Filing under Rule 425 under the U.S. Securities Act of 1933

Filing by: Mitsubishi Tokyo Financial Group, Inc.

Subject Company: UFJ Holdings, Inc.

SEC File No. 333-123136

Mitsubishi Tokyo Financial Group

Investor Meeting

May 31, 2005

This document contains forward-looking statements in regard to forecasts, targets and plans of Mitsubishi Tokyo Financial Group, Inc. (“MTFG”), UFJ Holdings, Inc. (“UFJ”) and their respective group companies (collectively, the “new group”). These forward-looking statements are based on information currently available to the new group and are stated here on the basis of the outlook at the time that this document was produced. In addition, in producing these statements certain assumptions (premises) have been utilized. These statements and assumptions (premises) are subjective and may prove to be incorrect and may not be realized in the future. Underlying such circumstances are a large number of risks and uncertainties. Please see the latest disclosure and other public filings made by MTFG, UFJ and the other companies comprising the new group, including Japanese securities reports, annual reports, shareholder convocation notices, and MTFG’s registration statement on Form F-4, for additional information regarding such risks and uncertainties.

In addition, information on companies and other entities outside the new group that is recorded in this document has been obtained from publicly available information and other sources. The accuracy and appropriateness of that information has not been verified by the new group and cannot be guaranteed.

The financial information used in this document was prepared in accordance with accounting standards generally accepted in Japan, or Japanese GAAP.

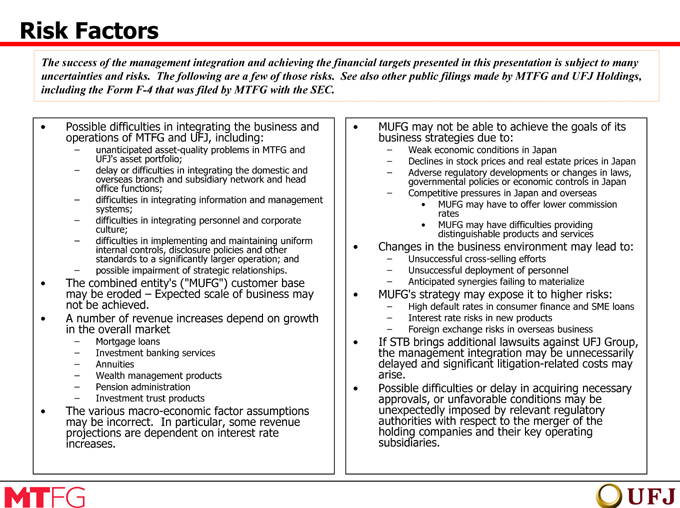

Risk Factors

The success of the management integration and achieving the financial targets presented in this presentation is subject to many uncertainties and risks. The following are a few of those risks. See also other public filings made by MTFG and UFJ Holdings, including the Form F-4 that was filed by MTFG with the SEC.

Possible difficulties in integrating the business and operations of MTFG and UFJ, including: unanticipated asset-quality problems in MTFG and UFJ’s asset portfolio; delay or difficulties in integrating the domestic and overseas branch and subsidiary network and head office functions; difficulties in integrating information and management systems; difficulties in integrating personnel and corporate culture; difficulties in implementing and maintaining uniform internal controls, disclosure policies and other standards to a significantly larger operation; and possible impairment of strategic relationships.

The combined entity’s (“MUFG”) customer base may be eroded – Expected scale of business may not be achieved.

A number of revenue increases depend on growth in the overall market

Mortgage loans

Investment banking services Annuities Wealth management products Pension administration Investment trust products

The various macro-economic factor assumptions may be incorrect. In particular, some revenue projections are dependent on interest rate increases.

MUFG may not be able to achieve the goals of its business strategies due to:

Weak economic conditions in Japan

Declines in stock prices and real estate prices in Japan Adverse regulatory developments or changes in laws, governmental policies or economic controls in Japan Competitive pressures in Japan and overseas

MUFG may have to offer lower commission rates MUFG may have difficulties providing distinguishable products and services

Changes in the business environment may lead to:

Unsuccessful cross-selling efforts Unsuccessful deployment of personnel Anticipated synergies failing to materialize

MUFG’s strategy may expose it to higher risks:

High default rates in consumer finance and SME loans Interest rate risks in new products Foreign exchange risks in overseas business

If STB brings additional lawsuits against UFJ Group, the management integration may be unnecessarily delayed and significant litigation-related costs may arise.

Possible difficulties or delay in acquiring necessary approvals, or unfavorable conditions may be unexpectedly imposed by relevant regulatory authorities with respect to the merger of the holding companies and their key operating subsidiaries.

Agenda

FY2004 Results

Summary of FY04 results 1 Consolidated Gross Profits 2

Deposit and Lending Income 3 Fees and commissions 4

Consolidated Expenses 5 Financial Highlights by Customer 6

Segments

1-Retail 7 2-Corporate 8 3-Trust assets 9

NPLs 10-11

Securities Gains and Losses/Equity 12

Holdings

Capital 13

Deferred tax assets 14

Mitsubishi Securities 15

UnionBanCal Corporation 16

FY05 Earnings Targets 17

Appendix

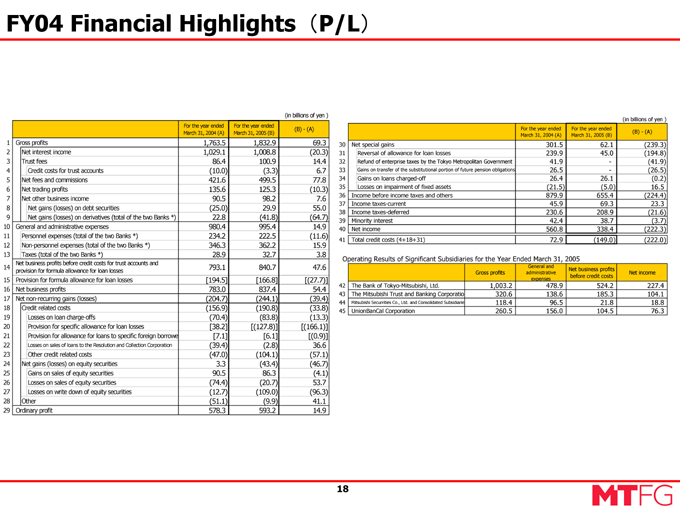

FY2004 Financial Highlights (P/L) 18

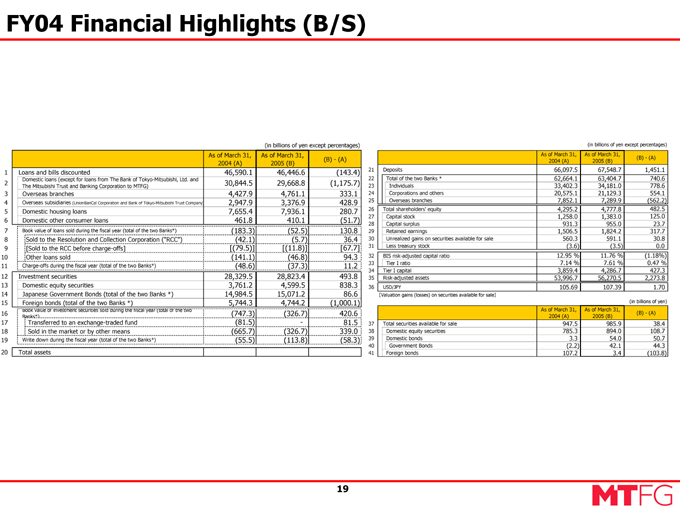

FY2004 Financial Highlights (B/S) 19

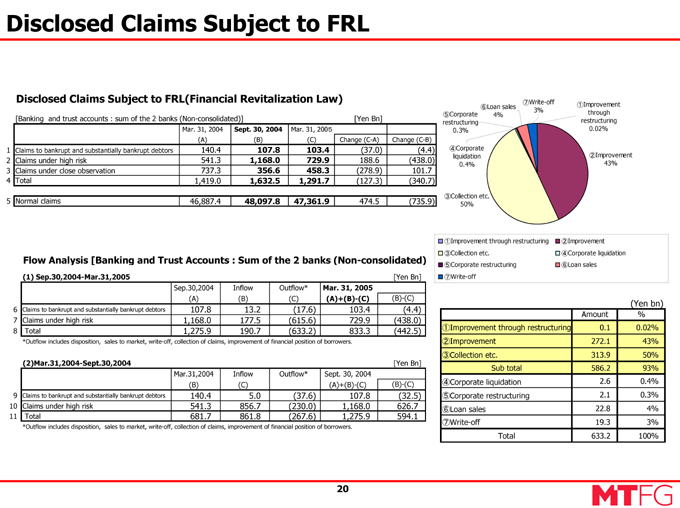

Disclosed Claims Subject to FRL 20

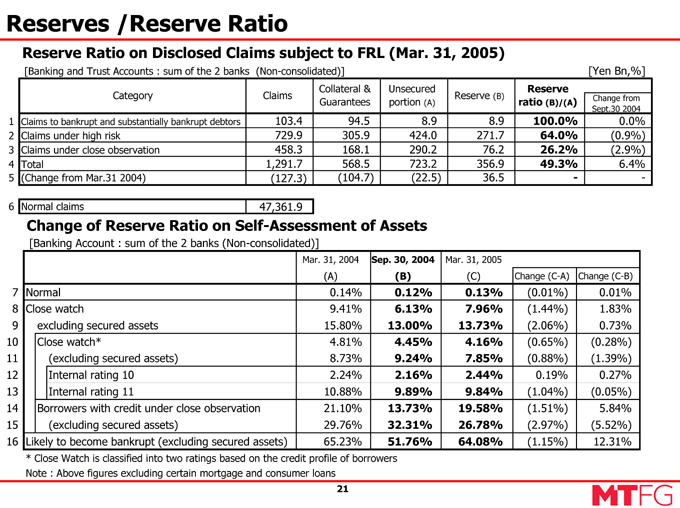

Reserves / Reserve Ratio 21

Taxable Income 22

Achievements of Core Businesses 23

Figures used in this report are defined as follows:

Consolidated : MTFG Consolidated.

Sum of the 2 banks : Sum of the non-consolidated figures for BTM and MTB on a simple combined basis.

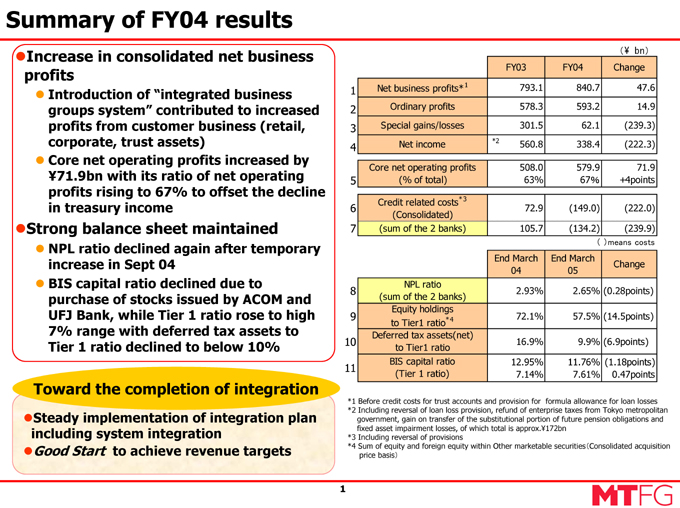

Summary of FY04 results

Increase in consolidated net business profits

Introduction of “integrated business groups system” contributed to increased profits from customer business (retail, corporate, trust assets) Core net operating profits increased by ¥71.9bn with its ratio of net operating profits rising to 67% to offset the decline in treasury income

Strong balance sheet maintained

NPL ratio declined again after temporary increase in Sept 04 BIS capital ratio declined due to purchase of stocks issued by ACOM and UFJ Bank, while Tier 1 ratio rose to high 7% range with deferred tax assets to Tier 1 ratio declined to below 10%

Toward the completion of integration

Steady implementation of integration plan including system integration

Good Start to achieve revenue targets

(¥ bn)

FY03 FY04 Change

1 Net business profits*1 793.1 840.7 47.6

2 Ordinary profits 578.3 593.2 14.9

3 Special gains/losses 301.5 62.1 (239.3)

Net income *2 560.8 338.4 (222.3)

4

Core net operating profits 508.0 579.9 71.9

5 (% of total) 63% 67% +4points

Credit related costs*3

6 72.9 (149.0) (222.0)

(Consolidated)

7 (sum of the 2 banks) 105.7 (134.2) (239.9)

() means costs

End March End March

Change

04 05

NPL ratio

8 2.93% 2.65% (0.28points)

(sum of the 2 banks)

Equity holdings

9 72.1% 57.5% (14.5points)

to Tier1 ratio*4

Deferred tax assets(net)

10 16.9% 9.9% (6.9points)

to Tier1 ratio

BIS capital ratio 12.95% 11.76% (1.18points)

11

(Tier 1 ratio) 7.14% 7.61% 0.47points

*1 Before credit costs for trust accounts and provision for formula allowance for loan losses *2 Including reversal of loan loss provision, refund of enterprise taxes from Tokyo metropolitan government, gain on transfer of the substitutional portion of future pension obligations and fixed asset impairment losses, of which total is approx.¥172bn

*3 Including reversal of provisions

*4 Sum of equity and foreign equity within Other marketable securities(Consolidated acquisition price basis)

1

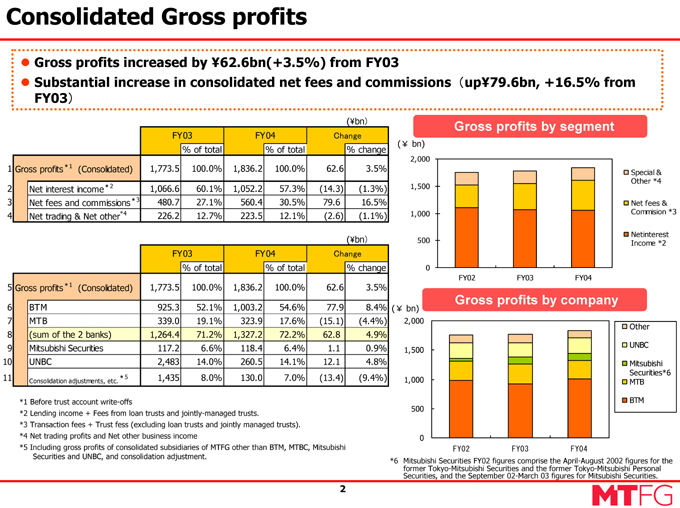

Consolidated Gross profits

Gross profits increased by ¥62.6bn(+3.5%) from FY03

Substantial increase in consolidated net fees and commissions(up¥79.6bn, +16.5% from FY03)

(¥ bn)

FY03 FY04 Cha nge

% of total % of total % change

1 Gross profits*1 (Consolidated) 1,773.5 100.0% 1,836.2 100.0% 62.6 3.5%

2 Net inter est income*2 1,066.6 60.1% 1,052.2 57.3% (14.3) (1.3%)

3 Net fees and commissions*3 480.7 27.1% 560.4 30.5% 79.6 16.5%

4 Net trading & Net other*4 226.2 12.7% 223.5 12.1% (2.6) (1.1%)

FY03 FY04 Cha nge

% of total % of total % change

5 Gross profits*1 (Consolidated) 1,773.5 100.0% 1,836.2 100.0% 62.6 3.5%

6 BTM 925.3 52.1% 1,003.2 54.6% 77.9 8.4%

7 MTB 339.0 19.1% 323.9 17.6% (15.1) (4.4%)

8 (sum of t he 2 banks) 1,264.4 71.2% 1,327.2 72.2% 62.8 4.9%

9 Mitsubishi S ecurities 117.2 6.6% 118.4 6.4% 1.1 0.9%

10 UNBC 2,483 14.0% 260.5 14.1% 12.1 4.8%

11 5 1,435 8.0% 130.0 7.0% (13.4) (9.4%)

Consolidation a djustments, etc.*

(¥ bn)

*1 Before trust account write-offs

*2 Lending income + Fees from loan trusts and jointly-managed trusts.

*3 Transaction fees + Trust fess (excluding loan trusts and jointly managed trusts).

*4 Net trading profits and Net other business income

*5 Including gross profits of consolidated subsidiaries of MTFG other than BTM, MTBC, Mitsubishi Securities and UNBC, and consolidation adjustment.

Gross profits by segment

(?bn)

2,000 1,500 1,000 500 0

FY02 FY03 FY04

Special & Other *4

Net fees & Commision *3

Netinterest Income *2

Gross profits by company

(?bn)

2,000 1,500 1,000 500 0

FY02 FY03

Other

UNBC

Mitsubishi Securities*6 MTB

BTM

*6 Mitsubishi Securities FY02 figures comprise the April-August 2002 figures for the former Tokyo-Mitsubishi Securities and the former Tokyo-Mitsubishi Personal Securities, and the September 02-March 03 figures for Mitsubishi Securities.

2

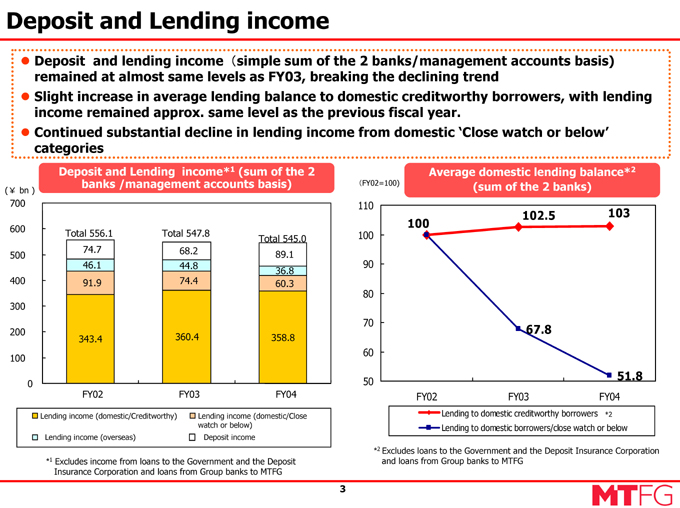

Deposit and Lending income

Deposit and lending income(simple sum of the 2 banks/management accounts basis) remained at almost same levels as FY03, breaking the declining trend Slight increase in average lending balance to domestic creditworthy borrowers, with lending income remained approx. same level as the previous fiscal year.

Continued substantial decline in lending income from domestic ‘Close watch or below’ categories

Deposit and Lending income*1 (sum of the 2 banks /management accounts basis)

(¥ bn )

700

600

500

400

300

200

100

0

FY02 FY03 FY04

Total 556.1 74.7 46.1 91.9

343.4

Total 547.8 68.2 44.8 74.4

360.4

Total 545.0 89.1 36.8 60.3

358.8

Lending income (domestic/Creditworthy) Lending income (domestic/Close watch or below) Lending income (overseas) Deposit income

*1 Excludes income from loans to the Government and the Deposit Insurance Corporation and loans from Group banks to MTFG

Average domestic lending balance*2 (sum of the 2 banks)

(FY02=100)

110 100 90 80 70 60 50

FY02 FY03 FY04

100

102.5

103

67.8

51.8

Lending to domestic creditworthy borrowers *2 Lending to domestic borrowers/close watch or below

*2 Excludes loans to the Government and the Deposit Insurance Corporation and loans from Group banks to MTFG

3

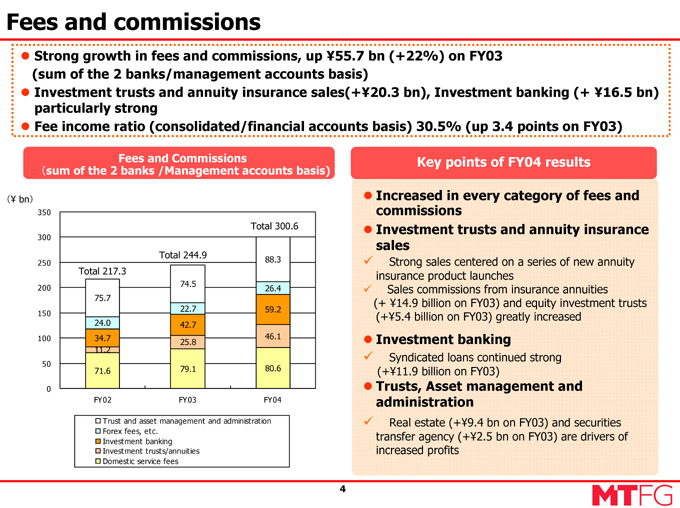

Fees and commissions

Strong growth in fees and commissions, up ¥55.7 bn (+22%) on FY03 (sum of the 2 banks/management accounts basis)

Investment trusts and annuity insurance sales(+¥20.3 bn), Investment banking (+ ¥16.5 bn) particularly strong Fee income ratio (consolidated/financial accounts basis) 30.5% (up 3.4 points on FY03)

Fees and Commissions

(sum of the 2 banks /Management accounts basis)

(¥ bn)

350 300 250 200 150 100 50 0

FY02 FY03 FY04

Total 217.3

75.7

24.0 34.7 11.2

71.6

Total 244.9

74.5

22.7 42.7 25.8

79.1

Total 300.6

88.3

26.4

59.2

46.1

80.6

Trust and asset management and administration Forex fees, etc.

Investment banking Investment trusts/annuities Domestic service fees

Key points of FY04 results

Increased in every category of fees and commissions Investment trusts and annuity insurance sales

Strong sales centered on a series of new annuity insurance product launches

Sales commissions from insurance annuities

(+ ¥14.9 billion on FY03) and equity investment trusts (+¥5.4 billion on FY03) greatly increased

Investment banking

Syndicated loans continued strong

(+¥11.9 billion on FY03)

Trusts, Asset management and administration

Real estate (+¥9.4 bn on FY03) and securities transfer agency (+¥2.5 bn on FY03) are drivers of increased profits

4

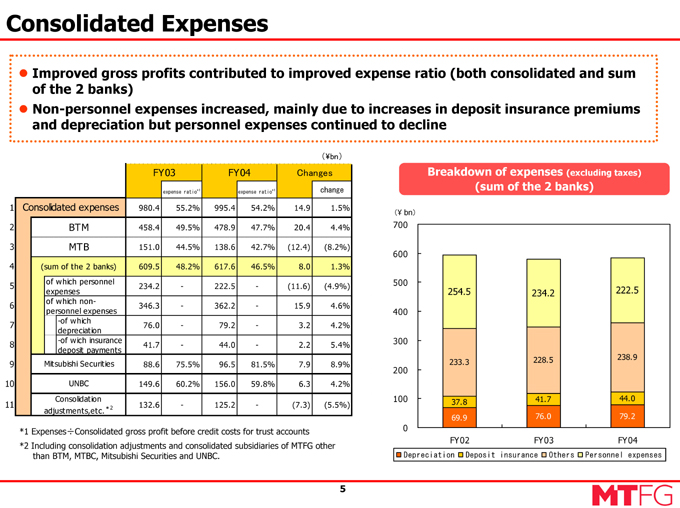

Consolidated Expenses

Improved gross profits contributed to improved expense ratio (both consolidated and sum of the 2 banks) Non-personnel expenses increased, mainly due to increases in deposit insurance premiums and depreciation but personnel expenses continued to decline

(¥ bn)

FY03 FY04 Changes

expense ratio *1 expense ratio *1 change

1 Consolidated expenses 980.4 55.2% 995.4 54.2% 14.9 1.5%

2 BTM 458.4 49.5% 478.9 47.7% 20.4 4.4%

3 MTB 151.0 44.5% 138.6 42.7% (12.4) (8.2%)

4 (sum of the 2 banks) 609.5 48.2% 617.6 46.5% 8.0 1.3%

5 of which personnel

234.2 - 222.5 - (11.6) (4.9%)

expenses

6 of which non-

346.3 - 362.2 - 15.9 4.6%

personnel expenses

-of which

7 76.0 - 79.2 - 3.2 4.2%

depreciation

8 -of wich insurance

41.7 - 44.0 - 2.2 5.4%

deposit payments

9 Mitsubishi Securities 88.6 75.5% 96.5 81.5% 7.9 8.9%

10 UNBC 149.6 60.2% 156.0 59.8% 6.3 4.2%

Consolidation

11 2 132.6 - 125.2 - (7.3) (5.5%)

adjustments,etc.*

*1 Expenses÷Consolidated gross profit before credit costs for trust accounts *2 Including consolidation adjustments and consolidated subsidiaries of MTFG other than BTM, MTBC, Mitsubishi Securities and UNBC.

Breakdown of expenses (excluding taxes) (sum of the 2 banks)

(¥ bn)

700 600 500 400 300 200 100 0

FY02 FY03 FY04

254.5

233.3

37.8 69.9

234.2

228.5

41.7 76.0

222.5

238.9

44.0

79.2

Depreciation Deposit insurance Others Personnel expenses

5

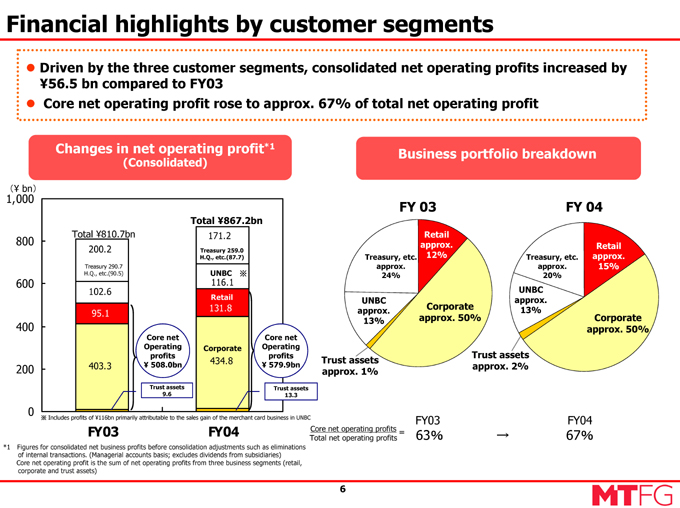

Financial highlights by customer segments

Driven by the three customer segments, consolidated net operating profits increased by ¥56.5 bn compared to FY03 Core net operating profit rose to approx. 67% of total net operating profit

Changes in net operating profit*1

(Consolidated)

(¥ bn)

1,000 800 600 400 200 0

Total ¥810.7bn 200.2

Treasury 290.7 H.Q., etc.(90.5)

102.6

95.1

403.3

Core net Operating profits

¥ 508.0 bn

Trust assets 9.6

Total ¥867.2bn

171.2

Treasury 259.0 H.Q., etc.(87.7)

UNBC ?

116.1

Retail

131.8

Corporate

434.8

Core net Operating profits

579.9bn

Trust assets 13.3

Includes profits of ¥116bn primarily attributable to the sales gain of the merchant card business in UNBC

FY03 FY04

*1 Figures for consolidated net business profits before consolidation adjustments such as eliminations of internal transactions. (Managerial accounts basis; excludes dividends from subsidiaries) Core net operating profit is the sum of net operating profits from three business segments (retail, corporate and trust assets)

Business portfolio breakdown

FY 03

Retail approx.

12%

Treasury, etc approx.

24%

UNBC approx.

13%

Trust assets approx. 1%

Corporate approx. 50%

Core net operating profits Total net operating profits =

FY03

63%

FY 04

Retail approx.

15%

Treasury, etc. approx.

20%

UNBC approx.

13%

Trust assets approx. 2%

Corporate approx. 50%

FY04

67%

6

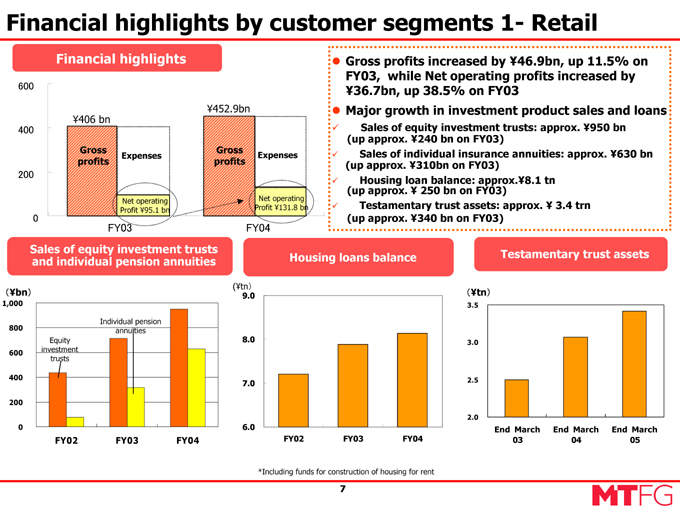

Financial highlights by customer segments 1- Retail

Financial highlights

600 400 200 0

¥406 bn

Gross

Expenses profits

Net operating Profit ¥95.1 bn

FY03

¥452.9bn

Gross profits

Expenses

Net operating Profit ¥131.8 bn

FY04

Sales of equity investment trusts and individual pension annuities

(¥ bn)

1,000 800 600 400 200 0

FY02 FY03 FY04

Equity investment trusts

Individual pension annuities

Housing loans balance

(¥tn)

9.0 8.0 7.0 6.0

FY02 FY03 FY04

Testamentary trust assets

( ¥tn)

3.5 3.0 2.5 2.0

End March End March End March

03 04 05

Gross profits increased by ¥46.9bn, up 11.5% on FY03, while Net operating profits increased by ¥36.7bn, up 38.5% on FY03 Major growth in investment product sales and loans

Sales of equity investment trusts: approx. ¥950 bn (up approx. ¥240 bn on FY03) Sales of individual insurance annuities: approx. ¥630 bn (up approx. ¥310bn on FY03) Housing loan balance: approx.¥8.1 tn (up approx. ¥ 250 bn on FY03) Testamentary trust assets: approx. ¥ 3.4 trn (up approx. ¥340 bn on FY03)

*Including funds for construction of housing for rent

7

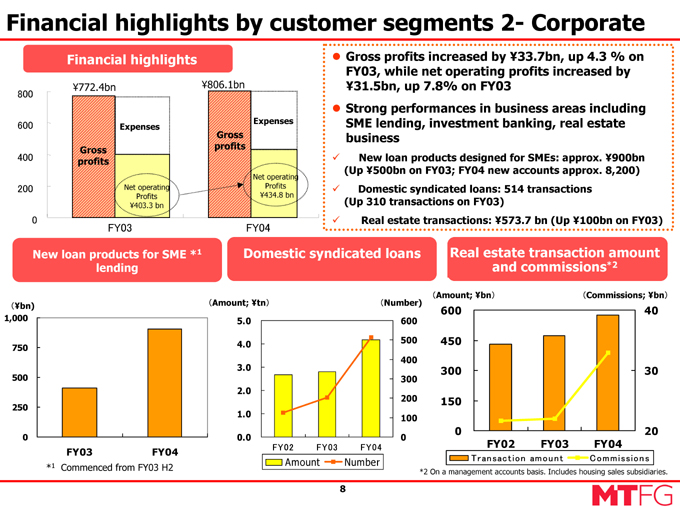

Financial highlights by customer segments 2- Corporate

Financial highlights

800 600 400 200 0

¥772.4bn ¥806.1bn

Expenses

Gross profits

Net operating Profits ¥403.3 bn

Expenses

Gross profits

Net operating Profits ¥434.8 bn

FY03 FY04

Gross profits increased by ¥33.7bn, up 4.3 % on FY03, while net operating profits increased by ¥31.5bn, up 7.8% on FY03 Strong performances in business areas including SME lending, investment banking, real estate business

New loan products designed for SMEs: approx. ¥900bn (Up ¥500bn on FY03; FY04 new accounts approx. 8,200) Domestic syndicated loans: 514 transactions (Up 310 transactions on FY03) Real estate transactions: ¥573.7 bn (Up ¥100bn on FY03)

New loan products for SME *1 lending

(¥ bn)

1,000 750 500 250 0

FY03 FY04

*1 Commenced from FY03 H2

(Amount; ¥tn)

5.0 4.0 3.0 2.0 1.0 0.0

FY02 FY03 FY04

Amount Number

(Number)

600 500 400 300 200 100 0

Domestic syndicated loans

Real estate transaction amount and commissions*2

(Amount; ¥bn)

600 450 300 150 0

(Commissions; ¥bn)

40 30 20

FY02 FY03 FY04

Transaction amount Commissions

*2 On a management accounts basis. Includes housing sales subsidiaries.

8

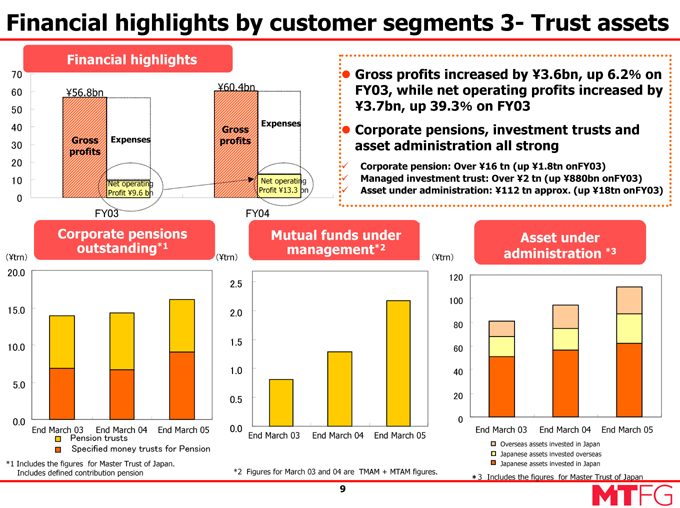

Financial highlights by customer segments 3- Trust assets

Financial highlights

70 60 50 40 30 20 10 0

¥56.8bn

Gross profits

Expenses

Net operating Profit ¥9.6 bn

FY03

¥60.4bn

Gross profits

Expenses

Net operating Profit ¥13.3 bn

FY04

Gross profits increased by ¥3.6bn, up 6.2% on FY03, while net operating profits increased by ¥3.7bn, up 39.3%on FY03 Corporate pensions, investment trusts and asset administration all strong

Corporate pension: Over ¥16 tn (up ¥1.8 tn on FY03) Managed investment trust: Over ¥2 tn (up ¥880 bn on FY03) Asset under administration: ¥112 tn approx. (up ¥18tn on FY03)

Corporate pensions outstanding*1

( ¥ trn)

20.0 15.0 10.0 5.0 0.0

End March 03 End March 04 End March 05

Pension trusts

Specified money trusts for Pension

*1 Includes the figures for Master Trust of Japan.

Includes defined contribution pension

Mutual funds under management*2

¥trn

2.5 2.0 1.5 1.0 0.5 0.0

End March 03 End March 04 End March 05

*2 Figures for March 03 and 04 are TMAM + MTAM figures.

Asset under administration *3

¥trn

120

100

80

60

40

20

0

End March 03 End March 04 End March 05

Overseas assets invested in Japan Japanese assets invested overseas Japanese assets invested in Japan

*3 Includes the figures for Master Trust of Japan

9

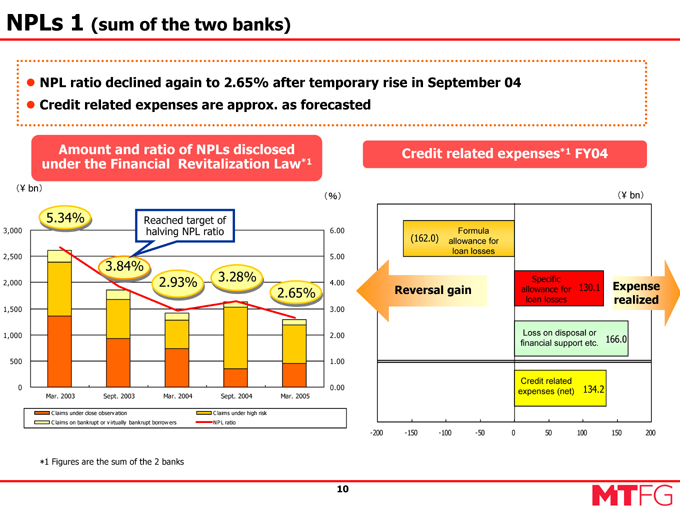

NPLs 1 (sum of the two banks)

NPL ratio declined again to 2.65% after temporary rise in September 04 Credit related expenses are approx. as forecasted

Amount and ratio of NPLs disclosed under the Financial Revitalization Law*1

(¥ bn)

3,000 2,500 2,000 1,500 1,000 500 0

5.34%

3.84%

2.93%

3.28%

2.65%

Reached target of halving NPL ratio

Mar. 2003 Sept. 2003 Mar. 2004 Sept. 2004 Mar. 2005

Claims under close observation

Claims on bankrupt or virtually bankrupt borrowers

Claims under high risk NPL ratio

*1 Figures are the sum of the 2 banks

Credit related expenses*1 FY04

(%)

6.00 5.00 4.00 3.00 2.00 1.00 0.00

(¥ bn)

Formula (162.0) allowance for loan losses

Reversal gain

Specific allowance for 130.1 loan losses

Expense realized

Loss on disposal or financial support etc. 166.0

Credit related expenses (net) 134.2

-200 -150 -100 -50 0 50 100 150 200

10

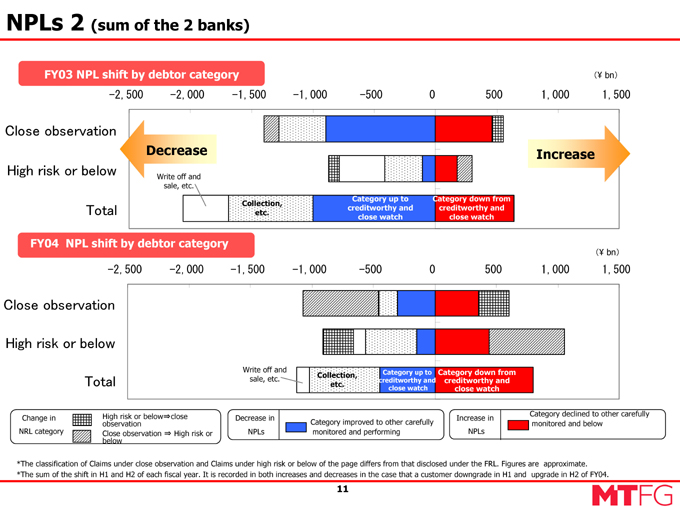

NPLs 2 (sum of the 2 banks)

FY03 NPL shift by debtor category

(¥ bn)

-2,500-2,000-1,500-1,000-500 0 500 1,000 1,500

Close observation High risk or below Total

Decrease

Increase

Write off and sale, etc.

Collection, etc.

Category up to creditworthy and close watch

Category down from creditworthy and close watch

FY04 NPL shift by debtor category

(¥ bn)

-2,500-2,000-1,500-1,000-500 0 500 1,000 1,500

Close observation High risk or below Total

Write off and sale, etc.

Collection, etc.

Category up to creditworthy and close watch

Category down from creditworthy and close watch

Change in NRL category

High risk or below?close observation

Close observation ?High risk or below

Decrease in NPLs

Category improved to other carefully monitored and performing

Increase in NPLs

Category declined to other carefully monitored and below

*The classification of Claims under close observation and Claims under high risk or below of the page differs from that disclosed under the FRL. Figures are approximate. *The sum of the shift in H1 and H2 of each fiscal year. It is recorded in both increases and decreases in the case that a customer downgrade in H1 and upgrade in H2 of FY04.

11

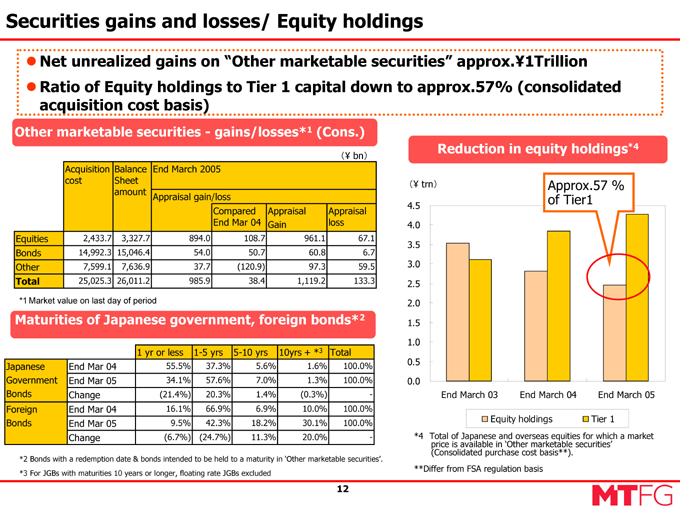

Securities gains and losses/ Equity holdings

Net unrealized gains on “Other marketable securities” approx.¥1Trillion Ratio of Equity holdings to Tier 1 capital down to approx.57% (consolidated acquisition cost basis)

Other marketable securities - gains/losses*1 (Cons.)

(¥ bn)

Acquisition Balance End March 2005

cost Sheet

amount

Appraisal gain/loss

Compared Appraisal Appraisal

End Mar 04 Gain loss

Equities 2,433.7 3,327.7 894.0 108.7 961.1 67.1

Bonds 14,992.3 15,046.4 54.0 50.7 60.8 6.7

Other 7,599.1 7,636.9 37.7 (120.9) 97.3 59.5

Total 25,025.3 26,011.2 985.9 38.4 1,119.2 133.3

*1 Market value on last day of period

Maturities of Japanese government, foreign bonds*2

1 yr or less 1-5 yrs 5-10 yrs 10yrs + *3 Total

Japanese End Mar 04 55.5% 37.3% 5.6% 1.6% 100.0%

Government End Mar 05 34.1% 57.6% 7.0% 1.3% 100.0%

Bonds Change (21.4%) 20.3% 1.4% (0.3%) -

Foreign End Mar 04 16.1% 66.9% 6.9% 10.0% 100.0%

Bonds End Mar 05 9.5% 42.3% 18.2% 30.1% 100.0%

Change (6.7%) (24.7%) 11.3% 20.0% -

*2 Bonds with a redemption date & bonds intended to be held to a maturity in ‘Other marketable securities’. *3 For JGBs with maturities 10 years or longer, floating rate JGBs excluded

Reduction in equity holdings*4

(¥ trn)

Approx.57 % of Tier1

4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0

End March 03 End March 04 End March 05

Equity holdings

Tier 1

*4

Total of Japanese and overseas equities for which a market price is available in ‘Other marketable securities’ (Consolidated purchase cost basis**).

**Differ from FSA regulation basis

12

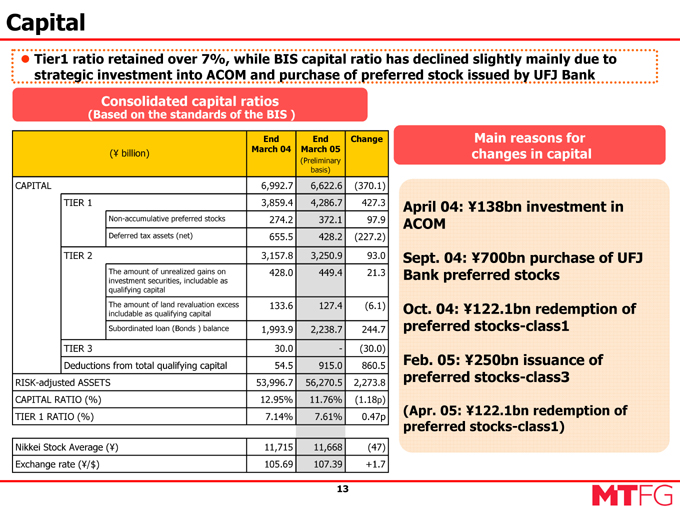

Capital

Tier1 ratio retained over 7%, while BIS capital ratio has declined slightly mainly due to strategic investment into ACOM and purchase of preferred stock issued by UFJ Bank

Consolidated capital ratios

(Based on the standards of the BIS )

End End Change

(¥ billion) March 04 March 05

(Preliminary

basis)

CAPITAL 6,992.7 6,622.6 (370.1)

TIER 1 3,859.4 4,286.7 427.3

Non-accumulative preferred stocks 274.2 372.1 97.9

Deferred tax assets (net) 655.5 428.2 (227.2)

TIER 2 3,157.8 3,250.9 93.0

The amount of unrealized gains on 428.0 449.4 21.3

investment securities, includable as

qualifying capital

The amount of land revaluation excess 133.6 127.4 (6.1)

includable as qualifying capital

Subordinated loan (Bonds ) balance 1,993.9 2,238.7 244.7

TIER 3 30.0 - (30.0)

Deductions from total qualifying capital 54.5 915.0 860.5

RISK-adjusted ASSETS 53,996.7 56,270.5 2,273.8

CAPITAL RATIO (%) 12.95% 11.76% (1.18p)

TIER 1 RATIO (%) 7.14% 7.61% 0.47p

Nikkei Stock Average (¥) 11,715 11,668 (47)

Exchange rate (¥/$) 105.69 107.39 +1.7

Main reasons for changes in capital

April 04: ¥138bn investment in ACOM

Sept. 04: ¥700bn purchase of UFJ Bank preferred stocks

Oct. 04: ¥122.1bn redemption of preferred stocks-class1

Feb. 05: ¥250bn issuance of preferred stocks-class3

(Apr. 05: ¥122.1bn redemption of preferred stocks-class1)

13

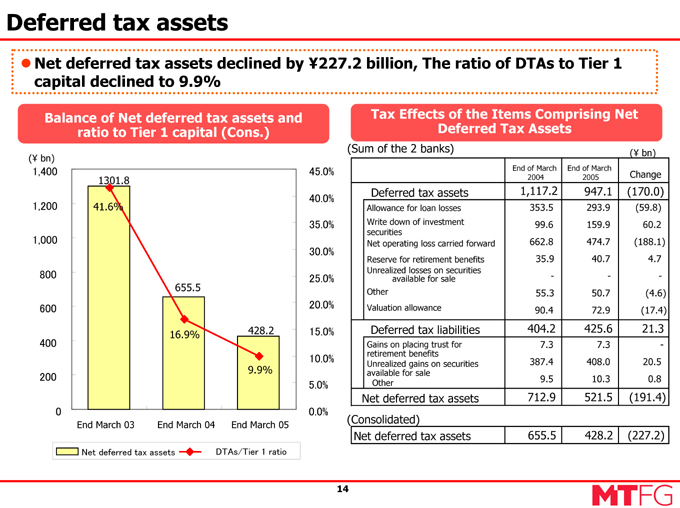

Deferred tax assets

Net deferred tax assets declined by ¥227.2 billion, The ratio of DTAs to Tier 1 capital declined to 9.9%

Balance of Net deferred tax assets and ratio to Tier 1 capital (Cons.)

(¥ bn)

1,400 1,200 1,000 800 600 400 200 0

1301.8

41.6%

655.5

16.9%

428.2

9.9%

End March 03 End March 04 End March 05

45.0% 40.0% 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0%

Net deferred tax assets

DTAs/Tier 1 ratio

Tax Effects of the Items Comprising Net Deferred Tax Assets

(Sum of the 2 banks) (¥ bn)

End of March End of March

2004 2005 Change

Deferred tax assets 1,117.2 947.1 (170.0)

Allowance for loan losses 353.5 293.9 (59.8)

Write down of investment 99.6 159.9 60.2

securities

Net operating loss carried forward 662.8 474.7 (188.1)

Reserve for retirement benefits 35.9 40.7 4.7

Unrealized losses on securities

available for sale - - -

Other 55.3 50.7 (4.6)

Valuation allowance 90.4 72.9 (17.4)

Deferred tax liabilities 404.2 425.6 21.3

Gains on placing trust for 7.3 7.3 -

retirement benefits

Unrealized gains on securities 387.4 408.0 20.5

available for sale

Other 9.5 10.3 0.8

Net deferred tax assets 712.9 521.5 (191.4)

(Consolidated)

Net deferred tax assets 655.5 428.2(227.2)

14

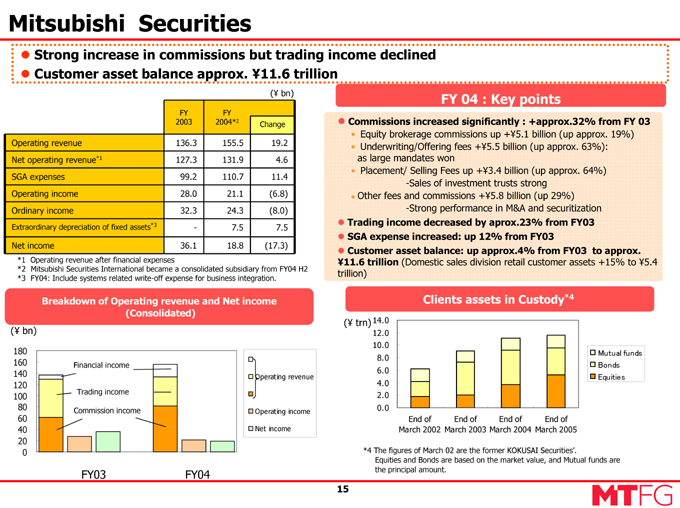

Mitsubishi Securities

Strong increase in commissions but trading income declined Customer asset balance approx. ¥11.6 trillion

(¥ bn)

FY FY

2003 2004*2 Change

Operating revenue 136.3 155.5 19.2

Net operating revenue*1 127.3 131.9 4.6

SGA expenses 99.2 110.7 11.4

Operating income 28.0 21.1 (6.8)

Ordinary income 32.3 24.3 (8.0)

Extraordinary depreciation of fixed assets*3 - 7.5 7.5

Net income 36.1 18.8 (17.3)

*1 Operating revenue after financial expenses

*2 Mitsubishi Securities International became a consolidated subsidiary from FY04 H2

*3 FY04: Include systems related write-off expense for business integration.

Breakdown of Operating revenue and Net income (Consolidated)

(¥ bn)

180 160 140 120 100 80 60 40 20 0

Financial income

Trading income

Commission income

FY03 FY04

Operating revenue

Operating income

Net income

FY 04 : Key points

Commissions increased significantly : +approx.32% from FY 03

Equity brokerage commissions up +¥5.1 billion (up approx. 19%) Underwriting/Offering fees +¥5.5 billion (up approx. 63%): as large mandates won Placement/ Selling Fees up +¥3.4 billion (up approx. 64%) -Sales of investment trusts strong Other fees and commissions +¥5.8 billion (up 29%) -Strong performance in M&A and securitization

Trading income decreased by aprox.23% from FY03 SGA expense increased: up 12% from FY03

Customer asset balance: up approx.4% from FY03 to approx.

¥11.6 trillion (Domestic sales division retail customer assets +15% to ¥5.4 trillion)

Clients assets in Custody*4

(¥ trn) 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0

End of End of End of End of March 2002 March 2003 March 2004 March 2005

Mutual funds Bonds Equities

*4 The figures of March 02 are the former KOKUSAI Securities’.

Equities and Bonds are based on the market value, and Mutual funds are the principal amount.

15

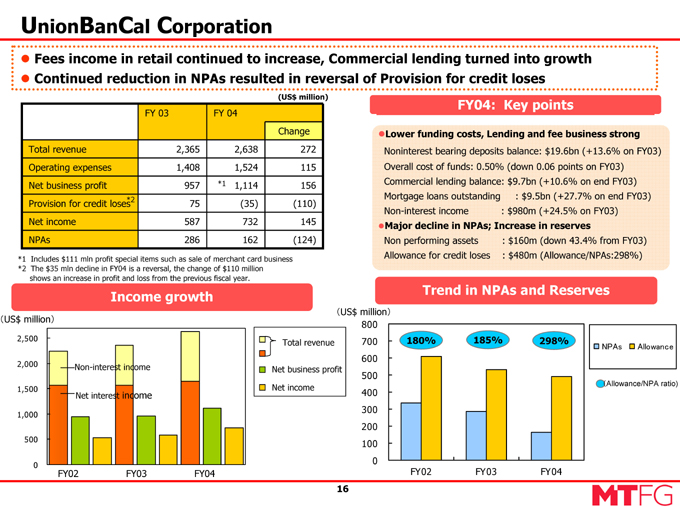

UnionBanCal Corporation

Fees income in retail continued to increase, Commercial lending turned into growth Continued reduction in NPAs resulted in reversal of Provision for credit loses

(US$ million)

FY 03 FY 04

Change

Total revenue 2,365 2,638 272

Operating expenses 1,408 1,524 115

Net business profit 957 *1 1,114 156

Provision for credit loses *2 75 (35) (110)

Net income 587 732 145

NPAs 286 162 (124)

*1 Includes $111 mln profit special items such as sale of merchant card business

*2 The $35 mln decline in FY04 is a reversal, the change of $110 million shows an increase in profit and loss from the previous fiscal year.

Income growth

(US$ million)

2,500 2,000 1,500 1,000 500 0

Non-interest income

Net interest income

FY02 FY03 FY04

Total revenue

Net business profit Net income

FY04: Key points

Lower funding costs, Lending and fee business strong

Noninterest bearing deposits balance: $19.6bn (+13.6% on FY03)

Overall cost of funds: 0.50% (down 0.06 points on FY03)

Commercial lending balance: $9.7bn (+10.6% on end FY03)

Mortgage loans outstanding : $9.5bn (+27.7% on end FY03)

Non-interest income : $980m (+24.5% on FY03)

Major decline in NPAs; Increase in reserves

Non performing assets : $160m (down 43.4% from FY03)

Allowance for credit loses : $480m (Allowance/NPAs:298%)

Trend in NPAs and Reserves

(US$ million) 800 700 600 500 400 300 200 100 0

180%

185%

298%

FY02 FY03 FY04

NPAs

Allowance

(Allowance/NPA ratio)

16

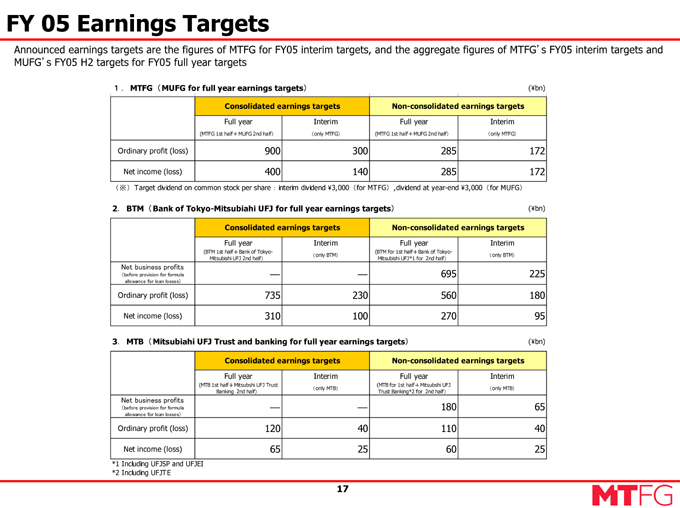

FY 05 Earnings Targets

Announced earnings targets are the figures of MTFG for FY05 interim targets, and the aggregate figures of MTFG’s FY05 interim targets and MUFG’s FY05 H2 targets for FY05 full year targets

1. MTFG(MUFG for full year earnings targets) (¥bn)

Consolidated earnings targets Non-consolidated earnings targets

Full year Interim Full year Interim

(MTFG 1st half+MUFG 2nd half) (only MTFG) (MTFG 1st half+MUFG 2nd half) (only MTFG)

Ordinary profit (loss) 900 300 285 172

Net income (loss) 400 140 285 172

Target dividend on common stock per share: interim dividend ¥3,000 (for MTFG), dividend at year-end ¥3,000 (for MUFG)

2.BTM (Bank of Tokyo-Mitsubishi UFJ for full year earnings targets) (¥bn)

Consolidated earnings targets Non-consolidated earnings targets

Full year Interim Full year Interim

(BTM 1st half+Bank of Tokyo- (BTM for 1st half+Bank of Tokyo-

(only BTM) (only BTM)

Mitsubishi UFJ 2nd half) Mitsubishi UFJ*1 for 2nd half)

Net business profits

(before provision for formula allowance for loan losses) — — 695 225

Ordinary profit (loss) 735 230 560 180

Net income (loss) 310 100 270 95

3.MTB (Mitsubishi UFJ Trust and banking for full year earnings targets) (¥bn)

Consolidated earnings targets Non-consolidated earnings targets

Full year (MTB 1st half+Mitsubshi UFJ Trust Banking 2nd half) Interim (only MTB) Full year (MTB for 1st half+Mitsubshi UFJ Trust Banking*2 for 2nd half) Interim (only MTB)

Net business profits (before provision for formula allowance for loan losses) — — 180 65

Ordinary profit (loss) 120 40 110 40

Net income (loss) 65 25 60 25

*1 Including UFJSP and UFJEI *2 Including UFJTE

17

FY04 Financial Highlights(P/L)

(in billions of yen )

For the year ended For the year ended

(B)—(A)

March 31, 2004 (A) March 31, 2005 (B)

1 Gross profits 1,763.5 1,832.9 69.3

2 Net interest income 1,029.1 1,008.8 (20.3)

3 Trust fees 86.4 100.9 14.4

4 Credit costs for trust accounts (10.0) (3.3) 6.7

5 Net fees and commissions 421.6 499.5 77.8

6 Net trading profits 135.6 125.3 (10.3)

7 Net other business income 90.5 98.2 7.6

8 Net gains (losses) on debt securities (25.0) 29.9 55.0

9 Net gains (losses) on derivatives (total of the two Banks *) 22.8 (41.8) (64.7)

10 General and administrative expenses 980.4 995.4 14.9

11 Personnel expenses (total of the two Banks *) 234.2 222.5 (11.6)

12 Non-personnel expenses (total of the two Banks *) 346.3 362.2 15.9

13 Taxes (total of the two Banks *) 28.9 32.7 3.8

Net business profits before credit costs for trust accounts and

14 793.1 840.7 47.6

provision for formula allowance for loan losses

15 Provision for formula allowance for loan losses [194.5] [166.8] [(27.7)]

16 Net business profits 783.0 837.4 54.4

17 Net non-recurring gains (losses) (204.7) (244.1) (39.4)

18 Credit related costs (156.9) (190.8) (33.8)

19 Losses on loan charge-offs (70.4) (83.8) (13.3)

20 Provision for specific allowance for loan losses [38.2] [(127.8)] [(166.1)]

21 Provision for allowance for loans to specific foreign borrowe [7.1] [6.1] [(0.9)]

22 Losses on sales of loans to the Resolution and Collection Corporation (39.4) (2.8) 36.6

23 Other credit related costs (47.0) (104.1) (57.1)

24 Net gains (losses) on equity securities 3.3 (43.4) (46.7)

25 Gains on sales of equity securities 90.5 86.3 (4.1)

26 Losses on sales of equity securities (74.4) (20.7) 53.7

27 Losses on write down of equity securities (12.7) (109.0) (96.3)

28 Other (51.1) (9.9) 41.1

29 Ordinary profit 578.3 593.2 14.9

(in billions of yen )

For the year ended For the year ended

(B)—(A)

March 31, 2004 (A) March 31, 2005 (B)

30 Net special gains 301.5 62.1 (239.3)

31 Reversal of allowance for loan losses 239.9 45.0 (194.8)

32 Refund of enterprise taxes by the Tokyo Metropolitan Government 41.9 - (41.9)

33 Gains on transfer of the substitutional portion of future pension obligations 26.5 - (26.5)

34 Gains on loans charged-off 26.4 26.1 (0.2)

35 Losses on impairment of fixed assets (21.5) (5.0) 16.5

36 Income before income taxes and others 879.9 655.4 (224.4)

37 Income taxes-current 45.9 69.3 23.3

38 Income taxes-deferred 230.6 208.9 (21.6)

39 Minority interest 42.4 38.7 (3.7)

40 Net income 560.8 338.4 (222.3)

41 Total credit costs (4+18+31) 72.9 (149.0) (222.0)

Operating Results of Significant Subsidiaries for the Year Ended March 31, 2005

General and

Net business profits

Gross profits administrative Net income

before credit costs

expenses

42 The Bank of Tokyo-Mitsubishi, Ltd. 1,003.2 478.9 524.2 227.4

43 The Mitsubishi Trust and Banking Corporation 320.6 138.6 185.3 104.1

44 Mitsubishi Securrities Co., Ltd. and Consolidated Subsidiaries 118.4 96.5 21.8 18.8

45 UnionBanCal Corporation 260.5 156.0 104.5 76.3

18

FY04 Financial Highlights (B/S)

(in billions of yen except percentages)

As of March 31, As of March 31,

(B)—(A)

2004 (A) 2005 (B)

1 Loans and bills discounted 46,590.1 46,446.6 (143.4)

Domestic loans (except for loans from The Bank of Tokyo-Mitsubishi, Ltd. and

2 30,844.5 29,668.8 (1,175.7)

The Mitsubishi Trust and Banking Corporation to MTFG)

3 Overseas branches 4,427.9 4,761.1 333.1

4 Overseas subsidiaries (UnionBanCal Corporation and Bank of Tokyo-Mitsubishi Trust Company 2,947.9 3,376.9 428.9

5 Domestic housing loans 7,655.4 7,936.1 280.7

6 Domestic other consumer loans 461.8 410.1 (51.7)

7 Book value of loans sold during the fiscal year (total of the two Banks*) (183.3) (52.5) 130.8

8 Sold to the Resolution and Collection Corporation (“RCC”) (42.1) (5.7) 36.4

9 [Sold to the RCC before charge-offs] [(79.5)] [(11.8)] [67.7]

10 Other loans sold (141.1) (46.8) 94.3

11 Charge-offs during the fiscal year (total of the two Banks*) (48.6) (37.3) 11.2

12 Investment securities 28,329.5 28,823.4 493.8

13 Domestic equity securities 3,761.2 4,599.5 838.3

14 Japanese Government Bonds (total of the two Banks *) 14,984.5 15,071.2 86.6

15 Foreign bonds (total of the two Banks *) 5,744.3 4,744.2 (1,000.1)

Book value of investment securities sold during the fiscal year (total of the two

16 (747.3) (326.7) 420.6

Banks*)

17 Transferred to an exchange-traded fund (81.5) - 81.5

18 Sold in the market or by other means (665.7) (326.7) 339.0

19 Write down during the fiscal year (total of the two Banks*) (55.5) (113.8) (58.3)

20 Total assets

(in billions of yen except percentages)

As of March 31, As of March 31,

(B)—(A)

2004 (A) 2005 (B)

21 Deposits 66,097.5 67,548.7 1,451.1

22 Total of the two Banks * 62,664.1 63,404.7 740.6

23 Individuals 33,402.3 34,181.0 778.6

24 Corporations and others 20,575.1 21,129.3 554.1

25 Overseas branches 7,852.1 7,289.9 (562.2)

26 Total shareholders’ equity 4,295.2 4,777.8 482.5

27 Capital stock 1,258.0 1,383.0 125.0

28 Capital surplus 931.3 955.0 23.7

29 Retained earnings 1,506.5 1,824.2 317.7

30 Unrealized gains on securities available for sale 560.3 591.1 30.8

31 Less treasury stock (3.6) (3.5) 0.0

32 BIS risk-adjusted capital ratio 12.95 % 11.76 % (1.18%)

33 Tier I ratio 7.14 % 7.61 % 0.47 %

34 Tier I capital 3,859.4 4,286.7 427.3

35 Risk-adjusted assets 53,996.7 56,270.5 2,273.8

36 USD/JPY 105.69 107.39 1.70

[Valuation gains (losses) on securities available for sale]

(in billions of yen)

As of March 31, As of March 31,

(B)—(A)

2004 (A) 2005 (B)

37 Total securities available for sale 947.5 985.9 38.4

38 Domestic equity securities 785.3 894.0 108.7

39 Domestic bonds 3.3 54.0 50.7

40 Government Bonds (2.2) 42.1 44.3

41 Foreign bonds 107.2 3.4 (103.8)

19

Disclosed Claims Subject to FRL

Disclosed Claims Subject to FRL(Financial Revitalization Law)

[Banking and trust accounts : sum of the 2 banks (Non-consolidated)] [Yen Bn]

Mar. 31, 2004 Sept. 30, 2004 Mar. 31, 2005

(A) (B) (C) Change (C-A) Change (C-B)

1 Claims to bankrupt and substantially bankrupt debtors 140.4 107.8 103.4 (37.0) (4.4)

2 Claims under high risk 541.3 1,168.0 729.9 188.6 (438.0)

3 Claims under close observation 737.3 356.6 458.3 (278.9) 101.7

4 Total 1,419.0 1,632.5 1,291.7 (127.3) (340.7)

5 Normal claims 46,887.4 48,097.8 47,361.9 474.5 (735.9)

Flow Analysis [Banking and Trust Accounts : Sum of the 2 banks (Non-consolidated)

(1) Sep.30,2004-Mar.31,2005 [Yen Bn]

Sep.30,2004 Inflow Outflow* Mar. 31, 2005

(A) (B) (C) (A)+(B)-(C) (B)-(C)

6 Claims to bankrupt and substantially bankrupt debtors 107.8 13.2 (17.6) 103.4 (4.4)

7 Claims under high risk 1,168.0 177.5 (615.6) 729.9 (438.0)

8 Total 1,275.9 190.7 (633.2) 833.3 (442.5)

*Outflow includes disposition, sales to market, write-off, collection of claims, improvement of financial position of borrowers.

(2)Mar.31,2004-Sept.30,2004 [Yen Bn]

Mar.31,2004 Inflow Outflow* Sept. 30, 2004

(B) (C) (A)+(B)-(C) (B)-(C)

9 Claims to bankrupt and substantially bankrupt debtors 140.4 5.0 (37.6) 107.8 (32.5)

10 Claims under high risk 541.3 856.7 (230.0) 1,168.0 626.7

11 Total 681.7 861.8 (267.6) 1,275.9 594.1

*Outflow includes disposition, sales to market, write-off, collection of claims, improvement of financial position of borrowers.

Corporate restructuring 0.3%

Corporate liquidation 0.4%

Collection etc.

50%

Improvement 43%

Improvement through restructuring 0.02%

Write-off 3%

Loan sales 4%

Improvement through restructuring

Collection etc.

Corporate restructuring

Write-off

Improvement

Corporate liquidation

Loan sales

(Yen bn)

Amount %

Improvement through restructuring 0.1 0.02%

Improvement 272.1 43%

Collection etc. 313.9 50%

Sub total 586.2 93%

Corporate liquidation 2.6 0.4%

Corporate restructuring 2.1 0.3%

Loan sales 22.8 4%

Write-off 19.3 3%

Total 633.2 100%

20

Reserves /Reserve Ratio

Reserve Ratio on Disclosed Claims subject to FRL (Mar. 31, 2005)

[Banking and Trust Accounts : sum of the 2 banks (Non-consolidated)] [Yen Bn,%]

Category Claims Collateral & Guarantees Unsecured portion (A) Reserve (B) Reserve ratio (B)/(A)

Change from Sept.30 2004

1 Claims to bankrupt and substantially bankrupt debtors 103.4 94.5 8.9 8.9 100.0% 0.0%

2 Claims under high risk 729.9 305.9 424.0 271.7 64.0% (0.9%)

3 Claims under close observation 458.3 168.1 290.2 76.2 26.2% (2.9%)

4 Total 1,291.7 568.5 723.2 356.9 49.3% 6.4%

5 (Change from Mar.31 2004) (127.3) (104.7) (22.5) 36.5 - -

6 Normal claims 47,361.9

Change of Reserve Ratio on Self-Assessment of Assets

[Banking Account : sum of the 2 banks (Non-consolidated)]

Mar. 31, 2004 Sep. 30, 2004 Mar. 31, 2005

(A) (B) (C) Change (C-A) Change (C-B)

7 Normal 0.14% 0.12% 0.13% (0.01%) 0.01%

8 Close watch 9.41% 6.13% 7.96% (1.44%) 1.83%

9 excluding secured assets 15.80% 13.00% 13.73% (2.06%) 0.73%

10 Close watch* 4.81% 4.45% 4.16% (0.65%) (0.28%)

11 (excluding secured assets) 8.73% 9.24% 7.85% (0.88%) (1.39%)

12 Internal rating 10 2.24% 2.16% 2.44% 0.19% 0.27%

13 Internal rating 11 10.88% 9.89% 9.84% (1.04%) (0.05%)

14 Borrowers with credit under close observation 21.10% 13.73% 19.58% (1.51%) 5.84%

15 (excluding secured assets) 29.76% 32.31% 26.78% (2.97%) (5.52%)

16 Likely to become bankrupt (excluding secured assets) 65.23% 51.76% 64.08% (1.15%) 12.31%

* Close Watch is classified into two ratings based on the credit profile of borrowers Note : Above figures excluding certain mortgage and consumer loans

21

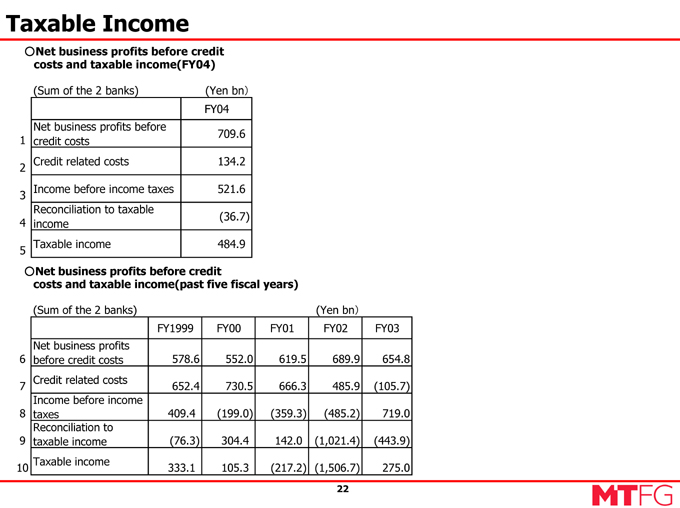

Taxable Income

Net business profits before credit costs and taxable income(FY04)

(Sum of the 2 banks) (Yen bn)

FY04

Net business profits before

709.6

1 credit costs

Credit related costs 134.2

2

Income before income taxes 521.6

3

Reconciliation to taxable

(36.7)

4 income

Taxable income 484.9

5

Net business profits before credit costs and taxable income(past five fiscal years)

(Sum of the 2 banks) (Yen bn)

FY1999 FY00 FY01 FY02 FY03

Net business profits

6 before credit costs 578.6 552.0 619.5 689.9 654.8

Credit related costs

7 652.4 730.5 666.3 485.9 (105.7)

Income before income

8 taxes 409.4 (199.0) (359.3) (485.2) 719.0

Reconciliation to

9 taxable income (76.3) 304.4 142.0 (1,021.4) (443.9)

Taxable income

10 333.1 105.3 (217.2) (1,506.7) 275.0

22

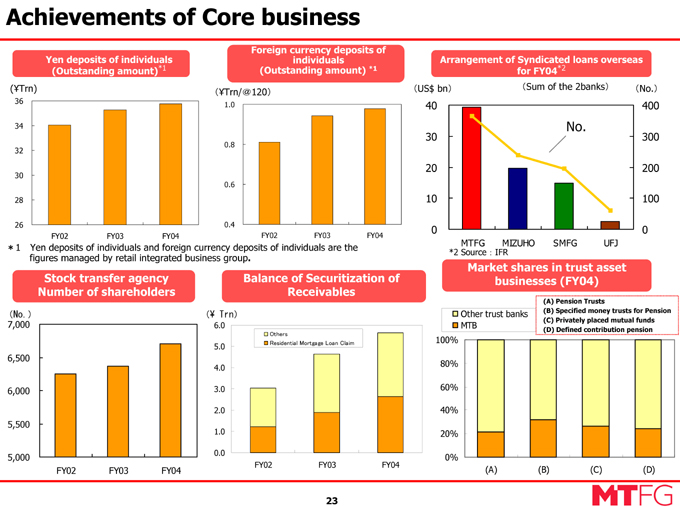

Achievements of Core business

Yen deposits of individuals (Outstanding amount)*1

(¥Trn)

36 34 32 30 28 26

FY02 FY03 FY04

Foreign currency deposits of individuals (Outstanding amount) *1

( ¥Trn/@120)

1.0 0.8 0.6 0.4

FY02 FY03 FY04

Arrangement of Syndicated loans overseas for FY04*2

(Sum of the 2banks)

(US$ bn)

40 30 20 10 0

MTFG MIZUHO SMFG UFJ

(No.)

400 300 200 100 0

* 1 Yen deposits of individuals and foreign currency deposits of individuals are the figures managed by retail integrated business group.

*2 Source:IFR

Stock transfer agency Number of shareholders

(No.)

7,000 6,500 6,000 5,500 5,000

FY02 FY03 FY04

Balance of Securitization of Receivables

(¥ Trn)

6.0 5.0 4.0 3.0 2.0 1.0 0.0

Others

Residential Mortgage Loan Claim

FY02 FY03 FY04

Market shares in trust asset businesses (FY04)

Other trust banks MTB

(A ) Pension Trusts

(B) Specified money trusts for Pension

(C) Privately placed mutual funds

(D) Defined contribution pension

100% 80% 60% 40% 20% 0%

(A) (B) (C) (D)

23

For U.S. Investors

Filings with the U.S. SEC

Mitsubishi Tokyo Financial Group, Inc. (“MTFG”) filed a registration statement on Form F-4 (“Form F-4”) with the U.S. SEC in connection with the proposed management integration of UFJ Holdings, Inc. (“UFJ”) with MTFG. The Form F-4 contains a prospectus and other documents. UFJ plans to mail the prospectus contained in the Form F-4 to its U.S. shareholders prior to the shareholders meeting at which the proposed business combination will be voted upon. The Form F-4 and prospectus contains important information about MTFG, UFJ, management integration and related matters. U.S. shareholders of UFJ are urged to read the Form F-4, the prospectus and the other documents that are filed with the U.S. SEC in connection with the management integration carefully before they make any decision at the UFJ shareholders meeting with respect to the proposed business combination. The Form F-4, the prospectus and all other documents filed with the U.S. SEC in connection with the management integration will be available when filed, free of charge, on the U.S. SEC’s web site at www.sec.gov. In addition, the prospectus and all other documents filed with the U.S. SEC in connection with the management integration will be made available to shareholders, free of charge, by calling, writing or e-mailing:

MTFG CONTACT: UFJ CONTACT:

Mr. Hirotsugu Hayashi

Mr. Shiro Ikushima

26F Marunouchi Bldg., 4-1 Marunouchi 2-chome, Chiyoda-ku

1-1 Otemachi 1-chome, Chiyoda-ku Tokyo 100-8114 Japan

Tokyo 100-6326 Japan

81-3-3212-5458

81-3-3240-9066 shiro_ikushima@ufj.co.jp

Hirotsugu_Hayashi@mtfg.co.jp

In addition to the Form F-4, the prospectus and the other documents filed with the U.S. SEC in connection with the management integration, MTFG is obligated to file annual reports with, and submit other information to, the U.S. SEC. You may read and copy any reports and other information filed with, or submitted to, the U.S. SEC at the U.S. SEC’s public reference rooms at 450 Fifth Street, N.W., Washington, D.C. 20549 or at the other public reference rooms in New York, New York and Chicago, Illinois. Please call the U.S. SEC at 1-800-SEC-0330 for further information on public reference rooms. Filings with the U.S. SEC also are available to the public from commercial document-retrieval services and at the web site maintained by the U.S. SEC at www.sec.gov.

Forward-Looking Statements

This communication contains forward-looking information and statements about MTFG, UFJ and their combined businesses after completion of the management integration. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although MTFG’s and UFJ’s management believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of UFJ securities are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of MTFG and UFJ, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the SEC and the local filings made by MTFG and UFJ, including those listed under “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” in the prospectus included in the registration statement on Form F-4 that MTFG may file with the U.S. SEC. Other than as required by applicable law, MTFG and UFJ do not undertake any obligation to update or revise any forward-looking information or statements.

UFJ Holdings

FY2004 Financial Results

May 31, 2005

Disclaimer

This document contains forward-looking statements in regard to forecasts, targets and plans of UFJ Holdings, Inc. (“UFJ”) and its group companies (“the group”). These forward-looking statements are based on information currently available to the group and are stated here on the basis of the outlook at the time that this document was produced. In addition, in producing these statements certain assumptions have been utilized. These statements and assumptions are subjective and may prove to be incorrect and may not be realized in the future. Underlying such circumstances are a large number of risks and uncertainties. Please see the latest disclosure and other public filings made by UFJ and the other companies comprising the group, including Japanese securities reports, annual reports, shareholder convocation notices, and the registration statement on Form F-4 filed by Mitsubishi Tokyo Financial Group, Inc. for additional information regarding such risks and uncertainties.

In addition, information on companies and other entities outside the group that is recorded in this document has been obtained from publicly available information and other sources. The accuracy and appropriateness of that information has not been verified by the new group and cannot be guaranteed.

The financial information used in this document was prepared in accordance with accounting standards generally accepted in Japan, or Japanese GAAP.

Risk Factors

The success of the management integration and achieving the financial targets presented in this presentation is subject to many uncertainties and risks. The following are a few of those risks. See also other public filings made by MTFG and UFJ Holdings, including the Form F-4 that was filed by MTFG with the SEC.

Possible difficulties in integrating the business and operations of MTFG and UFJ, including:

unanticipated asset-quality problems in MTFG and UFJ’s asset portfolio; – delay or difficulties in integrating the domestic and overseas branch and subsidiary network and head office functions; – difficulties in integrating information and management systems; difficulties in integrating personnel and corporate culture; – difficulties in implementing and maintaining uniform internal controls, disclosure policies and other standards to a significantly larger operation; and – possible impairment of strategic relationships.

The combined entity’s (“MUFG”) customer base may be eroded – Expected scale of business may not be achieved.

A number of revenue increases depend on growth in the overall market

Mortgage loans

Investment banking services

Annuities

Wealth management products

Pension administration

Investment trust products

The various macro-economic factor assumptions may be incorrect. In particular, some revenue projections are dependent on interest rate increases.

MUFG may not be able to achieve the goals of its business strategies due to:

Weak economic conditions in Japan

Declines in stock prices and real estate prices in Japan

Adverse regulatory developments or changes in laws, governmental policies or economic controls in Japan

Competitive pressures in Japan and overseas

MUFG may have to offer lower commission rates

MUFG may have difficulties providing distinguishable products and services

Changes in the business environment may lead to:

Unsuccessful cross-selling efforts

Unsuccessful deployment of personnel

Anticipated synergies failing to materialize

MUFG’s strategy may expose it to higher risks:

High default rates in consumer finance and SME loans

Interest rate risks in new products

Foreign exchange risks in overseas business

If STB brings additional lawsuits against UFJ Group, the management integration may be unnecessarily delayed and significant litigation-related costs may arise.

Possible difficulties or delay in acquiring necessary approvals, or unfavorable conditions may be unexpectedly imposed by relevant regulatory authorities with respect to the merger of the holding companies and their key operating subsidiaries.

Table of Contents

Presentation Material

Financial Highlights for FY2004 1

Initiatives to Reduce Problem Loans

Problem Loan Balance 2

Credit Related Expenses 3

Collateral & Reserves 4

Earnings by Business Lines 5

Income from Loans & Deposits 6

Non-interest Income 8

General & Administrative Expenses 11

Gains/Losses on Equities 12

Equity & Bond Portfolio 13

BIS Capital Ratio 14

Deferred Tax Assets (DTA) 15

Forecasts for FY2005 H1 16

Data Book (supplementary material)

Financial Results

Actions toward Improvement of

Financial Positions

Actions toward Improvement of

Profitability

Equity Capital

Reference

<Definition>

Consolidated : UFJ Holdings Consolidated UFJ Bank : UFJ Bank + UFJSP + UFJEI UFJ Trust : UFJ Trust +UFJTE

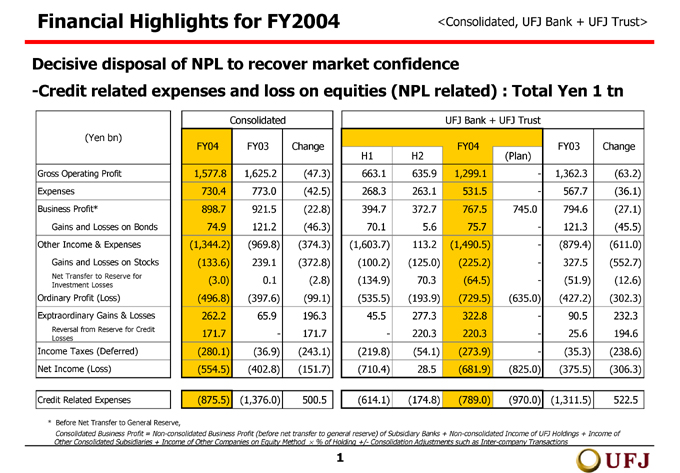

Financial Highlights for FY2004

<Consolidated, UFJ Bank + UFJ Trust>

Decisive disposal of NPL to recover market confidence

Credit related expenses and loss on equities (NPL related) : Total Yen 1 tn

Consolidated UFJ Bank + UFJ Trust

(Yen bn) FY04 FY03 Change FY04 FY03 Change

H1 H2 (Plan)

Gross Operating Profit 1,577.8 1,625.2 (47.3) 663.1 635.9 1,299.1 - 1,362.3 (63.2)

Expenses 730.4 773.0 (42.5) 268.3 263.1 531.5 - 567.7 (36.1)

Business Profit* 898.7 921.5 (22.8) 394.7 372.7 767.5 745.0 794.6 (27.1)

Gains and Losses on Bonds 74.9 121.2 (46.3) 70.1 5.6 75.7 - 121.3 (45.5)

Other Income & Expenses (1,344.2) (969.8) (374.3) (1,603.7) 113.2 (1,490.5) - (879.4) (611.0)

Gains and Losses on Stocks (133.6) 239.1 (372.8) (100.2) (125.0) (225.2) - 327.5 (552.7)

Net Transfer to Reserve for Investment Losses (3.0) 0.1 (2.8) (134.9) 70.3 (64.5) - (51.9) (12.6)

Ordinary Profit (Loss) (496.8) (397.6) (99.1) (535.5) (193.9) (729.5) (635.0) (427.2) (302.3)

Exptraordinary Gains & Losses 262.2 65.9 196.3 45.5 277.3 322.8 - 90.5 232.3

Reversal from Reserve for Credit Losses - 171.7 - 220.3 220.3 - 25.6 194.6

Income Taxes (Deferred) (280.1) (36.9) (243.1) (219.8) (54.1) (273.9) - (35.3) (238.6)

Net Income (Loss) (554.5) (402.8) (151.7) (710.4) 28.5 (681.9) (825.0) (375.5) (306.3)

Credit Related Expenses (875.5) (1,376.0) 500.5 (614.1) (174.8) (789.0) (970.0) (1,311.5) 522.5

* Before Net Transfer to General Reserve,

Consolidated Business Profit = Non-consolidated Business Profit (before net transfer to general reserve) of Subsidiary Banks + Non-consolidated Income of UFJ Holdings + Income of Other Consolidated Subsidiaries + Income of Other Companies on Equity Method * % of Holding +/- Consolidation Adjustments such as Inter-company Transactions

1

Initiatives to Reduce Problem Loans - Balance

<UFJ Bank + UFJ Trust>

FY04 End Balance: Yen 1.7 tn (- Yen 2.4 tn from End Sep. 04)

- Problem loan ratio reduced to 4.12%

Balance & Ratio

(Yen tn)

9 8 7 6 5 4 3 2 1 0

8.14%

3.84

0.79

8.50% 2.85 0.57

9.42%

1.95

0.13

4.12% 2.25

0.19 2.11 1.21 .37 2.16 1.48 0.30 0.62 3.27 0.25 0.86 0.67 0.17

Sep. 03 Mar. 04 Sep. 04 Mar. 05

10% 8% 6% 4% 2% 0%

Factors for decrease in balance since Sep.04

(Yen bn)

Upgrade to Normal Loan * (1,080)

Downgrade from Normal Loan * 360

Debt Forgiveness (360)

Loans Sold (590)

Collection, Write-offs, etc. (770)

Total (2,440)

* Normal + Other special mention

Other special mention

Normal loans to sub-standard borrrowers Sub-standard Doubtful Bankrupt & Quasi-bankrupt Problem loan ratio

Problem loans under Financial Reconstruction Law

2

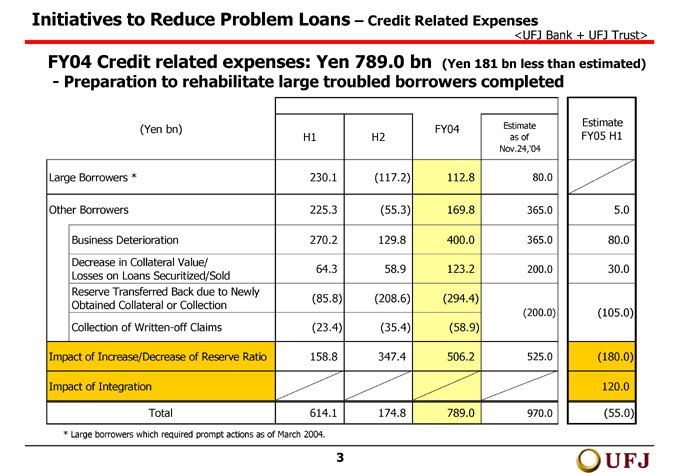

Initiatives to Reduce Problem Loans – Credit Related Expenses

<UFJ Bank + UFJ Trust>

FY04 Credit related expenses: Yen 789.0 bn (Yen 181 bn less than estimated)

- Preparation to rehabilitate large troubled borrowers completed

(Yen bn)

H1 H2 FY04 Estimate as of Nov.24,’04 Estimate FY05 H1

Large Borrowers * 230.1 (117.2) 112.8 80.0

Other Borrowers 225.3 (55.3) 169.8 365.0 5.0

Business Deterioration 270.2 129.8 400.0 365.0 80.0

Decrease in Collateral Value/ 64.3 58.9 123.2 200.0 30.0

Losses on Loans Securitized/Sold

Reserve Transferred Back due to Newly (85.8) (208.6) (294.4)

Obtained Collateral or Collection (200.0) (105.0)

Collection of Written-off Claims (23.4) (35.4) (58.9)

Impact of Increase/Decrease of Reserve Ratio 158.8 347.4 506.2 525.0 (180.0)

Impact of Integration 120.0

Total 614.1 174.8 789.0 970.0 (55.0)

* Large borrowers which required prompt actions as of March 2004.

3

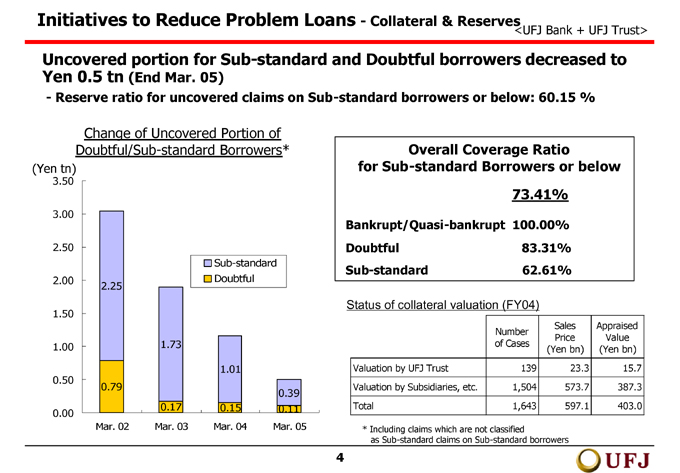

Initiatives to Reduce Problem Loans - Collateral & Reserves

<UFJ Bank + UFJ Trust>

Uncovered portion for Sub-standard and Doubtful borrowers decreased to

Yen 0.5 tn (End Mar. 05)

- Reserve ratio for uncovered claims on Sub-standard borrowers or below: 60.15 %

Change of Uncovered Portion of Doubtful/Sub-standard Borrowers*

(Yen tn)

3.50

3.00

2.50

2.00

1.50

1.00

0.50

0.00

2.25

0.79

1.73

0.17

1.01

0.15

0.39 0.11

Mar. 02 Mar. 03 Mar. 04 Mar. 05

Overall Coverage Ratio for Sub-standard Borrowers or below

73.41%

Bankrupt/Quasi-bankrupt 100.00%

Doubtful 83.31%

Sub-standard 62.61%

Status of collateral valuation (FY04)

Number of Cases Sales Price Appraised Value

(Yen bn) (Yen bn)

Valuation by UFJ Trust 139 23.3 15.7

Valuation by Subsidiaries, etc. 1,504 573.7 387.3

Total 1,643 597.1 403.0

* Including claims which are not classified as Sub-standard claims on Sub-standard borrowers

4

Earnings by Business Lines

<UFJ Bank + UFJ Trust>

Increase in business profit in retail and corporate banking

Total business profit declined due to decrease in market related income

(Yen bn)

FY04 (Plan) FY03 Change FY04 H1 (Plan)

Gross Operating Profit

UFJ Bank 1,140.3 1,132.0 1,198.2 (57.8) 517.6

Retail Banking 292.0 291.6 288.5 3.4 150.2

Corp. Banking 535.9 542.9 522.4 13.5 266.5

Global Banking & Trading 171.5 167.7 190.4 (18.9) 81.6

Others 140.9 129.8 196.8 (55.9) 19.3

Corp. Advisory Group* 74.0 80.6 107.6 (33.6) 31.3

Yen Denominated Bond Trading 108.6 112.2 149.4 (40.8) 25.0

UFJ Trust 158.7 161.0 164.1 (5.3) 72.9

Total 1,299.1 1,293.0 1,362.3 (63.2) 590.5

* The Corporate Advisory Group was integrated into Corporate Banking in April 05. Its results and plan are shown separately here for comparison purposes.

Expenses (minus) 531.5 548.0 567.7 (36.1) 275.5

Business Profit (before net transfer to General Reserve)

UFJ Bank 680.2 660.0 708.1 (27.8) 280.0

Retail Banking 82.8 82.4 70.6 12.2 50.2

Corp. Banking 337.0 343.9 319.2 17.9 167.0

Global Banking & Trading 124.7 118.7 142.2 (17.6) 59.5

Others 135.7 115.0 176.1 (40.4) 3.3

UFJ Trust 87.2 85.0 86.4 0.7 35.0

Total 767.5 745.0 794.6 (27.1) 315.0

<UFJ Holdings Consolidated>

Ordinary Profit (496.8) (530.0) (397.6) (99.1) 260.0

Gross Operating Profit (Yen bn)

FY03 FY04

148.7 36.8 176.6 354.0 60.5 44.5 201.2 340.0 92.2 40.2 195.5 335.2 64.6 49.4 206.6 315.4

16.0 47.4

200.1

327.0

FY03 H1 FY03 H2 FY04 H1 FY04 H2 FY05 H1

(Plan)

Market related Income and Others Trust related Business Fees & Commissions Interest Income on Loans and Deposits

5

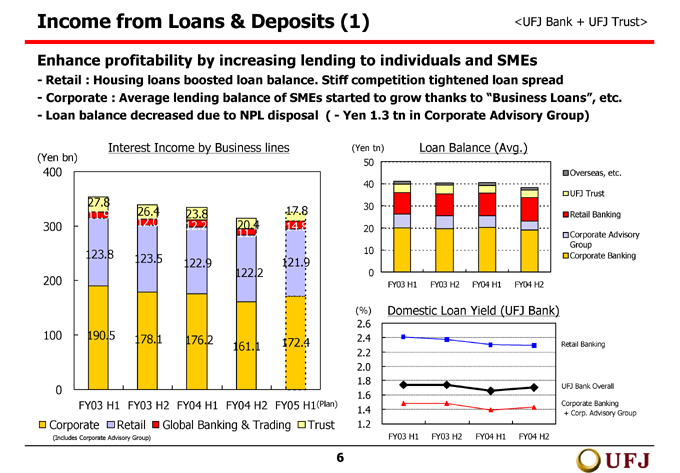

Income from Loans & Deposits (1) <UFJ Bank + UFJ Trust>

Enhance profitability by increasing lending to individuals and SMEs

Retail : Housing loans boosted loan balance. Stiff competition tightened loan spread

Corporate : Average lending balance of SMEs started to grow thanks to “Business Loans”, etc.

Loan balance decreased due to NPL disposal ( - Yen 1.3 tn in Corporate Advisory Group)

Interest Income by Business lines

(Yen bn)

400 300 200 100 0

27.8 11.9

123.8

190.5

26.4 12.0

123.5

178.1

23.8 12.2

122.9

176.2

11.7 20.4

122.2

161.1

17.8 14.8

121.9

172.4

FY03 H1 FY03 H2 FY04 H1 FY04 H2 FY05 H1(Plan)

Corporate Retail Global Banking & Trading Trust

(Includes Corporate Advisory Group)

(Yen tn)

Loan Balance (Avg.)

50

40

30

20

10

0

FY03 H1 FY03 H2 FY04 H1 FY04 H2

Overseas, etc. UFJ Trust Retail Banking

Corporate Advisory Group Corporate Banking

Domestic Loan Yield (UFJ Bank)

(%)

2.6 2.4 2.2 2.0 1.8 1.6 1.4 1.2

FY03 H1 FY03 H2 FY04 H1 FY04 H2

Retail Banking

UFJ Bank Overall

Corporate Banking + Corp. Advisory Group

6

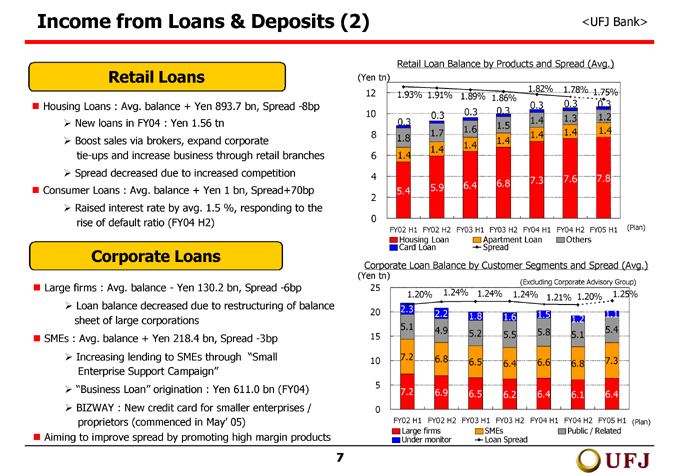

Income from Loans & Deposits (2) <UFJ Bank>

Retail Loans Housing Loans : Avg. balance + Yen 893.7 bn, Spread -8bp

New loans in FY04 : Yen 1.56 tn

Boost sales via brokers, expand corporate tie-ups and increase business through retail branches

Spread decreased due to increased competition

Consumer Loans : Avg. balance + Yen 1 bn, Spread+70bp

Raised interest rate by avg. 1.5 %, responding to the rise of default ratio (FY04 H2)

Corporate Loans Large firms : Avg. balance - Yen 130.2 bn, Spread -6bp

Loan balance decreased due to restructuring of balance sheet of large corporations SMEs : Avg. balance + Yen 218.4 bn, Spread -3bp

Increasing lending to SMEs through “Small Enterprise Support Campaign”

“Business Loan” origination : Yen 611.0 bn (FY04)

BIZWAY : New credit card for smaller enterprises / proprietors (commenced in May’ 05) Aiming to improve spread by promoting high margin products

Retail Loan Balance by Products and Spread (Avg.)

(Yen tn)

12 10 8 6 4 2 0

1.93% 1.91% 1.89% 1.86% 1.82% 1.78% 1.75%

0.3 0.3 0.3 0.3 0.3

0.3 0.3 1.4 1.3 1.2

1.6 1.5 1.4 1.4

1.8 1.7 1.4 1.4

1.4 1.4 1.4

6.4 6.8 7.3 7.6 7.8

5.4 5.9

FY02 H1 FY02 H2 FY03 H1 FY03 H2 FY04 H1 FY04 H2 FY05 H1 (Plan)

Housing Loan Apartment Loan Others Card Loan Spread

Corporate Loan Balance by Customer Segments and Spread (Avg.)

(Yen tn)

(Excluding Corporate Advisory Group)

25 20 15 10 5 0

1.20% 1.24% 1.24% 1.24% 1.25% 0.

1.21% 1.20%

2.3

2.2 1.8 1.6 1.5 1.1 1.2 5.1 5.4 4.9 5.2 5.8 5.5 5.1

7.2 6.8

6.5 6.4 6.6 6.8 7.3

7.2 6.9 6.5 6.2 6.4 6.1 6.4

FY02 H1 FY02 H2 FY03 H1 FY03 H2 FY04 H1 FY04 H2 FY05 H1 (Plan)

Large firms SMEs Public / Related Under monitor Loan Spread

7

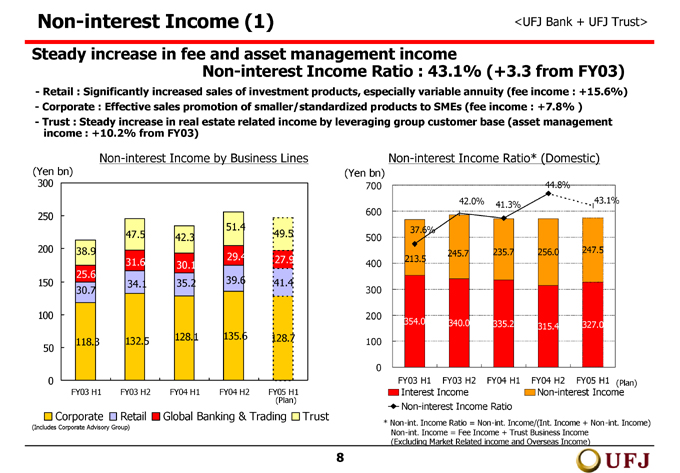

Non-interest Income (1) <UFJ Bank + UFJ Trust>

Steady increase in fee and asset management income

Non-interest Income Ratio : 43.1% (+3.3 from FY03)

Retail : Significantly increased sales of investment products, especially variable annuity (fee income : +15.6%)

Corporate : Effective sales promotion of smaller/standardized products to SMEs (fee income : +7.8% )

Trust : Steady increase in real estate related income by leveraging group customer base (asset management income : +10.2% from FY03)

Non-interest Income by Business Lines

(Yen bn)

300 250 200 150 100 50 0

38.9 47.5 42.3 51.4 49.5

25.6 31.6 30.1 29.4 27.9

30.7 34.1 35.2 39.6 41.4

118.3 132.5 128.1 135.6 128.7

FY03 H1 FY03 H2 FY04 H1 FY04 H2 FY05 H1

(Plan)

Corporate Retail Global Banking & Trading Trust

(Includes Corporate Advisory Group)

Non-interest Income Ratio* (Domestic)

(Yen bn)

700 600 500 400 300 200 100 0

37.6% 42.0% 41.3% 44.8% 43.1%

213.5 245.7 235.7 256.0 247.5

354.0 340.0 335.2 315.4 327.0

FY03 H1 FY03 H2 FY04 H1 FY04 H2 FY05 H1 (Plan)

Interest Income Non-interest Income Non-interest Income Ratio

* Non-int. Income Ratio = Non-int. Income/(Int. Income + Non-int. Income) Non-int. Income = Fee Income + Trust Business Income (Excluding Market Related income and Overseas Income)

8

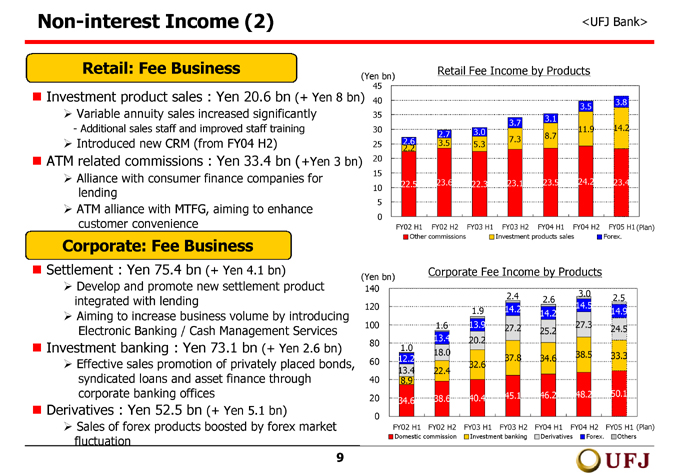

Non-interest Income (2)

<UFJ Bank>

Retail: Fee Business Investment product sales : Yen 20.6 bn (+ Yen 8 bn)

Variable annuity sales increased significantly

Additional sales staff and improved staff training

Introduced new CRM (from FY04 H2) ATM related commissions : Yen 33.4 bn (+Yen 3 bn)

Alliance with consumer finance companies for lending

ATM alliance with MTFG, aiming to enhance customer convenience

Corporate: Fee Business Settlement : Yen 75.4 bn (+ Yen 4.1 bn)

Develop and promote new settlement product integrated with lending

Aiming to increase business volume by introducing Electronic Banking / Cash Management Services

Investment banking : Yen 73.1 bn (+ Yen 2.6 bn)

Effective sales promotion of privately placed bonds, syndicated loans and asset finance through corporate banking offices n

Derivatives : Yen 52.5 bn (+ Yen 5.1 bn)

Sales of forex products boosted by forex market fluctuation

(Yen bn)

Retail Fee Income by Products

45

40 35

30

25 20

15

10 5

0

2.6 2.7 3.0 3.7 3.1 3.5 3.8

2.2 3.5 5.3 7.3 8.7 11.9 14.2

22.5 23.6 22.3 23.1 23.5 24.2 23.4

FY02 H1 FY02 H2 FY03 H1 FY03 H2 FY04 H1 FY04 H2 FY05 H1 (Plan)

Other commissions Investment products sales Forex.

Corporate Fee Income by Products

(Yen bn) 140

120 100 80 60 40 20 0

1.0 1.6 1.9 2.4 2.6 3.0 2.5

12.2 13.4 13.9 14.2 14.2 14.5 14.9

13.4 18.0 20.2 27.2 25.2 27.3 24.5

8.9 22.4 32.6 37.8 34.6 38.5 33.3

34.6 38.6 40.4 45.1 46.2 48.2 50.1

FY02 H1 FY02 H2 FY03 H1 FY03 H2 FY04 H1 FY04 H2 FY05 H1 (Plan)

Domestic commission Investment banking Derivatives Forex. Others

9

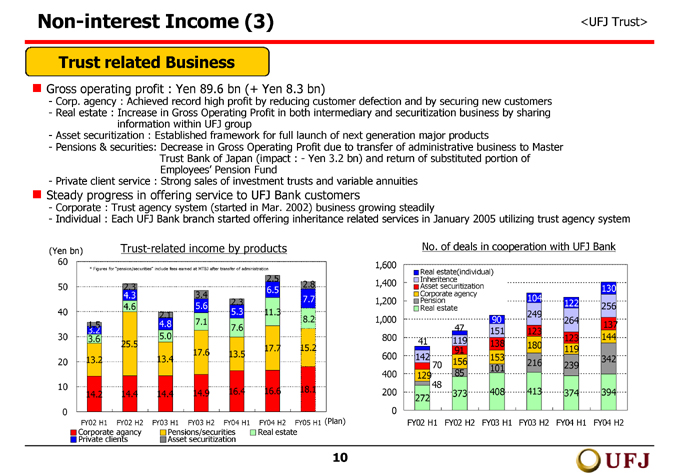

Non-interest Income (3)

<UFJ Trust>

Trust related Business

Gross operating profit : Yen 89.6 bn (+ Yen 8.3 bn)

Corp. agency : Achieved record high profit by reducing customer defection and by securing new customers

Real estate : Increase in Gross Operating Profit in both intermediary and securitization business by sharing information within UFJ group

Asset securitization : Established framework for full launch of next generation major products

Pensions & securities: Decrease in Gross Operating Profit due to transfer of administrative business to Master Trust Bank of Japan (impact : - Yen 3.2 bn) and return of substituted portion of Employees’ Pension Fund

Private client service : Strong sales of investment trusts and variable annuities

Steady progress in offering service to UFJ Bank customers

Corporate : Trust agency system (started in Mar. 2002) business growing steadily

Individual : Each UFJ Bank branch started offering inheritance related services in January 2005 utilizing trust agency system

Trust-related income by products

(Yen bn)

60 50 40 30 20 10 0

* Figures for “pension/securities” include fees earned at MTBJ after transfer of administration

1.5 2.3 2.1 3.4 2.3 2.5 2.8

3.2 4.3 4.8 5.6 5.3 6.5 7.7

3.6 4.6 5.0 7.1 7.6 11.3 8.2

13.2 25.5 13.4 17.6 13.5 17.7 15.2

14.2 14.4 14.4 14.9 16.4 16.6 18.1

FY02 H1 FY02 H2 FY03 H1 FY03 H2 FY04 H1 FY04 H2 FY05 H1 (Plan)

Corporate agancy Pensions/securities Real estate Private clients Asset securitization

No. of deals in cooperation with UFJ Bank

1,600 1,400 1,200 1,000 800 600 400 200 0

41 142 70 129 48 272

47 119 91 156 85

373

90 151 138 153 101

408

104

249

123 180

216

413

122

264

123 119

239

374

130

256

137 144

342

394

FY02 H1 FY02 H2 FY03 H1 FY03 H2 FY04 H1 FY04 H2

Real estate(individual) Inheritence Asset securitization Corporate agency Pension Real estate

10

General & Administrative Expenses <UFJ Bank + UFJ Trust>

Expenses decreased mainly due to reduction in workforce and employee bonuses

(Yen bn)

<non-consolidated> FY04 (Plan) FY03 Change

Expenses 531.5 548.0 567.7 (36.1)

Personnel exp. 165.5 174.9 210.2 (44.6)

Non-personnel exp. 335.5 341.1 329.0 6.4

FY04 General & Administrative Expenses Personnel expenses : Reduction in workforce and bonuses, strict application of performance based compensation plan reduced expenses by Yen 44.6 bn compared to FY03 Non-personnel expenses : Strategic business investments increased expenses by Yen 6.4 bn compared to FY03

Domestic Branches

600 500 400 300 200 100

Mar. 98 Mar. 02 Mar. 03 Mar. 04 Mar. 05

588

517

406 398 398

Reduction of overlapping branches after integration

No. of Employees

30 20 10 0

Mar. 98 Mar. 02 Mar. 03 Mar. 04 Mar. 05

29.8

24.2

22.3

20.3 19.5

(Thousand)

IT Investment

(Yen bn)

250 200 150 100 50 0

11.1

63.0

137.6 129.7 115.0

81.3 108.3

Integration of Sanwa Bank and Tokai Bank

FY00 FY01 FY02 FY03 FY04

IT cost for integration IT investment

Expenses (annual)

(Yen bn)

400 350 300 250 200 150 100

FY97 FY98 FY99 FY00 FY01 FY02 FY03 FY04

Personnel exp. Non-Personnel exp.

11

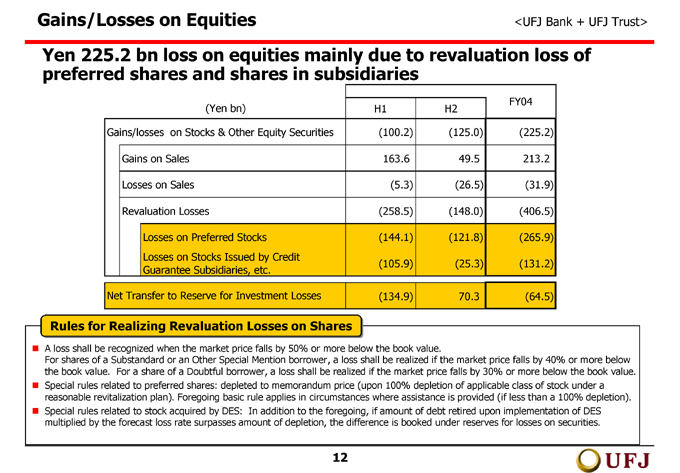

Gains/Losses on Equities <UFJ Bank + UFJ Trust>

Yen 225.2 bn loss on equities mainly due to revaluation loss of preferred shares and shares in subsidiaries

(Yen bn) H1 H2 FY04

Gains/losses on Stocks & Other Equity Securities (100.2) (125.0) (225.2)

Gains on Sales 163.6 49.5 213.2

Losses on Sales (5.3) (26.5) (31.9)

Revaluation Losses (258.5) (148.0) (406.5)

Losses on Preferred Stocks (144.1) (121.8) (265.9)

Losses on Stocks Issued by Credit Guarantee Subsidiaries, etc. (105.9) (25.3) (131.2)

Net Transfer to Reserve for Investment Losses (134.9) 70.3 (64.5)

Rules for Realizing Revaluation Losses on Shares

A loss shall be recognized when the market price falls by 50% or more below the book value.

For shares of a Substandard or an Other Special Mention borrower, a loss shall be realized if the market price falls by 40% or more below the book value. For a share of a Doubtful borrower, a loss shall be realized if the market price falls by 30% or more below the book value.

Special rules related to preferred shares: depleted to memorandum price (upon 100% depletion of applicable class of stock under a reasonable revitalization plan). Foregoing basic rule applies in circumstances where assistance is provided (if less than a 100% depletion).

Special rules related to stock acquired by DES: In addition to the foregoing, if amount of debt retired upon implementation of DES multiplied by the forecast loss rate surpasses amount of depletion, the difference is booked under reserves for losses on securities.

12

Equity & Bond Portfolio <UFJ Bank + UFJ Trust>

Total unrealized gain on stocks and bonds: UFJH Consolidated Yen 398.9 bn (Yen 147.8 bn increase from Sep. 04)

Balance & unrealized gain/loss

(UFJHD Consolidated)

<Stocks>

(Yen tn)

4 3 2 1 0

(Yen bn)

600 400 200 0 (200) (400)

0.43 342.9 358.6 343.9 454.3

2.42 0.56 0.87 0.72 0.64

(182.0) 2.55 2.12 1.87 1.92

Mar. 03 Sep. 03 Mar. 04 Sep. 04 Mar. 05

Securities with no market value Securities with market value Unrealized gain/loss Book value of stocks sold: Yen 550.4 bn

- Approximately 50% sold via block-trading Sales Plan in FY05 H1: Yen 85 bn

Balance & unrealized gain/loss

(Non-consolidated)

20 15 10 5 0

<Bonds>

(Yen tn)

(Yen bn)

200 100 0 (100) (200)

2.2 2.5 150.9 1.9 1.9 2.5 2.3 2.0 1.5 2.5 2.5 4.7 8.0 8.8 6.0 (24.9) 6.6 (57.7) (69.1) (125.4) 8.9 4.5 5.2 3.6 5.5

Mar. 03 Sep. 03 Mar. 04 Sep. 04 Mar. 05

Short-term JGB Foreign bond Unrealized gain/loss

Mid- to Long-term JGB Others

JGB Duration (Banking Account)

(Year) Mar. 04 Sep. 04 Mar. 05 Balance Mar.05

(Yen tn)

UFJ Bank 3.52 2.68 1.79 12.2

UFJ Trust 5.14 4.71 4.52 1.3

Sensitivity (BPV) (UFJ Bank + UFJ Trust)

(Yen bn) Mar. 04 Sep. 04 Mar. 05

Domestic Bond (4.58) (3.20) (2.66)

Foreign bond (0.54) (0.68) (0.65)

Note : Sensitivity is reduced by approx. Yen 500 mn for Sep. 04 and Mar. 05 as privately placed bonds are excluded from domestic bonds in terms of sensitivity management

13

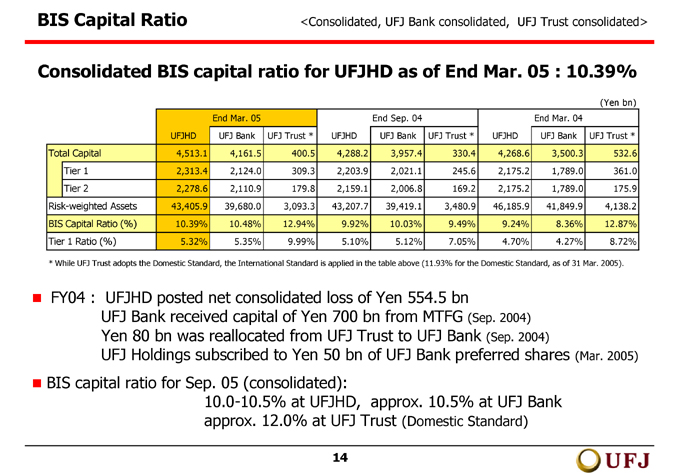

BIS Capital Ratio <Consolidated, UFJ Bank consolidated, UFJ Trust consolidated>

Consolidated BIS capital ratio for UFJHD as of End Mar. 05 : 10.39%

(Yen bn)

End Mar. 05 End Sep. 04 End Mar. 04

UFJHD UFJ Bank UFJ Trust * UFJHD UFJ Bank UFJ Trust * UFJHD UFJ Bank UFJ Trust *

Total Capital 4,513.1 4,161.5 400.5 4,288.2 3,957.4 330.4 4,268.6 3,500.3 532.6

Tier 1 2,313.4 2,124.0 309.3 2,203.9 2,021.1 245.6 2,175.2 1,789.0 361.0

Tier 2 2,278.6 2,110.9 179.8 2,159.1 2,006.8 169.2 2,175.2 1,789.0 175.9

Risk-weighted Assets 43,405.9 39,680.0 3,093.3 43,207.7 39,419.1 3,480.9 46,185.9 41,849.9 4,138.2

BIS Capital Ratio (%) 10.39% 10.48% 12.94% 9.92% 10.03% 9.49% 9.24% 8.36% 12.87%

Tier 1 Ratio (%) 5.32% 5.35% 9.99% 5.10% 5.12% 7.05% 4.70% 4.27% 8.72%

* While UFJ Trust adopts the Domestic Standard, the International Standard is applied in the table above (11.93% for the Domestic Standard, as of 31 Mar. 2005).

FY04 : UFJHD posted net consolidated loss of Yen 554.5 bn

UFJ Bank received capital of Yen 700 bn from MTFG (Sep. 2004)

Yen 80 bn was reallocated from UFJ Trust to UFJ Bank (Sep. 2004)

UFJ Holdings subscribed to Yen 50 bn of UFJ Bank preferred shares (Mar. 2005)

BIS capital ratio for Sep. 05 (consolidated):

10.0-10.5% at UFJHD, approx. 10.5% at UFJ Bank approx. 12.0% at UFJ Trust (Domestic Standard)

14

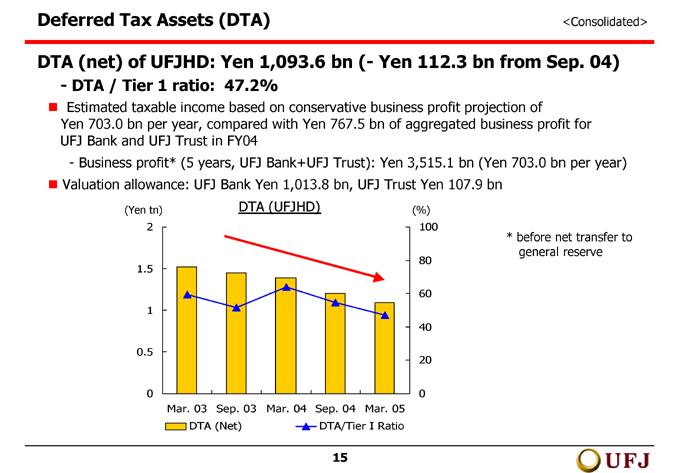

Deferred Tax Assets (DTA) <Consolidated>

DTA (net) of UFJHD: Yen 1,093.6 bn (- Yen 112.3 bn from Sep. 04)

DTA / Tier 1 ratio: 47.2%

Estimated taxable income based on conservative business profit projection of

Yen 703.0 bn per year, compared with Yen 767.5 bn of aggregated business profit for UFJ Bank and UFJ Trust in FY04

Business profit* (5 years, UFJ Bank+UFJ Trust): Yen 3,515.1 bn (Yen 703.0 bn per year) Valuation allowance: UFJ Bank Yen 1,013.8 bn, UFJ Trust Yen 107.9 bn

DTA (UFJHD)

(Yen tn)

2 1.5 1 0.5 0

Mar. 03 Sep. 03 Mar. 04 Sep. 04 Mar. 05

(%)

100 80 60 40 20 0

DTA (Net) DTA/Tier I Ratio

* before net transfer to general reserve

15

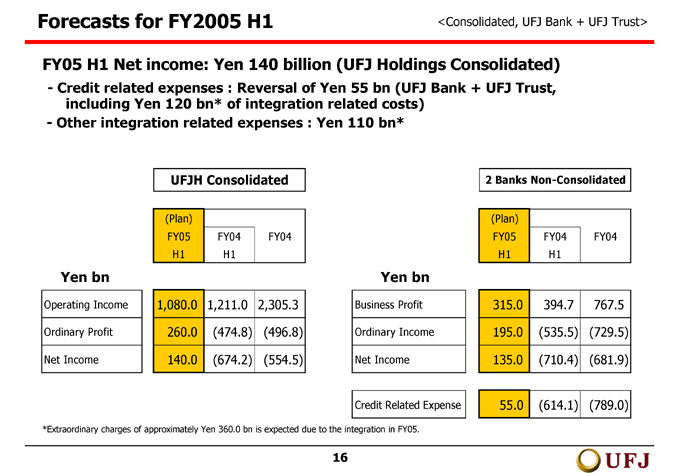

Forecasts for FY2005 H1 <Consolidated, UFJ Bank + UFJ Trust>

FY05 H1 Net income: Yen 140 billion (UFJ Holdings Consolidated)

Credit related expenses : Reversal of Yen 55 bn (UFJ Bank + UFJ Trust, including Yen 120 bn* of integration related costs)

Other integration related expenses : Yen 110 bn*

UFJH Consolidated

(Plan) FY05 H1 FY04 H1 FY04

Yen bn

Operating Income 1,080.0 1,211.0 2,305.3

Ordinary Profit 260.0 (474.8) (496.8)

Net Income 140.0 (674.2) (554.5)

2 Banks Non-Consolidated

(Plan)FY05H1 FY04H1 FY04

Yen bn

Business Profit 315.0 394.7 767.5

Ordinary Income 195.0 (535.5) (729.5)

Net Income 135.0 (710.4) (681.9)

Credit Related Expense 55.0 (614.1) (789.0)

*Extraordinary charges of approximately Yen 360.0 bn is expected due to the integration in FY05.

16

Integration

This document contains forward-looking statements in regard to forecasts, targets and plans of Mitsubishi Tokyo Financial Group, Inc. (“MTFG”), UFJ Holdings, Inc. (“UFJ”) and their respective group companies (collectively, the “new group”). These forward-looking statements are based on information currently available to the new group and are stated here on the basis of the outlook at the time that this document was produced. In addition, in producing these statements certain assumptions (premises) have been utilized. These statements and assumptions (premises) are subjective and may prove to be incorrect and may not be realized in the future. Underlying such circumstances are a large number of risks and uncertainties. Please see the latest disclosure and other public filings made by MTFG, UFJ and the other companies comprising the new group, including Japanese securities reports, annual reports, shareholder convocation notices, and MTFG’s registration statement on Form F-4, for additional information regarding such risks and uncertainties.

In addition, information on companies and other entities outside the new group that is recorded in this document has been obtained from publicly available information and other sources. The accuracy and appropriateness of that information has not been verified by the new group and cannot be guaranteed.

The financial information used in this document was prepared in accordance with accounting standards generally accepted in Japan, or Japanese GAAP.

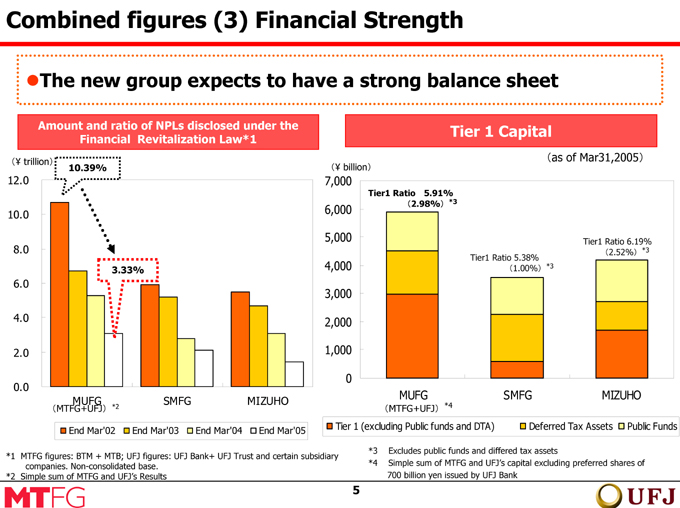

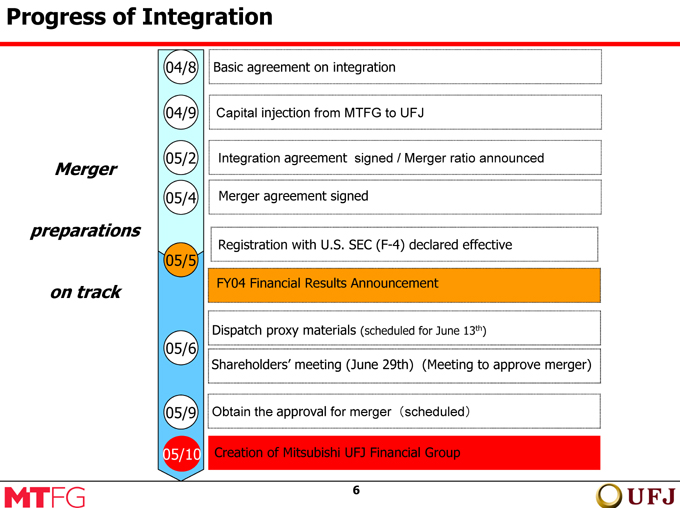

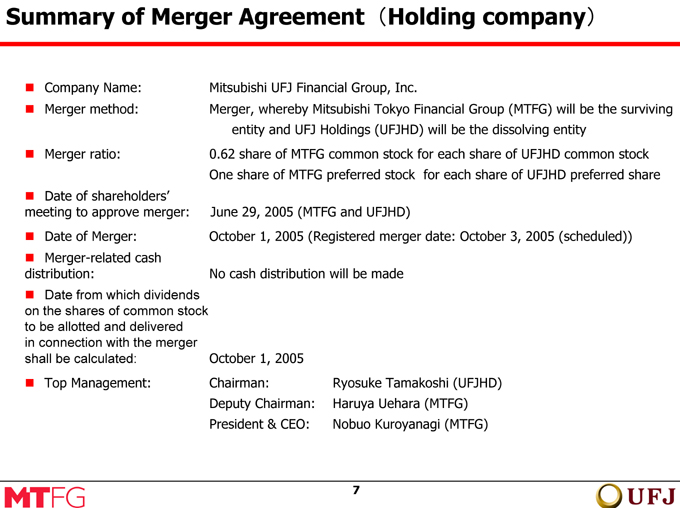

Risk factors

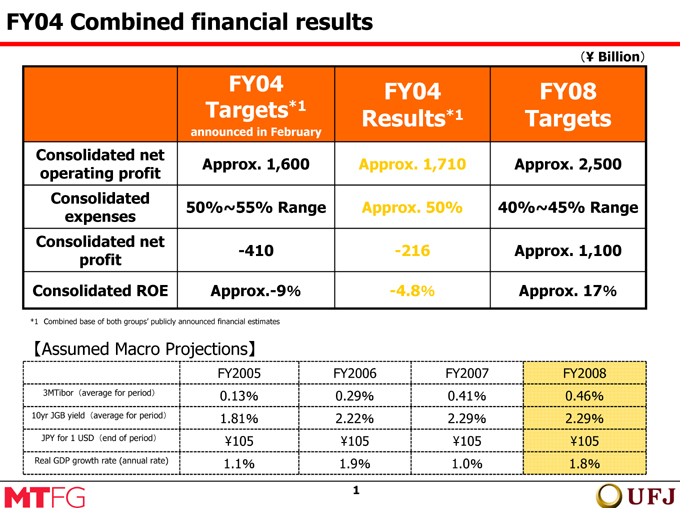

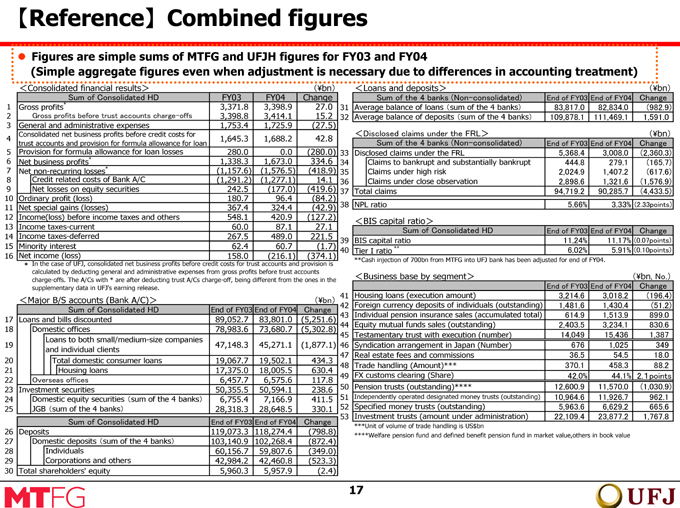

FY04 Combined financial results 1

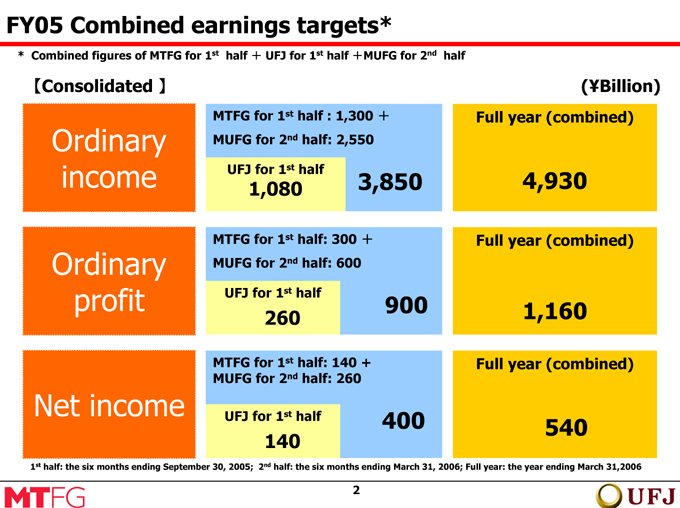

FY05 Combined earnings targets 2

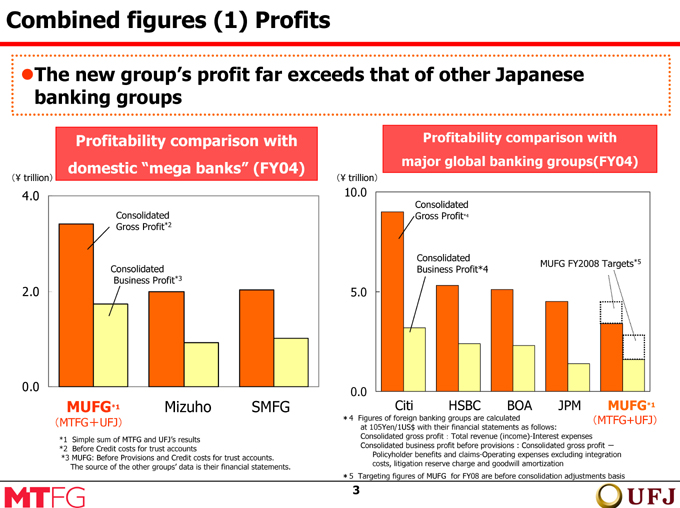

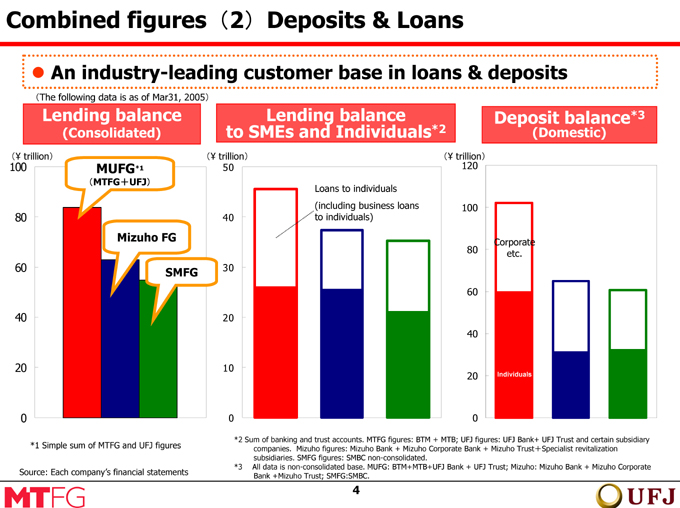

Combined figures (1) Profits 3

Combined figures (2) Deposits & 4

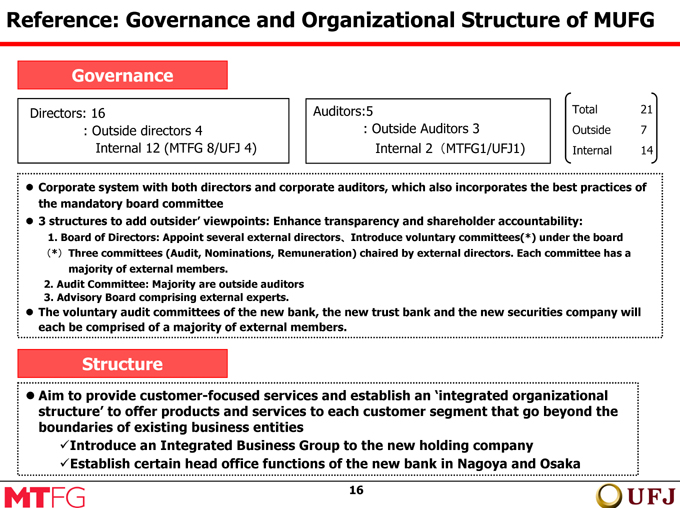

Loans