Searchable text section of graphics shown below

To Every Customer Everyday | |

| |

| [pictures] | |

Angelica Corporation

April, 2006 | |

| | |

|

| |

| This presentation contains forward-looking statements, which reflect Angelica Corporation’s current views with respect to future events and financial performance and are made pursuant to the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties that may cause our actual results to be materially different from those expressed or implied by these statements. A more detailed description of certain factors that could affect actual results include, but are not limited to, those discussed in Angelica Corporation’s filings with the Securities and Exchange Commission. |

| [Angelica Logo] |

| |

| | |

| Angelica’s objective is to be the leading provider of linen management services to the U.S. healthcare market by providing delightful service through innovation. | |

| | |

“Great Service Everyday to Every Customer” | |

[Angelica Logo] | |

| |

| | | |

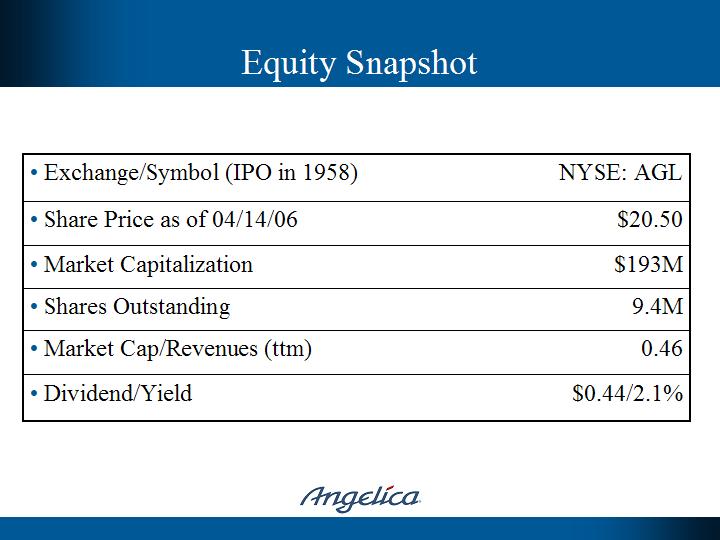

| • Exchange/Symbol (IPO in 1958) | NYSE: AGL | |

| | | |

| • Share Price as of 04/14/06 | $20.50 | |

| | | |

| • Market Capitalization | $193M | |

| | | |

| • Shares Outstanding | 9.4M | |

| | | |

| • Market Cap/Revenues (ttm) | 0.46 | |

| | | |

| • Dividend/Yield | $0.44/2.1% | |

| [Angelica Logo] | |

| | | |

| | | |

| • | Founded in 1878 as uniform manufacturing company and grew to three divisions in 1960’s: Manufacturing, Textile Services and Retail | |

| • | Sold Manufacturing division in 2002 | |

| • | Sold Retail division in 2004 | |

| • | Reduced corporate overhead from 50 people to 15 people in 2004 | |

| • | Focused textile rental services business on healthcare linen services | |

[Angelica Logo] | |

| |

| | |

| | | | |

| • | Completed reorganization November, 2005 | |

| | – | Moved to customer versus plant focused organizational structure, collapsing 31 facilities into nine markets, eliminated 50 exempt positions | |

| | – | Market Vice President (MVP) leads each market, supported by Directors of Service, Operations and Sales | |

| • | Rolling out programs to achieve 100% fill rates with on-time deliveries, and increase product quality | |

| • | Optimizing cost structure via best practice implementation in all 31 service centers | |

| • | Building an IT knowledge base and metrics | |

| | | | |

[Angelica Logo] | |

| |

| | | |

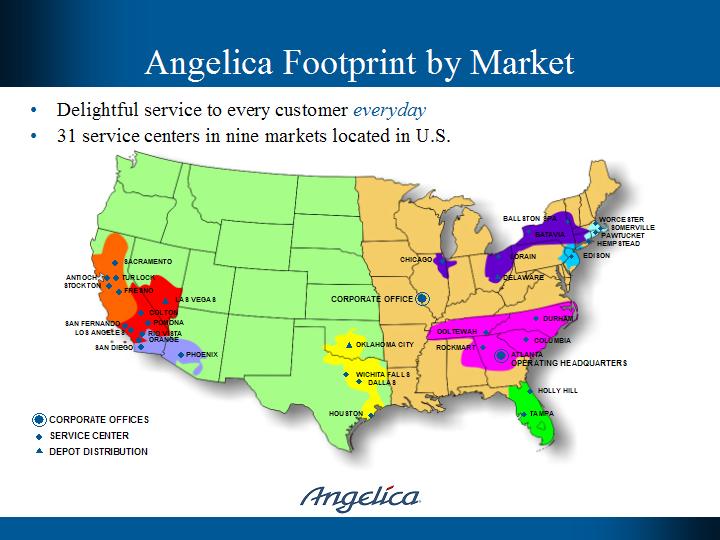

| • | Delightful service to every customer everyday | |

| | | |

| • | 31 service centers in nine markets located in U.S. | |

| | | |

| [picture] | |

[Angelica Logo] | |

| | | |

| | | |

| “Great Service Everyday to Every Customer” yields: | |

| | | |

| • | The unsurpassed healthcare linen management service provider, leading to organic growth rate of 7-10% | |

| | | |

| • | A more efficient operating model, leveraging our scale and best practices, growing gross margins to 20% | |

| | | |

| • | Additional growth through acquisitions by consolidating a fragmented market and by adding complementary healthcare services that fit our model | |

| | | |

| | [Angelica Logo] | |

| | | |

| |

| | |

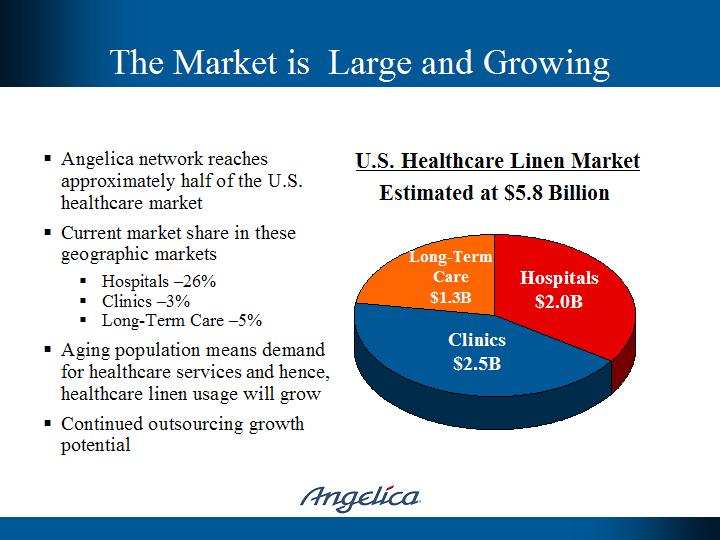

| § | Angelica network reaches approximately half of the U.S. healthcare market | U.S. Healthcare Linen Market Estimated at $5.8 Billion | |

| § | Current market share in these geographic markets | [pie chart] | |

| | § | Hospitals -26% | Long-Term Care $1.3B | |

| | § | Clinics -3% | Hospitals $2.0B | |

| | § | Long-Term Care -5% | Clinics $2.5B | |

| § | Aging population means demand for healthcare services and hence, healthcare linen usage will grow | | |

| § | Continued outsourcing growth potential | | |

[Angelica Logo] | |

| |

| | | |

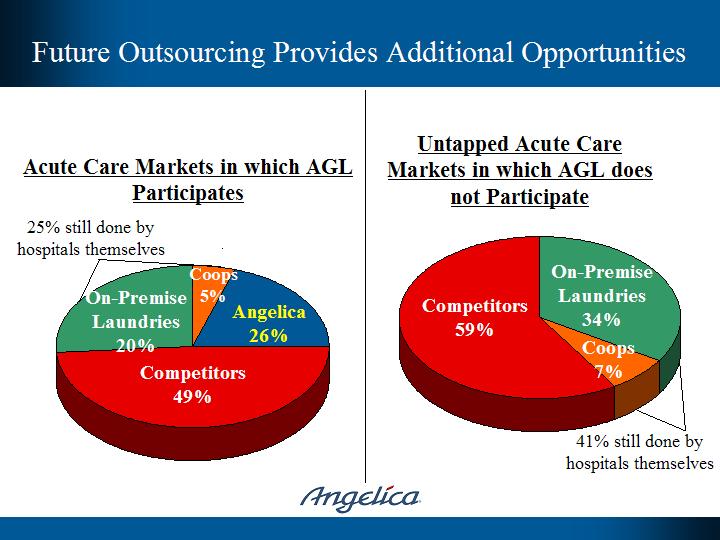

Acute Care Markets in which AGL Participates | Untapped Acute Care Markets in which AGL does not Participate | |

| | | |

25% still done by hospitals themselves | | |

| | | |

| [pie chart] | [pie chart] | |

| | | |

Competitors 49% | Competitors 59% | |

On-Premise Laundries 20% | On-Premise Laundries 34% | |

Angelica 26% | Coops 7% | |

| Coops 5% | | |

| | 41% still done by hospitals themselves | |

| [Angelica Logo] | |

| |

| | | |

| • | With less than 10% share of the total healthcare market, Angelica leads a fragmented $5.8 billion market | |

| • | Only two national hospital competitors (Crothall Services, a Compass division, and Sodexho Laundry Services) | |

| • | Approximately 11 mid-size regional hospital providers (between $20 million and $100 million) | |

| • | Over 1,500 hospitals still managing (or using management firm for) own laundry (OPL) or using coop | |

| • | In clinics, Aramark and Morgan Linen are the largest competitors with industry dominated by small players | |

| • | In long-term care, Health Care Services Group is an indirect national competitor | |

| [Angelica Logo] | |

| |

| | | |

| • | Organic Revenue Growth | |

| | – | Delightful service through innovation | |

| | | • | 100% fill rate; on-time delivery | |

| | | • | Improved product offerings | |

| | – | All products available and offered to all customers | |

| | – | Clinic and long-term care growth | |

| • | Acquired Revenue Growth | |

| | – | On premise laundry (OPL) conversion | |

| | – | Accretive competitor acquisition | |

| • | Improved Operational Efficiency | |

| | – | Market structure | |

| | – | Best practices | |

| [Angelica Logo] | |

| |

| | | |

| • | Restructure organization and reward system around the customer, increasing top 2 “willing to recommend” scores from 80% to 95+% | |

| • | Implement best practices that improve the customer experience, including 100% fill rates, on-time delivery and high quality products, leading to increased pricing | |

| • | Sell all current customers all current products—leveraging sheets and pillowcases into garments, mops and mats—maximizing revenue per customer | |

| • | Focus clinic and long-term care selling on current customer affiliates who already enjoy Angelica Service | |

| [Angelica Logo] | |

| |

| | | |

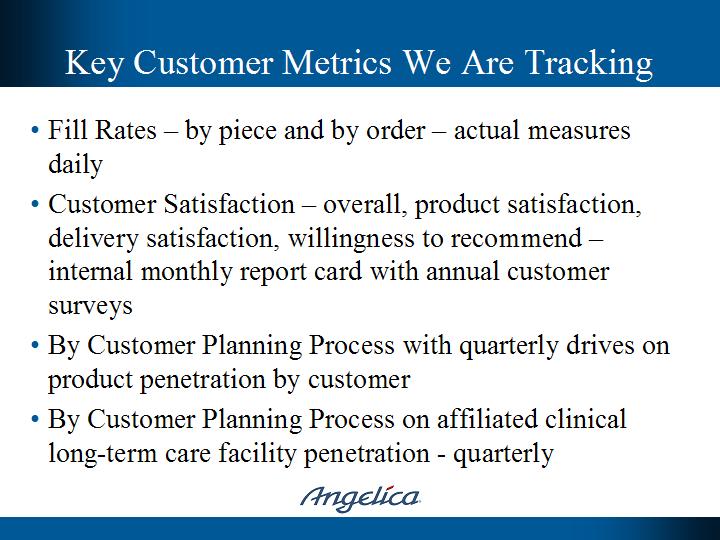

| • | Fill Rates - by piece and by order - actual measures daily | |

| • | Customer Satisfaction - overall, product satisfaction, delivery satisfaction, willingness to recommend - internal monthly report card with annual customer surveys | |

| • | By Customer Planning Process with quarterly drives on product penetration by customer | |

| • | By Customer Planning Process on affiliated clinical long-term care facility penetration - quarterly | |

| [Angelica Logo] | |

| |

| | | | |

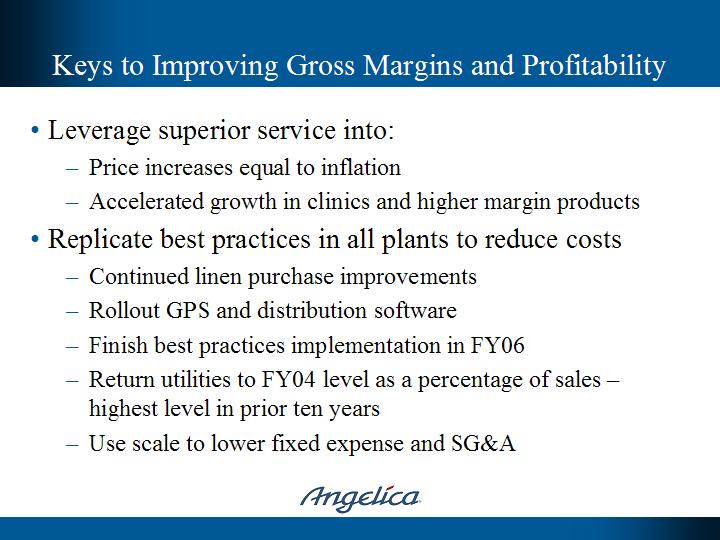

| • | Leverage superior service into: | |

| | – | Price increases equal to inflation | |

| | – | Accelerated growth in clinics and higher margin products | |

| • | Replicate best practices in all plants to reduce costs | |

| | – | Continued linen purchase improvements | |

| | – | Rollout GPS and distribution software | |

| | – | Finish best practices implementation in FY06 | |

| | – | Return utilities to FY04 level as a percentage of sales - highest level in prior ten years | |

| | – | Use scale to lower fixed expense and SG&A | |

| [Angelica Logo] | |

| |

| | | | |

| • | Yield total and net per pound | |

| • | Operating cost per pound—total and for all key segments | |

| • | Energy utilization per pound—gallons of water per pound, therms per pound | |

| • | Pounds per labor hour | |

| • | Distribution cost per pound and per mile—with and without fuel | |

| • | Service center and key processes capacity utilization | |

[Angelica Logo] | |

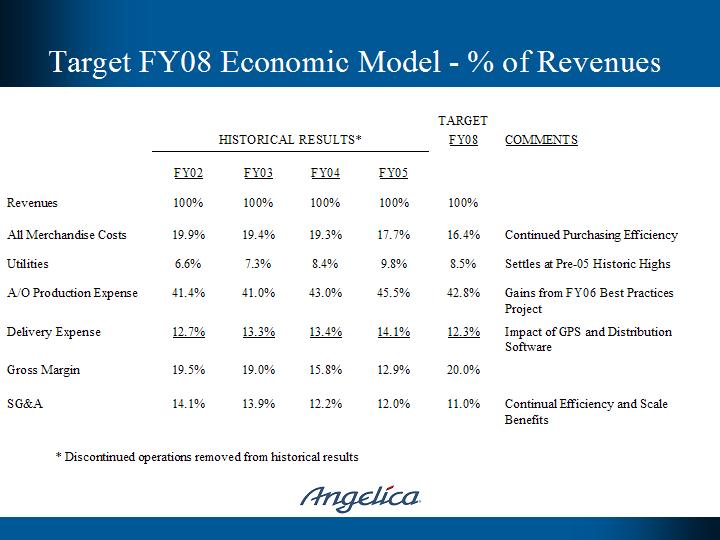

| | HISTORICAL RESULTS* | | TARGET FY08 | | COMMENTS |

| | | | | | | | | | | | | |

| | FY02 | | FY03 | | FY04 | | FY05 | | | | |

| | | | | | | | | | | | | |

| Revenues | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | |

| | | | | | | | | | | | | | | | | | |

| All Merchandise Costs | | 19.9 | % | | 19.4 | % | | 19.3 | % | | 17.7 | % | | 16.4 | % | | Continued Purchasing Efficiency |

| | | | | | | | | | | | | | | | | | |

| Utilities | | 6.6 | % | | 7.3 | % | | 8.4 | % | | 9.8 | % | | 8.5 | % | | Settles at Pre-05 Historic Highs |

| | | | | | | | | | | | | | | | | | |

| A/O Production Expense | | 41.4 | % | | 41.0 | % | | 43.0 | % | | 45.5 | % | | 42.8 | % | | Gains from FY06 Best Practices Project |

| | | | | | | | | | | | | | | | | | |

| Delivery Expense | | 12.7 | % | | 13.3 | % | | 13.4 | % | 14.1 | % | | 12.3 | % | | Impact of GPS and Distribution Software |

| | | | | | | | | | | | | | | | | | |

| Gross Margin | | 19.5 | % | | 19.0 | % | | 15.8 | % | | 12.9 | % | | 20.0 | % | | |

| | | | | | | | | | | | | | | | | | |

| SG&A | | 14.1 | % | | 13.9 | % | | 12.2 | % | | 12.0 | % | | 11.0 | % | | Continual Efficiency and Scale Benefits |

*Discontinued operations removed from historical results

|

| | |

| | FY05 |

| # Markets with 20+ % Gross Margin | 1 |

| | |

| # Markets with 17.5% to 19.9% Gross Margin | 1 |

| | |

| # Markets with 15.0% to 17.4% Gross Margin | 0 |

| | |

| # Markets with 2.5% to 14.9% Gross Margin | 2 |

| | |

| # Markets with 10.0% to 12.4% Gross Margin | 4 |

| | |

| # Markets with <10% Gross Margin | 1 |

| | |

| | |

| [Angelica Logo] | |

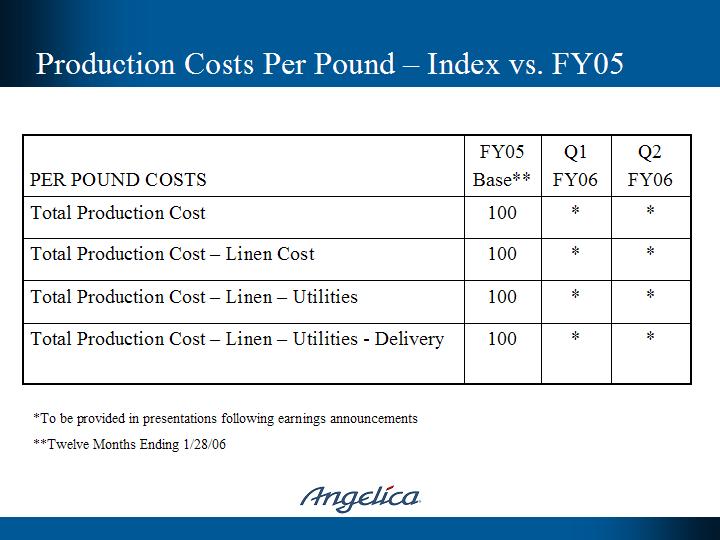

| PER POUND COSTS | FY05 Base** | Q1 FY06 | Q2 FY06 |

| Total Production Cost | 100 | * | * |

| Total Production Cost - Linen Cost | 100 | * | * |

| Total Production Cost - Linen - Utilities | 100 | * | * |

| Total Production Cost - Linen - Utilities - Delivery | 100 | * | * |

*To be provided in presentations following earnings announcements

**Twelve Months Ending 1/28/06

[Angelica Logo]

| |

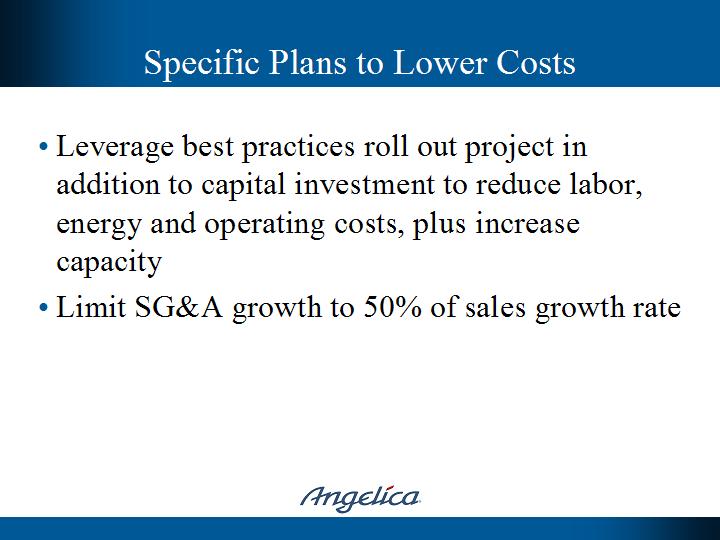

| | | | |

| • | Leverage best practices roll out project in addition to capital investment to reduce labor, energy and operating costs, plus increase capacity | |

| • | Limit SG&A growth to 50% of sales growth rate | |

[Angelica Logo] | |

| |

| | | |

| • | Since November 2003, we have purchased over $130 million in net healthcare revenue, while selling about $24 million of non-healthcare business | |

| • | Strategic focus is filling in market presence in Eastern and Southern United States with complementary, quality service providers | |

| • | Acquisitions range from small tuck-in volume to multiple free-standing plants | |

| • | Seek accretive acquisitions with 15% internal rate of return and 18% return on net assets. | |

| [Angelica Logo] | |

DATE | TRANSACTION | BENEFIT | REVENUES |

| August 2005 | Purchased customer contracts and assets from Bob White Services in northern Ohio and upstate New York | Strengthened regional position and capacity utilization | $3 M |

| March 2005 | Purchased Royal Institutional Services’ healthcare business in Somerville and Worcester, MA | More than tripled New England presence | $45 M |

| January 2005 | Laundry plants and contracts in Dallas and Wichita Falls from National Linen Services | Strengthened Southwest position | $18 M |

| January 2005 | Assumed lease and operations of Long Island healthcare plant from Tartan Textile | Improved access to NY market, especially long-term care | $28 M |

| December 2004 | Healthcare laundry operations and customer contracts of Golden State Services in Northern California | Strengthens presence in Northern California market | $20 M |

| May 2004 | Purchased New England healthcare business of Tartan Textile | Strengthened New England position | $1 M |

| April 2004 | Duke University Health System laundry in Durham, NC | Example of hospital system outsourcing linen management | $5 M |

| December 2003 | National Services’ healthcare plant and business located in Safety Harbor, FL | Enabled AGL to serve 75% of the Florida market | $12 M |

| November 2003 | Customer contracts and selected assets of Tenney Laundry Services in Batavia, NY | Strengthened regional position | $2 M |

| | | Revenue* | Rationale and Comments |

| 12/03 | Safety Harbor | $12 | Provided strong west coast Florida presence which with investment could grow |

| 4/04 | Durham | $5 | Gained new, one-third utilized facility with core, long-term customer at less than replacement cost of facility |

| 1/05 | Texas (NLS) | $18 | Built Texas market presence while allowing us to close and consolidate our smaller Dallas facility, reducing overall capex |

| 1/05 | Hempstead | $28 | Tripled our market share in NY/NJ, providing distribution synergies and long-term care expertise |

| 3/05 | Royal | $45 | Leader in New England healthcare with outstanding “best practices” in service; eliminated need for us to reinvest in Rhode Island facility |

*Dollars in millions

[Angelica Logo]

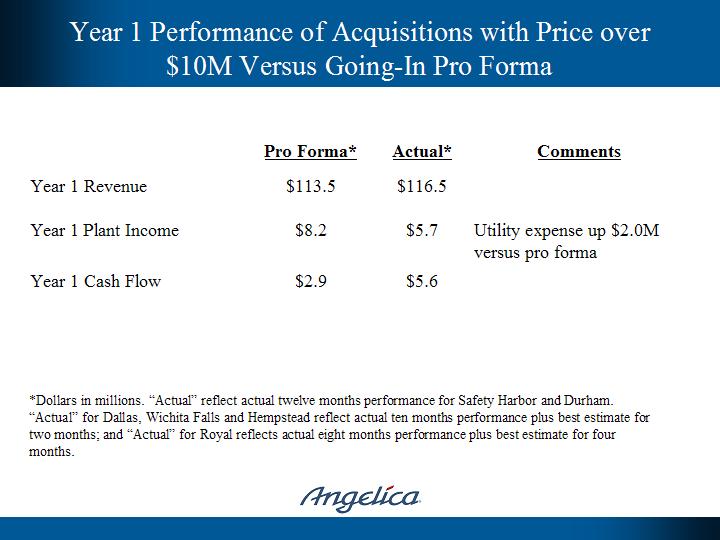

| | Pro Forma* | Actual* | Comments |

| Year 1 Revenue | $113.5 | $116.5 | |

| Year 1 Plant Income | $8.2 | $5.7 | Utility expense up $2.0M versus pro forma |

| Year 1 Cash Flow | $2.9 | $5.6 | |

*Dollars in millions. “Actual” reflects actual twelve months performance for Safety Harbor and Durham. “Actual” for Dallas, Wichita Falls and Hempstead reflect actual ten months performance plus best estimate for two months; and “Actual” for Royal reflects actual eight months performance plus best estimate for four months.

[Angelica Logo]

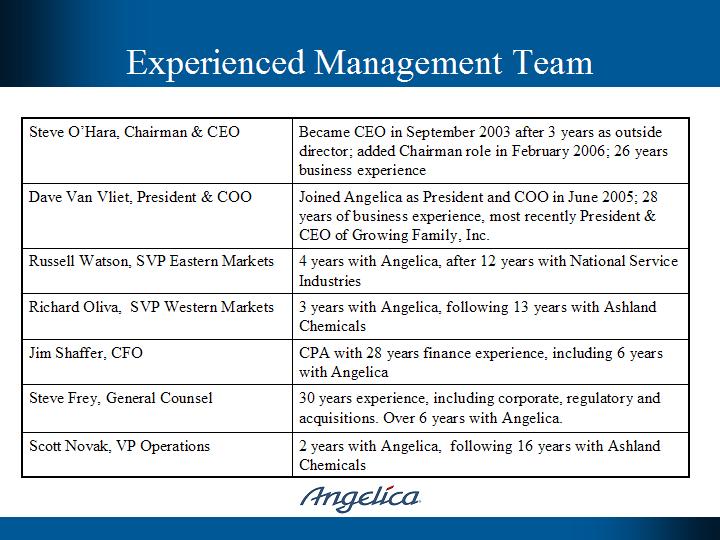

| Steve O’Hara, Chairman & CEO | Became CEO in September 2003 after 3 years as outside director; added Chairman role in February 2006; 26 years business experience |

| Dave Van Vliet, President & COO | Joined Angelica as President and COO in June 2005; 28 years of business experience, most recently President & CEO of Growing Family, Inc. |

| Russell Watson, SVP Eastern Markets | 4 years with Angelica, after 12 years with National Service Industries |

| Richard Oliva, SVP Western Markets | 3 years with Angelica, following 13 years with Ashland Chemicals |

| Jim Shaffer, CFO | CPA with 28 years finance experience, including 6 years with Angelica |

| Steve Frey, General Counsel | 30 years experience, including corporate, regulatory and acquisitions. Over 6 years with Angelica. |

| Scott Novak, VP Operations | 2 years with Angelica, following 16 years with Ashland Chemicals |

[Angelica Logo]

[Angelica Logo]

|

| |

| |

Annual Revenues * - $ Million |

|

| [Graph] |

|

| FY01 $250.7 |

| FY02 $263.8 |

| FY03 $283.3 |

| FY04 $308.0 |

| FY05 $418.4 |

*Adjusted to eliminate discontinued operations [Angelica Logo] |

Pretax Income from Continuing Operations |

| |

| |

Annual Pretax Income - $ Millions** |

| |

| [Graph] |

| |

FY01 $ 6.7 FY02 $ 5.3 FY03 $15.5* FY04 $13.2 FY05 $ 0.7 |

| * FY02 pretax income from continuing operations after reflecting a $6.8 loss on early extinguishment of debt **Adjusted to eliminate discontinued operations |

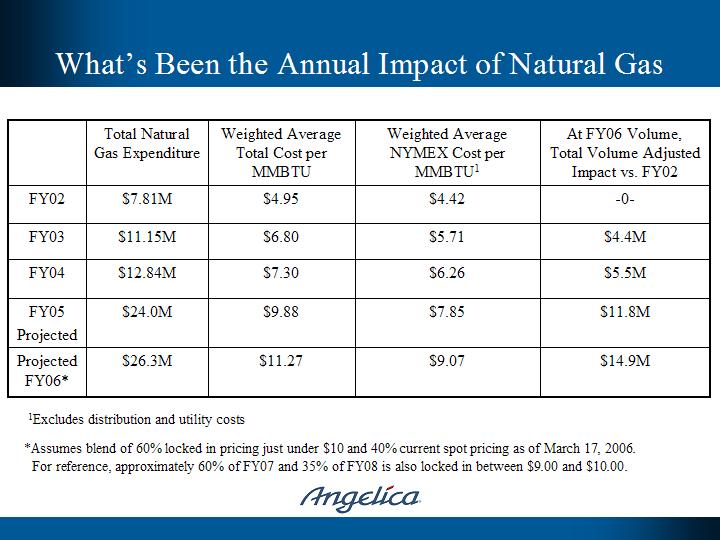

| | Total Natural Gas Expenditure | Weighted Average Total Cost per MMBTU | Weighted Average NYMEX Cost per MMBTU1 | At FY06 Volume, Total Volume Adjusted Impact vs. FY02 |

| FY02 | $7.81M | $4.95 | $4.42 | -0- |

| FY03 | $11.15M | $6.80 | $5.71 | $4.4M |

| FY04 | $12.84M | $7.30 | $6.26 | $5.5M |

FY05 Projected | $24.0M | $9.88 | $7.85 | $11.8M |

Projected FY06* | $26.3M | $11.27 | $9.07 | $14.9M |

1Excludes distribution and utility costs

*Assumes blend of 60% locked in pricing just under $10 and 40% current spot pricing as of March 17, 2006.

For reference, approximately 60% of FY07 and 35% of FY08 is also locked in between $9.00 and $10.00.

[Angelica Logo]

| |

| | | | | | |

Condensed and audited as of January 28, 2006 ($000,000) | |

| ASSETS | | | LIABILITIES AND EQUITY | |

| | | | | |

| Cash | | | Current Maturities of Debt | $ 0.3 |

| | | | | |

| Receivables - Net | 58.1 | | Accounts Payable | 37.2 |

| | | | | |

| Linens | 43.8 | | Accrued Compensation | 7.0 |

| | | | | |

| Prepaid | 3.6 | | Other Accrued Liabilities | 36.9 |

| | | | | |

| Total Current Assets | 109.9 | | Total Current Liabilities | 81.4 |

| | | | | |

| Net PP&E | 106.3 | | Long-Term Debt, Less Current Maturities | 85.1 |

| | | | | |

| Goodwill | 49.2 | | Other Long-Term Obligations | 15.4 |

| | | | | |

| Other Acquired Assets | 42.5 | | Shareholders’s Equity | 149.5 |

| | | | | |

| Other Long-Term Assets | 23.5 | | | |

| | | | | |

| Total Assets | $331.4 | | Total Liabilities and Equity | $331.4 |

[Angelica Logo] | |

§FY06

§Operational gains during year will be offset in part by $3 million in increased natural gas costs and $2 million of plant optimization expenses

§Natural gas and plant optimization expense will be mostly in first two quarters

§Expect sequential quarter to quarter improvement during year from Q1 with gross margins back over 15% for second half of FY06

§Long-term

§Gross margins rising to 20% by FY08

§15% total annual revenue growth from organic growth and acquisitions

[Angelica Logo]

§Market leader in healthcare textile services committed to great service everyday for every customer

§Extensive national reach, with regional focus

§Implementing operational best practices systemwide now to provide scalable base

§Strong, experienced management team focused on profitable growth

§Dividend, currently at $0.11 per share quarterly, provides 2.1% return

[Angelica Logo]

By pursuing its stated initiatives, Angelica will be the leading provider of linen management services

to the U.S. healthcare market with healthcare providers desiring our services due to our quality standards,

passion and creativity, allowing us to reach our goal of delivering

industry-leading growth and exceptional stakeholder value.

[Angelica Logo]

To Every Customer Everyday

[pictures]

Angelica Corporation

April, 2006