Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

MPR similar filings

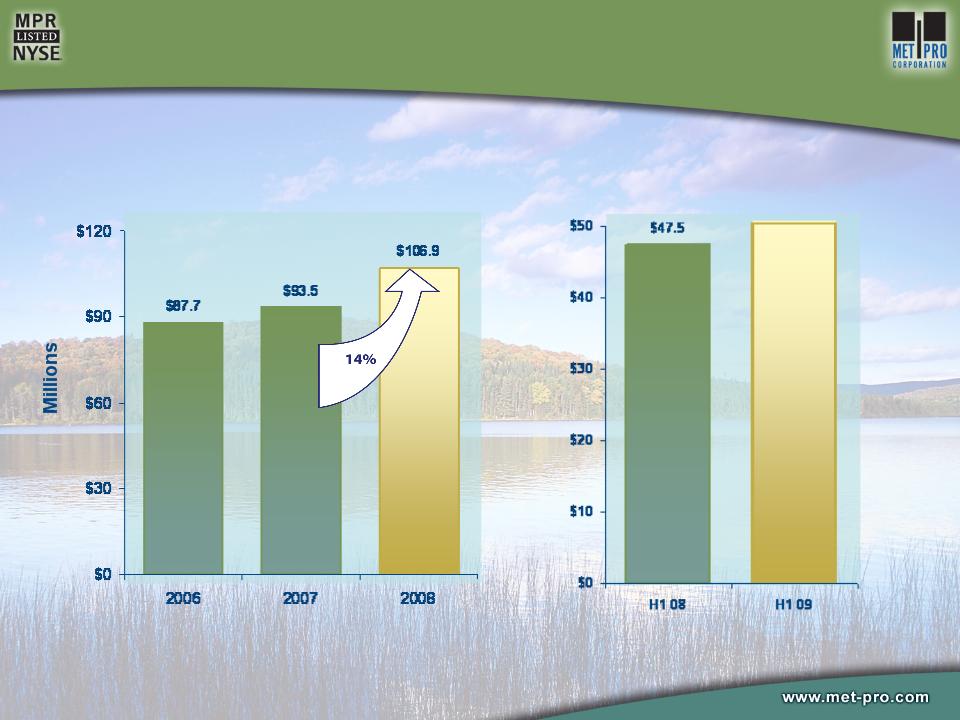

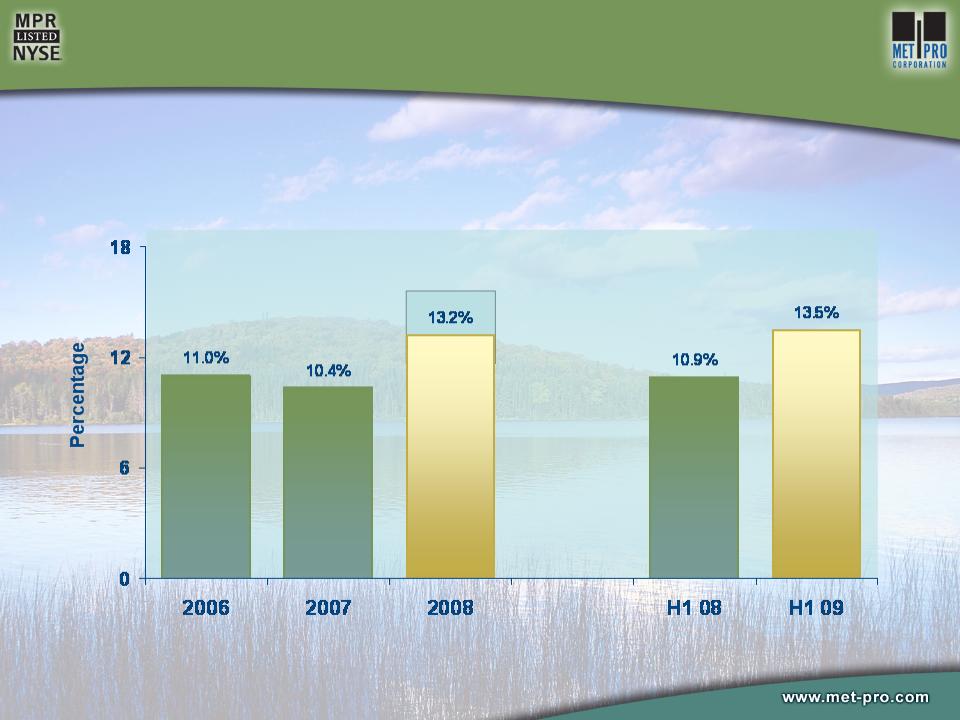

- 21 Nov 08 Met-Pro Corporation Announces Third Quarter Financial Results

- 5 Nov 08 Met-Pro Corporation Announces Initiation of NEW

- 14 Oct 08 Other Events

- 3 Oct 08 Regulation FD Disclosure

- 22 Aug 08 Met-Pro Corporation Announces Second Quarter Financial Results

- 10 Jun 08 Other Events

- 4 Jun 08 Other Events

Filing view

External links