Investor Presentation November & December 2017 Exhibit 99.1

2 Forward Looking Statements and Non-GAAP Information This presentation contains “forward-looking statements”. Other than statements of historical facts, all statements contained in this presentation, including statements regarding the Company’s future financial position, future revenue, prospects, plans and objectives of management, are forward-looking statements. Words such as “outlook,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “should,” “could,” “project,” and similar expressions, as well as statements in future tense, identify forward-looking statements. You should not consider forward-looking statements as a guarantee of future performance or results. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief at that time with respect to future events. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors, assumptions, uncertainties, and risks that could cause such differences are discussed in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on September 1, 2017, our Quarterly Report on Form 10-Q filed with the SEC on November 22, 2017, and other filings with the SEC. The forward-looking statements in this presentation are expressly qualified in their entirety by this cautionary statement. The Company undertakes no obligation to update these forward-looking statements to reflect new information, or events or circumstances arising after such date. This presentation includes certain “Non-GAAP” financial measures as defined by Regulation G of the SEC. As required by the SEC, we have provided a reconciliation of those measures to the most directly comparable GAAP measures on the Regulation G slides included as slides 30 through 36 of this presentation. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our reported GAAP results.

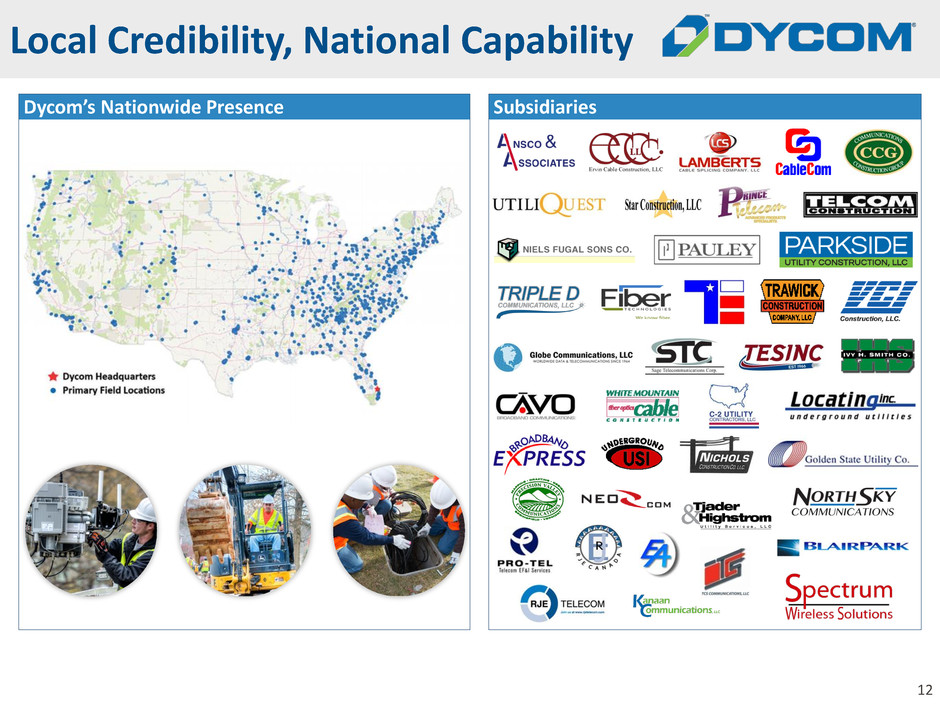

3 Nationwide footprint Operates in all 50 states, Washington, D.C. and in Canada Over 40 operating subsidiaries and over 14,000 employees Strong revenue base, customer relationships and profitable results Contract revenues of $756.2 million in Q1-18, included $15.5 million in revenue from storm restoration services. Non-GAAP Adjusted EBITDA of $97.6 million, or 12.9% of revenues in Q1-18 Non-GAAP Adjusted Diluted EPS of $0.99 in Q1-18 Solid financial profile Liquidity of $425.8 million at October 28, 2017, consisting of cash and availability under our credit facility No outstanding revolver borrowings at the end of Q1-18 Repurchased 200,000 common shares for $16.9 million at an average price of $84.38 per share Dycom Overview See “Regulation G Disclosure” slides 30-36 for a reconciliation of GAAP to Non-GAAP financial measures. Leading supplier of specialty contracting services to telecommunication providers

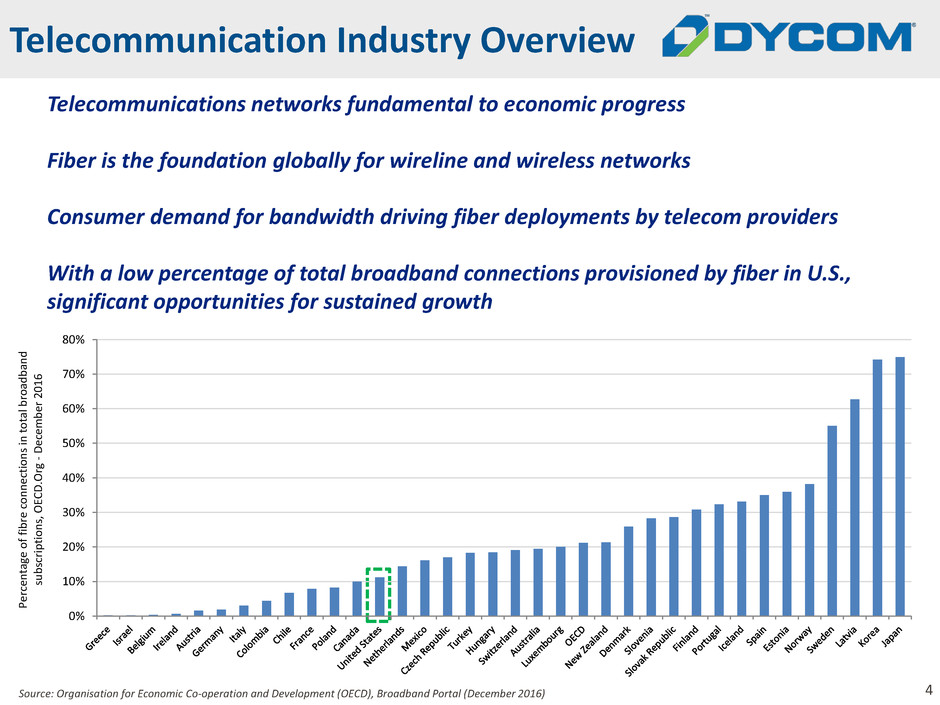

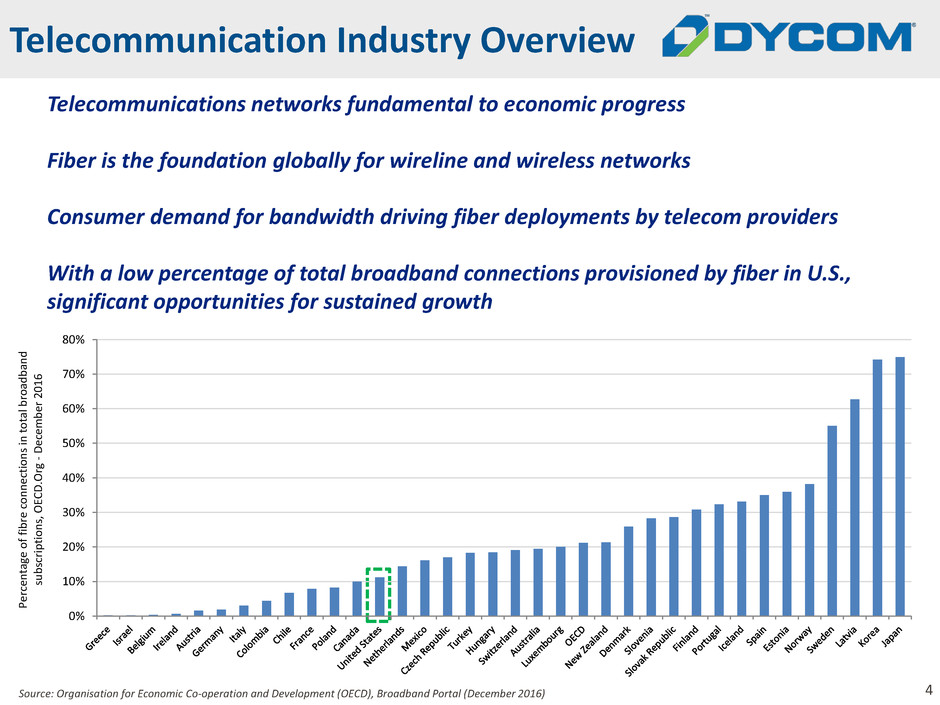

4 Telecommunications networks fundamental to economic progress Fiber is the foundation globally for wireline and wireless networks Consumer demand for bandwidth driving fiber deployments by telecom providers With a low percentage of total broadband connections provisioned by fiber in U.S., significant opportunities for sustained growth Telecommunication Industry Overview Source: Organisation for Economic Co-operation and Development (OECD), Broadband Portal (December 2016) 0% 10% 20% 30% 40% 50% 60% 70% 80% Pe rc en tag e o f fi b re c o n n ec tio n s in t o tal b ro ad b an d su b sc ri p tio n s, O EC D .Or g - D ec em b er 2 0 1 6

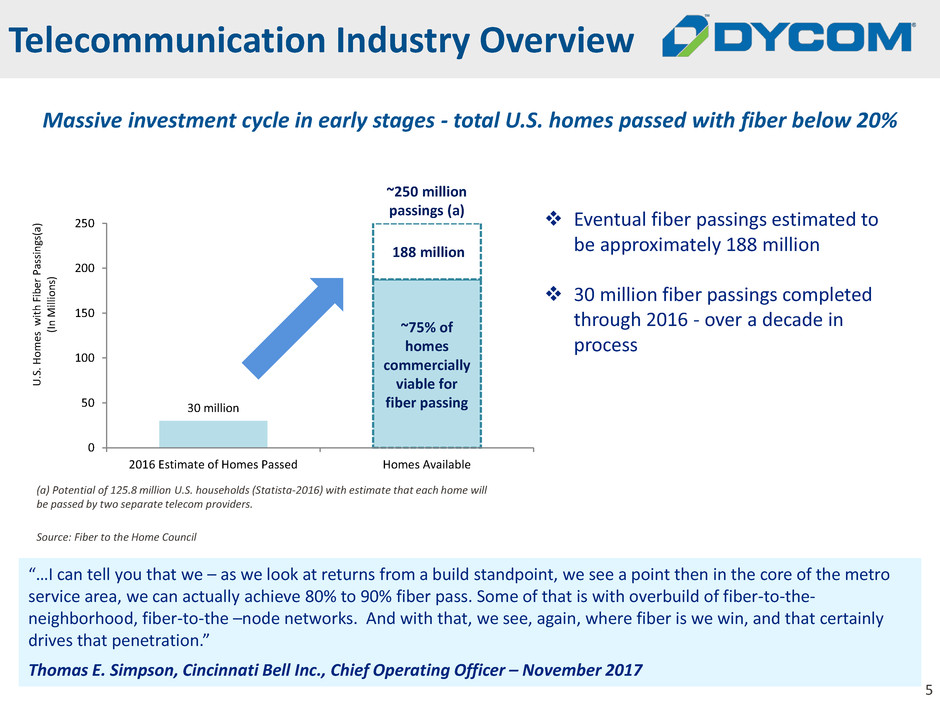

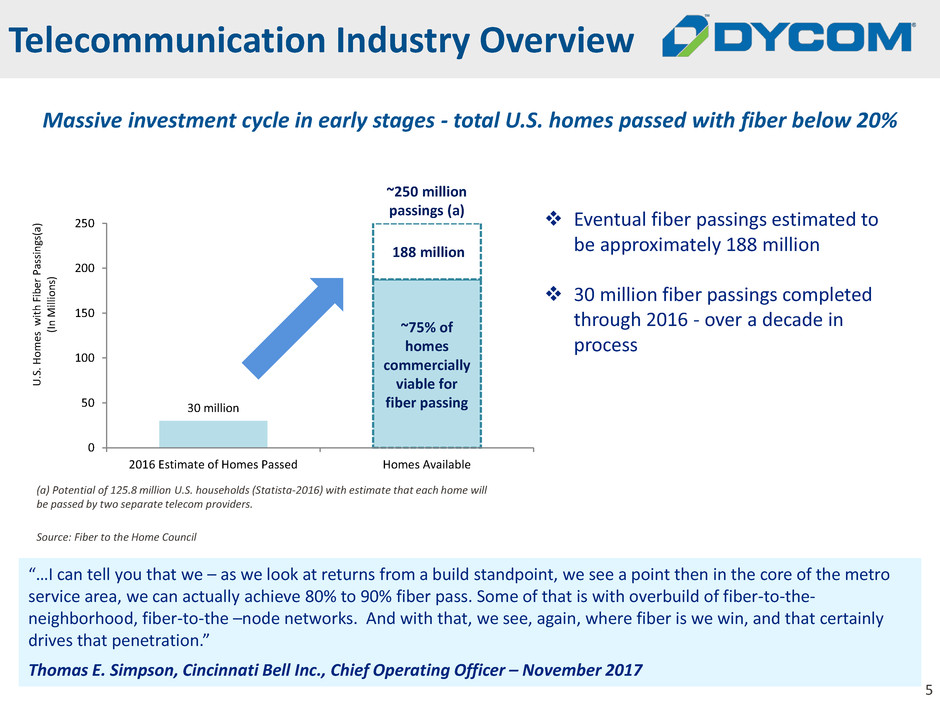

5 30 million 0 50 100 150 200 250 2016 Estimate of Homes Passed Homes Available U. S. H o m es w it h F ib er P as si n gs (a ) (I n M ill io n s) Massive investment cycle in early stages - total U.S. homes passed with fiber below 20% (a) Potential of 125.8 million U.S. households (Statista-2016) with estimate that each home will be passed by two separate telecom providers. Source: Fiber to the Home Council 188 million ~75% of homes commercially viable for fiber passing ~250 million passings (a) Eventual fiber passings estimated to be approximately 188 million 30 million fiber passings completed through 2016 - over a decade in process Telecommunication Industry Overview “…I can tell you that we – as we look at returns from a build standpoint, we see a point then in the core of the metro service area, we can actually achieve 80% to 90% fiber pass. Some of that is with overbuild of fiber-to-the- neighborhood, fiber-to-the –node networks. And with that, we see, again, where fiber is we win, and that certainly drives that penetration.” Thomas E. Simpson, Cincinnati Bell Inc., Chief Operating Officer – November 2017

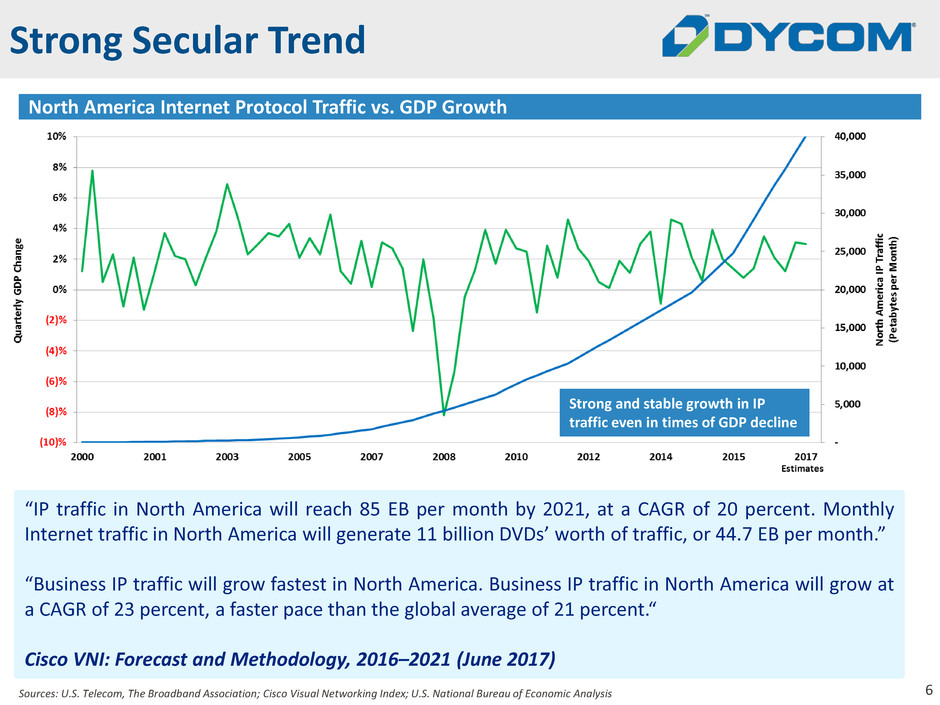

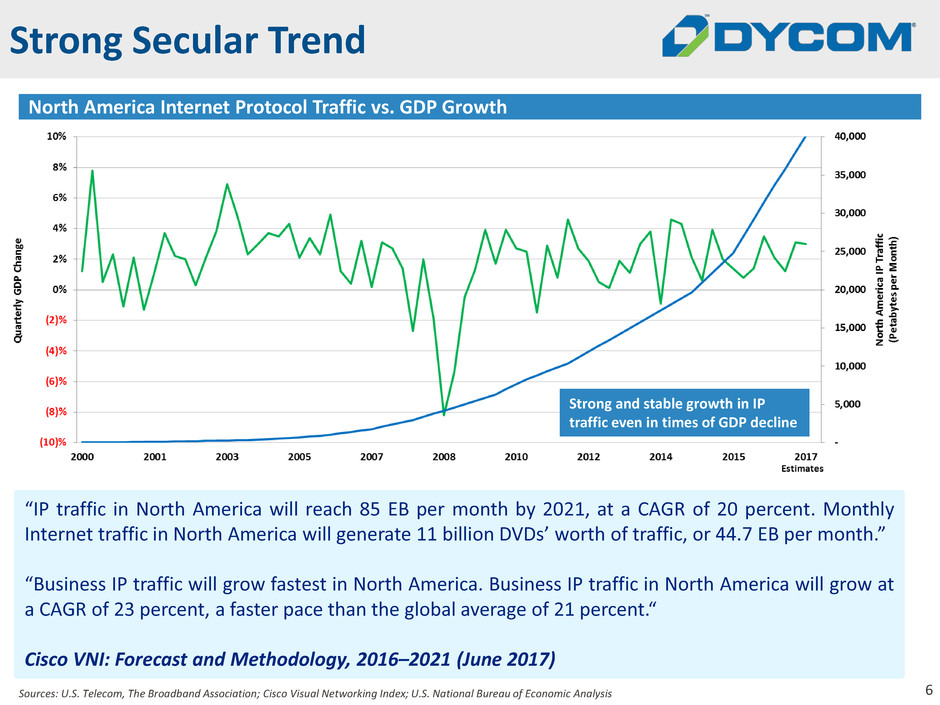

6 Strong Secular Trend “IP traffic in North America will reach 85 EB per month by 2021, at a CAGR of 20 percent. Monthly Internet traffic in North America will generate 11 billion DVDs’ worth of traffic, or 44.7 EB per month.” “Business IP traffic will grow fastest in North America. Business IP traffic in North America will grow at a CAGR of 23 percent, a faster pace than the global average of 21 percent.“ Cisco VNI: Forecast and Methodology, 2016–2021 (June 2017) North America Internet Protocol Traffic vs. GDP Growth Sources: U.S. Telecom, The Broadband Association; Cisco Visual Networking Index; U.S. National Bureau of Economic Analysis Strong and stable growth in IP traffic even in times of GDP decline

7 Industry drivers Firm and strengthening end market opportunities Fiber deployments in contemplation of newly emerging wireless technologies have begun in many regions of the country. A significant number of new project initiations will occur in the near term. Wireless construction activity in support of expanded coverage and capacity is poised to accelerate. Telephone companies deploying FTTH to enable video offerings and 1 gigabit connections. This activity is expected to reaccelerate in the near term. Cable operators continuing to deploy fiber to small and medium businesses and enterprises with increasing urgency. Fiber deep deployments to expand capacity, new build opportunities and overall cable capital expenditures are increasing. Customers are consolidating supply chains creating opportunities for market share growth and increasing the long-term value of our maintenance business. We are increasingly providing integrated planning, engineering and design, procurement and construction and maintenance services for our customers. Encouraged that industry participants are committed to multi-year capital spending initiatives; these initiatives are increasing in numbers across multiple customers

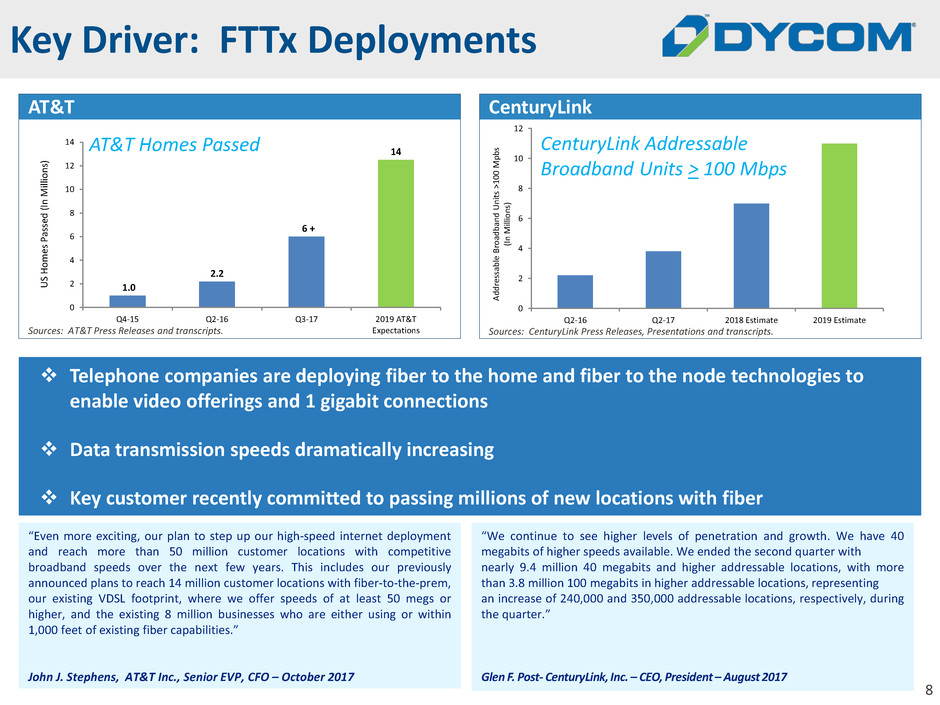

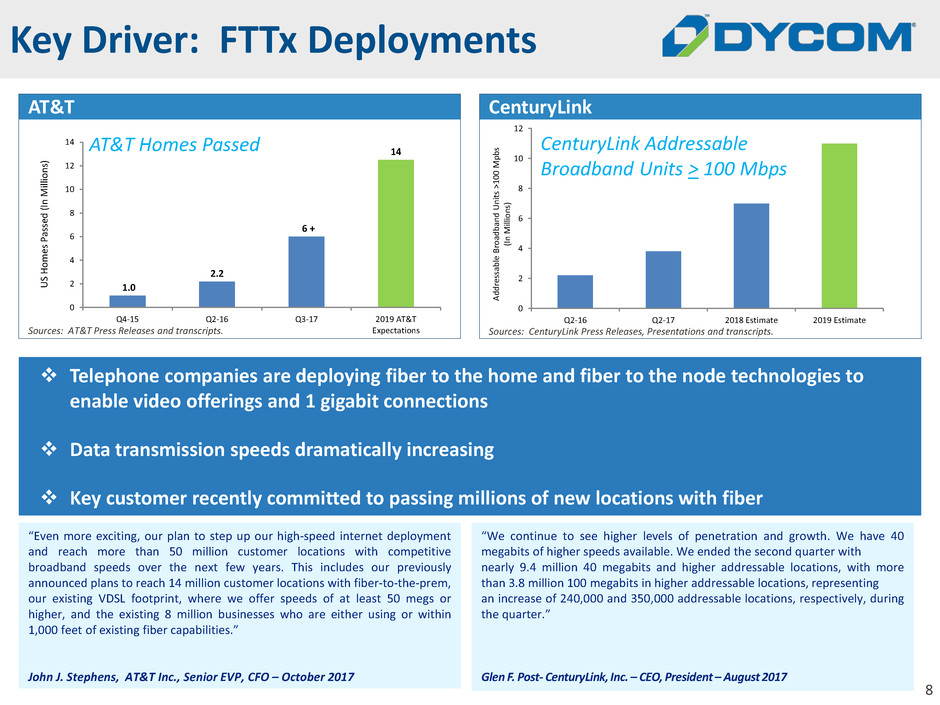

8 1.0 2.2 6 + 14 0 2 4 6 8 10 12 14 Q4-15 Q2-16 Q3-17 2019 AT&T Expectations U S H o m es P as se d ( In M ill io n s) 0 2 4 6 8 10 12 Q2-16 Q2-17 2018 Estimate 2019 Estimate A d d re ss ab le B ro ad b an d U n it s >1 0 0 M p b s (I n M ill io n s) Key Driver: FTTx Deployments “Even more exciting, our plan to step up our high-speed internet deployment and reach more than 50 million customer locations with competitive broadband speeds over the next few years. This includes our previously announced plans to reach 14 million customer locations with fiber-to-the-prem, our existing VDSL footprint, where we offer speeds of at least 50 megs or higher, and the existing 8 million businesses who are either using or within 1,000 feet of existing fiber capabilities.” John J. Stephens, AT&T Inc., Senior EVP, CFO – October 2017 Telephone companies are deploying fiber to the home and fiber to the node technologies to enable video offerings and 1 gigabit connections Data transmission speeds dramatically increasing Key customer recently committed to passing millions of new locations with fiber Sources: AT&T Press Releases and transcripts. AT&T CenturyLink Sources: CenturyLink Press Releases, Presentations and transcripts. AT&T Homes Passed CenturyLink Addressable Broadband Units > 100 Mbps “We continue to see higher levels of penetration and growth. We have 40 megabits of higher speeds available. We ended the second quarter with nearly 9.4 million 40 megabits and higher addressable locations, with more than 3.8 million 100 megabits in higher addressable locations, representing an increase of 240,000 and 350,000 addressable locations, respectively, during the quarter.” Glen F. Post- CenturyLink, Inc. – CEO, President – August 2017

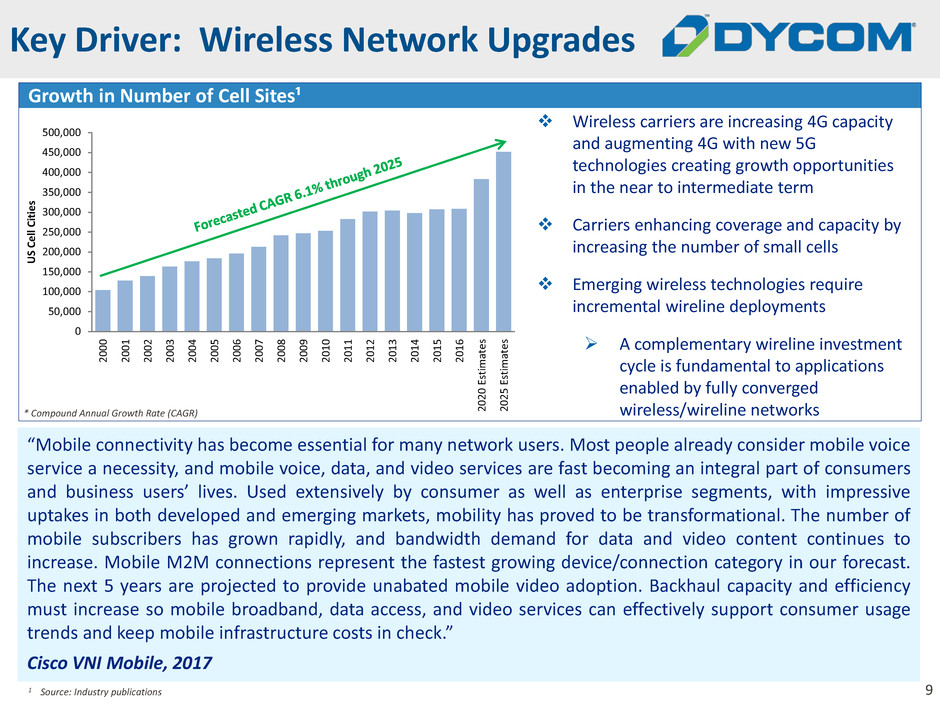

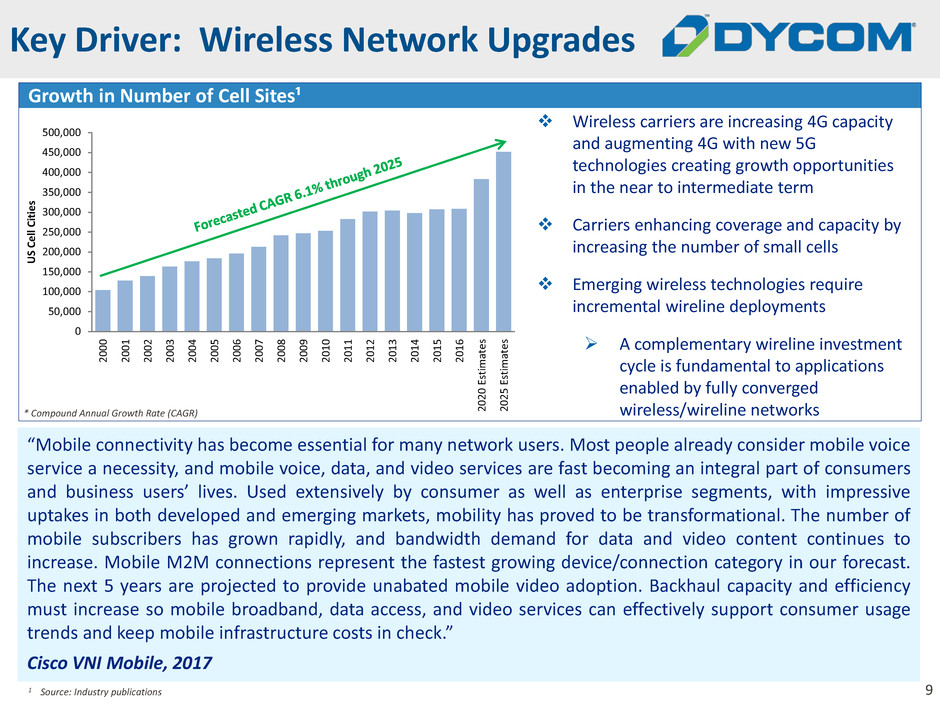

9 Key Driver: Wireless Network Upgrades “Mobile connectivity has become essential for many network users. Most people already consider mobile voice service a necessity, and mobile voice, data, and video services are fast becoming an integral part of consumers and business users’ lives. Used extensively by consumer as well as enterprise segments, with impressive uptakes in both developed and emerging markets, mobility has proved to be transformational. The number of mobile subscribers has grown rapidly, and bandwidth demand for data and video content continues to increase. Mobile M2M connections represent the fastest growing device/connection category in our forecast. The next 5 years are projected to provide unabated mobile video adoption. Backhaul capacity and efficiency must increase so mobile broadband, data access, and video services can effectively support consumer usage trends and keep mobile infrastructure costs in check.” Cisco VNI Mobile, 2017 Wireless carriers are increasing 4G capacity and augmenting 4G with new 5G technologies creating growth opportunities in the near to intermediate term Carriers enhancing coverage and capacity by increasing the number of small cells Emerging wireless technologies require incremental wireline deployments A complementary wireline investment cycle is fundamental to applications enabled by fully converged wireless/wireline networks Growth in Number of Cell Sites¹ 1 Source: Industry publications * Compound Annual Growth Rate (CAGR) 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 500,000 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2020 Es ti mat e s 2025 Es ti mat e s U S C e ll C it ie s

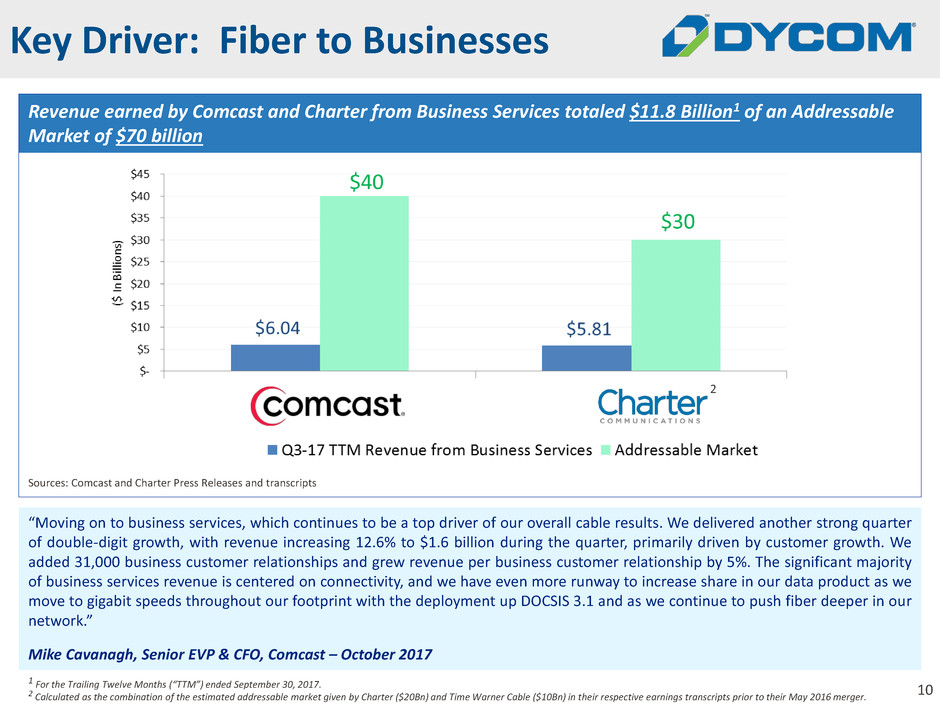

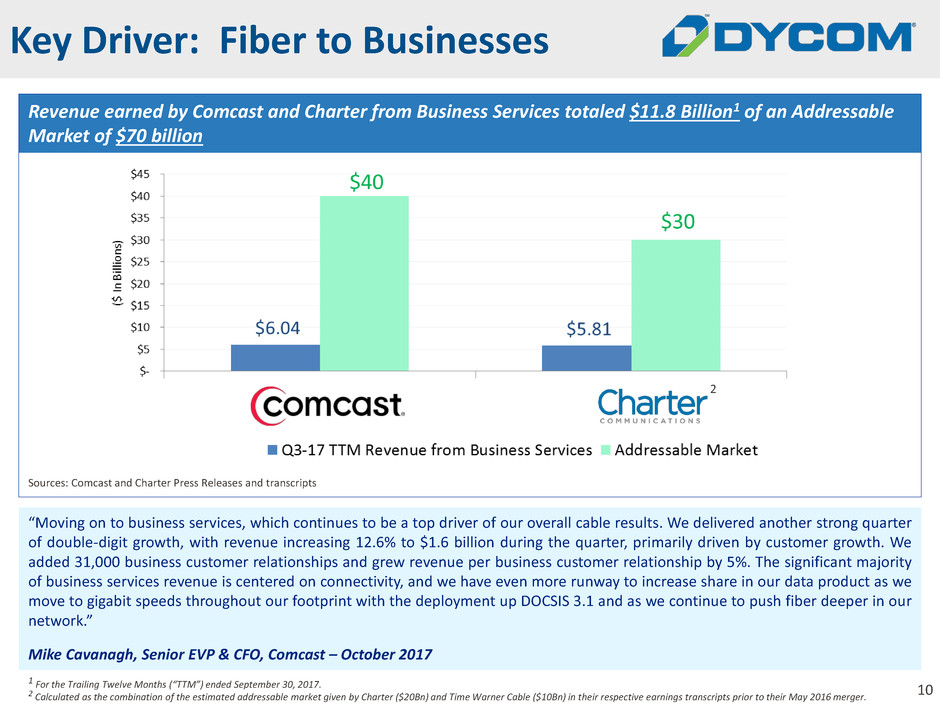

10 “Moving on to business services, which continues to be a top driver of our overall cable results. We delivered another strong quarter of double-digit growth, with revenue increasing 12.6% to $1.6 billion during the quarter, primarily driven by customer growth. We added 31,000 business customer relationships and grew revenue per business customer relationship by 5%. The significant majority of business services revenue is centered on connectivity, and we have even more runway to increase share in our data product as we move to gigabit speeds throughout our footprint with the deployment up DOCSIS 3.1 and as we continue to push fiber deeper in our network.” Mike Cavanagh, Senior EVP & CFO, Comcast – October 2017 Key Driver: Fiber to Businesses 1 For the Trailing Twelve Months (“TTM”) ended September 30, 2017. 2 Calculated as the combination of the estimated addressable market given by Charter ($20Bn) and Time Warner Cable ($10Bn) in their respective earnings transcripts prior to their May 2016 merger. Revenue earned by Comcast and Charter from Business Services totaled $11.8 Billion1 of an Addressable Market of $70 billion 2 Sources: Comcast and Charter Press Releases and transcripts

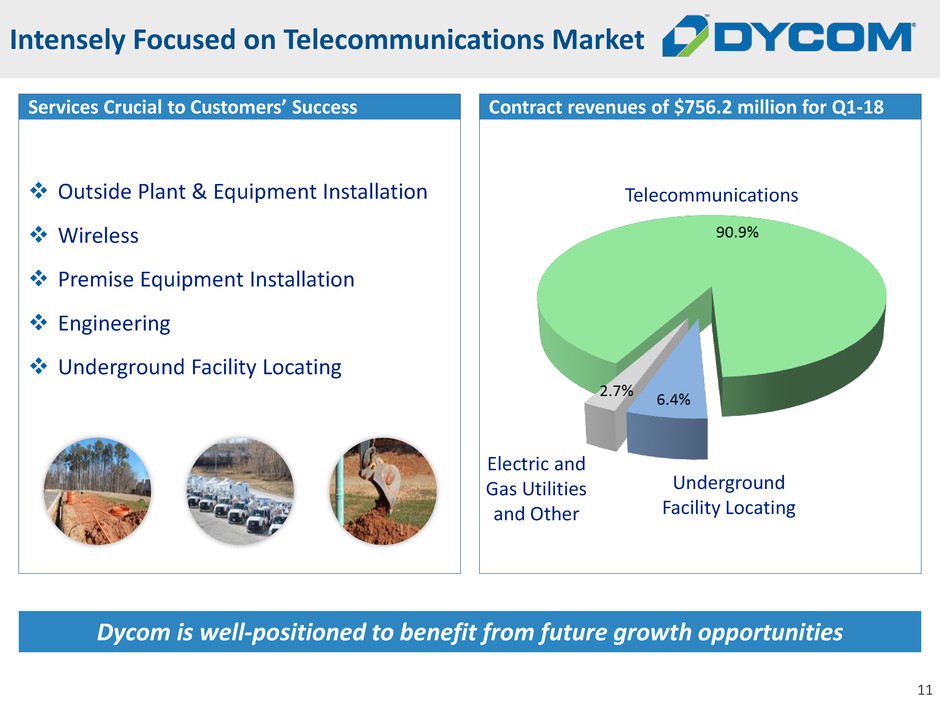

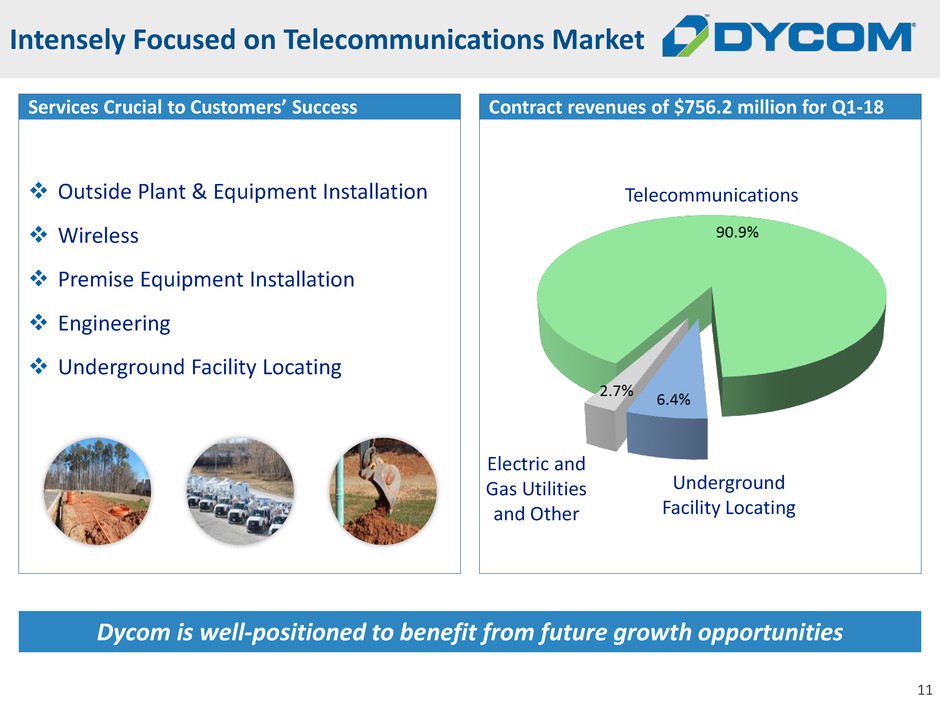

11 Intensely Focused on Telecommunications Market Contract revenues of $756.2 million for Q1-18 Services Crucial to Customers’ Success Electric and Gas Utilities and Other Underground Facility Locating Telecommunications Dycom is well-positioned to benefit from future growth opportunities Outside Plant & Equipment Installation Wireless Premise Equipment Installation Engineering Underground Facility Locating

12 Local Credibility, National Capability Subsidiaries Dycom’s Nationwide Presence

13 Focused on High Value Profitable Growth Anticipate emerging technology trends that drive capital spending Deliberately target high quality, long-term industry leaders which generate the vast majority of the industry’s profitable opportunities Selectively acquire businesses that complement our existing footprint and enhance our customer relationships Leverage our scale and expertise to expand margins through best practices

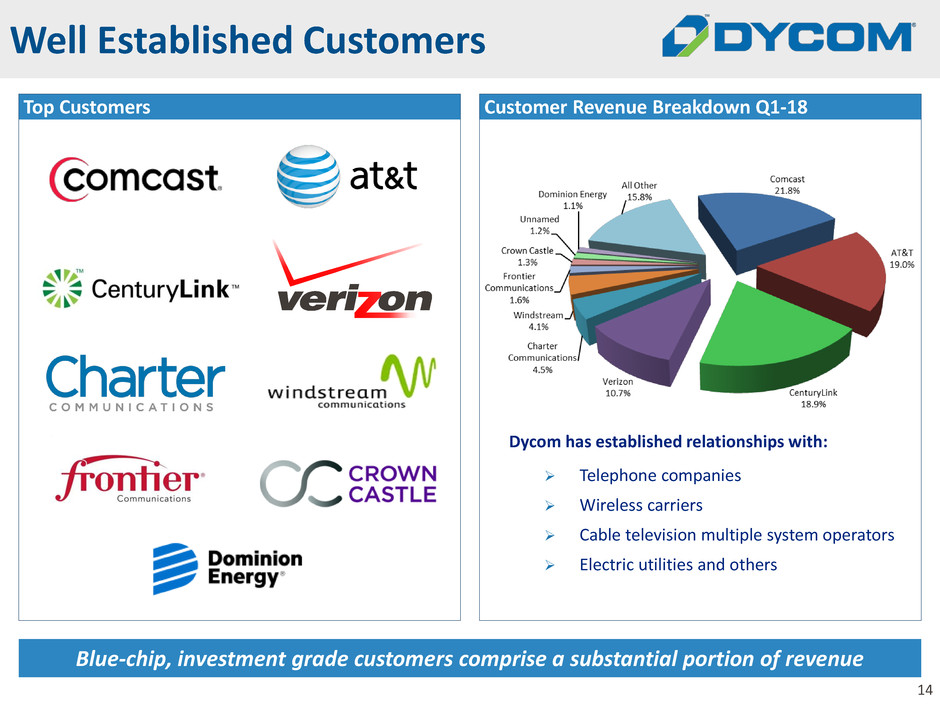

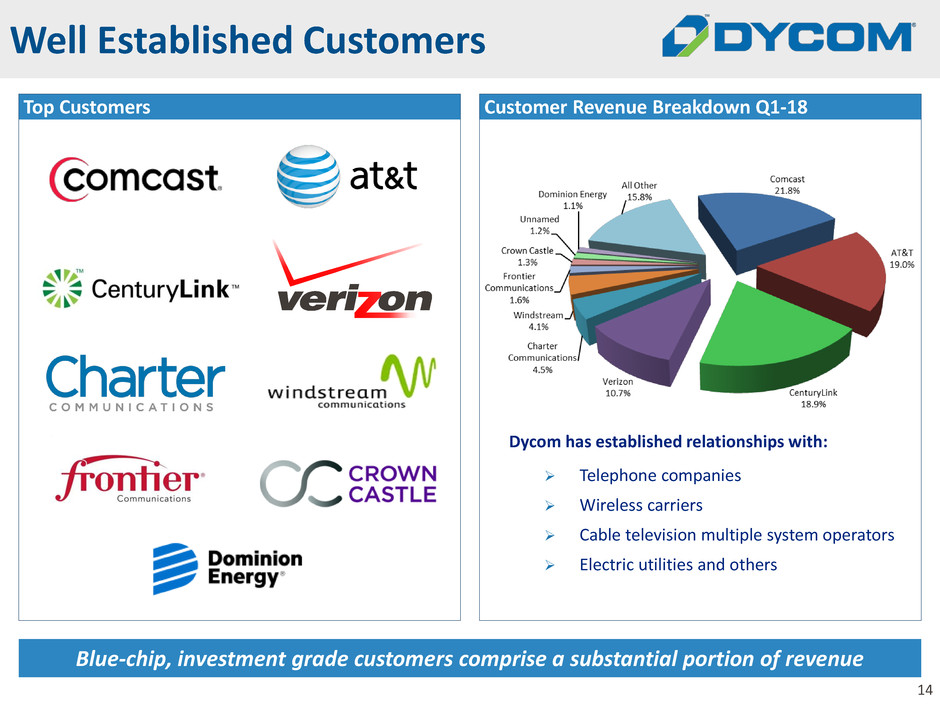

14 Well Established Customers Top Customers Dycom has established relationships with: Telephone companies Wireless carriers Cable television multiple system operators Electric utilities and others Customer Revenue Breakdown Q1-18 Blue-chip, investment grade customers comprise a substantial portion of revenue

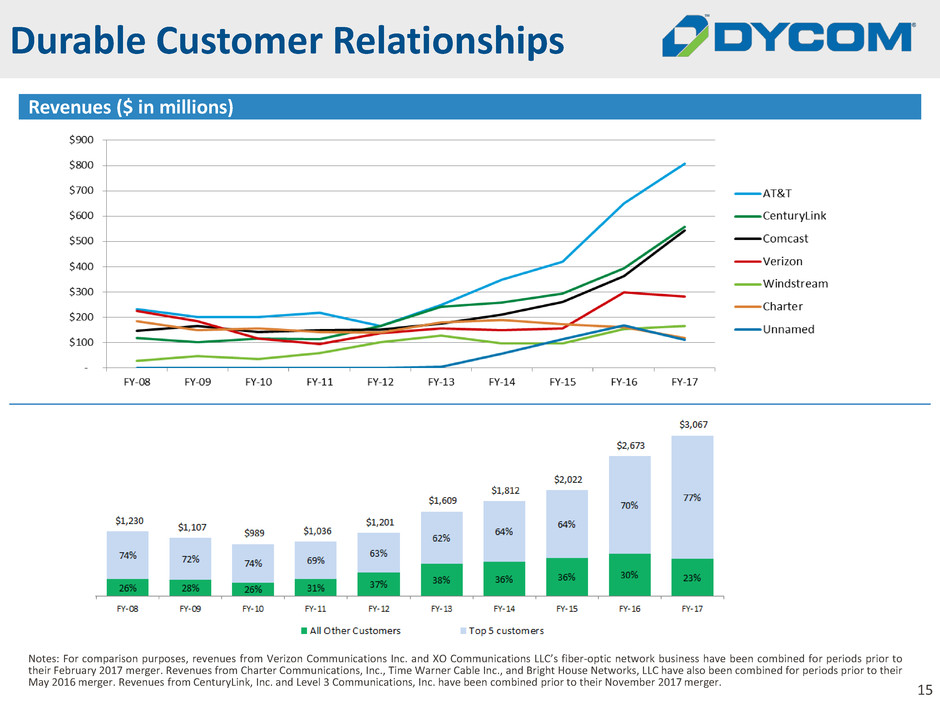

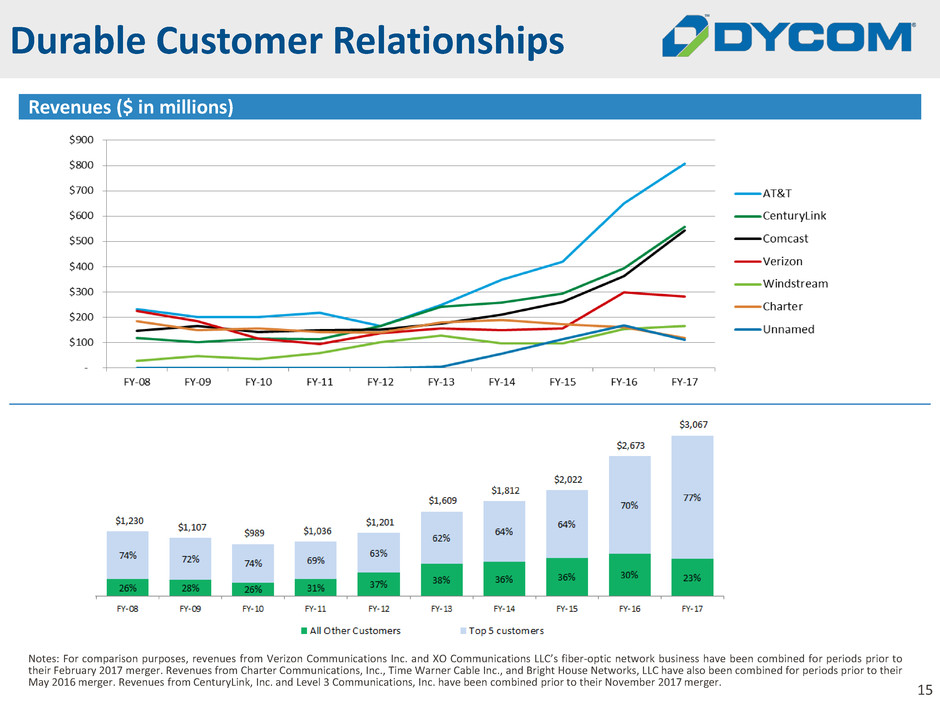

15 Durable Customer Relationships Revenues ($ in millions) Notes: For comparison purposes, revenues from Verizon Communications Inc. and XO Communications LLC’s fiber-optic network business have been combined for periods prior to their February 2017 merger. Revenues from Charter Communications, Inc., Time Warner Cable Inc., and Bright House Networks, LLC have also been combined for periods prior to their May 2016 merger. Revenues from CenturyLink, Inc. and Level 3 Communications, Inc. have been combined prior to their November 2017 merger.

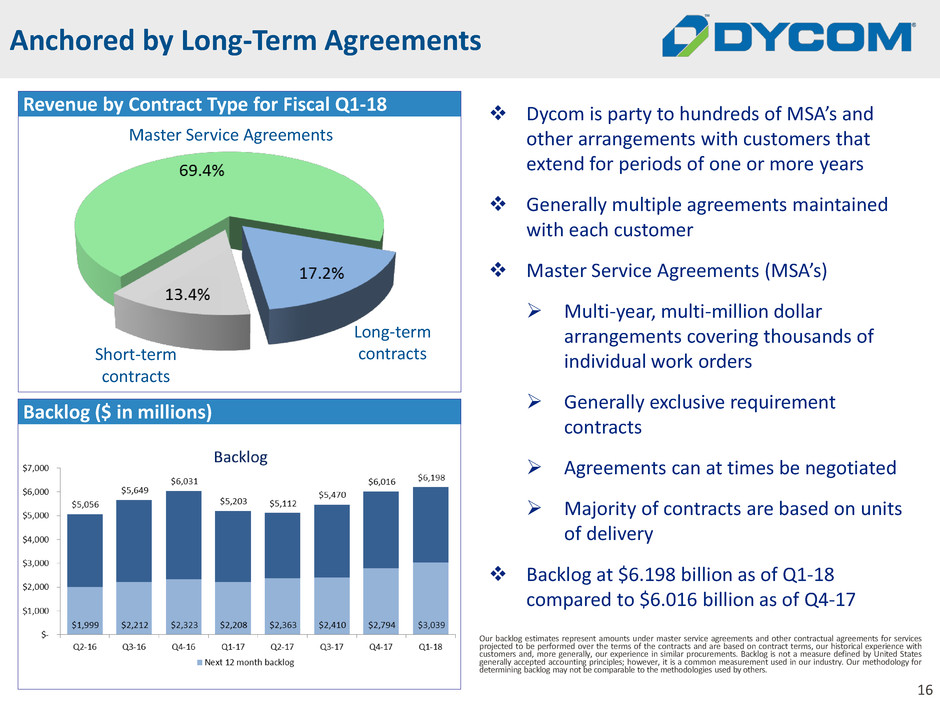

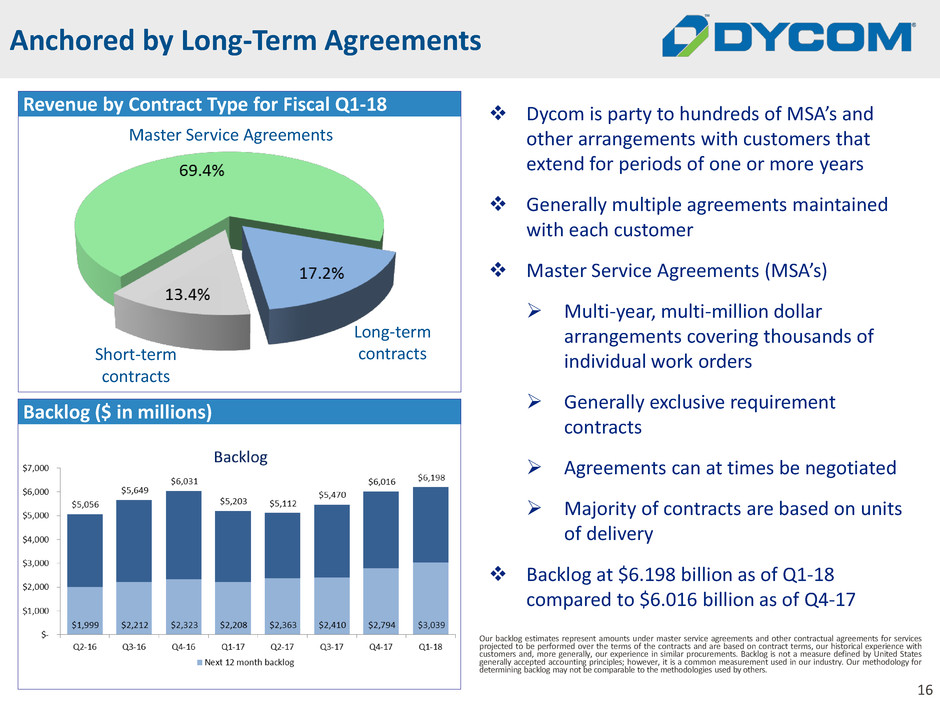

16 Anchored by Long-Term Agreements Dycom is party to hundreds of MSA’s and other arrangements with customers that extend for periods of one or more years Generally multiple agreements maintained with each customer Master Service Agreements (MSA’s) Multi-year, multi-million dollar arrangements covering thousands of individual work orders Generally exclusive requirement contracts Agreements can at times be negotiated Majority of contracts are based on units of delivery Backlog at $6.198 billion as of Q1-18 compared to $6.016 billion as of Q4-17 Revenue by Contract Type for Fiscal Q1-18 Backlog ($ in millions) Our backlog estimates represent amounts under master service agreements and other contractual agreements for services projected to be performed over the terms of the contracts and are based on contract terms, our historical experience with customers and, more generally, our experience in similar procurements. Backlog is not a measure defined by United States generally accepted accounting principles; however, it is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by others. Master Service Agreements Long-term contracts Short-term contracts

17 Industry Themes Industry increasing network bandwidth dramatically Major industry participants deploying significant 1 gigabit wireline networks Emerging wireless technologies require incremental wireline deployments o A complementary wireline investment cycle is fundamental to applications enabled by fully converged wireless/wireline networks Industry developments are producing opportunities which in aggregate are without precedent. Converged wireless/wireline network deployments only further broaden our set of opportunities. Delivering valuable service to customers Currently providing services for 1 gigabit full deployments across the country in dozens of metropolitan areas to a number of customers Have secured and are actively working on a number of converged wireless/wireline multi-use networks Customers are revealing with more specificity multi-year initiatives that are being implemented and managed locally Our ability to provide integrated planning, engineering and design, procurement and construction and maintenance services provides value to several industry participants Dycom’s scale, market position and financial strength position it well as opportunities continue to expand

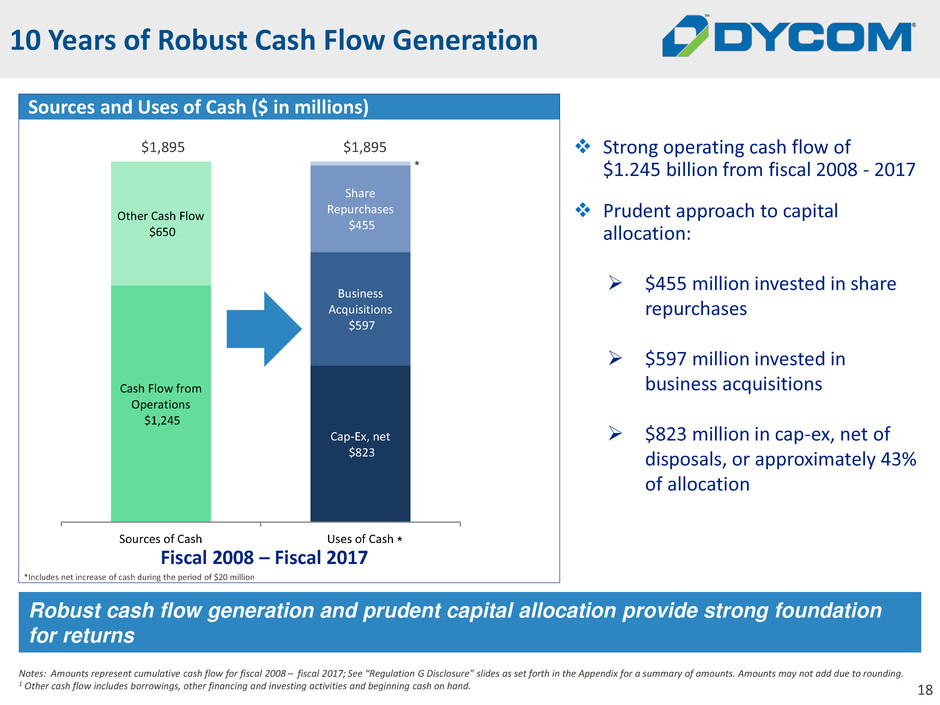

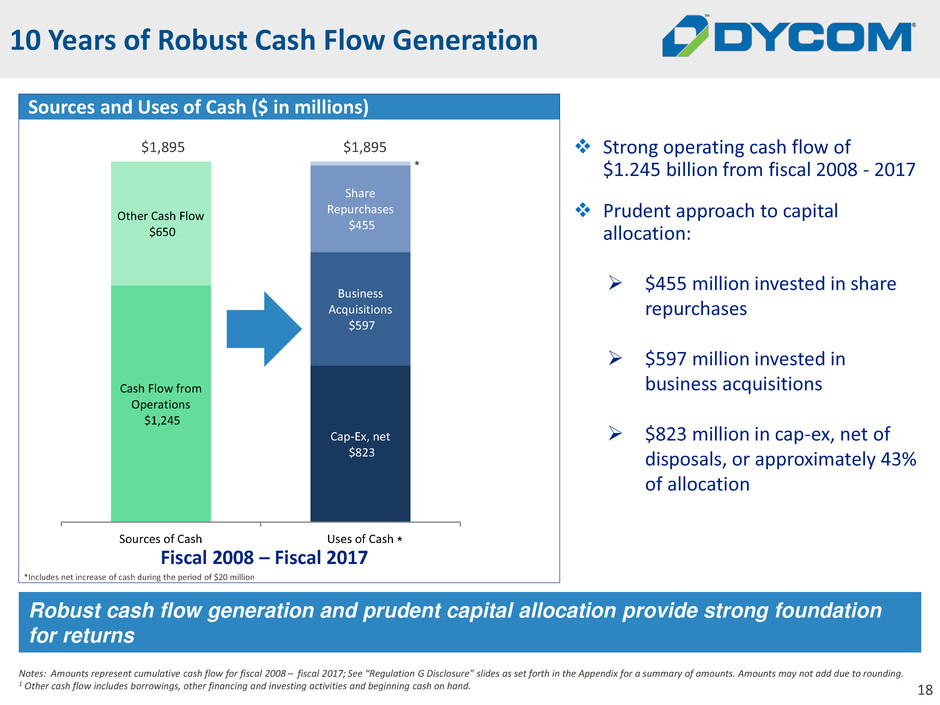

18 Cash Flow from Operations $1,245 Other Cash Flow $650 Cap-Ex, net $823 Business Acquisitions $597 Share Repurchases $455 Sources of Cash Uses of Cash * Sources and Uses of Cash ($ in millions) 10 Years of Robust Cash Flow Generation Notes: Amounts represent cumulative cash flow for fiscal 2008 – fiscal 2017; See “Regulation G Disclosure” slides as set forth in the Appendix for a summary of amounts. Amounts may not add due to rounding. 1 Other cash flow includes borrowings, other financing and investing activities and beginning cash on hand. Strong operating cash flow of $1.245 billion from fiscal 2008 - 2017 Prudent approach to capital allocation: $455 million invested in share repurchases $597 million invested in business acquisitions $823 million in cap-ex, net of disposals, or approximately 43% of allocation Fiscal 2008 – Fiscal 2017 Robust cash flow generation and prudent capital allocation provide strong foundation for returns $1,895 $1,895 *Includes net increase of cash during the period of $20 million *

19 Financial Update

20 Strengthening market opportunities Contract revenues of $756.2 million in Q1-18, included $15.5 million in revenue from storm restoration services Non-GAAP Adjusted EBITDA of $97.6 million, or 12.9% of revenues in Q1-18 Non-GAAP Adjusted Diluted EPS of $0.99 in Q1-18 Solid financial profile Strong balance sheet Robust operating cash flows Sound credit metrics and no near term debt maturities Capital structure designed to produce strong returns Repurchased 200,000 common shares for $16.9 million at an average price of $84.38 per share during Q1-18 and 713,006 common shares for $62.9 million at an average price of $88.23 per share during fiscal 2017 As of October 2017, $95.2 million authorized for share repurchases through August 2018 Financial Overview See “Regulation G Disclosure” slides 30-36 for a reconciliation of GAAP to Non-GAAP financial measures.

21 Fiscal Year Change In September 2017, the Company changed its fiscal year end from July to January Beginning with a six month transitional period ending January 27, 2018, the Company’s fiscal year will end on the last Saturday of January Fiscal year 2019 will be for the period from January 28, 2018 through January 26, 2019 As a result of the change in fiscal year and our increased visibility, the Company expects to provide a fiscal 2019 outlook for revenue and diluted earnings per share for its fiscal year ending January 26, 2019. This annual outlook will be provided in conjunction with the Company's release of results for the fiscal quarter ended January 27, 2018.

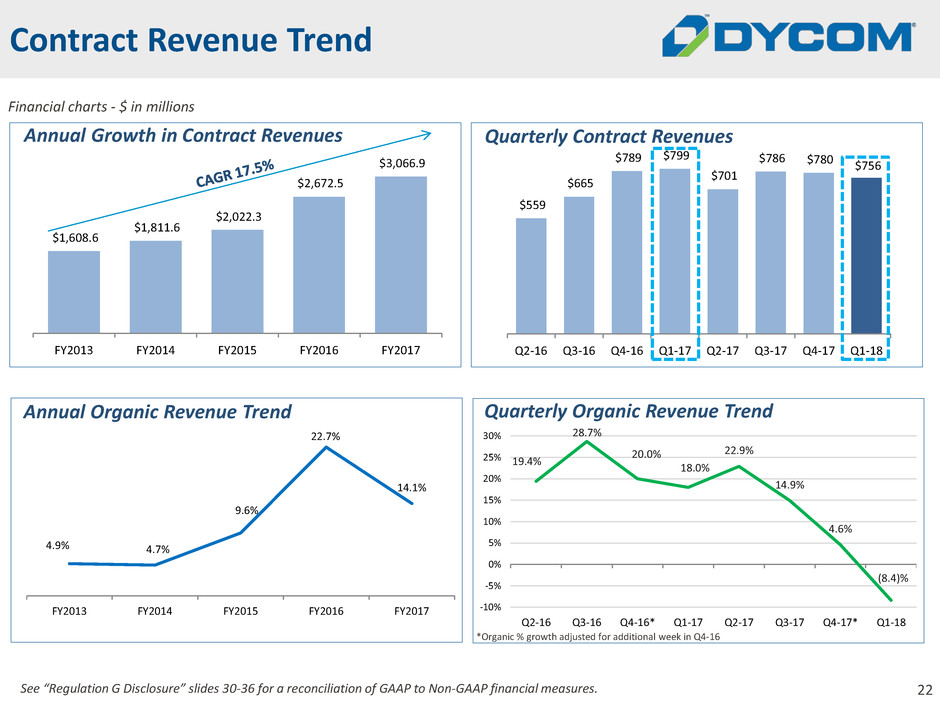

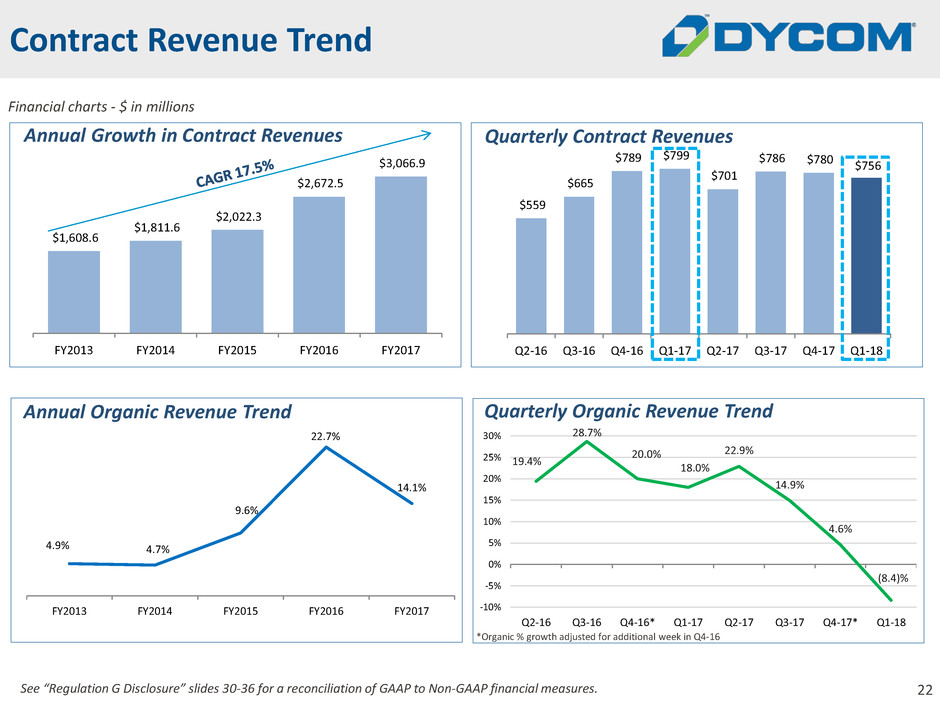

22 $559 $665 $789 $799 $701 $786 $780 $756 Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 Contract Revenue Trend Annual Organic Revenue Trend Quarterly Contract Revenues Quarterly Organic Revenue Trend Annual Growth in Contract Revenues Financial charts - $ in millions *Organic % growth adjusted for additional week in Q4-16 See “Regulation G Disclosure” slides 30-36 for a reconciliation of GAAP to Non-GAAP financial measures. $1,608.6 $1,811.6 $2,022.3 $2,672.5 $3,066.9 FY2013 FY2014 FY2015 FY2016 FY2017 4.9% 4.7% 9.6% 22.7% 14.1% FY2013 FY2014 FY2015 FY2016 FY2017 19.4% 28.7% 20.0% 18.0% 22.9% 14.9% 4.6% (8.4)% -10% -5% 0% 5% 10% 15% 20% 25% 30% Q2-16 Q3-16 Q4-16* Q1-17 Q2-17 Q3-17 Q4-17* Q1-18

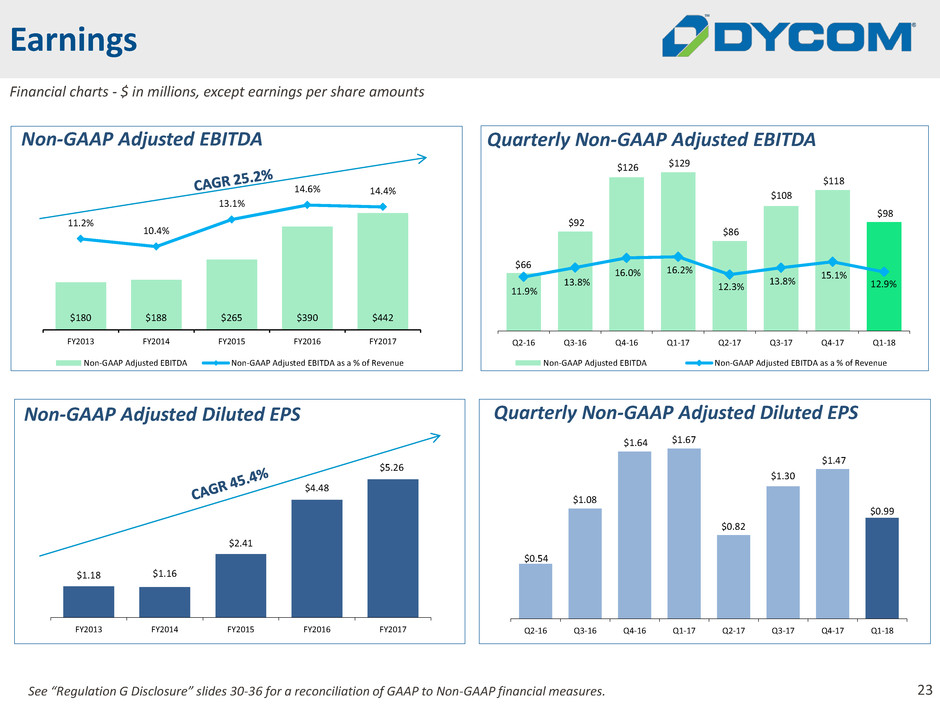

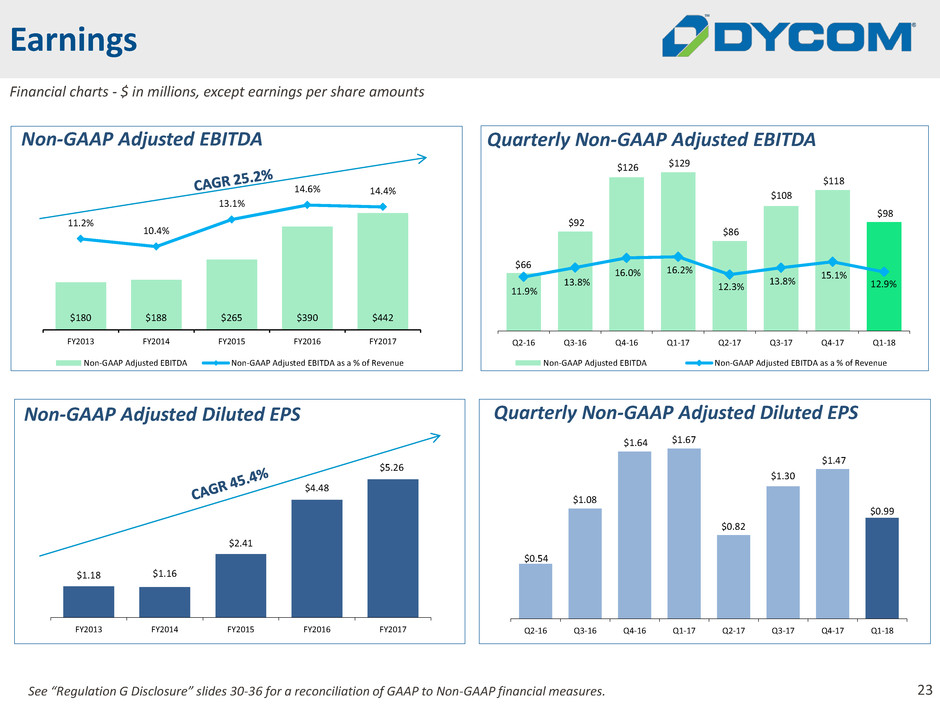

23 $180 $188 $265 $390 $442 11.2% 10.4% 13.1% 14.6% 14.4% FY2013 FY2014 FY2015 FY2016 FY2017 Non-GAAP Adjusted EBITDA Non-GAAP Adjusted EBITDA as a % of Revenue Non-GAAP Adjusted EBITDA $1.18 $1.16 $2.41 $4.48 $5.26 FY2013 FY2014 FY2015 FY2016 FY2017 Quarterly Non-GAAP Adjusted EBITDA Quarterly Non-GAAP Adjusted Diluted EPS Non-GAAP Adjusted Diluted EPS Financial charts - $ in millions, except earnings per share amounts Earnings See “Regulation G Disclosure” slides 30-36 for a reconciliation of GAAP to Non-GAAP financial measures. $66 $92 $126 $129 $86 $108 $118 $98 11.9% 13.8% 16.0% 16.2% 12.3% 13.8% 15.1% 12.9% Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 Non-GAAP Adjusted EBITDA Non-GAAP Adjusted EBITDA as a % of Revenue $0.54 $1.08 $1.64 $1.67 $0.82 $1.30 $1.47 $0.99 Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Q1-18

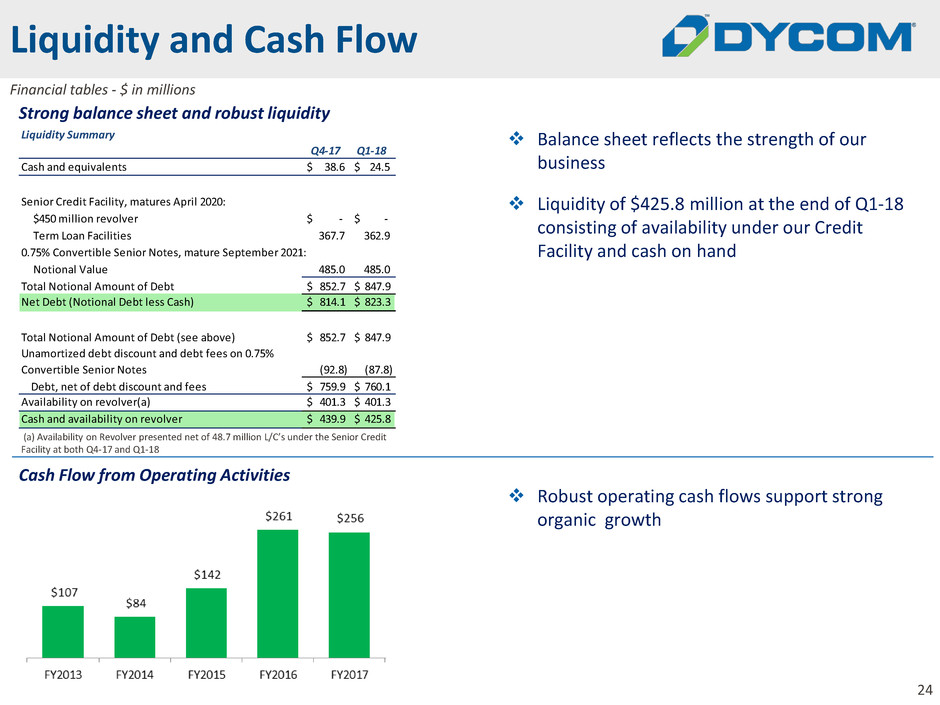

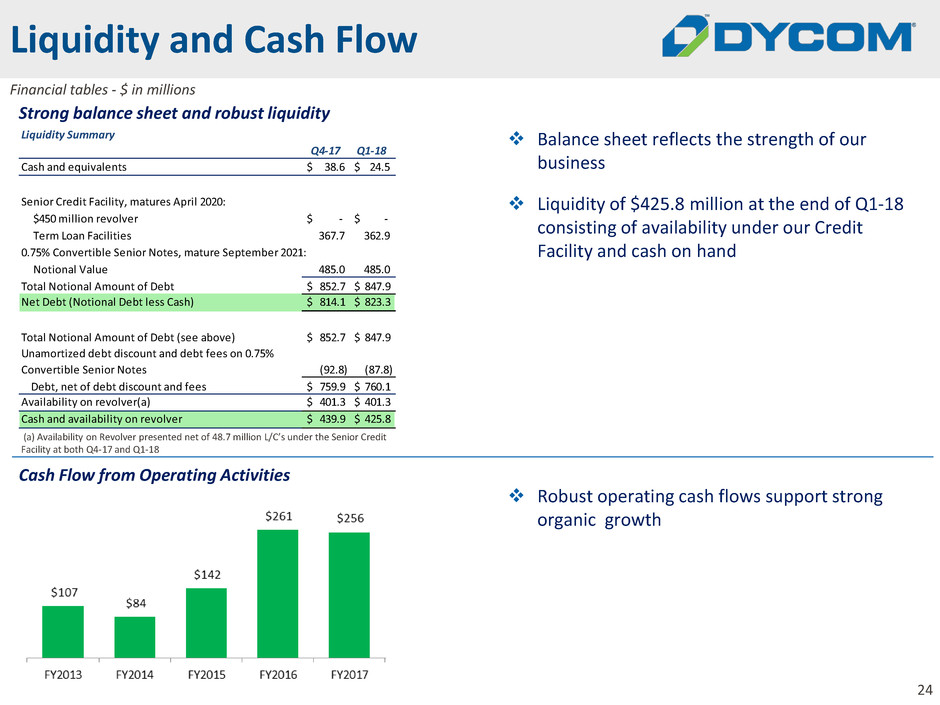

24 Strong balance sheet and robust liquidity Liquidity and Cash Flow Financial tables - $ in millions Balance sheet reflects the strength of our business Liquidity of $425.8 million at the end of Q1-18 consisting of availability under our Credit Facility and cash on hand Cash Flow from Operating Activities Robust operating cash flows support strong organic growth (a) Availability on Revolver presented net of 48.7 million L/C’s under the Senior Credit Facility at both Q4-17 and Q1-18 Liquidity Summary Q4-17 Q1-18 Cash and equivalents $ 38.6 $ 24.5 $450 million revolver $ - $ - Term Loan Facilities 367.7 362.9 Notional Value 485.0 485.0 Total Notional Amount of Debt $ 852.7 $ 847.9 Net Debt (Notional Debt less Cash) $ 814.1 $ 823.3 Total Notional Amount of Debt (see above) $ 852.7 $ 847.9 Unamortized debt discount and debt fees on 0.75% Convertible Senior Notes (92.8) (87.8) Debt, net of debt discount and fees $ 759.9 $ 760.1 Availability on revolver(a) $ 401.3 $ 401.3 Cash and availability on revolver $ 439.9 $ 425.8 Senior Credit Facility, matures April 2020: 0.75% Convertible Senior Notes, mature September 2021:

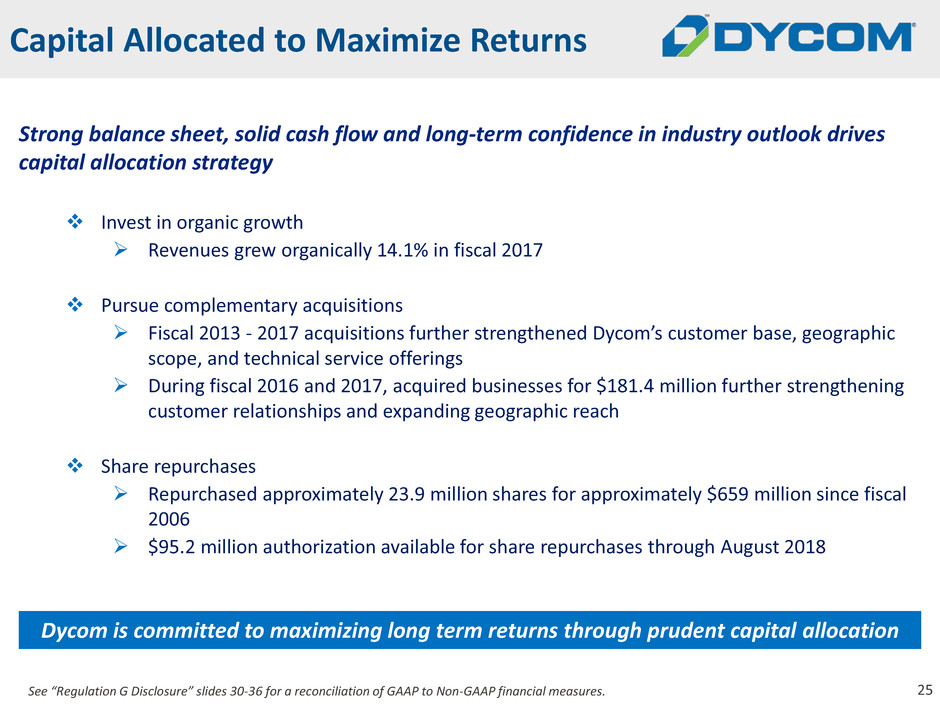

25 Capital Allocated to Maximize Returns Strong balance sheet, solid cash flow and long-term confidence in industry outlook drives capital allocation strategy Invest in organic growth Revenues grew organically 14.1% in fiscal 2017 Pursue complementary acquisitions Fiscal 2013 - 2017 acquisitions further strengthened Dycom’s customer base, geographic scope, and technical service offerings During fiscal 2016 and 2017, acquired businesses for $181.4 million further strengthening customer relationships and expanding geographic reach Share repurchases Repurchased approximately 23.9 million shares for approximately $659 million since fiscal 2006 $95.2 million authorization available for share repurchases through August 2018 Dycom is committed to maximizing long term returns through prudent capital allocation See “Regulation G Disclosure” slides 30-36 for a reconciliation of GAAP to Non-GAAP financial measures.

Questions and Answers

Selected Information from Q1-18 Dycom Results Conference Call Materials The following slides 28, 29 & 30 were used on November 20, 2017 in connection with the Company’s conference call for its fiscal 2018 first quarter results and are included for your convenience. Reference is made to slide 2 titled “Forward- Looking Statements and Non-GAAP Information” with respect to these slides. The information and statements contained in slides 28, 29 & 30 that are forward- looking are based on information that was available at the time the slides were initially prepared and/or management’s good faith belief at that time with respect to future events. Except as required by law, the Company may not update forward-looking statements even though its situation may change in the future. For a full copy of the conference call materials, including the conference call transcript, see the Company’s Form 8-Ks filed with the Securities and Exchange Commission on November 20, 2017 and November 21, 2017.

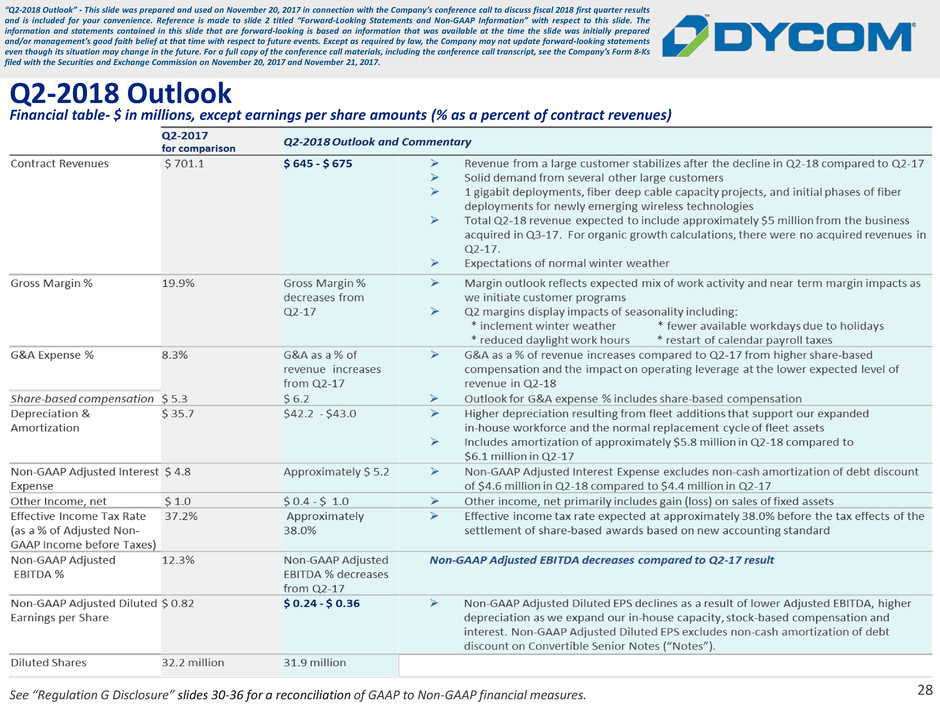

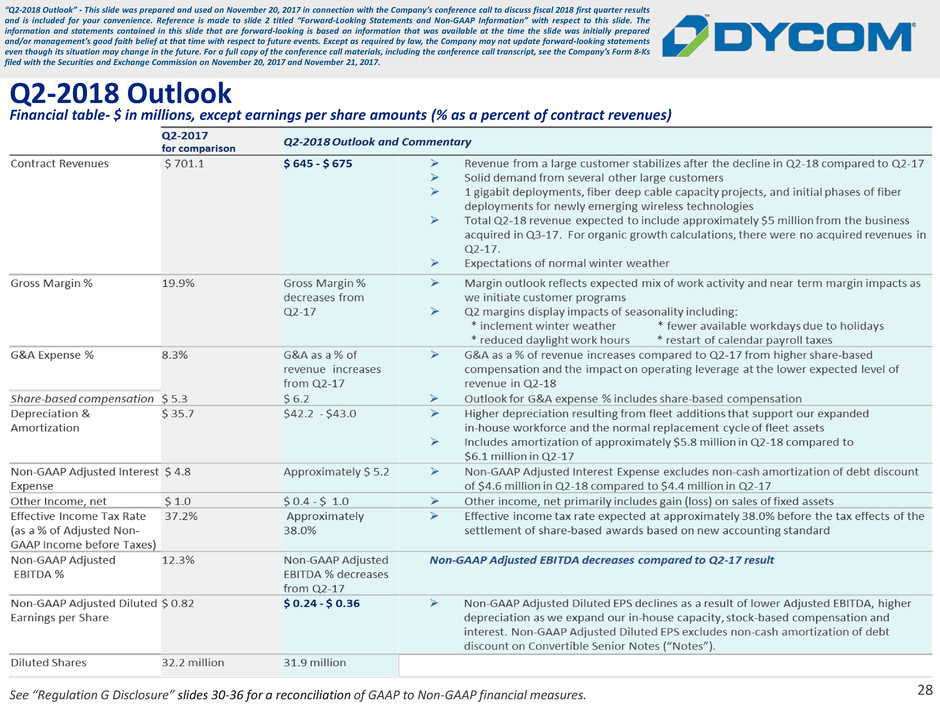

28 Q2-2018 Outlook Financial table- $ in millions, except earnings per share amounts (% as a percent of contract revenues) See “Regulation G Disclosure” slides 30-36 for a reconciliation of GAAP to Non-GAAP financial measures. “Q2-2018 Outlook” - This slide was prepared and used on November 20, 2017 in connection with the Company’s conference call to discuss fiscal 2018 first quarter results and is included for your convenience. Reference is made to slide 2 titled “Forward-Looking Statements and Non-GAAP Information” with respect to this slide. The information and statements contained in this slide that are forward-looking is based on information that was available at the time the slide was initially prepared and/or management’s good faith belief at that time with respect to future events. Except as required by law, the Company may not update forward-looking statements even though its situation may change in the future. For a full copy of the conference call materials, including the conference call transcript, see the Company’s Form 8-Ks filed with the Securities and Exchange Commission on November 20, 2017 and November 21, 2017.

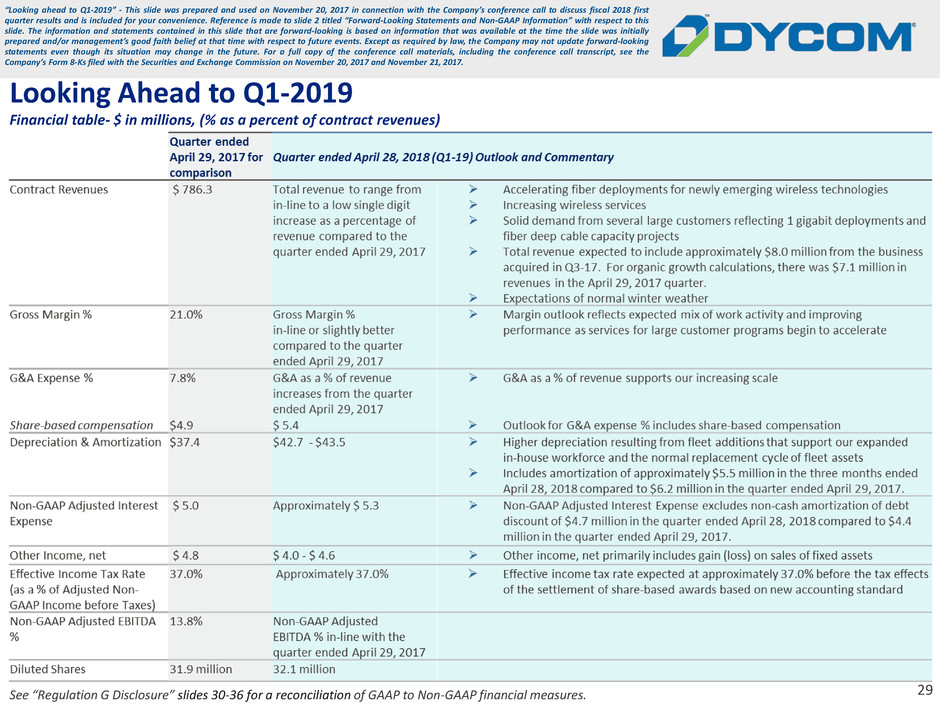

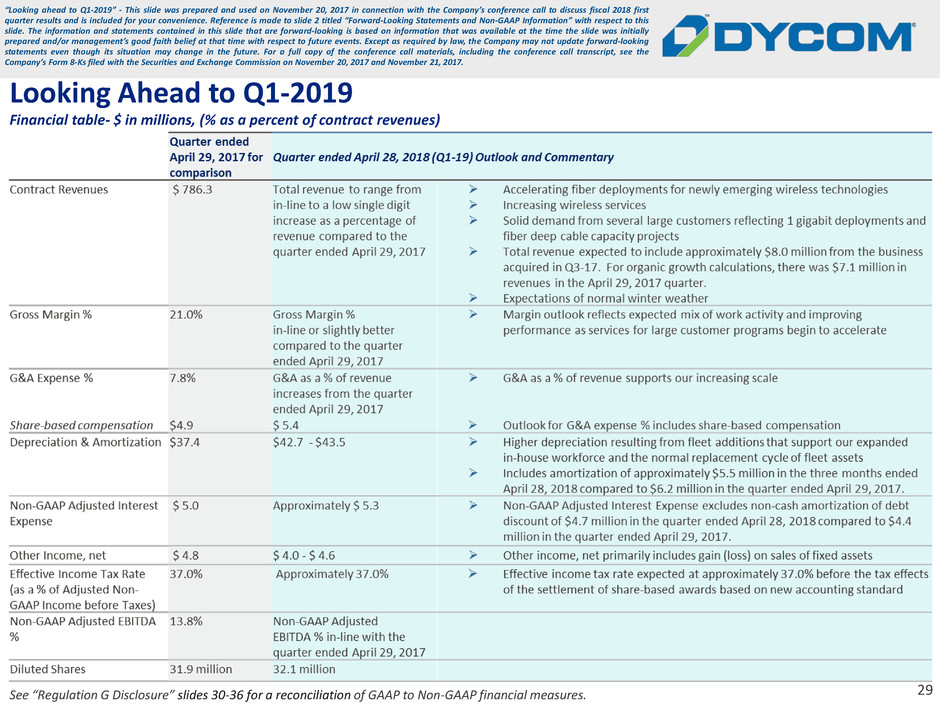

29 Looking Ahead to Q1-2019 See “Regulation G Disclosure” slides 30-36 for a reconciliation of GAAP to Non-GAAP financial measures. “Looking ahead to Q1-2019” - This slide was prepared and used on November 20, 2017 in connection with the Company’s conference call to discuss fiscal 2018 first quarter results and is included for your convenience. Reference is made to slide 2 titled “Forward-Looking Statements and Non-GAAP Information” with respect to this slide. The information and statements contained in this slide that are forward-looking is based on information that was available at the time the slide was initially prepared and/or management’s good faith belief at that time with respect to future events. Except as required by law, the Company may not update forward-looking statements even though its situation may change in the future. For a full copy of the conference call materials, including the conference call transcript, see the Company’s Form 8-Ks filed with the Securities and Exchange Commission on November 20, 2017 and November 21, 2017. Financial table- $ in millions, (% as a percent of contract revenues)

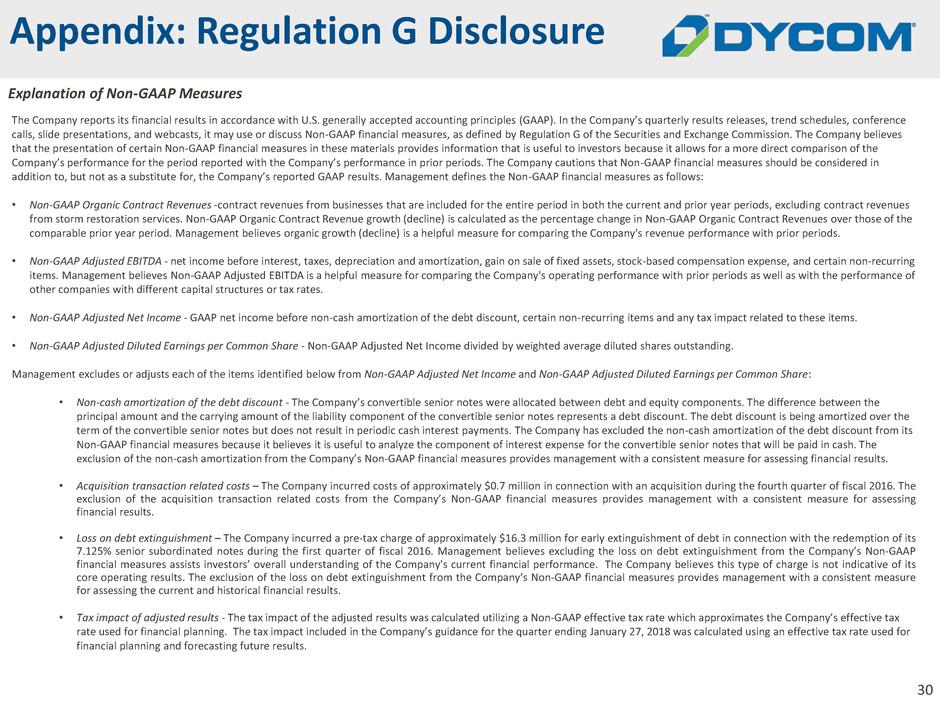

30 Explanation of Non-GAAP Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In the Company’s quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, it may use or discuss Non-GAAP financial measures, as defined by Regulation G of the Securities and Exchange Commission. The Company believes that the presentation of certain Non-GAAP financial measures in these materials provides information that is useful to investors because it allows for a more direct comparison of the Company’s performance for the period reported with the Company’s performance in prior periods. The Company cautions that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Management defines the Non-GAAP financial measures as follows: • Non-GAAP Organic Contract Revenues -contract revenues from businesses that are included for the entire period in both the current and prior year periods, excluding contract revenues from storm restoration services. Non-GAAP Organic Contract Revenue growth (decline) is calculated as the percentage change in Non-GAAP Organic Contract Revenues over those of the comparable prior year period. Management believes organic growth (decline) is a helpful measure for comparing the Company's revenue performance with prior periods. • Non-GAAP Adjusted EBITDA - net income before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, and certain non-recurring items. Management believes Non-GAAP Adjusted EBITDA is a helpful measure for comparing the Company's operating performance with prior periods as well as with the performance of other companies with different capital structures or tax rates. • Non-GAAP Adjusted Net Income - GAAP net income before non-cash amortization of the debt discount, certain non-recurring items and any tax impact related to these items. • Non-GAAP Adjusted Diluted Earnings per Common Share - Non-GAAP Adjusted Net Income divided by weighted average diluted shares outstanding. Management excludes or adjusts each of the items identified below from Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Diluted Earnings per Common Share: • Non-cash amortization of the debt discount - The Company’s convertible senior notes were allocated between debt and equity components. The difference between the principal amount and the carrying amount of the liability component of the convertible senior notes represents a debt discount. The debt discount is being amortized over the term of the convertible senior notes but does not result in periodic cash interest payments. The Company has excluded the non-cash amortization of the debt discount from its Non-GAAP financial measures because it believes it is useful to analyze the component of interest expense for the convertible senior notes that will be paid in cash. The exclusion of the non-cash amortization from the Company’s Non-GAAP financial measures provides management with a consistent measure for assessing financial results. • Acquisition transaction related costs – The Company incurred costs of approximately $0.7 million in connection with an acquisition during the fourth quarter of fiscal 2016. The exclusion of the acquisition transaction related costs from the Company’s Non-GAAP financial measures provides management with a consistent measure for assessing financial results. • Loss on debt extinguishment – The Company incurred a pre-tax charge of approximately $16.3 million for early extinguishment of debt in connection with the redemption of its 7.125% senior subordinated notes during the first quarter of fiscal 2016. Management believes excluding the loss on debt extinguishment from the Company’s Non-GAAP financial measures assists investors’ overall understanding of the Company's current financial performance. The Company believes this type of charge is not indicative of its core operating results. The exclusion of the loss on debt extinguishment from the Company’s Non-GAAP financial measures provides management with a consistent measure for assessing the current and historical financial results. • Tax impact of adjusted results - The tax impact of the adjusted results was calculated utilizing a Non-GAAP effective tax rate which approximates the Company’s effective tax rate used for financial planning. The tax impact included in the Company’s guidance for the quarter ending January 27, 2018 was calculated using an effective tax rate used for financial planning and forecasting future results. Appendix: Regulation G Disclosure

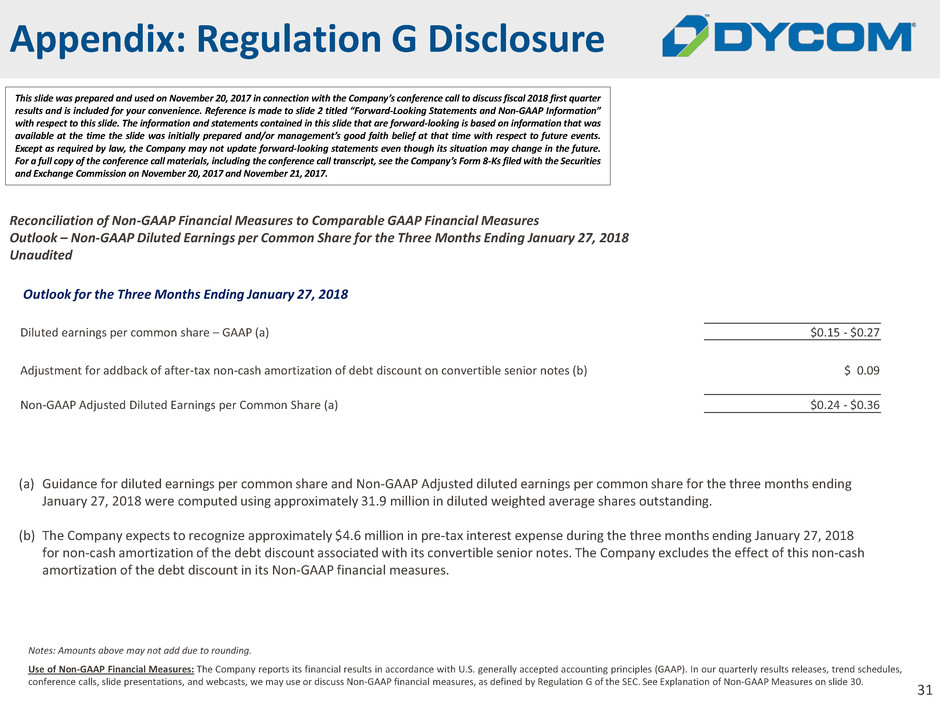

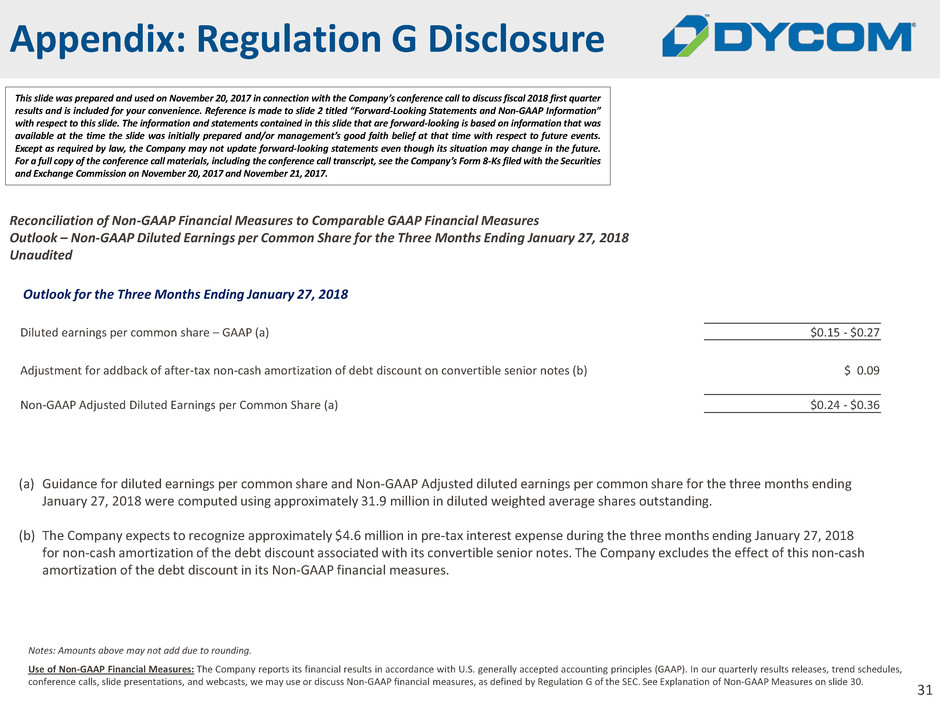

31 Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Outlook – Non-GAAP Diluted Earnings per Common Share for the Three Months Ending January 27, 2018 Unaudited Appendix: Regulation G Disclosure This slide was prepared and used on November 20, 2017 in connection with the Company’s conference call to discuss fiscal 2018 first quarter results and is included for your convenience. Reference is made to slide 2 titled “Forward-Looking Statements and Non-GAAP Information” with respect to this slide. The information and statements contained in this slide that are forward-looking is based on information that was available at the time the slide was initially prepared and/or management’s good faith belief at that time with respect to future events. Except as required by law, the Company may not update forward-looking statements even though its situation may change in the future. For a full copy of the conference call materials, including the conference call transcript, see the Company’s Form 8-Ks filed with the Securities and Exchange Commission on November 20, 2017 and November 21, 2017. Use of Non-GAAP Financial Measures: The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 30. Notes: Amounts above may not add due to rounding. Outlook for the Three Months Ending January 27, 2018 Diluted earnings per common share – GAAP (a) $0.15 - $0.27 Adjustment for addback of after-tax non-cash amortization of debt discount on convertible senior notes (b) $ 0.09 Non-GAAP Adjusted Diluted Earnings per Common Share (a) $0.24 - $0.36 (a) Guidance for diluted earnings per common share and Non-GAAP Adjusted diluted earnings per common share for the three months ending January 27, 2018 were computed using approximately 31.9 million in diluted weighted average shares outstanding. (b) The Company expects to recognize approximately $4.6 million in pre-tax interest expense during the three months ending January 27, 2018 for non-cash amortization of the debt discount associated with its convertible senior notes. The Company excludes the effect of this non-cash amortization of the debt discount in its Non-GAAP financial measures.

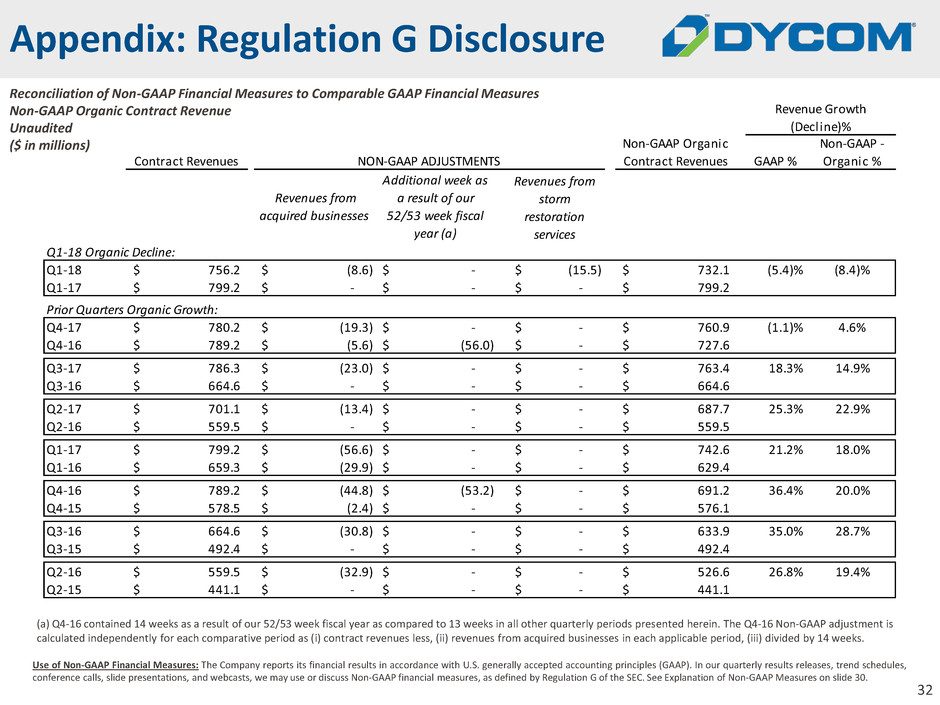

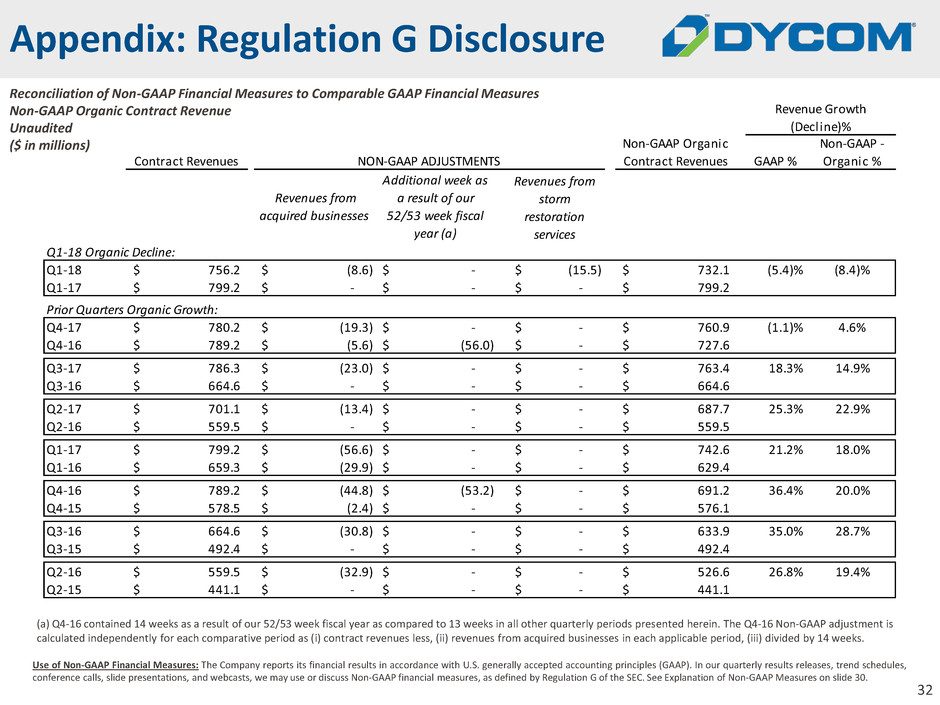

32 Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Organic Contract Revenue Unaudited ($ in millions) (a) Q4-16 contained 14 weeks as a result of our 52/53 week fiscal year as compared to 13 weeks in all other quarterly periods presented herein. The Q4-16 Non-GAAP adjustment is calculated independently for each comparative period as (i) contract revenues less, (ii) revenues from acquired businesses in each applicable period, (iii) divided by 14 weeks. Use of Non-GAAP Financial Measures: The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 30. GAAP % Non-GAAP - Organic % Revenues from acquired businesses Additional week as a result of our 52/53 week fiscal year (a) Revenues from storm restoration services Q1-18 Organic Decline: Q1-18 756.2$ (8.6)$ -$ (15.5)$ 732.1$ (5.4)% (8.4)% Q1-17 799.2$ -$ -$ -$ 799.2$ Prior Quarters Organic Growth: Q4-17 780.2$ (19.3)$ -$ -$ 760.9$ (1.1)% 4.6% Q4-16 789.2$ (5.6)$ (56.0)$ -$ 727.6$ Q3-17 786.3$ (23.0)$ -$ -$ 763.4$ 18.3% 14.9% Q3-16 664.6$ -$ -$ -$ 664.6$ Q2-17 701.1$ (13.4)$ -$ -$ 687.7$ 25.3% 22.9% Q2-16 559.5$ -$ -$ -$ 559.5$ Q1-17 799.2$ (56.6)$ -$ -$ 742.6$ 21.2% 18.0% Q1-16 659.3$ (29.9)$ -$ -$ 629.4$ Q4-16 789.2$ (44.8)$ (53.2)$ -$ 691.2$ 36.4% 20.0% Q4-15 578.5$ (2.4)$ -$ -$ 576.1$ Q3-16 664.6$ (30.8)$ -$ -$ 633.9$ 35.0% 28.7% Q3-15 492.4$ -$ -$ -$ 492.4$ Q2-16 559.5$ (32.9)$ -$ -$ 526.6$ 26.8% 19.4% Q2-15 441.1$ -$ -$ -$ 441.1$ Revenue Growth (Decline)% Non-GAAP Organic Contract RevenuesContract Revenues NON-GAAP ADJUSTMENTS

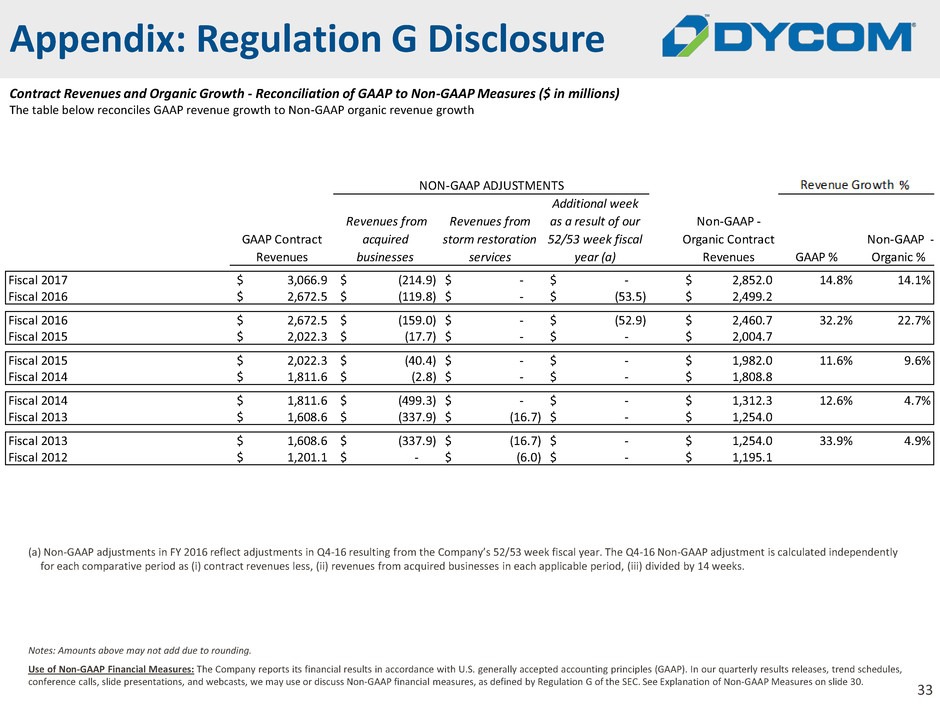

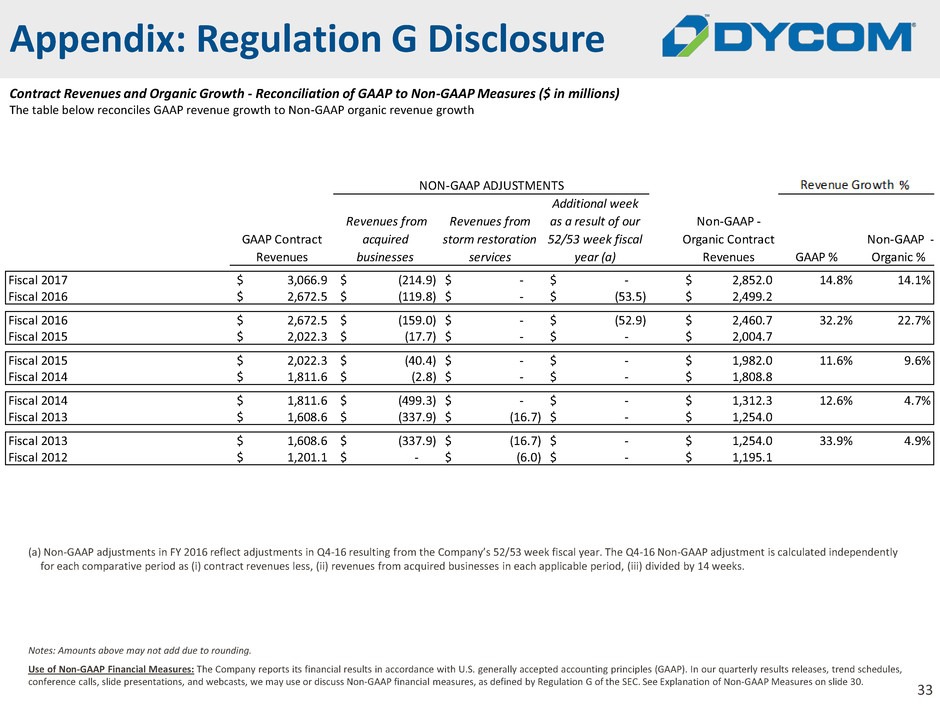

33 (a) Non-GAAP adjustments in FY 2016 reflect adjustments in Q4-16 resulting from the Company’s 52/53 week fiscal year. The Q4-16 Non-GAAP adjustment is calculated independently for each comparative period as (i) contract revenues less, (ii) revenues from acquired businesses in each applicable period, (iii) divided by 14 weeks. Contract Revenues and Organic Growth - Reconciliation of GAAP to Non-GAAP Measures ($ in millions) The table below reconciles GAAP revenue growth to Non-GAAP organic revenue growth Appendix: Regulation G Disclosure Notes: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures: The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 30. Revenues from acquired businesses Revenues from storm restoration services Additional week as a result of our 52/53 week fiscal year (a) GAAP % Non-GAAP - Organic % Fiscal 2017 3,066.9$ (214.9)$ -$ -$ 2,852.0$ 14.8% 14.1% Fiscal 2016 2,672.5$ (119.8)$ -$ (53.5)$ 2,499.2$ Fiscal 2016 2,672.5$ (159.0)$ -$ (52.9)$ 2,460.7$ 32.2% 22.7% Fiscal 2015 2,022.3$ (17.7)$ -$ -$ 2,004.7$ Fi al 2015 2,022.3$ (40.4)$ -$ -$ 1,982.0$ 11.6% 9.6% Fiscal 2014 1,811.6$ (2.8)$ -$ -$ 1,808.8$ Fiscal 2014 1,811.6$ (499.3)$ -$ -$ 1,312.3$ 12.6% 4.7% Fiscal 2013 1,608.6$ (337.9)$ (16.7)$ -$ 1,254.0$ Fiscal 2013 1,608.6$ (337.9)$ (16.7)$ -$ 1,254.0$ 33.9% 4.9% Fiscal 2012 1,201.1$ -$ (6.0)$ -$ 1,195.1$ GAAP Contract Revenues NON-GAAP ADJUSTMENTS Non-GAAP - Organic Contract Revenues Revenue Growth (Decline)%

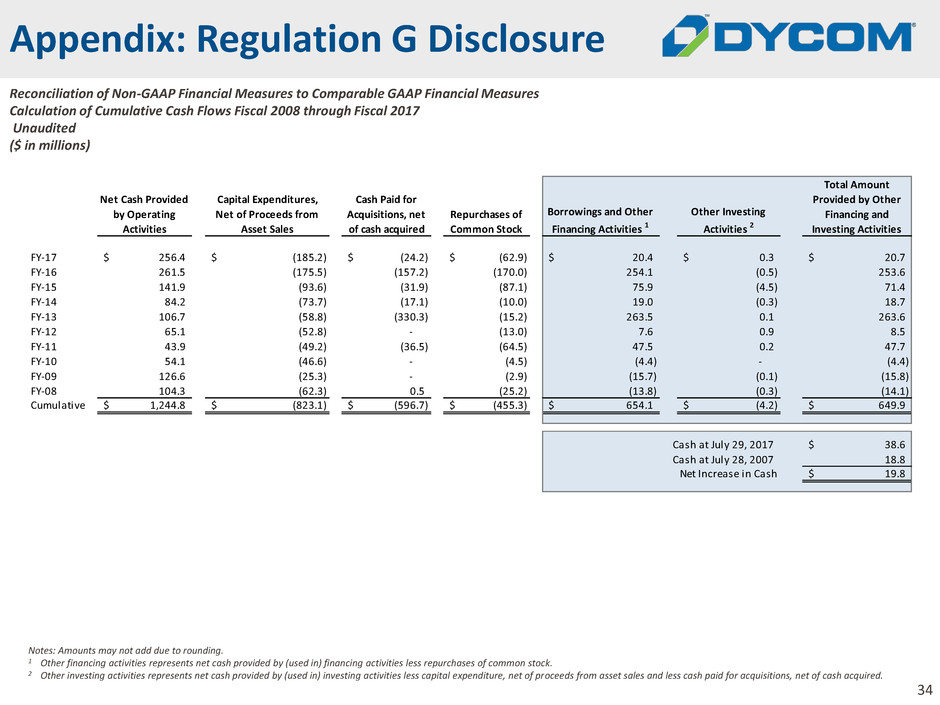

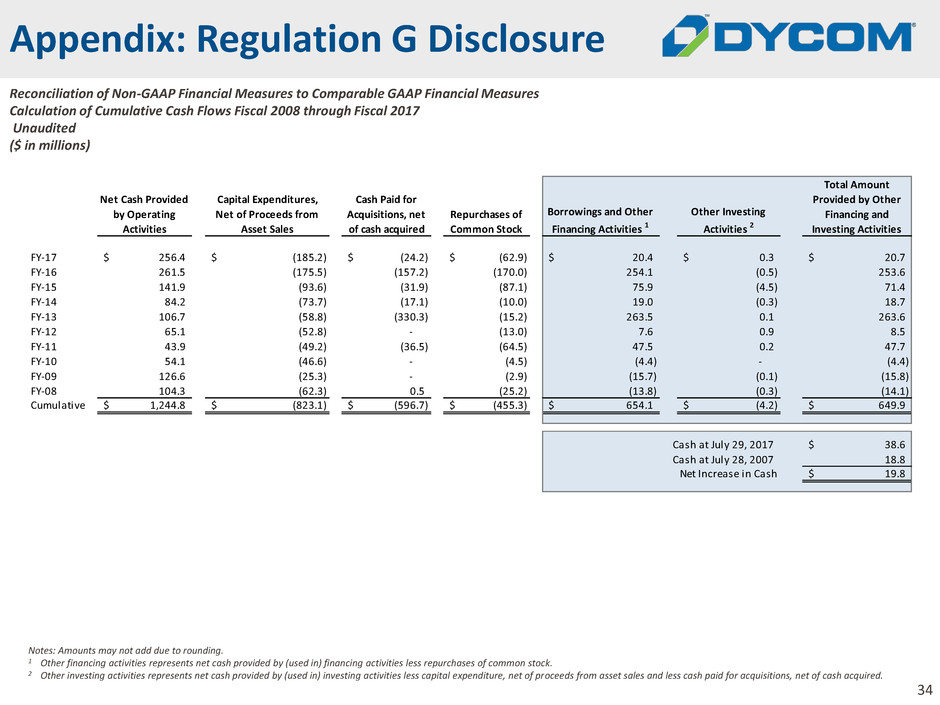

34 Notes: Amounts may not add due to rounding. 1 Other financing activities represents net cash provided by (used in) financing activities less repurchases of common stock. 2 Other investing activities represents net cash provided by (used in) investing activities less capital expenditure, net of proceeds from asset sales and less cash paid for acquisitions, net of cash acquired. Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Calculation of Cumulative Cash Flows Fiscal 2008 through Fiscal 2017 Unaudited ($ in millions) Appendix: Regulation G Disclosure Net Cash Provided by Operating Activities Capital Expenditures, Net of Proceeds from Asset Sales Cash Paid for Acquisitions, net of cash acquired Repurchases of Common Stock Borrowings and Other Financing Activities 1 Other Investing Activities 2 Total Amount Provided by Other Financing and Investing Activities FY-17 256.4$ (185.2)$ (24.2)$ (62.9)$ 20.4$ 0.3$ 20.7$ FY-16 261.5 (175.5) (157.2) (170.0) 254.1 (0.5) 253.6 FY-15 141.9 (93.6) (31.9) (87.1) 75.9 (4.5) 71.4 FY-14 84.2 (73.7) (17.1) (10.0) 19.0 (0.3) 18.7 FY-13 106.7 (58.8) (330.3) (15.2) 263.5 0.1 263.6 FY-12 65.1 (52.8) - (13.0) 7.6 0.9 8.5 FY-11 43.9 (49.2) (36.5) (64.5) 47.5 0.2 47.7 FY-10 54.1 (46.6) - (4.5) (4.4) - (4.4) FY-09 126.6 (25.3) - (2.9) (15.7) (0.1) (15.8) FY-08 104.3 (62.3) 0.5 (25.2) (13.8) (0.3) (14.1) Cumulative 1,244.8$ (823.1)$ (596.7)$ (455.3)$ 654.1$ (4.2)$ 649.9$ 38.6$ 18.8 19.8$ Cash at July 29, 2017 Cash at July 28, 2007 Net Increase in Cash

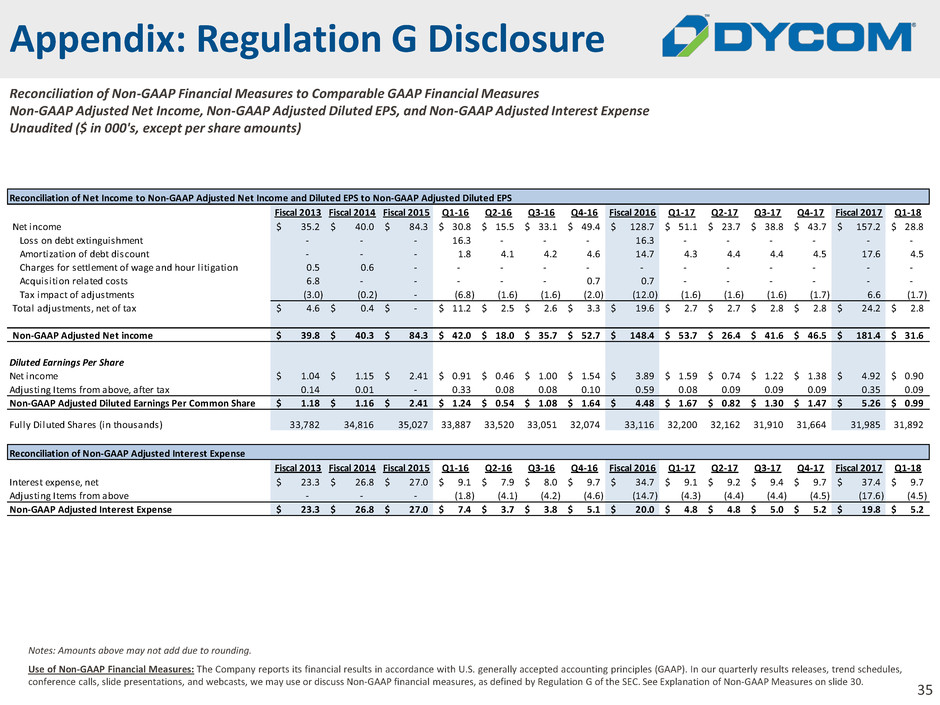

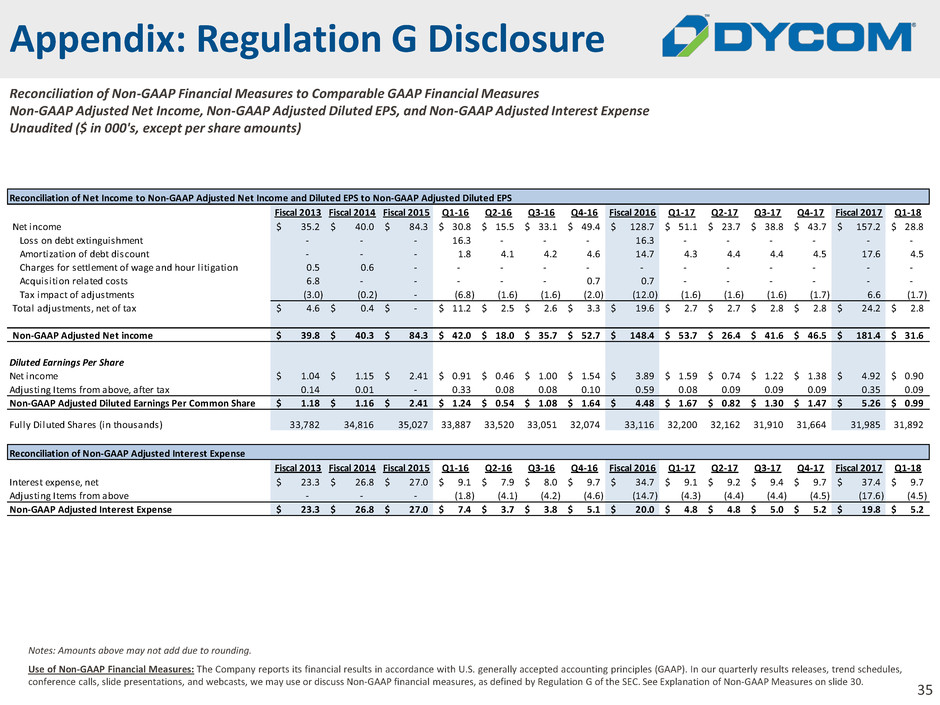

35 Notes: Amounts above may not add due to rounding. Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Adjusted Net Income, Non-GAAP Adjusted Diluted EPS, and Non-GAAP Adjusted Interest Expense Unaudited ($ in 000's, except per share amounts) Appendix: Regulation G Disclosure Use of Non-GAAP Financial Measures: The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 30. Reconciliation of Net Income to Non-GAAP Adjusted Net Income and Diluted EPS to Non-GAAP Adjusted Diluted EPS Fiscal 2013 Fiscal 2014 Fiscal 2015 Q1-16 Q2-16 Q3-16 Q4-16 Fiscal 2016 Q1-17 Q2-17 Q3-17 Q4-17 Fiscal 2017 Q1-18 Net income 35.2$ 40.0$ 84.3$ 30.8$ 15.5$ 33.1$ 49.4$ 128.7$ 51.1$ 23.7$ 38.8$ 43.7$ 157.2$ 28.8$ Loss on debt extinguishment - - - 16.3 - - - 16.3 - - - - - - Amortization of debt discount - - - 1.8 4.1 4.2 4.6 14.7 4.3 4.4 4.4 4.5 17.6 4.5 Charges for settlement of wage and hour litigation 0.5 0.6 - - - - - - - - - - - - Acquisition related costs 6.8 - - - - - 0.7 0.7 - - - - - - Tax impact of adjustments (3.0) (0.2) - (6.8) (1.6) (1.6) (2.0) (12.0) (1.6) (1.6) (1.6) (1.7) 6.6 (1.7) Total adjustments, net of tax 4.6$ 0.4$ -$ 11.2$ 2.5$ 2.6$ 3.3$ 19.6$ 2.7$ 2.7$ 2.8$ 2.8$ 24.2$ 2.8$ Non-GAAP Adjusted Net income 39.8$ 40.3$ 84.3$ 42.0$ 18.0$ 35.7$ 52.7$ 148.4$ 53.7$ 26.4$ 41.6$ 46.5$ 181.4$ 31.6$ Diluted Earnings Per Share Net income 1.04$ 1.15$ 2.41$ 0.91$ 0.46$ 1.00$ 1.54$ 3.89$ 1.59$ 0.74$ 1.22$ 1.38$ 4.92$ 0.90$ Adjusting Items from above, after tax 0.14 0.01 - 0.33 0.08 0.08 0.10 0.59 0.08 0.09 0.09 0.09 0.35 0.09 Non-GAAP Adjusted Diluted Earnings Per Common Share 1.18$ 1.16$ 2.41$ 1.24$ 0.54$ 1.08$ 1.64$ 4.48$ 1.67$ 0.82$ 1.30$ 1.47$ 5.26$ 0.99$ Fully iluted Shares (in thousands) 33,782 34,816 35,027 33,887 33,520 33,051 32,074 33,116 32,200 32,162 31,910 31,664 31,985 31,892 Reconciliation of Non-GAAP Adjusted Interest Expense Fiscal 2013 Fiscal 2014 Fiscal 2015 Q1-16 Q2-16 Q3-16 Q4-16 Fiscal 2016 Q1-17 Q2-17 Q3-17 Q4-17 Fiscal 2017 Q1-18 Interest expense, net 23.3$ 26.8$ 27.0$ 9.1$ 7.9$ 8.0$ 9.7$ 34.7$ 9.1$ 9.2$ 9.4$ 9.7$ 37.4$ 9.7$ Adjusting Items from above - - - (1.8) (4.1) (4.2) (4.6) (14.7) (4.3) (4.4) (4.4) (4.5) (17.6) (4.5) Non-GAAP Adjusted Interest Expense 23.3$ 26.8$ 27.0$ 7.4$ 3.7$ 3.8$ 5.1$ 20.0$ 4.8$ 4.8$ 5.0$ 5.2$ 19.8$ 5.2$

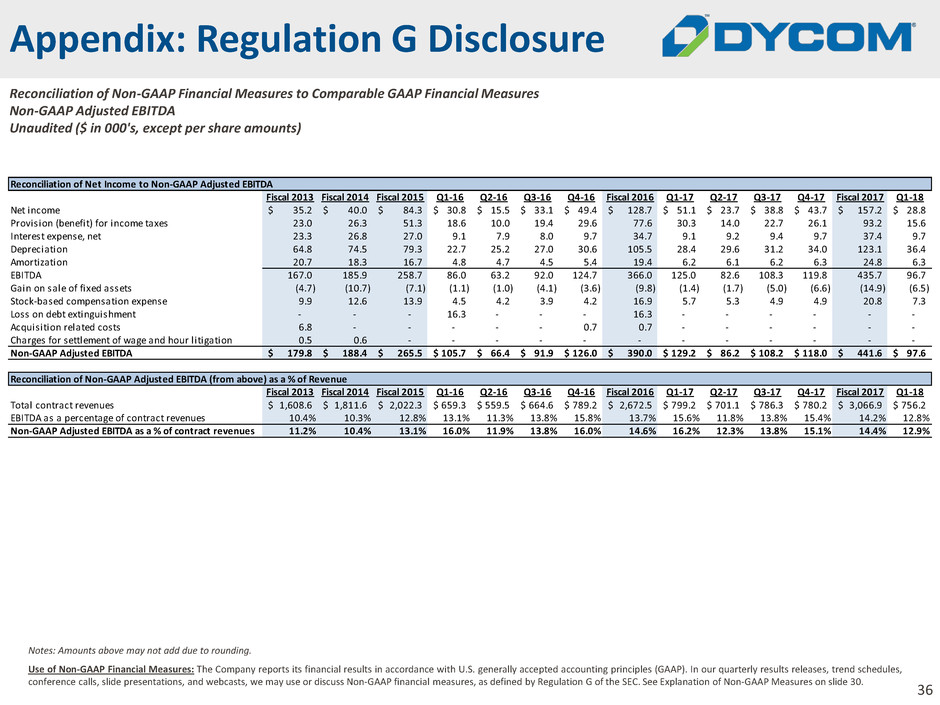

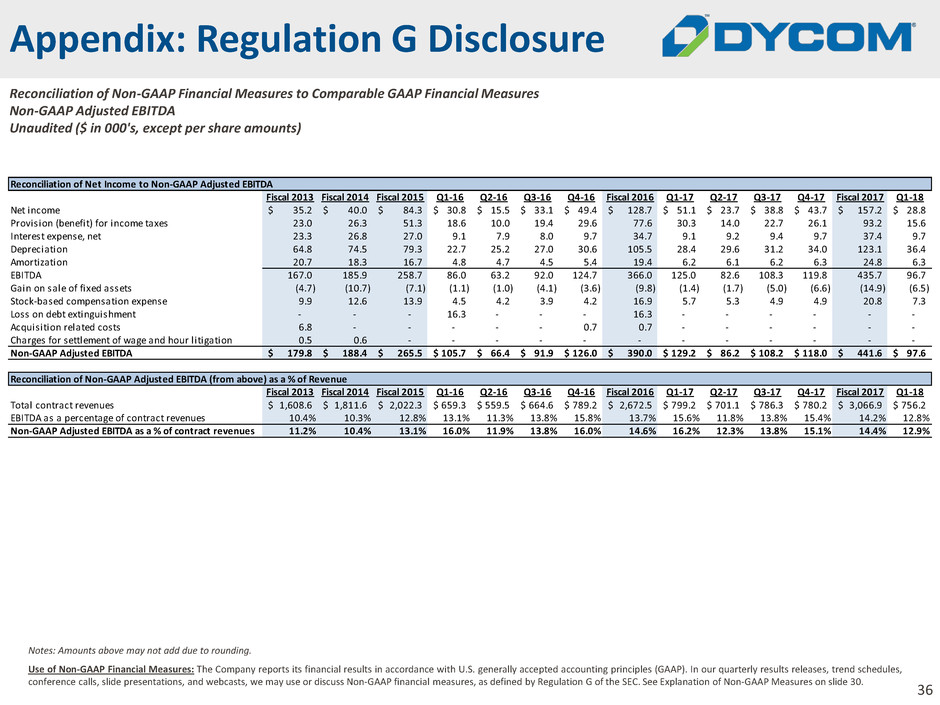

36 Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Adjusted EBITDA Unaudited ($ in 000's, except per share amounts) Notes: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures: The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 30. Reconciliation of Net Income to Non-GAAP Adjusted EBITDA Fiscal 2013 Fiscal 2014 Fiscal 2015 Q1-16 Q2-16 Q3-16 Q4-16 Fiscal 2016 Q1-17 Q2-17 Q3-17 Q4-17 Fiscal 2017 Q1-18 Net income 35.2$ 40.0$ 84.3$ 30.8$ 15.5$ 33.1$ 49.4$ 128.7$ 51.1$ 23.7$ 38.8$ 43.7$ 157.2$ 28.8$ Provision (benefit) for income taxes 23.0 26.3 51.3 18.6 10.0 19.4 29.6 77.6 30.3 14.0 22.7 26.1 93.2 15.6 Interest expense, net 23.3 26.8 27.0 9.1 7.9 8.0 9.7 34.7 9.1 9.2 9.4 9.7 37.4 9.7 Depreciation 64.8 74.5 79.3 22.7 25.2 27.0 30.6 105.5 28.4 29.6 31.2 34.0 123.1 36.4 Amortization 20.7 18.3 16.7 4.8 4.7 4.5 5.4 19.4 6.2 6.1 6.2 6.3 24.8 6.3 EBITDA 167.0 185.9 258.7 86.0 63.2 92.0 124.7 366.0 125.0 82.6 108.3 119.8 435.7 96.7 Gain on sale of fixed assets (4.7) (10.7) (7.1) (1.1) (1.0) (4.1) (3.6) (9.8) (1.4) (1.7) (5.0) (6.6) (14.9) (6.5) Stock-based compensation expense 9.9 12.6 13.9 4.5 4.2 3.9 4.2 16.9 5.7 5.3 4.9 4.9 20.8 7.3 Loss on debt extinguishment - - - 16.3 - - - 16.3 - - - - - - Acquisition related costs 6.8 - - - - - 0.7 0.7 - - - - - - Cha ges for settlement of wage and hour litigation 0.5 0.6 - - - - - - - - - - - - Non-GAAP Adjusted EBITDA 179.8$ 188.4$ 265.5$ 105.7$ 66.4$ 91.9$ 126.0$ 390.0$ 129.2$ 86.2$ 108.2$ 118.0$ 441.6$ 97.6$ Reconciliation of Non-GAAP Adjusted EBITDA (from above) as a % of Revenue Fiscal 2013 Fiscal 2014 Fiscal 2015 Q1-16 Q2-16 Q3-16 Q4-16 Fiscal 2016 Q1-17 Q2-17 Q3-17 Q4-17 Fiscal 2017 Q1-18 Total contract revenues 1,608.6$ 1,811.6$ 2,022.3$ 659.3$ 559.5$ 664.6$ 789.2$ 2,672.5$ 799.2$ 701.1$ 786.3$ 780.2$ 3,066.9$ 756.2$ EBITDA as a percentage of contract revenues 10.4% 10.3% 12.8% 13.1% 11.3% 13.8% 15.8% 13.7% 15.6% 11.8% 13.8% 15.4% 14.2% 12.8% Non-GAAP Adjusted EBITDA as a % of contract revenues 11.2% 10.4% 13.1% 16.0% 11.9% 13.8% 16.0% 14.6% 16.2% 12.3% 13.8% 15.1% 14.4% 12.9%

Investor Presentation November & December 2017