Click to edit Master title style Click to edit Master subtitle style Fiscal 2015 1st Quarter Presentation November 25, 2014 Exhibit 99.2

2 Steven E. Nielsen President & Chief Executive Officer Timothy R. Estes Chief Operating Officer H. Andrew DeFerrari Chief Financial Officer Richard B. Vilsoet General Counsel Participants

3 Fiscal 2015 first quarter results are unaudited. This presentation contains “forward-looking statements”. These statements relate to future events, our future financial performance, strategies, expectations, and competitive environment. Other than statements of historical facts, all statements contained in this presentation, including statements regarding the Company’s future financial position, future revenue, prospects, plans and objectives of management, are forward-looking statements. Forward-looking statements include statements of expectations regarding businesses acquired, including expected benefits and synergies of the transaction, future financial and operating results, and other statements regarding events or developments that the Company believes or anticipates will or may occur in the future as a result of the acquisitions. Words such as “outlook,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project,” “looking ahead” and similar expressions, as well as statements in future tense, identify forward-looking statements. You should not consider forward- looking statements as a guarantee of future performance or results. These statements do not necessarily indicate accurately whether such performance or results will be achieved or, if achieved, when. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief at that time with respect to future events. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors, assumptions, uncertainties, and risks that could cause such differences are discussed within Item 1, Business, Item 1A, Risk Factors and Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, included in our Annual Report on Form 10-K, filed with the SEC on September 9, 2014 and other risks outlined in our periodic filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements in this presentation are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect new information, or events or circumstances arising after such date. This presentation includes certain “Non-GAAP” financial measures as defined by SEC rules. We believe that the presentation of certain Non-GAAP financial measures provides information that is useful to investors because it allows for a more direct comparison of our performance for the period with our performance in the comparable prior-year periods. As required by the SEC, we have provided a reconciliation of those measures to the most directly comparable GAAP measures on the Regulation G slides included as slides 14 through 16 of this presentation. We caution that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our reported GAAP results. Forward Looking Statements and Non-GAAP Information

4 Q1-2015 Overview Notes: See “Regulation G Disclosure” slides 14-16 for a reconciliation of GAAP to Non-GAAP financial measures. xrhombus Contract revenue of $510.4 million in Q1-15 compared to $512.7 million in Q1-14 head2right Solid growth from several key customers head2right Declines from rural customers on stimulus projects, partially offset by expanding revenues from customers deploying 1 gigabit wireline networks xrhombus Strong operating results head2right Adjusted EBITDA - Non-GAAP of $66.4 million, or 13.0% of revenue, compared to $63.2 million, or 12.3% in Q1-14 head2right Net income of $0.59 per share diluted in Q1-15 compared to $0.54 per share diluted in Q1-14 xrhombus Acquired Hewitt Power & Communications, Inc. in Q1-15 xrhombus Unprecedented end market opportunities

5 Industry consensus that network bandwidth needs to increase dramatically head2right Major industry participants have initiated significant wireline network deployments head2right Most participants believe newly deployed networks should provision 1 gigabit speeds head2right Industry developments are producing opportunities which are in aggregate unprecedented Dycom well positioned to deliver valuable service to customers head2right Currently providing services for 1 gigabit full deployments across the country in eleven major metropolitan areas to a number of customers head2right Dycom revenues and opportunities driven by this new standard are accelerating head2right Near term customer spending modulations as network strategies adapt and timing uncertainty consistent with the initiation of large scale network deployments Recent regulatory discussions have introduced some unhelpful uncertainty head2right Uncertainty has impacted one customer’s near term plans head2right Dycom does not believe the final resolution will reduce the need to dramatically increase bandwidth in response to consumer demand head2right Trust our country will not shackle one of the most dynamic and competitive sectors of our economy Industry Update

6 3.5% 6.2% 7.5% 10.0% 0.9% (3.8)% (0.7)% (2.4)% 4.0% 10.7% 12.6% 15.8% 4.6% (2.5)% 1.7% 1.6% -10% -5% 0% 5% 10% 15% 20% 25% Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Q4-14 Q1-15 Organic Growth % Organic Growth % - Excluding stimulus revenue Revenue Summary xrhombus Top 5 customers represented 59.4% of revenue in Q1-15 compared to 57.2% in Q1-14 head2right AT&T, Dycom’s largest customer, grew 13.6% organically head2right Comcast, Dycom’s third largest customer, grew 19.8% head2right Dycom’s fifth largest customer, 5.0% of revenue with strong growth in Q1-15 xrhombus Organic growth of 1.6%, excluding services for stimulus funded projects xrhombus Network investments by several large customers head2right Revenue combined from Top 5 customers increased 6.6% organically head2right All other customers declined 13.0% organically Notes: See “Regulation G Disclosure” slides 14-16 for a reconciliation of GAAP to Non-GAAP financial measures. (a) Stimulus revenues comprised of projects funded in part by the American Recovery and Reinvestment Act of 2009. Organic Growth (Decline) – Non-GAAP Revenue % by Customer – Top 5 in Q1-15 (a) Q1-15 Revenue Highlights 0% 4% 8% 12% 16% 20% 24% AT&T CenturyLink Comcast Verizon Unnamed customerQ1-15 Q1-14

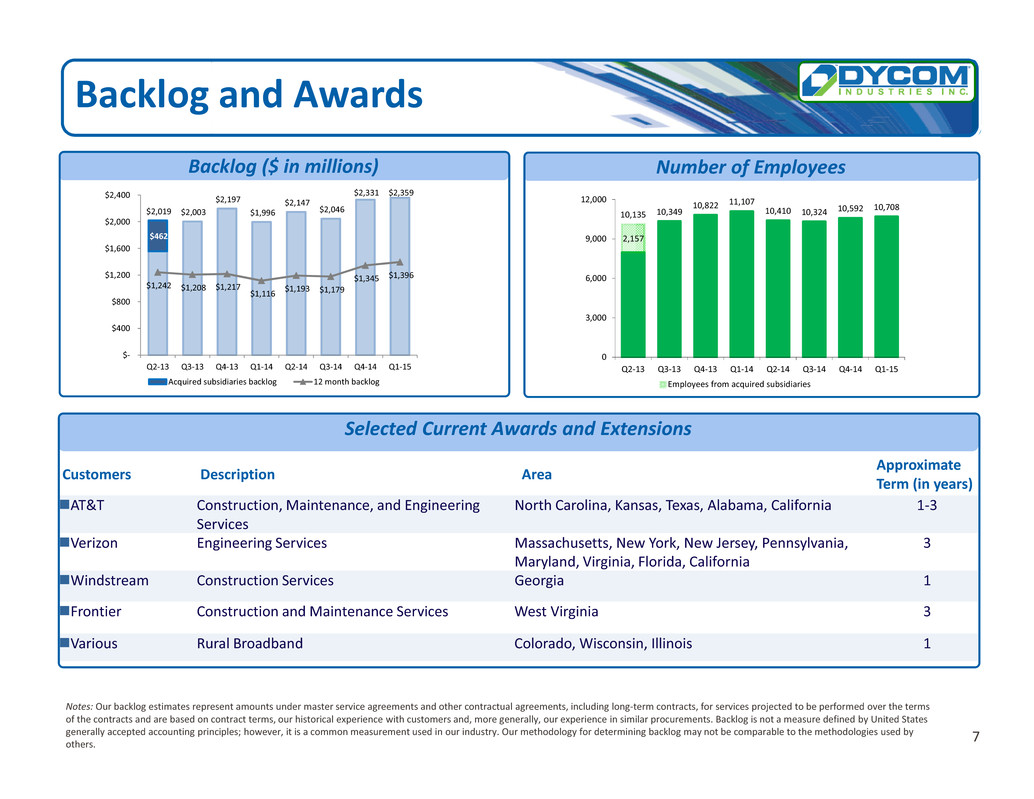

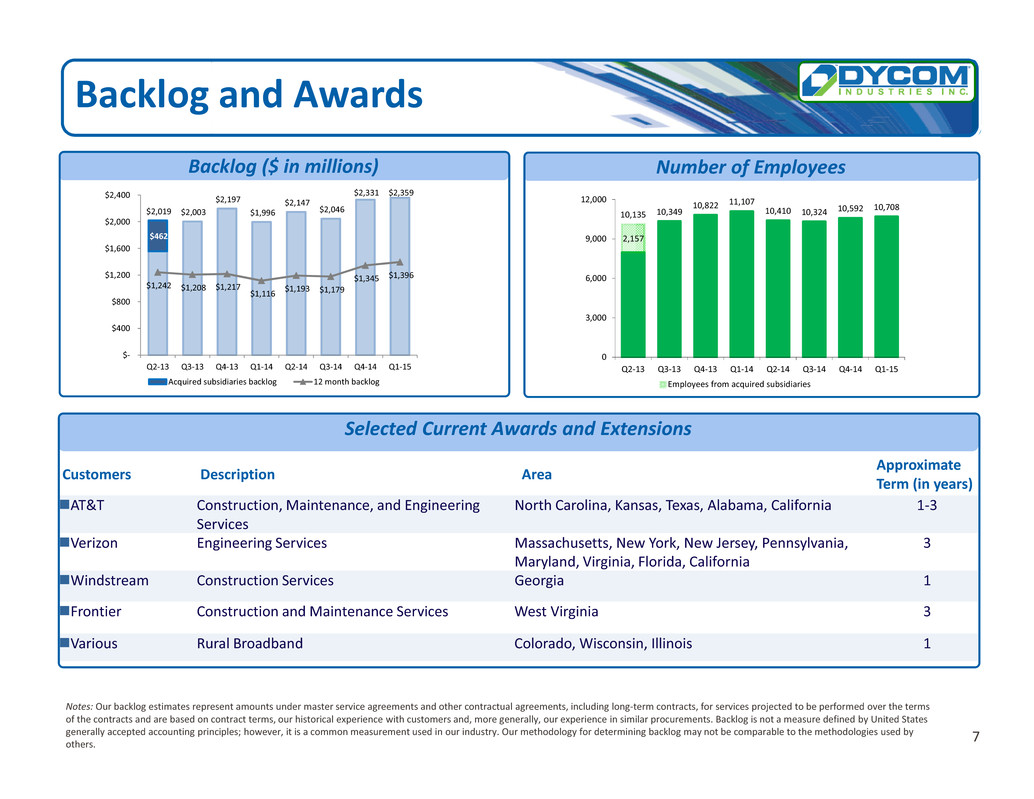

7 Customers Description Area Approximate Term (in years) square6AT&T Construction, Maintenance, and Engineering Services North Carolina, Kansas, Texas, Alabama, California 1-3 square6Verizon Engineering Services Massachusetts, New York, New Jersey, Pennsylvania, Maryland, Virginia, Florida, California 3 square6Windstream Construction Services Georgia 1 square6Frontier Construction and Maintenance Services West Virginia 3 square6Various Rural Broadband Colorado, Wisconsin, Illinois 1 Backlog and Awards Backlog ($ in millions) Number of Employees Selected Current Awards and Extensions Notes: Our backlog estimates represent amounts under master service agreements and other contractual agreements, including long-term contracts, for services projected to be performed over the terms of the contracts and are based on contract terms, our historical experience with customers and, more generally, our experience in similar procurements. Backlog is not a measure defined by United States generally accepted accounting principles; however, it is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by others. 2,157 10,135 10,349 10,822 11,107 10,410 10,324 10,592 10,708 0 3,000 6,000 9,000 12,000 Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Q4-14 Q1-15 Employees from acquired subsidiaries $462 $2,019 $2,003 $2,197 $1,996 $2,147 $2,046 $2,331 $2,359 $1,242 $1,208 $1,217 $1,116 $1,193 $1,179 $1,345 $1,396 $- $400 $800 $1,200 $1,600 $2,000 $2,400 Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Q4-14 Q1-15 Acquired subsidiaries backlog 12 month backlog

8 $510.4 $512.7 $150 $250 $350 $450 $550 Q1-15 Q1-14 Summary Results Contract Revenues ($ in millions) Adjusted EBITDA – Non-GAAP ($ in millions) Net Income and EPS ($ in millions, except EPS) Earnings per share of $0.59 in Q1-15 a historic high Q1-14 Net income $ 20.8 $ 18.7 Fully Diluted EPS $ 0.59 $ 0.54 Q1-15 $66.4 $63.2 $- $10 $20 $30 $40 $50 $60 $70 Q1-15 Q1-14 Adjusted EBITDA - Non-GAAP as a % of revenues: 13.0% 12.3% Notes: See “Regulation G Disclosure” slides 14-16 for a reconciliation of GAAP to Non-GAAP financial measures.

9 Selected Financial Information Notes: Amounts above may not add due to rounding. Additionally, see “Regulation G Disclosure” slides 14-16 for a reconciliation of GAAP to Non-GAAP financial measures. (a) Gross Margin % calculated as the excess of contract revenues over cost of earned revenues as a percentage of contract revenues for the applicable period. (b) Percentages represent Adjusted EBITDA - Non-GAAP as a percentage of contract revenues for the applicable period. Q1-15 Commentary xrhombus Contract revenue of $510.4 million compared to $512.7 million in Q1-14 head2right Growth from several key customers head2right Declines from rural customers on stimulus projects and customer spending modulations xrhombus Adjusted EBITDA 13.0% of revenue in Q1-15 compared to 12.3% in Q1-14 head2right Gross margin improvement of 94 basis points head2right General & administrative expenses reflect scale and addition of recently acquired businesses ($ in millions, except earnings per share) Q1-15 Q1-14 Change Contract Revenues $ 510.4 $ 512.7 $ (2.3) Cost of Earned Revenues $ 403.5 $ 410.1 $ (6.7) Gross Margin % (a) 20.95% 20.01% General & Administrative $ 44.7 $ 43.1 $ 1.6 Depreciation $ 18.8 $ 18.4 $ 0.4 Amortization $ 4.1 $ 5.2 $ (1.1) Interest Expense, net $ 6.7 $ 6.9 $ (0.1) Other Income, net $ 1.8 $ 2.0 $ (0.2) Net Income $ 20.8 $ 18.7 $ 2.1 Diluted Earnings Per Share $ 0.59 $ 0.54 $ 0.05 Adjusted EBITDA $ 66.4 $ 63.2 $ 3.2 Non-GAAP (b) 13.0% 12.3%

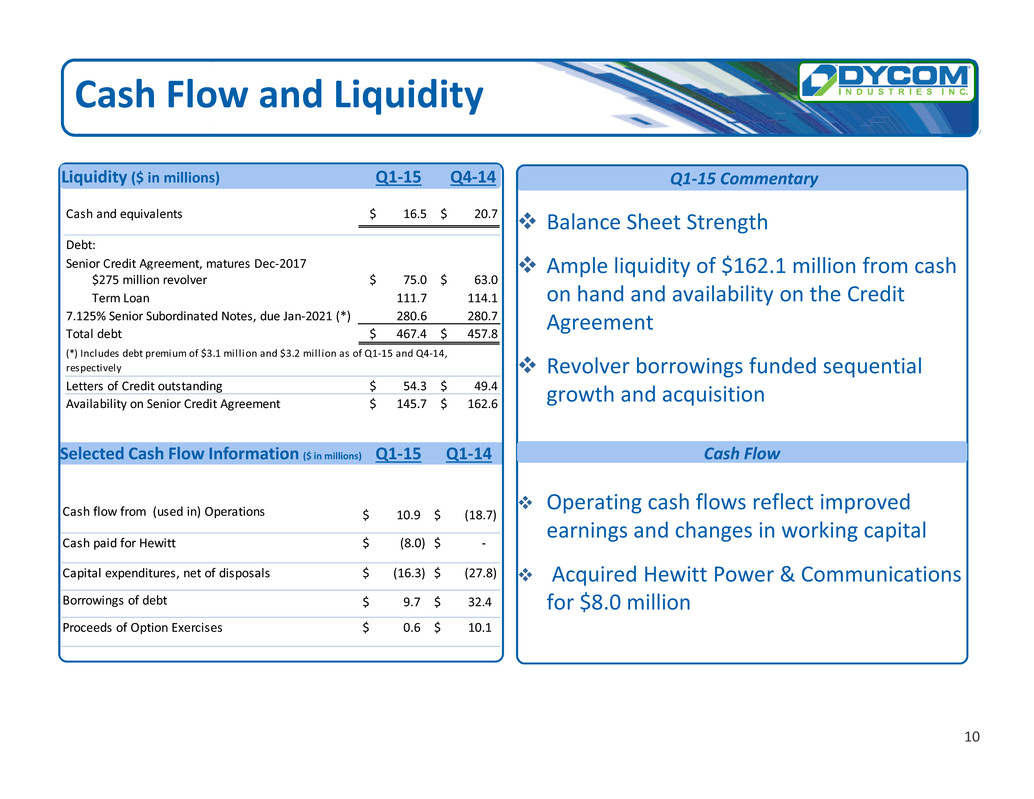

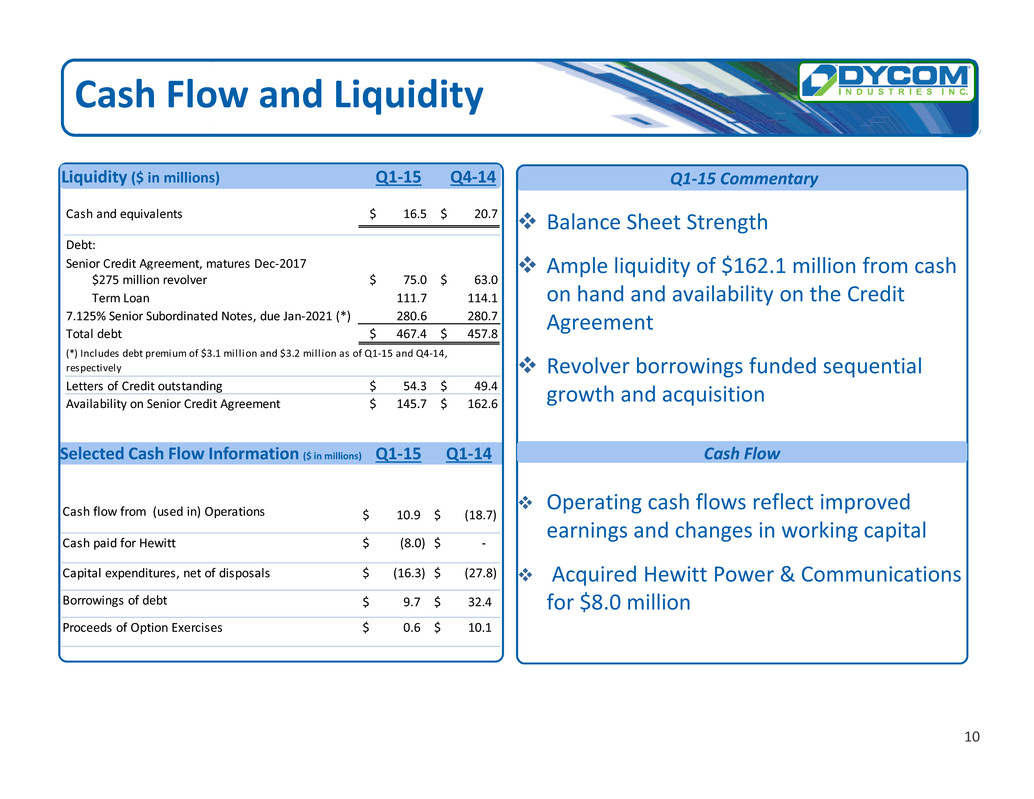

10 Cash Flow and Liquidity xrhombus Balance Sheet Strength xrhombus Ample liquidity of $162.1 million from cash on hand and availability on the Credit Agreement xrhombus Revolver borrowings funded sequential growth and acquisition xrhombus Operating cash flows reflect improved earnings and changes in working capital xrhombus Acquired Hewitt Power & Communications for $8.0 million Q1-15 Commentary Selected Cash Flow Information ($ in millions) Q1-15 Q1-14 Cash Flow Liquidity ($ in millions) Q1-15 Q4-14 $ 10.9 $ (18.7) $ (8.0) $ - $ (16.3) $ (27.8) $ 9.7 $ 32.4 $ 0.6 $ 10.1 Borrowings of debt Proceeds of Option Exercises Cash flow from (used in) Operations Capital expenditures, net of disposals Cash paid for Hewitt $ 16.5 $ 20.7 $ 75.0 $ 63.0 111.7 114.1 280.6 280.7 $ 467.4 $ 457.8 $ 54.3 $ 49.4 $ 145.7 $ 162.6 (*) Includes debt premium of $3.1 mil lion and $3.2 mil l ion as of Q1-15 and Q4-14, respectively Letters of Credit outstanding Availability on Senior Credit Agreement $275 million revolver Cash and equivalents Term Loan Debt: Senior Credit Agreement, matures Dec-2017 Total debt 7.125% Senior Subordinated Notes, due Jan-2021 (*)

11 Q2-2015 Outlook Included for comparison Contract Revenues $390.5 $410.0 - $430.0 xrhombus Expectation of normal winter weather patterns xrhombus Network investments by several large customers xrhombus Lower revenue from rural customers on stimulus projects xrhombus Customer spending modulations as strategies adapt to a changing environment Gross Margin % (as a percent of revenue) 16.2% Gross Margin % which expands year- over-year xrhombus Expectation of normal winter weather xrhombus Improving mix of customer growth opportunities xrhombus Fiscal Q2 gross margins display impacts of seasonality including: . *inclement winter weather *fewer available workdays due to holidays *reduced daylight work hours *restart of calendar payroll taxes G&A Expense % (as a percent of revenue) Includes stock-based compensation 9.9% 10.1% - 10.5% Includes stock-based compensation xrhombus G&A expense reflecting scale and recent M&A xrhombus Includes stock-based compensation of approximately $3.7 million Depreciation & Amortization $23.4 $23.4 - $23.7 xrhombus Depreciation increases from recent M&A and cap-ex xrhombus Includes amortization of $4.1 million in Q2-15 compared to $4.8 in Q2-14 Interest Expense $6.8 Approximately $6.7 xrhombus Interest expense reflects expected level of borrowings Other Income $0.6 $1.4 - $1.7 xrhombus Other income from asset disposals Adjusted EBITDA % - Non-GAAP (as a percent of revenue) 7.2% Adjusted EBITDA % expands from Q2-14 result xrhombus Adjusted EBITDA reflects gross margin improvement partially offset by higher G&A expense Earnings (Loss) Per Share– Diluted $(0.09) $0.07 - $0.14 per share diluted xrhombus Revenue range and operating results drive earnings per share outlook Diluted Shares (in millions)(a) 33.8 Approximately 35.2 xrhombus Diluted shares reflect vesting of employee equity awards Notes: See “Regulation G Disclosure” slides 14-16 for a reconciliation of GAAP to Non-GAAP financial measures. (a) Basic and diluted shares at 33.8 million for Q2-2014 due to net loss for the quarter Q2-2014 Q2-2015 Year Over Year Commentary on Outlook Outlook (Q2-2015 amounts are estimates – actual amounts may differ) ($ in millions, except earnings per share)

12 Looking Ahead to Fiscal Q3-2015 Looking Ahead Commentary ($ in millions) (Q3-2015 amounts are estimates – actual amounts may differ) Q3-14 ($ in millions) Included for comparison Contract Revenues xrhombus Expectation of normal winter weather patterns during early Q3-15 xrhombus Network investments by several large customers xrhombus Lower revenue from rural customers on stimulus projects xrhombus Customer spending modulations as strategies adapt to a changing environment xrhombus Normal timing uncertainty associated with large scale network deployments xrhombus Total revenue % growth of mid to high single digits compared to Q3-14 result $ 426.3 Gross Margin % (as a percent of revenue) xrhombus Gross margins which expand year over year with the expectation of normal winter weather during early Q3-15 and an improving mix of customer growth opportunities 17.8% G&A Expense (G&A % as a percent of revenue) Includes stock-based compensation xrhombus G&A expense in-line as a % of revenues year over year xrhombus Includes stock-based compensation of approximately $3.3 in Q3-15 $ 39.2 9.2% Adjusted EBITDA % – Non-GAAP xrhombus Adjusted EBITDA % which expands from Q3-14 9.3% Other Factors: Depreciation & Amortization xrhombus Ranges from $23.5 - $24.0 in Q3-15 xrhombus Includes amortization of approximately $4.1 in Q3-15 $ 22.7 Interest Expense xrhombus $6.6 - $6.7 in Q3-15 $ 6.6 Other Income xrhombus $3.0 - $4.0 in Q3-15 $ 5.6 Notes: See “Regulation G Disclosure” slides 14-16 for a reconciliation of GAAP to Non-GAAP financial measures.

13 Looking Ahead Firm and strengthening end market opportunities head2right Telephone companies deploying FTTX to enable video offerings and 1 gigabit connections head2right Cable operators continuing to deploy fiber to small and medium businesses with cable capital expenditures and new build opportunities expanding head2right Wireless carriers upgrading from 3G to 4G technologies and increasing 4G capacity head2right Industry participants aggressively extending or deploying fiber networks to provide wireless backhaul services head2right Projects funded by Connect America Fund are deploying fiber deeper into rural networks Encouraged that industry participants remain committed to multi- year capital spending initiatives which in some cases are meaningfully accelerating and expanding in scope

14 Appendix: Regulation G Disclosure Notes: Amounts above may not add due to rounding. The above table presents a reconciliation of the Non-GAAP financial measure of Adjusted EBITDA for the periods specified to the most directly comparable GAAP measure. Adjusted EBITDA is a Non-GAAP financial measure within the meaning of Regulation G promulgated by the Securities and Exchange Commission. The Company defines Adjusted EBITDA - Non-GAAP as earnings before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, and certain non-recurring items. The Company believes this Non-GAAP financial measure provides information that is useful to the Company’s investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the Company’s results of operations in any particular period. Additionally, the Company uses this Non-GAAP financial measure to evaluate its past performance and prospects for future performance. Adjusted EBITDA is not a recognized term under GAAP and does not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. Adjusted EBITDA - Reconciliation of GAAP to Non-GAAP Measures ($ in 000's) Q1-15 Q1-14 Q2-14 Q3-14 Three Months Three Months Three Months Three Months Ended Ended Ended Ended October 25, October 26, January 25, April 26, 2014 2013 2014 2014 Reconciliation of net income (loss) to Adjusted EBITDA -Non-GAAP: Net income (loss) $ 20,807 $ 18,660 $ (3,067) $ 7,895 Interest expense, net 6,749 6,886 6,800 6,563 Provision (benefit) for income taxes 13,534 12,440 (1,970) 5,179 Depreciation and amortization expense 22,930 23,552 23,435 22,726 Earnings Before Interest, Taxes, Depreciation & Amortization ("EBITDA") 64,020 61,538 25,198 42,363 Gain on sale of fixed assets (1,523) (1,865) (570) (5,469) Stock-based compensation expense 3,890 3,506 3,544 2,671 Adjusted EBITDA - Non-GAAP $ 66,387 $ 63,179 $ 28,172 $ 39,565 Contract revenues $ 510,389 $ 512,720 $ 390,518 $ 426,284 Adjusted EBITDA - Non-GAAP as a % of contract revenues 13.0% 12.3% 7.2% 9.3%

15 Notes: Amounts above may not add due to rounding. (a) Organic Revenue – Non-GAAP are revenues from businesses that are included for the full period in both the current and prior year quarter, excluding storm restoration services, if any. Organic Revenue growth is calculated as the percentage increase in revenues over those of the comparable prior year period (fiscal quarter) for revenues from businesses that are included in both periods for the full fiscal period, excluding revenues from storm restoration services, if any. (b) For comparisons of Organic Revenue beginning with Q3-14, Organic Revenue – Non-GAAP includes revenues of businesses acquired in Q2-13 (“Acquired Subsidiaries”) as the revenues from these businesses are included in both quarters (Q3-14 and Q3-13). (c) Organic revenues from customers for stimulus work is comprised of projects funded in part by the American Recovery and Reinvestment Act of 2009. Revenues from stimulus work included in the Non-GAAP adjustments include all stimulus revenues beginning with Q3-14 organic calculation when the Acquired Subsidiaries were in both periods. Appendix: Regulation G Disclosure Contract Revenue and Organic Growth - Reconciliation of GAAP to Non-GAAP Measures ($ in millions) The table below reconciles GAAP revenue growth (decline) to Non-GAAP organic revenue growth (decline). NON-GAAP ADJUSTMENTS GAAP % NON-GAAP - Organic % (a) NON-GAAP - Organic % excluding stimulus (a) (c) Q1-15 Organic Growth: Q1-15 510.4$ (10.1)$ -$ 500.3$ (14.0)$ 486.3$ (0.5)% (2.4)% 1.6% Q1-14 512.7$ -$ -$ 512.7$ (34.2)$ 478.6$ Prior Quarters Organic Growth (Decline): Q4-14 482.1$ (9.5)$ -$ 472.6$ (23.8)$ 448.7$ 0.7% (0.7)% 1.7% Q4-13 478.6$ (2.6)$ -$ 476.1$ (34.8)$ 441.3$ Q3-14 426.3$ (5.6)$ -$ 420.7$ (26.0)$ 394.7$ (2.5)% (3.8)% (2.5)% Q3-13 437.4$ -$ -$ 437.4$ (32.5)$ 404.8$ Q2-14 390.5$ (111.5)$ -$ 279.0$ (11.0)$ 268.1$ 5.7% 0.9% 4.6% Q2-13 369.3$ (75.9)$ (16.7)$ 276.7$ (20.3)$ 256.4$ Q1-14 512.7$ (157.1)$ -$ 355.6$ (19.7)$ 335.9$ 58.6% 10.0% 15.8% Q1-13 323.3$ -$ -$ 323.3$ (33.1)$ 290.2$ Q4-13 478.6$ (139.1)$ -$ 339.5$ (19.9)$ 319.6$ 50.5% 7.5% 12.6% Q4-12 318.0$ -$ (2.3)$ 315.8$ (31.9)$ 283.9$ Q3-13 437.4$ (122.9)$ -$ 314.5$ (19.0)$ 295.5$ 47.7% 6.2% 10.7% Q3-12 296.1$ -$ -$ 296.1$ (29.2)$ 266.9$ Q2-13 369.3$ (75.9)$ (16.7)$ 276.7$ (20.3)$ 256.4$ 38.1% 3.5% 4.0% Q2-12 267.4$ -$ -$ 267.4$ (20.8)$ 246.6$ NON-GAAP ADJUSTMENTS NON-GAAP Organic Contract Revenues - Excluding stimulus (a) Revenue Growth (Decline) % Revenues from businesses acquired (a) Revenues from storm restoration services Organic revenues from customers for stimulus work (c) NON-GAAP Organic Contract Revenues (a)(b) GAAP Contract Revenues

16 Notes: Amounts above may not add due to rounding. (a) Organic Revenue – Non-GAAP are revenues from businesses that are included for the full period in both the current and prior year quarter presented, excluding storm restoration services, if any. Organic Revenue growth is calculated as the percentage increase in revenues over those of the comparable prior year period (fiscal quarter) for revenues from businesses that are included in both periods for the full fiscal period, excluding revenues from storm restoration services, if any. Appendix: Regulation G Disclosure Contract Revenue and Organic Growth - Reconciliation of GAAP to Non-GAAP Measures ($ in millions) The table below reconciles GAAP revenue growth to Non-GAAP organic revenue growth (decline). Total Contract Revenue Top 5 Customers combined* All customers (excluding Top 5 Customers) AT&T Comcast GAAP Revenue Q1-15 510.4$ 303.2$ 207.2$ 108.5$ 65.1$ Q1-14 512.7$ 276.5$ 236.2$ 89.7$ 54.0$ GAAP Revenue - % Changes (0.5)% 9.7% (12.3)% 20.9% 20.7% Non-GAAP Adjustments Q1-15 - Revenue from businesses acquired in Q1-15 and Q4-14 (10.1)$ (8.5)$ (1.6)$ (6.6)$ (0.5)$ Non-GAAP Revenue Q1-15 500.3$ 294.7$ 205.6$ 101.8$ 64.7$ Q1-14 512.7$ 276.5$ 236.2$ 89.7$ 54.0$ Non-GAAP Revenue - % Changes (a) Organic Revenue % Change (excluding revenue from businesses acquired in Q1-15 and Q4-14) (2.4)% 6.6% (13.0)% 13.6% 19.8% * Includes AT&T, Comcast, CenturyLink, Verizon, and an unnamed customer in both Q1-15 and Q1-14

Click to edit Master title style Click to edit Master subtitle style Fiscal 2015 1st Quarter Presentation November 25, 2014