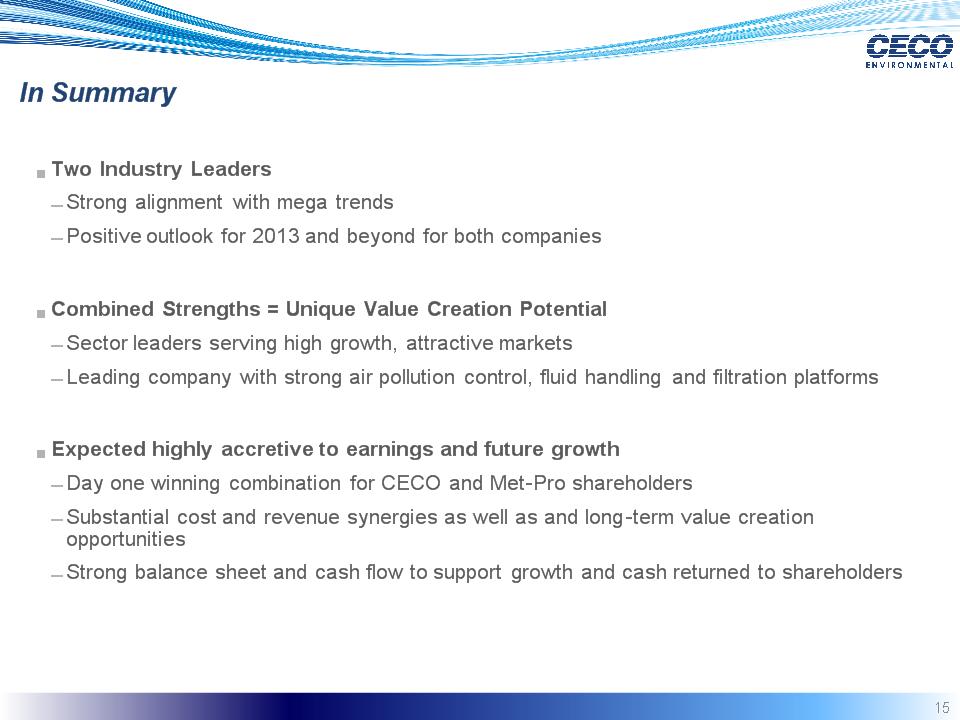

Integrated Clean Air Solutions for Industry Color Palette CECO Blue: 33, 68, 115 CECO Light Blue: 197, 226, 252 CECO Mid Blue: 159, 194, 245 CECO Grey Text: 89, 89, 89 CECO Yellow: 255, 255, 153 CECO Content Box: 74, 126, 187 CECO Green: 146, 208, 80 CECO Dark Green: 0, 153, 0 CECO Light Green: 201, 254, 172 * Forward Looking Statements Information in this document contains forward-looking statements, which involve a number of risks and uncertainties. CECO Environmental Corp. (“CECO”) and Met-Pro Corporation (“Met-Pro”) caution readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information. All such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving CECO and Met-Pro, including future financial and operating results, the new company’s plans, objectives, expectations and intentions and other statements that are not historical facts. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the failure of CECO or Met-Pro stockholders to approve the transaction; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; competition and its effect on pricing, spending, third-party relationships and revenues. Additional factors that may affect future results are contained in CECO’s and Met-Pro’s filings with the SEC. CECO and Met-Pro disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise. Important Information for Investors and Stockholders This communication does not constitute an offer to sell or the solicitation of an offer to buy securities or a solicitation of any vote or approval. This communication is not a substitute for the prospectus/proxy statement CECO Environmental Corp. and Met-Pro Corporation will file with the SEC. Investors in CECO or Met-Pro are urged to read the prospectus/proxy statement, which will contain important information, including detailed risk factors, when it becomes available. The prospectus/proxy statement and other documents that will be filed by the Company and Met-Pro with the SEC will be available free of charge at the SEC’s website, www.sec.gov, or by directing a request when such a filing is made to CECO Environmental Corp., 4625 Red Bank Road, Suite 200, Cincinnati, Ohio 45227, Attention: Investor Relations; or to Met-Pro Corporation, 160 Cassell Road, Harleysville, Pennsylvania 19438, Attention: Investor Relations. A final prospectus/proxy statement will be mailed to CECO’s stockholders and shareholders of Met-Pro. Non-GAAP These slides may contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of historical or future financial performance that excludes amounts that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements). In accordance with the requirements of Regulation G, the table in the Appendix presents the most directly comparable GAAP financial measure and reconciles non-GAAP adjusted EBITDA to the comparable GAAP measure. Adjusted EBITDA is not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Proxy Solicitation CECO and Met-Pro, and certain of their respective directors, executive officers and other members of management and employees may be deemed participants in the solicitation of proxies in connection with the proposed transactions. Information about the directors and executive officers of CECO is set forth in the proxy statement for CECO’s 2013 annual meeting of stockholders and CECO’s 10-K for the year ended December 31, 2012. Information about the directors and executive officers of Met-Pro is set forth in the proxy statement for Met-Pro’s 2012 annual meeting of shareholders and Met-Pro’s Form 10-K for the year ended January 31, 2012. Investors may obtain additional information regarding the interests of such participants in the proposed transactions by reading the prospectus/proxy statement for such proposed transactions when it becomes available.