Mitsubishi UFJ Financial (MUFG) 6-KCurrent report (foreign)

Filed: 7 Jun 19, 6:07am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form6-K

Report of Foreign Private Issuer

Pursuant to Rule13a-16 or15d-16 under

the Securities Exchange Act of 1934

For the month of June 2019

Commission FileNo. 000-54189

MITSUBISHI UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1, Marunouchi2-chome, Chiyoda-ku

Tokyo100-8330, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form20-F or Form40-F.

Form20-F ☒ Form40-F ☐

Indicate by check mark if the registrant is submitting the Form6-K

in paper as permitted by RegulationS-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form6-K

in paper as permitted by RegulationS-T Rule 101(b)(7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: June 7, 2019

| Mitsubishi UFJ Financial Group, Inc. | ||

| By: | /s/ Zenta Morokawa | |

| Name: | Zenta Morokawa | |

| Title: | Managing Director, Head of Documentation & Corporate Secretary Department, Corporate Administration Division | |

[NOTICE: This Notice of Convocation is a translation of the Japanese original for reference purposes only, and in the event of any discrepancy, the Japanese original shall prevail.]

Securities code: 8306

June 6, 2019

NOTICE OF CONVOCATION OF

THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

Dear Shareholders:

Notice is hereby given that the 14th Annual General Meeting of Shareholders (the “Meeting”) of Mitsubishi UFJ Financial Group, Inc. (the “Company”) will be held as described below. You are cordially invited to attend the Meeting. If you attend the Meeting in person, please present the enclosed voting right exercise form to the receptionist at the Meeting.

Please note that you may exercise your voting rights in writing, or electromagnetically (Internet), if you are unable to attend the Meeting in person. In such case, please review the attached “Reference Materials Concerning the General Meeting of Shareholders” and exercise your voting rights by 5:10 p.m. on Wednesday, June 26, 2019, following the procedure described on page 3 to 5.

| Yours very truly, | ||

| MITSUBISHI UFJ FINANCIAL GROUP, INC. Kanetsugu Mike Member of the Board of Directors, President & Group CEO (Representative Corporate Executive) 7-1, Marunouchi2-chome, Chiyoda-ku, Tokyo | ||

| PARTICULARS | ||

| 1. Date and Time of the Meeting: | Thursday, June 27, 2019, at 10:00 a.m. | |

| (Reception scheduled to open at 9:00 a.m.) | ||

| 2. Place of the Meeting: | Hiten Main Banquet Hall, Grand Prince Hotel New Takanawa at3-13-1 Takanawa,Minato-ku, Tokyo | |

1

3. Matters to be dealt with at the Meeting:

Matters for Reporting: | The Business Report for the 14th Fiscal Year (from April 1, 2018 to March 31, 2019), the Financial Statements, the Consolidated Financial Statements and the Results of the Audit of the Consolidated Financial Statements by the Independent Auditors and the Audit Committee. | |

Matters for Resolution: | ||

First Item of Business | Appropriation of Surplus | |

Second Item of Business | Election of 16 (sixteen) Directors

| |

If any matter included in the Reference Materials Concerning the General Meeting of Shareholders, the Business Report, the Financial Statements, and the Consolidated Financial Statements is to be modified, we will disclose the details of such modification onour website.

The Company website: https://www.mufg.jp/ |

2

Exercise of Voting Rights

Please review the “Reference Materials Concerning the General Meeting of Shareholders” on page 6 onward and exercise your voting rights by either of the following methods:

Exercise of voting rights by attending the Meeting in person

Please submit the enclosed voting right exercise form at the reception.

You are also kindly requested to bring this Notice of Convocation for your reference at the Meeting.

| * | In the case of attendance by proxy, please present, to the receptionist at the Meeting, a document evidencing authority of the proxy to act as such, together with the voting right exercise form. Please note that such proxy must be one shareholder of the Company entitled to exercise its own voting rights at the Meeting. |

Date and time of the Meeting: Thursday, June 27, 2019 at 10:00 a.m.

Exercise of voting rights in writing (voting right exercise form)

Please indicate your votes for or against the propositions on the enclosed voting right exercise form and send the completed form to the Company by return mail.

Deadline: Wednesday, June 26, 2019, to reach the Company no later than 5:10 p.m.

Exercise of voting rights via the Internet Please see page 4 to 5 for details.

Please access the voting right exercise website (https://evote.tr.mufg.jp/) via the Internet and exercise your voting rights.

Please scan the “smartphone voting right exercise website login QR code” to exercise voting rights via smartphone

You can access the voting right exercise website without entering a voting rights exercise code and a password.

Please see next page for details.

3

Exercise of voting rights via smartphone

You can access the voting right exercise website without

*Voting rights can be exercised only once using the above

| Deadline: 5:10 p.m., Wednesday, June 26, 2019 | |||||

| 1. Scan the QR code

| Please use your smartphone to scan the “smartphone voting right exercise website login QR code” on the bottom right of the enclosed voting right exercise form. | |||||

*QR code is a registered trademark of DENSO WAVE INCORPORATED.

| ||||||

2. Select a method of exercising voting rights

| Access the URL shown on the screen to display the voting right exercise website screen.

There are two methods of exercising voting rights available. | |||||

3. Select a vote for or against each proposal

| Select your vote for or against for each proposal by following the instructions on the screen. | |||||

4. Complete your vote

|

If there are no problems with the details shown on the confirmation screen, click the “Send” button and complete your vote. |

Please Note: Should you wish to change the content of your votes after having once exercised your voting rights, you will need to scan the QR code again and input the ‘voting rights exercise code’ and ‘password’ indicated on the voting right exercise form. |

4

Exercise of voting rights via the Internet

*Exercise of voting rights via the Internet includes exercise of voting rights using an electronic voting rights exercise platform.

| Please access the voting right exercise website (https://evote.tr.mufg.jp/) via the Internet and exercise your voting rights. | Deadline: 5:10 p.m., Wednesday, June 26, 2019 | |||||||||||

| Notes | ||||||||||||

1. Access the voting right exercise website (screen on PC) | • Please note that we request shareholders who exercise their voting rights via the Internet to change their “temporary password” on the voting right exercise website in order to prevent unauthorized access (“spoofing”) by third parties other than shareholders and to prevent tampering with the contents of the voting.

• A new “login ID” and “temporary password” will be provided each time when a General Meeting of Shareholders is convened.

• Internet access fees, communication charges, etc. incurred in accessing the voting right exercise website from your PC, smartphone or mobile phone are to be borne by the shareholders.

For inquiries regarding exercise of voting rights via the Internet (Help desk) Securities Transfer Agency Division, Mitsubishi UFJ Trust and Banking Corporation 0120-173-027 (toll-free within Japan) Business hours: From 9:00 a.m. to 9:00 p.m. | |||||||||||

|

(1) Click “Go to the next page.”

| |||||||||||

2. Log in

|

(2) Use your “login ID” and “temporary password” provided on the bottom-right of the voting right exercise form. | |||||||||||

(3) Click “Log in.”

| ||||||||||||

3. Register your password

| ||||||||||||

| (4) Enter the “temporary password” in the “current password” field and enter a new password of your choice in both the “new password input field” and the “new password input field (for confirmation).” Please be careful not to forget your password. | |||||||||||

◾ Information for Institutional Investors Institutional investors may use an “electronic voting rights exercise platform” as a method of exercising the voting rights.

| ||||||||||||

Handling of the voting rights exercised multiple times

1. Please be advised that if you exercise the voting rights both in writing and via the Internet, the contents of the voting rights exercised via the Internet shall be deemed valid.

| ||||||||||||

(5) Click “Send.” |

2. Please be advised that if you exercise the voting rights multiple times via the Internet, the last exercise of the voting rights shall be deemed valid. Similarly, if you exercise the voting rights redundantly via PC, smart phone and mobile phone, the last exercise of the voting rights shall be deemed valid.

| |||||||||||

Hereafter, please enter your approval or disapproval by following the instructions on the screen. | ||||||||||||

5

[TRANSLATION]

REFERENCE MATERIALS CONCERNING

THE GENERAL MEETING OF SHAREHOLDERS

Items of Business and Reference Matters

First Item of Business Appropriation of Surplus

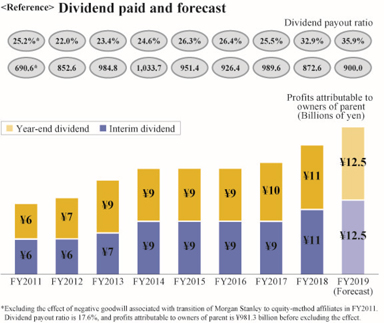

MUFG’s basic policies call for continuously seeking to improve shareholder returns, focusing on dividends in the pursuit of an optimal balance with solid equity capital and strategic investment for growth.

MUFG will aim for the stable and sustainable increase in dividends per share through profit growth, with a dividend payout ratio target of 40%. MUFG will flexibly repurchase its own shares as part of its shareholder return strategies in order to improve capital efficiency. Also, in principle, MUFG will hold a maximum of approximately 5% of the total number of issued shares, and cancel the shares that exceed this amount.

Based on these policies, MUFG proposes theyear-end dividend of ¥11 per share. Combined with the interim dividend of ¥11 per share, annual dividends will total ¥22 per share, an increase of ¥3 per share over the previous fiscal year.

Matters concerning theyear-end dividend:

1. Kind of dividend property

|  | |

Cash

| ||

2. Matters concerning allocation and | ||

the total amount of dividend property

| ||

Ordinary Shares ¥11 per share ¥142,552,394,809 in total

| ||

3. Date on which dividends from surplus | ||

shall be effective

| ||

June 28, 2019 |

6

Second Item of Business Election of 16 (sixteen) Directors

The terms of office of all directors will expire at the close of this Meeting. Therefore, based on the decision of the Nominating and Governance Committee (which constitutes a Nominating Committee under the Companies Act), you are hereby requested to elect 16 (sixteen) directors.

The candidates are as follows.

Each of the 9 (nine) candidates for outside directors meets the Company’s “Independence Standards for Outside Directors.”

| No. | Candidate’s Name | Current Position and Responsibilities at the Company | Concurrent Posts at Listed Companies | Expertise | ||||||||||||

Corporate management | Finance | Financial accounting | Law | |||||||||||||

1 | (Ms.) Mariko Fujii |

| 1 | — | ● | — | — | |||||||||

2 | (Mr.) Kaoru Kato |

| — | — | ||||||||||||

3 | (Ms.) Haruka Matsuyama |  | Member of the Board of Directors Nominating Member Compensation Member (Chairperson) | 3 | — | — | — | ● | ||||||||

4 | (Mr.) Toby S. Myerson |

| Member of the Board of Directors Risk Member | 0 | — | — | — | ● | ||||||||

5 | (Mr.) Hirofumi Nomoto |

| 4 | — | — | |||||||||||

6 | (Mr.) Tsutomu Okuda |  | Member of the Board of Directors Nominating Member (Chairperson) Compensation Member | 0 | ● | — | — | — | ||||||||

7 | (Mr.) Yasushi Shingai |  | Member of the Board of Directors Audit Member Risk Member | 2 | ● | — | ● | — | ||||||||

8 | (Ms.) Tarisa Watanagase |

| Member of the Board of Directors Risk Member | 1 | — | ● | — | — | ||||||||

9 | (Mr.) Akira Yamate |  | Member of the Board of Directors Audit Member (Chairperson) | 0 | — | — | ● | — | ||||||||

7

| No. | Candidate’s Name | Current Position and Responsibilities at the Company | Concurrent Posts at Listed Companies | |||||

10 | (Mr.) Tadashi Kuroda |

| Member of the Board of Directors Audit Member | 0 | ||||

11 | (Mr.) Junichi Okamoto |

| Member of the Board of Directors Audit Member | 0 | ||||

12 | (Mr.) Nobuyuki Hirano |

| Member of the Board of Directors Chairman (Corporate Executive) | 3 | ||||

13 | (Mr.) Mikio Ikegaya |

| Member of the Board of Directors Deputy Chairman (Representative Corporate Executive) | 0 | ||||

14 | (Mr.) Saburo Araki |

| Member of the Board of Directors Deputy Chairman (Representative Corporate Executive) | 0 | ||||

15 | (Mr.) Kanetsugu Mike |

| Member of the Board of Directors President & Group CEO (Representative Corporate Executive) Nominating Member Compensation Member | 0 | ||||

16 |

(Mr.) Hironori Kamezawa |

|

Deputy President (Representative Corporate Executive) Group COO & Group CDTO |

0 | ||||

| Candidate for Outside Director | |

| Person, being as a non-executive director, who does not concurrently serve as corporate executive, executive officer, employee or executive directors of the Company or its subsidiaries (excluding outside directors) | |

|

Candidate for independent director provided for by Tokyo Stock Exchange, Inc. | |

| Nominating Member: | Member of the Nominating and Governance Committee | |

| Audit Member: | Member of the Audit Committee | |

| Compensation Member: | Member of the Compensation Committee | |

| Risk Member: | Member of the Risk Committee | |

8

(Reference) Composition, etc. of the Board of Directors

Composition

The board of directors as a whole shall have an appropriately balanced composition that provides a deep understanding of the Group’s business and a wealth of knowledge and expertise on finance, financial accounting, risk management and compliance and so forth in order to ensure its effectiveness, and shall meet the following requirements in particular.

Appropriate balance | The board of directors shall have a balanced composition consisting of internal directors who are familiar with the business of MUFG and independent outside directors who oversee management and directors from an independent and objective standpoint. | |

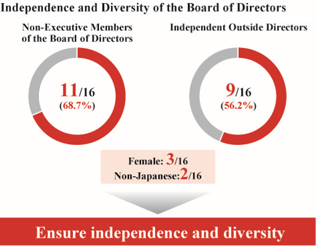

Ensure independence | The percentage of independent outside directors, in principle, shall be more than half. | |

Oversight of the Group’s management | To ensure the effectiveness of oversight of MUFG Group’s management by the board of directors, the Presidents of MUFG Bank, Ltd., Mitsubishi UFJ Trust and Banking Corporation, and Mitsubishi UFJ Securities Holdings Co., Ltd. will, in principle, also serve as directors of the Company. |

Policy for Election of Members of Directors

For election of directors, the Nominating and Governance Committee shall set forth director election standards focusing on the following and nominate persons who meet such standards as director candidates.

[Outline of Election Standards for Directors]

Qualities of those entrusted as managers | Directors shall have the qualities required to be able to appropriately fulfill their duty of loyalty and duty of care in the execution of their duties and to contribute to the sustainable growth and the increase of corporate value of MUFG over the medium- to long-term. | |

Qualities of independent outside director | Independent outside directors shall have a wealth of knowledge and experience in the fields of corporate management, finance, financial accounting and law and the qualities required for oversight of the execution of duties by management from an independent and objective standpoint, meeting the independence standards of the MUFG. | |

Ability of executive directors | Executive directors shall have extensive knowledge of MUFG Group’s business and the ability to appropriately perform management of MUFG. |

Term of Office and Concurrent Posts of Directors

Term of office of directors | The term of office of directors shall be 1 (one) year. In discussions and decisions by the Nominating and Governance Committee on a candidate for reappointment, the number of years since such candidate assumed the office of a director of MUFG shall be considered. | |

Directors with concurrent posts | A director may concurrently serve as a director, corporate auditor, executive or corporate officer at a company other than MUFG Group company only to the extent such directors is able to have enough time required to appropriately fulfill the duties as a directors of MUFG, such as understanding the business and other aspects of the MUFG Group, and the directors shall report periodically to the board of directors on such concurrent posts. |

9

MUFG Independence Standards for Outside Directors

1. | (1) | The person does not serve as an executive director, Corporate executive, executive officer, manager or other employee (hereinafter “Executive”) of the Company or its subsidiaries, and has not served as an Executive of the Company or its subsidiaries in the 10 years prior to his or her appointment. |

| (2) | If the person at some time during the 10 years prior to his or her appointment had served as a Director, accounting advisor or corporate auditor (excluding a person who served as an Executive) of the Company or its subsidiaries, he or she had not served as an Executive in the 10 years prior to his or her appointment as such Director, accounting advisor or corporate auditor. |

2. | (1) | The person is not a person or an Executive thereof who deals with the Company or its major subsidiaries*1 as a major business partner*2 and has not been an Executive thereof in the last 3 years. |

| (2) | The person is not a major business partner or an Executive thereof of the Company or its major subsidiaries, and has not been an Executive thereof in the last 3 years. |

| 3. | If the person is a consultant, accounting expert or legal expert, he or she has not received more than an average of 10 million yen per year in monetary or other assets from the Company excluding executive compensation, in the last 3 years, and is not an employee or other member of an accounting and law firms which deals with the Company as a major business partner*3. |

| 4. | The person is not a spouse or a relative within the second degree of kinship of a Director, corporate executive, executive officer of the Company or its subsidiaries or a person whose independence from the Company has not been deemed to be assured by reason of Requirements 2 and 3 above. |

| 5. | The person is not a current major shareholder*4 of the Company or an Executive thereof. |

| 6. | The person is not an audit corporation or an employee or other member of such audit corporation of the Company or its subsidiaries, and has not engaged in the audit operations of the Company or its subsidiaries as such employee in the last 3 years. |

*1 Major subsidiaries: | MUFG Bank, Ltd., Mitsubishi UFJ Trust and Banking Corporation, Mitsubishi UFJ Securities Holding Co., Ltd. | |

*2 Major business partner: | Based on the criterion of 2% or more of annual consolidated net sales (annual consolidated gross profits in the case of the Company). | |

*3 Major business partner: | Based on the criterion of 2% or more of annual net sales. | |

*4 Major shareholder: | Shareholder holding 10% or more of total voting rights |

|  |

10

| Number 1 Mariko Fujii | |||||||

Date of Birth: March 9, 1955 (Age: 64) *As of the date of assumption of office. | ||||||||

Type and Number of Company’s Shares Owned |

Ordinary Shares 0 | |||||||

| Career summary | |||||||

| April 1977 | Joined the Ministry of Finance | |||||||

| July 1997 | Director of International Affairs and Research Division, Customs and Tariff Bureau of the Ministry of Finance | |||||||

| April 1999 | Associate Professor of Research Center for Advanced Science and Technology of the University of Tokyo | |||||||

| March 2001 | Professor of Research Center for Advanced Economic Engineering of the University of Tokyo | |||||||

| April 2004 | Professor of Research Center for Advanced Science and Technology of the University of Tokyo (National University Corporation) | |||||||

| June 2014 | Outside Director of Electric Power Development Co., Ltd. | |||||||

| October 2015 | Resigned from Professor of Research Center for Advanced Science and Technology of the University of Tokyo (National University Corporation) | |||||||

| Resigned from Outside Director of Electric Power Development Co., Ltd. | ||||||||

| October 2015 | Ambassador Extraordinary and Plenipotentiary of Japan to the Republic of Latvia | |||||||

| January 2019 | Retired from Ambassador Extraordinary and Plenipotentiary of Japan to the Republic of Latvia | |||||||

| Important status in other companies |

Outside Director of NTT DATA CORPORATION*

|

| Reason for proposing as candidate for Outside Director |

After serving at the Ministry of Finance, Ms. Fujii has served in various important positions, including Professor of Research Center for Advanced Science and Technology of the University of Tokyo and Ambassador Extraordinary and Plenipotentiary of Japan and has built expertise and abundant experience in the areas of finance and economy through her career. The Company proposes her election as outside director since she is expected to contribute to the effective enhancement of the board of directors’ decision-making function and oversight function, with the aim of facilitating sustainable growth of the Company and increasing its corporate value over the medium- to long-term. Although she has not been directly involved in the management of a corporation, except as outside Director or outside corporate auditor, the Company believes that she is well qualified to act as an outside Director because of the reason stated above. |

| Supplementary information on independence |

Ms. Fujii meets the Company’s “Independence Standards for Outside Directors.”

|

| * | Ms. Fujii is scheduled to be elected at the Ordinary General Meeting of Shareholders of NTT DATA CORPORATION to be held in June 2019 and assume the post thereafter. |

11

| Number 2 Kaoru Kato | |||||||

Date of Birth: May 20, 1951 (Age: 68) *As of the date of assumption of office. | ||||||||

Type and Number of Company’s Shares Owned

|

Ordinary Shares 0

| |||||||

| Career summary | |||||||

| April 1977 | Joined Nippon Telegraph and Telephone Public Corporation (NTT) | |||||||

| July 1999 | General Manager of Plant Department of NTT Kansai Mobile Communications Network, Inc. | |||||||

| April 2000 | General Manager of Plant Department of NTT DoCoMo Kansai Inc. | |||||||

| June 2002 | General Manager of Corporate Strategy and Planning Department, Member of the Board of Directors of NTT DoCoMo Kansai Inc. | |||||||

| July 2005 | Representative Director and Senior Corporate Executive Officer of Sumitomo Mitsui Card Co., Ltd | |||||||

| July 2007 | Executive Vice President, General Manager of Corporate Strategy and Planning Department, Member of the Board of Directors of NTT DoCoMo Kansai Inc. | |||||||

| June 2008 | Executive Vice President, General Manager of Corporate Strategy and Planning Department, Member of the Board of Directors of NTT DOCOMO Inc. | |||||||

| June 2012 | President and Chief Executive Officer, Member of the Board of Directors of NTT DOCOMO Inc. | |||||||

| June 2016 | Corporate Advisor, Member of the Board of Directors of NTT DOCOMO Inc. | |||||||

| June 2018 | Corporate Advisor of NTT DOCOMO Inc. (incumbent) | |||||||

| Important status in other companies |

Corporate Advisor of NTT DOCOMO Inc., President of Japan Telework Association

|

| Reason for proposing as candidate for Outside Director |

| Having served in various important positions, including President and Chief Executive Officer, Member of the Board of Directors, and Corporate Advisor of NTT DOCOMO Inc., Mr. Kato has affluent experience, knowledge and wisdom as a corporate manager. The Company proposes his election as outside director since he is expected to contribute to the effective enhancement of the board of directors’ decision-making function and oversight function, with the aim of facilitating sustainable growth of the Company and increasing its corporate value over the medium- to long-term. |

| Supplementary information on independence |

Mr. Kato meets the Company’s “Independence Standards for Outside Directors.” He currently serves as Corporate Advisor of NTT DOCOMO Inc., with which the Company had business accounting for less than 1% of NTT DOCOMO Inc.’s consolidated net sales and the Company’s consolidated gross profit in fiscal year 2018. In light of this, among other reasons, such relationship would not affect his independence from the Company.

|

12

| Number 3 Haruka Matsuyama | |||||||

Date of Birth: August 22, 1967 (Age: 51)*As of the date of assumption of office. * The officially registered name of Ms. Haruka Matsuyama is Haruka Kato. | ||||||||

Type and Number of Company’s Shares Owned

|

Ordinary Shares 3,300

| |||||||

| Current Position, Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc. | ||||||||

| Member of the Board of Directors | Meeting of the Board of Directors | 9/9 (100%) | ||||||

Number of Years in Office as Outside Director 5 years | Member of the Nominating and Governance Committee | Nominating and Governance Committee | 13/13 (100%) | |||||

| Member of the Compensation Committee (Chairperson) | Compensation Committee | 7/7 (100%) | ||||||

| Career summary | ||||||||

| April 1995 | Assistant Judge to the Tokyo District Court | |||||||

| July 2000 | Registered as an attorney at law, Member of the Daini Tokyo Bar Association | |||||||

Joined Hibiya Park Law Offices | ||||||||

| January 2002 | Partner of Hibiya Park Law Offices (incumbent) | |||||||

| June 2012 | Outside Corporate Auditor of Vitec Co., Ltd. | |||||||

| June 2013 | Outside Director of T&D Holdings, Inc. (incumbent) | |||||||

| June 2014 | External Auditor & Supervisory Board Member of MITSUI & CO., LTD. (incumbent) | |||||||

| Member of the Board of Directors (Outside Director) of the Company (incumbent) | ||||||||

June 2015 | Outside Director of Vitec Co., Ltd. (current Restar Holdings Corporation) (incumbent) | |||||||

| Important status in other companies |

Partner of Hibiya Park Law Offices Outside Director of T&D Holdings, Inc. Outside Director of Restar Holdings Corporation External Auditor & Supervisory Board Member of MITSUI & CO., LTD.

|

| Reason for proposing as candidate for Outside Director |

Ms. Matsuyama has extensive experience as an attorney and professional insight on general legal affairs. The Company proposes her election as outside director since she is expected to contribute to the effective enhancement of the board of directors’ decision-making function and oversight function, with the aim of facilitating sustainable growth of the Company and increasing its corporate value over the medium- to long-term. Although she has not been directly involved in the management of a corporation, except as outside director or outside corporate auditor, the Company believes that she is well qualified to act as an outside director because of the reason stated above. |

| Supplementary information on independence |

Ms. Matsuyama meets the Company’s “Independence Standards for Outside Directors.” She currently serves as the Partner of Hibiya Park Law Offices, with which the Company has no advisory contract and has not had transaction since fiscal year 2014 in which she assumed the post of the Company’s director. In addition, although there was transaction related to legal advice, etc. between the Company and the concerned law office in fiscal year 2013, before she assumed the post of the Company’s director, since the amount of transaction was less than ¥2 million, among other reasons, such relationship would not affect her independence from the Company.

|

13

| Number 4 Toby S. Myerson | |||||||

Date of Birth: July 20, 1949 (Age: 69) *As of the date of assumption of office.

| ||||||||

Type and Number of Company’s Shares Owned

|

Ordinary Shares 0

| |||||||

| Current Position, Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc. | ||||||||

| Member of the Board of Directors | Meeting of the Board of Directors | 9/9 (100%) | ||||||

| Member of the Risk Committee | ||||||||

Career summary

| ||||||||

Number of Years in Office as Outside Director 2 years | September 1977 | Registered an attorney at law, admitted in States of California and New York in the United States | ||||||

| October 1981 | Joined Paul, Weiss, Rifkind, Wharton & Garrison LLP | |||||||

| June 1983 | Partner of Paul, Weiss, Rifkind, Wharton & Garrison LLP | |||||||

| April 1989 | Managing Director of Wasserstein Perella & Co. Inc. | |||||||

| November 1990 | Partner of Paul, Weiss, Rifkind, Wharton & Garrison LLP | |||||||

| June 2014 | Outside Director of MUFG Union Bank, N.A. (incumbent) | |||||||

| December 2016 | Resigned from Paul, Weiss, Rifkind, Wharton & Garrison LLP | |||||||

| January 2017 | Chairman & CEO of Longsight Strategic Advisors LLC (incumbent) | |||||||

| February 2017 | Outside Director of MUFG Americas Holdings Corporation (incumbent) | |||||||

| June 2017 | Member of the Board of Directors (Outside Director) of the Company (incumbent) | |||||||

| Important status in other companies |

Chairman & CEO of Longsight Strategic Advisors LLC Outside Director of MUFG Americas Holdings Corporation Outside Director of MUFG Union Bank, N.A.

|

| Reason for proposing as candidate for Outside Director |

| Mr. Myerson has extensive experience as an attorney and professional insight on the fields of corporate legal affairs and successful mergers, acquisitions, divestiture and takeover transactions. The Company proposes his election as outside director since he is expected to contribute extensive global outlook to the effective enhancement of the board of directors’ decision-making function and oversight function, with the aim of facilitating sustainable growth of the Company and increasing its corporate value over the medium- to long-term. |

| Supplementary information on independence |

Mr. Myerson meets the Company’s “Independence Standards for Outside Directors.” Although he served as a Partner andCo-Head of the Global Mergers and Acquisitions Group of Paul, Weiss, Rifkind, Wharton & Garrison LLP, he left the Firm in December 2016, and has not been involved in its management after resignation. In addition, although he currently serves as Chairman & CEO of Longsight Strategic Advisors LLC, a strategic advisory firm he established in January 2017, there is no relation between this company and the Company. In light of this and other reasons, such relationship would not affect his independence from the Company.

|

14

| Number 5 Hirofumi Nomoto | |||||||

Date of Birth: September 27, 1947 (Age: 71) *As of the date of assumption of office. | ||||||||

Type and Number of Company’s Shares Owned

|

Ordinary Shares 25,000

| |||||||

| Career summary

| |||||||

| April 1971 | Joined Tokyu Corporation | |||||||

| April 2003 | Executive General Manager of Media Business Headquarters of Tokyu Corporation | |||||||

| April 2004 | President & Representative Director of its communications Inc. | |||||||

| June 2007 | Director of Tokyu Corporation | |||||||

| Executive Officer of Real Estate Development Business Unit of Tokyu Corporation | ||||||||

| January 2008 | Managing Director of Tokyu Corporation | |||||||

| June 2008 | Senior Managing Director of Tokyu Corporation | |||||||

| April 2010 | Executive Officer & Senior Executive General Manager of Urban Life Produce Business Unit of Tokyu Corporation | |||||||

| June 2010 | Senior Managing Director & Representative Director of Tokyu Corporation | |||||||

| April 2011 | President & Representative Director of Tokyu Corporation | |||||||

| April 2018 | Chairman & Representative Director of Tokyu Corporation (incumbent) | |||||||

| Important status in other companies |

Chairman & Representative Director of Tokyu Corporation |

Outside Director of Tokyu Fudosan Holdings Corporation |

Outside Director of TOKYU RECREATION CO., LTD. |

Outside Director of TOEI COMPANY, LTD.

|

| Reason for proposing as candidate for Outside Director |

| Having served in various important positions, including President & Representative Director and Chairman & Representative Director of Tokyu Corporation, Mr. Nomoto has affluent experience, knowledge and wisdom as a corporate manager. The Company proposes his election as outside director since he is expected to contribute to the effective enhancement of the board of directors’ decision-making function and oversight function, with the aim of facilitating sustainable growth of the Company and increasing its corporate value over the medium- to long-term. |

| Supplementary information on independence |

Mr. Nomoto meets the Company’s “Independence Standards for Outside Directors.” He currently serves as Chairman & Representative Director of Tokyu Corporation, with which the Company had business accounting for less than 1% of the Tokyu Corporation’s consolidated net sales and the Company’s consolidated gross profit in fiscal year 2018. In light of this, among other reasons, such relationship would not affect his independence from the Company.

|

15

Number of Years in Office as Outside Director 5 years | Number 6 Tsutomu Okuda | |||||||

Date of Birth: October 14, 1939 (Age: 79) *As of the date of assumption of office.

| ||||||||

Type and Number of Company’s Shares Owned

|

Ordinary Shares 26,100

| |||||||

| Current Position, Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc. | ||||||||

| Member of the Board of Directors (Lead Independent Outside Director) | Meeting of the Board of Directors | 9/9 (100%) | ||||||

| Member of the Nominating and Governance Committee (Chairperson) | Nominating and Governance Committee | 13/13 (100%) | ||||||

| Member of the Compensation Committee | Compensation Committee | 7/7 (100%) | ||||||

| Career summary | ||||||||

April 1964 |

Joined The Daimaru, Inc. | |||||||

| September 1991 | Managing Director of Daimaru Australia Pty. Ltd. | |||||||

| May 1995 | Director of The Daimaru, Inc. | |||||||

| May 1996 | Managing Director of The Daimaru, Inc. | |||||||

| March 1997 | President of The Daimaru, Inc. | |||||||

| May 2003 | Chairman and Chief Executive Officer of The Daimaru, Inc. | |||||||

| September 2007 | Chairman of The Daimaru, Inc. | |||||||

| President and Chief Executive Officer of J. Front Retailing Co., Ltd. | ||||||||

| March 2010 | Chairman and Chief Executive Officer of J. Front Retailing Co., Ltd. | |||||||

| April 2013 | Director and Senior Advisor of J. Front Retailing Co., Ltd. | |||||||

| May 2014 | Senior Advisor of J. Front Retailing Co., Ltd. | |||||||

| June 2014 | Member of the Board of Directors (Outside Director) of the Company (incumbent) | |||||||

| May 2018 | Special Advisor of J. Front Retailing Co., Ltd. (incumbent) | |||||||

| Important status in other companies |

Special Advisor of J. Front Retailing Co., Ltd.

|

| Reason for proposing as candidate for Outside Director |

| Having served in various important positions, including President and Chairman of J. Front Retailing Co., Ltd., Mr. Okuda has affluent experience, knowledge and wisdom as a corporate manager. The Company proposes his election as outside director since he is expected to contribute to the effective enhancement of the board of directors’ decision-making function and oversight function, with the aim of facilitating sustainable growth of the Company and increasing its corporate value over the medium- to long-term. |

| Supplementary information on independence |

Mr. Okuda meets the Company’s “Independence Standards for Outside Directors.” He currently serves as Special Advisor of J. Front Retailing Co., Ltd., with which the Company had business accounting for less than 1% of the J. Front Retailing Co., Ltd.’s consolidated net sales and the Company’s consolidated gross profit in fiscal year 2018. In light of this, among other reasons, such relationship would not affect his independence from the Company.

|

16

Number of Years in Office as Outside Director 1 year | Number 7 Yasushi Shingai | |||||||

Date of Birth: January 11, 1956 (Age: 63) *As of the date of assumption of office.

| ||||||||

Type and Number of Company’s Shares Owned

| Ordinary Shares 0

| |||||||

| Current Position, Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc. | ||||||||

| Member of the Board of Directors | Meeting of the Board of Directors | 8/8 (100%) | ||||||

| Member of the Audit Committee | Audit Committee | 11/11 (100%) | ||||||

| Member of the Risk Committee | ||||||||

| Career summary | ||||||||

| April 1980 | Joined Japan Tobacco and Salt Public Corporation | |||||||

| July 2001 | Vice President, Financial Planning Division of Japan Tobacco Inc. (JT) | |||||||

| June 2004 | Senior Vice President, Head of Finance Group of JT | |||||||

| July 2004 | Senior Vice President, Chief Finance Officer of JT | |||||||

| June 2005 | Member of the Board, Senior Vice President, and Chief Finance Officer of JT | |||||||

| June 2006 | Member of the Board of JT | |||||||

| Executive Vice President and Deputy CEO of JT International S.A. | ||||||||

| June 2011 | Representative Director and Executive Vice President of JT | |||||||

| June 2014 | External Board Director of Recruit Holdings Co., Ltd. | |||||||

| January 2018 | Member of the Board of JT | |||||||

| March 2018 | Outside Director of Asahi Group Holdings, Ltd. (incumbent) | |||||||

| June 2018 | Member of the Board of Directors (Outside Director) of the Company (incumbent) | |||||||

| Important status in other companies | ||||||||

| Outside Director of Asahi Group Holdings, Ltd., Outside Director ofDai-ichi Life Holdings, Inc.* | ||||||||

| Reason for proposing as candidate for Outside Director | ||||||||

| Having served in various important positions, including Member of the Board, Senior Vice President and Chief Finance Officer (CFO) of Japan Tobacco Inc. (JT), Executive Vice President and Deputy CEO and CFO of JT International S.A., and Executive Deputy President and Representative Director and Deputy CEO of JT, Mr. Shingai has affluent experience as a global corporate manager and professional insight not only in corporate finance, but also M&A and corporate management after M&A. The Company proposes his election as outside director since he is expected to contribute to the effective enhancement of the board of directors’ decision-making function and oversight function, with the aim of facilitating sustainable growth of the Company and increasing its corporate value over the medium- to long-term. | ||||||||

| Supplementary information on independence | ||||||||

Mr. Shingai meets the Company’s “Independence Standards for Outside Directors.” He resigned as Member of the Board of JT in March 2018 and has not been involved in its management or business execution since his resignation. In addition, the Company had business accounting for less than 1% of the Japan Tobacco Inc.’s consolidated net sales and the Company’s consolidated gross profit in fiscal year 2018. In light of this, among other reasons, such relationship would not affect his independence from the Company.

| ||||||||

| * | Mr. Shingai is scheduled to be elected at the Annual General Meeting of Shareholders ofDai-ichi Life Holdings, Inc. to be held in June 2019 and assume the post thereafter. |

17

Number of Years in Office as Outside Director 2 years | Number 8 Tarisa Watanagase | |||||||

Date of Birth: November 30, 1949 (Age: 69) *As of the date of assumption of office.

| ||||||||

Type and Number of Company’s Shares Owned |

Ordinary Shares 0 | |||||||

| Current Position, Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc. | ||||||||

| Member of the Board of Directors | Meeting of the Board of Directors | 9/9 (100%) | ||||||

| Member of the Risk Committee | ||||||||

| Career summary | ||||||||

| June 1975 | Joined the Bank of Thailand | |||||||

| January 1988 | Economist of International Monetary Fund (IMF) (Secondment) | |||||||

| October 2002 | Deputy Governor of the Bank of Thailand | |||||||

| November 2006 | Governor of the Bank of Thailand | |||||||

| September 2010 | Retired from the Bank of Thailand | |||||||

| March 2013 | Outside Director of The Siam Cement Public Company Limited (incumbent) | |||||||

| June 2017 | Member of the Board of Directors (Outside Director) of the Company (incumbent) | |||||||

| Important status in other companies | ||||||||

Outside Director of The Siam Cement Public Company Limited

| ||||||||

| Reason for proposing as candidate for Outside Director | ||||||||

Ms. Watanagase has extensive experience as the former Governor of the Bank of Thailand, the central bank of the country, and professional insight on finance and economics. The Company proposes her election as outside director since she is expected to contribute extensive global outlook to the effective enhancement of the board of directors’ decision-making function and oversight function, with the aim of facilitating sustainable growth of the Company and increasing its corporate value over the medium- to long-term. Although she has not been directly involved in the management of a corporation, except as outside director or outside corporate auditor, the Company believes that she is well qualified to act as an outside director because of the reason stated above. | ||||||||

| Supplementary information on independence | ||||||||

Ms. Watanagase meets the Company’s “Independence Standards for Outside Directors.”

| ||||||||

18

| Number 9 Akira Yamate | |||||||

Date of Birth: November 23, 1952 (Age: 66) *As of the date of assumption of office.

| ||||||||

Type and Number of Company’s Shares Owned

|

Ordinary Shares 0

| |||||||

| Current Position, Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc. | ||||||||

| Member of the Board of Directors | Meeting of the Board of Directors | 9/9 (100%) | ||||||

| Member of the Audit Committee (Chairperson) | Audit Committee | 17/17 (100%) | ||||||

Number of Years in | Career summary | |||||||

| November 1977 | Joined Price Waterhouse Japan | |||||||

| March 1983 | Registered as Certified public accountant in Japan | |||||||

| July 1991 | Representative Partner of Aoyama Audit Corporation Partner of Price Waterhouse | |||||||

| April 2000 | Representative Partner of Chuo Aoyama Audit Corporation Partner of PricewaterhouseCoopers | |||||||

| September 2006 | Representative Partner of PricewaterhouseCoopers Aarata | |||||||

| June 2013 | Resigned from PricewaterhouseCoopers Aarata | |||||||

| External Audit & Supervisory Board Member of Nomura Real Estate Holdings, Inc. | ||||||||

| External Audit & Supervisory Board Member of Nomura Real Estate Development Co., Ltd. | ||||||||

| June 2015 | Member of the Board of Directors (Outside Director) of the Company (incumbent) | |||||||

| External Director of Nomura Real Estate Holdings, Inc. (scheduled to retire in June 2019) | ||||||||

External Member of Board of Statutory Auditors, of Prudential Holdings of Japan, Inc. (incumbent)

| ||||||||

| Important status in other companies | ||||||||

External Member of Board of Statutory Corporate Auditors, Prudential Holdings of Japan, Inc. External Director of Nomura Real Estate Development Co., Ltd.*

| ||||||||

| Reason for proposing as candidate for Outside Director | ||||||||

Mr. Yamate has affluent experience as a certified public accountant and professional insight in accounting and auditing. The Company proposes his election as outside director since he is expected to contribute to the effective enhancement of the board of directors’ decision-making function and oversight function, with the aim of facilitating sustainable growth of the Company and increasing its corporate value over the medium- to long-term.

| ||||||||

| Supplementary information on independence | ||||||||

Mr. Yamate meets the Company’s “Independence Standards for Outside Directors.” Although he had been a Representative Partner of PricewaterhouseCoopers Aarata LLC in the past, he resigned from the PricewaterhouseCoopers Aarata in June 2013, and has not been involved in its management. In light of this, among other reasons, such relationship would not affect his independence from the Company.

| ||||||||

| * | Mr. Yamate is scheduled to be elected at the Annual General Meeting of Shareholders of Nomura Real Estate Development Co., Ltd. to be held in June 2019 and assume the post thereafter. |

19

Number of Years in Office as Director 5 years | Number 10 Tadashi Kuroda | |||||||

Date of Birth: June 7, 1958 (Age: 61) *As of the date of assumption of office. | ||||||||

Type and Number of Company’s Shares Owned |

Ordinary Shares 124,600 Dilutive Shares* 69,981 | |||||||

| *The number of corresponding vested points in the stock compensation system using a trust structure | ||||||||

| Current Position, Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc. | ||||||||

| Member of the Board of Directors | Meeting of the Board of Directors | 9/9 (100%) | ||||||

| Member of the Audit Committee | Audit Committee | 11/11 (100%) | ||||||

Career summary The Company | ||||||||

| May 2014 | Managing Executive Officer | |||||||

| June 2014 | Member of the Board of Directors, Managing Executive Officer | |||||||

| May 2015 | Member of the Board of Directors, Senior Managing Executive Officer | |||||||

| June 2015 | Member of the Board of Directors, Senior Managing Corporate Executive | |||||||

May 2018

| Member of the Board of Directors (incumbent) | |||||||

| Subsidiaries, etc. | ||||||||

| April 1981 | Joined The Sanwa Bank, Limited | |||||||

| April 2008 | Executive Officer of The Bank of Tokyo-Mitsubishi UFJ, Ltd. (current MUFG Bank, hereafter “the Bank”) | |||||||

| June 2011 | Director and Senior Managing Executive Officer of Mitsubishi UFJ Research and Consulting Co., Ltd. | |||||||

| May 2013 | Managing Executive Officer of the Bank | |||||||

| June 2015 | Member of the Board of Directors, Senior Managing Executive Officer of the Bank | |||||||

| Reason for proposing as candidate for Director |

Since assuming the post of Executive Officer of The Bank of Tokyo-Mitsubishi UFJ, Ltd. (currently the Bank) in 2008, Mr. Kuroda has served as General Manager of the Credit Division, Officer in charge of East Region of Japan, Member of the Board of Directors, Senior Managing Executive Officer and CSO at the Bank. He also served as Member of the Board of Directors, Senior Managing Corporate Executive, Group CSO, and Group CHRO of the Bank. At present, he is Member of the Board of Directors, Member of the Audit Committee (Full-Time) of the Company. He is thoroughly familiar with the Group’s businesses and possesses affluent business experience and extensive knowledge necessary to manage the Group in an appropriate manner. The Company proposes his election as director since he is expected to contribute to the effective enhancement of the board of directors’ decision-making function and supervisory function, with the aim of achieving sustainable growth of the Company and its increased corporate value over the medium- to long-term.

|

20

| Number 11 Junichi Okamoto | |||||||

Date of Birth: November 9, 1957 (Age: 61) *As of the date of assumption of office. | ||||||||

Type and Number of Company’s Shares Owned |

Ordinary Shares 182,800 | |||||||

| Current Position, Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc. | ||||||||

| Member of the Board of Directors | Meeting of the Board of Directors | 9/9 (100%) | ||||||

| Member of the Audit Committee | Audit Committee | 16/17 (94%) | ||||||

| Career summary | |||||||

The Company | ||||||||

| June 2010 | Executive Officer | |||||||

| June 2013 | Member of the Board of Directors | |||||||

Number of Years in Office as Director 2 years | June 2015 | Senior Managing Corporate Executive | ||||||

| June 2017 | Member of the Board of Directors (incumbent) | |||||||

Subsidiaries, etc. | ||||||||

| April 1980 | Joined The Toyo Trust and Banking Company, Limited | |||||||

| June 2008 | Executive Officer of Mitsubishi UFJ Trust and Banking Corporation (hereafter “the Trust Bank”) | |||||||

| June 2010 | Managing Executive Officer of the Trust Bank | |||||||

| June 2012 | Senior Managing Executive Officer of the Trust Bank | |||||||

| June 2013 | Deputy President of the Trust Bank | |||||||

| Reason for proposing as candidate for Director |

Since assuming the post of Executive Officer of the Trust Bank in 2008, Mr. Okamoto has served as General Manager of Pension Trust Division, General Manager of Business Division VI and Deputy President at the Trust Bank. He also served as Senior Managing Corporate Executive, Group Head of Trust Assets Business Group of the Company. At present, he is Member of the Board of Directors, Member of the Audit Committee (Full-Time) of the Company. The Company proposes his election as director since he is expected to contribute to the effective enhancement of the Board of Directors’ decision-making function and supervisory function, with the aim of achieving sustainable growth of the Company and its increased corporate value over the medium- to long-term.

|

21

Number of Years in Office as Director 9 years | Number 12 Nobuyuki Hirano | |||||||

Date of Birth: October 23, 1951 (Age: 67) *As of the date of assumption of office. | ||||||||

Type and Number of Company’s Shares Owned |

Ordinary Shares 80,400 Dilutive Shares* 625,577 | |||||||

| *The number of corresponding vested points in the stock compensation system using a trust structure | ||||||||

| Current Position, Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc. | ||||||||

| Member of the Board of Directors Chairman (Corporate Executive) | Meeting of the Board of Directors | 9/9 (100%) | ||||||

| Nominating and Governance Committee | 13/13 (100%) | |||||||

| Compensation Committee | 7/7 (100%) | |||||||

| Career summary | ||||||||

| The Company | ||||||||

| July 2004 | Executive Officer | |||||||

| June 2005 | Member of the Board of Directors | |||||||

| June 2009 | Managing Executive Officer | |||||||

| June 2010 | Member of the Board of Directors | |||||||

| October 2010 | Member of the Board of Directors, Deputy President | |||||||

| April 2012 | Member of the Board of Directors | |||||||

| April 2013 | President & CEO | |||||||

| June 2015 | Member of the Board of Directors, President & Group CEO | |||||||

| April 2019 | Member of the Board of Directors, Chairman (Corporate Executive) (incumbent) | |||||||

Subsidiaries, etc. | ||||||||

| April 1974 | Joined The Mitsubishi Bank, Limited | |||||||

| June 2001 | Executive Officer of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) | |||||||

| May 2005 | Managing Executive Officer of BTM | |||||||

| June 2005 | Member of the Board of Directors, Managing Executive Officer of BTM | |||||||

| October 2008 | Member of the Board of Directors, Senior Managing Executive Officer of The Bank of Tokyo-Mitsubishi UFJ, Ltd. (current MUFG Bank, hereafter “the Bank”) | |||||||

| June 2009 | Member of the Board of Directors, Deputy President of the Bank | |||||||

| April 2012 | President & CEO of the Bank | |||||||

| April 2016 | Chairman of the Board of Directors of the Bank | |||||||

| April 2019 | Member of the Board of Directors of the Bank (incumbent) | |||||||

| Important status in other companies |

Member of the Board of Directors of MUFG Bank, Ltd. |

Director of Morgan Stanley |

Outside Audit & Supervisory Board Members of TOYOTA MOTOR CORPORATION |

Outside Director of Mitsubishi Heavy Industries, Ltd.*

|

| Reason for proposing as candidate for Director |

Since assuming the post of Executive Officer of The Bank of Tokyo-Mitsubishi, Ltd. (currently the Bank) in 2001, Mr. Hirano has served as General Manager of the Corporate Banking Division No. 2, General Manager of the Corporate Planning Office, Officer in charge of the Corporate Administration Division and Corporate Planning Division, Deputy President, and President at the Bank. He also served as President & Group CEO of the Company. At present, he is Member of the Board of Directors, Chairman (Corporate Executive) of the Company, concurrently serving as Member of the Board of Directors of MUFG Bank, Ltd. He is thoroughly familiar with the Group’s businesses and possesses affluent business experience and extensive knowledge necessary to manage the Group in an appropriate manner. The Company proposes his election as director since he is expected to contribute to the effective enhancement of the board of directors’ decision-making function and supervisory function, with the aim of achieving sustainable growth of the Company and its increased corporate value over the medium- to long-term. |

| * | Mr. Hirano is scheduled to be elected at the Annual General Meeting of Shareholders of Mitsubishi Heavy Industries, Ltd. to be held in June 2019 and assume the post thereafter. |

22

Number of Years in 3 years | Number 13 Mikio Ikegaya | |||||||

| Date of Birth: July 6, 1958 (Age: 60) *As of the date of assumption of office. | ||||||||

| Type and Number of Company’s Shares Owned | Ordinary Shares 75,630 Dilutive Shares* 304,796 | |||||||

*The number of corresponding vested points in the stock compensation system using a trust structure | ||||||||

| Current Position, Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc. | ||||||||

| Member of the Board of Directors | Meeting of the Board of Directors | 9/9 (100%) | ||||||

| Deputy Chairman (Representative Corporate Executive) | ||||||||

| Career summary | ||||||||

| The Company | ||||||||

| June 2008 | Executive Officer | |||||||

| June 2011 | Managing Executive Officer | |||||||

| June 2012 | Executive Officer | |||||||

| June 2015 | Managing Executive Officer | |||||||

| April 2016 | Deputy Chairman (Representative Corporate Executive) | |||||||

| June 2016 | Member of the Board of Directors, Deputy Chairman | |||||||

Subsidiaries, etc. | ||||||||

| April 1981 | Joined The Mitsubishi Trust and Banking Corporation | |||||||

| June 2008 | Executive Officer of Mitsubishi UFJ Trust and Banking Corporation (hereafter “the Trust Bank”) | |||||||

| June 2011 | Director and Managing Executive Officer of the Trust Bank | |||||||

| June 2012 | Managing Executive Officer of the Trust Bank | |||||||

| June 2013 | Senior Managing Executive Officer of the Trust Bank | |||||||

| June 2015 | Director and Senior Managing Executive Officer of the Trust Bank | |||||||

| April 2016 | President and CEO of the Trust Bank (incumbent) | |||||||

| Important status in other companies |

President and CEO of Mitsubishi UFJ Trust and Banking Corporation |

Chairman of the Trust Companies Association of Japan

|

Reason for proposing as candidate for Director |

Since assuming the post of Executive Officer of Mitsubishi UFJ Trust and Banking Corporation (the Trust Bank) in 2008, Mr. Ikegaya has served as General Manager of the Corporate Planning Division, Deputy Chief Executive of the Trust Asset Business Unit and Chief Executive of the Corporate Banking Business Unit at the Trust Bank. He also served as Deputy Group Head of the Integrated Corporate Banking Business Group of the Company. At present, he is Member of the Board of Directors, Deputy Chairman (Representative Corporate Executive) of the Company, concurrently serving as President and CEO of the Trust Bank. He is thoroughly familiar with the Group’s businesses and possesses affluent business experience and extensive knowledge necessary to manage the Group in an appropriate manner. The Company proposes his election as director since he is expected to contribute to the effective enhancement of the board of directors’ decision-making function and supervisory function, with the aim of achieving sustainable growth of the Company and its increased corporate value over the medium- to long-term.

|

23

| Number 14 Saburo Araki | |||||||

Date of Birth: August 6, 1957 (Age: 61) *As of the date of assumption of office. | ||||||||

Type and Number of Company’s Shares Owned |

Ordinary Shares 210,980 Dilutive Shares* 61,520 | |||||||

*The number of corresponding vested points in the stock compensation system using a trust structure

| ||||||||

| Current Position and Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc | ||||||||

| Member of the Board of Directors | Meeting of the Board of Directors | 8/8 (100%) | ||||||

| Deputy Chairman | |||||||

| (Representative Corporate Executive) | ||||||||

Number of Years in Office as Director 1 year | Career summary | |||||||

The Company | ||||||||

| May 2009 | Executive Officer | |||||||

| May 2011 | Managing Executive Officer | |||||||

| June 2012 | Member of the Board of Directors | |||||||

| June 2014 | Managing Executive Officer | |||||||

| June 2015 | Senior Managing Corporate Executive | |||||||

| April 2018 | Deputy Chairman (Representative Corporate Executive) | |||||||

| June 2018 | Member of the Board of Directors, Deputy Chairman (Representative Corporate Executive) (incumbent) | |||||||

Subsidiaries, etc. | ||||||||

| April 1981 | Joined The Mitsubishi Bank, Limited | |||||||

| June 2007 | Executive Officer of The Bank of Tokyo-Mitsubishi UFJ, Ltd. (current MUFG Bank, hereafter “the Bank”) | |||||||

| May 2011 | Managing Executive Officer of the Bank | |||||||

| June 2012 | Member of the Board of Directors, Managing Executive Officer of the Bank | |||||||

| May 2015 | Member of the Board of Directors, Senior Managing Executive Officer of the Bank | |||||||

| May 2016 | Member of the Board of Directors, Deputy President of the Bank | |||||||

| April 2018 | President & CEO of Mitsubishi UFJ Securities Holdings Co., Ltd. (incumbent) | |||||||

| President & CEO of Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. (incumbent) | ||||||||

| Important status in other companies |

President & CEO of Mitsubishi UFJ Securities Holdings Co., Ltd. President & CEO of Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

|

| Reason for proposing as candidate for Director |

Since assuming the post of Executive Officer of The Bank of Tokyo-Mitsubishi UFJ, Ltd. (currently the Bank) in 2007, Mr. Araki has served as General Manager of the Human Resources Division, General Manager of the Corporate Planning Division, General Manager of Corporate Banking Group No. 1, Officer in charge of the Corporate Administration Division and Corporate Planning Division, and Deputy President and Chief Executive of the Corporate Banking Business Unit at the Bank. He also served as Group Head of the Integrated Corporate Banking Business Group of the Company. At present, he is Member of the Board of Directors, Deputy Chairman (Representative Corporate Executive) of the Company, concurrently serving as President & CEO of Mitsubishi UFJ Securities Holdings Co., Ltd. and President & CEO of Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. He is thoroughly familiar with the Group’s businesses and possesses affluent business experience and extensive knowledge necessary to manage the Group in an appropriate manner. The Company proposes his election as director since he is expected to contribute to the effective enhancement of the board of directors’ decision-making function and supervisory function, with the aim of achieving sustainable growth of the Company and its increased corporate value over the medium- to long-term.

|

24

Number of Years in 2 years | Number 15 Kanetsugu Mike | |||||||

| Date of Birth: November 4, 1956 (Age: 62) *As of the date of assumption of office. | ||||||||

| Type and Number of Company’s Shares Owned | Ordinary Shares 49,055 | |||||||

| Dilutive Shares* 356,140 | ||||||||

*The number of corresponding vested points in the stock compensation system using a trust structure | ||||||||

| Current Position, Responsibilities at the Company and Attendance at Meeting of the Board of Directors, etc. | ||||||||

| Member of the Board of Directors President & Group CEO (Representative Corporate Executive) | Meeting of the Board of Directors | 9/9 (100%) | ||||||

| Member of the Nominating and Governance Committee | ||||||||

| Member of the Compensation Committee | ||||||||

| Career summary | ||||||||

| The Company | ||||||||

| June 2005 | Executive Officer | |||||||

| May 2011 | Managing Executive Officer | |||||||

| May 2016 | Senior Managing Corporate Executive | |||||||

| June 2017 | Member of the Board of Directors, Deputy Chairman (Representative Corporate Executive) | |||||||

| April 2019 | Member of the Board of Directors, President & Group CEO (Representative Corporate Executive) (incumbent) | |||||||

Subsidiaries, etc. | ||||||||

| April 1979 | Joined The Mitsubishi Bank, Limited | |||||||

| June 2005 | Executive Officer of The Bank of Tokyo-Mitsubishi, Ltd. | |||||||

| May 2009 | Managing Executive Officer of The Bank of Tokyo-Mitsubishi UFJ, Ltd. (current MUFG Bank, hereafter “the Bank”) | |||||||

| June 2011 | Member of the Board of Directors, Managing Executive Officer of the Bank | |||||||

| May 2013 | Senior Managing Executive Officer of the Bank | |||||||

| October 2015 | Executive Chairman of MUFG Americas Holdings Corporation | |||||||

| May 2016 | Deputy President of the Bank | |||||||

| June 2016 | Member of the Board of Director and Deputy President of the Bank | |||||||

| June 2017 | President & CEO of the Bank (incumbent) | |||||||

| Important status in other companies |

President & CEO of MUFG Bank, Ltd.

|

Reason for proposing as candidate for Director |

Since assuming the post of Executive Officer of The Bank of Tokyo-Mitsubishi, Ltd. (current the Bank) in 2005, Mr. Mike has served as General Manager of the Business & Systems Integration Division, Chief Executive of Corporate Services andCo-Chief Executive of the Global Business Unit. He also served as Director of Bank of Ayudhya Public Company Limited, Executive Chairman of MUFG Americas Holdings Corporation, Executive Chairman of MUFG Union Bank, N.A., and Group Head of the Global Business Group of the Company. At present, he is Member of the Board of Directors, President & Group CEO (Representative Corporate Executive) of the Company, concurrently serving as President & CEO of MUFG Bank, Ltd. He is thoroughly familiar with the Group’s businesses and possesses affluent business experience and extensive knowledge necessary to manage the Group in an appropriate manner. The Company proposes his election as director since he is expected to contribute to the effective enhancement of the board of directors’ decision-making function and supervisory function, with the aim of achieving sustainable growth of the Company and its increased corporate value over the medium- to long-term.

|

25

| Number 16 Hironori Kamezawa | |||||||

Date of Birth: November 18, 1961 (Age: 57) *As of the date of assumption of office. | ||||||||

| Type and Number of Company’s Shares Owned |

Ordinary Shares 25,500 | |||||||

| Dilutive Shares* 251,725 | ||||||||

| *The number of corresponding vested points in the stock compensation system using a trust structure | ||||||||

| Current Position, Responsibilities at the Company | ||||||||

| Deputy President | ||||||||

| (Representative Corporate Executive) | ||||||||

| Group COO & Group CDTO | ||||||||

| Career summary | ||||||||

| The Company | ||||||||

| June 2010 | Executive Officer | |||||||

| May 2014 | Managing Executive Officer | |||||||

| May 2017 | Managing Corporate Executive | |||||||

| May 2018 | Senior Managing Corporate Executive | |||||||

| April 2019 | Deputy President (Representative Corporate Executive) (incumbent) | |||||||

| Subsidiaries, etc. | ||||||||

| April 1986 | Joined The Mitsubishi Bank, Limited | |||||||

| June 2010 | Executive Officer of The Bank of Tokyo-Mitsubishi UFJ, Ltd. (current MUFG Bank, hereafter “the Bank”) | |||||||

| May 2014 | Managing Executive Officer of the Bank | |||||||

| June 2017 | Member of the Board of Directors, Managing Executive Officer of the Bank | |||||||

| May 2018 | Member of the Board of Directors, Senior Managing Executive Officer of the Bank | |||||||

| December 2018 | Representative of the Board of Directors & CEO of Global Open Network, Inc. (incumbent) | |||||||

| April 2019 | Member of the Board of Directors, Deputy President of the Bank (incumbent) | |||||||

| Representative of the Board of Directors & CEO of Global Open Network Japan, Inc. (incumbent) | ||||||||

| Important status in other companies |

Member of the Board of Directors, Deputy President of the MUFG Bank, Ltd. Representative of the Board of Directors & CEO of Global Open Network, Inc. Representative of the Board of Directors & CEO of Global Open Network Japan, Inc.

|

| Reason for proposing as candidate for Director |

Since assuming the post of Executive Officer of The Bank of Tokyo-Mitsubishi, Ltd. (currently the Bank) in 2010, Mr. Kamezawa has served as General Manager of Credit Policy & Planning Division, General Manager of Global Markets Planning Division, and Deputy Chief Executive of Regional Headquarters for the Americas, General Manager of New York Branch (concurrently seconded to MUFG Union Bank, N.A.). He also served as Managing Director, Head of Investment and Credit Policy & Planning Division, and Deputy Managing Director for the Americas of the Company. At present, he is Deputy Chairman (Representative Corporate Executive), Group COO & Group CDTO of the Company, concurrently serving as Member of the Board of Directors, Deputy President of MUFG Bank, Ltd. He is thoroughly familiar with the Group’s businesses and possesses affluent business experience and extensive knowledge necessary to manage the Group in an appropriate manner. The Company proposes his election as director since he is expected to contribute to the effective enhancement of the board of directors’ decision-making function and supervisory function, with the aim of achieving sustainable growth of the Company and its increased corporate value over the medium- to long-term. |

26

(Notes)

| 1. | The Company has entered into limited liability agreements with directors who are non-executive directors. Ms. Haruka Matsuyama, Mr. Toby S. Myerson, Mr. Tsutomu Okuda, Mr. Yasushi Shingai, Ms. Tarisa Watanagase, Mr. Akira Yamate, Mr. Tadashi Kuroda and Mr. Junichi Okamoto in accordance with the provision set forth in Article 427, Paragraph 1 of the Companies Act. The content of limited liability agreement is as follows. In addition, the Company plans to enter into the same limited liability agreement with Ms. Mariko Fujii, Mr. Kaoru Kato and Mr. Hirofumi Nomoto. |

(Summary of the content of the Limited Liability Agreement)

With respect to the liability set forth in Articles 423, Paragraph 1 of the Companies Act, when an outside director acts in good faith and is not grossly negligent in conducting an outside director’s duties, the outside director shall assume liability for damages limited by the greater of ¥10 million or the minimum liability amount prescribed in Articles 425, Paragraph 1 of the Companies Act.

| 2. | The Company designated Ms. Haruka Matsuyama, Mr. Toby S. Myerson, Mr. Tsutomu Okuda, Mr. Yasushi Shingai, Ms. Tarisa Watanagase and Mr. Akira Yamate as independent directors provided for by Tokyo Stock Exchange, Inc., and has notified the Tokyo Stock Exchange, Inc. to that effect. Likewise, the Company intends to designate Ms. Mariko Fujii, Mr. Kaoru Kato and Mr. Hirofumi Nomoto as independent directors and notify the Tokyo Stock Exchange to that effect. |

| 3. | Mr. Mikio Ikegaya, Mr. Saburo Araki, Mr. Kanetsugu Mike and Mr. Hironori Kamezawa are the Representative Corporate Executives of the Company. |

| 4. | Mr. Saburo Araki serves concurrently as President & CEO of Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. There is a business relationship, etc. with respect to financial instruments such as shares and bonds between the Company and Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. |

| 5. | Mr. Hironori Kamezawa serves concurrently as CEO of Global Open Network, Inc. and Global Open Network Japan, Inc. There is a system infrastructure-related business relationship between the Company and Global Open Network, Inc. through subsidiaries and a system infrastructure-related business relationship between the Company and Global Open Network Japan, Inc. In addition, Global Open Network Japan, Inc. is a wholly owned consolidated subsidiary of Global Open Network, Inc. |

| 6. | There are no special interests between each of the other candidates and the Company. |

| 7. | Attendance at meeting of the board of directors, etc. for Mr. Yasushi Shingai and Mr. Saburo Araki refers to the meetings held after they assumed the post of Member of the Board of directors in June 2018. |

| 8. | The members of the committees will be as follows upon approval of this Item of Business. The chairperson of each committee is scheduled to be appointed from among independent outside directors. |

Name | Nominating and Governance Committee (Nominating Committee under the Companies Act) | Compensation Committee | Audit Committee | |||

Mariko Fujii | ● | ● | ||||

Kaoru Kato | ● | |||||

Haruka Matsuyama | ● | ● | ||||

Hirofumi Nomoto | ● | ● | ||||

Tsutomu Okuda | ● | ● | ||||

Yasushi Shingai | ● | |||||

Akira Yamate | ● | |||||

Tadashi Kuroda | ● | |||||

Junichi Okamoto | ● | |||||

Kanetsugu Mike | ● | ● |

27

(Reference) Corporate Governance Highlight

Fundamental Concepts

The Company will aim for sustainable growth and the increase of corporate value over the medium- to long-term, in consideration of the perspectives of its stakeholders, including shareholders as well as customers, employees and local communities. The Company will aim to realize effective corporate governance through fair and highly transparent management based on the guidance provided by MUFG Corporate Governance Policies established in May 2015.

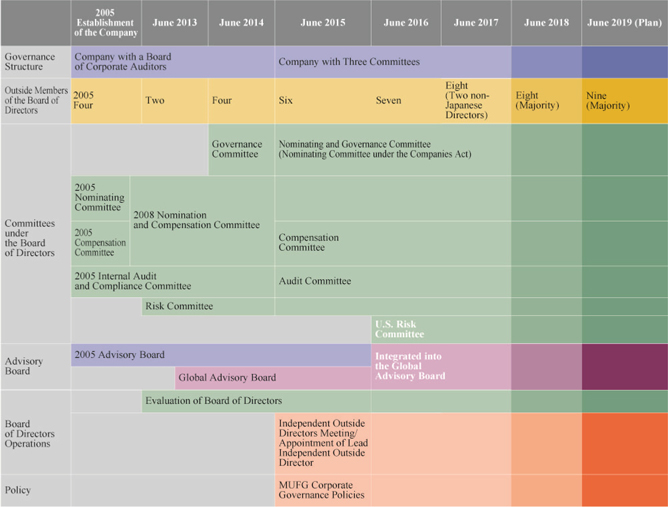

Steps to Improve Our Governance Structure

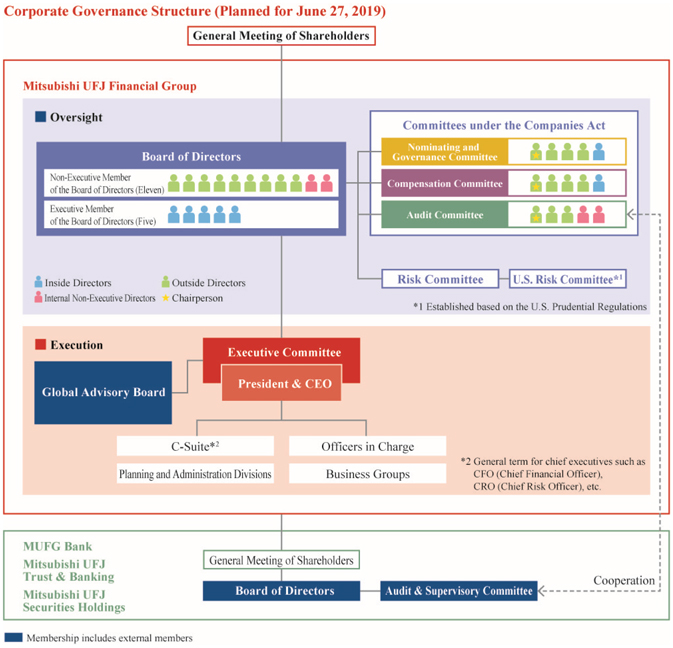

Since its establishment, the Company has worked to build a stable and effective corporate governance structure, putting emphasis on ensuring external oversight. In June 2015, the Company transitioned to the “company with three committees” governance structure. The functions of oversight and execution in the holding company are separated, thereby strengthening the oversight function of the board of directors and the committee system has also been reorganized for more effective governance. We are aiming for a governance framework that will be more familiar and transparent to overseas stakeholders, in line with our status as aG-SIB (Global Systemically Important Bank Group).

In June 2017, two foreign nationals were invited as outside directors in an effort to further diversify the board of directors, and in June 2018 a system was established in which outside directors made up the majority of the board of directors. In addition, upon the approval of the Second Item of Business as proposed at this Annual General Meeting of Shareholders, the number of outside directors will increase by one, thus further improving the quality of discussion by bringing in outside perspectives and strengthening the oversight function.

Corporate Governance Development

28

29

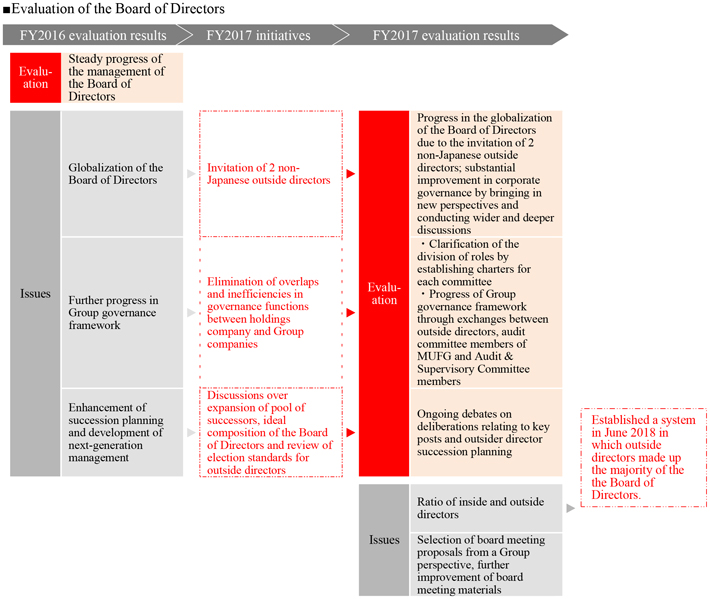

Evaluation of the Board of Directors

Since 2013, the Company has retained external consultants to evaluate the Board of Directors. These consultants conduct questionnaire surveys of and interviews with all of the directors regarding the composition of committees, advance preparations, the content of discussions, the status of operations and contributions, as well as assessments of the execution system. The results of these questionnaire surveys and interviews are reported to and discussed by the Nominating and Governance Committee and the Board of Directors.

In fiscal year 2017, the Company invited 2non-Japanese outside directors based on the results of the evaluation of the Board of Directors in fiscal year 2016. As a result, the fiscal year 2017 evaluation results assessed that such an initiative helped advance the globalization of the Board of Directors and bring in new perspectives in the areas of overseas business and risk governance, confirming the conduct of broader and deeper discussions and the substantial improvement of corporate governance. Meanwhile, because the total number of directors and the ratio of inside and outside directors were raised as issues, in June 2018 the Company created a system in which the majority of members are outside directors.

30

Initiatives taken during fiscal year 2018 in response to results of the evaluation of the Board of Directors for fiscal year 2017

Some initiatives taken by the Company during fiscal year 2018 based on the results of the evaluation of the board of directors above are presented below.

| - | Improved the outside director candidates selection process and established a system in which independent outside directors made up the majority of the board of directors |

| - | Confirmed the sharing of the status of the medium-term business plan among Group companies, the initiatives for further enhancing functions of the business group system and other measures, aimed at the improvement of discussions by the board of directors from a Group perspective |

| - | Discussed the results of the Group employee awareness survey in a meeting of the board of directors as part of efforts to transform the Group’s corporate culture. |

The results of the evaluation of the board of directors for fiscal year 2018 are scheduled to be disclosed in the “Corporate Governance Report” to be submitted after this Annual General Meeting of Shareholders.

31

Business Report for the Fourteenth Fiscal Year (April 1, 2018 to March 31, 2019)

| 1. | Matters Concerning the Current State of the Company |

| (1) | Business Operations and Results of the Group |

| a. | Major Business Matters |

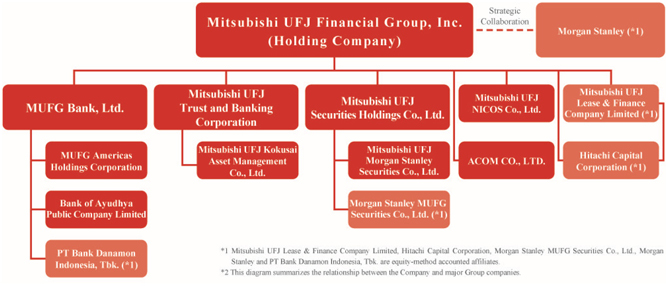

The group/MUFG (the “Group”) is a corporate group that is comprised of the Company, 147 subsidiaries, 76 subsidiary entities, etc., and 55 affiliated corporate entities, etc. The Group conducts business in areas that include mainly commercial banking, trust banking and securities, and also credit cards and consumer finance, leasing, and asset management, and other areas, with the aim of becoming the world’s most trusted financial group.

| b. | Financial and Economic Environment |