UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant x | |

| Filed by a Party other than the Registrant o | |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Rule 14a-12 |

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction: | |

| 5. | Total fee paid: | |

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1. | Amount Previously Paid: | |

| 2. | Form, Schedule or Registration Statement No.: | |

| 3. | Filing Party: | |

| 4. | Date Filed: | |

METHODE ELECTRONICS, INC.

7401 West Wilson Avenue

Chicago, Illinois 60706

(708) 867-6777

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

February 17, 2004

To the Stockholders of

METHODE ELECTRONICS, INC.:

| 1. | To elect a board of directors; and |

| 2. | To transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

Chairman

January 16, 2004

PROXY STATEMENT

THE ANNUAL MEETING

General

Record Date; Shares Outstanding

Quorum; Votes Required

Voting Procedures

Revoking Your Proxy

Proxy Solicitation Expenses

2

SECURITY OWNERSHIP

Five Percent Stockholders

| Name and Address of Beneficial Owner | Title of Class | Number of Shares and Nature of Beneficial Ownership (1) | Percent of Class | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Barclays Global Investors, N.A. (2) 45 Fremont Street San Francisco, California 94105 | Common Stock | 3,245,321 | 9.2% | |||||||||||

| T. Rowe Price Associates, Inc. (3) 100 East Pratt Street Baltimore, Maryland 21202 | Common Stock | 2,671,900 | 7.5% | |||||||||||

| NFJ Investment Group L.P. (4) c/o Allianz Dresdner Asset Management of America L.P. 888 San Clemente Drive, Suite 100 Newport Beach, California 92660 | Common Stock | 1,912,650 | 5.4% | |||||||||||

| (1) | Beneficial ownership arises from sole voting and investment power unless otherwise indicated by footnote. |

| (2) | Based solely on a Schedule 13F filed by Barclays Global Investors, N.A. with the Securities and Exchange Commission on November 14, 2003. |

| (3) | Based solely on a Schedule 13F filed by T. Rowe Price Associates, Inc. with the Securities and Exchange Commission on November 14, 2003. |

| (4) | Based solely on a Schedule 13F filed by Allianz Dresdner Asset Management of America L.P. with the Securities and Exchange Commission on November 14, 2003. |

Directors and Executive Officers

| Name of Beneficial Owner | Title of Class | Number of Shares and Nature of Beneficial Ownership (1) | Percent of Class | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Warren L. Batts | Common Stock | 24,000 | (2) | * | ||||||||||

| William C. Croft | Common Stock | 117,107 | (3) | * | ||||||||||

| Donald W. Duda | Common Stock | 156,943 | (4) | * | ||||||||||

| Christopher J. Hornung | Common Stock | 0 | — | |||||||||||

| William T. Jensen | Common Stock | 270,133 | (5) | * | ||||||||||

| Paul G. Shelton | Common Stock | 0 | — | |||||||||||

| Lawrence B. Skatoff | Common Stock | 0 | — | |||||||||||

| George C. Wright | Common Stock | 113,176 | (6) | * | ||||||||||

| Douglas A. Koman | Common Stock | 65,212 | (7) | * | ||||||||||

| Robert J. Kuehnau | Common Stock | 108,985 | (8) | * | ||||||||||

| James F. McQuillen | Common Stock | 36,028 | (9) | * | ||||||||||

| All current directors and executive officers as a group (12 individuals) | Common Stock | 990,884 | (10) | 2.8% | ||||||||||

| * | Percentage represents less than 1% of the total shares of common stock outstanding as of January 9, 2004. |

| (1) | Beneficial ownership arises from sole voting and investment power unless otherwise indicated in the footnotes below. |

| (2) | Includes options to purchase 10,000 shares of common stock exercisable within sixty days. |

| (3) | Includes options to purchase 29,707 shares of common stock exercisable within sixty days. |

3

| (4) | Includes options to purchase 154,413 shares of common stock exercisable within sixty days and 2,030 shares of common stock held in Methode’s 401(k) Plan. |

| (5) | Includes options to purchase 150,000 shares of common stock exercisable within sixty days. |

| (6) | Includes 83,469 shares of common stock held as co-trustee and options to purchase 29,707 shares of common stock exercisable within sixty days. |

| (7) | Includes options to purchase 61,398 shares of common stock exercisable within sixty days and 3,814 shares of common stock held in Methode’s 401(k) Plan. |

| (8) | Includes options to purchase 76,076 shares of common stock exercisable within sixty days and 8,486 shares of common stock held in Methode’s 401(k) Plan. |

| (9) | Includes options to purchase 28,256 shares of common stock exercisable within sixty days. |

| (10) | Includes options to purchase 561,632 shares of common stock exercisable within sixty days, 50,429 shares of common stock held in Methode’s 401(k) Plan and 83,469 shares of common stock held as co-trustee. |

4

THE BOARD OF DIRECTORS

| Name | Age | Director Since | Principal Occupation for Last 5 Years and Other Directorships | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Warren L. Batts | 71 | 2001 | Retired Chairman and Chief Executive Officer of Tupperware Corporation, a diversified consumer products company. Mr. Batts is also the Retired Chairman of Premark International, Inc., a diversified consumer products company. | |||||||||||

| William C. Croft | 86 | 1975 | Chairman of the Board, Clements National Company, a manufacturer of electrical equipment, since 1975. | |||||||||||

| Donald W. Duda | 48 | 2001 | President of Methode since February 2001. Prior thereto, Mr. Duda was Vice President – Interconnect Products Group of Methode since March 2000. Prior thereto, Mr. Duda was with Amphenol Corporation, a manufacturer of electronic connectors, as General Manager of its Fiber Optic Products Division from 1988 through November 1998. | |||||||||||

| Christopher J. Hornung | 51 | 2004 | Founder, Chairman and Chief Executive Officer of Pacific Cycle, a large bicycle company in the United States marketing Schwinn, Mongoose, Roadmaster and GT bicycles worldwide through 43 international distributors. | |||||||||||

| William T. Jensen | 76 | 2001; 1959–1997 | Chairman of the Board since February 2001; President of Methode from December 1994 through February 1997. | |||||||||||

| Paul G. Shelton | 53 | 2004 | Retired since December 2003. Prior thereto, Mr. Shelton was Vice President and Chief Financial Officer of FleetPride Inc., an independent heavy-duty parts distributor, since 2001. Mr. Shelton was Chief Financial Officer of AMCOL International Corporation, a supplier of specialty minerals and chemicals, from 1984 through 2001. | |||||||||||

| Lawrence B. Skatoff | 64 | 2004 | Retired since March 2001. Prior thereto, Mr. Skatoff was Executive Vice President and Chief Financial Officer of BorgWarner Inc., a manufacturer of highly engineered systems and components for the automotive industry, since 2000. Prior thereto, Mr. Skatoff was Senior Vice President and Chief Financial Officer of Premark International, Inc. from 1991 through 1999. | |||||||||||

| George C. Wright | 80 | 1968 | Retired since December 2001. Prior thereto, Mr. Wright was President of Piedmont Co. Inc., a distributor of marine products. | |||||||||||

5

BOARD COMMITTEES

CORPORATE GOVERNANCE MATTERS

Director Independence

Committees of the Board

Director Nominations

6

received from stockholders will be evaluated in the same manner that potential nominees suggested by board members, management or other parties are evaluated. Methode does not intend to treat stockholder recommendations in any manner different from other recommendations.

Stockholder Communication with Board Members

7

AUDIT COMMITTEE MATTERS

Report of the Audit Committee

George C. Wright,Chairman

Warren L. Batts

William C. Croft

Audit Committee Charter

Auditing and Related Fees

| Audit Fees | $ | 358,000 | ||||

| Financial Information Systems Design and Implementation Fees | $ | 0 | ||||

| All Other Fees | $ | 101,500 | ||||

| Total Fees | $ | 459,500 |

8

Audit Committee Pre-Approval Policies

9

EXECUTIVE COMPENSATION

Summary Compensation Table

| Annual Compensation | Long Term Compensation | All Other Compensation ($)(4) | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Awards | Payouts | ||||||||||||||||||||||||||

| Name and Principal Position | Fiscal Year | Salary ($)(1) | Bonus ($) | Securities Underlying Options (#) | LTIP Payouts ($)(3) | ||||||||||||||||||||||

| William T. Jensen Chairman | 2003 2002 2001 | 279,447 260,664 59,615 | 132,124 114,498 237,549 | (2) | 50,000 50,000 100,000 | — — — | 2,408 2,529 2,641 | ||||||||||||||||||||

| Donald W. Duda President | 2003 2002 2001 | 291,038 268,914 206,647 | 132,124 114,498 136,983 | 100,000 100,000 100,000 | 15,454 — — | 7,214 5,100 — | |||||||||||||||||||||

| Douglas A. Koman Vice President Corporate Finance | 2003 2002 2001 | 189,994 152,719 51,913 | 66,489 54,065 20,006 | 35,000 75,000 42,648 | — — — | 6,005 1,414 — | |||||||||||||||||||||

| Robert J. Kuehnau Vice President, Treasurer and Controller | 2003 2002 2001 | 183,409 170,053 161,972 | 66,489 54,065 70,135 | 20,000 30,000 20,000 | 83,836 74,751 73,450 | 7,852 6,518 6,332 | |||||||||||||||||||||

| James F. McQuillen Executive Vice President | 2003 2002 2001 | 180,160 160,691 142,592 | 17,219 7,500 53,029 | 15,000 20,000 15,000 | 32,521 42,206 18,980 | 5,874 5,100 5,100 | |||||||||||||||||||||

| (1) | Includes the following cash car allowances for the following Named Executives in 2003, 2002 and 2001 respectively: Mr. Duda, $9,450, $8,250 and $6,000; Mr. Koman, $9,200 and $4,400; Mr. Kuehnau, $9,200, $4,725 and $3,900; and Mr. McQuillen, $8,750, $6,000 and $6,000. |

| (2) | Includes a $200,000 payment pursuant to the Supplemental Executive Benefit Plan (“SEBP”). The SEBP terminated in fiscal year 2001. |

| (3) | Long-Term Incentive Plan (“LTIP”) payouts represent amounts paid pursuant to Methode’s Longevity Contingent Bonus Program. See “Long-Term Incentive Plans—Awards in Last Fiscal Year” and “Board Compensation Committee Report on Executive Compensation—Long-Term Incentive” below for a description of the Longevity Contingent Bonus Program. |

| (4) | Includes the following company contribution under Methode’s 401(k) Plan for the following Named Executives in fiscal 2003, 2002, and 2001 respectively: Mr. Duda, $7,214 and $5,100; Mr. Koman, $6,005 and $1,414; Mr. Kuehnau, $6,285, $5,100 and $5,100; and Mr. McQuillen, $5,874, $5,100 and $5,100. Includes the following above-market interest accruals under Methode’s Capital Accumulation Program for the following Named Executives in fiscal 2003, 2002 and 2001, respectively: Mr. Jensen, $2,408, $2,529 and $2,641; and Mr. Kuehnau, $1,567, $1,418 and $1,232. |

10

Option Grants In Last Fiscal Year

| Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Number of Securities Underlying Options Granted (1) | % of Total Options Granted to Employees (2) | Exercise Price (3) | Expiration Date | 5% | 10% | |||||||||||||||||||||

| William T. Jensen | 50,000 | 9.1 | % | $ | 11.44 | 7/3/2013 | 359,500 | 911,500 | |||||||||||||||||||

| Donald W. Duda | 100,000 | 18.1 | % | $ | 11.44 | 7/3/2013 | 719,000 | 1,823,000 | |||||||||||||||||||

| Douglas A. Koman | 35,000 | 6.3 | % | $ | 11.44 | 7/3/2013 | 251,650 | 638,050 | |||||||||||||||||||

| Robert J. Kuehnau | 20,000 | 3.6 | % | $ | 11.44 | 7/3/2013 | 143,800 | 364,600 | |||||||||||||||||||

| James F. McQuillen | 15,000 | 2.7 | % | $ | 11.44 | 7/3/2013 | 107,850 | 273,450 | |||||||||||||||||||

| (1) | These non-qualified stock options to purchase shares of Methode’s common stock were issued pursuant to Methode’s 2000 Stock Plan and may not be exercised until they vest. Mr. Jensen’s options vest after one year; options granted to Messrs. Duda and Koman vest 25% after one year, 50% after two years, 75% after three years and 100% after four years; and options granted to Messrs. Kuehnau and McQuillen vest 33% after one year, 67% after two years and 100% after three years. |

| (2) | Based on a total of 551,900 options granted to all employees. |

| (3) | Fair market value on the date of grant. |

Aggregated Option Exercises In Last Fiscal Year And Fiscal Year-End Option Values

| Name | Shares Acquired on Exercise (#) | Value Realized ($) | Number of Securities Underlying Unexercised Options at 4/30/03 Exercisable / Unexercisable | Value of Unexercised In-the-Money Options at FY-End ($) Exercisable / Unexercisable | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| William T. Jensen | — | — | 50,000 / 100,000 | $226,500 / $245,500 | ||||||||||||||

| Donald W. Duda | — | — | 79,413 / 150,000 | $226,500 / $264,500 | ||||||||||||||

| Douglas A. Koman | — | — | 30,148 / 87,500 | $47,393 / $71,375 | ||||||||||||||

| Robert J. Kuehnau | — | — | 58,576 / 40,000 | $34,300 / $45,700 | ||||||||||||||

| James F. McQuillen | — | — | 14,089 / 27,500 | $25,725 / $33,325 | ||||||||||||||

Long-Term Incentive Plans—Awards In Last Fiscal Year

| Estimated Future | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Performance or Other Period Until Maturation or Payout | Threshold ($) | Target ($) | Maximum ($) | |||||||||||||||

| William T. Jensen | 3 years | 132,124 | 132,124 | 132,124 | |||||||||||||||

| Donald W. Duda | 3 years | 132,124 | 132,124 | 132,124 | |||||||||||||||

| Douglas A. Koman | 3 years | 66,489 | 66,489 | 66,489 | |||||||||||||||

| Robert J. Kuehnau | 3 years | 66,489 | 66,489 | 66,489 | |||||||||||||||

| James F. McQuillen | 3 years | 17,219 | 17,219 | 17,219 | |||||||||||||||

11

Employment Agreements

Jensen Employment Agreement

Employment Security Agreements

| (1) | any person or group is or becomes the beneficial owner of 25 percent or more of Methode’s common stock (excluding shares acquired directly from Methode or acquired in certain mergers and business combinations); |

| (2) | at any time during any period of two consecutive 12-month periods, members of Methode’s board of directors at the beginning of the period (the “Incumbent Board”) cease for any reason to constitute at least a majority of the board. Directors approved by a majority of the Incumbent Board will be considered members of the Incumbent Board. However, directors elected in connection with an actual or threatened proxy contest or solicitation by a third party will not be considered members of the Incumbent Board for this purpose; or |

| (3) | there is a merger or other business combination of Methode pursuant to which Methode’s stockholders own less than 60 percent of the voting stock of the surviving corporation. |

Donald W. Duda Cash Bonus Agreement

12

increase, if any, in the value of the common stock, and the date Mr. Duda is paid the bonus. All bonuses payable under the Cash Bonus Agreement are forfeited if Mr. Duda is terminated for cause.

Longevity Contingent Bonus Program

Director Compensation

2000 Stock Plan

13

Section 16(a) Beneficial Ownership Reporting Compliance

Compensation Committee Interlocks and Insider Participation

BOARD COMPENSATION COMMITTEE REPORT

ON EXECUTIVE COMPENSATION

Base Salary

Bonus Compensation

Long-Term Incentives

14

Donald W. Duda Cash Bonus Agreement

Warren L. Batts

William C. Croft

15

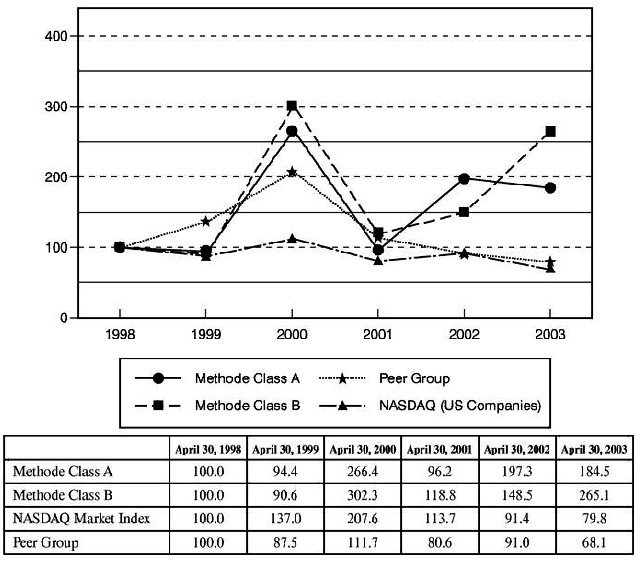

PERFORMANCE GRAPH

16

RELATED PARTY TRANSACTIONS

The Merger Agreement

The Planned Tender Offer by Methode

The Horizon Loan

17

William McGinley’s Estate, as the owner of such Class A common stock and Class B common stock, provide a similar undertaking to that provided by William McGinley.

Split-Dollar Insurance Agreement

18

OTHER INFORMATION

Stockholder Proposals

Additional Information

Other Matters

Chairman

Chicago, Illinois

January 16, 2004

19

APPENDIX 1

METHODE ELECTRONICS, INC.

AUDIT COMMITTEE CHARTER

Organization

Purpose

Duties and Responsibilities

| • | The firm’s internal quality control procedures. |

A-1

| • | Any material issues raised by the most recent internal quality control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues. |

| • | All relationships between the independent auditor and the Company (to assess the auditor’s independence). |

A-2

7401 WEST WILSON AVE. CHICAGO, IL 60706-4548 | VOTE BY INTERNET - www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL - Mark, sign and date your proxy card and return it in the postage-paid envelope we’ve provided or return to Methode Electronics, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | MELEC1 | KEEP THIS PORTION FOR YOUR RECORDS |

DETACH AND RETURN THIS PORTION ONLY | ||

| THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. | ||

| METHODE ELECTRONICS, INC. COMMON STOCK | ||||||||||

| Vote On Directors | ||||||||||

| 1. | The election of the following nominees as directors: | For All | Withhold All | For All Except | To withhold authority to vote, mark “For All Except” and write the nominee's number on the line below. | |||||

| 01) Warren L. Batts 02) William C. Croft 03) Donald W. Duda 04) Christopher J. Hornung 05) William T. Jensen 06) Paul G. Shelton 07) Lawrence B. Skatoff 08) George C. Wright | [ ] | [ ] | [ ] | |||||||

| IMPORTANT — PLEASE VOTE, SIGN AND RETURN PROMPTLY. When there is more than one owner of shares, both should sign. Signatures should correspond with names printed on this proxy card. When signing as an attorney, executor, administrator, trustee, or guardian, please add your full title as such. If a corporation, please sign in full corporate name, and this proxy should be signed by a duly authorized officer. If a partnership, please sign in partnership name by an authorized person. |

| Signature [PLEASE SIGN WITHIN BOX] | Date | Signature (Joint Owners) | Date |

METHODE ELECTRONICS, INC.

COMMON STOCK

P R O X Y

FOR THE ANNUAL MEETING OF THE STOCKHOLDERS OF

METHODE ELECTRONICS, INC.

THIS PROXY IS SOLICITED ON BEHALF OF

THE BOARD OF DIRECTORS

The undersigned hereby appoints Warren L. Batts, William T. Jensen and George C. Wright, and each of them, with full power of substitution, as proxies to vote all shares of Methode Electronics, Inc. common stock which the undersigned is entitled to vote at the Annual Meeting of Methode Electronics, Inc. to be held on Tuesday, February 17, 2004 at 10:30 a.m., Chicago time, at The Rosewood Meeting Facility, 9421 W. Higgins Road, Rosemont, Illinois, and at any adjournment or postponement thereof.

This proxy when properly signed will be voted in the manner directed herein by the undersigned stockholder. IF NO DIRECTION IS PROVIDED, THIS PROXY WILL BE VOTED AS RECOMMENDED BY THE BOARD OF DIRECTORS. If other business is presented at the Annual Meeting, this proxy shall be voted in accordance with the best judgment of the persons named as proxies above.