COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the key components of our executive compensation program, including an analysis of compensation awarded to, earned by or paid to our named executive officers in fiscal 2022. Our fiscal 2022 named executive officers included Donald W. Duda, President and Chief Executive Officer; Ronald L.G. Tsoumas, Chief Financial Officer; Joseph E. Khoury, Chief Operating Officer; Andrea J. Barry, Chief Administrative Officer and Chief Human Resources Officer; and Kevin M. Martin, Vice President, North America. Ms. Barry was promoted to Chief Administrative Officer in January 2022.

Executive Summary

Our Business. We are a leading global supplier of custom-engineered solutions with sales, engineering and manufacturing locations in North America, Europe, Middle East, and Asia. We design, engineer, and produce mechatronic products for OEMs utilizing our broad range of technologies for user interface, LED lighting system, power distribution and sensor applications.

Our solutions are found in the end markets of transportation (including automotive, commercial vehicle, e-bike, aerospace, bus and rail), cloud computing infrastructure, construction equipment, consumer appliance, and medical devices. Our business is managed on a segment basis, with those segments being Automotive, Industrial, Interface and Medical.

We strive to create a company with a diverse customer base, high and consistent cash flow, and a strong balance sheet. We are committed to world class manufacturing quality, and our global footprint puts us in close proximity to key markets and customers.

In fiscal 2022, we continued to capitalize on key market trends, such as new business focused on electric and hybrid vehicles (EVs) and LED lighting solutions. In the EV market, our combination of user interface, LED lighting and power distribution solutions positions us well for continued growth. In fiscal 2022, EV product applications comprised approximately 17% of our net sales..

We employ a balanced and growth-focused capital allocation strategy. We maintain a strong balance sheet and pay down indebtedness when appropriate to reduce leverage. We return capital to our stockholders through dividends and our stock buyback program. As of April 30, 2022, we had executed over $70 million of our $100 million stock buyback authorization. In June 2022, our Board authorized the purchase of an additional $100 million of the Company’s common stock, bringing the total program authorization to $200 million. We invest in organic growth through R&D and capital expenditures. We actively seek accretive acquisitions to enhance and grow our businesses.

Our strong commitment to financial management focuses on, among other things, margin expansion through improved product mixes and operational efficiencies, leverage of SG&A on sales volume growth, and reduction of working capital percentage of sales through lean manufacturing.

COVID-19 Pandemic. The COVID-19 pandemic and the ongoing measures to reduce its spread have negatively impacted the global economy, disrupted consumer and customer demand and global supply chains, and resulted in manufacturing inefficiencies and increased freight costs due to global capacity constraints. We continue to focus on effectively managing the unprecedented challenges and uncertainties of the pandemic on a global basis.

Global Supply Chain Disruptions. In fiscal 2022 we experienced significant business interruptions, including government lockdowns in China, customer shutdowns, increased material and logistics costs, labor shortages, and ongoing challenges related to the worldwide semiconductor supply shortage. Management worked diligently to minimize production and customer issues. The Company strengthened processes to continuously monitor the supply chain to proactively mitigate potential disruptions.

Fiscal 2022 Financial Highlights. Despite the impact from the COVID-19 pandemic and global supply chain disruptions, we reported record fiscal 2022 net sales of almost $1.2 billion, and reported net income of $102.2 million. For fiscal 2022, our quarterly dividend rate was $0.14 per share, and we distributed dividends of $20.6 million to our stockholders. In addition, we purchased 1,425,244 shares of our common stock in fiscal 2022 through our stock buyback program, for an aggregate purchase price of $63.9 million.

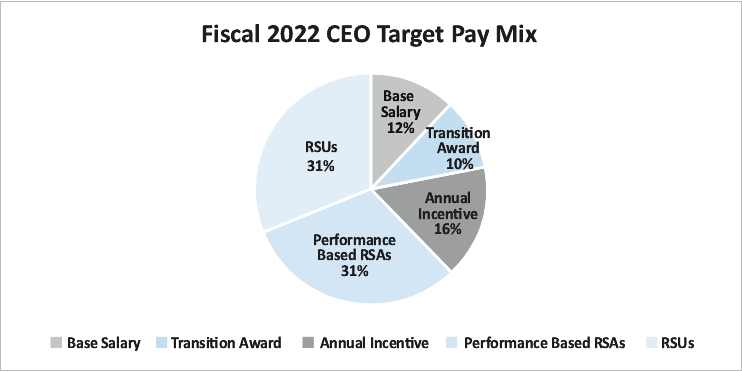

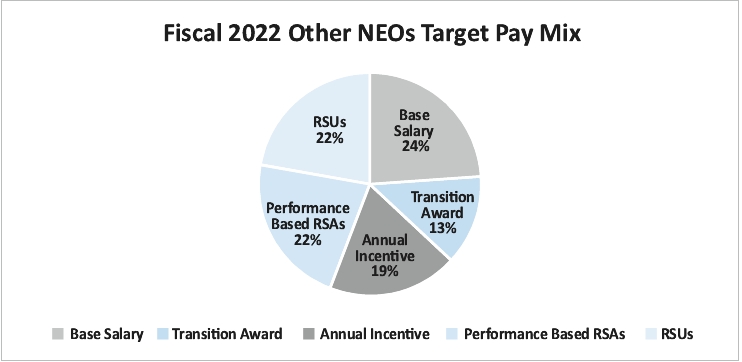

Key Compensation Decisions and Highlights. Our Compensation Committee strives to provide compensation programs that align our executives’ interests with those of our stockholders and appropriately reward our executives for performance against annual and long-term objectives. The key components of the fiscal 2022 compensation program for our named executive officers are salary, an annual performance-based cash bonus, a transition award and