Credit Suisse 2010 Engineering

and Construction Conference

June 3, 2010

and Construction Conference

June 3, 2010

2

Forward-Looking Statements and Non-GAAP

Information

Information

Forward-Looking Statements and Non-GAAP

Information

Information

This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,”

“estimate,” “intend,” “forecast,” “may,” “should”, “could”, “project,” “outlook” and similar

expressions identify forward-looking statements. These forward-looking statements are

based on management’s current expectations, estimates and projections and speak only as

of the date of this presentation. Forward-looking statements are subject to known and

unknown risks and uncertainties that may cause actual results in the future to differ

materially from the results projected or implied in any forward-looking statements contained

in this presentation. The factors that could affect future results and could cause these results

to differ materially from those expressed in the forward-looking statements include, but are

not limited to, those described under Item 1A, “Risk Factors” of the Company’s Annual

Report on Form 10-K for the year ended July 25, 2009, and other risks outlined in the

Company’s periodic filings with the Securities and Exchange Commission (“SEC”). Except

as required by law, the Company may not update forward-looking statements even though

its situation may change in the future.

Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,”

“estimate,” “intend,” “forecast,” “may,” “should”, “could”, “project,” “outlook” and similar

expressions identify forward-looking statements. These forward-looking statements are

based on management’s current expectations, estimates and projections and speak only as

of the date of this presentation. Forward-looking statements are subject to known and

unknown risks and uncertainties that may cause actual results in the future to differ

materially from the results projected or implied in any forward-looking statements contained

in this presentation. The factors that could affect future results and could cause these results

to differ materially from those expressed in the forward-looking statements include, but are

not limited to, those described under Item 1A, “Risk Factors” of the Company’s Annual

Report on Form 10-K for the year ended July 25, 2009, and other risks outlined in the

Company’s periodic filings with the Securities and Exchange Commission (“SEC”). Except

as required by law, the Company may not update forward-looking statements even though

its situation may change in the future.

This presentation includes certain “Non-GAAP” financial measures as defined by SEC rules.

As required by the SEC we have provided a reconciliation of those measures to the most

directly comparable GAAP measures on the Regulation G slide included at the end of this

presentation.

As required by the SEC we have provided a reconciliation of those measures to the most

directly comparable GAAP measures on the Regulation G slide included at the end of this

presentation.

3

Dycom Industries Introduction

n Leading provider of specialty contracting services principally to

telephone and cable companies

telephone and cable companies

n Telecommunications industry dynamics driving growth potential

n Major participant in a large, but fragmented industry, which offers

acquisition opportunities

acquisition opportunities

n Significant portion of revenues from multi-year Master Service

Agreements

Agreements

n Experienced management team operating through a decentralized,

customer-focused organizational structure

customer-focused organizational structure

n Strong cash flows and liquidity

4

Revenue Mix

Quarter Ended April 24, 2010- $231.6 million

5

Providing End-To-End Services

Engineering

Underground Facility Locating

Outside Plant & Equipment Installation

6

Dycom Industries At a Glance

Dycom is a leading telecommunications infrastructure provider in the United States

n Headquartered in Palm Beach Gardens, Florida

n Third quarter fiscal 2010 revenues of $231.6 million

n Strong financial profile

} Cash and equivalents $116.2 million at April 24, 2010

} Shareholders’ equity $389.1 million at April 24, 2010

} Operating cash flow of $126.6 million for fiscal year 2009

n Nationwide footprint

} Operates in 48 states and to a limited extent in Canada

} 30 operating subsidiaries and hundreds of field offices

n Over 8,500 employees

n Listed on the NYSE under the ticker: DY

7

Strong subsidiaries, broad national footprint

Subsidiaries

Dycom’s Nationwide Presence

Dycom Operating Overview

8

Industry Developments…

n Telephone/cable industry convergence - a reality

} Competition for customers drives growth

n Network bandwidth expansion - an imperative

} Telephone companies expanding network capacity

} Cable responding to match capabilities and facilitate new

products such as VOIP, HDTV, and wideband

products such as VOIP, HDTV, and wideband

n Product bundles - key to telephone/cable success

} Decrease churn

} Provide revenue growth opportunities to offset market share

erosion

erosion

} Differentiate service from satellite video providers

9

…And Opportunities

n Increased capital spending

} Telephone company deployments of Fiber (FTTx)

} Cable company bandwidth expansion

} Customer premise equipment deployments

} Fiber to the cell site

n Renewed focus on network reliability and availability as subscribers

demand better service levels

demand better service levels

n Continued outsourcing as time to market and installation quality

crucial for new product launches

crucial for new product launches

10

Telecom Capital Spending

Capex Commentary

n Continued capital spending in wireline reflects burgeoning demand for voice, data and

video transmission

video transmission

n RBOCs will continue to constitute the vast majority of U.S. fixed line investment

n Significant portion of RBOCs’ capital budgets are expected to be from fiber deployments,

including fiber to the cell site initiatives

including fiber to the cell site initiatives

n Carriers are shifting capital spending to address growth needs and increased

competition from cable companies

competition from cable companies

“… we believe IPTV is an important part of our future. And we’ll be looking for

ways to continue to expand our investment and the rollout of this product in the

months ahead.”

ways to continue to expand our investment and the rollout of this product in the

months ahead.”

Glen Post III - CenturyLink - - Chairman and Chief Executive Officer May 2010

11

Cable Capital Spending

Capex Commentary

n Continued capital expenditures on bandwidth reclamation, VOIP and HDTV product

offerings, and cellular backhaul

offerings, and cellular backhaul

n Ongoing plant and network enhancements are critical as cable operators continue to

offer services that require greater reliability

offer services that require greater reliability

n Network capacity and reliability increasingly crucial as cable companies compete with

traditional telecom firms

traditional telecom firms

“We also continue to make significant progress deploying All-Digital and DOCSIS

3.0. We reach nearly 80% of our footprint with DOCSIS 3.0, reinforcing our

leadership position in broadband. As we deploy this capability, we are doubling the

speeds to our existing customers and introducing new, higher-speed services in

these markets. Today, we offer 50 Mb speed service to 40 million homes where it is

available and will soon begin to roll out 100 Mb service. We are now actively

deploying All-Digital in many of our markets, recapturing and more efficiently using

our bandwidth.”

3.0. We reach nearly 80% of our footprint with DOCSIS 3.0, reinforcing our

leadership position in broadband. As we deploy this capability, we are doubling the

speeds to our existing customers and introducing new, higher-speed services in

these markets. Today, we offer 50 Mb speed service to 40 million homes where it is

available and will soon begin to roll out 100 Mb service. We are now actively

deploying All-Digital in many of our markets, recapturing and more efficiently using

our bandwidth.”

Brian Roberts, Comcast - Chairman and Chief Executive Officer April 2010

12

n “Dig Safe” laws in all 50 states require owners of underground utilities to

identify and mark their facilities prior to excavation

identify and mark their facilities prior to excavation

} Regulate telephone, cable, power, gas, water & sewer utilities

} Seek to minimize network outages, protect job-site workers, and

safeguard the general public

safeguard the general public

} Locates often required as a condition for permit issuance

n Generally outsourced by telecom companies and cable operators

} Work generated by excavators via “800 number” call centers

} High volume of transactions must be completed within 48-72 hours

n Regulatory backdrop promotes steady workflow

} Driven by regional macro-economic factors

Underground Facility Locating Services

13

Dycom’s Competitive Advantages

n Established customer relationships and reputation

n Broad geographic coverage

n Scale to satisfy customer time and service requirements

n Responsive, local decentralized business units

n Access to capital

n Senior management operating expertise

14

Growth Strategy As Opportunities

Expand

Expand

n Build and maintain long-term customer relationships at the local level

} Position business to capture both recurring maintenance and new capital

spending

spending

n Empower subsidiary management

} Build relationships with customer contracting decision makers

} Utilize detailed knowledge of local pricing dynamics

} Leverage subcontractors and local trade relationships

n Deliberately select attractive customers with profitable business

} Focus on higher quality, long-term telecommunications industry leaders

n Selectively screen potential acquisitions

} Healthy players that bring long-term, established customer relationships

} Complement existing Dycom customer footprint

} Position Company for significant customer capital or maintenance

spending

spending

Dycom employs a deliberate and methodical growth strategy

15

Blue-chip, predominantly investment grade clients comprise the vast majority of revenue

Well Established Customers

Fiscal Quarter Ended April 24, 2010

Customer Revenue Breakdown

Other

Comcast

Charter

Cablevision

Windstream

AT&T

CenturyLink

Qwest

Verizon

Time Warner Cable

West Carolina Telephone

Electric Power Board

16

Customer Rotation

Key long-term relationships help Dycom manage the cyclical nature of telecom and cable capex spending

For comparison purposes, when customers have been combined through acquisition or merger, their revenues have been combined for all periods.

65%

35%

62%

38%

63%

68%

32%

68%

32%

64%

36%

37%

63%

33%

67%

37%

64%

36%

64%

36%

17

Dycom’s revenue stream is primarily generated by long-term contractual agreements

n Master Service Agreements (MSA’s)

n Significant majority of contracts are

based on units of delivery

based on units of delivery

Revenue By Contract Type

Quarter Ended April 24, 2010

Quarter Ended April 24, 2010

Revenue - - Q3 Fiscal 2010

18

Senior Management

Seasoned management team with several decades of combined industry experience

Financial Update

20

nCentralize activities which yield synergistic benefits

} Treasury

} Tax

} Risk management

} Capital asset procurement

} Information technology resources

nDecentralize financial operations to provide solid support

and flexibility at operating unit level

and flexibility at operating unit level

nMaintain financial resources to support internal growth

and acquisition opportunities

and acquisition opportunities

Financial Overview

21

Fiscal Year Results - Revenue and

Earnings

Earnings

(1) The amounts for EBITDA - Adjusted and Income from continuing operations -Non-GAAP are Non-GAAP financial measures adjusted to exclude certain items. See

“Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

“Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

n Annual revenue exceeding $1.1

billion for the three most recent

fiscal years

billion for the three most recent

fiscal years

n Revenue of $707.1 million for the

nine months ended April 24, 2010

compared to $837.2 million for the

nine months ended April 25, 2009

nine months ended April 24, 2010

compared to $837.2 million for the

nine months ended April 25, 2009

n Revenue and results impacted by

customer reductions in capital

spending plans in response to

challenging economic conditions

customer reductions in capital

spending plans in response to

challenging economic conditions

22

Quarterly Results - Revenue and

Earnings

Earnings

n Seasonal revenue pattern driven by

weather and available work days

weather and available work days

n Q3-10 impacted by difficult weather

conditions; total revenue trends

beginning to improve in Q3-10

conditions; total revenue trends

beginning to improve in Q3-10

n EBITDA - Adjusted and Income from

Continuing Operations increased

sequentially reflecting higher levels of

operations and increased productivity

Continuing Operations increased

sequentially reflecting higher levels of

operations and increased productivity

(1) The amounts for EBITDA - Adjusted and Income (Loss) from continuing operations - -Non-GAAP are Non-GAAP financial measures adjusted to exclude certain

items. See “Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

items. See “Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

23

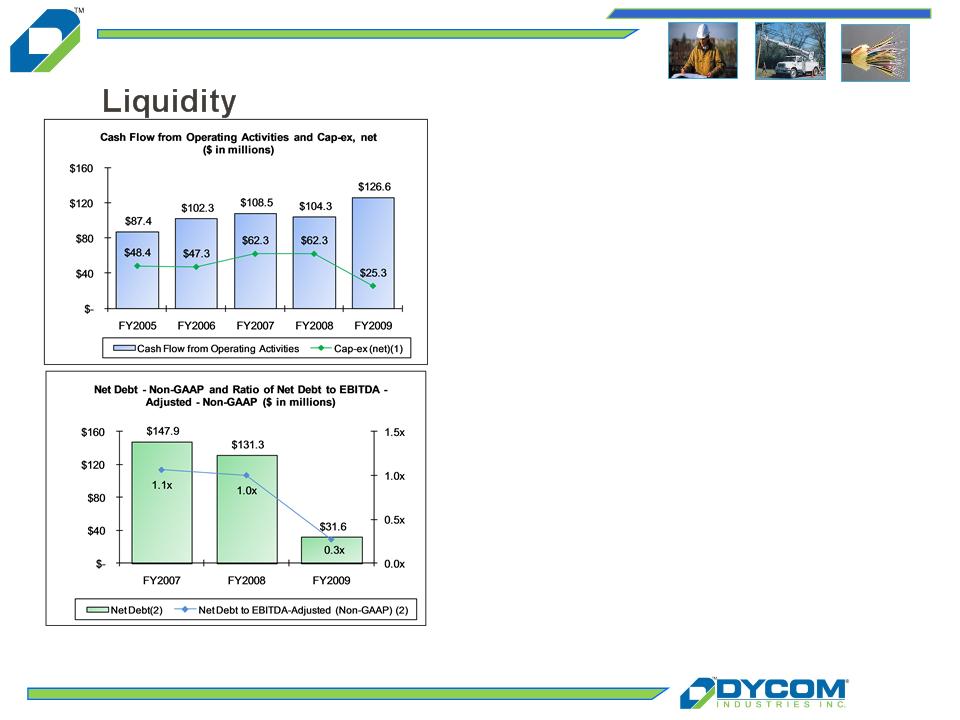

Fiscal Year Results - Cash Flow and

(1) Capital expenditures net of proceeds from the sale of assets

(2) The amounts for EBITDA - Adjusted and Net Debt used in the calculations herein are Non-GAAP financial measures adjusted to exclude certain items. See

“Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

“Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

n Cash flow from operations over $100

million for the four most recent years

million for the four most recent years

n Ample cash flows to support capital

expenditures and fund operations

expenditures and fund operations

n Long term financing in place as of

April 24, 2010

April 24, 2010

} $135.35 million Senior Subordinated

Notes - October 2015 maturity

Notes - October 2015 maturity

} $210 million Credit Facility:

} September 2011 maturity

} No borrowings outstanding

n 0.3x ratio of Net Debt to EBITDA-Adjusted

in fiscal 2009

in fiscal 2009

24

Quarterly Results - Cash Flow and

Liquidity

(1) Capital expenditures net of proceeds from the sale of assets

(2) The amounts for EBITDA - Adjusted and Net Debt used in the calculations herein are Non-GAAP financial measures adjusted to exclude certain items. See

“Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

“Regulation G Disclosure” slide for a reconciliation of Non-GAAP financial measures to GAAP financial measures.

n Cash flows used to fund operations as

activity level increased during the quarter

activity level increased during the quarter

n Capital expenditures, net of disposals at

$6.9 million

$6.9 million

n Strong financial profile

n Ample liquidity as of April 2010

} $116.2 million cash and equivalents

} $131.4 million availability under

Revolving Credit Facility

Revolving Credit Facility

25

Regulation G Disclosure

Credit Suisse 2010 Engineering

and Construction Conference

June 3, 2010

and Construction Conference

June 3, 2010