Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year ended December 31, 2007 | Commission File No. 1-15579 |

MINE SAFETY APPLIANCES COMPANY

(Exact name of registrant as specified in its charter)

| Pennsylvania | 25-0668780 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

121 Gamma Drive RIDC Industrial Park O’Hara Township Pittsburgh, Pennsylvania | 15238 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 412-967-3000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, no par value | New York Stock Exchange |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in the definitive proxy statement incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x | Accelerated filer ¨ | |

| Non-accelerated filer ¨ | Smaller reporting company ¨ |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of February 15, 2008, there were outstanding 35,672,042 shares of common stock, no par value, not including 2,519,940 shares held by the Mine Safety Appliances Company Stock Compensation Trust. The aggregate market value of voting stock held by non-affiliates as of June 30, 2007 was approximately $1.3 billion.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the May 13, 2008 Annual Meeting of Shareholders are incorporated by reference into Part III.

Table of Contents

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks and other factors include, but are not limited to, those listed in this report under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this report. In some cases, you can identify forward-looking statements by words such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable words. These statements are only predictions and are not guarantees of future performance. Therefore, actual events or results may differ materially from those expressed or forecast in these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We are under no duty to update publicly any of the forward-looking statements after the date of this report whether as a result of new information, future events or otherwise.

2

Table of Contents

Overview—Mine Safety Appliances Company was incorporated in Pennsylvania in 1914. We are a global leader in the development, manufacture and supply of sophisticated products that protect people’s health and safety. Sophisticated safety products typically integrate any combination of electronics, mechanical systems, and advanced materials to protect users against hazardous or life threatening situations. Our comprehensive line of safety products is used by workers around the world in the fire service, homeland security, construction, and other industries, as well as the military. Our broad product offering includes self-contained breathing apparatus, or SCBAs, gas masks, gas detection instruments, head protection, respirators, thermal imaging cameras, fall protection, and ballistic helmets and body armor. We also provide a broad offering of consumer and contractor safety products through retail channels.

We dedicate significant resources to research and development, which allows us to produce innovative, sophisticated safety products that are often first to market and exceed industry standards. Our global product development teams include cross-geographic and cross-functional members from various functional areas throughout the company, including research and development, marketing, sales, operations, and quality management. Our engineers and technical associates work closely with the safety industry’s leading standards-setting groups and trade associations, such as the National Institute for Occupational Safety and Health, or NIOSH, and the National Fire Protection Association, or NFPA, to develop industry product requirements and standards and to anticipate their impact on our product lines.

Segments—We tailor our product offerings and distribution strategy to satisfy distinct customer preferences that vary across geographic regions. We believe that we best serve these customer preferences by organizing our business into three geographic segments: North America, Europe, and International. Segment information is presented in the note entitled “Segment Information” in Item 8—Financial Statements and Supplementary Data.

Because our financial statements are stated in U.S. dollars, currency fluctuations may affect our results of operations and financial position and may affect the comparability of our results between financial periods.

Principal Products—We manufacture and sell a comprehensive line of sophisticated safety products to protect workers around the world in the fire service, homeland security, construction, and other industries, as well as the military. We also provide a broad offering of consumer and contractor safety products through retail channels. Our products protect people against a wide variety of hazardous or life-threatening situations. The following is a brief description of each of our principal product categories:

Respiratory protection.Respiratory protection products are used to protect against the harmful effects of contamination caused by dust, gases, fumes, volatile chemicals, sprays, micro-organisms, fibers, and other contaminants. We offer a broad and comprehensive line of respiratory protection products.

| • | Self Contained Breathing Apparatus.SCBAs are used by first responders, petrochemical plant workers, and anyone entering an environment deemed immediately dangerous to life and health. SCBAs are also used by first responders to protect against exposure to chemical, biological, radiological, and nuclear, or CBRN, agents. In September 2007, our latest generation SCBA, the FireHawk M7, was certified as meeting new rigorous performance requirements adopted by the NFPA. The FireHawk M7 Air Mask was the first device of its kind to be certified by the Safety Equipment Institute, or SEI, as NFPA compliant for both its breathing apparatus and Personal Alert Safety System, or PASS. The PASS device is an SCBA component that sounds a loud, piercing alarm when a firefighter becomes disabled or lies motionless for 30 seconds. The new NFPA standards also established higher benchmarks for electronics durability. |

3

Table of Contents

| • | Air-purifying respirators. Air-purifying respirators range from the simple, filtering types to powered full-facepiece versions for many hazardous applications, including: |

| • | full face gas masks for military personnel and first responders exposed to known and unknown concentrations of hazardous gases, chemicals, vapors, and particulates; |

| • | half-mask respirators for industrial workers, painters, and construction workers exposed to known concentrations of gases, vapors, and particulates; |

| • | powered-air purifying respirators for industrial, hazmat, and remediation workers who have longer term exposures to hazards in their work environment; and |

| • | dust and pollen masks for maintenance workers, contractors, and at-home consumers exposed to nuisance dusts, allergens, and other particulates. |

| • | Gas masks.We have supplied gas masks to the U.S. military for several decades. The latest versions of these masks are currently in use by the U.S. military in Iraq, Afghanistan, and other parts of the world. Our commercial version of this gas mask, the Millennium, was developed based on the MCU-2/P, the gas mask currently used by the U.S. Air Force, and U.S. Navy. |

| • | Escape hoods. Our Response Escape Hood is used by law enforcement personnel, government workers, chemical and pharmaceutical workers, and anyone needing to escape from unknown concentrations of a chemical, biological or radiological release of toxic gases and vapors. The hood gives users head and upper neck coverage and respiratory protection to help them escape from threatening situations quickly and easily. |

Portable and permanent gas detection instruments.Our hand-held and permanent instruments are used to detect the presence or absence of various gases in the air. These instruments can be either hand-held or permanently installed. Typical applications of these instruments include the detection of the lack of oxygen in confined spaces or the presence of combustible or toxic gases.

| • | Single- and multi-gas hand-held detectors.Our single- and multi-gas detectors provide portable solutions for detecting the presence of oxygen, hydrogen sulfide, carbon monoxide, and combustible gas, either singularly or all four gases at once. Our hand-held portable instruments are used by chemical workers, oil and gas workers, utility workers entering confined spaces, or anywhere a user needs protection to continuously monitor the quality of the atmosphere they are working in and around. |

• | Multi-point permanently installed gas detection systems.Our comprehensive line of gas monitoring systems is used to continuously monitor for combustible and toxic gases and oxygen deficiency in virtually any gas detection application where continuous monitoring is required. Our systems are used for gas detection in pulp and paper, refrigerant monitoring, petrochemical, and general industrial applications. One of our newest lines, the SafeSite® Multi-Threat Wireless Detection System, designed and developed for homeland security applications, combines the technologies and features from our line of permanent and portable gas detection offerings. The SafeSite System detects and communicates the presence of toxic industrial chemicals and chemical warfare agents. With up to 16 monitoring stations, wirelessly connected to a base station, the SafeSite System allows law enforcement officials to rapidly deploy and set up perimeter gas sensing sentinels that continuously monitor the air for toxic gases at large public events, in subways or at federal facilities, and continuously report their status to incident command. |

| • | Flame detectors and open-path infrared gas detectors.Our line of flame and combustible gas detectors is used for plant-wide monitoring of toxic gas concentrations and for detecting the presence of flames. These systems use infrared optics to detect potentially hazardous conditions across distances as far as 120 meters, making them suitable for use in such places as offshore oil rigs, storage vessels, refineries, pipelines, and ventilation ducts. First used in the oil and gas industry, our systems currently have broad applications in petrochemical facilities, the transportation industry, and in pharmaceutical production. |

4

Table of Contents

Thermal imaging cameras.Our hand-held infrared thermal imaging cameras, or TICs, are used in the global fire service market. TICs detect sources of heat in order to locate downed firefighters and other people trapped inside burning or smoke-filled structures. TICs can also be used to identify “hot spots.” Our Evolution® 5200 and Evolution 5200 HD2 Thermal Imaging Cameras, combine the functionality and durability required by the fire service with features and performance capabilities not found in other small format TICs. The recently-introduced Evolution 5600 Thermal Imaging Camera provides high resolution and an extended high sensitivity operating range in a rugged, user-friendly and affordable design.

Head, eye, face, and hearing protection.Head, eye, face, and hearing protection is used in work environments where hazards present dangers such as dust, flying particles, metal fragments, chemicals, extreme glare, optical radiation, and items dropped from above.

| • | Industrial hard hats.Our broad line of hard hats include full-brim hats and traditional hard hats, available in custom colors and with custom logos. These hard hats are used by plant, steel and construction workers, miners and welders. |

| • | Fire helmets.Our fire service products include leather, traditional, modern, and specialty helmets designed to satisfy the preferences of firefighters across geographic regions. Our CairnsHELMET is the number one helmet in the North American fire service market based on 2007 sales. Similarly, our Gallet firefighting helmet has a number one market position in Europe based on 2007 sales. |

| • | Military helmets and communication systems.The Advanced Combat Helmet, or ACH, is used by the military for ballistic head protection. The ACH was originally designed for the Special Forces of the U.S. military and has now been designated as the “basis of issue” by the U.S. Army. In recent years military forces in Iraq and Afghanistan have trusted MSA’s battle-tested ACH and related Modular Integrated Communication Headset, or MICH™. MICH is a light weight and comfortable communication system that provides superior hearing protection as well as clear radio/intercom communications. |

| • | Eye, face, and hearing protection. We manufacture and sell a broad line of hearing protection products, non-prescription protective eyewear, and face shields, used in a variety of industries. |

Body protection.

| • | Fall protection. Our broad line of fall protection equipment includes confined space equipment, harnesses/fall arrest equipment, lanyards, and lifelines. |

| • | Ballistic body armor.Our MSA Paraclete Releasable Assault Vest and Releasable Modular Vest are used primarily by the U.S. military, including Special Forces Units.Our ForceField™ Body Armor line features concealable ballistic vests and over-the-uniform tactical vests designed primarily for law enforcement applications. |

Customers—Our customers generally fall into three categories: industrial and military end-users, distributors, and retail consumers. In North America, we make nearly all of our non-military sales through our distributors.In our European and International segments, we make our sales through both indirect and direct sales channels. Our U.S. military customers, which are comprised of multiple U.S. government entities, including the Department of Defense, accounted for approximately 8% of our 2007 sales. The year-end backlog of orders under contracts with U.S. government agencies was $35.1 million in 2007, $33.1 million in 2006, and $57.9 million in 2005.

5

Table of Contents

Industrial and military end-users—Examples of the primary industrial and military end-users of our core products are listed below:

Products | Primary End-Users | |

Respiratory Protection | First Responders; General Industry Workers; Military Personnel | |

Gas Detection | Oil, Gas, Petrochemical and Chemical Workers; First Responders; Hazmat, and Confined Space Workers | |

Head, Eye and Face, and Hearing Protection | Construction Workers and Contractors; First Responders; General Industry Workers; Military Personnel | |

Thermal Imaging Cameras | First Responders | |

Sales and Distribution—Our sales and distribution team consists of distinct marketing, field sales and customer service organizations for our three geographic segments: North America, Europe, and International. We believe our sales and distribution team, totaling over 400 dedicated associates, is the largest in our industry. In most geographic areas, our field sales organizations work jointly with select distributors to call on end-users, educating them about hazards, exposure limits, safety requirements, and product applications, as well as specific performance requirements of our products. In our International segment and Eastern Europe where distributors are not well established, our sales associates work with and sell directly to end-users. Our development of relationships with end-users is critical to increasing the overall demand for our products.

The in-depth customer training and education provided by our sales associates to our customers are critical to ensure proper use of many of our products, such as SCBAs and gas detection instruments. As a result of our sales associates working closely with end-users, they gain valuable insight into customers’ preferences and needs. To better serve our customers and to ensure that our sales associates are among the most knowledgeable and professional in the industry, we place significant emphasis on training our sales associates with respect to product application, industry standards and regulations, sales skills and sales force automation.

We believe our sales and distribution strategy allows us to deliver a customer value proposition that differentiates our products and services from those of our competitors, resulting in increased customer loyalty and demand.

In areas where we use indirect selling, we promote, distribute, and service our products to general industry through select authorized national, regional, and local distributors. Some of our key distributors include Airgas, W.W. Grainger Inc., Fisher Safety, and Hagemeyer. In North America, we distribute fire service products primarily through specially trained local and regional distributors who provide advanced training and service capabilities to volunteer and paid municipal fire departments. In our European and International segments, we primarily sell to and service the fire service market directly. Because of our broad and diverse product line and our desire to reach as many markets and market segments as possible, we have over 4,000 authorized distributor locations worldwide.

We market consumer products under the MSA Safety Works brand through a dedicated sales and marketing force. We serve the retail consumer through various channels, including distributors, such as Orgill Bros., hardware and equipment rental outlets, such as United Rentals, and retail chains, such as The Home Depot and TrueValue.

Competition—We believe the worldwide personal protection equipment market, including the sophisticated safety products market in which we compete, generates annual sales in excess of $13 billion. The industry supplying this market is broad and highly fragmented with few participants able to offer a comprehensive line of safety products. Generally, global demand for safety products has been stable or growing because purchases of these products are non-discretionary since they protect workers in hazardous and life-threatening work environments and because their use is often mandated by government and industry regulations. Moreover, safety products industry revenues reflect the need to consistently replace many safety products that have limited life spans due to normal wear-and-tear or because they are one-time use products by design.

6

Table of Contents

The safety products market is highly competitive, with participants ranging in size from small companies focusing on a single type of personal protection equipment to a few large multinational corporations which manufacture and supply many types of sophisticated safety products. Our main competitors vary by region and product. We believe that participants in this industry compete primarily on the basis of product characteristics (such as functional performance, agency approvals, design and style), price, brand name recognition and service.

We believe we compete favorably within each of our operating segments as a result of our high quality and cost-efficient product offering and strong brand trust and recognition.

Research and Development—To maintain our position at the forefront of safety equipment technology, we operate three sophisticated research and development facilities. We believe our dedication and commitment to innovation and research and development allow us to produce innovative sophisticated safety products that are often first to market and exceed industry standards. In 2007, 2006, and 2005, on a global basis, we spent approximately $30.2 million, $26.0 million, and $21.9 million, respectively, on research and development. Our engineering groups operate primarily in the United States and Germany, and to a lesser extent in France and Sweden. Our global product development teams include cross-geographic and cross-functional members from various areas throughout the company, including research and development, marketing, sales, operations, and quality management. These teams are responsible for setting product line strategy based on their understanding of the markets and the technologies, opportunities and challenges they foresee in each product area. We believe our team-based, cross-geographic and cross-functional approach to new product development is a source of competitive advantage. Our approach to the new product development process allows us to tailor our product offerings and product line strategies to satisfy distinct customer preferences and industry regulations that vary across our three geographic segments.

We believe another important aspect of our approach to new product development is that our engineers and technical associates work closely with the safety industry’s leading standards-setting groups and trade associations, such as the National Institute for Occupational Safety and Health, or NIOSH, and the National Fire Protection Association, or NFPA, to develop industry product requirements and standards and anticipate their impact on our product lines. For example, nearly every consensus standard-setting body around the world that impacts our product lines has one of our key managers as a voting member. Key members of our management team understand the impact that these standard-setting organizations have on our new product development pipeline and devote time and attention to anticipating a new standard’s impact on our net sales and operating results. Because of our technological sophistication, commitment to and membership on global standard-setting bodies, resource dedication to research and development and unique approach to the new product development process, we believe we are well-positioned to anticipate and adapt to the needs of changing product standards and gain the approvals and certifications necessary to meet new government and multinational product regulations.

Patents and Intellectual Property—We own and have obtained licenses to significant intellectual property, including a number of domestic and foreign patents, patent applications and trademarks related to our products, processes and business. Although our intellectual property plays an important role in maintaining our competitive position in a number of markets that we serve, no single patent, or patent application, trademark or license is, in our opinion, of such value to us that our business would be materially affected by the expiration or termination thereof, other than the “MSA” trademark. Our patents expire at various times in the future not exceeding 20 years. Our general policy is to apply for patents on an ongoing basis in the United States and other countries, as appropriate, to perfect our patent development. In addition to our patents, we have also developed or acquired a substantial body of manufacturing know-how that we believe provides a significant competitive advantage over our competitors.

Raw Materials and Suppliers—Nearly all components of our products are formulated, machined, tooled, or molded in-house from raw materials. For example, we rely on integrated manufacturing capabilities for breathing apparatus, gas masks, ballistic helmets, hard hats, and circuit boards. The primary raw materials that we source from third parties include rubber, chemical filter media, eye and face protective lenses, air cylinders, certain metals, electronic components, and ballistic resistant and non-ballistic fabrics. We purchase these materials both

7

Table of Contents

domestically and internationally, and we believe our supply sources are both well established and reliable. We have close vendor relationship programs with the majority of our key raw material suppliers. Although we generally do not have long-term supply contracts, we have not experienced any significant problems in obtaining adequate raw materials.

Associates—At December 31, 2007, we had approximately 5,100 associates, approximately 2,800 of whom were employed by our European and International segments. None of our U.S. associates are subject to the provisions of a collective bargaining agreement. Some of our associates outside the United States are members of unions. We have not experienced a work stoppage in over 10 years and believe our relations with our associates are good.

Available Information—We post the following filings on the Investor Relations page on our Web site at www.msanet.com as soon as reasonably practicable after they have been electronically filed with or furnished to the Securities and Exchange Commission: our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. All such filings on our Investor Relations Web page are available to be viewed on this page free of charge. Information contained on our Web site is not part of this annual report on Form 10-K or our other filings with the Securities and Exchange Commission.

A reduction in the spending patterns of government agencies could materially and adversely affect our net sales, earnings and cash flow.

The demand for our products sold to the fire service market, the homeland security market, and to U.S. government agencies, including the Department of Defense, is, in large part, driven by available government funding. For example, the level of government funding in these areas increased significantly after the attacks of September 11, 2001, fueling the demand for many of our products such as SCBAs, gas masks, and Advanced Combat Helmets, and declined in 2005 and 2006, as government funding priorities changed. Approximately 8% of our net sales for the year ended December 31, 2007 were made directly to U.S. military customers. Government budgets are set annually and we cannot assure you that government funding will be sustained at the same level in the future. A significant reduction in available government funding in the future could materially and adversely affect our net sales, earnings and cash flow.

The markets in which we compete are highly competitive, and some of our competitors have greater financial and other resources than we do. The competitive pressures faced by us could materially and adversely affect our business, results of operations and financial condition.

The safety products market is highly competitive, with participants ranging in size from small companies focusing on single types of safety products, to large multinational corporations that manufacture and supply many types of safety products. Our main competitors vary by region and product. We believe that participants in this industry compete primarily on the basis of product characteristics (such as functional performance, agency approvals, design and style), price, brand name trust and recognition, and customer service. Some of our competitors have greater financial and other resources than we do and our cash flows from operations could be adversely affected by competitors’ new product innovations, technological advances made to competing products and pricing changes made by us in response to competition from existing or new competitors. We may not be able to compete successfully against current and future competitors and the competitive pressures faced by us could materially and adversely affect our business, results of operations and financial condition.

8

Table of Contents

If we fail to introduce successful new products or extend our existing product lines, we may lose our market position and our financial performance may be materially and adversely affected.

In the safety products market, there are frequent introductions of new products and product line extensions. If we are unable to identify emerging consumer and technological trends, maintain and improve the competitiveness of our products and introduce new products, we may lose our market position, which could have a materially adverse effect on our business, financial condition and results of operations. Although we continue to invest significant resources in research and development and market research, continued product development and marketing efforts are subject to the risks inherent in the development of new products and product line extensions, including development delays, the failure of new products and product line extensions to achieve anticipated levels of market acceptance, and the cost of failed product introductions.

Product liability claims and our ability to collect related insurance receivables could have a materially adverse effect on our business, operating results, and financial condition.

We face an inherent business risk of exposure to product liability claims arising from the alleged failure of our products to prevent the types of personal injury or death against which they are designed to protect. Although we have not experienced any material uninsured losses due to product liability claims, it is possible that we could experience material losses in the future. In the event any of our products prove to be defective, we could be required to recall or redesign such products. In addition, we may voluntarily recall or redesign certain products that could potentially be harmful to end users. A successful claim brought against us in excess of available insurance coverage, or any claim or product recall that results in significant expense or adverse publicity against us, could have a materially adverse effect on our business, operating results, and financial condition.

In the normal course of business, we make payments to settle product liability claims and for related legal fees and record receivables for the amounts covered by insurance. Various factors could affect the timing and amount of recovery of insurance receivables, including: the outcome of negotiations with insurers, legal proceedings with respect to product liability insurance coverage, and the extent to which insurers may become insolvent in the future. Failure to recover amounts due from our insurance carriers could have a materially adverse effect on our business, operating results, and financial condition.

Our ability to market and sell our products is subject to existing regulations and standards. Changes in such regulations and standards or our failure to comply with them could materially and adversely affect our results of operations.

Most of our products are required to meet performance and test standards designed to protect the health and safety of people around the world. Our inability to comply with these standards may materially and adversely affect our results of operations. Changes in regulations could reduce the demand for our products or require us to reengineer our products, thereby creating opportunities for our competitors. Regulatory approvals for our products may be delayed or denied for a variety of reasons that are outside of our control. Additionally, market anticipation of significant new standards, such as the National Fire Protection Association (NFPA) standard for breathing apparatus which was recently promulgated and became effective August 31, 2007, can cause customers to accelerate or delay buying decisions.

We have significant international operations, and we are subject to the risks of doing business in foreign countries.

We have business operations in over 30 foreign countries. In 2007, approximately 50% of our net sales were made by operations located outside the United States. Our international operations are subject to various political, economic, and other risks and uncertainties, which could adversely affect our business. These risks include the following:

| • | unexpected changes in regulatory requirements; |

| • | currency exchange rate fluctuations; |

9

Table of Contents

| • | changes in trade policy or tariff regulations; |

| • | changes in tax laws and regulations; |

| • | intellectual property protection difficulties; |

| • | difficulty in collecting accounts receivable; |

| • | complications in complying with a variety of foreign laws and regulations, some of which conflict with U.S. laws; |

| • | trade protection measures and price controls; |

| • | trade sanctions and embargos; |

| • | nationalization and expropriation; |

| • | increased international instability or potential instability of foreign governments; |

| • | the need to take extra security precautions for our international operations; and |

| • | costs and difficulties in managing culturally and geographically diverse international operations. |

Any one or more of these risks could have a negative impact on the success of our international operations, and thereby materially and adversely affect our business as a whole.

Our future results are subject to availability of, and fluctuations in the costs of, purchased components and materials due to market demand, currency exchange risks, material shortages, and other factors.

We depend on various components and materials to manufacture our products. Although we have not experienced any difficulty in obtaining components and materials, it is possible that any of our supplier relationships could be terminated. Any sustained interruption in our receipt of adequate supplies could have a materially adverse effect on our business, results of operations and financial condition. We cannot assure you that we will be able to successfully manage price fluctuations due to market demand, currency risks or material shortages, or that future price fluctuations will not have a materially adverse effect on our business, results of operations and financial condition.

If we lose any of our key personnel or are unable to attract, train and retain qualified personnel, our ability to manage our business and continue our growth would be negatively impacted.

Our success depends in large part on the continued contributions of our key management, engineering, and sales and marketing personnel, many of whom are highly skilled and would be difficult to replace. Our success also depends on the abilities of new personnel to function effectively, both individually and as a group. If we are unable to attract, effectively integrate and retain management, engineering or sales and marketing personnel, then the execution of our growth strategy and our ability to react to changing market requirements may be impeded, and our business could suffer as a result. Competition for personnel is intense, and we cannot assure you that we will be successful in attracting and retaining qualified personnel. In addition, we do not currently maintain key person life insurance.

We are subject to various environmental laws and any violation of these laws could adversely affect our results of operations.

We are subject to federal, state, and local laws, regulations and ordinances relating to the protection of the environment, including those governing discharges to air and water, handling and disposal practices for solid and hazardous wastes, and the maintenance of a safe workplace. These laws impose penalties for noncompliance and liability for response costs and certain damages resulting from past and current spills, disposals, or other releases of hazardous materials. We could incur substantial costs as a result of noncompliance with or liability for cleanup

10

Table of Contents

pursuant to these environmental laws. We have identified several known and potential environmental liabilities, which we do not believe are material. Environmental laws have changed rapidly in recent years, and we may be subject to more stringent environmental laws in the future. If more stringent environmental laws are enacted, these future laws could have a materially adverse effect on our results of operations.

Our inability to successfully identify, consummate and integrate future acquisitions, or to realize anticipated cost savings and other benefits could adversely affect our business.

One of our key operating strategies is to selectively pursue acquisitions. Any future acquisitions will depend on our ability to identify suitable acquisition candidates and successfully consummate such acquisitions. Acquisitions involve a number of risks including:

| • | failure of the acquired businesses to achieve the results we expect; |

| • | diversion of our management’s attention from operational matters; |

| • | our inability to retain key personnel of the acquired businesses; |

| • | risks associated with unanticipated events or liabilities; |

| • | potential disruption of our existing business; and |

| • | customer dissatisfaction or performance problems at the acquired businesses. |

If we are unable to integrate or successfully manage businesses that we may acquire in the future, we may not realize anticipated cost savings, improved manufacturing efficiencies and increased revenue, which may result in materially adverse short- and long-term effects on our operating results, financial condition and liquidity. Even if we are able to integrate the operations of our acquired businesses into our operations, we may not realize the full benefits of the cost savings, revenue enhancements or other benefits that we may have expected at the time of acquisition. In addition, even if we achieve the expected benefits, we may not be able to achieve them within the anticipated time frame, and such benefits may be offset by costs incurred in integrating the companies and increases in other expenses.

Because we derive a significant portion of our sales from the operations of our foreign subsidiaries, future exchange rate fluctuations may adversely affect our results of operations and financial condition, and may affect the comparability of our results between financial periods.

For the year ended December 31, 2007, our operations in our European and International segments each accounted for approximately 24% of our net sales. The results of our foreign operations are reported in the local currency and then translated into U.S. dollars at the applicable exchange rates for inclusion in our consolidated financial statements. The exchange rates between some of these currencies and the U.S. dollar have fluctuated significantly in recent years, and may continue to do so in the future. In addition, because our financial statements are stated in U.S. dollars, such fluctuations may affect our results of operations and financial position, and may affect the comparability of our results between financial periods. We cannot assure you that we will be able to effectively manage our exchange rate risks or that any volatility in currency exchange rates will not have a materially adverse effect on our results of operations and financial condition.

Our continued success depends on our ability to protect our intellectual property. If we are unable to protect our intellectual property, our net sales could be materially and adversely affected.

Our success depends, in part, on our ability to obtain and enforce patents, maintain trade secret protection and operate without infringing on the proprietary rights of third parties.We have been issued patents and have registered trademarks with respect to many of our products, but our competitors could independently develop similar or superior products or technologies, duplicate any of our designs, trademarks, processes or other intellectual property or design around any processes or designs on which we have or may obtain patents or trademark protection. In addition, it is possible that third parties may have, or will acquire, licenses for patents or

11

Table of Contents

trademarks that we may use or desire to use, so that we may need to acquire licenses to, or to contest the validity of, such patents or trademarks of third parties.Such licenses may not be made available to us on acceptable terms, if at all, and we may not prevail in contesting the validity of third party rights.

In addition to patent and trademark protection, we also protect trade secrets, know-how, and other confidential information against unauthorized use by others or disclosure by persons who have access to them, such as our employees, through contractual arrangements.These agreements may not provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information.If we are unable to maintain the proprietary nature of our technologies, our results of operations and financial condition could be materially and adversely affected.

Item 1B. Unresolved Staff Comments

None.

12

Table of Contents

Our principal executive offices are located at 121 Gamma Drive, RIDC Industrial Park, O’Hara Township, Pittsburgh, Pennsylvania 15238 in a 93,000 square-foot building owned by us. We own or lease our primary facilities located in seven states in the United States and in a number of other countries. We believe that all of our facilities, including the manufacturing facilities, are in good repair and in suitable condition for the purposes for which they are used.

The following table sets forth a list of our primary facilities:

Location | Function | Square Feet | Owned or Leased | |||

North America | ||||||

Murrysville, PA | Manufacturing | 295,000 | Owned | |||

Cranberry Twp., PA | Office, Research and Development, and Manufacturing | 212,000 | Owned | |||

Evans City, PA | Manufacturing | 194,000 | Leased | |||

St. Pauls, NC | Manufacturing | 144,000 | Leased | |||

Jacksonville, NC | Manufacturing | 107,000 | Owned | |||

Pittsburgh, PA | Office | 93,000 | Owned | |||

Pittsburgh, PA | Distribution | 81,000 | Leased | |||

Queretaro, Mexico | Office, Manufacturing and Distribution | 77,000 | Leased | |||

Cranberry Twp., PA | Research and Development | 68,000 | Owned | |||

Englewood, CO | Manufacturing | 41,000 | Leased | |||

Englewood, CO | Distribution | 15,000 | Leased | |||

Newport, VT | Manufacturing | 12,000 | Leased | |||

Bowling Green, KY | Office, Research and Development, and Manufacturing | 7,000 | Leased | |||

Toronto, Canada | Distribution | 5,000 | Leased | |||

Europe | ||||||

Berlin, Germany | Office, Research and Development, Manufacturing, and Distribution | 340,000 | Leased | |||

Chatillon sur Chalaronne, France | Office, Research and Development, Manufacturing, and Distribution | 94,000 | Owned | |||

Glasgow, Scotland | Office and Manufacturing | 25,000 | Leased | |||

Milan, Italy | Office, Research and Development, and Distribution | 25,000 | Owned | |||

Mohammedia, Morocco | Manufacturing | 24,000 | Owned | |||

Vernamo, Sweden | Office, Research and Development, Manufacturing, and Distribution | 17,000 | Leased | |||

Glasgow, Scotland | Office and Distribution | 6,000 | Leased | |||

International | ||||||

Wuxi, China | Office, Research and Development, Manufacturing, and Distribution | 92,000 | Owned | |||

Johannesburg, South Africa | Office, Manufacturing, and Distribution | 89,000 | Leased | |||

Sao Paulo, Brazil | Office, Research and Development, Manufacturing, and Distribution | 60,000 | Owned | |||

Sydney, Australia | Office, Research and Development, Manufacturing, and Distribution | 57,000 | Owned | |||

Lima, Peru | Office and Distribution | 34,000 | Owned | |||

Rajarhat, India | Office and Distribution | 10,000 | Leased | |||

Buenos Aires, Argentina | Office and Distribution | 9,000 | Owned | |||

13

Table of Contents

We are subject to federal, state, and local laws, regulations and ordinances relating to the protection of the environment, including those governing discharges to air and water, handling and disposal practices for solid and hazardous wastes, and the maintenance of a safe workplace. There are no current or expected legal proceedings or expenditures with respect to environmental matters that would materially affect our operations.

Various lawsuits and claims arising in the normal course of business are pending against us. These lawsuits are primarily product liability claims. We are presently named as a defendant in approximately 2,600 lawsuits primarily involving respiratory protection products allegedly manufactured and sold by us. Collectively, these lawsuits represent a total of approximately 16,500 plaintiffs. Approximately 90% of these lawsuits involve plaintiffs alleging they suffer from silicosis, with the remainder alleging they suffer from other or combined injuries, including asbestosis. These lawsuits typically allege that these conditions resulted in part from respirators that were negligently designed or manufactured by us. Consistent with the experience of other companies involved in silica and asbestos-related litigation, in recent years there has been an increase in the number of asserted claims that could potentially involve us. We cannot determine our potential maximum liability for such claims, in part because the defendants in these lawsuits are often numerous, and the claims generally do not specify the amount of damages sought.

With some limited exceptions, we maintain insurance against product liability claims. We also maintain a reserve for uninsured product liability based on expected settlement charges for pending claims and an estimate of unreported claims derived from experience, sales volumes, and other relevant information. We evaluate our exposures on an ongoing basis and make adjustments to the reserve as appropriate. Based on information currently available, we believe that the disposition of matters that are pending will not have a materially adverse effect on our financial condition.

In the normal course of business, we make payments to settle product liability claims and for related legal fees and record receivables for the amounts covered by insurance. Various factors could affect the timing and amount of recovery of insurance receivables, including: the outcome of negotiations with insurers, legal proceedings with respect to product liability insurance coverage, and the extent to which insurers may become insolvent in the future.

We are currently involved in coverage litigation with Century Indemnity Company (Century). Century filed a lawsuit in the Superior Court of New Jersey seeking a declaration of Century’s obligations with respect to certain asbestos, silica and other claims under five insurance policies issued to us by Century. The New Jersey Superior Court issued an order granting our motion to dismiss this case on jurisdictional grounds. Century appealed that order and on February 26, 2008, the Appellate Division of the Superior Court of New Jersey affirmed the decision of the trial court dismissing the case. It is unknown whether Century will seek to appeal that decision. We have sued Century in the Court of Common Pleas of Allegheny County, Pennsylvania, alleging that Century breached the five insurance policies by failing to pay amounts owing to us. The Pennsylvania court has denied a motion by Century to stay or dismiss the Pennsylvania lawsuit in favor of the New Jersey action and the Pennsylvania action is proceeding. We believe that Century’s refusal to indemnify us under the policies is wholly contrary to Pennsylvania law and we are vigorously pursuing the legal actions necessary to collect all amounts. The case is currently in discovery.

We regularly evaluate the collectibility of these receivables and record the amounts that we conclude are probable of collection based on our analysis of our various policies, pertinent case law interpreting comparable policies and our experience with similar claims. The net balance of receivables from insurance carriers was $39.1 million and $18.4 million at December 31, 2007 and 2006, respectively.

14

Table of Contents

Item 4. Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of our security holders during the fourth quarter of 2007.

Executive Officers of the Registrant

The following sets forth the names and ages of our executive officers as of February 29, 2008, indicating all positions held during the past five years:

Name | Age | Title | ||

John T. Ryan III | 64 | Chairman of the Board of Directors and Chief Executive Officer since October 1991. | ||

William M. Lambert(a) | 49 | President and Chief Operating Officer since March 2007. | ||

Joseph A. Bigler(b) | 58 | Vice President and President, MSA North America since May 2007. | ||

Kerry M. Bove(c) | 49 | Vice President, Global Operational Excellence since May 2007. | ||

Rob Cañizares(d) | 58 | Executive Vice President and President, MSA International since May 2007. | ||

Ronald N. Herring, Jr.(e) | 47 | Vice President, Global Product Leadership since May 2007. | ||

Douglas K. McClaine(f) | 50 | Vice President, Secretary and General Counsel since May 2005. | ||

Stephen C. Plut(g) | 48 | Vice President and Chief Information Officer since May 2005. | ||

Paul R. Uhler(h) | 49 | Vice President, Global Human Resources since May 2007. | ||

Dennis L. Zeitler(i) | 59 | Senior Vice President, Chief Financial Officer and Treasurer since June 2007. | ||

| (a) | Prior to his present position, Mr. Lambert held the positions of Vice President and President, MSA North America; and Vice President and General Manager of the Safety Products Division. |

| (b) | Prior to his present position, Mr. Bigler was Vice President, primarily responsible for North American Sales and Distribution. |

| (c) | Prior to his present position, Mr. Bove was Vice President, primarily responsible for Global Manufacturing Operations and Materials Management. |

| (d) | Prior to his present position, Mr. Cañizares was Vice President and President, MSA International. |

| (e) | Prior to his present position, Mr. Herring held the positions of Vice President, primarily responsible for Global Marketing, Research and Engineering and Quality Assurance; and General Manager, Safety Products Division. |

| (f) | Prior to his present position, Mr. McClaine was Secretary and General Counsel. |

| (g) | Prior to his present position, Mr. Plut was Chief Information Officer. |

| (h) | Prior to his present position, Mr. Uhler held the positions of Vice President, primarily responsible for North American Human Resources and Corporate Communications; Director of Human Resources and Corporate Communications; and Manager of the Murrysville, PA plant. |

| (i) | Prior to his present position, Mr. Zeitler was Vice President, Chief Financial Officer and Treasurer. |

15

Table of Contents

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Our common stock is traded on the New York Stock Exchange under the symbol “MSA”. Stock price ranges and dividends declared were as follows:

| Price Range of Our Common Stock | |||||||||

| High | Low | Dividends | |||||||

Year ended December 31, 2006 | |||||||||

First Quarter | $ | 44.16 | $ | 36.18 | $ | 0.14 | |||

Second Quarter | 44.00 | 38.62 | 0.18 | ||||||

Third Quarter | 41.19 | 34.05 | 0.18 | ||||||

Fourth Quarter | 39.09 | 34.98 | 0.18 | ||||||

Year ended December 31, 2007 | |||||||||

First Quarter | $ | 43.71 | $ | 35.98 | $ | 0.18 | |||

Second Quarter | 44.49 | 39.67 | 0.22 | ||||||

Third Quarter | 60.64 | 41.13 | 0.22 | ||||||

Fourth Quarter | 56.94 | 42.84 | 0.22 | ||||||

On February 15, 2008, there were 428 registered holders of our shares of common stock.

The information appearing in Part III below regarding common stock issuable under our equity compensation plans is incorporated herein by reference.

Issuer Purchases of Equity Securities

Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number Of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | |||||

October 1 - October 31, 2007 | — | — | — | 1,063,556 | |||||

November 1 - November 30, 2007 | 343 | $ | 46.46 | — | 993,679 | ||||

December 1 - December 31, 2007 | — | — | — | 938,890 | |||||

On November 2, 2005, the Board of Directors authorized the purchase of up to $100 million of common stock from time to time in private transactions and on the open market. The share purchase program has no expiration date. The maximum shares that may yet be purchased is calculated based on the dollars remaining under the program and the respective month-end closing share price.

We do not have any other share purchase programs.

The November 2007 shares purchases related to stock compensation transactions.

16

Table of Contents

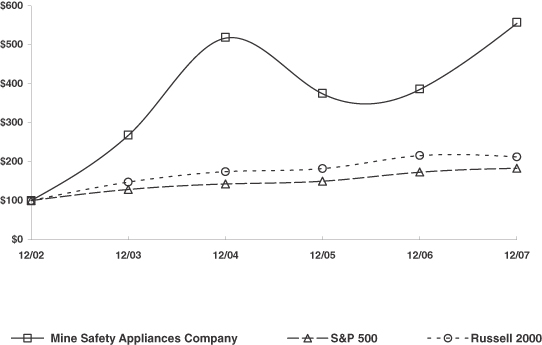

Comparison of Five-Year Cumulative Total Return

Set forth below is a line graph and table comparing the cumulative total returns (assuming reinvestment of dividends) for the five years ended December 31, 2007 of $100 invested on December 31, 2002 in each of Mine Safety Appliances Company’s common stock, the Standard & Poor’s 500 Composite Index, and the Russell 2000 Index. Because our competitors are principally privately held concerns or subsidiaries or divisions of corporations engaged in multiple lines of business, we do not believe it feasible to construct a peer group comparison on an industry or line-of-business basis. The Russell 2000 Index, while including corporations both larger and smaller than MSA in terms of market capitalization, is composed of corporations with an average market capitalization similar to us.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Mine Safety Appliances Company, The S&P 500 Index

And The Russell 2000 Index

| Value at December 31 | ||||||||||||||||||

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | |||||||||||||

MSA | $ | 100.00 | $ | 268.22 | $ | 518.92 | $ | 375.10 | $ | 386.39 | $ | 557.23 | ||||||

S&P 500 | 100.00 | 128.68 | 142.69 | 149.70 | 173.34 | 182.87 | ||||||||||||

Russell 2000 | 100.00 | 147.25 | 174.24 | 182.18 | 215.64 | 212.26 | ||||||||||||

17

Table of Contents

Item 6. Selected Financial Data

The following selected financial data should be read in conjunction with our consolidated financial statements, including the respective notes thereto, as well as the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included elsewhere in this annual report on Form 10-K.

| 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||

| (In thousands, except as noted) | |||||||||||||||||

Statement of Income Data: | |||||||||||||||||

Net sales | $ | 990,252 | $ | 913,714 | $ | 907,912 | $ | 852,509 | $ | 696,473 | |||||||

Other income | 17,396 | 5,384 | 4,058 | 5,004 | 1,724 | ||||||||||||

Cost of products sold | 616,203 | 568,410 | 558,921 | 518,174 | 427,632 | ||||||||||||

Selling, general and administrative | 241,138 | 215,663 | 201,367 | 198,714 | 174,701 | ||||||||||||

Research and development | 30,196 | 26,037 | 21,928 | 22,648 | 20,897 | ||||||||||||

Restructuring and other charges | 4,142 | 6,981 | — | — | — | ||||||||||||

Interest | 9,913 | 6,228 | 5,484 | 3,845 | 4,564 | ||||||||||||

Currency exchange (gains) losses | (132 | ) | 3,139 | 474 | 264 | (3,356 | ) | ||||||||||

Provision for income taxes | 38,600 | 28,722 | 42,013 | 42,821 | 24,835 | ||||||||||||

Net income from continuing operations | 67,588 | 63,918 | 81,783 | 71,047 | 48,924 | ||||||||||||

Net income from discontinued operations | — | — | — | — | 2,685 | ||||||||||||

Gain on sale of discontinued operations—after tax | — | — | — | — | 13,658 | ||||||||||||

Net income | 67,588 | 63,918 | 81,783 | 71,047 | 65,267 | ||||||||||||

Earnings per Share Data: | |||||||||||||||||

Basic per common share continuing operations | $ | 1.89 | $ | 1.76 | $ | 2.24 | $ | 1.91 | $ | 1.33 | |||||||

Diluted per common share continuing operations (in dollars) | 1.86 | 1.73 | 2.19 | 1.86 | 1.31 | ||||||||||||

Dividends paid per common share (in dollars) | .84 | .68 | .52 | .37 | .26 | ||||||||||||

Weighted average common shares outstanding—basic | 35,651 | 36,366 | 36,560 | 37,111 | 36,730 | ||||||||||||

Balance Sheet Data: | |||||||||||||||||

Working capital | $ | 287,861 | $ | 289,424 | $ | 246,367 | $ | 270,593 | $ | 207,216 | |||||||

Working capital ratio | 2.4 | 3.3 | 2.9 | 3.1 | 2.8 | ||||||||||||

Net property | 130,445 | 120,651 | 116,209 | 123,716 | 120,560 | ||||||||||||

Total assets | 1,016,306 | 898,620 | 725,357 | 734,110 | 643,885 | ||||||||||||

Long-term debt | 103,726 | 112,541 | 45,834 | 54,463 | 59,915 | ||||||||||||

Common shareholders’ equity | 460,604 | 436,926 | 381,470 | 376,679 | 306,867 | ||||||||||||

Equity per common share (in dollars) | 12.92 | 12.13 | 10.44 | 10.09 | 8.31 | ||||||||||||

Note: | |||||||||||||||||

Cost of products sold, selling, general and administrative expenses, and research and development expenses include noncash pension income. | |||||||||||||||||

Noncash pension income, pre-tax | $ | 4,535 | $ | 4,147 | $ | 6,104 | $ | 7,188 | $ | 8,845 | |||||||

Working capital at December 31, 2003 excludes assets held for sale.

18

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with the historical financial statements and other financial information included elsewhere in this annual report on Form 10-K. This discussion may contain forward-looking statements that involve risks and uncertainties. The forward-looking statements are not historical facts, but rather are based on current expectations, estimates, assumptions, and projections about our industry, business, and future financial results. Our actual results could differ materially from the results contemplated by these forward-looking statements due to a number of factors, including those discussed in the sections of this annual report entitled “Forward-Looking Statements” and “Risk Factors.”

BUSINESS OVERVIEW

We are a global leader in the development, manufacture and supply of sophisticated products that protect people’s health and safety. Sophisticated safety products typically integrate any combination of electronics, mechanical systems, and advanced materials to protect users against hazardous or life threatening situations. Our comprehensive lines of safety products are used by workers around the world in the fire service, homeland security, construction, and other industries, as well as the military.

In recent years, we have concentrated on specific initiatives intended to help improve our competitive position and profitability, including:

| • | identifying and developing promising new markets; |

| • | focusing on innovation and new product introductions; |

| • | further strengthening relationships with major distributors; |

| • | optimizing factory performance and driving operational excellence; |

| • | positioning international business to capture significant growth opportunities; and |

| • | pursuing strategic acquisitions. |

We tailor our product offerings and distribution strategy to satisfy distinct customer preferences that vary across geographic regions. We believe that we best serve these customer preferences by organizing our business into three geographic segments: North America, Europe, and International. Each segment includes a number of operating companies. In 2007, approximately 52%, 24%, and 24% of our net sales were made by our North American, European, and International segments, respectively.

North America. Our largest manufacturing and research and development facilities are located in the United States. We serve our North American markets with sales and distribution functions in the U.S., Canada, and Mexico.

Europe. Our European segment includes well-established companies in most Western European countries and more recently established operations in a number of Eastern European locations. Our largest European companies, based in Germany and France, develop, manufacture, and sell a wide variety of products. Operations in other European countries focus primarily on sales and distribution in their respective home country markets. While some of these companies may perform limited production, most of their sales are of products that are manufactured in our plants in Germany, France, and the U.S., or are purchased from third party vendors.

International. Our International segment includes operating entities located in Abu Dhabi, Argentina, Australia, Brazil, Chile, China, Hong Kong, India, Indonesia, Japan, Malaysia, Peru, Singapore, South Africa, and Thailand, some of which are in developing regions of the world. Principal manufacturing operations are located in Australia, Brazil, South Africa, and China. These companies develop and manufacture products that are sold primarily in each company’s home country and regional markets. The other companies in the International segment focus primarily on sales and distribution in their respective home country markets. While

19

Table of Contents

some of these companies may perform limited production, most of their sales are of products that are manufactured in our plants in the U.S., Germany, and France, or are purchased from third party vendors.

We believe that our financial performance in recent years is the result of initiatives that have allowed us to anticipate and respond quickly to market requirements, particularly in the North American fire service, homeland security, construction and industrial markets, as well as the military, and reflects our ability to quickly bring to market products that comply with changing industry standards and to create new market demand with innovative products.

ACQUISITIONS

In December 2007, we acquired TecBOS GmbH of Halstenbek, Germany. TecBOS is a leading developer of software solutions for the fire service and other emergency planning organizations. We believe that this acquisition will strengthen our presence in the European fire service and emergency responder market by adding complementary software solutions used for on-site management and reporting of major incidents such as fires, traffic accidents, industrial plant emergencies and public events.

In March 2007, we acquired Acceleron Technologies, LLC, a San Francisco-based developer of advanced technology suitable for personal locator devices. Acceleron has key patents and know-how in the area of compensated inertial navigation sensing as applied to personnel tracking. We believe that this technology is particularly well-suited for personal locator applications inside buildings where GPS is denied. The patented technology and know-how significantly increases data accuracy and minimizes the drift that can occur in conventional systems. We believe that the acquisition of this technology expedites the development of much needed and more reliable systems for use in first responder and soldier location applications.

In March 2007, we acquired the outstanding shares of MSA (India) Limited that were previously held by our joint venture partner. As a wholly-owned subsidiary under MSA management, we believe that we are better positioned to take advantage of opportunities in the large and growing Indian market.

In September 2006, we acquired Paraclete Armor and Equipment, Inc. of St. Pauls, North Carolina. Paraclete is an innovator and developer of advanced ballistic body armor used by military personnel, including Special Forces units of the U.S. military. We believe that the acquisition of Paraclete strategically positions us to provide a broad range of ballistic protective equipment to both the military and law enforcement markets.

In January 2006, we took steps to ensure our compliance with South African Black Economic Empowerment (BEE) requirements by forming a new South African holding company in which Mineworkers Investment Company of Johannesburg, South Africa holds a 25.1% ownership interest. Compliance with BEE, a South African government program similar to Affirmative Action in the United States, is key to achieving meaningful growth in South Africa, particularly in the mining industry. At the same time, we acquired Select Personal Protective Equipment (Select PPE) of South Africa, an established supplier of multi-brand safety equipment and solutions to the South African mining industry. Our existing South African company, MSA Africa, and Select PPE are operating independently under the newly-established South African holding company. We believe that our new South African operating structure significantly improves our market presence and expertise in serving the mining industry and provides significant growth opportunities in the region.

In September 2005, we acquired Microsensor Systems, Inc. of Bowling Green, Kentucky. Microsensor Systems is a world leader in surface acoustic wave-based chemical sensing technology used to detect chemical warfare agents. We believe the acquisition of Microsensor Systems significantly strengthens our position as a premier provider of leading edge detection technology, while expanding our product offerings in the homeland security, emergency responder, law enforcement, military and industrial markets.

20

Table of Contents

RESULTS OF OPERATIONS

Year Ended December 31, 2007 Compared to Year Ended December 31, 2006

Net sales.Net sales for the year ended December 31, 2007 were $990.3 million, an increase of $76.6 million, or 8%, from $913.7 million for the year ended December 31, 2006.

| 2007 | 2006 | Dollar Increase | Percent Increase | |||||||||

| (In millions) | ||||||||||||

North America | $ | 515.1 | $ | 503.4 | $ | 11.7 | 2 | % | ||||

Europe | 238.3 | 219.2 | 19.1 | 9 | ||||||||

International | 236.8 | 191.1 | 45.7 | 24 | ||||||||

Net sales of our North American segment were $515.1 million for the year ended December 31, 2007, an increase of $11.7 million, or 2%, compared to $503.4 million for the year ended December 31, 2006. North American sales of ballistic vests, including those made by Paraclete, improved $7.1 million in 2007. Shipments of Advanced Combat Helmets and gas masks to the military were up $6.8 million and $6.1 million, respectively. Our sales of fall protection and head protection improved approximately $4.3 million and $6.5 million, respectively, on increased demand in construction and industrial markets. These sales improvements were partially offset by a $4.5 million decrease in instrument shipments, primarily due to lower sales of the SAFESITE monitoring system for the homeland security market, and a $15.7 million decrease in SCBA shipments, primarily due to lower demand from the U.S. fire service market as customers waited for the implementation of the new NFPA standards that all manufacturers had to meet by August 31, 2007. In early September, our next-generation breathing apparatus for firefighters, the FireHawk® M7 Air Mask, was the first device to be certified by the Safety Equipment Institute as compliant to both the new NFPA standards covering breathing apparatus performance and Personal Alert Systems (PASS) performance.

Net sales by European operations were $238.3 million for the year ended December 31, 2007, an increase of $19.1 million, or 9%, from $219.2 million for the year ended December 31, 2006. The increase in European sales, when stated in U.S. dollars, includes favorable currency translation effects of $20.7 million, primarily due to a stronger euro in the current year. Local currency sales in Europe for the year ended December 31, 2007 were $1.6 million lower than in the prior year, primarily due to lower fourth quarter shipments in Eastern Europe. In 2006, European segment sales benefited from $8.8 million in shipments of chemical suits to the Slovakian Army and strong shipments of gas masks and self-rescuer canisters to the German Army. The absence of similar orders in 2007 was largely offset by sales improvements in most Western European markets.

Net sales by International operations were $236.8 million for the year ended December 31, 2007, an increase of $45.7 million, or 24%, compared to $191.1 million for the year ended December 31, 2006. The increase reflects local currency sales growth in nearly all International segment markets. In South Africa, local currency sales were up $11.4 million, primarily due to growth in business with the mining industry. Local currency sales in China were up $5.9 million, including a large shipment of breathing apparatus to the Beijing Fire Bureau. Local currency sales in Latin America improved $8.5 million, with strong growth in all markets. The International segment sales increase includes a $4.8 million shipment of ballistic vests to the Iraq Joint Contracting Command. The increase in International segment sales, when stated in U.S. dollars, includes favorable currency translation effects of $7.5 million, primarily due to a stronger Australian dollar and Brazilian real, partially offset by a weaker South African rand.

Cost of products sold. Cost of products sold was $616.2 million for the year ended December 31, 2007, an increase of $47.8 million, or 8%, from $568.4 million for the year ended December 31, 2006.

Cost of products sold and operating expenses include net periodic pension benefit costs and credits. Pension credits, combined with pension costs, resulted in net pension credits for the year ended December 31, 2007 of $4.5 million, of which credits of approximately $5.4 million and $0.8 million were included in cost of products sold and research and development expenses, respectively, and charges of $1.7 million in selling, general and

21

Table of Contents

administrative expenses. Excluding $4.8 million in special termination benefits, which were reported in restructuring and other charges, net pension credits for the year ended December 31, 2006 were $4.1 million, of which credits of approximately $4.6 million and $0.7 million were included in cost of products sold and research and development expenses, respectively, and charges of $1.2 million in selling, general and administrative expenses. The recognition of pension income in the years ended December 31, 2007 and 2006 is primarily the result of the exceptional investment performance of the MSA Non-Contributory Pension Plan for the Employees, or the MSA Pension Plan, over the past ten years. During that period, the investment performance of the MSA Pension Plan has ranked among the top 5% of all U.S. pension funds according to a comparison of fund performance as computed by Yanni Partners, an independent investment consulting firm. Future net pension credits can be volatile depending on the future performance of plan assets, changes in actuarial assumptions regarding such factors as the selection of discount rates and rates of return on plan assets, changes in the amortization levels of actuarial gains and losses, plan amendments affecting benefit pay-out levels, and profile changes in the participant populations being valued. Changes in any of these factors could cause net pension credits to change. To the extent net pension credits decline in the future, our net income would be adversely affected.

Gross profit. Gross profit for the year ended December 31, 2007 was $374.0 million, an increase of $28.7 million, or 8%, from $345.3 million for the year ended December 31, 2006. The ratio of gross profit to sales was steady at 37.8% in both 2007 and 2006.

Selling, general and administrative expenses. Selling, general and administrative expenses for the year ended December 31, 2007 were $241.1 million, an increase of $25.4 million, or 12%, from $215.7 million for the year ended December 31, 2006. Selling, general and administrative expenses were 24.4% of sales in 2007 compared to 23.6% of sales in 2006. Local currency selling, general and administrative expenses in the European and International segments were up $2.5 million and $9.9 million, respectively. These increases reflect our ongoing efforts to increase sales in European markets, as well as our continued expansion in China, Southeast Asia, and South Africa. North American segment selling, general and administrative expenses increased $3.8 million, including an increase of $2.4 million in insurance and product liability expense, which was based on the results of our annual actuarial study. Currency exchange effects increased selling, general and administrative expenses, when stated in U.S. dollars, by $7.5 million, primarily due to a stronger euro.

Research and development expenses. Research and development expenses were $30.2 million for the year ended December 31, 2007, an increase of $4.2 million, or 16%, from $26.0 million for the year ended December 31, 2006. Research and development expenses were up $3.3 million in North America, reflecting our continued focus on developing innovative new products. The remainder of the increase occurred in the European segment and was primarily related to the translation effects of a stronger euro.

Depreciation and amortization expense. Depreciation and amortization expense, which is reported in cost of sales, selling, general and administrative expenses, and research and development expenses, was $24.4 million for the year ended December 31, 2007, an increase of $2.3 million, or 10%, from $22.1 million for the year ended December 31, 2006. Amortization of intangible assets increased $0.9 million in the current year. Currency exchange effects increased depreciation and amortization expense, when stated in U.S. dollars, by $0.6 million, primarily due to a stronger euro.

Restructuring and other charges. Restructuring and other charges were $4.1 million for the year ended December 31, 2007, compared to $7.0 million for the year ended December 31, 2006.

For the year ended December 31, 2007, these charges were primarily related to reorganization activities. North American segment charges of $2.5 million were primarily severance costs and moving expenses associated with our Project Magellan initiative to move fire helmet manufacturing from Clifton, New Jersey to Jacksonville,

22

Table of Contents

North Carolina and to move our Mexican manufacturing operations to a new factory in Queretaro, Mexico. The Clifton plant, which employed about 60 associates, was closed during the fourth quarter of 2007. We expect to complete the move to the new factory in Mexico during 2008. European segment charges of $1.1 million were primarily severance costs associated with the reorganization of our management team. International segment charges of $0.5 million relate to severance costs associated with the workforce reductions in Brazil and Australia.

Charges during the year ended December 31, 2006 were primarily related to the North American segment Project Outlook reorganization plan that was completed that year. A significant portion of the charges were for a focused voluntary retirement incentive program (VRIP). In 2006 approximately 60 associates retired under the terms of the VRIP. Project Outlook charges for the year ended December 31, 2006, included $5.3 million for VRIP retirees, primarily non-cash special termination benefits, $0.7 million in severance costs related to other staff reductions, and $0.5 million to relocate various employee work groups within the new organizational structure. The remaining $0.5 million of charges in 2006 were for severance costs related to discontinuing manufacturing operations in Britain.

Interest expense.Interest expense for the year ended December 31, 2007 was $9.9 million, an increase of $3.7 million, or 59%, from $6.2 million for the year ended December 31, 2006. The increase was primarily due to higher short-term debt during the current year.