2

Forward-Looking Statements and

Non-GAAP Information

Forward-Looking Statements and

Non-GAAP Information

Fiscal 2011 fourth quarter results are unaudited. This presentation contains “forward-looking statements” which

are statements relating to future events, future financial performance, strategies, expectations, and competitive

environment. All statements, other than statements of historical facts, contained in this presentation, including

statements regarding our future financial position, future revenue, prospects, plans and objectives of

management, are forward-looking statements. Words such as “believe,” “expect,” “anticipate,” “estimate,”

“intend,” “forecast,” “may,” “should,” “could,” “project,” “looking ahead” and similar expressions, as well as

statements in future tense, identify forward looking statements. You should not read forward looking statements

as a guarantee of future performance or results. They will not necessarily be accurate indications of whether or

at what time such performance or results will be achieved. Forward looking statements are based on

information available at the time those statements are made and/or management’s good faith belief at that time

with respect to future events. Such statements are subject to risks and uncertainties that could cause actual

performance or results to differ materially from those expressed in or suggested by the forward looking

statements. Important factors that could cause such differences include, but are not limited to factors described

under Item 1A, “Risk Factors” of the Company’s Annual Report on Form 10-K for the year ended July 31, 2010,

and other risks outlined in the Company’s periodic filings with the Securities and Exchange Commission

(“SEC”). The forward-looking statements in this presentation are expressly qualified in their entirety by this

cautionary statement. Except as required by law, the Company may not update forward-looking statements

even though its situation may change in the future.

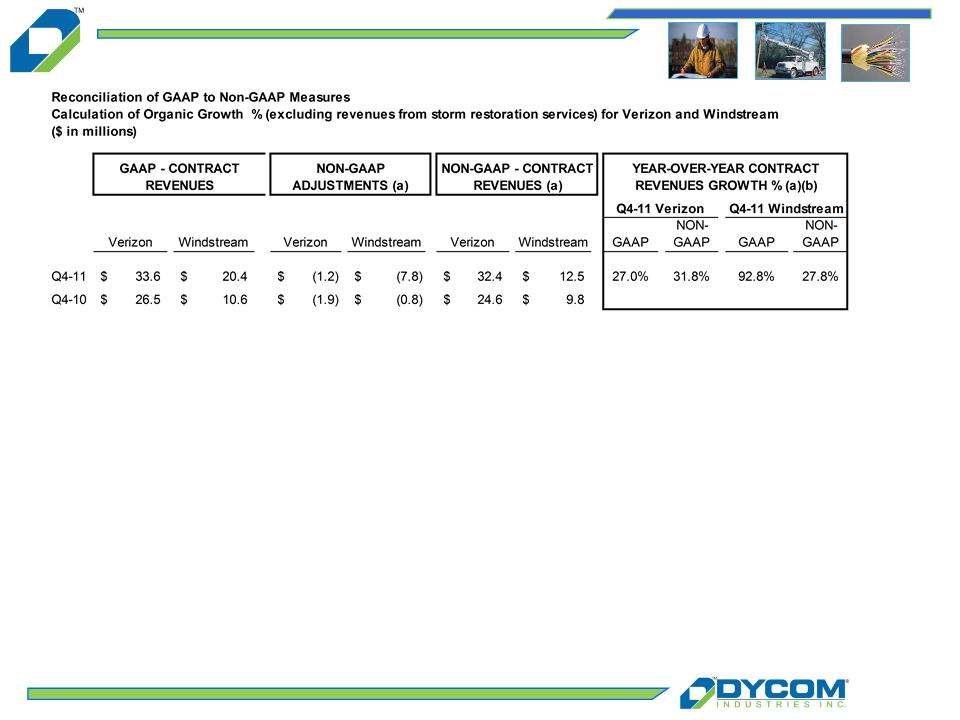

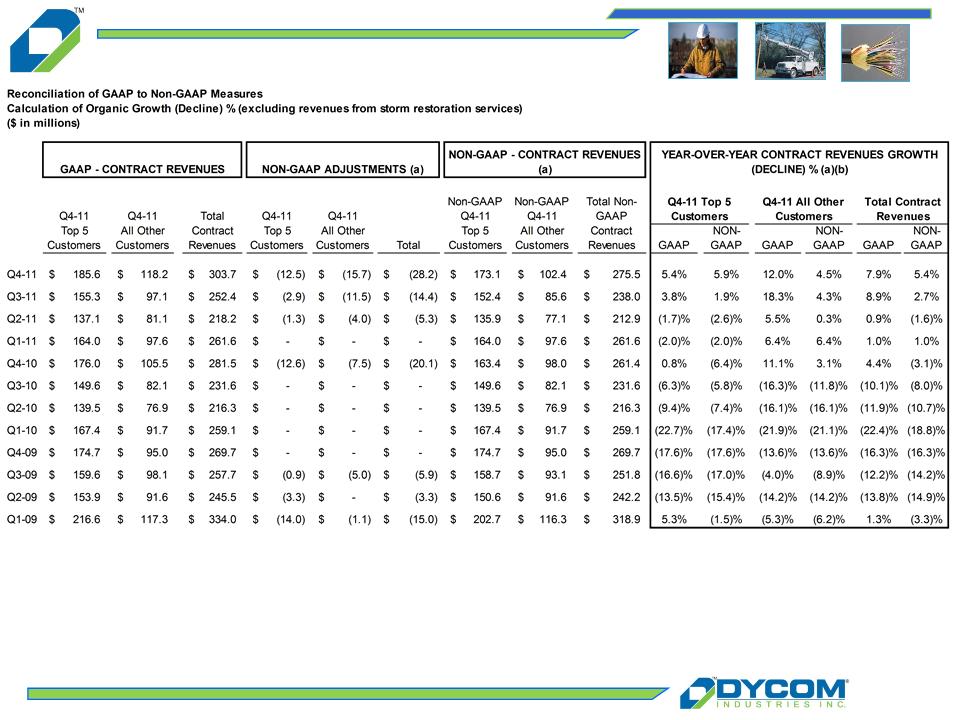

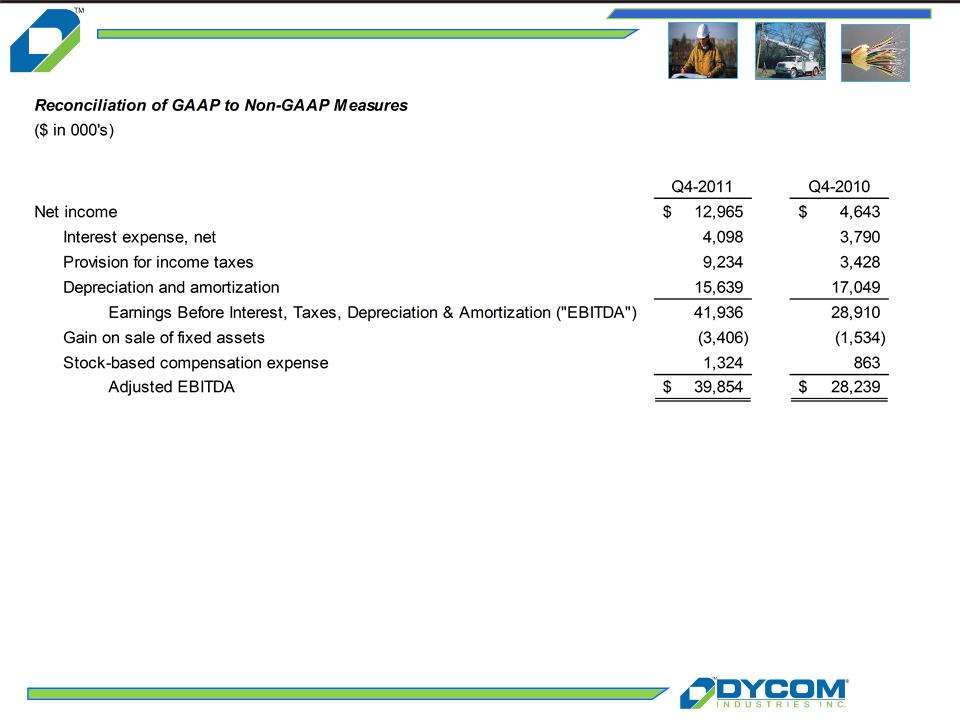

This presentation includes certain “Non-GAAP” financial measures as defined by SEC rules. We believe that the

presentation of certain Non-GAAP financial measures provides information that is useful to investors because it

allows for a more direct comparison of our performance for the period with our performance in the comparable

prior-year periods. As required by the SEC we have provided a reconciliation of those measures to the most

directly comparable GAAP measures on the Regulation G slides included as slides 11 through 14 of this

presentation. We caution that Non-GAAP financial measures should be considered in addition to, but not as a

substitute for, our reported GAAP results.