UNITED STATES SECURITIES AND EXCHANGE COMMISSION

| [ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-07763

MET-PRO CORPORATION

(Exact name of registrant as specified in its charter)

| Pennsylvania | | 23-1683282 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | | |

| 160 Cassell Road, P. O. Box 144 | | |

| Harleysville, Pennsylvania | | 19438 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (215) 723-6751

Securities registered pursuant to Section 12(b) of the Act:

| | | Name of each exchange on |

| Title of each class | | which registered |

| Common Shares, par value $0.10 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

| Common Shares, par value $0.10 per share | | |

| (Title of Class) | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [ X ]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 under the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ X ] Non-accelerated filer [ ] Smaller reporting company [ ]

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ X ]

The aggregate market value of the Common Shares, par value $0.10 per share, held by non-affiliates as of (based upon the closing sales price on the New York Stock Exchange on July 31, 2008) the last business day of the Registrant’s most recently completed second fiscal quarter was $230,579,461.

The number of Registrant’s outstanding Common Shares was 14,600,109 as of April 10, 2009.

DOCUMENTS INCORPORATED BY REFERENCE

| | Form 10-K |

| | Part Number |

| Portions of Registrant’s Definitive Proxy Statement filed pursuant to Regulation 14A | |

| in connection with Registrant’s Annual Meeting of Shareholders to be held on June 3, 2009 | III |

| | | | | Page |

| | | | | | |

| PART I | | | | |

| | Item 1. | | | 1 | |

| | | | | 7 | |

| | Item 1A. | | | 8 | |

| | Item 1B. | | | 11 | |

| | Item 2. | | | 12 | |

| | Item 3. | | | 13 | |

| | Item 4. | | | 13 | |

| | | | | | |

| PART II | | | | |

| | Item 5. | | | 14 | |

| | Item 6. | | | 17 | |

| | Item 7. | | | 18 | |

| | | | | 26 | |

| | Item 7A. | | | 27 | |

| | Item 8. | | | 28 | |

| | Item 9. | | | 59 | |

| | Item 9A. | | | 59 | |

| | Item 9B. | | | 59 | |

| | | | | | |

| | | | | | |

| PART III | | | | |

| | Item 10. | | | 60 | |

| | Item 11. | | | 60 | |

| | Item 12. | | | 60 | |

| | Item 13. | | | 60 | |

| | Item 14. | | | 60 | |

| | | | | | |

| PART IV | | | | |

| | Item 15. | | | 61 | |

| | | | | | |

| | | 65 | |

Met-Pro’s prospects are subject to certain uncertainties and risks. This Annual Report on Form 10-K also contains certain forward-looking statements within the meaning of the Federal securities laws. Met-Pro’s future results may differ materially from its current results and actual results could differ materially from those projected in the forward-looking statements, perhaps for reasons described in “Risk Factors”, and perhaps for other unanticipated reasons. Readers should pay particular attention to the considerations described in the section of this report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Forward-Looking Statements; Factors That May Affect Future Results.” Readers should also carefully review the risk factors identified in this Annual Report and in other documents Met-Pro files from time to time with the Securities and Exchange Commission.

|

Item 1. Business:

General:

Met-Pro Corporation (“Met-Pro” or the “Company”), incorporated in the State of Delaware on March 30, 1966 and reincorporated in the State of Pennsylvania on July 31, 2003, manufactures and sells product recovery and pollution control equipment for purification of air and liquids, fluid handling equipment for corrosive, abrasive and high temperature liquids, and filtration and purification products. The Company markets and sells its products through its own personnel, distributors, representatives and agents. The Company’s products are sold worldwide primarily in industrial markets. The Company was taken public on April 6, 1967 and traded on the American Stock Exchange from July 25, 1978 until June 18, 1998, at which time the Company’s Common Shares began trading on the New York Stock Exchange, where it currently trades under the symbol “MPR”.

The Company’s principal executive offices are located at 160 Cassell Road, Harleysville, Pennsylvania and the telephone number at that location is (215) 723-6751. Our website address is www.met-pro.com.

Our Annual Report on Form 10-K and other reports filed pursuant to Section 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are made available free of charge on or through our website at www.met-pro.com as soon as reasonably practicable after such reports are filed with, or furnished to, the Securities and Exchange Commission (the “SEC”). Copies of our (i) Corporate Governance Guidelines, (ii) charters for the Audit Committee, Compensation and Management Development Committee, and Corporate Governance and Nominating Committee, and (iii) Code of Business Conduct and Ethics are available at www.met-pro.com under the “Investor Relations – Corporate Governance” captions. Copies will also be provided to any shareholder upon written request to the Secretary, Met-Pro Corporation, 160 Cassell Road, P.O. Box 144, Harleysville, Pennsylvania 19438.

Except where otherwise indicated by the context used herein, references to the “Company”, “we”, “our” and “us” refer to Met-Pro Corporation, its business units and its wholly-owned subsidiaries.

Products, Services and Markets:

The Company has identified five operating segments and has aggregated those operating segments into three reportable segments: Product Recovery/Pollution Control Technologies, Fluid Handling Technologies and Mefiag Filtration Technologies, and one other segment (Filtration/Purification Technologies). The Filtration/Purification Technologies segment is comprised of two operating segments that do not meet the criteria for aggregation outlined in Statement of Financial Accounting Standards (“SFAS”) No. 131, but which can be combined due to certain quantitative thresholds listed in SFAS No. 131.

The following is a description of each segment:

Product Recovery/Pollution Control Technologies Reporting Segment:

This reportable segment consists of one operating segment that manufactures products for the purification of air or liquids. Many of these products are custom designed and engineered to solve a customer’s product recovery or pollution control issues. The products are sold worldwide through Company sales personnel and a network of manufacturer’s representatives. This reporting segment is comprised of the Duall, Systems, Flex-Kleen, Strobic Air and Met-Pro Product Recovery/Pollution Control Technologies Inc. (formerly named Flex-Kleen Canada Inc.) business units.

Duall, located in Owosso, Michigan, is a leading manufacturer of industrial and municipal air and water quality control systems. The business unit’s major products include chemical and AroBIOS™ biological odor control systems, fume and emergency gas scrubbers, HydroLance™ wet particulate collectors, air strippers and degasifiers for contaminated groundwater treatment, ducting and exhaust fans. Equipment is fabricated from corrosion resistant materials. Duall’s support services include pilot studies, engineering, installation, preventative maintenance, and performance testing. Duall products are sold both domestically and internationally to a wide variety of markets including the metal finishing, plating, wastewater treatment, composting, food processing, ethanol production, chemical, printed circuit, semiconductor, steel pickling, pharmaceutical, battery manufacturing and groundwater remediation markets. Market specific sales managers and factory trained manufacturer’s representatives sell Duall’s engineered systems to industrial and municipal clients with international sales being achieved through our International Sales business unit as well as through our wholly-owned Canadian subsidiary, Met-Pro Product Recovery/Pollution Control Technologies Inc.

Systems, located in Harleysville, Pennsylvania, is a leader in the supply of custom designed and manufactured air and water pollution control equipment. The business unit’s air pollution control capabilities include: carbon adsorption systems for the concentration and recovery of volatile solvents, thermal and catalytic oxidation systems, regenerative thermal oxidizers, enclosed flares and the supply of abatement catalysts. These systems are custom engineered for clients in the emerging ethanol industry as well as the automotive, aerospace and furniture industries. Additional applications include the painting, pharmaceutical, petrochemical, chemical, electronics, food processing and printing industries. Systems in-depth engineering capabilities allow plant owners to satisfy strict air pollution regulations while minimizing fuel costs. Systems also offers a full range of catalyst products for the oxidation of pollutants, which include catalysts for the oxidation of chlorinated solvents and low temperature oxidation catalysts. Systems products are sold by a combination of in-house personnel and manufacturer’s representatives with international sales being achieved through our International Sales business unit as well as through our wholly-owned Canadian subsidiary, Met-Pro Product Recovery/Pollution Control Technologies Inc.

Flex-Kleen, located in Glendale Heights, Illinois, is a leading supplier of product recovery and dry particulate collectors that are used primarily in the process of manufacturing industrial and consumer goods, food products and pharmaceuticals. While some of Flex-Kleen’s products are used for nuisance collection of particulates to conform to environmental concerns, the larger portion of its sales activity is for product collection and is process driven. Flex-Kleen’s products are sold by a combination of in-house personnel and manufacturer’s representatives with international sales being achieved through our International Sales business unit as well as through our wholly-owned Canadian subsidiary, Met-Pro Product Recovery/Pollution Control Technologies Inc.

Strobic Air, located in Harleysville, Pennsylvania, a recognized technological leader in the air movement industry, designs and manufactures technologically advanced exhaust systems for laboratory fume hoods in university, public health, government, chemical, pharmaceutical, industrial and other process industries. With three decades of experience in addressing the needs of laboratory researchers and facility owners, Strobic Air has continued to develop and enhance its Tri-Stack™ roof exhaust systems to provide even greater flows, lower energy costs and decreased noise levels. Strobic Air Tri-Stack™ laboratory fume hood exhaust systems meet the requirements of ANSI Z9.5, American National Standard for Laboratory Ventilation. Heat recovery systems by Strobic Air provide energy conservation on laboratory fume hood exhaust systems. Unique glycol/water heat exchanger coil modules for Tri-Stack™ systems extract exhaust heat for heating or cooling conditioned makeup air. Strobic’s HEPA filtration system complies with ventilation standards for specialized care environments such as airborne infection isolation rooms. Sales, engineering and customer service are provided both internally and through a network of manufacturer’s representatives located in offices worldwide. International sales are achieved through our International Sales business unit as well as through our wholly-owned Canadian subsidiary, Met-Pro Product Recovery/Pollution Control Technologies Inc.

Met-Pro Product Recovery/Pollution Control Technologies Inc. located in Vaughan, Ontario, Canada, markets, sells and distributes in Canada products of the other business units in our Product Recovery/Pollution Control reporting segment.

Fluid Handling Technologies Reporting Segment:

This reportable segment is comprised of one operating segment that manufactures high quality horizontal, vertical, and in-tank centrifugal pumps that handle corrosive, abrasive and high temperature liquids. This combination of pump types and configurations provides products that excel in applications requiring corrosion resistance such as: the pumping of acids, brines, caustics, bleaches, seawater, a wide variety of waste liquids, and high temperature liquids used in many industrial and commercial applications. These products are sold worldwide through an extensive network of distributors. This reporting segment is comprised of the Dean Pump, Fybroc and Sethco business units.

Dean Pump, located in Indianapolis, Indiana, designs and manufactures high quality horizontal and vertical centrifugal pumps that handle a broad range of applications. Industrial markets served include the chemical, petrochemical, refinery, pharmaceutical, plastics, pulp and paper, and food processing industries. Commercial users include hospitals, universities, and laboratories. Customers choose Dean Pump products for their quality and for suitability to handle difficult applications, particularly on high temperature liquid applications. Dean Pump’s products are sold worldwide through an extensive network of distributors.

Fybroc, located in Telford, Pennsylvania, is the world leader in the manufacture of fiberglass reinforced plastic (“FRP”) centrifugal pumps. These pumps provide excellent corrosion resistance for tough applications including the pumping of acids, brines, caustics, bleaches, seawater and a wide variety of waste liquids. Fybroc’s second generation epoxy resin, EY-2, allows the Company to offer corrosion resistant and high temperature FRP thermoset pumps suitable for solvent applications. The EY-2 material also expands Fybroc’s pumping capabilities to include certain acid applications such as high concentration sulfuric acid (75-98%). Fybroc pumps are sold to many markets including the chemical, petrochemical, pharmaceutical, fertilizer, pesticides, steel, pulp and paper, electric utility, aquaculture, aquarium, commercial marine/navy, desalination/water reuse, and industrial and municipal waste treatment industries. Fybroc’s products are sold worldwide through an extensive network of distributors.

Sethco, located in Telford, Pennsylvania, designs, manufactures and sells a variety of horizontal and vertical corrosion resistant pumps with flow rates of up to approximately 250 gallons per minute. Primarily manufactured from polypropylene or Kynar (PVDF), Sethco’s products are used extensively in the metal finishing, electronics, chemical processing and waste water treatment industries. Sethco’s products are sold directly through Company regional sales managers and through a worldwide network of non-exclusive distributors, catalog houses, and original equipment manufacturers.

Mefiag Filtration Technologies Reporting Segment:

This reportable segment is comprised of one operating segment that manufactures filtration systems utilizing primarily horizontal disc technology. This reporting segment is comprised of the Mefiag B.V., Mefiag (Guangzhou) Filter Systems Ltd., and the Mefiag business units.

Mefiag B.V., the Company’s wholly-owned subsidiary located in Heerenveen, The Netherlands, and the Company’s indirect wholly-owned subsidiary, Mefiag (Guangzhou) Filter Systems Ltd., located in Guangzhou, the People’s Republic of China, designs, manufactures and sells filter systems primarily utilizing horizontal disc technology for superior performance, particularly in high efficiency and high-flow applications. Mefiag® filters are used in tough, corrosive applications in the plating, metal finishing and printing industries. Worldwide sales are accomplished directly through regional sales managers, qualified market-based distributors and original equipment manufacturers located throughout Europe, Asia and other major markets around the world.

Mefiag, located in Owosso, Michigan, designs, manufactures and sells horizontal disc, cartridge, bag, carbon, and oil absorbing filter products for use in tough, corrosive applications in the plating, metal finishing and printing industries. Sales in the Americas are generated directly through regional sales managers, qualified market-based distributors and original equipment manufacturers.

Filtration/Purification Technologies Segment:

This other segment consists of two operating segments that produce the following products: proprietary chemicals for the treatment of municipal drinking water systems and boiler and cooling tower systems, cartridges and filter housings, and filtration products for difficult industrial air and liquid applications. This other segment is comprised of the Keystone Filter and Pristine Water Solutions operating segments.

Keystone Filter, located in Hatfield, Pennsylvania, is an established custom pleater and filter cartridge manufacturer. Keystone Filter provides custom designed and engineered products which are currently used in a diversity of applications such as the nuclear power industry, components in medical equipment and in indoor air quality equipment. Keystone Filter also provides standard filters for water purification and industrial applications. Sales and customer service are provided directly through sales managers and through a non-exclusive distributor network.

Pristine Water Solutions Inc. (“Pristine”), located in Waukegan, Illinois, is a leading manufacturer of safe and reliable water treatment compounds. Pristine is the consolidation of the Company’s Stiles-Kem and Pristine Hydrochemical Inc. businesses, product lines and operations into a wholly owned subsidiary of the Company. This consolidation was effective as of February 1, 2006. Products sold by Pristine have been used in the public drinking water industry since 1955. Pristine’s Aquadene™ products are designed to eliminate problems created by high iron and manganese levels in municipal water systems. They also reduce scaling and general corrosion tendencies within water distribution piping systems as well as help municipalities meet soluble lead and copper limits in drinking water. These food grade products are NSF/ANSI approved for use in municipal drinking water supplies and are certified to meet or exceed existing state and federal guidelines. Pristine’s product line also includes coagulant and flocculent polymer products for both municipal and industrial applications which are used to improve water clarity and reduce sludge volume. Pristine also markets a chlorine dioxide treatment program for municipal drinking water disinfection which helps customers reduce trihalomethane formation as required by the EPA. In addition, Pristine markets and sells a line of Bio-Purge™ products for drinking well water remediation as well as boiler and cooling tower chemicals and services to industrial and commercial markets. This allows customers to maximize their heat transfer efficiency and save operating costs through energy conservation. Pristine’s products are sold directly through regional sales managers or agents and also through a network of distributors located in the United States and Canada. Pristine offers technical and laboratory customer support from the Waukegan facility.

United States Sales versus Foreign Sales:

The following table sets forth certain data concerning total net sales to customers by geographic area in the past three years:

| | Percentage of Net Sales |

| | Fiscal Year Ended January 31, |

| | 2009 | | 2008 | | 2007 | |

| United States | 74.3 | % | 71.7 | % | 75.9 | % |

| Foreign | 25.7 | % | 28.3 | % | 24.1 | % |

| Net Sales | 100.0 | % | 100.0 | % | 100.0 | % |

Customers:

During each of the past three fiscal years, no single customer accounted for 10% or more of the total net sales of the Company in any year. The Company does not believe that it would be materially adversely affected by the loss of any single customer.

Seasonality:

The Company does not consider its business, as a whole, to be seasonal in nature, although a limited number of its product lines are seasonal in nature.

Competition:

The Company experiences competition from a variety of sources with respect to virtually all of its products. The Company knows of no single entity that competes with it across the full range of its products and systems. The lines of business in which the Company is engaged are highly competitive. Competition in the markets served is based on a number of considerations, which may include price, technology, applications experience, know-how, reputation, product warranties, service and distribution.

With respect to the Fluid Handling Technologies reporting segment, specifically the pump manufacturing operations, several companies, including Ingersoll Dresser Pump Co. (a subsidiary of Flowserve Corporation) and Goulds Pumps, Inc. (a subsidiary of ITT Industries), dominate the industry with several smaller companies, including Met-Pro, competing in select product lines and niche markets.

With respect to the Product Recovery/Pollution Control Technologies reporting segment, Mefiag Filtration Technologies reporting segment and Filtration/Purification Technologies segment, we compete with numerous smaller as well as larger competitors, but there are no companies that dominate the markets in which we participate.

The Company is unable to state with certainty its relative positions in its various markets, but believes that it is a leading and respected competitor in each of its niche markets.

Research and Development:

Historically, due in part to the diversity of the Company’s products, research and development activities were typically initiated and conducted on a business unit basis. Effective February 1, 2007, the Company created the position of Technical Director who is responsible for coordinating the Company’s research and development activities on a Company-wide basis. Research is directed towards the development of new products related to current product lines, and the improvement and enhancement of existing products.

The principal goals of the Company’s research programs are maintaining the Company’s technological capabilities in the production of product recovery/pollution control equipment, fluid handling equipment, Mefiag filtration equipment and filtration/purification equipment; developing new products; and providing technological support to the manufacturing operations.

Research and development expenses were $1.8 million, $1.8 million and $2.3 million for the years ended January 31, 2009, 2008 and 2007, respectively.

Patents and Trademarks:

The Company has a number of patents and trademarks. The Company considers these rights important to certain of its businesses, although it considers no individual right material to its business as a whole.

Regulatory Matters:

The Company is subject to environmental laws and regulations concerning air emissions, discharges to water processing facilities, and the generation, handling, storage and disposal of waste materials in all operations. All of the Company’s production and manufacturing facilities are controlled under permits issued by federal, state and local regulatory agencies. The Company believes it is presently in compliance in all material respects with these laws and regulations. To date, compliance with federal, state and local provisions relating to protection of the environment has had no material effect upon capital expenditures, earnings or the competitive position of the Company.

Backlog:

Generally, the Company’s customers do not enter into long-term contracts, but rather issue purchase orders which are subject to negotiation and acceptance by the Company, at which point the Company considers the order to be “booked” and to be in backlog. Certain orders that are included in our backlog amounts may be subject to customer approvals, most typically, approval of engineering drawings. The rate of the Company’s bookings of new orders varies from month to month. Orders have varying delivery schedules, and as of any particular date, the Company’s backlog may not be predictive of actual revenues for any succeeding specific period, in part due to potential customer requested delays in delivery of which the extent and duration may vary widely from period to period. Additionally, the Company’s customers typically have the right to cancel a given order, although the Company has historically experienced a very low rate of cancellation.

The dollar amount of the Company’s backlog of orders totaled $15,345,892 and $17,330,906 as of January 31, 2009 and 2008, respectively. The Company expects that substantially all of the backlog that existed as of January 31, 2009 will be shipped during the ensuing fiscal year. We have observed a trend over the last several years where larger projects are more frequently booked and shipped in the same quarter in which we received the customer purchase order due to improved project execution and shorter lead times, resulting in such projects not appearing in publicly disclosed annual or quarterly backlog figures.

Working Capital:

Certain business units require more significant working capital requirements than other business units, such as in the larger project business units comprising our Product Recovery/Pollution Control Technologies reporting segment. Additionally, inventory levels of our Fluid Handling Technologies reporting segment are not insubstantial. However, there have been no material changes in business practices that would result in material changes to our working capital requirements apart from the growth in sales, and we consider our working capital to be adequate.

Raw Materials:

The Company procures its raw materials and supplies from various sources. The Company believes it could secure substitutes for the raw materials and supplies should they become unavailable, but there are no assurances that the substitutes would perform as well or be priced as competitively. The Company has not experienced any significant difficulty in securing raw materials and supplies, and does not anticipate any significant difficulty in procurement in the coming year or foreseeable future.

Employees:

As of January 31, 2009, the Company employed 363 people, of whom 149 were involved in manufacturing, and 214 were engaged in administration, sales, engineering, supervision and clerical work. The Company has had no work stoppages during the past five years and considers its employee relations to be good.

Foreign Operations:

Most of the Company’s operations and assets are located in the United States. However, the Company also owns a manufacturing operation in Heerenveen, The Netherlands, through its wholly-owned subsidiary, Mefiag B.V., operates a sales office and warehouse in Vaughan, Ontario, Canada through its wholly-owned subsidiary, Met-Pro Product Recovery/Pollution Control Technologies Inc., and operates a manufacturing facility in the People’s Republic of China, through its wholly-owned subsidiary, Mefiag (Guangzhou) Filter Systems Ltd.

The Company believes that currency fluctuations and political and economic instability do not constitute substantial risks to its business.

For information concerning foreign net sales on a reporting segment basis, reference is made to the consolidated business segment data contained on page 36.

New York Stock Exchange and Securities and Exchange Commission Certifications:

During the fiscal year ended January 31, 2009, the Company submitted to the New York Stock Exchange (the "NYSE") the certification of the Chief Executive Officer that he was not aware of any violation by Met-Pro Corporation of the NYSE's corporate governance listing standards as required by Section 303A.12(a) of the New York Stock Exchange Listed Company Manual. In addition, the Company has filed with the SEC, as exhibits to this Form 10-K for the fiscal year ended January 31, 2009, the Chief Executive Officer's and Chief Financial Officer's certifications regarding the quality of the Company's public disclosure, disclosure controls and procedures, and internal controls over financial reporting as required by Section 302 of the Sarbanes-Oxley Act of 2002 and related SEC rules.

The following table sets forth certain information regarding the Executive Officers of the Registrant as of the filing date of this report:

Raymond J. De Hont, age 55, is Chairman of the Board, Chief Executive Officer and President of the Company. Mr. De Hont was elected Chairman of the Board in September 2003. He was elected President and Chief Executive Officer in March 2003 and a Director of the Company in February 2003. Mr. De Hont served as the Chief Operating Officer of the Company from June 2000 to March 2003. From June 1995 to December 2000, Mr. De Hont was Vice President and General Manager of the Company’s Fybroc business unit, during which time, starting in October 1999, he also served as General Manager for the Company’s Dean Pump business unit.

Gary J. Morgan, CPA, age 54, is Senior Vice President-Finance, Chief Financial Officer, Secretary, Treasurer and a Director of the Company. He was appointed Vice President-Finance, Chief Financial Officer, Secretary and Treasurer in October 1997, and became a Director of the Company in February 1998. Mr. Morgan joined the Company in 1980 and served as the Company’s Corporate Controller immediately prior to October 1997.

Paul A. Tetley, age 50, is Executive Vice President of the Company, a position to which he was appointed in March 2006, with responsibilities for Duall, Flex-Kleen, Met-Pro Product Recovery/Pollution Control Technologies Inc., Systems and the International Sales business unit, as well as for Strobic Air Corporation where he continues to serve as General Manager, a position he has held since December 1999. Mr. Tetley joined the Company in 1996 in connection with the Company’s acquisition of the business now conducted by Strobic Air Corporation, where he had worked as the Engineering/Production Manager.

Gennaro A. D’Alterio, age 37, is Vice President of the Company, a position to which he was appointed in February 2009. Mr. D’Alterio continues to serve as General Manager of the Company’s Pump Group, which includes the Sethco, Fybroc and Dean Pump business units, a position he has held since July 2007. Since joining the Company in 1994, he has served in a variety of roles including: Sales and Marketing Manager for the Sethco, Fybroc and Dean Pump business units and Regional Sales Manager for the Fybroc business unit.

Gregory C. Kimmer, age 54, is Vice President of the Company and General Manager of Duall, to which offices he was appointed in October 1989. For more than five years prior thereto, Mr. Kimmer was employed by the company whose business is now operated as Duall.

Lewis E. Osterhoudt, age 58, is Vice President of the Company and General Manager of Keystone Filter, to which offices he was appointed in June 2004. Mr. Osterhoudt joined the Company in March 2004, initially serving as Assistant to the President. For more than five years prior thereto, Mr. Osterhoudt was employed by Hardy Machine and Design Inc. and I.O. Gold Systems Inc., most recently as Operations Manager and President, respectively.

Vincent J. Verdone, age 61, is Vice President of the Company and General Manager of the Company’s Pristine Water Solutions Inc. subsidiary. Mr. Verdone joined the Company in January 2005. For more than five years prior thereto, Mr. Verdone was employed by Ashland Inc., in which his last position was North American Corporate Sales Manager.

There are no family relationships between any of the Directors or Executive Officers of the Registrant. Each officer serves at the pleasure of the Board of Directors, subject, however, to agreements the Company has with certain officers providing for compensation in the event of termination of employment following a change in control of the Company. ��See “Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters” referenced in Item 12 of this Report.

Any of the events discussed as risk factors below may occur. If they do, our business, financial condition, results of operations and cash flows could be materially adversely affected. Additional risks and uncertainties not identified in this or other SEC filings, or that we currently deem immaterial, may also impair our business operations.

Our operating results may be adversely affected by unfavorable economic and market conditions and the uncertain geopolitical environment.

Economic conditions have recently deteriorated significantly in many of the countries and regions in which we do business and may remain depressed for the foreseeable future. Global economic conditions have been challenged by slowing growth and the sub-prime debt devaluation crisis, causing worldwide liquidity and credit concerns. Continuing adverse global economic conditions in our markets would likely negatively impact our business, which could result in:

| reduced demand for our products, especially for those offered by our Product Recovery/Pollution Control Technologies reporting segment, which include large dollar projects more likely to be affected by economic conditions; |

| increased price competition for our products; |

| increased risk of excess and obsolete inventories; |

| increased risk in the collectability of cash from our customers; |

| increased risk in potential reserves for doubtful accounts and write-offs of accounts receivable; and |

| · | higher operating costs as a percentage of revenues. |

| We sell our products in highly competitive markets, which puts pressure on our profit margins and limits our ability to maintain or increase the market share of our products. |

The markets for our products are fragmented and highly competitive. We compete against a very diverse number of companies across our many markets. Depending upon the market, our competitors include large and well-established national and global companies; regional and local companies; low cost replicators of spare parts; and in-house maintenance departments of our end user customers. We compete based on price, technical expertise, timeliness of delivery, previous installation history and reputation for quality and reliability, with price competition tending to be more significant for sales to original equipment manufacturers. Some of our customers are attempting to reduce the number of vendors from which they purchase in order to reduce the size and diversity of their inventory. To remain competitive, we will need to invest continuously in manufacturing, marketing, customer service and support, and our distribution networks. No assurances can be made that we will have sufficient resources to continue to make the investment required to maintain or increase our market share or that our investments will be successful. If we do not compete successfully, our business, our financial condition, results of operations and cash flows could be adversely affected.

| We are party to asbestos-containing product litigation that could adversely affect our financial condition, results of operations and cash flows. |

Beginning in 2002, the Company and/or one of its business units began to be named as one of many defendants in asbestos-related lawsuits filed predominantly in Mississippi on a mass basis by large numbers of plaintiffs against a large number of industrial companies including, in particular, those in the pump and fluid handling industries. The complaints filed against the Company and/or this business unit have been vague, general and speculative, alleging that the Company, and/or the business unit, along with the numerous other defendants, sold unidentified asbestos-containing products and engaged in other related actions which caused injuries (including death) and loss to the plaintiffs. More recent cases typically allege more serious claims of mesothelioma. The Company believes that it and/or the business unit have meritorious defenses to the cases which have been filed and that none of its and/or the business unit's products were a cause of any injury or loss to any of the plaintiffs. The Company’s insurers have hired attorneys who, together with the Company, are vigorously defending these cases. The Company and/or the business unit have been dismissed from or settled a number of these cases. The sum total of payments made through January 31, 2009 to settle these cases is $355,000, all of which has been paid by the Company’s insurers including legal expenses, except for corporate counsel expenses, with an average cost per settled claim, excluding legal fees, of approximately $24,000. As of January 31, 2009, there were a total of 57 cases pending against the Company (with a majority of those cases pending in New York, Mississippi and Maryland), as compared with 38 cases that were pending as of January 31, 2008. During the fiscal year ended January 31, 2009, 29 new cases were filed against the Company, and the Company was dismissed from 10 cases. Most of the pending cases have not advanced beyond the early stages of discovery, although a number of cases are on schedules leading to, or are scheduled for trial. The Company believes that its insurance coverage is adequate for the cases currently pending against the Company and for the foreseeable future assuming a continuation of the current volume and nature of cases; however, the Company has no control over the number and nature of cases that are filed against it nor as to the financial health of its insurers or their position as to coverage. The Company also presently

believes that none of the pending cases will have a material adverse impact upon the Company’s results of operations, liquidity or financial condition.

| Significant changes in pension fund investment performance or assumptions relating to pension costs may have a material effect on the valuation of our obligations under our defined benefit pension plans, the funded status of these plans and our pension expense. |

We maintain defined benefit pension plans that we must fund despite the freezing of the accrual of future benefits for our salaried and non-union hourly employees, effective December 31, 2006, and our union hourly employees, effective December 31, 2008. In these plans’ fiscal year ended January 31, 2009, we contributed approximately $0.9 million. As of January 31, 2009, our unfunded pension liability was approximately $8.8 million, which is an increase of $6.6 million from the unfunded liability as of October 31, 2007, due to losses in the funds’ investment portfolios. We anticipate that we will be required to contribute approximately $1.7 million to these pension funds during the fiscal year ending January 31, 2010. The amount of this pension liability is also materially affected by the discount rate used to measure our pension obligations and, in the case of the plans such as ours that are required to be funded, the level of plan assets available to fund those obligations and the expected long-term rate of return on plan assets. A change in the discount rate can result in a significant increase or decrease in the valuation of pension obligations, affecting the reported status of our pension plans and our pension expense. Significant changes in investment performance or a change in the portfolio mix of invested assets can result in increases and decreases in the valuation of plan assets or in a change of the expected rate of return on plan assets. Changes in the expected return on plan assets assumption can result in significant changes in our pension expense.

| If our goodwill or indefinite-lived intangible assets become impaired, we may be required to record a significant charge to earnings. |

We carry approximately $20.8 million of goodwill on our balance sheet, or approximately 20% of our total assets. Approximately $11.1 million of the $20.8 million relates to our Flex-Kleen business unit. Under United States generally accepted accounting principles, goodwill and indefinite-lived intangible assets are not amortized but are reviewed for impairment on an annual basis or more frequently whenever events or changes in circumstances indicate that their carrying value may not be recoverable. The Flex-Kleen business unit, which initially performed well after being acquired by Met-Pro, thereafter had several years of declining performance which we attributed primarily to a general weakness in its served markets, followed by improved performance in the fiscal years ended January 31, 2007, 2008 and 2009. We have also made management changes at Flex-Kleen which we believe are helping to improve Flex-Kleen’s performance. During each of the last several fiscal years, including the fiscal year ended January 31, 2009, we performed an impairment analysis of the $11.1 million of goodwill that the Company carries for Flex-Kleen and concluded that no impairment has occurred. The carrying value of the Flex-Kleen business unit as of January 31, 2009 and 2008 amounted to $12.8 million and $12.2 million, respectively. The fair value of the Flex-Kleen business unit as of January 31, 2009 and 2008 totaled $14.2 million and $14.4 million, respectively. As a result, the fair value exceeded the carrying amount, including goodwill, by $1.4 million and $2.2 million at January 31, 2009 and 2008, respectively. Therefore, as of January 31, 2009, the Flex-Kleen business unit’s goodwill was not impaired. Because of market conditions and/or potential changes in strategy and product portfolio, it is possible that forecasts used to support asset carrying values may change in the future, which could result in non-cash charges that would adversely affect our results of operations and financial condition. Based on current projections, a one percent decrease in revenue growth, a one percent decrease in gross margin or a one percent increase in the weighted average cost of capital would reduce the fair value for the Flex-Kleen business unit by $2.2 million, $1.5 million, and $0.9 million, respectively. Additionally, the Company cannot predict the occurrence of unknown events that might adversely affect the reportable value of costs in excess of net assets of businesses acquired.

Flex-Kleen’s performance needs to continue to improve in order for us not to be required to write-off some or all of its goodwill. If in the future we determine that there has been an impairment of Flex-Kleen’s goodwill, we will be required to record a non-cash charge to earnings, to the extent of the impairment, during the period in which any impairment of our goodwill or indefinite-lived intangible assets is determined, which would produce an adverse impact upon our results of operations. For each of the last three fiscal years, including the fiscal year ended January 31, 2009, the actual net sales and operating profit for our Flex-Kleen business unit exceeded the projections used in our annual impairment model. We anticipate that Flex-Kleen’s performance during the fiscal year beginning February 1, 2009 will be at a level that will not indicate impairment of its goodwill, but this expectation is a forward-looking statement where the actual results may not be as we presently anticipate. Please refer to page 25 “Critical Accounting Policies and Estimates” for additional information concerning goodwill impairment.

During our fiscal year ended January 31, 2008, we restated prior period financial statements and determined that we had material weaknesses in our internal control over financial reporting. Although we have made changes in our internal controls and believe that our internal control over financial reporting was effective as of January 31, 2009 as well as January 31, 2008, no evaluation of controls can provide absolute assurances that misstatements due to fraud or errors will not occur. |

During our prior fiscal year ended January 31, 2008, we restated our financial statements for the fiscal year and fiscal quarter ended January 31, 2007 and for the fiscal quarters ended October 30, 2006, April 30, 2007, July 31, 2007 and October 30, 2007 as a result of revenue recognition errors. Specifically, the combination of the lack of effective policies and procedures surrounding the review of terms and conditions of customer purchase orders and with respect to the status of those orders, and other weaknesses in our controls as more fully identified in Item 9A in our Annual Report on Form 10-K for the fiscal year ended January 31, 2008, contributed (together with false statements by vendors, documents fabricated by an employee, and other unauthorized actions by the employee explicitly intended to circumvent our revenue recognition policies and procedures, as well as other policies and procedures) to the reporting of incorrect net sales and net income, as well as related errors, in our financial statements for the indicated fiscal periods.

In connection with this we determined that we had material weaknesses in our internal control over financial reporting, which we believe was remediated prior to January 31, 2008. However, because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all instances of fraud, if any, within the Company have been detected.

| If we are unable to obtain raw materials at favorable prices, our operating margins and results of operations will be adversely affected. |

We purchase substantially all electric power and other raw materials we use in the manufacturing of our products from outside sources. The costs of these raw materials have been volatile historically and are influenced by factors that are outside our control. In recent years, the prices for energy, metal alloys and certain other of our raw materials have increased, with the prices for energy currently exceeding historical averages. If we are unable to pass increases in the costs of our raw materials to our customers, our operating margins and results of operations will be adversely affected.

| We may incur material costs as a result of product liability and warranty claims, which could adversely affect our financial condition, results of operations and cash flows. |

We may be exposed to product liability and warranty claims in the event that the use of our products results, or is alleged to result, in bodily injury and/or property damage or our products actually or allegedly fail to perform as expected. While we maintain insurance coverage with respect to certain product liability claims, we may not be able to obtain such insurance on acceptable terms in the future, if at all, and any such insurance may not provide adequate coverage against product liability claims. In addition, product liability claims can be expensive to defend and can divert the attention of management and other personnel for significant periods of time, regardless of the ultimate outcome. An unsuccessful defense of a product liability claim could have an adverse affect on our business, results of operations and financial condition and cash flows. Even if we are successful in defending against a claim relating to our products, claims of this nature could cause our customers to lose confidence in our products and our Company. Warranty claims are not covered by insurance, and we may incur significant warranty costs in the future for which we would not be reimbursed.

| Natural or man-made disasters could negatively affect our business. |

Future disasters caused by earthquakes, hurricanes, floods, terrorist attacks or other events, and any potential response by the U.S. government or military, could have a significant adverse effect on the general economic, market and political conditions, which in turn could have a material adverse effect on our business.

A substantial portion of our business is sold internationally, we also manufacture outside the United States, and we plan to increase our international distribution and manufacturing of our products. These international activities subject us to additional business risks. |

In the fiscal year ended January 31, 2009, 26% of our sales were to customers outside the United States, as compared with 28% in the prior fiscal year. As part of our business strategy, we intend to increase our international sales, although we cannot assure you that we will be able to do so. Conducting business outside of the United States subjects us to additional risks, including:

| | · | export and import restrictions, tax consequences and other trade barriers, |

| | · | currency fluctuations, |

| | · | greater difficulty in accounts receivable collections, |

| | · | economic and political instability, |

| | · | foreign exchange controls that prohibit payment in U.S. dollars, and |

| | · | increased complexity and costs of managing and staffing international operations. |

| Our products could infringe the intellectual property rights of others and we may be exposed to costly litigation. |

The products we sell are continually changing as a result of improved technology. Although we and our suppliers attempt to avoid infringing known proprietary rights of third parties in our products, we may be subject to legal proceedings and claims for alleged infringement by us, our suppliers or our distributors, of third parties’ patents, trade secrets, trademarks or copyrights.

Any claims relating to the infringement of third-party proprietary rights, even if not meritorious, could result in costly litigation, divert management's attention and resources, or require us to either enter into royalty or license agreements which are not advantageous to us, or pay material amounts of damages. In addition, parties making these claims may be able to obtain an injunction, which could prevent us from selling our products. We may increasingly be subject to infringement claims as we expand our product offerings.

| Our ability to operate our Company effectively could be impaired if we fail to attract and retain key personnel. |

Our ability to operate our businesses and implement our strategies depends, in part, on the efforts of our executive officers and other key employees. In addition, our future success will depend on, among other factors, our ability to attract and retain qualified personnel, particularly research professionals, technical sales professionals and engineers. The loss of the services of any key employee or the failure to attract or retain other qualified personnel could have a material adverse effect on our business or business prospects.

| Changes in accounting may affect our reported earnings. |

For many aspects of our business, United States generally accepted accounting principles, including pronouncements, implementation guidelines, and interpretations, are highly complex and require subjective judgments. Additionally, changes in these accounting principles, including their interpretation and application, could significantly change our reported earnings, adding significant volatility to our reported results without a comparable underlying change in our cash flows.

| Additional Risks to the Company. |

The Company is subject to various risks occurring in the normal course of business. The Forward-Looking Statements; Factors That May Affect Future Results in the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of this Report sets forth a list of risks, including those identified above, that may adversely affect the Company and is incorporated herein by reference.

None.

The following manufacturing and production facilities were owned or leased by the Company as of the date of filing this report:

| | Name | | Structure | | | Property/Location | Status |

| | | | | |

| Executive Offices, | 73,000 square foot, cement | | 17 acres in Harleysville, | Owned |

| International Sales, | building, with finestone facing | | Pennsylvania | |

| Systems and | | | | |

| Strobic Air | | | | |

| | | | | |

| Keystone Filter | 31,000 square foot, cement | | 2.3 acres in Hatfield, | Owned |

| | block building | | Pennsylvania | |

| | | | | |

| Sethco and Fybroc | 93,500 square foot, cement | | 8 acres in Telford, | Owned |

| | building with brick facing | | Pennsylvania | |

| | | | | |

| Dean Pump | 66,000 square foot, metal | | 17.1 acres in Indianapolis, | Owned |

| | building | | Indiana | |

| | | | | |

| Duall and Mefiag | 63,000 square foot, metal | | 7 acres in Owosso, | Owned |

| | and masonry building | | Michigan | |

| | | | | |

| Flex-Kleen | 45,500 square foot, brick building | | 2.3 acres in Glendale Heights, | Owned |

| | | | Illinois | |

| | | | | |

| Met-Pro Product | 3,239 square foot, masonry | | Vaughan, Ontario, Canada | Leased(1) |

| Recovery/Pollution Control | building | | | |

| Technologies Inc. | | | | |

| | | | | |

| Pristine Water Solutions Inc. | 22,000 square foot, cement | | 2.55 acres in Waukegan, | Owned |

| | block building | | Illinois | |

| | | | | |

| Mefiag B.V. | 34,000 square foot, metal | | 1.1 acres in Heerenveen, | Owned |

| | and masonry building | | The Netherlands | |

| | | | | |

| | Vacant land | | 3 acres in Heerenveen, | Owned |

| | | | The Netherlands | |

| | | | | |

| Mefiag (Guangzhou) Filter | 11,000 square foot cement | | Guangzhou, People’s Republic | Leased(2) |

| Systems Ltd. | building | | of China | |

| (1) | On April 1, 2008, Met-Pro Product Recovery/Pollution Control Technologies Inc. entered into a lease for a sales and warehouse facility in Vaughan, Ontario, Canada which expires on March 31, 2011. |

| (2) | Mefiag (Guangzhou) Filter Systems Ltd.’s lease for the operation in Guangzhou, People’s Republic of China expires on July 31, 2010. |

Certain of the statements made in this Item 3 (and elsewhere in this Report) are “forward-looking” statements which are subject to the considerations set forth in “Forward-Looking Statements; Factors That May Affect Future Results” located in the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of this Report, and we refer you to these considerations.

Beginning in 2002, the Company and/or one of its business units began to be named as one of many defendants in asbestos-related lawsuits filed predominantly in Mississippi on a mass basis by large numbers of plaintiffs against a large number of industrial companies including, in particular, those in the pump and fluid handling industries. The complaints filed against the Company and/or this business unit have been vague, general and speculative, alleging that the Company, and/or the business unit, along with the numerous other defendants, sold unidentified asbestos-containing products and engaged in other related actions which caused injuries (including death) and loss to the plaintiffs. More recent cases typically allege more serious claims of mesothelioma. The Company believes that it and/or the business unit have meritorious defenses to the cases which have been filed and that none of its and/or the business unit's products were a cause of any injury or loss to any of the plaintiffs. The Company’s insurers have hired attorneys who, together with the Company, are vigorously defending these cases. The Company and/or the business unit have been dismissed from or settled a number of these cases. The sum total of payments made through January 31, 2009 to settle these cases is $355,000, all of which has been paid by the Company’s insurers including legal expenses, except for corporate counsel expenses, with an average cost per settled claim, excluding legal fees, of approximately $24,000. As of January 31, 2009, there were a total of 57 cases pending against the Company (with a majority of those cases pending in New York, Mississippi and Maryland), as compared with 38 cases that were pending as of January 31, 2008. During the fiscal year ended January 31, 2009, 29 new cases were filed against the Company, and the Company was dismissed from 10 cases. Most of the pending cases have not advanced beyond the early stages of discovery, although a number of cases are on schedules leading to, or are scheduled for trial. The Company believes that its insurance coverage is adequate for the cases currently pending against the Company and for the foreseeable future assuming a continuation of the current volume and nature of cases; however, the Company has no control over the number and nature of cases that are filed against it nor as to the financial health of its insurers or their position as to coverage. The Company also presently believes that none of the pending cases will have a material adverse impact upon the Company’s results of operations, liquidity or financial condition.

At any given time, the Company is typically also party to a small number of other legal proceedings arising in the ordinary course of business. Although the ultimate outcome of any legal matter cannot be predicted with certainty, based upon the present information, including the Company’s assessment of the facts of each particular claim as well as accruals, the Company believes that no pending proceeding will have a material adverse impact upon the Company’s results of operations, liquidity, or financial condition.

No matters were submitted to a vote of security holders during the fourth quarter of the fiscal year ended January 31, 2009.

(a) Market Information. The Company’s Common Shares are traded on the New York Stock Exchange under the symbol “MPR”. The high and low selling prices of the Common Shares for each quarterly period for the last two fiscal years, as reported on the New York Stock Exchange, are shown below.

| | | Quarter ended | |

| Year ended January 31, 2009 | April | | July | | October | | January |

| | | | | | | | |

| Price range of common shares: | | | | | | | |

| High | $11.76 | | $15.38 | | $16.65 | | $13.50 |

| Low | 9.83 | | 11.67 | | 9.10 | | 8.93 |

| Cash dividend paid | .0550 | | .0550 | | .0550 | | .0600 |

| | | | | | | | |

| Year ended January 31, 2008 | April | | July | | October | | January |

| | | | | | | | |

| Price range of common shares: | | | | | | | |

| High | $12.01 | | $12.21 | | $13.52 | | $12.82 |

| Low | 10.69 | | 11.18 | | 10.40 | | 10.20 |

| Cash dividend paid | .0506 | | .0506 | | .0506 | | .0550 |

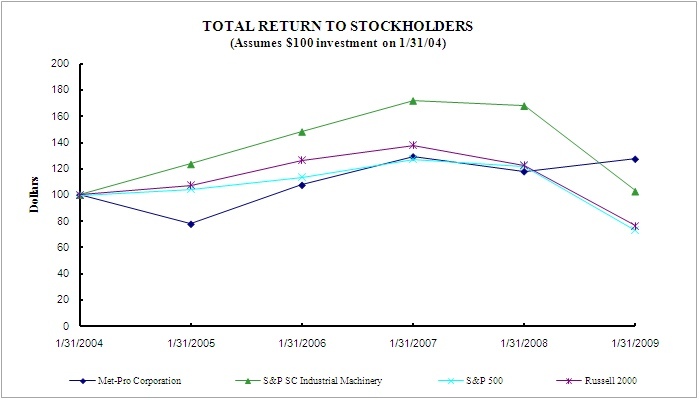

(b) Performance Graph. The following graph sets forth the Company's total cumulative shareholder return as compared to the Russell 2000 Index, the Standard and Poor’s (the “S&P”) 600 Small Cap Industrial Machinery Index and the S&P 500 Index.

The total return on investment assumes $100 invested at the beginning of the period in (i) the Common Shares of the Company, (ii) S&P 600 Small Cap Machinery Index, (iii) S&P 500 Index, and (iv) the Russell 2000 Index. Total return assumes reinvestment of dividends and reflects stock splits. Historical stock price performance is not necessarily indicative of future price performance.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN

Met-Pro Corporation, S&P Industrial Machinery Index,

S&P 500 Index and Russell 2000 Index

| | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| | | | | | | |

| Met-Pro Corporation | $100.00 | $77.82 | $107.43 | $129.04 | $117.77 | $127.29 |

| S&P Industrial Machinery Index | 100.00 | 123.37 | 148.01 | 171.57 | 167.70 | 102.77 |

| S&P 500 Index | 100.00 | 104.43 | 113.17 | 127.15 | 121.87 | 73.01 |

| Russell 2000 Index | 100.00 | 107.45 | 126.25 | 137.81 | 122.82 | 76.37 |

(c) Holders. There were 571 registered shareholders on January 31, 2009, and the Company estimates that there are approximately 2,000 additional shareholders with shares held in street name.

(d) Dividends. The Board of Directors declared quarterly dividends of $.055 per share payable on March 11, 2008, June 12, 2008, and September 10, 2008 to shareholders of record at the close of business on February 26, 2008, May 29, 2008 and August 27, 2008, respectively. The Board of Directors declared quarterly dividends of $.06 per share payable on December 10, 2008 and March 12, 2009 to shareholders of record as of November 26, 2008 and February 26, 2009, respectively.

(e) Securities Authorized For Issuance Under Equity Compensation Plans. Set forth below is information aggregated as of January 31, 2009 with respect to four equity compensation plans previously approved by the Company’s shareholders, being the 1997 Stock Option Plan, the 2001 Equity Incentive Plan, 2005 Equity Incentive Plan and the 2008 Equity Incentive Plan.

| | | | | | | | Number of Securities |

| | | | | | | | Remaining Available |

| | Number of Securities | | | For Future Issuance |

| | to be Issued Upon | Weighted-Average | Under Equity |

| | Exercise of | Exercise Price of | Compensation Plans |

| | Outstanding Options, | Outstanding Options, | (Excluding Securities |

| Plan Category | Warrants and Rights | Warrants and Rights | Reflected in Column (A)) |

| | (A) | (B) | (C) |

| Equity compensation plans approved by | | | | | | | | |

| security holders | | 1,193,533 | (1) | | $9.54 | (1) | 1,078,242 | (1) |

| Equity compensation plans not approved | | | | | | | | |

| by security holders | | - | | | - | | - | |

| (1) | Subject to adjustment by the terms of the plans in connection with stock splits and other similar transactions. |

(f) Stock Repurchases. The Company’s purchases of its Common Shares during the fiscal year ended January 31, 2009, represented in the table below, were made pursuant to the Company’s stock repurchase program first announced on December 19, 2000 (the “2000 Stock Buy Back Program”), which the Company enlarged in connection with stock splits to an aggregate of 711,111 shares. The Company’s purchases during the fiscal year ended January 31, 2009 also included a privately negotiated purchase of 539,867 shares (which is included in the chart below) that was specifically approved by the Company’s Board of Directors. As a result of this transaction, the Company considers the 2000 Stock Buy Back Program to be complete and now terminated. On November 5, 2008, the Company announced a new stock repurchase program covering 300,000 Common Shares. This program has no fixed expiration date.

| Issuer Purchases of |

| Equity Securities |

| | | | | | | | | | |

| | | | | | | Total | | Maximum | |

| | | | | | | Number of | | Number of | |

| | | | | | | Shares | | Shares | |

| | | | | | | Purchased | | That May | |

| | | | | | | As Part of | | Yet Be | |

| | | Total | | | | Publicly | | Purchased | |

| | | Number of | | Average | | Announced | | Under the | |

| | | Shares | | Price Paid | | Plans or | | Plan or | |

| Period | | Purchased | | Per Share | | Programs | | Programs | |

| February 1-29, 2008 | | 0 | | $ - | | 0 | | 310,019 | |

| March 1-31, 2008 | | 0 | | - | | 0 | | 310,019 | |

| April 1-30, 2008 | | 0 | | - | | 0 | | 310,019 | |

| May 1-31, 2008 | | 0 | | - | | 0 | | 310,019 | |

| June 1-30, 2008 | | 0 | | - | | 0 | | 310,019 | |

| July 1-31, 2008 | | 37,327 | | 14.80 | | 0 | | 272,692 | |

| August 1-31, 2008 | | 27,086 | | 15.56 | | 0 | | 245,606 | |

| September 1-30, 2008 | | 100,247 | | 15.67 | | 0 | | 145,359 | |

| October 1-31, 2008 | | 567,075 | | 9.09 | | 0 | | 0 | |

| November 1-30, 2008 | | 0 | | - | | 0 | | 300,000 | |

| December 1-31, 2008 | | 0 | | - | | 0 | | 300,000 | |

| January 1-31, 2009 | | 0 | | - | | 0 | | 300,000 | |

| Total | | 731,735 | | $10.52 | | 0 | | 300,000 | |

| | | | | Years ended January 31, | | | | |

| | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | |

| | | | | | | | | | | |

| Selected Operating Statement Data | | | | | | | | | | |

| Net sales | $103,391,926 | | $106,867,849 | | $93,505,504 | | $87,687,053 | | $74,431,932 | |

| Income from operations | 14,057,079 | | 17,597,491 | (1) | 9,757,075 | | 9,662,604 | | 7,384,115 | |

| Net income | 9,861,065 | | 11,906,165 | (2) | 6,926,804 | | 7,313,284 | | 4,814,679 | |

| Earnings per share, basic | .66 | | .79 | (3) | .46 | | .49 | | .32 | |

| Earnings per share, diluted | .65 | | .78 | (4) | .46 | | .48 | | .32 | |

| | | | | | | | | | | |

| Selected Balance Sheet Data | | | | | | | | | | |

| Current assets | $64,161,732 | | $68,095,140 | | $58,803,353 | | $53,413,413 | | $50,034,033 | |

| Current liabilities | 12,239,667 | | 16,850,801 | | 14,364,393 | | 14,361,953 | | 12,916,500 | |

| Working capital | 51,922,065 | | 51,244,339 | | 44,438,960 | | 39,051,460 | | 37,117,533 | |

| Current ratio | 5.2 | | 4.0 | | 4.1 | | 3.7 | | 3.9 | |

| Total assets | 104,752,304 | | 109,410,903 | | 96,741,657 | | 89,071,391 | | 82,687,604 | |

| Long-term obligations | 3,753,228 | | 4,075,682 | | 5,417,990 | | 2,723,586 | | 4,039,068 | |

| Total shareholders’ equity | 78,777,481 | | 83,243,168 | | 72,313,132 | | 67,538,238 | | 63,165,191 | |

| Total capitalization | 82,530,709 | | 87,318,850 | | 77,731,122 | | 70,261,824 | | 67,204,259 | |

| Return on average total assets, % | 9.2 | | 11.6 | | 7.5 | | 8.5 | | 5.9 | |

| Return on average shareholders’ equity, % | 12.2 | | 15.3 | | 9.9 | | 11.2 | | 7.8 | |

| | | | | | | | | | | |

| Other Financial Data | | | | | | | | | | |

| Net cash flows from operating activities | $12,142,087 | | $9,875,144 | | $3,900,152 | | $4,441,414 | | $8,545,521 | |

| Capital expenditures | 1,580,528 | | 5,456,418 | | 4,398,910 | | 4,151,253 | | 1,193,767 | |

| Dollar value of share repurchases | 7,694,333 | | 630,515 | | - | | 140,135 | | 538,499 | |

| Shareholders’ equity per share | 5.40 | | 5.56 | | 4.84 | | 4.53 | | 4.25 | |

| Cash dividends paid per share | .230 | | .207 | | .191 | | .178 | | .166 | |

| Average common shares, basic | 14,909,809 | | 15,002,012 | | 14,943,174 | | 14,918,209 | | 14,861,124 | |

| Average common shares, diluted | 15,219,540 | | 15,328,368 | | 15,205,012 | | 15,111,483 | | 15,045,342 | |

| Common shares outstanding | 14,600,109 | | 15,039,030 | | 14,953,658 | | 14,929,480 | | 14,876,518 | |

| (1) | Includes $3,513,940 from the sale of a building owned by the Company in Hauppauge, New York. |

| (2) | Includes $2,213,782 (net of tax) from the sale of a building owned by the Company in Hauppauge, New York. |

| (3) | Includes $0.14 per share from the sale of a building owned by the Company in Hauppauge, New York. |

| (4) | Includes $0.15 per share from the sale of a building owned by the Company in Hauppauge, New York. |

The following discussion should be read in conjunction with the Company’s Consolidated Financial Statements and Notes thereto included elsewhere in this Form 10-K, together with “Forward-Looking Statements; Factors That May Affect Future Results” located in the Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Results of Operations:

The following table sets forth for the periods indicated the percentage of total net sales that such items represent in the consolidated statement of operations.

| | | Years ended January 31, |

| | 2009 | | 2008 | | 2007 | |

| Net sales | 100.0 | % | 100.0 | % | 100.0 | % |

| Cost of goods sold | 65.1 | % | 66.0 | % | 67.9 | % |

| Gross profit | 34.9 | % | 34.0 | % | 32.1 | % |

| | | | | | | |

| Selling, general and administrative expense | 21.3 | % | 20.8 | % | 21.7 | % |

| Gain on sale of building | - | | (3.3 | %) | - | |

| Income from operations | 13.6 | % | 16.5 | % | 10.4 | % |

| | | | | | | |

| Interest expense | (.2 | %) | (.3 | %) | (.4 | %) |

| Other income, net | .4 | % | .9 | % | 1.0 | % |

| Income before taxes | 13.8 | % | 17.1 | % | 11.0 | % |

| | | | | | | |

| Provision for taxes | 4.3 | % | 6.0 | % | 3.6 | % |

| Net income | 9.5 | % | 11.1 | % | 7.4 | % |

FYE 2009 vs FYE 2008:

Net sales for the fiscal year ended January 31, 2009 were $103.4 million compared with $106.9 million for the fiscal year ended January 31, 2008, a decrease of $3.5 million or 3.3%.

Sales in the Product Recovery/Pollution Control Technologies reporting segment were $50.0 million, or $6.9 million lower than the $56.9 million of sales for the fiscal year ended January 31, 2008, a decrease of 12.2%. The sales decrease in the Product Recovery/Pollution Control Technologies reporting segment was due primarily to lower sales of our air pollution control systems for the removal of volatile organic compounds and other atmospheric pollutants, partially offset by higher sales of our particulate collection equipment and laboratory fume hood exhaust systems. The sales for this segment in fiscal year 2009 were impacted by a global economic slowdown. The fiscal year 2008 sales benefited from a $7.4 million sale of an air pollution control system for the removal of volatile organic compounds and other atmospheric pollutants, the largest order in the Company’s history; there was no similar large order in the fiscal year 2009.

Sales in the Fluid Handling Technologies reporting segment totaled $30.4 million, or $2.8 million higher than the $27.6 million of sales for the fiscal year ended January 31, 2008, an increase of 10.3%. The sales increase in the Fluid Handling Technologies reporting segment was due to increased demand for our metallic industrial process pumps and fiberglass reinforced plastic centrifugal pumps that handle a broad range of applications.

Sales in the Mefiag Filtration Technologies reporting segment totaled $11.2 million, or $0.3 million lower than the $11.5 million of sales for the fiscal year ended January 31, 2008, a decrease of 3.1%. The sales decrease in the Mefiag Filtration Technologies reporting segment was due primarily to decreased demand for our horizontal disc filter systems, due to a slowdown in the markets this segment services, such as the automotive and housing.

Sales in the Filtration/Purification Technologies segment were $11.8 million, or $1.0 million higher than the $10.8 million of sales for the fiscal year ended January 31, 2008, an increase of 9.0%. This increase was due to increased demand for our filters, cartridges and filter housings designed for industrial and residential air and liquid filtration applications, as well as for our proprietary chemicals for the treatment of municipal drinking water systems and boiler and cooling tower systems.

Foreign sales were $26.5 million for the fiscal year ended January 31, 2009, compared with $30.2 million for the same period last year, a decrease of 12.2%. Compared with the prior fiscal year, foreign sales decreased 27.4% in the Product Recovery/Pollution Control Technologies reporting segment, increased 9.7% in the Fluid Handling Technologies reporting segment, decreased 4.3% in the Mefiag Filtration Technologies reporting segment and increased 17.5% in the Filtration/Purification Technologies segment. The decrease in the Product Recovery/Pollution Control Technologies reporting segment sales was primarily due to global economic slowdown.

Income from operations for the fiscal year ended January 31, 2009 was $14.1 million compared with $17.6 million for the fiscal year ended January 31, 2008, a decrease of $3.5 million. The decrease in income from operations was due to the $3.5 million gain recognized during the first quarter ended April 30, 2007 from the sale of the Company’s property in Hauppauge, Long Island, New York. Excluding the gain on the sale of this New York property, income from operations for the fiscal year ended January 31, 2009 was equal to the income from operations for the fiscal year ended January 31, 2008. For comparative purposes, the following income from operations analysis by segment does not include the gain on the sale of the New York property.

Income from operations in the Product Recovery/Pollution Control Technologies reporting segment was $5.6 million, or $1.0 million lower than the $6.6 million for the fiscal year ended January 31, 2008, a decrease of 15.5%. The decrease in income from operations in the Product Recovery/Pollution Control Technologies reporting segment was primarily related to decreased net sales of our air pollution control systems for the removal of volatile organic compounds and other atmospheric pollutants, our particulate collection equipment and odor control equipment, partially offset by increased net sales of our laboratory fume hood exhaust systems.

Income from operations in the Fluid Handling Technologies reporting segment totaled $6.8 million, or $0.9 million higher than the $5.9 million for the fiscal year ended January 31, 2008, an increase of 16.2%. The increase in income from operations in the Fluid Handling Technologies reporting segment was principally related to increased sales and higher gross margins for our metallic industrial process pumps and fiberglass reinforced plastic centrifugal pumps that handle a broad range of applications.

Income from operations in the Mefiag Filtration Technologies reporting segment totaled $0.5 million, or $0.4 million lower than the $0.9 million for the fiscal year ended January 31, 2008, a decrease of 43.7%. The decrease in income from operations in the Mefiag Filtration Technologies reporting segment was primarily related to a decrease in net sales and lower gross margins for our horizontal disc filter systems.

Income from operations in the Filtration/Purification Technologies segment was $1.2 million, or $0.5 million higher than the $0.7 million for the fiscal year ended January 31, 2008, an increase of 55.9%. The increase in income from operations in the Filtration/Purification Technologies segment was due to increased net sales and higher gross margins for our water treatment compounds.

Net income for the fiscal year ended January 31, 2009 was $9.9 million compared with $11.9 million for the fiscal year ended January 31, 2008, a decrease of $2.0 million. This decrease in net income was related to the gain during the first quarter ended April 30, 2007 on the sale of the New York property, which increased net income by $2.2 million. Excluding the gain on the sale of this New York property, net income for the fiscal year ended January 31, 2009 was $0.2 million higher than the net income for the fiscal year ended January 31, 2008 of $9.7 million, an increase of 1.7%.

The gross margin for the fiscal year ended January 31, 2009 was 34.9% compared with 34.0% for the same period in the prior year. This increase in gross margin was due to higher gross margins in three segments (the Product Recovery/Pollution Control Technologies and Fluid Handling Technologies reporting segments and the Filtration/Purification Technologies segment), offset by lower gross margins in the Mefiag Filtration Technologies reporting segment as compared with the fiscal year ended January 31, 2008.

Selling expense was $10.7 million for the fiscal year ended January 31, 2009, a decrease of $0.8 million over the prior year. This decrease was primarily due to lower representative and distributor commission expense for the period. Selling expense as a percentage of net sales was 10.4% for the fiscal year ended January 31, 2009 compared with 10.7% for the same period last year. Selling expense may vary quarter-to-quarter, in part as a result of variations which result in some sales being commissionable and others not.

General and administrative expense was $11.3 million for the fiscal year ended January 31, 2009, compared with $10.8 million in the prior fiscal year. This increase was primarily related to higher consultant and legal expenses and management incentive accruals. General and administrative expense as a percentage of net sales was 11.0% for the fiscal year ended January 31, 2009 compared with 10.1% for the prior fiscal year.

Interest expense was approximately $0.2 million for the fiscal year ended January 31, 2009 compared with $0.3 million for the prior year. This decrease was due principally to a decrease in long-term debt.

Other income, net, was $0.4 million for the fiscal year ended January 31, 2009 compared with $1.0 million in the prior year. Other income, net, consisted primarily of interest income, which was affected by a decrease in interest rates.