Delivering Growth by Design NASDAQ: MLHR Investor Event at New York Flagship March 27, 2017

2 This information contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act, as amended, that are based on management’s beliefs, assumptions, current expectations, estimates, and projections about the office furniture industry, the economy, and the company itself. Words like “anticipates,” “believes,” “confident,” “estimates,” “expects,” “forecasts,” likely,” “plans,” “projects,” “should,” variations of such words, and similar expressions identify such forward-looking statements. These statements do not guarantee future performance and involve certain risks, uncertainties, and assumptions that are difficult to predict with regard to timing, extent, likelihood, and degree of occurrence. These risks include, without limitation, the success of our growth strategy, employment and general economic conditions, the pace of economic recovery in the U.S, and in our International markets, the increase in white-collar employment, the willingness of customers to undertake capital expenditures, the types of products purchased by customers, competitive-pricing pressures, the availability and pricing of raw materials, our reliance on a limited number of suppliers, our ability to expand globally given the risks associated with regulatory and legal compliance challenges and accompanying currency fluctuations, the ability to increase prices to absorb the additional costs of raw materials, the financial strength of our dealers and the financial strength of our customers, the mix of our products purchased by customers, our ability to locate new DWR studios, negotiate favorable lease terms for new and existing locations and the implementation of our studio portfolio transformation, our ability to attract and retain key executives and other qualified employees, our ability to continue to make product innovations, the success of newly introduced products, our ability to serve all of our markets, possible acquisitions, divestitures or alliances, the pace and level of government procurement, the outcome of pending litigation or governmental audits or investigations, political risk in the markets we serve, and other risks identified in our filings with the Securities and Exchange Commission. Therefore, actual results and outcomes may materially differ from what we express or forecast. Furthermore, Herman Miller, Inc., undertakes no obligation to update, amend or clarify forward-looking statements. Forward looking statements

3 Our Strategic Intent Expand Addressable Market Build Multi-Channel Capability

4 Our Goals *Measured as interest, dividends and share repurchase as a % of EBITDA on a trailing 3-year basis 30 35% OF EBITDA 2 2.5x THE RATE OF SALES GROWTH 3 6%TO TO TO ORGANIC SALES GROWTH OPERATING INCOME GROWTH CASH RETURNS TO INVESTORS*

5 Areas of Focus REALIZE LIVING OFFICE SCALE CONSUMER LEVERAGE DEALER ECO-SYSTEM DELIVER INNOVATION DRIVE COST SAVINGS

6 Accelerating Strategic Execution BRIAN WALKER CEO Joined 1989 JEREMY HOCKING EVP, Strategy and Business Development Joined 1984 JOHN EDELMAN CEO, Herman Miller Consumer Joined 2014 JEFF STUTZ Chief Financial Officer Joined 2001 GREG BYLSMA President, North America Contract Joined 2000 BEN WATSON Chief Creative Officer Joined 2010 ANDY LOCK President, International Joined 1990 KEVIN VELTMAN VP, Investor Relations and Treasurer Joined 2014 STEVE GANE President, Specialty Brands Joined 2007

7 North America Contract Greg Bylsma President, North America Contract

8 Design, manufacture and sale of furniture for office, healthcare and education environments in US and Canada OFFICE HEALTHCARE EDUCATION North America Contract

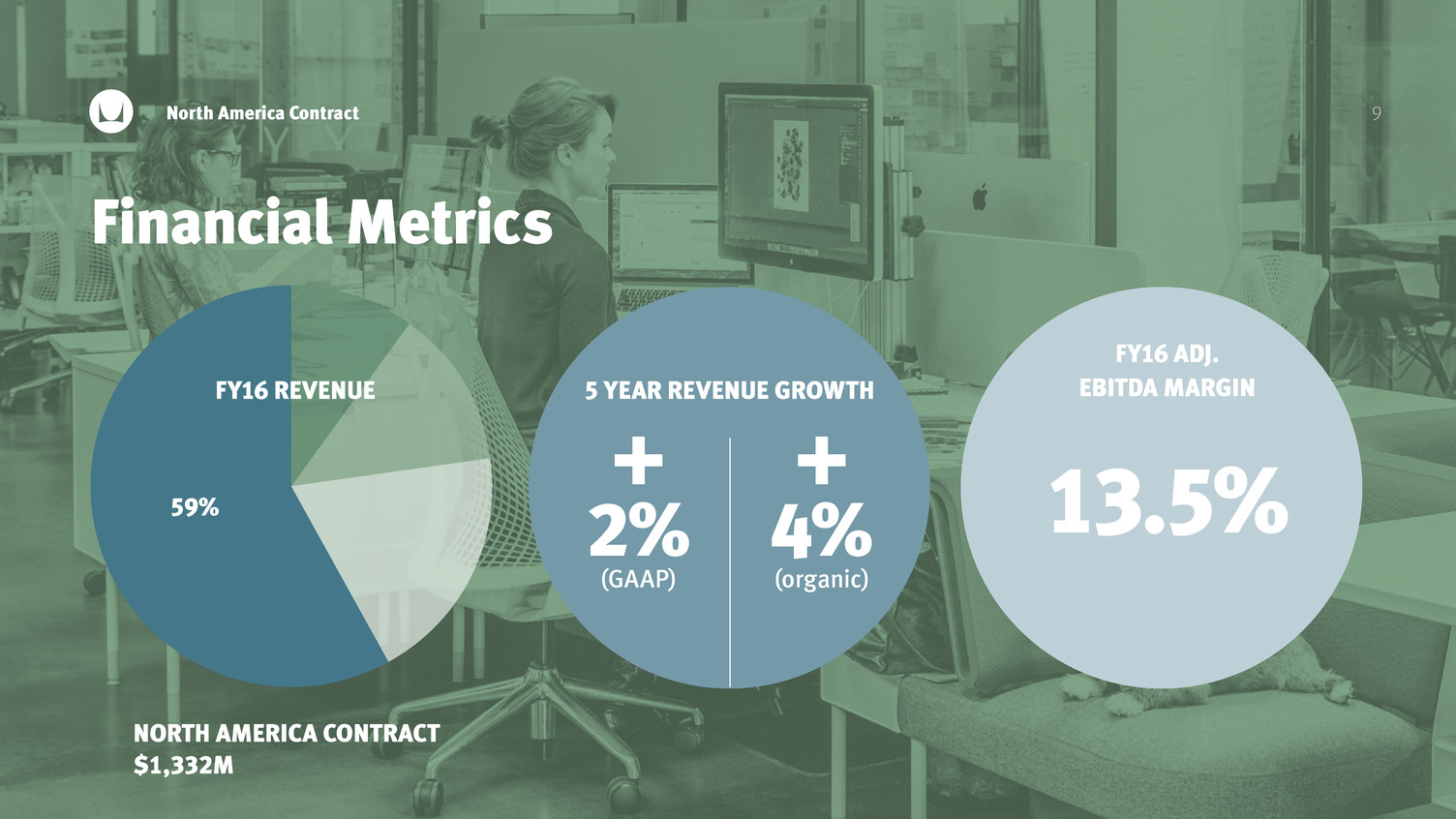

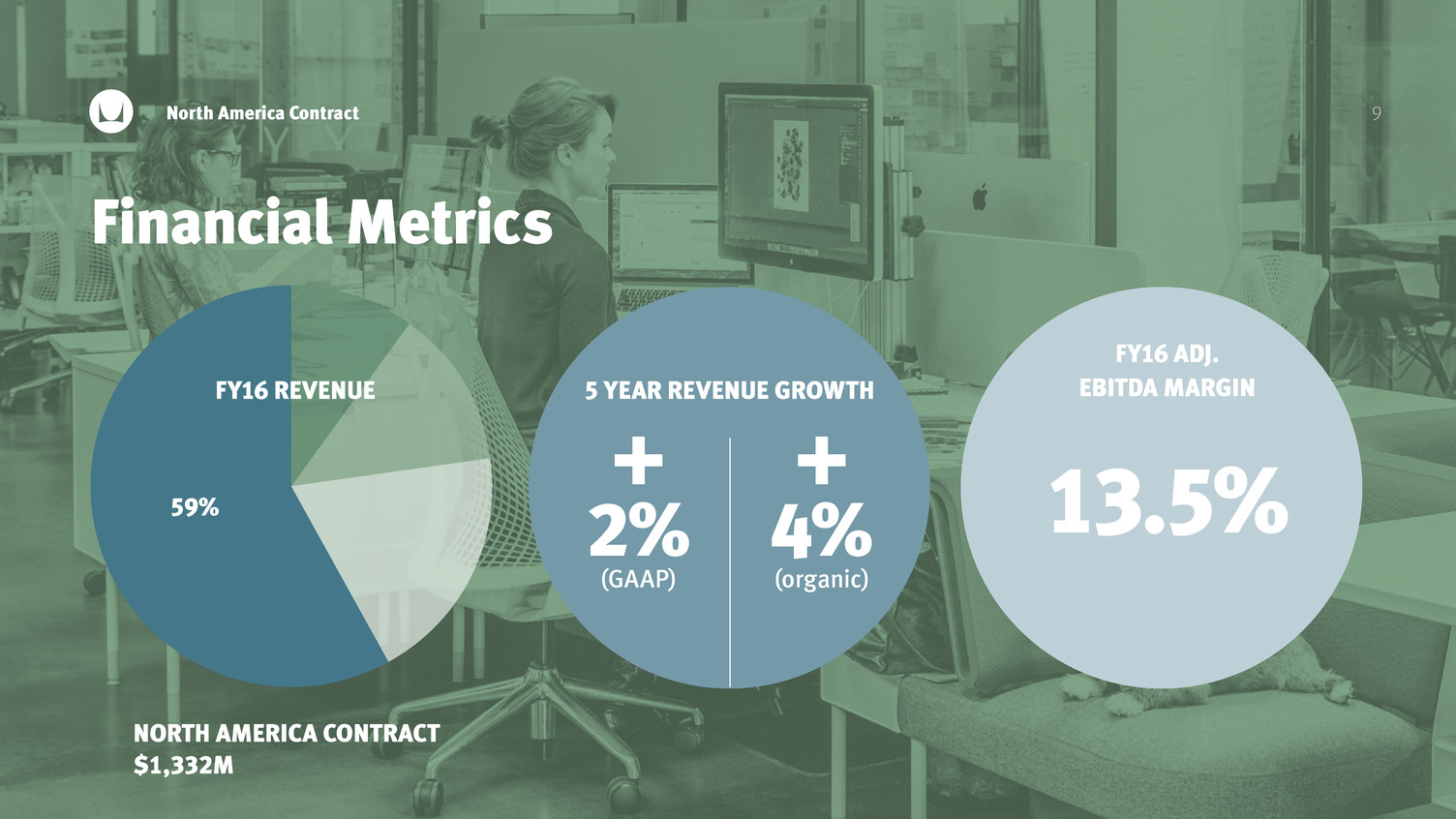

9 Financial Metrics North America Contract NORTH AMERICA CONTRACT $1,332M 5 YEAR REVENUE GROWTHFY16 REVENUE FY16 ADJ. EBITDA MARGIN + 2% (GAAP) + 4% (organic) 13.5% 59%

10 DEALER ECO-SYSTEM North America Contract | Key Initiatives

11 SALES LEVERAGE North America Contract | Key Initiatives

12 LIVING OFFICE 2.0 North America Contract | Key Initiatives

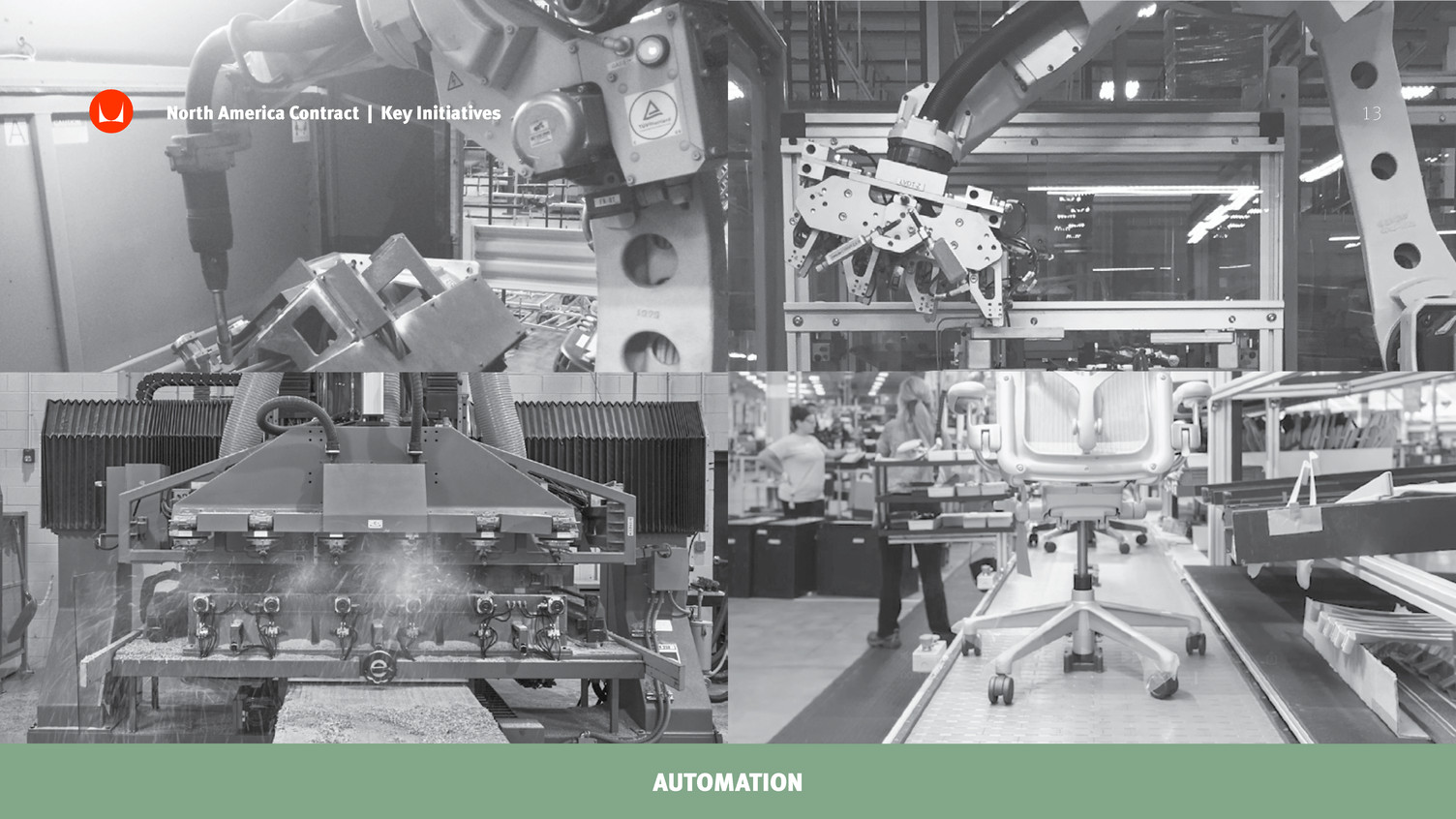

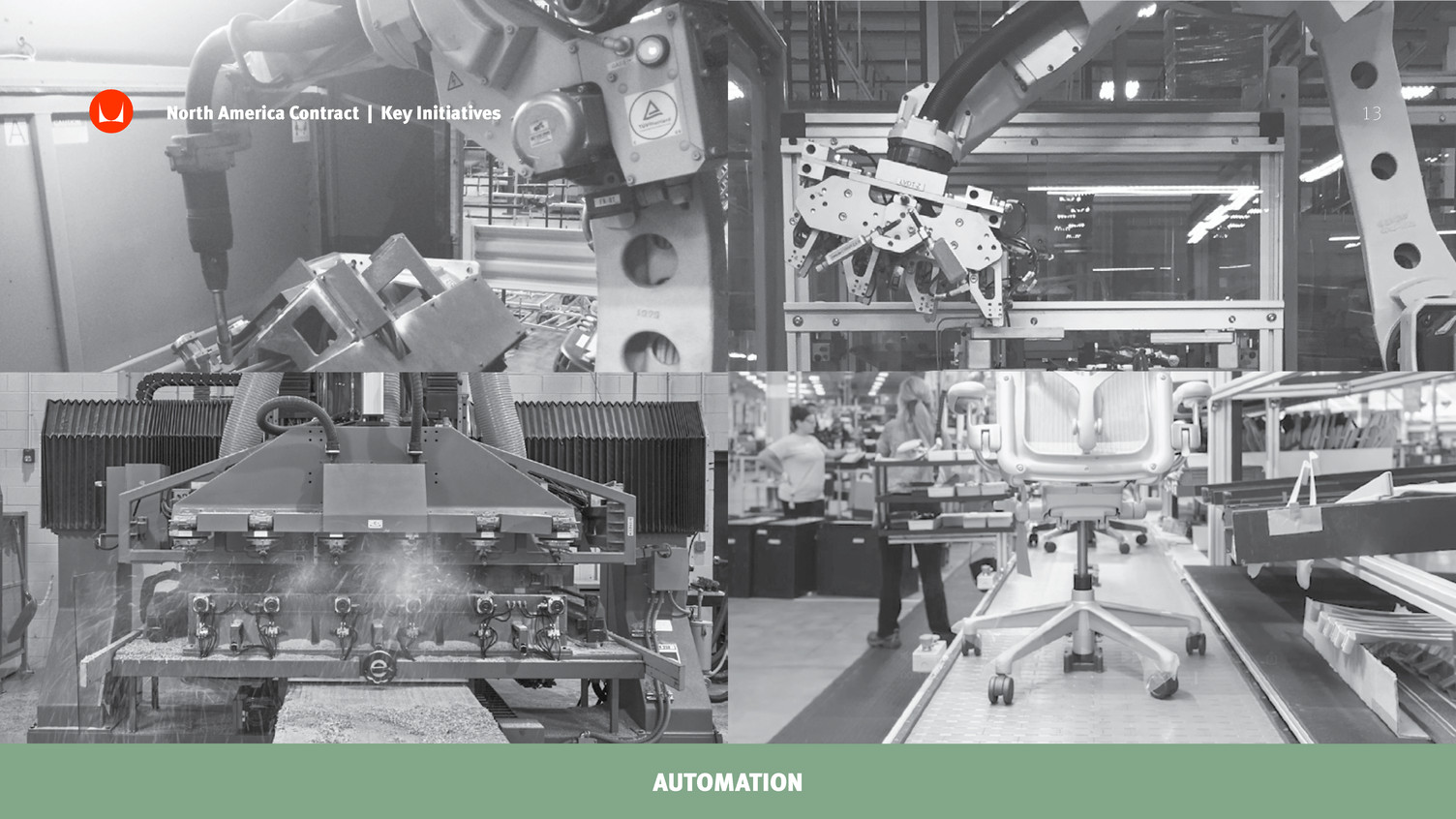

13 AUTOMATION North America Contract | Key Initiatives

14 Consumer John Edelman CEO, Herman Miller Consumer

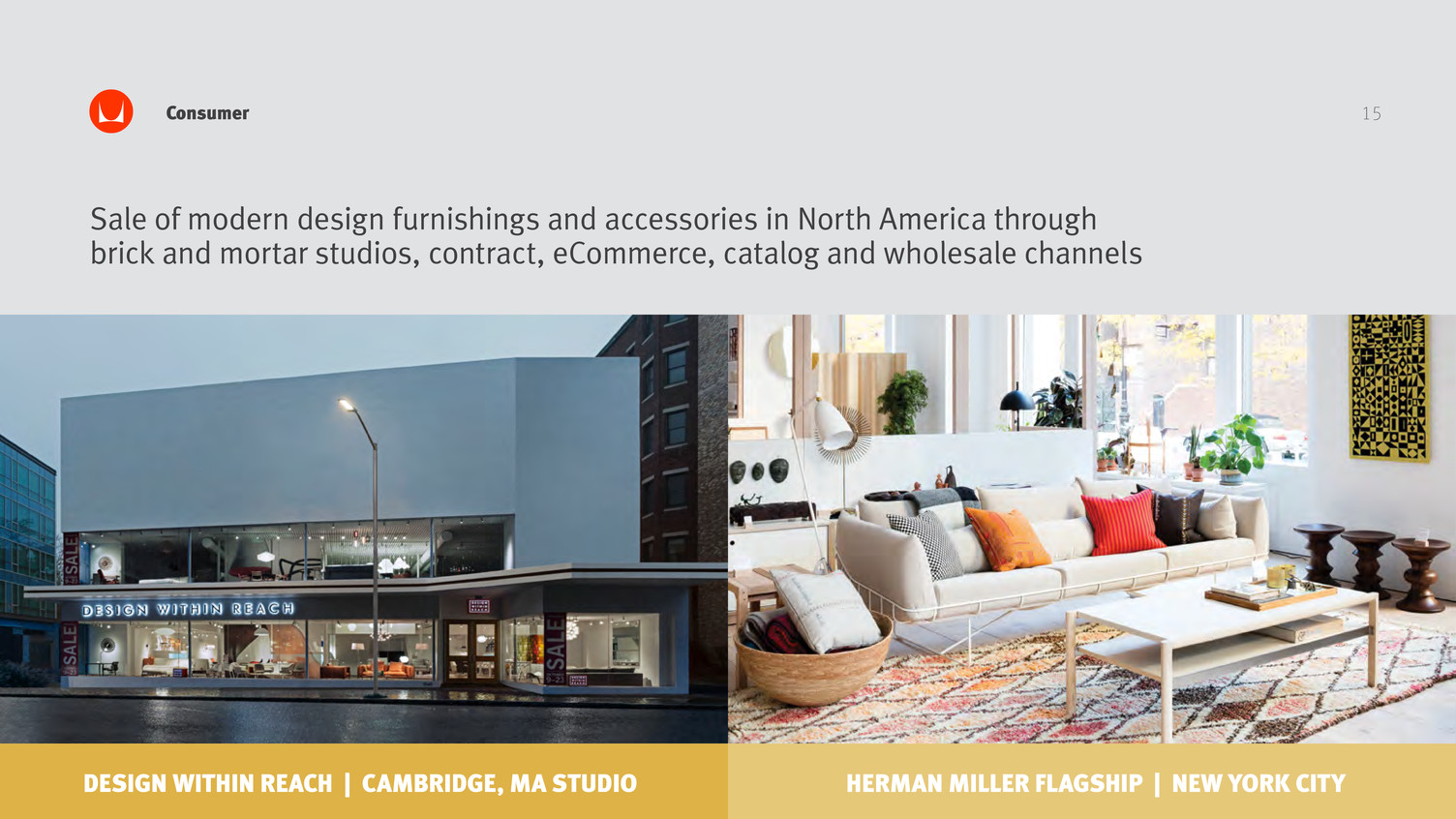

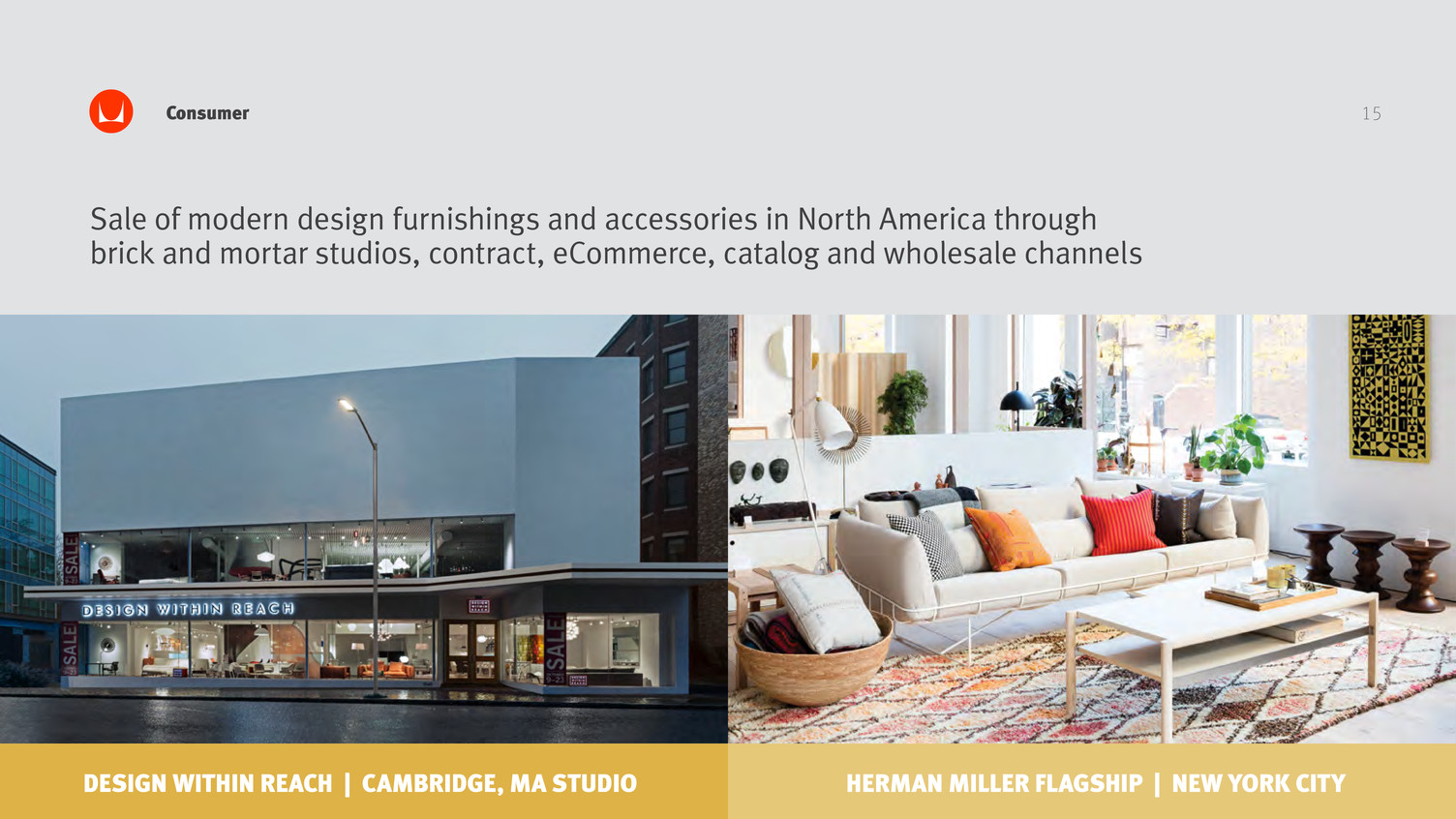

15 DESIGN WITHIN REACH | CAMBRIDGE, MA STUDIO HERMAN MILLER FLAGSHIP | NEW YORK CITY Sale of modern design furnishings and accessories in North America through brick and mortar studios, contract, eCommerce, catalog and wholesale channels Consumer

16 CATALOG & ECOMMERCE Consumer

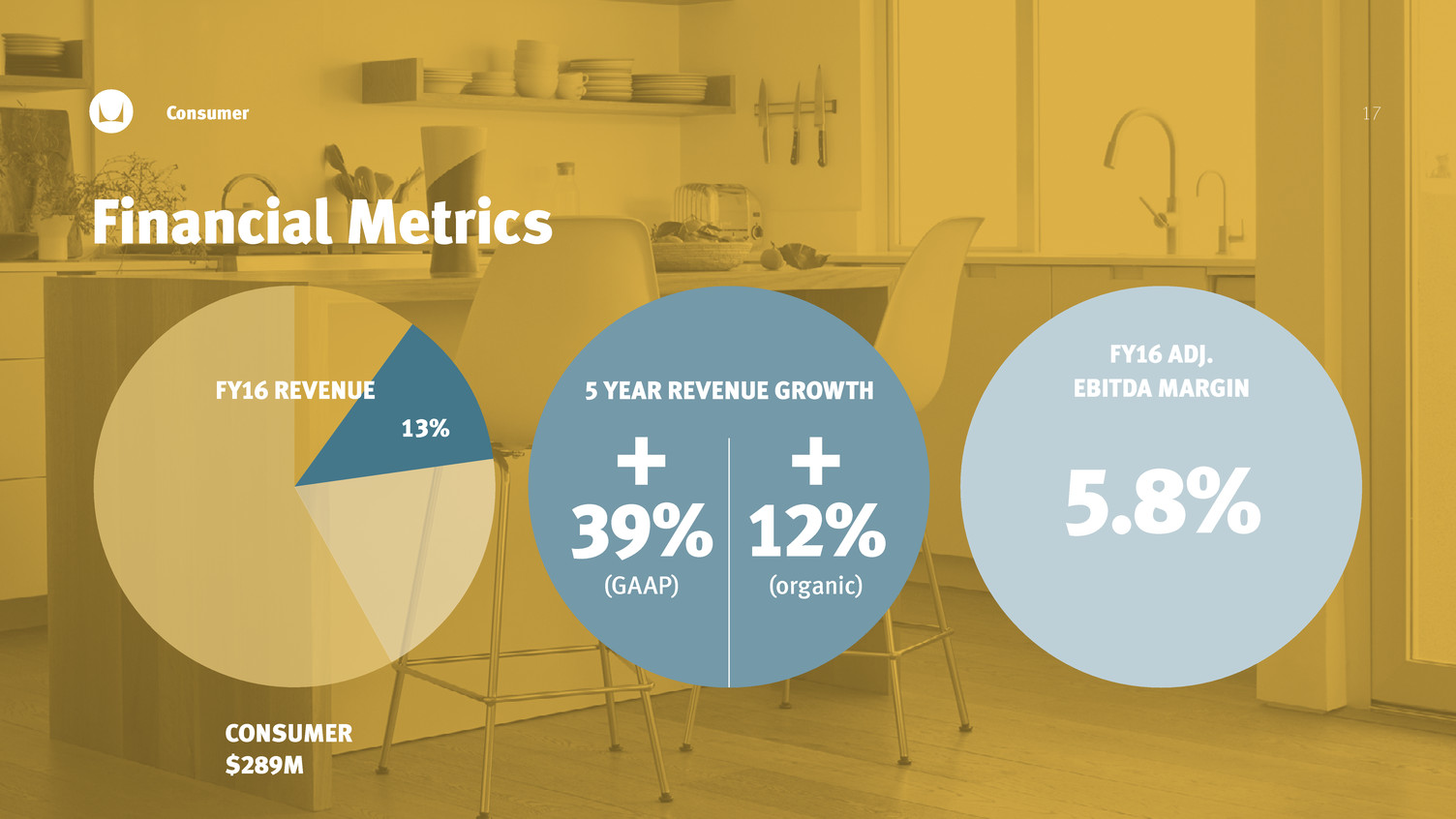

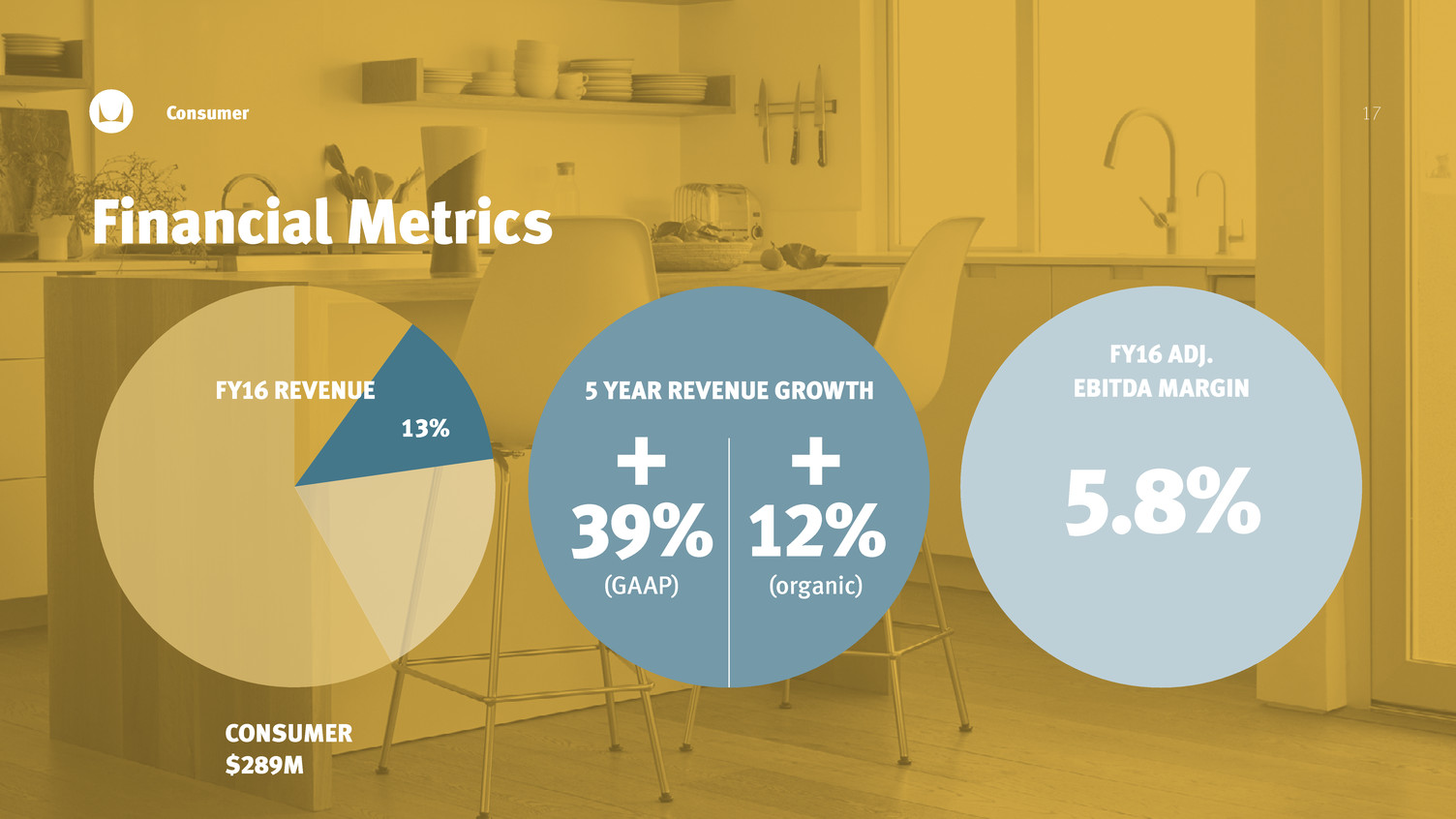

17 Financial Metrics Consumer CONSUMER $289M 5 YEAR REVENUE GROWTH + 39% (GAAP) + 12% (organic) 5.8% FY16 ADJ. EBITDA MARGIN 13% FY16 REVENUE

18 REAL ESTATE TRANSFORMATION Consumer | Key Initiatives

19 PROPRIETARY PRODUCT MIX Consumer | Key Initiatives

20 DWR CONTRACT Consumer | Key Initiatives

21 LOGISTICS OPTIMIZATION Consumer | Key Initiatives

22 MOBILE / ONLINE EXPANSION Consumer | Key Initiatives

23 ELA Furniture Solutions Andy Lock President, International

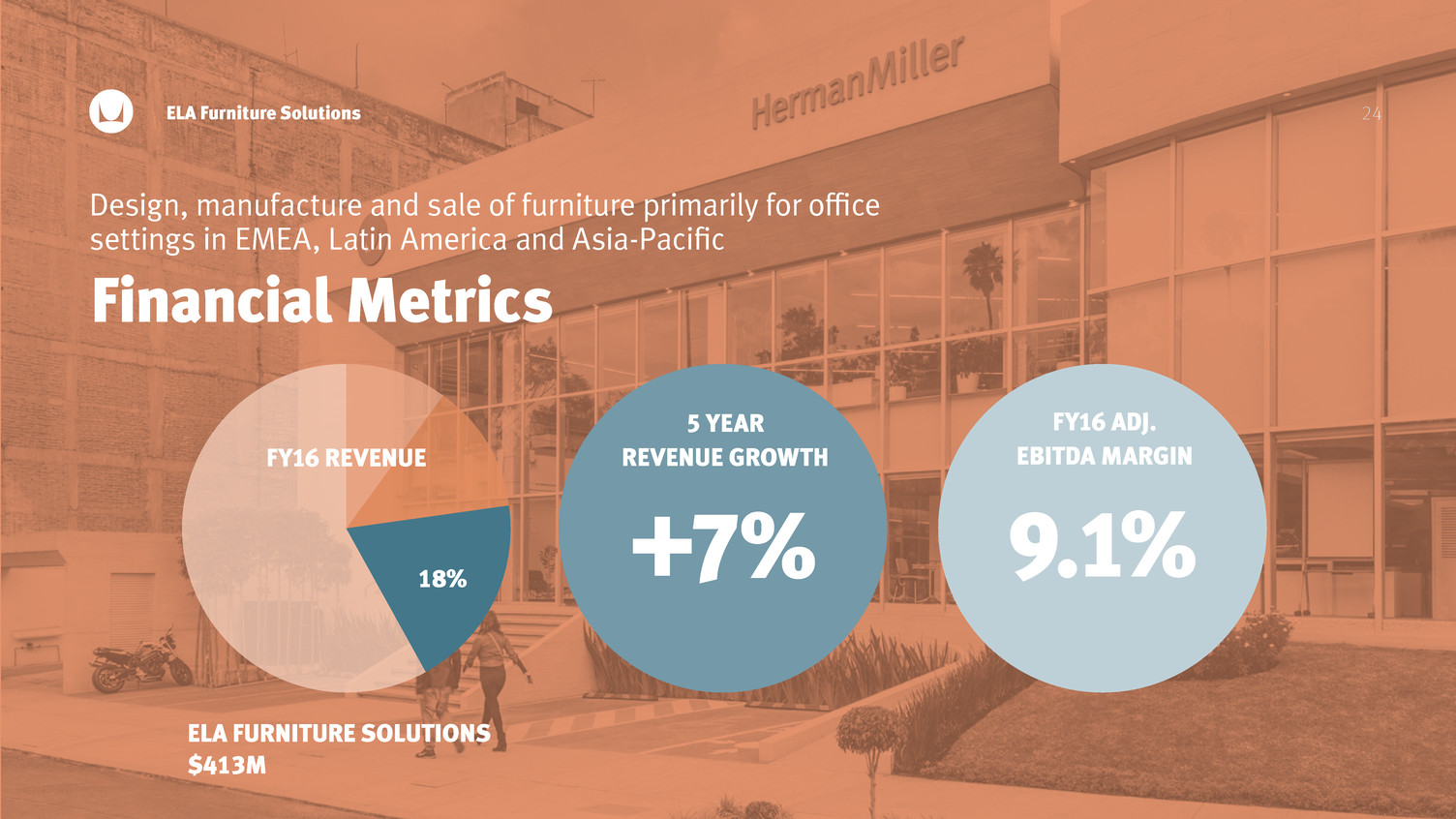

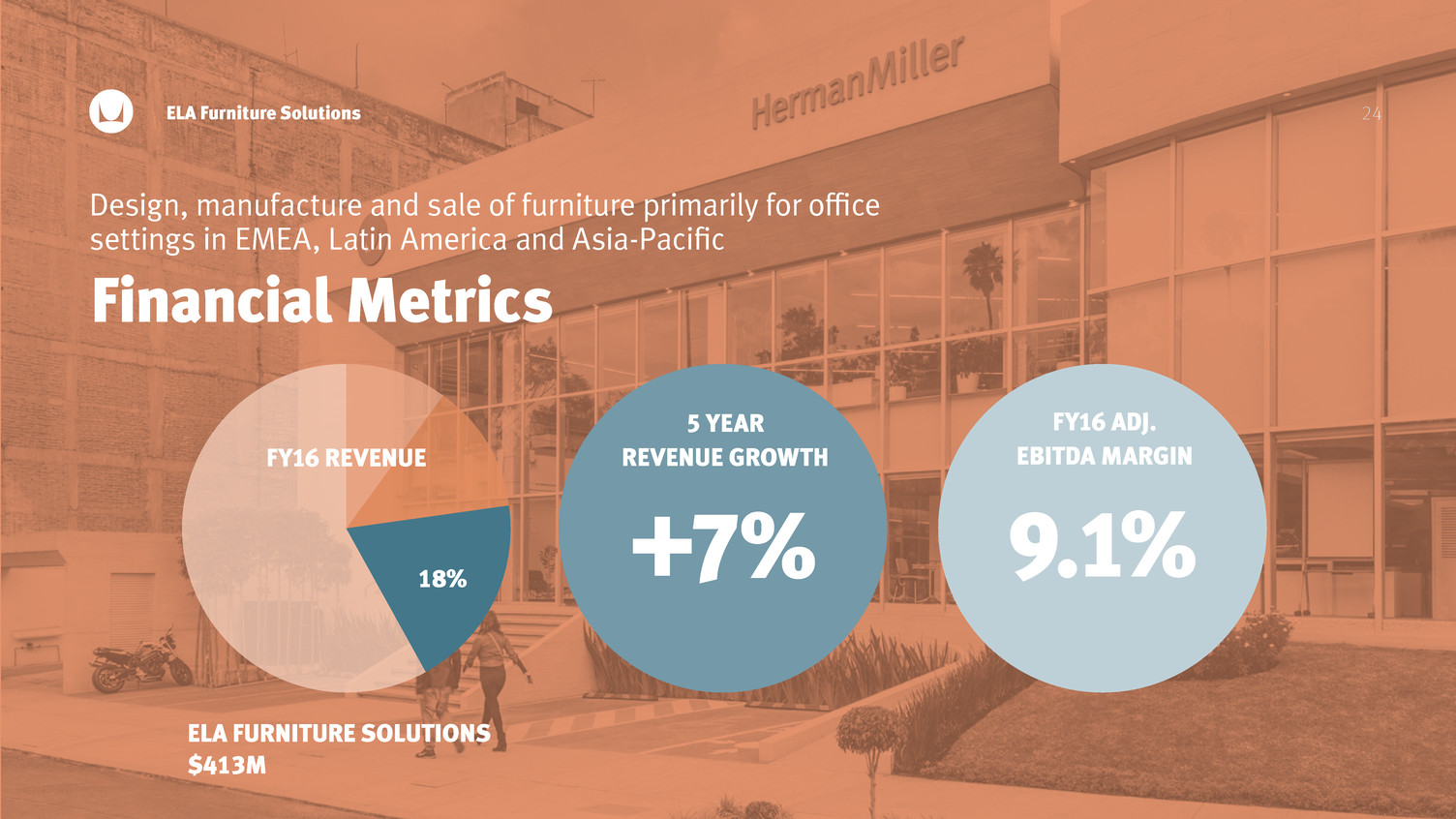

24 Design, manufacture and sale of furniture primarily for office settings in EMEA, Latin America and Asia-Pacific Financial Metrics ELA Furniture Solutions ELA FURNITURE SOLUTIONS $413M FY16 ADJ. EBITDA MARGIN 9.1% 5 YEAR REVENUE GROWTH +7% 18% FY16 REVENUE

25 PORTALMILL FACTORY | MELKSHAM, UK ELA Furniture Solutions

26ELA Furniture Solutions POSH FACTORY | DONGGUAN, CHINA

27ELA Furniture Solutions BIDADI FACTORY | BANGALORE, INDIA

28ELA Furniture Solutions | Key Initiatives DEALER SHARE | REGIONAL R&D

29 DEALER SHARE | COLLABORATIVE FURNITURE ELA Furniture Solutions | Key Initiatives

30 INTERNATIONAL CONSUMER EXPANSION ELA Furniture Solutions | Key Initiatives

31 Specialty Brands Steve Gane President, Specialty Brands

32 Design, manufacture and sale of high-craft furniture and textiles focused on architect and design specifiers GEIGER HERMAN MILLER COLLECTION MAHARAM Specialty Brands

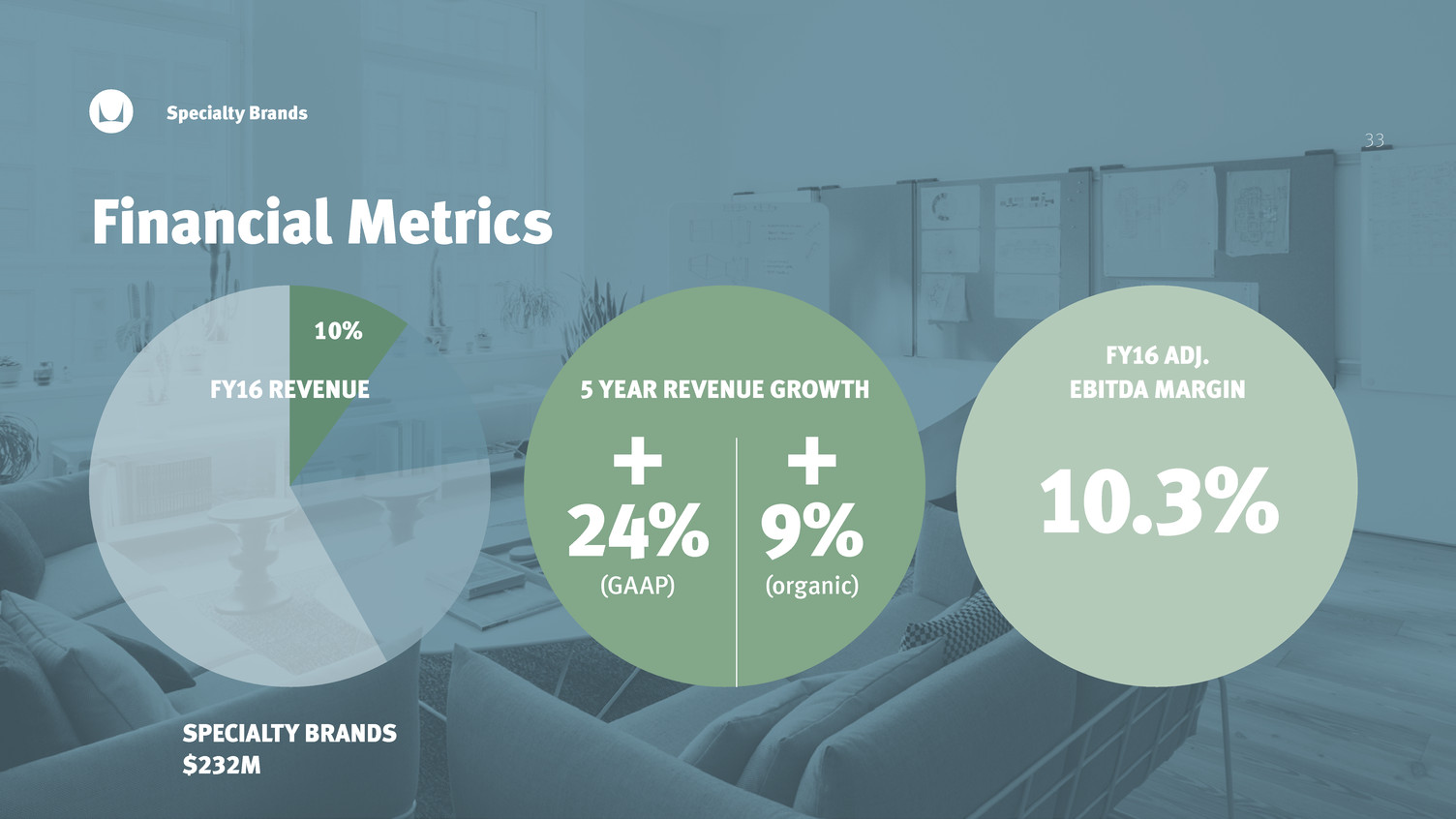

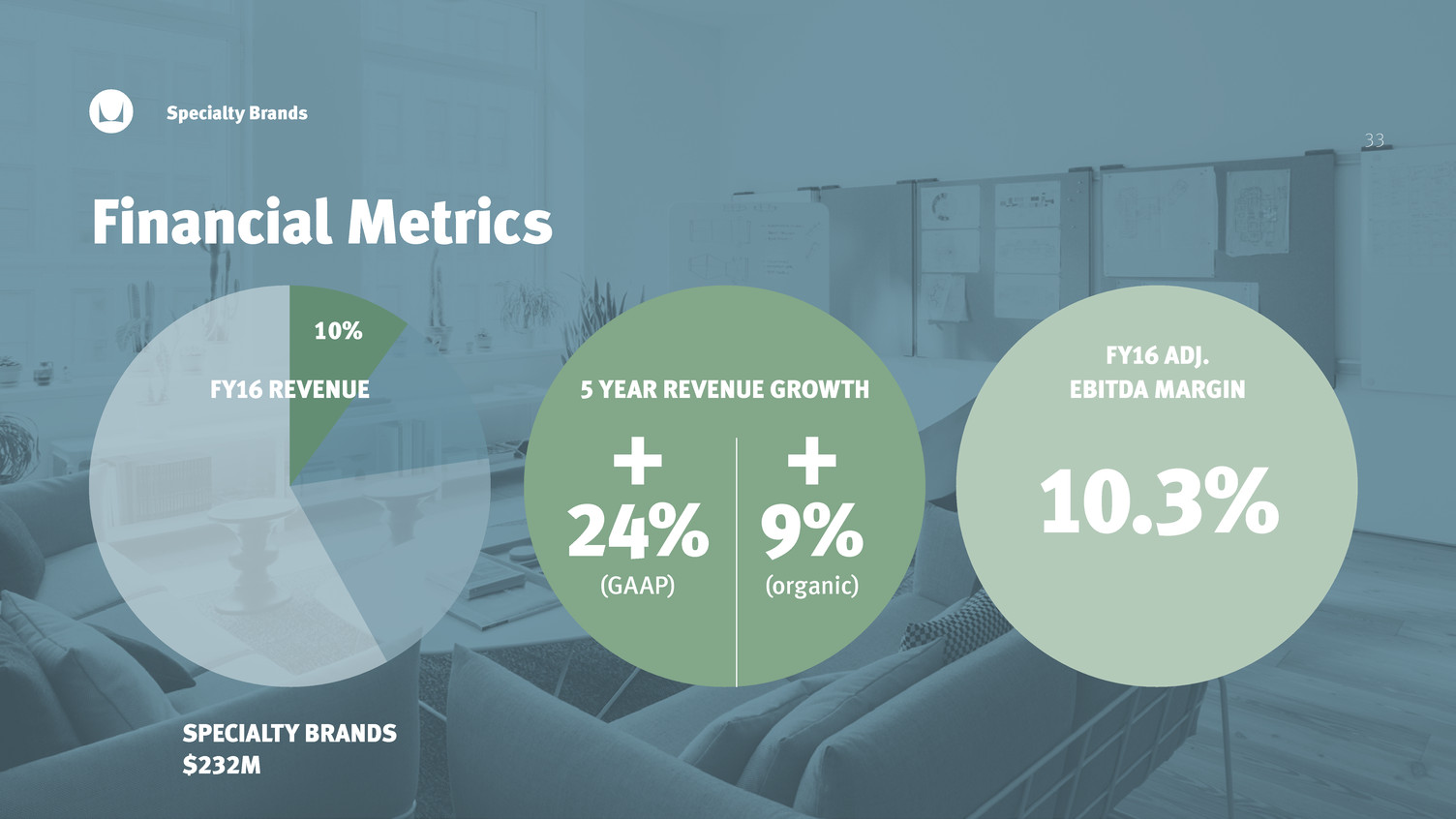

33 10% 33 Financial Metrics Specialty Brands 5 YEAR REVENUE GROWTH + 24% (GAAP) + 9% (organic) 10.3% FY16 ADJ. EBITDA MARGINFY16 REVENUE SPECIALTY BRANDS $232M

34Specialty Brands | Key Initiatives INNOVATIVE AND ROBUST PRODUCT DEVELOPMENT

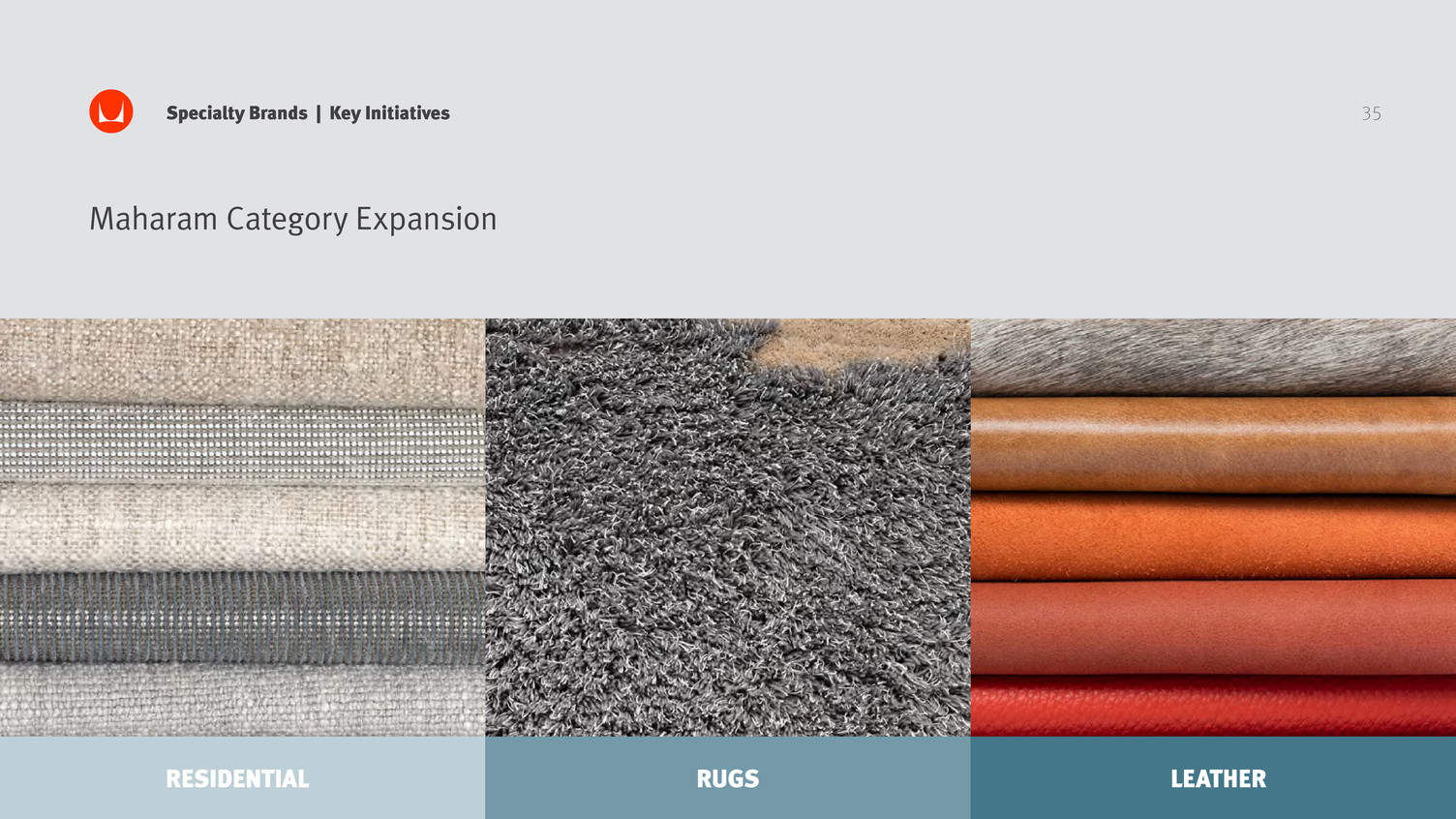

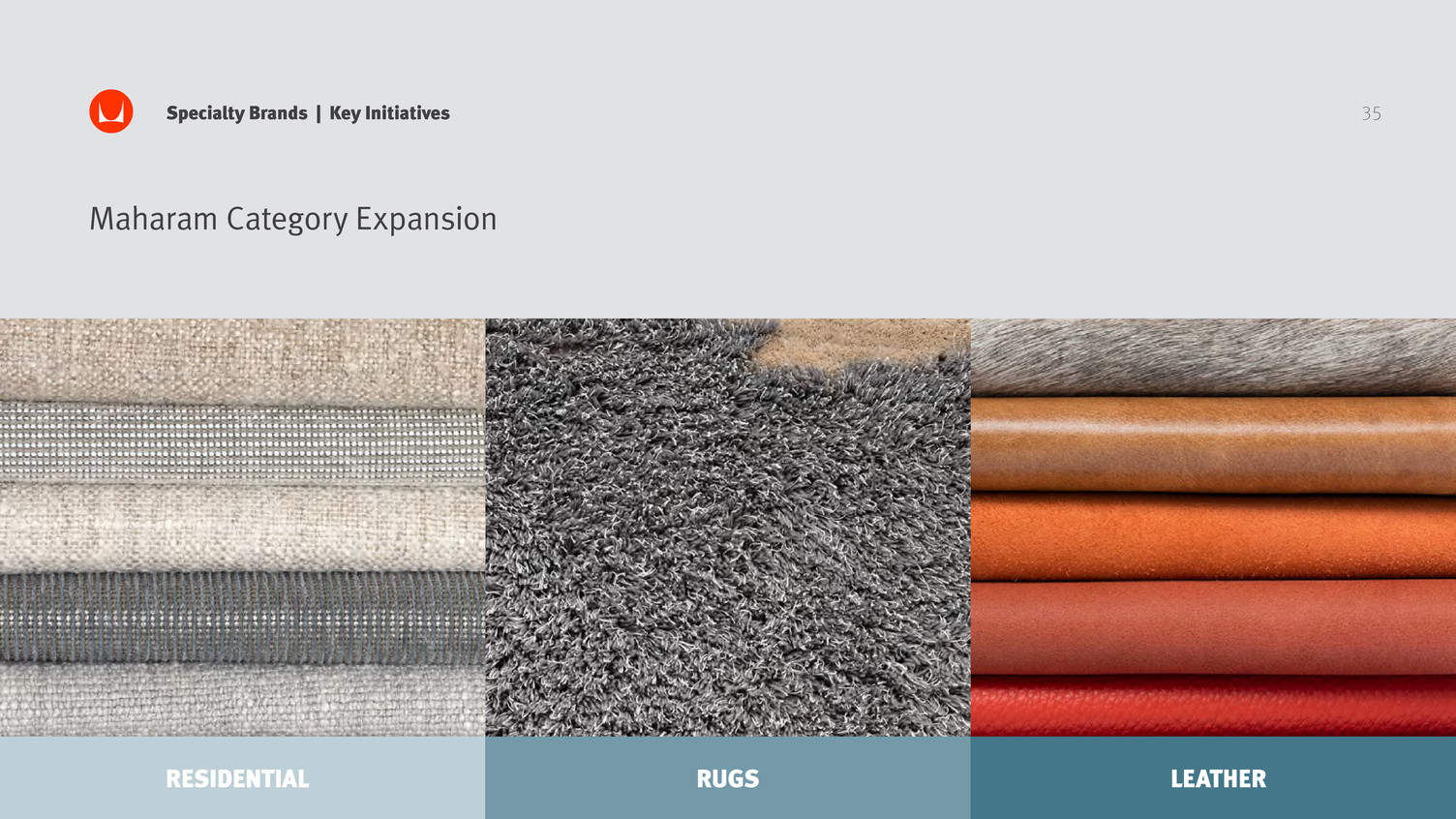

35 Maharam Category Expansion RESIDENTIAL RUGS LEATHER Specialty Brands | Key Initiatives

36Specialty Brands | Key Initiatives AUTOMATION AND LEAN ENTERPRISE

37Specialty Brands | Key Initiatives ARCHITECT AND DESIGNER EXPERIENCE

38 Dealer Eco-System Jeremy Hocking EVP – Strategy and Business Development

39 EVOLVING FLOORPLATE Dealer Eco-System

40 CREATED LIVING OFFICE FRAMEWORK Dealer Eco-System

41 DEVELOPED RELEVANT NEW PRODUCTS Dealer Eco-System

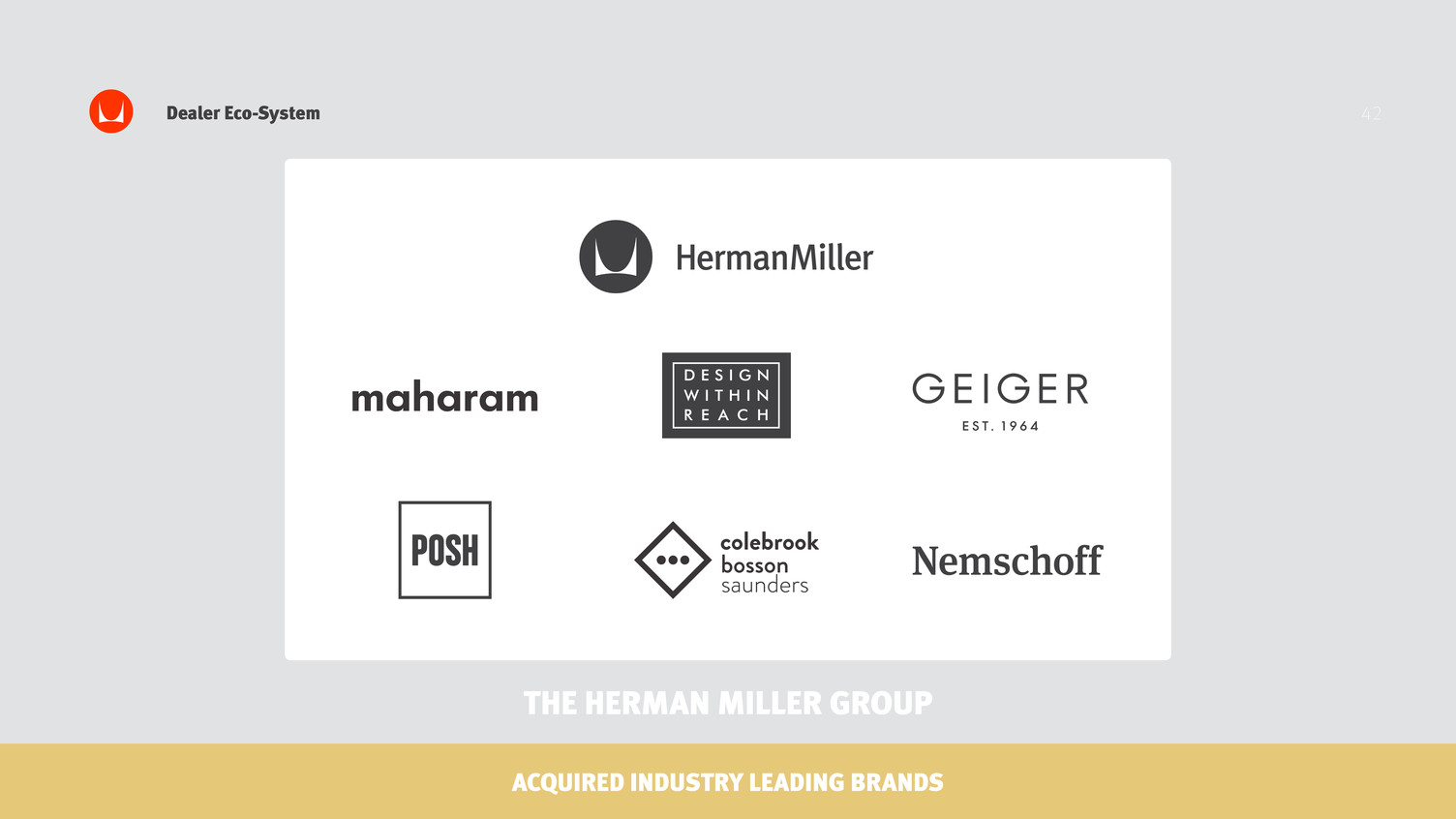

42 ACQUIRED INDUSTRY LEADING BRANDS Dealer Eco-System THE HERMAN MILLER GROUP

43 DIGITAL ECO-SYSTEM Dealer Eco-System | Key Initiatives

44 DEALER EXCELLENCE PROGRAM Dealer Eco-System | Key Initiatives

45 Innovation Ben Watson Chief Creative Officer

46 GLOBAL FAMILY OF BRANDS Innovation

47 Global Product Creation Excellence Innovation

48 Pipeline of Paradigm-Setting Products Innovation

49 NEXT GENERATION OF LIVING OFFICE Innovation

50 Outlook Jeff Stutz Chief Financial Officer

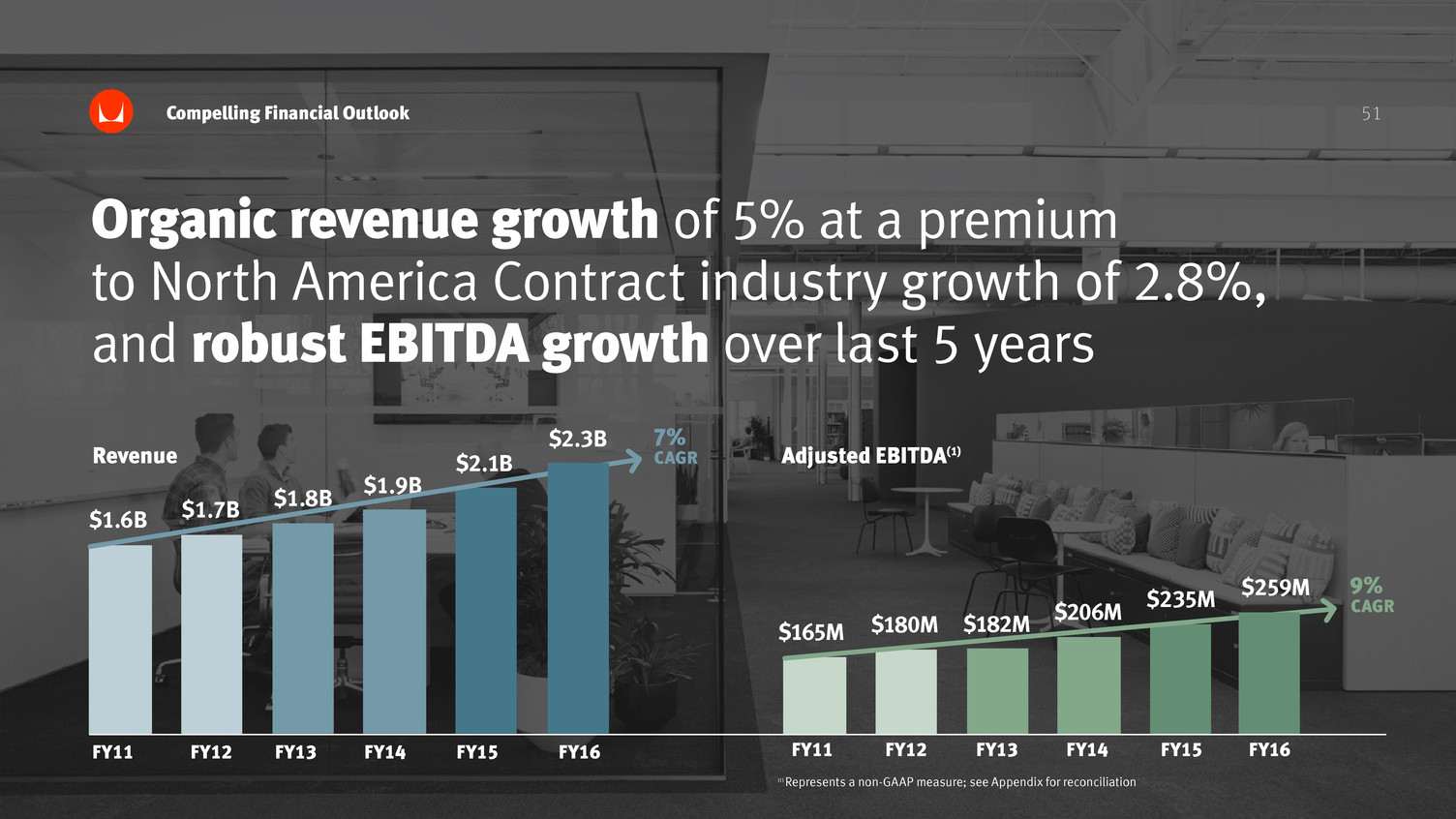

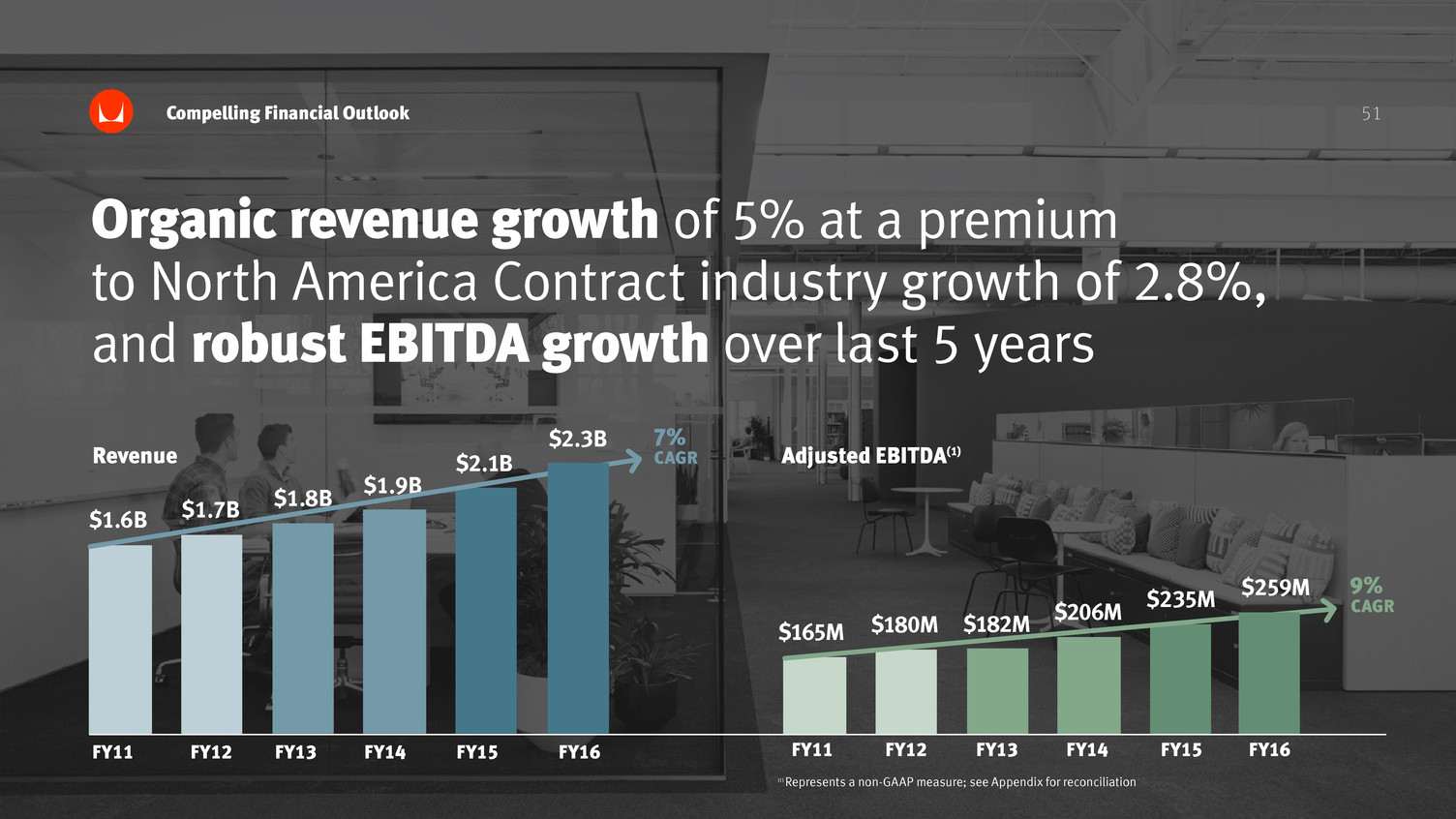

51 Organic revenue growth of 5% at a premium to North America Contract industry growth of 2.8%, and robust EBITDA growth over last 5 years Compelling Financial Outlook FY11 FY12 FY13 FY14 FY15 FY16 $1.9B $2.1B $1.8B$1.7B$1.6B FY11 FY12 FY13 FY14 FY15 FY16 $206M $235M$182M$180M$165M Revenue Adjusted EBITDA(1) (1) Represents a non-GAAP measure; see Appendix for reconciliation 9% CAGR $2.3B $259M 7% CAGR

Opportunity for continued above-average revenue performance over the next three to five years Compelling Financial Outlook Market Growth 1-3% New Products and Initiatives 1-1.5% Consumer Growth 1-1.5% Estimated Annual Organic Revenue Growth 3-6% Plus Targeted Acquisitions Revenue 52

Compelling Financial Outlook 53 Cost Savings Initiatives OPERATING MARGIN OF: $25 TO $35M (BY FY20) BUSINESS UNIT SYNERGIES LOGISTICS OPTIMIZATION FACILITIES CONSOLIDATION GENERAL COST RATIONALIZATION > 10% OF SALES (BY FY20)

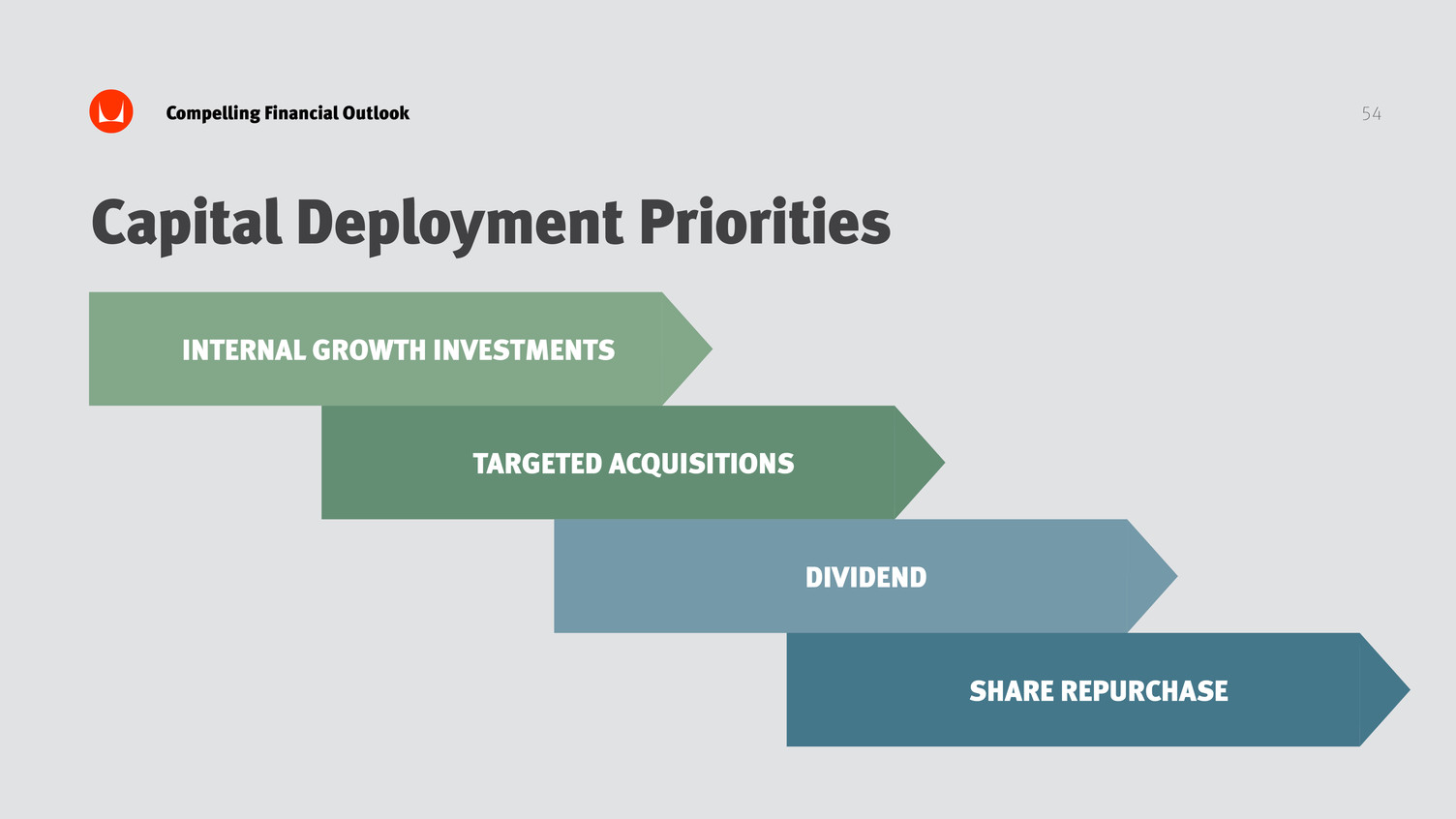

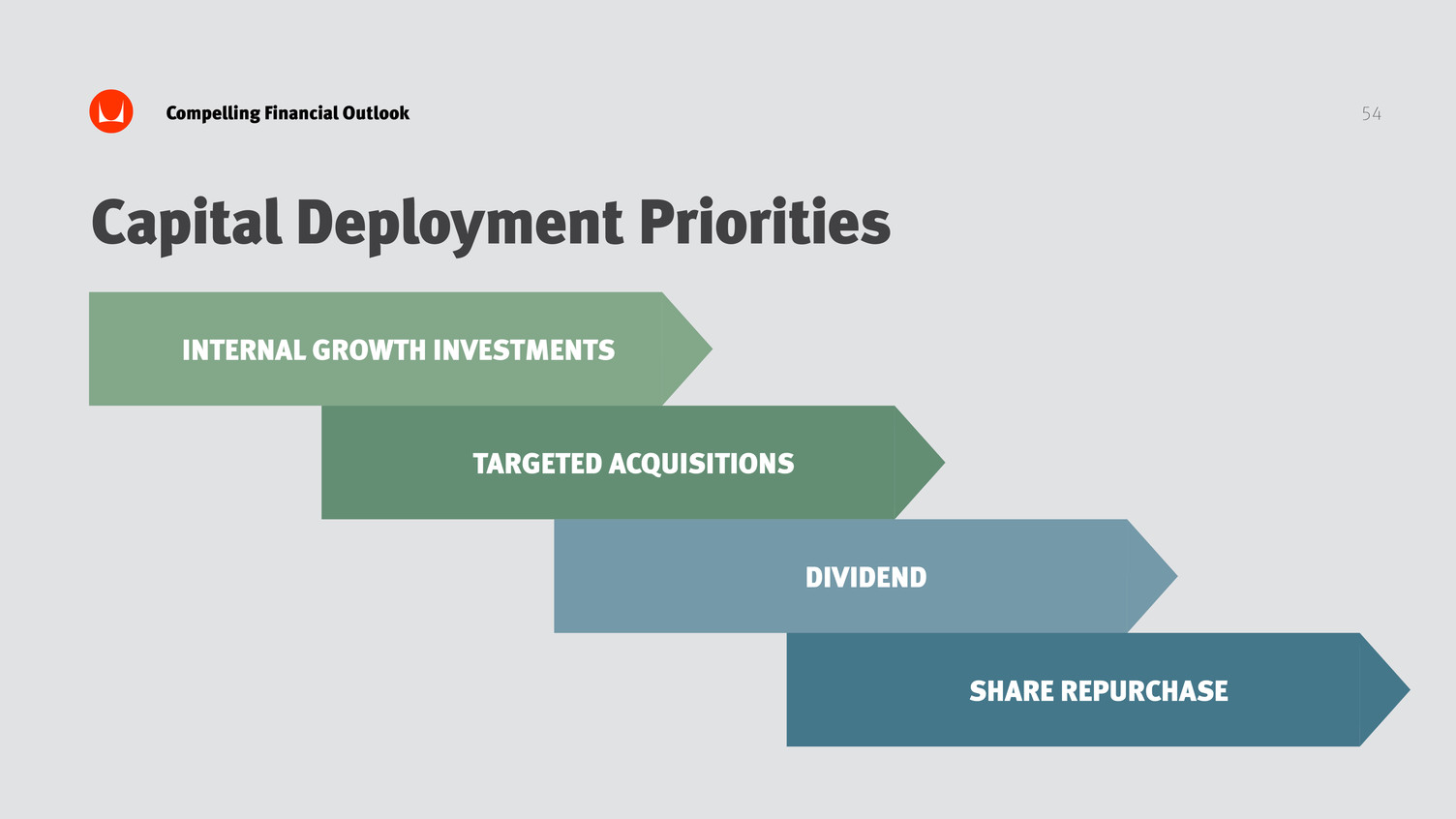

54Compelling Financial Outlook Capital Deployment Priorities INTERNAL GROWTH INVESTMENTS TARGETED ACQUISITIONS DIVIDEND SHARE REPURCHASE

55 Areas of Focus

56 Q&A

57 Appendix

58 This presentation contains Organic Sales Growth, Adjusted EBITDA, Adjusted EBITDA ratios, Adjusted Operating Earnings, and Adjusted Earnings Per Share, all of which constitute non-GAAP financial measures. Each of these financial measures is calculated by excluding items the Company believes are not indicative of its ongoing operating performance. The Company presents these non-GAAP financial measures because it considers them to be important supplemental indicators of financial performance and believes them to be useful in analyzing ongoing results from operations. These non-GAAP financial measures are not measures of financial performance under GAAP and should not be considered alternatives to GAAP. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. In addition, you should be aware that in the future the Company may incur expenses similar to the adjustments presented. Appendix –Reconciliation of Non-GAAP Measures

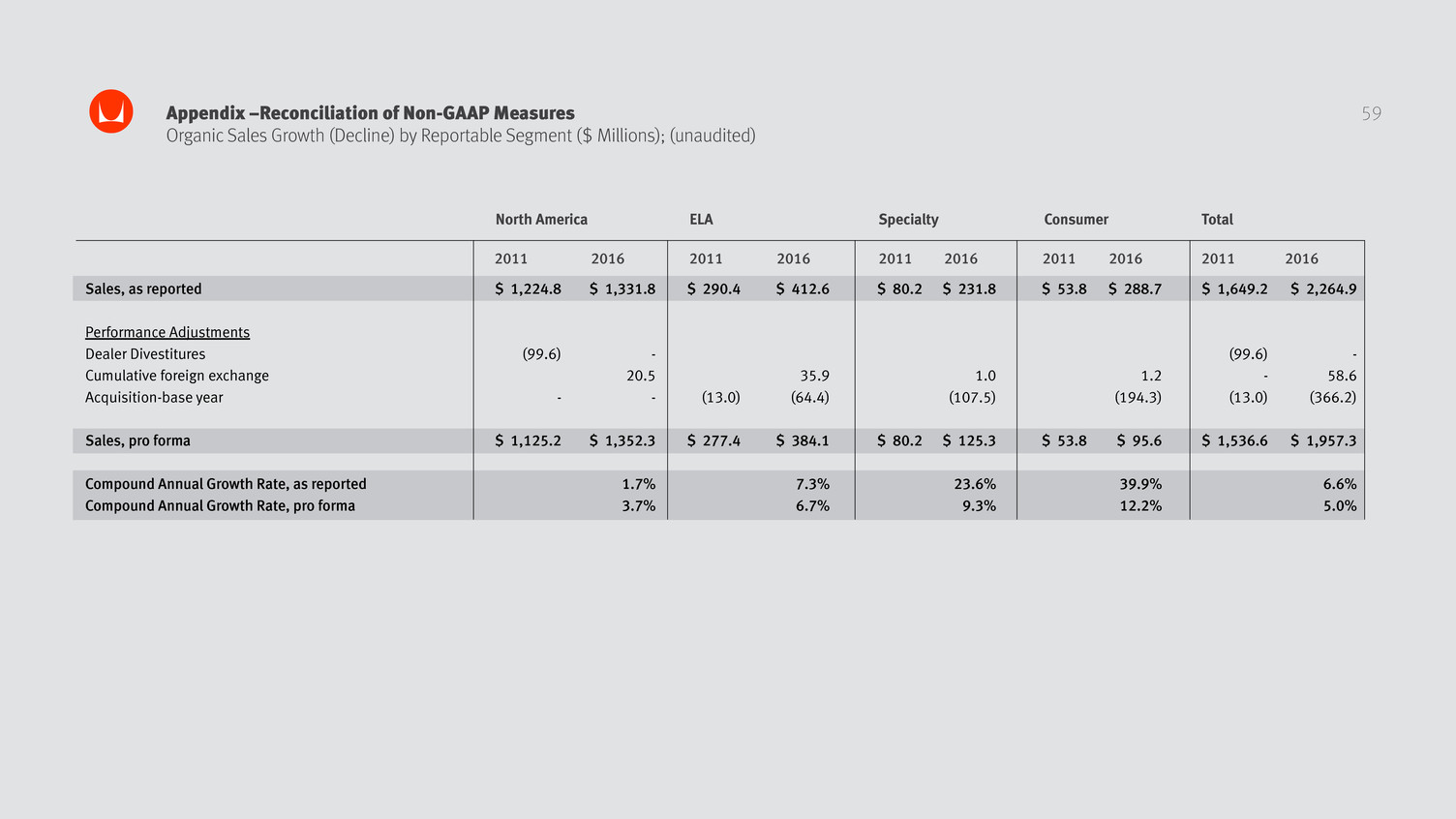

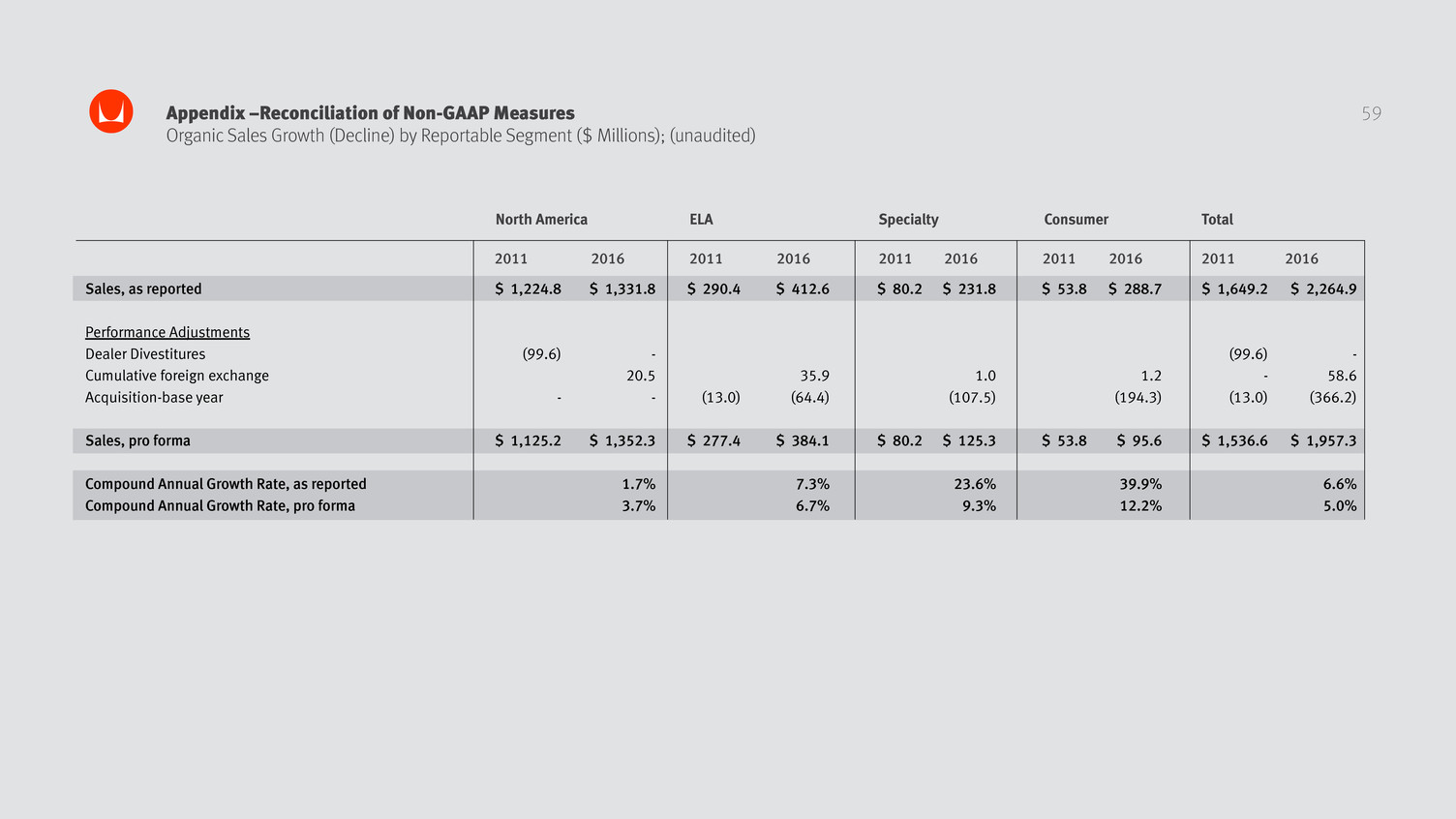

59Appendix –Reconciliation of Non-GAAP Measures Organic Sales Growth (Decline) by Reportable Segment ($ Millions); (unaudited) Sales, as reported Performance Adjustments Dealer Divestitures Cumulative foreign exchange Acquisition-base year Sales, pro forma Compound Annual Growth Rate, as reported Compound Annual Growth Rate, pro forma $ 1,224.8 (99.6) - $ 1,125.2 $ 1,649.2 (99.6) - (13.0) $ 1,536.6 $ 290.4 (13.0) $ 277.4 $ 80.2 $ 80.2 $ 53.8 $ 53.8 $ 1,331.8 - 20.5 - $ 1,352.3 1.7% 3.7% $ 2,264.9 - 58.6 (366.2) $ 1,957.3 6.6% 5.0% $ 412.6 35.9 (64.4) $ 384.1 7.3% 6.7% $ 231.8 1.0 (107.5) $ 125.3 23.6% 9.3% $ 288.7 1.2 (194.3) $ 95.6 39.9% 12.2% North America ELA Specialty Consumer Total 2011 2011 2011 2011 20112016 2016 2016 2016 2016

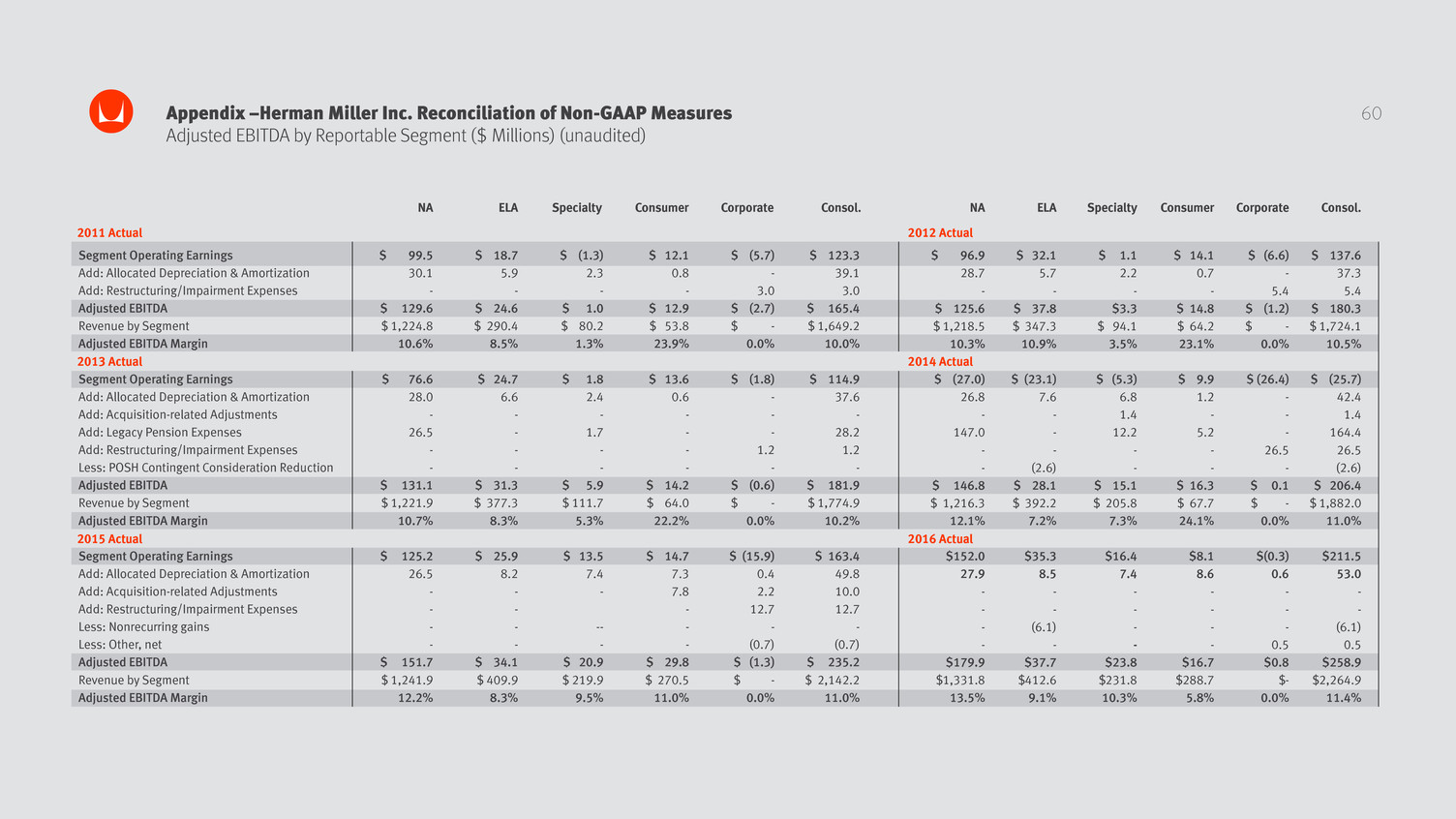

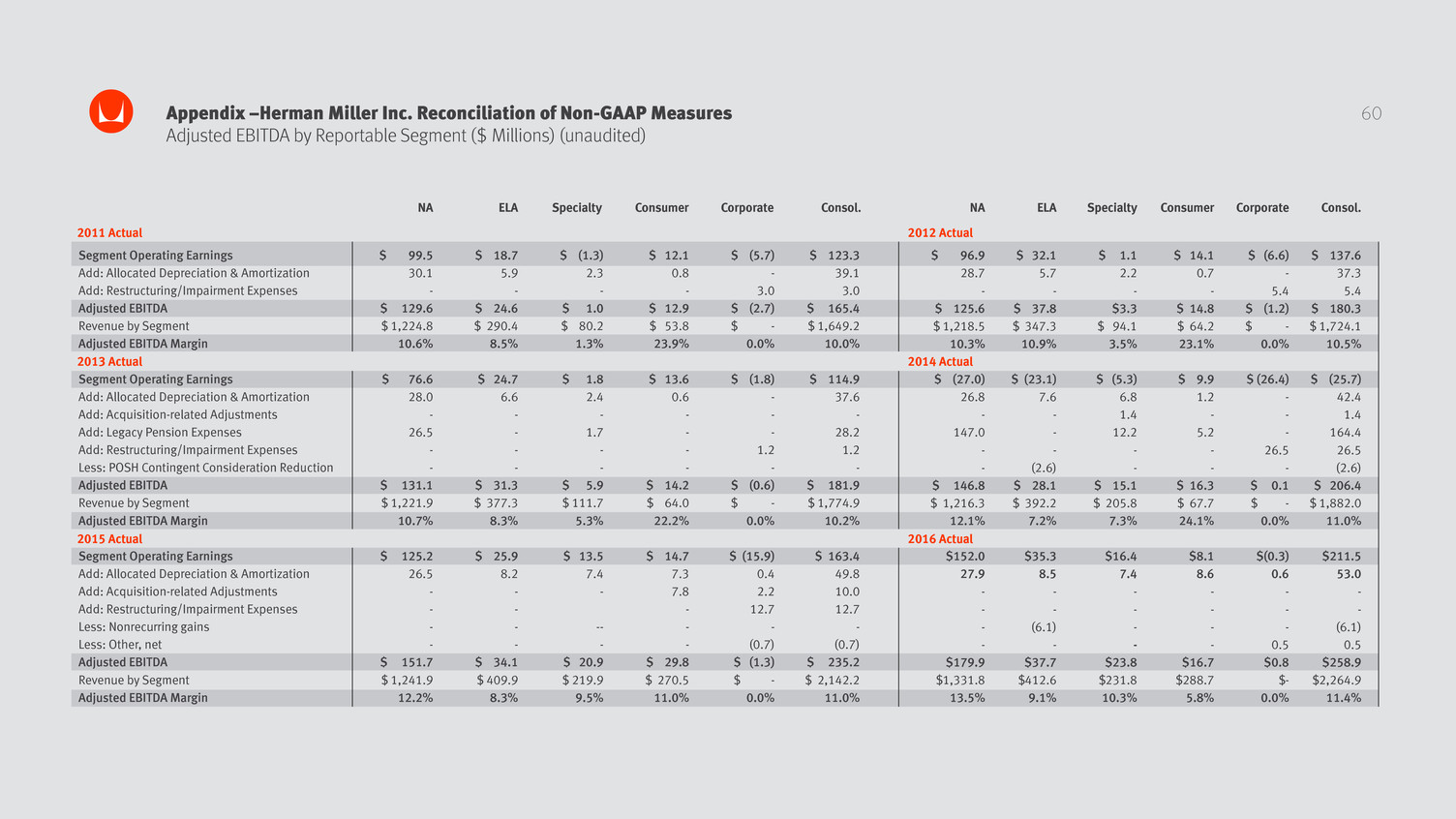

60Appendix –Herman Miller Inc. Reconciliation of Non-GAAP Measures Adjusted EBITDA by Reportable Segment ($ Millions) (unaudited) Segment Operating Earnings Add: Allocated Depreciation & Amortization Add: Restructuring/Impairment Expenses Adjusted EBITDA Revenue by Segment Adjusted EBITDA Margin Segment Operating Earnings Add: Allocated Depreciation & Amortization Add: Acquisition-related Adjustments Add: Legacy Pension Expenses Add: Restructuring/Impairment Expenses Less: POSH Contingent Consideration Reduction Adjusted EBITDA Revenue by Segment Adjusted EBITDA Margin Segment Operating Earnings Add: Allocated Depreciation & Amortization Add: Acquisition-related Adjustments Add: Restructuring/Impairment Expenses Less: Nonrecurring gains Less: Other, net Adjusted EBITDA Revenue by Segment Adjusted EBITDA Margin $ 99.5 30.1 - $ 129.6 $ 1,224.8 10.6% $ 76.6 28.0 - 26.5 - - $ 131.1 $ 1,221.9 10.7% $ 125.2 26.5 - - - - $ 151.7 $ 1,241.9 12.2% $ 18.7 5.9 - $ 24.6 $ 290.4 8.5% $ 24.7 6.6 - - - - $ 31.3 $ 377.3 8.3% $ 25.9 8.2 - - - - $ 34.1 $ 409.9 8.3% $ (1.3) 2.3 - $ 1.0 $ 80.2 1.3% $ 1.8 2.4 - 1.7 - - $ 5.9 $ 111.7 5.3% $ 13.5 7.4 - -- - $ 20.9 $ 219.9 9.5% $ 12.1 0.8 - $ 12.9 $ 53.8 23.9% $ 13.6 0.6 - - - - $ 14.2 $ 64.0 22.2% $ 14.7 7.3 7.8 - - - $ 29.8 $ 270.5 11.0% $ (5.7) - 3.0 $ (2.7) $ - 0.0% $ (1.8) - - - 1.2 - $ (0.6) $ - 0.0% $ (15.9) 0.4 2.2 12.7 - (0.7) $ (1.3) $ - 0.0% $ 123.3 39.1 3.0 $ 165.4 $ 1,649.2 10.0% $ 114.9 37.6 - 28.2 1.2 - $ 181.9 $ 1,774.9 10.2% $ 163.4 49.8 10.0 12.7 - (0.7) $ 235.2 $ 2,142.2 11.0% $ 96.9 28.7 - $ 125.6 $ 1,218.5 10.3% $ (27.0) 26.8 - 147.0 - - $ 146.8 $ 1,216.3 12.1% $152.0 27.9 - - - - $179.9 $1,331.8 13.5% $ 32.1 5.7 - $ 37.8 $ 347.3 10.9% $ (23.1) 7.6 - - - (2.6) $ 28.1 $ 392.2 7.2% $35.3 8.5 - - (6.1) - $37.7 $412.6 9.1% $ 1.1 2.2 - $3.3 $ 94.1 3.5% $ (5.3) 6.8 1.4 12.2 - - $ 15.1 $ 205.8 7.3% $16.4 7.4 - - - - $23.8 $231.8 10.3% $ 14.1 0.7 - $ 14.8 $ 64.2 23.1% $ 9.9 1.2 - 5.2 - - $ 16.3 $ 67.7 24.1% $8.1 8.6 - - - - $16.7 $288.7 5.8% $ (6.6) - 5.4 $ (1.2) $ - 0.0% $ (26.4) - - - 26.5 - $ 0.1 $ - 0.0% $(0.3) 0.6 - - - 0.5 $0.8 $- 0.0% $ 137.6 37.3 5.4 $ 180.3 $ 1,724.1 10.5% $ (25.7) 42.4 1.4 164.4 26.5 (2.6) $ 206.4 $ 1,882.0 11.0% $211.5 53.0 - - (6.1) 0.5 $258.9 $2,264.9 11.4% NA NAELA ELASpecialty Specialty 2011 Actual 2012 Actual 2013 Actual 2014 Actual 2015 Actual Consumer ConsumerCorporate CorporateConsol. Consol. 2016 Actual