BB&T Capital Markets 7th Annual Commercial & Industrial Conference March 21, 2013 Exhibit 99.1

2 Forward-Looking Statements and Non-GAAP Information Fiscal 2013 second quarter results are unaudited. This presentation contains “forward-looking statements” which are statements relating to future events, future financial performance, strategies, expectations, and the competitive environment. All statements, other than statements of historical facts, contained in this presentation, including statements regarding the Company’s future financial position, future revenue, prospects, plans and objectives of management, are forward-looking statements. Additionally, forward–looking statements may include statements of expectations regarding our recent acquisition of the businesses of the telecommunications infrastructure services subsidiaries of Quanta Services, Inc., including expected benefits and synergies of the transaction, future financial and operating results and future opportunities for the combined businesses, and other statements regarding events or developments that the Company believes or anticipates will or may occur in the future as a result of the recently completed acquisition. Words such as “outlook,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project,” “looking ahead” and similar expressions, as well as statements in future tense, identify forward-looking statements. You should not read forward looking statements as a guarantee of future performance or results. They will not necessarily be accurate indications of whether or at what time such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief at that time with respect to future events. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to factors described under Item 1A, “Risk Factors” of the Company’s Annual Report on Form 10-K for the year ended July 28, 2012, and other risks outlined in the Company’s periodic filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements in this presentation are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company may not update forward-looking statements even though its situation may change in the future. This presentation includes certain “Non-GAAP” financial measures as defined by SEC rules. We believe that the presentation of certain Non-GAAP financial measures provides information that is useful to investors because it allows for a more direct comparison of our performance for the period with our performance in the comparable prior-year periods. As required by the SEC, we have provided a reconciliation of those measures to the most directly comparable GAAP measures on the Regulation G slides included at the end of this presentation. We caution that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our reported GAAP results.

3 Positioned for strong equity returns A leading supplier of specialty contracting services to telecommunication providers nationwide Telecommunications networks fundamental to economic progress Firm end market opportunities Wireless backhaul Fiber deployments to businesses Wireless network upgrades FTTx deployments Increased market share as our customers consolidate vendor relationships and reward scale Capital allocation strategy designed to produce strong equity returns

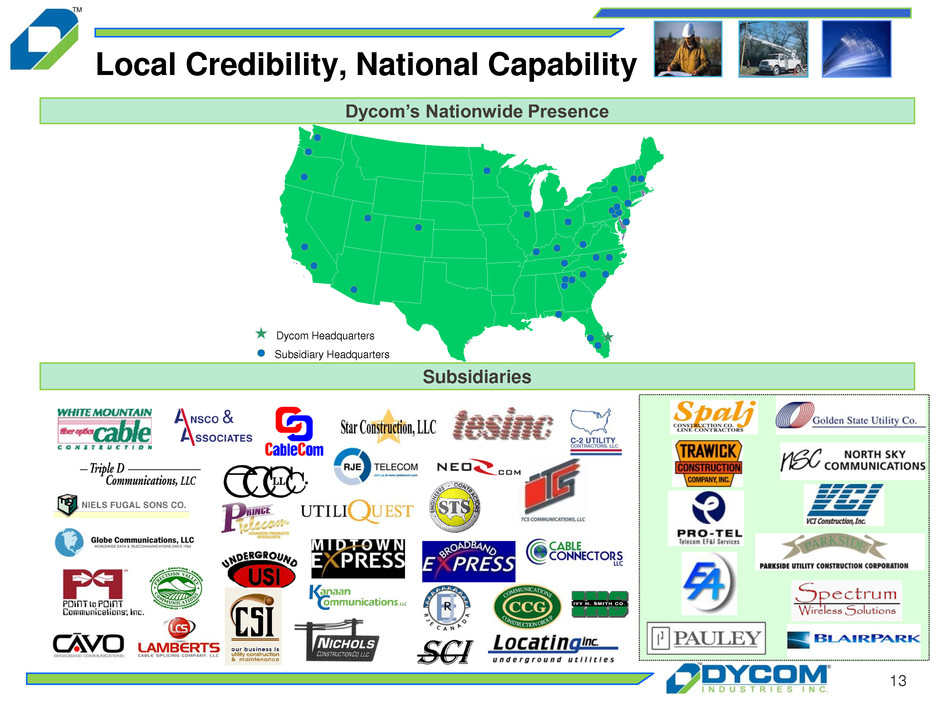

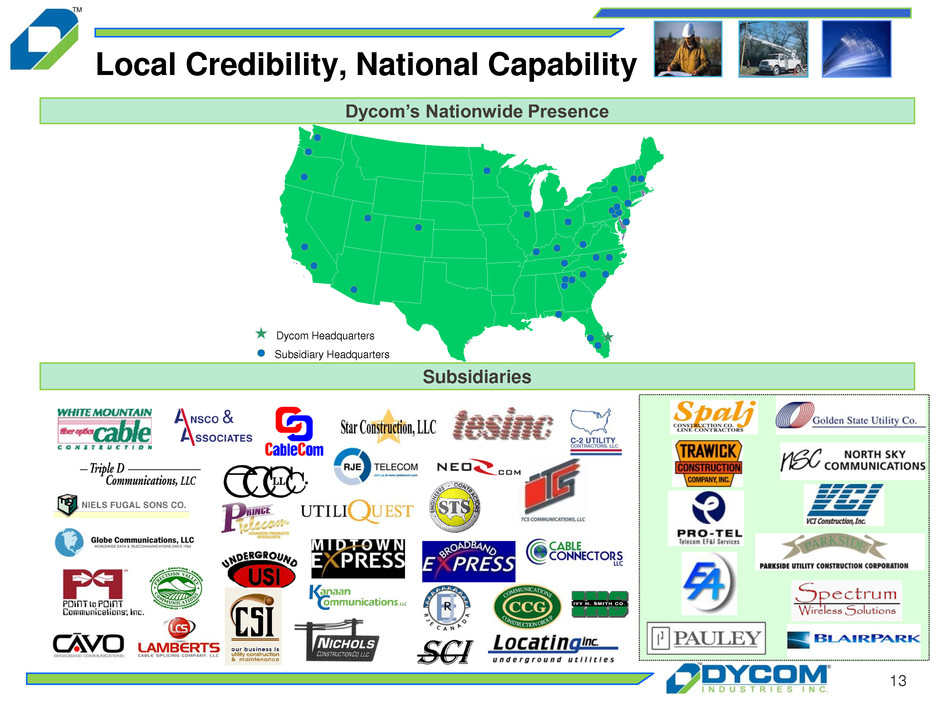

4 Nationwide Footprint and Significant Resources Headquartered in Palm Beach Gardens, Florida Nationwide footprint Operates in 49 states and in Canada Over 40 operating subsidiaries and hundreds of field offices Fiscal 2013 second quarter revenues of $369.3 million grew organically 3.5% year over year Strong financial profile Cash and equivalents $22.6 million at January 26, 2013 New $400 million Senior Credit Facility maturing in December 2017 7.125% Senior Subordinated Notes due 2021 Over 10,000 employees Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

5 Recent Developments Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures. Acquisition Acquired substantially all of the domestic telecommunications infrastructure services operations of Quanta Services, Inc. in December 2012 Purchase price of $275 million Adjustment for working capital and other items totaling approximately $45 million in additional consideration Structured to produce attractive cash tax benefits Strengthens our customer base, geographic scope, and technical service offerings Reinforces our rural engineering and construction capabilities, wireless construction resources, and broadband construction competencies Creates scale as industry announcements indicate customer expenditures will be growing Financing Activities New, five year $400 million Credit Agreement $275 million revolving credit facility – $20 million outstanding at end of Q2-13 $125 million term loan outstanding – begins to amortize on an annual basis in Q3-13 Attractively priced to lower effective borrowing cost Matures in December 2017 Senior Subordinated Notes Issued $90.0 million face value add-on to existing 7.125% senior subordinated notes at price of 104.25 Matures in January 2021

6 Services Crucial to Customer Success Engineering Underground Facility Locating Outside Plant & Equipment Installation Premise Equipment Installation Wireless Services

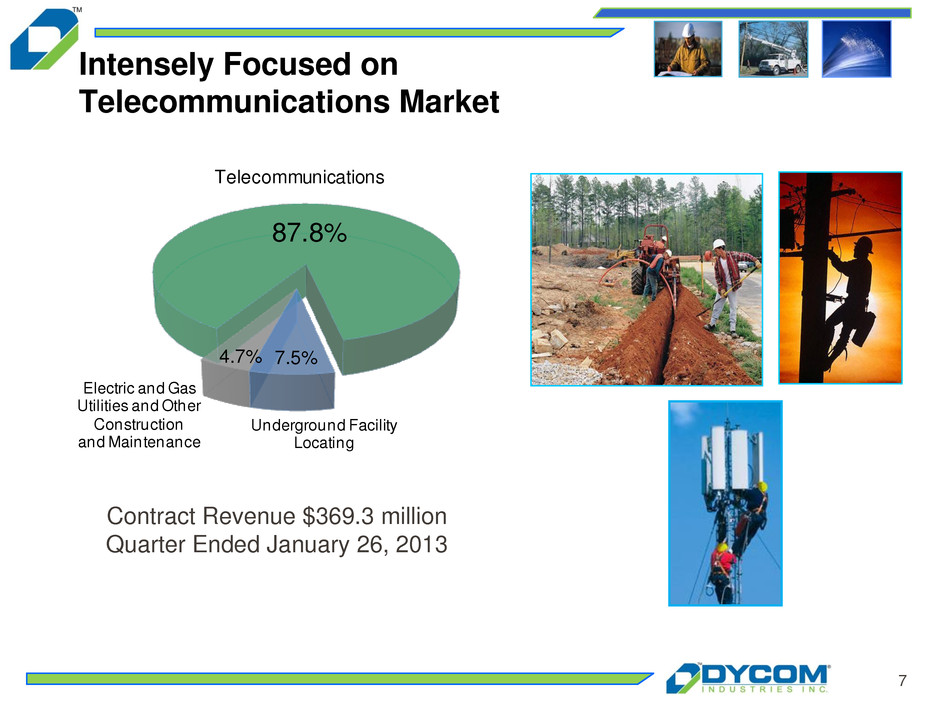

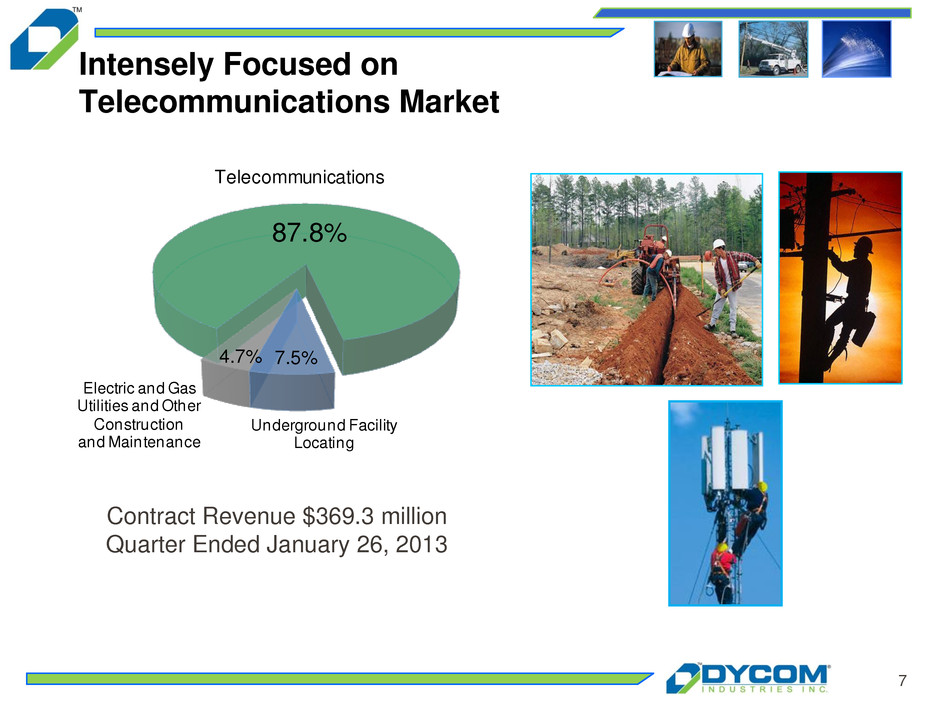

7 Intensely Focused on Telecommunications Market Contract Revenue $369.3 million Quarter Ended January 26, 2013 87.8% 7.5%4.7% Telecommunications Electric and Gas Utilities and Other Construction and Maintenance Underground Facility Locating

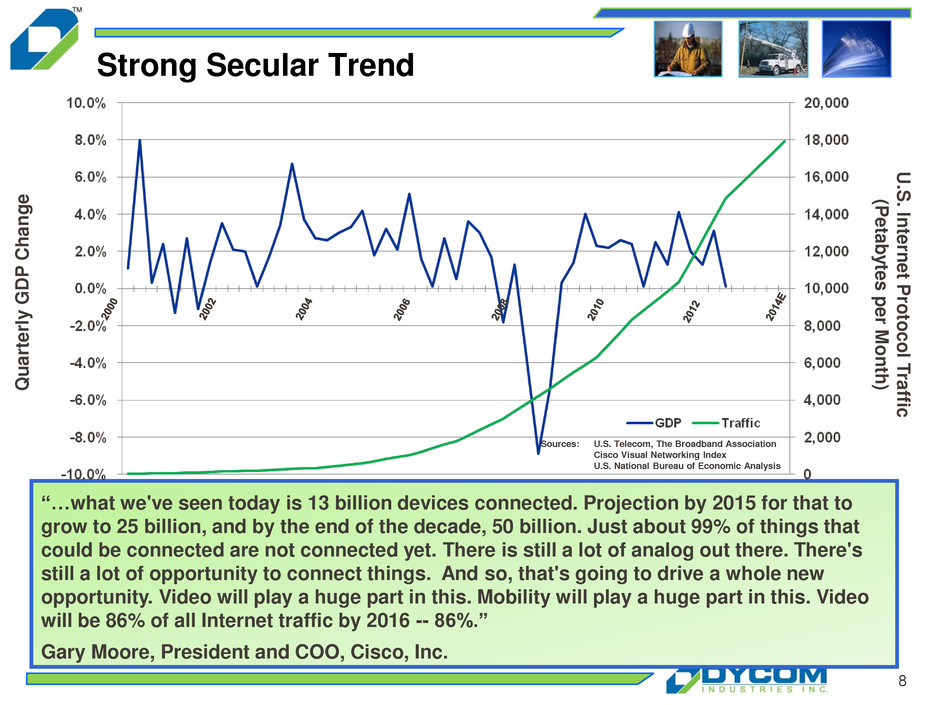

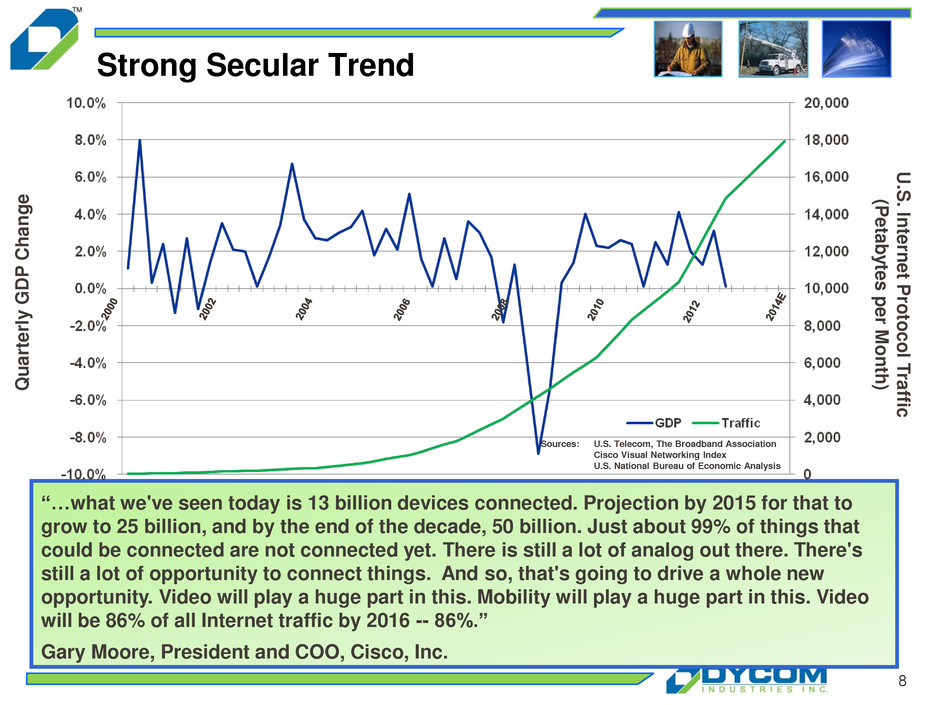

8 Strong Secular Trend Q u a rte rl y G D P C h a n g e U .S . In te rn et P ro to c o l T raff ic (Peta b y tes p e r M o n th ) Sources: U.S. Telecom, The Broadband Association Cisco Visual Networking Index U.S. National Bureau of Economic Analysis “…what we've seen today is 13 billion devices connected. Projection by 2015 for that to grow to 25 billion, and by the end of the decade, 50 billion. Just about 99% of things that could be connected are not connected yet. There is still a lot of analog out there. There's still a lot of opportunity to connect things. And so, that's going to drive a whole new opportunity. Video will play a huge part in this. Mobility will play a huge part in this. Video will be 86% of all Internet traffic by 2016 -- 86%.” Gary Moore, President and COO, Cisco, Inc.

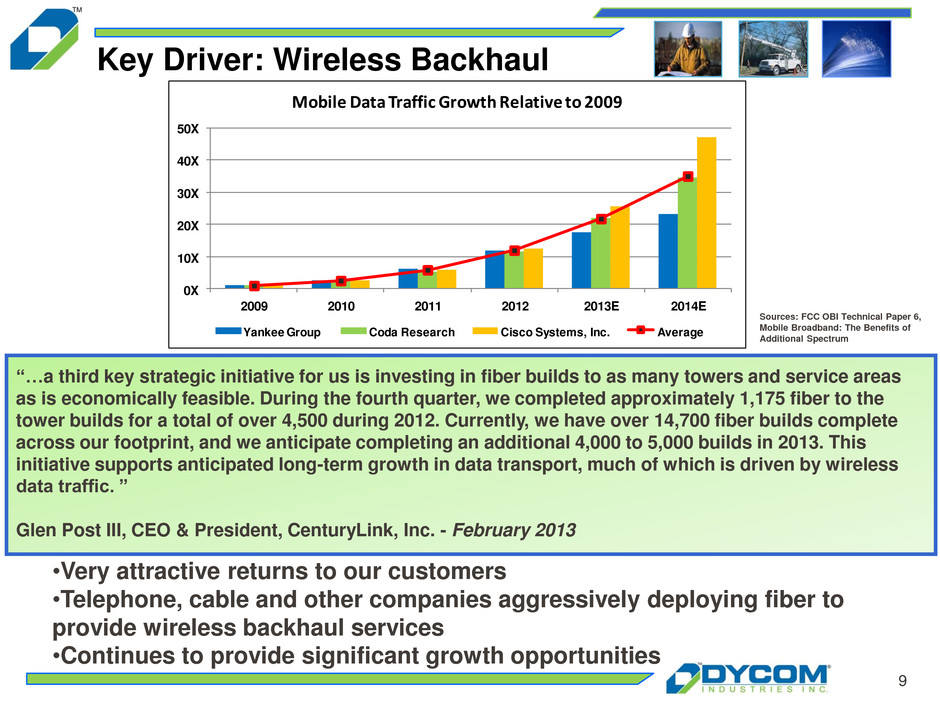

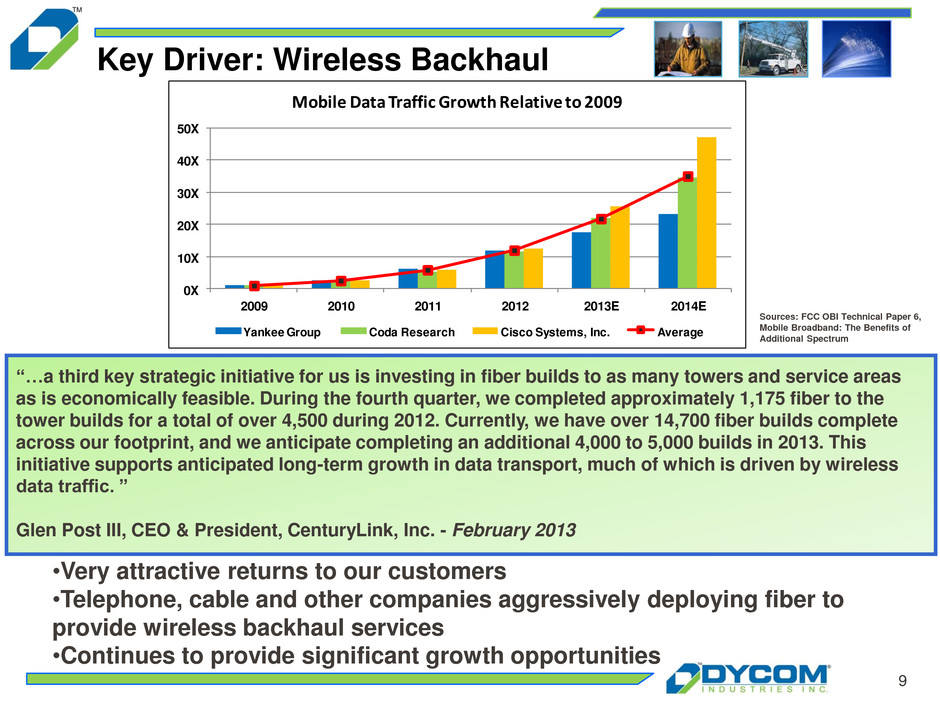

9 Key Driver: Wireless Backhaul 0X 10X 20X 30X 40X 50X 2009 2010 2011 2012 2013E 2014E Mobile Data Traffic Growth Relative to 2009 Yankee Group Coda Research Cisco Systems, Inc. Average “…a third key strategic initiative for us is investing in fiber builds to as many towers and service areas as is economically feasible. During the fourth quarter, we completed approximately 1,175 fiber to the tower builds for a total of over 4,500 during 2012. Currently, we have over 14,700 fiber builds complete across our footprint, and we anticipate completing an additional 4,000 to 5,000 builds in 2013. This initiative supports anticipated long-term growth in data transport, much of which is driven by wireless data traffic. ” Glen Post III, CEO & President, CenturyLink, Inc. - February 2013 •Very attractive returns to our customers •Telephone, cable and other companies aggressively deploying fiber to provide wireless backhaul services •Continues to provide significant growth opportunities Sources: FCC OBI Technical Paper 6, Mobile Broadband: The Benefits of Additional Spectrum

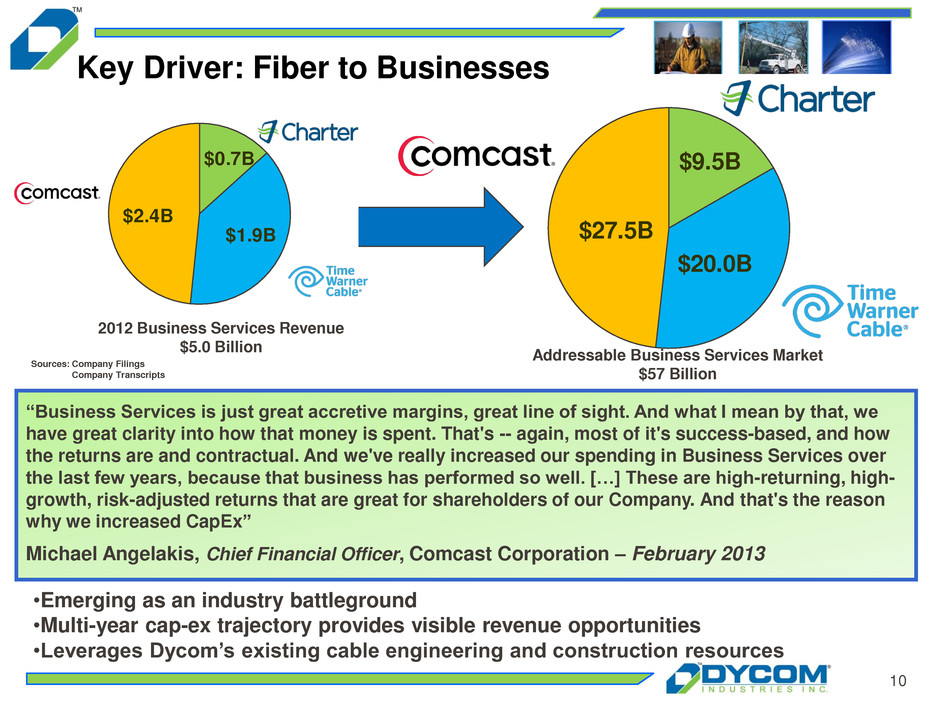

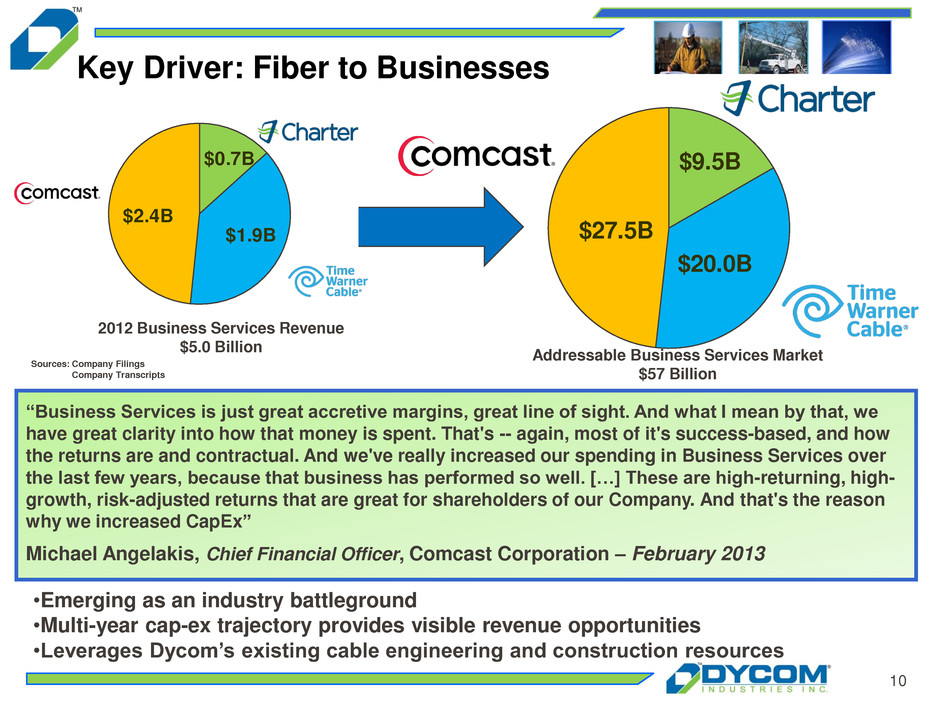

10 $9.5B $20.0B $27.5B 2012 Business Services Revenue $5.0 Billion Addressable Business Services Market $57 Billion •Emerging as an industry battleground •Multi-year cap-ex trajectory provides visible revenue opportunities •Leverages Dycom’s existing cable engineering and construction resources “Business Services is just great accretive margins, great line of sight. And what I mean by that, we have great clarity into how that money is spent. That's -- again, most of it's success-based, and how the returns are and contractual. And we've really increased our spending in Business Services over the last few years, because that business has performed so well. […] These are high-returning, high- growth, risk-adjusted returns that are great for shareholders of our Company. And that's the reason why we increased CapEx” Michael Angelakis, Chief Financial Officer, Comcast Corporation – February 2013 Sources: Company Filings Company Transcripts $0.7B $1.9B $2.4BKey Driver: Fiber to Businesses

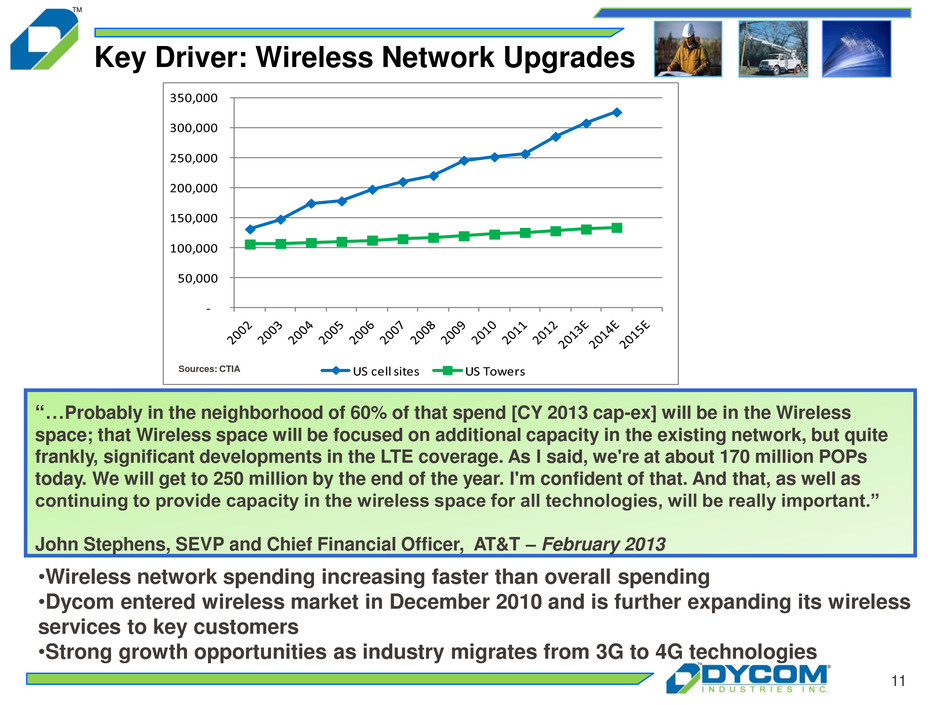

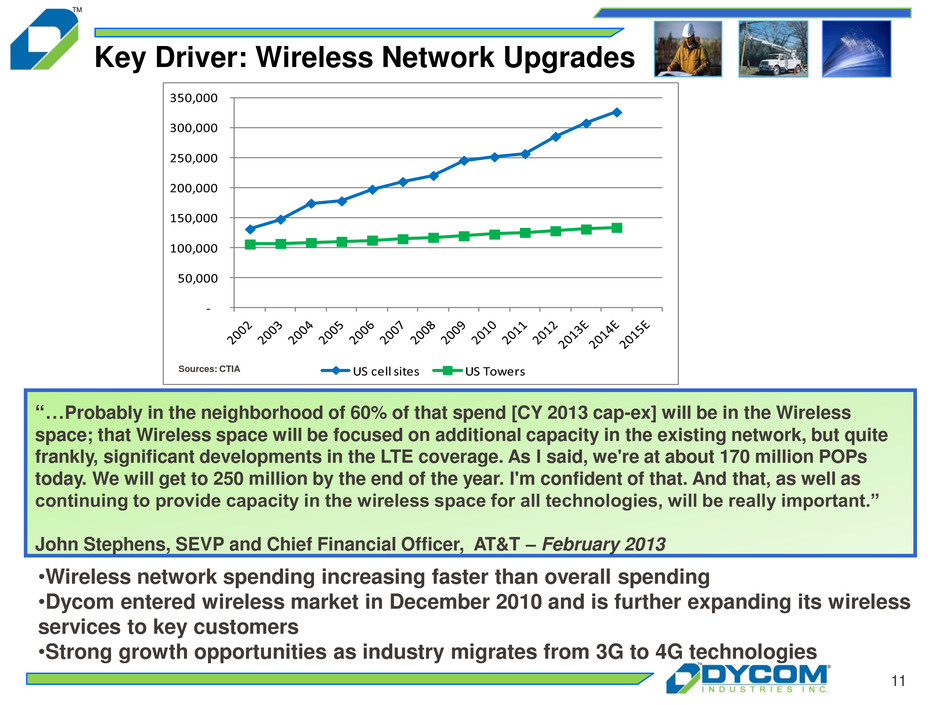

11 - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 US cell sites US Towers Key Driver: Wireless Network Upgrades “…Probably in the neighborhood of 60% of that spend [CY 2013 cap-ex] will be in the Wireless space; that Wireless space will be focused on additional capacity in the existing network, but quite frankly, significant developments in the LTE coverage. As I said, we're at about 170 million POPs today. We will get to 250 million by the end of the year. I'm confident of that. And that, as well as continuing to provide capacity in the wireless space for all technologies, will be really important.” John Stephens, SEVP and Chief Financial Officer, AT&T – February 2013 •Wireless network spending increasing faster than overall spending •Dycom entered wireless market in December 2010 and is further expanding its wireless services to key customers •Strong growth opportunities as industry migrates from 3G to 4G technologies Sources: CTIA

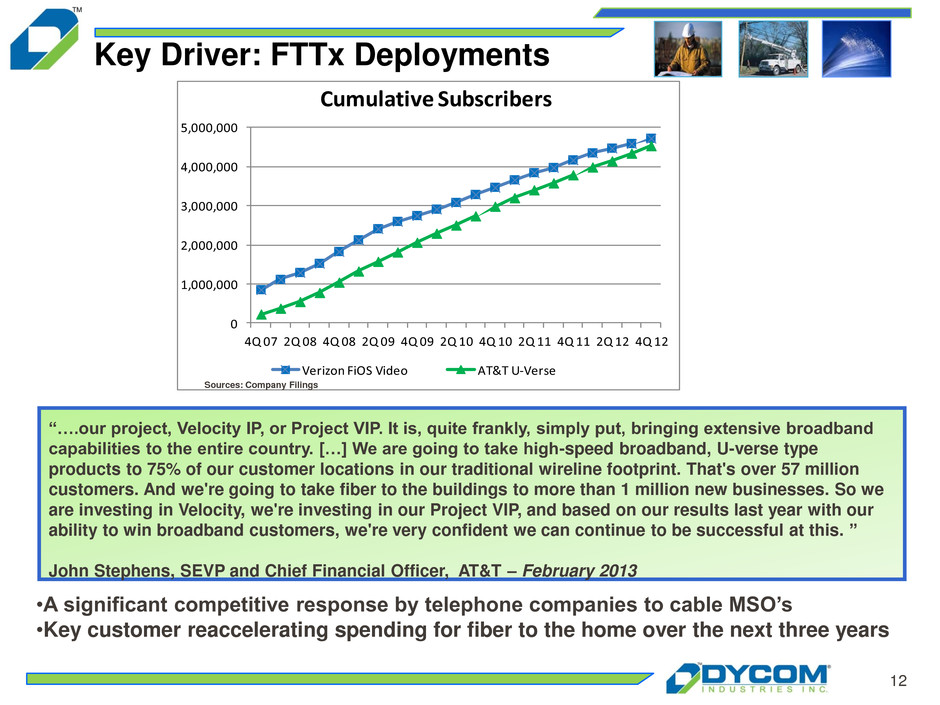

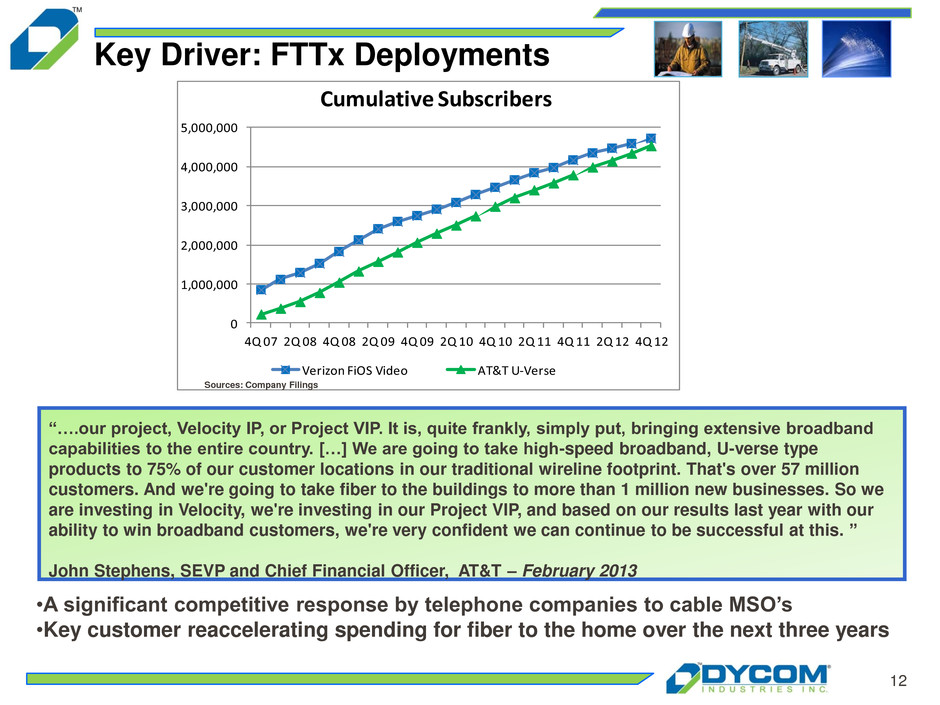

12 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 4Q 07 2Q 08 4Q 08 2Q 09 4Q 09 2Q 10 4Q 10 2Q 11 4Q 11 2Q 12 4Q 12 Cumulative Subscribers Verizon FiOS Video AT&T U-Verse Key Driver: FTTx Deployments “….our project, Velocity IP, or Project VIP. It is, quite frankly, simply put, bringing extensive broadband capabilities to the entire country. […] We are going to take high-speed broadband, U-verse type products to 75% of our customer locations in our traditional wireline footprint. That's over 57 million customers. And we're going to take fiber to the buildings to more than 1 million new businesses. So we are investing in Velocity, we're investing in our Project VIP, and based on our results last year with our ability to win broadband customers, we're very confident we can continue to be successful at this. ” John Stephens, SEVP and Chief Financial Officer, AT&T – February 2013 •A significant competitive response by telephone companies to cable MSO’s •Key customer reaccelerating spending for fiber to the home over the next three years Sources: Company Filings

13 Subsidiaries Dycom’s Nationwide Presence Local Credibility, National Capability Dycom Headquarters Subsidiary Headquarters

14 Focused on High Value Profitable Growth Anticipating emerging technology trends which drive capital spending Deliberately targeting high quality, long-term industry leaders which generate the vast majority of the industry’s profitable opportunities Selectively acquiring businesses which complement our existing footprint and enhance our customer relationships, as evidenced with recent M&A activity Leveraging our scale and expertise to expand margins through best practices

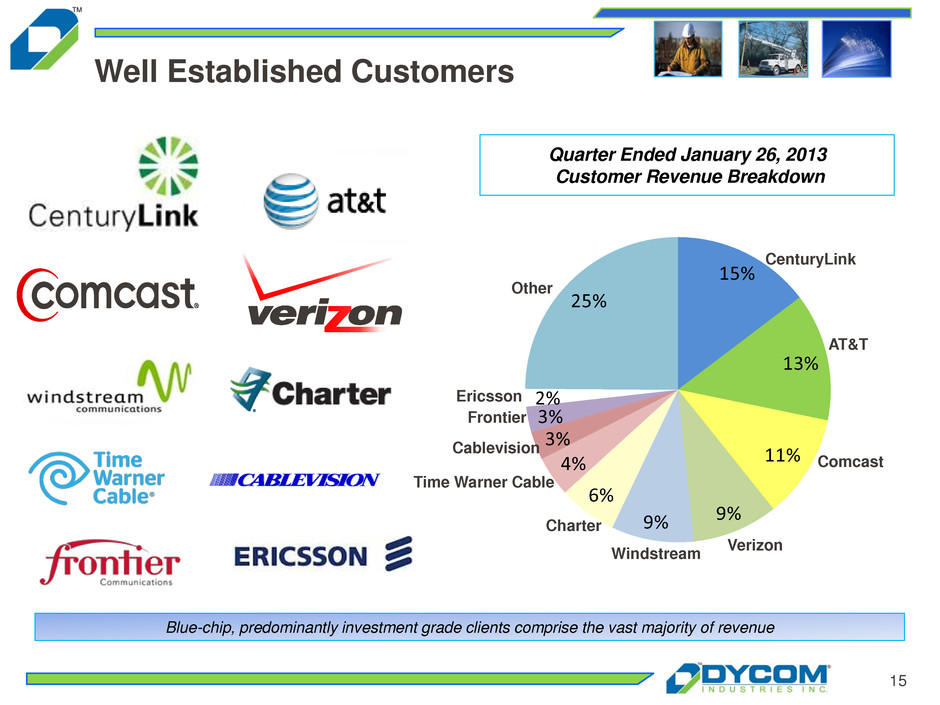

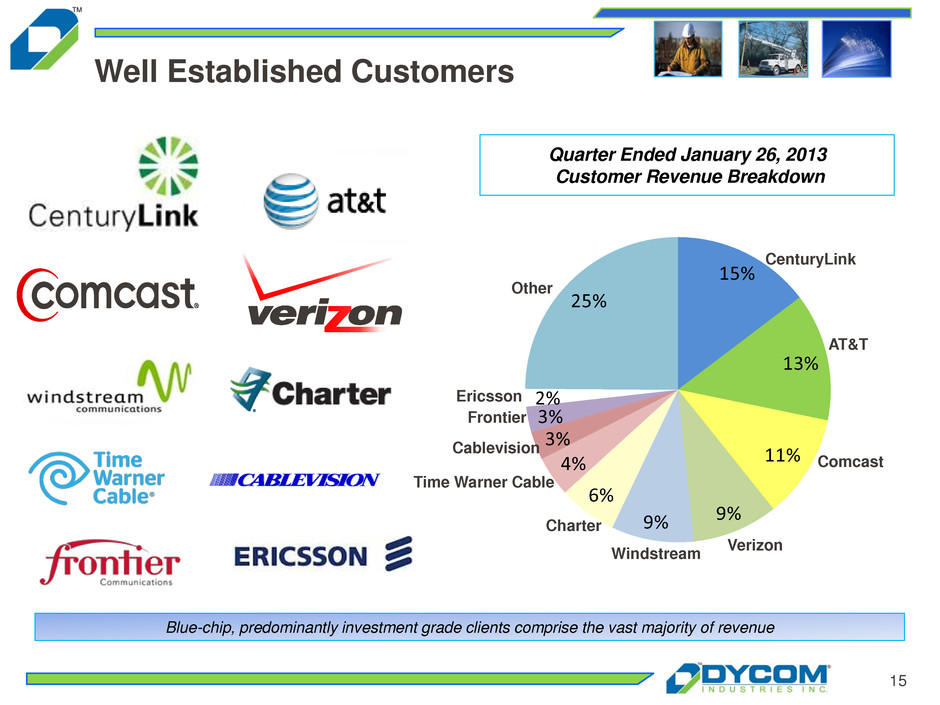

15 15% 13% 11% 9%9% 6% 4% 3% 3% 2% 25% Blue-chip, predominantly investment grade clients comprise the vast majority of revenue Well Established Customers Quarter Ended January 26, 2013 Customer Revenue Breakdown Comcast AT&T CenturyLink Verizon Windstream Charter Ericsson Time Warner Cable Other Frontier Cablevision

16 Durable Customer Relationships R e v enue ( $ in mil lions ) For comparison purposes, when customers have been combined through acquisition or merger, their revenues have been combined for all periods. $- $50 $100 $150 $200 $250 $300 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 AT&T Comcast CenturyLink Verizon Adelphia Charter Comm Time Warner Cable Windstream $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Top 5 All Other $588 $842 $958 $995 $1,138 $1,230 $1,107 $989 71% 72% 72% 67% 66% 66%66% 67% 33%34%33%28%28%29% 34%34% $1,036 62% 38% $1,201 60% 40% Numbers reflect Dycom prior to Acquisition

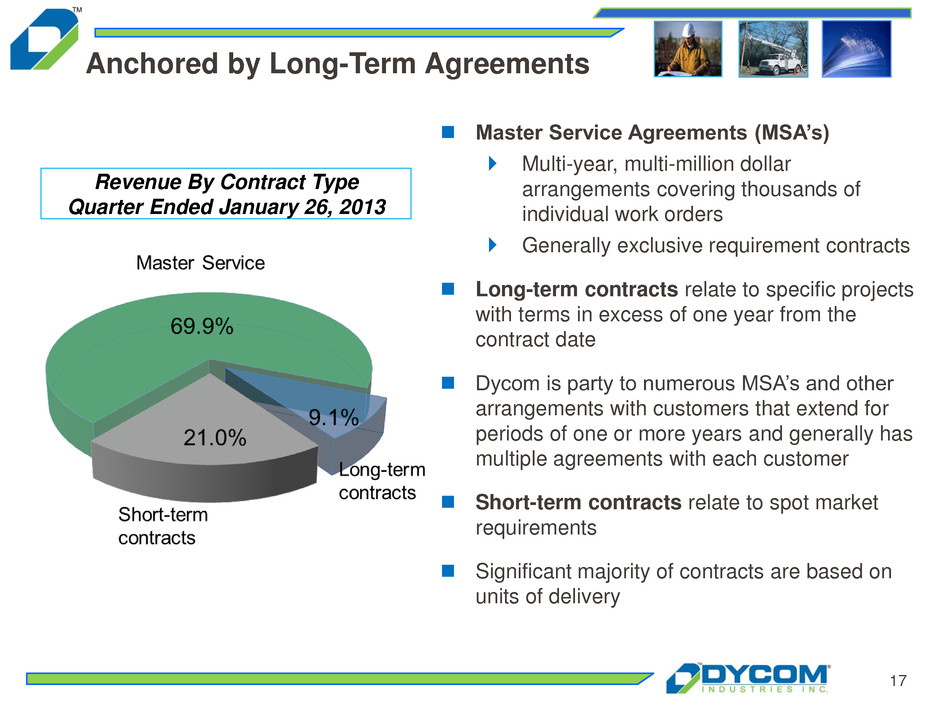

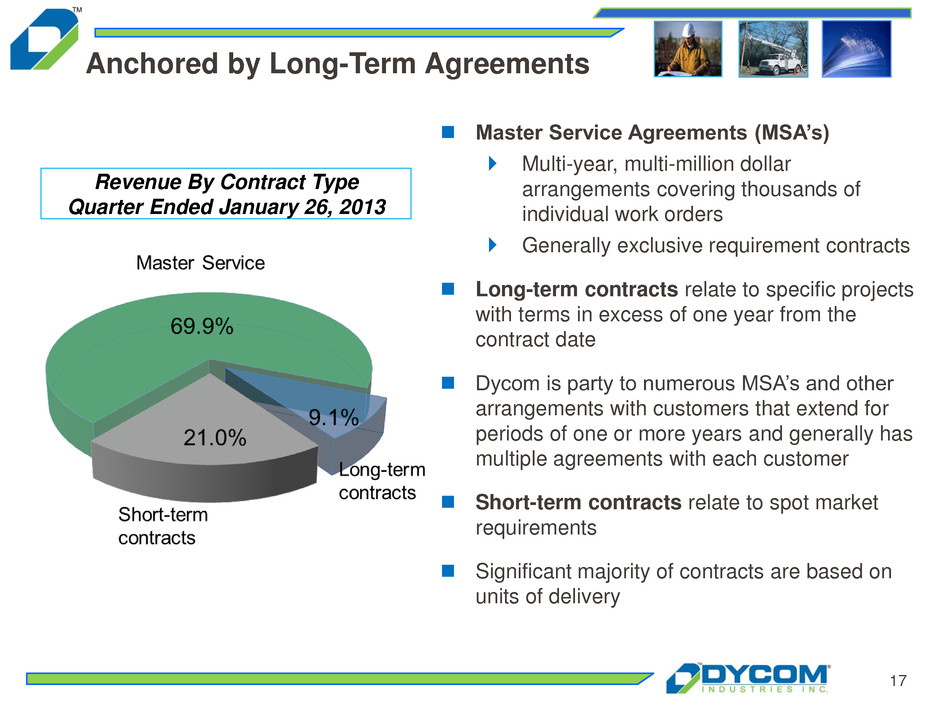

17 Master Service Agreements (MSA’s) Multi-year, multi-million dollar arrangements covering thousands of individual work orders Generally exclusive requirement contracts Long-term contracts relate to specific projects with terms in excess of one year from the contract date Dycom is party to numerous MSA’s and other arrangements with customers that extend for periods of one or more years and generally has multiple agreements with each customer Short-term contracts relate to spot market requirements Significant majority of contracts are based on units of delivery Revenue By Contract Type Quarter Ended January 26, 2013 Anchored by Long-Term Agreements

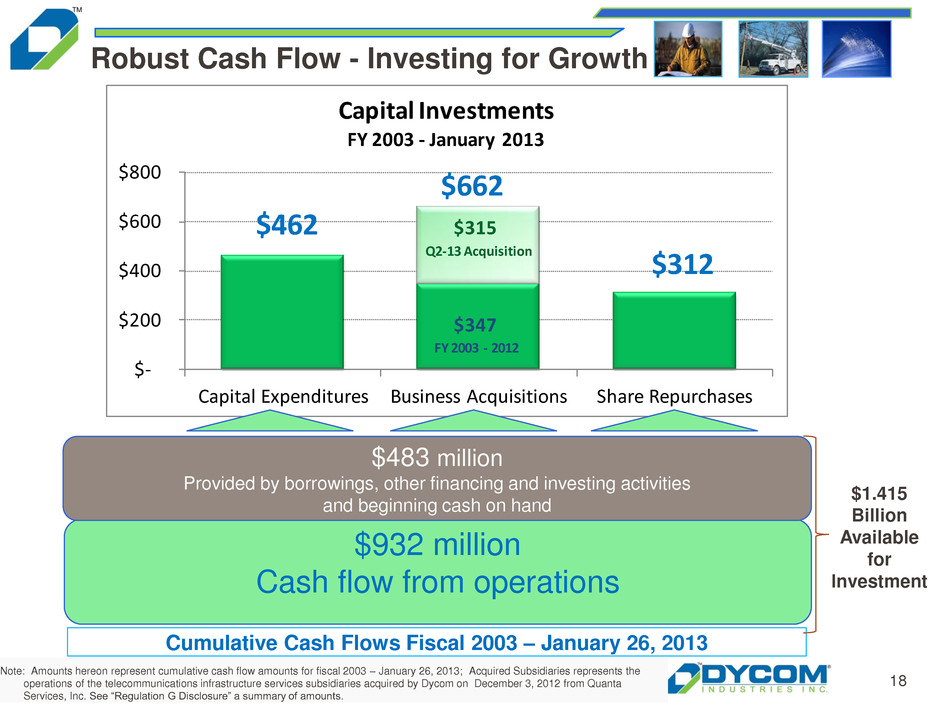

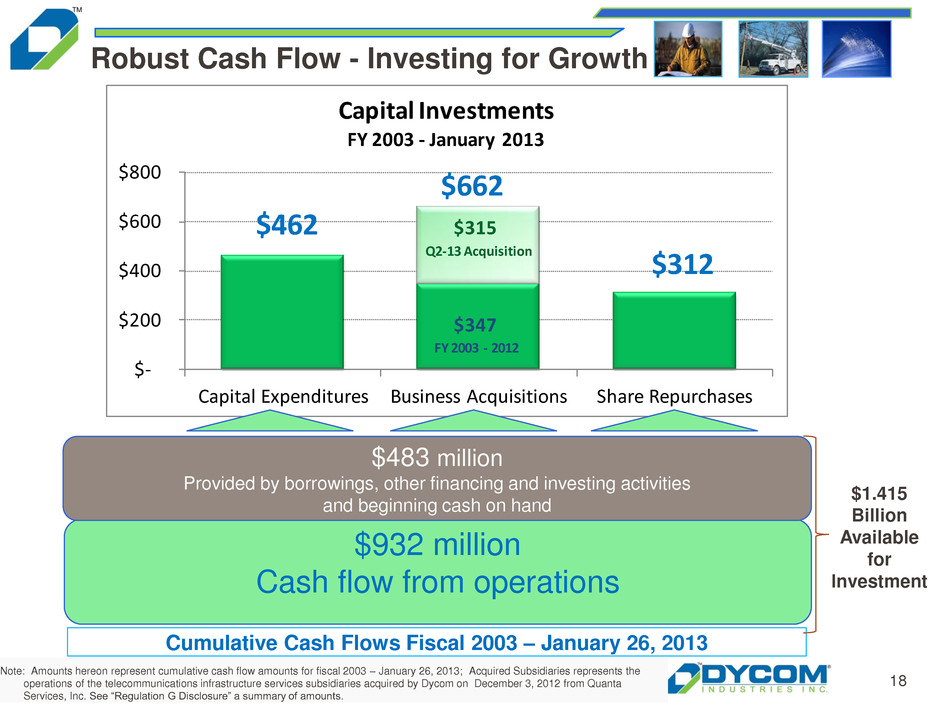

18 $462 $347 $312 $315 $- $200 $400 $600 $800 Capital Expenditures Business Acquisitions Share Repurchases Capital Investments FY 2003 - January 2013 Q2-13 Acquisition $662 FY 2003 - 2012 Robust Cash Flow - Investing for Growth $932 million Cash flow from operations $483 million Provided by borrowings, other financing and investing activities and beginning cash on hand Cumulative Cash Flows Fiscal 2003 – January 26, 2013 Note: Amounts hereon represent cumulative cash flow amounts for fiscal 2003 – January 26, 2013; Acquired Subsidiaries represents the operations of the telecommunications infrastructure services subsidiaries acquired by Dycom on December 3, 2012 from Quanta Services, Inc. See “Regulation G Disclosure” a summary of amounts. $1.415 Billion Available for Investment

Financial Update

20 Organic revenue growth of 3.5% during Q2-2013 Solid margins and earnings Stable balance sheet Strong cash flows and liquidity Capital structure designed to produce strong equity returns Financial Overview

21 (12.0)% (10.5)% 2.0% 15.4% 2.9% (15)% (10)% (5)% 0% 5% 10% 15% 20% FY2009 FY2010(a) FY2011 FY2012 FY 2013 (Q2 YTD) Annual Organic Growth Note: Subsidiaries acquired in Q2-13 represent the operations of the telecommunications infrastructure services subsidiaries acquired by Dycom on December 3, 2012 from Quanta Services, Inc. (the “Acquisition”). Numbers before Q2-13 reflect Dycom prior to the Acquisition. See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures. Contract Revenue Growth Growth within existing contracts and rural broadband projects during FY 2012 Quarterly results exhibit seasonal weather patterns Organic growth trend since fiscal 2009 Eight consecutive quarters of organic growth $1,107 $989 $1,036 $1,201 $- $200 $400 $600 $800 $1,000 $1,200 $1,400 FY2009 FY2010(a) FY2011 FY2012 Annual Contract Revenues ($ in millions) 2.7% 5.4% 15.2% 19.2% 17.3% 9.0% 2.4% 3.5% (1 )% (5)% 0 5% 10% 15% 20% 25% Q3-11 Q4-11 Q1-12 Q2-12 Q3-12 Q4-12 Q1-13 Q2-13 Quarterly Organic Growth (a)Fiscal 2010 includes an incremental week as the result of our 52/53 week fiscal year. $252 $304 $320 $267 $296 $318 $323 $293 $76 $- $60 $120 $180 $240 $300 $360 $420 Q3-11 Q4-11 Q1-12 Q2-12 Q3-12 Q4-12 Q1-13 Q2-13 Qu rterly Contract Revenues ($ in millions) Subsidiaries Acquired in Q2-13 $369

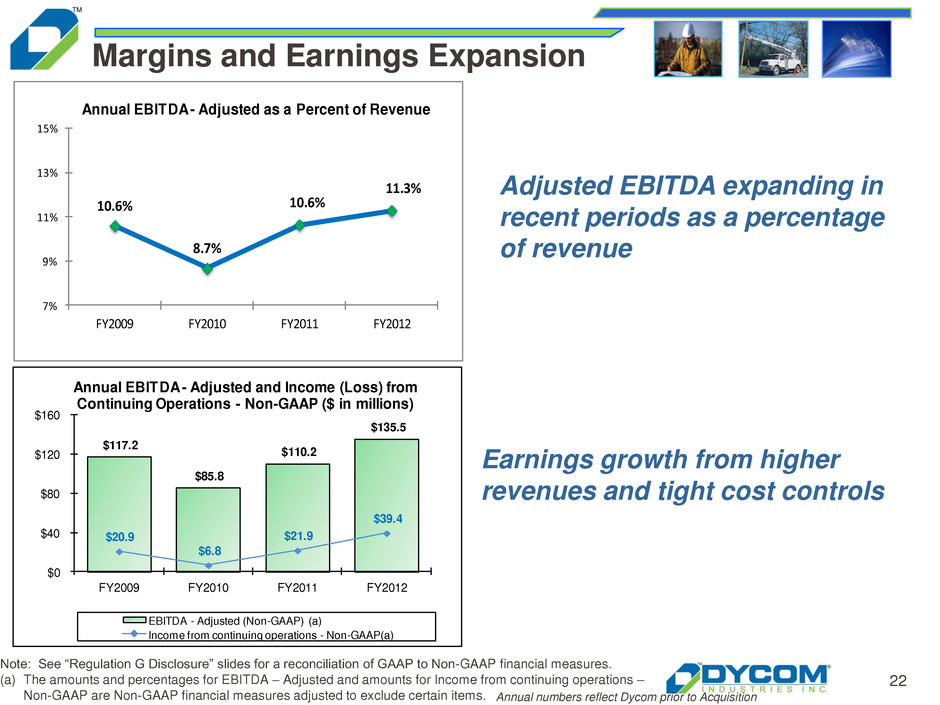

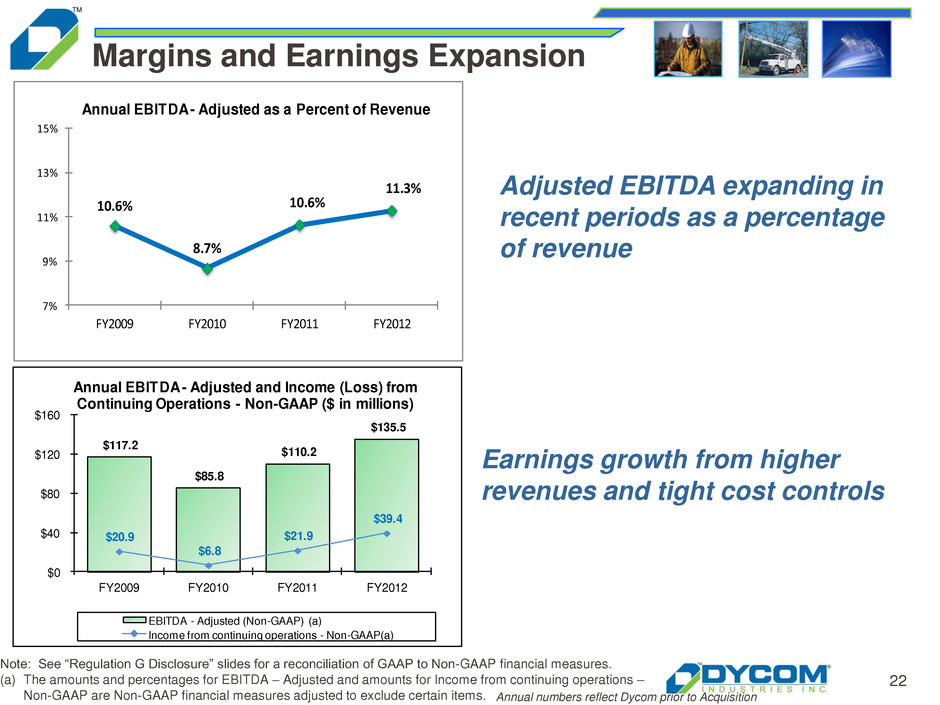

22 Margins and Earnings Expansion Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures. (a) The amounts and percentages for EBITDA – Adjusted and amounts for Income from continuing operations – Non-GAAP are Non-GAAP financial measures adjusted to exclude certain items. Adjusted EBITDA expanding in recent periods as a percentage of revenue Earnings growth from higher revenues and tight cost controls $117.2 $85.8 $110.2 $135.5 $20.9 $6.8 $21.9 $39.4 $0 $40 $80 $120 $160 FY2009 FY2010 FY2011 FY2012 Annual EBITDA - Adjusted and Income (Loss) from Continuing Operations - Non-GAAP ($ in millions) EBITDA - Adjusted (Non-GAAP) (a) Income from continuing operations - Non-GAAP(a) 10.6% 8.7% 10.6% 11.3% 7% 9% 11% 13% 15% FY2009 FY2010 FY2011 FY2012 Annual EBITDA - Adjusted as a Percent of Revenue Annual numbers reflect Dycom prior to Acquisition

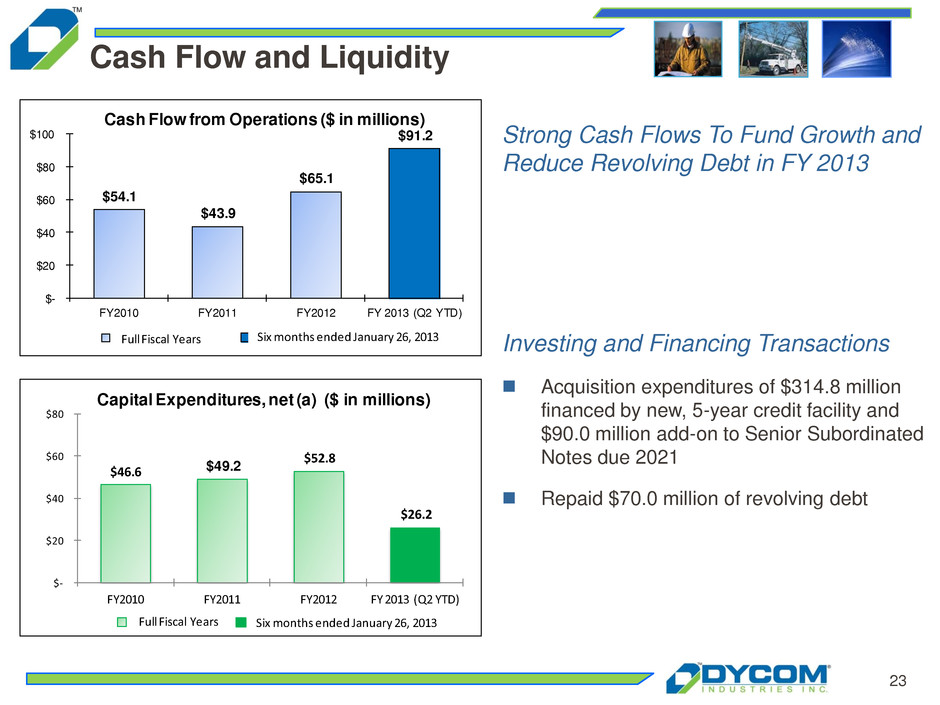

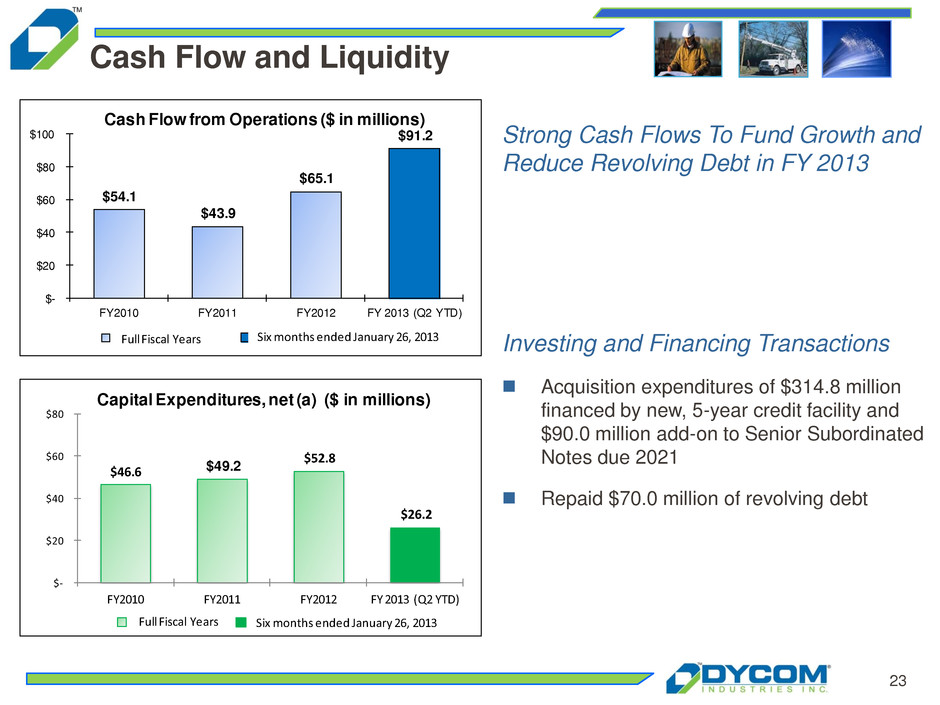

23 Cash Flow and Liquidity Strong Cash Flows To Fund Growth and Reduce Revolving Debt in FY 2013 Investing and Financing Transactions Acquisition expenditures of $314.8 million financed by new, 5-year credit facility and $90.0 million add-on to Senior Subordinated Notes due 2021 Repaid $70.0 million of revolving debt $54.1 $43.9 $65.1 $91.2 $- $20 $40 $60 $80 $100 FY2010 FY2011 FY2012 FY 2013 (Q2 YTD) Cash Flow from Operations ($ in millions) FY2010 FY 2013 (Q2 YTD)Full Fiscal Years Six months ended January 26, 2013 $46.6 $49.2 $52.8 $26.2 $- $20 $40 $60 $80 FY2010 FY2011 FY2012 FY 2013 (Q2 YTD) Capital Expenditures, net (a) ($ in millions) FY2012 FY 2013 (Q2 YTD)Full Fiscal Years Six months ended January 26, 2013

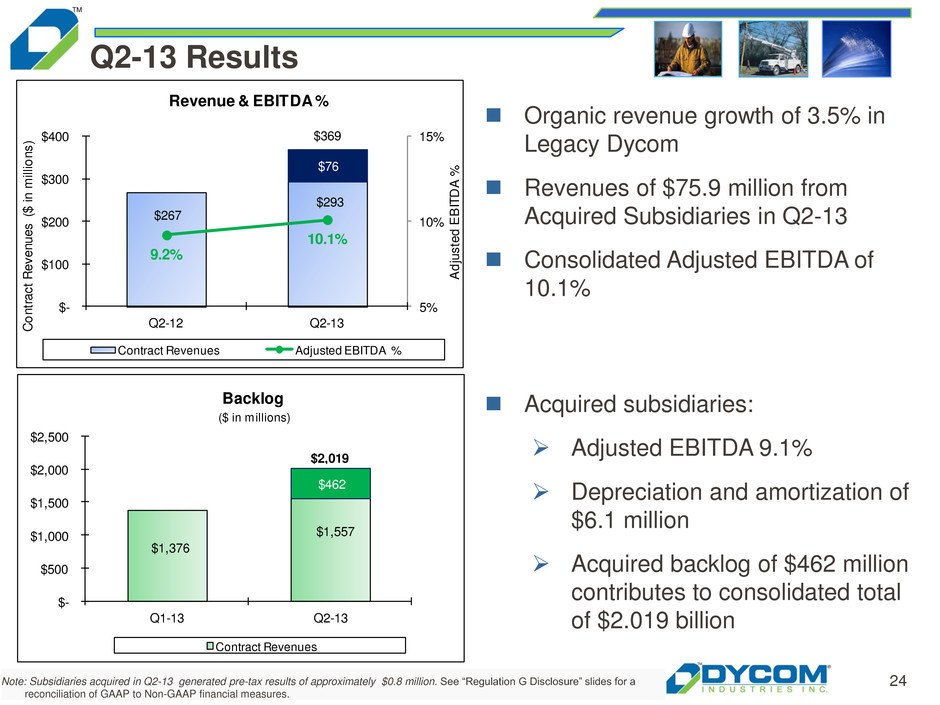

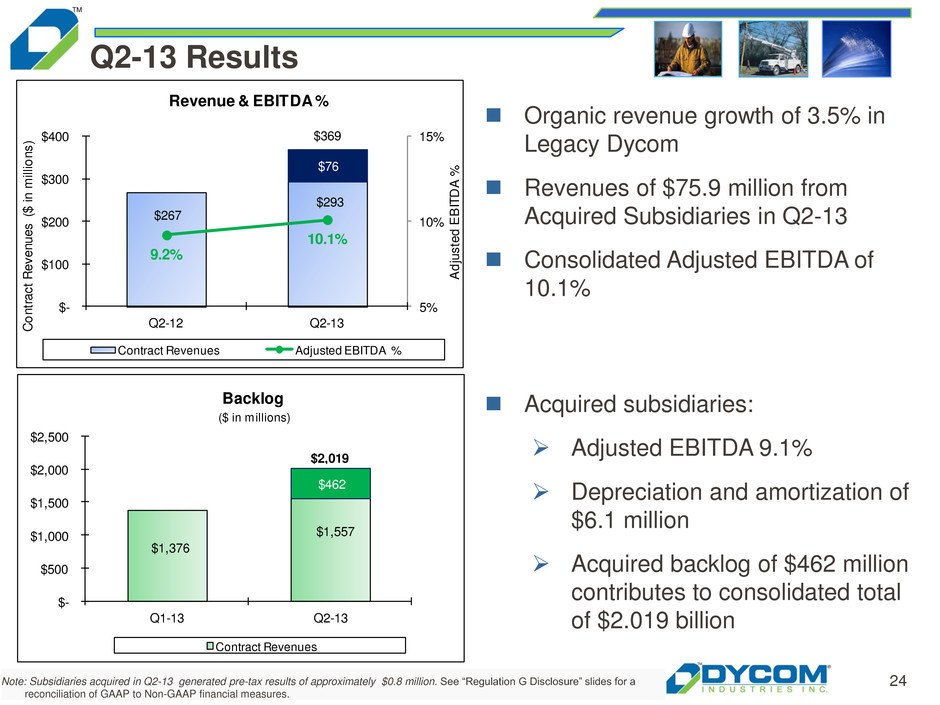

24 Q2-13 Results Organic revenue growth of 3.5% in Legacy Dycom Revenues of $75.9 million from Acquired Subsidiaries in Q2-13 Consolidated Adjusted EBITDA of 10.1% Acquired subsidiaries: Adjusted EBITDA 9.1% Depreciation and amortization of $6.1 million Acquired backlog of $462 million contributes to consolidated total of $2.019 billion Note: Subsidiaries acquired in Q2-13 generated pre-tax results of approximately $0.8 million. See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures. $267 $293 $76 9.2% 10.1% 5% 10% 15% $- $100 $200 $300 $400 Q2-12 Q2-13 A d ju s te d E B IT D A % C o n tr a c t R e v e n u e s ($ i n m il li o n s ) Revenue & EBITDA % Contract Revenues Adjusted EBITDA % $369 $1,376 $1,557 $462 $- $500 $1,000 $1,500 $2,000 $2,500 Q1-13 Q2-13 Backlog ($ in millions) Contract Revenues $2,019

25 Strong Balance Sheet and Liquidity Financial profile positioned to address emerging industry opportunities $400 million Senior Credit Facility entered into in Q2-13 - maturity in Dec 2017 $125 million Term Loan $275 Revolver Attractive financing terms Ample liquidity Senior Subordinated Notes - maturity in 2021 July 28, 2012 January 26, 2013 Cash and equivalents $ 52.6 $ 22.6 Debt: Senior Credit Agreement, matures December 2017: $275 million revolver $ 20.0 Term Loan 125.0 Senior Credit Agreement, replaced December 2012 $ - 7.125% Senior Subordinated Notes due January 2021 ("2021 Notes") 187.5 277.5 Debt Premium on 2021 Notes - 3.8 Capital Leases 0.1 - Total Debt $ 187.6 $ 426.3 Letters of Credit Outstanding $ 38.5 $ 44.1 Availability on Senior Credit Agreement $ 186.5 $ 210.9

26 Capital Allocated to Maximize Shareholder Returns Organic growth, solid free cash flow and confidence in industry outlook promotes capital allocation strategy to further expand shareholder returns December 2012 acquisition of substantially all of Quanta Services, Inc.’s domestic telecommunications infrastructure services subsidiaries further strengthens our customer base, geographic scope, and technical service offerings Share repurchases of over 15% of outstanding shares during fiscal 2011 through fiscal 2013 creates incremental shareholder value and reduces equity claims on future earnings

Selected Information from Q2-13 Dycom Results Conference Call Materials** **The following three slides (slides 28 through 30) were used on February 27, 2013 in connection with the Company’s conference call to discuss fiscal 2013 second quarter results and are included here for your convenience. Reference is made to slide (slide 2) titled “Forward-Looking Statements and Non-GAAP Information.” The information and statements contained in these slides that are forward-looking are based on information that was available at the time the slides were initially prepared and/or management’s good faith belief at that time with respect to future events. Except as required by law, the Company may not update forward-looking statements even though its situation may change in the future. For a full copy of the conference call materials, including the conference call transcript, see the Company’s Form 8-K’s filed with the Securities and Exchange Commission on February 27, 2013 and February 28, 2013.

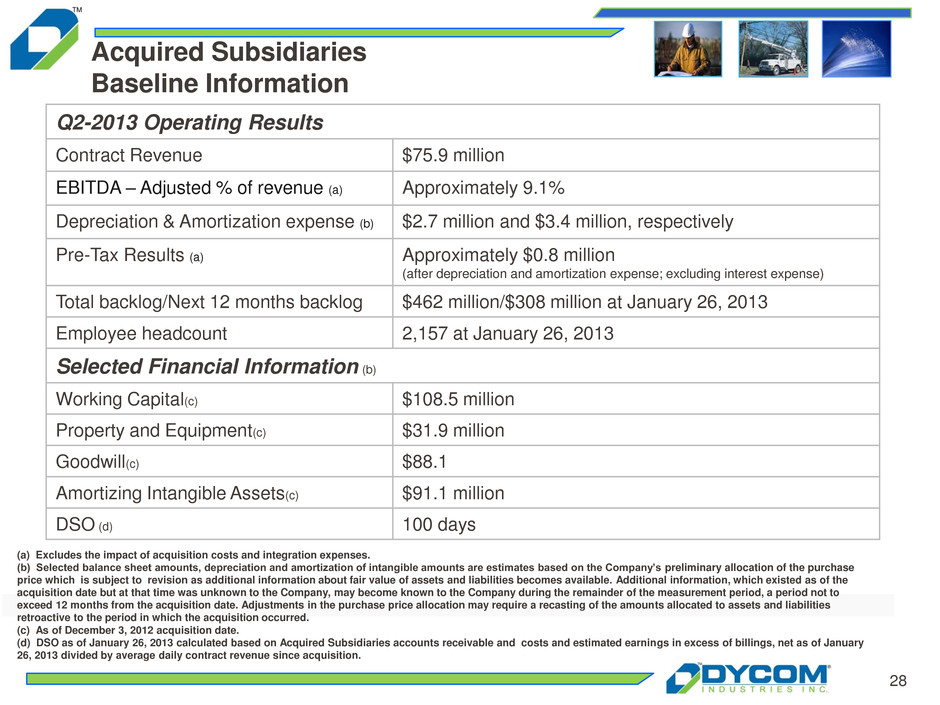

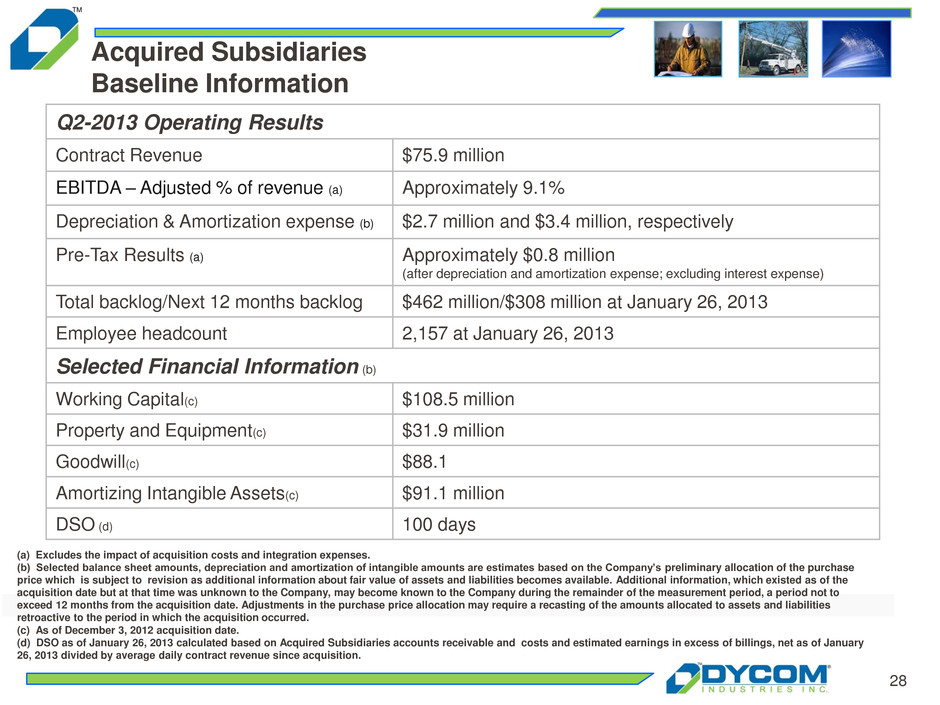

28 Acquired Subsidiaries Baseline Information Q2-2013 Operating Results Contract Revenue $75.9 million EBITDA – Adjusted % of revenue (a) Approximately 9.1% Depreciation & Amortization expense (b) $2.7 million and $3.4 million, respectively Pre-Tax Results (a) Approximately $0.8 million (after depreciation and amortization expense; excluding interest expense) Total backlog/Next 12 months backlog $462 million/$308 million at January 26, 2013 Employee headcount 2,157 at January 26, 2013 Selected Financial Information (b) Working Capital(c) $108.5 million Property and Equipment(c) $31.9 million Goodwill(c) $88.1 Amortizing Intangible Assets(c) $91.1 million DSO (d) 100 days (a) Excludes the impact of acquisition costs and integration expenses. (b) Selected balance sheet amounts, depreciation and amortization of intangible amounts are estimates based on the Company’s preliminary allocation of the purchase price which is subject to revision as additional information about fair value of assets and liabilities becomes available. Additional information, which existed as of the acquisition date but at that time was unknown to the Company, may become known to the Company during the remainder of the measurement period, a period not to exceed 12 months from the acquisition date. Adjustments in the purchase price allocation may require a recasting of the amounts allocated to assets and liabilities retroactive to the period in which the acquisition occurred. (c) As of December 3, 2012 acquisition date. (d) DSO as of January 26, 2013 calculated based on Acquired Subsidiaries accounts receivable and costs and estimated earnings in excess of billings, net as of January 26, 2013 divided by average daily contract revenue since acquisition.

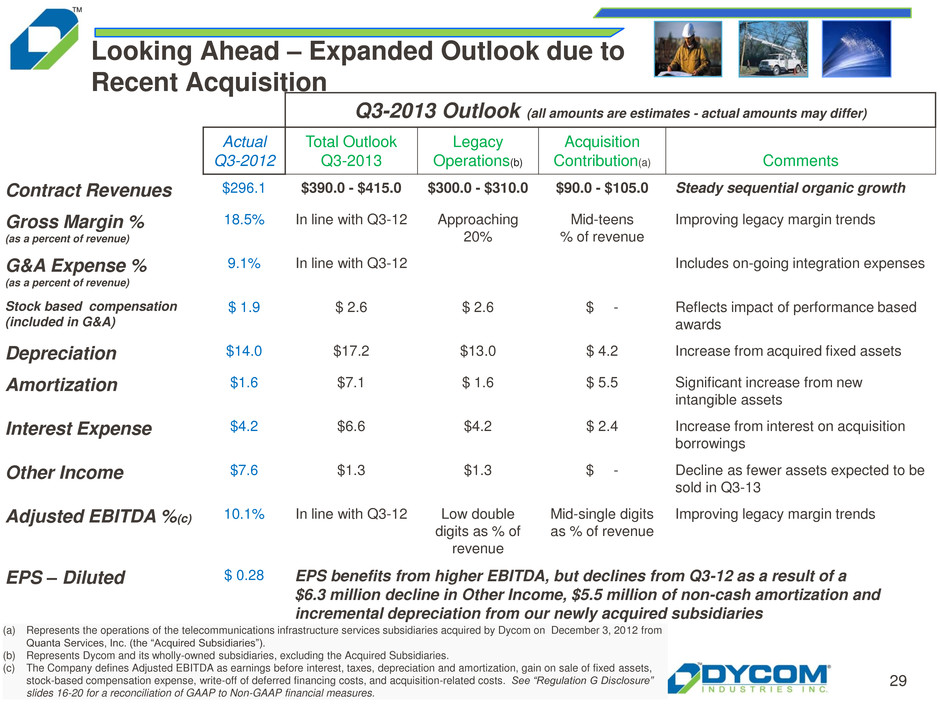

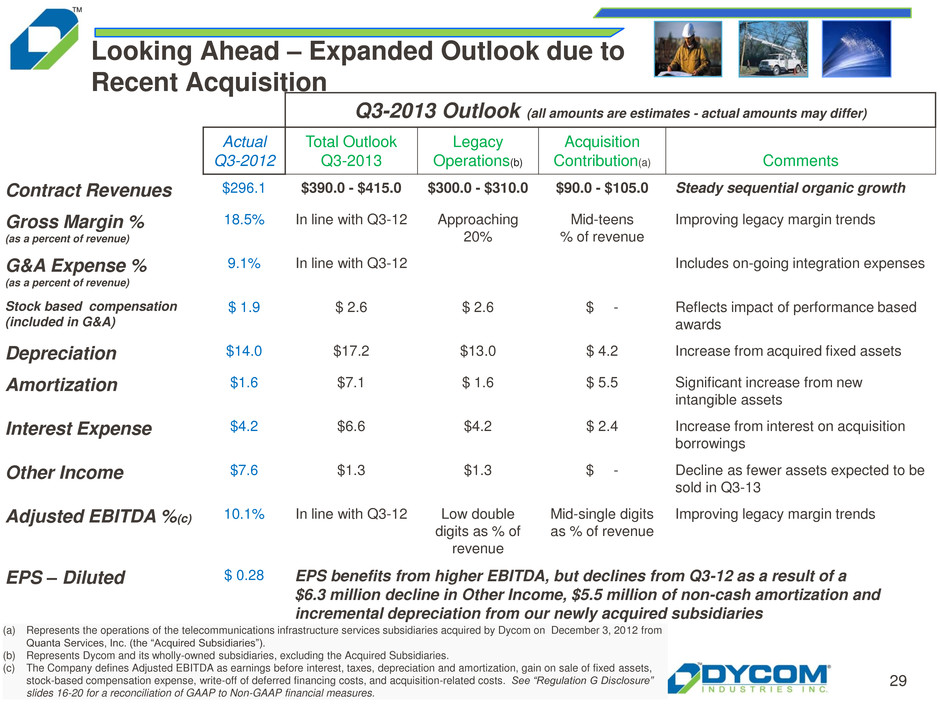

29 Looking Ahead – Expanded Outlook due to Recent Acquisition Q3-2013 Outlook (all amounts are estimates - actual amounts may differ) Actual Q3-2012 Total Outlook Q3-2013 Legacy Operations(b) Acquisition Contribution(a) Comments Contract Revenues $296.1 $390.0 - $415.0 $300.0 - $310.0 $90.0 - $105.0 Steady sequential organic growth Gross Margin % (as a percent of revenue) 18.5% In line with Q3-12 Approaching 20% Mid-teens % of revenue Improving legacy margin trends G&A Expense % (as a percent of revenue) 9.1% In line with Q3-12 Includes on-going integration expenses Stock based compensation (included in G&A) $ 1.9 $ 2.6 $ 2.6 $ - Reflects impact of performance based awards Depreciation $14.0 $17.2 $13.0 $ 4.2 Increase from acquired fixed assets Amortization $1.6 $7.1 $ 1.6 $ 5.5 Significant increase from new intangible assets Interest Expense $4.2 $6.6 $4.2 $ 2.4 Increase from interest on acquisition borrowings Other Income $7.6 $1.3 $1.3 $ - Decline as fewer assets expected to be sold in Q3-13 Adjusted EBITDA %(c) 10.1% In line with Q3-12 Low double digits as % of revenue Mid-single digits as % of revenue Improving legacy margin trends EPS – Diluted $ 0.28 EPS benefits from higher EBITDA, but declines from Q3-12 as a result of a $6.3 million decline in Other Income, $5.5 million of non-cash amortization and incremental depreciation from our newly acquired subsidiaries (a) Represents the operations of the telecommunications infrastructure services subsidiaries acquired by Dycom on December 3, 2012 from Quanta Services, Inc. (the “Acquired Subsidiaries”). (b) Represents Dycom and its wholly-owned subsidiaries, excluding the Acquired Subsidiaries. (c) The Company defines Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, write-off of deferred financing costs, and acquisition-related costs. See “Regulation G Disclosure” slides 16-20 for a reconciliation of GAAP to Non-GAAP financial measures.

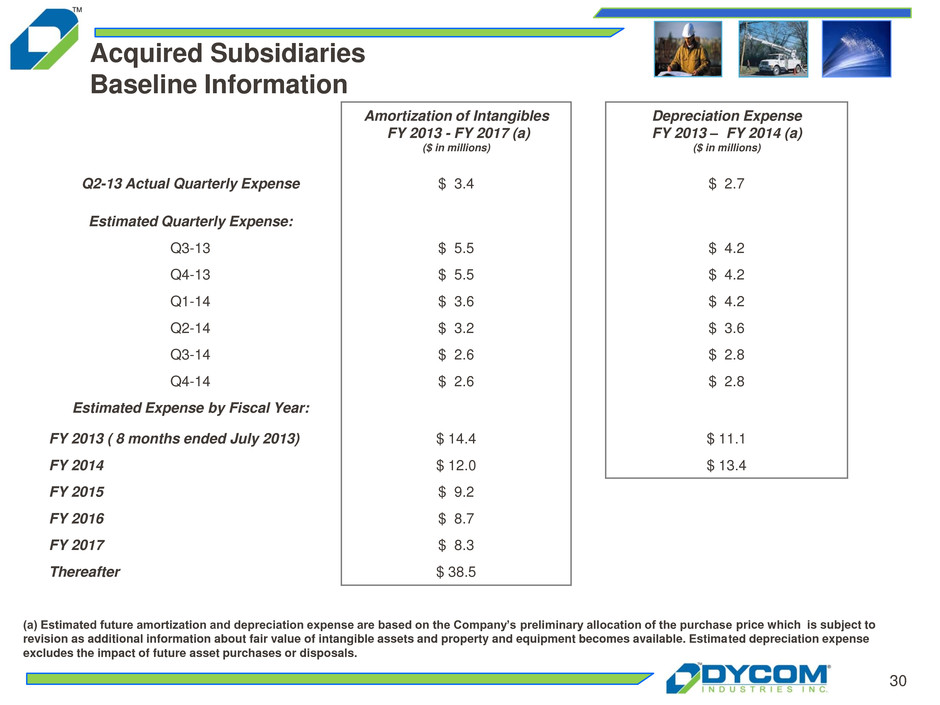

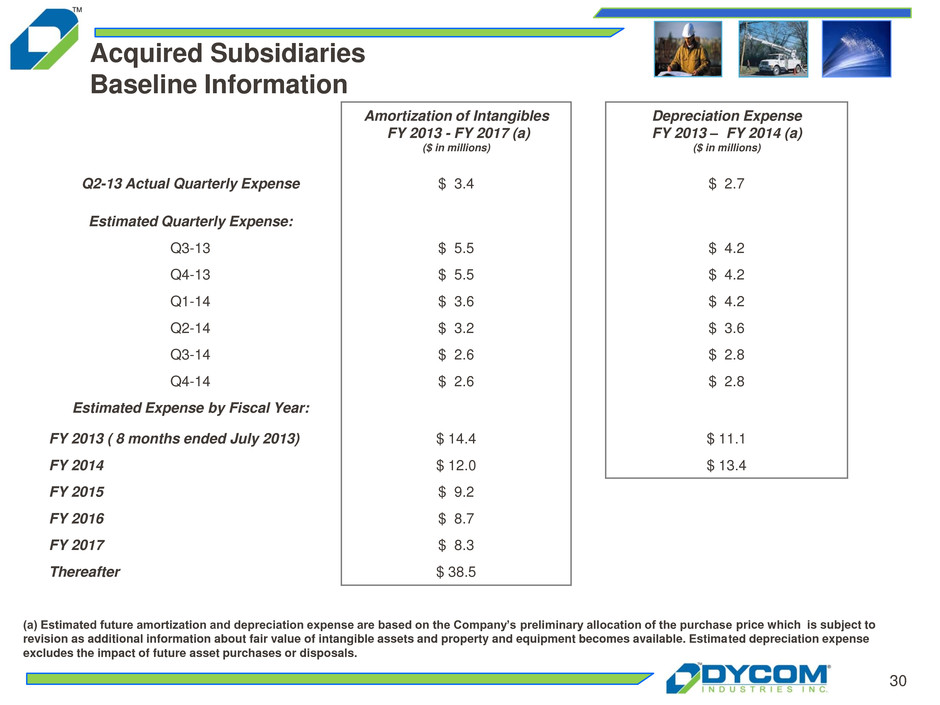

30 Acquired Subsidiaries Baseline Information (a) Estimated future amortization and depreciation expense are based on the Company’s preliminary allocation of the purchase price which is subject to revision as additional information about fair value of intangible assets and property and equipment becomes available. Estimated depreciation expense excludes the impact of future asset purchases or disposals. Amortization of Intangibles FY 2013 - FY 2017 (a) ($ in millions) Depreciation Expense FY 2013 – FY 2014 (a) ($ in millions) Q2-13 Actual Quarterly Expense $ 3.4 $ 2.7 Estimated Quarterly Expense: Q3-13 $ 5.5 $ 4.2 Q4-13 $ 5.5 $ 4.2 Q1-14 $ 3.6 $ 4.2 Q2-14 $ 3.2 $ 3.6 Q3-14 $ 2.6 $ 2.8 Q4-14 $ 2.6 $ 2.8 Estimated Expense by Fiscal Year: FY 2013 ( 8 months ended July 2013) $ 14.4 $ 11.1 FY 2014 $ 12.0 $ 13.4 FY 2015 $ 9.2 FY 2016 $ 8.7 FY 2017 $ 8.3 Thereafter $ 38.5

Supplemental schedules Regulation G Disclosures

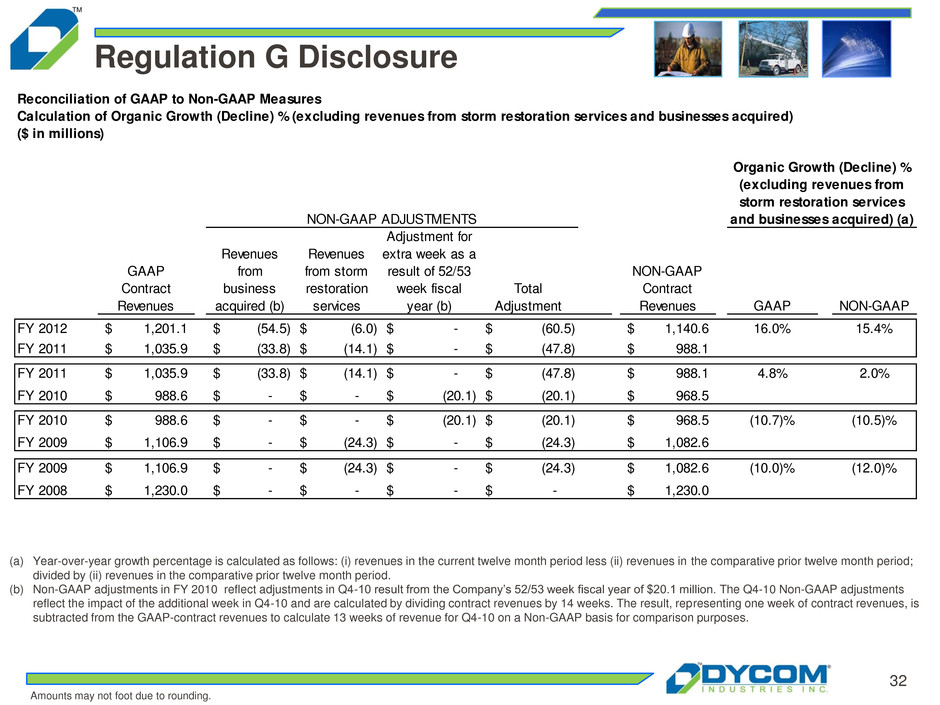

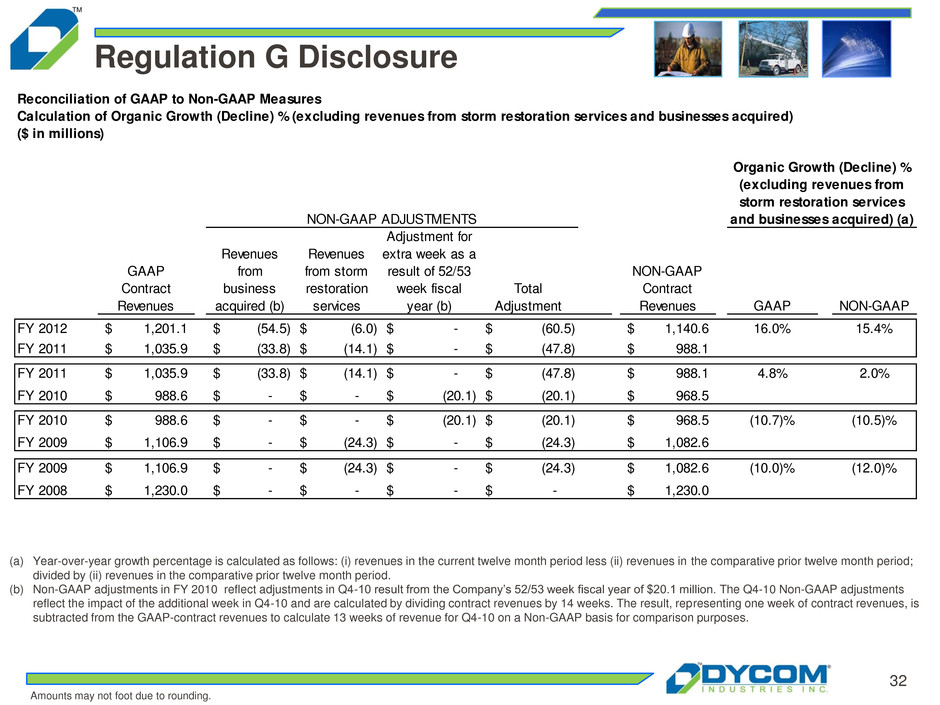

32 Regulation G Disclosure (a) Year-over-year growth percentage is calculated as follows: (i) revenues in the current twelve month period less (ii) revenues in the comparative prior twelve month period; divided by (ii) revenues in the comparative prior twelve month period. (b) Non-GAAP adjustments in FY 2010 reflect adjustments in Q4-10 result from the Company’s 52/53 week fiscal year of $20.1 million. The Q4-10 Non-GAAP adjustments reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks. The result, representing one week of contract revenues, is subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP basis for comparison purposes. Amounts may not foot due to rounding. Reconciliation of GAAP to Non-GAAP Measures Calculation of Organic Growth (Decline) % (excluding revenues from storm restoration services and businesses acquired) ($ in millions) Revenues from business acquired (b) Revenues from storm restoration services Adjustment for extra week as a result of 52/53 week fiscal year (b) Total Adjustment GAAP NON-GAAP FY 2012 1,201.1$ (54.5)$ (6.0)$ -$ (60.5)$ 1,140.6$ 16.0% 15.4%,035.9 33.8 47.8 988.1 FY 2011 1,035.9$ (33.8)$ (14.1)$ -$ (47.8)$ 988.1$ FY 2011 1,035.9$ (33.8)$ (14.1)$ -$ (47.8)$ 988.1$ 4.8% 2.0%988.6 - (20.1) 6 .5 FY 2010 988.6$ -$ -$ (20.1)$ (20.1)$ 968.5$ FY 2010 988.6$ -$ -$ (20.1)$ (20.1)$ 968.5$ (10.7)% (10.5)%Q4-1 1,106.9 - ( 4.3) 1,082.6 0.0% 0.0% FY 2009 1,106.9$ -$ (24.3)$ -$ (24.3)$ 1,082.6$ Q4-09 1,230.0$ (101.9)$ (101.9)$ 1,128.1$ FY 2009 1,106.9$ -$ (24.3)$ -$ (24.3)$ 1,082.6$ (10.0)% (12.0)%,230.0 - - ,230.0 FY 2008 1,230.0$ -$ -$ -$ -$ 1,230.0$ GAAP Contract Revenues NON-GAAP Contract Revenues Organic Growth (Decline) % (excluding revenues from storm restoration services and businesses acquired) (a)NON-GAAP ADJUSTMENTS

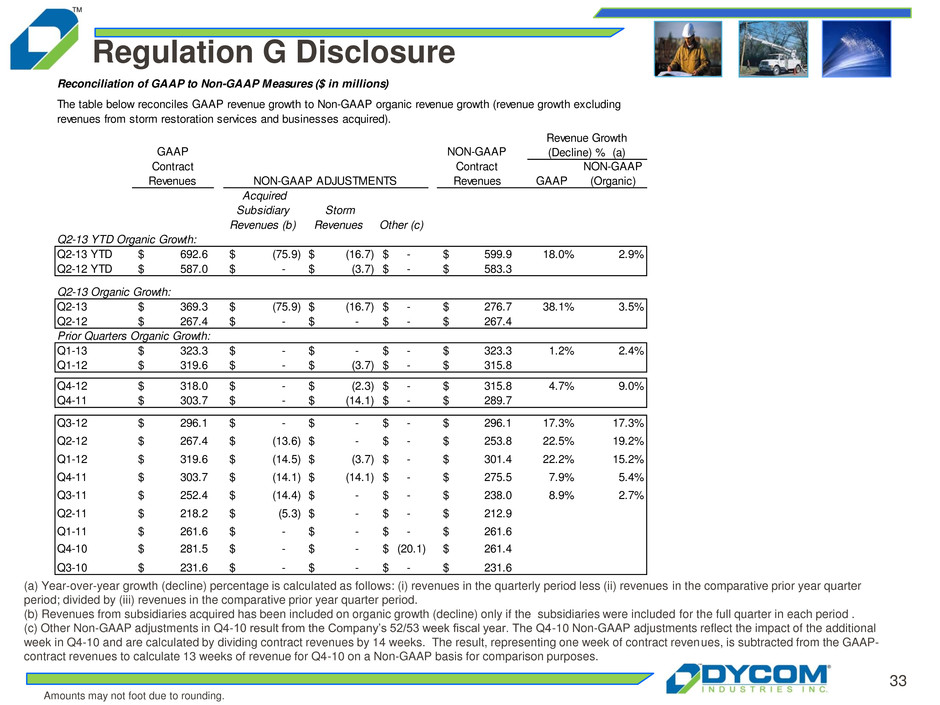

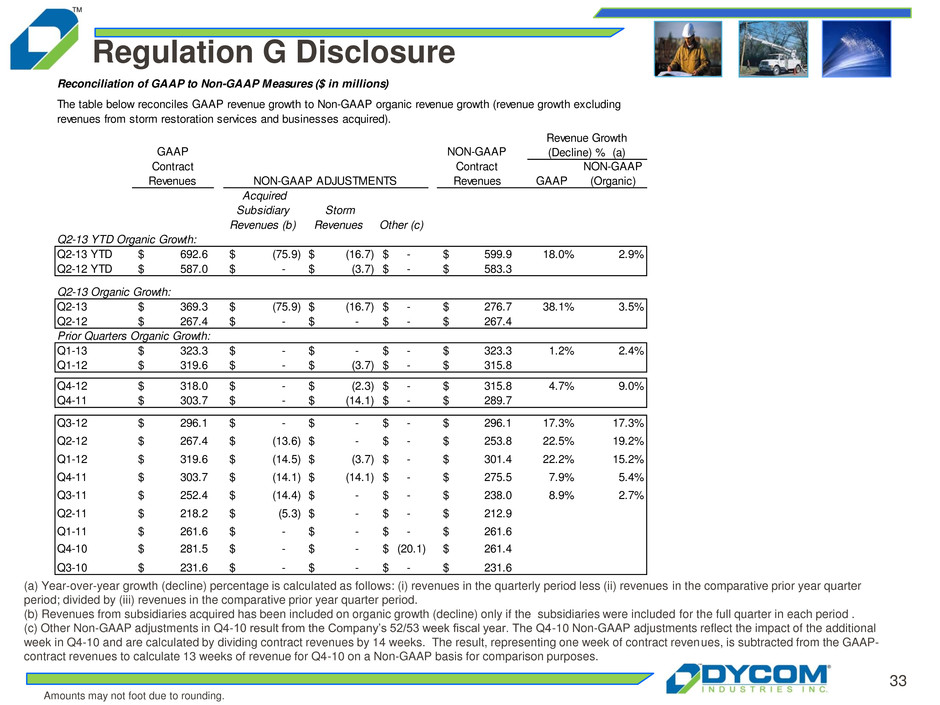

33 Regulation G Disclosure Amounts may not foot due to rounding. (a) Year-over-year growth (decline) percentage is calculated as follows: (i) revenues in the quarterly period less (ii) revenues in the comparative prior year quarter period; divided by (iii) revenues in the comparative prior year quarter period. (b) Revenues from subsidiaries acquired has been included on organic growth (decline) only if the subsidiaries were included for the full quarter in each period . (c) Other Non-GAAP adjustments in Q4-10 result from the Company’s 52/53 week fiscal year. The Q4-10 Non-GAAP adjustments reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks. The result, representing one week of contract revenues, is subtracted from the GAAP- contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP basis for comparison purposes. Reconciliation of GAAP to Non-GAAP Measures ($ in millions) GAAP NON-GAAP (Organic) Acquired Subsidiary Revenues (b) Storm Revenues Other (c) Q2-13 YTD Organic Growth: Q2-13 YTD 692.6$ (75.9)$ (16.7)$ -$ 599.9$ 18.0% 2.9% Q2-12 YTD 587.0$ -$ (3.7)$ -$ 583.3$ Q2-13 Organic Growth: Q2-13 369.3$ (75.9)$ (16.7)$ -$ 276.7$ 38.1% 3.5% Q2-12 267.4$ -$ -$ -$ 267.4$ Prior Quarters Organic Growth: Q1-13 323.3$ -$ -$ -$ 323.3$ 1.2% 2.4% Q1-12 319.6$ -$ (3.7)$ -$ 315.8$ Q4-12 318.0$ -$ (2.3)$ -$ 315.8$ 4.7% 9.0% Q4-11 303.7$ -$ (14.1)$ -$ 289.7$ Q3-12 296.1$ -$ -$ -$ 296.1$ 17.3% 17.3% Q2-12 267.4$ (13.6)$ -$ -$ 253.8$ 22.5% 19.2%2-11 218.2$ (5.3)$ 212.9$ Q1-12 319.6$ (14.5)$ (3.7)$ -$ 301.4$ 22.2% 15.2%261.6$ -$ 261.6$ Q4-11 303.7$ (14.1)$ (14.1)$ -$ 275.5$ 7.9% 5.4%4-10 281.5$ (20.1)$ 261.4$ 11.6 9.9 Q3-11 252.4$ (14.4)$ -$ -$ 238.0$ 8.9% 2.7%4-09 231.6$ -$ 231.6$ Q2-11 218.2$ (5.3)$ -$ -$ 212.9$ 0.9% (1.6)%4-09 216.3$ -$ 216.3$ Q1-11 261.6$ -$ -$ -$ 261.6$ 1.0% (c) 1.0% (c)4-09 259.1$ -$ 259.1$ Q4-10 281.5$ -$ -$ (20.1)$ 261.4$ 4.4% (3.1)%Q4-09 269.7$ -$ 269.7$ Q3-10 231.6$ -$ -$ -$ 231.6$ (10.1)% (8.0)% The table below reconciles GAAP revenue growth to Non-GAAP organic revenue growth (revenue growth excluding revenues from storm restoration services and businesses acquired). GAAP Contract Revenues NON-GAAP ADJUSTMENTS NON-GAAP Contract Revenues Revenue Growth (Decline) % (a)

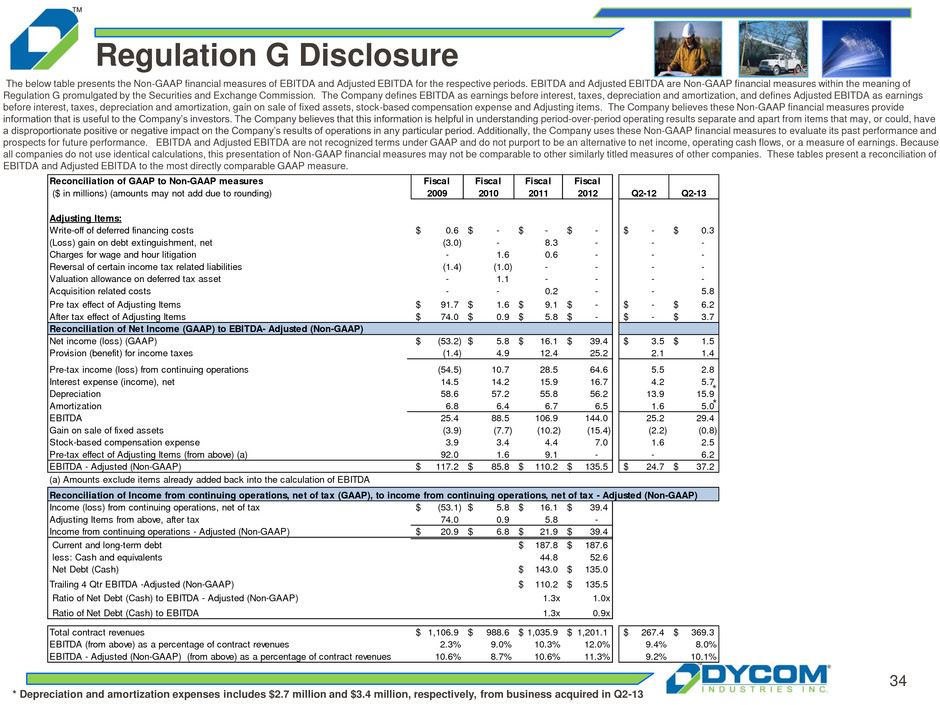

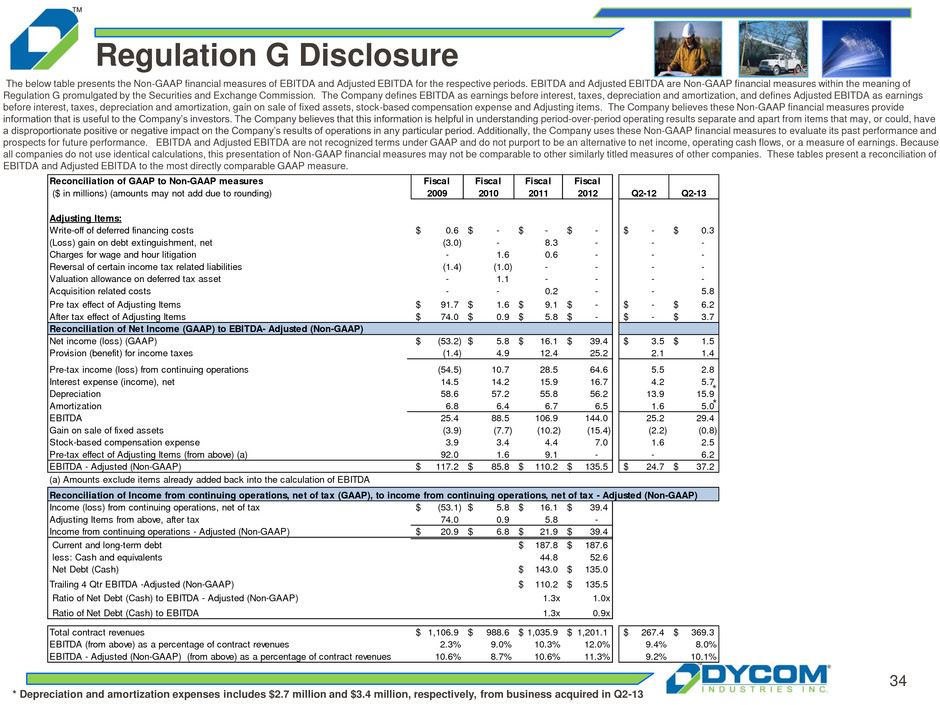

34 Regulation G Disclosure The below table presents the Non-GAAP financial measures of EBITDA and Adjusted EBITDA for the respective periods. EBITDA and Adjusted EBITDA are Non-GAAP financial measures within the meaning of Regulation G promulgated by the Securities and Exchange Commission. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization, and defines Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense and Adjusting items. The Company believes these Non-GAAP financial measures provide information that is useful to the Company’s investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the Company’s results of operations in any particular period. Additionally, the Company uses these Non-GAAP financial measures to evaluate its past performance and prospects for future performance. EBITDA and Adjusted EBITDA are not recognized terms under GAAP and do not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. These tables present a reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure. Reconciliation of GAAP to Non-GAAP measures ($ in millions) (amounts may not add due to rounding) Fiscal 2009 Fiscal 2010 Fiscal 2011 Fiscal 2012 Q2-12 Q2-13 Adjusting Items: Write-off of deferred financing costs 0.6$ -$ -$ -$ -$ 0.3$ (Loss) gain on debt extinguishment, net (3.0) - 8.3 - - - Charges for wage and hour litigation - 1.6 0.6 - - - Reversal of certain income tax related liabilities (1.4) (1.0) - - - - Valuation allowance on deferred tax asset - 1.1 - - - - Acquisition related costs - - 0.2 - - 5.8 Pre tax effect of Adjusting Items 91.7$ 1.6$ 9.1$ -$ -$ 6.2$ After tax effect of Adjusting Items 74.0$ 0.9$ 5.8$ -$ -$ 3.7$ Reconciliation of Net Income (GAAP) to EBITDA- Adjusted (Non-GAAP) Net income (loss) (GAAP) (53.2)$ 5.8$ 16.1$ 39.4$ 3.5$ 1.5$ Provision (benefit) for income taxes (1.4) 4.9 12.4 25.2 2.1 1.4 Pre-tax income (loss) from continuing operations (54.5) 10.7 28.5 64.6 5.5 2.8 Interest expense (income), net 14.5 14.2 15.9 16.7 4.2 5.7 Depreciation 58.6 57.2 55.8 56.2 13.9 15.9 Amortization 6.8 6.4 6.7 6.5 1.6 5.0 EBITDA 25.4 88.5 106.9 144.0 25.2 29.4 Gain on sale of fixed assets (3.9) (7.7) (10.2) (15.4) (2.2) (0.8) Stock-based compensation expense 3.9 3.4 4.4 7.0 1.6 2.5 Pre-tax effect of Adjusting Items (from above) (a) 92.0 1.6 9.1 - - 6.2 EBITDA - Adjusted (Non-GAAP) 117.2$ 85.8$ 110.2$ 135.5$ 24.7$ 37.2$ - (a) Amounts exclude items already added back into the calculation of EBITDA 0 Income (loss) from continuing operations, net of tax (53.1)$ 5.8$ 16.1$ 39.4$ Adjusting Items from above, after tax 74.0 0.9 5.8 - Income from continuing operations - Adjusted (Non-GAAP) 20.9$ 6.8$ 21.9$ 39.4$ - Current and long-term debt 136.3$ 135.4$ 187.8$ 187.6$ less: Cash and equivalents 104.7 103.3 44.8 52.6 Net Debt (Cash) 31.6$ 32.1$ 143.0$ 135.0$ - - - - Trailing 4 Q EBITDA -Adjusted (Non-GAAP) 117.2$ 85.8$ 110.2$ 135.5$ - - - - Ratio of Net Debt (Cash) to EBITDA - Adjusted (Non-GAAP) 0.3x 0.4x 1.3x 1.0x- - - - Ratio of Net Debt (Cash) to EBITDA 1.2x 0.4x 1.3x 0.9x Total contract revenues 1,106.9$ 988.6$ 1,035.9$ 1,201.1$ 267.4$ 369.3$ EBITDA (from above) as a percentage of contract revenues 2.3% 9.0% 10.3% 12.0% 9.4% 8.0% EBITDA - Adjusted (Non-GAAP) (from above) as a percentage of contract revenues 10.6% 8.7% 10.6% 11.3% 9.2% 10.1% Reconciliation of Income from continuing operations, net of tax (GAAP), to income from continuing operations, net of tax - Adjusted (Non-GAAP) * * * Depreciation and amortization expenses includes $2.7 million and $3.4 million, respectively, from business acquired in Q2-13

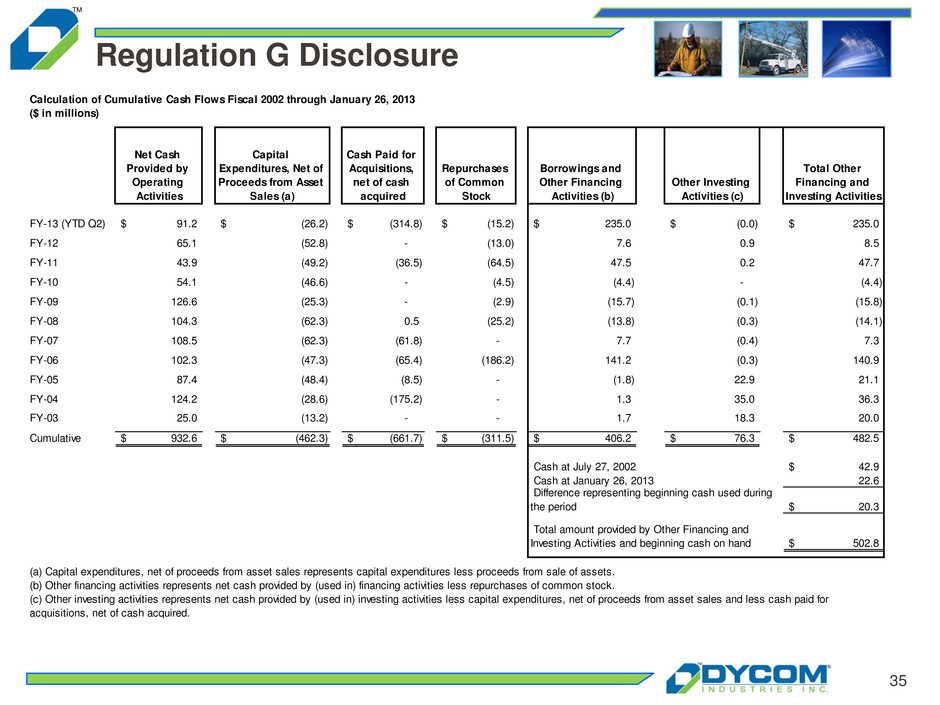

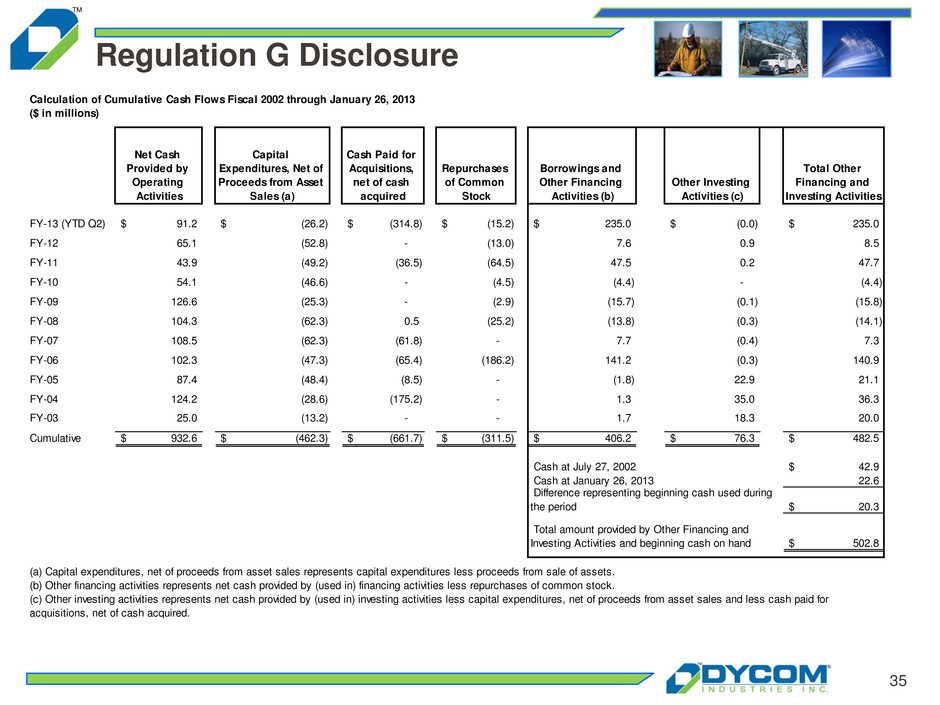

35 Regulation G Disclosure Calculation of Cumulative Cash Flows Fiscal 2002 through January 26, 2013 ($ in millions) Net Cash Provided by Operating Activities Capital Expenditures, Net of Proceeds from Asset Sales (a) Cash Paid for Acquisitions, net of cash acquired Repurchases of Common Stock Borrowings and Other Financing Activities (b) Other Investing Activities (c) Total Other Financing and Investing Activities FY-13 (YTD Q2) 91.2$ (26.2)$ (314.8)$ (15.2)$ 235.0$ (0.0)$ 235.0$ FY-12 65.1 (52.8) - (13.0) 7.6 0.9 8.5 FY-11 43.9 (49.2) (36.5) (64.5) 47.5 0.2 47.7 FY-10 54.1 (46.6) - (4.5) (4.4) - (4.4) FY-09 126.6 (25.3) - (2.9) (15.7) (0.1) (15.8) FY-08 104.3 (62.3) 0.5 (25.2) (13.8) (0.3) (14.1) FY-07 108.5 (62.3) (61.8) - 7.7 (0.4) 7.3 FY-06 102.3 (47.3) (65.4) (186.2) 141.2 (0.3) 140.9 FY-05 87.4 (48.4) (8.5) - (1.8) 22.9 21.1 FY-04 124.2 (28.6) (175.2) - 1.3 35.0 36.3 FY-03 25.0 (13.2) - - 1.7 18.3 20.0 Cumulative 932.6$ (462.3)$ (661.7)$ (311.5)$ 406.2$ 76.3$ 482.5$ Cash at July 27, 2002 42.9$ Cash at January 26, 2013 22.6 20.3$ 502.8$ (a) Capital expenditures, net of proceeds from asset sales represents capital expenditures less proceeds from sale of assets. (b) Other financing activities represents net cash provided by (used in) financing activities less repurchases of common stock. (c) Other investing activities represents net cash provided by (used in) investing activities less capital expenditures, net of proceeds from asset sales and less cash paid for acquisitions, net of cash acquired. Difference representing beginning cash used during the period Total amount provided by Other Financing and Investing Activities and beginning cash on hand

BB&T Capital Markets 7th Annual Commercial & Industrial Conference March 21, 2013