Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

| (Mark One) | |

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006 |

OR |

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number 001-32047

MINES MANAGEMENT, INC.

(Exact Name of Registrant as Specified in its Charter)

Idaho

(State of Incorporation or Organization) | | 91-0538859

(I.R.S. Employer Identification No.) |

|

|

|

905 W. Riverside Avenue, Suite 311

Spokane, Washington

(Address of principal executive office) | | 99201

(Zip Code) |

(509) 838-6050

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

| | Name of each exchange on which registered

|

|---|

| Common Stock, $0.001 par value | | American Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

Large Accelerated Filer o Accelerated Filer ý Non-accelerated Filer o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2006, was approximately $95,086,056, based on the closing price of the Common Stock on the American Stock Exchange of $7.40 per share. The number of shares of our common stock outstanding as of March 20, 2007 was 12.899,467.

TABLE OF CONTENTS

i

EXPLANATORY NOTE

This amendment on Form 10-K/A is being filed in order to amend Mines Management, Inc.'s Annual Report on Form 10-K for the fiscal year ended December 31, 2006, as originally filed with the Securities and Exchange Commission (the "Commission") on March 12, 2007, to (i) correct the par value of our common stock; (ii) provide updated information in Items 1 and 2 and revisions to our risk factors in Item 1A with respect to our Montanore Project; (iii) revise Item 7 to reflect immaterial changes to the expenses allocated to the Montanore Project, (iv) include the information required by Items 10, 11, 12, 13 and 14 of Part III of the Annual Report on Form 10-K in lieu of incorporation by reference to MMI's proxy statement for the 2007 annual meeting of shareholders and (iv) to make certain other immaterial revisions and corrections.

FORWARD LOOKING STATEMENTS

Some information contained in or incorporated by reference into this report may contain forward looking statements as defined in the Private Securities Litigation Reform Act of 1995. These statements include comments regarding further exploration and evaluation of the Montanore Project, including planned rehabilitation and extension of the Libby adit, drilling activities, feasibility determination, engineering studies, environmental and permitting requirements, process and timing, and estimates of mineralized material and measured, indicated and inferred resources; financing needs; the markets for silver and copper and planned expenditures in 2007 and 2008; and potential completion of a bankable feasibility study. The use of any of the words "development," "anticipate," "continues," "estimate," "expect," "may," "project," "should," "believe," and similar expressions are intended to identify uncertainties. We believe the expectations reflected in those forward looking statements are reasonable. However, we cannot assure that the expectations will prove to be correct. Actual results could differ materially from those anticipated in these forward looking statements as a result of the factors set forth below and other factors set forth and incorporated by reference into this report:

- •

- Worldwide economic and political events affecting the supply of and demand for silver and copper

- •

- Volatility in the market price for silver and copper

- •

- Financial market conditions and the availability of financing on acceptable terms or on any terms

- •

- Uncertainty regarding whether reserves or feasibility will be established at Montanore

- •

- Uncertainties associated with developing new mines

- •

- Variations in ore grade and other characteristics affecting mining, crushing, milling and smelting and mineral recoveries

- •

- Geological, technical, permitting, mining and processing problems

- •

- The availability, terms, conditions and timing of required governmental permits and approvals

- •

- Uncertainty regarding future changes in applicable law or implementation of existing law

- •

- The availability of experienced employees

- •

- The factors discussed under "Risk Factors" in this Annual Report on Form 10-K/A for the period ending December 31, 2006.

2

GLOSSARY OF TERMS

We report our reserves to two separate standards to meet the requirements for reporting in both the United States ("U.S.") and Canada. U.S. reporting requirements for disclosure of mineral properties are governed by Securities and Exchange Commission Industry Guide 7. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 ("NI 43-101"). The definitions given in NI 43-101 are adopted from those given by the Canadian Institute of Mining Metallurgy and Petroleum.

The definitions for each reporting standard are presented below with supplementary explanation and descriptions of the parallels and differences.

| Mineralized material(1) | | The term "mineralized material" refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. |

- (1)

- This category is substantially equivalent to the combined categories of measured and indicated mineral resources specified in NI 43-101.

| Non-reserves | | The term "non-reserves" refers to mineralized material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. |

Exploration stage |

|

An "exploration stage" prospect is one which is not in either the development or production stage. |

Development stage |

|

A "development stage" project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study. |

Production stage |

|

A "production stage" project is one actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. |

NI 43-101 Definitions |

|

|

Mineral resource |

|

The term "mineral resource" refers to a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| | | |

3

Measured mineral resource |

|

The term "measured mineral resource" refers to that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

Indicated mineral resource |

|

The term "indicated mineral resource" refers to that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

Inferred mineral resource |

|

The term "inferred mineral resource" refers to that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

Qualified person(2) |

|

The term "qualified person" refers to an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development, production activities and project assessment, or any combination thereof, including experience relevant to the subject matter of the project or report and is a member in good standing of a self-regulating organization. |

- (2)

- Industry Guide 7 does not require designation of a qualified person.

| Additional Definitions | | |

Adit |

|

A horizontal tunnel or drive, open to the surface at one end, which is used as an entrance to a mine. |

Axis |

|

Intersection of the axial plane of a fold with a particular bed; axial line. |

Bornite |

|

An isometric mineral, 1[Cu5 FeS4]; metallic; brownish bronze tarnishing to iridescent blue and purple; brittle; massive; in hypogene and contact metamorphic deposits and mafic rocks; a valuable source of copper. |

Breccia |

|

Rock consisting of angular fragments of other rocks held together by mineral cement or a fine-grained matrix. |

| | | |

4

Chalcocite |

|

A monoclinic mineral, 96[Cu2 S]; pseudohexagonal, metallic gray-black with blue to green tarnish; sp gr, 5.5 to 5.8; a secondary vein mineral; an important source of copper. |

Chalcopyrite |

|

A tetragonal mineral, CuFeS2; brass-yellow with bluish tarnish; massive; softer than pyrite; occurs in late magmatic hydrothermal veins and secondary enrichment zones; the most important source of copper. |

Covellite |

|

A hexagonal mineral, CuS; metallic indigo blue with iridescent tarnish; soft; a supergene mineral in copper deposits; a source of copper. |

Development |

|

Work carried out for the purpose of opening up a mineral deposit and making the actual ore extraction possible. |

Digenite |

|

An isometric mineral, Cu9 S5; blue to black; in veins with chalcocite; a source of copper |

Dip |

|

The angle at which a vein, structure or rock bed is inclined from the horizontal as measured at right angles to the strike. A vein is a mineralized zone having a more or less regular development in length, width and depth, which clearly separates it from neighboring rock. A strike is the direction or bearing from true north of a vein or rock formation measured on a horizontal surface. |

Drift |

|

A horizontal underground opening that follows along the length of a vein or rock formation as opposed to a cross-cut which crosses the rock formation. |

Enechelon |

|

Pattern of off-set mineralized strata similar to stair steps. |

Exploration |

|

Work involved in searching for ore, usually by drilling or driving a drift. |

Facia |

|

Transition zone between rock types. |

Galena |

|

A sulphide mineral of lead, being a common lead ore mineral. |

Gersdorffite |

|

An isometric mineral, NiAsS; cobaltite group; massive; sp gr, 5.9 to 6.0; a source of nickel. |

Grade |

|

The average assay of a ton of ore, reflecting metal content. |

Horizon |

|

In geology, any given definite position or interval in the stratigraphic column or the scheme of stratigraphic classification; generally used in a relative sense. |

Host rock |

|

The rock surrounding an ore deposit. |

Interbed |

|

Occurring between distinct rock layers or strata. |

Lensoid(al) |

|

Flat lenses of mineralized material between layers of host rock. |

Limestone |

|

A bedded, sedimentary deposit consisting chiefly of calcium carbonate. |

Lithology |

|

The physical characteristic of a rock. |

Metasediment |

|

A sedimentary rock which shows evidence of having been subjected to metamorphism. |

| | | |

5

Mineral |

|

A naturally occurring homogeneous substance having definite physical properties and chemical composition and, if formed under favorable conditions, a definite crystal form. |

Mineralization |

|

The presence of economic minerals in a specific area or geological formation. |

Molybdenite |

|

A hexagonal and trigonal mineral, MoS2; polymorphous with jordisite; foliated; soft; metallic lead gray; an accessory in granites and deep veins; an ore of molybdenum. |

Ore |

|

Material that can be mined and processed at a positive cash flow. |

Patented mining claim |

|

A patented mining claim is one for which the federal government has passed its title to the claimant, making it private land. A person may mine and remove minerals from a mining claim without a mineral patent. However, a mineral patent gives the owner exclusive title to the locatable minerals. It also gives the owner title to the surface and other resources. |

Precambrian |

|

All geologic time before the Paleozoic era. |

Prospect |

|

A mining property, the value of which has not been determined by exploration. |

Quartzite |

|

A metamorphic rock formed by the transformation of a sandstone rock by heat and pressure. |

Reclamation |

|

The restoration of a site after mining or exploration activity is completed. |

Recovery |

|

The percentage of valuable metal in the ore that is recovered by metallurgical treatment. |

Shear or shearing |

|

The deformation of rocks by lateral movement along numerous parallel planes, generally resulting from pressure and producing such metamorphic structures as cleavage and schistosity. |

Siltite |

|

An indurated silt having the texture and composition of shale but lacking its fine lamination or fissility; a massive mudstone in which the silt predominates over clay; a nonfissile silt shale. It tends to be flaggy, containing hard, durable, generally thin layers, and often showing various primary current structures. |

Sphalerite |

|

Zinc sulfide based mineral. |

Stratabound |

|

A situation in which mineralization is essentially contained in or confined to a particular sedimentary or volcanic unit. |

Stratigraphy |

|

The branch of geology which studies the formation, composition, sequence and correlation of the stratified rock as parts of the earth's crust. |

Strike |

|

The direction, or bearing from true north, of a vein or rock formation measured on a horizontal surface. |

Sulfide |

|

A compound of bivalent sulfur with an electropositive element or group, especially a binary compound of sulfur with a metal. |

| | | |

6

Tailings |

|

Material rejected from a mill after more of the recoverable valuable minerals have been extracted. |

Tetrahedrite |

|

An isometric mineral, (Cu,Fe)12 Sb4 S13, having copper replaced by zinc, lead, mercury, cobalt, nickel, or silver; forms a series with tennantite and freibergite; metallic; crystallizes in tetrahedra; occurs in hydrothermal veins and contact metamorphic deposits; a source of copper and other metals. |

Trend |

|

The direction, in the horizontal plane, or a linear geological feature (for example, an ore zone), measured from true north. |

Unpatented mining claim |

|

A parcel of property located on federal lands pursuant to the General Mining Law of 1872 and the requirements of the state in which the unpatented claim is located, the paramount title of which remains with the federal government. The holder of a valid, unpatented lode-mining claim is granted certain rights including the right to explore and mine such claim under the U.S. General Mining Law. |

Vein |

|

A mineralized zone having a more or less regular development in length, width and depth, which clearly separates it from neighboring rock. |

7

PART I

ITEM 1. BUSINESS

General

Mines Management, Inc. (together with its subsidiaries, "MMI," "Mines Management," the "Company" or "we"), is engaged in the business of acquiring and exploring, and if exploration is successful, developing mineral properties, primarily those containing silver and associated base and precious metals. The Company was incorporated under the laws of the State of Idaho on February 20, 1947. The Company's executive offices are located at 905 W. Riverside, Suite 311, Spokane, Washington 99201.

The Company's principal mineral property interest, the Montanore Project, is held by its wholly owned subsidiary, Newhi, Inc. The Company's properties, including the Montanore property, are currently in the exploration stage. The Company has commenced re-permitting of the Montanore Project and is determining its feasibility for development. No property is currently in production.

The Montanore Project is located in northwestern Montana, and from 1988 to 2002 was owned by Noranda Minerals Corporation. During that time the project received an approved environmental impact statement and all of its primary environmental permits. From 1988 to 2002 the Company held royalty rights to a portion of the deposit. In 2002 Noranda announced that it was abandoning the project, and subsequently transferred to the Company by quitclaim deed the patented and unpatented mining claims that control the mineral rights, and all drill core and intellectual property including geologic, environmental and engineering studies.

In May 2006, we acquired two Noranda subsidiaries that held title to the property providing access to the 14,000 foot Libby adit and related permits. We have obtained permit revisions that allowed us to reopen the Libby adit and to dewater and rehabilitate the adit. The Libby adit, when extended, will provide access to the Montanore deposit for our planned underground evaluation drilling program. We reopened the Libby adit in June 2006 and water samples and testing were completed in July 2006.

In November 2006, we received another permit revision which would allow us to proceed with our planned $40 million underground evaluation drilling program at the Montanore Project. This advanced exploration and delineation drilling program as currently planned includes the following:

- •

- Development and advancement of the Libby adit by 3,000 feet to access the deposit.

- •

- Drifting of approximately 10,000 feet and establishment of drill stations.

- •

- Diamond core drilling of approximately 45,000 feet among approximately 50 holes.

Results of the drill program, if successful, are expected to provide data to assist in completion of a bankable feasibility study and further optimization of the mine plan.

Also in the fourth quarter 2006, we purchased a site generator and erected a warehouse building at the Libby adit site, along with an office and employee change facility. We established a $1.124 million stand-by letter of credit in early January 2007 to satisfy reclamation bonding requirements related to our planned exploration at the Libby adit. Currently we are engaged in staffing, equipment acquisition, and pilot water treatment testing for the drilling program.

Our focus for 2007 is the commencement of our planned underground evaluation drilling program, the update of the Montanore environmental and engineering studies focused on determining an economically viable operational design, and the re-establishment of previously issued environmental and mining permits.

The Company continues to hold its Iroquois and Advance zinc-lead properties in Washington on a care and maintenance basis and plans to evaluate these properties in light of the current base metals

8

market in the first half of 2007. The Company also has a small income from a working interest royalty, acquired more than 40 years ago, in several producing oil wells located in Kansas.

Competition

There is aggressive competition within the minerals industry to discover and acquire properties considered to have commercial potential. When we wish to acquire an exploration project, we typically compete with other entities, many of which have greater resources than we do. In addition, we compete with others in efforts to obtain financing to explore and develop mineral properties.

Employees

As of March 20, 2007, the Company had seven employees located in Spokane, Washington and six employees in Libby, Montana. Outside consultants are engaged to perform project and permitting tasks involved in re-permitting the Montanore Project. The Company expects to continue to rely on the use of outside services in the immediate future.

Regulation

The Company's activities in the United States are subject to various federal, state, and local laws and regulations governing exploration, labor standards, occupational health and mine safety, control of toxic substances, and other matters involving environmental protection and taxation. In addition, it is possible that future changes in these laws or regulations could have a significant impact on the Company's business, causing those activities to be economically reevaluated at that time.

ITEM 1A. RISK FACTORS

Our business, operations, and financial condition are subject to various risks. We urge you to consider the following risk factors in addition to the other information contained in, or incorporated by reference into, this Annual Report on Form 10-K.

We have no history recent of production.

We have no recent history of producing silver or other metals. The development of our Montanore Project would require the construction and operation of mines, processing plants, and related infrastructure. As a result, we would be subject to all of the risks associated with establishing a new mining operation and business enterprise. We may never successfully establish mining operations, and any operations may not achieve profitability.

We have a history of losses and we expect losses to continue for at least the next three years.

As an exploration company that has no production history, we have incurred losses since our inception and we expect to continue to incur additional losses for at least the next three years. As of December 31, 2006, we had an accumulated deficit of $15.8 million. There can be no assurance that we will achieve or sustain profitability in the future.

We have no proven or probable reserves.

We have no proven or probable reserves on any of our properties. We are currently focused on our Montanore Project. Substantial additional work, including delineation drilling, will be required in order to determine if any proven or probable reserves exist on our Montanore Project. The commercial viability of a mineral deposit once discovered is dependent on a number of factors beyond our control, including particular attributes of the deposit such as size, grade and proximity to infrastructure, as well as metal prices.

9

Estimates of reserves, mineralized material, resources, and capital and production costs can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. Material changes in ore reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project. Even if commercial quantities of minerals are discovered, the Montanore Project may not be brought into commercial production.

The exploration of mineral properties is highly speculative in nature, involves substantial expenditures and is frequently non-productive.

Mineral exploration is highly speculative in nature and is frequently non-productive. Substantial expenditures are required to:

- •

- establish ore reserves through drilling and metallurgical and other testing techniques;

- •

- determine metal content and metallurgical recovery processes to extract metal from the ore; and

- •

- design mining and processing facilities.

If we discover ore at the Montanore Project, we expect that it would be several additional years from the initial phases of exploration until production is possible. During this time, the economic feasibility of production could change. As a result of these uncertainties, there can be no assurance that our exploration programs will result in new proven and probable reserves in sufficient quantities to justify commercial operations at the Montanore Project.

We may not be able to obtain permits required for development of the Montanore Project.

In the ordinary course of business, mining companies are required to seek governmental permits for expansion of existing operations or for the commencement of new operations. We will be required to obtain numerous permits for our Montanore Project. Obtaining the necessary governmental permits is a complex and time-consuming process involving numerous jurisdictions and often involving public hearings and costly undertakings. Obtaining required permits for the Montanore Project may be more difficult due to its location within the Cabinet Wilderness Area, its proximity to core habitat of certain protected species, including the grizzly bear, bull trout and lynx and the efforts of a third party to permit a mining operation near the Montanore Project.

In addition, mining projects require the evaluation of environmental impacts for air, water, vegetation, wildlife, cultural, historical, geological, geotechnical, geochemical, soil and socioeconomic conditions. An Environmental Impact Statement would be required before we could commence mine development or mining activities. Baseline environmental conditions are the basis on which direct and indirect impacts of the Project are evaluated and based on which potential mitigation measures would be proposed. If the Montanore Project were found to significantly adversely impact the baseline conditions, we could incur significant additional costs to avoid or mitigate the adverse impact and delays in the Montanore Project could result.

In addition, permits would also be required for, among other things, storm-water discharge; air quality; wetland disturbance; dam safety (for water storage and/or tailing storage); septic and sewage and water rights appropriation. In addition, compliance must be demonstrated with the Endangered Species Act and the National Historical Preservation Act.

The duration and success of our efforts to re-permit are contingent upon many variables not within our control. There can be no assurance that we will obtain all necessary permits will be obtained and, if obtained, that the permitting costs involved will not exceed those that had been previously estimated. It is possible that the costs and delays associated with the compliance with such standards and regulations could become such that we would not proceed with the further exploration, development or operation of a mine or mines at the Montanore Project.

10

Even if our exploration efforts at Montanore are successful, we may not be able to raise the funds necessary to develop the Montanore Project.

If our exploration efforts at Montanore are successful, our current estimates indicate that we would be required to raise approximately $415 million in external financing to develop and construct the Montanore Project. Sources of external financing could include bank borrowings and debt and equity offerings. The failure to obtain financing would have a material adverse effect on our growth strategy and our results of operations and financial condition. There can be no assurance that we will commence production at Montanore or generate sufficient revenues to meet our obligations as they become due or obtain necessary financing on acceptable terms, if at all, and we may not be able to secure the financing necessary to begin or sustain production at the Montanore Project. In addition, should we incur significant losses in future periods, we may be unable to continue as a going concern, and realization of assets and settlement of liabilities in other than the normal course of business may be at amounts significantly different than those included in this prospectus supplement.

The mining industry is intensely competitive.

The mining industry is intensely competitive. We may be at a competitive disadvantage because we must compete with other individuals and companies, many of which have greater financial resources, operational experience and technical capabilities than we do. Increased competition could adversely affect our ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future. We may also encounter increasing competition from other mining companies in our efforts to hire experienced mining professionals. Competition for exploration resources at all levels is currently intense, particularly affecting the availability of manpower and exploration equipment.

Our future success is subject to risks inherent in the mining industry.

Our future mining operations, if any, would be subject to all of the hazards and risks normally incident to developing and operating mining properties. These risks include insufficient ore reserves, fluctuations in metal prices and increases in production costs that may make mining of reserves uneconomic; significant environmental and other regulatory restrictions; labor disputes; geological problems; failure of underground stopes and/or surface dams; force majeure events; and the risk of injury to persons, property or the environment.

Our future profitability will be affected by changes in the prices of metals.

If we establish reserves, complete a favorable feasibility study for the Montanore Project, and complete development of a mine, our profitability and long-term viability will depend, in large part, on the market price of silver and copper. The market prices for these metals are volatile and are affected by numerous factors beyond our control, including:

- •

- global or regional consumption patterns;

- •

- supply of, and demand for, silver and copper;

- •

- speculative activities;

- •

- expectations for inflation; and

- •

- political and economic conditions.

The aggregate effect of these factors on metals prices is impossible for us to predict. Decreases in metals prices have delayed, and could in the future adversely affect our ability to finance, the exploration and development of our properties, which would have a material adverse effect on our financial condition and results of operations and cash flows. There can be no assurance that metals

11

prices will not decline. During the five-year period ended December 31, 2006, the high and low settlement prices for silver and copper were $14.94 and $4.07 per ounce and $4.08 and $0.68 per pound, respectively.

We have ongoing reclamation obligations on the Montanore Project properties.

Although we have posted bonds with the State of Montana to cover expected future mine reclamation costs, there is no guarantee that the amount of these bonds will satisfy the environmental regulations and requirements. Should government regulators determine that additional reclamation work is required, we may be required to fund this work, which could have a material adverse effect on our financial position.

We are subject to significant governmental regulations.

Our operations and exploration and development activities are subject to extensive federal, state, and local laws and regulations governing various matters, including:

- •

- environmental protection;

- •

- management and use of toxic substances and explosives;

- •

- management of natural resources;

- •

- exploration and development of mines, production and post-closure reclamation;

- •

- taxation;

- •

- labor standards and occupational health and safety, including mine safety; and

- •

- historic and cultural preservation.

Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining or curtailing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in us incurring significant expenditures. We may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations, or a more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of any future operations and delays in the exploration of our properties.

Changes in mining or environmental laws could increase costs and impair our ability to develop our properties.

From time to time the U.S. Congress may consider revisions in its mining and environmental laws. It remains unclear to what extent new legislation may affect existing mining claims or operations. The effect of any such revisions on our operations cannot be determined conclusively until such revision is enacted; however, such legislation could materially increase costs on properties located on federal lands, such as ours, and such revision could also impair our ability to develop the Montanore Project and other mineral projects.

We are subject to environmental risks.

Mineral exploration and mining is subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Insurance against environmental risk (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) is not

12

generally available to us (or to other companies in the minerals industry) at a reasonable price. To the extent that we become subject to environmental liabilities, the satisfaction of those liabilities would reduce funds otherwise available to us and could have a material adverse effect on us. Laws and regulations intended to ensure the protection of the environment are constantly changing, and are generally becoming more restrictive.

The title to some of our properties may be uncertain or defective.

Although the Montanore deposit is held by patented mining claims, a significant portion of our holdings consist of unpatented lode and millsite claims. Certain of our United States mineral rights consist of "unpatented" mining and millsite claims created and maintained in accordance with the U.S. General Mining Law of 1872. Unpatented mining and millsite claims are unique U.S. property interests, and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining and millsite claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations that supplement the General Mining Law. Also, unpatented mining and millsite claims and related rights, including rights to use the surface, are subject to possible challenges by third parties or contests by the federal government. The validity of an unpatented mining or millsite claim, in terms of both its location and its maintenance, is dependent on strict compliance with a complex body of federal and state statutory and decisional law. In addition, there are few public records that definitively control the issues of validity and ownership of unpatented mining and millsite claims. We have not filed a patent application for any of the unpatented and millsite claims that are located on federal public lands in the United States and, under possible future legislation to change the General Mining Law, patents may be difficult to obtain.

In recent years, the U.S. Congress has considered a number of proposed amendments to the General Mining Law, as well as legislation that would make comprehensive changes to the law. Although no such legislation has been adopted to date, there can be no assurance that such legislation will not be adopted in the future. If ever adopted, such legislation could, among other things, impose royalties on silver and copper production from unpatented mining and millsite claims located on federal lands or impose fees on production from patented mining and millsite claims. Further, it could have an adverse impact on earnings from our operations, could reduce estimates of any reserves we may establish and could curtail our future exploration and development activity on federal lands or patented claims.

While we have no reason to believe that title to any of our properties is in doubt, title to mining properties is subject to potential claims by third parties claiming an interest in them.

The market price of our common stock is subject to volatility and could decline significantly.

Our common stock is listed on the American Stock Exchange (AMEX) and the Toronto Stock Exchange (TSX).

Securities of small-cap companies such as ours have experienced substantial volatility in the past, often based on factors unrelated to the financial performance or prospects of the companies involved. These factors include macroeconomic developments in North America and globally and market perceptions of the attractiveness of particular industries. Our share price is also likely to be significantly affected by short-term changes in silver and copper prices or in our financial condition or results of operations as reflected in our quarterly earnings reports. Other factors unrelated to our performance that could have an effect on the price of our common stock include the following:

- •

- the extent of analytical coverage available to investors concerning our business is limited because investment banks with research capabilities do not follow our securities;

13

- •

- the trading volume and general market interest in our securities could affect an investor's ability to trade significant numbers of shares of our common stock;

- •

- the relatively small size of the public float will limit the ability of some institutions to invest in our securities; and

- •

- a substantial decline in our stock price that persists for a significant period of time could cause our securities to be delisted from the AMEX and the TSX, further reducing market liquidity.

As a result of any of these factors, the market price of our common stock at any given point in time might not accurately reflect our long-term value. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. We could in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management's attention and resources.

We do not intend to pay any cash dividends in the foreseeable future.

We have never paid dividends and any future decision as to the payment of dividends will be at the discretion of our board of directors and will depend upon our earnings, receipt of dividends from our subsidiaries, financial position, capital requirements, plans for expansion and such other factors as our board of directors deems relevant. We intend to retain our earnings, if any, to finance the growth and development of our business. Any return on an investment in our common stock will come from the appreciation, if any, in the value of our common stock. See "Description of Securities—Dividend Rights".

Our shareholders are subject to future dilution by the exercise of options and warrants, and the existence of a significant number of options and warrants can depress the price of our common stock.

As of March 26, 2007, we had 12,899,467 shares outstanding. As of that date, there were options outstanding to purchase up to 1,874,000 shares of common stock at exercise prices ranging from $1.60 to $5.01 per share and warrants outstanding to purchase 1,102,334 shares at an exercise prices ranging from $6.00 to $8.25 per share. 806,000 additional shares of common stock are available for issuance under our stock option plans. If currently outstanding options or warrants to purchase our common stock are exercised, the investments of our shareholders would be further diluted. In addition, the potential for exercise of a significant number of options and warrants can have a depressive effect on the market price for our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. DESCRIPTION OF PROPERTIES

The significant properties in which the Company has an interest are described below.

Montanore Property

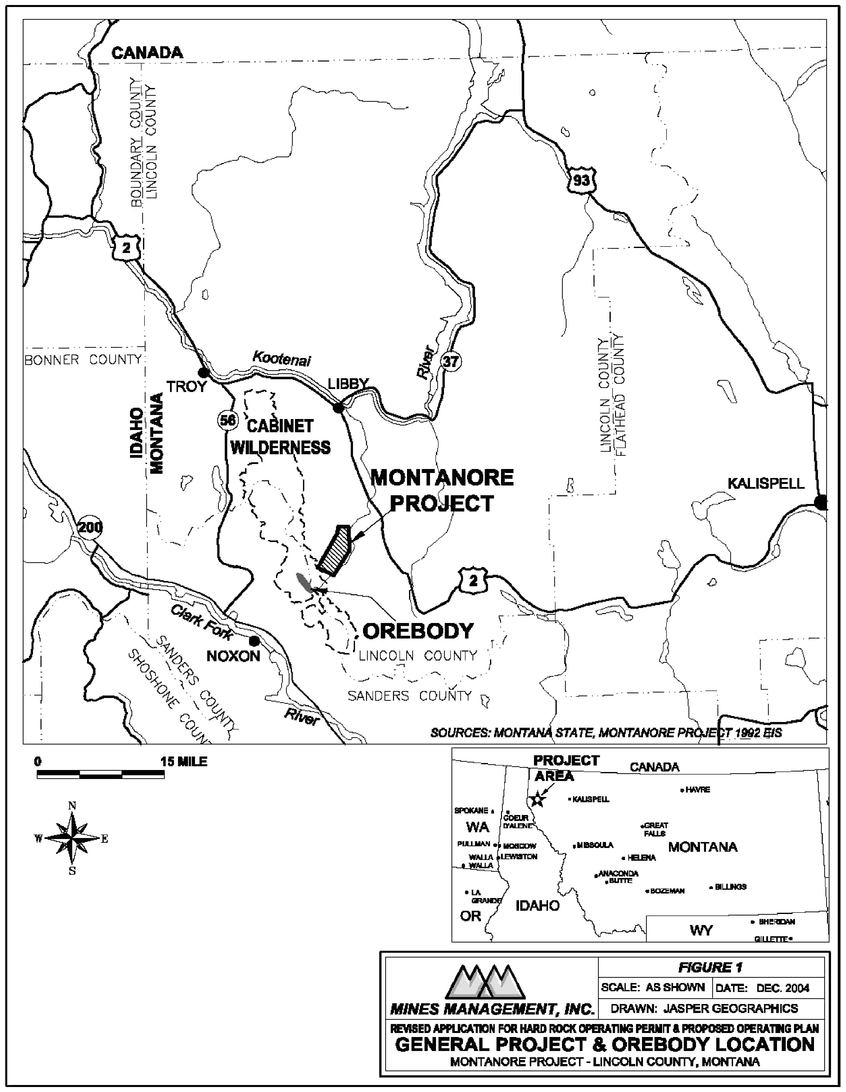

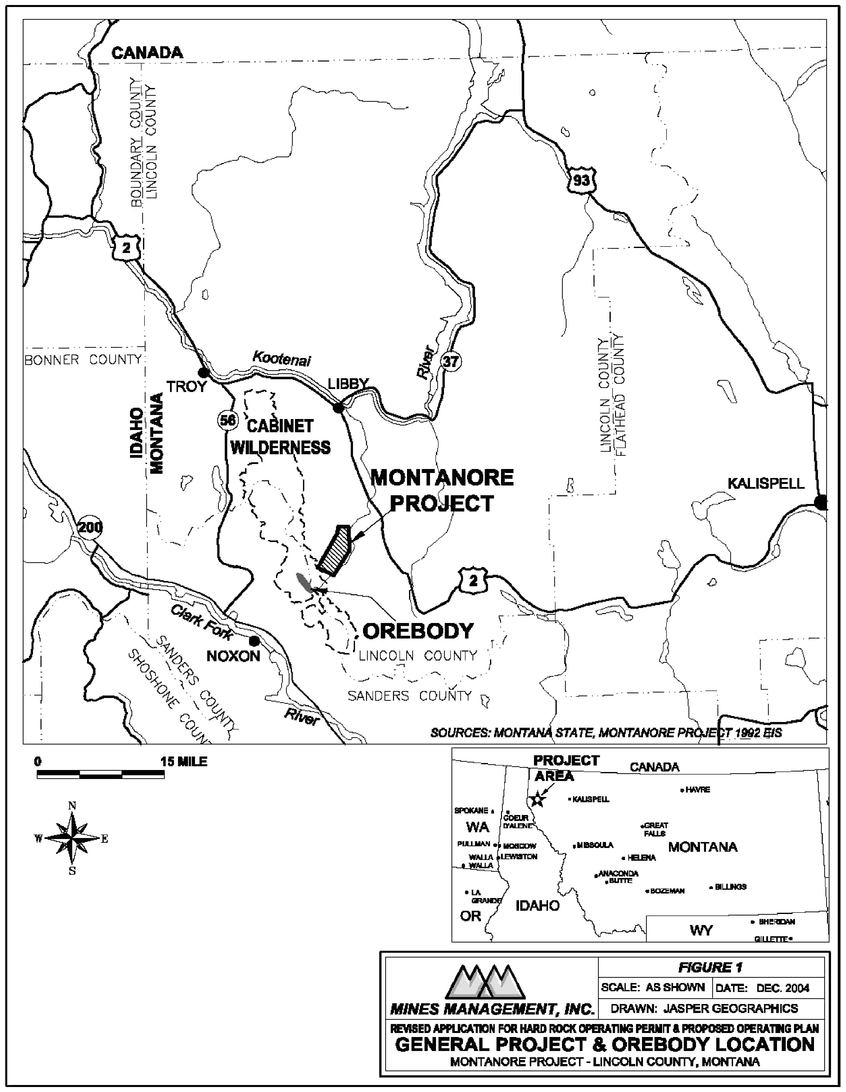

The Montanore Project is located in Sanders and Lincoln Counties in northwestern Montana and consists of two federal patented mining claims and approximately 1,064 unpatented lode mining claims and mill sites. The unpatented lode claims and mill sites are owned by the Company and are held subject to a $125 per claim annual payment to the Federal government.

The Company's ownership of the Montanore deposit stems primarily from its ownership of two patented mining claims, identified as HR 133 and HR 134, which cover the surface outcrop or "apex" of the gently dipping mineralized beds. According to U.S. mining law, the holders of claims covering

14

the apex of a dipping, tabular deposit own the minerals to depth, even if the deposit passes from beneath the apex claim. For the Company's claims at Montanore these "extralateral rights" have been confirmed by the U.S. Secretaries of Agriculture and Interior and upheld in U.S. District Court. In addition to the patented apex claims, the Company owns unpatented claims located along the fault which bounds the southwestern margin of the deposit and extends outside of the western border of the Cabinet Wilderness Area.

The Company's property holdings for operational access and infrastructure support for the Montanore Project are located to the east of the deposit, south of the town of Libby, and are accessed from Libby by about 16 miles of secondary road up Libby Creek. The apex of the deposit can be reached from Noxon, the nearest town, by taking State Highway 200 about 2 miles to the east and then north about 5 miles on a secondary graveled road to the junction of the west and east forks of Rock Creek. From this point it is about a 4-mile hike up a Jeep trail behind a locked U.S. Forest Service gate to the deposit outcrop. The deposit outcrops near the border of, and lies entirely within the Cabinet Wilderness Area. Because any future mining of the deposit would take place underground and the Company has access to the deposit from outside the Cabinet Wilderness Area, (our patented mining claims and certain other mineral rights predate the wilderness area designation), we do not believe that any future mining or associated surface activity would impact the wilderness area.

On May 31, 2006, we acquired Hard Rock Operating Permit 150 that covers certain exploration activities and the Montana Pollution Discharge Elimination System (MPDES) water discharge permit for the Montanore Project and title to properties providing access to the portal of the Libby adit. The 14,000 foot Libby adit was constructed in the early 1990s by previous operators. The adit stops approximately 2,000 feet short of the deposit. During the third quarter of 2006, the Company reopened the adit and completed initial water testing to determine the treatment method for water discharged from the adit. The necessary permit revisions were received in November 2006 to undertake a planned $40 million underground evaluation drilling program over the next two years. Also in the fourth quarter 2006, we purchased a site generator and erected a warehouse building at the Libby adit site, along with an office and employee change facility. We established a $1.124 million stand-by letter of credit in early January 2007 to satisfy reclamation bonding requirements related to our planned exploration at the Libby adit. Currently we are engaged in staffing, equipment acquisition, and pilot water treatment testing for the drilling program. Prior to this acquisition there were no plant, equipment, subsurface improvements or equipment other than the Libby adit, which was plugged and in reclamation. Power for the planned evaluation drilling program is expected to be provided by three on-site generators. The Company owns water rights associated with the Montanore property that it believes would be sufficient for possible mining activities.

Non-Reserves—Mineralized Material; Measured, Indicated and Inferred Resources

Non-Reserves Reported in the United States. The estimate of mineralized material set forth below was prepared by Mine Development Associates, referred to as MDA. The estimate was prepared in accordance with SEC Industry Guide 7.

Mineralized Material Estimate in Accordance with U.S. SEC Industry Guide 7

| |

| | Silver Grade

| |

| | Cutoff Grade

|

|---|

| | Tons

| | (Ounces per ton)

| | Copper Grade

| | (Silver ounces per ton)

|

|---|

| Mineralized Material | | 81,506,000 | | 2.04 | | 0.75 | % | 1.0 |

Non-Reserves Reported in Canada. In accordance with Canada's National Instrument 43-101, the estimate of resources at Montanore as set forth below was prepared by MDA. Steve Ristorcelli, R.P.

15

Geo., C.P.G., and David C. Fitch, C.P.G., acting on behalf of MDA, are the qualified persons under Canada's National Instrument 43-101 for this resource estimate.

Cautionary Note to U.S. Investors concerning estimates of Measured and Indicated Mineral Resources

This section uses the terms "measured mineral resources" and "indicated mineral resources." We advise U.S. investors that these terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them.U.S. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into mineral reserves.

Cautionary Note to U.S. Investors concerning estimates of Inferred Mineral Resources

This section uses the term "inferred mineral resources." We advise U.S. investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. "Inferred mineral resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. In accordance with Canadian rules, estimates of inferred mineral resources cannot form the basis of feasibility or other economic studies.U.S. investors are cautioned not to assume that part or all of the inferred mineral resource exists, or is economically or legally mineable.

Resource Estimate as presented in Accordance with Canada's National Instrument 43-101

| |

| | Silver Grade

| |

| | Cutoff Grade

|

|---|

| | Tons

| | (Ounces per ton)

| | Copper Grade

| | (Silver ounces per ton)

|

|---|

| Measured | | 4,026,000 | | 1.85 | | 0.74 | % | 1.0 |

| Indicated | | 77,480,000 | | 2.05 | | 0.75 | % | 1.0 |

| Inferred | | 35,080,000 | | 1.85 | | 0.71 | % | 1.0 |

Geology

The Montanore Project contains a strata-bound silver-copper deposit occurring in the Revett Formation, which is part of an extensive series of Precambrian-aged metasedimentary rocks belonging to the Belt Supergroup. The Revett Formation has been subdivided into three members (upper, middle and lower) based on the contained amounts of quartzite, silty quartzite and siltite. The lower Revett, which hosts the mineralized horizons, is composed primarily of quartzite with lesser interbeds of siltite and silty quartzite.

The silver-copper mineralization at Montanore is strata-bound in the upper portions of the lower Revett Formation. Copper and silver values are carried predominately in the minerals bornite, chalcocite, chalcopyrite and native silver in variable proportions and concentrations. Sulfide content of the mineralized rock rarely exceeds 3% to 4% and is commonly 1% to 2%.

The mineralized zone crops out at the surface and expends down dip at least 12,000 ft to the north-northwest. The mineralization is open ended in the down dip direction. Mineralization occurs in at least two sub-parallel horizons separated by a silver- and copper-deficient zone containing low-grade lead in the form of galena. The two horizons are identified as the B1 for the upper zone and the B for the lower and more extensive zone. Both zones dip to the northwest between 15 degrees and 30 degrees, with an average of just over 15 degrees. The width of the main (B) horizon in plan view, defined by a fault on one side and a fold axis on the other, varies from 804 feet to 3,540 feet. The

16

property boundaries, however, limit the controlled portion of the deposit to a maximum of 2,000 feet. The average thickness for each of the two horizons is 35 feet, depending upon cutoff.

History

In 2002, Noranda notified us that it was abandoning its rights to the project. Under the terms of its claim lease agreement with Newhi, Inc., Noranda was required to quitclaim to us any claims owned by Noranda that overlapped the original Heidelberg claims. As the newly patented apex claims were overlapping, Noranda deeded these claims to Newhi in August 2002. The mineral rights we acquired are subject to a $0.20 per ton royalty, and a 5% net profits royalty which would commence after the operator has recovered all of its exploration and development costs. In December 2002, Noranda transferred to us approximately 63,000 feet of drill core and all geologic, environmental, and engineering data generated during its 14 year management of the project.

The Company resubmitted its plan of operation and hard rock mine operating permit application for the Montanore project to the U.S. Forest Service and Montana Department of Environmental Quality (MDEQ) at the end of December 2004. See "—Permitting and Environmental."

We are conducting an extensive optimization review and feasibility study of the Montanore Project in order to update the potential mine plan and to determine the optimal rates of production. We have spent an estimated $5.9 million on the Montanore property since acquiring it, primarily on the re-permitting process, a pre-feasibility study, exploration and an additional $133,000 per year in property holding costs. We estimate expenditures of at least $16.0 million in 2007 in connection with the continued permitting, engineering, exploration and preparation for and commencement of the underground evaluation drilling program.

Engineering

McIntosh Engineering and Hatch Ltd. completed the Cost Update Study and generated a draft report for the project in May 2006. This report included engineering optimization, engineering review, cost updates, mine planning, and other aspects of the project. The report also provides additional optimization opportunities that should be evaluated as part of the on-going internal engineering work currently underway.

As part of the mine planning effort, we assembled all of the geologic information developed by Noranda and U.S. Borax for the project and incorporated the information into the Vulcan mine modeling package. This 3-dimensional geologic model is a critical first step in further evaluating mine planning activities and projection of ore zones. This information was also used to develop the underground drilling targets for the evaluation drilling program, described below.

Advanced Exploration and Delineation Drilling Program

In 2006, we acquired the property providing access to the 14,000 foot Libby adit. With additional development, the Libby adit will provide access to the Montanore deposit. We also acquired two permits related to the Libby adit that, with minor revisions, allow us to reopen, dewater and rehabilitate the adit.

In 2007, we plan to commence a two-year, advanced exploration and delineation drilling program at Montanore. We expect to dewater and rehabilitate the Libby adit, and then advance the adit approximately 3,000 feet towards the middle of the deposit. An additional 10,000 feet of development drifting will be necessary to provide drill access. Once the drifting is underway, we expect to undertake delineation diamond core drilling of approximately 50 holes totaling approximately 45,000 feet. The objectives of our underground evaluation program are to:

- •

- expand the known higher grade intercepts of the Montanore deposit;

17

With the exception of the first 600 feet, the length of the Libby adit contains water. During the first stage of the evaluation drilling program, we plan to dewater the adit, and treat the discharged water using ultra-filtration and possibly chemical pre-treatment so that discharged water, both during the dewatering process as well as during development of the adit and drilling program, meets Montana's water quality standards. We completed the pilot scale tests of the water treatment method in February 2007.

As dewatering takes place, we plan to rehabilitate the adit, which we anticipate to involve, among other activities, scaling the walls, installing new roof bolts and extending electricity, ventilation and dewatering infrastructure into the adit. We estimate that Stage 1 activities will cost approximately $7.3 million.

Stage 2—Advancement of Adit, Drifting and Establishment of Drill Stations

Once rehabilitation is complete, expected by the third quarter of 2007, we plan to advance the adit approximately 3,000 feet towards the middle of the deposit. Following the advancement of the adit, we expect to commence 10,000 feet of development drifting, which will be necessary to provide drill access. Once drifting is underway we will also begin to establish drill stations. The process of drifting and the establishment of drill stations will continue throughout the remainder of the program. We expect that Stage 2 will cost approximately $7.5 million.

In Stage 3 of the advanced exploration and delineation drilling program, we expect to commence approximately 20,000 feet of delineation diamond core drilling. We expect to spend approximately $0.5 million on Phase I delineation drilling. We also expect to spend approximately $12.7 million during Stages 1, 2 and 3 on site operating and capital costs, optimization studies and general corporate support.

During this stage we anticipate completing an additional 25,000 feet of diamond core drilling, undertaking additional metallurgical and geotechnical testing and analysis, and if the results of our exploration are successful, preparing for and completing a bankable feasibility study at an estimated cost, with site operating and capital costs, of approximately $10.0 million.

Permitting and Environmental

In 2006, we acquired the property providing access to the portal of the Libby adit and two permits: Hard Rock Operating Permit 150 that covers certain exploration activities and the Montana Pollution Discharge Elimination System (MPDES) water discharge permit for the Montanore Project. With minor revisions completed in 2006, these permits allow us to proceed with our planned advanced exploration and delineation drilling program, including adit rehabilitation, dewatering and extension, drifting and establishment of drill stations, and drilling activities.

18

In order to advance the Montanore Project past the exploration stage, we must obtain project approval from the U.S. Forest Service (USFS) and the State of Montana and final permits. The USFS and the State of Montana are undertaking a joint review of the Montanore Project and related permits, a process that typically takes several years.

To initiate the joint review process, in 2004 we submitted a proposed plan of operations to the USFS and a hard rock mining program application to the State of Montana, which included baseline environmental data, certain technical documents and other pertinent information about the Montanore Project. We have also submitted applications and technical supporting data for an air quality permit, a wetland 404 permit that would establish the allowable level of discharge of dredged or fill material into wetlands and non-wetland waters, an MPDES water discharge permit that would establish the allowable levels of mine and rain water discharge that might occur during any development of and operations at the Montanore Project, a power transmission line permit for the power line that would connect the Project to the power grid; and revisions to Hard Rock Operating Permit 150 that would permit mining operations on federal land, along with a permit to cover mining operations on private land. We have benefited from the work completed by previous holders of the Montanore Project, who obtained final Project permits in 1993. Rather than being required to develop all of the initial data, we were able to update the environmental baseline and other environmental and technical data developed by the prior holders. This allowed us to submit applications and technical information approximately 12 months earlier than otherwise would have been the case. Since our applications were initially submitted, we have responded to agency comments and submitted supplemental technical information and applications.

A central element of the federal and state project review is the completion of a thorough environmental review process, which will be documented in a joint Environmental Impact Statement (EIS). As an integral part of drafting the EIS, the USFS is required under the Endangered Species Act to complete a biological assessment and initiate a consultation with the U.S. Fish and Wildlife Service for the purpose of issuing a biological opinion addressing the impact of the project on threatened and endangered species, including grizzly bear, lynx and bull trout. The agencies have initiated preparation of the draft EIS, and we expect that it will be completed in the second quarter of 2007. We continue to address technical questions and comments generated by the USFS and the State during the EIS drafting process.

Once the agencies have completed their review and preparation of the draft EIS, the draft EIS and the draft permits are provided to the public for review and comment. The agencies may consider public comments in preparing the final EIS and final permits. If the public review process is successfully completed, the agencies would proceed to determine the form of the final EIS and permits and would issue a joint Record of Decision setting forth their decisions on our proposed plan of operations and hard rock mining program. Following issuance of the Record of Decision, and resolution of any appeals or legal challenges to the Record of Decision, we would receive the required permits and finalize the Montanore Project Description based on the results of the completed agency review.

19

20

Advance and Iroquois Properties

The Company owns the Advance and Iroquois zinc-lead exploration properties located in northeastern Washington State, approximately six miles south of the Canadian border. The properties are situated five miles apart along a belt of Cambrian carbonate sediments that have acted as host rocks for several former mines. Both properties are easily accessible on secondary graveled roads by two wheel drive vehicles. A large zinc smelter and refinery is located at Trail, British Columbia, Canada, approximately 17 miles distance, over excellent roads.

The Company was originally formed in 1947 to explore the Advance and Iroquois properties. Since that time, it has leased its holdings to major companies including Rare Metals, Inc. (El Paso Natural Gas) (1959-65), The Bunker Hill Company (1962-65), Cominco American, Inc. (1966-67 and 1974-75), Brinco, Ltd. (RTZ Group) (1977-78), and Equinox Resources Ltd. (1989-91). Total expenditures on the properties to date are estimated to be at least $1,500,000.

The Advance and Iroquois properties are located along the Deep Lake Trend, a northeast-striking belt of Cambrian carbonate rocks collectively designated as the Metaline Limestone. Rocks of the Deep Lake Trend have been strongly folded and faulted by numerous high-angle as well as thrust faults. As a result the Metaline Limestone has a complex outcrop pattern, with steeply overturned bedding.

Zones of brecciation are found throughout the Metaline Limestone and are often, but not always, the location of zinc and lead sulfide mineralization. These features are predominantly stratabound and have gradational, often irregular borders. Individual breccia bodies are crudely lensoid in cross section and have third dimensions that attain considerable length. The zones often occur in an enechelon, and sometimes interconnected, pattern. A variety of evidence suggests that the breccia bodies are solution collapse features controlled by favorable stratigraphy or lithologic facies.

Mineralization consists of irregular bands, lenses, and fine disseminations of sphalerite and galena accompanied by varying amounts of pyrite. The mineralization is considered to have been localized by permeable zones within and peripheral to breccia bodies created by solution collapse. The sulfide minerals are found in white dolomite that makes up the breccia matrix and fills other voids, and also as selective replacements of the host carbonate rocks. Individual deposits have irregular gradational borders and are crudely lensoidal to oval in outline. Their elongated third dimension parallels the regional strike of the host rocks, and often plunge at low angles. Cross sectional widths up to 80 feet and heights of as much as 150 feet have been noted in the more prominent zones. Lengths of mineralization vary up to 650 feet. The deposits have a tendency to occur together in an enechelon pattern over a stratigraphic interval of as much as 300 feet. Such groupings of deposits may be more or less interconnected and have composite lengths of as much as 5,000 feet. Metal values generally decrease outward thus necessitating a border to be established by economic consideration. Although individual sample values within a deposit may be as high as 20% zinc, average values for a deposit will usually range up to 7% zinc and 1% lead depending upon the "assay border" selected.

The Advance property consists of 720 acres of patented mining claims located approximately five miles east of the town of Northport. The property is reached from Northport, the nearest town, by taking the paved Deep Lake road south for four miles to the graveled Black Canyon road and thence north for three miles. The Metaline Formation is the principal rock unit to crop out on the Advance property. Previous exploration consisting of soil sampling, drilling, trenching, and tunneling has shown that several zones of low-grade, disseminated zinc mineralization occur on the property. The Advance property is without known reserves, is considered to be of an exploratory nature, and is held by the Company on a maintenance basis. We expect to undertake a technical review and commence disposition of this property in mid-2007.

The Iroquois property consists of 62 acres of patented mining claims and surface rights, and 15 unpatented mining claims containing about 300 acres. The property is reached from Northport, the

21

nearest town, by taking the paved Deep Lake road south and east for 19 miles to the graveled Iroquois Mine Road, and thence northeast for three miles. The unpatented mining claims are held subject to a $125 per claim annual payment to the U.S. Federal government. More than 25,000 feet of drilling and approximately 2,600 feet of tunneling have shown low-grade mineralization to occur in multiple zones, extending for the entire 5,000 foot length of the property. Most of the exploration has been concentrated in one area where a mineralized zone of disseminated zinc with associated lead values has been outlined over approximately 900 feet in length and within 300 feet of the surface. The Iroquois property is without known reserves, is considered to be of an exploratory nature and is held by the Company on a maintenance basis. We expect to undertake a technical review and commence disposition of this property in mid-2007.

Oil Interests

We receive income from a 10.16% working interest in four oil wells on a lease in Sumner County, Kansas. We do not engage in oil and gas exploration or production activities.

ITEM 3. LEGAL PROCEEDINGS

On August 11, 2005, Mines Management was named as a co-defendant in a lawsuit filed by Montana Reserves Company in the Superior Court of the State of Washington in Spokane County, Washington. Named as co-defendants are Noranda Minerals, Normin Corp., Mines Management and Newhi, Inc. The action seeks damages in connection with the conveyance of the Montanore property from Noranda to Newhi, and challenges the computation of a net proceeds royalty payable to Montana Reserves pursuant to a Royalty Agreement between Noranda and Montana Reserves in respect of the Montanore property. We do not believe that the outcome of this lawsuit will have a material adverse effect on the Company.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matter was submitted during the fourth quarter of 2006 to a vote of security holders.

22

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES.

The common stock commenced trading on AMEX under the symbol, "MGN," on March 24, 2004. On January 10, 2006, the Company's common stock began trading on the Toronto Stock Exchange under the symbol "MGT."

The following table shows the high and low closing sales prices for our common stock for each quarter since January 1, 2005. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. On March 20, 2007, the closing price of the Company's common stock was $5.18 on AMEX and Cdn$5.97 on TSX.

Fiscal Year

| | High

| | Low

|

|---|

| 2006: | | | | | | |

| | First Quarter | | $ | 9.00 | | $ | 6.20 |

| | Second Quarter | | $ | 9.97 | | $ | 6.20 |

| | Third Quarter | | $ | 7.47 | | $ | 5.60 |

| | Fourth Quarter | | $ | 6.40 | | $ | 4.91 |

| 2005: | | | | | | |

| | First Quarter | | $ | 6.28 | | $ | 3.75 |

| | Second Quarter | | $ | 6.15 | | $ | 4.13 |

| | Third Quarter | | $ | 5.52 | | $ | 4.92 |

| | Fourth Quarter | | $ | 8.30 | | $ | 6.22 |

As of March 20, 2007 there were 879 shareholders of record of our common stock and approximately 3,175 additional shareholders whose shares are held through brokerage firms or other institutions.

We have never paid dividends and any future decision as to the payment of dividends will be at the discretion of our board of directors and will depend upon our earnings, receipt of dividends from our subsidiaries, financial position, capital requirements, plans for expansion and such other factors as our board of directors deems relevant.

Securities Authorized for Issuance Under Equity Compensation Plans

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

(a)

| | Weighted-average

exercise price of

outstanding

options, warrants

and rights

(b)

| | Number of securities remaining

available for future issuance

under equity compensation

available for future issuance

reflected in column (a))

(c)

|

|---|

| Equity compensation plans approved by shareholders | | 2,194,000 | | $ | 3.70 | | 806,000 |

| Equity compensation plans not approved shareholders | | — | | | — | | — |

| Total | | 2,194,000 | | $ | 3.70 | | 806,000 |

23

ITEM 6. SELECTED FINANCIAL DATA

The selected financial data of Mines Management, Inc. for the years ended December 31, 2006, December 31, 2005, December 31, 2004, and the period from August 12, 2002 (inception) through December 31, 2006 are derived from audited financial statements. This table should be read in conjunction with the Consolidated Financial Statements and Management's Discussion and Analysis of Financial Condition and Results of Operations.

| |

| |

| |

| | From Inception

August 12, 2002

Through

December 31,

2006

| |

|---|

| | Years Ended December 31

| |

|---|

| | 2006

| | 2005

| | 2004

| |

|---|

| Statement of Operations: | | | | | | | | | | | | | |

| Revenues | | $ | 13,130 | | $ | 11,282 | | $ | 8,604 | | $ | 41,499 | |

| Operating Expenses | | $ | (6,293,164 | ) | $ | (5,448,169 | ) | $ | (2,652,056 | ) | $ | (15,919,899 | ) |

| | |

| |

| |

| |

| |

| | Loss from Operations | | $ | (6,280,034 | ) | $ | (5,436,887 | ) | $ | (2,643,452 | ) | $ | (15,878,400 | ) |

| Other Income | | $ | 296,489 | | $ | 226,877 | | $ | 127,383 | | $ | 670,322 | |

| | |

| |

| |

| |

| |

| | Net Loss | | $ | (5,983,545 | ) | $ | (5,210,010 | ) | $ | (2,516,069 | ) | $ | (15,208,078 | ) |

| Net Loss per Share of Common Stock | | $ | (0.47 | ) | $ | (0.45 | ) | $ | (0.26 | ) | | | |

| Weighted Average Shares of Common Stock Outstanding | | | 12,781,827 | | | 11,461,043 | | | 9,745,097 | | | | |

Cash Flow Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash Flows from Financing Activities | | $ | 1,513,750 | | $ | 6,686,520 | | $ | 6,448,010 | | $ | 16,685,409 | |

| Cash Flows from Operating Activities | | $ | (4,858,322 | ) | $ | (4,178,761 | ) | $ | (1,217,131 | ) | $ | (10,885,416 | ) |

| Cash Flows from Investing Activities | | $ | (560,070 | ) | $ | (284,460 | ) | $ | (3,088,521 | ) | $ | (5,103,676 | ) |

Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Assets | | $ | 6,330,468 | | $ | 9,673,157 | | $ | 7,135,017 | | | | |

| Total Liabilities | | $ | 307,614 | | $ | 171,101 | | $ | 114,984 | | | | |

| Shareholders Equity | | $ | 6,022,854 | | $ | 9,502,056 | | $ | 7,020,033 | | | | |

24

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following discussion and analysis is provided as a supplement to, and should be read in conjunction with, our financial statements and the accompanying notes ("Notes").

Overview

We made significant progress on advancing the Montanore Project in 2006.

2006 Highlights

- •

- Cross-listed our common stock on the Toronto Stock Exchange, effective January 10, 2006.

- •

- Received independent estimates of mineralized material and mineral resources from Mine Development Associates on March 1, 2006 and filed a report under Canada's National Instrument 43-101, reporting mineral resources at Montanore.

- •

- Completed the initial Montanore Project mining and milling cost studies by Hatch of Vancouver, identifying critical areas of focus for project improvement and development.

- •

- Acquired two Noranda subsidiaries holding Hard Rock Operating Permit 150 and MPDES water discharge permit for exploration drilling, and title to the properties at the portal site of the Libby adit.

- •

- Filed a $65 million shelf registration statement with the Securities and Exchange Commission, which became effective June 27, 2006.

- •

- Continued drafting of the Montanore Project Environmental Impact Statement, in cooperation with an independent consultant and the MDEQ.

- •

- Received final approval on November 28, 2006 for a minor revision to Hard Rock Operating Permit 150 to resume exploration and drilling activities at the Libby adit following a review by the MDEQ.

- •

- Conducted the first phase of the re-opening of the Libby adit portal and preliminary evaluation and water quality tests in the third quarter of 2006.

Our year end cash and certificates of deposit balance remained strong at over $5.1 million. Our net cash expenditures for operating activities for the year 2006 totaled $4.9 million, as expected. In 2007, the Company plans to focus on commencement of a $40 million advanced exploration and delineation drilling program at the Montanore Project's Libby adit located in northwestern Montana. The Company intends to continue its emphasis on the re-permitting applications and commencement of a phased financing plan for the Montanore project. The Company will require additional capital to complete the proposed $40 million advanced exploration and delineation drilling program starting in early 2007.

Financial and Operating Results

Mines Management, Inc. reported a net loss for the year ended December 31, 2006 of $6.0 million or $0.47 per share versus a loss of $5.2 million or $0.45 per share and $2.5 million or $0.26 per share for the years ending December 31, 2005 and 2004, respectively. The 2006 increase in net loss versus

25

2005 of $0.8 million, and the 2005 net loss increase versus 2004 of $2.7 million, were primarily due to increased expenditures in Montanore Project and administrative expense:

| | Expense Summary

| |

|---|

Expenditures

| |

|---|

| | 2006

| | 2005

| | 2004

| |

|---|

| | (millions)

| |

|---|

| Montanore Project Expense | | $ | 2.7 | | $ | 2.7 | | $ | .3 | |

| Administrative Expense | | $ | 2.7 | | $ | 1.7 | | $ | .9 | |

| Non Cash Stock Option Expense | | $ | 0.9 | | $ | 1.0 | | $ | 1.4 | |

| Interest Income | | $ | (.3 | ) | $ | (.2 | ) | $ | (.1 | ) |

Montanore project expense includes exploration, fees, filing and licenses, environmental, engineering and permitting expense. Increased activity on the Montanore Project was primarily the result of increased payments to consultants for permitting activities, collecting additional environmental baseline data, mineralized material and resource studies, and exploration activities related to reopening the Libby adit. Administrative expense, which includes general overhead and office expense, legal, accounting, compensation, rent, taxes, and investor relations expense, increased $1.0 million or 50% in 2006 over 2005 as we added two additional staff members, increased legal and accounting fees due to increased regulatory requirements and implementation of the requirements of the Sarbanes-Oxley Act of 2002 reporting on internal controls as an accelerated filer for 2006, and a general increase in the Company's activities. Stock option expense, which includes stock options granted to officers, employees and consultants, remained approximately unchanged from 2005 to 2006, while interest income increased slightly due to a full year of interest for certificates of deposit purchased in October of 2005.