UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to §240.14a-12 |

Mine Safety Appliances Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

MINE SAFETY APPLIANCES COMPANY Ÿ P.O. BOX 426, PITTSBURGH, PENNSYLVANIA 15230 Ÿ PHONE (412) 967-3000

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TOTHE HOLDERSOF COMMON STOCKOF

MINE SAFETY APPLIANCES COMPANY:

Notice is hereby given that the Annual Meeting of Shareholders of Mine Safety Appliances Company will be held on Tuesday, May 10, 2005, at 9:00 A.M., local Pittsburgh time, at the Company’s headquarters, 121 Gamma Drive, RIDC Industrial Park, O’Hara Township, Pittsburgh, Pennsylvania for the purpose of considering and acting upon the following:

(1) Election of Directors: The election of three directors for a term of three years;

(2) CEO Annual Incentive Award Plan: Approval of the CEO Annual Incentive Award Plan;

(3) Selection of Independent Registered Public Accounting Firm: The selection of the independent registered public accounting firm for the year ending December 31, 2005;

and such other business as may properly come before the Annual Meeting or any adjournment thereof.

Only the holders of Common Stock of the Company of record on the books of the Company at the close of business on February 18, 2005 are entitled to notice of and to vote at the meeting and any adjournment thereof.

You are cordially invited to attend the meeting. Whether or not you expect to attend the meeting, please execute and date the accompanying form of proxy and return it in the enclosed self-addressed, stamped envelope at your earliest convenience. If you attend the meeting, you may, if you wish, withdraw your proxy and vote your shares in person.

By Order of the Board of Directors,

DOUGLAS K. MCCLAINE

Secretary

March 29, 2005

March 29, 2005

MINE SAFETY APPLIANCES COMPANY

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Mine Safety Appliances Company (the “Company”) of proxies in the accompanying form to be voted at the Annual Meeting of Shareholders of the Company to be held on Tuesday, May 10, 2005, and at any and all adjournments thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. If a proxy in the accompanying form is duly executed and returned, the shares of Common Stock represented thereby will be voted and, where a specification is made by the shareholder, will be voted in accordance with such specification. A shareholder giving the accompanying proxy has the power to revoke it at any time prior to its exercise upon written notice given to the Secretary of the Company.

The mailing address of the principal executive offices of the Company is P.O. Box 426, Pittsburgh, Pennsylvania 15230.

VOTING SECURITIES AND RECORD DATE

As of February 18, 2005, the record date for the Annual Meeting, 36,360,358 shares of Common Stock were issued and outstanding, not including 3,062,767 shares held in the Company’s Stock Compensation Trust. The shares held in the Stock Compensation Trust are not considered outstanding for accounting purposes but are treated as outstanding for certain purposes, including voting at the Annual Meeting. See “Stock Ownership—Beneficial Ownership of Management.”

Only holders of Common Stock of the Company of record on the books of the Company at the close of business on February 18, 2005 are entitled to notice of and to vote at the Annual Meeting and at any adjournment thereof. Such holders are entitled to one vote for each share held and do not have cumulative voting rights with respect to the election of directors. Holders of outstanding shares of the Company’s 4 1/2% Cumulative Preferred Stock are not entitled to vote at the meeting.

See “Stock Ownership” for information with respect to share ownership by the directors and executive officers of the Company and the beneficial owners of 5% or more of the Company’s Common Stock.

PROPOSAL NO. 1 ELECTION OF DIRECTORS

Three directors will be elected at the Annual Meeting to serve until the Annual Meeting in 2008. The term of each director will continue until a successor has been elected and qualified. The Board of Directors and its Nominating and Corporate Governance Committee recommend a vote FOR the election of the nominees named below, each of whom has consented to be named as a nominee and to serve if elected. Properly executed proxies timely received in the accompanying form will be voted for the election of the nominees named below, unless otherwise directed thereon, or for a substitute nominee designated by the Nominating and Corporate Governance Committee in the event a nominee named becomes unavailable for election.

1

The following table sets forth certain information about the nominees, all of whom are currently members of the Board, and about the other directors whose terms of office will continue after the Annual Meeting:

Name | Principal Occupation and any Position with the Company; Other Reporting Company Directorships | Age | Director Since | |||

Nominees for terms expiring in 2008

| ||||||

Diane M. Pearse | Chief Financial Officer, Crate and Barrel (home furnishings retailer) | 47 | 2004 | |||

L. Edward Shaw, Jr. | Of Counsel, Gibson, Dunn & Crutcher LLP (full service law firm) | 60 | 1998 | |||

Thomas H. Witmer | Retired (1998); formerly President and Chief Executive Officer, Medrad, Inc. (manufacturer of medical devices); Chairman of the Board, Granite State Log Homes (log home construction) | 62 | 1997 | |||

Continuing Directors with terms expiring in 2006

| ||||||

Calvin A. Campbell, Jr. | Retired (2003); formerly Chairman, President and Chief Executive Officer, Goodman Equipment Corporation (manufactured underground mining and tunneling locomotives and parts and services for plastics injection molding machinery); Director of Eastman Chemical Company | 70 | 1994 | |||

Thomas B. Hotopp | Retired (2003); formerly President of the Company | 63 | 1998 | |||

Continuing Directors with terms expiring in 2007

| ||||||

James A. Cederna | Founder and owner, Cederna International Inc. (executive coaching) | 54 | 2002 | |||

John T. Ryan III | Chairman and Chief Executive Officer of the Company | 61 | 1981 | |||

John C. Unkovic | Partner and General Counsel, Reed Smith LLP (full service law firm) | 61 | 2002 | |||

Mr. Cederna was Chairman, President and Chief Executive Officer of Calgon Carbon Corporation until February 2003. From April 2000 to January 2001, Ms. Pearse was Chief Financial Officer of iCastle.com, Inc., a home improvement business. Previously, she was Vice President, Business Financial Services – Americas, of BP Amoco, Plc., an oil and gas company. Mr. Shaw was Executive Vice President and General Counsel of Aetna, Inc., a health care and group benefits insurer, until his retirement in December 2003. Mr. Shaw is the brother-in-law of Mr. Ryan. Each other director has engaged in the principal occupation indicated in the above table for at least the past five years.

Director Independence

The Board of Directors has determined that each of directors Campbell, Cederna, Pearse, Unkovic and Witmer has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and is therefore an independent director. In reaching these determinations, the Board reviewed the director’s individual circumstances, the corporate governance rules of the New York Stock Exchange and the following standards:

(a)(i) A director who is an employee, or whose immediate family member is an executive officer, of the Company is not independent until three years after the end of the employment relationship.

2

(ii) A director who receives, or whose immediate family member receives (other than in a non-executive officer employee capacity), more than $100,000 per year in direct compensation from the Company (other than director and committee fees and pension or other forms of deferred compensation for prior service) is not independent until three years after he or she ceases to receive more than $100,000 per year in such compensation.

(iii) A director who is affiliated with or employed by, or whose immediate family member is affiliated with or employed in a professional capacity by, a present or former internal or external auditor of the Company is not independent until three years after the end of the affiliation or the employment or auditing relationship.

(iv) A director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of the Company’s present executives serve on that company’s compensation committee is not independent until three years after the end of such service or the employment relationship.

(v) A director who is currently an executive officer or an employee, or whose immediate family member is currently an executive officer, of a company that makes payments to or receives payments from, the Company for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million, or 2% of the other company’s consolidated gross revenue, is not independent until three years after falling below such threshold.

(b) In addition, the following commercial or charitable relationships will not be considered to be material relationships that would impair a director’s independence: (i) if a director is an executive officer of another company that is indebted to the Company, or to which the Company is indebted, and the total amount of either company’s indebtedness to the other is less than 5% of the total consolidated assets of the company he or she serves as an executive officer; (ii) if a director is an executive officer of another company in which the Company owns a common stock interest, and the amount of the common stock interest is less than 5% of the total shareholders’ equity of the company he or she serves as an executive officer; and (iii) if a director serves as an executive officer of a charitable organization, and the Company’s discretionary charitable contributions to the organization are less than 2% of that organization’s annual revenue. (The Company’s automatic matching of employee charitable contributions will not be included in the amount of the Company’s contributions for this purpose.) A commercial relationship in which a director is an executive officer of another company that owns a common stock interest in the Company will not be considered to be a material relationship which would impair a director’s independence. The Board will annually review commercial and charitable relationships of directors.

(c) For relationships outside the safe-harbor guidelines in (b) above, the determinations of whether the relationship is material or not, and therefore whether the director would be independent or not, shall be made by the directors who satisfy the independence guidelines set forth in (a) and (b) above. For example, if a director is the executive officer of a charitable organization, and the Company’s discretionary charitable contributions to the organization are more than 2% of that organization’s annual revenue, the independent directors could determine, after considering all of the relevant circumstances, whether such a relationship was material or immaterial, and whether the director should therefore be considered independent. The Company would explain in its proxy statement the basis for any Board determination that a relationship was immaterial, despite the fact that it did not meet the safe-harbor for immateriality set forth in paragraph (b) above.

Board Committees

The Board of Directors has established an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and certain other committees.

The Audit Committee, which met six times during 2004, assists the Board in fulfilling its oversight responsibility relating to the integrity of the Company’s financial statements and financial reporting process. The Committee selects and recommends annually to the Board and the shareholders the independent registered public accounting firm to audit the Company’s financial statements, approves in advance all audit and non-audit

3

services performed by the independent registered public accounting firm, reviews the plans, findings and recommendations of the independent registered public accounting firm, and reviews and evaluates the performance of the independent registered public accounting firm, their independence and their fees. The Committee reviews and discusses with management and the independent registered public accounting firm the Company’s financial statements and reports, its internal and disclosure controls and matters relating to the Company’s internal control structure, its business ethics policy and legal and regulatory compliance. The current members of the Audit Committee are directors Campbell, Cederna, Pearse and Witmer, each for a term expiring at the 2005 organizational meeting of the Board of Directors. The Board of Directors has determined that Director Pearse is an “audit committee financial expert,” as defined by the rules of the Securities and Exchange Commission.

The Compensation Committee presently consists of directors Campbell, Cederna, Unkovic and Witmer, each for a term expiring at the 2005 organizational meeting of the Board. The Compensation Committee, which met three times in 2004, reviews and approves the annual goals, objectives and performance of the Company’s chief executive officer, reviews and approves the compensation of the Company’s executive officers and other key executives and monitors the effectiveness of the Company’s employee benefit offerings. A report of the Compensation Committee as to its policies in determining the 2004 compensation of the Company’s executive officers appears later. The Compensation Committee also administers the Company’s 1998 Management Share Incentive Plan (the “MSIP”).

The current members of the Nominating and Corporate Governance Committee are directors Campbell, Cederna, and Unkovic, each for a term expiring at the 2005 organizational meeting of the Board. The Committee, which met three times in 2004, reviews and makes recommendations to the Board regarding the composition and structure of the Board, criteria and qualifications for Board membership, director compensation and evaluation of current directors and potential candidates for director. It is also responsible for establishing and monitoring policies and procedures concerning corporate governance. Further information concerning the Nominating and Corporate Governance Committee and its procedures appears below.

Corporate Governance Matters

The Board of Directors has adopted Corporate Governance Guidelines which cover a wide range of subjects, such as the role of the Board and its responsibilities, Board composition, operations and Committees, director compensation, Board and management evaluation and succession planning, director orientation and training and communications with the Board. The Corporate Governance Guidelines, as well as the Charters of the Board’s Audit, Compensation and Nominating and Corporate Governance Committees and the Company’s Code of Business Conduct and Ethics for directors, officers and employees, are available in the Investor Relations section of the Company’s website at www.MSAnet.com. Such material will also be furnished without charge to any shareholder upon written request to the Corporate Secretary at the Company’s address appearing on page 1.

The Corporate Governance Guidelines provide that it is the Company’s practice for the non-management directors to meet at each Board meeting in executive session, with no members of management present. The non-management directors include, in addition to the independent directors, any other director who is not a current officer of the Company. In addition, the independent directors hold at least one executive session per year. A chairperson for the executive sessions is selected annually from the chairpersons of the Audit, Compensation and Nominating and Corporate Governance Committees. A chairperson who serves in that role may not be the chairperson of the executive sessions again until at least two years have passed since he or she last held the position. In 2004, director Campbell served as chairperson of the executive sessions of the non-management directors, and director Cederna served as chairperson of the executive sessions of the independent directors.

The Board of Directors met on eleven days during 2004. All directors attended at least 75% of the combined total of the meetings of the Board and of all committees on which they served. Directors are expected to attend the Annual Meeting of Shareholders. In 2004, all members of the Board of Directors attended the Annual Meeting.

4

Vote Required

In the election of directors for terms expiring in 2008, the three candidates receiving the highest numbers of votes cast by the holders of Common Stock voting in person or by proxy will be elected as directors. A proxy vote indicated as withheld from a nominee will not be cast for such nominee but will be counted in determining whether a quorum exists for the meeting.

The Company’s Restated Articles require that any shareholder intending to nominate a candidate for election as a director must give written notice, containing specified information, to the Secretary of the Company not later than 90 days in advance of the meeting at which the election is to be held. No such notices were received with respect to the 2005 Annual Meeting. Therefore, only the nominees named above will be eligible for election at the meeting.

OTHER INFORMATION CONCERNING DIRECTORS AND OFFICERS

Executive Compensation

The following table sets forth information concerning the annual, long-term and other compensation earned from the Company and its subsidiaries for the years 2004, 2003 and 2002 by the persons who were in 2004 the chief executive officer and the other four most highly compensated executive officers of the Company (the “Named Officers”):

SUMMARY COMPENSATION TABLE

| Annual Compensation (1) | Long-Term Compensation Awards | ||||||||||||||

Name and | Year | Salary ($) | Bonus ($) | Restricted Stock Awards ($)(2) | Shares Underlying Stock Options (# of Shares) (3) | All Other Compensation ($)(4) | |||||||||

John T. Ryan III | 2004 | $ | 586,618 | $ | 763,370 | $ | 212,048 | 76,069 | $76,580 | ||||||

Chairman and | 2003 | $ | 555,990 | $ | 744,750 | $ | 207,045 | 205,575 | $59,319 | ||||||

Chief Executive Officer | 2002 | $ | 525,207 | $ | 364,120 | $ | 200,986 | 151,326 | $66,244 | ||||||

| William M. Lambert | 2004 | $ | 282,155 | $ | 297,350 | $ | 102,762 | 36,119 | $29,362 | ||||||

Vice President; | 2003 | $ | 259,647 | $ | 300,760 | $ | 100,250 | 97,629 | $20,675 | ||||||

President, | 2002 | $ | 210,209 | $ | 106,110 | $ | 39,648 | 29,184 | $19,705 | ||||||

MSA North America | |||||||||||||||

| James H. Baillie | 2004 | $ | 325,547 | $ | 209,229 | $ | 80,856 | 28,419 | $24,821 | ||||||

Vice President; | 2003 | $ | 304,705 | $ | 252,927 | $ | 76,824 | 74,700 | $33,041 | ||||||

President, MSA Europe | 2002 | $ | 277,808 | $ | 127,733 | $ | 71,052 | 52,500 | $25,666 | ||||||

Rob Cañizares M. (5) | 2004 | $ | 271,077 | $ | 188,550 | $ | 66,239 | 23,279 | $26,572 | ||||||

Vice President; | 2003 | $ | 245,000 | $ | 163,460 | $ | 64,766 | 62,931 | $18,686 | ||||||

President, MSA | 2002 | — | — | — | — | — | |||||||||

International | |||||||||||||||

| Dennis L. Zeitler | 2004 | $ | 255,899 | $ | 260,890 | $ | 70,274 | 24,699 | $ 8,656 | ||||||

Vice President, Chief | 2003 | $ | 240,674 | $ | 252,430 | $ | 68,556 | 66,747 | $ 8,656 | ||||||

Financial Officer and Treasurer | 2002 | $ | 225,477 | $ | 119,300 | $ | 66,734 | 49,071 | $22,624 | ||||||

| (1) | For each year, the incremental cost to the Company of personal benefits provided to any Named Officer did not exceed the lesser of $50,000 or 10% of aggregate salary and bonus. |

| (2) | The amounts shown in this column represent the market values on March 9, 2004, March 12, 2003 and March 11, 2002 of restricted shares awarded on those dates. At December 31, 2004 the number and market values of restricted shares held by the Named Officers were as follows: Mr. Ryan, 41,850 shares |

5

($2,129,328); Mr. Lambert, 15,860 shares ($806,957); Mr. Baillie, 15,350 shares ($781,008); Mr. Cañizares, 8,280 shares ($421,286); and Mr. Zeitler, 13,870 shares ($705,706). Holders of restricted shares receive dividends at the same rate as paid on other shares of Common Stock. |

| (3) | Share numbers have been adjusted to reflect the special distribution to shareholders in November 2003 and the 3-for-1 Common Stock split in January 2004. |

| (4) | 2004 amounts include Company matching contributions to the Company’s Retirement Savings and Supplemental Savings Plans as follows: Mr. Ryan, $53,255; Mr. Lambert, $23,317; Mr. Cañizares, $17,686; and Mr. Zeitler, none. The 2004 amounts also include life insurance premiums paid by the Company as follows: Mr. Ryan, $23,325; Mr. Lambert, $6,045; Mr. Cañizares, $8,886; and Mr. Zeitler, $8,656. The 2004 amount for Mr. Baillie is the amount paid to him in lieu of contributions to a retirement plan. |

| (5) | Mr. Cañizares was first employed by the Company in January 2003. |

Stock Option Grants in 2004

The following table sets forth information concerning stock options granted to the Named Officers in 2004 under the MSIP:

Name | Number of Shares Underlying Options Granted (#)(1) | Percent of Total Options Granted to Employees in 2004 | Exercise Price ($/Share) (1) | Expiration Date | Grant Date Present Value (2) | ||||||||

John T. Ryan III | 3,989 | 1.4 | % | $ | 27.570 | 3/9/2009 | $ | 20,937 | |||||

| 72,080 | 25.2 | % | $ | 25.065 | 3/9/2014 | $ | 615,206 | ||||||

William M. Lambert | 36,119 | 12.6 | % | $ | 25.065 | 3/9/2014 | $ | 308,286 | |||||

James H. Baillie | 28,419 | 9.9 | % | $ | 25.065 | 3/9/2014 | $ | 242,569 | |||||

Rob Cañizares M. | 23,279 | 8.1 | % | $ | 25.065 | 3/9/2014 | $ | 198,718 | |||||

Dennis L. Zeitler | 24,699 | 8.6 | % | $ | 25.065 | 3/9/2014 | $ | 210,821 | |||||

| (1) | The exercise price is the market value of the Common Stock on the date the options were granted, except that in the case of the option for 3,989 shares granted to Mr. Ryan it is 110% of such value. The options became exercisable on March 9, 2005. The option for 3,989 shares granted to Mr. Ryan, and 3,989 shares of the options granted to each other Named Officer are intended to qualify as incentive stock options under the Internal Revenue Code. |

| (2) | The grant date present value of the options has been determined utilizing the Black-Scholes option pricing model. The assumptions used to arrive at the present values were: stock price volatility of 28.95%, expected dividend yield of 2.00%, expected option term of five years for the option for 3,989 shares granted to Mr. Ryan and ten years for the remaining options, and a risk-free rate of return of 2.89% for the option for 3,989 shares granted to Mr. Ryan and 4.15% for the remaining options. |

Stock Option Exercises and Year-End Values

The following table sets forth information concerning the stock options under the MSIP exercised by the Named Officers during 2004 and the stock options under the MSIP held by the Named Officers at December 31, 2004.

Name | Number of Shares Acquired on Exercise | Value Realized (1) | Number of Shares Underlying Unexercised Options at 12/31/2004 | Value of Unexercised In-the-Money Options at 12/31/2004 (2) | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

John T. Ryan III | 49,378 | $ | 1,223,769 | 674,678 | 76,069 | $ | 28,033,956 | $ | 1,953,729 | ||||||

William M. Lambert | 81,525 | $ | 2,915,231 | 126,813 | 36,119 | $ | 5,057,945 | $ | 932,412 | ||||||

James H. Baillie | 20,263 | $ | 634,763 | 106,937 | 28,419 | $ | 4,253,857 | $ | 733,636 | ||||||

Rob Cañizares M. | 32,000 | $ | 1,044,364 | 30,931 | 23,279 | $ | 1,244,261 | $ | 600,947 | ||||||

Dennis L. Zeitler | 66,747 | $ | 2,080,637 | 49,071 | 24,699 | $ | 1,901,069 | $ | 637,605 | ||||||

6

| (1) | Represents the difference between the fair market value of the shares acquired on the date of the option exercise and the option price of those shares. |

| (2) | Represents the amount by which the December 31, 2004 market value of the shares subject to unexercised options exceeded the option price of those options. |

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Board of Directors has furnished the following report on 2004 executive compensation:

The Compensation Committee of the Board of Directors is responsible for approving salaries and bonuses to be paid to the Company’s executive officers. The Compensation Committee is also responsible for administering the Company’s shareholder approved 1998 Management Share Incentive Plan (the “MSIP”), which permits the Committee to make discretionary grants of stock options and restricted stock as incentives to executive officers and other key employees.

The Compensation Committee’s policy in approving salaries is designed to pay executive officer salaries at competitive levels necessary to attract and retain competent personnel while at the same time recognizing individual performance factors. To do this, the Company periodically retains compensation consultants to assist in evaluating each United States executive officer position and in determining the market level salary range for the position based on salaries paid for executive positions with similar duties and responsibilities by other manufacturing companies of comparable size and sales volumes. Between these periodic evaluations, market level salary ranges for each position are reviewed to reflect changes shown by data provided from compensation surveys. Within the market level salary range for each executive officer position, the salary to be paid to the individual officer is determined by taking into consideration the relationship of the officer’s current salary to the market level range and an evaluation of the officer’s individual performance made initially by the chief executive officer or the officer’s other immediate supervisor. In the case of the chief executive officer, the individual performance evaluation and the determination of the amount of the salary adjustment are made by the Compensation Committee.

The Company has one executive officer located overseas, James H. Baillie, Vice President of the Company and President of MSA Europe. Mr. Baillie’s salary is determined in a manner similar to that used for executive officers located in the United States, except that the market level salary range for his position is determined by reference to salaries paid for similar executive positions in Europe.

At its meeting in March 2004 the Committee considered executive officer salaries for the period April 1, 2004 through March 31, 2005. The increase in Mr. Ryan’s salary for this period was awarded in recognition of the Company having exceeded its net income target in 2003.

The Company’s annual bonus policy is designed to make a significant percentage of an executive officer’s total cash compensation dependent upon corporate and individual performance. At targeted levels for 2004, this percentage was 60% of median market level salary for the chief executive officer, and was from 30% to 45% of median market level salary for other executive officers. For the chief executive and chief financial officers, the percentage of the targeted bonus earned is initially determined as the percentage of achievement of a targeted level of consolidated net income for the year. For other officers, 25% to 50% of the initial bonus determination is based on the percentage of achievement of the consolidated net income target, and the remainder is determined based on the percentage of achievement of income or other targets established for the geographic areas and/or operating divisions with which the officer is associated. The initial percentage of the targeted bonus earned based on Company performance may be adjusted upward or downward for each officer based upon an evaluation of the individual officer’s performance during the year, which is made initially by the chief executive officer or the officer’s other immediate supervisor or, in the case of the chief executive officer, by the Compensation

7

Committee. Individual bonuses under the regular bonus program may not exceed 150% of targeted levels, and no bonus is paid based on net income or other performance which is less than 50% of the targeted amount. The Committee may make exceptions to these rules in special cases. The total amounts payable as bonuses in any year for all participants under the regular bonus program may not exceed 6% of consolidated earnings before interest and taxes.

At its meeting in March 2004, the Committee determined to continue its practice of offering additional incentives to meet and exceed the Company’s annual consolidated net income target. Under the additional incentive plan approved for 2004, annual bonuses earned under the regular bonus plan would be increased by 10% if the Company exceeded its plan for 2004 consolidated net income and could be increased by up to 50% if the Company exceeded the plan by a specified percentage amount. The Company exceeded its plan for 2004 consolidated net income by the amount required to trigger the maximum 50% increase in the bonuses payable under the regular bonus program.

The Committee determined bonuses for 2004 at its meeting in February 2005. The amount of the bonus awarded to Mr. Ryan was 109% of the amount determined under the regular and enhanced bonus program formulas, which was the maximum amount which could be awarded consistent with the regular bonus program’s cap of 150% of the targeted bonus. This amount was awarded by the Committee in recognition of the outstanding performance of the Company for its shareholders in 2004 and Mr. Ryan’s uniquely superior individual performance.

Awards under the MSIP are intended to provide executive officers with long-term incentives in the form of stock-based compensation to remain with the Company and to work to increase shareowner value. Under both types of awards utilized under the MSIP, stock options and restricted stock, the value realized in the future by the officer is a direct function of the Company’s success in achieving a long-term increase in the market value of its Common Stock. The Committee’s long-term incentive award program under the MSIP was designed based on recommendations resulting from a study by a compensation consulting firm. Under the program, the annual dollar value of MSIP awards for each executive officer position is based on the market level annual dollar value of long-term incentive awards for similar positions, as determined from compensation survey data.

Each year, 75% of the dollar value of long-term incentive awards, as so determined, is made in the form of stock options and 25% in the form of restricted stock awards. The number of shares for which stock options are granted to each executive officer is determined by dividing 75% of the dollar value for the officer’s position by the per share value of the options as determined under the Black-Scholes option pricing model. Stock options are normally granted as incentive stock options within the limits established by the Internal Revenue Code and as nonqualified options above those limits. The option price is equal to the fair market value of the option shares as of the date the options are granted, except that in the case of incentive stock options granted to Mr. Ryan, the option price is 110% of the grant date fair market value. The options granted in 2004 become exercisable one year from the date of grant and have a term of ten years, except that in the case of incentive stock options granted to Mr. Ryan the term is five years. The options generally are exercisable only while the grantee remains an employee of the Company or a subsidiary, except that the options may be exercised for limited periods after a termination of employment due to death, disability or retirement or a voluntary termination with the consent of the Company.

The number of shares awarded in the form of restricted stock is determined by dividing 25% of the dollar value of long-term incentive awards for each executive officer position by the per share market value on the date of the award. Restricted shares are awarded annually and vest on March 15 of the third year following the award date. Until vesting, the restricted shares are held in escrow by the Company, may not be sold and generally will be forfeited if the officer’s employment terminates other than by death, disability or retirement under a Company retirement plan. Unless and until the restricted shares are forfeited to the Company, the officer may vote and receive dividends on the restricted shares.

8

In accordance with the Committee’s long-term incentive program, the Committee granted stock options and restricted stock awards under the MSIP at its meeting in March 2004. The awards granted to Mr. Ryan were in the amounts determined under the program formulas.

The Committee has adopted, and recommends that the shareholders approve, the proposed CEO Annual Incentive Award Plan to help ensure that all compensation paid to the Company’s executive officers remains deductible under Section 162(m) of the Internal Revenue Code. At 2005 compensation levels, and assuming shareholder approval of the proposed Plan, the Company does not anticipate that it will be affected by Section 162(m)’s $1 million cap on deductibility of individual executive officer compensation.

The foregoing report was submitted by the Compensation Committee of the Board of Directors:

Calvin A. Campbell, Jr., Chairman

James A. Cederna

John C. Unkovic

Thomas H. Witmer

Compensation Committee Interlocks and Insider Participation

There are no interlocking relationships, as defined in regulations of the Securities and Exchange Commission, involving members of the Compensation Committee.

Directors Campbell, Cederna, Unkovic and Witmer served as members of the Compensation Committee during all of 2004. The Board of Directors has determined that each of these directors is independent in accordance with the listing standards of the New York Stock Exchange. Prior to the 2004 organizational meeting of the Board in April 2004, Mr. Shaw also served as a member of the Compensation Committee.

Mr. Unkovic is a partner in the law firm of Reed Smith LLP, which provides legal services to the Company as its outside counsel.

Retirement Plans

The following table shows the estimated annual retirement benefits payable upon normal retirement at age 65 under the Company’s Non-Contributory Pension Plan for Employees to participating employees, including executive officers, in selected compensation and years-of-service classifications.

Years of Service | 5 Year Average Compensation | |||||||||||||||||

| $200,000 | $400,000 | $600,000 | $800,000 | $1,000,000 | $1,200,000 | |||||||||||||

5 | $ | 12,375 | $ | 26,841 | $ | 41,308 | $ | 55,775 | $ | 70,241 | $ | 84,708 | ||||||

15 | 37,124 | 80,524 | 123,924 | 167,324 | 210,724 | 254,124 | ||||||||||||

25 | 61,873 | 134,207 | 206,540 | 278,873 | 351,206 | 423,540 | ||||||||||||

35 | 86,622 | 187,889 | 289,156 | 390,422 | 491,689 | 592,956 | ||||||||||||

45 | 105,289 | 225,222 | 345,156 | 465,089 | 585,022 | 704,956 | ||||||||||||

Notes:

| 1. | Years of service are based upon completed months of service from date of hire to date of retirement. |

| 2. | The benefits actually payable under the plan will be subject to the limitations of Sections 415 and 401(a)(17) of the Internal Revenue Code. These limitations have not been reflected in the table. However, the Company has a supplemental plan providing for the payment by the Company to officers on an unfunded basis of the difference between the amounts payable under the benefit formula of the pension plan and the benefit limitations of Sections 415 and 401(a)(17) of the Internal Revenue Code. |

9

| 3. | This table applies to employees born in calendar year 1945. The actual benefits payable will vary slightly depending upon the actual year of birth. |

| 4. | The benefits shown have been calculated using the Social Security law in effect on January 1, 2005, with a maximum taxable wage base of $90,000 assumed until retirement. |

The amounts shown in the table are straight-life annuity amounts, assuming no election of any available survivorship option, and are not subject to any Social Security or other offsets. Benefits under the plan are based on the highest annual average of the participant’s covered compensation for any five consecutive years of service, with covered compensation including salary and bonus. As of December 31, 2004, years of service under the plan for the Named Officers were: Mr. Ryan, 35.50 years; Mr. Lambert, 23.33 years; Mr. Cañizares, 1.95 years; and Mr. Zeitler, 28.00 years.

Mr. Baillie does not participate in the Company’s retirement plans, but instead receives an annual payment in lieu of retirement plan contributions. This payment is included under “All Other Compensation” in the Summary Compensation Table on page 4. Mr. Ryan also participates in the Retirement Plan for Directors. Under this plan, the annual benefit payable to Mr. Ryan upon retirement after 5 years service as a director, and commencing when the sum of age and years of service equals 75, would be $20,000.

The Company’s Executive Insurance Program was established to assist members of senior management approved by the Board in procuring life insurance during their working careers and to provide them with additional flexibility and benefits upon retirement. Under the program, the Company’s group term life insurance in excess of $50,000 is replaced with individual insurance up to an approved amount. Premiums are paid by the Company and are included under “All Other Compensation” in the above compensation table. In lieu of insurance after retirement, the participant may elect (i) an uninsured death benefit from the Company in the insurance amount, which would be taxable when paid, or (ii) to have the insurance amount paid to him by the Company in monthly installments over 15 years. If the second uninsured alternative were selected, the annual amount payable by the Company upon retirement would be $66,667 for Mr. Ryan, $50,000 for Mr. Lambert, $40,000 for Messrs. Cañizares and Zeitler. If either of the two uninsured alternatives are selected, the death benefit on the insurance policy would be paid to the Company. Mr. Baillie does not participate in this program.

Change In Control Severance Agreements

The Company has entered into agreements with each of the Named Officers the stated purpose of which is to encourage the officers’ continued attention and dedication to their duties without distraction in the event of an actual or potential change in control of the Company. In the agreements, the officers agree that if a potential change in control, as defined in the agreements, occurs, the officers will remain in the employment of the Company for at least 6 months or until an actual change in control occurs, unless employment is sooner terminated by the executive for good reason, as defined in the agreement, or due to death, disability or retirement or by the Company. In return, the agreements provide that if within 3 years after a change in control, as defined in the agreement, the officer’s employment is terminated by the Company without cause, as defined in the agreement, or the officer terminates his employment for good reason, as defined in the agreement, the officer will be entitled to receive (a) a lump sum payment equal to three times the sum of (i) the officer’s annual salary plus (ii) the average annual bonus paid to the officer for the preceding two years, (b) continuation for 36 months of medical, dental, accident and life insurance benefits and (c) 36 months additional service credit under the Company’s executive insurance and post-retirement health care programs. In the case of Mr. Ryan, these benefits would also be payable if he voluntarily terminated his employment for any reason within one year after a change in control. The benefits payable under the agreements are limited to the amount that can be paid without triggering any excise tax or rendering any amounts non-deductible under the Internal Revenue Code. Except in the case of Mr. Ryan, the limitation will not apply if the reduced benefit is less than the unreduced benefit after payment of any excise tax.

10

Director Compensation

In 2004 directors who are not employees of the Company or one of its subsidiaries were paid a retainer at the rate of $6,250 per quarter and $1,200 for each day of a Board meeting and each meeting of a Committee of the Board that they attended. For 2005, the quarterly retainer rate has been increased to $7,500, and the fee for attendance at Board meetings has been reduced to $750 per day. Non-employee directors who serve as Chair of a Board Committee receive an additional retainer of $2,500 per quarter in the case of the Audit Committee and $1,250 per quarter in the case of the Compensation Committee and the Nominating and Corporate Governance Committee.

The 1990 Non-Employee Directors’ Stock Option Plan (the “DSOP”) was approved by the shareholders at the 1991 Annual Meeting. Its purposes are to enhance the mutuality of interests between the Board and the shareholders by increasing the share ownership of the non-employee directors and to assist the Company in attracting and retaining able persons to serve as directors. The total number of shares which may be issued under the DSOP is limited to 450,000 shares of Common Stock. Under the DSOP, directors who are not employees of the Company or a subsidiary receive on the third business day following each annual meeting stock option grants having a grant date value under the Black-Scholes option pricing model equal to 75% of the annual directors’ retainer and grants of restricted stock having a grant date market value equal to 125% of the annual directors’ retainer. The options will have an option price equal to the market value on the grant date, will become exercisable three years from the date of grant and will expire ten years from the date of grant. If a director resigns or is removed from office for cause, options which have not yet become exercisable are forfeited, and exercisable options will remain exercisable for 90 days. Otherwise, unexpired options may generally be exercised for five years following termination of service as a director. The restricted shares will vest on the date of the third annual meeting following the date of grant. Unvested shares are forfeited if the director terminates service for reasons other than death, disability or retirement. Pursuant to the terms of the DSOP, on May 4, 2004 directors Campbell, Cederna, Hotopp, Pearse, Shaw, Unkovic and Witmer were each granted an option to purchase 1,529 shares of Common Stock at an option price of $28.06 and 1,114 shares of restricted stock.

Prior to April 1, 2001, directors who retired from the Board after completing at least 5 years of service as a director were entitled under the Retirement Plan for Directors to receive a lifetime quarterly retirement allowance, beginning when the sum of their age and years of service equals or exceeds 75, in an amount equal to the quarterly directors’ retainer payable at the time of their retirement. Effective April 1, 2001, benefits under the Plan were frozen so that the quarterly retirement allowance, if any, payable to future retirees will be limited to (a)(1) the director’s years of service as of April 1, 2001 divided by (2) the years of service at the date the sum of the director’s age and years of service would equal 75, times (b) the $5,000 quarterly retainer amount previously in effect. Directors who are employees of the Company or a subsidiary participated in the Retirement Plan for Directors, but do not receive other additional compensation for service as a director.

Transactions with Directors and Officers

In December 2004, the Company entered into an agreement to purchase 185,000 shares of Common Stock from the Estate of Mary Irene Ryan and 857,000 shares of Common Stock from the Mary Irene Ryan Marital Trust at a price of $46.36 per share. Mary Irene Ryan was the mother of John T. Ryan III, the Company’s Chairman and Chief Executive Officer. Mr. Ryan and his sister, Irene Ryan Shaw, the wife of director L. Edward Shaw, Jr., are the executors of the estate and among its beneficiaries. Mr. Ryan and director John C. Unkovic are the trustees of the Marital Trust, and Mr. Ryan and Mrs. Shaw are among its beneficiaries. The purchase price in the sale was determined by a committee of disinterested directors consisting of directors Campbell, Cederna, Hotopp, Pearse and Witmer, based on an analysis done by investment bankers retained by the Company. The proceeds of the sale, which closed in January 2005, are to be used to pay the estate’s death taxes.

Nominating and Corporate Governance Committee Procedures

The current members of the Nominating and Corporate Governance Committee are directors Cederna, the Chairman, Campbell and Unkovic, whose terms as Committee members will expire at the 2005 organizational

11

meeting of the Board to be held on the date of the Annual Meeting of Shareholders. The Board has determined that each of the current members of the Committee is independent as defined in the listing standards of the New York Stock Exchange.

The Committee has a written charter which is available in the Investor Relations section of the Company’s Internet website at www.MSAnet.com.

The Committee will consider nominees brought to the attention of the Board by a shareholder, a non-management director, the chief executive officer, any other executive officer, a third-party search firm or other appropriate sources. The fundamental criterion for selecting a prospective director of the Company shall be the ability to contribute to the well-being of the Company and its shareholders. Good judgment, integrity and a commitment to the mission of the Company are essential. Other criteria used in connection with selecting prospective directors shall include skills and experience needed by the Board, diversity, commitment and any other factor considered relevant by the Committee and/or the Board. The Committee may prioritize the criteria depending on the current needs of the Board and the Company.

Any shareholder who desires to have an individual considered for nomination by the Committee must submit a recommendation in writing to the Corporate Secretary, at the Company’s address appearing on page 1, not later than November 30 preceding the annual meeting at which the election is to be held. The recommendation should include the name and address of both the shareholder and the candidate and the qualifications of the candidate recommended.

The Committee does not at this time have a formal process for identifying and evaluating nominees for director. It is not anticipated that the process for evaluating a nominee would differ based on whether the nominee is recommended by a shareholder.

Shareholder Communications

A shareholder who wishes to communicate with the Board, a Committee of the Board or any individual director or group of directors may do so by sending the communication in writing, addressed to the Board, the Committee, the individual director or group of directors, c/o Corporate Secretary, at the Company’s address appearing on page 1.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors assists the Board in fulfilling its oversight responsibilities relating to, among other things, the quality and integrity of the Company’s financial reports. The Committee operates pursuant to a written charter which was approved by the Board of Directors and is available in the Investor Relations section of the Company’s website atwww.MSAnet.com. The Board of Directors, in its business judgment, has determined that all members of the Audit Committee are independent as defined in the listing standards of the New York Stock Exchange and Securities and Exchange Commission Rule 10A-3.

The management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements and the adequacy of its internal controls. The independent registered public accounting firm is responsible for planning and carrying out an audit in accordance with generally accepted auditing standards and expressing an opinion based on the audit as to whether the Company’s audited financial statements fairly present the Company’s consolidated financial position, results of operation and cash flows in conformity with generally accepted accounting principles.

The Audit Committee has reviewed the Company’s audited financial statements for the year ended December 31, 2004 and has discussed the financial statements with management and with

12

PricewaterhouseCoopers LLP (“PwC”), the Company’s independent registered public accounting firm for 2004. The Audit Committee has received from the independent registered public accounting firm written disclosures pursuant to Statement on Auditing Standards No. 61,Communication with Audit Committees, and has discussed those matters with the independent registered public accounting firm. The Audit Committee has also received from the independent registered public accounting firm the written disclosures and the letter required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, and has discussed with the independent registered public accounting firm their independence.

In performance of its oversight function, the Audit Committee also monitored Company management’s compliance with Section 404 of the Sarbanes-Oxley Act of 2002 by discussing with management and PwC (i) management’s assessment of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2004 (“Management’s Assessment”); (ii) PwC’s opinion of Management’s Assessment and (iii) PwC’s opinion of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2004.

Based upon the review and discussions described in this Report, and subject to the limitations on the role and responsibilities of the Audit Committee as referred to in this report and described in the Committee’s charter, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004 to be filed with the Securities and Exchange Commission.

The foregoing report was submitted by the Audit Committee of the Board of Directors.

Thomas H. Witmer, Chairman

Calvin A. Campbell, Jr.

James A. Cederna

Diane M. Pearse

13

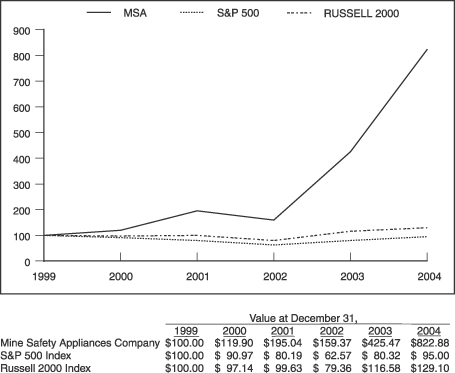

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN

Among S&P 500 Index, Russell 2000 Index and Mine Safety Appliances Company

Set forth below is a line graph and table comparing the cumulative total returns (assuming reinvestment of dividends) for the five years ended December 31, 2004 of $100 invested on December 31, 1999 in each of the Company’s Common Stock, the Standard & Poor’s 500 Composite Index and the Russell 2000 Index. Because its competitors are principally privately held concerns or subsidiaries or divisions of corporations engaged in multiple lines of business, the Company does not believe it feasible to construct a peer group comparison on an industry or line-of-business basis. The Russell 2000 Index, while including corporations both larger and smaller than the Company in terms of market capitalization, is composed of corporations with an average market capitalization similar to that of the Company.

14

STOCK OWNERSHIP

Under regulations of the Securities and Exchange Commission, a person is considered the “beneficial owner” of a security if the person has or shares with others the power to vote the security (voting power) or the power to dispose of the security (investment power). In the tables which follow, “beneficial ownership” of the Company’s stock is determined in accordance with these regulations and does not necessarily indicate that the person listed as a “beneficial owner” has an economic interest in the shares indicated as “beneficially owned.”

Beneficial Ownership of Management

The following table sets forth information regarding the amount and nature of beneficial ownership of the Company’s Common Stock and 4 1/2% Cumulative Preferred Stock as of February 18, 2005 by each director and Named Officer and by all directors and executive officers as a group. Except as otherwise indicated in the footnotes to the table, the person named or a member of the group has sole voting and investment power with respect to the shares listed.

| Common Stock | 4 1/2% Cumulative Preferred Stock | ||||||||||||||||

| Amount and Nature of Beneficial Ownership | |||||||||||||||||

| Non-Trust Shares (1) | Trust Shares (2) | Total Common Stock | Percent Class (1) | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||||||||

John T. Ryan III | 2,145,184 | (3) | 3,285,317 | (4) | 5,430,501 | 13.52 | % | 187 | 1.00 | % | |||||||

Calvin A. Campbell, Jr. | 49,810 | — | 49,810 | 0.13 | % | — | — | ||||||||||

James A. Cederna | 11,368 | — | 11,368 | 0.03 | % | — | — | ||||||||||

Thomas B. Hotopp | 68,866 | (3) | — | 68,866 | 0.17 | % | — | — | |||||||||

Diane M. Pearse | 1,114 | — | 1,114 | — | — | — | |||||||||||

L. Edward Shaw, Jr. | 661,531 | (3) | 59,406 | 720,937 | 1.83 | % | — | (3) | — | ||||||||

John C. Unkovic | 20,238 | 2,076,397 | (4) | 2,096,635 | 5.32 | % | 93 | (4) | 0.50 | % | |||||||

Thomas H. Witmer | 28,210 | — | 28,210 | 0.07 | % | — | — | ||||||||||

James H. Baillie | 167,107 | 127,615 | (5) | 294,722 | 0.75 | % | — | — | |||||||||

Rob Cañizares M. | 62,490 | 153,623 | (3)(5) | 216,113 | 0.55 | % | |||||||||||

William M. Lambert | 239,921 | (3) | 127,615 | (5) | 367,536 | 0.93 | % | — | — | ||||||||

Dennis L. Zeitler | 71,343 | 127,615 | (5) | 198,958 | 0.50 | % | — | — | |||||||||

All executive officers and directors as a group (16 persons) | 3,888,300 | (3) | 4,599,618 | (5) | 8,487,918 | 20.76 | % | 280 | 1.50 | % | |||||||

| (1) | The number of shares of Common Stock beneficially owned and the number of shares of Common Stock outstanding used in calculating the percent of class include the following shares of Common Stock which may be acquired within 60 days upon the exercise of stock options held under the MSIP or the DSOP: Mr. Ryan, 750,747 shares; Mr. Campbell, 25,206 shares; Mr. Cederna, 5,238; Mr. Hotopp, 37,013 shares; Ms. Pearse, none; Mr. Shaw, 25,206 shares; Mr. Unkovic, 5,238; Mr. Witmer, 15,504 shares; Mr. Baillie, 135,356 shares; Mr. Cañizares, 54,210 shares; Mr. Lambert, 162,932 shares; Mr. Zeitler, 24,699 shares; and all directors and executive officers as a group, 1,468,666 shares. The number of shares of Common Stock beneficially owned also includes the following restricted shares awarded under the MSIP, as to which such persons have voting power only: Mr. Ryan, 41,850 shares; Mr. Campbell, 2,008 shares; Mr. Cederna, 2,008 shares; Mr. Hotopp, 1,579 shares; Ms. Pearse, 1,114 shares; Mr. Shaw, 2,008 shares; Mr. Unkovic, 2,008 shares; Mr. Witmer, 2,008 shares; Mr. Baillie, 15,350 shares; Mr. Cañizares, 8,280 shares; Mr. Lambert, 15,860 shares; Mr. Zeitler, 13,870 shares; and all directors and executive officers as a group, 138,823 shares. |

| (2) | The shares in this column are those as to which the director or officer holds voting and or investment power as a fiduciary or otherwise under the terms of a trust instrument. In certain cases, the director or officer is also among the beneficiaries of the trust. |

15

| (3) | Includes shares of Common Stock as to which voting and investment power is shared with the spouse as follows: Mr. Ryan, 435,292 shares; Mr. Hotopp, 30,274 shares; Mr. Shaw, 590,097 shares; Mr. Cañizares, 26,008 shares; Mr. Lambert, 61,129 shares; and all directors and executive officers as a group, 1,172,330 shares. Amounts shown do not include 521,882 shares of Common Stock held by Mr. Ryan’s wife, including 160,344 shares held as trustee. The amount shown for Mr. Shaw does not include 1,581,096 additional shares of Common Stock, including 1,176,213 shares held as trustee, and 721 shares of 4 1/2% Cumulative Preferred Stock held by Mr. Shaw’s wife. See the following discussion of the beneficial ownership of Irene Ryan Shaw. |

| (4) | Includes 1,836,889 shares of Common Stock as to which Messrs. Ryan and Unkovic share voting and investment power as co-trustees and 159,156 additional shares of Common Stock as to which Messrs. Ryan and Unkovic share voting and investment power with Irene Ryan Shaw as co-trustees. The amount shown for Mr. Ryan also includes 1,016,617 additional shares of Common Stock as to which Mr. Ryan and Irene Ryan Shaw, and in certain cases other members of their family, share voting and investment power as co-trustees. Mr. Unkovic also holds 93 shares of 4½% Cumulative Preferred Stock as trustee. |

| (5) | The Company has established a Stock Compensation Trust which holds 3,062,767 shares of Common Stock which are available to satisfy obligations of the Company under its stock incentive plans. Under the terms of the Trust Agreement, the trustee, PNC Bank, must follow the directions of the holders of stock options under the plans, excluding members of the Board of Directors, in voting the shares held by the Trust and in determining whether such shares should be tendered in the event of a tender or exchange offer for the Common Stock. Each such option holder has the power to direct the trustee with respect to a number of shares of Common Stock equal to the shares held by the Trust divided by the number of option holders. Included in the table are 127,615 shares of Common Stock each for Messrs. Baillie, Cañizares, Lambert and Zeitler, and 1,148,535 shares of Common Stock for all directors and executive officers as a group, as to which such persons and other executive officers of the Company have such voting and investment power. See the following discussion of the beneficial ownership of The PNC Financial Services Group, Inc. |

5% Beneficial Owners

As of February 18, 2005, to the best of the Company’s knowledge, seven persons or entities beneficially owned more than 5% of the Company’s Common Stock. The beneficial ownership of John T. Ryan III and John C. Unkovic appears in the immediately preceding table. The following table sets forth the beneficial ownership of the other 5% beneficial owners, based upon information provided by such persons:

Name and Address | Amount and Nature of Ownership | Percent | ||

| Irene Ryan Shaw 9 Carriage House Lane Mamaroneck, NY 10543 | 2,171,193(1) | 5.51% | ||

| The PNC Financial Services Group, Inc. PNC Bank Building Pittsburgh, Pennsylvania 15265 | 3,227,423(2)(3) | 8.19% | ||

| Bruce S. Sherman 8889 Pelican Bay Blvd. Naples, FL 34108 | 3,554,585(4) | 9.02% | ||

| Gregg J. Powers 8889 Pelican Bay Blvd. Naples, FL 34108 | 3,508,385(4) | 8.90% | ||

| Private Capital Management, Inc. 8889 Pelican Bay Blvd. Naples, FL 34108 | 3,508,385(4) | 8.90% | ||

16

| (1) | Irene Ryan Shaw is the sister of John T. Ryan III and the wife of L. Edward Shaw, Jr. Mrs. Shaw has sole voting and investment power over 405,323 shares of Common Stock and shares voting and investment power over 1,765,870 shares of Common Stock. Of such shares, voting and investment power over 590,097 shares is shared with L. Edward Shaw, Jr., voting and investment power over 159,156 shares is shared with John T. Ryan III and John C. Unkovic and voting and investment power over 1,016,617 additional shares is shared with Mr. Ryan and in certain cases other members of the Ryan family. |

| (2) | All shares are held by subsidiaries of The PNC Financial Services Group, Inc. in various fiduciary capacities. The subsidiaries have sole voting and investment power with respect to 162,656 and 141,239 shares, respectively, and share voting and investment power with respect to 0 and 3,065,534 shares, respectively. |

| (3) | Includes 3,062,767 shares of Common Stock held by the Company’s Stock Compensation Trust, as to which investment power is shared with certain executive officers of the Company and other holders of stock options under Company plans. See footnote (5) to the immediately preceding table. |

| (4) | According to a Schedule 13G filed February 14, 2005, Mr. Sherman is CEO and Mr. Powers is President of Private Capital Management, Inc., an investment advisor (“PCM”), and in that capacity share voting and investment power with PCM over 3,508,385 shares of Common Stock which PCM holds on behalf of its clients. Mr. Sherman has sole voting and investment power over 46,200 shares of Common Stock. |

Beneficial Ownership of Ryan Family

The preceding tables disclose in accordance with Securities and Exchange Commission requirements only a portion of the aggregate beneficial ownership of the Company’s Common Stock by the Ryan family. As of February 18, 2005, members of the extended family of John T. Ryan III and Irene Ryan Shaw, including trusts for their benefit, beneficially owned to the knowledge of the Company an aggregate of 11,641,934 shares of Common Stock, representing 28.98% of the outstanding shares.

Shareholder Rights Plan

The Company has established a shareholder rights plan intended to promote continuity and stability, deter coercive or partial offers and other unfair takeover tactics which will not provide fair value to all shareholders, and enhance the Board’s ability to represent all shareholders and thereby maximize shareholder values.

Under the plan, each share of Common Stock presently outstanding or which is issued hereafter prior to the Distribution Date (defined below) is granted one-ninth of a Right. Each Right entitles the registered holder to purchase from the Company one one-thousandth of a share of Series A Junior Participating Preferred Stock of the Company (the “Preferred Shares”) at a price of $225.00 per one one-thousandth of a Preferred Share, subject to adjustment in the event of stock dividends and similar events occurring prior to the Distribution Date. Each one one-thousandth of a Preferred Share would have voting, dividend and liquidation rights which are the approximate equivalent of one share of Common Stock.

The Rights are not exercisable until the Distribution Date, which is the earlier to occur of (i) 10 days following a public announcement that a person (an “Acquiring Person”) has acquired beneficial ownership, as defined in the Rights Agreement, of 15% or more of the outstanding Common Stock or (ii) 10 business days (unless extended by the Board of Directors) following the commencement of a tender offer or exchange offer which would result in the beneficial ownership by a person of 15% or more of the outstanding Common Stock. Until the Distribution Date, the Rights will be transferred only with the Common Stock, and the transfer of a share of Common Stock will also constitute the transfer of the associated Right. Following the Distribution Date, separate certificates evidencing the Rights will be mailed to record holders of Common Stock on the Distribution Date, and the Rights will then become separately tradable. In determining whether an individual or a qualifying nonbusiness entity has become an Acquiring Person, shares of Common Stock held continuously on and after

17

February 10, 1997, or acquired by gift or inheritance from another individual or qualifying entity which held them on that date, are excluded from the 15% beneficial ownership calculation.

In the event that any person becomes an Acquiring Person (other than pursuant to certain qualifying tender or exchange offers approved by the Board) and after expiration of the period during which the Rights may be redeemed, each holder of a Right, other than Rights beneficially owned by the Acquiring Person or its associates or affiliates (which will be void), will thereafter have the right to receive upon exercise shares of Common Stock (or in certain circumstances, cash, property or other securities of the Company) having a market value of two times the exercise price of the Right. In the event that after the first public announcement that any person has become an Acquiring Person, the Company is acquired in a merger or other business combination transaction (other than a merger pursuant to certain qualifying tender or exchange offers) or 50% or more of its assets or earning power are sold, each holder of a Right, other than Rights beneficially owned by the Acquiring Person or its associates or affiliates (which will be void), will thereafter have the right to receive upon exercise of the Right, shares of common stock of the acquiring company having a market value of two times the exercise price of the Right.

At any time after a person becomes an Acquiring Person and prior to the acquisition by such person of 50% or more of the outstanding Common Stock, the Board of Directors may exchange the Rights (other than Rights which have become void), in whole or in part, at an exchange ratio of one share of Common Stock, or one one-thousandth of a Preferred Share (or of a share of a class or series of the Company’s preferred stock having equivalent rights, preferences and privileges) per Right, subject to adjustment.

At any time prior to 10 days after the public announcement of an Acquiring Person, the Board of Directors may redeem the Rights in whole, but not in part, at a redemption price of $.01 per Right. Prior to the Distribution Date, the terms of the Rights may be amended by the Board of Directors in any respect whatever, without the consent of the holders of the Rights, except that the redemption price, the expiration date of the Rights, the exercise price or the number of Preferred Shares for which a Right is exercisable may not be amended. After the Distribution Date, the Board may amend certain time periods and other provisions relating to the Rights, except that the time period for redemption of the Rights may not be amended after the Rights have become nonredeemable. The Rights will expire on February 21, 2007 unless earlier redeemed or exchanged by the Company as described above.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires that directors and officers of the Company and beneficial owners of more than 10% of its Common Stock file reports with the Securities and Exchange Commission with respect to changes in their beneficial ownership of equity securities of the Company. In 2004, Benedict DeMaria, an officer of the Company was late in filing one Form 4 to report a single transaction. Based solely upon a review of the copies of such reports furnished to the Company and written representations by certain persons that reports on Form 5 were not required, the Company believes that all other 2004 Section 16(a) filing requirements applicable to its directors, officers and greater-than-10% beneficial owners were complied with.

PROPOSAL NO. 2

CEO ANNUAL INCENTIVE AWARD PLAN

The shareholders are being asked to consider and approve the CEO Annual Incentive Award Plan (the “Plan”). The Plan was adopted by the Compensation Committee of the Board of Directors in February 2005, subject to approval by the shareholders at the Annual Meeting. The principal features of the Plan are summarized below. The summary is qualified in its entirety by reference to the full text of the Plan, which is set forth as Appendix A to this Proxy Statement.

18

The Board of Directors recommends that shareholders vote “FOR” approval of the CEO Annual Incentive Award Plan.Unless otherwise specified thereon, proxies received in the accompanying form will be voted in favor of approval of the Plan.

General

The purposes of the Plan are to provide a strong financial incentive each year for performance of the Company’s Chief Executive Officer (“CEO”) by making a significant percentage of the CEO’s total cash compensation dependent upon the level of corporate performance attained for the year, and to do so in a manner which preserves deductibility of CEO compensation expense under Section 162(m) of the Internal Revenue Code (the “Code”).

Section 162(m) generally limits the Company’s federal income tax deduction for compensation paid to the CEO in any year to $1 million, unless any excess qualifies as “performance-based compensation.” Under the Company’s current annual executive bonus plan, which is described above in the Compensation Committee Report, the amount of the annual bonus paid to the CEO each year is dependent upon the Company’s performance for the year as compared to its net income target. However, because the current plan gives the Compensation Committee the discretion to vary the amount of the bonus based on its evaluation of the CEO’s individual performance and because the plan has not been approved by the shareholders, compensation paid under the current plan does not qualify as “performance-based compensation” under Section 162(m). The Plan is intended to conform the determination of the annual CEO incentive award to the requirements of Section 162(m) and thereby preserve the deductibility of any compensation expense exceeding the Section 162(m) cap.

Administration

The Plan will be administered by a Committee (the “Committee”) appointed by the Board of Directors or its Compensation Committee and consisting of not less than two members of the Board, each of whom must be both an “outside director” as defined in Section 162(m) and an “independent director” under the listing requirements of the New York Stock Exchange. The Plan will initially be administered by a subcommittee of the Board’s Compensation Committee consisting of directors Campbell, Cederna and Witmer.

Annual Incentive Awards

Under the Plan, the CEO’s annual incentive award will be earned by meeting a Performance Target, which is a specific level or levels set by the Committee of achievement by the Company of one or more objective Performance Criteria. The Performance Criteria may be based on consolidated net income, earnings before interest and taxes, income from continuing operations, income before extraordinary items, income from continuing operations before extraordinary items, earnings per share, return on equity or return on assets. Performance Criteria based on any of those measures may be based on the Company’s absolute performance under such measure for the year and/or upon a comparison of such performance with the performance of the Company in a prior period or the performance of a peer group of companies.

On or before the 90th day of each year, the Committee will determine the Performance Criteria to be used for such year and the method of determining the amount earned, including the applicable Performance Target. In addition to the Performance Target, the Committee may establish a Performance Threshold, which is a minimum level of achievement of the selected Performance Criteria necessary for any part of the annual incentive award to be earned, and/or a Performance Maximum, which is a maximum dollar amount which may be earned based on the level of achievement of the Performance Criteria. In such cases, the terms of the award must set forth the dollar value of the annual incentive award at the Performance Threshold, the level of achievement necessary to earn the Performance Maximum and the method of determining the amount earned if the level of achievement of the Performance Criteria is between the Performance Threshold and the Performance Maximum. The terms of

19

the award established by the Committee must be objective such that a third party having knowledge of the relevant facts could determine (1) whether or not the Performance Target and any Performance Threshold or Performance Maximum has been achieved and (2) the dollar amount which has been earned based on such performance.

Within 75 days following the end of the year, the Committee must determine and certify in writing whether the Performance Target, any Performance Threshold or Performance Maximum, and any other material terms of an annual incentive award were achieved or satisfied and the amount, if any, of the award payable to the CEO. The Committee may decrease, but may not increase, the amount of the award as calculated pursuant to the terms originally established by the Committee. The amount earned, as certified by the Committee, is payable to the CEO on or before March 15 of the year following the award year.

2005 Annual Incentive Award

Subject to shareholder approval of the Plan, the Committee has established the terms of the CEO annual incentive award for 2005. The terms of the 2005 award are essentially the same as the terms of the 2004 CEO bonus award, as described above in the Compensation Committee Report, except that the Committee will no longer have discretion to increase the award amount based on its evaluation of the CEO’s individual performance.

The targeted amount of the award, which is 60% of the market level salary midpoint for the chief executive officer position, may be earned by the Company meeting a Performance Target, which is a specified level of income before extraordinary items for 2005. There is also a Performance Threshold level of income before extraordinary items which must be achieved before any part of the award may be earned and a Performance Maximum which may be earned if the Company’s 2005 income before extraordinary items exceeds the Performance Target by a specified amount. The following table shows the amounts of the 2005 CEO annual incentive award which may be earned at the Performance Threshold, Performance Target and Performance Maximum levels:

| Performance Threshold | Performance Target | Performance Maximum | ||

| $189,000 | $378,000 | $850,500 |

Miscellaneous

The maximum amount of annual incentive awards which may be paid with respect to the service of all persons serving as CEO in any fiscal year of the Company is limited to $950,000.

A CEO may receive a pro rata portion of an annual incentive award otherwise earned by Company performance if the CEO’s employment terminates during the year due to death, disability or retirement. An individual who becomes CEO during the year may receive a pro rata award based on the original award terms, or the Committee may establish separate award terms based on Company performance for all or part of the remainder of the year. If a change in control, as defined in the Plan, occurs during a year for which a Performance Target has been established, the Performance Target will be deemed to have been achieved, and a pro rata portion of the annual incentive award calculated at the Performance Target shall be payable immediately. Except as set forth above in this paragraph, an individual must be employed as CEO during the entire fiscal year in order to earn an annual incentive award under the Plan.

If approved by the shareholders, the Plan will continue in effect through the year ending December 31, 2009, unless sooner terminated by the Board or the Board’s Compensation Committee. The Board or the Compensation Committee may amend, suspend or terminate the Plan at any time, except that no amendment shall be made without shareholder approval if shareholder approval is necessary for awards under the Plan to qualify as “performance based compensation” under Section 162(m) of the Internal Revenue Code.

20

Vote Required for Approval