UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2007

or

¨ Transition report pursuant to Section 13 or 15(d) of the Securities Act of 1934

For the transition period from to

Commission File Number 001-09781 (0-1052)

MILLIPORE CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Massachusetts | | 04-2170233 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I. R. S. Employer Identification No.) |

| |

| 290 Concord Road, Billerica, MA | | 01821 |

| (Address of principal executive offices) | | (Zip Code) |

(978) 715-4321

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT:

| | |

| Title of Class | | Name of Exchange on Which Registered |

| Common Stock, $1.00 Par Value | | New York Stock Exchange, Inc. |

SECURITIES REGISTERED PURSUANT TO SECTION 12(G) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part Ill of Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

x Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company

(Do not check if smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). ¨ Yes x No

The aggregate market value of Common Stock held by non-affiliates of the registrant, based upon the closing sale price of the registrant’s Common Stock on June 30, 2007, the last business day of its most recently completed second fiscal quarter, as reported on the New York Stock Exchange, was approximately $3,123,753,685. Shares of Common Stock held by each executive officer and director and by each person known to beneficially own more than 5 percent of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 20, 2008, 55,028,903 shares of the registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

| | |

Document Definitive Proxy Statement for the 2008 Annual Meeting | | Incorporated into Form 10-K Part Ill |

| | |

MILLIPORE FORM 10-K 2007 | | 1 |

Table of Contents

| | |

| 2 | | MILLIPORE FORM 10-K 2007 |

PART I

ITEM 1BUSINESS

| | |

Summary Millipore is a global leader in life science, providing

innovative products, services, and solutions so our customers can advance their research, development, and

production. Our academic, biotechnology, and pharmaceutical

customers use our consumable products and services to increase

their speed and to improve their consistency while saving costs in

laboratory applications and in biopharmaceutical manufacturing.

With our extensive technical expertise and applications knowledge,

we have the unique ability to engage in peer-to-peer discussions

with scientists to help them confront challenging scientific and

human health issues. | |  |

We help scientists conduct their research easily, efficiently and economically.

| | |

DEVELOPMENT | | |

BIOSCIENCE | | BIOPROCESS |

We help pharmaceutical and biotech companies discover new drugs. | | We help companies develop manufacturing processes to bring new drugs to market. |

PRODUCTION | | |

| | BIOPROCESS |

We help companies manufacture drugs efficiently and ensure drug purity and safety. |

| | |

MILLIPORE FORM 10-K 2007 | | 3 |

PART I

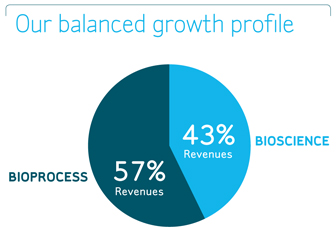

Millipore is organized around two operating divisions. Our Bioscience Division, which contributed approximately 43% of our 2007 revenues, improves laboratory productivity and workflows by providing innovative products and technologies for life science research. Our Bioprocess Division, which contributed approximately 57% of our 2007 revenues, helps pharmaceutical and biotechnology companies develop their manufacturing processes, optimize their manufacturing productivity, and ensure the quality of drugs.

RESEARCH

In the bioscience research market, we improve laboratory productivity by providing a range of products and solutions that help scientists conduct their research more easily, efficiently, and economically. We focus primarily on highly technical areas such as the cell biology and protein research markets.

DEVELOPMENT

Our Bioscience Division focuses on the drug discovery market and provides products and services that help pharmaceutical and biotechnology companies discover, evaluate, and prioritize potential drugs before moving them into clinical development. Our Bioprocess Division helps biopharmaceutical companies develop the processes used to manufacture drugs for clinical development and the processes to manufacture the drugs at commercial scale once the drugs receive regulatory approval.

PRODUCTION

Our products and expertise help biotechnology and pharmaceuticaI companies efficiently manufacture therapeutics, particularly biologic drugs and vaccines. Our products and expertise ensure the purity and safety of biologic drugs by removing contaminants such as viruses and bacteria and by providing tests so companies can monitor their manufacturing processes.

Our History

Millipore Corporation was formed as a Massachusetts corporation in 1954. During much of our history, we have

developed and sold products based on our proprietary filtration and other separations technologies to a variety of industries. In 2001, we made a strategic decision to focus primarily on the life science markets. Beginning in 2005, we began implementing a new strategy that sharpened our focus on the fast growing biopharmaceutical manufacturing and laboratory research markets. In 2005 and 2006, we made four acquisitions to transform Millipore into a larger and more innovative company. These acquisitions expanded and improved the products and services we offer and complemented our brand, sales force, and customer relationships.

Our Strategy

Our corporate strategy is to provide differentiated solutions to the life science research and biopharmaceutical manufacturing markets, which we believe have significant needs for new products that drive results, productivity improvements and new research goals. Since 2005, our strategy has been organized around five objectives:

| | |

1 | | Strengthen our leadership position with biotechnology manufacturing customers by expanding our bioprocess product offerings |

2 | | Establish Millipore as a strategic supplier in bioscience research markets by increasing our laboratory productivity platforms and market reach |

3 | | Lead our industry in product quality and manufacturing effectiveness |

4 | | Attract, retain and develop talented and motivated employees |

5 | | Double the value of the company between 2005 and 2009 |

| | |

| 4 | | MILLIPORE FORM 10-K 2007 |

PART I

Our Bioscience Division strategy is to capitalize on its global infrastructure and core capabilities in filtration, reagents and assay development to provide differentiated offerings in fast growing market segments. The division pursues targeted, market-specific strategies in laboratory water, drug discovery, and life science research. The division leverages three expert sales organizations to execute the multiple-segment strategy under one premium brand.

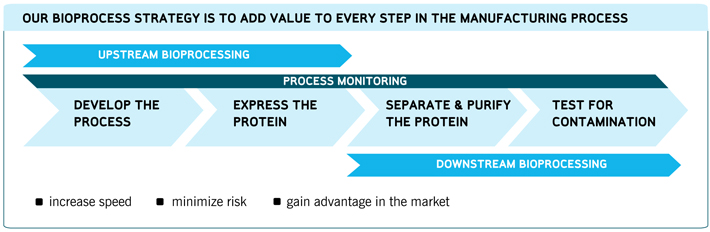

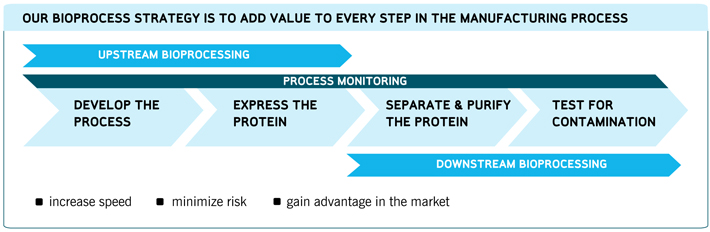

Our Bioprocess Division strategy is to leverage its leading position and broad portfolio of products to offer its biopharmaceutical customers integrated solutions that improve their productivity. By enabling companies to move from a product-centric approach to an integrated approach, the division can uniquely help customers to increase their speed, lower their costs, minimize their risk, and increase their quality. The division’s global sales organization is focused on selling products, services, and applications expertise that provide its customers with a comprehensive approach to optimize their biopharmaceutical manufacturing process.

RECENT DEVELOPMENTS

Some of our 2007 achievements that continued to advance our strategy and transform our company include:

| n | | Launching many new products, including |

| | — | successful new product launches for laboratory water in our Bioscience Division, and |

| | — | an upgrade to our core product portfolio in our Bioprocess Division along with 15 new product launches, compared to 8 in 2006. |

| n | | Establishing or broadening several key alliances to expand our product offerings and extend our development capabilities. |

| n | | Completing the integration of our Serologicals acquisition. The integration consisted of more than 800 milestones that significantly strengthened our capabilities, broadened our product portfolio, and advanced our position as a life science leader. |

| n | | Launching a new corporate brand to communicate our expanded capabilities to our customers and the market. |

| n | | Introducing a new corporate website making it easier for customers to do business with us. |

| n | | Achieving a record level of sales in Asia and continuing to expand in other emerging markets. |

| n | | Launching a formal sustainability initiative to reduce our overall impact on the environment. |

| n | | Continuing a number of initiatives to further improve our profitability, such as significant reductions in the number of our worldwide manufacturing facilities, improvements to our procurement and manufacturing processes, and enhancements of sales productivity. |

| | |

STRATEGIC ALLIANCES |

| | Recombinant Insulin |

| | Animal-free Cell Culture Supplements |

| | New Chromatography Media |

| | Real-time tests for microbial contamination |

| | Biomarkers for the drug discovery market |

| | Combining our Lab Water products in Siemens’ Vista® Intelligent Lab System for clinical laboratories |

| | |

MILLIPORE FORM 10-K 2007 | | 5 |

PART I

Our Customers

| | | | |

| | |

MILLIPORE | | | | |

| | |

DIVISIONS | | PRODUCT APPLICATIONS | | CUSTOMERS |

| | | |

BIOSCIENCE | | LAB WATER DRUG DISCOVERY LIFE SCIENCE | | n Research departments at biotechnology and pharmaceutical companies |

| | | n Life science research companies |

| | | n Private and public research laboratories, such as universities, medical research centers, and government institutions |

| | | n Hospitals and clinical laboratories |

| | | n Clinical research organizations |

| | | n Environmental, industrial, and other analytical laboratories |

| | | |

BIOPROCESS | | UPSTREAM BIOPROCESSING DOWNSTREAM BIOPROCESSING PROCESS MONITORING | | n Biotechnology companies |

| | | n Pharmaceutical companies |

| | | n Contract drug manufacturers |

| | | n Diagnostics and medical device companies |

| | | n Beverage companies |

| | | | | n Environmental testing companies |

Almost all of our revenue is related to customers engaged in life science research or biopharmaceutical production. A small portion of our business is related to customers in the food and beverage, environmental, diagnostics, and other industries.

BIOSCIENCE CUSTOMERS

Our Bioscience Division serves the life science research market, principally composed of companies and institutions conducting basic research, drug discovery, and other analytical laboratory work.

While the overall bioscience market is very broad, Millipore does not seek to serve all segments of the market. For example, in the life science research market we focus primarily on scientists conducting research in cell biology, protein research, and drug discovery.

These customers focus on applications such as stem cells, cell signaling and nuclear function, target identification, and compound screening. Our laboratory water and some lab filtration products are sold into many different types of research, analytical, and clinical laboratories worldwide and serve a more general, diverse customer base.

BIOPROCESS CUSTOMERS

Our Bioprocess Division serves the biopharmaceutical manufacturing market, principally composed of biotechnology and pharmaceutical companies that develop, manufacture, and sell products for the diagnosis, prevention, and treatment of diseases.

These Bioprocess customers are engaged in the development, scale-up, manufacturing, and testing of therapeutic, vaccine, and diagnostic products, as well as a variety of healthcare and other products.

Although no single customer accounts for 10 percent or more of our sales, some of our individual biotechnology customers do purchase significant quantities of our products. Our Bioprocess Division has significantly higher customer concentration than our Bioscience Division.

| | |

| 6 | | MILLIPORE FORM 10-K 2007 |

PART I

Our Business

OVERVIEW

We compete in two related markets, life science research and biopharmaceutical manufacturing.

In response to demand for healthcare improvement and disease prevention, new therapeutic products and vaccines, particularly biologics based on recombinant proteins, are being developed, approved, and produced in growing numbers.

We have worldwide operations with a strong brand, global infrastructure, proprietary technologies, highly qualified sales force, and manufacturing operations. We sell thousands of products, and we are continually developing and/or acquiring new proprietary products and technologies to advance our businesses. We believe we offer a balanced product mix that offers strong growth and profitability.

Most of our products are consumables that are used, disposed, and replaced, such as reagent kits or filtration cartridges. We derive a small portion of our revenue from standard hardware products ranging from small benchtop laboratory water systems to large filtration systems.

| | | | |

OUR BIOSCIENCE STRATEGY IMPROVES SCIENTIFIC WORK FLOWS |

RESEARCHERS WANT |

| | | |

n Reduced complexity in experiment work flow | | n Increased confidence in outcomes | | n Ongoing support during experiments |

|

MILLIPORE PRODUCTS AND SERVICES |

| | | |

n Simplify researchers’ work flow | | n Offer consolidated and validated solutions | | n Provide technical support |

In addition, we provide a variety of services, including drug target screening and selectivity testing, microbial contamination testing, consulting, manufacturing process validation, and product maintenance services. Although service revenues represent a small percentage of our revenues, they have grown significantly over the past two years due to strong market growth and the acquisition of service businesses.

Because of the differing applications required by each of our target markets, we believe our approach to these markets benefits from more specialized and focused attention. Accordingly, we have aligned our business to better address each of these markets. The following describes more specifically the principal markets in which we compete.

LABORATORY/LIFE SCIENCE

RESEARCH MARKETS

Industry Background

As researchers seek to understand complex biological systems and to identify and characterize new therapeutic targets, the market demand for tools that improve productivity and efficiency in the laboratory has grown. Intensive and expensive laboratory research is required to feed the pipeline of biologics, bioengineered vaccines, and other therapeutic and diagnostic products in development. Research organizations have come under increasing competitive and economic pressure to screen and identify possible new drugs with more speed and accuracy. In particular, the rapid growth in the development of new therapeutics has brought a heightened focus on protein research, including protein identification and characterization. Laboratory markets have also grown with the increase in concerns about bioterrorism and the emergence of new public health threats.

Our Bioscience Division serves major fields of life science research, including cellular biology, protein research, and drug discovery, which we believe are high growth market segments. Researchers want reduced complexity in their experimental work flows, increased confidence in the outcome, and ongoing support during their experiments. Our bioscience strategy is to create products and services which span the entire work flow, by simplifying the work flow for

| | |

MILLIPORE FORM 10-K 2007 | | 7 |

PART I

researchers, offering consolidated and validated solutions, and providing the necessary support along the way.

We offer products to advance life science research in a wide variety of areas from neuroscience, infectious disease, oncology, and metabolic disorders to stem cells, cell signaling, nuclear function, and chromatin biology.

Our Bioscience Division is organized around three specific market areas within the broad bioscience research market as described below.

Laboratory Water

All life science research starts with the use of pure water. Water purification systems are present in nearly every laboratory. Daily demand for purified water can range from a few liters to several thousand liters. We offer a wide selection of sophisticated bench-top and central laboratory water systems that ensure water purity for critical laboratory analysis and clinical testing. These systems provide the flexibility to produce the water quality needed for a variety of laboratory needs and applications.

| | |

MILLIPORE BIOSCIENCE VALUE PROPOSITION |

| | |

| FASTER | | INTEGRATED, PRE-VALIDATED KITS reduce the number of individual steps required CUSTOMIZED PRODUCTS (such as an antibody) fit the specific experiment |

| | |

| BETTER | | BEST-IN-CLASS QUALITY PRODUCTS yield reliable and consistent results TARGETED SOLUTIONSmeet researcher’s specific protocol |

| | |

| EASIER | | MILLIPORE APPLICATION PROTOCOLSguide scientist through the experiment EASY TO USE KITS ADDRESS SEVERAL STEPSin a combined format SERVICES AND STAND ALONE PRODUCTSfill any gaps in the experiment protocol WORLD-CLASS CUSTOMER SUPPORTto provide technical support on key experiments |

Drug Discovery

Millipore provides products and services that help pharmaceutical and biotech companies discover, evaluate, and prioritize potential drugs. A major challenge is to find promising drug candidates faster and then ensure that they will not generate unwanted or unexpected side effects in clinical trials or when they are commercially on the market. To improve the efficiency and economy of this research, we provide tools and services to identify disease targets and better understand how to improve the efficacy of drugs on targeted patient groups. In each case, the overriding goal is the transformation of medical practice from a “diagnose and treat” model to one of “predict and prevent”.

When researchers identify potential drugs, they must evaluate which drugs are most likely to function effectively and safely in the human body. This complex task of prioritizing possible drugs requires that the drugs be screened both for specificity and affinity for the specific target of interest, and for potential side effects.

The majority of new biotherapeutic targets are proteins, either newly discovered or those for which their function is better understood through recent research. Protein-based therapeutics are often more effective than chemically-based drugs in treating a number of diseases.

We provide bulk reagents required to perform the complex analyses involved in prioritizing drug candidates through screening for specificity and affinity for a target class of interest.

We also offer outsourced drug discovery screening services to ascertain activity and safety for drug candidates. As an outsourcing partner to the world’s leading biotechnology and pharmaceutical firms, we offer an efficient, comprehensive service to screen molecules before the expensive and time consuming development of drugs to treat cardiovascular, oncology, neurology, metabolic, and many other disorders.

| | |

| 8 | | MILLIPORE FORM 10-K 2007 |

PART I

Life Science

Our life science business is focused on serving the cell biology and protein research markets. All life science researchers conduct experiments on biological samples, such as cells, proteins, and nucleic acids. Most experiments follow a work flow protocol which requires the use of a broad range of research products, including consumable devices, reagents, kits, antibodies, and other molecular biology tools for purifying, preparing, or screening biological samples.

We offer product and service solutions designed around the entire protocol, so researchers can work faster, better, and easier than if they did not use our products and services.

The consistency and reproducibility of experimental results requires that the samples used by researchers are pure and properly isolated. The varying physical and biochemical characteristics of biological samples make the processes of isolation extremely complex. Research, clinical, and analytical laboratories use many sample preparation steps for a variety of laboratory procedures.

Millipore filtration devices and specialty membranes can be designed to accommodate the parameters of a wide variety of experiments. Millipore’s customized antibodies serve as biological markers that can be used to produce consistent and repeatable results, saving time and reducing costs.

Research scientists also outsource various services such as the development and production of custom antibodies, which we provide.

Life science researchers who study the structure and function of cells and proteins require innovative and high quality biological reagents to conduct their experiments consistently. A reagent is a substance used to detect, quantify, produce, modify or otherwise manipulate a biological target. Millipore offers a wide range of biological reagents.

Kits enhance research productivity by combining in one box all the disposables, reagents, and protocols needed to reliably and reproducibly conduct a particular experiment. Millipore offers a wide variety of kits that improve research productivity and efficiency.

BIOPHARMACEUTICAL MANUFACTURING MARKET

Industry Background

Our Bioprocess Division provides tools and services for the commercial production of bioengineered and pharmaceutical substances, including biologics, vaccines and other biotherapeutic products. Manufacturers of these products are under increasing competitive and economic pressure to:

| n | | maintain safety and quality |

| n | | minimize process deviations |

| n | | shorten production time |

| n | | improve manufacturing productivity and yield |

| n | | ensure security of supply |

Manufacturing of therapeutics generally encompasses production of two broad categories of molecules, small molecule drugs and large molecule drugs. Small molecule therapeutics are primarily chemical compounds that are made through an organic or inorganic chemistry process. These are sometimes referred to as synthetic pharmaceuticals. Chemical or pharmaceutical companies manufacture these therapeutics and their active ingredients in bulk. Large molecule therapeutics are primarily protein-based biologics. These represent the fastest growing segment of the biotech industry.

Biologics are products derived from living organisms, generated in a bioreactor or fermentor, and used in the prevention or treatment of disease. They include therapeutic products and vaccines based on recombinant proteins, such as monoclonal antibodies. About half of our Bioprocess business is related to biotechnology products.

| | |

MILLIPORE FORM 10-K 2007 | | 9 |

PART I

In many instances, recombinant proteins replace or mimic naturally occurring human proteins and are produced by cells containing modified DNA. One subset of recombinant protein-based drugs, monoclonal antibodies, has been shown to be extremely effective at treating otherwise intractable diseases such as cancer. This has led to a fast growing market for monoclonal antibodies, which are difficult to produce and require a variety of complex technologies and processes to enable their development and production.

Industry sources predict that volumes of monoclonal antibodies and bioengineered vaccines will continue to grow substantially over the next five years. There are approximately 2,300 biologics in various stages of pre-clinical and clinical development, of which approximately 660 are monoclonal antibodies and approximately 640 are bioengineered vaccines. In addition, applications and approvals for biologics drug supplements, which address incremental indications for a previously approved biologic, are also on the rise. In contrast, growth in sales of small molecule pharmaceuticals is expected to be lower because of intense generic competition as the patents expire on the chemical compounds comprising the drugs. Synthetic pharmaceuticals, however, continue to constitute a significant percentage of all marketed therapeutic products and are manufactured in large volumes.

As the demand for marketed biologics and vaccines grows and new products and applications are approved, the market for products that facilitate and accelerate the

identification, development and production of biologics and bioengineered vaccines is expanding.

Successfully bringing a biologic or a bioengineered vaccine to the market is a complex and lengthy process. It begins with extensive laboratory research and discovery, continues with years of development, clinical trials and scale-up of the manufacturing process, and culminates with establishing a manufacturing process that meets regulatory approvals and generates sufficient quantities of a safe and effective drug. Going from the initial research to full production scale cannot be achieved without increasingly effective cell culture and purification processes.

We view the value chain of our bioprocess customers to include:

| n | | process development and scale up; |

| n | | upstream bioprocessing (the growth and expression process in bioreactors); |

| n | | downstream purification and filtration (harvesting); and |

| n | | compliance monitoring and testing. |

We believe we offer one of the industry’s broadest offerings for biopharmaceutical manufacturing. Additionally, we believe we are the only company to offer consumable products in both upstream and downstream bioprocessing. Our Bioprocess Division serves the breadth of this development and manufacturing process by targeting the three principal applications described below. The development of a customer’s process involves aspects from each of these three product categories.

| | |

| 10 | | MILLIPORE FORM 10-K 2007 |

PART I

Upstream Bioprocessing

Biologic products must be grown in living cells since they cannot be synthesized chemically. We provide products and technologies that improve the ability of cells to efficiently produce proteins that ultimately become therapeutic drugs and vaccines.

The cells are grown in cell cultures held in large bioreactor or fermentation tanks of varying capacity. In order to achieve high protein concentrations, cells in the bioreactor require nutrients and supplements. As the cells grow and metabolize, they secrete into the cell culture medium the therapeutic protein that is then harvested, purified, and further processed.

To facilitate the manufacture of biologic drugs in mammalian cell cultures, we offer high quality nutrients and supplements for these cultures. Our products include the leading branded fatty acid supplements, recombinant insulin, bovine serum albumin, and other growth factors that improve the ability of cells to produce proteins efficiently. We also offer unique gene expression technology which permits screening and isolation of highly productive cell lines much faster than conventional technologies. The technology enables our customers to more efficiently manufacture recombinant proteins in mammalian cells by generating higher protein yields. Today, some of our upstream products are derived using materials from animals. Many customers are increasingly demanding products that do not use animal-derived products. We are actively expanding our portfolio of animal-free cell culture supplements. In December 2007, we entered into an exclusive long-term strategic alliance with Novozymes to bring recombinant albumin and transferrin to the market.

Downstream Bioprocessing

FILTRATION & CHROMATOGRAPHY

The production of biologics requires the extraction of proteins from the fluids in which these proteins are grown. The process also requires the removal of impurities such as bacteria, viruses, cellular debris, and other contaminants. Accordingly, manufacturing processes for biologics, particularly for monoclonal antibodies, are separation-intensive, often requiring numerous filtration and chromatography steps for clarification, concentration, and sterilization.

A complex biologic, such as a monoclonal antibody, can require as many as ten different separation processes. A typical synthetic drug may require between one and four filtration and sterilization steps.

We offer the broadest range of filtration, purification, and chromatography technologies to clarify, concentrate, purify, and remove viruses or other biological contaminants from biologics, synthetic pharmaceuticals, and beverages. Approximately half of our business is related to biologic drug production, with the remaining portion of our business primarily related to synthetic pharmaceutical manufacturing and food and beverage processing. We also sell membrane sheets and rolls and bulk chromatographic media to original equipment manufacturers of medical devices, environmental testing equipment, or other products for use as a material or component in these products. We also offer a line of monoclonal antibodies that serve as reagents for classifying antigens on red blood cells and detecting regular and irregular antibodies in blood specimens.

MIXING AND DISPOSABLE SOLUTIONS

Until recently, all biotherapeutic drugs were produced with stainless steel or glass equipment. Although these types of equipment are currently the prevalent processing tools, the industry has sought ways to reduce the costs and delays associated with cleaning fixed equipment in place between manufacturing runs. Contamination risks also arise if the equipment is not thoroughly purged of all residual materials from prior production runs. Companies have begun to migrate to single use, disposable technologies that eliminate the need for cleaning, thus shortening the time between processing runs. Biopharmaceutical manufacturers are also seeking flexible manufacturing components and solutions that can be configured and validated to meet customized biological manufacturing needs.

| | |

MILLIPORE FORM 10-K 2007 | | 11 |

PART I

We design and manufacture sophisticated systems for use in sterile biomanufacturing environments, such as chromatography columns, manufacturing skids, mixers, and valves. We are also a leading innovator in the transition from such systems to disposable manufacturing, offering a broad range of disposable manufacturing components. In the past several years, we have developed and/or acquired rights to products and technologies that simplify and reduce the time and expense of some steps in the downstream and final fill processes of biotechnology and pharmaceutical manufacturing primarily by replacing stainless steel hardware with disposable plastic products. Our hardware products range from large stainless steel process scale filtration and chromatography systems and columns that can sell for more than a million dollars to small filter housings or valves that cost much less.

Process Monitoring

Regulatory agencies such as the U.S. Federal Drug Administration (FDA) require drug manufacturers to ensure the purity and sterility of products before they are released to the public. This requires sampling and testing of therapeutics throughout the manufacturing process. During nearly all phases of drug development and production, companies take multiple steps to ensure their products

| | | | |

MILLIPORE COMPETITORS |

| | | |

| | | BIOSCIENCE | | BIOPROCESS |

Becton Dickinson | | n | | |

Bio-Rad Laboratories | | n | | |

Corning | | n | | |

GE Healthcare | | n | | n |

Invitrogen | | n | | n |

MDS Pharma | | n | | |

Pall Corporation | | n | | n |

Perkin Elmer | | n | | |

Sartorius Stedim | | n | | n |

Sigma-Aldrich | | n | | n |

TECHNE Corporation | | n | | |

Thermo Fisher | | n | | n |

are produced safely and without contamination. Millipore provides a broad range of products and services that enable sampling and testing of drugs throughout the manufacturing process to ensure the safety and purity of drugs.

Companies that produce beverages (including wine, beer, and bottled juices and water) also benefit from using our process monitoring products to monitor for microbiological contamination and remove bacteria and yeast.

Our process monitoring products are designed to test for microbiological, viral or other contamination in biologics and synthetic pharmaceuticals as a quality control or assurance step in their manufacture or processing. We are also developing next-generation technologies that are faster and more sensitive so bioprocess manufacturers can identify contamination earlier in their processes. Our alliance with Gen-Probe Incorporated (“Gen-Probe”) is designed to produce new process monitoring tools capable of significantly reducing the time-to-result from days or weeks to hours. In January 2008, we announced the launch of MiIIiPROBE™, the alliance’s first product. We also offer outsourced testing for biological and viral contamination of biologics.

Competition

The markets for our products and services are intensely competitive and we compete with a variety of public and private companies. Given the breadth of our product and service offerings, our competition comes from a wide array of competitors, ranging from specialized companies with strengths in niche segments of the life science markets to large manufacturers offering a broad portfolio of products, tools, and services. Many of these competitors have significant financial, operational, sales, and marketing resources, and experience in research and development. In some cases, these and other competitors are also our customers, distributors, and suppliers, and in some circumstances we serve these roles for such competitors as well.

We believe that a company’s competitive position in any of our markets is determined by a varying mix of product availability and performance, quality, responsiveness, technical support, price, and breadth of product line. Our customers are diverse

| | |

| 12 | | MILLIPORE FORM 10-K 2007 |

PART I

and we believe they place varying degrees of importance on these competitive attributes. In our judgment we are well positioned to compete in each of these categories.

Sales, Marketing, and

Customer Support

We sell our products to end users worldwide, primarily through our own direct global sales force. Augmenting our direct sales, we also sell our products through our website and, in selected locations and markets, through independent distributors.

We market to our customers through advertising, trade shows, conferences, and other techniques. Our marketing efforts focus on application development for existing products and on new and differentiated products for newly identified and proposed customer needs. We seek to educate customers about the variety of problems that may be addressed by our products as well as to adapt our products and technologies to the problems identified by our customers. Our technical support services are important to our marketing efforts. These services include assisting in defining a customer’s needs, evaluating alternative solutions, selecting or designing a specific system to perform the desired application, training users, and assisting the customer in compliance with relevant government regulations.

Our direct sales organization is a critical competitive differentiator for us. An important component of our strategy is to leverage our direct sales organization by expanding our product portfolio available for sale and increasing our penetration of our current customer base.

Research and Development

We believe that a strong research and product development effort is important to our future growth.

Our research and development activities are intended both to improve on our extensive core technologies and to create

new applications and breakthroughs that complement our business. Our core technologies include:

| n | | Separation and purification membranes |

| n | | Customized monoclonal antibodies |

| n | | Cell culture supplements |

| n | | Disposable manufacturing |

Some of these technologies are incorporated into devices, cartridges, and modules of different configurations that span many of our markets while others are focused on a specific or customized application.

We do most of our own research and development and do not provide material amounts of research and development services for others. We have followed a practice of

| | |

MILLIPORE FORM 10-K 2007 | | 13 |

PART I

supplementing our internal research and development efforts by acquiring or licensing new technologies from unaffiliated third parties, acquiring distribution rights for new technologies, and undertaking collaborative or sponsored research and development activities with unaffiliated companies and academic or research institutions when we believe it is in our interests to do so.

For example, through our alliance with Gen-Probe, we are working to develop next-generation process monitoring tools for the biopharmaceutical manufacturing market by coupling Millipore membrane-based sample preparation technologies with Gen-Probe’s nucleic acid amplification and gene sequencing technologies. Additionally, through our acquisition of Serologicals, we have greatly expanded our product development capabilities to include antibodies, enzymes, labeling and detection reagents, molecular biology kits, multiplexed immunoassays, cell based assays, and drug screening services.

Quality Assurance

To compete effectively in our markets, we maintain a global quality assurance system and program designed to assure compliance with the stringent requirements of regulatory authorities, voluntary quality standards, industry trade associations, and our customers. Using our quality assurance program and an internally maintained regulatory compliance program, we conduct periodic audits of each of our facilities to ascertain the status and compliance of the quality system as implemented. The audits, in combination with performance metrics, are designed to ensure adherence to regulations and our procedures and to assess the effectiveness of our quality system as a whole. The audits are one component of the key performance indicators that we collect, review, and monitor in order to maintain our program of continuous improvement and compliance with our established systems and programs.

Most of our operating facilities are registered to ISO 9001:2000 quality standards. The ISO 9001:2000 series of standards is a voluntary quality standard recognized throughout the world.

Global Supply Chain—

Manufacturing and Sourcing

We manufacture the majority of our products in our own manufacturing facilities, primarily at those properties described and listed under Item 2 of this Form 10-K. Our global supply chain initiative, which began in 2004, is expected to result, over five years, in a new manufacturing landscape through the consolidation of current sites, the implementation of new raw material procurement practices by consolidating our current supplier base, and streamlined manufacturing processes through improvements using lean manufacturing and Six Sigma methodologies.

Our Employees

As of December 31, 2007, Millipore employed approximately 6,000 people worldwide, of whom approximately 2,300 were employed in the United States.

Patents, Trademarks and Licenses

We have been granted and have licensed rights under a number of patents and have other patent applications pending both in the United States and abroad. While these patents and licenses in the aggregate are viewed as valuable assets, we believe that no individual patent is material to our ongoing operations. We also own a number of trademarks, the most significant being “Millipore”.

Many of our research reagent products are sold under licenses that have varying terms and conditions. We expect to continue to in-license new technologies from academic and government institutions, as well as biotechnology and pharmaceutical companies. We use licensed technologies to create new products, including high value kits and services, many of which address bottlenecks in the research or drug discovery laboratories.

| | |

| 14 | | MILLIPORE FORM 10-K 2007 |

PART I

Our ability to obtain licenses to allow the introduction of new products is very important to allow us to offer new, innovative, and technologically superior research products. The licenses from others typically cover patents or biological materials, such as cell lines, that we use to develop new products. Most of them are for fixed terms with options for renewal and typically impose obligations on us to market the licensed technology. No single license is material to our business.

Government and Industry

Regulation

Many of our activities are subject to regulation by governmental authorities within the United States and similar bodies outside of the United States. The regulatory authorities may govern the collection, testing, manufacturing, safety, efficacy, labeling, storage, record keeping, transportation, approval, advertising, and promotion of our products, as well as the training of our employees. However, some of these products are subject to import and export regulations specific to the country of import. Certain of our products are considered “medical devices” under the Food, Drug and Cosmetic Act. Accordingly, these products are subject to the law’s general control provisions that include requirements for registration, listing of devices, quality regulations, labeling, and prohibitions against misbranding and adulteration. These products subject us to regulatory inspection and scrutiny. We believe that we are in substantial compliance with all relevant laws and regulations.

Environmental Matters

We are subject to numerous federal, state, and foreign laws and regulations that impose strict requirements for the control and abatement of air, water, and soil pollutants and the manufacturing, storage, handling, and disposal of hazardous substances and waste. We believe we are in substantial compliance with all applicable environmental requirements. We continue to invest in maintaining facilities that enable our compliance with these

environmental laws. These environmental related expenditures have not had a material effect on our financial results. Because regulatory standards under environmental laws and regulations have become increasingly stringent, there can be no assurance that future developments will not cause us to incur material environmental liabilities or costs. See the applicable risk factor under Item 1A of this Form 10-K.

Raw Materials

Our products are made from a wide variety of raw materials that are generally available from alternate sources of supply. For certain critical raw materials, we have qualified only a single source. We periodically purchase quantities of some of these critical raw materials in excess of current requirements in anticipation of future manufacturing needs. With sufficient lead times, we believe we would be able to validate alternate suppliers for each of these raw materials. As described in the applicable risk factor under Item 1A of this Form 10-K, several of these critical raw materials are used in a significant portion of our products, and if we were unable to obtain supply of any one of them, our loss of revenues would be material.

Seasonality

In general, we do not believe our business is inherently seasonal.

Backlog

We do not have a material amount of firm commitments that serve as backlog orders.

| | |

MILLIPORE FORM 10-K 2007 | | 15 |

PART I

Geographic and Segment Information

We are a multinational company with approximately 63 percent of our 2007 sales outside the United States and approximately 50 percent of our long-lived assets outside the United States at December 31, 2007. Geographic and segment information, including the identification of operating segments and their aggregation, is discussed in Note 16 to our Consolidated Financial Statements.

Other Information

Millipore’s corporate headquarters are at 290 Concord Road, Billerica, Massachusetts, and our telephone number at that location is 1-978-715-4321.

The U.S. Securities and Exchange Commission (the “SEC”) maintains an internet website at http://www.sec.gov that contains our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy statements, and all amendments thereto. All reports that we file with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. Information about the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.

Millipore’s internet website address is www.millipore.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy statements, and all amendments thereto, are available free of charge on our website as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC. In addition, our corporate governance guidelines, the charters of each of the committees of our Board of Directors, our code of ethics (consisting of our Corporate Compliance Policy, our Employee Code of Conduct and our Rules of Conduct) and our Director Code of Conduct are

available on our website and are available in print to any Millipore shareholder upon request in writing to “General Counsel, Millipore Corporation, 290 Concord Road, Billerica, MA 01821”.

The certifications of Millipore’s Chief Executive Officer and Chief Financial Officer, as required by the rules adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, are filed as exhibits to this Form 10-K. Millipore’s Chief Executive Officer, Martin D. Madaus, provided an annual certification to the New York Stock Exchange dated May 29, 2007, that he was not aware of any violations by the Company of the New York Stock Exchange corporate governance listing standards.

| | |

| 16 | | MILLIPORE FORM 10-K 2007 |

PART I

ITEM 1A. RISK FACTORS.

Lack of early success with our pharmaceutical and biotechnology customers can shut us out of future business with those customers.

Many of the products we sell to the pharmaceutical and biotechnology customers are incorporated into the customers’ drug manufacturing processes. In some cases, once a customer chooses a particular product for use in a drug manufacturing process, it is unlikely that the customer will later switch to a competing alternative. In many cases, the regulatory license for the product will specify the separation and cell culture supplement products qualified for use in the process. Obtaining the regulatory approvals needed for a change in the manufacturing process is time consuming, expensive and uncertain. Accordingly, if we fail to convince a pharmaceutical or biotechnology customer to choose our products early in its manufacturing design phase, we may lose permanently the opportunity to participate in the customer’s production of such product. Because we face vigorous competition in this market from companies with substantial financial and technical resources, we run the risk that our competitors will win significant early business with a customer making it difficult for us to recover that opportunity.

The suspension or termination of production of a customer’s therapeutic product may result in the abrupt suspension or termination of their purchases of our products, resulting in an unexpected reduction in our revenue.

Success in our Bioprocess division substantially depends on the incorporation of our products into a customer’s manufacturing process. If this “design in” is achieved, we will likely have the opportunity to sell consumable products to the customer during the life cycle of the customer’s product, which could continue for many years. Our planning and growth projections are built in part on the volume assumptions deriving from these customer successes. If a customer stops production of its product, either temporarily or permanently, our sales to the customer for the applicable product will drop or stop. A customer may suspend or terminate production of a product, either voluntarily or involuntarily, and related sales and distribution for many reasons. These may include adverse regulatory, competitive, legal or economic circumstances. We have had in the past, and expect to have in the future, situations in which a customer suspends its purchases of our products. A suspension or permanent cessation of a process in which we would otherwise anticipate selling a significant volume of consumables will reduce our revenues and negatively impact our earnings.

Disruptions in the supply of raw materials and distributed products from our single source suppliers could result in a significant disruption in sales and profitability.

Our products are made from a wide variety of raw materials that are generally available from alternate sources of supply. However, certain critical raw materials and supplies required for the production of some of our principal products are available only from a single supplier, as are some products that we distribute. Such raw materials and distributed products cannot be obtained from other sources without significant delay or at all. If such suppliers were to limit or terminate production or otherwise fail to supply these materials for any reason, such failures could have a material adverse impact on our product sales and our business.

If our efforts to integrate acquired or licensed businesses or technologies into our business are not successful, our business could be harmed.

As part of our business strategy, we have grown our business through acquisitions of technologies or of companies that offer products, services and technologies that we believe complement our products, technologies and services. In 2005, we acquired NovAseptic and MicroSafe B.V. In April 2006, we acquired Newport and in July 2006, we acquired Serologicals. We expect to continue to grow our business through additional acquisitions if appropriate opportunities arise.

| | |

MILLIPORE FORM 10-K 2007 | | 17 |

PART I

Managing these recent acquisitions and any future acquisitions will entail numerous operational, legal and financial risks, including:

| | n | | difficulties in assimilating new technologies, operations, sites and personnel; |

| | n | | diversion of resources and management attention from our existing businesses and technologies; |

| | n | | inability to maintain uniform quality standards, controls, and procedures; |

| | n | | inability to retain key employees of any acquired businesses or hire enough qualified personnel to staff any new or expanded operations; |

| | n | | impairment or loss of relationships with key customers and suppliers of acquired businesses; |

| | n | | issuance of dilutive equity securities; |

| | n | | incurrence or assumption of debt; |

| | n | | exposure to unknown or unanticipated liabilities; |

| | n | | additional expenses associated with future amortization or impairment of acquired intangible assets or potential businesses; and |

| | n | | exposure to federal, state, local and foreign tax liabilities in connection with any acquisition or the integration of any acquired businesses. |

Our failure to address these risks successfully in the future could harm our business and prevent our achievement of anticipated growth.

Increased leverage as a result of our debt offerings and other debt we have incurred to finance our acquisition of Serologicals may harm our financial condition and results of operations.

As of December 31, 2007, our total long term debt was $1,260.0 million and approximately $331.6 million represents indebtedness of our subsidiaries under our revolving credit facilities that is guaranteed by us. Our revolving credit facilities permit us to borrow in either the United States or Europe, with a combined maximum borrowing not to exceed€465.0 million, or $678.3 million.

Our level of indebtedness could have important consequences because:

| | n | | a substantial portion of our cash flows from operations will be dedicated to interest and principal payments and may not be available for operations, working capital, capital expenditures, expansion, acquisitions or general corporate or other purposes; |

| | n | | it may impair our ability to obtain additional or replacement financing in the future; |

| | n | | it may limit our flexibility in planning for, or reacting to, changes in our business and industry; and |

| | n | | it may make us more vulnerable to downturns in our business, our industry or the economy in general. |

Our operations may not generate sufficient cash to enable us to service our debt. If we fail to make a payment on any of our debt obligations or comply with financial covenants in our debt agreements, we could be in default on such debts, and this default could cause us to be in default on our other outstanding indebtedness. In each case of default, we may be required to repay all of our outstanding indebtedness or renegotiate the terms of our indebtedness on unfavorable terms.

If we fail to maintain adequate quality standards for our products and services, our business may be adversely affected and our reputation harmed.

Our customers are subject to rigorous quality standards in order to maintain their products and the manufacturing processes and testing methods that generate them. A failure to sustain the specified quality requirements, including the processing and testing functions performed by our products, could result in the loss of the applicable regulatory license. Delays or quality lapses in our customer’s production line could result in substantial economic losses to them and to us. For example, large production lots of biotherapeutics are very delicate and expensive and a failure of a separation mem-

| | |

| 18 | | MILLIPORE FORM 10-K 2007 |

PART I

brane could result in the contamination of the entire lot, requiring its destruction. We also perform services that may be considered an extension of our customers’ manufacturing and quality assurance processes, which also require the maintenance of prescribed levels of quality. Although we believe that our continued focus on quality throughout the company adequately addresses these risks, there can be no assurance that we will not experience occasional or systemic quality lapses in our manufacturing and service operations. If we experience significant or prolonged quality problems, our business and reputation may be harmed, which may result in the loss of customers, our inability to participate in future customer product opportunities, and reduced revenues and earnings.

We may be unable to establish and to maintain collaborative development and marketing relationships with business partners, which could result in a decline in revenues or slower than anticipated growth rates.

As a part of our business strategy, we have formed, and intend to continue to form, strategic alliances, license agreements and marketing and distribution arrangements with corporate partners relating to the development, commercialization, marketing and distribution of certain of our existing and potential products to increase our revenues and to leverage our product and service offerings. Our success will depend, in part, on our ability to maintain these relationships and to cultivate additional corporate alliances with such companies. In 2005, we entered into a joint development agreement with Gen-Probe. In 2007, we entered into agreements with Novozymes A/S, Rohm and Haas, and Stem Cell Sciences, among others.

We cannot ensure that our historical collaborative relationships will be commercially successful or yield the desired results, that we will be able to negotiate additional collaborative relationships, that such additional collaborative relationships will be available to us on acceptable terms, or that any such relationships, if established, will be commercially successful. In addition, we cannot ensure that parties with which we have established, or will establish, collaborative relationships will not, either directly or in collaboration with others, pursue alternative technologies or develop alternative products in addition to, or instead of, our products. Such parties may also be acquired by our competitors to terminate our relationship. They may also experience financial or other difficulties that lessen their value to us and to our customers. Our results of operations and opportunities for growth may be adversely affected by our failure to establish and maintain successful collaborative relationships.

Demand for our bioprocess products and services are subject to the commercial success of our customers’ products which may vary for reasons outside our control.

Even if we are successful in securing participation for our products in a customer’s manufacturing process, sales of many of our bioprocess products and services remain dependent on the timing and volume of the customer’s production, over which we have no control. The customer’s demand for our products will depend on the regulatory approval and commercial success of the supported product. The regulatory process is complex, lengthy and expensive and can often take years to complete, if at all. Commercial success of a customer’s product, which would drive demand in production and commensurate demand for our products and services, is dependent on many factors, some of which can change rapidly, despite early positive indications. Any delay or cancellation by a customer of volume manufacturing may harm our revenues and earnings.

Technology innovations in the markets that we serve may create alternatives to our products and result in reduced sales.

Our customers constantly attempt to reduce their manufacturing costs and to improve product quality. Technology innovations to which our current and potential customers would have access could reduce or eliminate their need for our membrane or chromatography products. For example, if a new membrane or chromatography technology of one of our competitors is accepted by the pharmaceutical or biotechnology industry as a market standard, sales of our membrane or

| | |

MILLIPORE FORM 10-K 2007 | | 19 |

PART I

chromatography products would be negatively impacted. In addition, a disruptive technology that reduces or eliminates the use of our core technologies would negatively impact the sale of our products. As an example, animal–free serum products are generally favored over bovine serum. We may be unable to respond on a timely basis to the changing needs of our customer base and the new technologies we design for our customers may prove to be ineffective. Our failure to develop and to introduce or to enhance products able to compete with such new technologies in a timely manner could have a material adverse effect on our business, results of operations, and financial condition. We may be unable to respond on a timely basis to the changing needs of our customer base and the new technologies we design for our customers may prove to be ineffective.

We may be unable to realize our growth strategy if we cannot identify suitable acquisition opportunities in the future.

As part of our business strategy, we expect to continue to grow our business through acquisitions of technologies or companies. We may not identify or complete complementary acquisitions in a timely manner, on a cost-effective basis, or at all. In addition, we compete with other companies, including large, well funded competitors, to acquire suitable targets, and may not be able to acquire certain targets that we seek. There can be no assurance that we will be able to execute this component of our growth strategy which may harm our business and hinder our future growth.

To achieve desired growth rates as we become larger, we may seek larger or public companies as potential acquisition candidates. The acquisition of a public company may involve additional risks, including the potential for lack of recourse against public shareholders for undisclosed material liabilities of the acquired business. In addition, if we were to proceed with one or more significant future acquisitions in which the consideration consisted of cash, a substantial portion of our available cash resources could be used.

Our continued growth is dependent on our development and successful commercialization of new products.

Our future success will depend in part on timely development and introduction of new products that address changing market requirements. We believe that successful new product introductions provide a significant competitive advantage because customers make an investment of time in selecting and learning to use a new product. Customers are reluctant to switch to a competing product after making their initial selection. To the extent that we fail to introduce new and innovative products, we may lose market share to our competitors, which will be difficult or impossible to regain. An inability, for technological or other reasons, to successfully develop and introduce new products could reduce our growth rate or otherwise damage our business. In the past, we have experienced, and are likely to experience in the future, delays in the development and introduction of products. We cannot assure that we will keep pace with the rapid rate of change in life sciences research, or that our new products will adequately meet the requirements of the marketplace or achieve market acceptance.

If we fail to attract, hire, develop and retain qualified personnel, we may not be able to design, manufacture, market or sell our products or successfully grow our business.

Competition for individuals with skills including sales, marketing, research, product development, engineering and others is strong and we may not be able to secure the personnel we need. The loss of the services of any key personnel, or our inability to hire new personnel with the requisite skills, could restrict our ability to develop new products and services or enhance existing products and services in a timely manner, sell products to our customers, or manage our business effectively. As part of our global supply chain initiative to improve customer service and to amplify our product expertise, we have begun to concentrate our facilities in fewer geographical areas in which there is high demand for qualified staff.

| | |

| 20 | | MILLIPORE FORM 10-K 2007 |

PART I

If our consolidated manufacturing operations were disrupted, we may be unable to supply products to our customers and achieve expected revenues.

We are in the process of executing a coordinated reorganization of our supply chain and manufacturing operations. In an effort to better serve our customers and to attain efficiencies of scale and expertise, we are consolidating the majority of our production facilities into fewer sites. Each of these remaining facilities serves as our primary production facility for specific product lines. This concentration of production, however, exposes us to a greater risk of disruption to our ability to manufacture and supply our products. If operation at any of these facilities were disrupted, we may not be able to deliver products to our customers and achieve expected revenues or earnings. If we were unable to reestablish production in a timely manner, we may lose customers and have difficulty regaining them. It is uncertain whether the safety measures and contingency plans that we have implemented or may implement will successfully address the risks that may arise if production is disrupted. Also, there can be no assurance that the insurance that we maintain to protect against business interruption loss will be adequate or that such insurance will continue to remain available on acceptable terms, if at all. The extent of the coverage of our insurance could limit our ability to mitigate for lost sales and could result in such losses materially and adversely affecting our operating results.

Sales of several of our products are dependent on a small number of customers, the loss of which may harm our business and result in a reduction in revenues and earnings.

No single customer represents more than 10 percent of our annual sales. However, sales of some of our products are dependent on a limited number of customers, who account for a significant portion of such sales. Some of these products are in areas in which we plan to grow substantially. The loss of such key customers for such products, or a significant reduction in sales to those customers, could significantly reduce our revenues in these products and adversely affect our future growth in such markets.

We may become involved in disputes regarding our patents and other intellectual property rights, which could result in prohibition on the use of certain technology in current or planned products, exposure of the business to significant liability and diversion of management’s focus.

We and our major competitors spend substantial time and resources developing and patenting new and improved products and technologies. Many of our products are based on complex, rapidly developing technologies. Although we try to identify all relevant third party patents and intellectual property rights, these products could be developed by the business without knowledge of published or unpublished patent applications that cover or use some aspect of these technologies. We also license products and technologies developed by other biotechnology companies or academic research laboratories for further resale. We have been and may in the future be sued by third parties alleging that we are infringing their intellectual property rights. These lawsuits are expensive, take significant time and divert management’s focus from other business concerns. If we are found to be infringing the intellectual property of others, we could be required to stop the infringing activity, or we may be required to design around or license the intellectual property in question. If we are unable to obtain a required license on acceptable terms, or are unable to design around any third party patent, we may be unable to sell some of our products and services, which could result in reduced revenue. In addition, if we do not prevail, a court may find damages or award other remedies in favor of the opposing party in any of these suits, which may adversely affect our earnings.

Concern about the transmission of “mad-cow disease” could reduce the demand for our cell culture products that are derived from bovine serum.

The demand for several of our cell culture products could be adversely affected by concerns about the use of bovine material in the process by which they are manufactured. The concern arises from the risk that the agent causing bovine

| | |

MILLIPORE FORM 10-K 2007 | | 21 |

PART I

spongiform encephalopathy, or “mad-cow disease,” might be present in the raw materials used in the production process and that the agent might be introduced into a therapeutic substance manufactured by one of our customers. The regulatory authorities of certain countries, including Japan, have refused to approve pharmaceuticals that are manufactured using a product that was derived from bovine serum or that was manufactured by a process that uses bovine material. The regulatory authorities of other countries could adopt similar restrictions.

Our operations must comply with environmental statutes and regulations, and any failure to comply could result in extensive costs which would harm our business.

The manufacture of some of our products involves the use, transportation, storage and disposal of hazardous, radioactive or toxic materials and is subject to various environmental protection and occupational health and safety laws and regulations in the countries in which we operate. This has exposed us in the past, and could expose us in the future, to risks of accidental contamination and events of non-compliance with environmental laws. Any such occurrences could result in regulatory enforcement or personal injury and property damage claims or could lead to a shutdown of some of our operations, which could have an adverse effect on our business and results of operations. We currently incur costs to comply with environmental laws and regulations and these costs may become more significant.

The environmental laws of many jurisdictions impose actual and potential obligations on us to remediate contaminated sites. These obligations may relate to sites:

| | n | | that we currently own or operate; |

| | n | | that we formerly owned or operated; or |

| | n | | where waste from our operations was disposed. |

These environmental remediation obligations could reduce our operating results. In particular, our accruals for these obligations may be insufficient if the assumptions underlying the accruals prove incorrect or if we are held responsible for additional, currently undiscovered contamination.

A substantial fine or penalty, the payment of significant environmental remediation costs or the loss of a permit or other authorization to operate or engage in our ordinary course of business could result in material, unanticipated expenses and the possible inability to satisfy customer demand.

Our sales may be negatively affected by the implementation of second source programs by our customers.

For many customers, we are the single source supplier for one or more critical components used in their production lines. We are aware of customers that have begun to implement second sourcing programs to reduce the potential risk of disruptions to their production due to a supply bottleneck. These can include diversifying purchases of one component among vendors or spreading the sources of components of a process, such as purification, among different suppliers. If, as a result of these second sourcing programs, existing customers were to choose another company to supply components that we currently supply, or if we lose future business opportunities for which we would otherwise be qualified, our future revenues may be harmed.

Our use of third party manufacturers exposes us to increased risks that may affect our ability to supply our customers.

As part of our efforts to consolidate our manufacturing operations, we have increased the outsourcing of certain manufacturing operations. For example, in 2006 we migrated most of our standard bioprocess systems production to a company in India in which we have a minority equity interest. In addition, we often source products resulting from collaborative development relationships from such development partners. Our increased dependence on third party contract manufacturers exposes us to increased risks associated with delivery schedules, manufacturing capability, quality control, quality

| | |

| 22 | | MILLIPORE FORM 10-K 2007 |

PART I

assurance and costs. If any of our third party manufacturers experiences delays, disruptions, capacity constraints or quality control problems in its manufacturing operations or becomes insolvent, then product shipments to our customers could be delayed, which would decrease our revenues and harm our competitive position and reputation.

Because we compete directly with one of our key suppliers and one of our significant distributors, our results of operations could be adversely affected if either of these parties discontinues or materially changes the terms of the agreement.

We currently source a key raw material from a significant competitor in the market into which we sell the resulting products. Although we purchase these materials under a supply agreement which provides for some supply protections, our business could be adversely affected if this supplier discontinues selling the raw materials to us and if we have not established an alternate source of supply. In addition, one of our competitors also serves as a significant distributor. If this distributor discontinued selling our products or materially changed the terms, our sales and earnings could be adversely affected in the short term.

Violation of government regulations or voluntary quality programs could result in loss of sales and customers and additional expense to attain compliance.

Several of our facilities are subject to extensive regulation by the FDA and similar governmental bodies in other countries. These facilities are subject to periodic inspection by the FDA and other similar governmental bodies to ensure their compliance with applicable laws and regulations. New facilities, products and operating procedures also may require approval by the FDA and/or similar governmental bodies in other countries. Failure to comply with these laws and regulations could lead to sanctions by the governmental bodies, such as written observations of deficiencies made following inspections, warning letters, product recalls, fines, product seizures and consent decrees, which would be made available to the public. Such actions and publicity could affect our ability to sell products and to provide our services.

Several of our operations are also subject to U.S. Department of Agriculture regulations and various foreign regulations for the sourcing, manufacturing and distribution of animal based proteins, all of which now apply to us as a result of the acquisition. Our failure to comply with these requirements could negatively impact our business and potentially cause the loss of customers and sales. ISO 9001:2000 quality standards are an internationally recognized set of voluntary quality standards that require compliance with a variety of quality requirements somewhat similar to the requirements of the FDA’s Quality System Regulations, which were formerly known as Good Manufacturing Practices or GMP. Some of our facilities are registered under the ISO standards. Failure to comply with this voluntary standard can lead to observations of non-compliance or even suspension of ISO certification by the certifying unit. Loss of ISO certification could cause some customers to purchase products from other suppliers.

If we experience a significant disruption in our information technology systems or if we fail to implement new systems and software successfully, our business could be adversely affected.

We rely on one centralized information system throughout our company to keep financial records, process orders, manage inventory, process shipments to customers and operate other critical functions. If we were to experience a prolonged system disruption in the information technology systems that involve our interactions with customers and suppliers, it could result in the loss of sales and customers, which could adversely affect our business.

We are subject to economic, governmental, political, legal and other risks associated with our significant international sales and operations, which could adversely affect our business.

We conduct operations throughout the world through a variety of subsidiaries and distributors. Sales outside the United States were approximately 63 percent and 61 percent of total sales in 2007 and 2006, respectively. A significant portion

| | |

MILLIPORE FORM 10-K 2007 | | 23 |

PART I

of our revenues, approximately 41 percent and 17 percent in 2007, is generated in Europe and Asia, respectively. We anticipate that revenue from international operations will continue to represent a significant portion of our revenues. In addition, two of our primary manufacturing facilities, Molsheim, France and Cork, Ireland, and many of our employees and suppliers, are located outside the United States. Our sales and earnings could be adversely affected by a variety of factors resulting from our international operations, including: