- MSEX Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Middlesex Water (MSEX) 8-KOther Events

Filed: 24 Sep 07, 12:00am

“A Provider of Water, Wastewater & Related Services”

Today’s Presenters

Dennis W. Doll, President & CEO

Bruce O’Connor, Vice President & CFO

Forward Looking Statement

Certain matters discussed in this presentation are forward-looking

statements intended to qualify for the “safe harbor” from liability

established by the Private Securities Litigation Reform Act of 1995.

These forward-looking statements can generally be identified as

such because the context of the statement will include words such

as the Company “believes,” “anticipates,” “expects” or words of

similar import. Similarly, statements that describe the Company’s

future plans, objectives, estimates or goals are also forward-

looking statements that are subject to the risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied in the statements.

© Middlesex Water Company

OVERVIEW

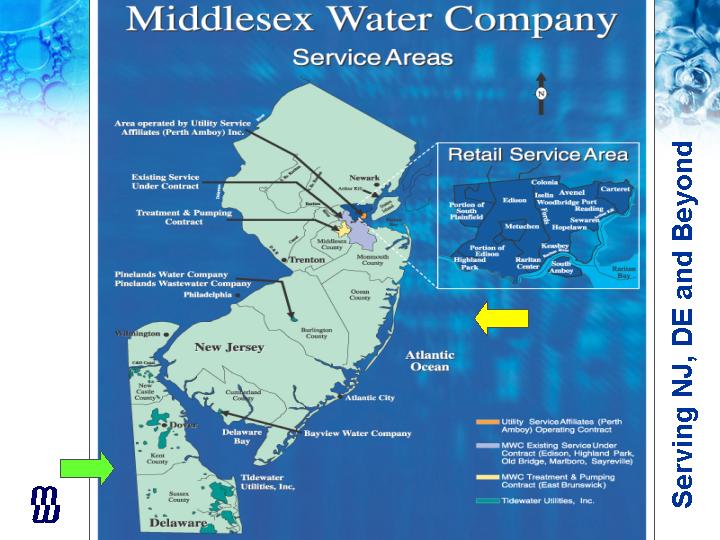

Serve approximately 125,000 retail and

wholesale water customers in New Jersey and

Delaware

Expanded over time to provide a full range of

regulated and non-regulated water, wastewater

and related services

Cash dividends paid in varying amounts

continually since 1912.

NASDAQ Global Select Market: MSEX

Established in 1897 to

collect, treat and

distribute water for

domestic, commercial,

industrial and fire

protection purposes

© Middlesex Water Company

STATS AT A GLANCE

52-week low/high: $16.93/$20.24

Market capitalization: $249.81 million

Common shares outstanding: 13.2 million

Average daily volume: 30,000 shares (3 months)

Current dividend yield: 3.65%

Institutional Ownership: 25%

As of September 12, 2007

© Middlesex Water Company

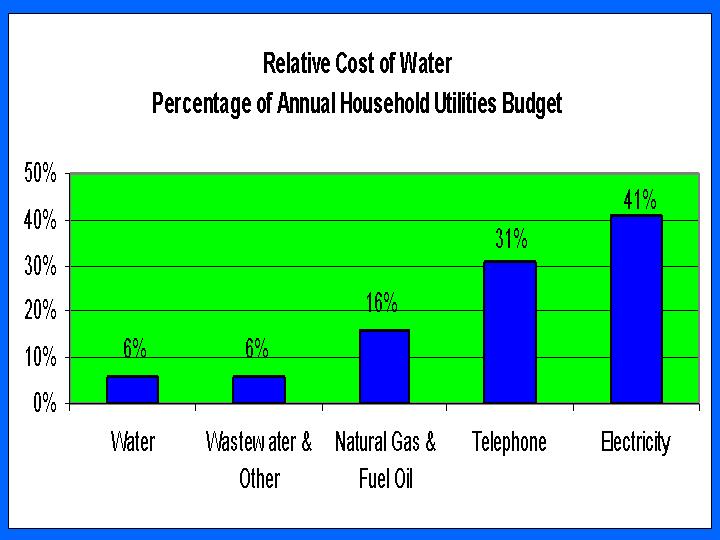

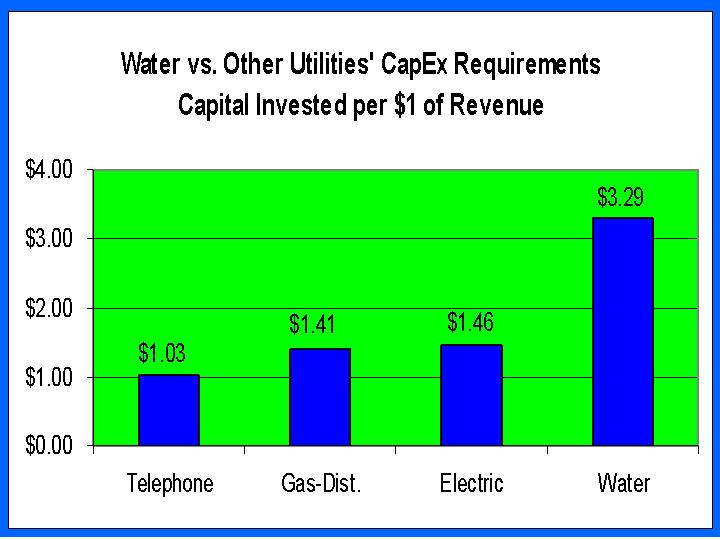

Investor-Owned Water/Wastewater Industry

Capital intensive, high barriers to entry

Significant need for continued capital investment on a national level

Consolidation has left only 11 publicly-traded investor owned-

companies (23 ten years ago)

54,000 community water systems in the U.S.

47,000 serve fewer than 3,000 customers each.

84% of market is government-controlled.

Consolidation and privatization is expected to continue

Rate base/rate of return methodology provides return of and

return on investments plus recovery of operating expenses

© Middlesex Water Company

- Background -

Investor-Owned Water/Wastewater Industry

Wastewater is a growing opportunity for

investor-owned water purveyors.

Skills are complementary

Non-regulated contract operations can be

an important part of the menu of services

Range of products and services continues to expand

Regulated utilities are only one component (related products and

services continue to expand).

“Water is the next oil.”

© Middlesex Water Company

- Background -

The Middlesex Story

© Middlesex Water Company

Build long-term shareholder value by being a

trusted provider of safe, reliable and

cost-effective water, wastewater and related

products and services in New Jersey,

Delaware and beyond.

Vision & Strategy

© Middlesex Water Company

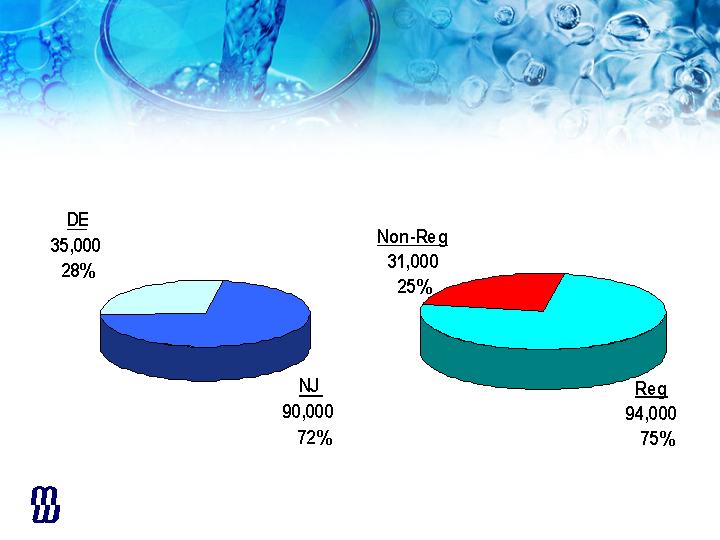

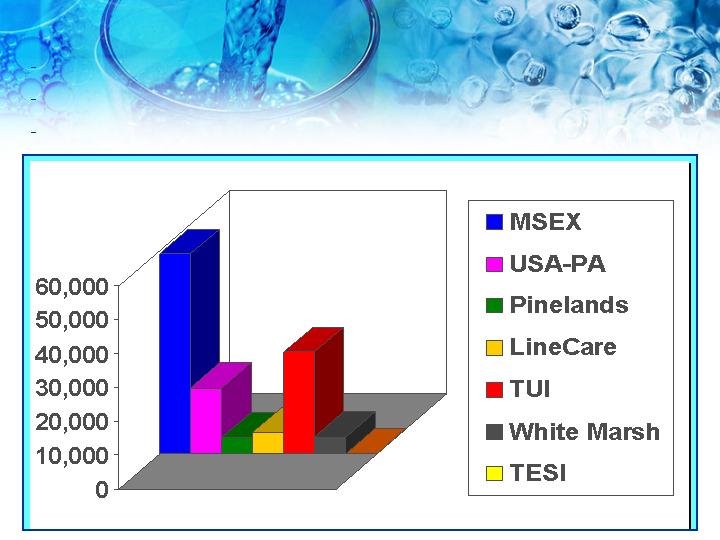

Total Customers Served – 125,000

© Middlesex Water Company

What We Do

Regulated

Non-regulated

© Middlesex Water Company

What We Do

Any Combination Along the

Public/Private Partnership Continuum

Design

Bid

Build

Private

Contract

Fee (O&M)

Services

Design

Build

Build

Operate

Transfer

Design

Build

Finance

Operate

Build

Own

Operate

Public

Projects

Public Owns

We Operate

Public Owns

& Operates,

We Design

& Build

Public Owns.

We Design,

Build &

Operate

Public Owns. We

Design, Build,

Finance &

Operate

(Concession Deal)

We Do it All

(Traditional

Regulated Utility

Model)

PUBLIC

Responsibility

PRIVATE

Responsibility

© Middlesex Water Company

Our Services

Design, build, own and operate water and wastewater assets

Complementary water and wastewater products & services

Public/Private partnerships

Customers

2006

Renewable Energy: Good for the

Environment and Good for Business

Solar Panels at Our Largest Treatment Plant

Plentiful and Reliable Supply of

Surface Water and Groundwater

Building Our Reputation, Drop by Drop

Emergency Planning & Preparedness

Review emergency preparedness plans to ensure the health

and safety of our customers.

Communicate regularly with local emergency management

officials to address crisis planning.

Work with State/County Health Departments to plan for the

fixed distribution of preventive medication to employees in

an regional emergency.

Member - State Water Sector Security Task Force.

Community Anti-Terrorism Training (C.A.T. Eyes).

© Middlesex Water Company

Corporate Social Responsibility

Building Relationships

Outreach/Education

Delivering

Shareholder Value

Prudent Investment In

Regulated Utility Infrastructure

Rate Base/Rate of Return

methodology allows for a

return on prudently

incurred costs to

construct utility assets

How We Deliver

Shareholder Value

Acquisition and Development of

Regulated and Non-Regulated

Businesses and Contracts

Combine organic customer and

utility infrastructure growth with

prudent investments in

additional regulated utilities,

non-regulated contract

operations and complementary

products and services.

Maximizing Shareholder Value

Timely/adequate rate case outcomes, minimize

regulatory lag

Diligently manage costs and drive down both

capital and O&M costs between rate cases

Profitable Growth

Organic customer growth, economies of scale

Acquisitions at reasonable prices

Complementary non-regulated products and

services with returns greater than achievable in the

regulated environment

The Challenge is Careful Execution of the Plan!

Delaware and Beyond

Privatizations and

acquisitions in NJ, DE

and beyond

Significant

opportunities in both

water and wastewater in

DE and beyond

Wastewater a key

driver of growth

Reputation for sound

technical solutions

spreading beyond NJ &

DE

Complementary

products and services

continue to grow

(LineCare & LineCare

Plus)

The Growth Story

Solid retail and

wholesale revenue base

in NJ

Experience in water and

wastewater contract ops

in both NJ and DE

Purchased TUI in 1992

with 2,400 customers.

Grown to 30,000

TUI operating in 60

active districts in DE:

90+ small plants

183 wells

270+ communities

Entered the regulated

wastewater business in

2005

The Recent Past

The Future

Where’s the Wastewater Treatment Plant?

Wastewater Plant

Critical Facilities Blend into the Landscape

ATER COMPANY

IDDLESEX

FINANCIAL

OVERVIEW

Performance

(millions except per share amounts)

© Middlesex Water Company

Six Months

Ended June 30,

2007

2006

Operating Revenues

$ 40.7

$ 39.3

Operating Expenses

$ 30.7

$ 29.1

Net Income

$

5.1

$

4.8

Diluted Earnings per Share

$

0.37

$

0.40

Key Drivers of Performance

Rate increases

Utility plant investment

Customer Growth

Upgrades & Replacements

Variable production costs

Power

Chemicals

Purchased Water

Treatment Residuals

Labor and benefits costs

© Middlesex Water Company

Rate Increases

© Middlesex Water Company

Amount

Increase

($ Millions)

Approved

Pinelands

$0.1

4/13/06

Tidewater

$2.1

6/27/06

(Interim Rates – 15%)

Tidewater

$1.8

2/28/07

Customer Growth

© Middlesex Water Company

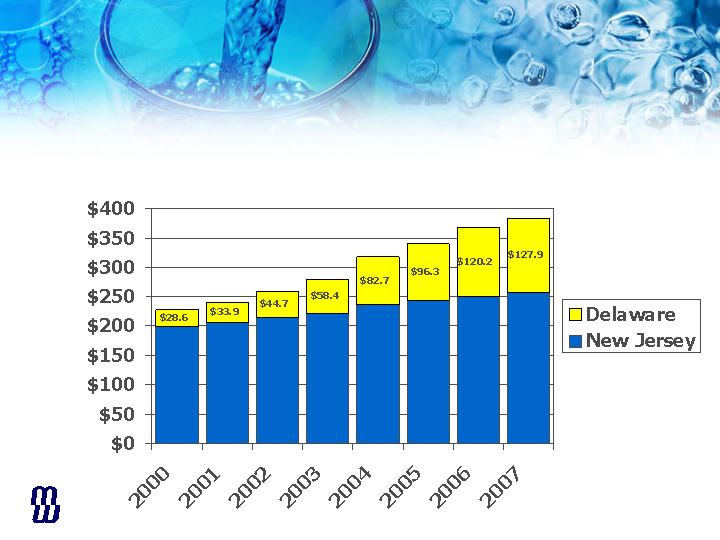

Utility Plant

($ millions)

© Middlesex Water Company

2007 Capital Investment

New Jersey

$3.9 million on

infrastructure upgrades

replacements and

RENEW Program

Delaware

$4.9 million on

infrastructure

upgrades,

replacements and

new water and

wastewater

treatment facilities

© Middlesex Water Company

Equity Financing

Issued 1,495,000 common shares on 11/02/06

for gross proceeds of $27.6 million

Dividend Reinvestment Plan

$1.2 Million Annual Inflow

© Middlesex Water Company

2007 Debt Financing

State Revolving Fund

Delaware - $1.0 Million, 20 Years

New Jersey - $4.0 Million, 20 Years

© Middlesex Water Company

Capital Structure

($ millions)

© Middlesex Water Company

% to

6/30/2007

Total

LT Debt

$ 130.4

49.3%

Preferred

4.0

1.5%

Common

130.1

49.2%

$ 264.5

100.0%

© Middlesex Water Company

2007 Construction Program

($ millions)

Delaware Water Systems

$12.1

Delaware Wastewater Systems

6.0

MWC RENEW Program

3.9

Other Scheduled Upgrades

Total

$32.1

10.1

2007 Construction Funding

($ millions)

SRF Loans

Short Term

Reinvestment Plan

Common Stock Offering

Net Cash Flows

Total Funding

6.0

6.0

1.2

8.9

10.0

$32.1

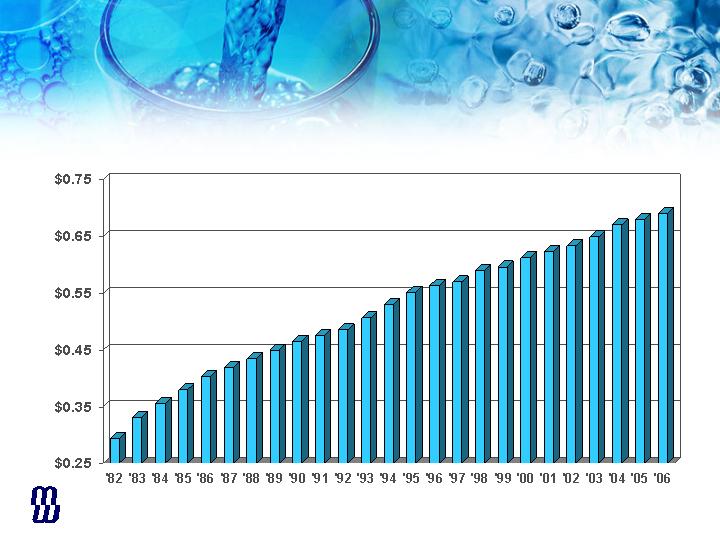

Dividends

Annual Rate

Quarterly dividends paid since 1912

© Middlesex Water Company

2004

2005

2006

$0.67

$0.68

$0.69

Dividends Paid

$0.69

© Middlesex Water Company

2007 Dividend Yield

© Middlesex Water Company

Connecticut Water

3.6%

Middlesex Water

3.6%

Artesian Resources

3.5%

California Water

2.9%

York Water

2.8%

Pennichuck Corp.

2.7%

American States Water

2.3%

Aqua America

2.0%

SJW Corp.

1.9%

Southwest Water

1.7%

2006 Total Shareholder Return*

*Dividends plus change in stock price

© Middlesex Water Company

SJW Corp.

74%

American States Water

29%

Middlesex Water

12%

California Water

9%

York Water

6%

Artesian Resources

3%

Pennichuck Corp.

2%

Southwest Water

- 2%

Connecticut Water

- 4%

Aqua America

-15%

A Quality Investment

Stable customer base & excellent regulatory relations

+

Solid balance sheet & financing capability

+

Comprehensive suite of service offerings

+

Further growth and profitability

(expanding markets in NJ, DE and beyond)

+

Experienced management team and active industry leader

+

Reputation as honest and ethical problem-

solver for developers and municipalities

=

Total Shareholder Returns

© Middlesex Water Company

For Additional Information about

Middlesex Water Company, visit

www.middlesexwater.com

For Additional Information about

Tidewater Utilities, Inc., visit

www.tuiwater.com

QUESTIONS?

© Middlesex Water Company

A Provider of Water, Wastewater and

Related Products and Services

Thank you for your interest and support!

© Middlesex Water Company