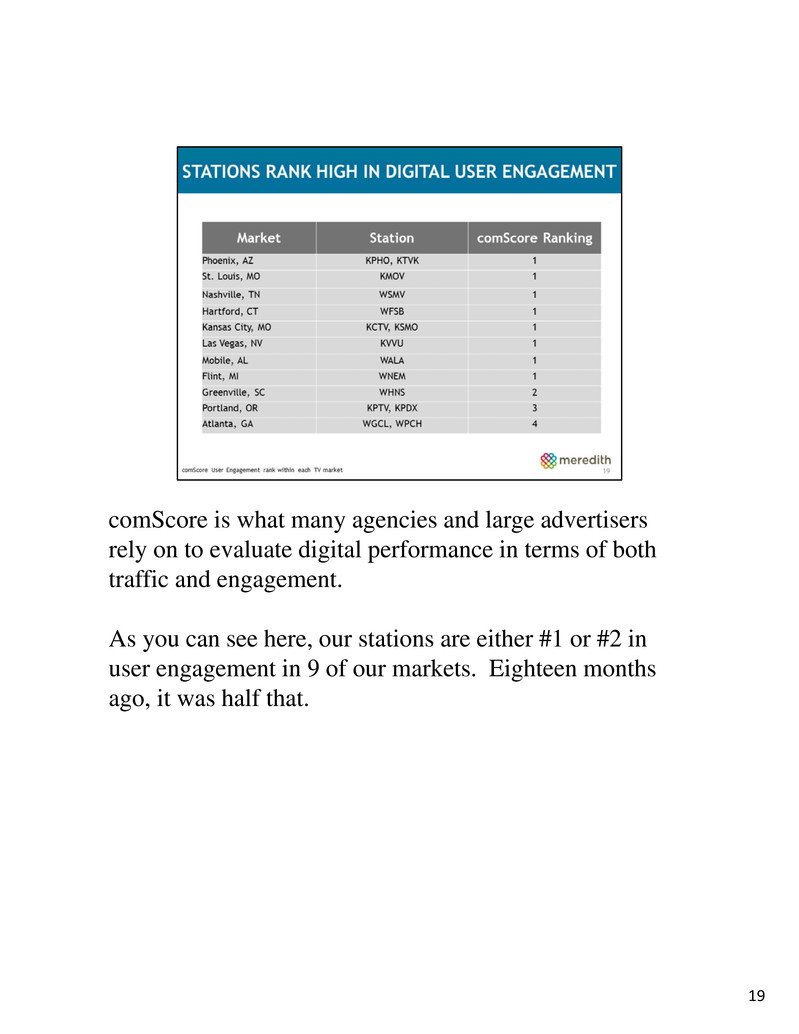

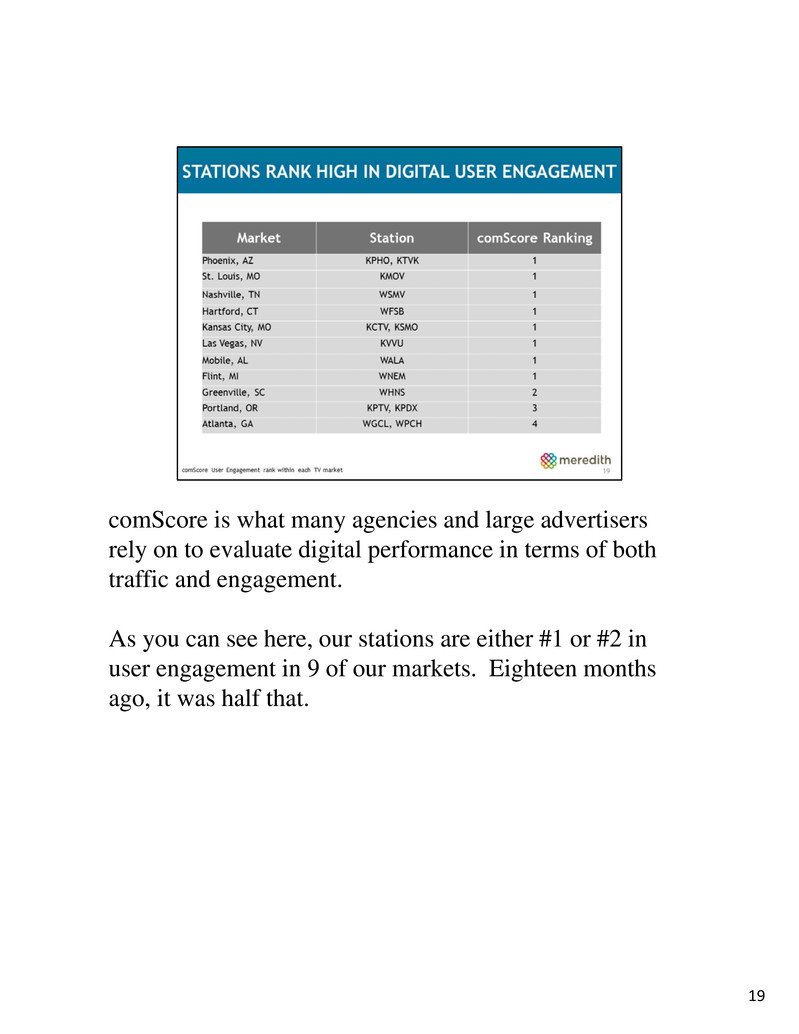

comScore is what many agencies and large advertisers rely on to evaluate digital performance in terms of both traffic and engagement. As you can see here, our stations are either #1 or #2 in user engagement in 9 of our markets. Eighteen months ago, it was half that. 19

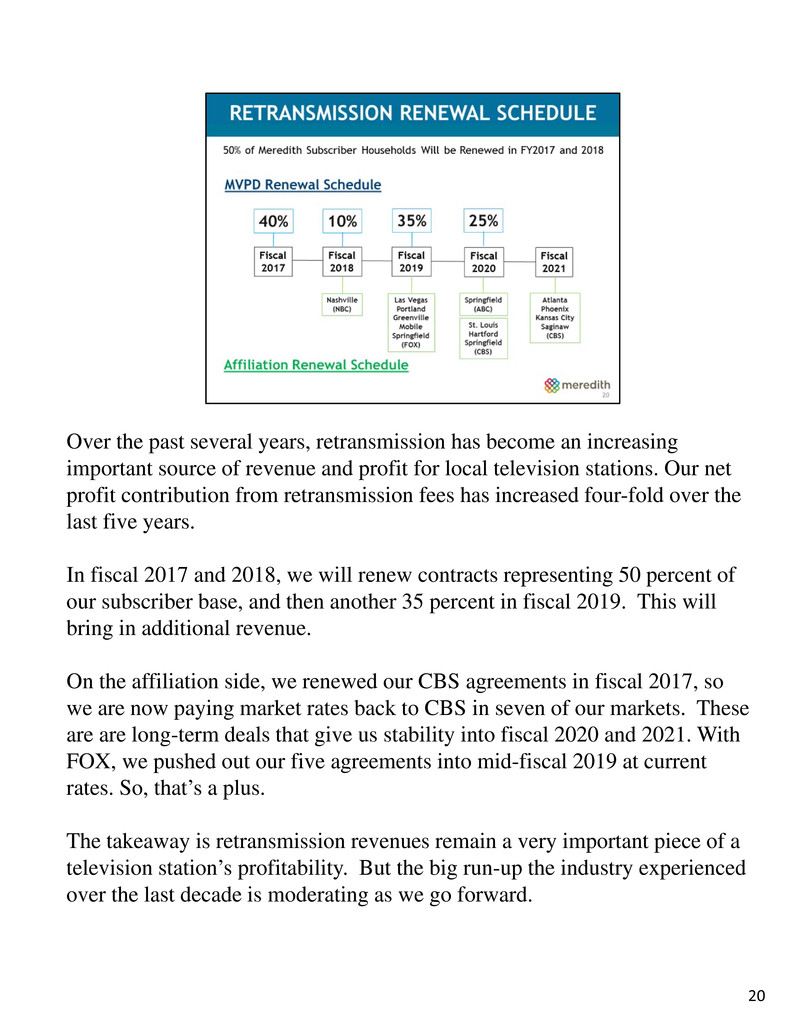

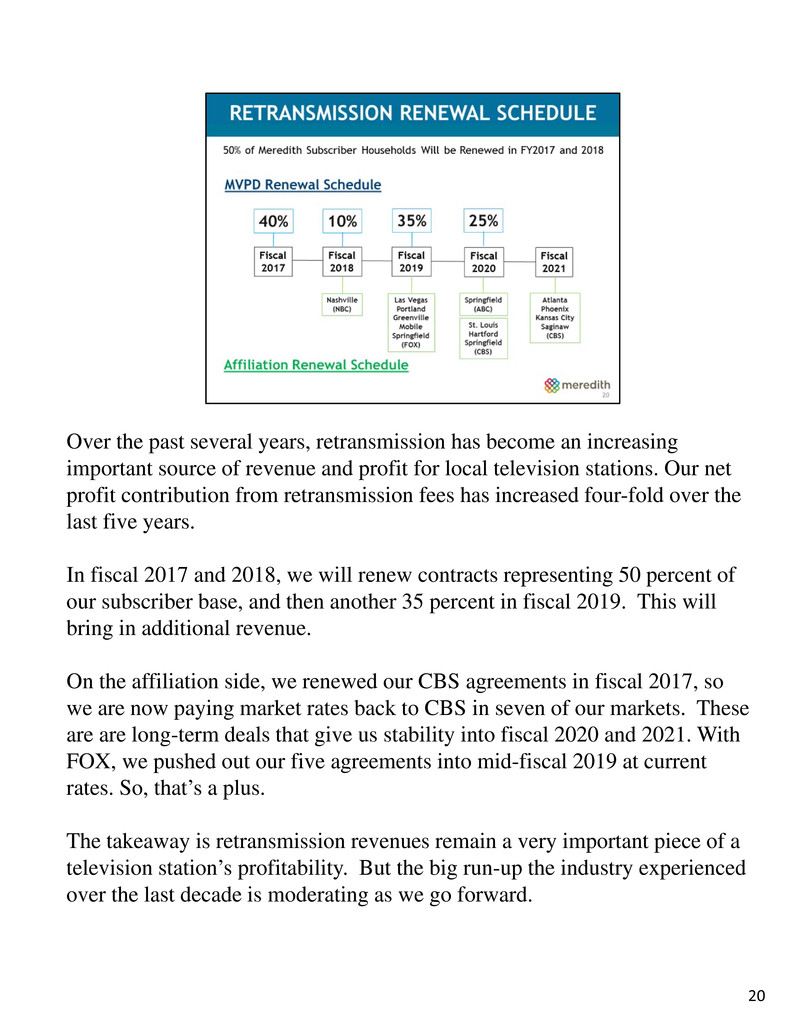

Over the past several years, retransmission has become an increasing important source of revenue and profit for local television stations. Our net profit contribution from retransmission fees has increased four-fold over the last five years. In fiscal 2017 and 2018, we will renew contracts representing 50 percent of our subscriber base, and then another 35 percent in fiscal 2019. This will bring in additional revenue. On the affiliation side, we renewed our CBS agreements in fiscal 2017, so we are now paying market rates back to CBS in seven of our markets. These are are long-term deals that give us stability into fiscal 2020 and 2021. With FOX, we pushed out our five agreements into mid-fiscal 2019 at current rates. So, that’s a plus. The takeaway is retransmission revenues remain a very important piece of a television station’s profitability. But the big run-up the industry experienced over the last decade is moderating as we go forward. 20

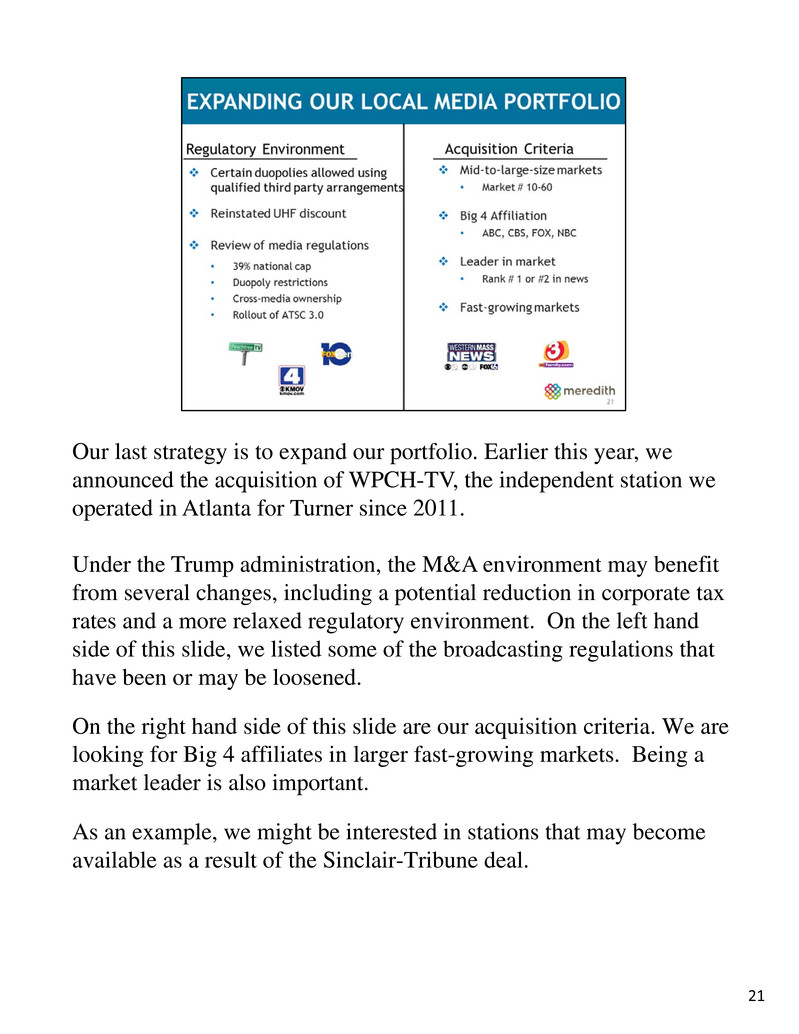

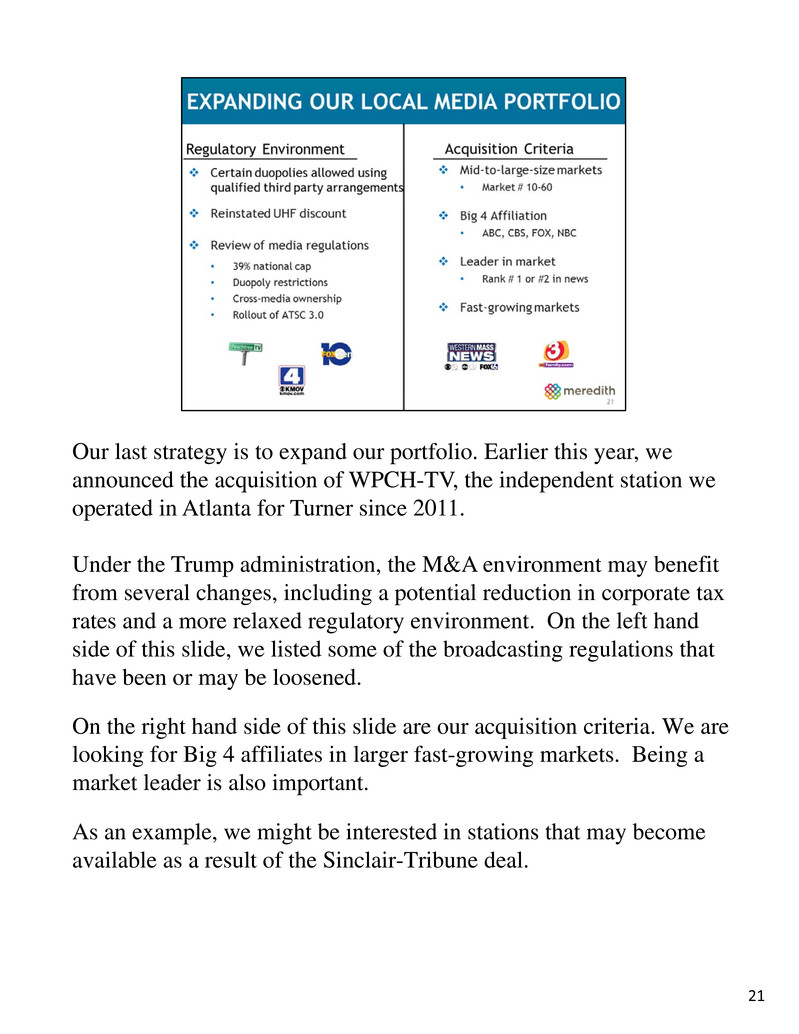

Our last strategy is to expand our portfolio. Earlier this year, we announced the acquisition of WPCH-TV, the independent station we operated in Atlanta for Turner since 2011. Under the Trump administration, the M&A environment may benefit from several changes, including a potential reduction in corporate tax rates and a more relaxed regulatory environment. On the left hand side of this slide, we listed some of the broadcasting regulations that have been or may be loosened. On the right hand side of this slide are our acquisition criteria. We are looking for Big 4 affiliates in larger fast-growing markets. Being a market leader is also important. As an example, we might be interested in stations that may become available as a result of the Sinclair-Tribune deal. 21

Now I’ll turn it over to Jon Werther to discuss Meredith’s National Media Group’s growth strategies. 22

JON: Thanks Paul. • Within Meredith’s National Media Group, our mission is to inspire women to achieve daily and dream big – from life’s most important milestones and every moment in between. • As a team, we believe that this mission statement truly captures the core of who we are and what we do across our entire portfolio. • Not only does our mission have external application to our customers, but it also speaks to our internal parallel focus on execution and innovation – as well as on balancing short-term and long-term objectives. 23

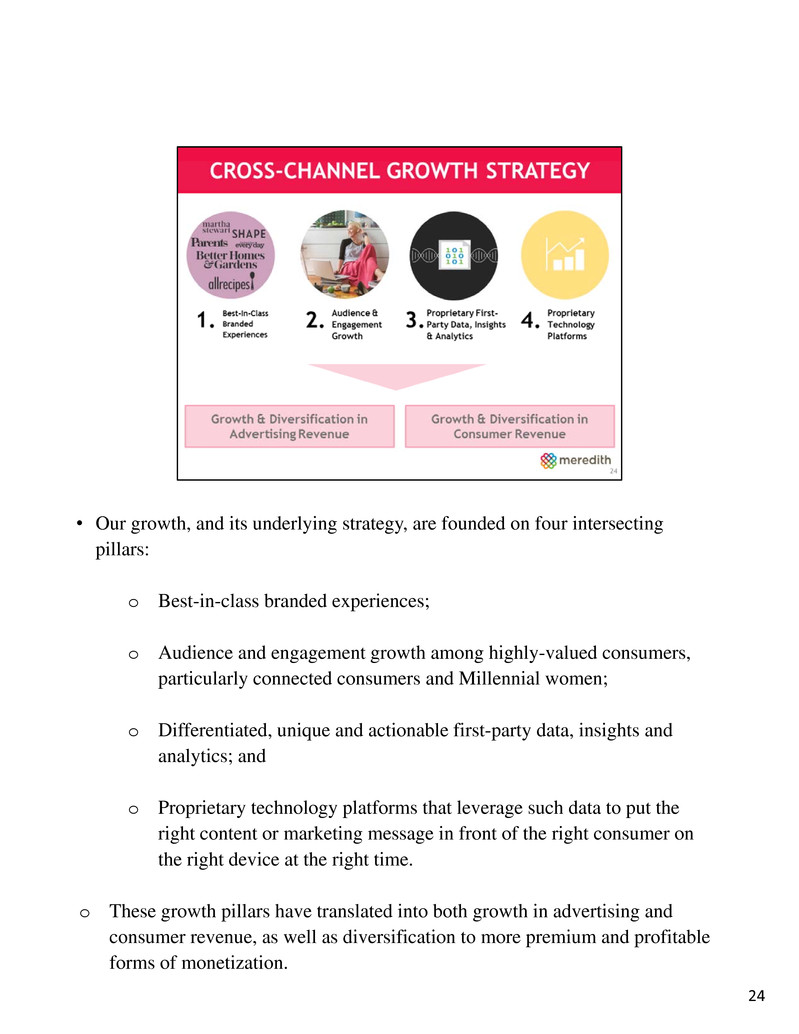

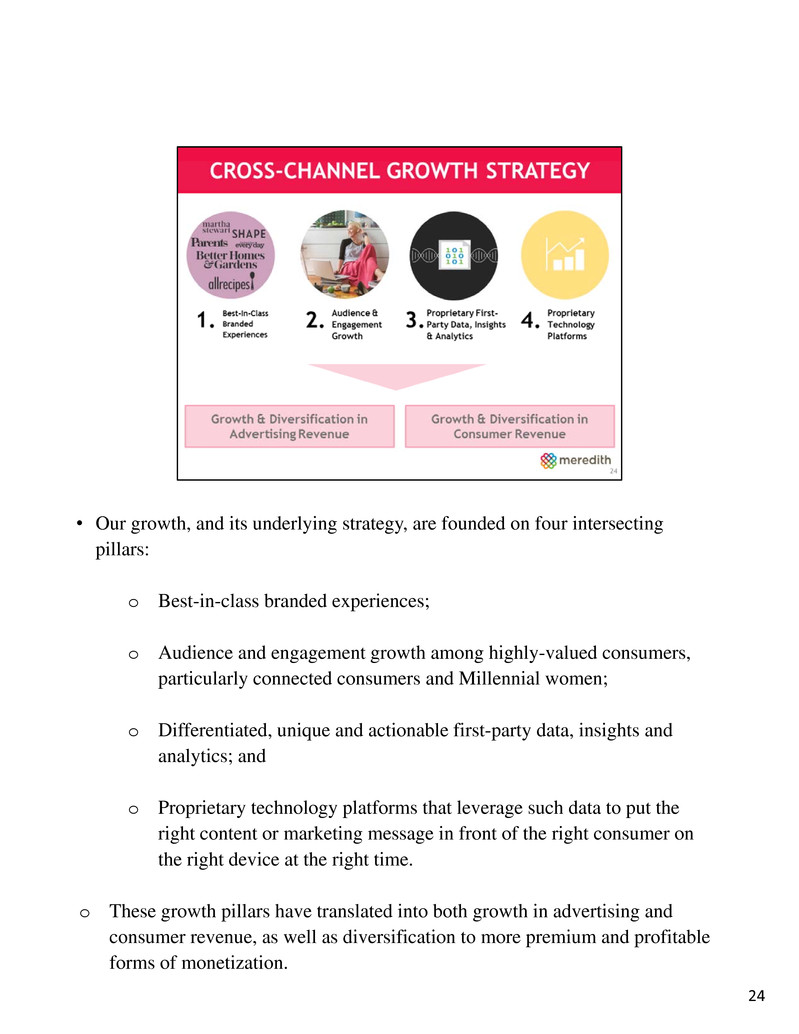

• Our growth, and its underlying strategy, are founded on four intersecting pillars: o Best-in-class branded experiences; o Audience and engagement growth among highly-valued consumers, particularly connected consumers and Millennial women; o Differentiated, unique and actionable first-party data, insights and analytics; and o Proprietary technology platforms that leverage such data to put the right content or marketing message in front of the right consumer on the right device at the right time. o These growth pillars have translated into both growth in advertising and consumer revenue, as well as diversification to more premium and profitable forms of monetization. 24

• Our brands are at the forefront of our strategy – and we continue to focus on: o Optimizing our branded experiences across platforms to drive advertising and consumer revenue growth, and o Appealing to new consumers while not alienating our core consumer base. • Allrecipes is a great example of how we inspire and activate consumers: o We have redesigned our experience to bring the best of food, peer-to-peer content and social media to our consumers – and to brands that seek to reach and engage with them. o Home cooks can follow other cooks and brands -- with activities organically appearing in a news-feed similar to that of other social media properties – keeping site content fresh, relevant and inspiring. o We also have integrated a number of tools and features – like notifications, real-time commenting and local offers tied to recipe ingredients. These have improved the experience, and also increased audience engagement in terms of both frequency and time spent, and facilitated shopper decision-making from the home to the store aisle. 25

• Quality, branded experiences are fueling growth not only in digital, but in print channels as well, where we continue to successfully launch new subscription products -- including one about which we are particularly excited: The Magnolia Journal. • Piloted as a quarterly newsstand title earlier this fiscal year, The Magnolia Journal – which features HGTV “Fixer Upper” show personalities Chip and Joanna Gaines -- continues to be a runaway success unlike any we have ever seen before in print. • The magazine will be profitable this Fiscal year. As we transition it to a quarterly print subscription offering, Magnolia Journal is expected to become the most profitable title in the first year of operation in Meredith history. • Incredible subscription offer response and newsstand sell-through rates are fueling this growth. Because of this, we expect to be able to drive the overwhelming majority of our initial 1 million rate base through higher- 26

lifetime-value Direct-to-Publisher subscriptions and newsstand sales. 26

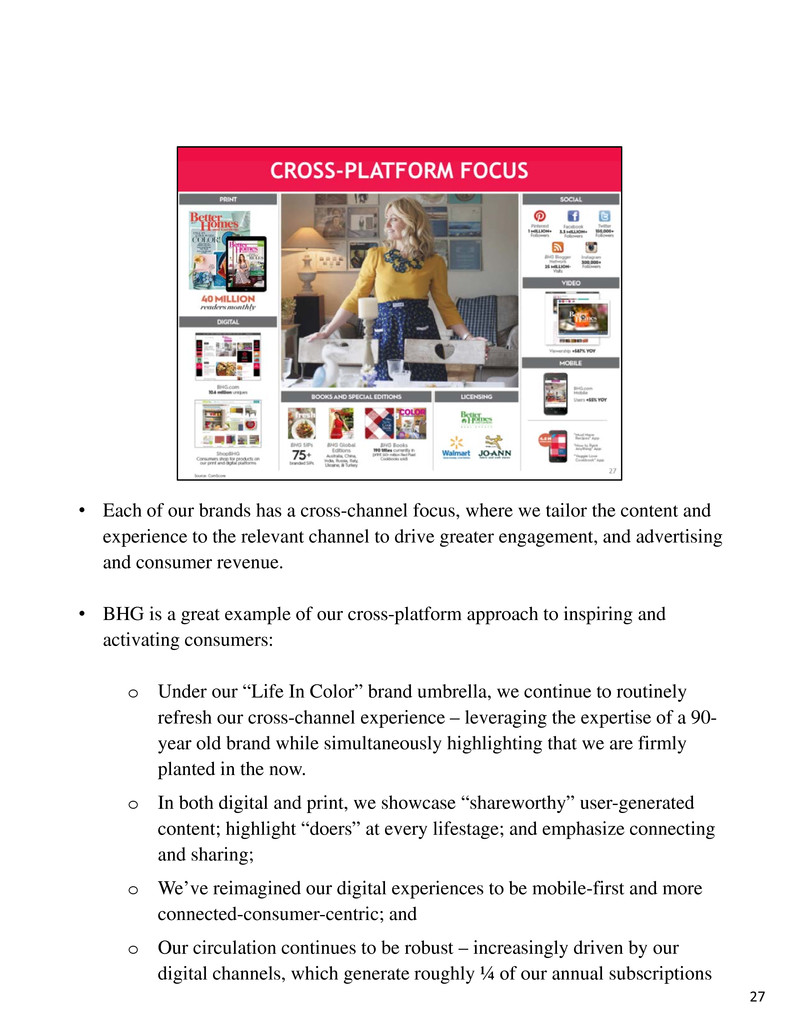

• Each of our brands has a cross-channel focus, where we tailor the content and experience to the relevant channel to drive greater engagement, and advertising and consumer revenue. • BHG is a great example of our cross-platform approach to inspiring and activating consumers: o Under our “Life In Color” brand umbrella, we continue to routinely refresh our cross-channel experience – leveraging the expertise of a 90- year old brand while simultaneously highlighting that we are firmly planted in the now. o In both digital and print, we showcase “shareworthy” user-generated content; highlight “doers” at every lifestage; and emphasize connecting and sharing; o We’ve reimagined our digital experiences to be mobile-first and more connected-consumer-centric; and o Our circulation continues to be robust – increasingly driven by our digital channels, which generate roughly ¼ of our annual subscriptions 27

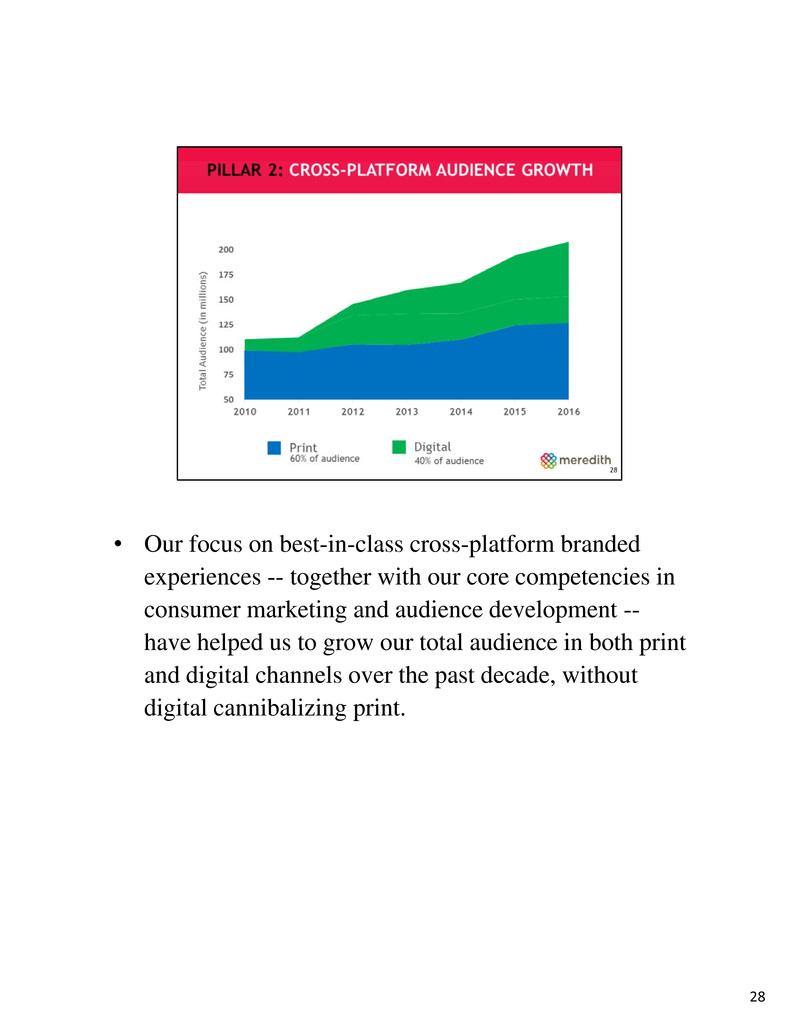

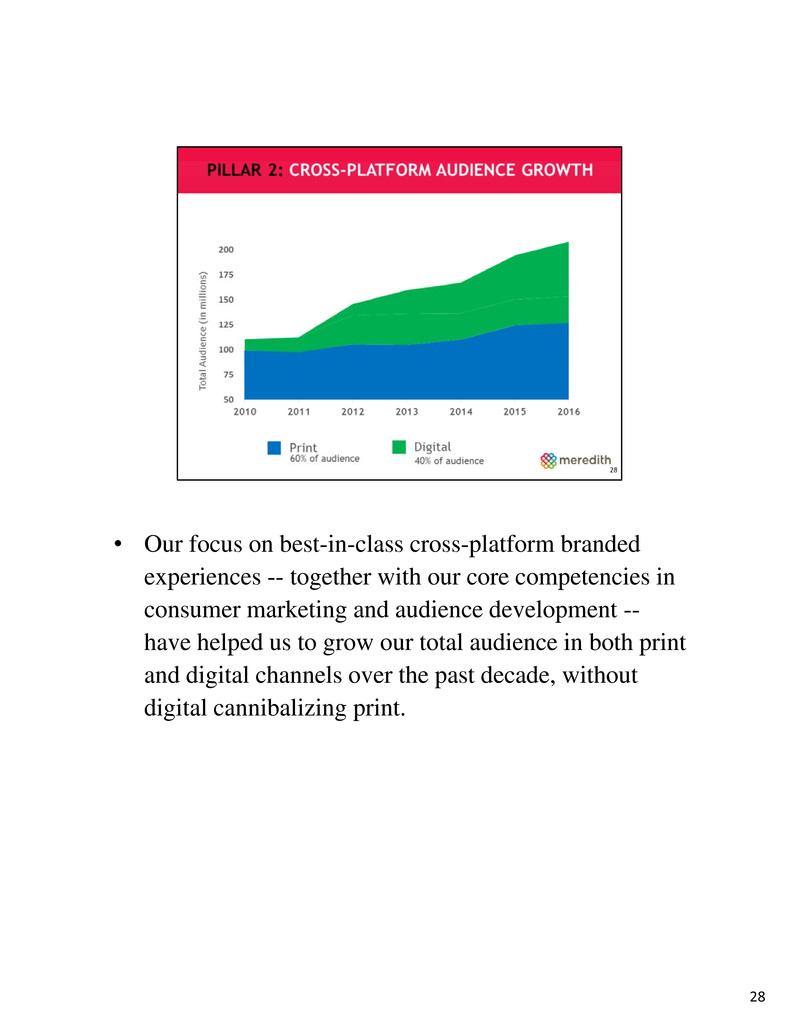

• Our focus on best-in-class cross-platform branded experiences -- together with our core competencies in consumer marketing and audience development -- have helped us to grow our total audience in both print and digital channels over the past decade, without digital cannibalizing print. 28

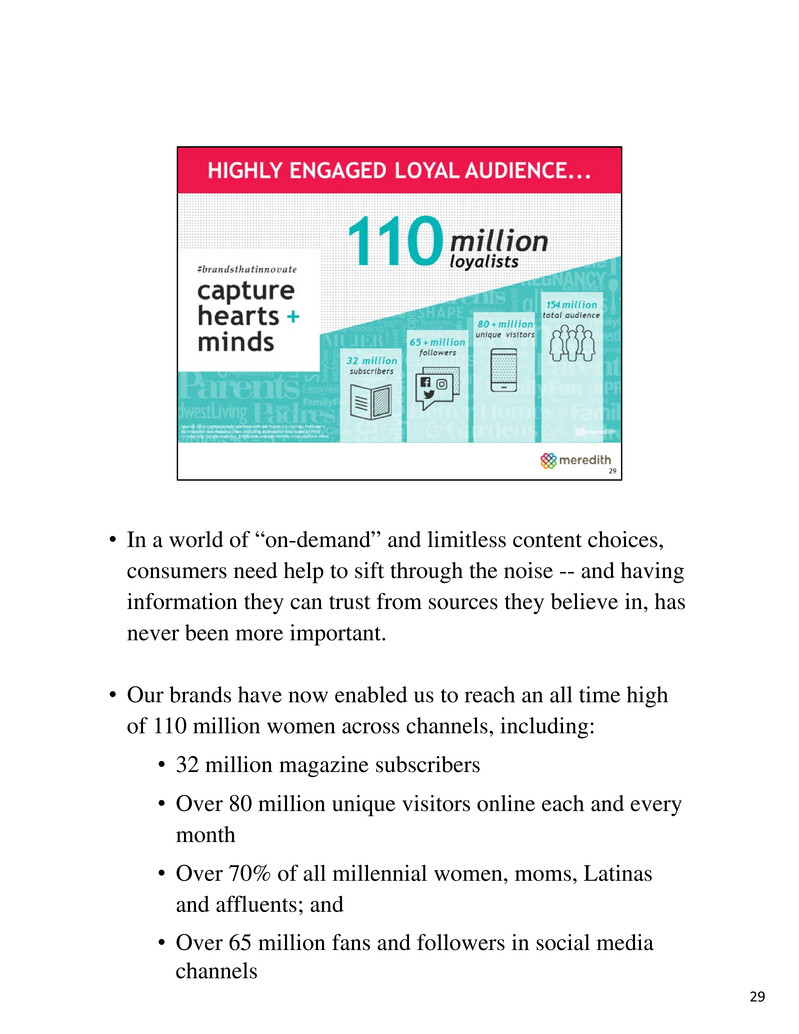

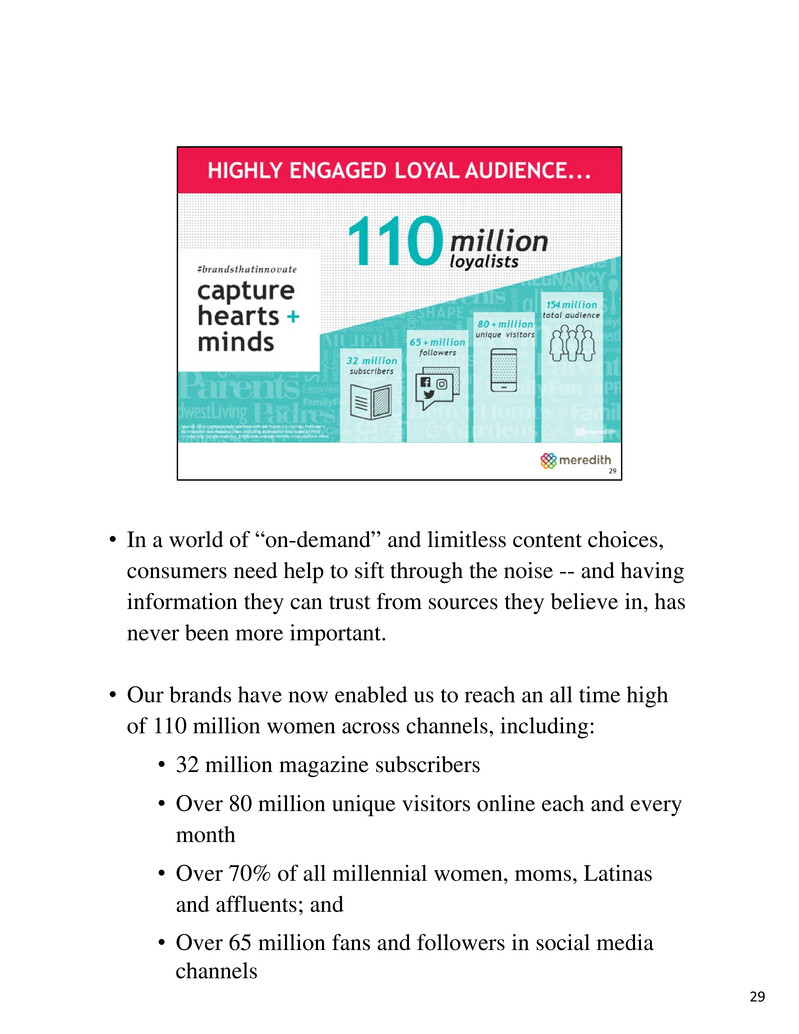

• In a world of “on-demand” and limitless content choices, consumers need help to sift through the noise -- and having information they can trust from sources they believe in, has never been more important. • Our brands have now enabled us to reach an all time high of 110 million women across channels, including: • 32 million magazine subscribers • Over 80 million unique visitors online each and every month • Over 70% of all millennial women, moms, Latinas and affluents; and • Over 65 million fans and followers in social media channels 29

• Since her priorities and point of view are influenced by major milestones throughout a woman’s life, we speak to her across our branded portfolio and through that lens in an authentic and relevant way. • Whether she’s recently engaged to be married, raising a young family, or buying a home, we know what she’s looking for and how she engages with that content. • And, as our audience evolves, we program our content to meet her changing needs. • As the numbers indicate, our reach is vast against each of these life stages – from early adulthood to empty nesters. 30

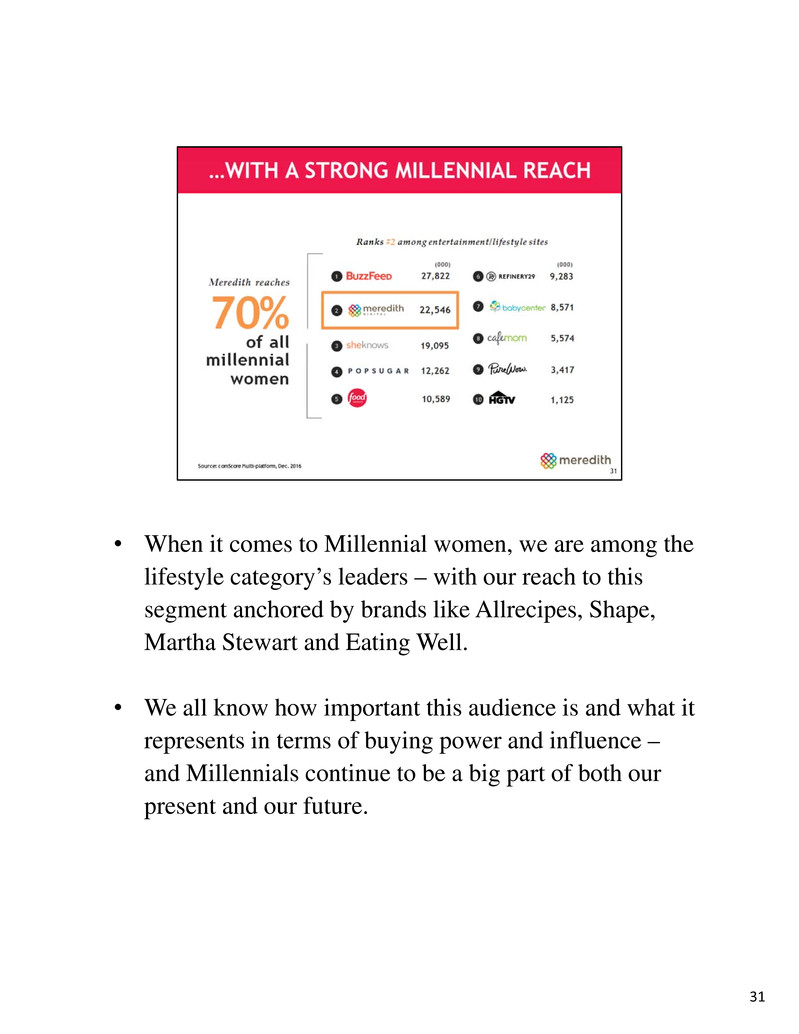

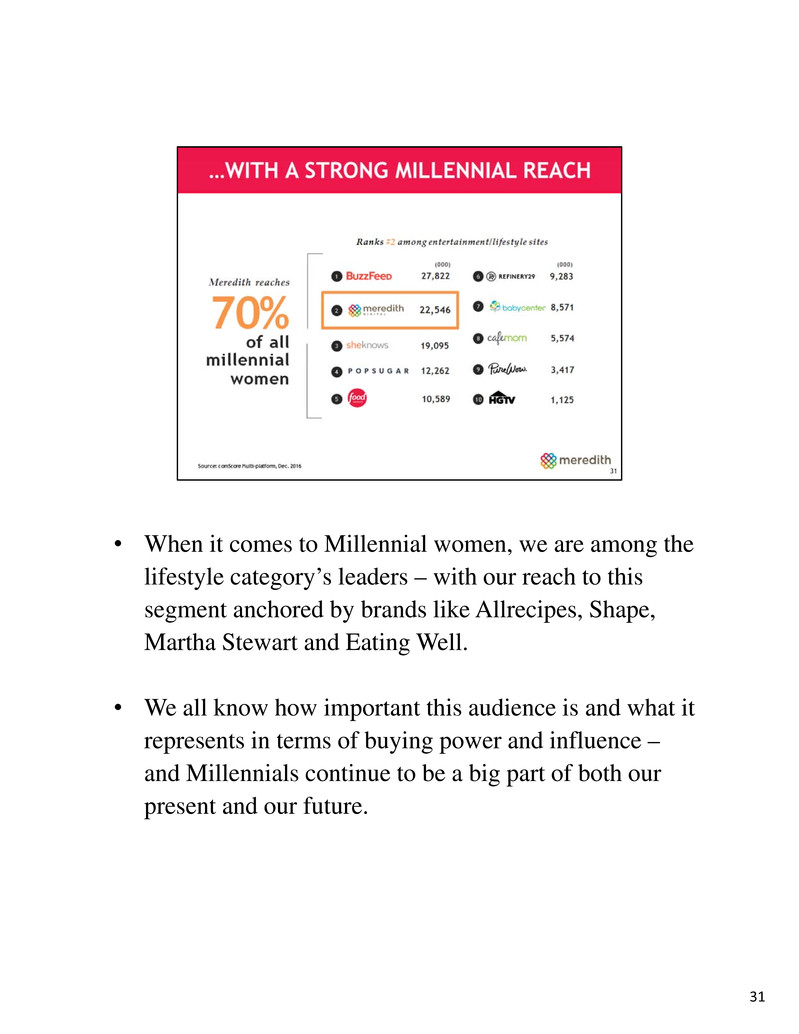

• When it comes to Millennial women, we are among the lifestyle category’s leaders – with our reach to this segment anchored by brands like Allrecipes, Shape, Martha Stewart and Eating Well. • We all know how important this audience is and what it represents in terms of buying power and influence – and Millennials continue to be a big part of both our present and our future. 31

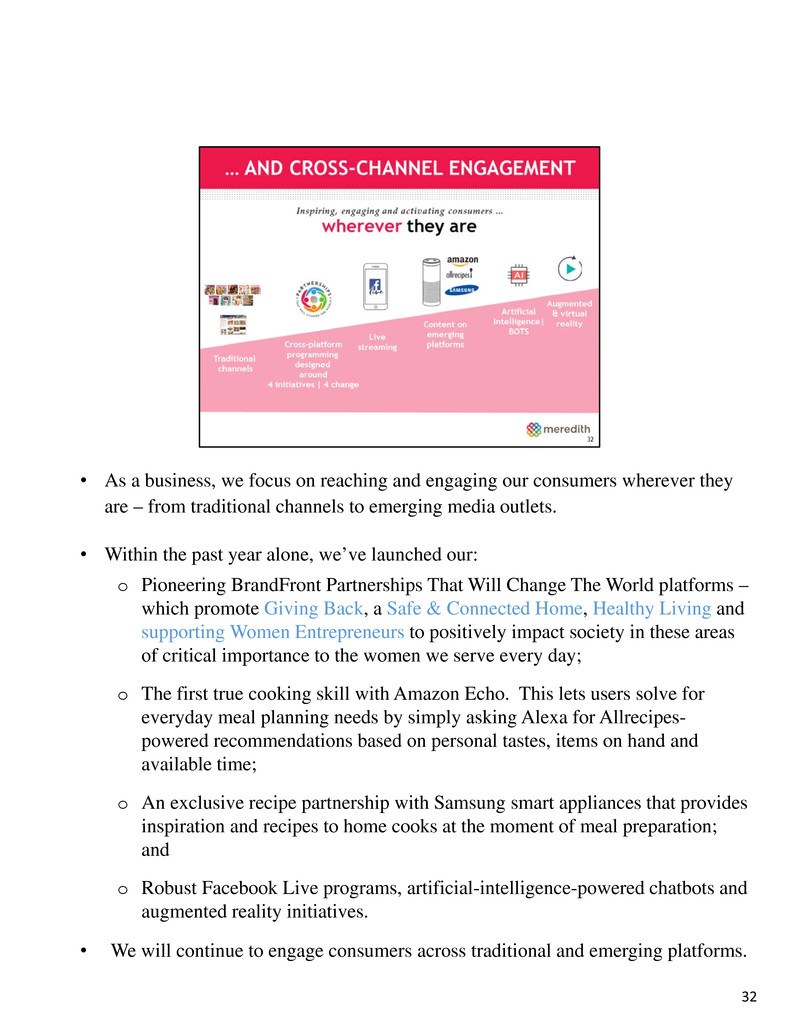

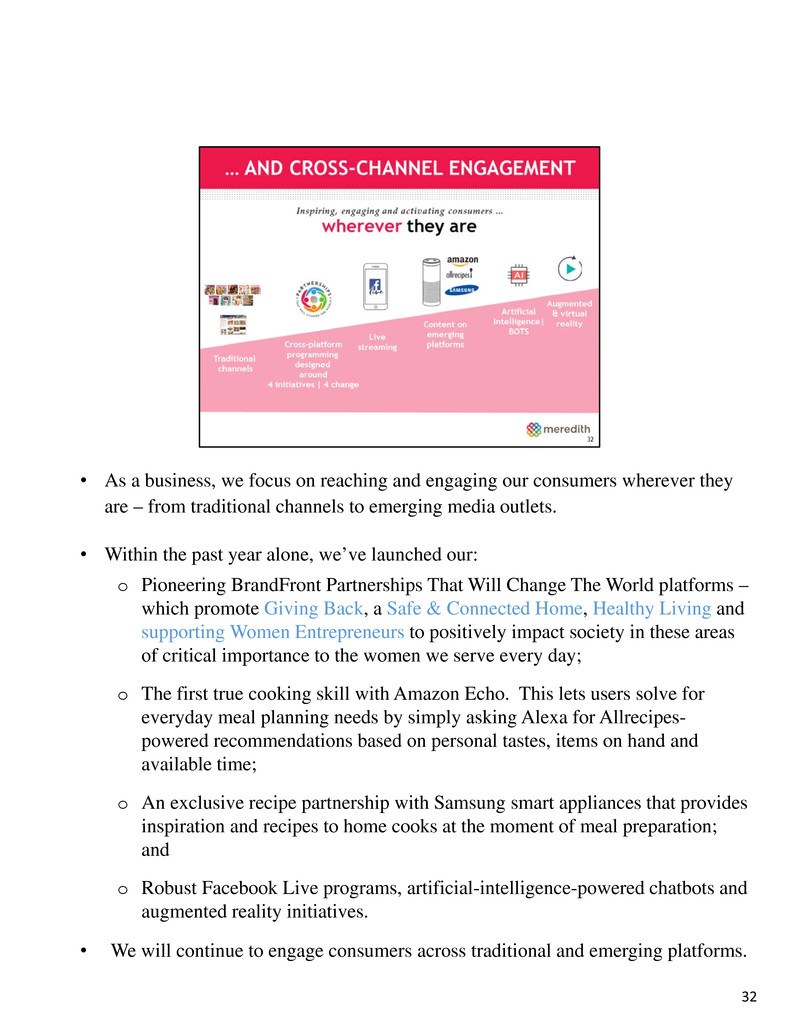

• As a business, we focus on reaching and engaging our consumers wherever they are – from traditional channels to emerging media outlets. • Within the past year alone, we’ve launched our: o Pioneering BrandFront Partnerships That Will Change The World platforms – which promote Giving Back, a Safe & Connected Home, Healthy Living and supporting Women Entrepreneurs to positively impact society in these areas of critical importance to the women we serve every day; o The first true cooking skill with Amazon Echo. This lets users solve for everyday meal planning needs by simply asking Alexa for Allrecipes- powered recommendations based on personal tastes, items on hand and available time; o An exclusive recipe partnership with Samsung smart appliances that provides inspiration and recipes to home cooks at the moment of meal preparation; and o Robust Facebook Live programs, artificial-intelligence-powered chatbots and augmented reality initiatives. • We will continue to engage consumers across traditional and emerging platforms. 32

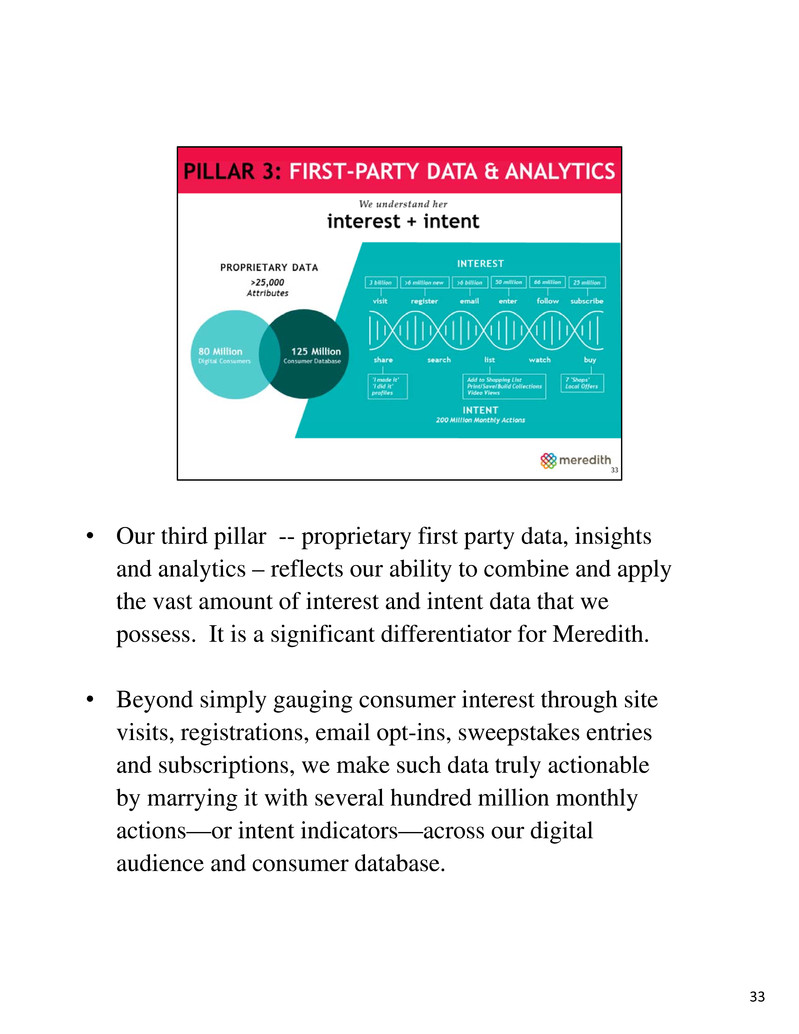

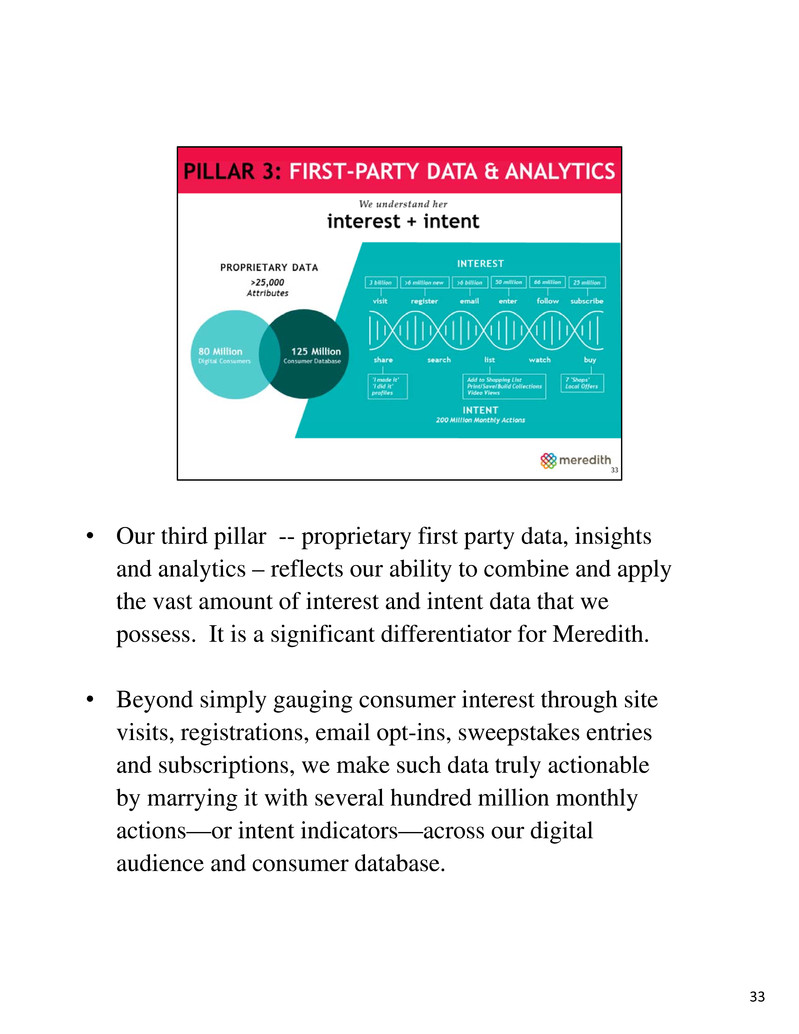

33 • Our third pillar -- proprietary first party data, insights and analytics – reflects our ability to combine and apply the vast amount of interest and intent data that we possess. It is a significant differentiator for Meredith. • Beyond simply gauging consumer interest through site visits, registrations, email opt-ins, sweepstakes entries and subscriptions, we make such data truly actionable by marrying it with several hundred million monthly actions—or intent indicators—across our digital audience and consumer database.

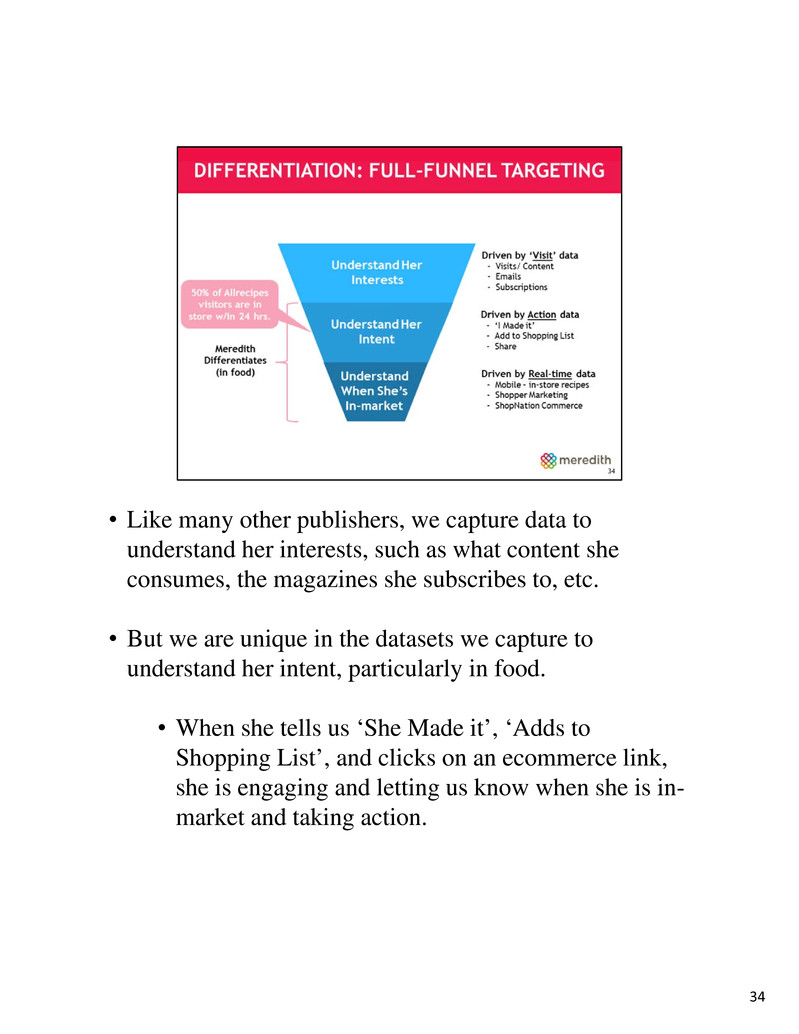

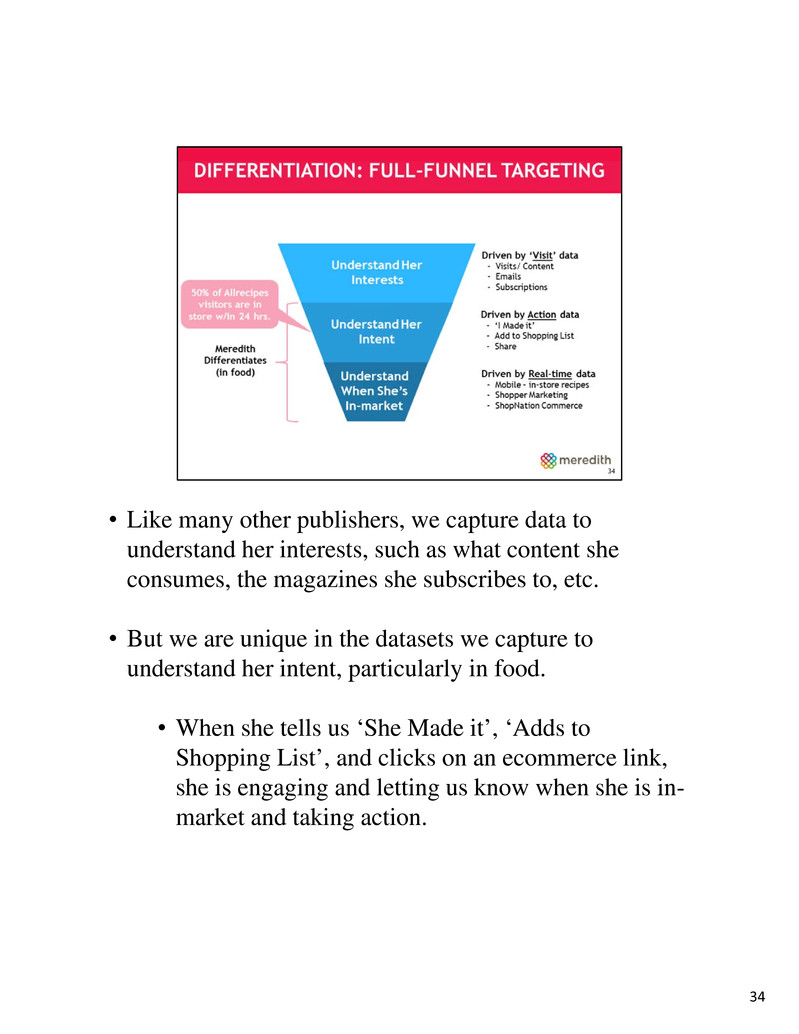

34 • Like many other publishers, we capture data to understand her interests, such as what content she consumes, the magazines she subscribes to, etc. • But we are unique in the datasets we capture to understand her intent, particularly in food. • When she tells us ‘She Made it’, ‘Adds to Shopping List’, and clicks on an ecommerce link, she is engaging and letting us know when she is in- market and taking action.

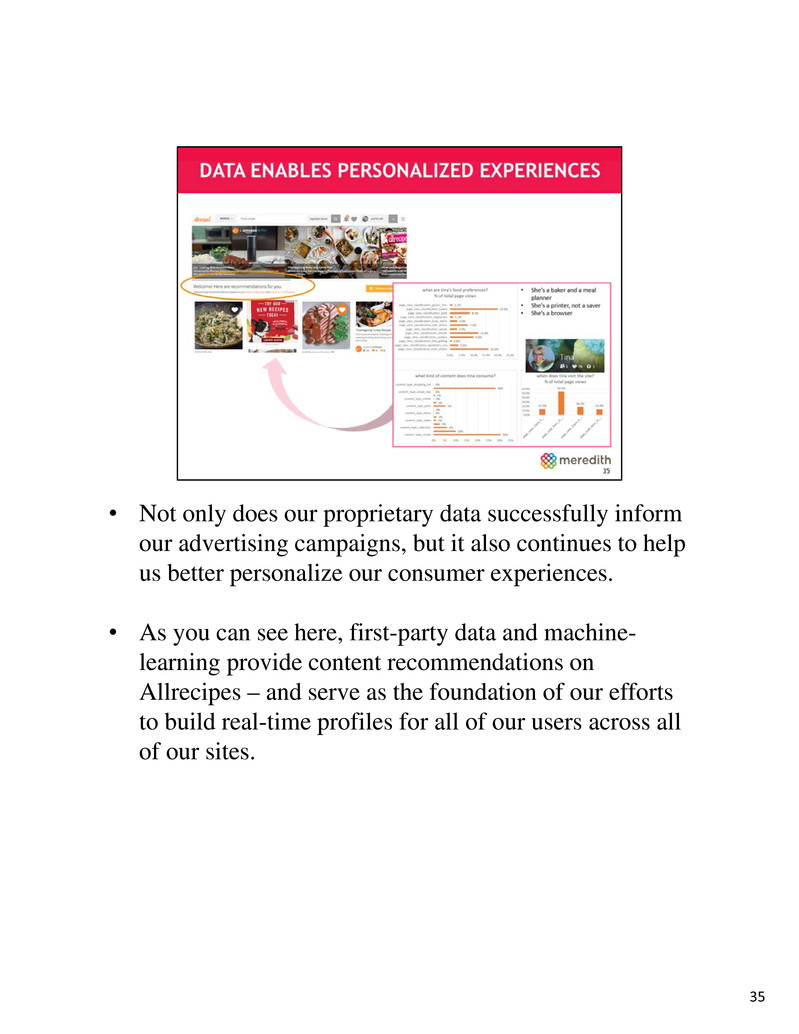

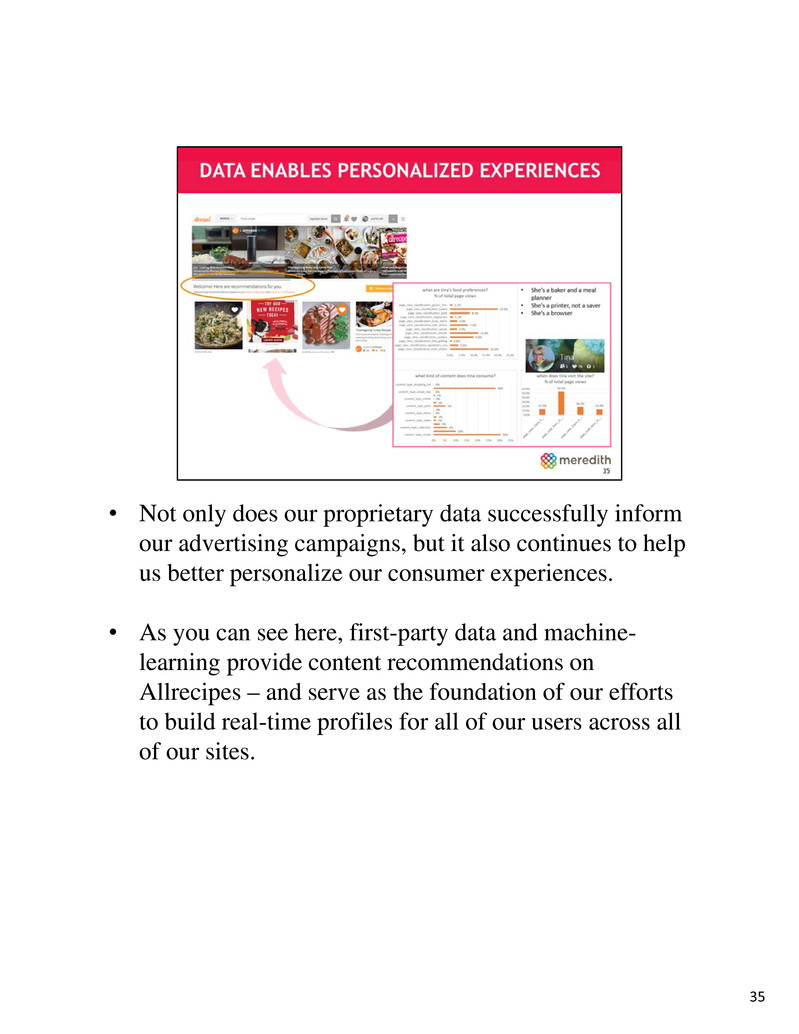

• Not only does our proprietary data successfully inform our advertising campaigns, but it also continues to help us better personalize our consumer experiences. • As you can see here, first-party data and machine- learning provide content recommendations on Allrecipes – and serve as the foundation of our efforts to build real-time profiles for all of our users across all of our sites. 35

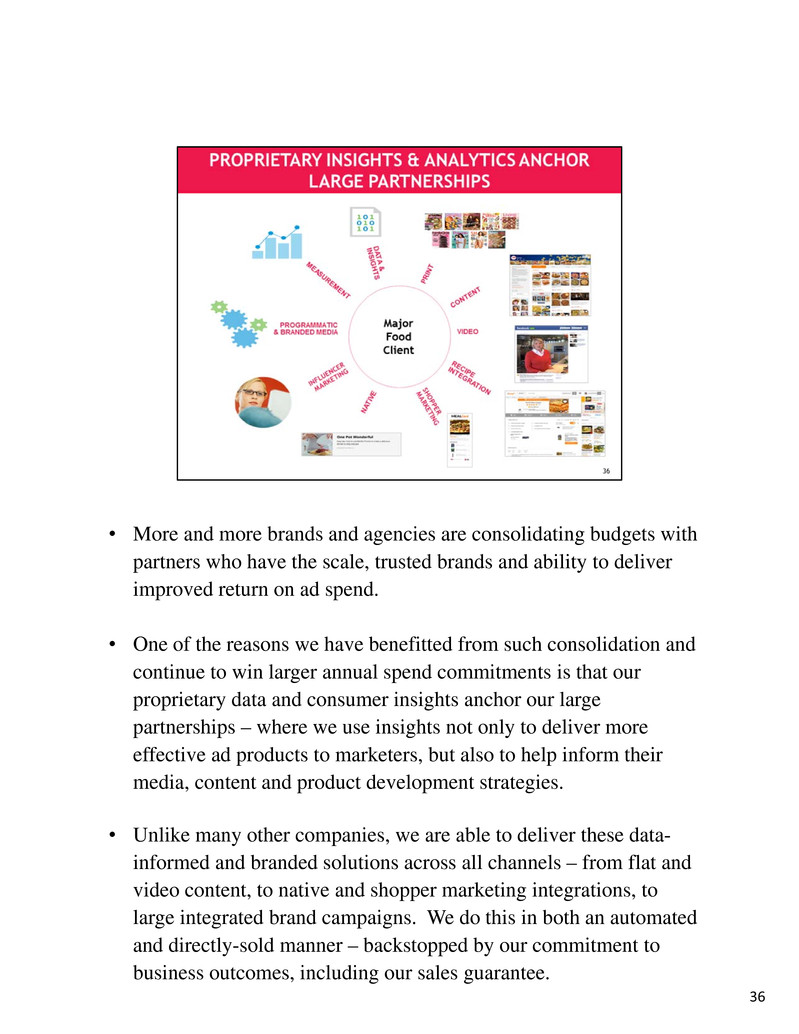

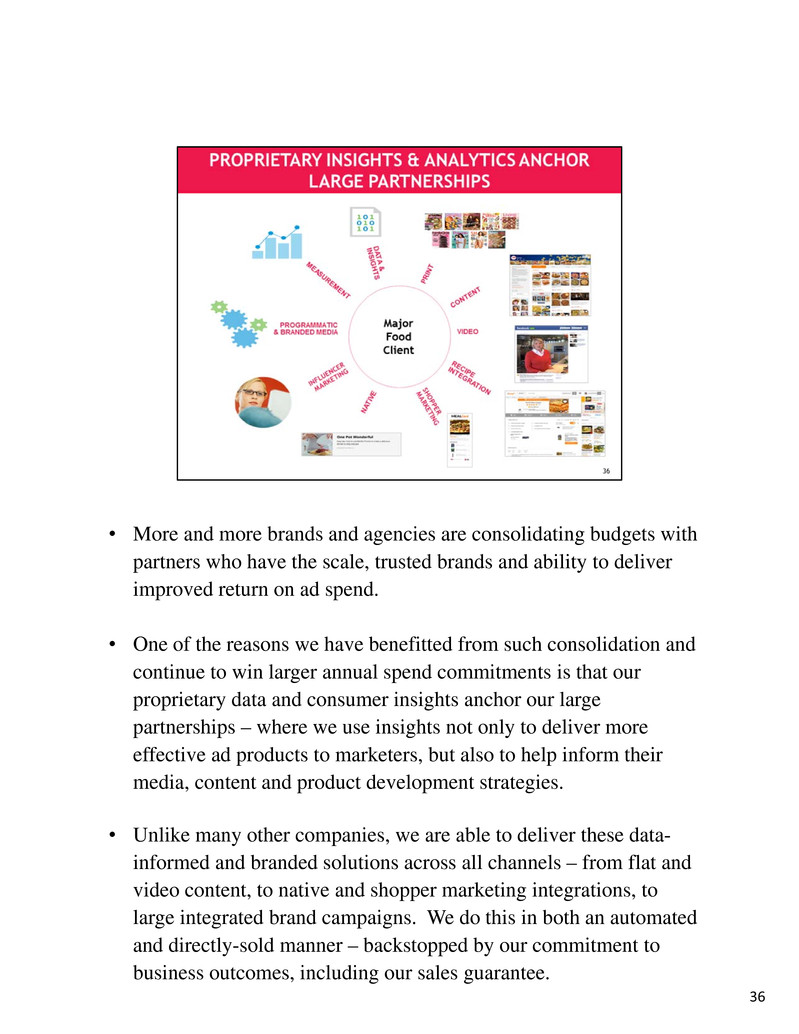

36 • More and more brands and agencies are consolidating budgets with partners who have the scale, trusted brands and ability to deliver improved return on ad spend. • One of the reasons we have benefitted from such consolidation and continue to win larger annual spend commitments is that our proprietary data and consumer insights anchor our large partnerships – where we use insights not only to deliver more effective ad products to marketers, but also to help inform their media, content and product development strategies. • Unlike many other companies, we are able to deliver these data- informed and branded solutions across all channels – from flat and video content, to native and shopper marketing integrations, to large integrated brand campaigns. We do this in both an automated and directly-sold manner – backstopped by our commitment to business outcomes, including our sales guarantee.

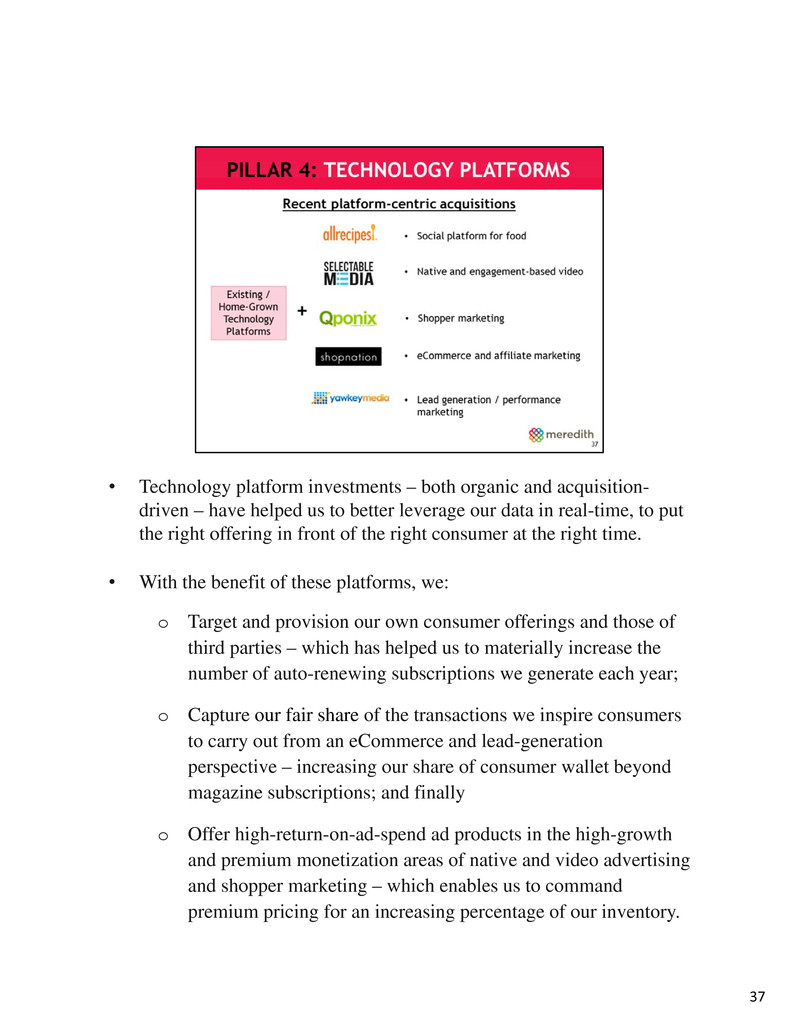

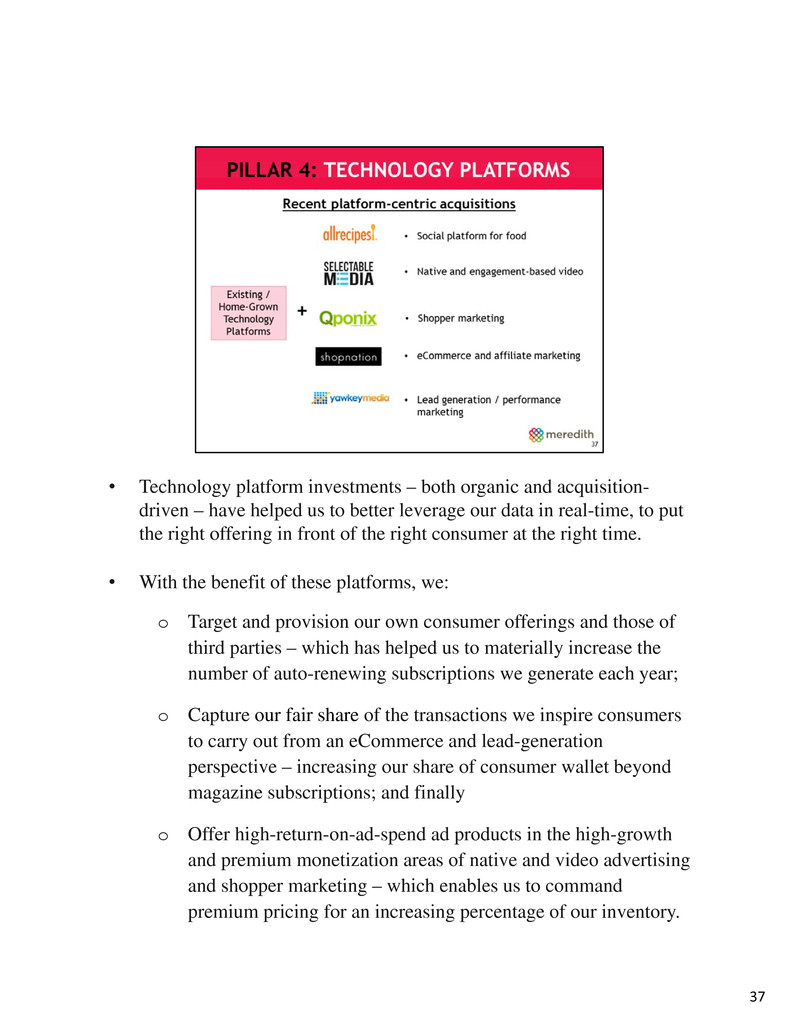

37 • Technology platform investments – both organic and acquisition- driven – have helped us to better leverage our data in real-time, to put the right offering in front of the right consumer at the right time. • With the benefit of these platforms, we: o Target and provision our own consumer offerings and those of third parties – which has helped us to materially increase the number of auto-renewing subscriptions we generate each year; o Capture our fair share of the transactions we inspire consumers to carry out from an eCommerce and lead-generation perspective – increasing our share of consumer wallet beyond magazine subscriptions; and finally o Offer high-return-on-ad-spend ad products in the high-growth and premium monetization areas of native and video advertising and shopper marketing – which enables us to command premium pricing for an increasing percentage of our inventory.

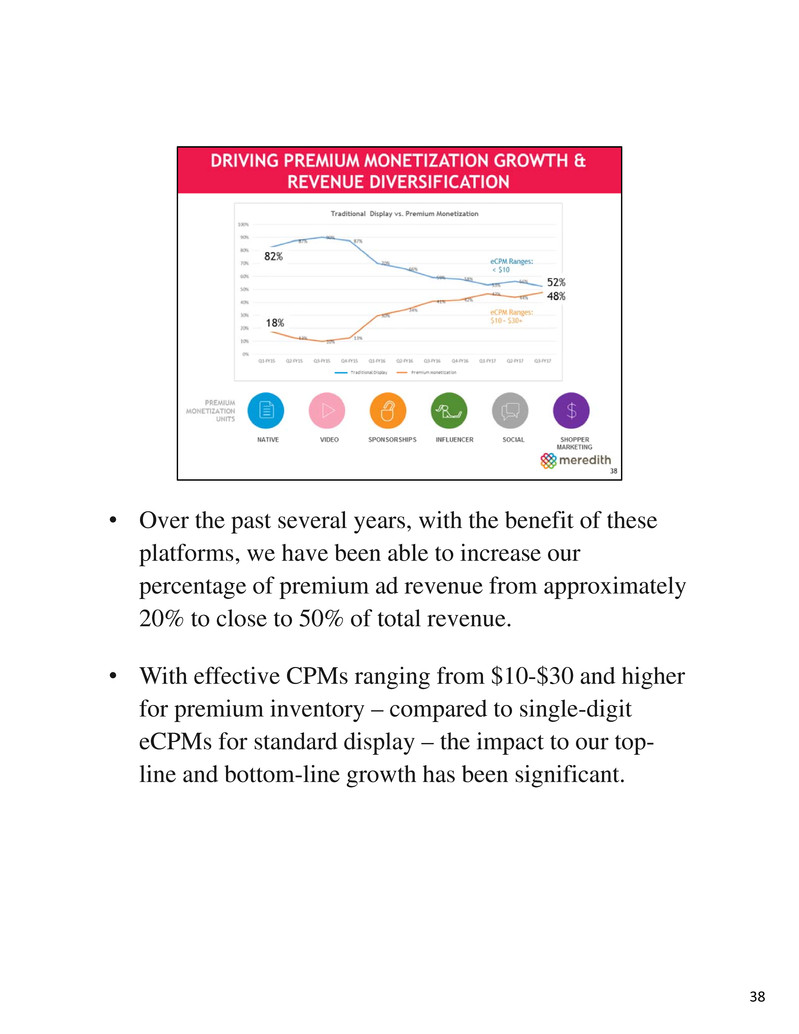

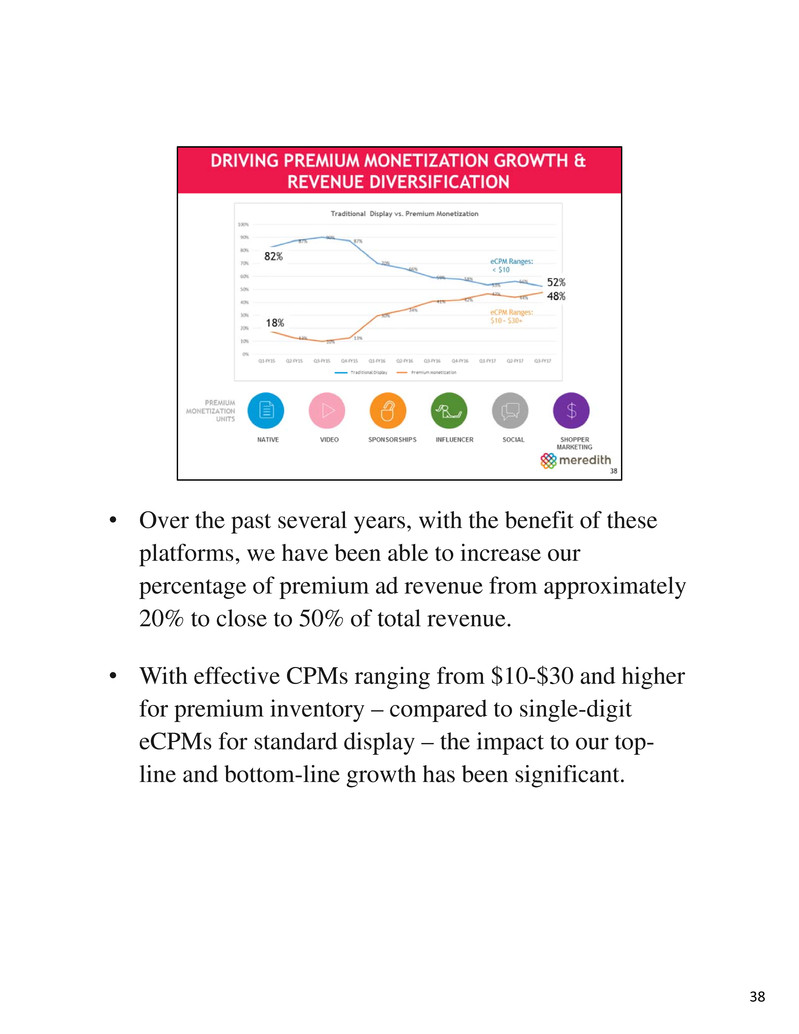

38 • Over the past several years, with the benefit of these platforms, we have been able to increase our percentage of premium ad revenue from approximately 20% to close to 50% of total revenue. • With effective CPMs ranging from $10-$30 and higher for premium inventory – compared to single-digit eCPMs for standard display – the impact to our top- line and bottom-line growth has been significant.

• However, we’re not stopping here. We are continuing to innovate on the platforms we’ve acquired, from shoppable emails and pins to beacon-enabled ads, and from native shopper meal cards to social and chatbot units across both our owned and operated and third party media platforms. 39

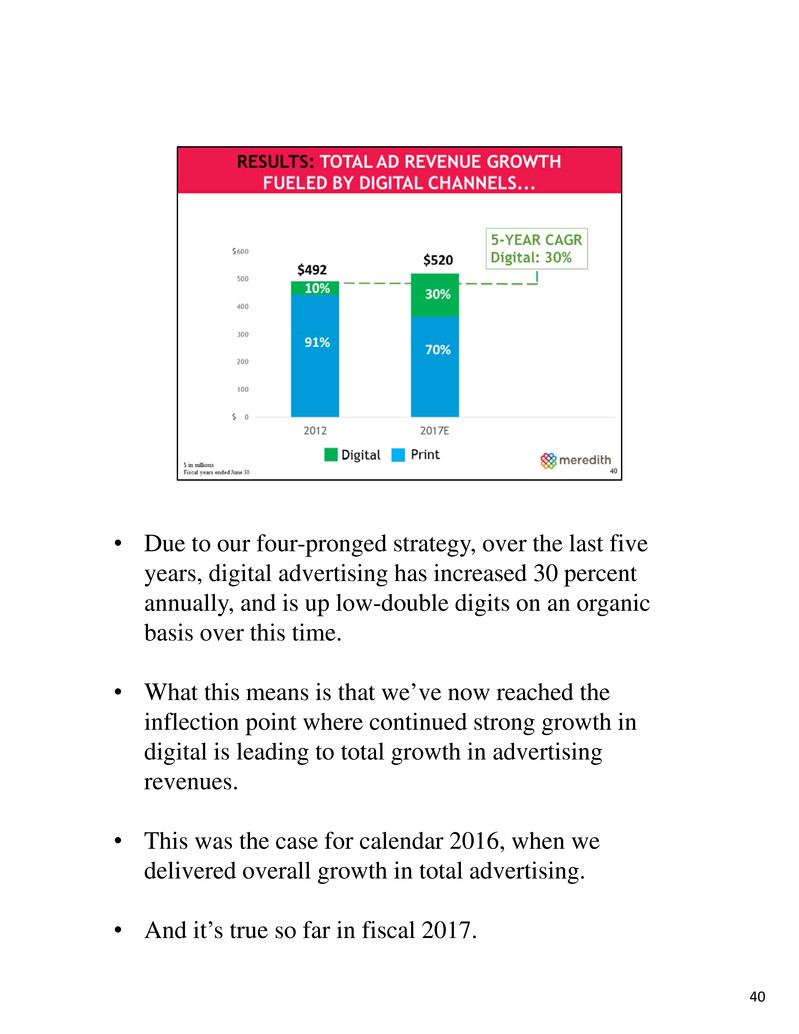

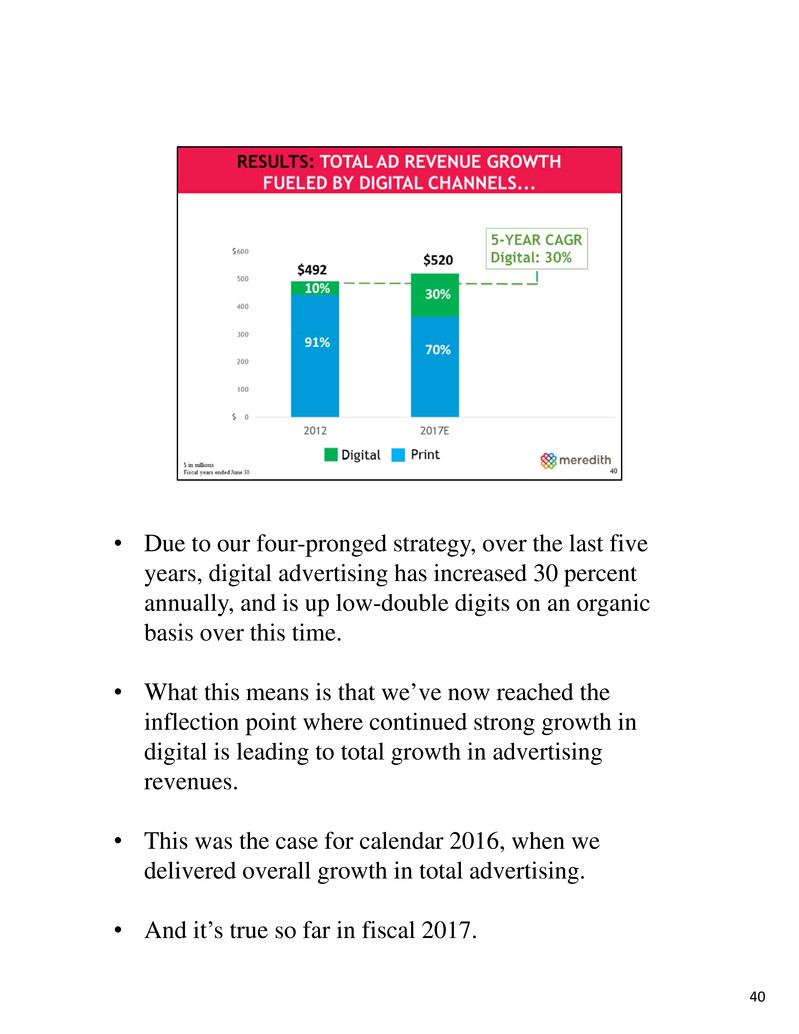

• Due to our four-pronged strategy, over the last five years, digital advertising has increased 30 percent annually, and is up low-double digits on an organic basis over this time. • What this means is that we’ve now reached the inflection point where continued strong growth in digital is leading to total growth in advertising revenues. • This was the case for calendar 2016, when we delivered overall growth in total advertising. • And it’s true so far in fiscal 2017. 40

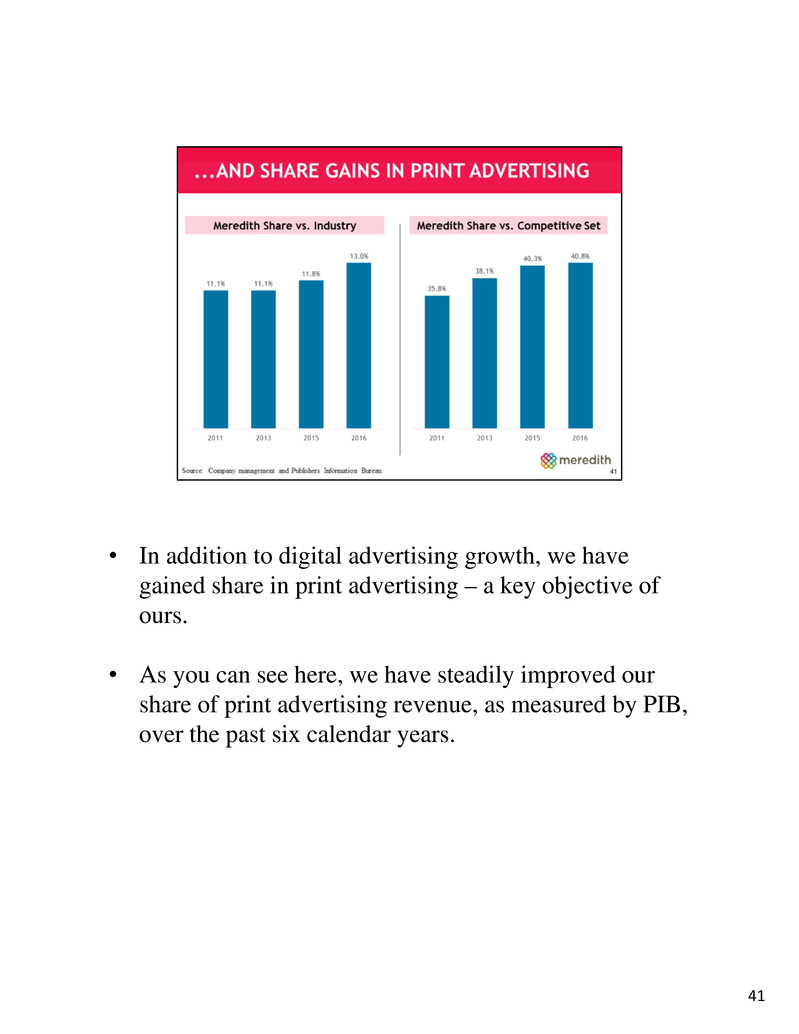

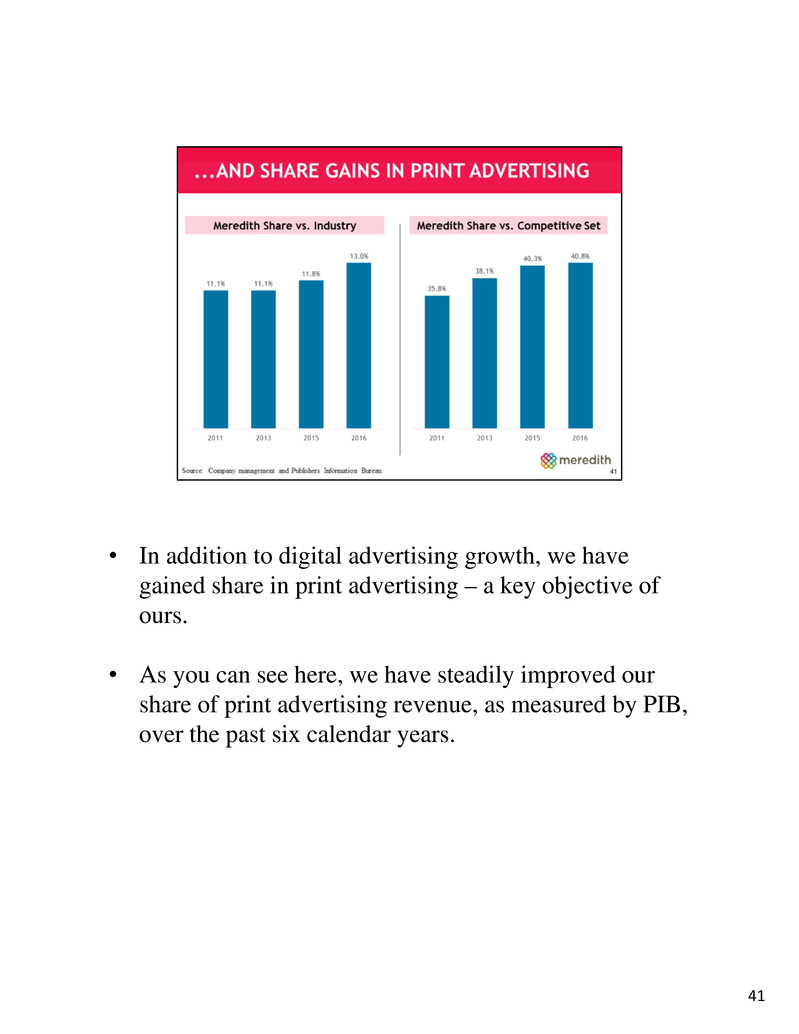

• In addition to digital advertising growth, we have gained share in print advertising – a key objective of ours. • As you can see here, we have steadily improved our share of print advertising revenue, as measured by PIB, over the past six calendar years. 41

• In addition to advertising, consumer-generated revenue is a growth area for us as well. • Our Consumer-generated revenue strategy effectively is comprised of three core business lines: o Consumer Marketing – or our paid products business – which includes our magazine subscriptions and newsstand sales; new paid products such as membership programs and meal plans; and book annuals; o Brand Licensing – where we license our brands to third parties in association with particular products in agreed-upon domestic and international territories; and o eCommerce – which includes (1) our Shop Nation affiliate marketing business, where we earn a revenue share for the promotion of third-party products and (2) our performance marketing business, where we earn a revenue share for leads we generate in the home services arena. 42

• Our ability to create authentic and relevant content with commerce in mind has helped to put us on a pathway to diversified and sustainable consumer revenue growth. • Our consumers account for one out of every two dollars spent across the key categories of food, home, automotive, travel, beauty and prescription drugs. • In short, they are America’s shoppers, and we know how to authentically inspire and activate them on behalf of both third-party and Meredith brands – and take our fair share of the value we create in the process. 43

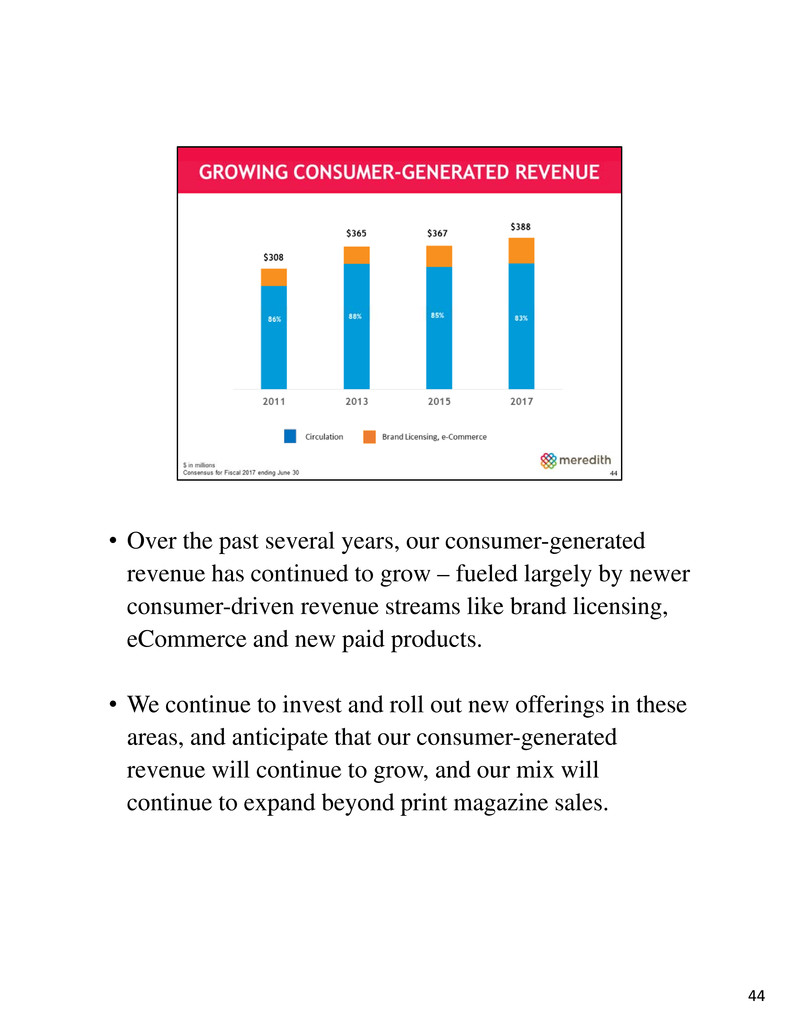

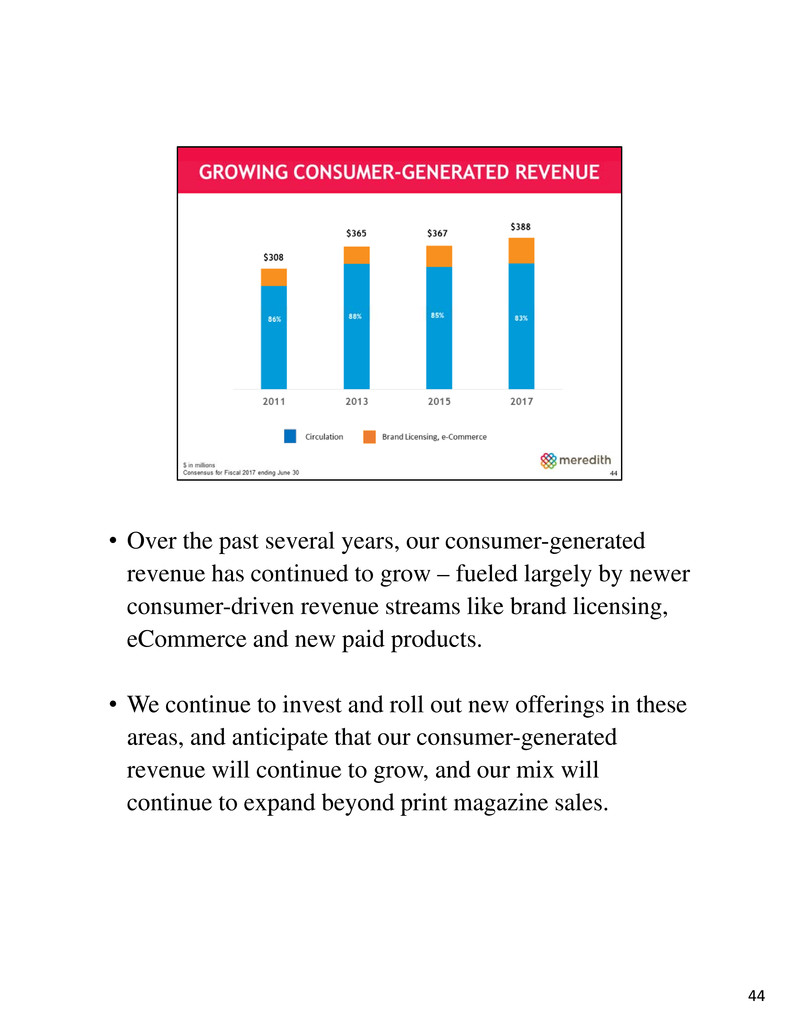

• Over the past several years, our consumer-generated revenue has continued to grow – fueled largely by newer consumer-driven revenue streams like brand licensing, eCommerce and new paid products. • We continue to invest and roll out new offerings in these areas, and anticipate that our consumer-generated revenue will continue to grow, and our mix will continue to expand beyond print magazine sales. 44

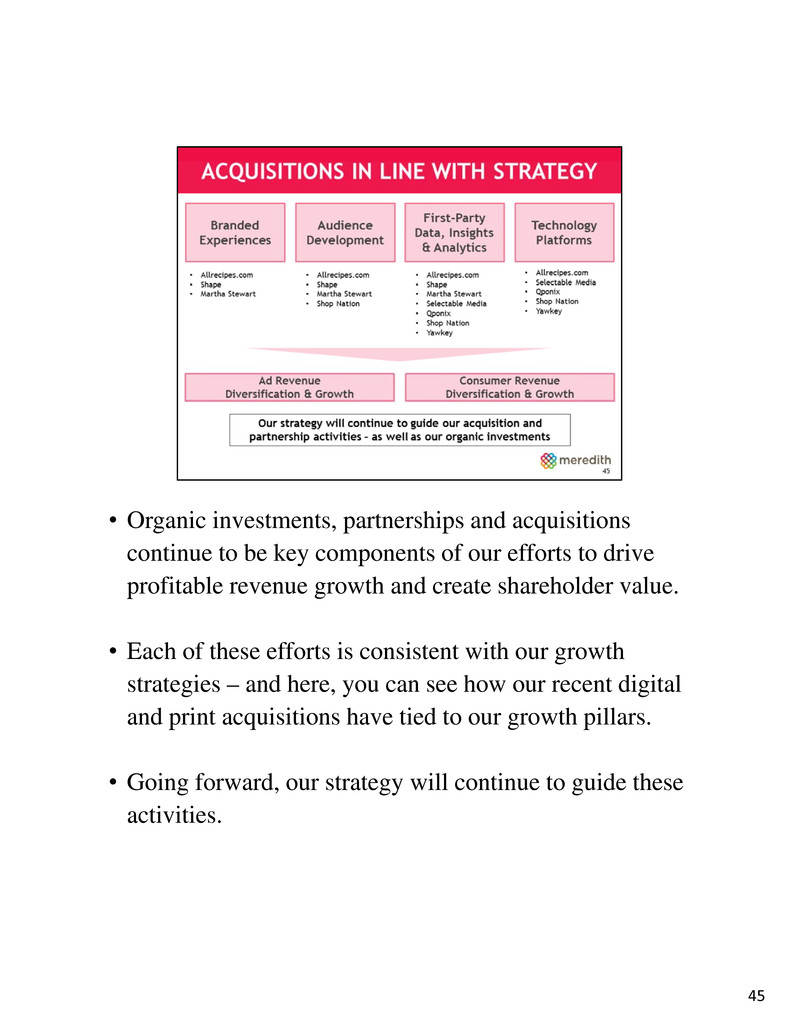

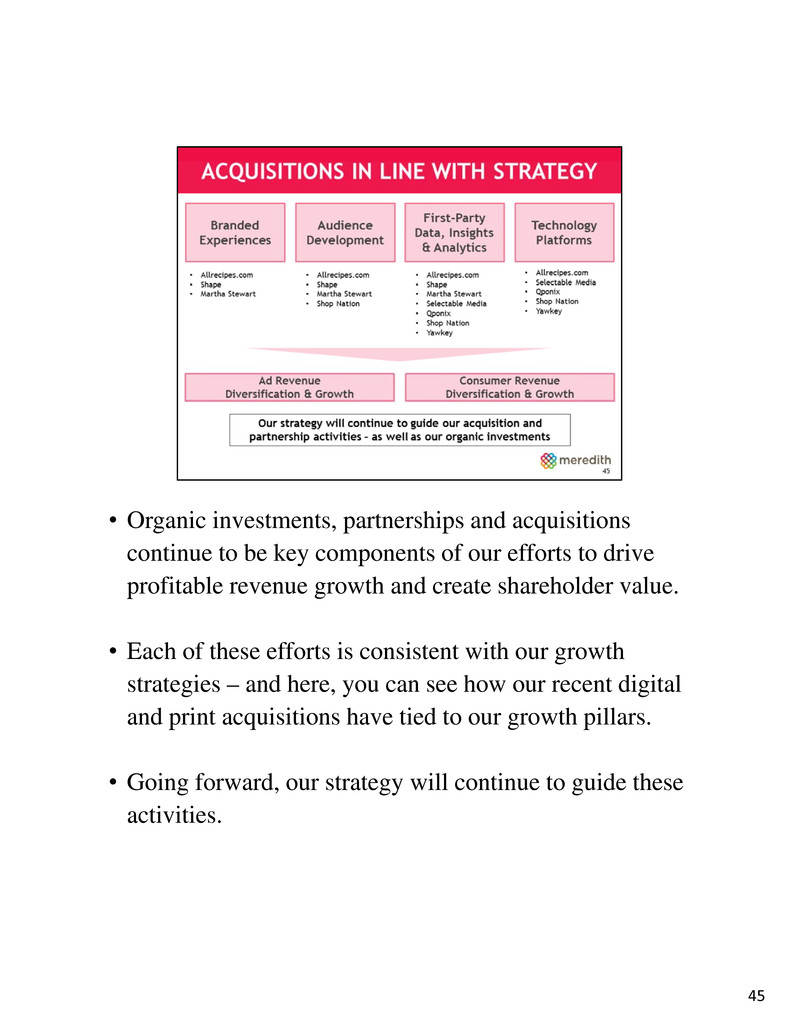

• Organic investments, partnerships and acquisitions continue to be key components of our efforts to drive profitable revenue growth and create shareholder value. • Each of these efforts is consistent with our growth strategies – and here, you can see how our recent digital and print acquisitions have tied to our growth pillars. • Going forward, our strategy will continue to guide these activities. 45

Now I’ll turn it over Joe Ceryanec to discuss our Total Shareholder Return strategies. 46

JOE: Thanks Jon. At Meredith, we are committed to delivering top-third total shareholder return. In order to achieve this, we are pursuing these four strategies: • Balanced capital allocation, which means we return ½ of our cash to shareholders and invest ½ back into the business over time. • This begins with a consistent and growing dividend. • We also have in place an opportunistic share buyback program; and • Lastly, we continue to pursue accretive strategic acquisitions, which I’ll talk about in a minute. 47

A hallmark of our business model is that it generates substantial and consistent cash flows. Over the past 10 years, we’ve generated $2.3 billion of cash. Here are our priorities for using that cash. First, we have a strong commitment to returning cash to shareholders and maintaining dividend growth. Most recently, we increased our annual dividend to $2.08 per share, up 5 percent from $1.98 per share. It’s current yield is approximately 4% Second, we have added tuck-in acquisitions to strengthen our existing portfolio. We look for deals that are accretive to TSR, organic growth and/or margins. Third, we will pursue larger acquisitions only if extremely strategic at attractive valuation with strong synergies. These deals must have limited and manageable financial risk. We will not do a deal just for the sake of doing a deal. Fourth, we will selectively repurchase our stock to enable shareholders to benefit from dips in price. Our current authorization is $100 million with $70 million remaining. Additionally, we would like to maintain our current conservative net debt levels not exceeding 2.5x EBITDA. Now, for the right strategic opportunity we would take on more debt, provided there’s a clear path to paying it down in a reasonable time period. 48

When it comes to future acquisitions and investments, we are constantly looking for opportunities that strengthen and expand our existing portfolio and are available at reasonable prices. In our Local Media Group, we’re looking for strong stations in faster- growing markets, as well as opportunities to diversify our network and geographic footprint. Stations in strong political markets are also a priority. In our National Media Group, we’re actively looking for businesses that would provide access to new audiences and advertisers. And we continue to evaluate opportunities to increase our digital activities. 49

When it comes to our approach, first and foremost we consider the strategic benefit. Does the target offer richer prospects for growth than we can achieve without it? Does it really move our business ahead? Obviously, there are a host of financial questions, but more important: Does it meet our internal hurdle rate, which is north of 15 percent? Does it offer synergies on the topline or in terms of operating efficiencies? We prefer deals that are accretive relatively quickly to Total Shareholder Return. Leadership and the target’s culture are also important factors. We maintain an aggressive corporate development function that’s out there every day looking for potential opportunities. And, as we’ve demonstrated, this group has an impressive track record. 50

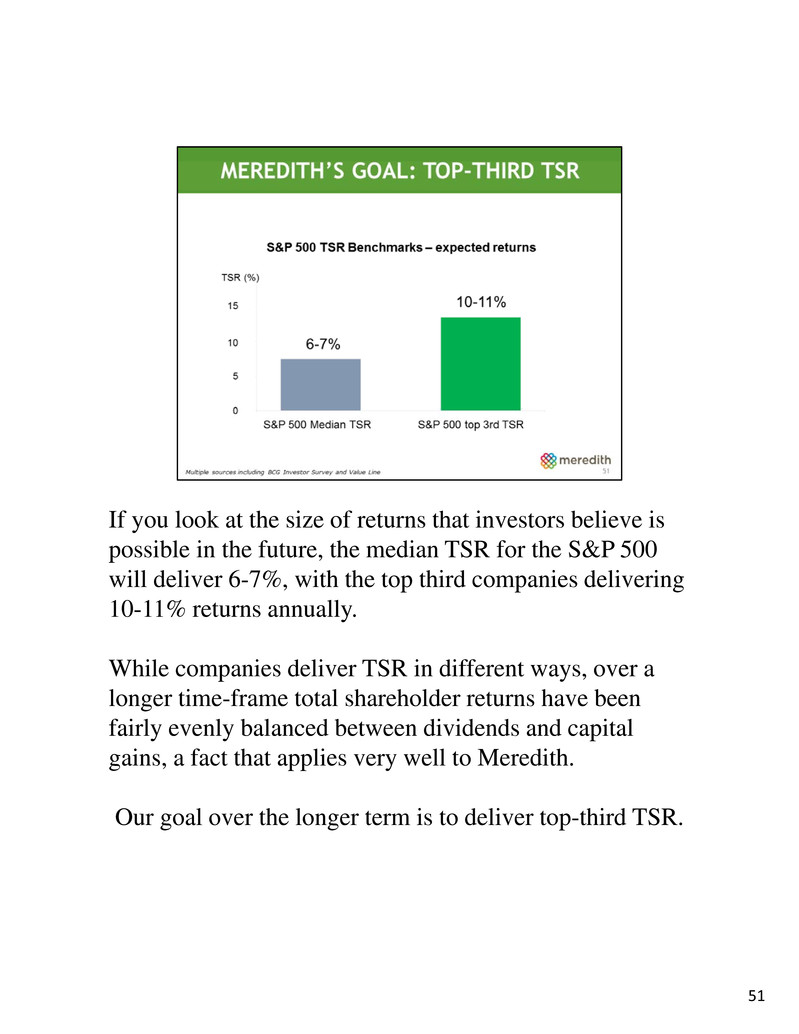

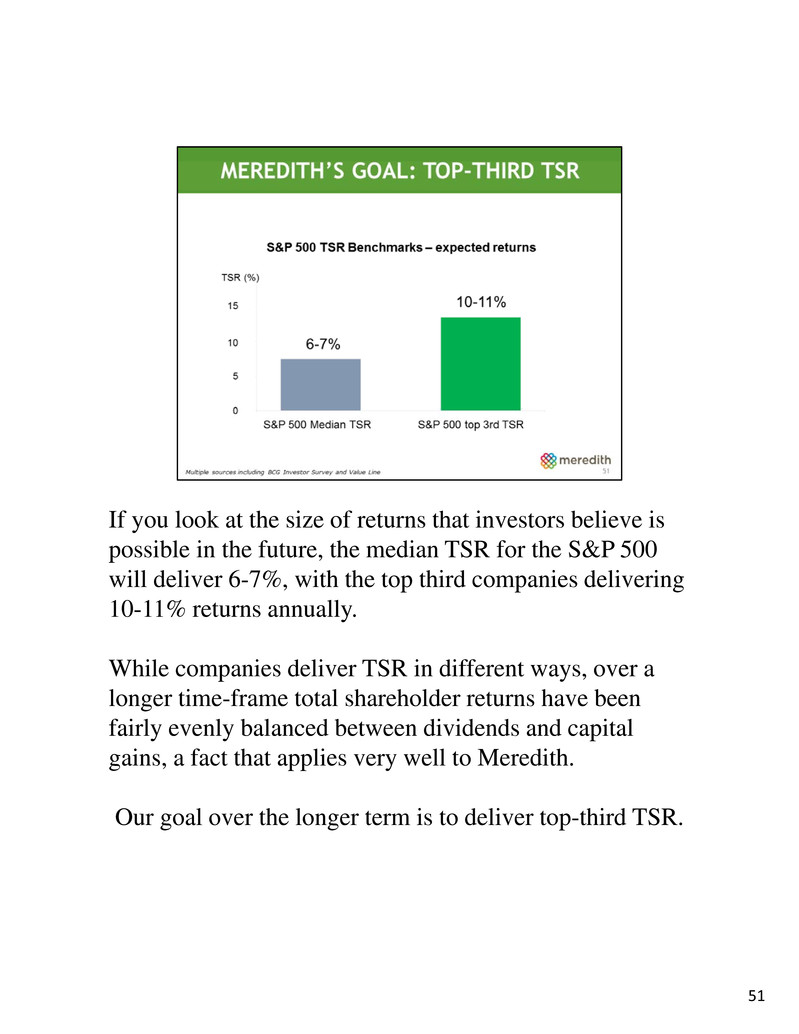

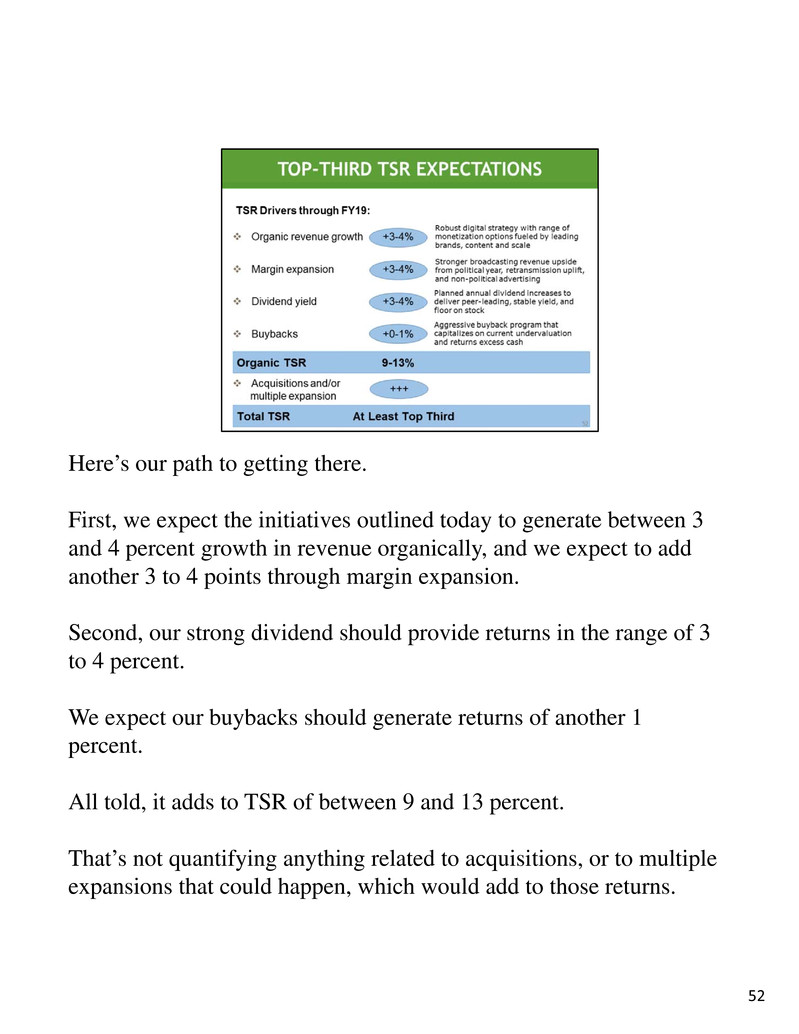

If you look at the size of returns that investors believe is possible in the future, the median TSR for the S&P 500 will deliver 6-7%, with the top third companies delivering 10-11% returns annually. While companies deliver TSR in different ways, over a longer time-frame total shareholder returns have been fairly evenly balanced between dividends and capital gains, a fact that applies very well to Meredith. Our goal over the longer term is to deliver top-third TSR. 51

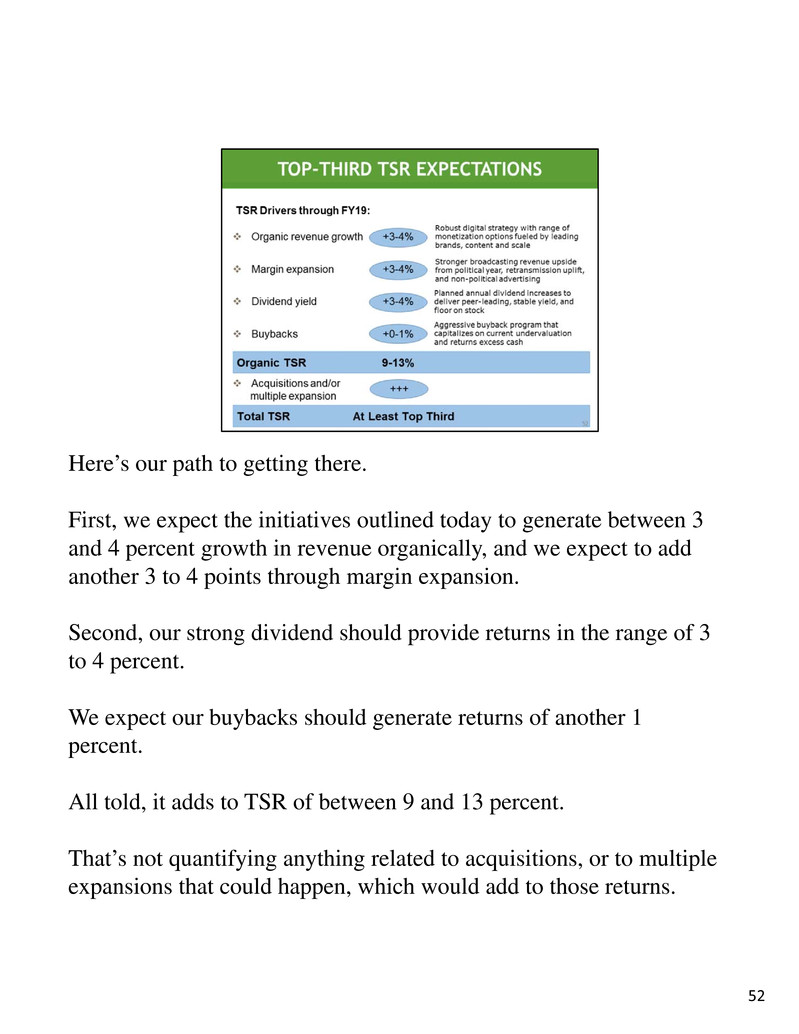

Here’s our path to getting there. First, we expect the initiatives outlined today to generate between 3 and 4 percent growth in revenue organically, and we expect to add another 3 to 4 points through margin expansion. Second, our strong dividend should provide returns in the range of 3 to 4 percent. We expect our buybacks should generate returns of another 1 percent. All told, it adds to TSR of between 9 and 13 percent. That’s not quantifying anything related to acquisitions, or to multiple expansions that could happen, which would add to those returns. 52

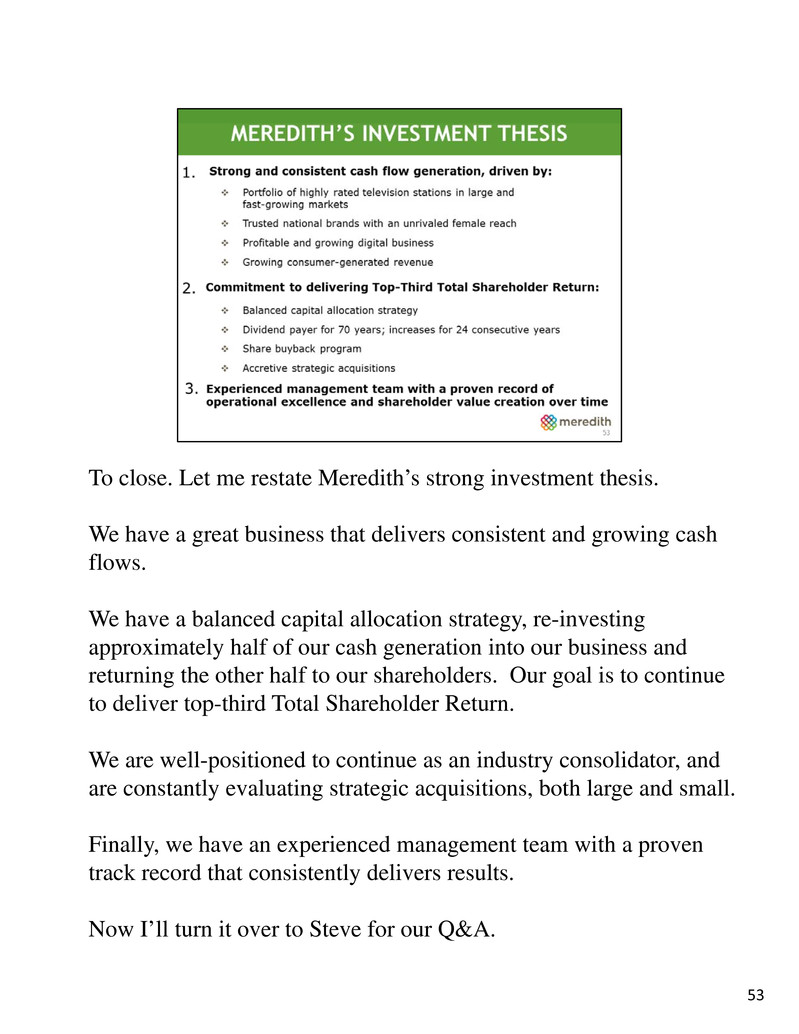

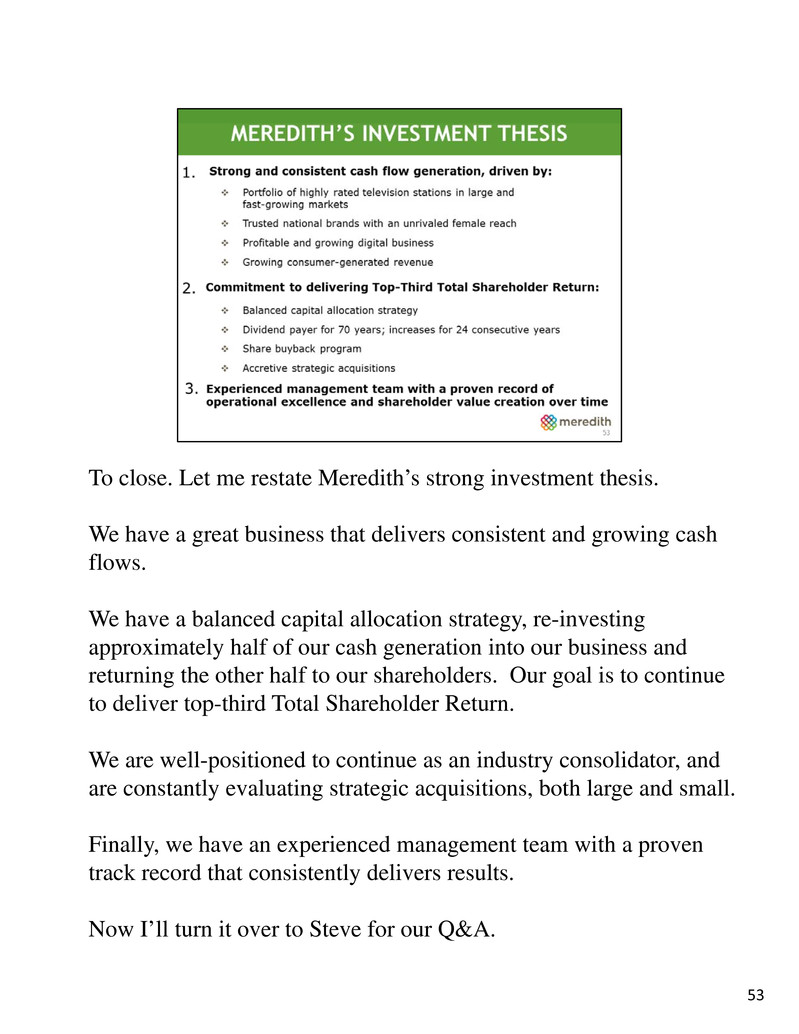

To close. Let me restate Meredith’s strong investment thesis. We have a great business that delivers consistent and growing cash flows. We have a balanced capital allocation strategy, re-investing approximately half of our cash generation into our business and returning the other half to our shareholders. Our goal is to continue to deliver top-third Total Shareholder Return. We are well-positioned to continue as an industry consolidator, and are constantly evaluating strategic acquisitions, both large and small. Finally, we have an experienced management team with a proven track record that consistently delivers results. Now I’ll turn it over to Steve for our Q&A. 53

Steve: Thanks Joe. Now we will entertain your questions. 54

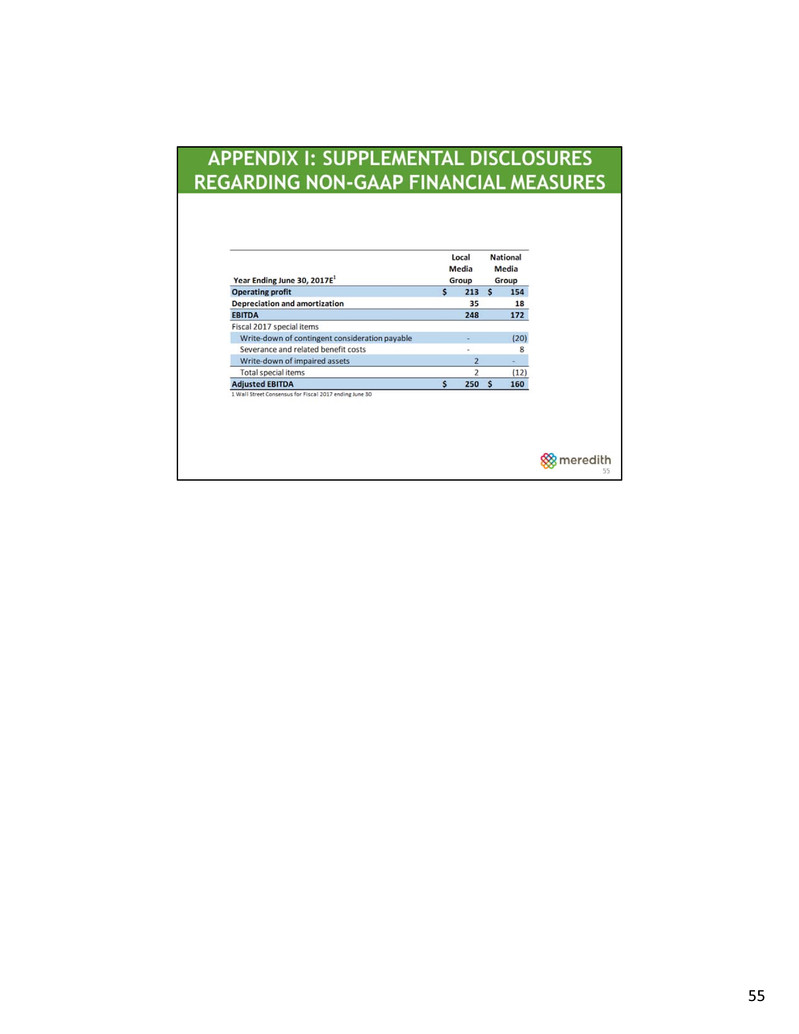

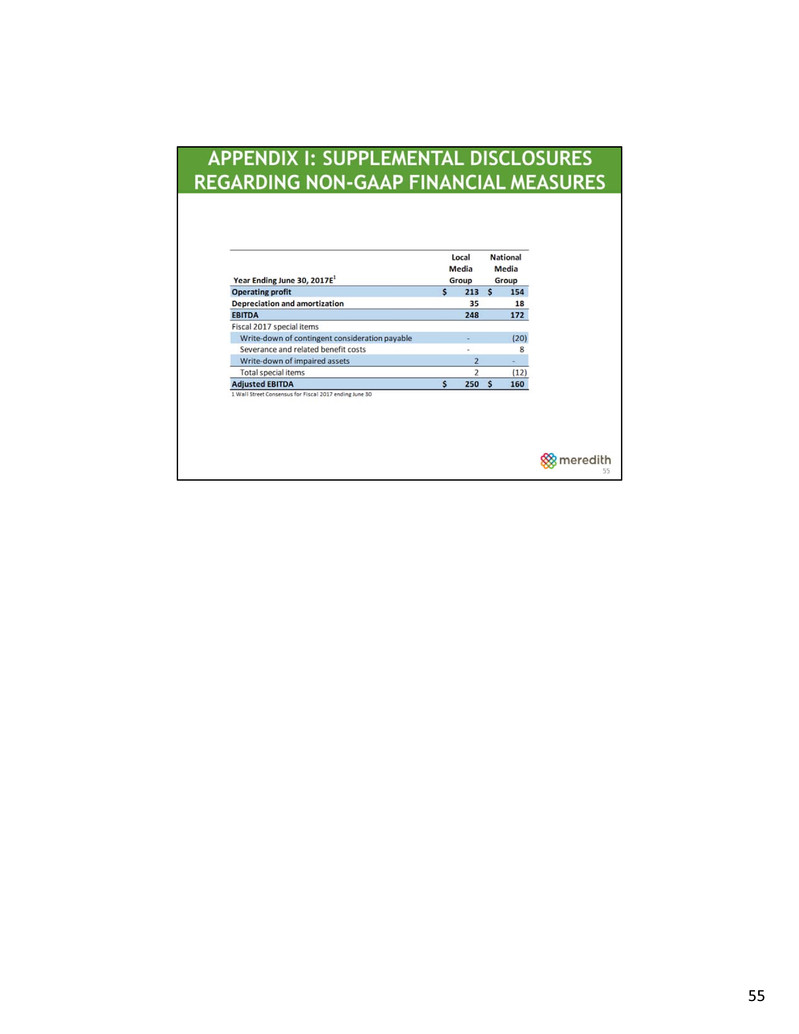

55

56

57