UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | Filed by the Registrant x |

| | Filed by a Party other than the Registrant o |

| | Check the appropriate box: |

| Preliminary Proxy Statement |

| | |

| Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| Definitive Proxy Statement |

| | |

| Definitive Additional Materials |

| | |

| Soliciting Material Pursuant to §240.14a-12 |

MET-PRO CORPORATION

(Name of registrant as specified in its charter)

| Payment of Filing Fee (Check the appropriate box): |

| | |

| x | No fee required. |

| | | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Amount previously paid: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| |

| | |

| Fee paid previously with preliminary materials. |

| | | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing party: |

| | | |

| | (4) | Date filed: |

160 Cassell Road, Harleysville, Pennsylvania 19438

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

To Be Held On June 2, 2010

To the Shareholders of MET-PRO CORPORATION:

Notice is hereby given that the Annual Meeting of Shareholders of MET-PRO CORPORATION, a Pennsylvania corporation (the “Company”), will be held at The Inn at Towamencin, 1750 Sumneytown Pike, Kulpsville, Pennsylvania, on Wednesday, June 2, 2010, at 9:30 a.m. for the following purposes:

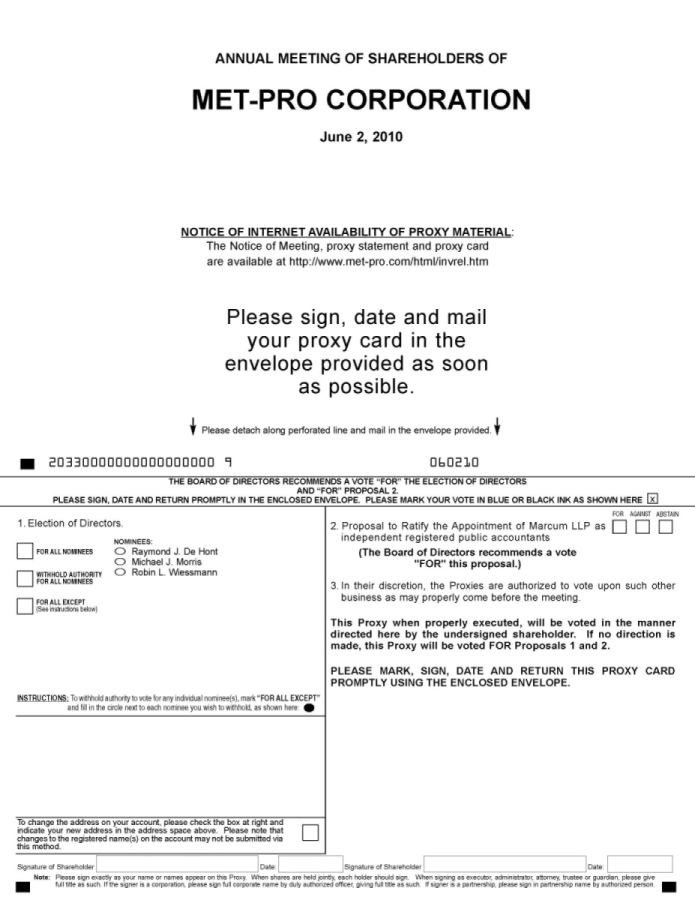

1. | To elect three Directors to serve until the 2013 Annual Meeting of Shareholders. |

| | |

2. | To ratify the selection of Marcum LLP as independent registered public accountants for the Company’s fiscal year ending January 31, 2011. |

| | |

3. | To transact such other business as may properly come before the meeting. |

Only shareholders of record at the close of business on April 9, 2010, the record date fixed by the Board of Directors, are entitled to notice of, and to vote at, the Annual Meeting. Directions to The Inn at Towamencin are located on the back cover of this proxy statement.

Your vote is important! Under recently adopted New York Stock Exchange rules, your broker cannot vote your shares on your behalf with respect to the election of Directors until it receives your voting instructions. Whether or not you plan to attend the Annual Meeting, please cast your vote by completing, signing and dating the enclosed proxy card and returning it promptly in the accompanying envelope. If for any reason you later desire to revoke your proxy, you may do so at any time before the vote is held at the Annual Meeting by following the procedures described in the accompanying proxy statement.

| | Gary J. Morgan |

| | Secretary |

| | |

| | |

| Harleysville, Pennsylvania | |

| April 16, 2010 | |

MET-PRO CORPORATION

160 Cassell Road, Harleysville, Pennsylvania 19438

PROXY STATEMENT

The Board of Directors of Met-Pro Corporation (the “Company” or “Met-Pro”) presents this proxy statement to all shareholders and solicits their proxies for the Annual Meeting of Shareholders to be held on June 2, 2010. These proxy materials were first mailed to shareholders of the Company on or about April 16, 2010. A list of shareholders entitled to vote at the meeting will be available at the Company’s offices, 160 Cassell Road, Harleysville, Pennsylvania 19438, for a period of ten (10) days prior to the meeting for examination by any shareholder.

Proposals to be Voted Upon

At our 2010 Annual Meeting of Shareholders, we are asking our shareholders to consider and act upon two proposals: (i) to elect three Directors to serve until our 2013 Annual Meeting of Shareholders, and (ii) to ratify the selection of Marcum LLP as independent registered public accountants for our fiscal year ending January 31, 2011.

We do not know of any other matters that may be brought before the meeting nor do we foresee or have reason to believe that proxy holders will have to vote for a substitute or alternate Director nominee(s). In the event that any other matter should come before the meeting or any Director nominee(s) is not available for election, the persons named in the enclosed proxy will have discretionary authority to vote all proxies not marked to the contrary with respect to such matters in accordance with their best judgment.

Common Shares Issued and Outstanding on Record Date

Only shareholders of record as of the close of business on April 9, 2010 will be entitled to vote. The total number of Common Shares of the Company outstanding as of April 9, 2010 was 14,617,015. The Common Shares are our only class of securities which is entitled to vote, and each share is entitled to one noncumulative vote.

Quorum Required

A majority of the Common Shares outstanding on the April 9, 2010 record date must be present in person or by proxy at the Annual Meeting in order to have a quorum for the transaction of business. Under Pennsylvania law, abstentions (votes “withheld”) and broker non-votes will be counted as present for purposes of determining the presence of a quorum. A broker non-vote occurs when a broker’s customer does not provide the broker with voting instructions on non-routine matters for shares that are owned by the customer but held in the name of the broker. For such matters, the broker may not vote and reports the number of shares as “non-votes”.

Vote Required

Election of Directors

Directors are elected by a plurality of the votes cast. A plurality occurs when more votes are cast for a candidate than those cast for an opposing candidate.

A shareholder eligible to vote may: (i) vote for the election of the three nominees identified in this proxy statement; (ii) withhold authority to vote for the three nominees identified in this proxy statement; or (iii) vote for the election of one or two nominees and withhold authority to vote for one or two nominees.

All proxies that are properly executed and timely received will be voted on all matters presented at the meeting in accordance with the specifications made in such proxies. If your Met-Pro Corporation shares are registered directly in your name, in the absence of your specific vote on your executed proxy card, your shares will be voted consistent with the recommendations of the Board of Directors and in favor of the election of the three nominees for the election of Directors.

Under recently adopted New York Stock Exchange rules, your broker cannot vote your shares on your behalf with respect to the election of Directors until it receives your voting instructions. Accordingly, if the Met-Pro Corporation shares that you own are registered in the name of your broker (“street name”), in the absence of your specific instructions on your executed proxy card, your broker will not vote your shares in favor of the named nominees to the Company’s Board of Directors.

Broker non-votes and shares that are represented by proxies that are marked “withhold authority” with respect to the election of one or more nominees as Directors are deemed under Pennsylvania law not to have been cast, and will have no effect upon the vote as to the election of Directors.

Ratification of Selection of Marcum LLP

The approval of the ratification of the selection of Marcum LLP requires the affirmative “FOR” vote of a majority of the shares which are present in person or by proxy at the Annual Meeting and which are actually cast on this proposal.

A shareholder eligible to vote may vote for or against the approval of the ratification of the selection of Marcum LLP or may abstain.

All proxies that are properly executed and timely received will be voted on all matters presented at the meeting in accordance with the specifications made in such proxies. In the absence of your specific vote on your executed proxy card, if your Met-Pro Corporation shares are registered directly in your name, your shares will be voted consistent with the recommendations of the Board of Directors and in favor of the ratification of the selection of Marcum LLP.

If the Met-Pro Corporation shares that you own are registered in the name of your broker (“street name”), in the absence of your specific instructions on your executed proxy card, your broker will vote your shares in favor of the ratification of the selection of Marcum LLP as independent registered public accountants for the fiscal year 2011.

Abstentions and broker non-votes will not be deemed as having been “cast” and will have no effect upon the approval of this proposal.

How to Vote

You may vote in person at the Annual Meeting or by proxy. Even if you plan to attend the Annual Meeting in person, we encourage you to complete, sign and return your proxy card in advance of the Annual Meeting.

Proxy

To vote by proxy, please mail your completed, signed and dated proxy card in the enclosed postage-paid return envelope as soon as possible so that your shares will be represented at the Annual Meeting.

In person

If you plan to attend the Annual Meeting and vote in person, we will give you a ballot at the meeting. However, if your shares are held in the name of your broker, you must obtain from the brokerage firm an account statement, letter or other evidence satisfactory to us of your beneficial ownership of the shares.

Revoking Your Proxy

You may revoke your proxy at any time before it is voted by giving written notice to such effect to the Company, 160 Cassell Road, P.O. Box 144, Harleysville, Pennsylvania 19438, attention: President, prior to exercise of the proxy, by delivery of a later proxy or by a vote cast in person at the meeting; however, if the shares are held in street name, you may vote these shares in person at the meeting only if you obtain a signed proxy from the record holder giving you the right to vote the shares. If you have instructed your broker to vote your shares, you must follow the directions received from your broker if you want to change those instructions.

Solicitation and Mailing of Proxies

The Company will pay the entire expense of soliciting these proxies. This solicitation will be primarily by mail, although we may engage officers of the Company or outside parties to solicit proxies personally or by telephone if we deem it expedient. In accordance with New York Stock Exchange rules, we will reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in sending proxy materials to beneficial owners of Met-Pro Corporation shares.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Shareholders to be held on June 2, 2010

This proxy statement and our annual report to shareholders are available at www.met-pro.com.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company’s Articles of Incorporation provide for a classified Board of Directors, with the Board divided into three classes whose terms expire at different times. Three Directors, Raymond J. De Hont, Michael J. Morris and Robin L. Wiessmann, whose terms of office expire with the June 2, 2010 meeting, have been recommended by the Corporate Governance and Nominating Committee and nominated by the Board for re-election to terms that expire at the 2013 Annual Meeting. Information regarding the Board’s three nominees is set forth below. Information regarding the Directors whose terms expire after the 2010 Annual Meeting is set forth on pages 5-6.

Please note that under recently adopted New York Stock Exchange rules, your broker cannot vote your shares on your behalf with respect to the election of Directors until it receives your voting instructions. Thus, if the Met-Pro Corporation shares that you own are registered in the name of your broker (“street name”), in the absence of your specific instructions on your executed proxy card, your broker will not vote your shares with respect to any of the named nominees to the Company’s Board of Directors. Accordingly, we encourage you to give specific voting instructions to your broker.

If your shares are registered in your name, unless otherwise indicated in valid proxies received pursuant to this solicitation, such proxies will be voted for the election of the persons listed below as nominees for the terms set forth below.

Management has no reason to believe that the nominees will not be available or will not serve if elected. Proxies may not be voted for more than three persons. If Messrs. De Hont or Morris, or Ms. Wiessmann should become unavailable to serve as a Director, full discretion is reserved to the persons named as proxies to vote for such other persons as may be nominated in accordance with the Company’s by-laws.

The following sets forth certain information as to the nominees for election as Directors and for each other person whose term of office as a Director will continue after this Annual Meeting of Shareholders:

NOMINEES FOR TERMS TO EXPIRE IN 2013

| Raymond J. De Hont | Mr. De Hont, 56, has served as Chairman of the Board of Directors since September 2003 and as President and Chief Executive Officer since March 2003. Mr. De Hont has been a member of the Board of Directors since February 2003. From June 2000 until March 2003, Mr. De Hont was the Chief Operating Officer of the Company, and from June 1995 through December 2000, he was Vice President and General Manager of the Company’s Fybroc business. In addition, during the period October 1999 to December 2000, Mr. De Hont also served as General Manager of the Company’s Dean Pump business. Prior to joining Met-Pro Corporation, he held various management positions at Hosokawa Micron Corporation and Air & Water Technologies. Mr. De Hont is a member of the Greater Philadelphia Chamber of Commerce Board of Directors. Mr. De Hont received a Bachelor of Scienc e degree in Civil Engineering from New Jersey Institute of Technology. Mr. De Hont’s extensive knowledge and experience with all aspects of the Company’s business and its management, his role as Chief Executive Officer and his strategic vision for the Company are considered extremely valuable to the Board of Directors, and this, together with his leadership skills, executive and board experience, his substantial industry knowledge and experience, and corporate governance knowledge, among other factors, led the Board to conclude that he should serve, and that he should be nominated to continue to serve, on Met-Pro Corporation’s Board of Directors. |

NOMINEES FOR TERMS TO EXPIRE IN 2013

| | |

| Michael J. Morris | Mr. Morris, 75, who has served has a member of the Board of Directors of the Company since August 1999, is the retired Chief Executive Officer and President of both Transport International Pool (TIP) and GE Modular Buildings. Mr. Morris is a Director of Beneficial Mutual Bancorp and a Trustee of Beneficial Mutual Savings Bank where he serves as a member of the Senior Loan Committee and Audit Committee. Mr. Morris is also a Director of Philadelphia Insurance Company and Philadelphia Indemnity Insurance Company and is a member of the Audit Committee. Mr. Morris, as founder in 1968 of TIP and later GE Modular Buildings, was associated with both companies for a period of twenty-four years utilizing the skills of entrepreneur, banker, executive and visionary. Ownership during his tenure changed form six times: twice privately owned, once publicly owned and three mergers, which provided Mr. Morris with vast experience and significant responsibilities in other companies beyond TIP and GE Modular Buildings. Mr. Morris has had significant roles on various boards/committees such as for GE Capital, GELCO Corporation, Philadelphia Consolidated Holding Corporation, Mercy Health System-Medical Centers, Saint Joseph’s University and Gwynedd-Mercy College. Mr. Morris received a Bachelor of Science degree in Accounting and Busines s Administration from Saint Joseph’s University. Mr. Morris serves on two committees of Met-Pro Corporation’s Board of Directors, the Audit Committee and the Corporate Governance and Nominating Committee, and is Chairman of both committees. As the Chairman of the Corporate Governance and Nominating Committee, Mr. Morris is the Company’s Lead Director. Mr. Morris had been a member of the class of Met-Pro Directors whose term of office expires with the 2011 Annual Meeting of Shareholders. At its February 2010 meeting, the Board of Directors appointed Mr. Morris a member of the class of Directors whose term of office expires with the 2010 Annual Meeting of Shareholders, filling a vacancy that had been created by Mr. DeBenedictis’ resignation from the Board of Directors. Mr. Morris’ knowledge and experience in business, accounting and finance, his entrepreneurial and business leadership skills, his extensive board experience, his leadership of the Company’s Audit Committee, his corporate governance knowledge and experience, his expert business judgment, and his substantial knowledge and understanding of the Company, among other factors, led the Board of Directors to conclude that Mr. Morris should serve, and be nominated to continue to serve, on Met-Pro Corporation’s Board of Directors. In considering Mr. Morris’ nomination for re-election at the 2010 Annual Meeting, the Board of Directors noted the provisions of the Company’s Corporate Governance Guidelines which make Mr. Morris ineligible on account of his age to be nominated for re-election for additional service as a Director. The Board determined to waive this provision and nominate Mr. Morris for an additional term of service, on account of the aforementioned reasons and on account of his record as a very effective and active Board member and the expectation that he would continue to be effective and active, and the Board’s desire for continuity within the Board of Directors. |

| | |

| Robin L. Wiessmann | Ms. Wiessmann, 57, who has served as a member of the Board of Directors of the Company since December 2009, served as State Treasurer of the Commonwealth of Pennsylvania from April 2007 to January 2009. During her term as State Treasurer, she focused on asset allocation, institutional investing standards, and operating efficiencies, among other initiatives. Prior to serving as State Treasurer, Ms. Wiessmann was a founding principal and President of Artemis Capital Group, a municipal broker-dealer investment banking firm that was acquired by RBC Dain Rauscher, which she then joined as a Managing Director. Ms. Wiessmann began her investment-banking career at Goldman Sachs. As an investment banker, Ms. Wiessmann specialized in diverse and complex municipal issues while working with Governors and Treasurers nationwide. She also served as a Director in investment banking at Merrill Lynch. Ms. Wiessmann has also served as Vice Chairman of the Delaware River Joint Toll Bridge Commission and as a trustee of the Citizen’s Budget Commission of New York. She presently serves as an independent Director of the ICMARC Vantagepoint Funds and as a Commissioner of the Delaware River Port Authority. Ms. Wiessmann received a Bachelor of Arts degree from Lafayette College and a Juris Doctor from Rutgers University. She is a member of the Pennsylvania Bar. Ms. Wiessmann serves on two committees of Met-Pro Corporation’s Board of Directors, the Audit Committee and the Compensation and Management Development Committee. Ms. Wiessmann’s extensive knowledge and experience in investment banking and finance, her entrepreneurial and business leadership skills, her legal background, and her skill, prominence and reputation as a female civic, governmental and business leader, among other factors, led the Board of Directors to conclude that Ms. Wiessmann should serve, and be nominated to continue to serve, on Met-Pro’s Corporation’s Board of Directors. |

The Board of Directors recommends a vote FOR the election of the above nominees as Directors.

CONTINUING DIRECTORS - TERMS EXPIRE AT 2011 ANNUAL MEETING

| Judith A. Spires | Ms. Spires, 57, who has served as a member of the Board of Directors of the Company since January 2009, is the Chief Executive Officer of Kings Super Markets. Prior to this, she served as the President of Acme Markets, a Pennsylvania-based retail grocery chain, from February 2006 to March 2010. Prior to serving as the President of Acme Markets, Ms. Spires served as President of the Dallas/Fort Worth Division of Albertsons, Inc. for two years, after having served as President of Albertsons, Inc.'s Denver Division. Ms. Spires' previous experience also includes a variety of roles for Acme including: Senior Vice President of Marketing and Merchandising, Vice President of Integration, Vice President-Operations, Vice Pre sident-Human Resources, Vice President-Administration, and Vice President-Advertising. Ms. Spires received a Bachelor of Arts degree and a Master of Business Administration degree from LaSalle University. Ms. Spires also currently serves on a number of civic and community Boards including St. Joseph's University Academy of Food Marketing, and La Salle University. Ms. Spires serves on two committees of Met-Pro Corporation’s Board of Directors, the Audit Committee and the Corporate Governance and Nominating Committee. Ms. Spires’ knowledge and experience in management, marketing, distribution and human resources, her board experience and community involvement and her leadership skills, reputation and prominence as a female business and civic leader, among other factors, led the Board of Directors to conclude that Ms. Spires should serve on Met-Pro Corporation’s Board of Directors. |

| | |

| Stanley W. Silverman | Mr. Silverman, 62, who has served as a member of the Board of Directors of the Company since September 2009, is the President of Horizon Venture Group LLC, a private firm that invests as a limited partner in companies which have the potential for growth and value creation. From January 2000 to February 2005, Mr. Silverman served as President and Chief Executive Officer, and was a member of the Board of Directors, of PQ Corporation, a privately held global company operating in 19 countries in two core businesses, chemicals and engineered glass materials. He was appointed Executive Vice President and Chief Operating Officer of PQ Corporation in 1991. During his 34 year career at PQ Corporation, he held positions in engineering, operations planning, marketing, sales and business unit executive management. Mr. Silverman is a former Chairman of the Board of the Soap and Detergent Association, where he had served as Chairman of the Compensation and Finance Committees, and is a former Board member of the American Chemistry Council. Mr. Silverman currently serves on the Board of Directors and the Audit Committee of C&D Technologies, Inc., a New York Stock Exchange listed company that produces and markets systems for the power conversion and storage of electric power including industrial batteries; on the Board of Directors and the Audit and Compensation Committees of A. Schulman, Inc., a NASDAQ listed company that is a leading international supplier of higher performance plastic compounds and resins; and on the Boards of Directors of three private equity-owned companies. He is also a trustee of Drexel University, where he is Chairman of the Finance Committee. Mr. Silverman received a Bachelor of Science degree in Chemical Engineering and a Master of Business Administration degree from Drexel University. He also completed the Advanced Management Program at the Harvard Business School. Mr. Silverman serves on two committees of Met-Pro Corporation’s Board of Directors, the Audit Committee and the Compensation and Management Development Committee. Mr. Silverman’s extensive business, executive, and organizational leadership skills and experience, global industrial manufacturing, marketing and sales experience, board of directors, audit and compensation committee experience with respect to publicly traded companies from which he has obtained substantial corporate governance experience, knowledge and judgment, and his relevant industry experience, among other factors, led the Board of Directors to conclude that Mr. Silverman should serve on Met-Pro Corporation’s Board of Directors. |

CONTINUING DIRECTORS - TERMS EXPIRE AT 2012 ANNUAL MEETING

| George H. Glatfelter II | Mr. Glatfelter, 58, who has served as a member of the Board Directors of the Company since May 2004, has been Chairman of the Board and Chief Executive Officer of P.H. Glatfelter Company (NYSE: GLT) since 1999 and 1998, respectively. P.H. Glatfelter Company is a multinational company that produces specialized papers and paper products that are marketed in over eighty countries worldwide. Throughout his 33-year career at P.H. Glatfelter Company, Mr. Glatfelter has held positions in human resources, maintenance and engineering, operations, planning and sales and marketing, leading to his election as a Director of the P.H. Glatfelter Company in 1992. Mr. Glatfelter is also a Director of the National Council for Air and Stream Improvements, a Trustee of York College of Pennsylvania, a Director of American Forest and Paper Association, and a Director of the Alliance for the Chesapeake Bay. Mr. Glatfelter received a Bachelor of Science degree from Roanoke College in 1975. Mr. Glatfelter serves on two committees of Met-Pro Corporation’s Board of Directors, the Compensation and Management Development Committee, where he is Chairman, and the Corporate Governance and Nominating Committee. Mr. Glatfelter’s strong executive, business and organizational leadership skills, his industrial manufacturing and multinational business experience, his experience as a member of the Board of Directors of a publicly traded company from which he has developed significant relevant corporate governance and other experience and knowledge, among other factors, led the Board of Directors to conclude that Mr. Glatfelter should serve on Met-Pro Corporation’s Board of Directors. |

| | |

| Gary J. Morgan | Mr. Morgan, 55, who has served as a member of the Board of Directors of the Company since February 1998, has been the Company’s Senior Vice President-Finance, Secretary, Treasurer, and Chief Financial Officer since June 2006, prior to which, since October 1997, he served as Vice President-Finance, as well as Secretary, Treasurer and Chief Financial Officer. Immediately prior to October 1997, Mr. Morgan was the Corporate Controller of the Company. He has been employed by the Company since 1980. Mr. Morgan received a Bachelor of Science degree in Accounting from Pennsylvania State University and a Master of Business Administration degree from Temple University. Mr. Morgan is a Certified Public Accountant. Mr. Morgan’s business leadership skills, his extensive knowledge and skill in accounting, finance, financial reporting, mergers and acquisitions, and corporate governance, as well as his extensive knowledge of the Company, among other factors, led the Board of Directors to conclude that Mr. Morgan should serve on Met-Pro Corporation’s Board of Directors. |

THE BOARD OF DIRECTORS AND ITS COMMITTEES

The Board of Directors presently consists of seven persons, with the Board having the authority under the Bylaws from time to time to set the number of Directors constituting the whole of the Board.

The Board of Directors of the Company held six meetings during the fiscal year ended January 31, 2010. The Board of Directors has three standing committees: the Audit, Compensation and Management Development, and Corporate Governance and Nominating Committees.

The Board’s policy at present is that Committee appointments are for not less than a two-year term or such earlier termination of the Director’s term of office as such. During the fiscal year ended January 31, 2010, no Director attended fewer than 75% of (i) the total number of meetings of our Board of Directors held during the period for which he or she was a Director and (ii) the total number of meetings held by all Committees of the Board on which he or she served during the period that he or she served.

We have chosen to have Mr. De Hont serve as both our Chief Executive Officer and as the Chairman of our Board of Directors. Our Board of Directors believes that this leadership structure is appropriate because our Chief Executive Officer works most closely with our Company’s management team on a daily basis, which our Board believes places him in the best position to determine the timing of Board meetings, to propose agendas for Board meetings and to run the Board meetings. However, any Director can, and many from time to time do, establish agenda items for a Board meeting. As required by the rules of the New York Stock Exchange, our Board has appointed a Director to preside at meetings of our independent Directors; our policy is that this Director is the Chairman of the Corporate Governance and Nominating Committee, whom we call our Lead Director. The role of the Lead Director includes, among other responsibilities, setting the agenda for Board meetings, in collaboration with the Chairman of the Board. The duties of our Lead Director are more fully described in “Independence of Directors/Corporate Governance Guidelines” elsewhere in this proxy statement.

Risk Oversight

The Board of Directors oversees an annual assessment of enterprise risk exposure and the management of such risk, conducted by the Company’s executives. When assessing enterprise risk, the Board focuses on the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. Direct oversight allows the Board to assess management’s inclination for risk, to determine what constitutes an appropriate level of risk for the Company and to discuss with management the means by which to control risk. In addition, while the Board of Directors has the ultimate oversight responsibility for the risk management process, the Audit Committee focuses on financial risk management and exposure. The Audit Committee receives an an nual risk assessment report from the Company’s internal auditor and reviews and discusses the Company’s financial risk exposures and the steps management has taken to monitor, control and report such exposures.

Audit Committee

The Audit Committee of the Board of Directors is presently comprised of Mr. Morris, Chairman, Mr. Silverman, Ms. Spires and Ms. Wiessmann. The Board has determined that all of the members of the Audit Committee are “independent” within the meaning of Securities and Exchange Commission (“SEC”) regulations, the listing standards of the New York Stock Exchange and the Company’s Corporate Governance Guidelines. (See “Independence of Directors/Corporate Governance Guidelines” elsewhere in this proxy statement.) The Board has also determined that there is at least one “Audit Committee financial expert” serving on the Audit Committee, as that term is defined in Item 401(h) of Regulation S-K promulg ated by the SEC, namely Mr. Morris. The Audit Committee met four times during fiscal year 2010.

The focus of the Audit Committee, as described in its charter, is upon:

| | | the adequacy of the Company’s internal controls and financial reporting process and the reliability of the Company’s financial statements; |

| | | the independence and performance of the Company’s independent registered public accounting firm; |

| | | hiring and firing the Company’s independent registered public accounting firm; |

| | | approving any audit and non-audit work performed by the independent registered public accounting firm; |

| | ♦ | monitoring the performance of the Company’s internal audit function; and |

| | | the Company’s compliance with designated legal and regulatory requirements. |

Further information regarding the functions of the Audit Committee are set forth in the “Report of the Audit Committee” on page 34 and the “Audit Committee Charter” which is available on our Company’s website at www.met-pro.com under the “Investor Relations – Corporate Governance” captions. A copy of the entire charter may also be obtained upon request from the Company’s Corporate Secretary. The Audit Committee periodically reviews and modifies its charter.

Compensation and Management Development Committee

The Compensation and Management Development Committee of the Board of Directors is presently comprised of Mr. Glatfelter, Chairman, Mr. Silverman and Ms. Wiessmann. The Board has determined that all the members of the Compensation and Management Development Committee are “independent” within the meaning of the listing standards of the New York Stock Exchange and the Company’s Corporate Governance Guidelines. The Compensation and Management Development Committee met three times during fiscal year 2010.

The focus of the Compensation and Management Development Committee, as described in its charter, is as follows:

| | | together with the other independent members of the Board of Directors, to discharge as to the Chief Executive Officer (“CEO”), and to assist the Board in otherwise discharging, the Board’s responsibilities relating to the compensation of the Company’s executives (consisting of the Company’s elected officers and General Managers and such other key employees as determined by the Committee with guidance from the CEO) and members of the Board; |

| | | to review and discuss with the Company’s senior executives the Compensation Discussion and Analysis included in the Company’s proxy statement and to provide the Compensation and Management Development Committee Report for inclusion in the Company’s proxy statement that complies with the rules and regulations of the SEC; and |

| | | to assist the Board in ensuring that the Company has in place effective policies and programs for senior executive succession and for the development of its executives. |

The charter of the Compensation and Management Development Committee is available on our Company’s website at www.met-pro.com under the “Investor Relations – Corporate Governance” captions. A copy of the entire charter may also be obtained upon request from the Company’s Corporate Secretary. The Compensation and Management Development Committee periodically reviews and modifies its charter.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee of the Board of Directors is presently comprised of Mr. Morris, Chairman, Mr. Glatfelter and Ms. Spires. The Board has determined that all of the members of the Committee are “independent” within the meaning of the listing standards of the New York Stock Exchange and the Company’s Corporate Governance Guidelines. The Corporate Governance and Nominating Committee met four times during fiscal year 2010.

The Corporate Governance and Nominating Committee is responsible for developing and implementing policies and practices relating to corporate governance, including reviewing and monitoring implementation of the Company’s Corporate Governance Guidelines. In addition, the Committee is responsible for developing and reviewing background information on candidates for the Board, and making recommendations to the Board regarding such candidates. The Committee also is responsible for preparing and supervising the Board’s annual review of Directors independence and the Board’s performance self-evaluation. The charter of the Corporate Governance and Nominating Committee is available on our Company’s website at www.met-pro.com under the “Investor Relations – Corporate Governance” captions. A copy of the entire charter may also be obtained upon request from the Company’s Corporate Secretary. The Corporate Governance and Nominating Committee periodically reviews and modifies its charter.

The Corporate Governance and Nominating Committee will consider candidate(s) for Board membership suggested by its members and other Board members, as well as management and shareholders. A shareholder who wishes to recommend a prospective nominee(s) for the Board should notify the Company’s Corporate Secretary or any member of the Corporate Governance and Nominating Committee in writing with whatever supporting material the shareholder considers appropriate. The Corporate Governance and Nominating Committee will also consider whether to nominate any person(s) proposed by a shareholder pursuant to the provisions of the Company’s Bylaws relating to shareholder nominations (see “Shareholder Proposals” elsewher e in this proxy statement).

Once the Corporate Governance and Nominating Committee has identified a new prospective nominee(s), the Committee expects to make an initial determination as to whether to conduct a full evaluation of the candidate(s). This initial determination will be based on whatever information is provided to the Committee with the recommendation of the prospective candidate(s), as well as the Committee’s own knowledge of the prospective candidate(s), which may be supplemented by inquiries to the person(s) making the recommendation or others. The preliminary determination is anticipated to be based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee(s) can satisfy the evaluation factors described below . If the Committee determines, in consultation with the Chairman of the Board and other Board members as appropriate, that additional consideration is warranted, with prior approval of the candidate(s), it may request a third-party search firm to gather additional information about the prospective nominee’s background and experience and report its findings to the Committee. The Committee then expects to evaluate the prospective nominee(s) against the standards and qualifications set out in the Company’s Corporate Governance Guidelines, including:

| | | the ability of the prospective nominee(s) to represent the interests of the shareholders of the Company; |

| | | the prospective nominee’s standards of integrity, commitment and independence of thought and judgment; |

| | | the prospective nominee’s ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards, as specifically set out in the Company’s Corporate Governance Guidelines; and |

| | | the extent to which the prospective nominee(s) contributes to the range of talent, skill and expertise appropriate for the Board. |

The Committee also intends to consider such other relevant factors as it deems appropriate, including the current composition of the Board, the balance of management and independent Directors, the need for Audit Committee expertise and, as part of the Company’s commitment to diversity, the candidate’s race and gender. In connection with this evaluation, the Committee will determine whether to interview the prospective nominee(s), and if warranted, one or more members of the Committee, and others as appropriate, will interview the prospective nominee(s) in person or by telephone. After completing these evaluations and interviews, the Committee will make a recommendation to the full Board as to the person(s) who should be nominated by the Board, and the Board will determ ine the nominee(s) after considering the recommendation and report of the Committee.

Shareholder and Other Interested Party Communications with Directors

Met-Pro shareholders and other interested parties who wish to communicate directly with the Board, a Board Committee, the Lead Director or any individual Director (including non-management Directors) can write to: Met-Pro Corporation, Board Administration, 160 Cassell Road, P.O. Box 144, Harleysville, PA 19438. The Company will review all such correspondence and provide any comments along with the full text of the communication to the Lead Director or the non-management Directors as a group, as the case may be.

In the case of a shareholder, your letter should indicate that you are a Met-Pro shareholder. Depending upon the subject matter, management will: forward the communication to the Director or Directors to whom it is addressed; attempt to handle the inquiry directly, if appropriate, such as a request for information about the Company or a stock-related matter; or not forward the communication, if it is primarily commercial in nature or if it relates to an improper, irrelevant or inappropriate topic.

At each Board meeting, a member of management will present a summary of any and all communications received since the last meeting that were not forwarded, and will make those communications available to Directors upon request.

The Board’s policy is to encourage attendance by each Board member at the Annual Meeting of Shareholders. All Directors attended the 2009 Annual Meeting of Shareholders with the exception of Mr. Glatfelter.

How to Request Copies of Certain Documents

The Company will provide without charge, upon written request, a copy of the Company’s Annual Report on Form 10-K, Corporate Governance Guidelines, charters of the various Committees of the Board of Directors (Corporate Governance and Nominating; Compensation and Management Development; and Audit) and Codes of Conduct (Code of Business Conduct and Ethics (all employees and Directors) and Code of Ethics (CEO and CFO only)). Please direct your requests to Gary J. Morgan, Secretary, Met-Pro Corporation, 160 Cassell Road, P.O. Box 144, Harleysville, Pennsylvania 19438.

INDEPENDENCE OF DIRECTORS/CORPORATE GOVERNANCE GUIDELINES

The Corporate Governance Guidelines adopted by the Board are intended to meet or exceed the listing standards adopted by the New York Stock Exchange. The Guidelines describing the composition of the Board addressing Director independence are available on our Company’s website at www.met-pro.com under the “Investor Relations – Corporate Governance” captions. A copy may also be obtained upon request from the Company’s Corporate Secretary.

At its March 2010 meeting, the Board reviewed Director independence, inquiring into transactions and relationships between each Director or any member of his or her immediate family and the Company and its subsidiaries and affiliates, the disclosure of which would be required under Securities and Exchange Commission (“SEC”) rules in this proxy statement under the section “Certain Business Relationships,” as to which there are none. The Board also examined transactions and relationships between Directors or their affiliates and members of the Company’s senior management or their affiliates. As provided in the Guidelines, the purpose of this review was to determine whether any such relationships or transactions were consistent with a determination that the Director is independent.

As a result of this review, the Board determined that George H. Glatfelter, Michael J. Morris, Stanley W. Silverman, Judith A. Spires and Robin L. Wiessmann are “independent” Directors for purposes of Section 303A of the Listed Company Manual of the New York Stock Exchange, and that the members of the Audit Committee are also “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934 and Section 303.01 of the Listed Company Manual of the New York Stock Exchange.

The Company’s independent Directors meet periodically, without management being present, generally in connection with a scheduled meeting of the Board of Directors. These meetings are presided over by the Lead Director, and prior to the creation of this position in March 2010, were presided over by the Company’s Presiding Independent Director. The policy of our Board of Directors is that the Chair of the Corporate Governance and Nominating Committee is the Lead Director. Mr. DeBenedictis served as the Presiding Independent Director in fiscal year 2010 and through his resignation from the Board in February 2010, at which time Mr. Morris, was elected Chair of the Corporate Governance and Nominating Committee and as such assumed the position of Presiding Indepe ndent Director (now Lead Director).

The duties of the Lead Director include presiding at all meetings of the Board of Directors at which the Chairman is not present, including executive sessions of the non-management Directors, and determining the agenda for these meetings; making recommendations to the Board regarding the structure of Board meetings; recommending matters for consideration by the Board; setting Board meeting agendas, in collaboration with the Chairman; developing the annual calendar for the Board and committee meetings, in collaboration with the Chairman of the Board and the Chairman of each committee; determining appropriate materials to be provided to the Directors, in collaboration with the Chairman; and serving as an independent point of contact for shareholders who wish to communicate with the Board, other than thro ugh the Chairman.

CODES OF ETHICS

The Company has a Code of Business Conduct and Ethics, which is applicable to all employees of the Company, including the Chief Executive Officer and Chief Financial Officer. The Board has also approved a separate Code of Ethics which is specifically applicable to the Chief Executive Officer and Chief Financial Officer. Both the Code of Business Conduct and Ethics and the Code of Ethics for the Chief Executive Officer and Chief Financial Officer are available on our Company’s website at www.met-pro.com under the “Investor Relations – Corporate Governance” captions. A copy of either code may also be obtained upon request from the Company’s Corporate Secretary.

SHARE OWNERSHIP OF

EXECUTIVE OFFICERS AND DIRECTORS

The following table sets forth as of March 29, 2010 the number and percentage of shares held by each Director and nominee for Director of the Company, each executive officer of the Company named in the Summary Compensation Table and by all Directors, nominees and executive officers as a group. Unless otherwise stated, the beneficial owners exercise sole voting and/or investment power over their shares.

Name of Executive Officers and Directors | | | Number of Common Shares Owned | | | Common Shares Underlying Options Exercisable Within 60 Days (1) | Percent of Shares Beneficially Owned (2) |

| Raymond J. De Hont | | 33,264 | | (3) | | 261,948 | | | 1.9 | % |

| | | | | | | | | | | |

| George H. Glatfelter II | | 4,444 | | | | 52,113 | | | * | |

| | | | | | | | | | | |

| Gary J. Morgan | | 63,829 | | (4) | | 111,504 | | | 1.1 | % |

| | | | | | | | | | | |

| Michael J. Morris | | 51,359 | | | | 52,113 | | | * | |

| | | | | | | | | | | |

| Stanley W. Silverman | | 2,500 | | | | - | | | * | |

| | | | | | | | | | | |

| Judith A. Spires | | - | | | | - | | | * | |

| | | | | | | | | | | |

| Robin L. Wiessmann | | - | | | | - | | | * | |

| | | | | | | | | | | |

| Gennaro A. D’Alterio | | 2,549 | | (5) | | 8,533 | | | * | |

| | | | | | | | | | | |

| Gregory C. Kimmer | | 36,070 | | (6) | | 65,936 | | | * | |

| | | | | | | | | | | |

| Paul A. Tetley | | 11,048 | | (7) | | 95,314 | | | * | |

| | | | | | | | | | | |

| All Directors, nominees and executive officers as a group (13 persons) | | 208,792 | | (8) | | 739,596 | | | 6.1 | % |

| * | Less than 1% of the Company’s outstanding Common Shares. |

| | |

| (1) | The number of Common Shares beneficially owned by each person is determined under rules promulgated by the Securities and Exchange Commission. Under these rules, a person is deemed to have “beneficial ownership” of any shares over which that person has or shares voting or investment power, plus any shares that the person may acquire within 60 days, after January 31, 2010, including through the exercise of stock options. This number of shares beneficially owned therefore includes all shares that may be acquired within 60 days pursuant to the exercise of stock options. |

| | |

(2) | The percent ownership for each shareholder on March 29, 2010 is calculated by dividing (a) the total number of shares beneficially owned by the shareholder by (b) 14,617,015 shares plus any shares acquirable (including stock options exercisable) by that person within 60 days after January 31, 2010. |

| | |

| (3) | The number of shares held by Mr. De Hont includes 9,841 Common Shares beneficially held through the Met-Pro Corporation Salaried Employee Stock Ownership Trust and through the Company’s 401(k) Plan. Excludes shares owned by Mr. De Hont’s adult children, as to which he disclaims beneficial ownership or control. |

| | |

| (4) | The number of shares held by Mr. Morgan includes 25,640 Common Shares beneficially held through the Met-Pro Corporation Salaried Employee Stock Ownership Trust and through the Company’s 401(k) Plan. |

| | |

| (5) | The number of shares held by Mr. D’Alterio includes 2,313 Common Shares beneficially held through the Company’s 401(k) Plan. |

| | |

| (6) | The number of shares held by Mr. Kimmer includes 15,533 Common Shares beneficially held through the Met-Pro Corporation Salaried Employee Stock Ownership Trust and through the Company’s 401(k) Plan. |

| | |

| (7) | The number of shares held by Mr. Tetley includes 6,502 Common Shares beneficially held through the Met-Pro Corporation Salaried Employee Stock Ownership Trust and through the Company’s 401(k) Plan. |

| | |

| (8) | The number of shares held by all 13 executive officers and Directors as a group include 63,153 Common Shares beneficially held through the Met-Pro Corporation Salaried Employee Stock Ownership Trust and through the Company’s 401(k) Plan. |

BENEFICIAL OWNERSHIP OF PRINCIPAL SHAREHOLDERS

The following table provides information regarding the only entities known to us to be beneficial owners of more than five percent of our outstanding Common Shares as of January 31, 2010. Unless otherwise stated, the beneficial owners exercise sole voting and/or investment power over their shares.

| Name of Beneficial Owner | Shares Beneficially Owned | | Percent of Shares Beneficially Owned |

| BlackRock Inc. | 824,607 | (1) | | | 5.7 | % |

40 East 52nd Street | | | | | | |

| New York, NY 10022 | | | | | | |

| | | | | | | |

| Royce & Associates, LLC | 806,189 | (2) | | | 5.5 | % |

| 745 Fifth Avenue | | | | | | |

| New York, NY 10151 | | | | | | |

(1) | BlackRock Inc., a registered investment advisor, is deemed to have beneficial ownership of 824,607 shares, as described on Schedule 13G filed with the Securities and Exchange Commission on January 20, 2010. |

(2) | Royce and Associates, LLC, a registered investment advisor, is deemed to have beneficial ownership of 806,189 shares, as described on Schedule 13G filed with the Securities and Exchange Commission on January 26, 2010. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Each director and certain officers of the Company are required to report to the Securities and Exchange Commission, by a specified date, his or her transactions related to Met-Pro Corporation Common Shares. Based solely on a review of the copies of reports furnished to the Company, or written representations that no other reports were required, the Company believes that during the 2010 fiscal year, all filing requirements applicable to its officers and directors were complied with on a timely basis.

At the Compensation and Management Development Committee’s direction, management conducted a risk assessment of the Company’s compensation policies and practices, including its executive compensation programs. The Committee reviewed and discussed the findings of the assessment and concluded that the Company’s compensation policies and practices are designed with the appropriate balance of risk and reward in relation to the Company’s overall business strategy, do not incent executives to take unnecessary or excessive risks, and that any risks arising from the Company’s policies and practices are not reasonably likely to have a material adverse effect on the Company. In the review, management considered the attributes of the Company’s policies and practices, including:

| | | The mix of fixed and variable compensation opportunities; |

| | | |

| | | The balance between annual and longer-term performance opportunities; |

| | | |

| | | The alignment of annual and long-term incentive award objectives to ensure that both types of awards encourage consistent behaviors and sustainable performance results; |

| | | |

| | | Performance factors tied to key measures of short-term and long-term performance that motivate sustained performance; and |

| | | |

| | | The Committee’s ability to consider non-financial and other qualitative performance factors in determining actual compensation payouts. |

COMPENSATION DISCUSSION AND ANALYSIS

The purpose of the Compensation and Management Development Committee of the Board of Directors (the “Compensation Committee” or “Committee”) is (i) to establish the Company’s Compensation Philosophy, which serves as the basis for all employee remuneration policies and programs; (ii) to monitor the implementation of the Company’s compensation programs to ensure each is consistent with the Compensation Philosophy; (iii) to discharge as to the Chief Executive Officer, and to assist the Board in otherwise discharging, the Board’s responsibilities relating to the compensation of the Company’s executives (consisting of the Company’s elected officers and general managers and such other key employees as determined by the Committee with guidance from the Chief Ex ecutive Officer) and members of the Board; (iv) to review and discuss with the Company’s senior executives the Compensation Discussion and Analysis to be included in the Company’s Proxy Statement and recommend to the Board that the Compensation Discussion and Analysis be included in the Proxy Statement and to provide the Compensation and Management Development Committee Report for inclusion in the Company’s Proxy Statement that complies with the rules and regulations of the Securities and Exchange Commission; and (v) to assist the Board in ensuring that the Company has in place effective policies and programs for senior executive succession and for the development of its executives.

The Committee is comprised only of independent non-employee members of the Board of Directors and has responsibility for among other matters, establishing and implementing the Company’s executive compensation philosophy. The Committee makes recommendations to the Board of Directors (the “Board”) concerning compensation policies for the Company’s executive officers, other senior managers and the Directors, except that the Committee, with other independent Directors as determined by the Board, has the sole authority to set compensation for the Chief Executive Officer. Throughout this proxy statement, the individuals who served as the Company’s Chief Executive Officer and Chief Financial Officer during the fisca l year ended January 31, 2010, as well as the other individuals included in the Summary Compensation Table on page 23, are referred to as the “named executive officers.”

Compensation Philosophy and Objectives

The Committee makes every effort to ensure that the Company’s compensation program is consistent with the values of Met-Pro Corporation and furthers its business strategy. The Committee has established the following compensation objectives for the Company’s named executive officers and other senior managers as important elements of its overall compensation philosophy:

| | ♦ | Align the interests of executives, including the Company’s named executive officers, with those of the shareholders. The Committee believes it is appropriate to tie a portion of executive compensation to the value of the Company’s stock in order to more closely align the interests of the named executive officers and other senior managers with the interests of the Company’s shareholders. |

| | ♦ | Retain and develop competent management. The Company’s executive compensation program components are designed to attract, retain, develop and motivate highly qualified executives critical to achieving Met-Pro’s strategic objectives and building shareholder value. |

| | | Relate executive compensation to the achievement of the Company’s goals and financial performance, both short and long-term. The Committee’s executive compensation programs are designed to reward executives when performance results for the Company and the executive are above stated objectives. The Committee believes that compensation paid to executives should be closely aligned with the performance of the Company on both a short-term and long-term basis. |

The Committee reviews the Company’s compensation philosophy and objectives at least twice each year, once in December near the end of the fiscal year and once again in February at the start of the new fiscal year, to determine if revisions are necessary in light of market conditions, the Company’s strategic goals, and/or other relevant factors.

Role of Company Management in Compensation Decisions

The Committee, together with the other independent Directors of the Board, as determined by the Board, has the full authority as to compensation of the Chief Executive Officer and sets the Chief Executive Officer’s compensation. As to the other named executive officers and the Company’s other senior managers, the Chief Executive Officer annually reviews compensation for the other named executive officers and other senior managers and makes recommendations to the Committee based on individual performance. The Chief Executive Officer proposes base salary adjustments and long-term incentive award grants for each of the other named executive officers and other senior managers to the Committee for approval. Together with the Chief Financial Officer, the Chief Executive Officer also works with the participants in the annual Management Incentive Plan (the � 220;Plan”) to establish the performance goals under the Management Incentive Plan (at least some of which are with reference to the Company’s annual operating plan), presents these performance goals to the Committee as part of the Company’s annual budgeting process, monitors and reports to the Board and the Committee on a periodic basis as to performance relative to these performance goals, and presents to the Committee an assessment after the end of the fiscal year as to the extent to which the performance goals

were met by each of the participants in the Plan. The Chief Executive Officer also has discretionary authority to distribute a certain pool of bonus money that may be available under the Management Incentive Plan to participants in the Plan whose performance he believes merits a bonus award notwithstanding that such participant did not otherwise qualify for an award under the Plan. The Committee reviews and approves, and retains discretion to modify, all awards under the Plan. The Committee’s actions are subject to Board approval, except with respect to decisions as to the compensation of the Chief Executive Officer.

Establishing Executive Compensation

The primary objectives of Met-Pro Corporation’s senior executive compensation program is to attract and retain highly qualified senior executives, to motivate them to achieve measurable performance objectives at their management level and to align their interests with those of Met-Pro Corporation’s shareholders. To achieve these objectives, the Company follows the basic principles that annual compensation should be competitive with other public manufacturing companies of similar size and/or market base, and that long-term compensation should generally be linked to Met-Pro Corporation’s total return to shareholders. The Company’s executive compensation presently consists of the following primary components, (i) base salary; (ii) the Company’s Management Incentive Plan; (iii) a long-term incentive (equity-based) program, currently in the form of stock options; and (iv) other executive benefits, including a defined contribution 401(k) plan, a non-qualified deferred contribution supplemental executive retirement plan, health and retirement benefits, and other benefits. Detail on these is set out later in this proxy statement.

The Compensation and Management Development Committee’s (“Committee”) approach is to periodically (currently on an approximately two or three year cycle) engage an outside consultant to provide a comparative assessment of executive level compensation; to consider compensation increases in February, in connection with the annual salary review process; and where the sense of the Committee is that compensation levels are within the range considered by the Committee to be appropriate, provide for annual base salary increases within a range of 2% to 5%, with the actual specific amount of the increase to take into account a variety of factors including, without limitation, market based data provided by outside consultants; the scope and nature of the executive’s responsibilities; comparati ve geographical cost of living differences; and the nature of the executive’s performance during the prior fiscal year, with superior effort and performance resulting in a base salary increase at the upper end of the range. Similarly, where the sense of the Committee is that compensation is below the bottom end of the range that the Committee considers to be acceptable, the Committee will award a compensation increase that is beyond the “normal” range of increases, it being the Committee’s view that, depending upon the circumstances, the process of bringing the executive’s compensation into an acceptable range may occur over the course of several years.

Specifically, compensation decisions for the fiscal years ended January 31, 2008 and 2009 relied in part upon data provided during the fiscal year ended January 31, 2008 by the Hay Group Inc., an independent compensation consultant. In December 2009, the Committee engaged Frederic W. Cook & Co. Inc., an independent compensation consultant, to perform a competitive assessment of the Company’s compensation program and for related guidance applicable for compensation for the Company’s fiscal year ending January 31, 2011.

The Hay Group Inc. report, provided during the fiscal year ended January 31, 2008, analyzed the Company’s compensation program for a total of 15 senior executives, examining three components of compensation: base salary; total direct compensation (defined as the sum of base compensation plus the target cash bonus amount); and total compensation (defined as the sum of base compensation, the target cash bonus amount, and the value of long-term incentives). The competitive assessment performed by the Hay Group was limited to market data contained in published surveys. The Hay Group provided comparative data with respect to a group of companies considered by the Hay Group to be a peer group consisting of publicly traded companies’ selected based on size, similar business or financial characteristics , international presence and companies with which Met-Pro Corporation competes for business opportunities, managerial talent and shareholder investments (collectively representing the Company’s “FY 2008/2009 Compensation Peer Group”), as follows:

| ○ | Calgon Carbon Corporation | ○ | Gorman-Rupp Corporation | ○ | Fuel Tech Inc. |

| ○ | CECO Environmental Corporation | ○ | Graco Inc. | ○ | Reunion Industries |

| ○ | Environmental Tectonics Corporation | ○ | K-Tron International Inc. | ○ | SL Industries Inc. |

| ○ | Flanders Corporation | ○ | MFRI Inc. | ○ | Strategic Distribution Inc. |

| ○ | PMFG Inc. | ○ | Misonix Inc. | | |

The Committee’s approach for compensation decisions for the fiscal year ended January 31, 2010 was to consider compensation for an executive to be “market competitive” and appropriate for Met-Pro Corporation if all major items of compensation are within a range of 15% (plus or minus) of market median of the FY 2008/2009 Compensation Peer Group.

The Hay Group Report indicated that target bonus levels and long-term incentive values for the Company’s 15 executives were market competitive. The base salary of 11 of these senior executives was considered market competitive. The base salary for the Chief Executive Officer and for two general managers was more than 15% below the market median, and the salary of one general manager was more than 15% above the market median. Of such four persons who were not market competitive, only the

Chief Executive Officer was one of the five most highly compensated employees. The compensation for the other four named executive officers during the fiscal year ended January 31, 2009 was found to be market competitive.

Based in part upon the Hay Group Report, it was the sense of the Committee that the fiscal year ended January 31, 2009 compensation levels for the 11 executives whose compensation was found in all three respects to be market competitive was appropriate to accomplish the Committee’s goals of incentivizing and retaining these key executives, and that no major changes to the compensation paid to these executives was needed to accomplish the Committee’s goals. Accordingly, consistent with this approach, in February 2008, the Committee approved base salary increases recommended by the Chief Executive Officer for these executives that were within the 2-5% range referenced above. As indicated above, the Hay Group Report concluded that the Chief Executive Officer’s base salary as of the time was below the range considered to be market competitive. The Committee relied upon this analysis, in part, in making its decision to increase Mr. De Hont’s fiscal year ended January 31, 2009 salary by 10%, from $310,000 to $341,000. The Committee considered Mr. De Hont’s performance during the year to be at a very high level and to warrant a “normal” increase at the top of the range. The remainder of this increase was explicitly intended to bring Mr. De Hont’s base salary closer to the market competitive level desired by the Committee, with the Committee’s view being that, assuming that Mr. De Hont continued to perform at expected high levels, a similar percentage increase in base salary could be anticipated for the fiscal year ended January 31, 2010 before Mr. De Hont’s base salary would be at the Committee’s desired level.

As noted above, in December 2009, the Committee engaged Frederic W. Cook & Co. Inc., an independent compensation consultant, to perform a competitive assessment of the Company’s compensation program and review the Compensation Peer Group. As a result, for the fiscal year ended January 31, 2011 the following changes have been made to the Company’s compensation peer group (the new compensation peer group being referred to as the “FY 2011 Compensation Peer Group”): Badger Meter Inc., Energy Recovery Inc., Evergreen Solar Inc. and Graham Corp. have been added to our peer group, replacing Calgon Carbon Corporation, Environmental Tectonics Corporation, Graco Inc., Misonix Inc., Reunion Industries, SL Industries Inc. and Strategic Distribution Inc. Frederic W. Cook & Co. Inc.’ s analysis was that total senior executive compensation was in the 25th to 50th percentile of the Company’s FY 2011 Compensation Peer Group relative to base salary, target bonus as a percent of salary, target cash compensation and long-term incentives, which as to the fiscal year ending January 31, 2011 is the Committee’s target range for senior executive compensation.

Base Salary for Fiscal Years 2010 and 2011

As noted above, the Company’s intent is to provide the named executive officers and other senior managers (totaling 14 individuals during the fiscal year ended January 31, 2010) with base salaries at dollar levels intended to be market competitive so as to fairly compensate them for services rendered during the year, consistent with the primary compensation philosophy and objectives previously stated.

Consistent with the stated compensation philosophy and objectives, the Committee, together with the other independent Directors as determined by the Board, sets the base salary for the Chief Executive Officer. As to the other named executive officers and other senior managers, the Chief Executive Officer reviews and recommends salary adjustments to the Committee for approval. In establishing base salary ranges, the Committee takes the following items into consideration:

| The Compensation Peer Group data and other market data for comparable positions; |

| Individual level of experience, responsibility, performance and contributions to the Company; and |

♦ | The Chief Executive Officer’s recommendations for named executive officers (other than himself). |

Fiscal Year 2010

In setting base salaries for the fiscal year ended January 31, 2010, the Committee’s view was that the market data provided by the Hay Group report continued to be relevant but warranted a slight upward adjustment for normal cost of living increases, with the Committee’s intent being to continue to seek to provide market competitive base salaries, which the Committee continued to define as having all major items of compensation be within a range of 15% (plus or minus) of market median (“targeted range”) of the FY 2008/2009 Compensation Peer Group. Giving due consideration to the factors outlined above in the second paragraph of “Establishing Executive Compensation”, the Committee approved the following base salaries for the Company’s fiscal 2010 Named Executive Offi cers:

Mr. De Hont: base salary increased from $341,000 to $375,000. In increasing Mr. De Hont’s base salary by approximately 10%, the Committee took into account the Hay Group report that had indicated that Mr. De Hont’s compensation during the fiscal year ended January 31, 2008 ($310,000) was more than 15% below the market median, and the Committee’s communication to Mr. De Hont at time of increasing his fiscal year ended January 31, 2009 base salary to $341,000 that, assuming continued performance, he should anticipate a similar base salary increase for the fiscal year ended January 31, 2010. The Committee considered Mr. De Hont’s performance during the 2009 fiscal year to be at a very high level and to warrant the indicated fiscal year 2010 increase. The fiscal year 2010 base salary was within the targeted range.

Mr. Morgan: base salary increased from $220,000 to $227,700. The Hay Group report had indicated that Mr. Morgan’s fiscal year 2008 salary was market competitive, and the fiscal year 2010 base salary increase was intended to recognize Mr. Morgan’s level of performance during fiscal year 2009. The fiscal year 2010 base salary was within the targeted range.

Mr. Kimmer: base salary increased from $154,000 to $158,500. The Hay Group report had indicated that Mr. Kimmer’s fiscal year 2008 salary was market competitive, and the base salary increase was intended to recognize Mr. Kimmer’s level of performance during fiscal year 2009. The fiscal year 2010 base salary was within the targeted range.

Mr. Tetley: base salary increased from $187,400 to $192,000. The Hay Group report had indicated that Mr. Tetley’s fiscal year 2008 salary was market competitive, and the base salary increase was intended to recognize Mr. Tetley’s level of performance during fiscal year 2009. The fiscal year 2010 base salary was within the targeted range.

Mr. D’Alterio: base salary increased from $157,500 to $170,000. In awarding an approximately 8% salary increase, the Committee took into account the significance of Mr. D’Alterio’s current responsibilities and awarded him a base salary increase intended to reflect this, to ensure retention, to reward his performance during fiscal year 2009. The fiscal year 2010 base salary was within the targeted range.

Fiscal Year 2011

As earlier noted in this proxy statement, during the fiscal year ended January 31, 2010 the Committee engaged Frederic W. Cook & Co. Inc. (“Cook & Co.”), an independent compensation consultant, to review and report on the competitiveness of the Company’s senior executive compensation structure and practices. The Cook & Co. competitive compensation analysis was based upon compensation data from the FY 2011 Compensation Peer Group as well as a recent general industry survey from a proprietary database that Cook & Co. maintains. Cook and Co.’s analysis was that, in aggregate, base salaries that the Company pays to its senior managers were between the 25th and 50th percentile (“targeted range”) of both the FY 2011 Compensation Peer Group as well as the general industry survey. In setting base salaries for the fiscal year ending January 31, 2011, the Committee sought to maintain base salaries within this 25th to 50th percentile range and sought to give due consideration to the factors outlined above in the second paragraph of “Establishing Executive Compensation”. Based upon the foregoing, the Committee approved the following base salaries for the fiscal year ending January 31, 2011 for the Company’s fiscal 2010 Named Executive Officers:

Mr. De Hont: As per Mr. De Hont’s request, the Committee agreed not to increase Mr. De Hont’s base salary from the $375,000 base salary amount in effect for the fiscal year ended January 31, 2010. The current base salary of Mr. De Hont is within the targeted range.

Mr. Morgan: base salary increased from $227,700 to $232,000. The Cook & Co. report had indicated that Mr. Morgan’s fiscal year 2010 base salary was within the targeted range, and the fiscal year 2011 base salary increase was intended to recognize Mr. Morgan’s level of performance during fiscal year 2010. The fiscal year 2011 base salary is within the targeted range.

Mr. Kimmer: base salary increased from $158,500 to $175,000. The increase in Mr. Kimmer’s base salary was intended to reflect Mr. Kimmer’s increased responsibilities as the General Manager of the newly formed Met-Pro Environmental Air Solutions business unit, to reward him for his level of performance during fiscal year 2010. The fiscal year 2011 base salary is within the targeted range.

Mr. Tetley: base salary increased from $192,000 to $195,000. The Cook & Co. report had indicated that Mr. Tetley’s fiscal year 2010 base salary was within the targeted range, and the fiscal year 2011 base salary increase was intended to recognize Mr. Tetley’s level of performance during fiscal year 2010. The fiscal year 2011 base salary is within the targeted range.

Mr. D’Alterio: base salary increased from $170,000 to $175,000. The Cook & Co. report had indicated that Mr. D’Alterio’s fiscal year 2010 base salary was within the targeted range, and the fiscal year 2011 base salary increase was intended to recognize Mr. D’Alterio’s level of performance during fiscal year 2010. The fiscal year 2011 base salary is within the targeted range.

Management Incentive Plan

The Company’s Management Incentive Plan (the “Plan” or the “Management Incentive Plan”) provides participating individuals with the opportunity to earn annual cash incentive awards (“awards”). Participants in the Plan include the Chief Executive Officer (the “CEO”), the Chief Financial Officer (the “CFO”), the Company’s Executive Vice President, various individuals who function as General Managers of the Company’s businesses, as well as other senior executives. In the case of the CEO and the CFO, awards are based upon the performance of the overall Company, as well as the achievement of specified personal performance goals. In the case of the Executive Vice President, the General Managers and the other senior executives, awards ar e based upon the performance of the operating segment or business managed by the individual, the performance of the overall Company and the achievement of personal performance goals.

The types of measures and relative weight of those measures used in determining annual incentive awards are tailored to the position and organizational responsibility. The Plan does not contemplate or provide for any specific weighting for the individual quantitative and qualitative personal objective portion of the Plan, and it is the Committee’s intent to retain discretion with respect to the measurement of the personal objective portion of the Plan. The Committee received reports from the CEO as to the level of performance by each named executive officer who is eligible for an award under the Plan. In assessing each such named executive officer’s fiscal year ended 2010 financial and personal objective performance goals, the Committee did not assign relative weighting to such person ’s personal objective portion of the Plan.

During February 2009, the Compensation Committee engaged the Hay Group Inc. to analyze the Plan, and based upon the analysis provided in connection with this engagement, the Committee approved certain changes to the Plan effective for the fiscal year ended January 31, 2010.

The amount of the award to be paid under the Plan is based on a percentage of annual base salary. This percentage reflects the executive’s respective organizational level, position and responsibility for achievement of the Company’s strategic goals. In the fiscal year ended January 31, 2010, these percentages were as follows: for the CEO, 50% of base salary; for the CFO, 40% of base salary; for the Executive Vice President, 35% of base salary; and for the General Managers, 25% of base salary.