Filing under Rule 425 under the U.S. Securities Act of 1933

Filing by: Mitsubishi Tokyo Financial Group, Inc.

Subject Company: UFJ Holdings, Inc.

SEC File No. 333-123136

Mitsubishi Tokyo Financial Group, Inc.

UFJ Holdings, Inc.

The Bank of Tokyo-Mitsubishi, Ltd.

UFJ Bank Limited

The Mitsubishi Trust and Banking Corporation

UFJ Trust Bank Limited

Mitsubishi Securities Co., Ltd.

UFJ Tsubasa Securities Co., Ltd.

Execution of a Merger Agreement

Tokyo, April20, 2005 —Mitsubishi Tokyo Financial Group, Inc. (MTFG; President and CEO: Nobuo Kuroyanagi) and UFJ Holdings, Inc. (UFJ; President and CEO: Ryosuke Tamakoshi), The Bank of Tokyo-Mitsubishi, Ltd. (BTM; President: Nobuo Kuroyanagi) and UFJ Bank Limited (UFJ Bank; President: Takamune Okihara), The Mitsubishi Trust and Banking Corporation (MTB; President: Haruya Uehara) and UFJ Trust Bank Limited (UFJ Trust Bank; President: Shintaro Yasuda) and, Mitsubishi Securities Co., Ltd. (Mitsubishi Securities; President: Koichi Kane) and UFJ Tsubasa Securities Co., Ltd. (UFJ Tsubasa Securities; President: Kimisuke Fujimoto), have been preparing for the two group’s management integration in October 2005, subject to the approval of their shareholders and relevant authorities, and respectively signed relevant merger agreements today.

The main terms of the merger agreements, etc. are as set forth in the attached reference material.

(Contacts:)

| Mitsubishi Tokyo Financial Group, Inc. | Corporate Communications Office | (03-3240-9059) | ||

| UFJ Holdings, Inc. | Public Relations Department | (03-3212-5460) | ||

| The Bank of Tokyo-Mitsubishi, Ltd. | Public Relations Office | (03-3240-2950) | ||

| UFJ Bank Limited | Corporate Communications Department | (03-3212-5460) | ||

| The Mitsubishi Trust and Banking Corporation | Public Relations Section | (03-6214-6044) | ||

| UFJ Trust Bank Limited | Public Relations Office | (03-3218-0775) | ||

| Mitsubishi Securities Co., Ltd. | Public Relations Office | (03-6213-6124) | ||

| UFJ Tsubasa Securities Co., Ltd. | Public Relations Department | (03-5222-8355) |

1

[Reference Material]

Main terms of the merger agreement, etc.

1. New Holding Company

| (1) Company name: | Japanese Name: Kabushiki Kaisha Mitsubishi UFJ Financial Group English Name: Mitsubishi UFJ Financial Group, Inc. | |

| (2) Merger structure: | Merger, whereby Mitsubishi Tokyo Financial Group, Inc. (MTFG) will be the surviving entity and UFJ Holdings, Inc. (UFJ) will be the dissolving entity. | |

| (3) Date of the shareholders’ meetings to approve the merger: | General meetings will be held on June 29, 2005 | |

| (4) Date of the merger: | October 1, 2005 Date of commercial registration of the merger: October 3, 2005 (Scheduled) | |

| (5) Date from which dividends on the shares of common stock to be allotted and delivered in connection with the merger shall be calculated: | October 1, 2005 | |

| (6) Representatives: | Chairman: Ryosuke Tamakoshi Deputy Chairman: Haruya Uehara President & CEO: Nobuo Kuroyanagi | |

| (7) Merger ratio: | 0.62 share of MTFG common stock for each share of UFJ common stock. One Class 8, Class 9, Class 10, Class 11 and Class 12 share of preferred stock of MTFG for each Class II, Class IV, Class V, Class VI and Class VII share of preferred stock of UFJ. | |

2

| (8) Number of new shares to be issued in connection with the merger: | The number of shares to be issued is obtained by multiplying (x) the total number of shares of UFJ held by the shareholders entered or recorded in the shareholder register as of the day immediately preceding the date of the merger by (y) the above merger ratio. However, allotment will not be made for shares of common stock held by MTFG and treasury stock held by UFJ. (The number of new shares to be issued in connection with the merger is not decided as the preferred shares of UFJ may be converted to common stock by the date of the merger.) [Note] Total number of issued shares of UFJ as of March 31, 2005 Shares of common stock: 5,165,292.70 shares Class I shares of preferred stock: 6,543 shares Class II shares of preferred stock: 200,000 shares Class IV shares of preferred stock: 150,000 shares Class V shares of preferred stock: 150,000 shares Class VI shares of preferred stock: 8 shares Class VII shares of preferred stock: 200,000 shares (Note) Class I shares of preferred stock that have not been converted by July 31, 2005 shall be converted into shares of common stock on August 1, 2005. | |

| (9) Merger-related cash distribution: | No cash distribution will be made. | |

3

2. New Bank

| (1) Company name: | Japanese Name: Kabushiki Kaisha Mitsubishi Tokyo UFJ Ginko English Name: The Bank of Tokyo-Mitsubishi UFJ, Ltd. | |

| (2) Merger structure: | Merger, whereby The Bank of Tokyo-Mitsubishi, Ltd. (BTM) will be the surviving entity and UFJ Bank Limited (UFJ Bank) will be the dissolving entity. | |

| (3) Dates of the shareholders’ meetings to approve the merger: | BTM: June 28, 2005 UFJ Bank: June 29, 2005 | |

| (4) Date of the merger: | October 1, 2005 Date of commercial registration of the merger: October 3, 2005 (Scheduled) | |

| (5) Date from which dividends on the shares of common stock to be allotted and delivered in connection with the merger shall be calculated: | October 1, 2005 | |

| (6) Representatives: | Chairman: Shigemitsu Miki Deputy Chairman: Ryosuke Tamakoshi President: Nobuo Kuroyanagi | |

| (7) Merger ratio: | 0.62 shares of BTM common stock for each share of UFJ Bank common stock. One Class 3 of Series 1, Class 4 of Series 1 and Class 5 of Series 1 share of preferred stock of BTM for each Class A Series 1, Class D Series 1 and Class D Series 2 share of preferred stock of UFJ Bank. 0.34 shares of BTM common stock for each of Class E Series 1, Class G Series 1 and Class G Series 2 share of preferred stock of UFJ Bank. 3.44 shares of BTM common stock for each Class H Series 1 share of preferred stock of UFJ Bank. As for Class E Series 1 preferred shares, if the conversion right has been exercised to convert to Class F shares of preferred stock, 0.34 shares of BTM common stock will be allotted and delivered for each Class F share of preferred stock. | |

4

| (8) Number of new shares to be issued in connection with the merger: | The number of shares to be issued is obtained by multiplying (x) the total number of shares of UFJ Bank held by the shareholders entered or recorded in the shareholder register as of the day immediately preceding the date of the merger by (y) the above merger ratio. (The number of new shares to be issued in connection with the merger is not decided as the preferred shares of UFJ Bank may be converted to common stock by the date of the merger.) [Note] Number of total issued shares of UFJ Bank as of March 31, 2005 Shares of common stock: 4,598,911,452 shares Series 1 shares of preferred stock: 6,543,000 shares Class A Series 1 shares of preferred stock: 200,000,000 shares Class D Series 1 shares of preferred stock: 150,000,000 shares Class D Series 2 shares of preferred stock: 150,000,000 shares Class E Series 1 shares of preferred stock: 3,500,000,000 shares Class G Series 1 shares of preferred stock: 400,000,000 shares Class G Series 2 shares of preferred stock: 20,000,000 shares Class H Series 1 shares of preferred stock: 25,000,000 shares (Note) Shares of Series 1 preferred stock that have not been converted by July 31, 2005 shall be converted into shares of common stock on August 1, 2005. | |

| (9) Merger-related cash distribution: | No cash distribution will be made. | |

5

3. New Trust Bank

| (1) Company name: | Japanese Name: Mitsubishi UFJ Shintaku Ginko Kabushiki Kaisha English Name: Mitsubishi UFJ Trust and Banking Corporation | |

| (2) Merger structure: | Merger, whereby The Mitsubishi Trust and Banking Corporation (MTB) will be the surviving entity and UFJ Trust Bank Limited (UFJ Trust Bank) will be the dissolving entity. | |

| (3) Date of the shareholders’ meetings to approve the merger: | MTB: June 28, 2005 UFJ Trust Bank: June 29, 2005 | |

| (4) Date of the merger: | October 1, 2005 Date of commercial registration of the merger: October 3, 2005 (Scheduled) | |

| (5) Date from which dividends on the shares of common stock to be allotted and delivered in connection with the merger shall be calculated: | October 1, 2005 | |

| (6) Representatives: | Chairman: Akio Utsumi President: Haruya Uehara | |

| (7) Merger ratio: | 0.62 shares of MTB common stock for each share of UFJ Trust Bank common stock. One Class 3 of Series 1 and one Class 3 of Series 2 shares of preferred stock of MTB for each First Class First Series and First Class Second Series shares of preferred stock of UFJ Trust Bank. | |

| (8) Number of new shares to be issued in connection with the merger: | The number of shares to be issued is obtained by multiplying (x) the total number of shares of UFJ Trust Bank held by the shareholders entered or recorded in the shareholder register as of the day immediately preceding the date of the merger by (y) the above merger ratio. (The number of new shares to be issued in connection with the merger is not decided as the preferred shares of UFJ Trust Bank may be converted to common stock by the date of the merger.) [Note] Number of total issued shares of UFJ Trust Bank as of March 31, 2005 Shares of common stock: 1,231,281,875 shares First Class First Series shares of preferred stock: 8,000 shares First Class Second Series shares of preferred stock: 200,000,000 shares | |

| (9) Merger-related cash distribution: | No cash distribution will be made. | |

6

4. New Securities Company

| (1) Company name: | Japanese Name: Mitsubishi UFJ Shoken Kabushiki Kaisha English Name: Mitsubishi UFJ Securities Co., Ltd. | |

| (2) Merger structure: | Merger, whereby Mitsubishi Securities Co., Ltd. (Mitsubishi Securities) will be the surviving entity and UFJ Tsubasa Securities Co., Ltd. (UFJ Tsubasa Securities) will be the dissolving entity . | |

| (3) Dates of the shareholders’ meetings to approve the merger: | June 29, 2005 | |

| (4) Date of the merger: | October 1, 2005 Date of commercial registration of the merger: October 3, 2005 (Scheduled) | |

| (5) Date from which dividends on the shares of common stock to be allotted and delivered in connection with the merger shall be calculated: | April 1, 2005 | |

| (6) Representatives: | Chairman & CEO: Yasumasa Gomi Deputy Chairman: Koichi Kane President & COO: Kimisuke Fujimoto | |

| (7) Merger ratio: | 0.42 shares of Mitsubishi Securities common stock for each share of UFJ Tsubasa Securities common stock. | |

| (8) Number of new shares to be issued following the merger: | The number of shares to be issued is obtained by multiplying (x) the total number of shares of UFJ Tsubasa Securities held by the shareholders entered or recorded in the shareholder register as of the day immediately preceding the date of the merger by (y) the above merger ratio. [Note] Total number of issued shares of UFJ Tsubasa Securities as of March 31, 2005 Shares of common stock: 603,243,089 shares | |

| (9) Merger-related cash distribution: | No cash distribution will be made. | |

| (10) Transfer of Stock Acquisition Rights: | UFJ Tsubasa Securities granted stock options (exercise price: 593 yen, exercise period: until March 31, 2006) to officers and employees following the resolution of the board of directors held on June 29, 2000. However, as these stock options are based on the stock subscription rights method prescribed by the provision under the previous Japanese Commercial Code (and that provision is not currently applicable), they cannot be succeeded to or assumed by the new securities company. Therefore, UFJ Tsubasa Securities and the new securities company will issue and grant stock acquisition rights which will have the same commercial effect as the stock subscription rights which will be waived, and necessary procedures for the transfer of such rights will be taken. | |

7

Mitsubishi Tokyo Financial Group, Inc.

UFJ Holdings, Inc.

The Bank of Tokyo-Mitsubishi, Ltd.

UFJ Bank Limited

The Mitsubishi Trust and Banking Corporation

UFJ Trust Bank Limited

Mitsubishi Securities Co., Ltd.

UFJ Tsubasa Securities Co., Ltd.

Corporate Governance and Organizational Structure of the New Group

Tokyo, April20, 2005— Mitsubishi Tokyo Financial Group, Inc. (MTFG; President and CEO: Nobuo Kuroyanagi), UFJ Holdings, Inc. (UFJ; President and CEO: Ryosuke Tamakoshi), The Bank of Tokyo-Mitsubishi, Ltd. (BTM; President: Nobuo Kuroyanagi), UFJ Bank Limited (UFJ Bank; President: Takamune Okihara), The Mitsubishi Trust and Banking Corporation (MTB; President: Haruya Uehara), UFJ Trust Bank Limited (UFJ Trust Bank; President: Shintaro Yasuda), Mitsubishi Securities Co., Ltd. (Mitsubishi Securities; President: Koichi Kane) and UFJ Tsubasa Securities Co., Ltd. (UFJ Tsubasa Securities; President: Kimisuke Fujimoto), have been preparing for the two group’s management integration in October 2005, subject to the approval of their shareholders and relevant authorities, and have agreed on establishing the following corporate governance and organizational structure for the new group.

1. Corporate Governance Structure

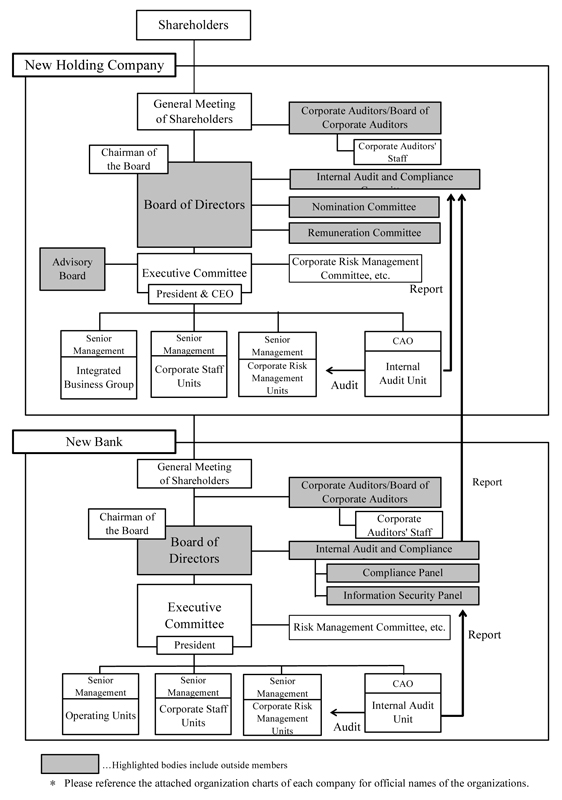

(1) Corporate Governance Structure of the New Holding Company (Please see Appendix 1)

The new holding company will establish a more stable and effective corporate governance system with both directors and corporate auditors, while enhancing various “outsiders’ viewpoints” and introducing a voluntary committee system. The holding company will enhance management transparency and accountability to its shareholders through three “outsiders’ viewpoints.” The first outsider’s viewpoint will be that three (majority) of the corporate auditors will be outside auditors. The second outsider’s viewpoint will be that by appointing four outside directors, more than 30% of the board members (directors and corporate auditors) will be outsiders. The outside directors will be given an enhanced role in the holding company’s management by serving as the chairs of board committees comprised mainly of outside members, such as the internal audit and compliance committee, the nomination committee and remuneration committee, to be established under the board of directors. The third outsider’s viewpoint will be that the new holding company will also establish an advisory board comprised of outside experts. The advisory board will provide expert advice on important management issues, including the holding company’s business strategies and financial plan.

In particular, the internal audit and compliance committee will receive reports from the Internal Audit Unit, deliberate important matters relating to internal audit and compliance and propose necessary improvement measures to the board of directors. This is intended to ensure sufficient independence of the Internal Audit Unit from business operations of the company. The holding company also aims to enhance the effectiveness of internal audits conducted by corporate auditors and continuously improve the internal audit function by enhancing the coordination between corporate auditors and the Internal Audit Unit through the internal audit and compliance committee.

1

The new holding company will also aim to develop its group-wide corporate governance structure that is appropriate for a “premier global comprehensive financial group” by implementing group-wide risk management and internal audit systems, promoting coordination among the group companies’ internal audit units and sending senior management to its major subsidiaries.

<Outline of Internal Audit and Compliance Committee, Nomination Committee and Remuneration Committee of the New Holding Company>

Internal Audit and Compliance Committee | Nomination Committee | Remuneration Committee | ||||

| Functions | Committees are organized under the board of directors.

Report and make proposals to the board of directors regarding the details of deliberations. | |||||

| Chairman | Hiroshi Hamada Senior Advisor Ricoh Company, Ltd. | Ryotaro Kaneko President Meiji Yasuda Life Insurance Company | Takuma Otoshi President IBM Japan, Ltd. | |||

| Structure | Majority of the committee members will be outside members comprising of outside directors and specialists. | Majority of the committee members will be outside members comprising of outside directors. | Majority of the committee member will be outside members comprising of outside directors. | |||

| Entities subject to committee’s deliberations | Holding company and subsidiary bank, trust bank and securities company | Holding company and subsidiary bank and trust bank | ||||

| Details of deliberations | Internal audit and compliance related matters will be discussed. The status of internal audit and necessary improvement measures will be reported and proposed to the board of directors of the holding company. | Deliberations will be made on matters relating to the appointment and dismissal of directors and reports and proposals will be made to the board of directors of the holding company. | Deliberations will be made on matters relating to the remuneration of directors and reports and proposals will be made to the board of directors of the holding company. | |||

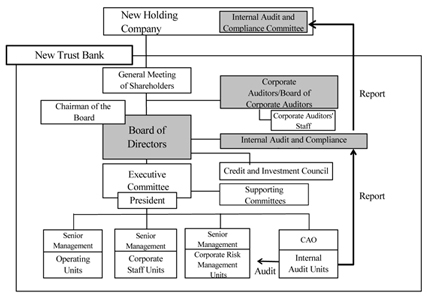

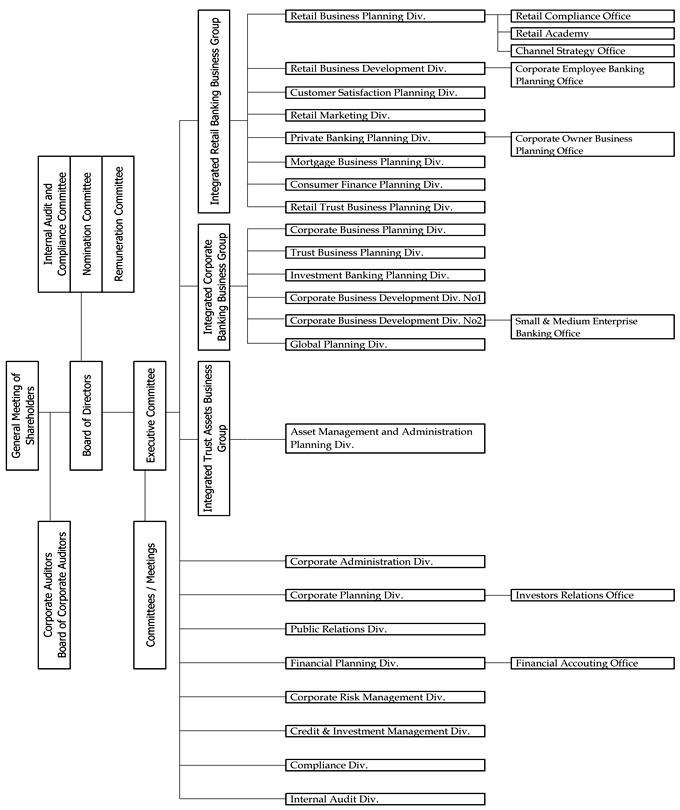

(2)Governance of the group’s bank, trust bank and securities company (Please refer to Appendix 1~2)

An internal audit and compliance committee which is comprised of a majority of outside members will be established for each of the group’s bank, trust bank and securities company. By deliberating the matters relating to internal audit and compliance, the combined group will strive to enhance the transparency of the management.

2

As for the bank, we aim to establish a sophisticated compliance and information security management structure and deal with related issues appropriately. A compliance panel and an information security panel will be set up as specialist panels for the internal audit and compliance committee. Deliberations on the matters relating to each area will be made.

<Chairmen of Internal Audit and Compliance Committees for bank, trust bank and securities company>

Bank | Trust Bank | Securities Company | ||||

Chairman | Teruo Ozaki Certified Public Accountant Teruo Ozaki & Co. | Tadao Takashima Certified Public Accountant | Naoteru Miyato President T&D Holdings, Inc. |

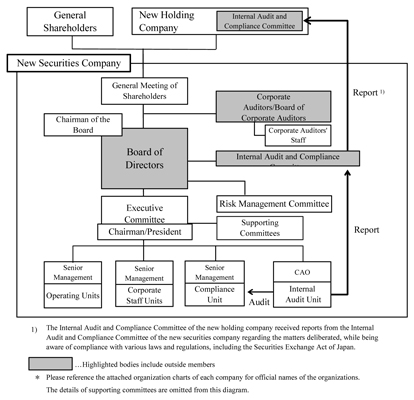

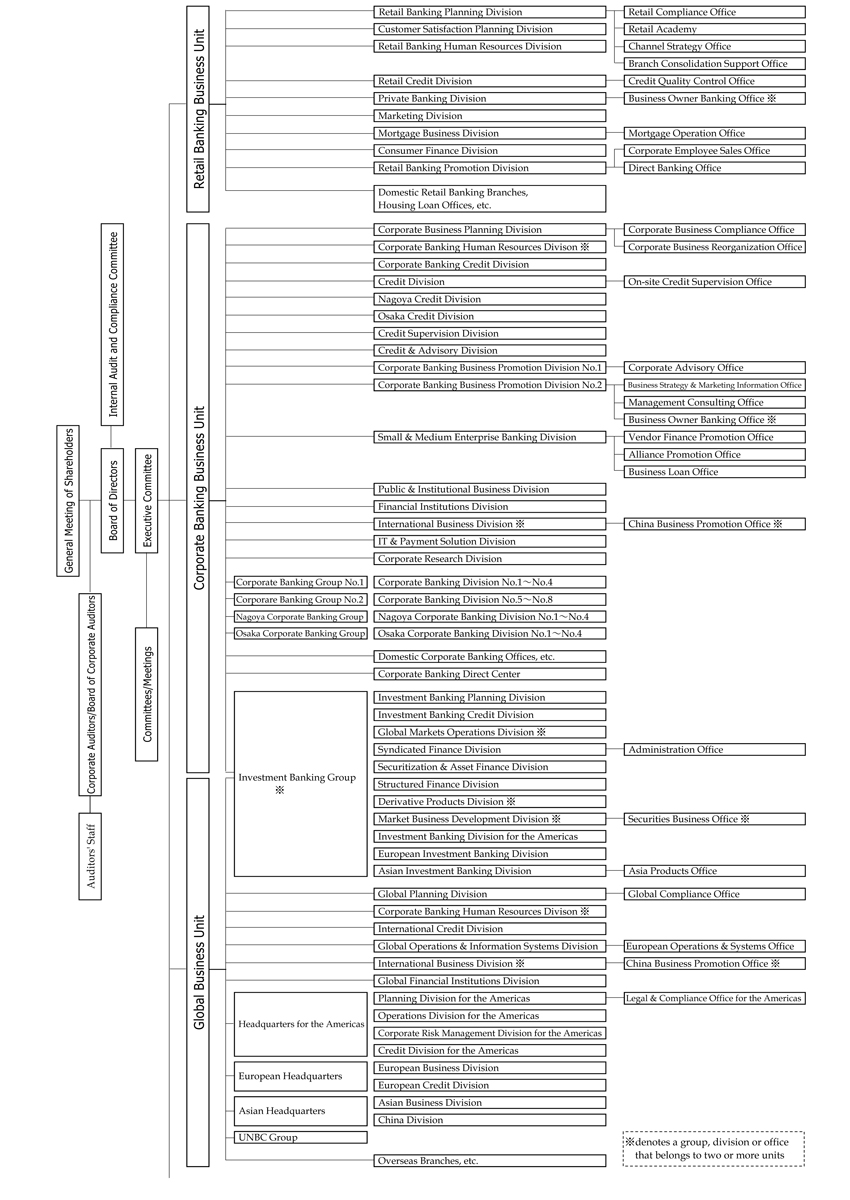

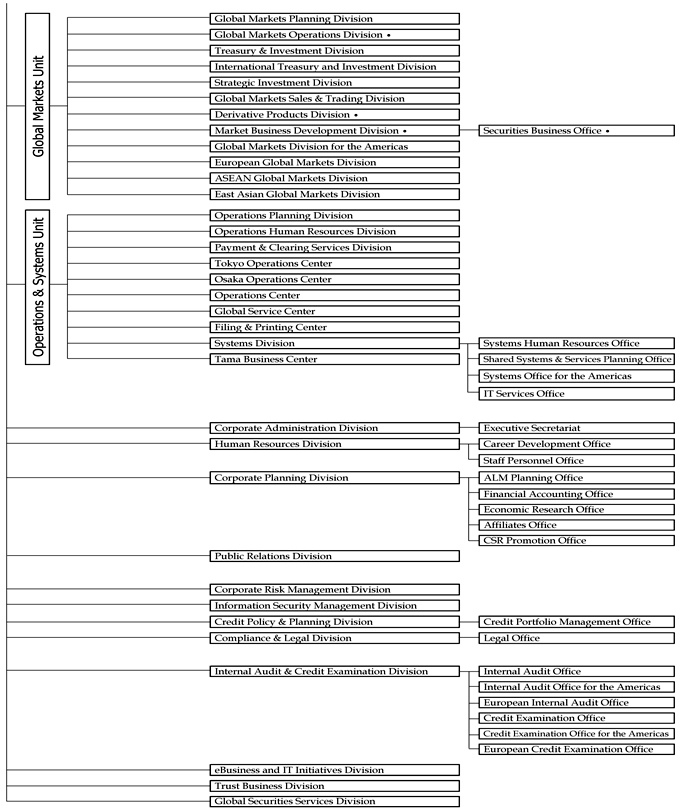

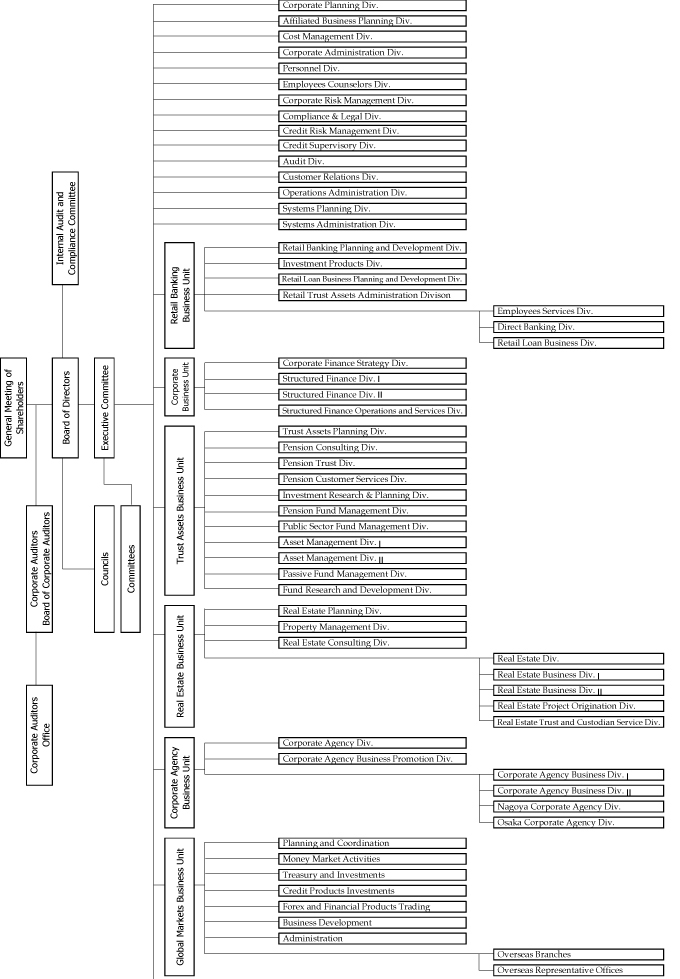

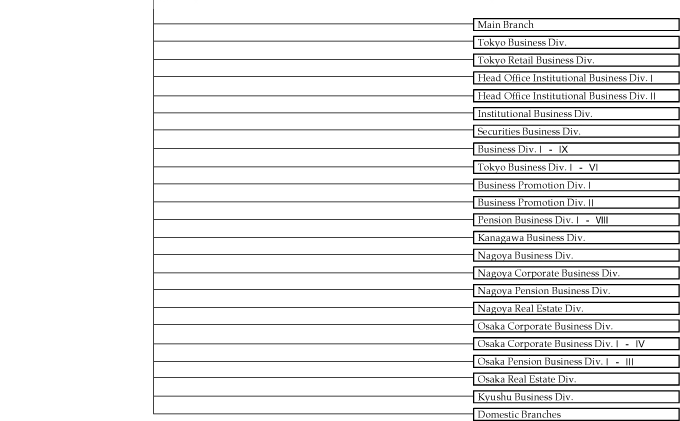

2. Organizational Structure

The new combined group aims to provide customer-focused services and establish an “integrated organizational structure” to offer timely, value-added financial products and services as a group, to each customer segment going beyond the boundaries of existing business entities. In addition, the combined group will also strive to establish risk management and internal control functions appropriate for a financial group that is aiming to become a “Global Top 5” financial institution. In order to achieve this, we have decided on the organizations of the new holding company and the affiliated bank, trust bank and securities company as described in Appendices 3 to 6.

(1)Common aim of the new group

² To establish a system to respond to various financial needs of customers comprehensively and flexibly.

Ø We aim to have an organization according to each customer segment at each of the bank, trust bank and securities company. Under the Integrated Business Group to be set up at the holding company, we will strive to make the organizational structure of each business entity as similar as possible and establish a structure to promote the group’s strategy further as a whole.

² To establish a sophisticated internal control system that can appropriately control the comprehensive financial group with the world’s largest asset base and various group companies under its umbrella.

Ø As a company listed on the New York Stock Exchange, we will establish a system that implements sophisticated risk management and has internal control functions that complies with the U.S. Sarbanes-Oxley Act and SEC standards. We will also strive to establish an independent and sophisticated internal audit system in order to strengthen our corporate governance.

² To establish a streamlined organizational structure to improve management efficiency and enable prompt decision making as a group.

Ø We intend to eliminate the duplication of functions between the holding company and the group companies and to implement an efficient organizational structure which is well balanced between the holding company and the group companies.

3

(2) Characteristics of each business category

[New Holding Company]

With respect to the three main businesses (retail, corporate and trust assets business), under close co-operation of the subsidiary bank, trust bank and securities company, we will strive to establish an integrated strategy, according to each customer segment, and establish an Integrated Business Group to promote business as a group.

[New Bank]

We aim to establish a market-based organizational structure according to each customer segment, taking into account the holding company’s integrated business group systems. A “business unit system” will be introduced to promote a decentralized management system where more responsibilities and decision-making authority will be given to each business unit.

We aim to establish head office functions such as service supply and credit analysis functions in Nagoya and Osaka to respond to the needs of customers in each area and provide a community-based business management system.

[New Trust Bank]

With respect to retail and corporate banking businesses, a “business unit system” will be introduced according to each customer segment. A “business unit system” will also be introduced to operations specific to the trust business area in order to strengthen the professionalism and clarify business responsibilities in this area.

[New Securities Company]

We aim to establish a business promotion system to provide sophisticated products and services according to each customer segment and will establish a “head office system” in front operations in order to clarify business responsibilities in each business areas.

(Contacts:)

| Mitsubishi Tokyo Financial Group, Inc. | Corporate Communications Office | (03-3240-9059) | ||

| UFJ Holdings, Inc. | Public Relations Department | (03-3212-5460) | ||

| The Bank of Tokyo-Mitsubishi, Ltd. | Public Relations Office | (03-3240-2950) | ||

| UFJ Bank Limited | Corporate Communications Department | (03-3212-5460) | ||

| The Mitsubishi Trust and Banking Corporation | Public Relations Section | (03-6214-6044) | ||

| UFJ Trust Bank Limited | Public Relations Office | (03-3218-0775) | ||

| Mitsubishi Securities Co., Ltd. | Public Relations Office | (03-6213-6124) | ||

| UFJ Tsubasa Securities Co., Ltd. | Public Relations Department | (03-5222-8355) |

4

Appendix 1

Corporate Governance Structure of the New Holding Company and the New Bank

Appendix 2

Corporate Governance Structure of the New Trust Bank

Corporate Governance Structure of the New Securities Company

Appendix 3

Organizational Chart of the New Holding Company

Appendix 4

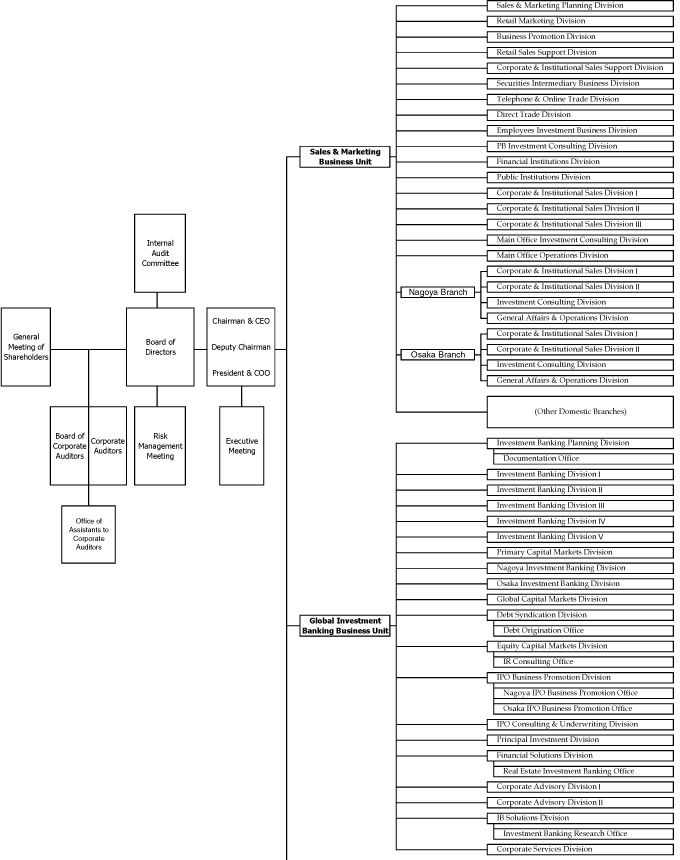

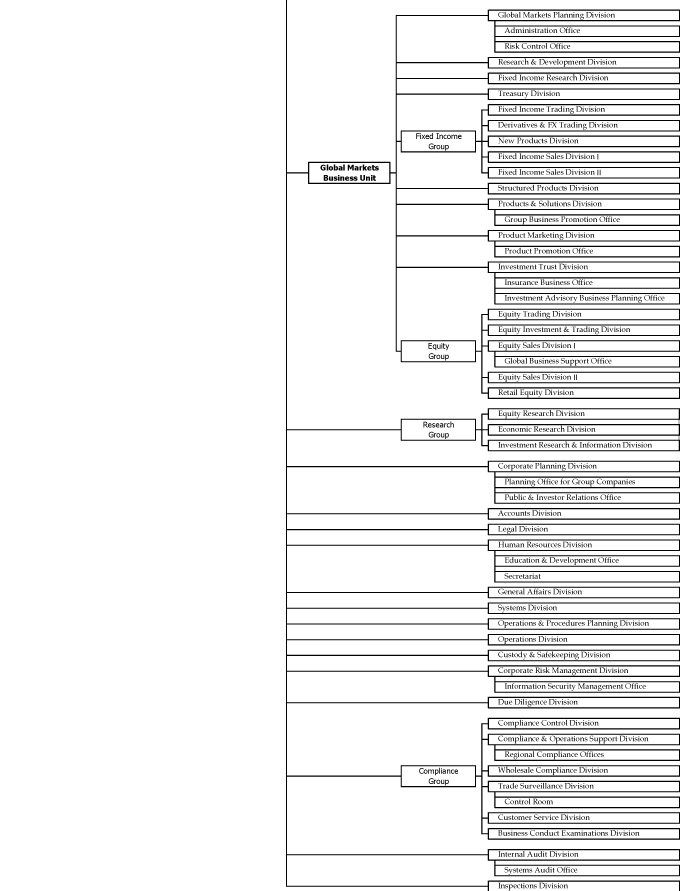

Organizational Chart of the New Bank (1)

Organizational Chart of the New Bank (2)

Appendix 5

Organizational Chart of the New Trust Bank (1)

Organizational Chart of the New Trust Bank (2)

Appendix 6

Organizational Chart of the New Securities Company (1)

Organizational Chart of the New Securities Company (2)

| Mitsubishi Tokyo Financial Group, Inc. | ||||||

| UFJ Holdings, Inc. |

Planned Directors, Corporate Auditors and Managing Officers

of Mitsubishi UFJ Financial Group

Tokyo, April 20, 2005 —In accordance with their preparations for integration in October 2005, Mitsubishi Tokyo Financial Group, Inc. (MTFG; President and CEO: Nobuo Kuroyanagi) and UFJ Holdings, Inc. (UFJ; President and CEO: Ryosuke Tamakoshi) today announced the planned directors, corporate auditors and managing officers of the new holding company as follows. The establishment of the new holding company and the planned appointments are subject to approval by the respective shareholders meetings of MTFG and UFJ, and the relevant regulatory authorities. The new holding company is planned to be established on October 1, 2005 and all appointments are scheduled to be effective from that date.

1. Directors (as of October 1, 2005)

Title | Name | Current Position | ||

Chairman* | Ryosuke Tamakoshi | President and CEO of UFJ | ||

Deputy Chairman and Chief Audit Officer* | Haruya Uehara | Chairman & Co-CEO of MTFG | ||

President & CEO* | Nobuo Kuroyanagi | President & CEO of MTFG | ||

Deputy President and Chief Planning Officer* | Tatsunori Imagawa | Deputy President and Chief Planning Officer of MTFG | ||

Senior Managing Director and Chief Financial Officer* | Hajime Sugizaki | Senior Managing Director and Chief Financial Officer of MTFG | ||

Senior Managing Director and Chief Risk Management Officer* | Yoshihiro Watanabe | Managing Officer of MTFG | ||

Senior Managing Director* | Toshihide Mizuno | Director and Senior Executive Officer of UFJ | ||

Director | Shigemitsu Miki | Director of MTFG | ||

Director | Shintaro Yasuda | Director of UFJ | ||

Director | Hirohisa Aoki | Director and Senior Executive Officer of UFJ Tsubasa Securities | ||

Director | Kinya Okauchi | Director of MTFG | ||

Director | Nobuyuki Hirano | Non-board member Director of The Bank of Tokyo-Mitsubishi, Ltd. | ||

Director** | Hiroshi Hamada | Principal Adviser of Ricoh Company, Ltd. | ||

Director** | Iwao Okijima | Senior Adviser of Hino Motors Ltd. | ||

Director** | Ryotaro Kaneko | President of Meiji Yasuda Life Insurance Company | ||

Director** | Takuma Otoshi | President of IBM Japan, Ltd. | ||

| * | Representative Director |

| ** | Outside director in compliance with the requirements of Item 7-2, Paragraph, Article 188 of the Commercial Code of Japan |

2. Corporate Auditors (as of October 1, 2005)

Title | Name | Current Position | ||

Corporate Auditor (Full-time) | Setsuo Uno | Corporate Auditor (Full-time) of MTFG | ||

Corporate Auditor (Full-time) | Haruo Matsuki | Senior Executive Officer of UFJ Trust Bank | ||

Corporate Auditor* | Takeo Imai | Attorney at Law | ||

Corporate Auditor* | Tsutomu Takasuka | Certified Public Accountant | ||

Corporate Auditor* | Kunie Okamoto | President of Nippon Life Insurance Company | ||

| * | Outside auditor in compliance with the requirements of Article 18, Paragraph 2 of The Audit Special Exceptions Law of Japan |

3. Managing Officers (as of October 1, 2005)

Title | Name | Current Position | ||

Managing Officer, Group Head of Integrated Retail Banking Business Group | Ryuichi Murata | Managing Officer of MTFG | ||

Managing Officer, Group Head of Integrated Corporate Banking Business Group | Takamune Okihara | Director of UFJ | ||

Managing Officer, Group Head of Integrated Trust Assets Business Group | Toshio Goto | Managing Officer of MTFG | ||

Managing Officer, Deputy Group Head of Integrated Retail Banking Business Group | Hajime Mita | Executive Officer of MTFG | ||

Managing Officer, Deputy Group Head of Integrated Corporate Banking Business Group | Norimichi Kanari | Managing Director of The Bank of Tokyo-Mitsubishi | ||

Managing Officer, Deputy Group Head of Integrated Corporate Banking Business Group | Noriaki Hanamizu | Managing Officer of MTFG | ||

Managing Officer, Deputy Group Head of Integrated Trust Assets Business Group | Akira Naito | Non-board member Director of The Bank of Tokyo-Mitsubishi, Ltd. | ||

The following is a brief biography of each director.

Ryosuke Tamakoshi has served as the president and chief executive officer of UFJ Holdings, Inc. (UFJ) since June 2004, and as the chairman of UFJ Bank Limited (UFJ Bank) since May 2004. He served as a deputy president of UFJ Bank from May 2002 to May 2004, and as a senior executive officer of UFJ Bank from January 2002 to May 2002. He served as a senior executive officer of The Sanwa Bank, Limited (Sanwa Bank) from June 1999 to January 2002, and as a director of Sanwa Bank from June 1997 to June 1999. Mr. Tamakoshi was born on July 10,1947.

Haruya Uehara has served as the chairman and co-chief executive officer of Mitsubishi Tokyo Financial Group, Inc. (MTFG) since June 2004, and as a director of MTFG since June 2003. He has also served as the president of The Mitsubishi Trust and Banking Corporation (MTBC) since April 2004. He served as deputy president of MTBC from June 2002 to April 2004 and as a senior managing director of MTBC from June 2001 to June 2002. He served as a managing director of MTBC from June 1998 to June 2001, and as a director of MTBC from June 1996 to June 1998. Mr. Uehara was born on July 25, 1946.

Nobuo Kuroyanagi has served as the president and chief executive officer of Mitsubishi Tokyo Financial Group, Inc. (MTFG) since June 2004, and as a director of MTFG since June 2003. He has also served as the president of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) since June 2004. He served as a deputy president of BTM from June 2002 to June 2004, and as a managing director of BTM from June 1996 to June 2002, during which period he also served as a board member of BTM from June 1996 to June 2001. He served as a director of BTM from April 1996 to June 1996 and as a director of The Mitsubishi Bank, Limited from June 1992 to April 1996. Mr. Kuroyanagi was born on December 18, 1941.

Tatsunori Imagawahas served as a director, deputy president and chief planning officer of Mitsubishi Tokyo Financial Group, Inc. (MTFG) since April 2004. He served as a senior managing director and chief planning officer of MTFG from May 2003 to April 2004, and as a director of MTFG from April 2001 to May 2003. He served as a senior managing director of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) from June 2002 to May 2003 and as a managing director of BTM from May 1997 to June 2002. He served as a director of BTM from April 1996 to May 1997 and as a director of The Mitsubishi Bank, Limited from June 1993 to April 1996. Mr. Imagawa was born on October 15, 1943.

Hajime Sugizakihas served as a senior managing director and chief financial officer of Mitsubishi Tokyo Financial Group, Inc. (MTFG) since April 2004. He has also served as a director of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) since June 2004. He served as a director of MTFG from April 2001 to March 2004. He served as a senior managing director of The Mitsubishi Trust and Banking Corporation (MTBC) from June 2001 to March 2004, as a managing director of MTBC from June 1999 to June 2001, and as a director of MTBC from June 1997 to June 1999. Mr. Sugizaki was born on April 3, 1945.

Yoshihiro Watanabehas served as a managing officer and deputy group head of the Integrated Corporate Banking Business Group of Mitsubishi Tokyo Financial Group, Inc. (MTFG) since April 2004. He has also served as a senior managing director of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) since January 2005, and as the chief executive of the Global Corporate Banking Business Unit of BTM since May 2004. He served as a managing director of BTM from June 2004 to January 2005, and as a non-board member managing director of BTM from June 2001 to June 2004. He served as a managing director of BTM from May 2001 to June 2001, and as a director of BTM from June 1997 to May 2001. Mr. Watanabe was born on July 26, 1947.

Toshihide Mizuno has served as a director and senior executive officer of UFJ Holdings, Inc. (UFJ) since June 2002 and as a director of UFJ Trust Bank, Ltd. since May 2004. He served as a director of UFJ Bank Limited (UFJ Bank) from June 2002 to October 2004, during which period he also served as a senior executive officer of UFJ Bank from May 2004 to July 2004. He served as a senior executive officer of UFJ from May 2002 to June 2002 and as an executive officer of UFJ from January 2002 to May 2002. He served as an executive officer of The Sanwa Bank, Limited from May 2000 to January 2002. Mr. Mizuno was born on April 19, 1950.

Shigemitsu Miki has served as a director of Mitsubishi Tokyo Financial Group, Inc. (MTFG) since April 2001. He served as the president of MTFG from April 2001 to June 2004, during which period he also served as the chief executive officer of MTFG from April 2002 to June 2004, and as co-chief executive officer from April 2001 to April 2002. He has also served as the chairman of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) since June 2004. He served as the president of BTM from June 2000 to June 2004, and as a deputy president of BTM from May 1997 to June 2000. He served as a senior managing director of BTM from April 1996 to May 1997 and as a senior managing director of The Mitsubishi Bank, Limited (Mitsubishi Bank) from June 1994 to April 1996. He served as a managing director of Mitsubishi Bank from June 1989 to June 1994 and as a director of Mitsubishi Bank from June 1986 to June 1989. Mr. Miki was born on April 4, 1935.

Shintaro Yasuda has served as a director of UFJ Holdings, Inc. (UFJ) since June 2004, and as the president of UFJ Trust Bank, Ltd. (UFJ Trust) since May 2004. He served as a deputy president of UFJ Trust from May 2003 to May 2004 and as a director and senior executive officer of UFJ Trust from January 2002 to May 2003. He served as a senior executive officer of UFJ from April 2001 to January 2002, and as a managing director of Toyo Trust & Banking Co., Ltd. (Toyo Trust) from June 2000 to April 2001. He served as a senior executive officer of Toyo Trust from May 2000 to June 2000 and as an executive officer of Toyo Trust from June 1999 to May 2000. He served as a director of Toyo Trust from January 1998 to June 1999. Mr. Yasuda was born on December 23, 1946.

Hirohisa Aoki has served as a director and senior executive officer of UFJ Tsubasa Securities Co., Ltd. (UFJ Tsubasa) since June 2004. He served as a senior executive officer of UFJ Tsubasa from June 2002 to June 2004, and as a senior executive officer of UFJ Capital Markets Securities Co., Ltd. from January 2002 to May 2002. He served as a senior executive officer of The Tokai Bank, Limited (Tokai Bank) from April 2000 to January 2002, and as an executive officer of Tokai Bank from June 1998 to April 2000. Mr. Aoki was born on July 11, 1949.

Kinya Okauchihas served as a director of Mitsubishi Tokyo Financial Group, Inc. (MTFG) since June 2004. He has also served as a managing director of The Mitsubishi Trust and Banking Corporation (MTBC) since April 2003, and as a board member of MTBC since March 2004. He served as a director of MTBC from June 2001 to April 2003. Mr. Okauchi was born on September 10, 1951.

Nobuyuki Hirano has served as an executive officer and co-general manager of the Corporate Policy Division of Mitsubishi Tokyo Financial Group, Inc. (MTFG) since July 2004. He has also served as a non-board member director of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) since June 2001 and as a general manager of the Corporate Planning Office of BTM since May 2004. Mr. Hirano was born on October 23, 1951.

Hiroshi Hamada has served as a director of UFJ Holdings, Inc. (UFJ) since June 2002. He has also served as the principal adviser of Ricoh Company Limited (Ricoh) since June 2004. He served as the chairman of Ricoh from April 1996 to June 2004, during which period he also served as the chief executive officer of Ricoh from April 1996 to June 2003. He served as a corporate auditor of UFJ from April 2001 to June 2002. He served as the president of Ricoh from April 1983 to April 1996, and as a executive managing director of Ricoh from April 1981 to April 1983. He served as a managing director of Ricoh from June 1980 to April 1981, and as a director of Ricoh from May 1975 to June 1980. Mr. Hamada was born on April 28, 1933.

Iwao Okijima has served as a director of UFJ Holdings, Inc. (UFJ) since June 2004. He has also served as a senior advisor of Hino Motors Ltd. (Hino Motors) since June 2004, and as an advisor of Toyota Motor Corporation (Toyota) since July 2002. He served as the chairman of the board of Hino Motors from June 2000 to June 2004, and as the chairman of the board of Koito Manufacturing Co., Ltd., from June 1999 to June 2003. He served as a director of Hino Motors from June 1999 to June 2000, and as a senior adviser of Toyota from June 1999 to July 2002. He served as a vice president of Toyota from August 1995 to June 1999, and as a senior managing director of Toyota from September 1992 to August 1995. He served as a executive managing director of Toyota from September 1990 to September 1992, and as a director from September 1985 to September 1990. Mr. Okijima was born on December 27, 1934.

Ryotaro Kanekohas served as a director of Mitsubishi Tokyo Financial Group, Inc. since April 2001. He has also served as the president of Meiji Yasuda Life Insurance Company since January 2004. Mr. Kaneko served as the president of Meiji Life Insurance Company (Meiji Yasuda Life) from April 1998 to December 2003, and as a senior managing director of Meiji Life from April 1997 to April 1998. He served as a managing director of Meiji Yasuda Life from April 1994 to April 1997, and as a director of Meiji Yasuda Life from July 1991 to April 1994. Mr. Kaneko was born on June 20, 1941.

Takuma Otoshihas served as a director of Mitsubishi Tokyo Financial Group, Inc. since June 2004. He has also served as the president of IBM Japan, Ltd. since December 1999. He served as a managing director of IBM Japan, Ltd. from March 1997 to December 1999, and as a director of IBM Japan, Ltd. from March 1994 to March 1997. Mr. Otoshi was born on October 17, 1948.

The following is a brief biography of each corporate auditor.

Setsuo Unohas served as a full-time corporate auditor of Mitsubishi Tokyo Financial Group, Inc. (MTFG) since June 2003. He has also served as a corporate auditor of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) since June 2003. He served as a senior managing director of MTFG from April 2001 to June 2003, and as a managing director of BTM from May 1997 to March 2001. He served as a director of BTM from April 1996 to May 1997 and as a director of The Mitsubishi Bank, Limited from June 1992 to April 1996. Mr. Uno was born on April 29, 1942.

Haruo Matsukihas served as a senior executive officer of UFJ Trust Bank, Ltd. (UFJ Trust) since January 2002, during which period he served as a director of UFJ Trust from January 2002 to September 2004. He served as a managing director of The Toyo Trust & Banking Co., Ltd. (Toyo Trust) from June 2001 to January 2002, and as a senior executive officer of Toyo Trust from March 2001 to June 2001. He served as an executive officer of Toyo Trust from June 1999 to March 2001. Mr. Matsuki was born on April 25, 1948.

Takeo Imai has served as a corporate auditor of Mitsubishi Tokyo Financial Group, Inc. since April 2001. He has been a partner of the law firm Miyake, Imai & Ikeda since January 1972. Mr. Imai was born on January 29, 1942.

Tsutomu Takasuka has served as a full-time corporate auditor of The Bank of Tokyo-Mitsubishi, Ltd. since October 2004. He has also been a professor of the Bunkyo Gakuin University since April 2004. He served as the chief executive officer of Tohmatsu & Co. from February 1990 to September 2002, and as the chief executive officer of Mita & Co. from June 1985 to February 1990. Mr. Takasuka was born on February 11, 1942.

Kunie Okamotohas served as the president of Nippon Life Insurance Company (Nippon Life) since April 2005. He served as a senior managing director of Nippon Life from March 2002 to April 2005, and as a managing director of Nippon Life from March 1999 to March 2002. He served as a director of Nippon Life from July 1995 to March 1999. Mr. Okamoto was born on September 11, 1944.

The following is a brief biography of each Managing Officer.

Ryuichi Muratahas served as a managing officer and group head of the Integrated Retail Banking Business Group of Mitsubishi Tokyo Financial Group, Inc. since April 2004. He has also served as a managing director of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) since June 2003, and as the chief executive of the Retail Banking Business Unit of BTM since May 2003. He served as a non-board member managing director of BTM from May 2002 to June 2003. He served as a director of BTM from June 1998 to May 2002, during which period he also served as a board member of BTM from June 1998 to June 2001. Mr. Murata was born on April 12, 1948.

Takamune Okiharahas served as a director of UFJ Holdings, Inc. (UFJ) since June 2004. He has also served as the president and CEO of UFJ Bank Limited (UFJ Bank) since May 2004. He served as a senior executive officer of UFJ Bank from May 2003 to May 2004 and as an executive officer of UFJ Bank from January 2002 to May 2003. He served as an executive officer of The Sanwa Bank, Limited from March 2001 to January 2002. Mr. Okihara was born on July 11, 1951.

Toshio Gotohas served as a managing officer and group head of the Integrated Trust Assets Business Group of Mitsubishi Tokyo Financial Group, Inc. since April 2004. He has also served as a managing director of The Mitsubishi Trust and Banking Corporation (MTBC) since March 2004. He served as a non-board director of MTBC from June 2002 to March 2004. Mr. Goto was born on March 8, 1952.

Hajime Mitahas served as an executive officer of Mitsubishi Tokyo Financial Group, Inc. manager of the Retail Business Development Division, and deputy general manager of the Comprehensive Card Division of the Integrated Retail Banking Business Group since April 2004. He has also served as a non-board member director of The Mitsubishi Trust and Banking Corporation (MTBC) since June 2003, and as a general manager of Retail Banking Planning and Development Division since October 2004. He served as a general manager of the Personal Banking Division of MTBC from April 2003 to October 2004. Mr. Mita was born on December 15, 1950.

Norimichi Kanari has served as a senior managing director of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) since January 2005 and as a managing director of BTM from June 2001 to January 2005, and as the chief executive of the UNBC Business Unit and the president and chief executive officer of UnionBanCal Corporation and Union Bank of California, N.A. since July 2001. He has served as a director of BTM from June 1997 to June 2001. Mr. Kanari was born on December 4, 1946.

Noriaki Hanamizuhas served as a managing officer and deputy group head of the Integrated Retail Banking Business Group of Mitsubishi Tokyo Financial Group, Inc. since April 2004. He has also served as a senior managing director of The Mitsubishi Trust and Banking Corporation (MTBC) since March 2004. He served as a non-board member managing director of MTBC from June 2001 to March 2004, and as a director of MTBC from June 1998 to June 2001. Mr. Hanamizu was born on September 11, 1947.

Akira Naitohas served as a general manager of the Foreign Exchange & Treasury Division of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) since May 2002 and as a non-board member director of BTM since June 2001. Mr. Naito was born on September 20, 1951.

(Contacts:)

Mitsubishi Tokyo Financial Group, Inc. Corporate Communications Office (03-3240-9059)

UFJ Holdings, Inc. Public Relations Department (03-3212-5460)

Filings with the U.S. SEC

Mitsubishi Tokyo Financial Group, Inc. (“MTFG”) filed a registration statement on Form F-4 (“Form F-4”) with the U.S. SEC in connection with the proposed management integration of UFJ Holdings, Inc. (“UFJ”) with MTFG. The Form F-4 contains a prospectus and other documents. After the Form F-4 is declared effective, UFJ plans to mail the prospectus contained in the Form F-4 to its U.S. shareholders prior to the shareholders meeting at which the proposed business combination will be voted upon. The Form F-4 and prospectus contains important information about MTFG, UFJ, management integration and related matters.U.S. shareholders of UFJ are urged to read the Form F-4, the prospectus and the other documents that are filed with the U.S. SEC in connection with the management integration carefully before they make any decision at the UFJ shareholders meeting with respect to the proposed business combination. The Form F-4, the prospectus and all other documents filed with the U.S. SEC in connection with the management integration will be available when filed, free of charge, on the U.S. SEC’s web site at www.sec.gov. In addition, the prospectus and all other documents filed with the U.S. SEC in connection with the management integration will be made available to shareholders, free of charge, by calling, writing or e-mailing:

MTFG CONTACT:

Mr. Hirotsugu Hayashi 26F Marunouchi Bldg., 4-1 Marunouchi 2-chome, Chiyoda-ku Tokyo 100-6326 Japan 81-3-3240-9059 Hirotsugu_Hayashi@mtfg.co.jp | UFJ CONTACT:

Mr. Shiro Ikushima 1-1 Otemachi 1-chome, Chiyoda-ku Tokyo 100-8114 Japan 81-3-3212-5458 shiro_ikushima@ufj.co.jp |

In addition to the Form F-4, the prospectus and the other documents filed with the U.S. SEC in connection with the management integration, MTFG is obligated to file annual reports with, and submit other information to, the U.S. SEC. You may read and copy any reports and other information filed with, or submitted to, the U.S. SEC at the U.S. SEC’s public reference rooms at 450 Fifth Street, N.W., Washington, D.C. 20549 or at the other public reference rooms in New York, New York and Chicago, Illinois. Please call the U.S. SEC at 1-800-SEC-0330 for further information on public reference rooms. Filings with the U.S. SEC also are available to the public from commercial document-retrieval services and at the web site maintained by the U.S. SEC at www.sec.gov.

Forward-Looking Statements

This communication contains forward-looking information and statements about MTFG, UFJ and their combined businesses after completion of the management integration. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although MTFG’s and UFJ’s management believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of UFJ securities are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of MTFG and UFJ, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the SEC and the local filings made by MTFG and UFJ, including those listed under “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” in the prospectus included in the registration statement on Form F-4 that MTFG filed with the U.S. SEC. Other than as required by applicable law, MTFG and UFJ do not undertake any obligation to update or revise any forward-looking information or statements.